A Closed-Loop Supply Chain with Competitive Dual Collection Channel under Asymmetric Information and Reward–Penalty Mechanism

Abstract

:1. Introduction

- (1)

- How does collection competition between the retailer and the third-party recycler affect the decisions and profits of CLSC members under information asymmetry?

- (2)

- Can the manufacturer design a valid information screening contract to obtain the real collection effort levels of the two competitive collection agents with and without RPM?

- (3)

- Can the RPM improve the collection rates and the profits of CLSC members with collection competition and asymmetric information?

2. Notations and Assumptions

Assumptions

- (1)

- (2)

- represents that unit production cost is more than unit remanufacturing cost [2,20,21]. We also assume that the unit cost of remanufacturing used products is fixed regardless of their different quality levels, which can avoid complex calculations without changing the major conclusions of the CLSC model.

- (3)

- (4)

- In this model, we assume that all CLSC members are risk-neutral, without regard to risk preference or risk aversion. Their targets are to earn the maximum profits.

- (5)

- (6)

- We assume the retailer’s collection quantity and the third-party recycler’s collection quantity are both collection-effort-sensitive and collection-price-sensitive. Specifically, in this paper the linear functions of and are employed by and respectively [23,38]. That is, for either party, collection quantity increases as the own collection effort level or collection price increases, but decreases as the competitor’s collection price increases.

3. CLSC Model without the RPM (Case 1)

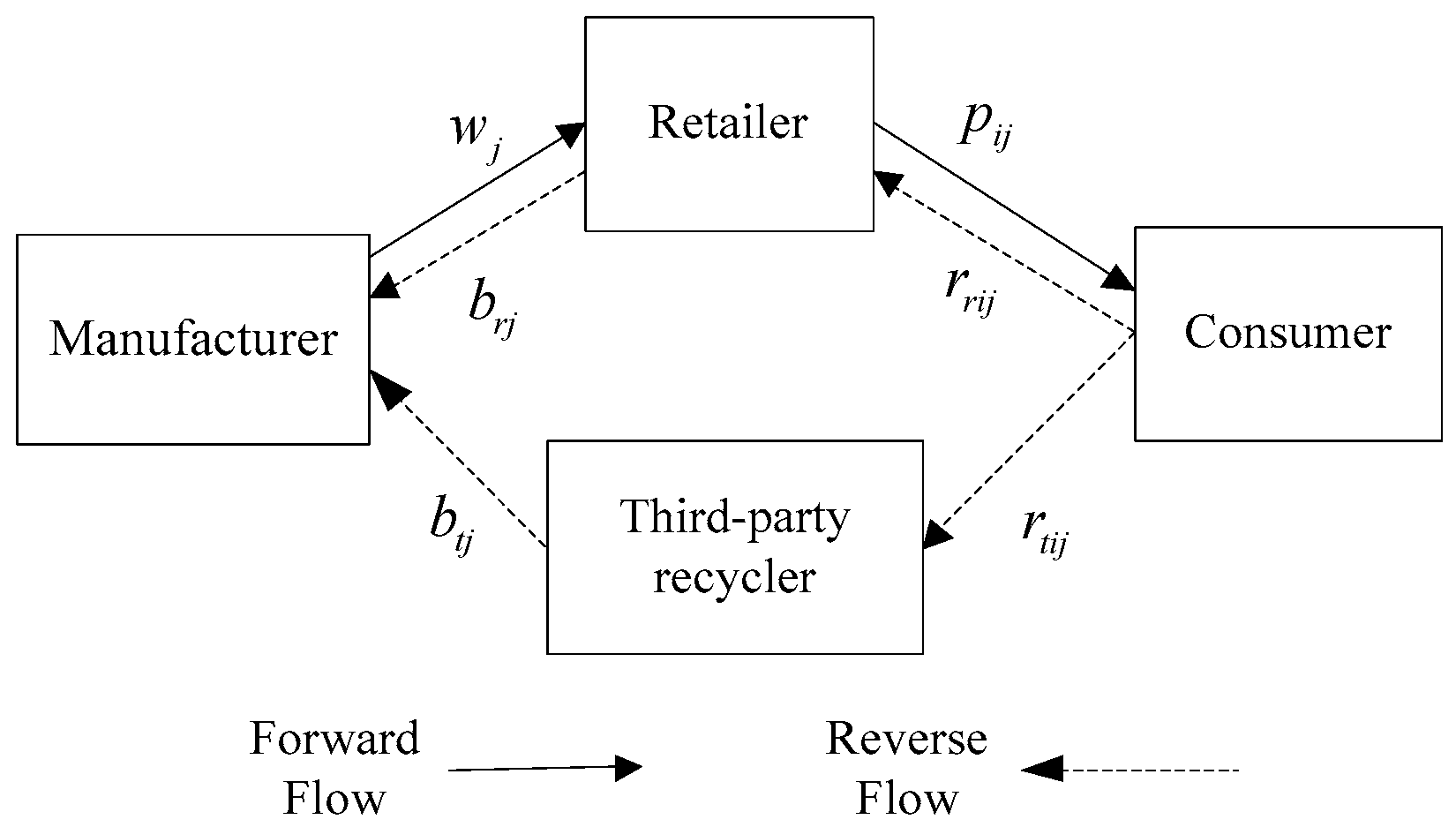

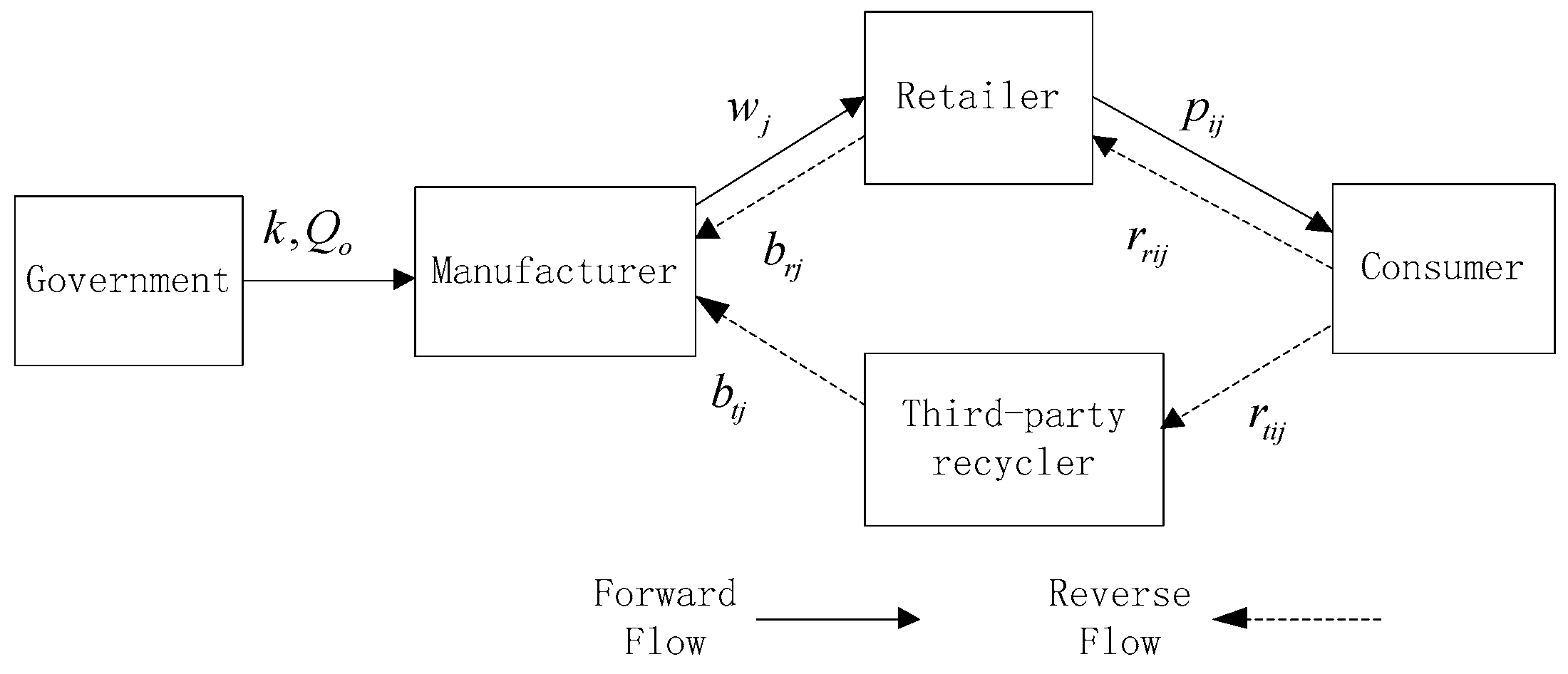

3.1. Model Description

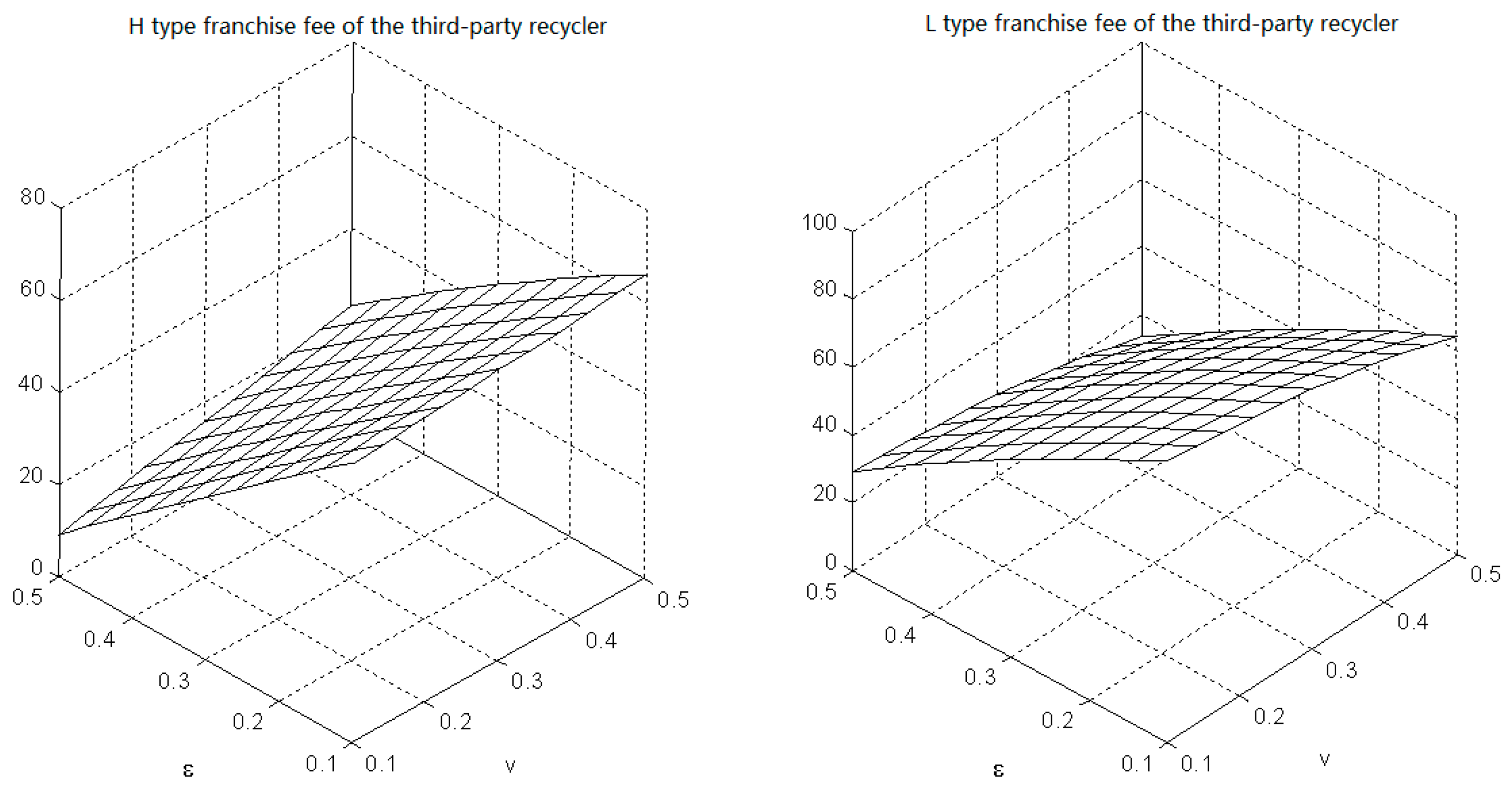

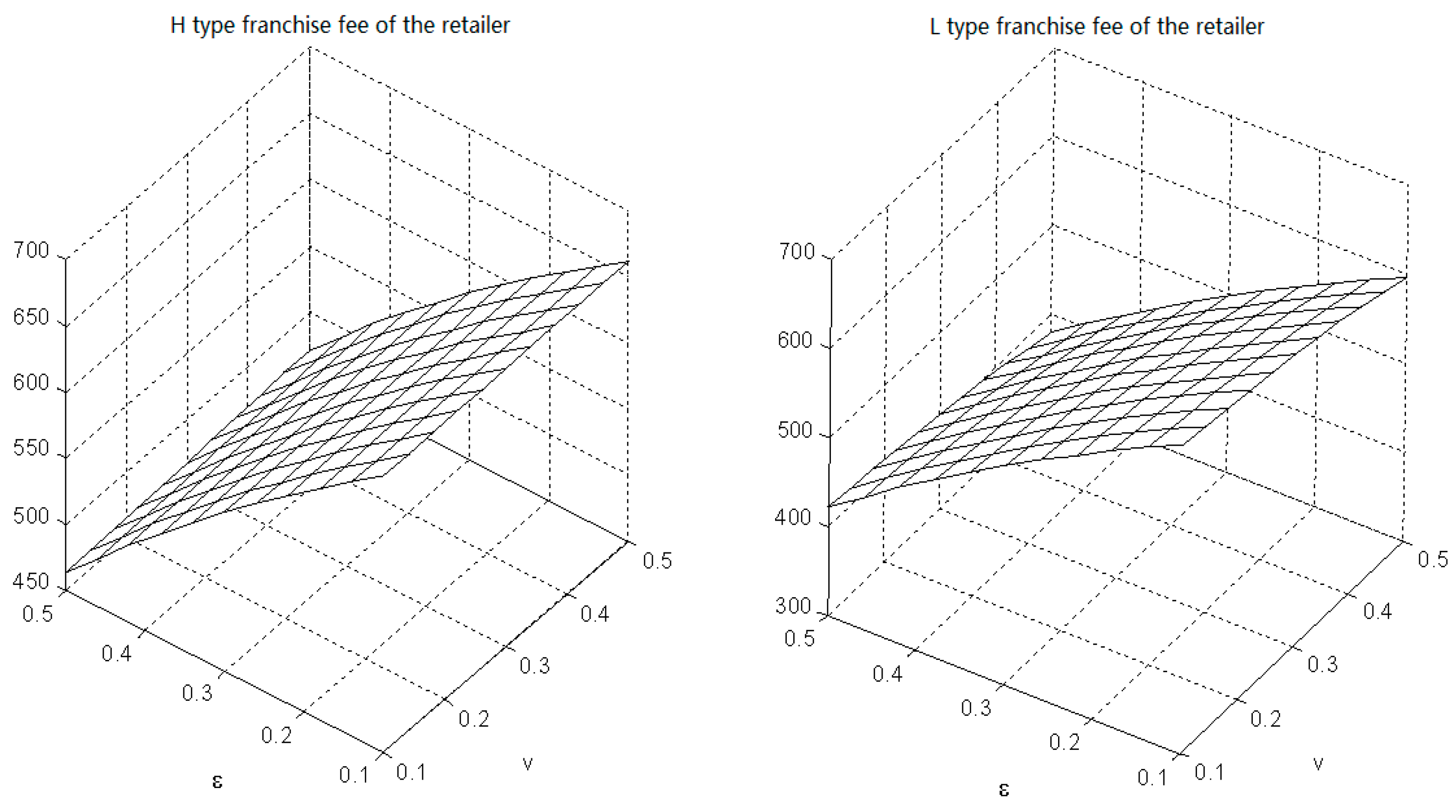

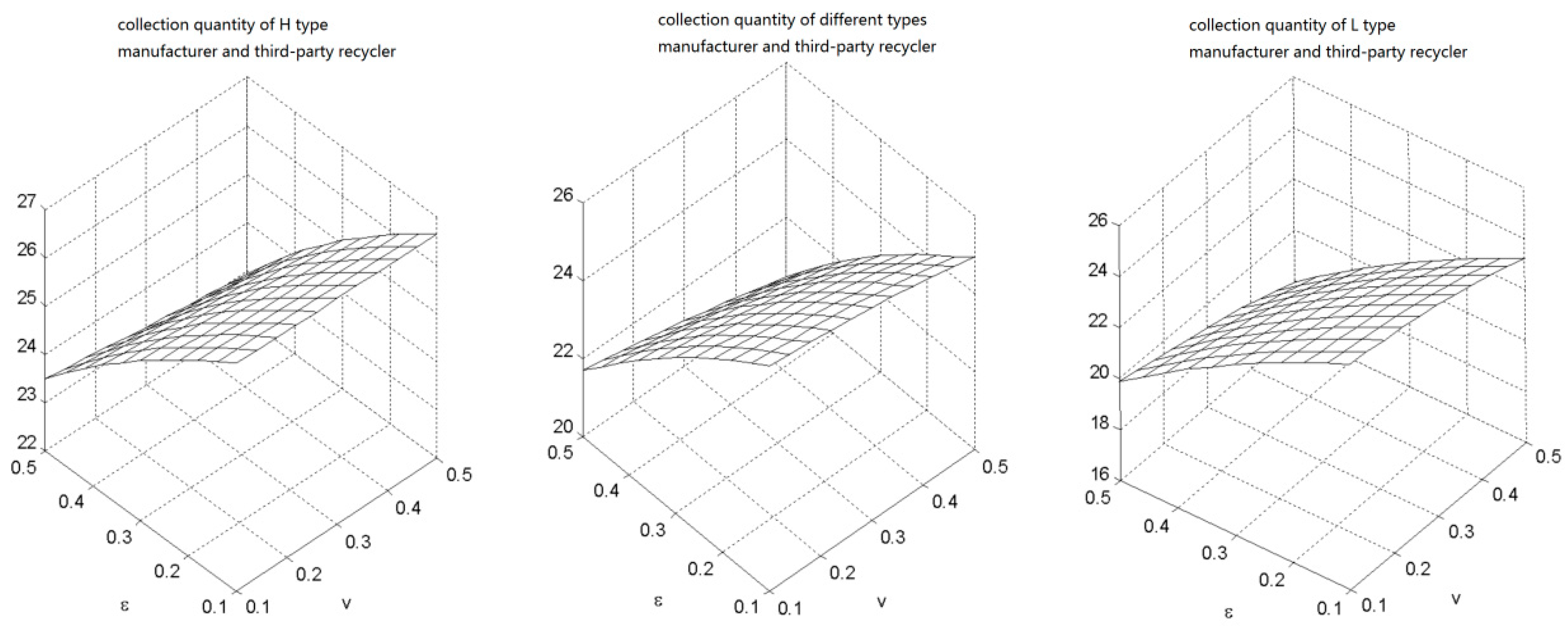

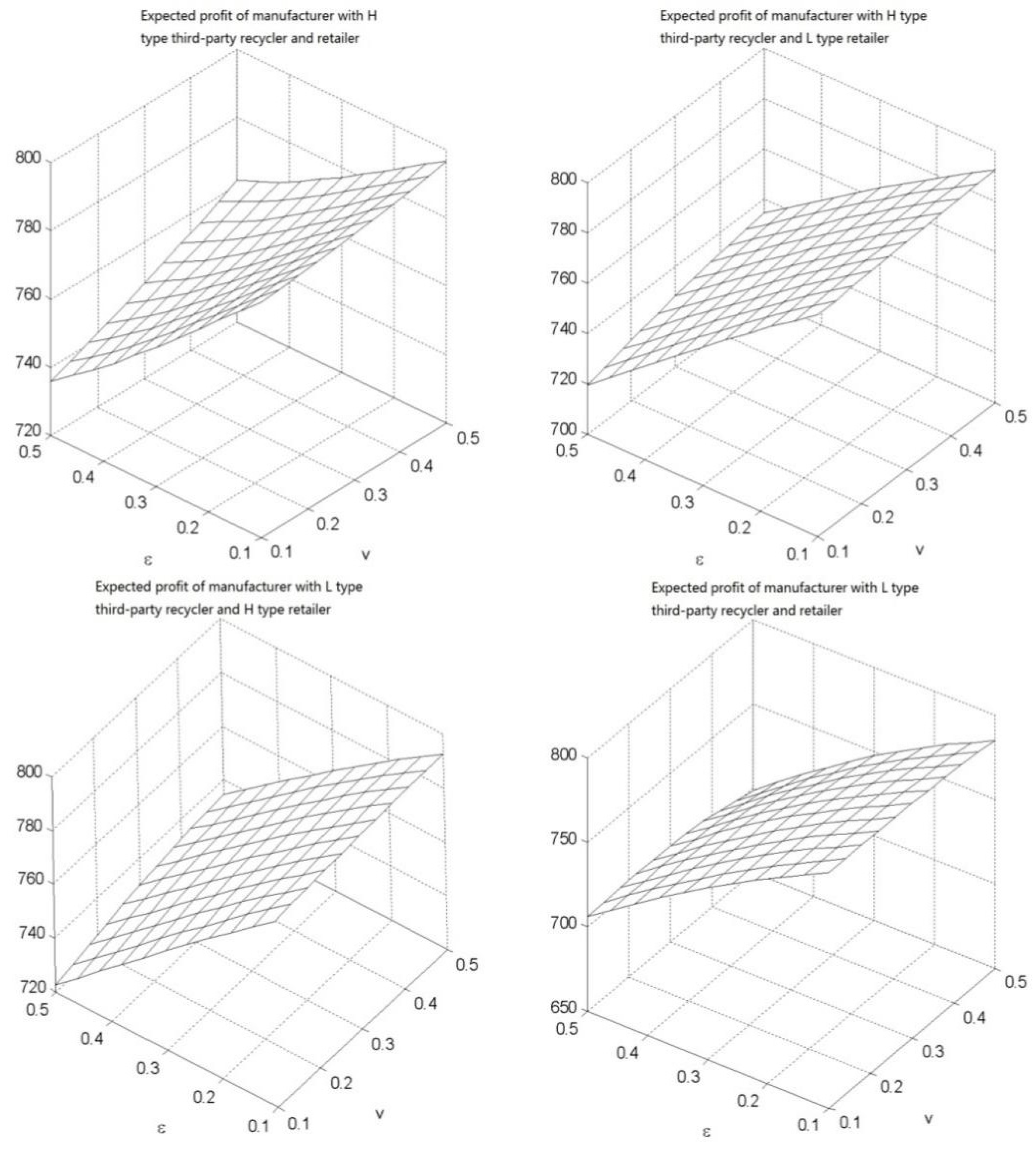

3.2. Numerical Examples

4. CLSC Model with the RPM (Case 2)

4.1. Model Description

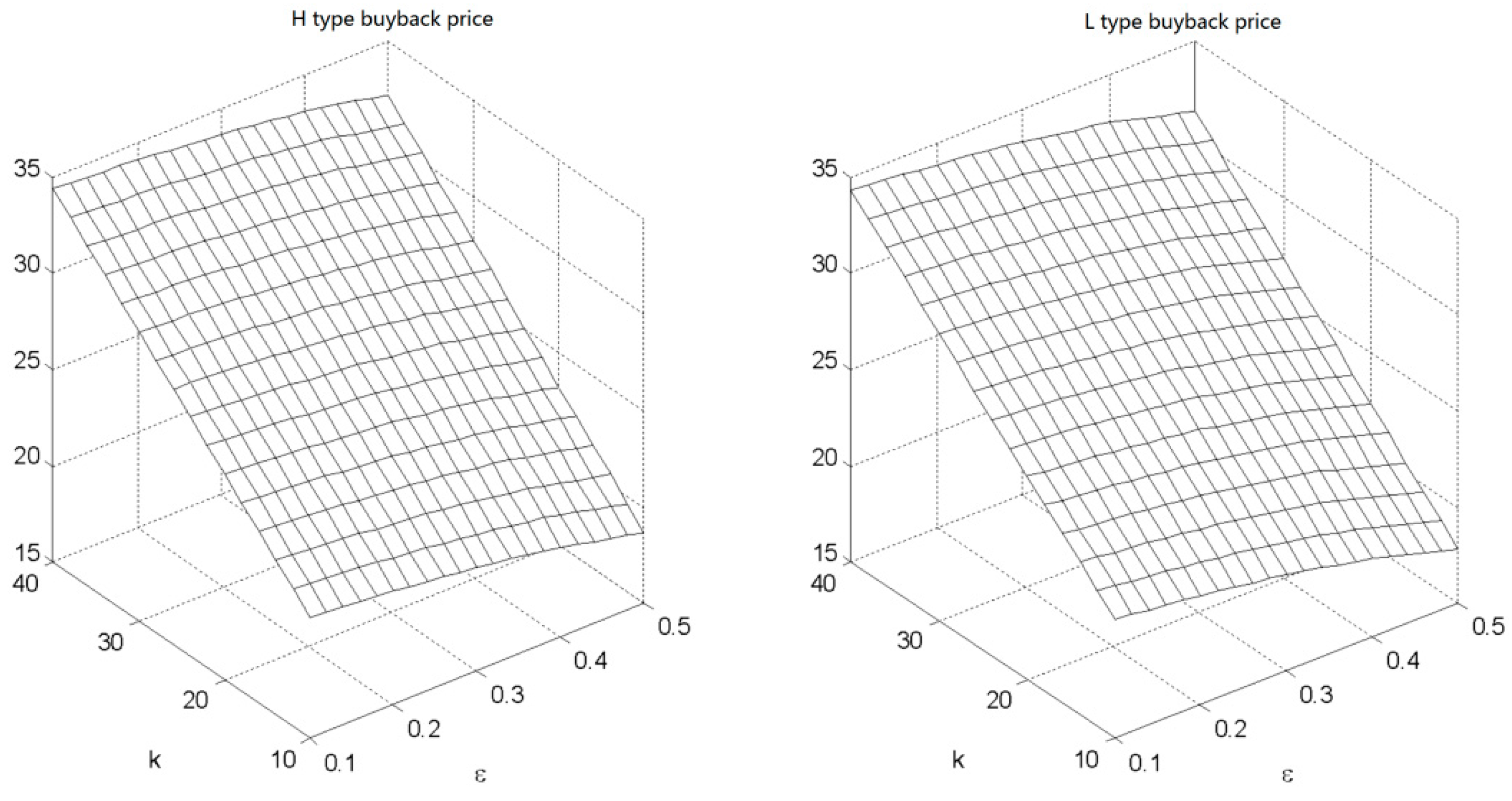

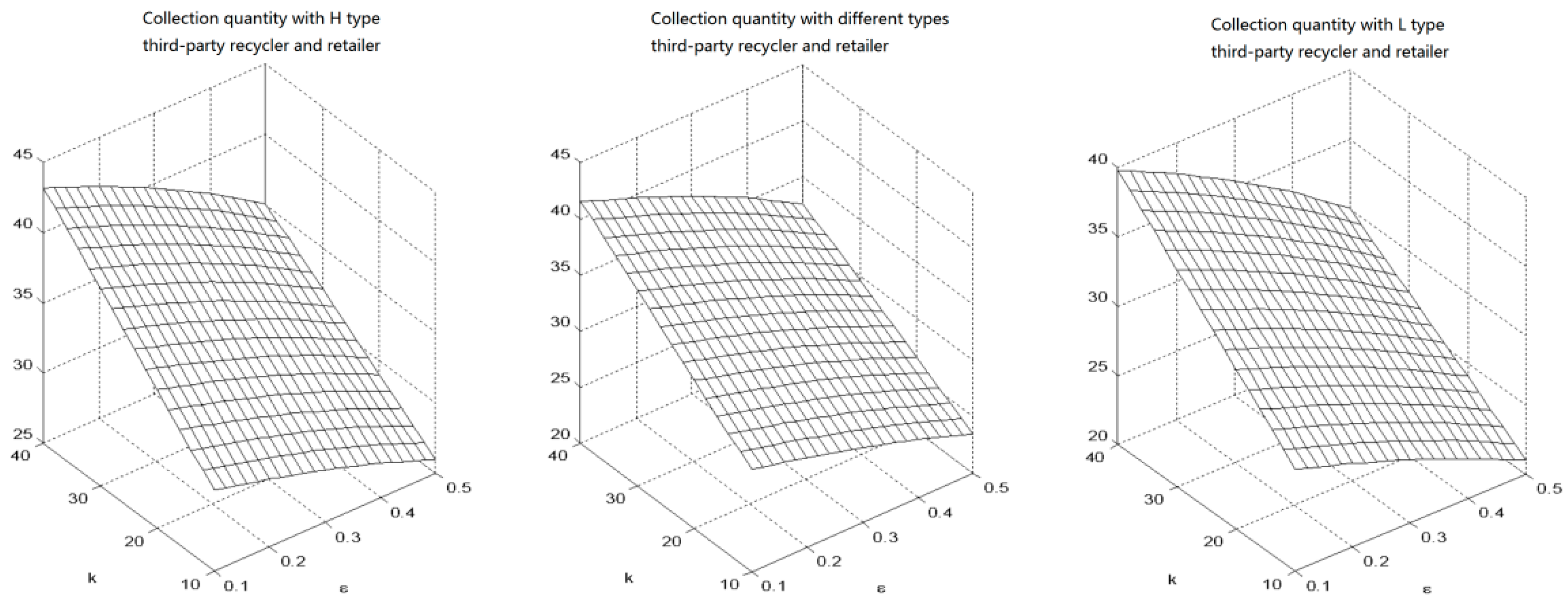

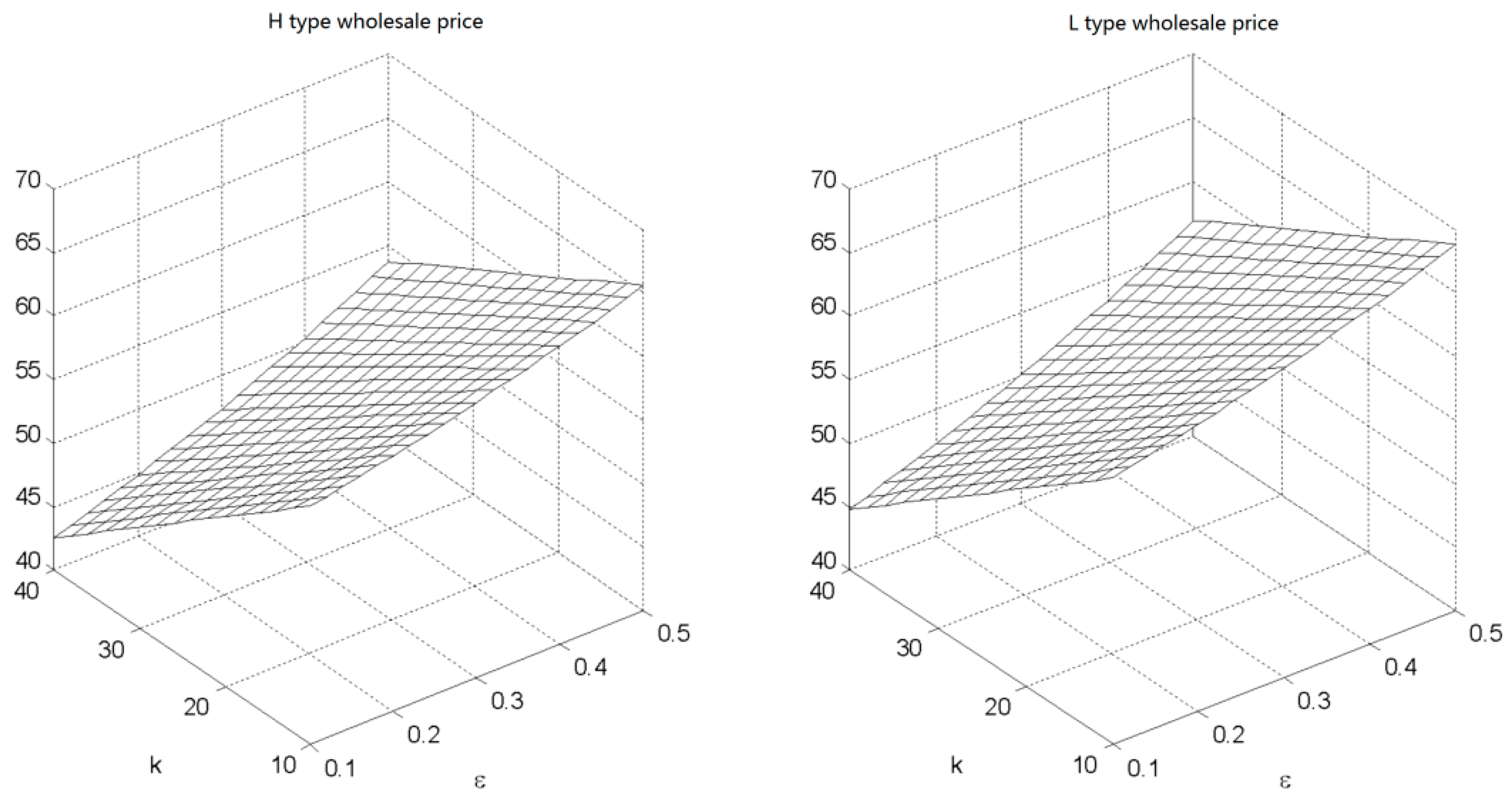

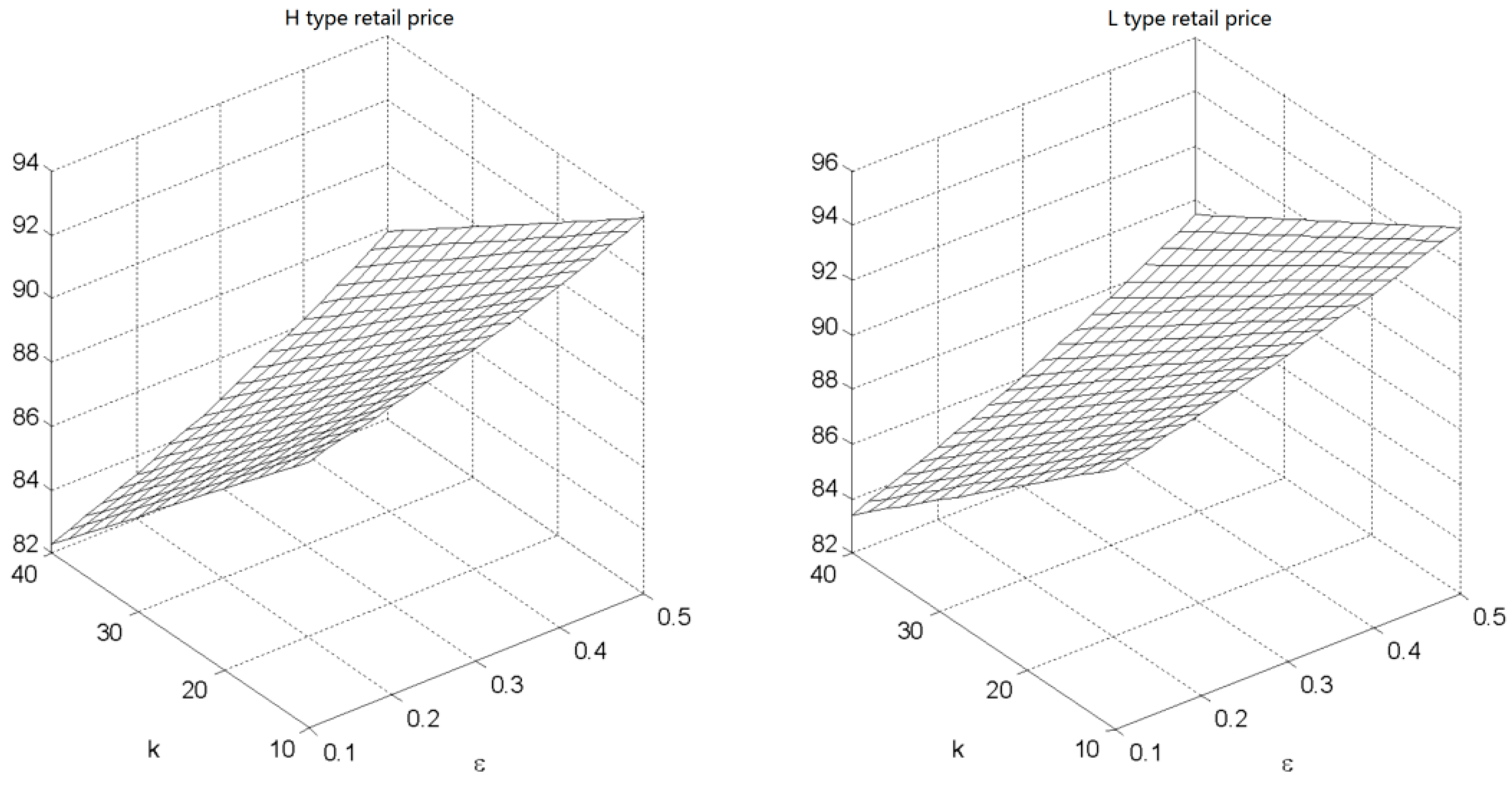

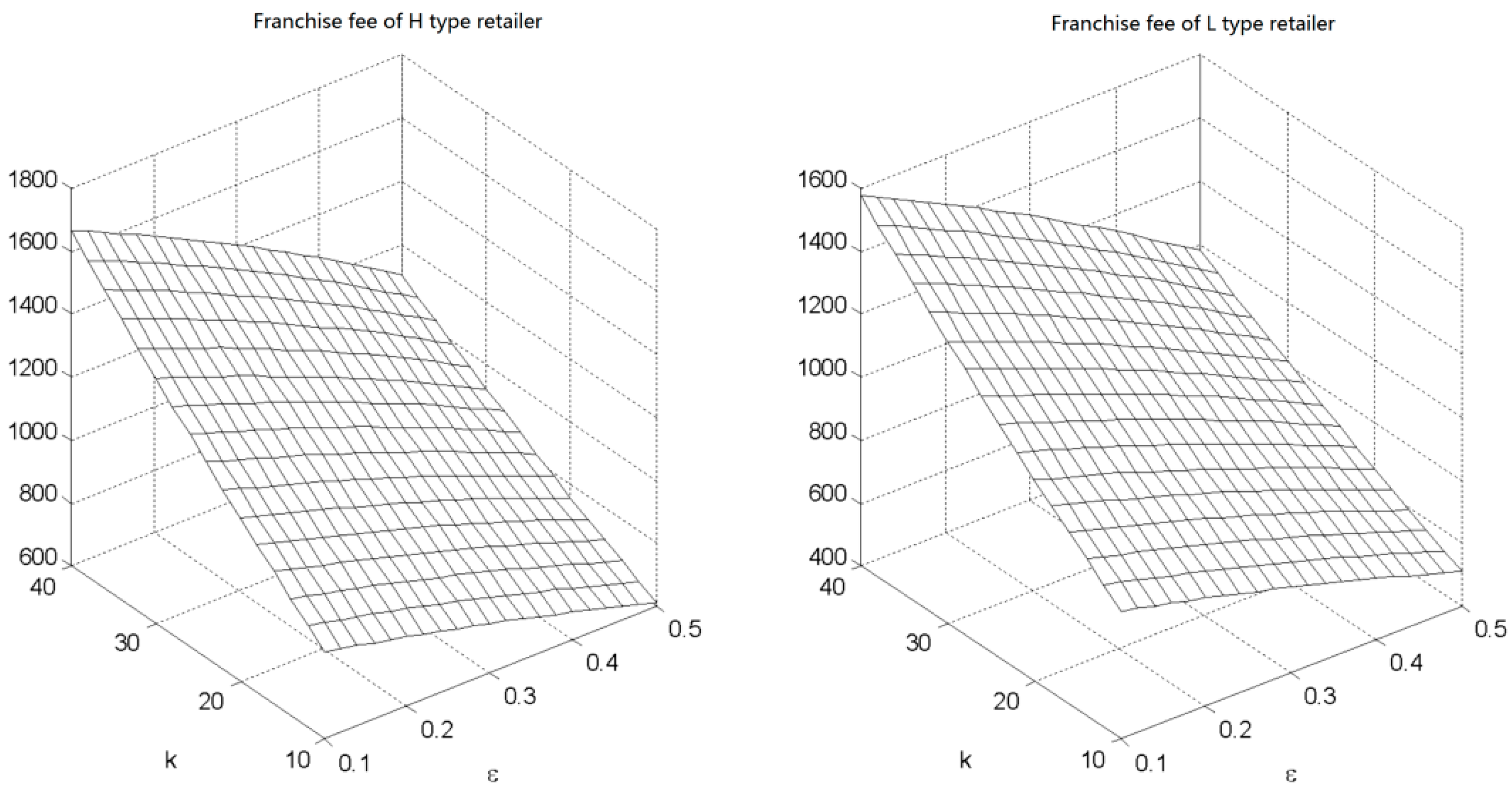

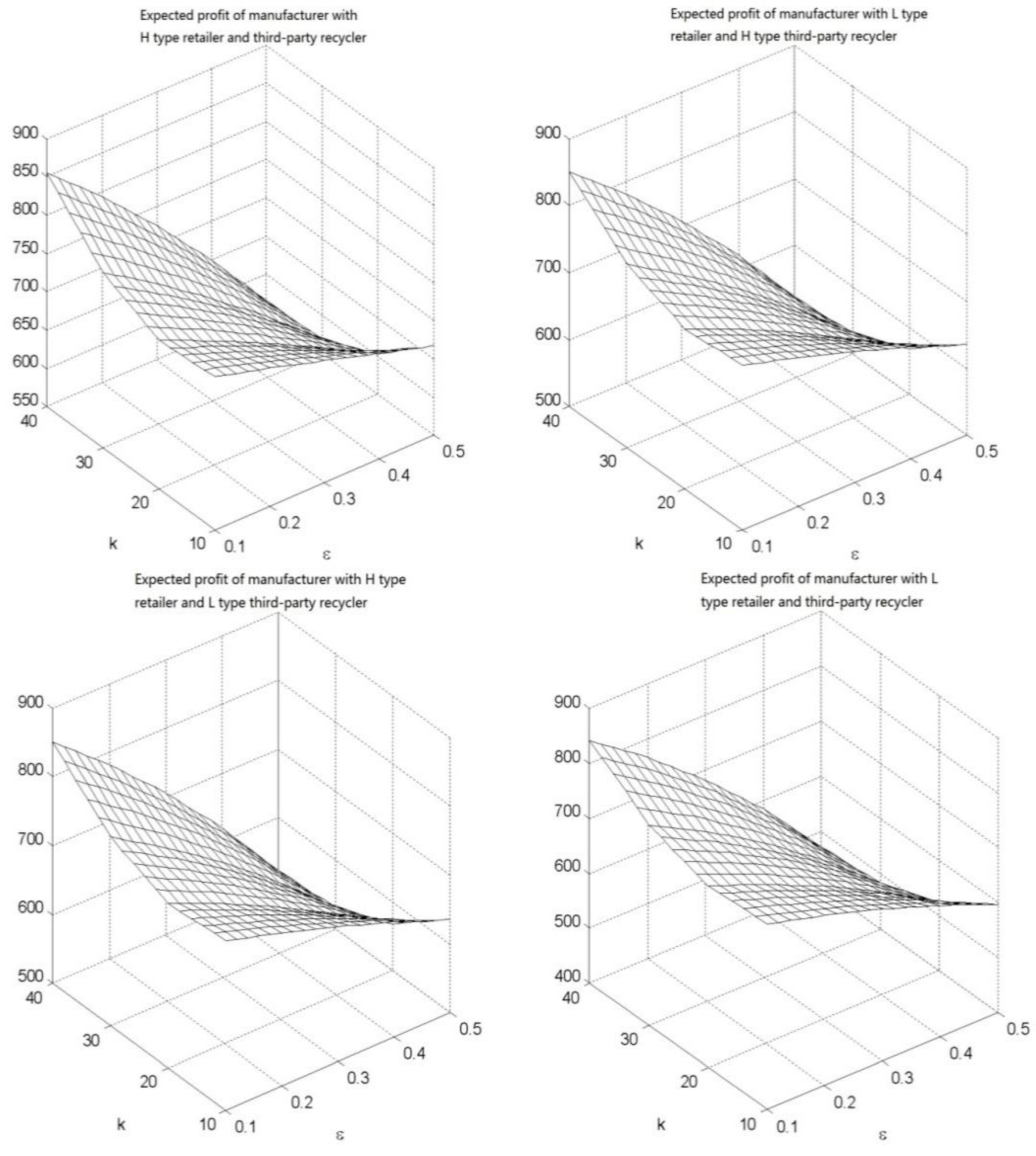

4.2. Numerical Example

5. Conclusions and Future Research

- (1)

- The information screening contract can help the manufacturer acquire the real collection effort levels effectively because the two collection agents are induced to choose the same type of contract as their collection effort type for profit maximization. That is, the screening contract can prevent them from lying and improve the efficiency of the CLSC system.

- (2)

- The retailer and the third-party recycler will earn more profit by choosing a high level collection effort when competing against each other. The collection competition reduces the total collection quantity and the expected profit of the manufacturer, while the expected profits of both two collection agents first increase and then decrease as the competition intensity increases. In addition, the more intense the collection competition is, the more losses they will suffer. Therefore, the CLSC channel members should make efforts to come to a cooperation agreement for mitigating the negative effect of the competition.

- (3)

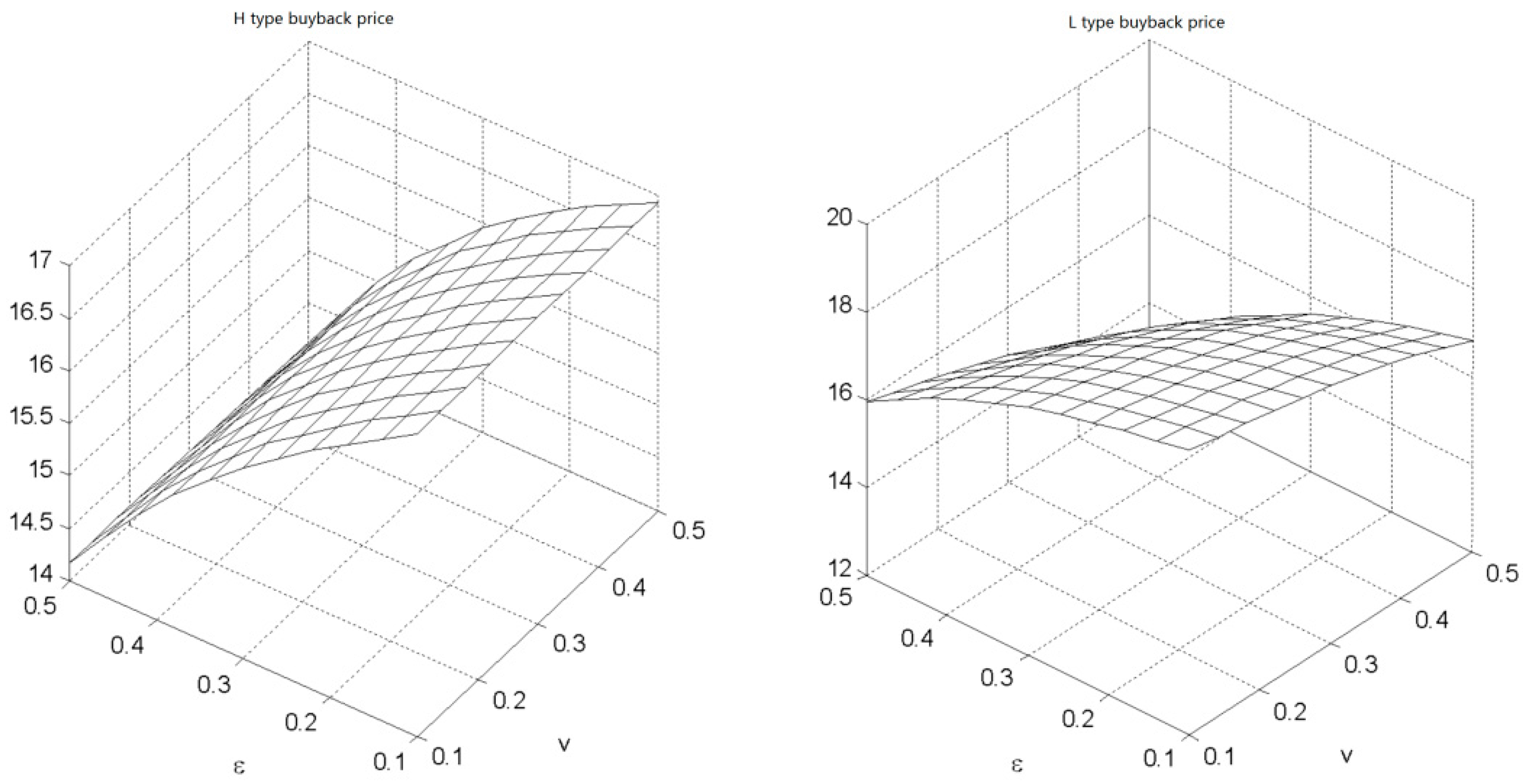

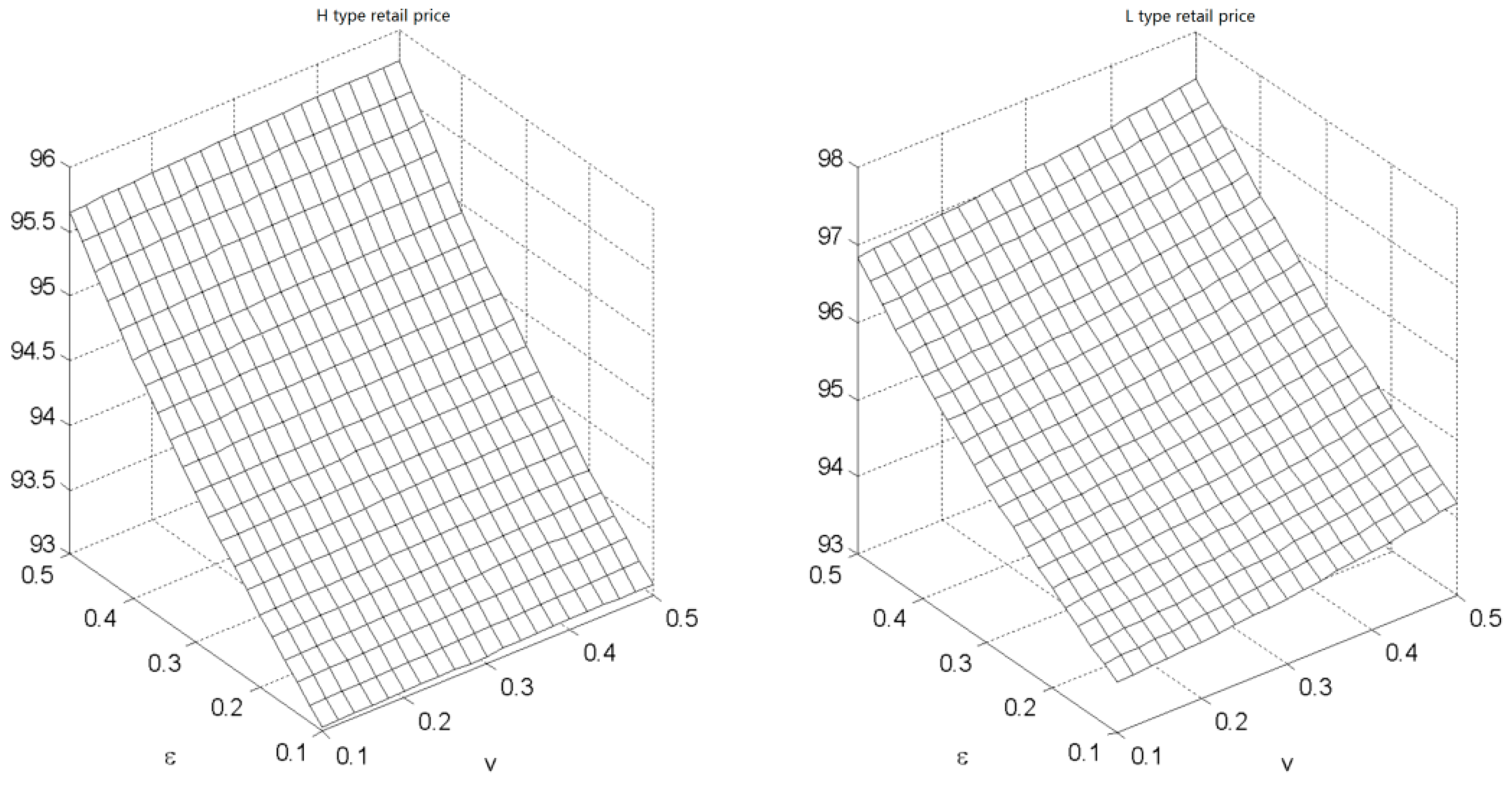

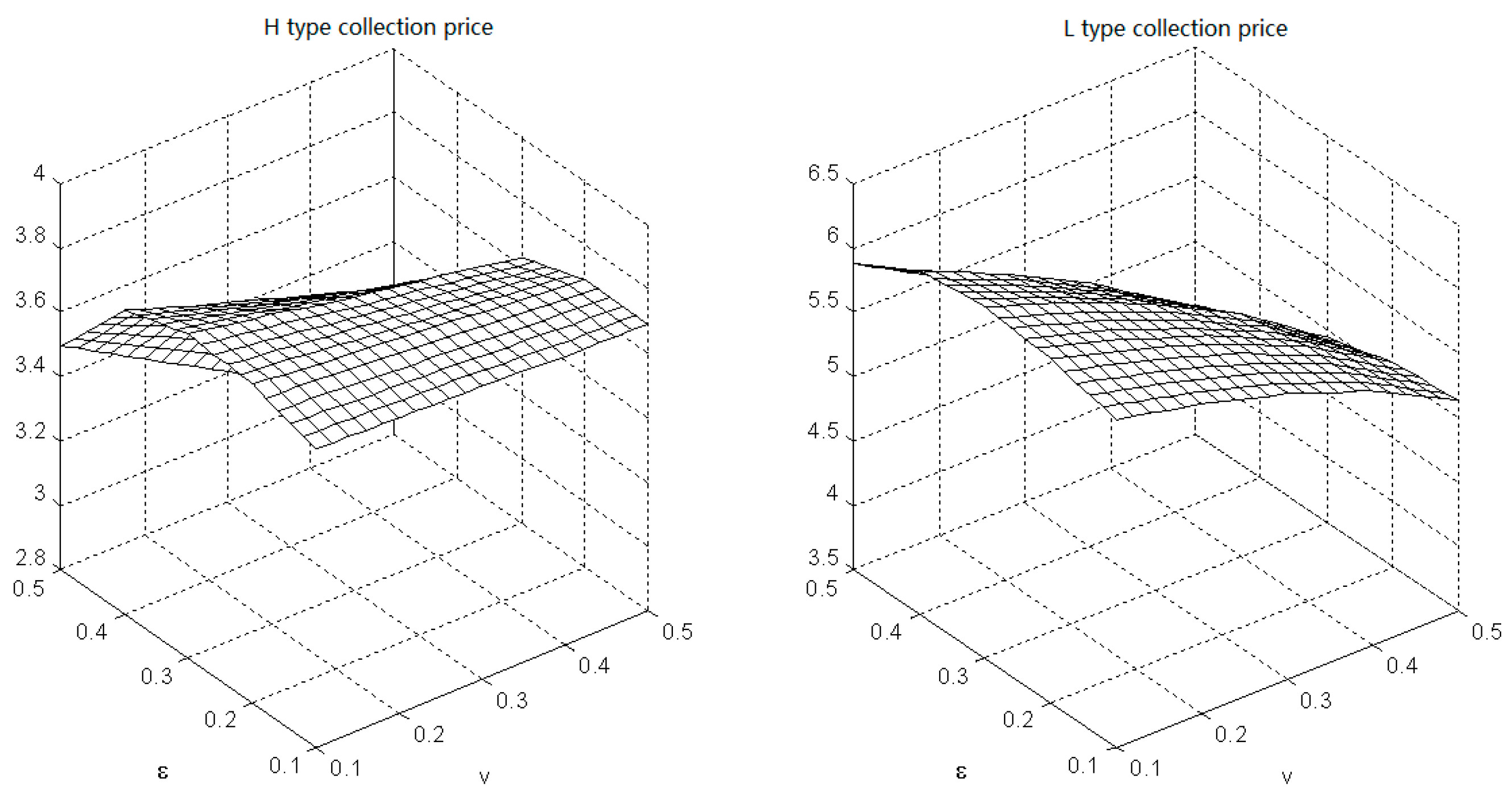

- The RPM has a positive effect on CLSC with collection competition. First, RPM increases the collection price, buyback price, franchise fee, and total collection quantity; secondly, it can encourage initiatives of the collectors in collecting WEEEs, and then the environmental benefits to society will improve. What is more, the RPM can ensure that the profits of all the CLSC members are superior to without RPM.

Author Contributions

Funding

Conflicts of Interest

Appendix A

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | |

|---|---|---|---|---|---|

| , | |||||

| 0.1 | 16.870 | 16.890 | 16.910 | 16.920 | 16.940 |

| 0.2 | 16.390 | 16.420 | 16.450 | 16.480 | 16.510 |

| 0.3 | 15.820 | 15.860 | 15.890 | 15.930 | 15.960 |

| 0.4 | 15.120 | 15.140 | 15.170 | 15.190 | 15.210 |

| 0.5 | 14.170 | 14.160 | 14.150 | 14.130 | 14.120 |

| , | |||||

| 0.1 | 18.510 | 18.250 | 17.920 | 17.470 | 16.830 |

| 0.2 | 18.150 | 17.860 | 17.490 | 17.000 | 16.300 |

| 0.3 | 17.660 | 17.330 | 16.910 | 16.360 | 15.590 |

| 0.4 | 16.960 | 16.580 | 16.100 | 15.470 | 14.620 |

| 0.5 | 15.940 | 15.480 | 14.910 | 14.190 | 13.230 |

| 0.1 | 64.070 | 64.090 | 64.120 | 64.150 | 64.180 |

| 0.2 | 65.120 | 65.160 | 65.190 | 65.230 | 65.260 |

| 0.3 | 66.320 | 66.370 | 66.410 | 66.450 | 66.480 |

| 0.4 | 67.700 | 67.760 | 67.810 | 67.850 | 67.890 |

| 0.5 | 69.300 | 69.380 | 69.440 | 69.500 | 69.540 |

| 0.1 | 65.260 | 65.450 | 65.680 | 65.990 | 66.400 |

| 0.2 | 66.550 | 66.760 | 67.000 | 67.300 | 67.720 |

| 0.3 | 68.030 | 68.240 | 68.490 | 68.790 | 69.190 |

| 0.4 | 69.710 | 69.930 | 70.180 | 70.480 | 70.860 |

| 0.5 | 71.660 | 71.880 | 72.130 | 72.410 | 72.770 |

| 0.1 | 3.726 | 3.718 | 3.711 | 3.698 | 3.691 |

| 0.2 | 3.788 | 3.764 | 3.740 | 3.717 | 3.694 |

| 0.3 | 3.808 | 3.763 | 3.713 | 3.670 | 3.622 |

| 0.4 | 3.744 | 3.656 | 3.575 | 3.490 | 3.407 |

| 0.5 | 3.496 | 3.349 | 3.205 | 3.059 | 2.922 |

| 0.1 | 6.046 | 5.898 | 5.716 | 5.473 | 5.136 |

| 0.2 | 6.168 | 5.984 | 5.760 | 5.477 | 5.089 |

| 0.3 | 6.228 | 5.998 | 5.723 | 5.385 | 4.937 |

| 0.4 | 6.164 | 5.876 | 5.540 | 5.130 | 4.612 |

| 0.5 | 5.880 | 5.509 | 5.085 | 4.589 | 3.978 |

| 0.1 | 3.726 | 3.718 | 3.711 | 3.698 | 3.691 |

| 0.2 | 3.788 | 3.764 | 3.740 | 3.717 | 3.694 |

| 0.3 | 3.808 | 3.763 | 3.713 | 3.670 | 3.622 |

| 0.4 | 3.744 | 3.656 | 3.575 | 3.490 | 3.407 |

| 0.5 | 3.496 | 3.349 | 3.205 | 3.059 | 2.922 |

| 0.1 | 6.046 | 5.898 | 5.716 | 5.473 | 5.136 |

| 0.2 | 6.168 | 5.984 | 5.760 | 5.477 | 5.089 |

| 0.3 | 6.228 | 5.998 | 5.723 | 5.385 | 4.937 |

| 0.4 | 6.164 | 5.876 | 5.540 | 5.130 | 4.612 |

| 0.5 | 5.880 | 5.509 | 5.085 | 4.589 | 3.978 |

| 0.1 | 93.035 | 93.045 | 93.060 | 93.080 | 93.090 |

| 0.2 | 93.560 | 93.580 | 93.600 | 93.620 | 93.630 |

| 0.3 | 94.160 | 94.180 | 94.200 | 94.220 | 94.240 |

| 0.4 | 94.850 | 94.880 | 94.900 | 94.920 | 94.940 |

| 0.5 | 95.650 | 95.690 | 95.720 | 95.750 | 95.770 |

| 0.1 | 93.630 | 93.720 | 93.840 | 94.000 | 94.200 |

| 0.2 | 94.280 | 94.380 | 94.500 | 94.650 | 94.860 |

| 0.3 | 95.020 | 95.120 | 95.240 | 95.400 | 95.600 |

| 0.4 | 95.860 | 95.960 | 96.090 | 96.240 | 96.430 |

| 0.5 | 96.830 | 96.940 | 97.060 | 97.200 | 97.380 |

| 0.1 | 60.880 | 61.943 | 63.108 | 64.326 | 65.961 |

| 0.2 | 48.364 | 50.046 | 51.846 | 53.819 | 56.113 |

| 0.3 | 35.494 | 37.849 | 40.218 | 42.886 | 45.769 |

| 0.4 | 22.517 | 25.262 | 28.262 | 31.374 | 34.789 |

| 0.5 | 9.269 | 12.460 | 15.814 | 19.259 | 23.127 |

| 0.1 | 83.109 | 80.319 | 76.694 | 71.674 | 64.507 |

| 0.2 | 71.318 | 68.789 | 65.334 | 60.523 | 53.433 |

| 0.3 | 58.443 | 56.172 | 52.899 | 48.204 | 41.238 |

| 0.4 | 44.295 | 42.317 | 39.261 | 34.670 | 27.912 |

| 0.5 | 28.946 | 27.166 | 24.276 | 19.924 | 13.359 |

| 0.1 | 659.860 | 660.340 | 660.630 | 660.980 | 661.750 |

| 0.2 | 617.190 | 617.740 | 618.690 | 619.530 | 620.970 |

| 0.3 | 570.560 | 571.530 | 572.780 | 574.340 | 576.380 |

| 0.4 | 519.640 | 520.760 | 522.400 | 524.430 | 526.760 |

| 0.5 | 463.590 | 464.680 | 466.450 | 468.330 | 471.140 |

| 0.1 | 647.970 | 639.800 | 629.680 | 615.950 | 597.350 |

| 0.2 | 599.990 | 591.650 | 581.580 | 568.550 | 550.010 |

| 0.3 | 546.630 | 538.710 | 528.730 | 516.030 | 498.460 |

| 0.4 | 487.860 | 480.140 | 470.590 | 458.250 | 441.740 |

| 0.5 | 422.470 | 415.170 | 406.030 | 394.720 | 379.260 |

| , | |||||

| 0.1 | 13.353 | 13.346 | 13.340 | 13.330 | 13.320 |

| 0.2 | 13.030 | 13.011 | 12.992 | 12.974 | 12.955 |

| 0.3 | 12.666 | 12.634 | 12.599 | 12.569 | 12.535 |

| 0.4 | 12.246 | 12.194 | 12.145 | 12.094 | 12.044 |

| 0.5 | 11.748 | 11.674 | 11.602 | 11.530 | 11.461 |

| , | |||||

| 0.1 | 13.120 | 13.130 | 13.140 | 13.150 | 13.180 |

| 0.2 | 12.550 | 12.570 | 12.590 | 12.620 | 12.680 |

| 0.3 | 11.940 | 11.960 | 12.000 | 12.050 | 12.140 |

| 0.4 | 11.280 | 11.310 | 11.360 | 11.440 | 11.560 |

| 0.5 | 10.560 | 10.590 | 10.660 | 10.760 | 10.930 |

| , | |||||

| 0.1 | 12.670 | 12.530 | 12.340 | 12.100 | 11.770 |

| 0.2 | 12.410 | 12.230 | 12.010 | 11.730 | 11.350 |

| 0.3 | 12.090 | 11.870 | 11.610 | 11.280 | 10.850 |

| 0.4 | 11.670 | 11.410 | 11.110 | 10.730 | 10.250 |

| 0.5 | 11.130 | 10.830 | 10.480 | 10.060 | 9.517 |

| , | |||||

| 0.1 | 12.440 | 12.310 | 12.140 | 11.930 | 11.620 |

| 0.2 | 11.930 | 11.790 | 11.610 | 11.380 | 11.070 |

| 0.3 | 11.360 | 11.200 | 11.010 | 10.770 | 10.460 |

| 0.4 | 10.700 | 10.530 | 10.320 | 10.080 | 9.767 |

| 0.5 | 9.940 | 9.754 | 9.542 | 9.294 | 8.989 |

| + | |||||

| 0.1 | 26.710 | 26.690 | 26.680 | 26.660 | 26.640 |

| 0.2 | 26.060 | 26.020 | 25.980 | 25.950 | 25.910 |

| 0.3 | 25.330 | 25.270 | 25.200 | 25.140 | 25.070 |

| 0.4 | 24.490 | 24.390 | 24.290 | 24.190 | 24.090 |

| 0.5 | 23.500 | 23.350 | 23.200 | 23.060 | 22.920 |

| +, + | |||||

| 0.1 | 25.790 | 25.650 | 25.480 | 25.250 | 24.940 |

| 0.2 | 24.960 | 24.800 | 24.600 | 24.360 | 24.030 |

| 0.3 | 24.030 | 23.830 | 23.610 | 23.340 | 22.990 |

| 0.4 | 22.940 | 22.720 | 22.470 | 22.170 | 21.810 |

| 0.5 | 21.690 | 21.430 | 21.140 | 20.820 | 20.450 |

| + | |||||

| 0.1 | 24.880 | 24.620 | 24.290 | 23.850 | 23.240 |

| 0.2 | 23.870 | 23.570 | 23.220 | 22.760 | 22.140 |

| 0.3 | 22.720 | 22.400 | 22.010 | 21.540 | 20.910 |

| 0.4 | 21.400 | 21.050 | 20.650 | 20.160 | 19.530 |

| 0.5 | 19.880 | 19.510 | 19.080 | 18.590 | 17.980 |

| 0.1 | 788.550 | 790.150 | 791.890 | 794.010 | 796.730 |

| 0.2 | 774.670 | 777.180 | 779.930 | 783.020 | 786.790 |

| 0.3 | 760.750 | 764.290 | 768.090 | 772.260 | 777.080 |

| 0.4 | 747.460 | 752.050 | 756.950 | 762.290 | 768.220 |

| 0.5 | 736.050 | 741.810 | 747.900 | 754.370 | 761.460 |

| 0.1 | 788.440 | 789.610 | 790.740 | 791.810 | 792.760 |

| 0.2 | 772.310 | 774.310 | 776.240 | 778.020 | 779.420 |

| 0.3 | 755.130 | 758.050 | 760.790 | 763.190 | 765.070 |

| 0.4 | 737.300 | 741.090 | 744.570 | 747.640 | 749.890 |

| 0.5 | 719.400 | 724.050 | 728.330 | 731.940 | 734.420 |

| 0.1 | 789.270 | 790.390 | 791.440 | 792.320 | 792.760 |

| 0.2 | 773.500 | 775.420 | 777.180 | 778.650 | 779.430 |

| 0.3 | 756.840 | 759.570 | 761.990 | 763.990 | 765.070 |

| 0.4 | 739.650 | 743.100 | 746.180 | 748.600 | 749.850 |

| 0.5 | 722.600 | 726.770 | 730.390 | 733.130 | 734.410 |

| 0.1 | 788.820 | 789.050 | 788.830 | 787.780 | 785.000 |

| 0.2 | 771.260 | 771.880 | 771.820 | 770.650 | 767.330 |

| 0.3 | 751.710 | 752.630 | 752.620 | 751.190 | 747.160 |

| 0.4 | 729.930 | 731.020 | 730.950 | 729.060 | 724.230 |

| 0.5 | 705.920 | 707.040 | 706.680 | 704.220 | 698.430 |

| 0.1 | 86.893 | 86.556 | 86.113 | 85.491 | 84.584 |

| 0.2 | 85.446 | 85.128 | 84.688 | 84.068 | 83.133 |

| 0.3 | 83.797 | 83.497 | 83.061 | 82.425 | 81.459 |

| 0.4 | 81.887 | 81.611 | 81.180 | 80.521 | 79.524 |

| 0.5 | 79.678 | 79.412 | 78.974 | 78.303 | 77.257 |

| 0.1 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 0.2 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 0.3 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 0.4 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 0.5 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 0.1 | 326.880 | 326.550 | 326.110 | 325.490 | 324.580 |

| 0.2 | 325.450 | 325.130 | 324.690 | 324.060 | 323.130 |

| 0.3 | 323.800 | 323.490 | 323.060 | 322.420 | 321.470 |

| 0.4 | 321.890 | 321.610 | 321.180 | 320.520 | 319.530 |

| 0.5 | 319.680 | 319.410 | 318.980 | 318.290 | 317.260 |

| 0.1 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

| 0.2 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

| 0.3 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

| 0.4 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

| 0.5 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

Appendix B

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | |

|---|---|---|---|---|---|

| , | |||||

| 10 | 21.310 | 20.920 | 20.400 | 19.700 | 18.660 |

| 20 | 25.680 | 25.320 | 24.850 | 24.180 | 23.190 |

| 30 | 30.050 | 29.730 | 29.290 | 28.670 | 27.730 |

| 40 | 34.420 | 34.130 | 33.730 | 33.160 | 32.270 |

| , | |||||

| 10 | 21.200 | 20.700 | 20.030 | 19.100 | 17.770 |

| 20 | 25.570 | 25.110 | 24.480 | 23.590 | 22.310 |

| 30 | 29.940 | 29.510 | 28.920 | 28.080 | 26.850 |

| 40 | 34.310 | 33.920 | 33.360 | 32.570 | 31.390 |

| 10 | 58.780 | 60.150 | 61.710 | 63.500 | 65.590 |

| 20 | 53.380 | 55.040 | 56.940 | 59.110 | 61.650 |

| 30 | 47.980 | 49.940 | 52.160 | 54.720 | 57.700 |

| 40 | 42.580 | 44.830 | 47.390 | 50.330 | 53.750 |

| 10 | 61.000 | 62.610 | 64.420 | 66.470 | 68.820 |

| 20 | 55.600 | 57.500 | 59.650 | 62.080 | 64.870 |

| 30 | 50.200 | 52.400 | 54.880 | 57.690 | 60.920 |

| 40 | 44.800 | 47.290 | 50.100 | 53.300 | 56.980 |

| 10 | 5.991 | 6.144 | 6.234 | 6.212 | 5.949 |

| 20 | 8.291 | 8.589 | 8.851 | 9.013 | 8.970 |

| 30 | 10.590 | 11.040 | 11.460 | 11.820 | 12.000 |

| 40 | 12.890 | 13.480 | 14.070 | 14.630 | 15.020 |

| 10 | 7.436 | 7.534 | 7.549 | 7.412 | 7.004 |

| 20 | 9.736 | 9.984 | 10.170 | 10.220 | 10.030 |

| 30 | 12.040 | 12.430 | 12.780 | 13.020 | 13.060 |

| 40 | 14.340 | 14.880 | 15.390 | 15.830 | 16.080 |

| 10 | 5.991 | 6.144 | 6.234 | 6.212 | 5.949 |

| 20 | 8.291 | 8.589 | 8.851 | 9.013 | 8.970 |

| 30 | 10.590 | 11.040 | 11.460 | 11.820 | 12.000 |

| 40 | 12.890 | 13.480 | 14.070 | 14.630 | 15.020 |

| 10 | 7.436 | 7.534 | 7.549 | 7.412 | 7.004 |

| 20 | 9.736 | 9.984 | 10.170 | 10.220 | 10.030 |

| 30 | 12.040 | 12.430 | 12.780 | 13.020 | 13.060 |

| 40 | 14.340 | 14.880 | 15.390 | 15.830 | 16.080 |

| 10 | 90.390 | 91.080 | 91.860 | 92.750 | 93.800 |

| 20 | 87.690 | 88.520 | 89.470 | 90.560 | 91.820 |

| 30 | 84.990 | 85.970 | 87.080 | 88.360 | 89.850 |

| 40 | 82.290 | 83.420 | 84.700 | 86.160 | 87.880 |

| 10 | 91.500 | 92.300 | 93.210 | 94.240 | 95.410 |

| 20 | 88.800 | 89.750 | 90.820 | 92.040 | 93.440 |

| 30 | 86.100 | 87.200 | 88.440 | 89.840 | 91.460 |

| 40 | 83.400 | 84.640 | 86.050 | 87.650 | 89.490 |

| 10 | 118.890 | 104.340 | 88.739 | 72.353 | 54.769 |

| 20 | 180.390 | 160.060 | 138.510 | 115.410 | 90.868 |

| 30 | 250.450 | 223.630 | 194.870 | 164.290 | 131.630 |

| 40 | 329.090 | 294.670 | 257.930 | 218.790 | 177.050 |

| 10 | 117.210 | 101.100 | 83.532 | 64.350 | 43.654 |

| 20 | 178.480 | 156.560 | 132.620 | 106.550 | 78.548 |

| 30 | 248.310 | 219.530 | 188.310 | 154.430 | 117.980 |

| 40 | 326.720 | 290.350 | 250.690 | 207.940 | 162.070 |

| 10 | 878.080 | 820.690 | 757.460 | 687.920 | 610.290 |

| 20 | 1117.500 | 1041.000 | 956.710 | 864.200 | 761.400 |

| 30 | 1380.200 | 1281.800 | 1174.300 | 1055.900 | 925.250 |

| 40 | 1666.000 | 1543.400 | 1409.600 | 1263.000 | 1101.600 |

| 10 | 807.460 | 742.890 | 672.400 | 595.250 | 510.680 |

| 20 | 1040.700 | 956.620 | 864.500 | 764.150 | 654.510 |

| 30 | 1297.100 | 1190.600 | 1074.600 | 948.380 | 810.670 |

| 40 | 1576.700 | 1445.700 | 1303.100 | 1147.900 | 978.970 |

| , | |||||

| 10 | 15.392 | 14.915 | 14.364 | 13.727 | 12.974 |

| 20 | 17.462 | 16.871 | 16.196 | 15.408 | 14.485 |

| 30 | 19.531 | 18.832 | 18.022 | 17.092 | 16.000 |

| 40 | 21.601 | 20.784 | 19.849 | 18.778 | 17.510 |

| , | |||||

| 10 | 15.250 | 14.640 | 13.970 | 13.250 | 12.450 |

| 20 | 17.320 | 16.590 | 15.800 | 14.920 | 13.960 |

| 30 | 19.390 | 18.550 | 17.630 | 16.610 | 15.470 |

| 40 | 21.460 | 20.500 | 19.450 | 18.300 | 16.980 |

| , | |||||

| 10 | 13.840 | 13.310 | 12.680 | 11.930 | 11.030 |

| 20 | 15.910 | 15.270 | 14.510 | 13.610 | 12.540 |

| 30 | 17.980 | 17.220 | 16.340 | 15.290 | 14.060 |

| 40 | 20.050 | 19.180 | 18.170 | 16.980 | 15.570 |

| , | |||||

| 10 | 13.690 | 13.030 | 12.280 | 11.450 | 10.500 |

| 20 | 15.760 | 14.990 | 14.120 | 13.130 | 12.020 |

| 30 | 17.840 | 16.940 | 15.950 | 14.810 | 13.530 |

| 40 | 19.910 | 18.900 | 17.770 | 16.500 | 15.040 |

| + | |||||

| 10 | 30.780 | 29.830 | 28.730 | 27.450 | 25.950 |

| 20 | 34.920 | 33.740 | 32.390 | 30.820 | 28.970 |

| 30 | 39.060 | 37.660 | 36.040 | 34.180 | 32.000 |

| 40 | 43.200 | 41.570 | 39.700 | 37.560 | 35.020 |

| +,+ | |||||

| 10 | 29.080 | 27.940 | 26.650 | 25.170 | 23.480 |

| 20 | 33.220 | 31.860 | 30.310 | 28.540 | 26.500 |

| 30 | 37.370 | 35.780 | 33.970 | 31.900 | 29.530 |

| 40 | 41.510 | 39.690 | 37.620 | 35.280 | 32.550 |

| + | |||||

| 10 | 27.380 | 26.050 | 24.570 | 22.890 | 21.000 |

| 20 | 31.520 | 29.970 | 28.240 | 26.260 | 24.030 |

| 30 | 35.670 | 33.890 | 31.890 | 29.620 | 27.060 |

| 40 | 39.810 | 37.810 | 35.550 | 33.000 | 30.080 |

| 10 | 749.410 | 729.820 | 709.240 | 688.080 | 667.100 |

| 20 | 743.440 | 712.030 | 677.950 | 641.510 | 603.030 |

| 30 | 778.980 | 733.340 | 683.350 | 628.660 | 569.160 |

| 40 | 855.890 | 793.690 | 725.290 | 649.550 | 565.640 |

| 10 | 745.050 | 721.570 | 695.630 | 667.150 | 636.310 |

| 20 | 738.730 | 702.800 | 662.750 | 618.080 | 568.460 |

| 30 | 773.810 | 723.230 | 666.450 | 602.690 | 530.920 |

| 40 | 850.340 | 782.720 | 706.790 | 620.940 | 523.600 |

| 10 | 745.050 | 721.570 | 695.630 | 667.150 | 636.330 |

| 20 | 738.680 | 702.830 | 662.770 | 618.080 | 568.460 |

| 30 | 773.850 | 723.240 | 666.460 | 602.590 | 530.920 |

| 40 | 850.360 | 782.700 | 706.770 | 620.950 | 523.640 |

| 10 | 736.900 | 708.460 | 676.040 | 638.890 | 596.610 |

| 20 | 730.180 | 688.860 | 641.610 | 587.300 | 525.080 |

| 30 | 764.920 | 708.360 | 643.700 | 569.220 | 483.780 |

| 40 | 841.070 | 766.960 | 682.320 | 585.010 | 472.700 |

| 10 | 90.792 | 88.993 | 86.944 | 84.562 | 81.797 |

| 20 | 96.999 | 94.878 | 92.440 | 89.619 | 86.340 |

| 30 | 103.210 | 100.740 | 97.932 | 94.666 | 90.882 |

| 40 | 109.420 | 106.630 | 103.410 | 99.719 | 95.426 |

| 10 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 20 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 30 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 40 | 60.000 | 60.000 | 60.000 | 60.000 | 60.000 |

| 10 | 330.790 | 329.000 | 326.940 | 324.560 | 321.800 |

| 20 | 337.060 | 334.850 | 332.440 | 329.620 | 326.340 |

| 30 | 343.200 | 340.730 | 337.910 | 334.710 | 330.880 |

| 40 | 349.390 | 346.700 | 343.400 | 339.660 | 335.390 |

| 10 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

| 20 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

| 30 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

| 40 | 300.000 | 300.000 | 300.000 | 300.000 | 300.000 |

References

- Wu, H.; Han, X.; Yang, Q.; Pu, X. Production and coordination decisions in a closed-loop supply chain with remanufacturing cost disruptions when retailers compete. J. Intell. Manuf. 2018, 29, 227–235. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Van Wassenhove, L.N. Closed-Loop Supply Chain Models with Product Remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Giovanni, P.D.; Reddy, P.V.; Zaccour, G. Incentive strategies for an optimal recovery program in a closed-loop supply chain. Eur. J. Oper. Res. 2016, 249, 605–617. [Google Scholar] [CrossRef]

- Hammond, D.; Beullens, P. Closed-loop supply chain network equilibrium under legislation. Eur. J. Oper. Res. 2007, 183, 895–908. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Van Wassenhove, L.N. Reverse Channel Design: The Case of Competing Retailers. Manag. Sci. 2006, 52, 1–14. [Google Scholar] [CrossRef]

- Hong, I.H.; Yeh, J.S. Modeling closed-loop supply chains in the electronics industry: A retailer collection application. Transp. Res. Part E 2012, 48, 817–829. [Google Scholar] [CrossRef]

- He, Y. Acquisition pricing and remanufacturing decisions in a closed-loop supply chain. Int. J. Prod. Econ. 2015, 163, 48–60. [Google Scholar] [CrossRef]

- Atasu, A.; Çetinkaya, S. Lot Sizing for Optimal Collection and Use of Remanufacturable Returns over a Finite Life-Cycle. Prod. Oper. Manag. 2006, 15, 473–487. [Google Scholar] [CrossRef]

- Gaur, J.; Amini, M.; Rao, A.K. Closed-loop supply chain configuration for new and reconditioned products: An integrated optimization model. Omega 2017, 66, 212–223. [Google Scholar] [CrossRef]

- Esenduran, G.; Kemahlýoðlu-Ziya, E.; Swaminathan, J.M. Impact of Take-Back Regulation on the Remanufacturing Industry. Prod. Oper. Manag. 2017, 26, 924–944. [Google Scholar] [CrossRef]

- Voigt, G.; Inderfurth, K. Supply chain coordination with information sharing in the presence of trust and trustworthiness. IIE Trans. 2012, 44, 637–654. [Google Scholar] [CrossRef]

- Biswas, I.; Avittathur, B.; Chatterjee, A.K. Impact of structure, market share and information asymmetry on supply contracts for a single supplier multiple buyer network. Eur. J. Oper. Res. 2016, 253, 593–601. [Google Scholar] [CrossRef]

- Liu, Z.; Zhao, R.; Liu, X.; Chen, L. Contract designing for a supply chain with uncertain information based on confidence level. Appl. Soft Comput. 2017, 56, 617–631. [Google Scholar] [CrossRef]

- Cao, E.; Ma, Y.; Wan, C.; Lai, M. Contracting with asymmetric cost information in a dual-channel supply chain. Oper. Res. Lett. 2013, 41, 410–414. [Google Scholar] [CrossRef]

- Çakanyýldýrým, M.; Feng, Q.; Gan, X.; Sethi, S.P. Contracting and Coordination under Asymmetric Production Cost Information. Prod. Oper. Manag. 2012, 21, 345–360. [Google Scholar] [CrossRef]

- Zhang, P.; Xiong, Y.; Xiong, Z.; Yan, W. Designing contracts for a closed-loop supply chain under information asymmetry. Oper. Res. Lett. 2014, 42, 150–155. [Google Scholar] [CrossRef]

- Giovanni, P.D. Closed-loop supply chain coordination through incentives with asymmetric information. Ann. Oper. Res. 2017, 253, 133–167. [Google Scholar] [CrossRef]

- Wei, J.; Govindan, K.; Li, Y.; Zhao, J. Pricing and collecting decisions in a closed-loop supply chain with symmetric and asymmetric information. Comput. Oper. Res. 2015, 54, 257–265. [Google Scholar] [CrossRef]

- Zhang, P.; Xiong, Z.; Mauro, A. Information Sharing in a Closed-Loop Supply Chain with Asymmetric Demand Forecasts. Math. Probl. Eng. 2017, 2017, 1–12. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.; Li, Y.; Zhao, X.; Cheng, M. Closed-loop supply chains under reward-penalty mechanism: Retailer collection and asymmetric information. J. Clean. Prod. 2017, 142, 3938–3955. [Google Scholar] [CrossRef]

- Huang, M.; Song, M.; Lee, L.; Ching, W. Analysis for strategy of closed-loop supply chain with dual recycling channel. Int. J. Prod. Econ. 2013, 144, 510–520. [Google Scholar] [CrossRef]

- Hong, X.; Wang, Z.; Wang, D.; Zhang, H. Decision models of closed-loop supply chain with remanufacturing under hybrid dual-channel collection. Int. J. Adv. Manuf. Technol. 2013, 68, 1851–1865. [Google Scholar] [CrossRef]

- Feng, L.; Govindan, K.; Li, C. Strategic planning: Design and coordination for dual-recycling channel reverse supply chain considering consumer behavior. Eur. J. Oper. Res. 2016, 260, 601–612. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Dual-Recycling Channel Decision in a Closed-Loop Supply Chain with Cost Disruptions. Sustainability 2017, 9, 2004. [Google Scholar] [CrossRef]

- Zhao, J.; Wei, J.; Li, M. Collecting channel choice and optimal decisions on pricing and collecting in a remanufacturing supply chain. J. Clean. Prod. 2017, 167, 530–544. [Google Scholar] [CrossRef]

- Xie, L.; Ma, J. Study the complexity and control of the recycling-supply chain of China’s color TVs market based on the government subsidy. Commun. Nonlinear Sci. Numer. Simul. 2016, 38, 102–116. [Google Scholar] [CrossRef]

- Shimada, T.; Van Wassenhove, L.N. Closed-Loop supply chain activities in Japanese home appliance/personal computer manufacturers: A case study. Int. J. Prod. Econ. 2016, in press. [Google Scholar] [CrossRef]

- Ma, W.; Zhao, Z.; Ke, H. Dual-channel closed-loop supply chain with government consumption-subsidy. Eur. J. Oper. Res. 2013, 226, 221–227. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Jafari, A. Reverse and closed loop supply chain coordination by considering government role. Transp. Res. Part D 2017, 52, 379–398. [Google Scholar] [CrossRef]

- Rahman, S.; Subramanian, N. Factors for implementing end-of-life computer recycling operations in reverse supply chains. Int. J. Prod. Econ. 2012, 140, 239–248. [Google Scholar] [CrossRef]

- He, S.; Yuan, X.; Zhang, X. The Government’s Environment Policy Index Impact on Recycler Behavior in Electronic Products Closed-Loop Supply Chain. Discret. Dyn. Nat. Soc. 2016, 2016, 1–8. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.; Zhang, K.; Bai, T.; Shang, J. Reward-penalty mechanism for closed-loop supply chains under responsibility-sharing and different power structures. Int. J. Prod. Econ. 2015, 170, 178–190. [Google Scholar] [CrossRef]

- Teunter, R.H.; Flapper, S.D.P. Optimal core acquisition and remanufacturing policies under uncertain core quality fractions. Eur. J. Oper. Res. 2011, 210, 241–248. [Google Scholar] [CrossRef]

- Yi, P.; Huang, M.; Guo, L.; Shi, T. Dual recycling channel decision in retailer oriented closed-loop supply chain for construction machinery remanufacturing. J. Clean. Prod. 2016, 137, 1393–1405. [Google Scholar] [CrossRef]

- Wang, N.; He, Q.; Jiang, B. Hybrid closed-loop supply chains with competition in recycling and product markets. Int. J. Prod. Econ. 2018, in press. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 569–583. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Giri, B.C.; Chakraborty, A.; Maiti, T. Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. J. Manuf. Syst. 2017, 42, 104–123. [Google Scholar] [CrossRef]

| Symbol | Description |

|---|---|

| Model parameters | |

| The cost of manufacturing one product with new materials. | |

| The cost of remanufacturing one product with recycling components. | |

| Unit cost savings from remanufacturing, . | |

| Competition intensity. It represents the degree of competition between the retailer and the third-party recycler when they collect WEEEs. . | |

| Collection effort level of the retailer. , . | |

| Collection effort level of the third-party recycler. , . | |

| The franchise fee that the manufacturer charges the retailer when she chooses contract , . | |

| The franchise fee that the manufacturer charges the third-party recycler when she chooses contract , . | |

| Collection quantity of the retailer when she chooses contract under her real collection effort level , while the third-party recycler chooses contract under her real collection effort level . | |

| Collection quantity of the third-party recycler when she chooses contract under her real collection effort level , while the retailer chooses contract under her real collection effort level . | |

| Reward–penalty intensity decided by government. | |

| Target collection quantity set by government. | |

| Probability of the retailer or the third-party recycler adopting collection effort level, which is available to both collection agents. | |

| Decision variables | |

| Wholesale price of the manufacturer when the retailer chooses contract , . | |

| Retail price of the retailer with the choice of contract when her real collection effort level is , . | |

| Unit collection price of the retailer with the choice of contract when her real collection effort level is , . | |

| Unit collection price of the third-party recycler with the choice of contract when her real collection effort level is , . | |

| Buyback price paid by the manufacturer to the retailer for each collected WEEE with her choice of contract , . | |

| Buyback price paid by the manufacturer to the third-party recycler for each collected WEEE with her choice of contract , . | |

| Other notations | |

| Information screening contract designed for the manufacturer, which means the retailer opts for buy-back price , wholesale price and gives franchise fee , . | |

| Information screening contract designed for the manufacturer, which means the third-party recycler opts for buy-back price , wholesale price and gives franchise fee , . | |

| Expected profit of the manufacturer with the third-party recycler’s choice of contract and the retailer’s choice of contract , . | |

| Expected profit of the retailer with her choice of contract under her real collection effort level , . | |

| Expected profit of the third-party recycler with her choice of contract under her real collection effort level , . | |

| Reserved profit of the retailer without contract. | |

| Reserved profit of the third-party recycler without contract. |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, W.; Zhou, S.; Zhang, M.; Sun, H.; He, L. A Closed-Loop Supply Chain with Competitive Dual Collection Channel under Asymmetric Information and Reward–Penalty Mechanism. Sustainability 2018, 10, 2131. https://doi.org/10.3390/su10072131

Wang W, Zhou S, Zhang M, Sun H, He L. A Closed-Loop Supply Chain with Competitive Dual Collection Channel under Asymmetric Information and Reward–Penalty Mechanism. Sustainability. 2018; 10(7):2131. https://doi.org/10.3390/su10072131

Chicago/Turabian StyleWang, Wenbin, Shuya Zhou, Meng Zhang, Hao Sun, and Lingyun He. 2018. "A Closed-Loop Supply Chain with Competitive Dual Collection Channel under Asymmetric Information and Reward–Penalty Mechanism" Sustainability 10, no. 7: 2131. https://doi.org/10.3390/su10072131

APA StyleWang, W., Zhou, S., Zhang, M., Sun, H., & He, L. (2018). A Closed-Loop Supply Chain with Competitive Dual Collection Channel under Asymmetric Information and Reward–Penalty Mechanism. Sustainability, 10(7), 2131. https://doi.org/10.3390/su10072131