How Business Idea Fit Affects Sustainability and Creates Opportunities for Value Co-Creation in Nascent Firms

Abstract

1. Introduction

“Businesses create shared value when they can make a profit—create economic value—while simultaneously meeting important social needs or important social goals like improving environmental performance, reducing problems of health, improving nutrition, reducing disability, improving safety, and helping people save for retirement. The basic idea of shared value is that there are many opportunities in meeting these societal needs to actually create economic value in the process. Shared value is where you do both.”[1] (p. 423)

2. Business Idea Fit

2.1. Knowledge Relatedness

2.2. Resource Relatedness

2.3. Market Profitability Relatedness

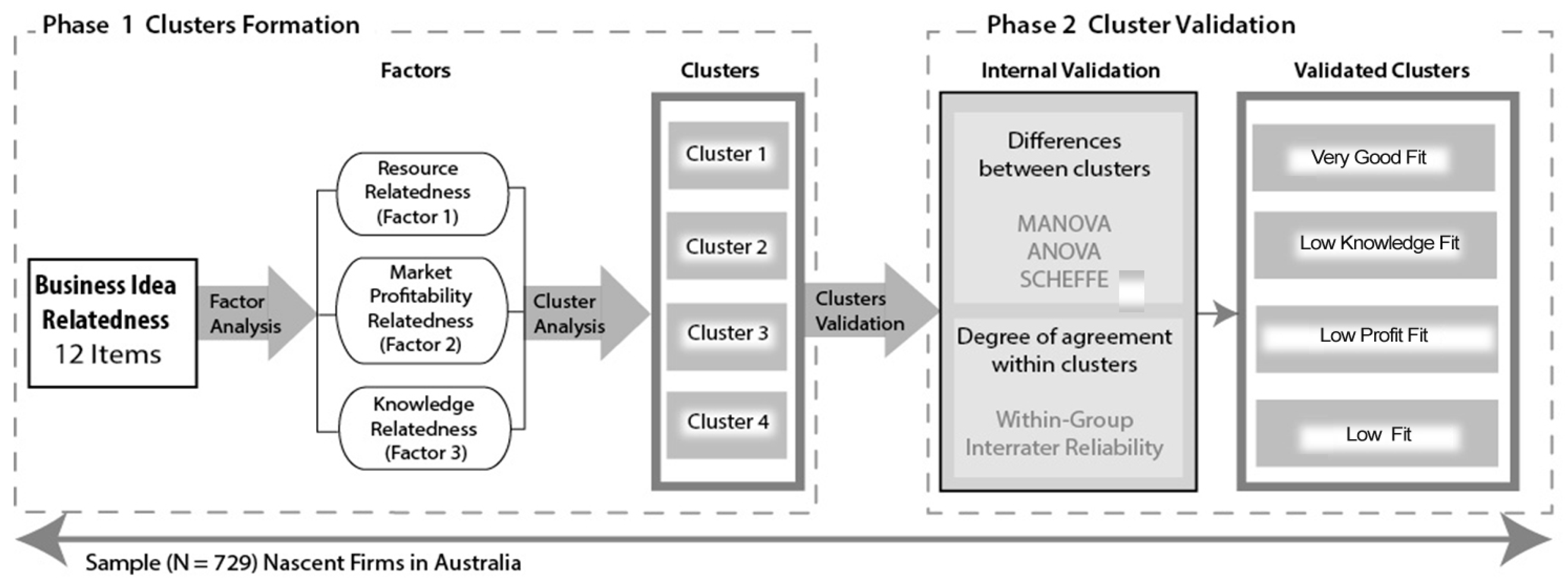

3. Empirical Taxonomy

4. Methodology

Data Analysis Overview

5. Results

6. Discussion

7. Conclusions and Limitations

Author Contributions

Conflicts of Interest

References

- Driver, M. An Interview with Micheal Porter: Social Entrepreneurship and the Transformation of Capitalism. Acad. Manag. Learn. Educ. 2012, 11, 421–431. [Google Scholar] [CrossRef]

- Williamson, O. Corporate Governance. Yale Law J. 1984, 93, 1197–1230. [Google Scholar] [CrossRef]

- Jensen, M.C. Non-rational behavior, value conflicts, stakeholder theory, and firm behavior. Bus. Ethics Q. 2008, 18, 167–171. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and Society: The Link between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [CrossRef] [PubMed]

- Dawson, P.; Daniel, L. Understanding social innovation: A provisional framework. Int. J. Technol. Manag. 2010, 51, 9–21. [Google Scholar] [CrossRef]

- Martins, T.C.M.; de Souza Bermejo, P.H. Open Social Innovation. In Handbook of Research on Democratic Strategies and Citizen-Centered E-Government Services; IGI Global: Hershey, PA, USA, 2015; pp. 144–163. ISBN 13: 9781466684683. [Google Scholar]

- European Union. Social Innovation. 2015. Available online: https://ec.europa.eu/growth/industry/innovation/policy/social_en (accessed on 12 October 2017).

- Hopwood, B.; Mellor, M.; O’Brien, G. Sustainable Development: Mapping Different Approaches. Sustain. Dev. 2005, 13, 38–52. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks—The Triple Bottom Line of 21st Century Business; Capstone Publishing Ltd.: Oxford, UK, 1997. [Google Scholar]

- Elkington, J. Governance for sustainability. Corp. Gov. 2006, 14, 522–529. [Google Scholar] [CrossRef]

- Kuckerts, A.; Wagner, M. The influence of sustainability orientation on entrepreneurial intentions-Investigating the role of business experience. J. Bus. Ventur. 2010, 25, 524–539. [Google Scholar] [CrossRef]

- Hawken, P. The Ecology of Commerce: A Declaration of Sustainability; Harper Business: New York, NY, USA, 1993. [Google Scholar]

- Viederman, S. Public policy: Challenge to ecological economic. In Investing in Natural Capital: The Ecological Economics Approach to Sustainability; Jansson, A., Hammer, M., Folke, C., Costanza, R., Eds.; Island Press: Washington, DC, USA, 1994; pp. 467–478. [Google Scholar]

- Davidsson, P. Researching Entrepreneurship; Springer: New York, NY, USA, 2004. [Google Scholar]

- Witell, L.; Kristensson, P.; Gustafsson, A.; Löfgren, M. Idea generation: Customer co-creation versus traditional market research techniques. J. Serv. Manag. 2011, 22, 140–159. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Evolving to a new dominant logic for marketing. J. Market. 2004, 68, 1–17. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service-dominant logic: Continuing the evolution. J. Acad. Mark. Sci. 2008, 36, 1–10. [Google Scholar] [CrossRef]

- Nenonen, S.; Storbacka, K. Business model design: Conceptualizing networked value co-creation. Int. J. Q. Serv. Sci. 2010, 2, 43–59. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Institutions and axioms: An extension and update of service-dominant logic. J. Acad. Mark. Sci. 2016, 44, 5–23. [Google Scholar] [CrossRef]

- Al-Debei, M.M.; El-Haddadeh, R.E.; Avison, D. Defining the Business Model in the New World of Digital Business. In Proceedings of the Americas Conference on Information Systems, Toronto, ON, Canada, 14–17 August 2008. [Google Scholar]

- Hamel, G. Leading the Revolution; Harvard Business School Press: Boston, MA, USA, 2000. [Google Scholar]

- Voelpel, S.C.; Leibold, M.; Tekie, E.B. The wheel of business model reinvention: How to reshape your business model to leapfrog competitors. J. Chang. Manag. 2004, 4, 259–276. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. The fit between product market strategy and business model: Implications for firm performance. Strateg. Manag.J. 2008, 29, 1–26. [Google Scholar] [CrossRef]

- Storbacka, K.; Frow, P.; Nenonen, S.; Payne, A. Designing Business Models for Value Co-Creation. In Special Isssue—Toward a Better Understanding of the Role of Value in Markets and Marketing Research; Vargo, S.L., Lusch, R.F., Eds.; Emerald Group Publishing: Bingley, UK, 2012; pp. 51–78. [Google Scholar]

- Semasinghe, D.M.; Davidsson, P.; Steffens, P.R. Nascent venture performance: Linking novelty of venture ideas and commitment of firm founders as predictors. In Proceedings of the 8th AGSE International Entrepreneurship Research Exchange, Melbourne, Australian, 1–4 February 2011; Maritz, A., Ed.; Swinburne University of Technology: Melbourne, Australia; pp. 597–607. [Google Scholar]

- Shane, S.; Venkataraman, S. The Promise of Entrepreneurship as a Field of Research. Acad. Manag. Rev. 2000, 25, 217–226. [Google Scholar] [CrossRef]

- Semasinghe, D.M. The Role of Idea Novelty and Relatedness on Venture Performance. Ph.D. Thesis, Business School, Queensland University of Technology, Brisbane, Australia, February 2011. [Google Scholar]

- Davis, P.S.; Robinson, R.B., Jr.; Pearce, J.A., II; Park, S.H. Business Unit Relatedness and Performance: A Look at the Pulp and Paper Industry. SMJ 1992, 13, 349–362. [Google Scholar] [CrossRef]

- Farjoun, M. The Independent and Joint Effects of The Skill and Physical Bases of Relatedness in Diversification. Strateg. Manag.J. 1998, 19, 611–630. [Google Scholar] [CrossRef]

- Lampert, C.M. Learning and Corporate Evolution: A Longitudinal Study of How Product-Market Relatedness and Environmental Relatedness Impact Firm Scope. Ph.D. Thesis, Degree of Doctor of Philosophy. Faculty of the Graduate School, University of Texas at Austin, Austin, TX, USA, August 2003. Available online: https://repositories.lib.utexas.edu/bitstream/handle/2152/418/lampertcm036.txt?sequence=3 (accessed on 10 October 2017).

- D’Aveni, R.A.; Ravenscraft, D.J.; Anderson, P. From corporate strategy to business-level advantage: Relatedness as resource congruence. Manag. Decis. Econ. 2004, 25, 365–381. [Google Scholar] [CrossRef]

- Pehrsson, A. Business relatedness measurements. Eur. Bus. Rev. 2006, 18, 350–363. [Google Scholar] [CrossRef]

- Cooper, A.C.; Folta, T.B.; Woo, C.Y. Entrepreneurial information search. J. Bus. Ventur. 1995, 10, 107–120. [Google Scholar] [CrossRef]

- Fiet, J.O. Entrepreneurial Competence as Knowledge; Jönköping International Business School: Jönköping, Sweden, 1999. [Google Scholar]

- Shane, S. Prior knowledge and the discovery of entrepreneurial opportunities. Organ. Sci. 2000, 11, 448–469. [Google Scholar] [CrossRef]

- Chandler, G.N.; Hanks, S.H. Market attractiveness, resource-based capabilities, venture strategies, and venture performance. J. Bus. Ventur. 1994, 9, 331–349. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 4th ed.; The Free Press: New York, NY, USA, 1995. [Google Scholar]

- Normann, R. Management for Growth; Wiley: Chichester, UK, 1977. [Google Scholar]

- Normann, R. Reframing Business: When the Map Changes the Landscape; Wiley: Chichester, UK, 2001. [Google Scholar]

- Hedman, J.; Kalling, T. The business model concept: Theoretical underpinnings and empirical illustrations. Eur. J. Inf. Syst. 2003, 12, 49–59. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business Model Design and the Performance of Entrepreneurial Firms. Organ. Sci. 2007, 18, 181–199. [Google Scholar] [CrossRef]

- Frow, P.; Payne, A. A stakeholder perspective of the value proposition concept. Eur. J. Market. 2011, 45, 223–240. [Google Scholar] [CrossRef]

- Bollinger, A.S.; Smith, R.D. Managing organizational knowledge as a strategic asset. J. Knowl. Manag. 2001, 5, 8–18. [Google Scholar] [CrossRef]

- Berger, P.L.; Luckmann, T. The Social Construction of Reality: A treatIse in the Sociology of Knowledge; Penguin: London, UK, 1967. [Google Scholar]

- Hunt, S.D. A General Theory of Competition: Resources, Competences, Productivity, Economic Growth; Sage Publications: Thousand Oaks, CA, USA, 2000. [Google Scholar]

- Lusch, R.F.; Vargo, S.L.; O’Brien, M. Competing through service: Insights from service-dominant logic. J. Retail. 2007, 83, 5–18. [Google Scholar] [CrossRef]

- Zhang, X.; Chen, R. Examining the mechanism of the value co-creation with customers. Int. J. Product. Econ. 2008, 116, 242–250. [Google Scholar] [CrossRef]

- Maglio, P.P.; Spohrer, J. Fundamentals of service science. J. Acad. Mark. Sci. 2008, 36, 18–20. [Google Scholar] [CrossRef]

- Enz, M.G.; Lambert, D.M. Using cross-functional, cross-firm teams to co-create value: The role of financial measures. Ind. Mark. Manag. 2012, 41, 495–507. [Google Scholar] [CrossRef]

- Grover, V.; Kohli, R. Co-creating IT value: New capabilities and metrics for multifirm environments. MIS Q. 2012, 36, 225–232. [Google Scholar]

- Powell, J.H.; Swart, J. Mapping the values in B2B relationships: A systemic, knowledge-based perspective. Ind. Mark. Manag. 2010, 39, 437–449. [Google Scholar] [CrossRef]

- Ramirez, R. Value co-production: Intellectual origins and implications for practice and research. Strateg. Manag. J. 1999, 20, 49–65. [Google Scholar] [CrossRef]

- Fisher, D.; Smith, S. Co-creation is chaotic: What it means for marketing when no one has control. Mark. Theory 2011, 11, 325–350. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D.A. Knowledge-Based Resources, Entrepreneurial Orientation, and the Performance of Small and Medium-Sized Businesses. SMJ 2003, 24, 1307–1314. [Google Scholar] [CrossRef]

- Tanriverdi, H.; Venkatraman, N. Knowledge Relatedness and the Performance of Multibusiness Firms. Strateg. Manag. J. 2005, 26, 97–119. [Google Scholar] [CrossRef]

- West, G.P.; Noel, T.W. The impact of knowledge resources on new venture performance. J. Small Bus. Manag. 2009, 47, 1–22. [Google Scholar] [CrossRef]

- Kirzner, I.M. Competition and Entrepreneurship; University of Chicago Press: Chicago, IL, USA, 1973. [Google Scholar]

- Katz, J.; Gartner, W.B. Properties of Emerging Organizations. Acad. Manag. Rev. 1988, 13, 429–441. [Google Scholar] [CrossRef]

- Brush, C.G.; Greene, P.G.; Hart, M.M. From initial idea to unique advantage: The entrepreneurial challenge of constructing a resource base. Acad. Manag. Exec. 2001, 15, 64–78. [Google Scholar] [CrossRef]

- Arnould, E.J. Service-dominant logic and resource theory. J. Acad. Mark. Sci. 2008, 36, 21–24. [Google Scholar] [CrossRef]

- Lusch, R.F.; Vargo, S.L. Service dominant logic as a foundation for a general theory. In The Service-Dominant Logic of Marketing: Dialog, Debate, and Directions; Lusch, R.F., Vargo, S.L., Eds.; ME Sharpe: Armonk, NY, USA, 2006; pp. 251–265. [Google Scholar]

- Storbacka, K.; Nenonen, S.; Korkman, O. Markets as Configurations: A Research Agenda for Cocreated Markets; Working Paper; Nyenrode Business Universiteit: Breukelen, The Netherlands, 2009. [Google Scholar]

- Vargo, S.L. On a theory of markets and marketing: From positively normative to normatively positive. Australas. Mark. J. 2007, 15, 53–60. [Google Scholar] [CrossRef]

- Storbacka, K.; Brodie, R.J.; Böhmann, T.; Maglio, P.P.; Nenonen, S. Actor engagement as a microfoundation for value co-creation. J. Bus. Res. 2016, 69, 3008–3017. [Google Scholar] [CrossRef]

- Vargo, S.L.; Maglio, P.P.; Akaka, M.A. On value and value co-creation: A service systems and service logic perspective. Eur. Manag. J. 2008, 26, 145–152. [Google Scholar] [CrossRef]

- Frow, P.; McColl-Kennedy, J.R.; Hilton, T.; Davidson, A.; Payne, A.; Brozovic, D. Value propositions: A service ecosystems perspective. Mark. Theory 2014, 14, 327–351. [Google Scholar] [CrossRef]

- Merz, M.A.; He, Y.; Vargo, S.L. The evolving brand logic: A service dominant logic perspective. J. Acad. Mark. Sci. 2009, 37, 328–344. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. It’s all B2B…and beyond: Toward a systems perspective of the market. Ind. Mark. Manag. 2011, 40, 181–187. [Google Scholar] [CrossRef]

- Hunt, S.D.; Derozier, C. The normative imperatives of business and marketing strategy: Grounding strategy in resource advantage theory. J. Bus. Ind. Market. 2004, 19, 5–22. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barreto, I. A behavioral theory of market expansion based on the opportunity prospects rule. Organ. Sci. 2012, 23, 1008–1023. [Google Scholar] [CrossRef]

- Plumly, L.W., Jr.; Marshall, L.L.; Eastman, J.; Iyer, R.; Stanley, K.L.; Boatwright, J. Developing entrepreneurial competencies: A student business. J. Entrep. Educ. 2008, 11, 17–28. [Google Scholar]

- Anker, T.B.; Sparks, L.; Moutinho, L.; Grönroos, C. Consumer dominant value creation: A theoretical response to the recent call for a consumer dominant logic for marketing. Eur. J. Market. 2015, 49, 532–560. [Google Scholar] [CrossRef]

- Grönroos, C. Value co-creation in service-logic: A critical analysis. Mark. Theory 2011, 11, 279–301. [Google Scholar] [CrossRef]

- Payne, A.F.; Storbacka, K.; Frow, P. Managing the co-creation of value. J. Acad. Mark. Sci. 2008, 36, 83–96. [Google Scholar] [CrossRef]

- Aarikka-Stenroos, L.; Jaakkola, E. Value co-creation in knowledge intensive business services: A dyadic perspective on the joint problem solving process. Ind. Mark. Manag. 2012, 41, 15–26. [Google Scholar] [CrossRef]

- Edvardsson, B.; Tronvoll, B.; Gruber, T. Expanding understanding of service exchange and value co-creation: A social construction approach. J. Acad. Mark. Sci. 2011, 39, 327–339. [Google Scholar] [CrossRef]

- Ordanini, A.; Pasini, P. Service co-production and value co-creation: The case for a service-oriented architecture (SOA). Eur. Manag. J. 2008, 26, 289–297. [Google Scholar] [CrossRef]

- Burns, T. The comparative study of organizations. In Methods of Organizational Research; Vroom, V.H., Ed.; University of Pittsburgh Press: Pittsburgh, PA, USA, 1967; pp. 113–170. [Google Scholar]

- Davidsson, P. Entrepreneurship—And after? A study of growth willingness in small firms. J. Bus. Ventur. 1989, 4, 211–226. [Google Scholar] [CrossRef]

- Rich, V. Code on medical ethics divides Poland’s doctors. New Sci. 1992, 133, 13. [Google Scholar]

- Archibugi, D. Pavitt’s taxonomy sixteen years on: A review article. Econ. Innovat. New Technol. 2001, 10, 415–425. [Google Scholar] [CrossRef]

- De Jong, J.P.; Marsili, O. The fruit flies of innovations: A taxonomy of innovative small firms. Res. Policy 2006, 35, 213–229. [Google Scholar] [CrossRef]

- Ketchen, D.J.; Shook, C.L. The application of cluster analysis in strategic management research: An analysis and critique. Strateg. Manag. J. 1996, 17, 441–458. [Google Scholar] [CrossRef]

- Sabherwal, R.; Robey, D. Reconciling variance and process strategies for studying information system development. Inf. Syst. Res. 1995, 6, 303–327. [Google Scholar] [CrossRef]

- Davidsson, P.; Steffens, P.R.; Gordon, S.R.; Reynolds, P. Anatomy of New Business Activity in Australia: Some Early Observations from the CAUSEE Project. In School of Management Technical Report, Faculty of Business; Queensland University of Technology: Brisbane, Australia, 2008. [Google Scholar]

- Hair, J.F., Jr.; Babin, B.; Money, A.H.; Samouel, P. Essential of Business Research Methods; Wiley: Hoboken, NJ, USA, 2003. [Google Scholar]

- James, L.R.; Memaree, R.G.; Wolf, G. An assessment of within-group interrater agreement. J. Appl. Psychol. 1993, 78, 306–309. [Google Scholar] [CrossRef]

- Ronstadt, R. The Corridor Principle. J. Bus. Ventur. 1988, 3, 31–40. [Google Scholar] [CrossRef]

| Variables | Mean | Std Dev. | Min. | Max. | 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Gender | 1.41 | 0.491 | 1 | 2 | 1 | 0.032 | −0.090 * | 0.018 | −0.029 | 0.023 |

| 2 | Employment Status | 1.91 | 1.065 | 1 | 6 | 0.032 | 1 | 0.100 ** | −0.037 | −0.011 | 0.009 |

| 3 | Education | 3.69 | 1.592 | 1 | 8 | −0.090 * | 0.100 ** | 1 | 0.001 | 0.065 | −0.047 |

| 4 | Resource Relatedness | 4.2561 | 0.8631 | 1 | 5 | 0.018 | −037 | 0.001 | 1 | 0.402 ** | 0.363 ** |

| 5 | Profitability Relatedness | 3.9272 | 0.9746 | 1 | 5 | −0.029 | −0.011 | 0.065 | 0.402 ** | 1 | 0.264 ** |

| 6 | Knowledge Relatedness | 4.1976 | 0.8006 | 1 | 5 | 0.023 | 0.009 | −0.047 | 0.363 ** | 0.264 ** | 1 |

| Knowledge Relatedness | |

| A | The PRODUCT/SERVICE offerings are selected so that they are very closely matched with the knowledge and skills that you already had |

| B | The customers or target markets are selected so that they are very closely matched with the knowledge and skills that you already had |

| C | The methods for producing or sourcing are selected so that they are very closely matched with the knowledge and skills that you already had |

| D | The methods for promotion and selling are selected so that they are very closely matched with the knowledge and skills that you already had |

| Profitability Relatedness | |

| E | The PRODUCT/SERVICE offerings are selected because they represent the most profitable opportunities that exist in the market |

| F | The customers or target markets are selected because they represent the most profitable opportunities that exist in the market |

| G | The methods for producing or sourcing are selected because they represent the most profitable opportunities that exist in the market |

| H | The methods for promotion and selling are selected because they represent the most profitable opportunities that exist in the market closely match the financial, physical and other resources you have access to |

| Resource Relatedness | |

| I | The PRODUCT/SERVICE offerings are selected to very closely match the financial, physical and other resources you have access to |

| J | The customers or target markets are selected to very closely match the financial, physical and other resources you have access to |

| K | The methods for producing or sourcing are selected to very closely match the financial, physical and other resources you have access to |

| L | The methods for promotion and selling are selected to very closely match the financial, physical and other resources you have access to |

| Items Business Idea Relatedness… | Factors 1 Loading Resource Relatedness | Factors 2 Loading Profitability Relatedness | Factors 3 Loading Knowledge Relatedness |

|---|---|---|---|

| …product related to knowledge and skills | 0.117 | 0.039 | 0.749 |

| …customer or target market related to knowledge and skills | 0.197 | 0.069 | 0.671 |

| …production methods related to knowledge and skills | 0.124 | 0.070 | 0.783 |

| …promotion methods related to knowledge and skills | 0.127 | 0.191 | 0.644 |

| …product represents most profitable opportunity | 0.126 | 0.776 | 0.074 |

| …customer or target market represents most profitable opportunity | 0.130 | 0.832 | 0.096 |

| …production methods represent most profitable opportunities | 0.189 | 0.770 | 0.086 |

| …represents the most profitable opportunities | 0.150 | 0.730 | 0.130 |

| …product matches own resources | 0.781 | 0.184 | 0.144 |

| …customer or target market matches own resources | 0.797 | 0.126 | 0.210 |

| …production methods matches own resources | 0.826 | 0.149 | 0.159 |

| …promotion method matches own resources | 0.765 | 0.175 | 0.137 |

| Cronbach’s Alpha | 0.719 (4 items) | 0.811 (4 items) | 0.842(4 items) |

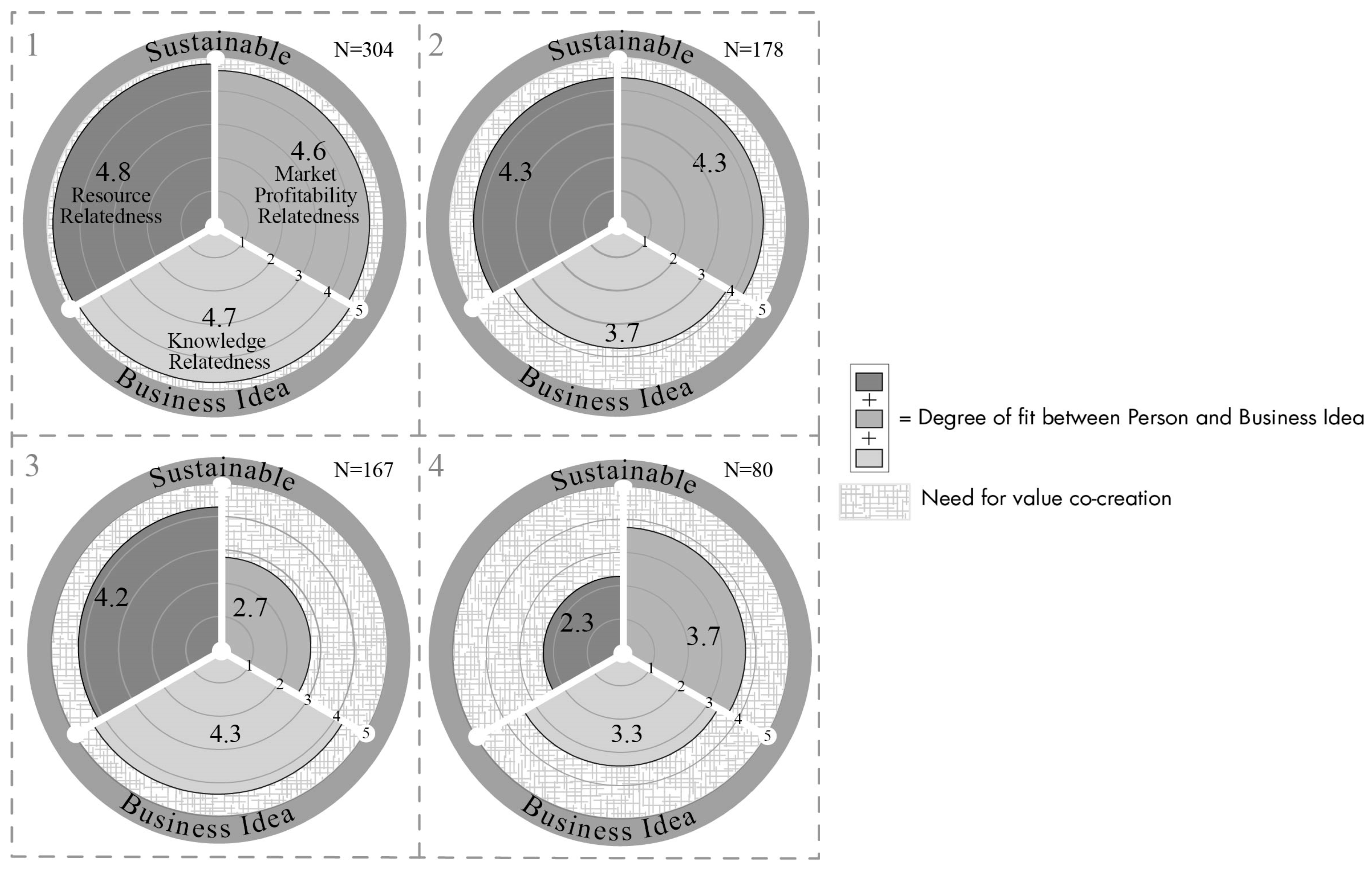

| Factors | Cluster 1 (N = 304) | Cluster 2 (N = 178) | Cluster 3 (N = 167) | Cluster 4 (N = 80) | Scheffe Results | F | Sig. |

|---|---|---|---|---|---|---|---|

| Factors 1 Resource Relatedness | 4.7656 | 4.2893 | 4.2231 | 2.3271 | 1 & 2, 2 & 3, 1 & 4, and 2 & 4 | 554.5 | 0.000 |

| Factor 2 Profitability Relatedness | 4.5543 | 4.2734 | 2.7440 | 3.2688 | 1 & 2, 2 & 3, and 13 | 350.1 | 0.000 |

| Factor 3 Knowledge Relatedness | 4.7196 | 3.6484 | 4.2560 | 3.3219 | 1 & 2, 2 & 3, and 1 & 3 | 179.1 | 0.000 |

| James test of internal interrater reliability | 98% | 97% | 95% | 83% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Casali, G.L.; Perano, M.; Moretta Tartaglione, A.; Zolin, R. How Business Idea Fit Affects Sustainability and Creates Opportunities for Value Co-Creation in Nascent Firms. Sustainability 2018, 10, 189. https://doi.org/10.3390/su10010189

Casali GL, Perano M, Moretta Tartaglione A, Zolin R. How Business Idea Fit Affects Sustainability and Creates Opportunities for Value Co-Creation in Nascent Firms. Sustainability. 2018; 10(1):189. https://doi.org/10.3390/su10010189

Chicago/Turabian StyleCasali, Gian Luca, Mirko Perano, Andrea Moretta Tartaglione, and Roxanne Zolin. 2018. "How Business Idea Fit Affects Sustainability and Creates Opportunities for Value Co-Creation in Nascent Firms" Sustainability 10, no. 1: 189. https://doi.org/10.3390/su10010189

APA StyleCasali, G. L., Perano, M., Moretta Tartaglione, A., & Zolin, R. (2018). How Business Idea Fit Affects Sustainability and Creates Opportunities for Value Co-Creation in Nascent Firms. Sustainability, 10(1), 189. https://doi.org/10.3390/su10010189