A Review of Factors Influencing the Cost Development of Electricity Generation Technologies

Abstract

:1. Introduction

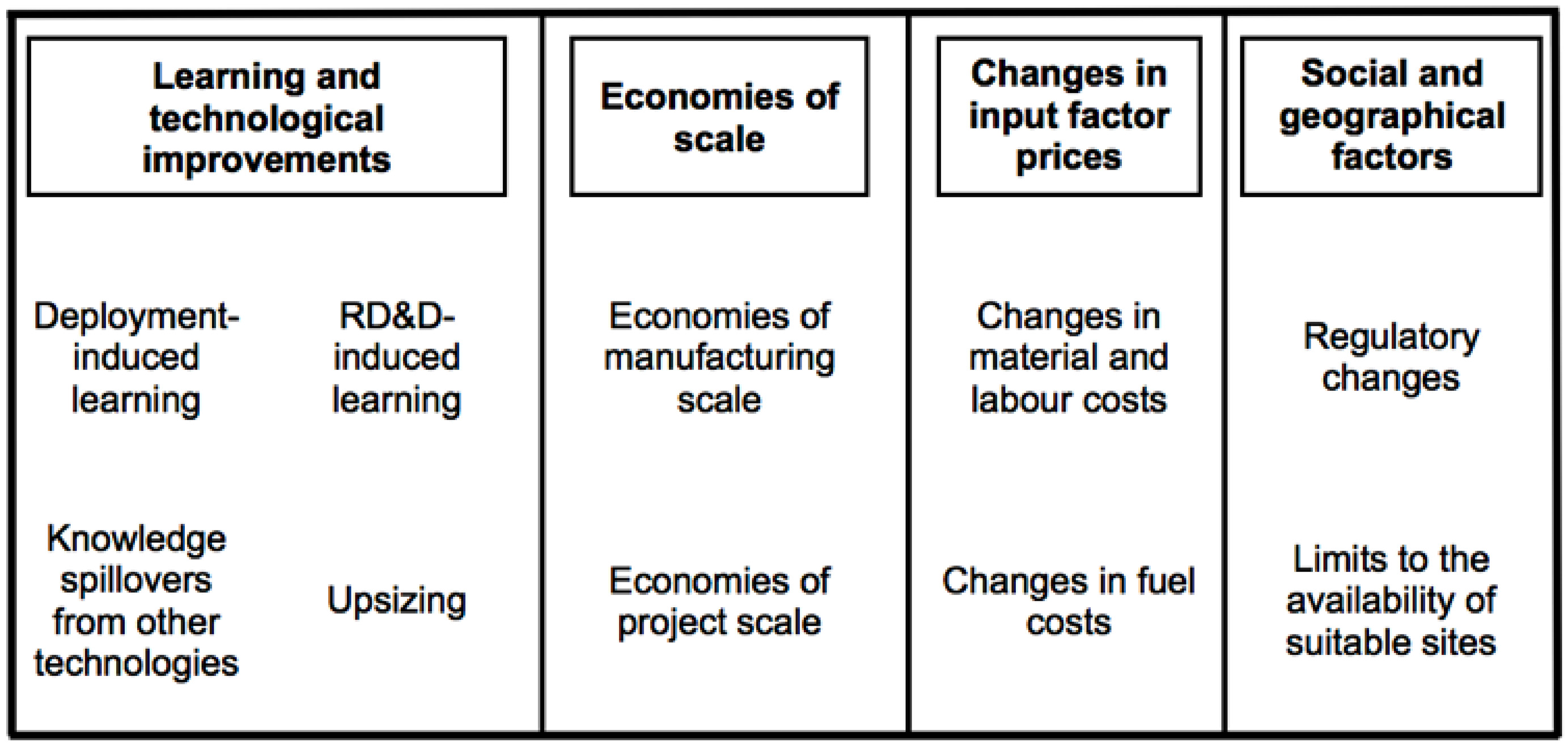

2. Factors Influencing the Market Costs of Electricity Generation Technologies

2.1. Learning and Technological Improvements

2.1.1. Deployment-Induced Learning

- Learning-by-doing: as more and more units of a technology are produced, managers gain experience with the production process and may learn how to improve it, e.g., by increasing work specialisation or by reducing waste. Workers may become more efficient in their respective tasks as they continuously repeat their individual production steps.

- Learning-by-using: this can be regarded as the “demand-side counterpart” [22] of learning-by-doing. Users may gain experience by using a technology and learn how to install and operate it more efficiently. The existence of formal user groups who interact with each other can strengthen this kind of learning through networking effects [23].

- Learning-by-interacting: by informing them about problems related to the use of a technology, users or project developers enable manufacturers to learn from actual on-site experiences of the product. Manufacturers can use this information to improve their respective products [24,25,26]. Furthermore, companies, users, project developers and other stakeholders—such as research institutes and policymakers—can learn from one another through the formal and informal exchange of information [27,28,29].

2.1.2. Upsizing (Economies of Unit Scale)

2.1.3. Research, Development and Demonstration (RD&D)-Induced Learning

2.1.4. Knowledge Spillovers from Other Technologies

2.2. Economies of Scale Effects

2.2.1. Economies of Manufacturing Scale (Mass Production)

2.2.2. Economies of Project Scale

2.3. Changes in Input Factor Prices

2.3.1. Changes in Material and Labour Costs

2.3.2. Changes in Fuel Costs

2.4. Social and Geographical Factors

2.4.1. Regulatory Changes

2.4.2. Limits to the Availability of Suitable Sites

2.5. Summary of Cost Factors

3. Insights Gained in Regard to Future Cost Developments

4. Conclusions

Acknowledgments

Conflicts of Interest

References

- Pereira, M.G.; Sena, J.A.; Freitas, M.A.V.; da Silva, N.F. Evaluation of the impact of access to electricity: A comparative analysis of South Africa, China, India and Brazil. Renew. Sustain. Energy Rev. 2011, 15, 1427–1441. [Google Scholar] [CrossRef]

- The World Bank World Development Indicators. Available online: http://databank.worldbank.org/data/download/WDI_excel.zip (accessed on 7 November 2016).

- Key World Energy Statistics 2015; International Energy Agency: Paris, France, 2015.

- World Energy Outlook 2015; IEA/Organisation for Economic Co-operation and Development OECD: Paris, France, 2015.

- Lechtenböhmer, S.; Samadi, S. The Power Sector: Pioneer and Workhouse of Decarbonization. In Decarbonization in the European Union: Internal Policies and External Strategies; Dupont, C., Ed.; Palgrave Macmillan: Basingstoke, UK, 2015; pp. 46–69. [Google Scholar]

- Teske, S.; Sawyer, S.; Schäfer, O. Energy [r]evolution—A Sustainable World Energy Outlook 2015—100% Renewable Energy for All; Greenpeace: Hamburg, Germany, 2015. [Google Scholar]

- Krey, V. Global energy-climate scenarios and models: A review. WIREs Energy Environ. 2014, 3, 363–383. [Google Scholar] [CrossRef]

- Pfenninger, S.; Hawkes, A.; Keirstead, J. Energy systems modeling for twenty-first century energy challenges. Renew. Sustain. Energy Rev. 2014, 33, 74–86. [Google Scholar] [CrossRef]

- Hirth, L.; Ueckerdt, F.; Edenhofer, O. Integration costs revisited—An economic framework for wind and solar variability. Renew. Energy 2015, 74, 925–939. [Google Scholar] [CrossRef]

- Ibenholt, K. Explaining learning curves for wind power. Energy Policy 2002, 30, 1181–1189. [Google Scholar] [CrossRef]

- Pan, H.; Köhler, J. Technological change in energy systems: Learning curves, logistic curves and input–output coefficients. Ecol. Econ. 2007, 63, 749–758. [Google Scholar] [CrossRef]

- Creating Markets for Energy Technologies; International Energy Agency: Paris, France, 2003.

- Wene, C.-O. Energy Technology Learning through Deployment in Competitive Markets. Eng. Econ. 2008, 53, 340–364. [Google Scholar] [CrossRef]

- Gilbert, R. Looking for Mr. Schumpeter: Where Are We in the Competition-Innovation Debate? In Innovation Policy and the Economy; Jaffe, A.B., Lerner, J., Stern, S., Eds.; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2006; Volume 6, pp. 159–215. [Google Scholar]

- Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Arvizu, D.; Balaya, P.; Cabeza, L.F.; Hollands, K.G.T.; Jäger-Waldau, A.; Kondo, M.; Konseibo, C.; Meleshko, V.; Stein, W.; Tamaura, Y.; et al. Direct Solar Energy. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation; Edenhofer, O., Pichs-Madruga, R., Sokona, Y., Seyboth, K., Matschoss, P., Kadner, S., Zwickel, T., Eickemeier, P., Hansen, G., Schlömer, S., et al., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2011. [Google Scholar]

- Voormolen, J.A.; Junginger, H.M.; van Sark, W.G.J.H.M. Unravelling historical cost developments of offshore wind energy in Europe. Energy Policy 2016, 88, 435–444. [Google Scholar] [CrossRef]

- Rosenberg, N. The Direction of Technological Change: Inducement Mechanisms and Focusing Devices. Econ. Dev. Cult. Chang. 1969, 18, 1–24. [Google Scholar] [CrossRef]

- Clarke, L.; Weyant, J.; Birky, A. On the sources of technological change: Assessing the evidence. Energy Econ. 2006, 28, 579–595. [Google Scholar] [CrossRef]

- Söderholm, P.; Sundqvist, T. Empirical challenges in the use of learning curves for assessing the economic prospects of renewable energy technologies. Renew. Energy 2007, 32, 2559–2578. [Google Scholar] [CrossRef]

- Wright, T.P. Factors Affecting the Cost of Airplanes. J. Aeronaut. Sci. 1936, 3, 122–128. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. Technological change and the Environment. In Handbook of Environmental Economics; Environmental Degradation and Institutional Responses; Mäler, K.G., Vincent, J.R., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, pp. 461–516. [Google Scholar]

- Schaeffer, G.J.; Alsema, E.; Seebregts, A.; Beurskens, L.; de Moor, H.; van Sark, W.; Durstewitz, M.; Perrin, M.; Boulanger, P.; Laukamp, H.; et al. Learning from the Sun. In Analysis of the Use of Experience Curves for Energy Policy Purposes: The Case of Photovoltaic Power; Final Report of the Photex Project; Energy Research Centre of the Netherlands (ECN): Petten, The Netherlands, 2004. [Google Scholar]

- Kamp, L.M.; Smits, R.E.H.M.; Andriesse, C.D. Notions on learning applied to wind turbine development in the Netherlands and Denmark. Energy Policy 2004, 32, 1625–1637. [Google Scholar] [CrossRef]

- Koornneef, J.; Junginger, M.; Faaij, A. Development of fluidized bed combustion—An overview of trends, performance and cost. Prog. Energy Combust. Sci. 2007, 33, 19–55. [Google Scholar] [CrossRef]

- Tang, T.; Popp, D. The Learning Process and Technological Change in Wind Power: Evidence from China’s CDM Wind Projects. J. Policy Anal. Manag. 2016, 35, 195–222. [Google Scholar] [CrossRef]

- Gross, R.; Heptonstall, P.; Greenacre, P.; Candelise, C.; Jones, F.; Castillo Castillo, A. Presenting the Future: Electricity Generation Cost Estimation Methodologies; UK Energy Research Centre (UKERC): London, UK, 2013. [Google Scholar]

- Junginger, M.; de Visser, E.; Hjort-Gregersen, K.; Koornneef, J.; Raven, R.; Faaij, A.; Turkenburg, W. Technological learning in bioenergy systems. Energy Policy 2006, 34, 4024–4041. [Google Scholar] [CrossRef]

- Yu, C.F.; van Sark, W.G.J.H.M.; Alsema, E.A. Unraveling the photovoltaic technology learning curve by incorporation of input price changes and scale effects. Renew. Sustain. Energy Rev. 2011, 15, 324–337. [Google Scholar] [CrossRef]

- De La Tour, A.; Glachant, M.; Ménière, Y. Predicting the costs of photovoltaic solar modules in 2020 using experience curve models. Energy 2013, 62, 341–348. [Google Scholar] [CrossRef]

- Rubin, E.S.; Azevedo, I.M.L.; Jaramillo, P.; Yeh, S. A review of learning rates for electricity supply technologies. Energy Policy 2015, 86, 198–218. [Google Scholar] [CrossRef]

- Samadi, S. The learning curve theory and its application in the field of electricity generation technologies. Renew. Sustain. Energy Rev. 2016. submitted. [Google Scholar]

- Junginger, M.; Faaij, A.; Turkenburg, W.C. Global experience curves for wind farms. Energy Policy 2005, 33, 133–150. [Google Scholar] [CrossRef]

- Coulomb, L.; Neuhoff, K. Learning Curves and Changing Product Attributes: The Case of Wind Turbines; University of Cambridge, Electricity Policy Research Group: Cambridge, UK, 2006. [Google Scholar]

- Madsen, E.S.; Jensen, C.; Hansen, J.D. Scale in technology and learning-by-doing in the windmill industry. J. Int. Bus. Entrep. Dev. 2003, 1, 27–35. [Google Scholar] [CrossRef]

- Milborrow, D. Wind energy technology—The state of the art. Proc. Inst. Mech. Eng. Part A J. Power Energy 2002, 216, 23–30. [Google Scholar] [CrossRef]

- Bolinger, M.; Wiser, R. Understanding wind turbine price trends in the U.S. over the past decade. Energy Policy 2012, 42, 628–641. [Google Scholar] [CrossRef]

- Ek, K.; Söderholm, P. Technology learning in the presence of public R&D: The case of European wind power. Ecol. Econ. 2010, 69, 2356–2362. [Google Scholar]

- Wiser, R.; Bolinger, M. 2014 Wind Technologies Market Report; US Department of Energy: Washington, DC, USA, 2015.

- Wiser, R.; Bolinger, M. 2013 Wind Technologies Market Report; US Department of Energy: Washington, DC, USA, 2014.

- Berry, D. Innovation and the price of wind energy in the US. Energy Policy 2009, 37, 4493–4499. [Google Scholar] [CrossRef]

- Nemet, G.F. Beyond the learning curve: Factors influencing cost reductions in photovoltaics. Energy Policy 2006, 34, 3218–3232. [Google Scholar] [CrossRef]

- Pilkington Solar International. Statusbericht Solarthermische Kraftwerke: Erfahrungen, Aussichten und Empfehlungen zur Überwindung der Markthemmnisse für die Technologie der Parabolrinnensolarkraftwerke; Pilkington Solar International: Cologne, Germany, 1996. (In German) [Google Scholar]

- Berthélemy, M.; Escobar Rangel, L. Nuclear reactors’ construction costs: The role of lead-time, standardization and technological progress. Energy Policy 2015, 82, 118–130. [Google Scholar] [CrossRef]

- Tolley, G.S.; Jones, D.W.; Castellano, M.; Clune, W.; Davidson, P.; Desai, K.; Foo, A.; Kats, A.; Liao, M.; Iantchev, E.; et al. The Economic Future of Nuclear Power; University of Chicago: Chicago, IL, USA, 2004. [Google Scholar]

- Komanoff, C. Power Plant Cost Escalation: Nuclear and Coal Capital Costs, Regulation, and Economics; Komanoff Energy Associates: New York, NY, USA, 1981. [Google Scholar]

- Cantor, R.; Hewlett, J. The economics of nuclear power: Further evidence on learning, economies of scale, and regulatory effects. Resour. Energy 1988, 10, 315–335. [Google Scholar] [CrossRef]

- Canterbery, E.R.; Johnson, B.; Reading, D. Cost Savings from Nuclear Regulatory Reform: An Econometric Model. South. Econ. J. 1996, 62, 554–566. [Google Scholar] [CrossRef]

- McCabe, M.J. Principals, Agents, and the Learning Curve: The Case of Steam-Electric Power Plant Design and Construction. J. Ind. Econ. 1996, 44, 357–375. [Google Scholar] [CrossRef]

- Mooz, W.E. A Second Cost Analysis of Light Water Reactor Power Plants; Rand Corporation: Santa Monica, CA, USA, 1979. [Google Scholar]

- Zimmerman, M.B. Learning Effects and the Commercialization of New Energy Technologies: The Case of Nuclear Power. Bell J. Econ. 1982, 13, 297–310. [Google Scholar] [CrossRef]

- Marshall, J.M.; Navarro, P. Costs of Nuclear Power Plant Construction: Theory and New Evidence. RAND J. Econ. 1991, 22, 148–154. [Google Scholar] [CrossRef]

- Escobar Rangel, L.; Lévêque, F. Revisiting the Cost Escalation Curse of Nuclear Power: New Lessons from the French Experience. Econ. Energy Environ. Policy 2015, 4, 103–125. [Google Scholar] [CrossRef]

- Cour des Comptes. The Costs of the Nuclear Power Sector; Cour des Comptes: Paris, France, 2012. [Google Scholar]

- Yeh, S.; Rubin, E.S. A centurial history of technological change and learning curves for pulverized coal-fired utility boilers. Energy 2007, 32, 1996–2005. [Google Scholar] [CrossRef]

- Joskow, P.L.; Rose, N.L. The Effects of Technological Change, Experience, and Environmental Regulation on the Construction Cost of Coal-Burning Generating Units. RAND J. Econ. 1985, 16, 1–27. [Google Scholar] [CrossRef]

- Grubler, A.; Aguayo, F.; Gallagher, K.; Hekkert, M.; Jiang, K.; Mytelka, L.; Neij, L.; Nemet, G.; Wilson, C. Chapter 24—Policies for the Energy Technology Innovation System (ETIS). In Global Energy Assessment—Toward a Sustainable Future; Cambridge University Press: Cambridge, UK; New York, NY, USA; The International Institute for Applied Systems Analysis: Laxenburg, Austria, 2012; pp. 1665–1744. [Google Scholar]

- Grubler, A. The costs of the French nuclear scale-up: A case of negative learning by doing. Energy Policy 2010, 38, 5174–5188. [Google Scholar] [CrossRef]

- Klaassen, G.; Miketa, A.; Larsen, K.; Sundqvist, T. The impact of R&D on innovation for wind energy in Denmark, Germany and the United Kingdom. Ecol. Econ. 2005, 54, 227–240. [Google Scholar]

- Miketa, A.; Schrattenholzer, L. Experiments with a methodology to model the role of R&D expenditures in energy technology learning processes; first results. Energy Policy 2004, 32, 1679–1692. [Google Scholar]

- Lindman, Å.; Söderholm, P. Wind power learning rates: A conceptual review and meta-analysis. Energy Econ. 2012, 34, 754–761. [Google Scholar] [CrossRef]

- Wiebe, K.S.; Lutz, C. Endogenous technological change and the policy mix in renewable power generation. Renew. Sustain. Energy Rev. 2016, 60, 739–751. [Google Scholar] [CrossRef]

- Cory, K.S.; Bernow, S.; Dougherty, W.; Kartha, S.; Williams, E. Analysis of Wind Turbine Cost Reductions: The Role of Research and Development and Cumulative Production. In Proceedings of the American Wind Energy Association (AWEA) Windpower 1999 Conference, Burlington, VT, USA, 22 June 1999.

- Kobos, P.H.; Erickson, J.D.; Drennen, T.E. Technological learning and renewable energy costs: Implications for US renewable energy policy. Energy Policy 2006, 34, 1645–1658. [Google Scholar] [CrossRef]

- Söderholm, P.; Klaassen, G. Wind Power in Europe: A Simultaneous Innovation–Diffusion Model. Environ. Resour. Econ. 2007, 36, 163–190. [Google Scholar] [CrossRef]

- Baker, E.; Fowlie, M.; Lemoine, D.; Reynolds, S.S. The Economics of Solar Electricity. Annu. Rev. Resour. Econ. 2013, 5, 387–426. [Google Scholar] [CrossRef]

- Nemet, G.F. Inter-technology knowledge spillovers for energy technologies. Energy Econ. 2012, 34, 1259–1270. [Google Scholar] [CrossRef]

- Loiter, J.M.; Norberg-Bohm, V. Technology policy and renewable energy: Public roles in the development of new energy technologies. Energy Policy 1999, 27, 85–97. [Google Scholar] [CrossRef]

- Winskel, M.; Markusson, N.; Jeffrey, H.; Candelise, C.; Dutton, G.; Howarth, P.; Jablonski, S.; Kalyvas, C.; Ward, D. Learning pathways for energy supply technologies: Bridging between innovation studies and learning rates. Technol. Forecast. Soc. Chang. 2014, 81, 96–114. [Google Scholar] [CrossRef]

- Winskel, M. When systems are overthrown: The ‘Dash for Gas’ in the British electricity supply industry. Soc. Stud. Sci. 2002, 32, 563–598. [Google Scholar]

- Alberth, S. Forecasting technology costs via the experience curve—Myth or magic? Technol. Forecast. Soc. Chang. 2008, 75, 952–983. [Google Scholar] [CrossRef]

- Neij, L. Cost development of future technologies for power generation—A study based on experience curves and complementary bottom-up assessments. Energy Policy 2008, 36, 2200–2211. [Google Scholar] [CrossRef]

- Dutton, J.M.; Thomas, A. Treating Progress Functions as a Managerial Opportunity. Acad. Manag. Rev. 1984, 9, 235–247. [Google Scholar]

- Hall, G.; Howell, S. The experience curve from the economist’s perspective. Strateg. Manag. J. 1985, 6, 197–212. [Google Scholar] [CrossRef]

- Abell, D.F.; Hammond, J.S. Strategic Market Planning: Problems and Analytical Approaches; Prentice-Hall: Englewood Cliffs, NJ, USA, 1979. [Google Scholar]

- Clarke, L.; Weyant, J.; Edmonds, J. On the sources of technological change: What do the models assume? Energy Econ. 2008, 30, 409–424. [Google Scholar] [CrossRef]

- Experience Curves for Energy Technology Policy; International Energy Agency: Paris, France, 2000.

- Mackay, R.M.; Probert, S.D. Likely market-penetrations of renewable-energy technologies. Appl. Energy 1998, 59, 1–38. [Google Scholar] [CrossRef]

- Huang, N.; Hwang, A. Tongwei to Set up 5GWp Solar Cell Plant in China; DigiTimes: Taipei, Taiwan, 2015. [Google Scholar]

- Suk-yee, J. Hanwha Q Cells to Build Nation’s First Solar Cell Plant; BusinessKorea: Seoul, Korea, 2015. [Google Scholar]

- Watanabe, C.; Wakabayashi, K.; Miyazawa, T. Industrial dynamism and the creation of a “virtuous cycle” between R&D, market growth and price reduction: The case of photovoltaic power generation (PV) development in Japan. Technovation 2000, 20, 299–312. [Google Scholar]

- Qiu, Y.; Anadon, L.D. The price of wind power in China during its expansion: Technology adoption, learning-by-doing, economies of scale, and manufacturing localization. Energy Econ. 2012, 34, 772–785. [Google Scholar] [CrossRef]

- Lovering, J.R.; Yip, A.; Nordhaus, T. Historical construction costs of global nuclear power reactors. Energy Policy 2016, 91, 371–382. [Google Scholar] [CrossRef]

- Navarro, P. Comparative Energy Policy: The Economics of Nuclear Power in Japan and the United States. Energy J. 1988, 9, 1–15. [Google Scholar] [CrossRef]

- David, P.A.; Rothwell, G.S. Standardization, diversity and learning: Strategies for the coevolution of technology and industrial capacity. Int. J. Ind. Organ. 1996, 14, 181–201. [Google Scholar] [CrossRef]

- Lantz, E.; Wiser, R.; Hand, M. IEA Wind Task 26: The Past and Future Cost of Wind Energy; National Renewable Energy Laboratory: Golden, CO, USA, 2012. [Google Scholar]

- Anderson, J.W. Experience and the Evolution of Wind Power Project Costs in the United States; Stanford Institute for Economic Policy Research: Stanford, CA, USA, 2013. [Google Scholar]

- Barbose, G.; Darghouth, N. Tracking the Sun VIII—The Installed Price of Residential and Non-Residential Photovoltaic Systems in the United States; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2015. [Google Scholar]

- International Monetary Fund. Indices of Primary Commodity Prices, 2005–2015; International Monetary Fund: Washington, DC, USA, 2016. [Google Scholar]

- Hayward, J.A.; Graham, P.W. A global and local endogenous experience curve model for projecting future uptake and cost of electricity generation technologies. Energy Econ. 2013, 40, 537–548. [Google Scholar] [CrossRef]

- Fondazione Eni Enrico Mattei (FEEM). Report on How to Improve the Representation of Technical Change into IAMs; FEEM: Milano, Italy, 2014. [Google Scholar]

- Greenacre, P.; Gross, R.; Heptonstall, P. Great Expectations: The Cost of Offshore Wind in UK Waters—Understanding the Past and Projecting the Future; UK Energy Research Centre (UKERC): London, UK, 2010. [Google Scholar]

- International Energy Agency. Projected Costs of Generating Electricity 2010; International Energy Agency: Paris, France, 2010. [Google Scholar]

- Van der Zwaan, B.; Rivera-Tinoco, R.; Lensink, S.; van den Oosterkamp, P. Cost reductions for offshore wind power: Exploring the balance between scaling, learning and R&D. Renew. Energy 2012, 41, 389–393. [Google Scholar]

- BWEA; Hassan, G. UK Offshore Wind: Charting the Right Course: Scenarios for Offshore Capital Costs for the Next Five Years; BWEA: London, UK, 2009. [Google Scholar]

- Nemet, G.F. Interim monitoring of cost dynamics for publicly supported energy technologies. Energy Policy 2009, 37, 825–835. [Google Scholar] [CrossRef]

- Gan, P.Y.; Li, Z. Quantitative study on long term global solar photovoltaic market. Renew. Sustain. Energy Rev. 2015, 46, 88–99. [Google Scholar] [CrossRef]

- Cohen, B.L. The Nuclear Energy Option: An Alternative for the 90’s; Plenum Publishing Corporation: New York, NY, USA, 1990. [Google Scholar]

- Shafiee, S.; Topal, E. A long-term view of worldwide fossil fuel prices. Appl. Energy 2010, 87, 988–1000. [Google Scholar] [CrossRef]

- Zellou, A.M.; Cuddington, J.T. Trends and Super Cycles in Crude Oil and Coal Prices; Colorado School of Mines: Golden, CO, USA, 2012. [Google Scholar]

- Department of Energy & Climate Change. Electricity Generation Costs 2013; Department of Energy & Climate Change: London, UK, 2013.

- Colpier, U.C.; Cornland, D. The economics of the combined cycle gas turbine—An experience curve analysis. Energy Policy 2002, 30, 309–316. [Google Scholar] [CrossRef]

- MacKerron, G. Nuclear costs: Why do they keep rising? Energy Policy 1992, 20, 641–652. [Google Scholar] [CrossRef]

- Rai, V.; Victor, D.G.; Thurber, M.C. Carbon capture and storage at scale: Lessons from the growth of analogous energy technologies. Energy Policy 2010, 38, 4089–4098. [Google Scholar] [CrossRef]

- McNerney, J.; Doyne Farmer, J.; Trancik, J.E. Historical costs of coal-fired electricity and implications for the future. Energy Policy 2011, 39, 3042–3054. [Google Scholar] [CrossRef]

- Wiesenthal, T.; Dowling, P.; Morbee, J.; Thiel, C.; Schade, B.; Russ, P.; Simoes, S.; Peteves, S.; Schoots, K.; Londo, M. Technology Learning Curves for Energy Policy Support; European Commission Joint Research Centre Institute for Prospective Technological Studies Institute for Energy and Transport: Luxemburg, 2012. [Google Scholar]

- Hewlett, J.G. Economic and Regulatory Factors Affecting the Maintenance of Nuclear Power Plants. Energy J. 1996, 17, 1–31. [Google Scholar] [CrossRef]

- Vogel, P. Wind Onshore Cost Development 2013. In Proceedings of the Workshop on Prospective Generation Costs until 2050, Berlin, Germany, 8 March 2013.

- Kuntze, J.-C.; Moerenhout, T. Local Content Requirements and the Renewable Energy Industry—A Good Match? International Centre for Trade and Sustainable Development: Geneva, Switzerland, 2013. [Google Scholar]

- Taylor, M.; Nemet, G.; Colvin, M.; Begley, L.; Wadia, C.; Dillavou, T. Government Actions and Innovation in Clean Energy Technologies: The Cases of Photovoltaic Cells, Solar Thermal Electric Power, and Solar Water Heating; California Energy Commission: Sacramento, CA, USA, 2007.

- Audus, H. The treatment of technology development in energy models. Int. J. Glob. Energy Issues 2000, 13, 58–69. [Google Scholar] [CrossRef]

- Technological Learning in the Energy Sector: Lessons for Policy, Industry and Science; Junginger, M.; van Sark, W.; Faaij, A. (Eds.) Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 2010.

- Kalkuhl, M.; Edenhofer, O.; Lessmann, K. Learning or lock-in: Optimal technology policies to support mitigation. Resour. Energy Econ. 2012, 34, 1–23. [Google Scholar] [CrossRef]

- Neij, L. Cost dynamics of wind power. Energy 1999, 24, 375–389. [Google Scholar] [CrossRef]

- Ferioli, F.; Schoots, K.; van der Zwaan, B.C.C. Use and limitations of learning curves for energy technology policy: A component-learning hypothesis. Energy Policy 2009, 37, 2525–2535. [Google Scholar] [CrossRef]

- Roeth, J.; McClellan, S.; Ozkan, D.; Kempton, W.; Levitt, A.; Thomson, H. New York Offshore Wind Cost Reduction Study; New York State Energy Research and Development Authority: Albany, NY, USA, 2015.

- The International Renewable Energy Agency (IRENA). Renewable Energy Technology Innovation Policy. A Process Development Guide; IRENA: Abu Dhabi, UAE, 2015. [Google Scholar]

- Partridge, I. Renewable electricity generation in India—A learning rate analysis. Energy Policy 2013, 60, 906–915. [Google Scholar] [CrossRef]

- MacGillivray, A.; Jeffrey, H.; Winskel, M.; Bryden, I. Innovation and cost reduction for marine renewable energy: A learning investment sensitivity analysis. Technol. Forecast. Soc. Chang. 2014, 87, 108–124. [Google Scholar] [CrossRef]

- UK Carbon Capture and Storage. CCS Cost Reduction Task Force. In The Potential for Reducing the Costs of CCS in The UK; UK Carbon Capture and Storage: London, UK, 2013. [Google Scholar]

- Azevedo, I.; Jaramillo, P.; Rubin, E.; Yeh, S. Modeling Technology Learning for Electricity Supply Technologies; Electric Power Research Institute: Palo Alto, CA, USA, 2013. [Google Scholar]

- Matteson, S.; Williams, E. Residual learning rates in lead-acid batteries: Effects on emerging technologies. Energy Policy 2015, 85, 71–79. [Google Scholar] [CrossRef]

| Literature Source | Geographical Domain | Independent Variable (Knowledge) | Dependent Variable (Costs or Prices) | Period | LbS Rate (%) | R2 | Additional Independent Variable(s) Controlled for |

|---|---|---|---|---|---|---|---|

| [63] | OECD countries/USA 1 | Cumulative public RD&D expenditure (time lag: 3 years) | Cost of generating electricity | 1985–1995 | 32% | 0.99 2 | Cumulative production |

| [59] | Denmark, Germany, UK | Knowledge stock derived from public RD&D expenditure (time lag: 2 years, depreciation factor: 3% p.a.) | Specific investment costs | 1986–2000 | 13% | 0.72 2 | Cumulative capacity |

| [64] | Global | Knowledge stock derived from public RD&D expenditure (time lag: 5 years, depreciation factor: 2.5% p.a.) | Specific investment costs | 1981–1997 | 18% | 0.95 2 | Cumulative capacity |

| [65] | Denmark, Germany, Spain, UK | Knowledge stock derived from public RD&D expenditure (time lag: 2 years, depreciation factor: 3% p.a.) | Specific investment costs | 1986–2000 | 13% | 0.81 | Cumulative capacity, wind generation level, feed-in-price |

| [20] | Denmark, Germany, Spain, UK | Cumulative public RD&D expenditure | Specific investment costs | 1986–2000 | 7% | 0.69 2 | Cumulative capacity |

| Knowledge stock derived from public RD&D expenditure (time lag: 2 years, depreciation factor: 3% p.a.) | 16% | 0.73 2 | Cumulative capacity | ||||

| 13% | 0.77 2 | Cumulative capacity, wind generation level, feed-in-price | |||||

| [38] | Denmark, Germany, Spain, Sweden, UK | Knowledge stock derived from public RD&D expenditures (time lag: 2 years, depreciation factor: 3% p.a.) | Specific investment costs | 1986–2002 | 21% | 0.88 | Cumulative capacity, economies of unit scale |

| [62] | Global | Knowledge stock derived from public RD&D expenditure (time lag: 15 years) | Wind turbine prices | 1990–2012 | 3% | 0.84 2 | Cumulative capacity |

| Categories of Cost-Influencing Factors | Cost-Influencing Factors | Wind (On- & Off-Shore) | Solar PV | CSP | Nuclear Energy | Coal | Natural Gas |

|---|---|---|---|---|---|---|---|

| Learning and Technological Improvements | Deployment-Induced Learning | ↓ | ↓ | ↓ | ↓ | ↓ | ↓ |

| RD&D-Induced Learning | ↓ | ↓ | ↓ | (↑) | (↓) | (↓) | |

| Knowledge Spillovers from Other Technologies | ↓ | ↓ | (↓) | (↓) | - | ↓ | |

| Upsizing | ↓/o | o | (↓) | o | ↓/(o) | - | |

| Economies of Scale | Economies of Manufacturing Scale | ↓ | ↓ | - | o | ↓ | (↓) |

| Economies of Project Scale | ↓ | ↓ | - | ↓ | ↓ | - | |

| Changes in Input Factor Prices | Changes in Material and Labour Costs | ↑ | ↓/↑ | - | ↑ | ↑ | - |

| Changes in Fuel Costs | o | o | o | (o) | o | ↑ | |

| Social and Geographical Factors | Regulatory Changes | ↑ | (o) | (o) | ↑ | ↑ | (↑) |

| Limits to the Availability of Suitable Sites | (↑) | (o) | (o) | ↑ | ↑ | - |

| Type of Electricity Generation | Possible Future Changes in the Factors Influencing the Cost of Electricity Generation |

|---|---|

| Wind |

|

| Solar PV |

|

| CSP |

|

| Nuclear Energy |

|

| Coal |

|

| Natural gas |

|

© 2016 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Samadi, S. A Review of Factors Influencing the Cost Development of Electricity Generation Technologies. Energies 2016, 9, 970. https://doi.org/10.3390/en9110970

Samadi S. A Review of Factors Influencing the Cost Development of Electricity Generation Technologies. Energies. 2016; 9(11):970. https://doi.org/10.3390/en9110970

Chicago/Turabian StyleSamadi, Sascha. 2016. "A Review of Factors Influencing the Cost Development of Electricity Generation Technologies" Energies 9, no. 11: 970. https://doi.org/10.3390/en9110970