Convergent Double Auction Mechanism for a Prosumers’ Decentralized Smart Grid

Abstract

:1. Introduction

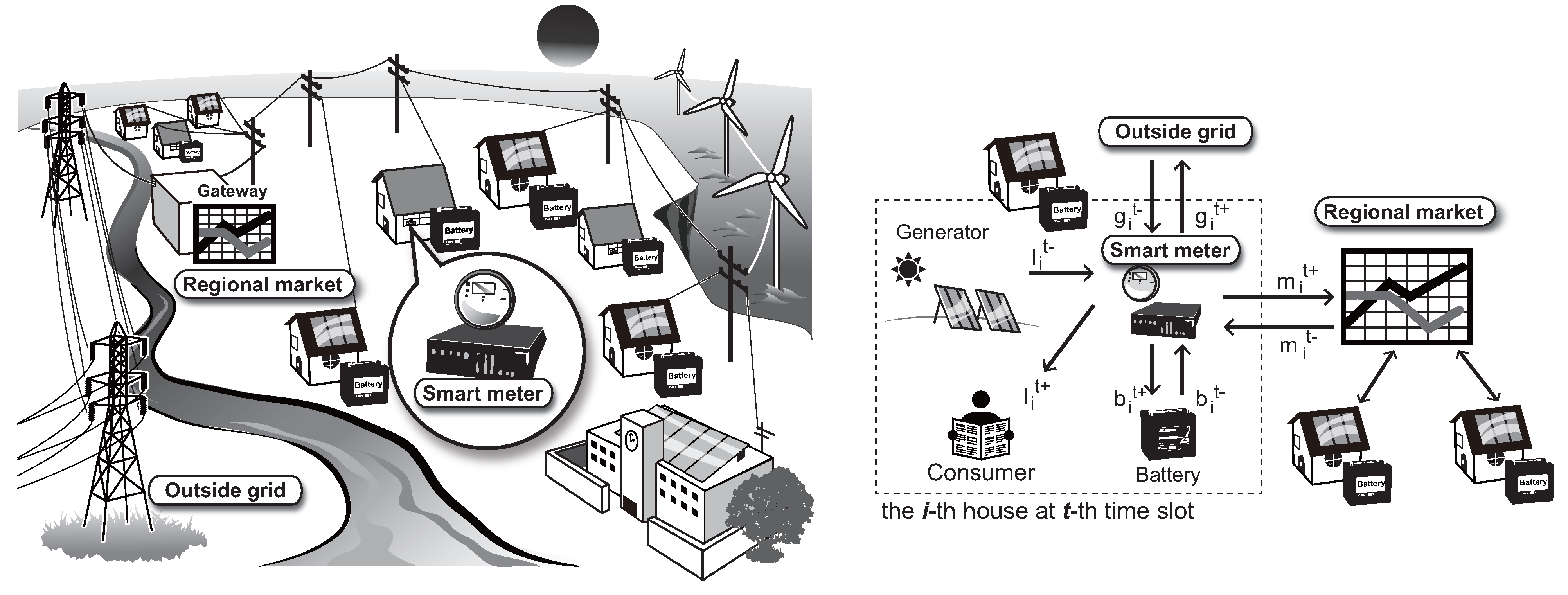

1.1. Prosumers’ Decentralized Smart Grid

1.2. Market-Based Demand-Side Management (DSM)

1.3. Convergent Double Auction Mechanism

| Characteristics | RTP-DDSG | LFS-DA | CLFS-DA |

|---|---|---|---|

| Fully decentralized | - | √ | √ |

| Balance of demand and supply | - | √ | √ |

| Convergence | √ | - | √ |

2. Model and Conventional Real-Time Pricing (RTP)

2.1. Basic Assumptions of i-Rene

2.2. Primal Problem

2.3. Dual Decomposition (DD)

2.3.1. Dual Problem

2.3.2. Sub-Problems

2.3.3. Master Problem

2.3.4. Real-Time Pricing based on a Dual Decomposition with a Sub-Gradient Method (RTP-DDSG)

3. Convergent Linear Function Submission-Based Double-Auction (CLFS-DA)

3.1. Overview

3.2. Transactions with the Convergent Linear Function Submission-Based Double-Auction (CLFS-DA)

| Algorithm 1 Iterative update in the CLFS-DA. |

| Initialize the price profile and the state vectors . |

| Each agent submits to the market. |

repeat

|

| until a predefined stopping criterion is satisfied. |

| return Transact with as a price profile. |

3.3. Iterative Process of the Convergent Linear Function Submission-Based Double-Auction (CLFS-DA)

3.4. Convergence Proof of the Convergent Linear Function Submission-Based Double-Auction (CLFS-DA)

3.5. Simple Convergent Linear Function Submission-Based Double-Auction (CLFS-DA)

4. Experiment

4.1. Experimental Conditions

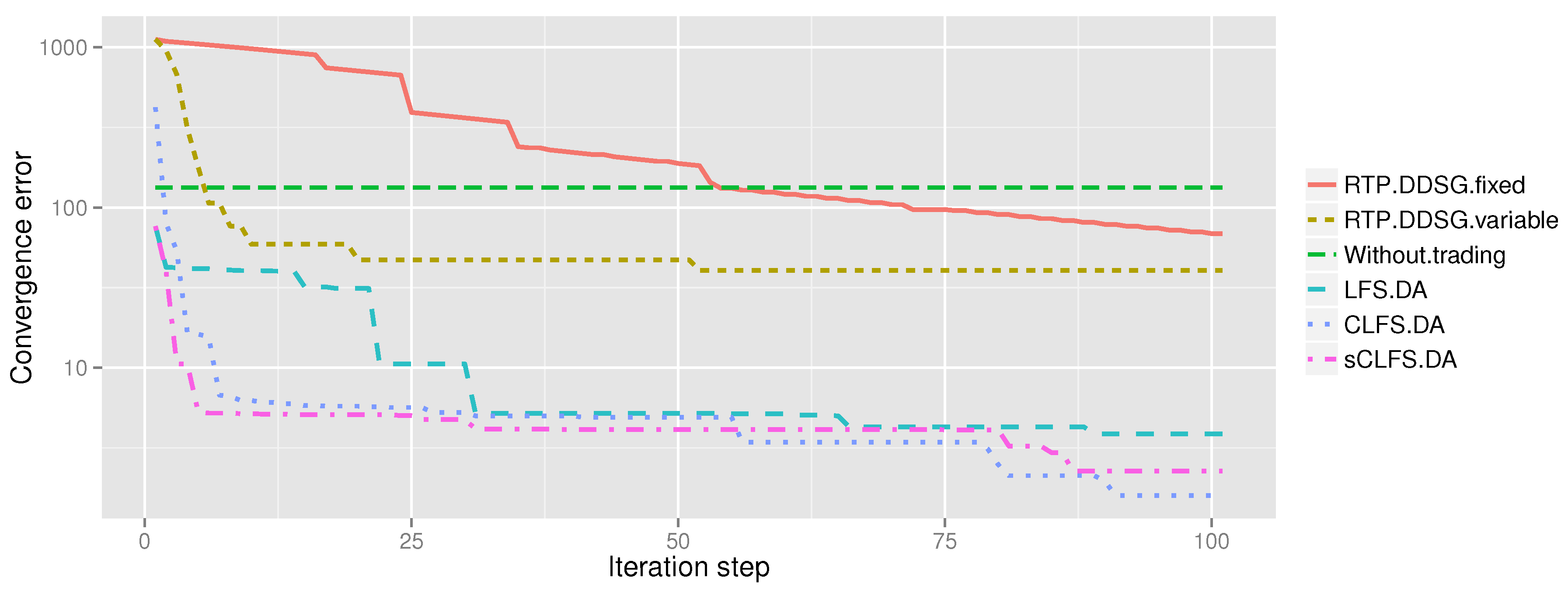

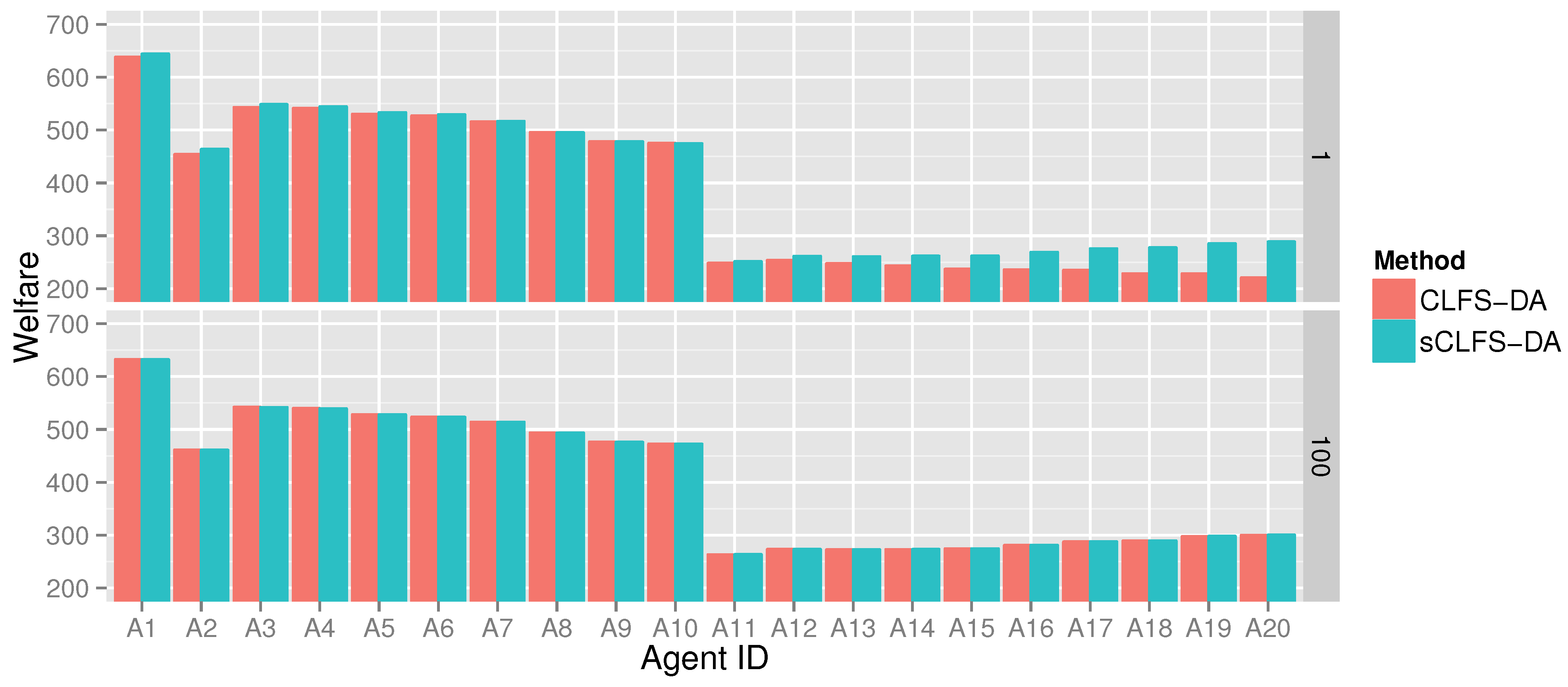

4.2. Results

5. Conclusions

Acknowledgments

Author Contributions

Nomenclature

| ☐ Variables controlled by each agent (output) | |

| Electric energy consumption profile | |

| Electric energy generation profile | |

| Battery charge profile | |

| Battery discharge profile | |

| Profile of electric energy sold to the local electricity market | |

| Profile of electric energy bought from the local electricity market | |

| Profile of electric energy sold to the outside grid | |

| Profile of electric energy bought from the outside grid | |

| Profile of state vector | |

| Profile of the state of charge (SOC) of the battery | |

| Constant term of parameters of the bidding function | |

| Initial slope of the bidding function, i.e., | |

| ☐ Variables determined by the market (output) | |

| Primary coefficient term of parameters of the bidding function | |

| Price profile | |

| ☐ Fixed parameters and functions for each agent (input) | |

| Storage efficiency | |

| Cost function for generating electric energy | |

| Utility function for consuming electric energy | |

| Individual utility function | |

| Individual welfare function | |

| ☐ Fixed parameters for the electricity network (input) | |

| Electricity transmission efficiency | |

| Price of electricity sold to the outside grid | |

| Price of electricity bought from the outside grid | |

Appendix

A. Convergence Proof of the RTP-DDSG

Conflicts of Interest

References

- Hommelberg, M.; Warmer, C.; Kamphuis, I.; Kok, J.; Schaeffer, G. Distributed control concepts using multi-agent technology and automatic markets: An indispensable feature of smart power grids. In Proceedings of the IEEE Power Engineering Society General Meeting, Tampa, FL, USA, 24–28 June 2007; pp. 1–7.

- Vytelingum, P.; Ramchurn, S.; Voice, T.; Rogers, A.; Jennings, N. Trading agents for the smart electricity grid. In Proceedings of the 9th International Conference on Autonomous Agents and Multiagent Systems, Toronto, Canada, 10–14 May 2010; Volume 1, pp. 897–904.

- Alizadeh, M.; Li, X.; Wang, Z.; Scaglione, A.; Melton, R. Demand-side management in the smart grid: Information processing for the power switch. IEEE Signal Process. Mag. 2012, 29, 55–67. [Google Scholar] [CrossRef]

- Samadi, P.; Mohsenian-Rad, A.H.; Schober, R.; Wong, V.W.S.; Jatskevich, J. Optimal Real-Time Pricing Algorithm Based on Utility Maximization for Smart Grid. In Proceedings of the First IEEE International Conference on Smart Grid Communications, Gaithersburg, MD, USA, 4–6 October 2010; pp. 415–420.

- Hammerstrom, D.; Brous, J.; Chassin, D.; Horst, G.; Kajfasz, R.; Michie, P.; Oliver, T.; Carlon, T.; Eustis, C.; Jarvegren, O.; et al. Pacific Northwest GridWiseTM Testbed Demonstration Projects Part II . Grid FriendlyTM Appliance Project; Pacific Northwest National Laboratory: Richland, WA, USA, 2007.

- Graditi, G.; Ippolito, M.; Telaretti, E.; Zizzo, G. An Innovative Conversion Device to the Grid Interface of Combined RES-Based Generators and Electric Storage Systems. IEEE Trans. Ind. Electron. 2015, 62, 2540–2550. [Google Scholar] [CrossRef]

- Cosentino, V.; Favuzza, S.; Graditi, G.; Ippolito, M.G.; Massaro, F.; Riva Sanseverino, E.; Zizzo, G. Transition of a distribution system towards an active network. Part II: Economical analysis of selected scenario. In Proceedings of the 3rd International Conference on Clean Electrical Power: Renewable Energy Resources Impact, Ischia, Italy, 14–16 June 2011; pp. 15–20.

- Dou, C.; Liu, B. Multi-Agent Based Hierarchical Hybrid Control for Smart Microgrid. IEEE Trans. Smart Grid 2013, 4, 771–778. [Google Scholar] [CrossRef]

- Molderink, A.; Bakker, V.; Bosman, M.G.C.; Hurink, J.L.; Smit, G.J.M. Management and control of domestic smart grid technology. IEEE Trans. Smart Grid 2010, 1, 109–119. [Google Scholar] [CrossRef]

- Roossien, B.; Hommelberg, M.; Warmer, C.; Kok, K.; Turkstra, J.W. Virtual power plant field experiment using 10 micro-CHP units at consumer premises. In Proceedings of the CIRED Seminar SmartGrids for Distribution, Frankfurt, France, 23–24 June 2008.

- Di Silvestre, M.L.; Graditi, G.; Riva Sanseverino, E. A generalized framework for optimal sizing of distributed energy resources in micro-grids using an indicator-based swarm approach. IEEE Trans. Ind. Inform. 2014, 10, 152–162. [Google Scholar] [CrossRef]

- Di Somma, M.; Yan, B.; Bianco, N.; Graditi, G.; Luh, P.; Mongibello, L.; Naso, V. Operation optimization of a distributed energy system considering energy costs and exergy efficiency. Energy Convers. Manag. 2015, 103, 739–751. [Google Scholar] [CrossRef]

- Saad, W.; Han, Z.; Poor, H.V.; Basar, T. Game-theoretic methods for the smart grid: An overview of microgrid systems, demand-side management, and smart grid communications. IEEE Signal Process. Mag. 2012, 29, 86–105. [Google Scholar] [CrossRef]

- Hammerstrom, D.J.; Investigator, P.; Ambrosio, R.; Carlon, T.A.; Desteese, J.G.; Kajfasz, R.; Pratt, R.G. Pacific Northwest GridWiseTM Testbed Demonstration Projects Part I. Olympic Peninsula Project; Pacific Northwest National Laboratory: Richland, WA, USA, 2007.

- Namerikawa, T.; Okubo, N.; Sato, R.; Okawa, Y. Real-Time Pricing Mechanism for Electricity Market With Built-In Incentive for Participation. IEEE Trans. Smart Grid 2015, 6, 2714–2724. [Google Scholar] [CrossRef]

- Vytelingum, P.; Voice, T.; Ramchurn, S.; Rogers, A.; Jennings, N. Agent-based micro-storage management for the smart grid. In Proceedings of the 9th International Conference on Autonomous Agents and Multiagent Systems, Toronto, Canada, 10–14 May 2010; Volume 1, pp. 39–46.

- Weckx, S.; Member, S.; Hulst, R.D.; Claessens, B.; Driesen, J. Multi-agent charging of electric vehicles respecting distribution transformer loading and voltage limits. IEEE Trans. Smart Grid 2014, 5, 2857–2867. [Google Scholar] [CrossRef]

- Yo, M.; Ono, M.; Williams, B.C.; Adachi, S. Risk-limiting , Market-based Power Dispatch and Pricing. In Proceedings of the European Control Conference (ECC), Zurich, Switzerland, 17–19 July 2013; pp. 3038–3045.

- Vogt, H.; Weiss, H.; Spiess, P.; Karduck, A. Market-based prosumer participation in the smart grid. In Proceedings of the 2010 4th IEEE International Conference on Digital Ecosystems and Technologies (DEST), Dubai, United Arab Emirates, 13–16 April 2010; pp. 592–597.

- Ferruzzi, G.; Graditi, G.; Rossi, F.; Russo, A. Optimal Operation of a Residential Microgrid: The Role of Demand Side Management. Intell. Ind. Syst. 2015, 1, 61–82. [Google Scholar] [CrossRef]

- Taniguchi, T.; Kawasaki, K.; Fukui, Y.; Takata, T.; Yano, S. Automated Linear Function Submission-based Double Auction as Bottom-up Real-Time Pricing in a Regional Prosumers’ Electricity Network. Energies 2015, 8, 7381–7406. [Google Scholar] [CrossRef]

- Lampropoulos, I.; Vanalme, G.M.; Kling, W.L. A methodology for modeling the behavior of electricity prosumers within the smart grid. In Proceedings of the 2010 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT Europe), Gothenburg, Sweden, 11–13 October 2010; pp. 1–8.

- Tapscott, D.; Williams, A.D. Wikinomics: How Mass Collaboration Changes Everything; Penguin Publishing Group: London, UK, 2010. [Google Scholar]

- Taniguchi, T.; Yano, S. Decentralized trading and demand side response in inter-intelligent renewable energy network. In Proceedings of the The 6th International Conference on Soft Computing and Intelligent Systems/The 13th International Symposium on Advanced Intelligent Systems (SCIS-ISIS), Kobe, Japan, 20–24 November 2012.

- Dusonchet, L.; Ippolito, M.G.; Telaretti, E.; Zizzo, G. An optimal operating strategy for combined RES - based Generators and Electric Storage Systems for load shifting applications. In Proceedings of the Fourth International Conference on Power Engineering, Energy and Electrical Drives (POWERENG), Istanbul, Turkey, 13–17 May 2013; pp. 552–557.

- Graditi, G.; Luisa, M.; Silvestre, D.; Gallea, R.; Sanseverino, E.R. Heuristic-based shiftable loads optimal management in smart micro-grids. IEEE Trans. Ind. Inform. 2014, 11, 271–280. [Google Scholar] [CrossRef]

- Hansen, J.; Knudsen, J.; Kiani, A.; Annaswamy, A.; Stoustrup, J. A Dynamic Market Mechanism for Markets with Shiftable Demand Response. In Proceedings of the 19th IFAC World Congress, Cape Town, South Africa, 24–29 August 2014; pp. 1873–1878.

- Mohsenian-Rad, A.H.; Wong, V.W.; Jatskevich, J.; Schober, R. Optimal and Autonomous Incentive-Based Energy Consumption Scheduling Algorithm for Smart Grid. In Proceedings of the Innovative Smart Grid Technologies (ISGT), Gaithersburg, MD, USA, 19–21 Janurary 2010; pp. 1–6.

- Okajima, Y.; Murao, T.; Hirata, K.; Uchida, K. Integration Mechanisms for LQ Energy Day-ahead Market Based on Demand Response. In Proceedings of the IEEE Conference on Control Applications (CCA), Juan Les Antibes, France, 8–10 October 2014.

- Li, N.; Chen, L.; Low, S.H. Optimal demand response based on utility maximization in power networks. In Proceedings of the IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 24–29 July 2011; pp. 1–8.

- Gatsis, N.; Giannakis, G.B. Cooperative multi-residence demand response scheduling. In Proceedings of the 45th Annual Conference on Information Sciences and Systems, Baltimore, MD, USA, 23–25 March 2011; pp. 1–6.

- Miyano, Y.; Namerikawa, T. Load Leveling Control by Real-Time Dynamical Pricing Based on Steepest Descent Method. In Proceedings of the SICE Annual Conference (SICE), Akita, Japan, 20–23 August 2012; pp. 131–136.

- Disfani, V.R.; Fan, L.; Piyasinghe, L.; Miao, Z. Multi-agent control of community and utility using Lagrangian relaxation based dual decomposition. Electr. Power Syst. Res. 2014, 110, 45–54. [Google Scholar] [CrossRef]

- Kiani, A.; Annaswamy, A. Distributed hierarchical control for renewable energy integration in a Smart Grid. In Proceedings of the IEEE PES Innovative Smart Grid Technologies (ISGT), Washington, DC, USA, 16–18 January 2012; pp. 1–8.

- Palomar, D. A tutorial on decomposition methods for network utility maximization. IEEE J. Sel. Areas Commun. 2006, 24, 1439–1451. [Google Scholar] [CrossRef]

- Kok, K.; Roossien, B.; Macdougall, P.; Pruissen, O.V. Dynamic Pricing by Scalable Energy Management Systems—Field Experiences and Simulation Results using PowerMatcher. In Proceedings of the IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–8.

- Xu, Y.; Li, N.; Low, S. Demand Response With Capacity Constrained Supply Function Bidding. IEEE Trans. Power Syst. 2015. [Google Scholar] [CrossRef]

- Papavasiliou, A.; Hindi, H.; Greene, D. Market-based control mechanisms for electric power demand response. In Proceedings of the 49th IEEE Conference on Decision and Control (CDC), Atlanta, GA, USA, 15–17 December 2010; pp. 1891–1898.

- Bertsekas, D.P. Nonlinear Programming; Athena Scientific: Nashua, NH, USA, 1999. [Google Scholar]

- Fahrioglu, M.; Alvarado, F.L. Using utility information to calibrate customer demand management behavior models. IEEE Trans. Power Syst. 2001, 16, 317–322. [Google Scholar] [CrossRef]

- Boyd, S.; Xiao, L.; Mutapcic, A. Subgradient methods; Stanford University: Stanford, CA, USA, 2008. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Taniguchi, T.; Takata, T.; Fukui, Y.; Kawasaki, K. Convergent Double Auction Mechanism for a Prosumers’ Decentralized Smart Grid. Energies 2015, 8, 12342-12361. https://doi.org/10.3390/en81112315

Taniguchi T, Takata T, Fukui Y, Kawasaki K. Convergent Double Auction Mechanism for a Prosumers’ Decentralized Smart Grid. Energies. 2015; 8(11):12342-12361. https://doi.org/10.3390/en81112315

Chicago/Turabian StyleTaniguchi, Tadahiro, Tomohiro Takata, Yoshiro Fukui, and Koki Kawasaki. 2015. "Convergent Double Auction Mechanism for a Prosumers’ Decentralized Smart Grid" Energies 8, no. 11: 12342-12361. https://doi.org/10.3390/en81112315

APA StyleTaniguchi, T., Takata, T., Fukui, Y., & Kawasaki, K. (2015). Convergent Double Auction Mechanism for a Prosumers’ Decentralized Smart Grid. Energies, 8(11), 12342-12361. https://doi.org/10.3390/en81112315