Impacts of Bioenergy Policies on Land-Use Change in Nigeria

Abstract

:1. Introduction

2. Methodology and Data

2.1. Description of Forest and Agricultural Sector Optimization Model for Nigeria (NGA–FASOM)

2.2. NGA–FASOM Baseline

2.3. NGA-FASOM Scenarios

2.4. Data

2.5. Model Uncertainties

3. Results and Discussion

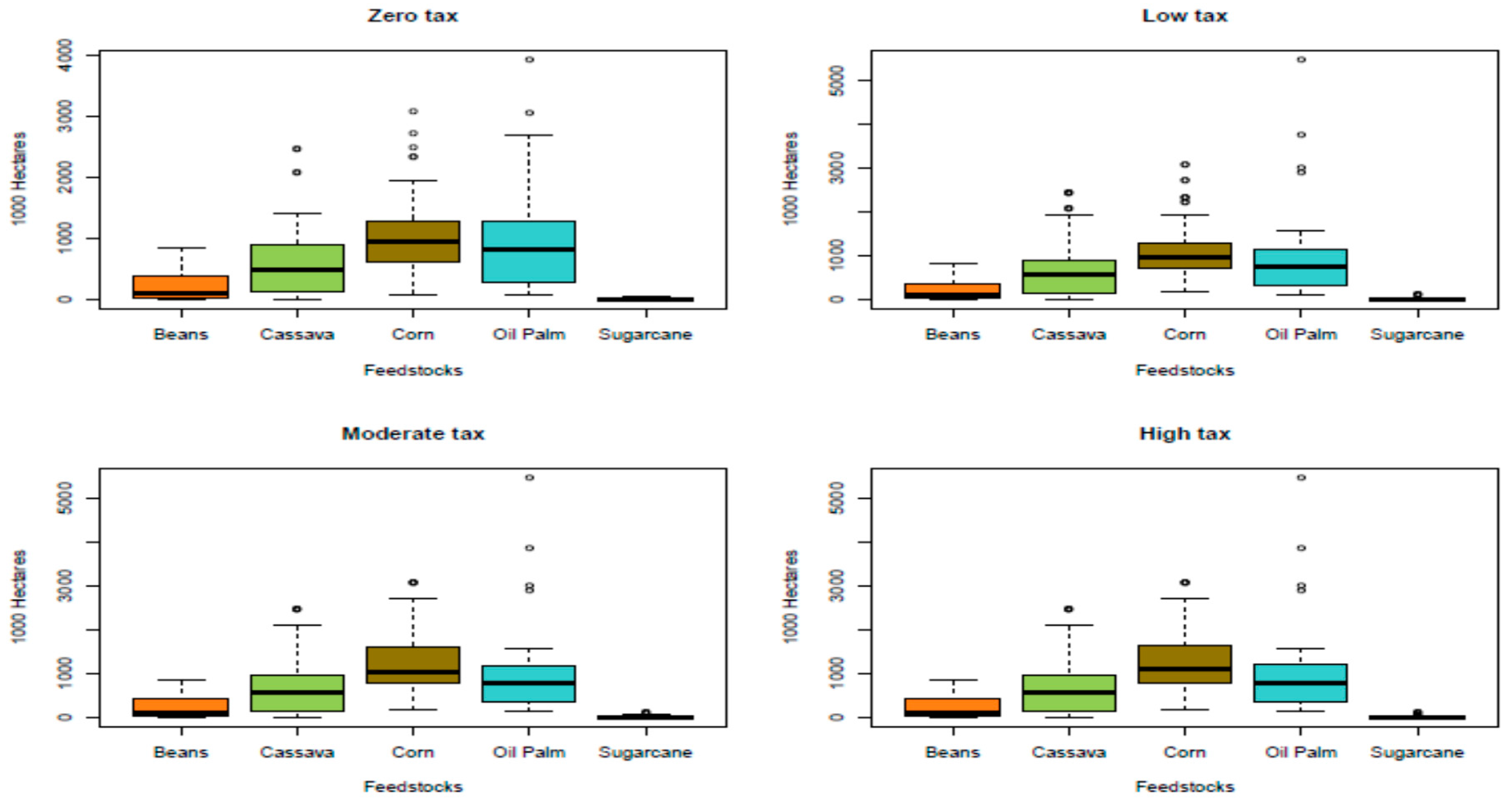

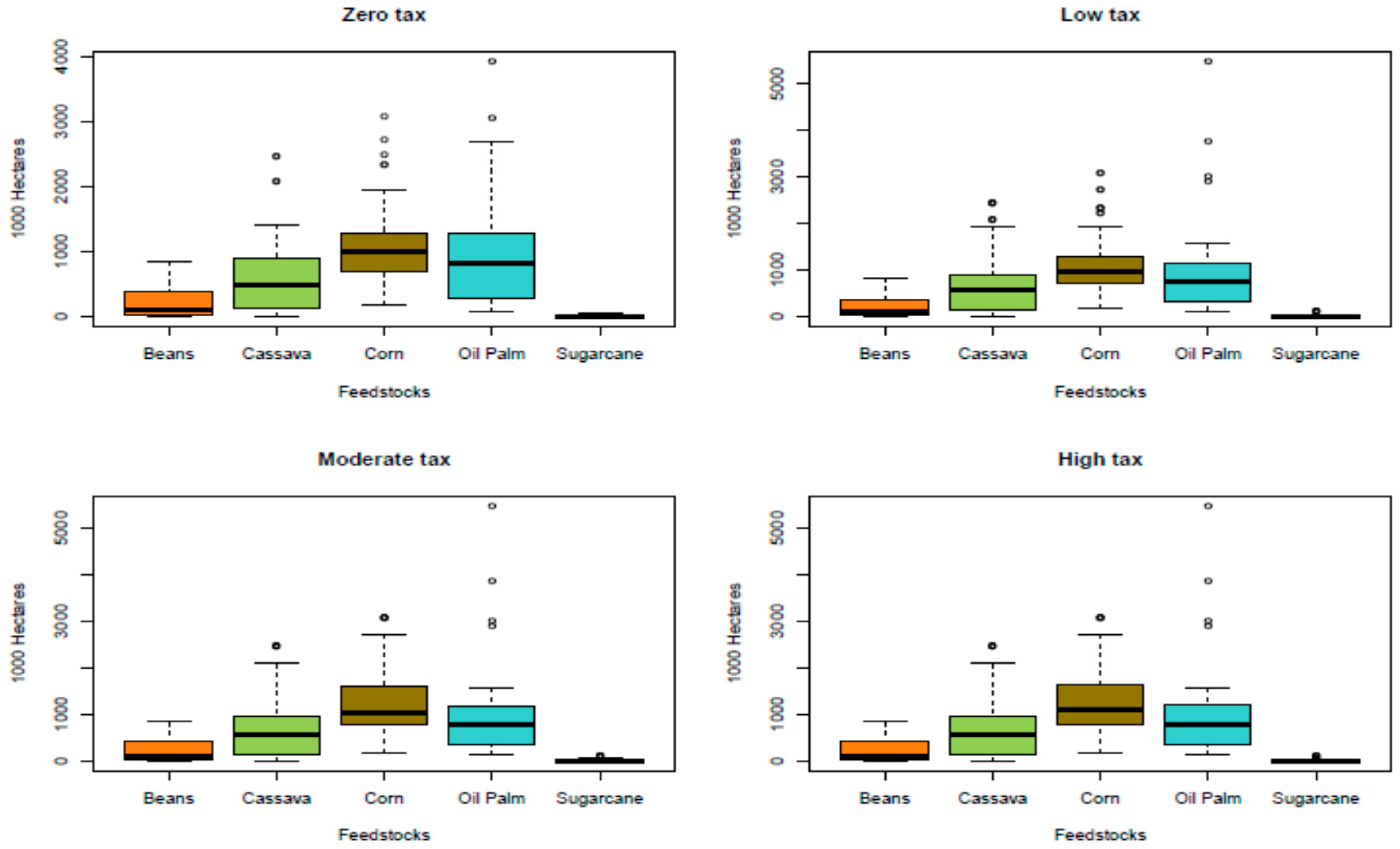

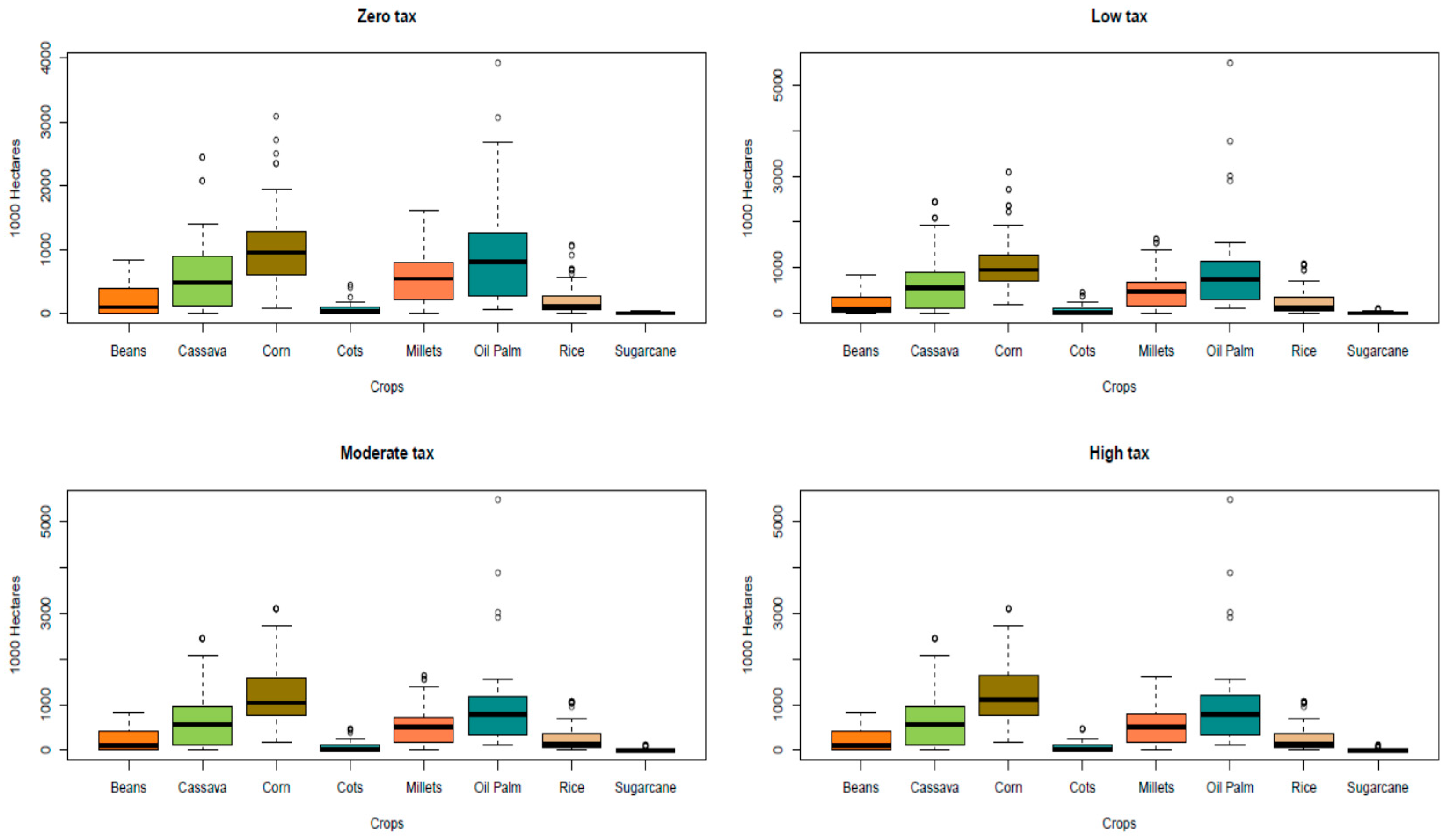

3.1. Land-Use Change Implications of Bioenergy Policy in Nigeria

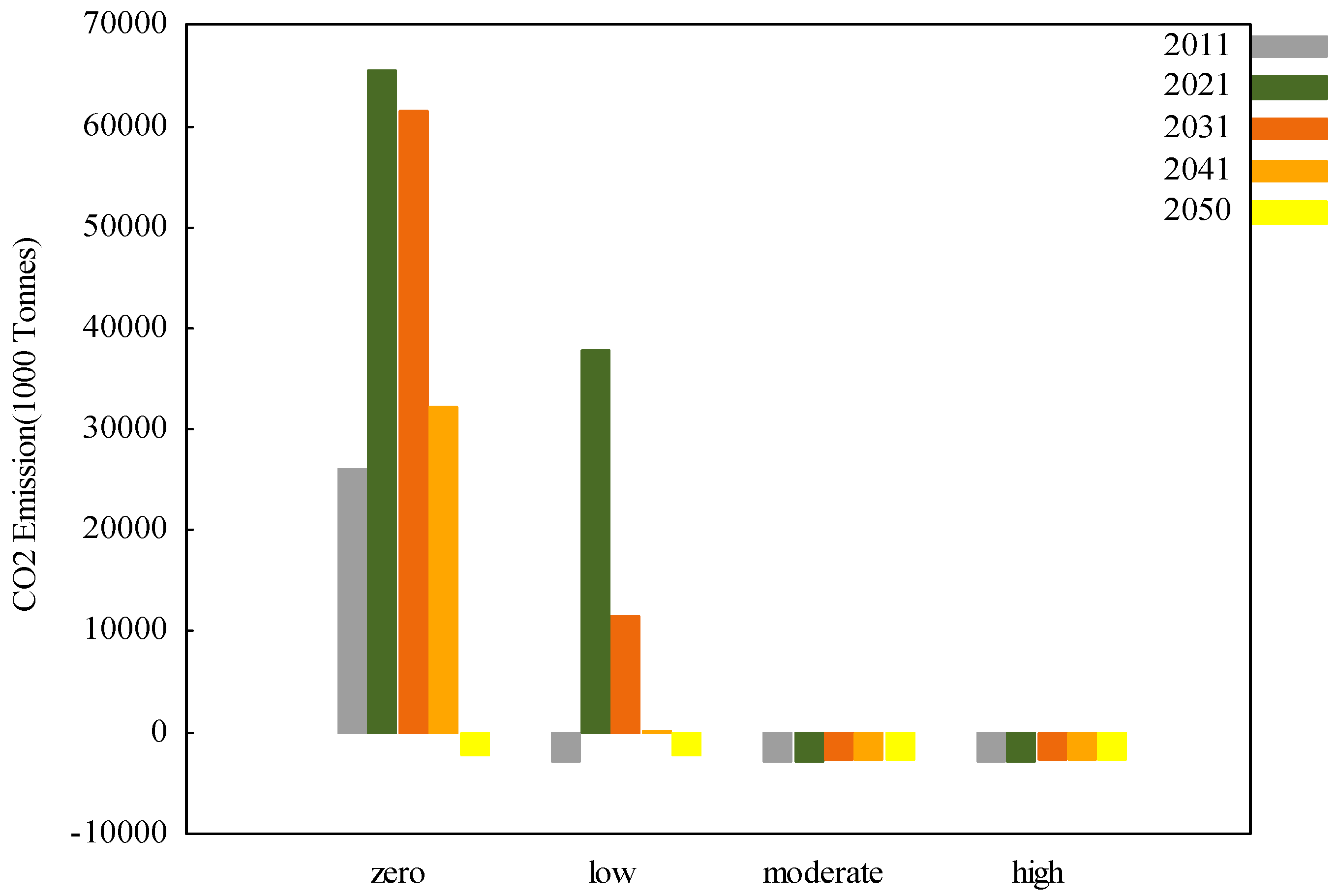

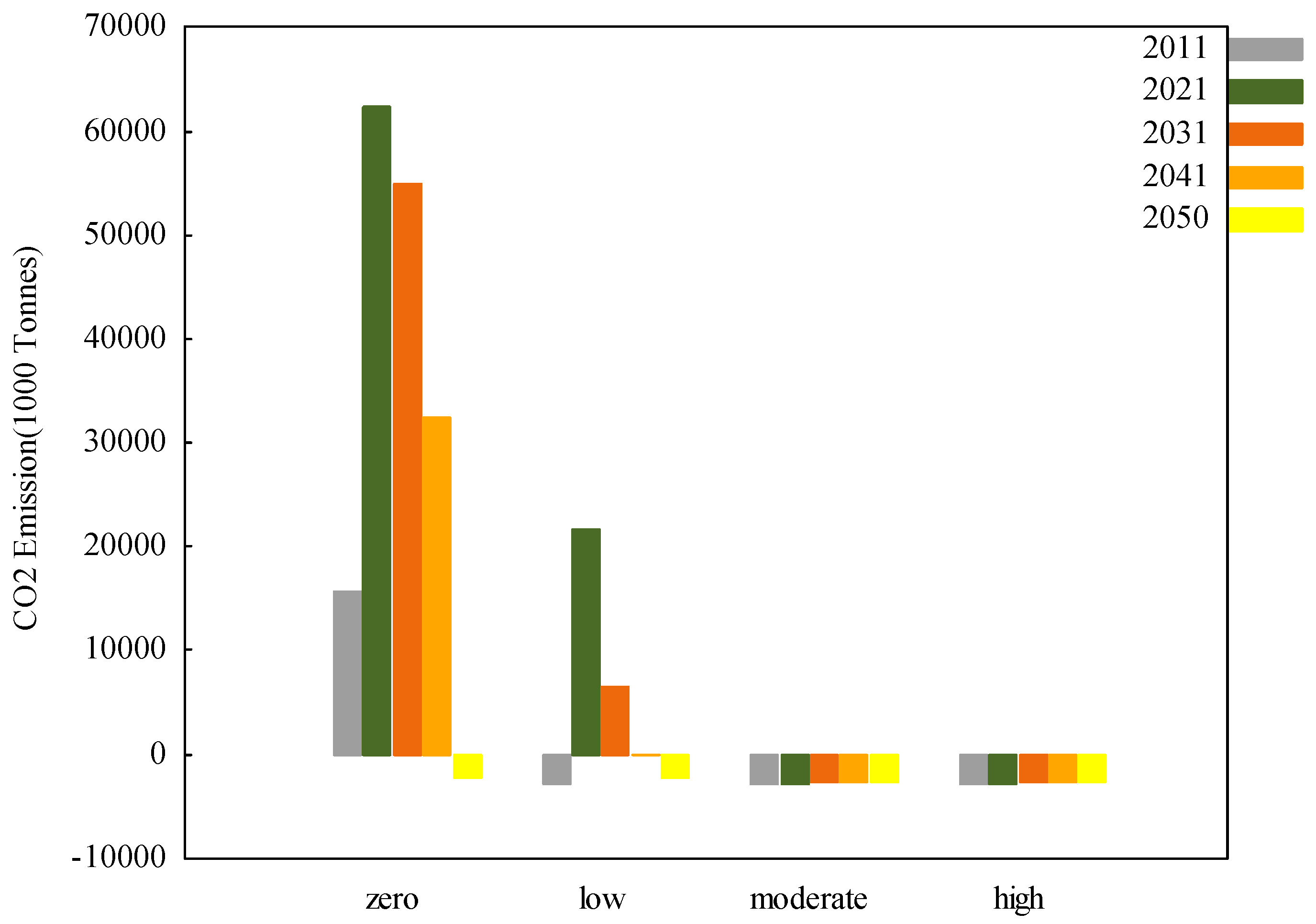

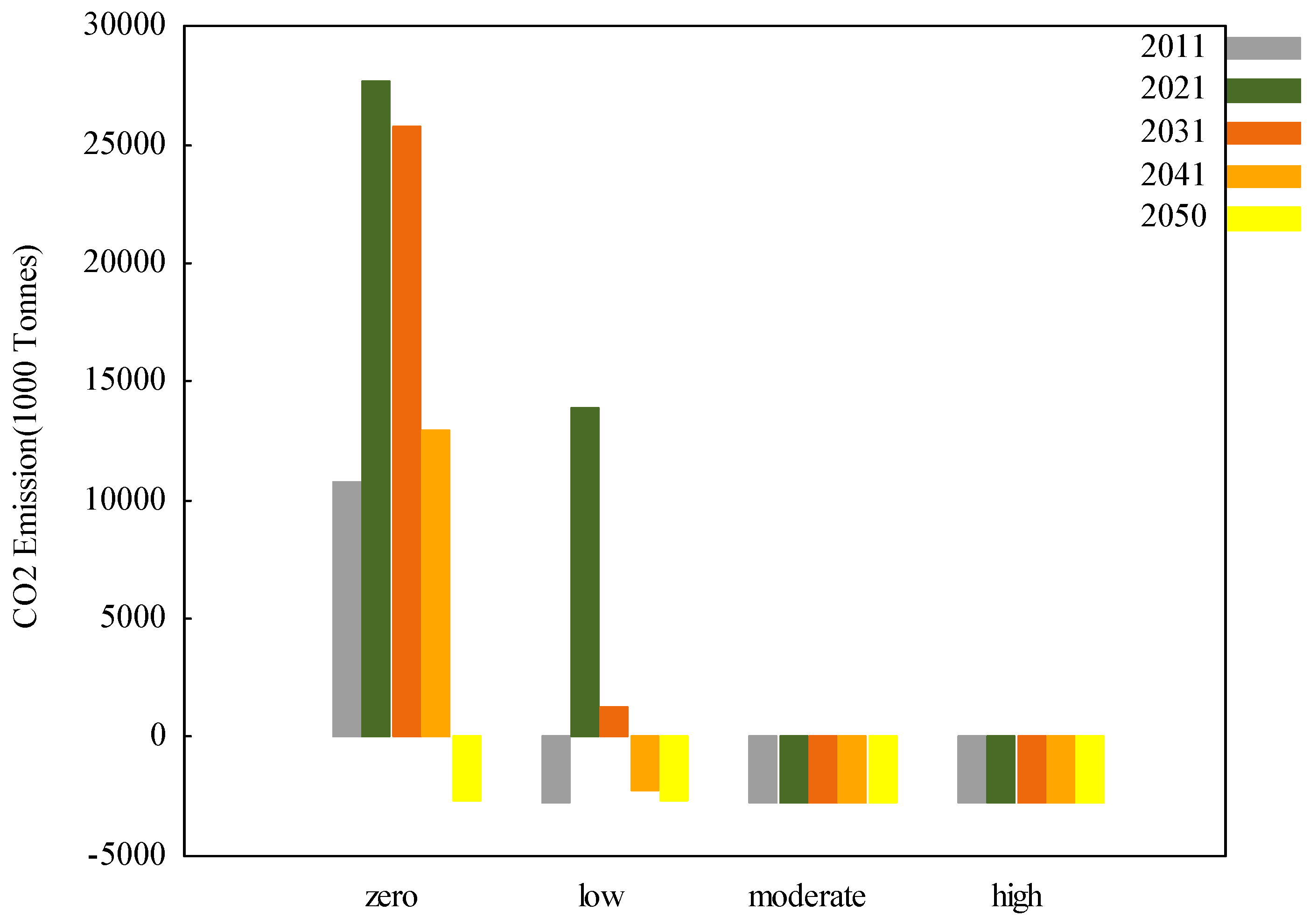

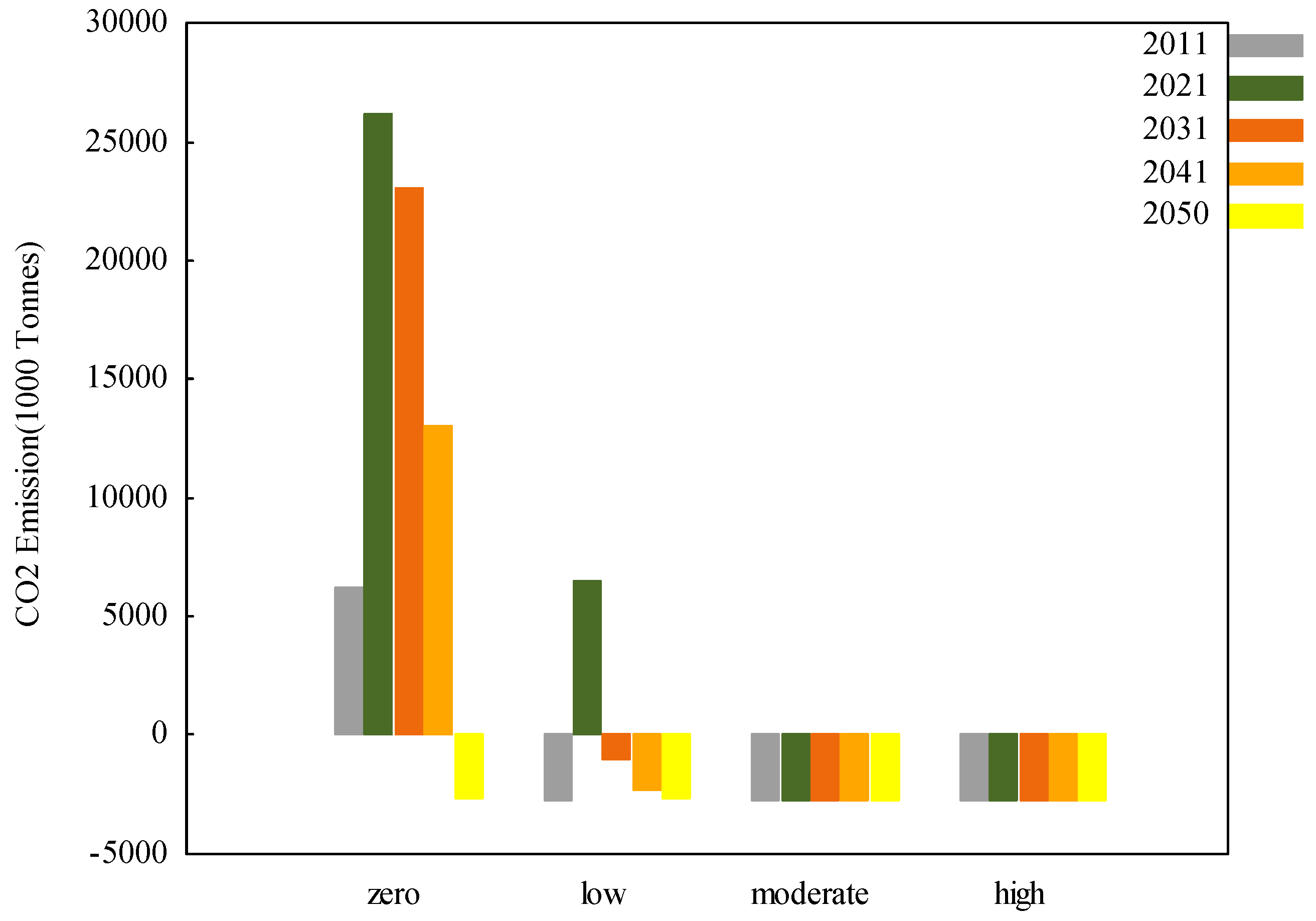

3.2. The Effect of Direct and Indirect Land-Use Change Greenhouse Gas Emissions (GHGs) as a Consequence of Bioenergy Policy Mix

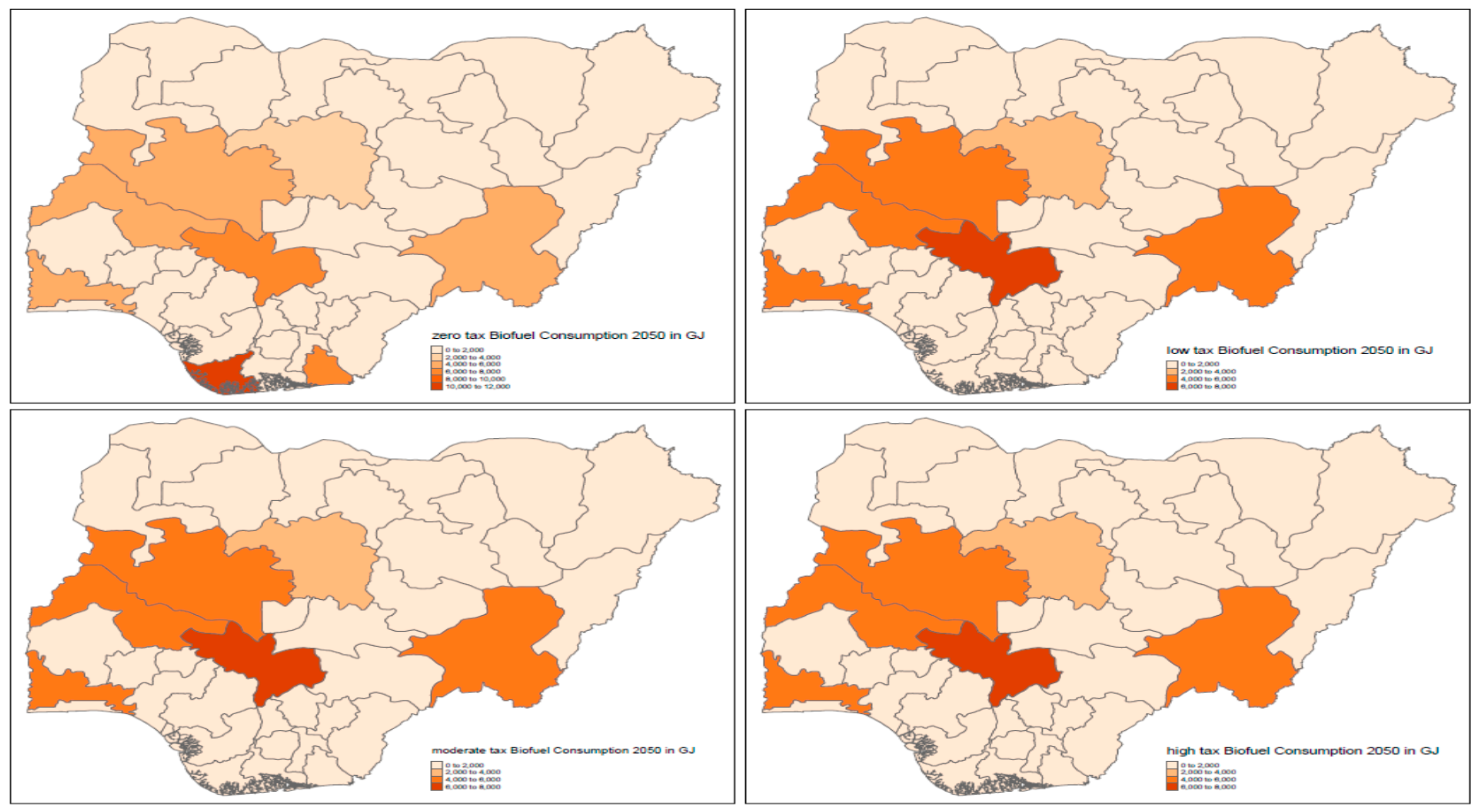

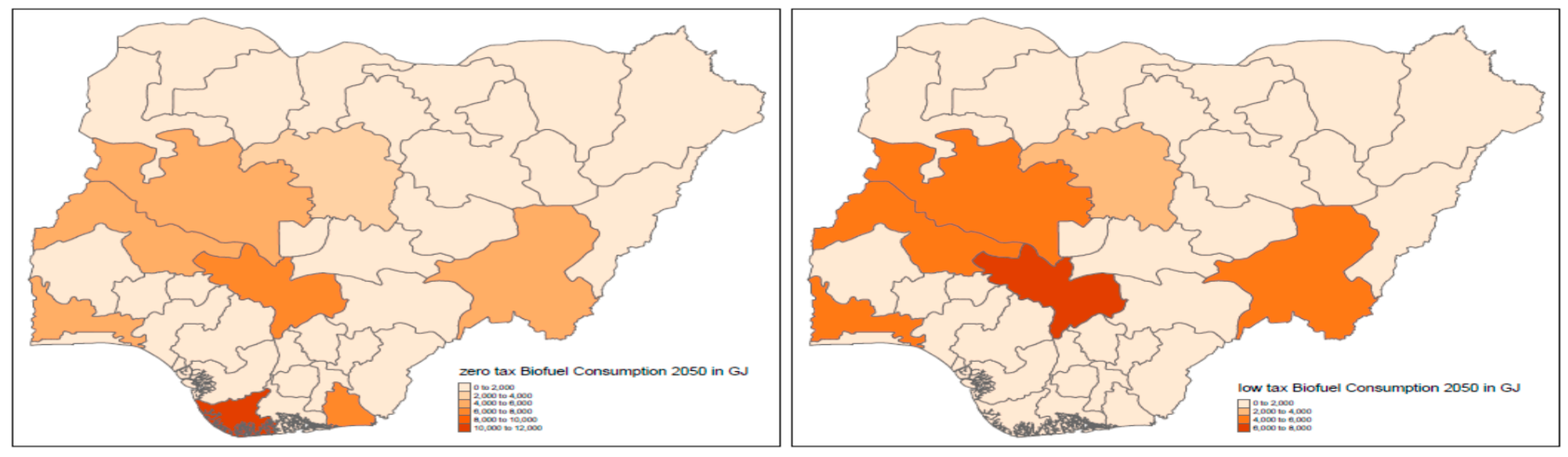

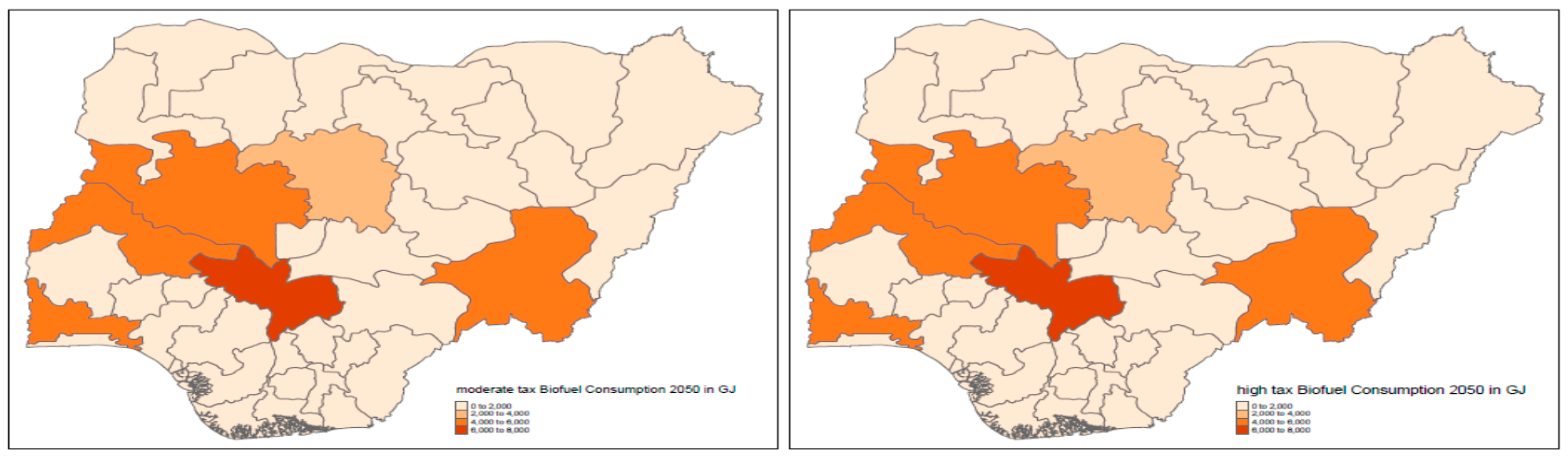

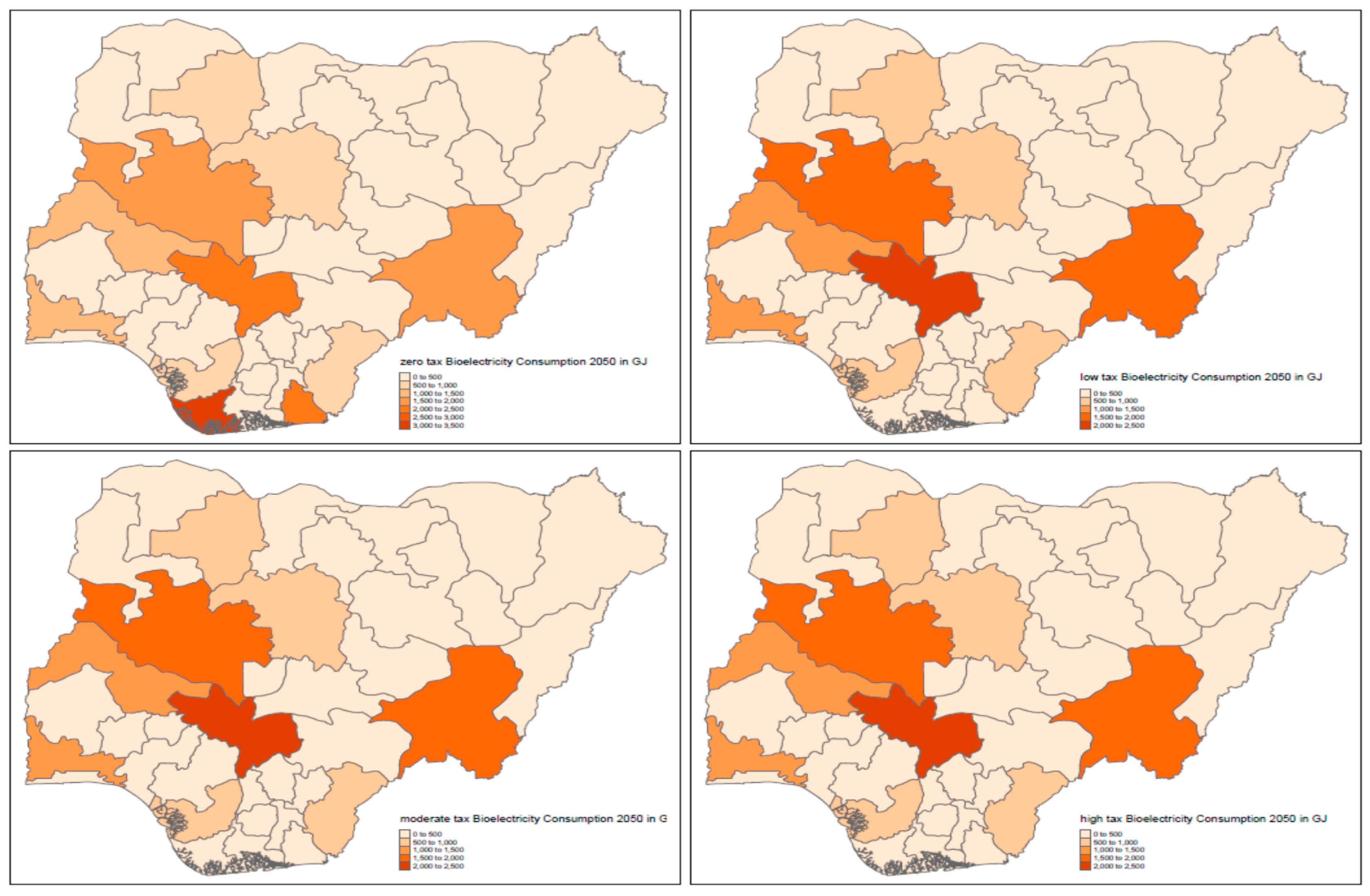

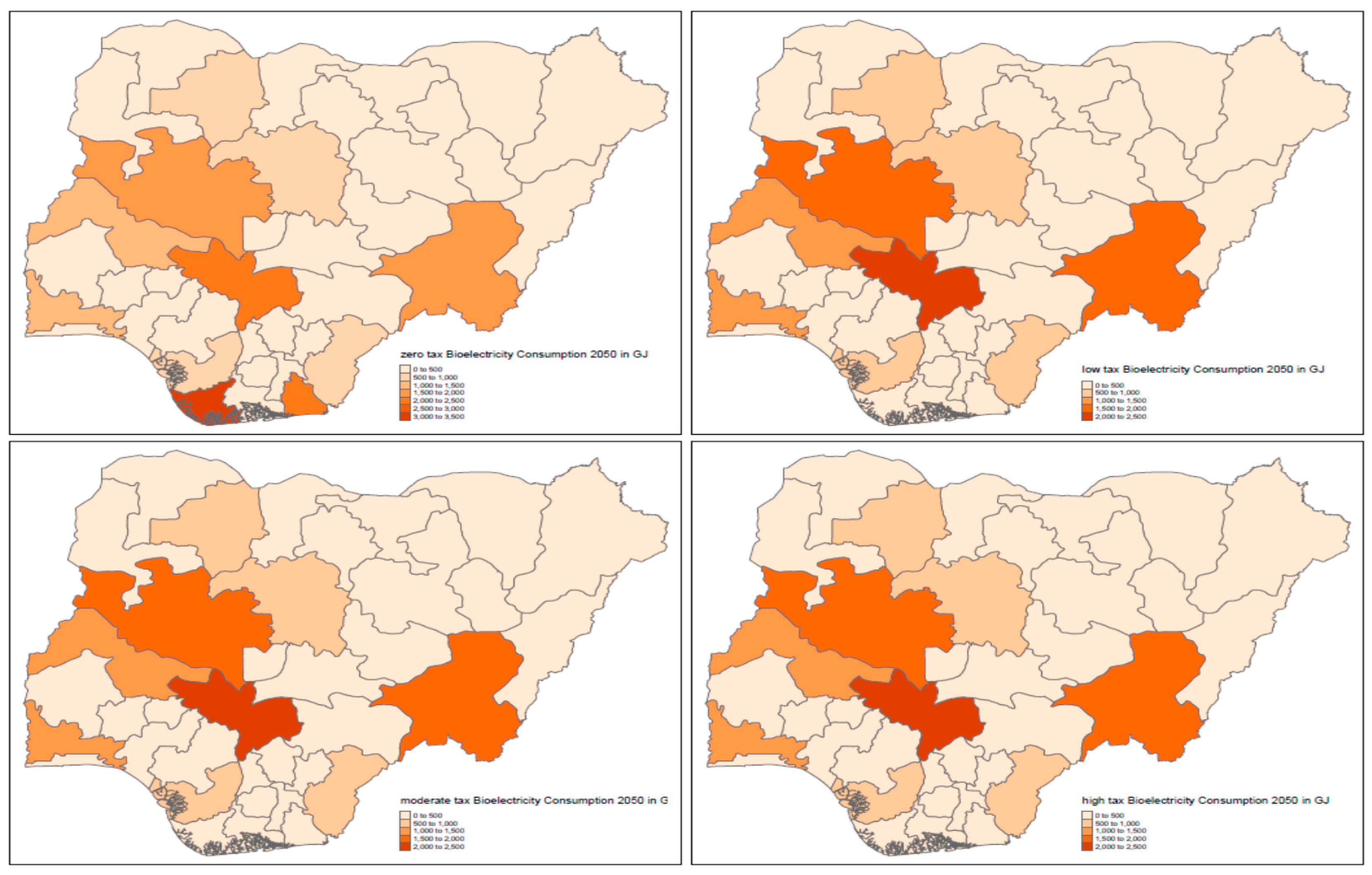

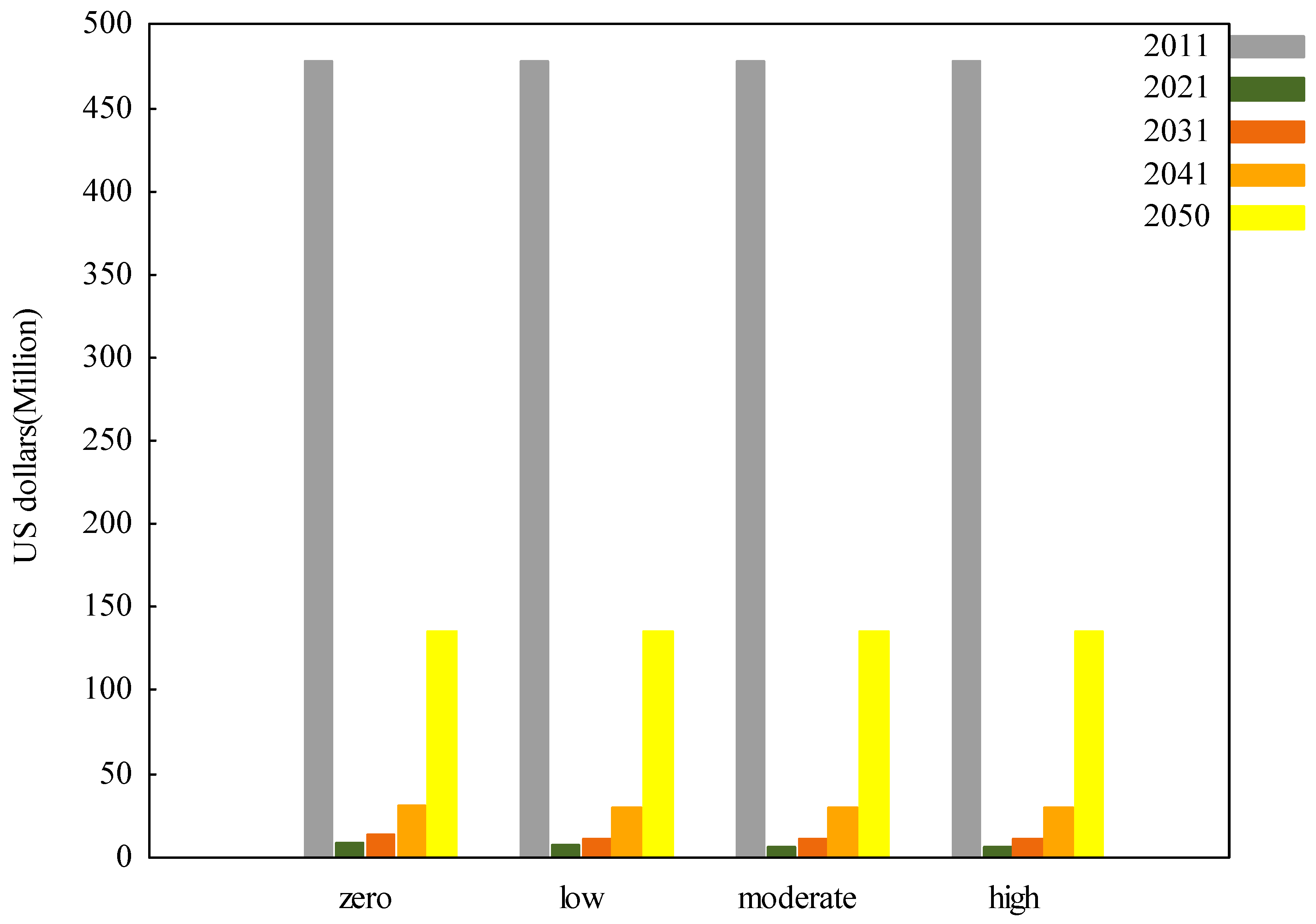

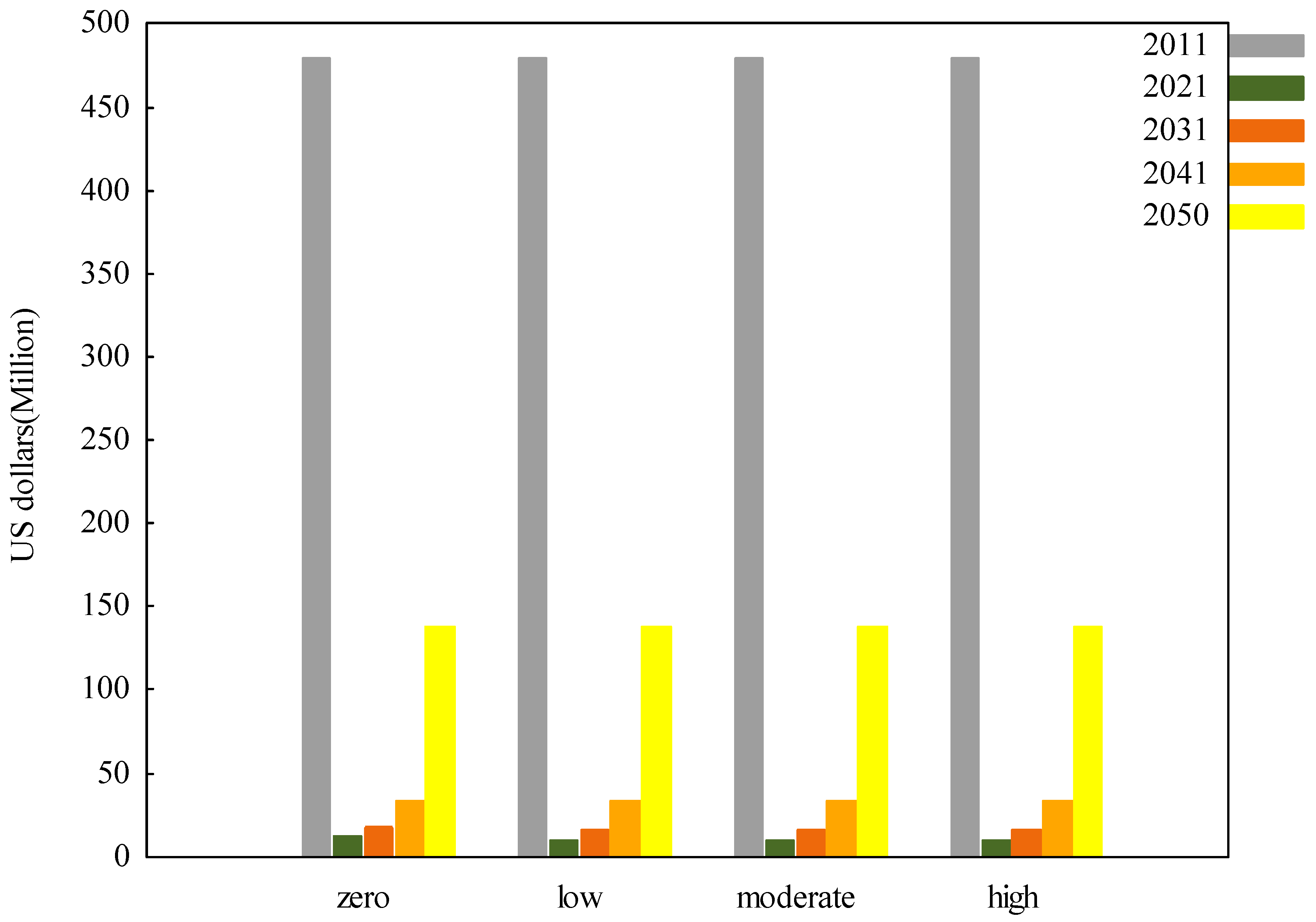

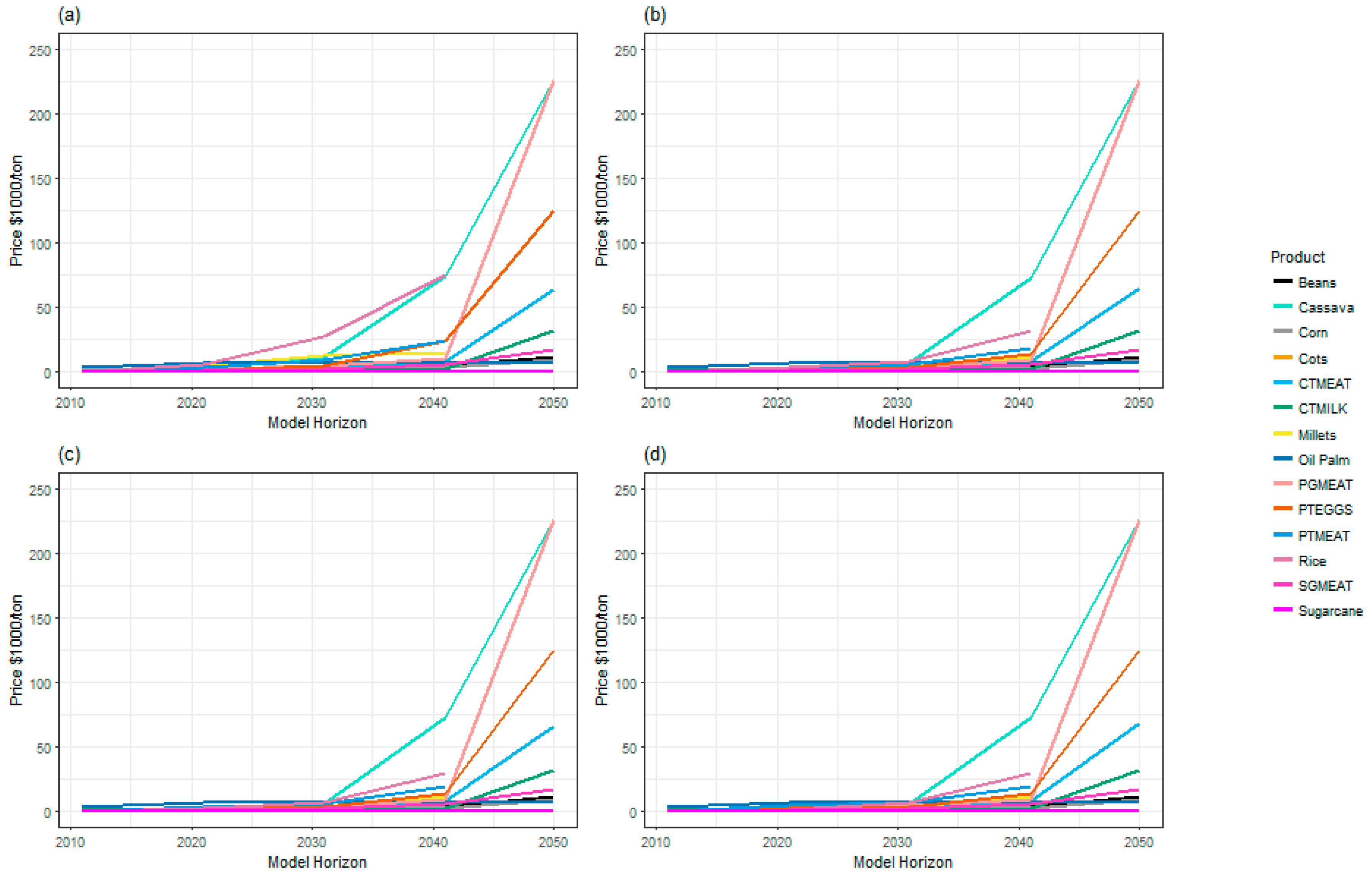

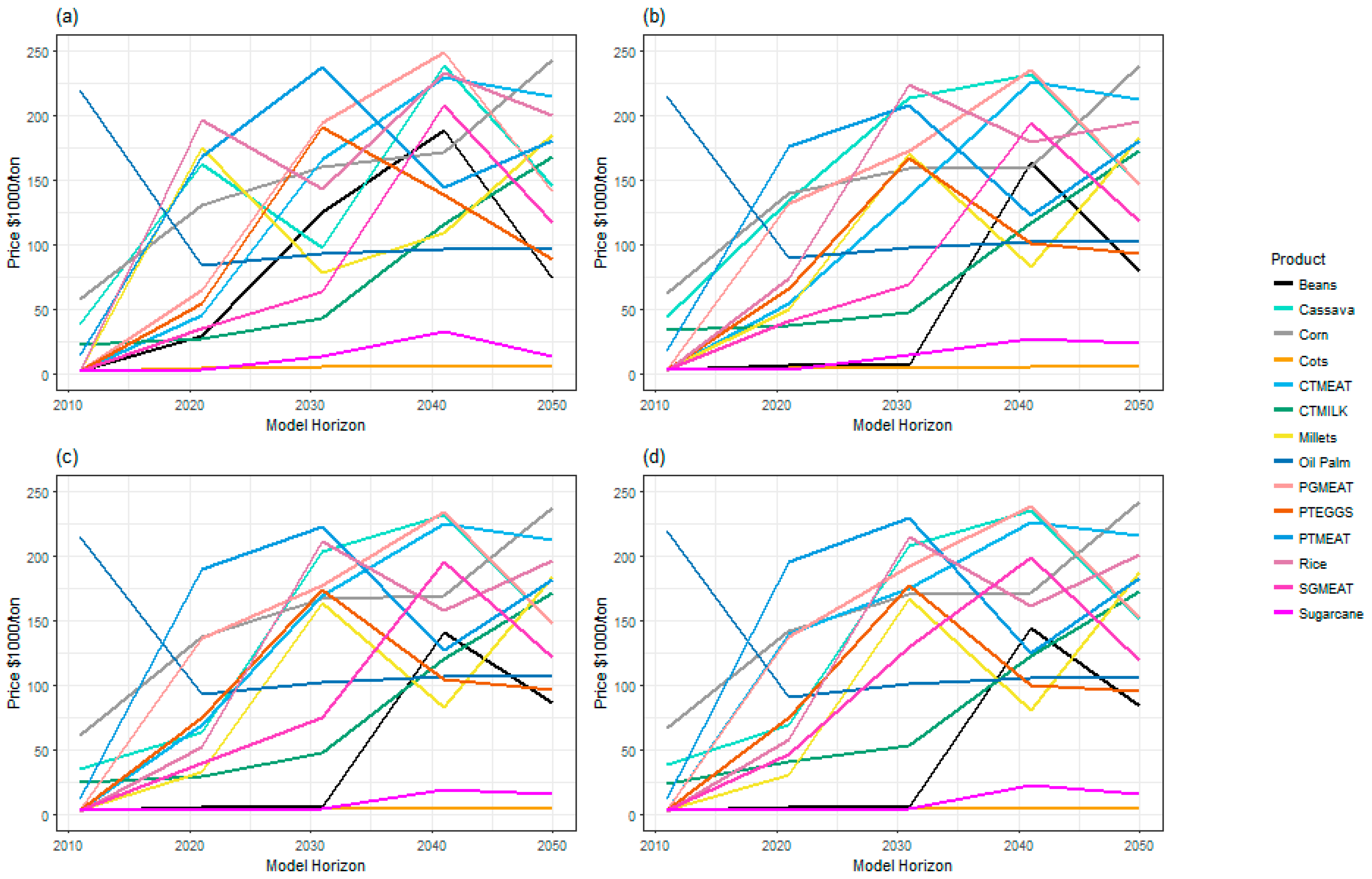

3.3. Implications of Bioenergy Subsidies on Food Prices, Total Welfare and Bioenergy Consumption Pattern

4. Conclusions and Policy Implications

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Model Equations

| Variable | Description | Unit |

| W | Welfare | million USD |

| D | Domestic demand quantity | 1000 tons |

| S | Domestic supply quantity | 1000 units |

| T | Trade quantity | 1000 tons |

| A | Land-use activity | 1000 ha |

| L | Livestock production activity | 1000 units |

| P | Processing activity (also used to depict product substitutions) | 1000 units |

| E | Environmental impacts | 1000 units |

| U | Land-use change | 1000 ha |

| Parameter | Description | Unit |

| a | Technical coefficient containing productivities, input coefficients, per-unit cost, environmental impact coefficients | product or resource unit/activity unit |

| b | Endowments | 1000 units |

| c | Objective function coefficients | USD/activity unit |

| k | Commodity coefficients | attribute unit/product unit |

| δ | discount factor | unit less |

| ε | elasticity | unit less |

| Function | Description | |

| ɸ | inverse demand/supply function | |

| χ | marginal cost function | |

| ν | marginal value function | |

| Index | Description | Elements |

| t | time | decades |

| r | region | 36 States + FCT |

| y | commodity | food commodities, forest products, and bioenergy |

| i | input (resource) | land and energy (implicitly represented) |

| e | environmental impact | GHG emissions (CO2eqv.) |

| s | species | ~8 Crops, ~1 forest type |

| a | animal | ~6 animal types |

| m | management | land, livestock production, and processing alternatives |

| u | land-use type | cropland, forest land, and grassland |

| z | commodity attribute | food commodities, animal feedstuffs, and bioenergy products |

References

- Ohimain, E.I. A review of the Nigerian biofuel policy and incentives (2007). Renew. Sustain. Energy Rev. 2013, 22, 246–256. [Google Scholar] [CrossRef]

- Ojo, O.V. An Overview of the Legal and Regulatory Framework for Renewable Energy Projects in Nigeria: Challenges and Prospects; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Fytili, D.; Zabaniotou, A. Social acceptance of bioenergy in the context of climate change and sustainability—A review. Curr. Opin. Green Sustain. Chem. 2017, 8, 5–9. [Google Scholar] [CrossRef]

- Gazull, L. Agricultural and Forestry Chains in the Countries of the South in the Age of Bioenergy. In Sustainable Development and Tropical Agri-Chains; Springer: Dordrecht, The Netherlands, 2017; pp. 175–186. [Google Scholar]

- Souza, G.M.; Ballester, M.V.R.; de Brito Cruz, C.H.; Chum, H.; Dale, B.; Dale, V.H.; Fernandes, E.C.M.; Foust, T.; Karp, A.; Lynd, L.; et al. The role of bioenergy in a climate-changing world. Environ. Dev. 2017. [Google Scholar] [CrossRef]

- The United Nations (UN). Climate Action Now: Summary for Policymakers 2016; United Nations Climate Change Secretariat: Bonn, Germany, 2016. [Google Scholar]

- Bottcher, H.; Aoki, K.; De Cara, S.; Gusti, M.; Havlik, P.; Kindermann, G.; Schneider, U.A.; Obersteiner, M. GHG Mitigation Potentials and Costs from Land-Use, Land-Use Change and Forestry (LULUCF) in Annex 1 Countries. Available online: http://gains.iiasa.ac.at/gains/reports/AnnexI-LULUCF.pdf (accessed on 9 August 2017).

- Havlík, P.; Schneider, U.A.; Schmid, E.; Böttcher, H.; Fritz, S.; Skalskỳ, R.; Aoki, K.; De Cara, S.; Kindermann, G.; Kraxner, F.; et al. Global land-use implications of first and second generation biofuel targets. Energy Policy 2011, 39, 5690–5702. [Google Scholar] [CrossRef]

- Mosnier, A.; Havlík, P.; Valin, H.; Baker, J.; Murray, B.; Feng, S.; Obersteiner, M.; McCarl, B.A.; Rose, S.K.; Schneider, U.A. Alternative U.S. biofuel mandates and global GHG emissions: The role of land use change, crop management and yield growth. Energy Policy 2013, 57, 602–614. [Google Scholar] [CrossRef]

- Murphy, F.; McDonnell, K. Investigation of the potential impact of the Paris Agreement on national mitigation policies and the risk of carbon leakage; an analysis of the Irish bioenergy industry. Energy Policy 2017, 104, 80–88. [Google Scholar] [CrossRef]

- Bracco, S. Effectiveness of EU biofuels sustainability criteria in the context of land acquisitions in Africa. Renew. Sustain. Energy Rev. 2015, 50, 130–143. [Google Scholar] [CrossRef]

- Aha, B.; Ayitey, J.Z. Biofuels and the hazards of land grabbing: Tenure (in)security and indigenous farmers’ investment decisions in Ghana. Land Use Policy 2017, 60, 48–59. [Google Scholar] [CrossRef]

- Warner, E.; Inman, D.; Kunstman, B.; Bush, B.; Vimmerstedt, L.; Peterson, S.; Macknick, J.; Zhang, Y. Modeling biofuel expansion effects on land use change dynamics. Environ. Res. Lett. 2013, 8, 015003. [Google Scholar] [CrossRef]

- The Food and Agriculture Organization (FAO). Global Agriculture towards 2050; The Food and Agriculture Organization of the United Nations: Rome, Italy, 2009. [Google Scholar]

- Plevin, R.J.; O’Hare, M.; Jones, A.D.; Torn, M.S.; Gibbs, H.K. Greenhouse Gas Emissions from Biofuels’ Indirect Land Use Change Are Uncertain but May Be Much Greater than Previously Estimated. Environ. Sci. Technol. 2010, 44, 8015–8021. [Google Scholar] [CrossRef] [PubMed]

- Smeets, E.M.W.; Faaij, A.P.C. Bioenergy potentials from forestry in 2050. Clim. Chang. 2007, 81, 353–390. [Google Scholar] [CrossRef]

- Emodi, N.V.; Ebele, N.E. Policies Enhancing Renewable Energy Development and Implications for Nigeria. Sustain. Energy Sustain. Energy 2016, 4, 7–16. [Google Scholar] [CrossRef]

- Emodi, N.V. Energy Policies for Sustainable Development Strategies Frontiers in African Business Research; Springer: Singapore, 2016; ISBN 978-981-10-0974-7. [Google Scholar]

- Okoro, S.U.; Schickhoff, U.; Boehner, J.; Schneider, U.A.; Huth, N.I. Climate impacts on palm oil yields in the Nigerian Niger Delta. Eur. J. Agron. 2017, 85, 38–50. [Google Scholar] [CrossRef]

- Schneider, U.A.; McCarl, B.A.; Schmid, E. Agricultural sector analysis on greenhouse gas mitigation in US agriculture and forestry. Agric. Syst. 2007, 94, 128–140. [Google Scholar] [CrossRef]

- McCarl, B.A.; Spreen, T.H. Price Endogenous Mathematical Programming as a Tool for Sector Analysis. Am. J. Agric. Econ. 1980, 62, 87–102. [Google Scholar] [CrossRef]

- Muth, J.F. Rational Expectations and the Theory of Price Movements. Econometrica 1961, 29, 315–335. [Google Scholar] [CrossRef]

- Dibblee, G.B. The Laws of Supply and Demand: With Special Reference to Their Influence on Over-Production and Unemployment; Constable and Company, Ltd.: London, UK, 1912. [Google Scholar]

- Anderson, K.P. Optimal growth when the stock of resources is finite and depletable. J. Econ. Theory 1972, 4, 256–267. [Google Scholar] [CrossRef]

- Samuelson, P.A. Spatial price equilibrium and linear programming. Am. Econ. Rev. 1952, 42, 283–303. [Google Scholar]

- Takayama, T.; Judge, G.G. An Intertemporal Price Equilibrium Model. J. Farm Econ. 1964, 46, 477–484. [Google Scholar] [CrossRef]

- Schleupner, C.; Schneider, U.A. Effects of bioenergy policies and targets on European wetland restoration options. Environ. Sci. Policy 2010, 13, 721–732. [Google Scholar] [CrossRef]

- Schneider, U.A.; McCarl, B.A. Economic potential of biomass based fuels for greenhouse gas emission mitigation. Environ. Resour. Econom. 2003, 24, 291–312. [Google Scholar] [CrossRef]

- Skalskỳ, R.; Tarasovičová, Z.; Balkovič, J.; Schmid, E.; Fuchs, M.; Moltchanova, E.; Scholtz, P. GEO-BENE Global Database for Bio-Physical Modeling. GEOBENE Project. 2008. Available online: http://www.geo-bene.eu/files/Deliverables/Geo-BeneGlbDb10%28DataDescription%29.pdf (accessed on 16 November 2017).

- Arino, O.; Ramos Perez, J.J.; Kalogirou, V.; Bontemps, S.; Defourny, P.; Van Bogaert, E. Global Land Cover Map for 2009 (GlobCover 2009); European Space Agency ESA & Univiversity Catholique Louvain (UCL), PANGAEA: Paris, France; Louvain-la-Neuve, Belgium, 2012. [Google Scholar]

- Okoro, S.U.; Schickhoff, U.; Böhner, J.; Schneider, U.A. A novel approach in monitoring land-cover change in the tropics: Oil palm cultivation in the Niger Delta, Nigeria. ERDE–J. Geogr. Soc. Berl. 2016, 147, 40–52. [Google Scholar]

- Seto, K.C.; Kaufmann, R.K.; Woodcock, C.E. Landsat reveals China’s farmland reserves, but they’re vanishing fast. Nature 2000, 406, 121. [Google Scholar] [CrossRef] [PubMed]

- Izaurralde, R.C.; Williams, J.R.; Mcgill, W.B.; Rosenberg, N.J.; Jakas, M.Q. Simulating soil C dynamics with EPIC: Model description and testing against long-term data. Ecol. Model. 2006, 192, 362–384. [Google Scholar] [CrossRef]

- Huth, N.I.; Banabas, M.; Nelson, P.N.; Webb, M. Development of an oil palm cropping systems model: Lessons learned and future directions. Environ. Model. Softw. 2014, 62, 411–419. [Google Scholar] [CrossRef]

- Herrero, M.; Havlik, P.; Valin, H.; Notenbaert, A.; Rufino, M.C.; Thornton, P.K.; Blummel, M.; Weiss, F.; Grace, D.; Obersteiner, M. Biomass use, production, feed efficiencies, and greenhouse gas emissions from global livestock systems. Proc. Natl. Acad. Sci. USA 2013, 110, 20888–20893. [Google Scholar] [CrossRef] [PubMed]

- Kruska, R.L. Seré and Steinfeld Version 3; Digit Data Set; ILRI: Nairobi, Kenya, 2006. [Google Scholar]

- Seré, C.; Steinfeld, H. World Livestock Production Systems: Current Status, Issues and Trends; Food Agriculture Organization (FAO): Rome, Italy, 1996. [Google Scholar]

- Kindermann, G.; Obersteiner, M.; Sohngen, B.; Sathaye, J.; Andrasko, K.; Rametsteiner, E.; Schlamadinger, B.; Wunder, S.; Beach, R. Global cost estimates of reducing carbon emissions through avoided deforestation. Proc. Natl. Acad. Sci. USA 2008, 105, 10302–10307. [Google Scholar] [CrossRef] [PubMed]

- Simonyan, K.J.; Fasina, O. Biomass resources and bioenergy potentials in Nigeria. Afr. J. Agric. Res. 2013, 8, 4975–4989. [Google Scholar]

- Sørensen, A.L. Economies of Scale in Biomass Gasification Systems; IIASA Interim Report; IIASA: Laxenburg, Austria, 2005. [Google Scholar]

- Leduc, S.; Schwab, D.; Dotzauer, E.; Schmid, E.; Obersteiner, M. Optimal location of wood gasification plants for methanol production with heat recovery. Int. J. Energy Res. 2008, 32, 1080–1091. [Google Scholar] [CrossRef]

- Valin, H.; Havlík, P.; Mosnier, A.; Herrero, M.; Schmid, E.; Obersteiner, M. Agricultural productivity and greenhouse gas emissions: Trade-offs or synergies between mitigation and food security? Environ. Res. Lett. 2013, 8, 035019. [Google Scholar] [CrossRef]

- Filoche, G. Playing musical chairs with land use obligations: Market-based instruments and environmental public policies in Brazil. Land Use Policy 2017, 63, 20–29. [Google Scholar] [CrossRef]

- Angelsen, A.; Brockhaus, M.; Duchelle, A.E.; Larson, A.; Martius, C.; Sunderlin, W.D.; Verchot, L.; Wong, G.; Wunder, S. Learning from REDD+: A response to Fletcher et al. Conserv. Biol. 2017, 31, 718–720. [Google Scholar] [CrossRef] [PubMed]

- Thamo, T.; Pannell, D.J.; Kragt, M.E.; Robertson, M.J.; Polyakov, M. Dynamics and the economics of carbon sequestration: Common oversights and their implications. Mitig. Adapt. Strateg. Glob. Chang. 2017, 22, 1095–1111. [Google Scholar] [CrossRef]

- Di Sbroiavacca, N.; Nadal, G.; Lallana, F.; Falzon, J.; Calvin, K. Emissions reduction scenarios in the Argentinean Energy Sector. Energy Econ. 2016, 56, 552–563. [Google Scholar] [CrossRef]

- Frank, S.; Havlík, P.; Soussana, J.-F.; Levesque, A.; Valin, H.; Wollenberg, E.; Kleinwechter, U.; Fricko, O.; Gusti, M.; Herrero, M.; et al. Reducing greenhouse gas emissions in agriculture without compromising food security? Environ. Res. Lett. 2017, 12, 105004. [Google Scholar] [CrossRef]

- Ben-Iwo, J.; Manovic, V.; Longhurst, P. Biomass resources and biofuels potential for the production of transportation fuels in Nigeria. Renew. Sustain. Energy Rev. 2016, 63, 172–192. [Google Scholar] [CrossRef] [Green Version]

| Productivity Input Pathways | Crop Management | |

|---|---|---|

| Fertilizer Adjustment | Other Input Adjustment | |

| High | Yes | Yes |

| Low | No | Yes |

| Subsistence | No | No |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Okoro, S.U.; Schickhoff, U.; Schneider, U.A. Impacts of Bioenergy Policies on Land-Use Change in Nigeria. Energies 2018, 11, 152. https://doi.org/10.3390/en11010152

Okoro SU, Schickhoff U, Schneider UA. Impacts of Bioenergy Policies on Land-Use Change in Nigeria. Energies. 2018; 11(1):152. https://doi.org/10.3390/en11010152

Chicago/Turabian StyleOkoro, Stanley U., Udo Schickhoff, and Uwe A. Schneider. 2018. "Impacts of Bioenergy Policies on Land-Use Change in Nigeria" Energies 11, no. 1: 152. https://doi.org/10.3390/en11010152