3.2. Unique Diffusions and Gyöngy

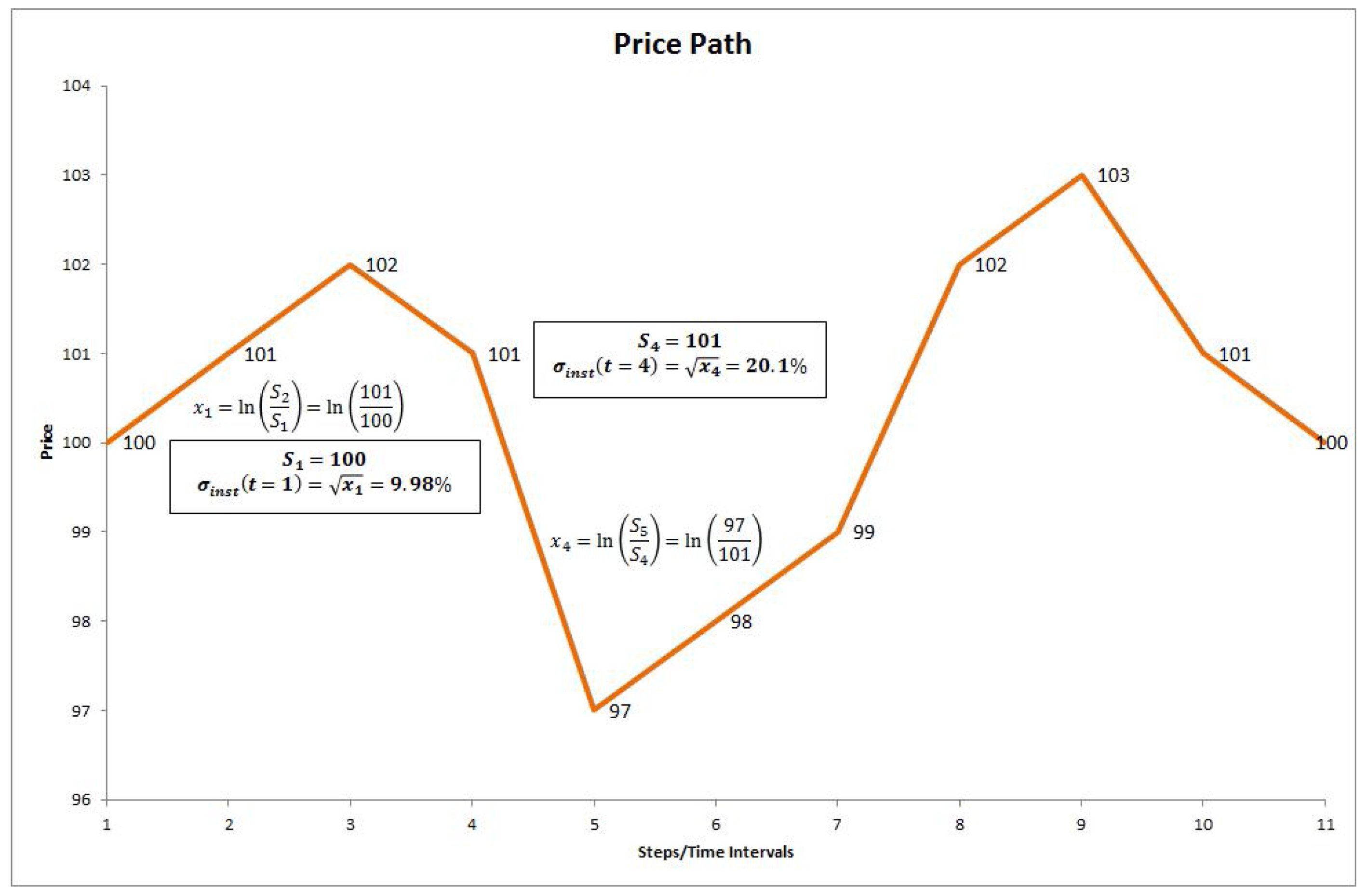

What significance does volatility have to an option trader. Remember, historical volatility is calculated from the time series of the stock prices. This volatility is thus “backward looking”. On the other hand, implied or market volatility is “forward looking” i.e., it is an estimate of the future volatility or the volatility that should prevail from today until the expiry of the option.

Rational market makers base option prices on these estimates of future volatility. To them, the Black-Scholes implied volatility

is, to some extent, “the estimated average future volatility” of the underlier over the lifetime of the option. In this sense,

is a

global measure of volatility. But, remember Rebonato’s statement that implied volatility is not a statistical measure, it is just a price [

29].

On the other hand, the local volatility

, represents “some kind of average” over all possible

instantaneous volatilities, at a certain point in time, in a stochastic volatility world [

33]. Unlike the naive implied volatility

produced by applying the Black-Scholes formula to market prices, the local volatility is the volatility implied by option values produced by the one factor Black-Scholes PDE given in Equation (

2.6).

Similarly, in the option market, each standard option with a particular strike and expiry time has its own implied volatility, which is the

implied constant future local volatility that equates the Black-Scholes value of an option to its current market price. Further insights led Dupire [

34] and Derman and Kani [

8] to realize that, knowing all European option prices merely amounts to knowing the probability densities of the underlying stock price at different times, conditional on its current value. This led them to state that under risk neutrality, there was a unique diffusion process consistent with the risk neutral probability densities derived from the prices of European options. This diffusion is unique for any particular stock price and holds for all options on that stock, irrespective of their strike level or time to expiration. This is in contrast to the general Black-Scholes theory supposing that the implied volatility skew infers that one stock should have many different diffusion processes: one for every strike and time to expiry. This, of course, cannot be the case.

Kani

et al. [

35] further showed that the local variance,

is the conditional risk-neutral expectation of the instantaneous future variance of the stock returns, given that the stock level at the future time

T is

K. We can also interpret this measure as a

K-level,

T-maturity forward-risk-adjusted measure. This is analogous to the known relationship between the forward and future spot interest rates where the forward rate is the forward-risk-adjusted expectation of the instantaneous future spot rate [

36].

Dupire, Derman, Kani and Kamal rediscovered a known (but lost) theorem stated and proved a decade earlier. They proved it independently from a practitioner’s point of view. This was a proposition by Krylov but proven by Gyöngy [

16]. Gyöngy’s theorem is an important theoretical result that links local volatility models to other diffusion models that are also capable of generating the implied volatility surface.

Alexander and Nogueira [

37] pointed out that the basic idea is that, a given stochastic differential equation (SDE) with stochastic drift and diffusion coefficients, can be mimicked by another constructed process. However, this mimicking SDE can be constructed such that it has

deterministic coefficients such that the solutions of the two equations have the same marginal probability distributions. In essence, Gyöngy’s theorem states that the local volatility SDE given in Equation (

2.5) is just a special case of a more general stochastic differential equation with stochastic drift and volatility.

With Gyöngy one can map a multi-dimensional Ito process to a one-dimensional Markov process with the same marginal distributions as the original process. It is used by practitioners to construct simpler SDEs by, for instance, reducing the number of stochastic processes in models that incorporate stochastic volatility and stochastic interest rates and/or dividends. Read more on this important theorem in

Appendix A.

3.5. Dupire Local Volatility

Let us recap what we know: From Equation (

5) we know that the general Black-Scholes differential equation is obtained from the SDE

In its most general form, the function

is called the instantaneous volatility for an option with time to expiry

T and its dynamics are stochastic. Furthermore, similar to the definition of the instantaneous forward interest rate [

36], we define the square of the at-the-money implied volatility as follows

by additivity of variance [

27]. This shows that the implied volatility is a fair average, across time, over all instantaneous variances.

Readers might be confused due to the last paragraph in

Section 2.1 and Equation (

2.4) where we stated that the implied volatility is not a volatility after all. The instantaneous variance in Equation (

3.13) is not the true variance of the stochastic process

. It is something different as explained by Rebonato [

29] and in §2.1.

We further know that the Black-Scholes backward parabolic equation in variables

S and

t, given in Equation (

2.6), is the Feynman-Kac representation of the discounted expected value of the final option value as given in Equation (

2.7) [

42].

Dupire [

34] attempted to answer the question of whether it was possible to construct a state-dependent instantaneous volatility that, when fed into the one-dimensional diffusion equation given in Equation (

3.12), will recover the entire implied volatility surface

? This suggests he wanted to know whether a deterministic volatility function exists that satisfies Equation (

3.12). The answer to this question is negative, however, it becomes true if we apply Gyöngy’s theorem where the stochastic differential Equation in (

3.12) is transformed to another SDE with a non-random volatility function. This is ultimately what Dupire proved.

According to standard financial theory, the price at time

t of a call option with strike price

K, maturity time

T is the discounted expectation of its payoff, under the risk-neutral measure. Dupire assumed that the probability density of the underlying asset

at the time

t has to satisfy the forward Fokker-Planck Equation (also known as the forward Kolmogorov equation) given by [

9]

where

is the forward transition probability density of the random variable

(final

S at expiry time

T) in the SDE shown in Equation (

3.12) [

27]. However, using the Breeden-Litzenberger formula [

43]

and doing a bit of calculus (see [

27,

33]), we can rewrite this and obtain the Dupire forward equation in terms of call option prices

where

is continuous, twice-differentiable in strike and once in time, and local volatility is uniquely determined by the surface of call option prices. Note how, when moving from the backward Kolmogorov Equation (the Black-Scholes PDE given in Equation (

2.3)) to the forward Fokker-Planck equation, the time to maturity

T has replaced the calendar time

t and the strike

K has replaced the stock level

S. The Fokker-Planck equation describes how a price propagates forward in time. This equation is usually used when one knows the distribution density at an earlier time, and one wants to discover how this density spreads out as time progresses, given the drift and volatility of the process [

29]. Dupire’s forward equation also provides useful insights into the inverse problem of calibrating diffusion models to observed call and put option prices.

This forward PDE is very useful because it holds in a more general context than the backward PDE: even if the (risk-neutral) dynamics of the underlying asset is not necessarily Markovian, but described by a continuous Brownian martingale

then call options still satisfy a forward PDE where the diffusion coefficient is given by the local (or effective) volatility function

given by

and

σ is the instantaneous or stochastic volatility of the process

. This method is linked to the Markovian projection problem: the construction of a Markov process which mimics the marginal distributions of a martingale. Such mimicking processes provide a method to extend the Dupire equation to non-Markovian settings (see

Appendix A).

Dupire [

9] used the strike/dual Gamma

) of a call option, that gives the marginal probability distribution function [

43], and thought of this as timeslices of the forward transition probabilities. Now, since the forward Fokker-Planck equation in Equation (

3.14) describes the time evolution of forward transition probabilities, we can isolate the volatility coefficients that recover the prices of tradable call options for all strikes and all times in Equation (

3.16).

Dupire actually proved that it is possible to find the same option price solving a dual problem, namely a forward parabolic equation in the variables K and T known as the dual Black-Scholes equation or Dupire’s equation. This equation is actually the Fokker-Planck equation for the probability density function of the underlying asset integrated twice. This solution allows us to calculate the price of an European call option for every strike and maturity, given the present spot value S and time t.

Dupire solved for the volatility and got [

9]

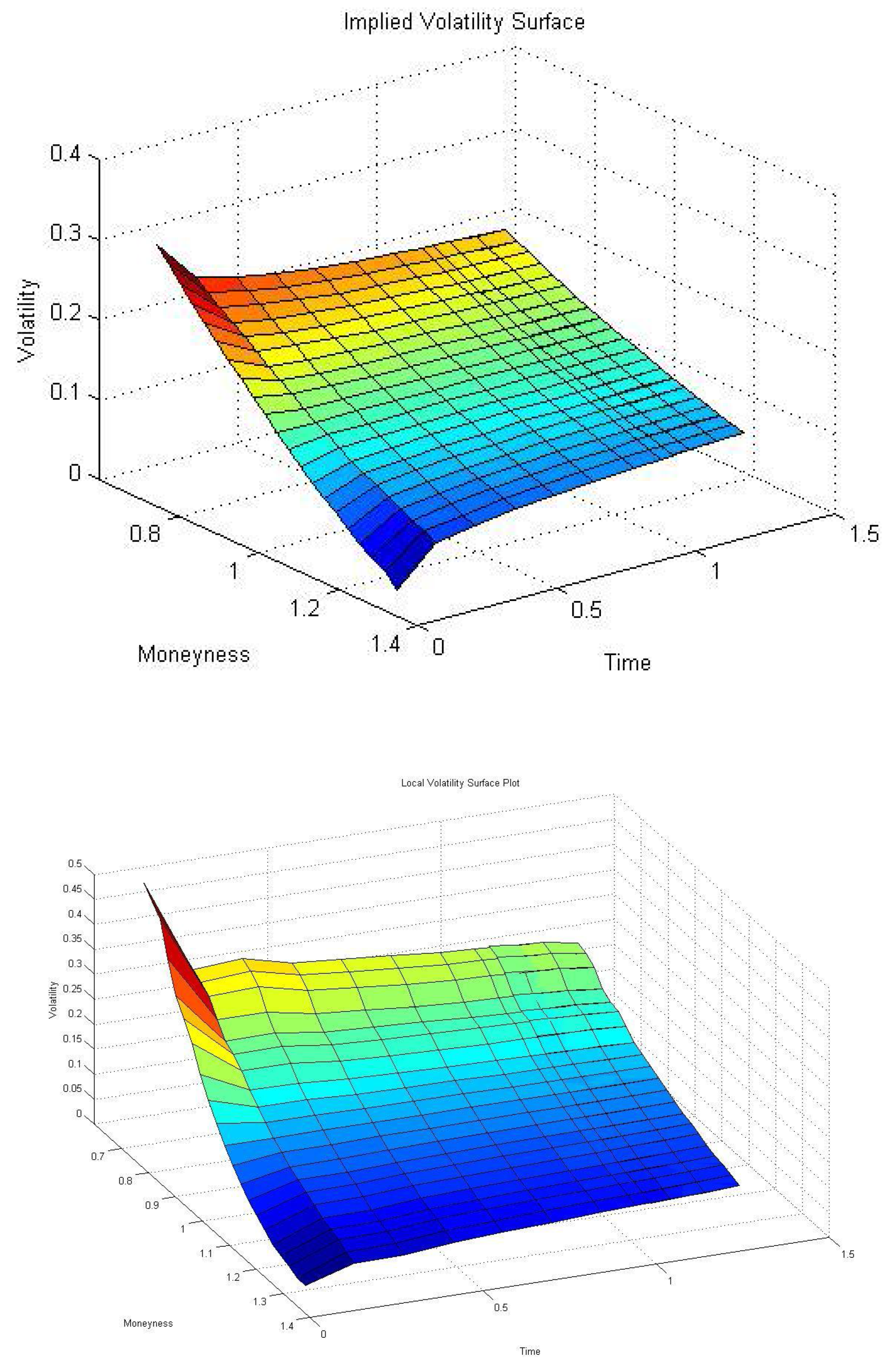

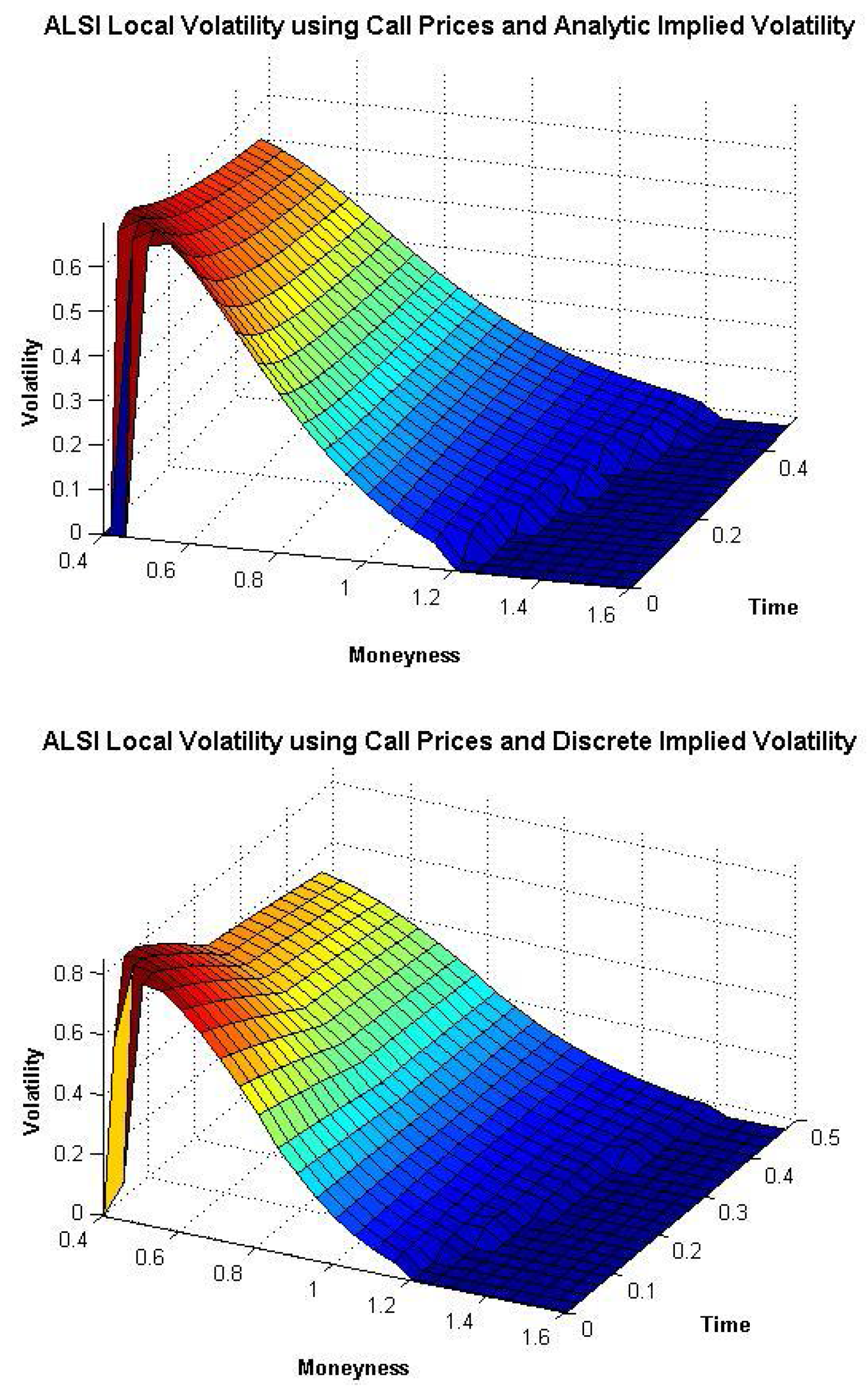

Thus, given prices for all plain-vanilla call options today, is the local volatility that will prevail at time τ when the future stock price is equal to K . Note that we introduced a new time variable and where —call this an interim expiry date. The reason is that it facilitates the calculation and plotting of the whole surface from t to the expiry date T. We now have that t and are respectively the market date, on which the volatility smile is observed, and the asset price on that date. To calculate the local volatility at each time point from t to the expiry time T, we let move forward in time while we keep t constant. To plot the 3D surface, start at the valuation date t, move forward in time by a small amount to a new ; for example a day or a week. Calculate τ and vary the strikes to calculate . Move forward to a new and do the same until one ends at .

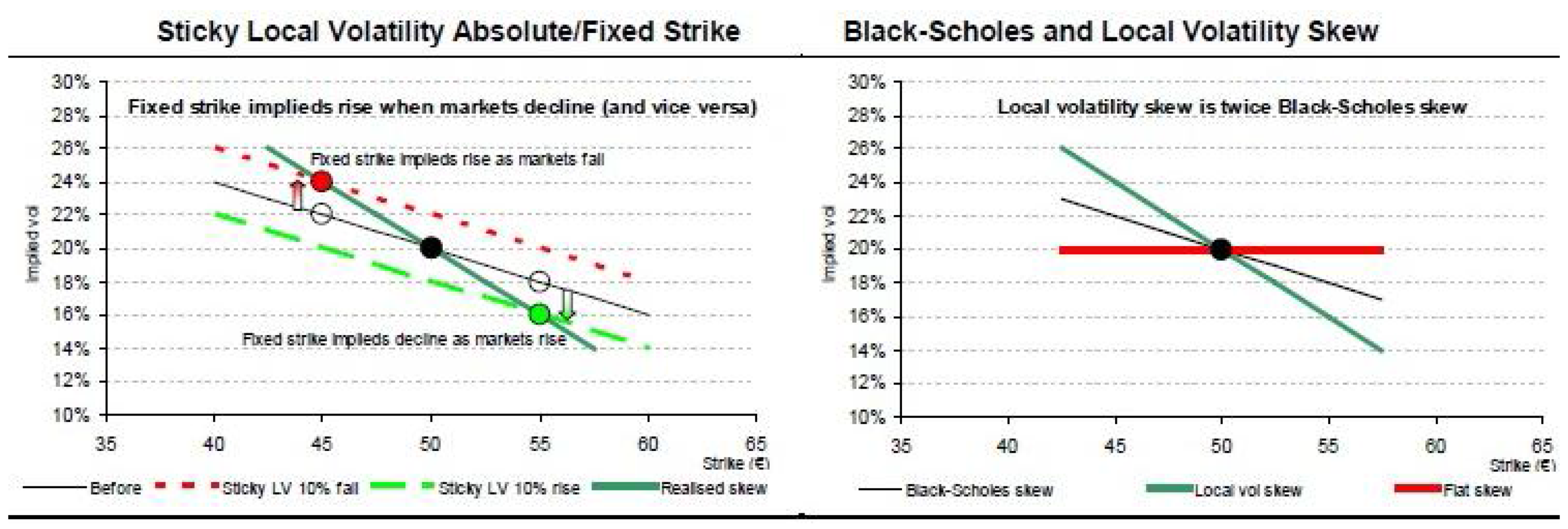

Note that

r is a fixed interest rate and

d a fixed dividend yield, both in continuous format. See the number 2 on the right hand side of Equation (

3.17). This backs our statement in

Section 3.3.3 up where we stated that the implied volatility is half the local volatility skew. Note that Equation (

3.17) ensures the existence and uniqueness of a local volatility surface which reproduces the market prices exactly.

We further note that for Equation (

3.17) to make sense, the right hand side must be positive. How can we be sure that volatilities are not imaginary? This is guaranteed by no-arbitrage arguments. We have from the denominator

is positive always and, the dual gamma or risk-neutral price density must be positive in the absence of arbitrage (butterfly spread). To ensure the positivity of the numerator, we note that no-arbitrage arguments state that calendar spreads should have positive values. Kotzé and Joseph [

44] and Kotzé

et al. [

18] discusses no-arbitrage arguments in detail. We can turn these statements around: An implied volatility surface is arbitrage free if the local volatility is a positive real number (not imaginary) where

.

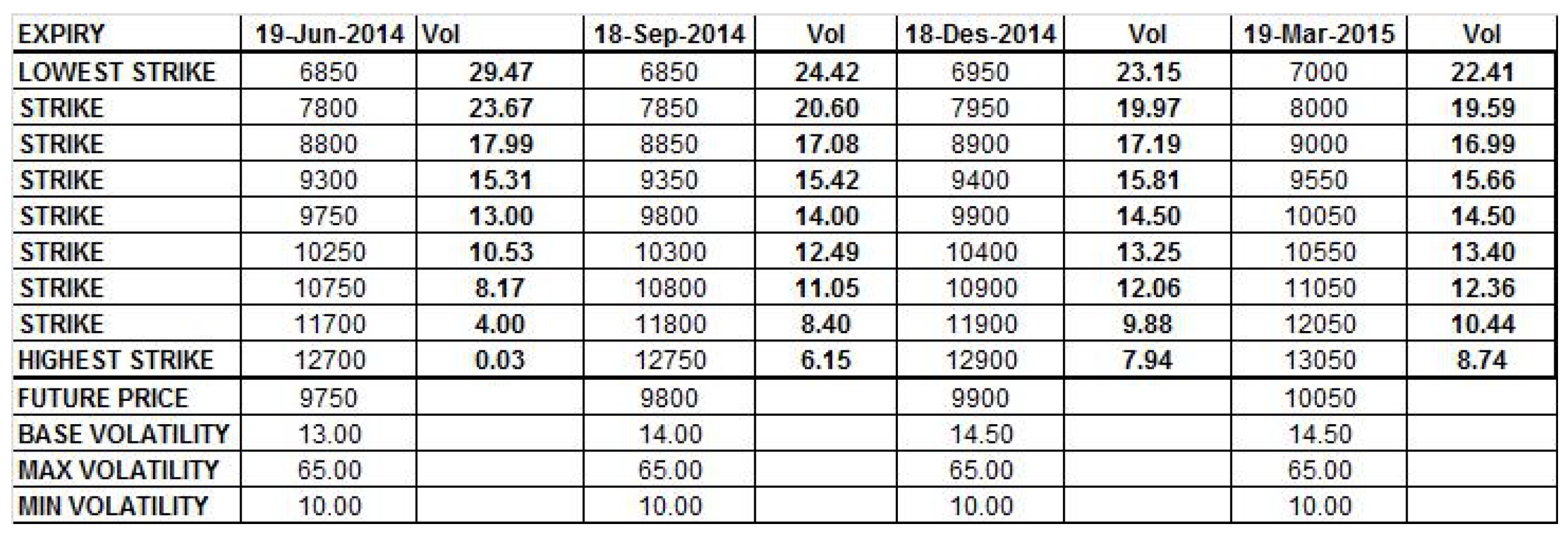

Dupire’s Equation (

3.17) is not analytically solvable. The option price function (and the derivatives) in this equation have to be approximated numerically. The derivatives are easily obtained in using Newton’s difference quotient. To obtain the dual delta,

, we therefore use

where we note that all calls should be priced with the implied volatility smile. Here,

denotes a call price at a strike of

where the implied volatility is found from the implied volatility skew for this option expiring at

T with a strike of

. To find an optimal size of the bump,

, it should be tested for. For an index like the Top 40, one or ten index points works very well but some people prefer it to be a percentage of the strike price. Be careful not to make it too big—1% might seem small but it is in general too big. One or ten basis points works rather well for the change in time interval.

Further note that one cannot use the closed-form Black-Scholes derivatives for the dual delta. We call the numeric dual delta in Equation (

3.18), the impact/modified dual delta. Traders call the ordinary delta calculated this way,

i.e., with the skew, the impact/modified delta due to the fact that it gives a truer reflection (or impact) of the dynamic hedging process—it takes some of the nonlinear effects of the Black-Scholes equation, together with the shape of the volatility skew, into account. The dual gamma is numerically obtained by

where we dropped the

T for clarity’s sake [

29].

Unfortunately there are practical issues with Equation (

3.17). Problems can arise when the values to be approximated are very small and small absolute errors in the approximation can lead to big relative errors, perturbing the estimated quantity heavily. Determining the density

is numerically delicate. It is very small for options that are far in- or out-of-the-money (the effect is particularly large for options with short maturities). Small errors in the approximation of this derivative will get multiplied by the strike value squared resulting in big errors at these values, sometimes even giving negative values, resulting in negative variances and complex local volatilities. The local volatility will remain finite and well-behaved only if the numerator approaches zero at the right speed for these cases.

Further to the numerical issues, the continuity assumption of option prices is, of course, not very realistic. In practice option prices are known for certain discrete points and at limited number of maturities (quarterly for instance like most Safex options). The result of this is that in practice the inversion problem is ill-posed i.e., the solution is not unique and is unstable—the positivity of the second derivative in the strike direction is not guaranteed.

3.6. Local Volatility in terms of Implied Volatility

The instability of Equation (

3.17) forces us to consider alternatives. We know options are traded in the market on implied volatility and not price. Can we thus not transform this equation such that we supply the implied volatilities instead of option prices?

This can be done if a change of variables is made in Equation (

3.17) by rewriting the Black-Scholes equation for a call

C in terms of the log-strike

y where

. This leads to [

23,

27]

where

and

where

such that

t and

are respectively the market date, on which the volatility smile is observed, and the asset price on that date. Note that Equation (

3.19) gives the variance,

i.e.,

. See the explanation following Equation (

3.17) on how the new variable

τ facilitates the plotting of the whole local volatility surface.

When comparing Equations (

3.17) and (

3.19) it is clear that the problem of numerical large errors no longer exists. The transformation of Dupire’s formula into one which depends on the implied volatility ensures that the dual Gamma is no longer alone in the denominator as it was in Equation (

3.17). The second derivative of the implied volatility is now one term of a sum, so small errors in it will not necessarily lead to large errors in the local volatility function. However, small differences in the input volatility surface can produce a big difference in the estimated local volatility.

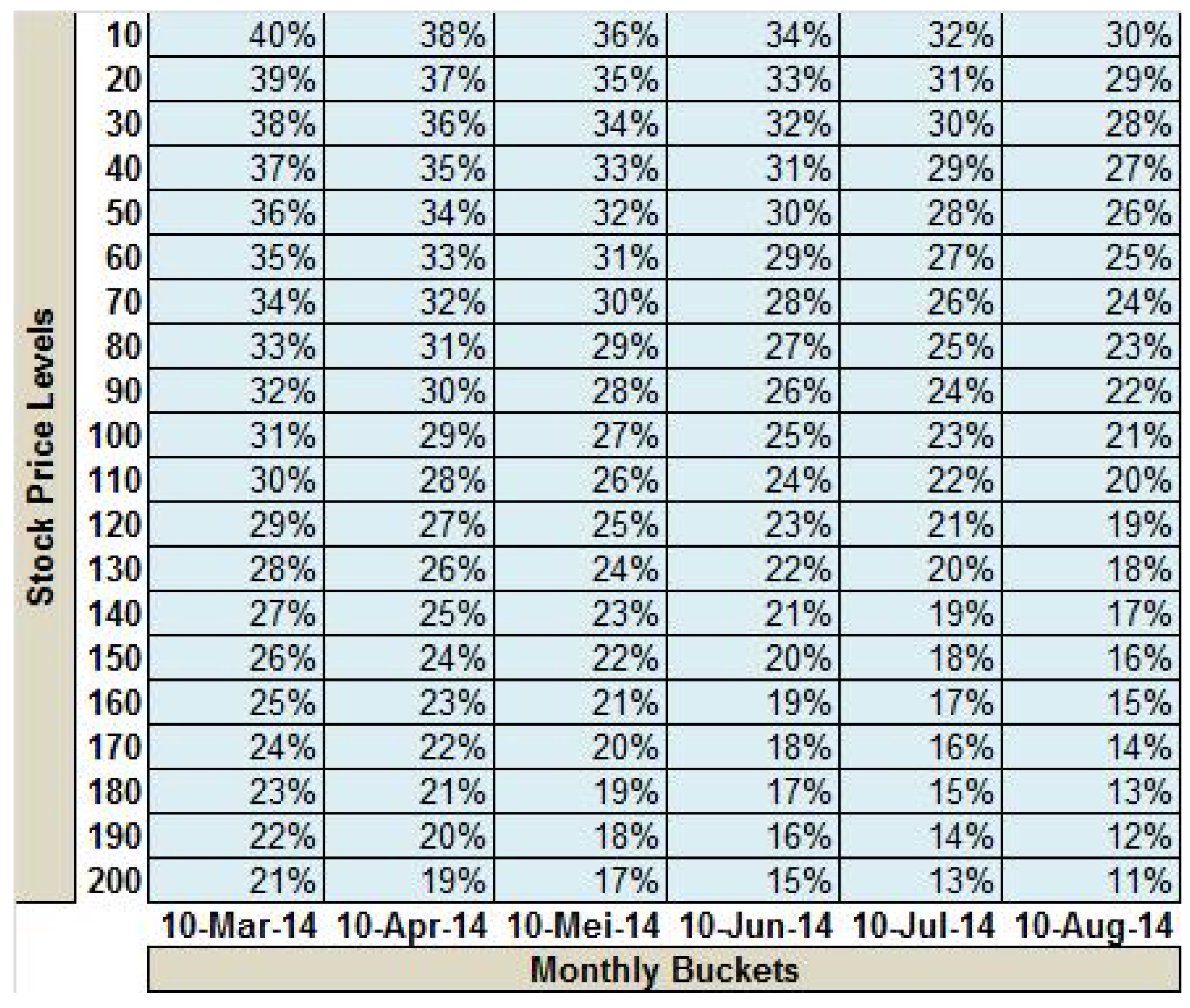

The main problem is that the implied or traded volatilities are only known at discrete strikes

K and expiries

T. This is why the parameterisation chosen for the implied volatility surface is very important. If implied volatilities are used directly from the market, the derivatives in Equation (

3.19) need to be obtained numerically using finite difference or other well-known techniques. This can still lead to an unstable local volatility surface. Furthermore we will have to interpolate and extrapolate the given data points unto a surface. Since obtaining the local volatility from the data involves taking derivatives, the extrapolated implied volatility surface cannot be too uneven. If it is, this unevenness will be exacerbated in the local volatility surface showing that it is not arbitrage free in these areas.

In the foreign exchange market, options are traded on the Delta—effectively a measure of the moneyness—as opposed to the absolute level of the strike. See Clark [

27] for the FX version of Equation (

3.19).