2. LITERATURE SUPPORT FOR ENTREPRENEUR PERFORMANCE

A growing body of finance literature examines the performance of firms and the underlying equity with respect to family ownership and management. Much of the support hinges on founder control and ownership versus non-family and descendent control. Agency theory suggests that owner-controlled companies outperform agent-operated corporations as the interests of management and shareholders are better aligned. On the other hand, Fama (1980), in his managerial labor market hypothesis posits that good managerial talent can be hired away by other organizations. Value accrues to shareholders only after netting out the pay premium afforded professional managers (e.g. value to organization associated with work less total compensation for agents). Moreover, founders and families may gain both perquisites and non-pecuniary rewards from ownership and control to the detriment of stockholder returns.

This paper examines the equity return performance of publicly traded U.S. entrepreneurial companies and compares against the return performance of a number of benchmark indices from January 1998 through April 30, 2010 time period. This time frame encompasses both boom and recession stages in the business cycle as well as bull and bear periods in the stock market. The U.S. capital markets enjoyed a high growth phase prior to the turn of the millennium and subsequently were severely impacted by a downturn in both the economy and capital markets in the most recent October, 2007 through February, 2009 recession. Given the upturn in the capital markets in the latter part of 2009, we find particular interest in the movements during both extremely weak and strong markets.

2.1 Literature Review

A number of studies including Shulman and Cox (2010), Barontini and Caprio (2006), and Villalonga and Amit (2005), support the notion that firm value is higher with a founder chief executive officer (CEO) rather than under second generation CEOs. Alternatively, Livingston (2007), McConaughy et al (1998), Fahhenbrach (2003), and Palia and Ravid (2002) find that firm value is higher when run by a descendent rather than a founder. In many cases, studies indicate that nepotism hurts performance, as discussed in Gonzalez (2006) and Smith and Amoako-Adu (1999).

Research shows that founder-CEO operated firms provide superior stock returns compared to non-founder CEO firms, McVey and Drako (2005), Cox and Shulman (2008), Morck, Shleifer and Vishny (1988) and Hermalin and Weisback (1980). This is in contrast to earlier research, Daily and Dalton (1992), Willard (1992), Jayaraman, Khoranan and Weiling (2000), Himmelberg, Hubbard and Palia (1999) and Demsetz and Villalonga (2001), providing conflicting evidence suggesting that there are no differences in stock returns between the two sets.

There are two competing views on how concentrated family ownership might affect the efficiency of a company: the entrenchment effect and alignment effect. The entrenchment effect address the agency conflicts between managers and outside shareholders (Jensen and Meckling 1976) and posits that concentrated ownership creates incentives for controlling shareholders to expropriate wealth from other shareholders ((Fama and Jensen 1983) and (Shleifer and Vishny 1988)). The alignment effect, Wang (2006), insinuates that focalized family ownership enables family members to maintain a long-term presence in the entity and have the enticement to preserve the family name and reputation to create lasting employee loyalty. Krug (2003) describes how executive departures disrupt continuity, internal decision making, stakeholder relationships and strategic projects. Further, Cannella and Hambrick (1993) and Krishnan et al (1997) chronicle how rates of top management departures are associated with lower firm performance. Chen and Lee (2008) analyze the financial performance of family-owned ventures and find that the return on assets is higher relative to non-family owned firms. They also discovered that employee remuneration is negatively related to family ownership.

Founder-controlled firms possess the original owner and manager of the organization. This founder has been endowed with vision and managerial acumen in so far as they have raised the firm from a startup, taken it public, listed the stock on an exchange, and grown it to be a large capitalization, publicly traded corporation. Shulman (2009) builds upon the work of Livingston (2007), Fahlenbrach (2009), Burkart, Panunzi and Shleifer (2003), Barontini and Caprio (2006) and Gonzalez (2006) and provides evidence that there may be a number of other factors, besides founder control, that distinguish entrepreneurial companies from non-entrepreneurial companies. In this paper, Shulman (2009) cites 15 key attributes used to describe Entrepreneurial companies, which we employ here:

Above average organic growth (versus growth through acquisition)

Above average ownership stake among key stakeholders

Low selling, general administrative expense (SG&A)

Above average return on invested capital

Sustainable growth

Manageable debt (relatively modest debt with capacity to repay debt and interest)

Active strategic alliances/partnerships/licensing

Aligned executive compensation packages

Low executive turnover

Transparent governance

Long duration of key managers

Low or no dividends

Family involvement

High earnings before interest, taxes depreciation and amortization (EBITDA) margin %

Other significant stakeholder relationships (such as key board members, etc.)

We employ the work of Shulman (2009) that goes beyond simple categorization of founder/non-founder-controlled companies. Shulman creates a new proprietary classification of entrepreneur which includes management and ownership criteria, and also incorporates a number of other characteristics or traits that help define the true significance of an entrepreneurial company. In this assessment the two opposing theories of management behavior; entrenchment or alignment, are presumed to prevail in the operations of the company. This selection creates a portfolio of publicly-traded companies that include the corporate traits correlated with entrepreneurial excellence in achievement. The U.S. entrepreneurial companies are expected to outperform, in terms of stock returns, a portfolio of benchmark indices (comprised primarily of non-entrepreneurial companies). The financial characteristics to be satisfied in the entrepreneurial companies include: (1) low selling, general and administrative expense, (2) high ownership stake of the top five stockholders, (3) high return on invested capital, (4) high sustainable growth, (5) low financial leverage, (6) executive compensation with stock option plans, (7) low executive turnover, and (8) low dividend payout ratio.

Our hypothesis is:

Ho: Entrepreneur-Controlled Firm’s Stock Returns Exceed Stock Market Benchmark

3. DATA AND METHODOLOGY

We hypothesize that our publicly traded U.S. entrepreneur companies’ entrepreneurs generate superior returns for investors, relative to our comparative benchmark indices, as well as risk-adjusted portfolio returns metrics. As a basis of comparison, we select several popular indices to benchmark our data including the Russell 2000, Russell 3000 and Standard and Poors’ (S&P) 500 indices. Both Russell indices provide broad representation of the U.S. markets, with the Russell 2000 providing a bias toward smaller market capitalizations compared to the Russell 3000 (the Russell 2000 includes the 2000 smallest companies in the Russell 3000). We offer the Russell 3000 as a useful benchmark for our middle capitalization entrepreneurs ($1 Billion-$5 Billion) and the Russell 2000 as a useful benchmark for our small capitalization entrepreneurs ($250 Million- $1 Billion). We also include the S&P 500 index, with its focus on the largest market capitalizations in the U.S. stock markets, as a useful benchmark for our large capitalization entrepreneurs (Over $5 Billion). Finally, since we also have non-U.S. exposure in our portfolios through American Depository Receipt (ADRs) companies, we also include the MSCI World Index as an overall global benchmark. We test for statistical significance in the next section and provide a number of illustrations and computations as support. The tests that we provide are based on a hypothetical, equally balanced portfolio of all companies holding the entrepreneurial characteristics across various industry sectors, market capitalizations, and geographic regions.

3.1 Sources of Information

We gather our data from a variety of sources including: 1) Compustat for financial data; 2) Center for Research in Security Prices (CRSP) for monthly stock price data; 3) Capital IQ for stock price data unavailable on CRSP; 4) ExecuComp for management compensation data; 5) Securities and Exchange Commission (SEC) monthly and quarterly corporate filings for ownership data, company acquisitions, financial reports and other noteworthy disclosures; 6) Company reports and management conference calls (accessed through archive records on Yahoo Finance); 7) S&P Net Advantage for ancillary debt information; 8) Thompson One Financial for merger-acquisition deal data; 9) Internet searches for miscellaneous company data.

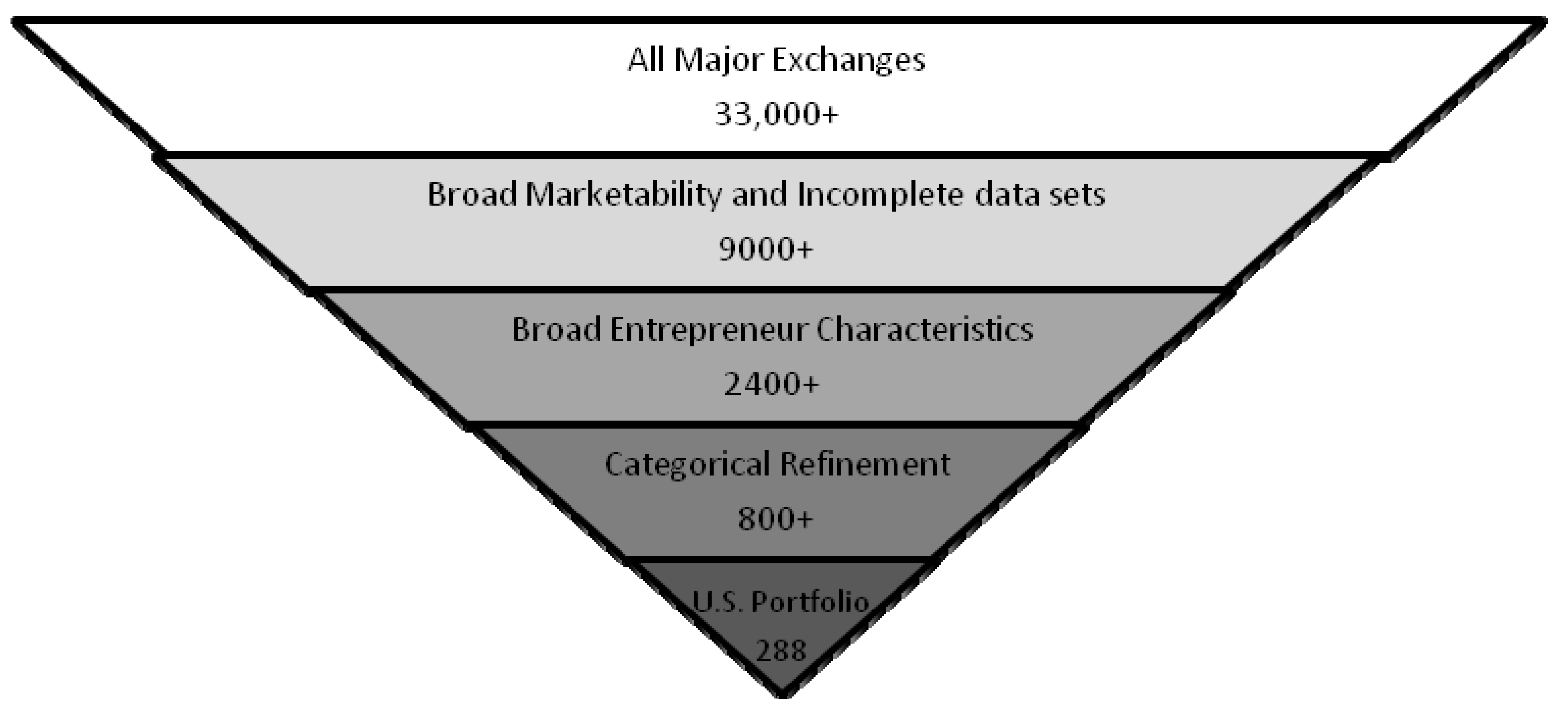

Figure 1.

Entrepreneur Company Filter

Figure 1.

Entrepreneur Company Filter

We begin our search process by gathering qualitative and quantitative data on our 15 entrepreneurial attributes from the data sources identified above. Our combined databases provide information on over 33,000 global companies. We narrow our list of 33,000+ companies down to 9,000+ after removing those companies with incomplete financial statement, stock price or informational disclosures. We then apply some of our 15 attribute criteria to arrive at approximately 2,400+ companies deemed to be in our broad entrepreneur classification (shown in

Figure 1). The first run of broad entrepreneur attribute filters can be handled very quickly and efficiently through quantitative screening. In particular, some (but not all) questions regarding team and especially financial resources can be handled in this manner and we are able to further reduce our broad entrepreneurs to a grouping of approximately 800+ publicly traded entrepreneurial companies. We then refine our set of broad entrepreneurs based on a company-by-company categorical refinement, since quick quantitative screens cannot determine many of the attributes identified above. For example, organic growth characteristics, management relationships, stakeholder relationships, research and development investments, ownership history, governance relationships, executive compensation, and notes to the financial statements are all refinements reviewed on a company-by-company basis. We further classify our entrepreneurs based on sector, size and geographical basis, enabling detailed review and statistical benchmarking. Our final data set for this paper includes 288 U.S. entrepreneurial companies deemed entrepreneurs and represents each of the nine major S&P 500 industry groupings with the largest representation residing in the information technology sector. Within this 288 grouping, we have 26 Large Cap U.S. entrepreneurs, 108 Mid Cap U.S. entrepreneurs, and 180 Small Cap U.S. entrepreneurs. We exclude companies with market capitalizations below $200 million due to the volatile nature of this group. These 3 entrepreneur portfolios are prefaced with the name Shulman.

In entrepreneur-controlled firms, the alignment theory is believed to be governing the conduct of the controlling entrepreneur (CEO) who has incentive to run a tight ship and cause the firm to excel. Entrepreneur firms have a higher ownership stake of the top five stockholders compared to non-entrepreneur or peer benchmark entities. Further, entrepreneur companies have a higher return on invested capital (ROIC) compared to the average ROIC for the benchmark index companies. Entrepreneur companies also have a sustainable growth rate (i.e. the retention rate multiplied by the return on equity) better than that of the benchmark index sustainable growth rate. And, in our study, entrepreneur companies have lower financial leverage, measured by the debt-to-assets ratio, than that of the benchmark companies. All selected entrepreneur corporations have lower executive turnover (i.e. Chairman of the Board (COB), CEO and Chief Financial Officer (CFO)) compared to the average of the benchmark indices with the average duration of service of the top three executives being longer than that of benchmark companies. Finally, the dividend payout ratio for entrepreneur companies is less than the average index firm’s dividend payout ratio.

Annual stock returns are calculated for the U.S. entrepreneur portfolio on an equally weighted average basis.

where

Rit is the annual return for stock i in time t

Pt is the stock price at time t,

Dt is the dividend paid during time t,

In addition, the average return,

![Jrfm 03 00118 i001]() pt

pt , and the standard deviation, σ

p, for each portfolio is calculated across the 15 year time period (t) such that

where n is the number of stocks in the portfolio.

4. EMPIRICAL RESULTS

The graph in

Figure 1 shows the Value Added Monthly Index (VAMI) for the U.S. entrepreneurs and comparative index benchmarks. The VAMI shows the growth of a hypothetical $1000 investment and is computed as:

Current VAMI = Previous VAMI x (1+ current rate of return)

As we see in

Figure 2, over the entire time period of the study, all three of the entrepreneur index benchmarks dominate the stock index benchmarks by a wide margin. During the 12 year 4 month time period, the Small Cap entrepreneurs produce the strongest results, with an increase of 3000% (bringing the $1000 starting VAMI level to approximately $30,000). Large-Cap entrepreneur portfolios experienced an increase from $1000 to approximately $25,000 and Mid-Caps had an increase of $1000 to approximately $19,000. By contrast, all of the key benchmarks including the Russell 3000, Russell 2000, S&P 500 and MSCI World Index barely changed during the same time period. In fact, the table shows the average annualized performance for our different groups and demonstrates that the U.S. entrepreneurs clearly outperform the stock market benchmarks during all of the time periods delineated (1, 2, 3, 5, 7, 10 year periods, as well as the 12 year 4 month period). For example, during the most recent 10 year time horizon, U.S. Large Cap, Mid-Cap and Small Cap entrepreneurs provide an average percentage annualized rate of return of 19.71, 21.43, 27.33, respectively. This compares to the percentage benchmark performance of the MSCI World, Russell 2000, Russell 3000 and S&P 500 index of 0.89, 3.52, -1.25 and -2.00 respectively.

Table 2 breaks out the annualized performance for each group. Although the entrepreneurs underperformed their benchmarks during the 2008 bear market, losing 40 to 45% compared to the 35 to 40% losses from the benchmarks, they more than made up for the small difference during the strong stock market in 2009. During calendar year 2009, the peer benchmarks increased by 23 to 31% compared to the spectacular 80 to 89% increase among the entrepreneurs. In fact, 2008 was the only year in the past decade that all of the entrepreneur portfolios underperformed their peer benchmarks and 2007 was the only other year in which any of the entrepreneur groups underperformed any index (Small Cap entrepreneurs provided 8.38% compared to 9.57% from MSCI World Index). In all of the other years in the past decade all of the entrepreneur portfolios outperformed all of their peer benchmarks, as well as for the overall period when the entrepreneur portfolios’ ROR ranged from 26.63 to 31.83% compared to the 1.64 to 4.17% for the peer benchmarks..

Table 3 provides an overall review of the risk metrics for the time period. The entrepreneur baskets have considerably higher standard deviation of returns compared to their underlying peer benchmarks. For example, the entrepreneur baskets have annual standard deviation of returns of roughly 25 to 31% whereas the peer benchmarks ranged from 16 to 22%. However, the Sharpe Ratio provides a risk-adjusted performance measure, determined as:

In the case of the entrepreneurs, the Sharpe ratio (relative to the MSCI World Index) ranges from an impressive 0.89 to 0.91. By contrast, the other benchmark indices (Russell 2000, Russell 3000 and S&P 500) have very low or negative Sharpe ratios ranging from 0.07 to -0.12. Another risk metric shown in

Table 3, the Sortino ratio, provides a measure of excess return relative to “bad” volatility.

The Sortino ratio is determined as:

The Sortino ratio is similar to the Sharpe ratio, except the former differentiates the standard deviation of returns when the investment falls. Investors prefer lower volatility on the downside and prefer higher volatility when the investment rises. Consequently, the Sortino ratio is a useful statistic that provides investors with information regarding the risk of negative results. The Sortino ratio for the entrepreneur groups is very strong, ranging from 0.90 to 1.05. By contrast, the major indices have negative Sortino ratios ranging from -0.33 to -0.59. The kurtosis measures the fourth moment around the mean and represents the thickness of the tails in the distribution. A high kurtosis implies a fat-tailed distribution, whereas a low kurtosis implies a thin tail with greater concentration of returns surrounding the mean. The Small Cap entrepreneurs have the largest kurtosis (3.42) with a positive skewness (0.69). This suggests that the Small Cap entrepreneurs have more positive outliers than the other portfolios shown.

Table 4 illustrates the maximum drawdown percentages and lengths among the varying groups. The drawdown period represents the losses associated with an investment in the fund of the underlying category. The maximum drawdown percentages do not vary appreciably among the different groups. Drawdown percentages range from -50.73 to -57.83 (US Mid Cap and Large Cap, respectively) with the peer industry benchmarks falling in between at -52.56 to -54.08. The maximum drawdown length for all of the groups is 16 months except for the Russell 2000 Index which is at 21 months. Most of the groups peaked at the end of October, 2007, just before the recession and hit a valley at the end of February, 2009.

Table 5 shows the percent profitable periods with all of the groups ranging from 60 to 70% during the entire 12 year period.

Figure 3 shows the distribution of monthly returns over this same time period.

Table 6 provides additional portfolio metrics among the varying groupings. The first column shows the risk-adjusted alpha for the varying groups, based on a MSCI World Index as the benchmark. Alpha, also known as Jensen’s alpha is computed as shown below:

This statistic is, arguably, the most important statistic to investors as it represents the annualized additional premium that investors receive, after adjusting the return for the beta risk in the portfolio. All of the entrepreneur groupings (Large Cap, Mid Cap and Small Cap) provide extraordinary premia ranging from an additional 21.95 to 27.86%, per year. By contrast, the other benchmarks (Russell 2000, Russell 3000 and S&P 500) each have much lower alpha’s ranging from 0.49 to -2.23%. The beta’s for the entrepreneurs, as measured against the MSCI World Index, are higher than each of the indices and vary from 1.25 to 1.41.

The correlations for the entrepreneurs provide some diversification benefit as the correlation ranges from 0.75 (Small Cap) to 0.85 (Large Cap). The correlation between the MSCI World index and the other indices are all close to 1.0 except for the Russell 2000 which has a correlation of 0.82. The active premium provides the excess return above the MSCI benchmark. The entrepreneur groupings yield an active premium of 22.46 to 27.64%, per year. By contrast, the other benchmark indices have a negative active premium of -0.13 to -2.53%.

The information ratio (IR) measures the portfolio manager’s ability to earn excess returns (active premium) relative to a specified benchmark, with a view toward consistency favoring a high IR.

The Information Ratio is determined as:

where,

Ir is the Information Ratio

Rp is the return of the portfolio

Ri is the return of the index or benchmark

Sp-i is the tracking error (standard deviation of the difference between returns of the portfolio and the returns of the index)

The tracking error will be high (and positive) if the portfolio manager has a few very strong months (relative to the index) and relatively low if the portfolio has consistently beaten the index in many months. Consequently, a relatively large numerator (excess premium) and relatively low denominator (low tracking error) will provide a relatively high information ratio.

The information ratios for the entrepreneurs range from a relatively strong 1.19 to 1.46 with corresponding tracking errors ranging from 23.26 to 15.36%. By contrast, the information ratios for the comparative indices range from -0.01 to -0.57 with tracking errors running from 12.58 to 4.46%. Although the entrepreneurs have considerably higher tracking errors than the benchmarks, the relatively high active premiums more than compensate for the higher volatility, thus yielding very large information ratios.

Table 6 also provides data describing the Down Capture Ratio and the Up Capture Ratio. These two columns correspond with the relative rise or fall the portfolios experience with comparative index movements.

An Up/Down Market Capture Ratio of 100 implies that the manager moves at the same rate as the market index. For example, an Up Capture Ratio of 200 implies that the investment manager outperforms the index by 100%, or double the index, during the up-market in the specified period.

Table 6 shows entrepreneur portfolios have Down Capture Ratios very close to 100% (ranging from 98.73 to 102.02%). The Up Capture Ratios however, are considerably higher than market indices. During the 1998 to 2010 time period, entrepreneur portfolios earn 1,024 to 2,002% more than the comparative MSCI World Index. That is entrepreneurs earn between 10 to20 times the returns earned on comparative benchmark investments. While these data are consistent with the risk-adjusted annualized alpha of 22 to 28%, the extraordinary performance is made clearer when one visualizes the Up Capture Ratios.

Figure 4 provides a risk/return scatter plot of the various entrepreneur portfolios and index benchmarks. Most of the index benchmarks are in the bottom left quadrant with the entrepreneur portfolios in the upper-right box. Since the Y axis represents percentage compounded rate of return and the X axis represents standard deviation over a percentage, the lower left quadrant depicts a lower, risk-return portfolio compared to the upper-right box of entrepreneurs. However, in order to compare whether or not one portfolio provides the appropriate risk-adjusted return, compared with another, a best-fit straight line or line of regression would be drawn with the index portfolio. In this case, if a line were drawn through the index benchmarks, all of the Entrepreneur portfolios would lie above the risk-adjusted line. Again this shows the superior risk-adjusted performance of the entrepreneurs.

As

Table 7 shows, the Small Cap entrepreneur group has the lowest overall correlation with other portfolio offerings, ranging from 0.72 to 0.82, the lowest correlation being between the S&P 500 indexes representing large capitalization stocks. The correlation matrix demonstrates that investors can gain not only additional return premium from the Small Cap entrepreneurs, but also some diversification benefit as well.

5. CONCLUSIONS

The equity performance of entrepreneurial publicly traded U.S. companies significantly outperforms peer benchmarks during the 1998-2010 period of our study. The entrepreneurial companies clearly dominate on all risk and return metrics, including annualized rate of return, Sharpe ratio, Sortino ratio, alpha, active premium, information ratio and Up Capture ratio. In some cases the differences between entrepreneurial companies and benchmarks are extraordinarily wide. Clearly, we do not know if the results of our time period can be extrapolated to future time periods.

Given the strong performance of the entrepreneurial portfolios we believe that investors would likely benefit from monitoring the behavior of company executives consistent with the entrepreneur approach. This includes compensation policies, R&D investments, and hiring/firing practices as well as personal investment/ownership patterns among key managers at the firm. These results lend support to the alignment hypothesis in conjunction with the agency theory. If the past portends the future, investors could create a trading rule of simply buying (long) entrepreneur-controlled U.S. company firms that also exhibit managerial performance characterized by the operating variable described in the paper.

Possibilities for future research include the persistence of this phenomenon in the U.S. capital market and perhaps the entrepreneurial anomaly in the other country markets as on industry effect. Moreover, the set of operating factors may change over time and would need to be explored to retain their relevancy.

pt , and the standard deviation, σp, for each portfolio is calculated across the 15 year time period (t) such that

pt , and the standard deviation, σp, for each portfolio is calculated across the 15 year time period (t) such that

pt = ∑ Rit / n and σp = ∑ (Rpt -

pt = ∑ Rit / n and σp = ∑ (Rpt -  pt)2 / (n-1)

pt)2 / (n-1)

p -Rf) / σp

p -Rf) / σp

p is the expected portfolio return

p -Rf) / σd

p -Rf) / σd

p is the expected return

p – ( Rf + βp (

p – ( Rf + βp (  m– Rf))

m– Rf))

p is the total portfolio return

m is the expected market return