1. Introduction

Interest in Enterprise Risk Management (ERM) has been growing since the 1990s as businesses face several shocks in competitive environments (

Arena et al. 2010). In response to unexpected threats, one school of thought believed in the direct impact of ERM on firm performance (

Callahan and Soileau 2017;

Florio and Leoni 2017;

Zou and Hassan 2017) while another group of researchers claimed that the relationship of ERM and firm performance could be affected by some internal factors (

Khan and Ali 2017;

Wang et al. 2010). Much research has discussed the importance of ERM practices among businesses (

Eckles et al. 2014;

Florio and Leoni 2017;

Yilmaz and Flouris 2017). In fact, most of the studies have been conducted particularly in developed economies (

Florio and Leoni 2017) while SMEs in emerging economies have received comparatively limited attention. Additionally, empirical studies on the relationship between ERM and SME performance are still lacking (

Farrell and Gallagher 2015). Therefore, this study aims to check the impact of ERM practices on SME performance with the mediating role of Competitive Advantage (CA). A manager cannot gain competitive position by using ERM approaches until he/she is aware of financial regulations and financial policies. Hereafter, this study also examines the moderating role of Financial Literacy (FL) between ERM practices and CA. To put it into another way, FL has been unexamined by researchers despite its significant role in the implementation of ERM practices and in the survival of SMEs.

ERM is defined in many ways but the accepted definition is:

“a process, effected by an entity’s board of directors, management and other personnel, applied in strategy setting and across the enterprise, designed to identify potential events that may affect the entity, and manage risks to be within its risk appetite, to provide reasonable assurance regarding the achievement of the entity’s objectives”.

ERM is supposed to minimize direct and indirect costs of financial distress, earnings volatility, and negative shocks in financial markets, as well as improve the decision-making process to select the best investment opportunities (

Beasley et al. 2008;

Hoyt and Liebenberg 2011;

Paape and Speklè 2012). Numerous internal fences and lack of resources compel SMEs to approach ERM practices to avoid poor performance and to enhance their survival in competitive markets (

Unnikrishnan et al. 2015). SMEs, due to the lack of management capabilities and lack of resources, are more likely focused on ERM practices. In fact, ERM practices enable a firm to reduce different types of costs associated with firms’ operational and non-operational activities (

Khan et al. 2016). However, in contrast, many small firms are unable to support risk management activities due to lack of resources and capabilities (

Brustbauer 2016). ERM is crucial for everyday business activities and organizational practices in the current era as it facilitates business firms to control their internal system. Risk management is deemed a core factor for business competitiveness. It facilitates a firm to develop a unique strategy to minimize the potential losses and open a door for the exploitation of new opportunities (

Radner and Shepp 1996). ERM helps top management to manage different types of risk effectively (

Annamalah et al. 2018). Effective ERM practices help to reply to unexpected threats, to ensure flexibility and to take the benefits of opportunities which in turn facilitate firms to gain competitive advantage (

Armeanu et al. 2017). It is doubtless that organizations with risk-related practices can smooth their income volatility and decrease the impact of financial crises to enhance their performance (

Ashraf et al. 2017). Meanwhile, especially in SMEs, top management needs to have enough financial knowledge to smooth operation in the dynamic markets (

Bongomin et al. 2017). In the current churning market, ERM practices and financial literacy are required to acquire a sustainable competitive position and high profitability.

The novelty of this paper can be demonstrated in two major ways. First, this study assesses the moderating role of FL between ERM and CA, which has been ignored in prior studies. Second, the mediating role of CA between ERM and SME performance is checked to establish whether ERM practices facilitate in gaining competitive advantage. Furthermore, this research contributes to the existing literature in several ways. For instance, this study uses empirical evidence collected from SMEs operating in the emerging market of Pakistan to test the model. Resource Based View (RBV) theory suggests that a firm’s tangible and intangible resources have a significant influence on its performance (

Barney 1991). This study assesses that the theory (RBV) in term of risk management and competitive advantage and clarifies the understanding of these capabilities toward SME performance. The findings of this study enable owners and managers of SMEs to focus on ERM practices and financial education and competitive strategy to gain superior performance in the intense markets.

Theoretical Background

ERM has quite similar meanings to business risk management, corporate risk management, holistic risk management, enterprise-wide risk management, integrated risk management, and strategic risk management (

Daud and Yazid 2009;

Manab et al. 2010).

Risk management theory demonstrates the reduction of different accounting costs which help in the improvement of a firm performance. This evidence posits that in reality, ERM is based on competitive advantage (

Stulz 1996). Academia, in this regard, has favored the arguments that ERM practices reduce costs associated with a business operation and facilitate competitive advantage and superior performance (

Krause and Tse 2016). This research discusses how ERM practices facilitate a firm competitive advantage and performance in the presence of top management financial awareness. A few studies such as (

Abd Razak et al. 2016;

Bogodistov and Wohlgemuth 2017;

Krause and Tse 2016) have claimed that ERM practices are aligned with firm resources and capabilities; however, they have missed the actual relationship between ERM and SME performance. In fact, a business firm operates for the main purpose of earning a profit, thus using different strategies to achieve this goal. As posited by RBV theory, a firm with unique resources (tangible and intangible) acquires competitiveness and superior performance over other firms which lack resources and capabilities (

Barney 1991). Studies agree (

Porter 1980) that competitive strategy, where a firm can reduce different costs and offer unique products to their customers, is the main tool to gain a competitive advantage in a turbulent market (

Anwar 2018;

Lechner and Gudmundsson 2014). We hereby suggest that ERM practices are the internal capabilities through which a firm can reduce different types of costs related to material, operational, supply and marketing to increase its value. The same theme has emerged in RBV theory where business organizations are engaged in the achievement of competitive advantage and superior profitability by reducing financial costs. However, as aforementioned, ERM practices do not always lead directly to superior performance; some internal managerial capabilities are also required. From this perspective,

Standard and Poor’s (

2008) developed an ERM framework which demonstrates that ERM practices are significantly aligned with managers behaviors in everyday decision-making. In fact, ERM practices are influenced by managerial mindsets and behaviors when they face uncertainty in turbulent markets (

Arena et al. 2010). We argue that top management financial education is associated with ERM practices, which in turn can influence a firm’s competitiveness and performance.

5. Discussion

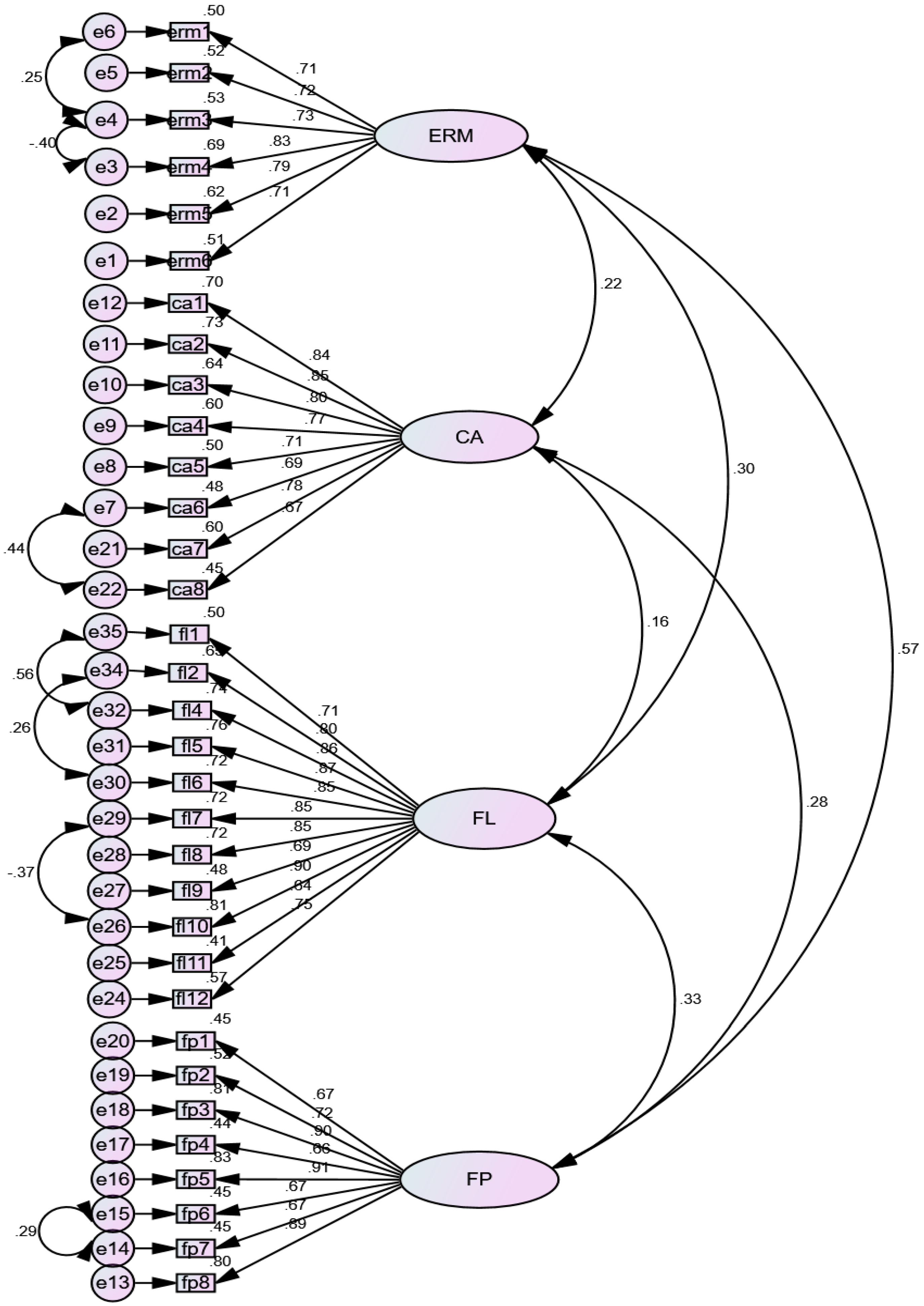

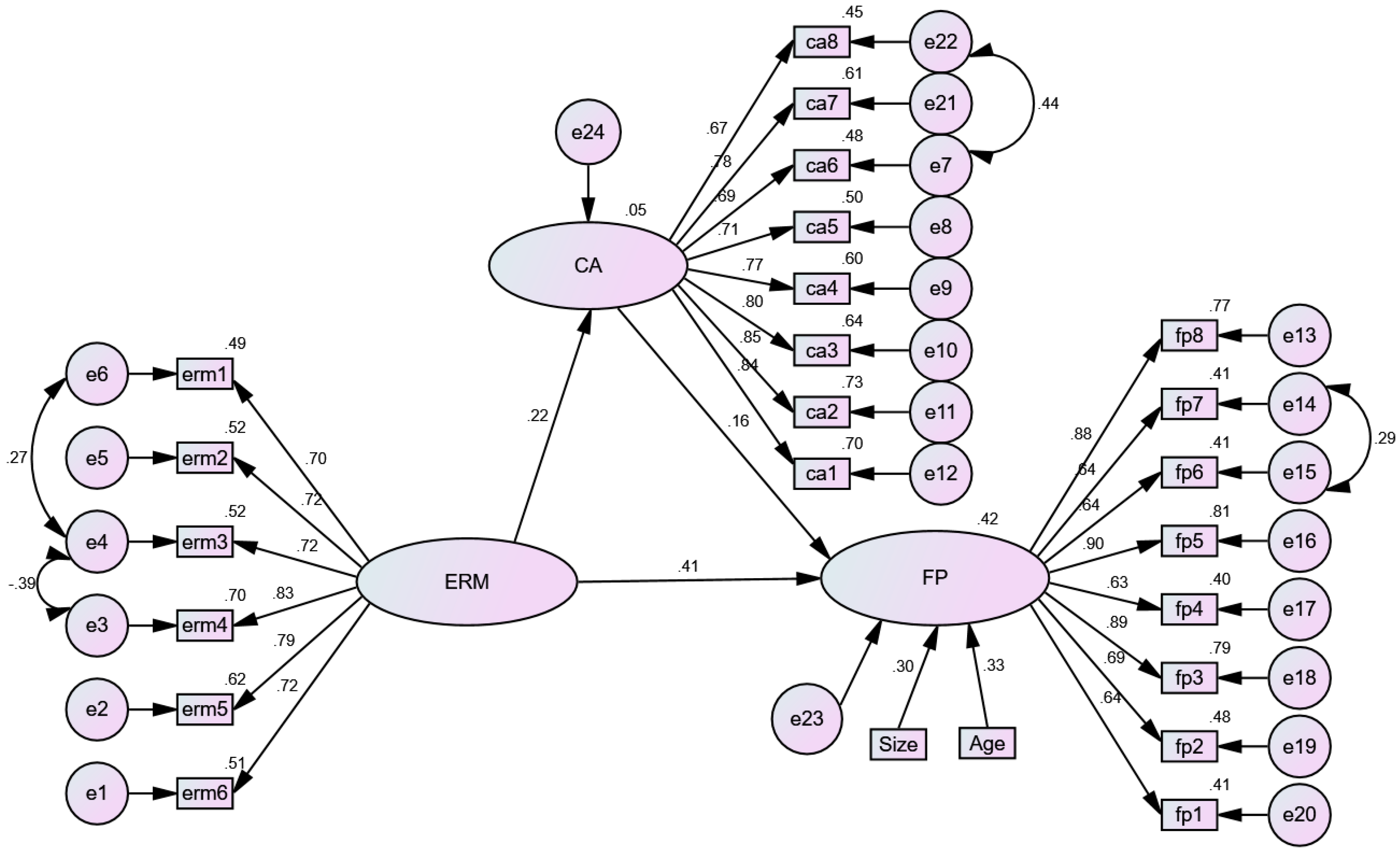

Steered by the growing interest of ERM in SMEs, this study examined the role of ERM practices on SME performance with competitive advantage as a mediator and financial literacy as a moderator. We collected empirical evidence from SMEs operating in the emerging market Pakistan.

Our findings indicate that ERM practices have a significant influence on SME performance, which supported H1 of this study. This is consistent with

Florio and Leoni (

2017), who examined those SMEs who succeed in the markets which have formal policies and ERM practices. Therefore, in the competitive environment, SMEs need to focus on risk reduction approaches to gain superior performance (

Callahan and Soileau 2017;

Florio and Leoni 2017). Our results strongly support

Zou and Hassan (

2017) who argued that in emerging economies, the performance of SMEs is significantly positively related to ERM practices.

We found that ERM practices have a significant influence on CA, which supported H2 of this study. This is in line with

Meidell and Kaarbøe (

2017) who revealed that ERM reduces different types of cost related to operation, material, and supply, which in turn leads to production of products and services at lower cost; thus, the firm can gain competitive advantage. Similarly,

Yilmaz and Flouris (

2017) also claimed that ERM practices facilitate SMEs to gain a competitive position in the market by offering lower-priced products. Our findings strongly favor

Soltanizadeh et al. (

2016) who argued that there is a significant relationship between ERM and business strategy.

Our results revealed that CA has a significant influence on firm performance, thus H3 of the study is positively supported. Our findings strongly supported

Anwar (

2018) who found that CA is a significant factor that can enhance the performance of SMEs in Pakistan. Similarly,

Parnell et al. (

2015) also argued that a firm with a sustainable competitive position in the market enjoys superior profitability.

The study found that CA partially mediates the relationship between ERM and firm performance, which partially supported H4 of our study. We reveal that ERM influences firm performance more than competitive advantage first. Unlike

Wang et al. (

2010) who argued that ERM first reduce the cost and then improve SME performance, our results favor

Chang et al. (

2015) who claimed that ERM is not significantly leading a firm to gain competitive position but in fact it facilities a firm to gain superior performance.

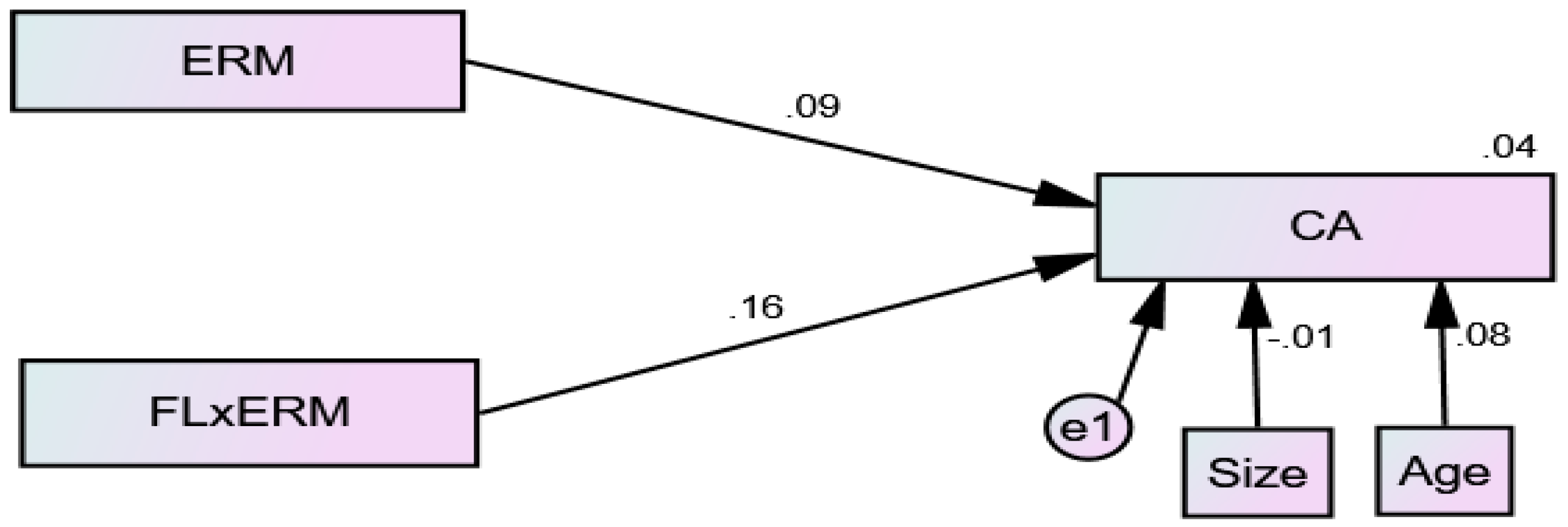

Finally, our results show that financial literacy significantly moderates the relationship between ERM and CA, which supported the H5 of the study. This is in the line with

Dionne and Triki (

2005) who found that managers with high financial education are familiar with different approaches of risk and financial concepts; hence, they can achieve a better position in the markets over those who have low financial education. Additionally,

Hommel and King (

2013) and

Shanahan and McParlane (

2005) claimed that top management teams with high financial education can reduce different types of accounting costs and are more likely inclined towards competitive advantage.

5.1. Contributions and Implications

The contributions made by the prior studies in the field of ERM practices, CA and SMEs performance are significant. In fact, prior studies have examined the direct impact of ERM on performance and mix results have been generated. However, this study contributes to the existing literature in several ways. For instance, this research examines the mediating role of CA between ERM and firm performance that has been rarely touched especially in the SME sector. Similarly, the moderating role of FL between ERM and CA has remained untouched. Moreover, many studies in terms of ERM and CA are focused on European regions while emerging markets have received minor attention. This research is examined in the emerging market of Pakistan by testing the hypotheses using AMOS. Our findings reveal that firms, where there are formal ERM practices, can achieve a competitive position and enjoy superior performance. Unlike prior studies, where often financial performance has been targeted, this study reveals that ERM practices are essential for gaining financial and non-financial performance. Additionally, this research supports the RBV theory and claims that ERM practices and financial literacy, as firm internal skills can facilitate sustainable competitive advantage and performance.

This study suggests several practical implications for owners, top management, and CEOs of business organizations to give considerable attention to ERM practices and financial education to gain competitive advantage and high profit. It is undoubted that every business organization is inclined towards profit earning. For this purpose, every small-, large- or medium-sized firm is persistently struggling to gain an advantageous position in the market and therefore better performance. To achieve this goal, a firm may need huge resources which may lead high to risk. From this perspective, small firms in particular, due to limited resources, are looking for less risky attempts to achieve their goals. This study advised owners and managers to give enough time to ERM to reduce different types of costs related to material, supply, and wages. It is also argued that ERM does not automatically give proper results until top management are aware of financial affairs and policies. Hence, firms are advised to consider highly financially literate managers for their strategic policies and planning. Additionally, the Small and Medium Enterprise Authority (SMEDA), being a responsible authority of SMEs in Pakistan, is advised to formulate its strategies and is recommended to initiate programs for top management to educate them in ERM and financial literacy. The implications are not only limited to emerging economies; other developed economies can benefit equally from the findings of this research.

5.2. Limitations and Future Research Directions

Despite the fact that this study has several important contributions to the existing literature, it is still not beyond limitations that can be addressed in future studies. We focused on SMEs operating in the emerging market of Pakistan, which may not be a suitable representative of the whole world including emerging and developed markets. Hence, the model can be tested in other emerging and developed economies to gain more fruitful insights. Moreover, researchers are advised to do a comparative study between emerging and developed economies to explore more useful results. This study can be extended in large firms where CEO and audit committee policies can be considered as suggest by

Ludin et al. (

2017) so that there is a significant relationship between CEO characteristics, audit work and risk management. Though we examined the moderating role of financial literacy between ERM and CA, future researchers can test the moderator between ERM practices and firm performance. Further research is needed to check the mediating role of each competitive strategy, e.g., cost leadership strategy and differentiation strategy, to disclose how ERM provides cost-based and differentiation-based competitive advantage.