FHA Loans in Foreclosure Proceedings: Distinguishing Sources of Interdependence in Competing Risks

Abstract

:1. Introduction

2. Data Description and Summary Statistics

- LTV: To measure equity remaining in the property, we calculate Loan-To-Value ratio (LTV) using the current balance of the loan in each month and the estimated property value.8

- FICO score: To proxy for the overall borrower’s creditworthiness, we use the borrower’s FICO score in each month.

- Unemployment rate: To proxy for financial instability, we use the seasonally-adjusted monthly unemployment rate lagged by six months in the state where the property is located.9

- Delinquency spell: To measure delinquency behavior, we calculate the fraction of months in delinquency prior to the beginning of a foreclosure proceedings.

- Judicial status: To examine state foreclosure laws, we use an indicator variable equal to one if the state is a judicial foreclosure state, and zero otherwise.10

3. Econometric Methodology

3.1. Model Specification

3.2. The Likelihood Function

4. Empirical Analysis

5. Conclusions

Author Contributions

Conflicts of Interest

Appendix A. Comparing Models (1), (2), (3) and (4) Based on the Likelihood Ratio Tests

References

- Abbring, Jaap H., and Gerard J. Van den Berg. 2003. The Identifiability of the Mixed Proportional Hazards Competing Risks Model. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 65: 701–10. [Google Scholar] [CrossRef]

- Andrews, Donald W. K., and Werner Ploberger. 1994. Optimal Tests When a Nuisance Parameter is Present Only Under the Alternative. Econometrica 62: 1383–414. [Google Scholar] [CrossRef]

- Clayton, David, and Jack Cuzick. 1985. Multivariate Generalization of the Proportional Hazards Model. Journal of Royal Statistical Society Series A 148: 82–117. [Google Scholar] [CrossRef]

- Colby, Gordana, and Paul Rilstone. 2004. Nonparametric Identification of Latent Competing Risks Models. Econometric Theory 20: 883–90. [Google Scholar] [CrossRef]

- Cunningham, Donald F., and Patric Hendershott. 1984. Pricing FHA Mortgage Default Insurance. Housing Finance Review 13: 373–92. [Google Scholar]

- Danis, Michelle A., and Anthony Pennington-Cross. 2005. A Dynamic Look at Subprime Loan Performance. Working paper. St. Louis: Federal Reserve Bank of St. Louis. [Google Scholar]

- Deng, Yongheng. 1997. Mortgage Termination: An Empirical Hazard Model with Stochastic Term Structure. The Journal of Real Estate Finance and Economics 14: 309–31. [Google Scholar] [CrossRef]

- Deng, Yongheng, John M. Quigley, Robert Van Order, and Freddie Mac. 1996. Mortgage Default and Low Down-payment Loans: The Cost of Public Subsidy. Regional Science and Urban Economics 26: 263–85. [Google Scholar] [CrossRef]

- Deng, Yongheng, John M. Quigley, and Robert Van Order. 2000. Mortgage Terminations, Heterogeneity and the Exercise of Mortgage Options. Econometrica 68: 275–307. [Google Scholar] [CrossRef]

- Flinn, Christopher, and James Heckman. 1982. New Methods for Analyzing Structural Models of Labor Force Dynamics. Journal of Econometrics 18: 115–68. [Google Scholar] [CrossRef]

- Foster, Chester, and Robert Van Order. 1985. FHA Terminations: A Prelude to Rational Mortgage Pricing. Journal of the American Real Estate and Urban Economics Association 13: 273–91. [Google Scholar] [CrossRef]

- Green, Jerry R., and John B. Shoven. 1986. The Effect of Interest Rates on Mortgage Prepayments. Journal of Money, Credit and Banking 18: 41–50. [Google Scholar] [CrossRef] [Green Version]

- Gourieroux, Christian, and Joann Jasiak. 2004. Heterogeneous INAR(1) Model with Application to Car Insurance. Insurance: Mathematics and Economics 34: 177–92. [Google Scholar] [CrossRef]

- Heckman, James J., and Bo E. Honore. 1989. The Identifiability of the Competing Risks Model. Biometrika 76: 325–30. [Google Scholar] [CrossRef]

- Heckman, James, and Burton Singer. 1984. A Method for Minimizing the Impact of Distributional Assumptions in Econometric Models for Duration Data. Econometrica 52: 271–320. [Google Scholar] [CrossRef]

- Heckman, James J., and James R. Walker. 1990. Estimating Fecundability from Data on Waiting Times to First Conception. Journal of American Statistical Association 85: 283–94. [Google Scholar] [CrossRef]

- Kau, James B., and Donald C. Keenan. 1996. Patterns of Rational Default. Working paper. Athens: The University of Georgia. [Google Scholar]

- Nickell, Stephen. 1979. Estimating the Probability of Leaving Unemployment. Econometrica 47: 1249–66. [Google Scholar] [CrossRef]

- Pennington-Cross, A. 2006. The Duration of Foreclosure on the Subprime Mortgage Market: A Competing Risks Model with Mixing. Working paper. St. Louis: Federal Reserve Bank of St. Louis. [Google Scholar]

- Quigley, John M., and Robert Van Order. 1990. Efficiency in the Mortgage Market: The Borrower’s Perspective. Journal of the American Real Estate and Urban Association 18: 237–52. [Google Scholar] [CrossRef]

- Quigley, John M., and Robert Van Order. 1995. Explicit Tests of Contingent Claims Models of Mortgage Default. The Journal of Real Estate Finance and Economics 11: 99–117. [Google Scholar] [CrossRef]

- Rosholm, Michael, and Michael Svarer. 2001. Structurally Dependent Competing Risks. Economic Letters 73: 169–73. [Google Scholar]

- Saha, Atanu, and Lynette Hilton. 1997. Expo-power: A Flexible Hazard Function for Duration Data Models. Economics Letters 54: 227–33. [Google Scholar] [CrossRef]

- Schwartz, Eduardo S., and Walter N. Torous. 1989. Prepayment and the Valuation of Mortgage-Backed Securities. The Journal of Finance 44: 375–92. [Google Scholar] [CrossRef]

- Schwartz, Eduardo S., and Walter N. Torous. 1993. Mortgage Prepayment and Default Decisions: A Poisson Reegression Approach. Journal of the American Real Estate and Urban Economics Association 21: 431–49. [Google Scholar] [CrossRef]

- Titman, Sheridan, and Walter Torous. 1989. Valuing Commercial Mortages: An Empirical Investigation of the Contingent Claims Approach to Pricing Risky Debt. The Journal of Finance 44: 345–73. [Google Scholar]

- Tsiatis, Anastasios. 1975. A Nonidentifiability Aspect of the Problem of Competing Risks. Proceedings of the National Academy of Sciences 72: 20–22. [Google Scholar] [CrossRef]

- Van den Berg, Gerard J., Marten Lindeboom, and Geert Ridder. 1994. Attrition in Longitudinal Panel Data and the Empirical Analysis of Dynamic Labour Market Behaviour. Journal of Applied Econometrics 9: 421–35. [Google Scholar] [CrossRef]

- Van den Berg, Gerard J., Bas Van der Klaauw, and Jan C. Van Ours. 2004. Punitive Sanctions and the Transition Rate from Welfare to Work. Journal of Labor Economics 22: 211–41. [Google Scholar] [CrossRef]

| 1 | It is the U.S. Department of Housing and Urban Development (HUD) that takes ownership of any properties that complete the foreclosure process for FHA mortgage loans. |

| 2 | This terminology is used by Danis and Pennington-Cross (2005). |

| 3 | The Federal Housing Administration (FHA) has a program called “Pre-Foreclosure Sales” that allows borrowers who are in foreclosure proceedings to sell their homes and to use the sales proceeds to satisfy the mortgage debt. Under this program, the debt is satisfied even if the sales proceeds are less than the loan balance owed. |

| 4 | See the quarterly OCC/OTSMortgage Metrics Reports for further details on the dataset. |

| 5 | FHA loans are mortgage loans on which the lender is insured against loss by the Federal Housing Administration, with the borrower paying the mortgage insurance premiums. These loans offer low down payments and generous credit score and debt to income requirements. |

| 6 | Ninety three percent of the FHA loans in our sample are 30-year fixed rate loans. |

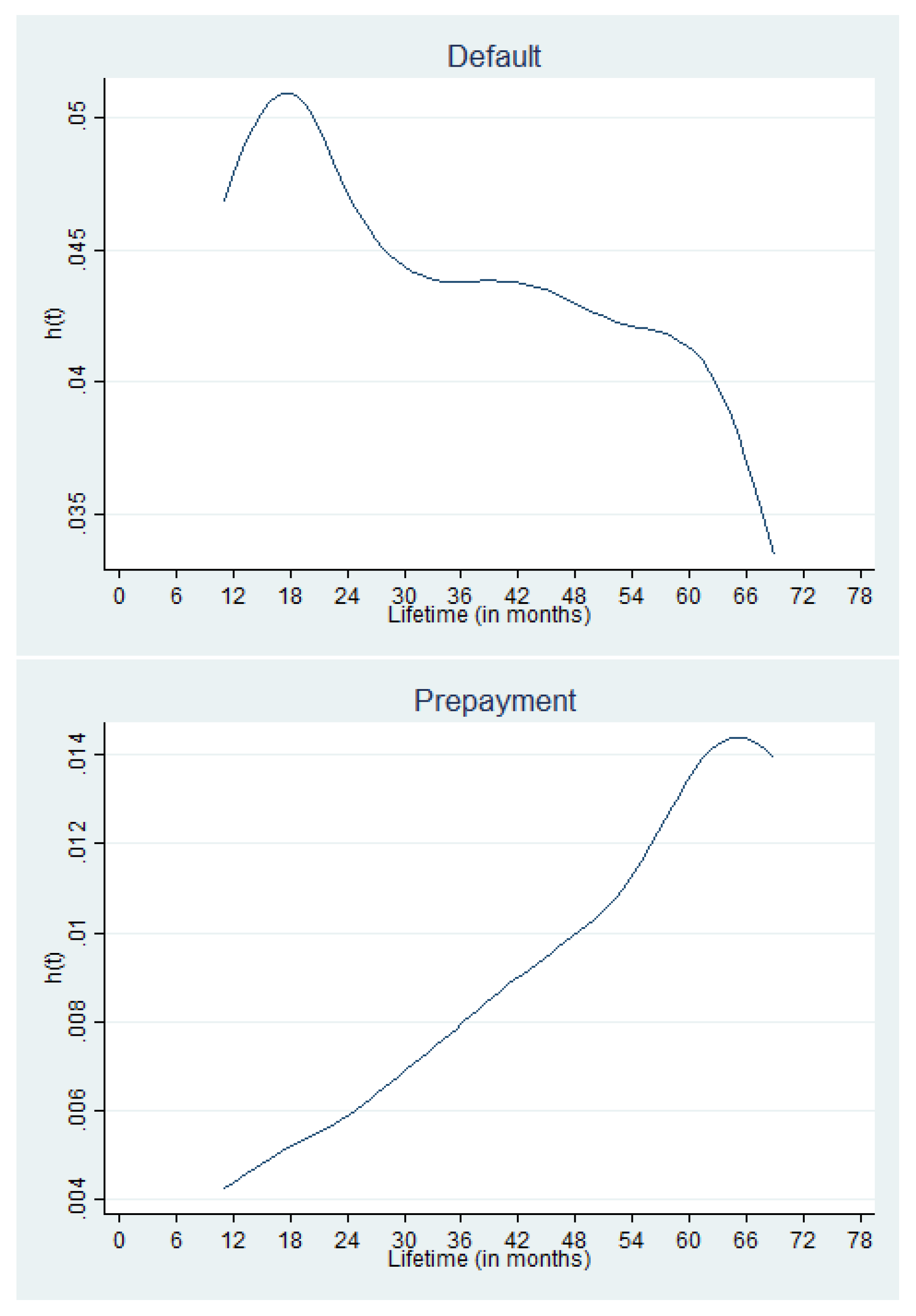

| 7 | The estimation is based on the Nelson–Aalen estimator. |

| 8 | The estimated property value is obtained from the Lender Processing Services (LPS) Home Price Index (HPI). |

| 9 | The seasonally-adjusted monthly unemployment rate is obtained from the Bureau of Labor Statistics (BLS). |

| 10 | We identified judicial states using RealtyTrac.com and FindLaw.com. |

| 11 | The 30-year fixed rate is obtained from primary mortgage market survey. |

| 12 | About 94 percent of the loans are 30-year fixed rate mortgages. |

| 13 | This assumption is commonly imposed in microeconomic studies, and it indicates that the focus of the analysis is on individual omitted heterogeneity. It implies that individual heterogeneities that depend on both individual loans and time are excluded. This allows us to assume away the moral hazard phenomena (e.g., Gourieroux and Jasiak 2004) and the omitted dynamic variables. The omitted time-dependent variables could be loan-specific or common to all loans. The analysis of these unobserved variables is left for further research. |

| 14 | Assumptions 2 to 4 are standard. |

| 15 | One of the main reasons for these studies to make the independence assumption, in addition to computational convenience, is the common misunderstanding that dependent competing risks’ specifications are not identifiable. This non-identifiability property is studied in detail by Tsiatis (1975), who proves that for any joint survival function with arbitrary dependence between the competing risks, one can find a different joint survival function with independent competing risks. If that is the case, then there is no point in complicating the model with the dependence assumption because the data cannot test for it anyway. However, Tsiatis’s argument is valid only if the sample is homogenous. Thus, the problem of non-identifiability can be resolved by introducing heterogeneity through the variation of the observed covariates, as discussed at length by Heckman and Honore (1989), Abbring and Van den Berg (2003) and Colby and Rilstone (2004). |

| 16 | To ensure that the probabilities lie between and sum up to one, we apply the logistic transformation, i.e.,

|

| 17 | The covariance of and can be derived as (see Van den Berg et al. 1994): Therefore, the correlation between and becomes:

|

| 18 | The mathematical details of the estimation of the likelihood function will be provided upon request. |

| 19 | The numbers in parentheses are the standard errors for the estimated coefficients. *, ** and *** indicate that the coefficients are statistically significant at the 10%, 5% and 1% levels, respectively. The standard errors reported for the and are estimated using the delta method. The mathematical details of the estimation will be provided upon request. |

| Status | Mean | Median | Std.Dev. | Min | Max | Qu. (25%) | Qu. (75%) |

|---|---|---|---|---|---|---|---|

| All Loans | 15.21 | 10.00 | 14.11 | 1.00 | 78.00 | 5.00 | 21.00 |

| Defaulted Loans | 14.00 | 9.00 | 12.25 | 2.00 | 78.00 | 5.00 | 19.00 |

| Prepaid Loans | 18.27 | 12.00 | 16.36 | 2.00 | 78.00 | 5.00 | 28.00 |

| LTV | |||||

| Status | Mean | Std.Dev. | Min | Max | |

| All Loans | 95.48 | 6.14 | 80.91 | 100.58 | |

| Defaulted Loans | 99.47 | 4.40 | 88.97 | 103.51 | |

| Prepaid Loans | 75.71 | 27.17 | 5.38 | 91.64 | |

| FICO Score | |||||

| Status | Mean | Std.Dev. | Min | Max | |

| All Loans | 540.20 | 18.31 | 516.51 | 567.38 | |

| Defaulted Loans | 538.76 | 17.57 | 516.54 | 564.87 | |

| Prepaid Loans | 556.64 | 23.27 | 523.40 | 590.85 | |

| Unemployment Rate | |||||

| Status | Mean | Std.Dev. | Min | Max | |

| All Loans | 7.84 | 0.56 | 6.97 | 8.74 | |

| Defaulted Loans | 8.20 | 0.54 | 7.38 | 9.06 | |

| Prepaid Loans | 7.70 | 0.62 | 6.70 | 8.72 | |

| Delinquency Spell | |||||

| Status | Mean | Std.Dev. | Min | Max | |

| All Loans | 0.41 | 0.23 | 0.02 | 1 | |

| Defaulted Loans | 0.41 | 0.23 | 0.02 | 1 | |

| Prepaid Loans | 0.40 | 0.22 | 0.03 | 1 | |

| Judicial Status | |||||

| Status | Mean | Std.Dev. | Min | Max | |

| All Loans | 0.41 | 0.49 | 0 | 1 | |

| Defaulted Loans | 0.37 | 0.48 | 0 | 1 | |

| Prepaid Loans | 0.37 | 0.48 | 0 | 1 | |

| Interest Rate Spread | |||||

| Status | Mean | Std.Dev. | Min | Max | |

| All Loans | 0.94 | 0.04 | 0.88 | 0.97 | |

| Defaulted Loans | 0.95 | 0.03 | 0.91 | 0.98 | |

| Prepaid Loans | 0.89 | 0.07 | 0.79 | 0.96 | |

| Model (1) | Model (2) | |||||||

|---|---|---|---|---|---|---|---|---|

| Default | Prepayment | Default | Prepayment | |||||

| LTV | −0.205 | * | −3.223 | *** | −0.183 | −3.373 | *** | |

| (0.108) | (0.182) | (0.122) | (0.274) | |||||

| FICO Score | −0.181 | *** | 0.299 | *** | −0.194 | *** | 0.131 | |

| (0.046) | (0.082) | (0.043) | (0.086) | |||||

| Unemployment Rate | 1.038 | *** | 0.369 | ** | 1.024 | *** | 0.818 | *** |

| (0.116) | (0.162) | (0.145) | (0.212) | |||||

| Delinquency Spell | −0.753 | *** | −0.671 | *** | −0.755 | *** | −1.28 | *** |

| (0.063) | (0.187) | (0.071) | (0.136) | |||||

| Judicial States | −0.859 | *** | −0.430 | *** | −0.86 | *** | −0.43 | *** |

| (0.030) | (0.030) | (0.025) | (0.025) | |||||

| Interest Rate Spread | 0.366 | ** | −0.530 | ** | 0.307 | *** | −0.424 | *** |

| (0.167) | (0.211) | (0.080) | (0.071) | |||||

| 2.956 | *** | 1.109 | *** | 2.974 | *** | 2.617 | *** | |

| (0.059) | (0.098) | (0.058) | (0.179) | |||||

| −7.595 | *** | −1.139 | *** | −8.349 | *** | 1.288 | *** | |

| (0.523) | (0.081) | (0.029) | (0.029) | |||||

| 6.553 | *** | 6.709 | *** | |||||

| (0.137) | (0.063) | |||||||

| 0.911 | *** | 1.069 | *** | |||||

| (0.146) | (0.057) | |||||||

| 0.524 | *** | 5.899 | *** | |||||

| (0.172) | (0.228) | |||||||

| −0.404 | *** | 0.665 | *** | |||||

| (0.067) | (0.257) | |||||||

| 0.353 | *** | 0.427 | *** | |||||

| (0.013) | (0.014) | |||||||

| 0.216 | *** | 0.046 | *** | |||||

| (0.010) | (0.012) | |||||||

| 0.000 | *** | 0.002 | *** | |||||

| (0.000) | (1.91 × 10) | |||||||

| 0.430 | *** | 0.525 | *** | |||||

| (0.015) | (0.171) | |||||||

| 0.624 | *** | 0.907 | *** | |||||

| (0.013) | (0.017) | |||||||

| 0.421 | *** | |||||||

| (0.055) | ||||||||

| Log-Likelihood | −107,855.160 | −108,080.63 | ||||||

| Model (3) | Model (4) | |||||||

|---|---|---|---|---|---|---|---|---|

| Default | Prepayment | Default | Prepayment | |||||

| Constant | 0.373 | −1.053 | ||||||

| (0.330) | (0.788) | |||||||

| LTV | −0.236 | −2.444 | *** | −0.542 | *** | −3.663 | *** | |

| (0.188) | (0.341) | (0.145) | (0.272) | |||||

| FICO Score | −0.196 | *** | 0.261 | −0.153 | *** | 0.112 | ||

| (0.050) | (0.170) | (0.049) | (0.091) | |||||

| Unemployment Rate | 1.050 | *** | 0.481 | 0.763 | *** | 1.041 | ** | |

| (0.234) | (0.671) | (0.179) | (0.473) | |||||

| Delinquency Spell | −0.696 | *** | −1.491 | ** | −1.331 | *** | −1.749 | *** |

| (0.203) | (0.656) | (0.159) | (0.229) | |||||

| Judicial States | −0.858 | *** | −0.433 | *** | −0.87 | *** | −0.42 | *** |

| (0.030) | (0.030) | (0.023) | (0.023) | |||||

| Interest Rate Spread | 0.321 | * | −0.599 | 0.525 | *** | −0.256 | ||

| (0.194) | (0.365) | (0.149) | (0.304) | |||||

| 2.977 | *** | 2.681 | *** | 1.231 | *** | 0.925 | *** | |

| (0.076) | (0.277) | (0.031) | (0.214) | |||||

| −8.400 | *** | 1.218 | *** | −1.829 | *** | 3.328 | *** | |

| (0.800) | (0.275) | (0.113) | (0.018) | |||||

| 6.749 | ||||||||

| (0.209) | ||||||||

| 1.073 | ||||||||

| (0.190) | ||||||||

| 6.756 | ||||||||

| (0.493) | ||||||||

| −0.283 | ||||||||

| (0.343) | ||||||||

| 0.039 | ||||||||

| (0.008) | ||||||||

| 0.511 | ||||||||

| (0.018) | ||||||||

| 0.032 | ||||||||

| (0.006) | ||||||||

| 0.418 | ||||||||

| (0.018) | ||||||||

| Log−Likelihood | −109,291.210 | −192,769.690 | ||||||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deng, R.; Haghani, S. FHA Loans in Foreclosure Proceedings: Distinguishing Sources of Interdependence in Competing Risks. J. Risk Financial Manag. 2018, 11, 2. https://doi.org/10.3390/jrfm11010002

Deng R, Haghani S. FHA Loans in Foreclosure Proceedings: Distinguishing Sources of Interdependence in Competing Risks. Journal of Risk and Financial Management. 2018; 11(1):2. https://doi.org/10.3390/jrfm11010002

Chicago/Turabian StyleDeng, Ran, and Shermineh Haghani. 2018. "FHA Loans in Foreclosure Proceedings: Distinguishing Sources of Interdependence in Competing Risks" Journal of Risk and Financial Management 11, no. 1: 2. https://doi.org/10.3390/jrfm11010002