1. Introduction

In this paper, we examine the impact of regulatory capital requirements on the cost of financial intermediation and the performance of Bangladeshi banks.

The first risk-based capital regulation, Basel-I Accord, was agreed by the Basel Committee on Banking Supervision (BCBS) in 1988. Basel-I mainly focused on bank credit risk and linked minimum capital requirements to the bank assets portfolio risk. Later on, Basel-II Accord was finalized in 2004 to overcome the shortcomings of Basel-I and to make risk-based capital regulation more effective. Several countries had incorporated Basel II guidelines in their national capital regulations while others were planning to do so that the global financial crisis hit the banking sectors throughout the world in 2008. This mega adverse banking event raised the questions against the viability of Basel-based capital regulation. In response, the Basel Committee on Banking Supervision (BCBS) issued a new Basel III Accord in 2010 in which, both the quantity and quality of regulatory capital requirements have been improved to ensure the future financial stability.

Since 1996, the Bangladesh Bank (BB) has adopted a risk-based capital regulation for Bangladeshi banks in line with the guidelines of Basel Accords. BB has revised risk-based capital regulation time-to-time to update it according to the amendments in the Basel Accords.

Although the capital regulation is likely to reduce the probability of the occurrence of future banking crises and arguably has been justified to avoid the forestalled losses (in terms of the level of GDP) caused by the financial crises [

1,

2,

3], the regulation is not free of criticisms. The impact of capital regulation on the cost of bank credit and bank profitability is under severe debate.

The opponents (i.e., bankers and some academicians) of the regulation argue that holding higher capital would jeopardize the banks’ability to lend and would adversely affect the economic output [

4,

5,

6]. For example, the Institute of International Finance [

4] representing over 400 financial institutions across the world, predicted that the price of credit in the United States would be almost 5 percentage points higher as a result of the regulatory changes proposed by Basel III, while the GDP in the major economies would be about 3 percent smaller than they would be without the effects of comprehensive financial reforms. Similarly, Wong, Fong, Li and Choi [

5] found that, for Hong Kong, a 1% increase in capital will reduce output by 4.2 basis points in the long run. In this context, Miles et al. [

7] identify that the changes in capital may affect economic activity through their effect on the cost of financial intermediation. Based on the standard corporate finance theory of capital structure, bank equity is an expensive source of funding and a percentage increase in equity increases the overall weighted average cost of capital (WACC) for the banks. Consequently, the banks pass on this cost to the borrowers by charging higher interest rates on loans. Through this channel, if all else is equal, the higher capital requirements would translate into the higher cost of financial intermediation, which would, in turn, reduce the demand for bank loans because the borrowers are less likely to borrow expensive bank loans.

In contrast, the proponents of the regulation argue that the impact of new regulation would be small. This literature takes into account another aspect of the capital structure theory, the bankruptcy costs, and argues that bank shareholders would not always require a higher return on equity for well-capitalized banks and may indeed reduce their required return. The underlying logic is straightforward. With the increase in bank capital, the probability of bank default becomes remote, and the banks are considered safer. As a result, the shareholders’ risk-adjusted required return on equity would decrease. Another factor which is likely to neutralize the effect of capital requirements on the cost of financial intermediation is capital buffers. Banks usually hold higher capital than the minimum regulatory requirements, and a further increase in regulatory capital would not translate into the exactly equal increase in bank capital due to the capital buffers. As found earlier, the banks could respond to a tightening in capital requirements by partially cutting their capital buffers [

6]. There are also other reasons to believe that the stringent regulatory capital requirements would have less effect on the cost of financial intermediation such as that banks would keep higher capital to get better credit ratings and a good share price in the stock market.

Building on this debate, we ask the question ‘How has the implementation of stringent capital requirements affected the cost of financial intermediation in Bangladesh?’

Similarly, the impact of strict capital regulation on bank profitability is uncertain. On the one hand, higher capital levels may adversely affect bank profits by reducing the debt in capital structure and, consequently, the tax shield provided by the deductibility of interest payments on the debt. Another way the higher capital requirements may reduce bank profits is that banks would reduce risk weighted assets to increase capital adequacy ratios [

8]. A decrease in risk-weighted assets which are also considered interest earning assets would jeopardize banks’ earning capacity. While on the other hand, stringent capital regulation may encourage banks to be efficient by reducing operating costs, restructuring business activities, monitoring bank loans and rationing poor credit quality loans [

9]. Further, banks may maintain higher capital levels to signal future better earnings prospects [

10]. Both of these factors would result in higher capital ratios ahead of higher profitability. Thus, our second research question is ‘What is the impact of stringent capital requirements on the bank profitability in Bangladesh?’

To answer these two questions, we use a panel dataset of 32 Bangladeshi banks over the period from 2000 to 2015. By employing a dynamic panel generalized method of moments (GMM) estimator, we find robust evidence that higher regulatory capital ratios reduce the cost of financial intermediation and increase bank profitability. We apply several robustness tests to confirm these results.

Our study contributes to the literature in at least four ways: First, this study is the first that examines the impact of capital regulation on the banks’ cost of financial intermediation and profitability for Bangladesh and South Asian countries as well. Over the last two decades, the banking sector of Bangladesh has undergone several capital regulation reforms and is an ideal laboratory to examine our hypothesis. Bangladesh is an important emerging economy and findings reported here can be generalized to other developing and emerging economies with a similar economic condition. Moreover, in this debate, Bangladesh is a central benchmark economy because in the post-millennium period their consistent economic growth on an above 6% as well as reflect the Basel II (2007) and partial Basel III (2014–15) implementation effect on the 16 years sample period.

Second, this study examines the impact of capital requirements on the cost of financial intermediation and complements the recent studies. For example, Naceur and Kandil [

11] examine the Egyptian bank, Soedarmono and Tarazi [

12] consider publicly traded banks in Asia, and Maudos and Solís [

13] examine Mexican banks and find a positive association between capital ratios and banks’ cost of financial intermediation. In contrast, Afzal and Mirza [

14] consider the Pakistani banks and find a negative relationship. Our study adds to this literature by carrying out an analysis of Bangladeshi banking sector.

Third, we examine the impact of capital regulation on bank profitability and complement the studies such as Casu et al. [

15] for Asian banks, Naceur and Kandil [

11] for Egyptian banks, and Goddard et al. [

16] and Altunbas et al. [

17] for European countries and Ozili [

18] for African banks. Among these studies, some find a positive association between bank capital and profitability some find a negative association, while some find mixed results. We add to this debate by examining the impact of capital on Bangladeshi banks.

Fourth, we include an influential variable off-balance activity (offsba) which was ignored in previous literature regarding the impact on the cost of intermediation.

The rest of the study proceeds as follows:

Section 2 reviews the related theoretical and empirical literature.

Section 3 provides an introduction to the evolution of banking industry in Bangladesh.

Section 4 econometric model and regression analysis. The last part concludes the study.

3. Banking Industry Landscape in Bangladesh

At the time of liberation in 1971, the banking sector in Bangladesh had only eleven banks, including two state-owned specialized banks, six nationalized commercialized banks and three Foreign Banks. The industry started expanding in the 1980s when the private commercial banks were allowed to operate. Presently, banks in Bangladesh are mainly of two types: (i) Scheduled Banks: Those banks which get a license to operate under Bank Company Act, 1991 (Amended up to 2013). (ii) Non-Scheduled Banks: The banks which are established for particular and definite objective and operate under the acts that are enacted for meeting up those objectives. These banks cannot perform all functions of scheduled banks.

On 31 December 2016, there were 56 scheduled banks which operate under the supervision of Bangladesh Bank

2, as per Bangladesh Bank Order, 1972 and Bank Company Act, 1991. The scheduled banks are classified into four major categories: State Owned Commercial Banks (SOCBs), Specialized Development Banks (SDBs), Private Commercial Banks (PCBs) and Foreign Commercial Banks (FCBs). Currently, there are 4 SOCBs which are wholly owned by the Government of Bangladesh. There are 4 SDBs which have been established to serve the specific objectives, such as the agricultural and industrial development. These banks are majorly owned by the Government of Bangladesh. There are 39 PCBs majorly owned by the shareholders and institutional owners. PCBs are further classified into two sub- groups: 31 conventional PCBs and 8 Islamic Shariah-based PCBs. Conventional PCBs function in a conventional manner where all transactions are madeon the base of interest rate. In contrast, Islamic Shariah-based PCBs follow Islamic Shariah principles where the transactionsare made on the base of profit-loss sharing policy. These are nine FCBs which work as the branches of international banks. On 31 December 2015, 56 scheduled banks had 9397 branches throughout the country

3. In total, 30 banks are listed while 26 banks are non-listed. Moreover, there are three co-operative banks and one micro-finance bank (Grameen Bank) operating in Bangladesh.

Table 1 shows that the overall assets of banking industry amounted to BDT (the local currency of Bangladesh) 10,314.6 billion in 2015. The assets have observed an increase of 839.27 percent over the sample period. Similarly, the deposits grew by 858.50 percent from 2000, and the overall deposits in 2014 show BDT 7928.6 billion.

To ensure financial stability, the Guidelines on Risk-Based Capital Adequacy (RBCA) for banks has been introduced from 1 January 2009 (BRPD Circular No. 9) parallel to existing BRPD Circular No. 10, dated 25 November 2002. These guidelines are prepared based on BASEL II which has come fully into force on 1 January 2010 with its successive supplements. As per BASEL II, banks in Bangladesh maintain the Minimum Capital Requirement (MCR) or Capital Adequacy Ratio (CAR) at 10% of the Risk Weighted Assets (RWA) or Taka 4000 million in capitals, whichever is higher. According to Supervisory Review Process (SRP), banks are directed to maintain a sufficient level of capital which is greater than the minimum required capital and cover all possible risks in their business.

According to the Bangladesh Bank annual report, the State-owned Commercial Banks (SCBs), Development Financing Institutions (DFIs), Private Commercial Banks (PCBs) and Foreign Commercial Banks (FCBs) maintained CAR of 6.4, −34.01, 12.40, and 25.60 percent, respectively, on 31 December 2015. But only for 6 banks (including 2 SCBs, 2 PCBs, and 2 DFIs), the CAR was below regulatory minimum limits.

Figure 1 shows the trend of the CAR of the banking industry. It was 11.89 percent at the end of December 2015 as against 9.28 percent at the start of the sample period. The foremost reason for an upsurge in CAR in 2014 was the enactment of a newly revised policy on loan rescheduling (BRPD Circular no.15/2013).

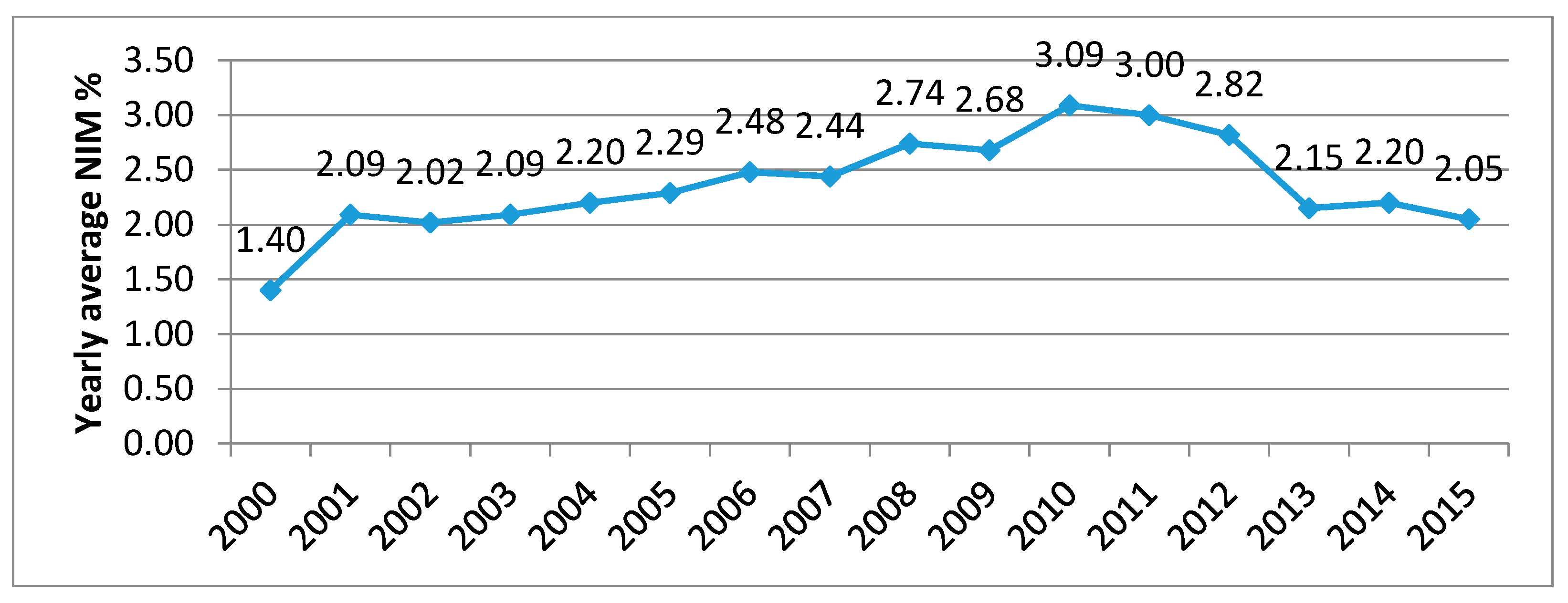

Figure 2 shows a trend of average net interest margins in Bangladeshi banking sector. As shown, the average margins increased from 2000 to 2010, however they decrease after 2010.

As mentioned earlier, Bangladesh Bank has recently circulated a road map to implement Basel III capital accord (BRPD Circular No. 7, March 2014) as shown in

Table 2.

Moreover, Bangladesh Bank provides the instructions that the new regulation will be adopted in a phased manner starting from the January 2015 and the full implementation in 2019. Banks will maintain a common equity tier 1 capita ratio of at least 4.5% of the total RWA, tier 1 capital ratio of at least 6.0% of the total RWA and minimum CAR of 10% of the total RWA. In addition to minimum CAR, Capital Conservation Buffer (CCB) of 2.5% of the total RWA is being introduced which will be maintained in the form of CET1.

5. Conclusions

The aim of this paper is to investigate the impact of capital regulation on banks’ cost of intermediation and profitability in Bangladesh.

We measure banks’ cost of financial intermediation with bank annual net interest margins. Bank profitability is measuredbyannual bank return on assets ratios.

Capital regulation is measured with three alternative measures: annual capital adequacy ratio of each bank, annual equity to total ratio of each bank and a dummy variable that captures the structural break marking the implementation of Basel II in 2006 for the banking sector of Bangladesh.

Using a panel dataset of 32 commercial banks over the period 2000–2015, we find robust evidence that higher bank capital ratios reduce the cost of financial intermediation and increase bank profitability. We also observe that switching from BASEL I to BASEL II in 2006 has no measurable impact on the cost of financial intermediation and bank profitability in later years in Bangladesh.

In the empirical analysis, we further observe that bank management, income diversification, size and off-balance activities are negatively associated with the cost of financial intermediation. Similarly, we observe that management and labor efficiencies have a positive impact on banks’ profitability whereas the cost inefficiency, financial intermediation, and implicit cost have a significant adverse effect.

We perform several robustness tests to confirm the main results including the use of alternative proxies of the banks’ cost of financial intermediation and profitability, VECM (Vector Error Correction Model) analysis and finally the fixed-effect model estimations with industry and macroeconomic indicators as additional control variables.

These results have important implications. Bankers and some academics have also criticized capital regulation on the ground that it would enhance the cost of funds for bank borrowers and deteriorate the bank profitability. However, we do not find any evidence of adverse effects of an increase in capital ratios of Bangladeshi banks on their cost of financial intermediation and profitability. In contrast, we find that higher bank capital ratios truly have a statistically significant negative association with bank net interest margins and a positive association with bank profitability. Finally, our findings support the Central Bank’s initiative to enforce capital regulation to ensure the stability and competitiveness of the banking sector in Bangladesh. Hence, Basel III implementation was deemed to be urgently warranted in the banking industry of Bangladesh.

Future research may examine the extensions of our model, including the impact of capital buffers and ownership structures. Last but not least, similar analysis can be conducted for other developed countries, especially the South Asian economies.