Information Technology Project Portfolio Implementation Process Optimization Based on Complex Network Theory and Entropy

Abstract

:1. Introduction

2. New Lens of “Projects as a Biological Network” for Visualization and Decision

2.1. Life View on a Single Project

2.2. New Lens of “Projects as a Biological Network”

3. Concepts and Methods

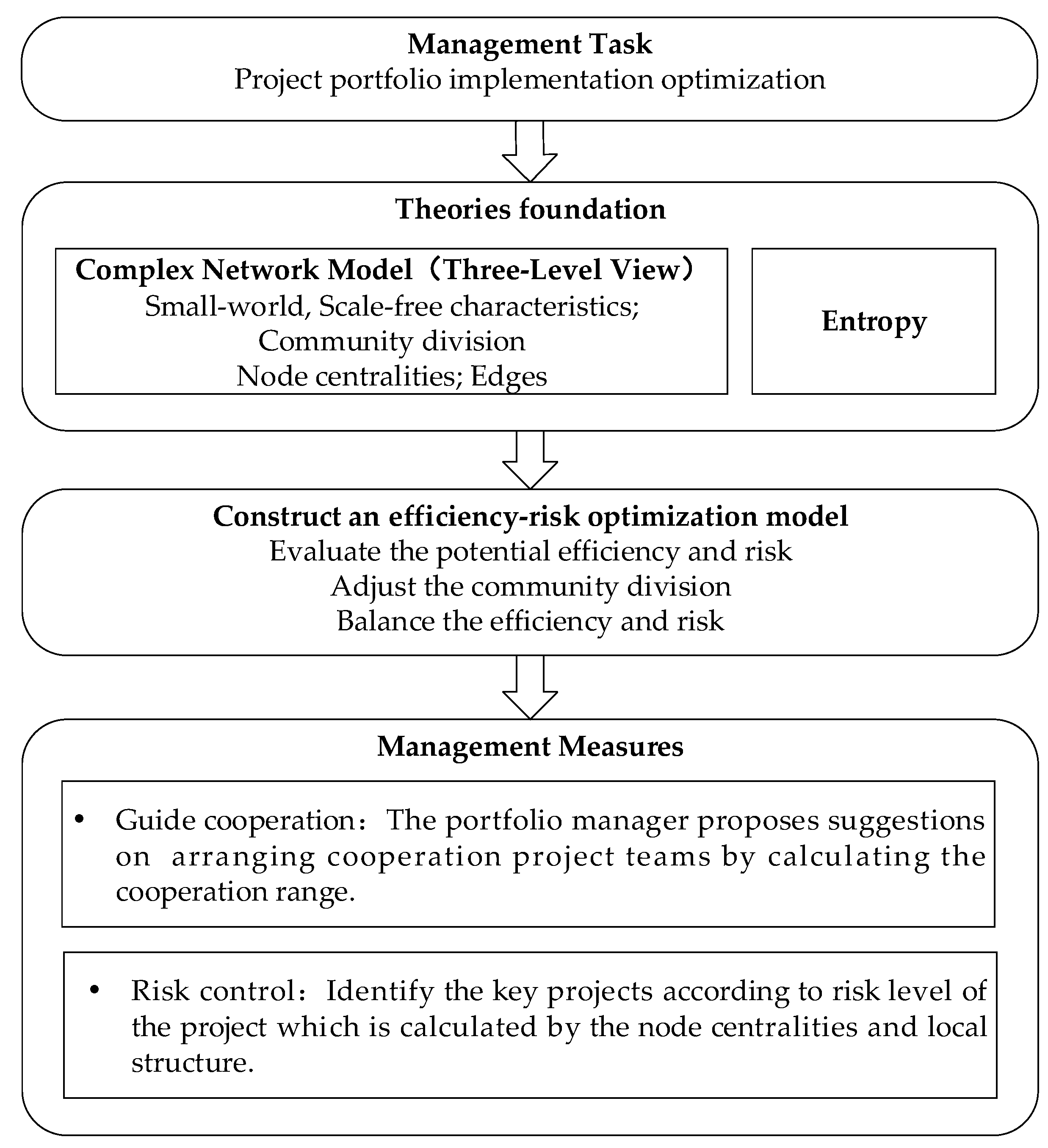

3.1. Framework of Portfolio Implementation Process Optimization

3.2. Weighted Network Model for an IT Project Portfolio

3.2.1. Weighted Network Model

3.2.2. Statistic Indicators of IT Project Portfolio Network

3.2.3. Community Detection of IT Project Portfolio Network

3.3. Efficiency–Risk Balance Based on the Network Model and Entropy

3.3.1. Efficiency–Risk Optimization Model

3.3.2. Efficiency Entropy and Risk Entropy

3.3.3. Efficiency–Risk Balance Optimization Algorithm

- Step 1:

- Construct the complex network model.

- Step 2:

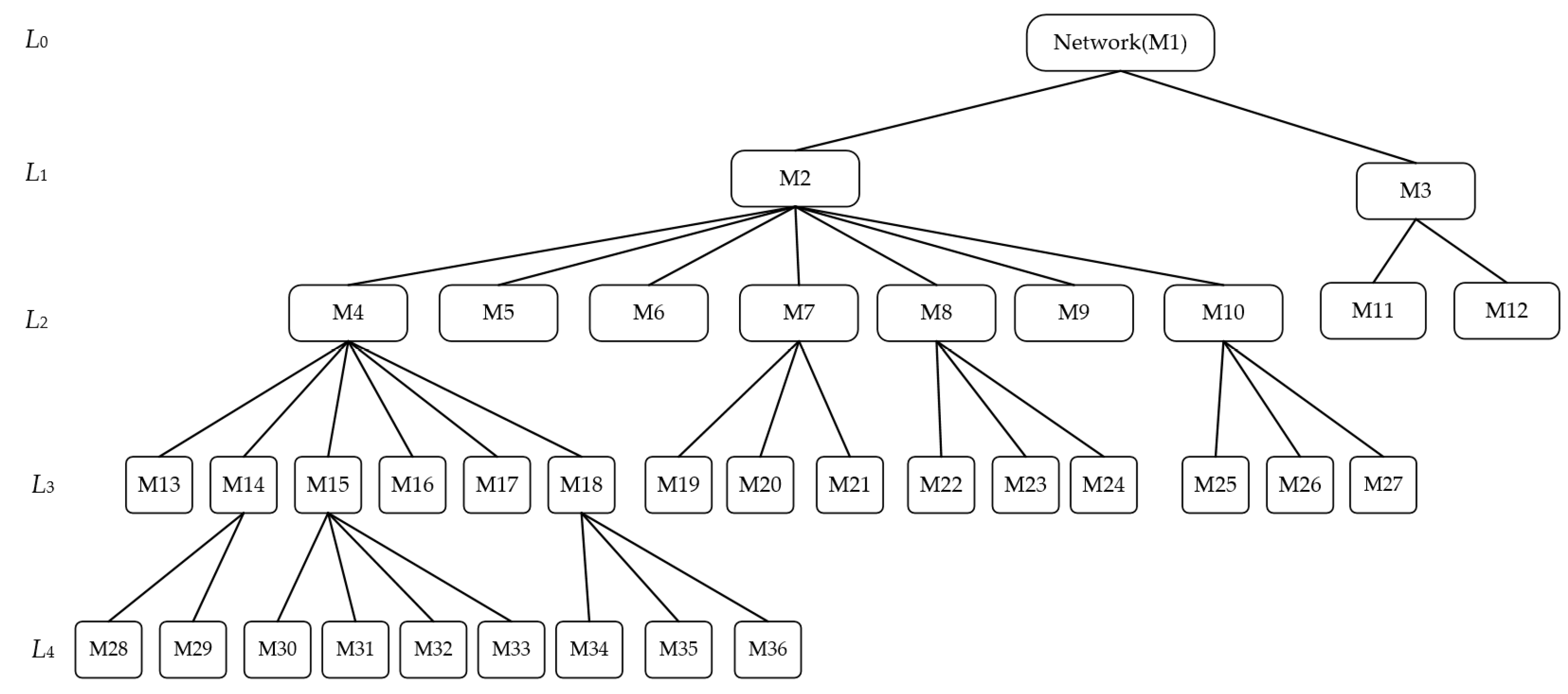

- Divide the network into several communities and repeat the division process on each community until the modularity value is less than a threshold. Following this, the division result can be organized as a hierarchical tree. Suppose there are Q layers L1, …, LQ. Each layer has nq communities. Layer L0 is the original network.

- Step 3:

- Search the tree from the top layer to the bottom layer in order to find the best combination to minimize the risk entropy HR and maintain the efficiency entropy HE not over the maximum entropy threshold HEθ.

4. Illustrative Example

4.1. Weighted Network Model of an IT Project Portfolio

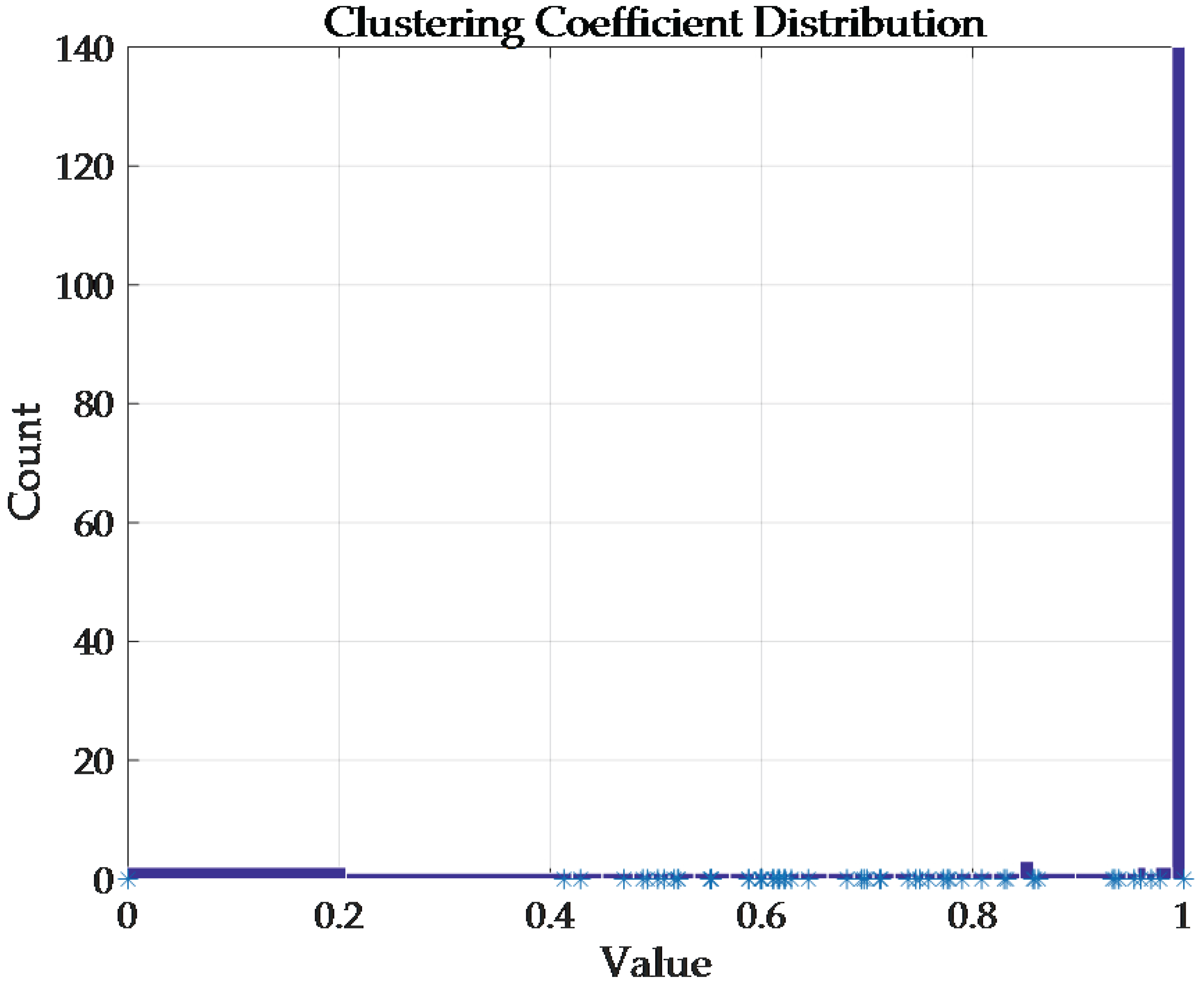

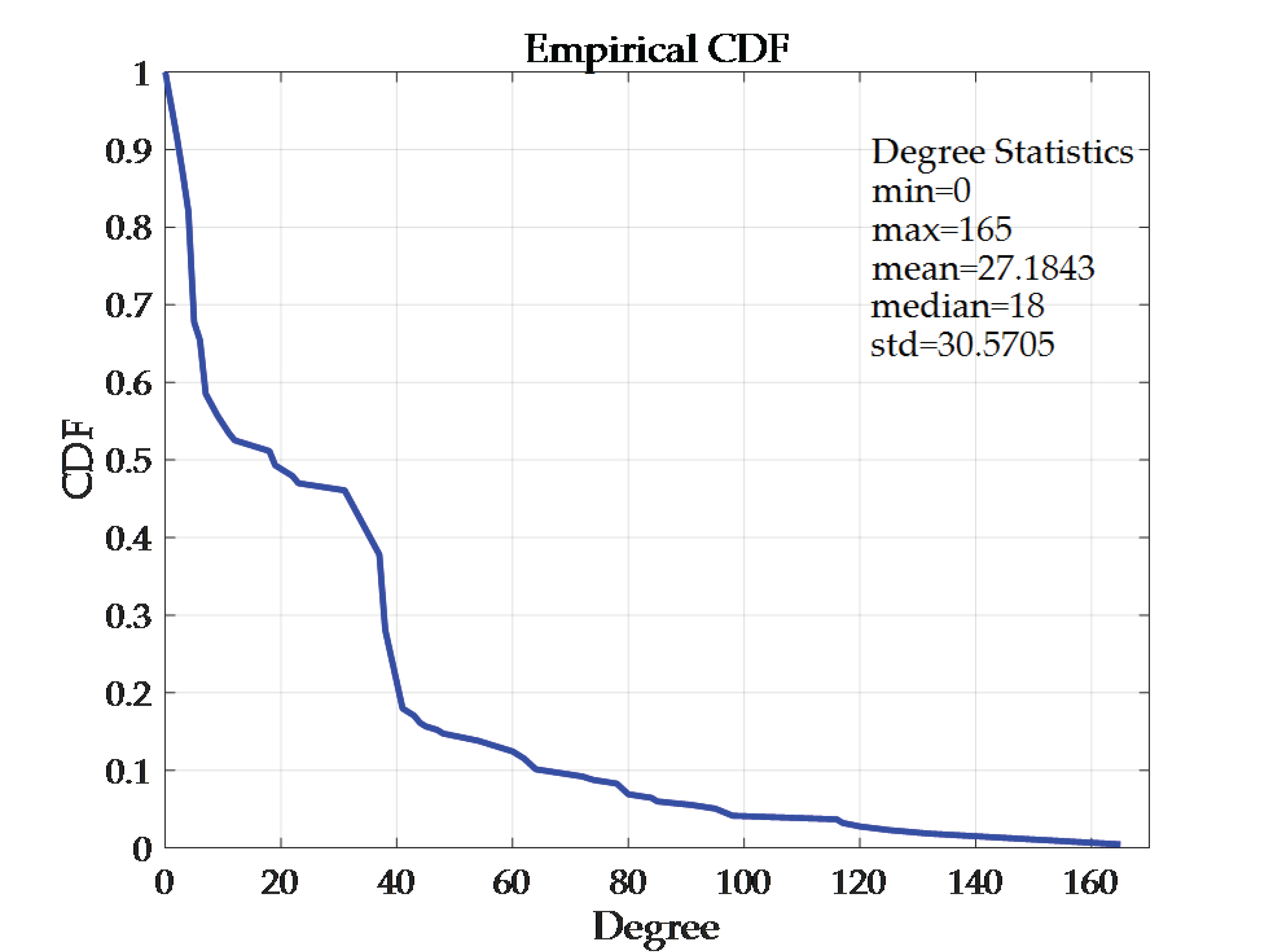

4.1.1. Properties of the Network

Overall Properties

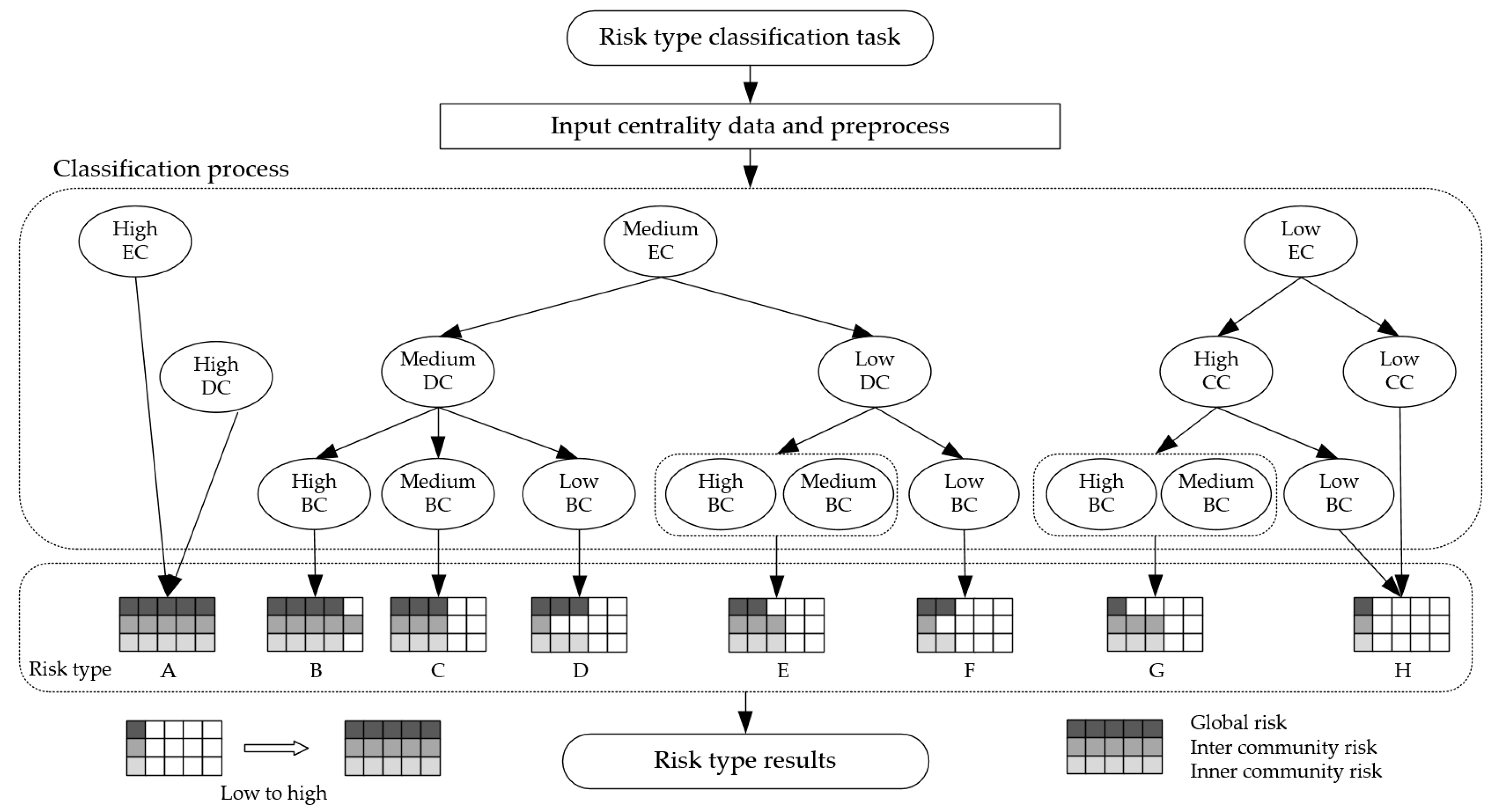

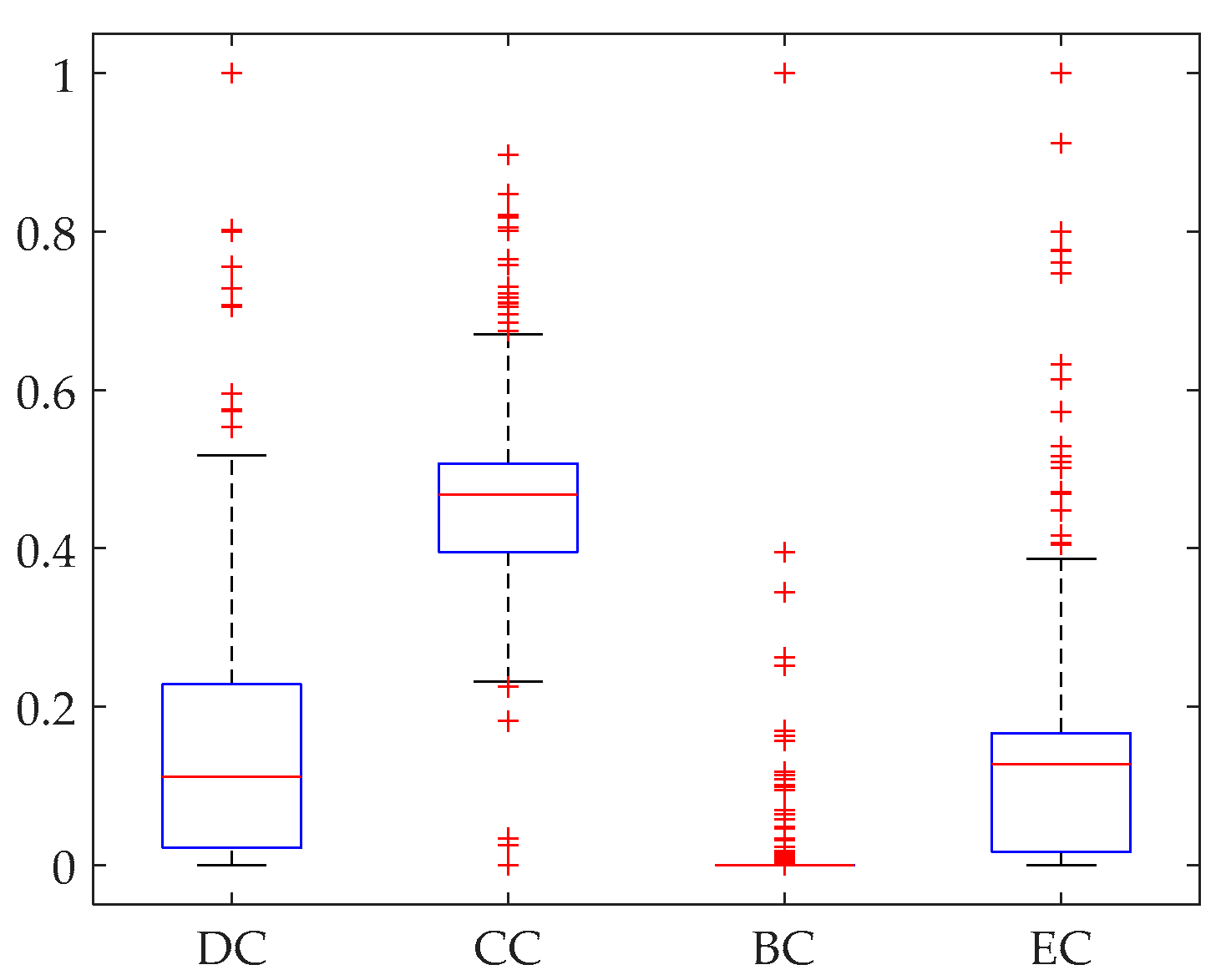

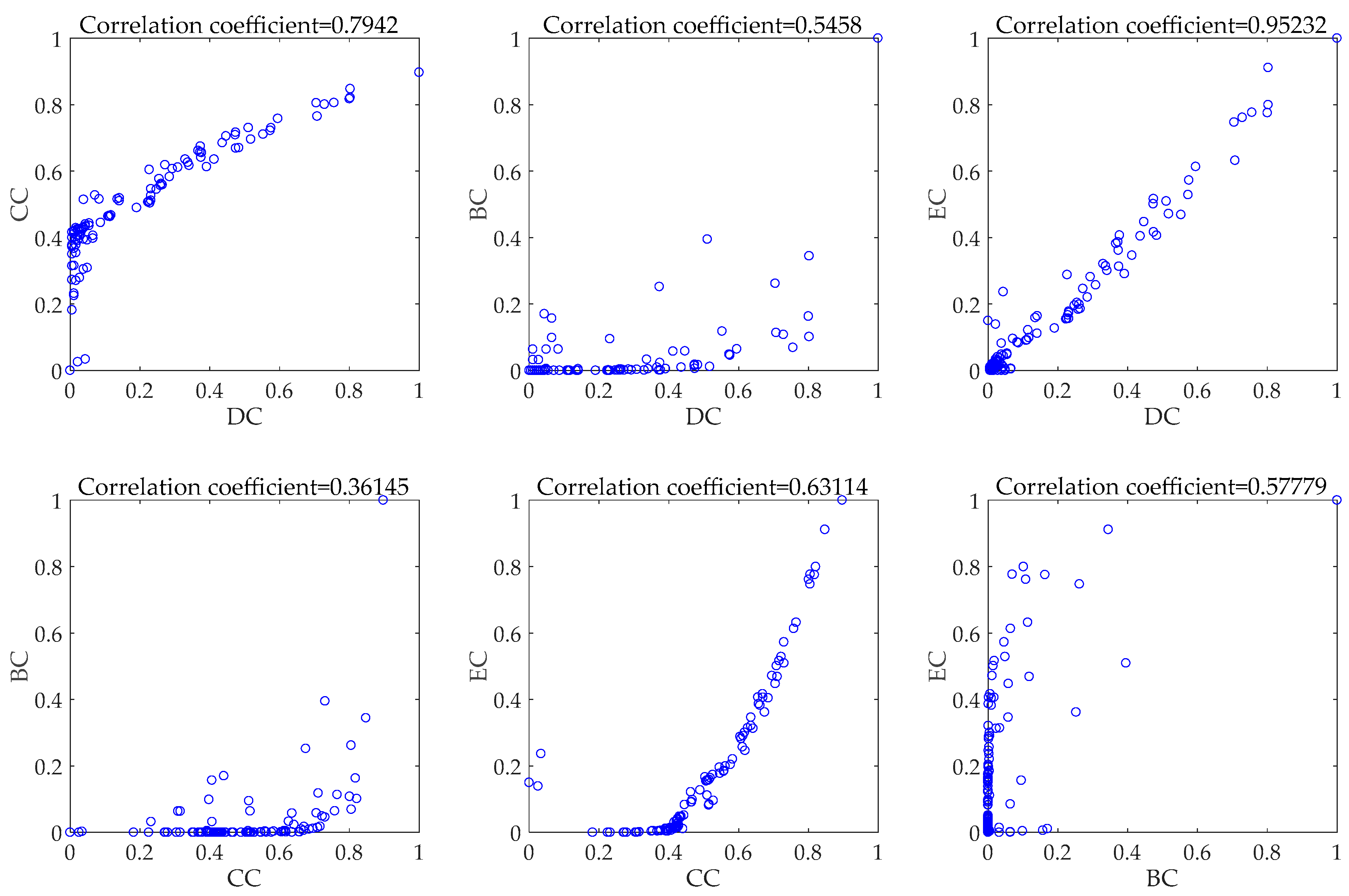

Centrality Results of Nodes

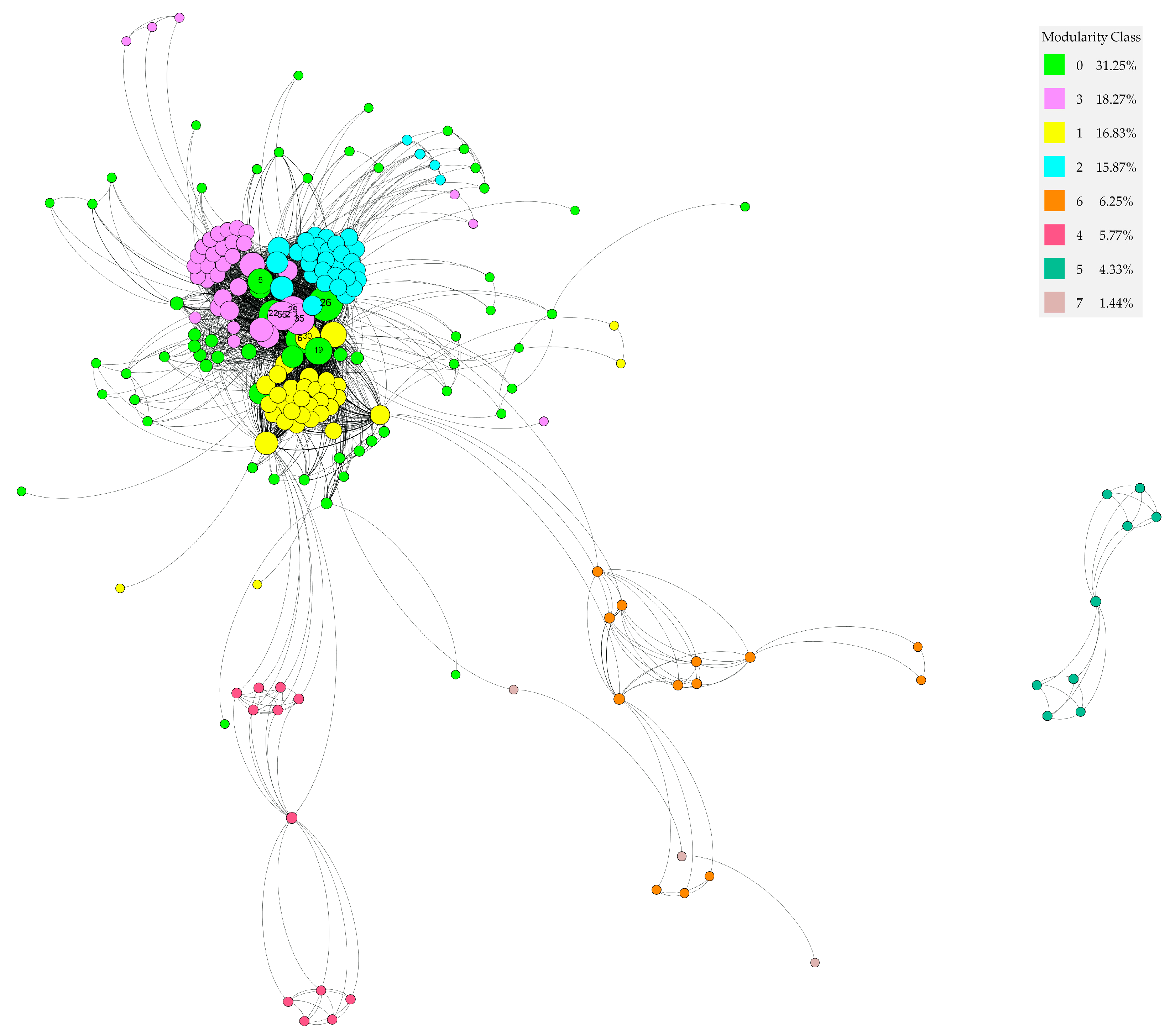

4.1.2. Community Division for GP

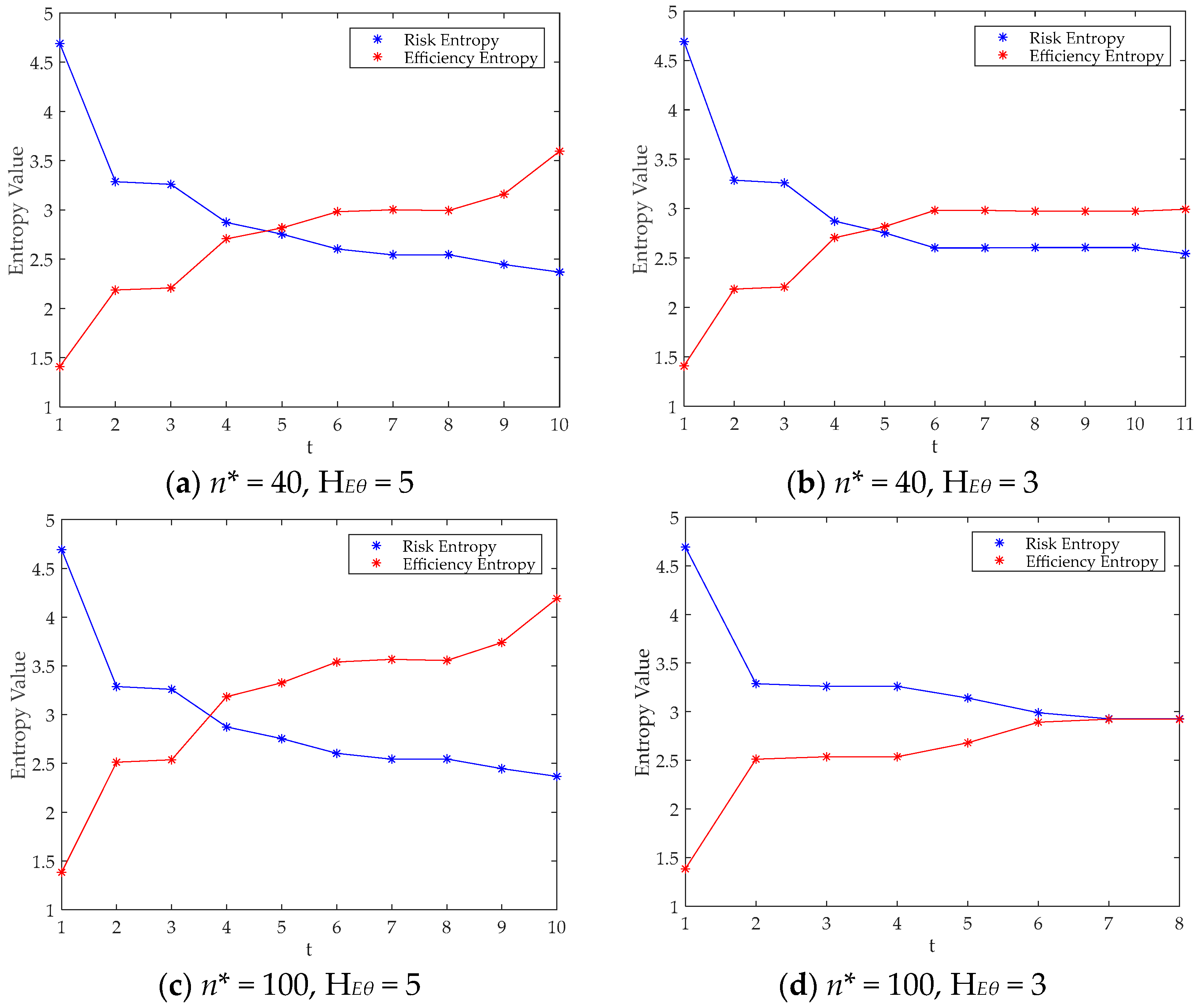

4.2. Project Portfolio Implementation Process Optimization Results

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Measures | Weighted Definitions |

|---|---|

| Basic concepts and notation | n is the total node of the network. V = {v1, v2, …, vn} is the node set of the network. E = {e1, e2, …, em} is the edge set of the network. W = {wij} is the set of edge weights in which wij is the weight of the connected edges between nodes vi and vj (i, j = 1, 2, ..., n). All the weights are normalized by the average of the weights. (i, j) is a link between vi and vj. aij is the connection status between vi and vj: aij = 1 when link (i, j) exists; aij = 0 otherwise. |

| Degree | Degree of node vi [53], . Weighted degree or the strength of vi [53], |

| Shortest path length | Shortest path length (distance) between vi and vj [53], , where is the shortest path (geodesic) between vi and vj, is a positive tuning parameter set by the users. Note that for all disconnected pairs (i, j). |

| Average path length | Average path length [53], |

| Global clustering coefficient | Global clustering coefficient [54], , where is the closed triplet and is any form triplet. |

| Local clustering coefficient | Local clustering coefficient of a node [68], , where . Clustering coefficient of a network, |

| Degree distribution | Cumulative degree distribution of the network [51], Cumulative weighted degree distribution of the network [69], where is the probability of a node having degree k’. |

| Degree centrality | Degree centrality [53], where is a positive tuning parameter set by the users, here set . Normalized version divides simple degree by the maximum value possible. |

| Closeness centrality | Closeness centrality of a node [53], (set ). Normalized version divides each value by n-1. |

| Betweenness centrality | Betweenness centrality [55], , where is the number of shortest paths from vs to vt that pass through vi , nst is the total number of shortest paths from vs to vt. Normalized version divides each value by the maximum value possible. |

| Eigenvector centrality | Eigenvector centrality [70], , where is the adjacency matrix constructed by , in which each eigenvalue has its own eigenvector . Note that the algorithm computes the eigenvector centrality individually for each disconnected component. The centrality score of disconnected nodes is 1/n. Normalized version divides each value by the maximum value possible. |

| Modularity | Modularity of a network [71], , where denotes the community to which node vi belongs. is a simple delta function which denotes whether vi and vj are in the same community, if they are in the same community, then the value is 1, otherwise is 0; . |

| Measure of network small-worldness | Network small-worldness [66], or , where and are the clustering coefficients and and are the average path lengths of the tested network and a random network. Small-worldness networks often have . |

| Measure of network scale-free property | A scale-free network is a network whose degree distribution follows a power law [46], , where is a parameter whose value is typically in the range, for the cumulative degree distribution. |

References

- Meskendahl, S. The influence of business strategy on project portfolio management and its success—A conceptual framework. Int. J. Proj. Manag. 2010, 28, 807–817. [Google Scholar] [CrossRef]

- Clancy, T. The Standish Group Report. Available online: https://www.projectsmart.co.uk/white-papers/chaos-report.pdf (accessed on 14 June 2017).

- Manifesto, C. Think Big, Act Small. Available online: http://athena.ecs.csus.edu/~buckley/CSc231_files/Standish_2013_Report.pdf (accessed on 10 Octorber 2016).

- Flyvbjerg, B.; Budzier, A. Why Your IT Project May Be Riskier Than You Think. Available online: https://hbr.org/2011/09/why-your-it-project-may-be-riskier-than-you-think/ar/1 (accessed on 20 October 2016).

- Hardy-Vallee, B. The Cost of Bad Project Management. Available online: http://www.gallup.com/businessjournal/152429/cost-bad-management.aspx#1 (accessed on 1 November 2016).

- Whittaker, B. What went wrong? Unsuccessful information technology projects. Inf. Manag. Comput. Secur. 1999, 7, 23–30. [Google Scholar] [CrossRef]

- Crawford, J.K. The Strategic Project Office, 2nd ed.; CRC Press: Boca Raton, FL, USA, 2010. [Google Scholar]

- Morris, P.; Pinto, J.K. The Wiley Guide to Project, Program, and Portfolio Management; John Wiley & Sons: Hoboken, NJ, USA, 2010; Volume 10. [Google Scholar]

- Institute, P.M. The Standard for Portfolio Management, 3rd ed.; Project Management Institute, Inc.: Newtown Square, PA, USA, 2013. [Google Scholar]

- Killen, C.P.; Jugdev, K.; Drouin, N.; Petit, Y. Advancing project and portfolio management research: Applying strategic management theories. Int. J. Proj. Manag. 2012, 30, 525–538. [Google Scholar] [CrossRef]

- Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. Portfolio Management for New Products, 2nd ed.; Basic Books: New York, NY, USA, 2002. [Google Scholar]

- Jonas, D.; Kock, A.; Gemünden, H.G. Predicting project portfolio success by measuring management quality—A longitudinal study. IEEE Trans. Eng. Manag. 2013, 60, 215–226. [Google Scholar] [CrossRef]

- Teller, J.; Kock, A. An empirical investigation on how portfolio risk management influences project portfolio success. Int. J. Proj. Manag. 2013, 31, 817–829. [Google Scholar] [CrossRef]

- Kwak, Y.H.; Stoddard, J. Project risk management: Lessons learned from software development environment. Technovation 2004, 24, 915–920. [Google Scholar] [CrossRef]

- Sanchez, H.; Robert, B.; Bourgault, M.; Pellerin, R. Risk management applied to projects, programs, and portfolios. Int. J. Manag. Proj. Bus. 2009, 2, 14–35. [Google Scholar] [CrossRef]

- Chang Lee, K.; Lee, N.; Li, H. A particle swarm optimization—Driven cognitive map approach to analyzing information systems project risk. J. Am. Soc. Inf. Sci. Technol. 2009, 60, 1208–1221. [Google Scholar] [CrossRef]

- Beer, M.; Wolf, T.; Zare Garizy, T. Systemic Risk in IT Portfolios—An Integrated Quantification Approach. In Proceedings of the Thirty Sixth International Conference on Information Systems, Fort Worth, TX, USA, 13–16 December 2015. [Google Scholar]

- Drake, J.R.; Byrd, T.A. Risk in information technology project portfolio management. J. Inf. Technol. Theory Appl. 2006, 8, 1–11. [Google Scholar]

- Hofman, M.; Grela, G. Project Portfolio Risk Identification—Application of Delphi Method. J. Bus. Econ. 2015, 6, 1857–1867. [Google Scholar] [CrossRef]

- Chien, C.F. A portfolio—Evaluation framework for selecting R&D projects. R D Manag. 2002, 32, 359–368. [Google Scholar]

- Killen, C.P.; Kjaer, C. Understanding project interdependencies: The role of visual representation, culture and process. Int. J. Proj. Manag. 2012, 30, 554–566. [Google Scholar] [CrossRef]

- Schwalbe, K. Information Technology Project Management, 8th ed.; Cengage Learning: Boston, MA, USA, 2015. [Google Scholar]

- Peffers, K.; Gengler, C.E.; Tuunanen, T. Extending critical success factors methodology to facilitate broadly participative information systems planning. J. Manag. Inf. Syst. 2003, 20, 51–85. [Google Scholar]

- Salmeron, J.L.; Herrero, I. An AHP-based methodology to rank critical success factors of executive information systems. Comput. Stand. Interfaces 2005, 28, 1–12. [Google Scholar] [CrossRef]

- Grabher, G. Cool projects, boring institutions: Temporary collaboration in social context. Reg. Stud. 2002, 36, 205–214. [Google Scholar] [CrossRef]

- Joslin, R.; Müller, R. New Insights into Project Management Research: A Natural Sciences Comparative. Proj. Manag. J. 2015, 46, 73–89. [Google Scholar] [CrossRef]

- Cowan, R.; Jonard, N. Network structure and the diffusion of knowledge. J. Econ. Dyn. Control 2004, 28, 1557–1575. [Google Scholar] [CrossRef]

- Killen, C.P. Evaluation of project interdependency visualizations through decision scenario experimentation. Int. J. Proj. Manag. 2013, 31, 804–816. [Google Scholar] [CrossRef]

- Durant-Law, G. Network Project Management: Visualising Collective Knowledge to Better Understand and Model a Project-Portfolio. Ph.D. Thesis, University of Canberra, Canberra, Australia, 2012. [Google Scholar]

- Mikkola, J.H. Portfolio management of R&D projects: Implications for innovation management. Technovation 2001, 21, 423–435. [Google Scholar]

- Warglien, M.; Jacobides, M.G. The power of representations: From visualization, maps and categories to dynamic tools. In Proceedings of the Academy of Management Meeting, Montreal, QC, Canada, 6 August 2010. [Google Scholar]

- Fang, C.; Marle, F.; Zio, E.; Bocquet, J.-C. Network theory-based analysis of risk interactions in large engineering projects. Reliab. Eng. Syst. Saf. 2012, 106, 1–10. [Google Scholar] [CrossRef]

- Unger, B.N.; Gemünden, H.G.; Aubry, M. The three roles of a project portfolio management office: Their impact on portfolio management execution and success. Int. J. Proj. Manag. 2012, 30, 608–620. [Google Scholar] [CrossRef]

- Cook, A.; Zanin, M. Complex Network Theory. In Complexity Science in Air Traffic Management; Routledge: London, UK, 2016; pp. 9–22. [Google Scholar]

- Scott, J. Social Network Analysis, 3rd ed.; SAGE Publications Ltd.: London, UK, 2012. [Google Scholar]

- Shannon, C.E. A mathematical theory of communication. ACM SIGMOBILE Mob. Comput. Commun. Rev. 2001, 5, 3–55. [Google Scholar] [CrossRef]

- Winter, M.; Szczepanek, T. Images of Projects; Gower Publishing, Ltd.: Surrey, UK, 2009. [Google Scholar]

- Patterson, M.G.; West, M.A.; Lawthom, R.; Nickell, S. Impact of People Management Practices on Business Performance; Institute of Personnel and Development London: London, UK, 1997. [Google Scholar]

- Arifin, R.S.; Moersidik, S.S.; Soesilo, E.T.B.; Hartono, D.M.; Latief, Y. Dynamic project interdependencies (PI) in optimizing project portfolio management (PPM). Int. J. Technol. 2015, 5, 828–837. [Google Scholar] [CrossRef]

- Tasevska, F.; Toropova, O. Management of Project Interdependencies in a Project Portfolio. Master Thesis, Umeå University, Umeå, Sweden, 2013. [Google Scholar]

- Rungi, M.; Hilmola, O.-P. Interdependency management of projects: Survey comparison between Estonia and Finland. Balt. J. Manag. 2011, 6, 146–162. [Google Scholar] [CrossRef]

- Zuluaga, A.; Sefair, J.A.; Medaglia, A.L. Model for the selection and scheduling of interdependent projects. In Proceedings of the 2007 IEEE Systems and Information Engineering Design Symposium, Charlottesville, VA, USA, 27 April 2007. [Google Scholar]

- Quimby, P. The Portfolio of Programs and Projects as a Network. Available online: http://www.caskllc.com/2014/05/the-portfolio-of-programs-and-projects-as-a-network/ (accessed on 1 November 2016).

- Pilato, C.M.; Collins-Sussman, B.; Fitzpatrick, B. Version Control with Subversion, 2nd ed.; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2008. [Google Scholar]

- Uzzi, B.; Spiro, J. Collaboration and creativity: The small world problem 1. Am. J. Sociol. 2005, 111, 447–504. [Google Scholar] [CrossRef]

- Albert, R.; Barabási, A.-L. Statistical mechanics of complex networks. Rev. Mod. Phys. 2002, 74. [Google Scholar] [CrossRef]

- Blondel, V.D.; Guillaume, J.-L.; Lambiotte, R.; Lefebvre, E. Fast unfolding of communities in large networks. J. Stat. Mech. Theory Exp. 2008, 2008, P10008. [Google Scholar] [CrossRef]

- Park, K.; Yilmaz, A. A social network analysis approach to analyze road networks. In Proceedings of the ASPRS Annual Conference, San Diego, CA, USA, 26–30 April 2010. [Google Scholar]

- Boccaletti, S.; Latora, V.; Moreno, Y.; Chavez, M.; Hwang, D.-U. Complex networks: Structure and dynamics. Phys. Rep. 2006, 424, 175–308. [Google Scholar] [CrossRef]

- Watts, D.; Strogatz, S. Collective dynamics of ‘small-world’ networks. Nature 1998, 393, 440–442. [Google Scholar] [CrossRef] [PubMed]

- Barabási, A.-L.; Albert, R. Emergence of scaling in random networks. Science 1999, 286, 509–512. [Google Scholar] [PubMed]

- Borgatti, S.P.; Everett, M.G. A graph-theoretic perspective on centrality. Soc. Netw. 2006, 28, 466–484. [Google Scholar] [CrossRef]

- Opsahl, T.; Agneessens, F.; Skvoretz, J. Node centrality in weighted networks: Generalizing degree and shortest paths. Soc. Netw. 2010, 32, 245–251. [Google Scholar] [CrossRef]

- Opsahl, T.; Panzarasa, P. Clustering in weighted networks. Soc. Netw. 2009, 31, 155–163. [Google Scholar] [CrossRef]

- Freeman, L.C. Centrality in social networks conceptual clarification. Soc. Netw. 1979, 1, 215–239. [Google Scholar] [CrossRef]

- Bavelas, A. Communication patterns in task-oriented groups. J. Acoust. Soc. Am. 1950, 22, 725–730. [Google Scholar] [CrossRef]

- Brandes, U. A faster algorithm for betweenness centrality. J. Math. Sociol. 2001, 25, 163–177. [Google Scholar] [CrossRef]

- Bonacich, P. Some unique properties of eigenvector centrality. Soc. Netw. 2007, 29, 555–564. [Google Scholar] [CrossRef]

- Fortunato, S.; Castellano, C. Community structure in graphs. In Computational Complexity: Theory, Techniques, and Applications; Springer: New York, NY, USA, 2012; pp. 490–512. [Google Scholar]

- Newman, M.E.; Girvan, M. Finding and evaluating community structure in networks. Phys. Rev. E 2004, 69, 026113. [Google Scholar] [CrossRef] [PubMed]

- Tan, Y.-J.; Wu, J. Network structure entropy and its application to scale-free networks. Syst. Eng. Theory Pract. 2004, 6, 1–3. [Google Scholar]

- Bianconi, G. Entropy of network ensembles. Phys. Rev. E 2009, 79, 036114. [Google Scholar] [CrossRef] [PubMed]

- Benston, G.J.; Hanweck, G.A.; Humphrey, D.B. Scale economies in banking: A restructuring and reassessment. J. Money Credit Bank. 1982, 14, 435–456. [Google Scholar] [CrossRef]

- Erdös, P.; Rényi, A. On random graphs I. Publ. Math. Debrecen 1959, 6, 290–297. [Google Scholar]

- Gephi Software. Available online: https://gephi.org/ (accessed on 15 October 2016).

- Humphries, M.D.; Gurney, K. Network ‘small-world-ness’: A quantitative method for determining canonical network equivalence. PLoS ONE 2008, 3, e0002051. [Google Scholar] [CrossRef] [PubMed]

- Hu, Y. Algorithms for visualizing large networks. Comb. Sci. Comput. 2011, 5, 180–186. [Google Scholar]

- Barrat, A.; Barthelemy, M.; Pastor-Satorras, R.; Vespignani, A. The architecture of complex weighted networks. Proc. Natl. Acad. Sci. USA 2004, 101, 3747–3752. [Google Scholar] [CrossRef] [PubMed]

- Rubinov, M.; Sporns, O. Complex network measures of brain connectivity: Uses and interpretations. Neuroimage 2010, 52, 1059–1069. [Google Scholar] [CrossRef] [PubMed]

- Newman, M.E. Analysis of weighted networks. Phys. Rev. E 2004, 70, 056131. [Google Scholar] [CrossRef] [PubMed]

- Newman, M.E. Modularity and community structure in networks. Proc. Natl. Acad. Sci. USA 2006, 103, 8577–8582. [Google Scholar] [CrossRef] [PubMed]

| Net | Average Path Length | Global Clustering Coefficient | Average Clustering Coefficient |

|---|---|---|---|

| GP | 2.3550 | 0.6735 | 0.9052 |

| ER1 | 1.4111 | 0.1347 | 0.1344 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Q.; Zeng, G.; Tu, X. Information Technology Project Portfolio Implementation Process Optimization Based on Complex Network Theory and Entropy. Entropy 2017, 19, 287. https://doi.org/10.3390/e19060287

Wang Q, Zeng G, Tu X. Information Technology Project Portfolio Implementation Process Optimization Based on Complex Network Theory and Entropy. Entropy. 2017; 19(6):287. https://doi.org/10.3390/e19060287

Chicago/Turabian StyleWang, Qin, Guangping Zeng, and Xuyan Tu. 2017. "Information Technology Project Portfolio Implementation Process Optimization Based on Complex Network Theory and Entropy" Entropy 19, no. 6: 287. https://doi.org/10.3390/e19060287