Decision Making in a Closed-Loop Supply Chain with a Waste Management Program: Manufacturers’ Take-Back Activity and Governmental Subsidies for Remanufacturing

Abstract

:1. Introduction

- In a CLSC, when a government asks a manufacturer to implement a take-back program, what are the equilibrium behaviors and profits of supply chain participants, and how does the landfill of uncollected products affect the supply chain performance?

- In a CLSC, when the government mandates a manufacturer to implement a take-back program and at the same time provides a subsidy program to a third-party remanufacturer, what are the equilibrium behaviors and profits of supply chain participants, and how does the landfill of uncollected products affect the supply chain performance?

- Is it more beneficial to a CLSC if the government implements only a take-back program or a take-back program and a subsidy program simultaneously?

2. Literature Review

2.1. CLSCs with a Take-Back Activity

2.2. Governmental Subsidy Programs in Supply Chains

2.3. Coalition Strategies in Supply Chains

2.4. Research Gaps and Contributions

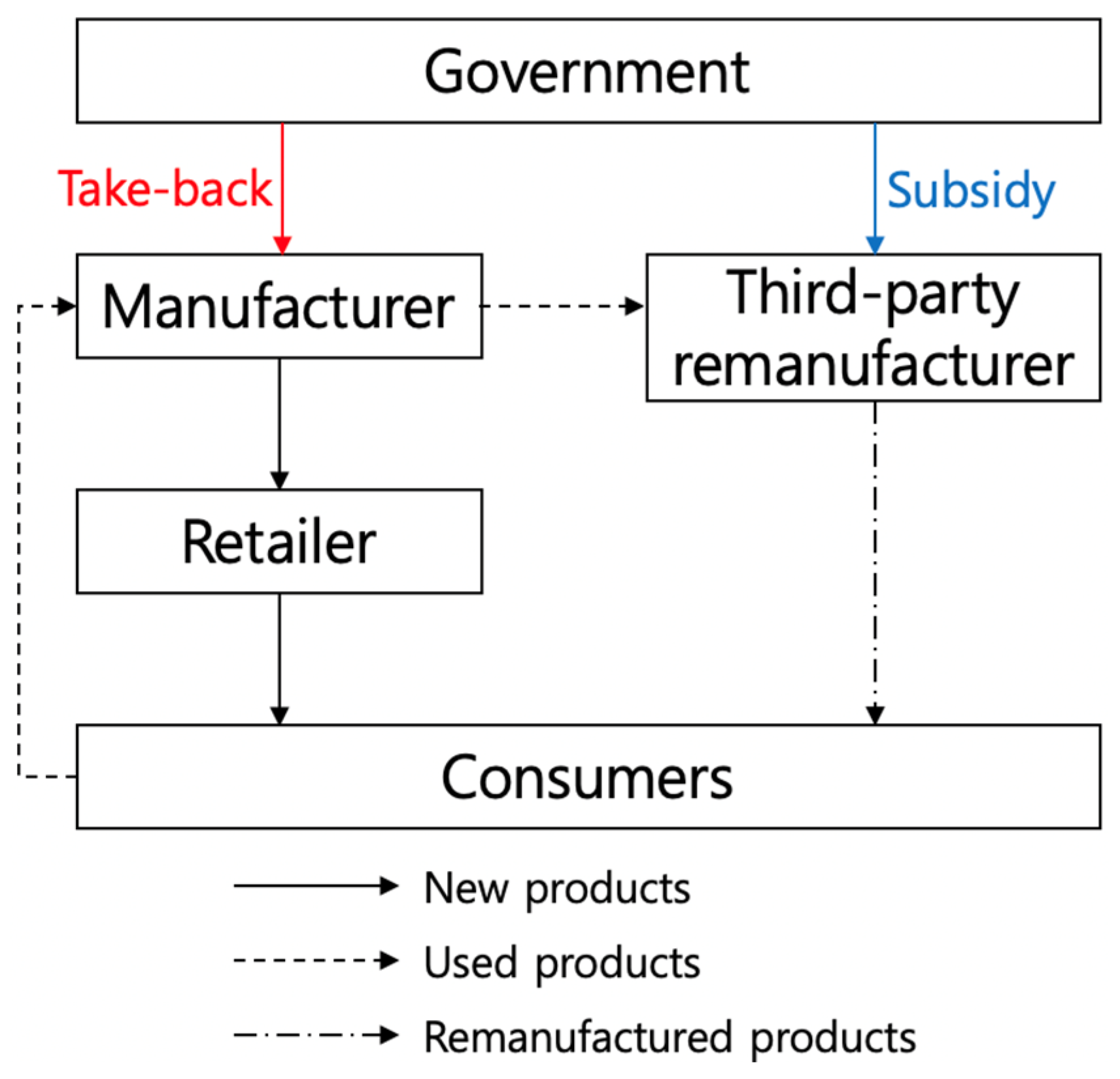

3. Problem Description

3.1. Notations

3.2. Assumptions

4. Equilibrium Analyses of Stackelberg Games

4.1. Model TO: Take-Back Program Only

4.2. Model TS: Both Take-Back and Subsidy Programs

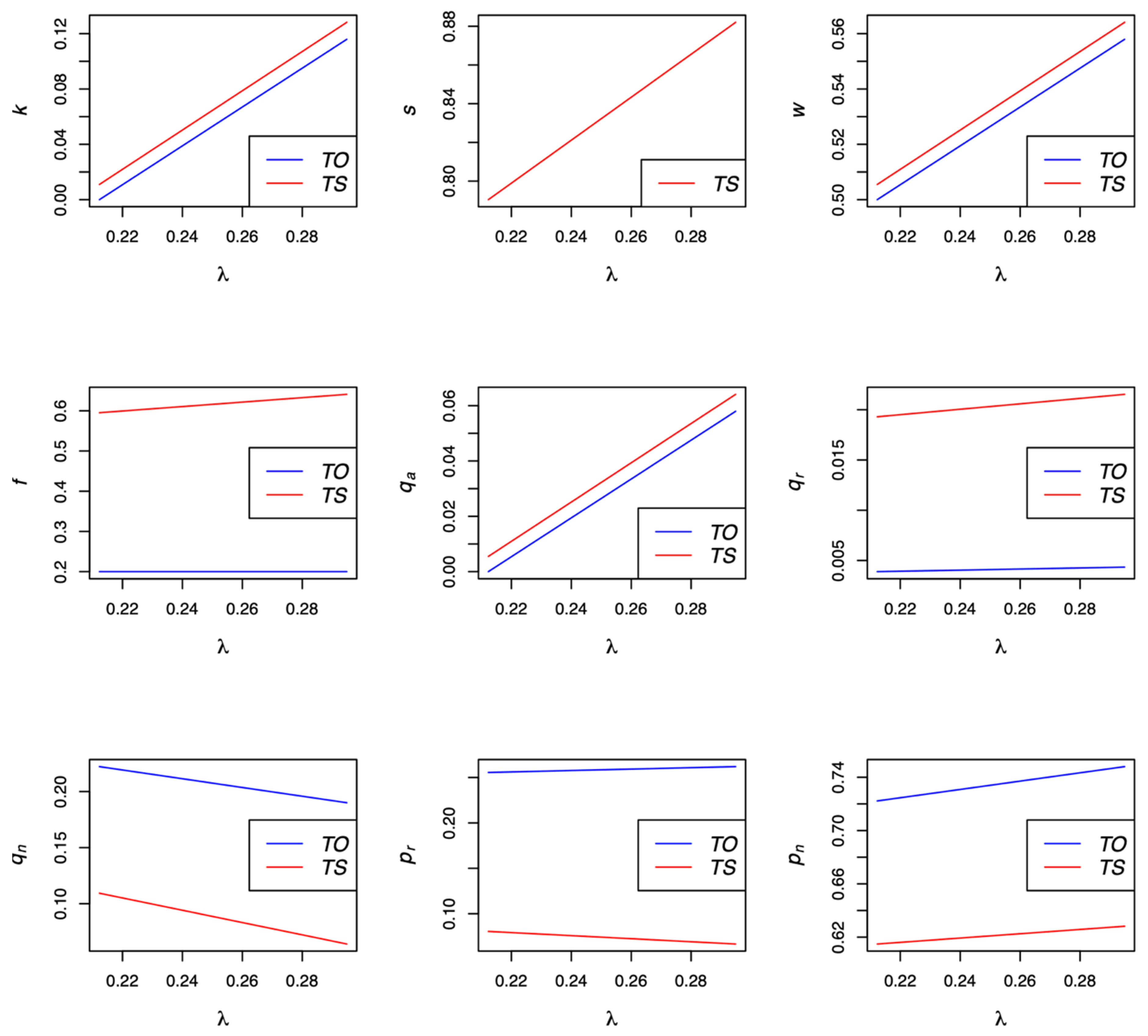

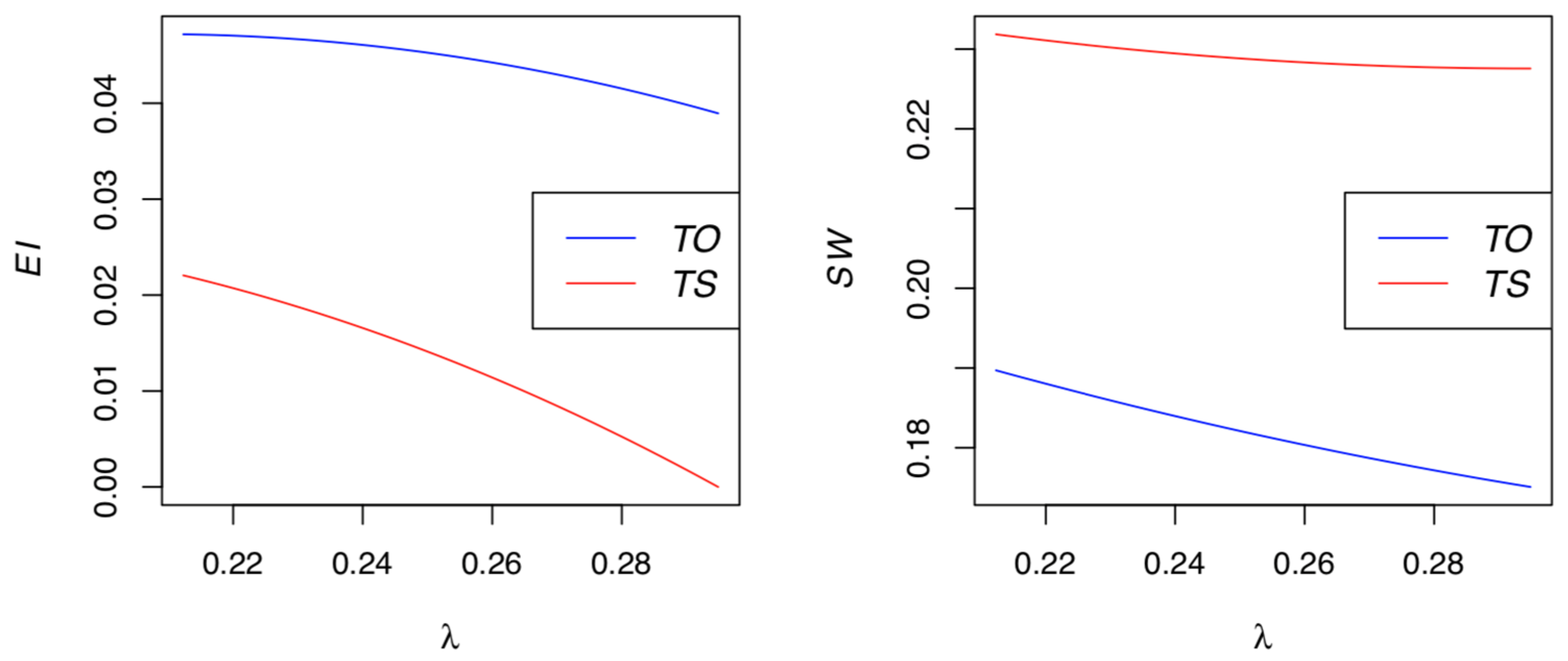

4.3. Discussion

4.3.1. Effects of the Unit Landfill Cost on Equilibrium Decisions

4.3.2. Comparisons between Models TO and TS

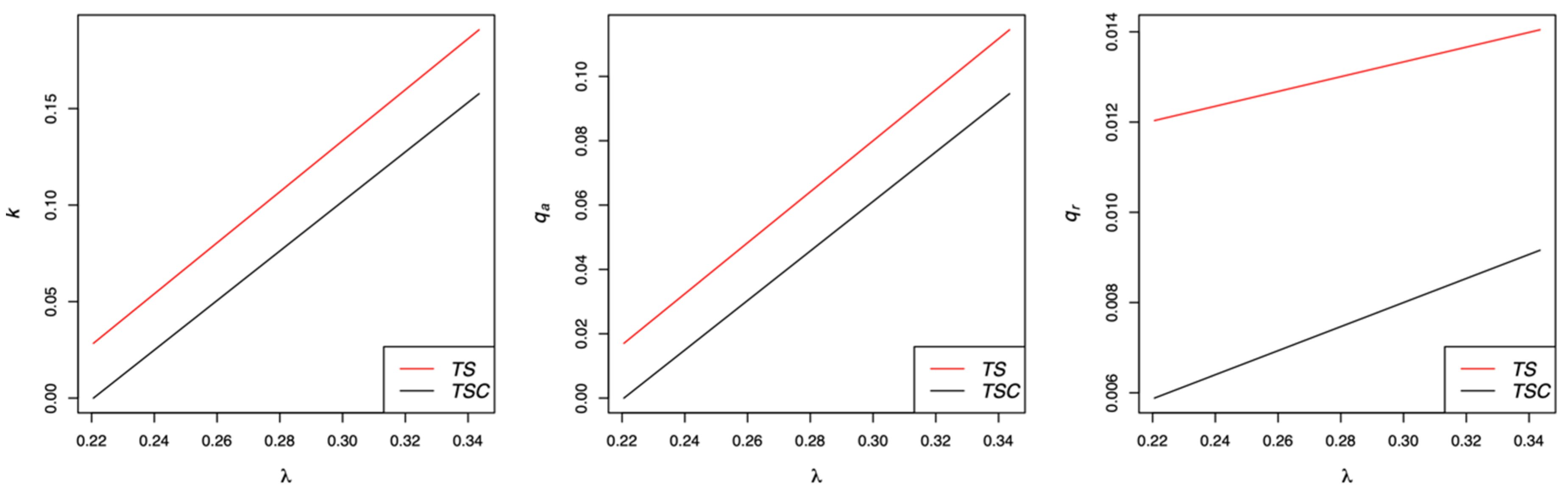

5. Extension

5.1. Model TSC: Model TS Considering Coalition

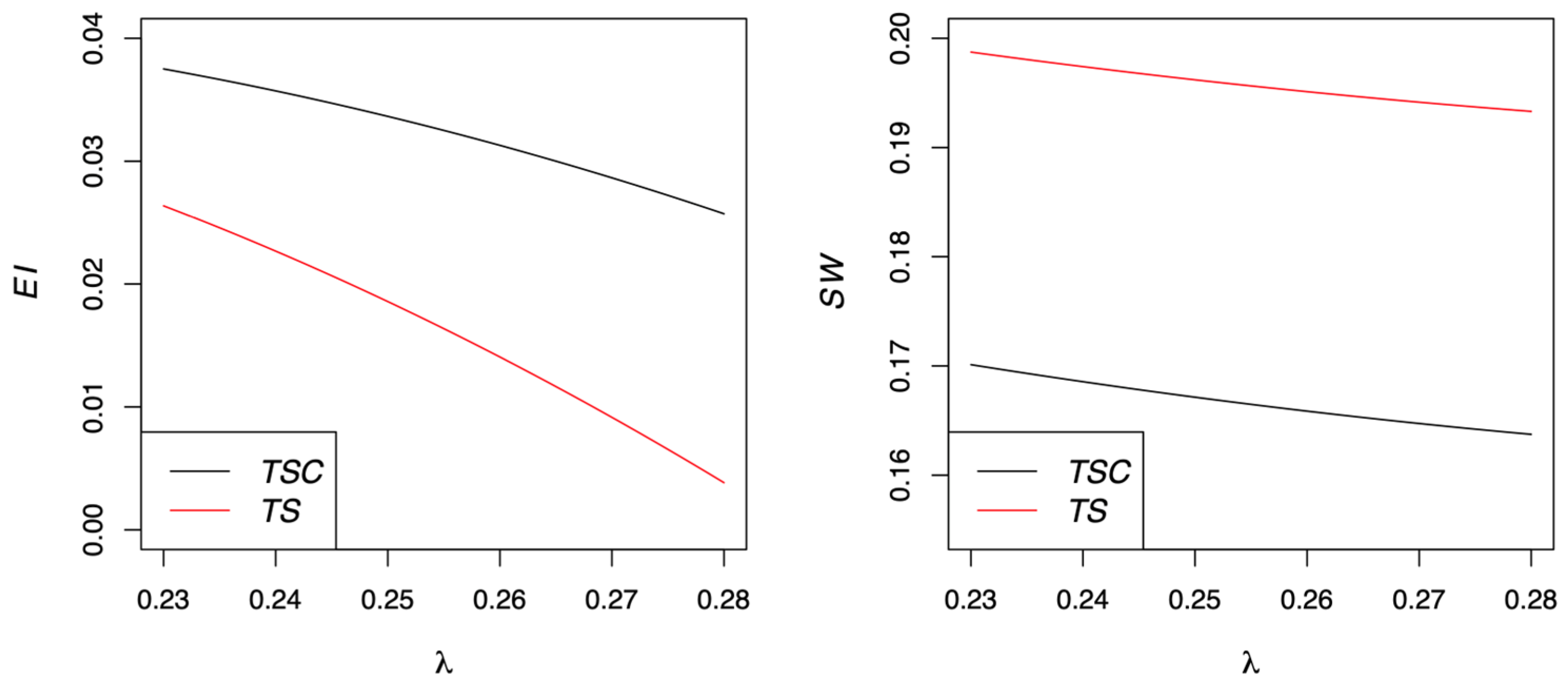

5.2. Comparison of Model TSC with Model TS

- (1)

- If , then ; otherwise, ;

- (2)

- .

6. Managerial Insights

- As can be seen from the results of all research models considered in this study, the greater the negative impact that uncollected product has on the environment, the higher the penalty the government should impose on this uncollected product. High penalties for products that are not collected force a manufacturer to put more efforts into take-back activities, which not only naturally reduces damages to the environment but also has positive effects on the sustainability of a CLSC.

- One of the important results of this study is that the subsidies for remanufactured products have positive impacts on supply chain performance in terms of environmental protection and social welfare. Therefore, the government needs to develop effective subsidy programs to revitalize the remanufacturing industry and implement various remanufacturing promotion policies that can help develop remanufacturing technology.

- According to the results of this study, the formation of the coalition between a retailer and a remanufacturer has a negative impact on overall social welfare. Their coalition is not always a good choice from an environmental or social welfare perspective because it has the effect of suppressing the demand for remanufactured products. Therefore, the government must recognize the negative effects of forming a coalition between a retailer and a remanufacturer and provide institutional support to other types of cooperation strategies in a CLSC.

7. Conclusions

- As shown in Models TO and TS, if the government implements a take-back program for the manufacturer, there is a greater negative environmental impact of landfilling and a higher penalty for uncollected used products. Thus, more products are collected and remanufactured in the supply chain. A take-back program results in increased social welfare because it reduces the environmental impact.

- In the supply chain, implementing a take-back program in conjunction with a government subsidy program results in a greater reduction in an environmentally negative impact and in an enhanced social welfare, compared to implementing them separately. In other words, promoting the recycling of disposed products or materials and providing subsidies for remanufactured products is a much better choice in terms of environmental protection and social welfare.

- Forming a coalition between the retailer and the third-party remanufacturer results in lowering the penalty imposed to the manufacturer, which leads to lowering the quantity of the collected and remanufactured products. Moreover, social welfare in the case of a coalition is smaller than that in the case of no coalition. In terms of maximizing the social welfare, it is much better for the retailer and the remanufacturer not to form the coalition. However, it is difficult to say whether the coalition is good or bad in terms of environmental protection.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Models | |||

|---|---|---|---|

| N/A | |||

Appendix B

Appendix C

References

- Chen, M.; Ogunseitan, O.A. Zero E-waste: Regulatory impediments and blockchain imperatives. Front. Environ. Sci. Eng. 2021, 15, 114. [Google Scholar] [CrossRef]

- Singh, N.; Ogunseitan, O.A. Disentangling the worldwide web of e-waste and climate change co-benefits. Circ. Econ. 2022, 1, 100011. [Google Scholar] [CrossRef]

- Anupam, K.; Vella, A.A.; Suchana, C.; Wilts, H.; Ishrat, I.; Ulrich, K.; Meng, L.; Xiao, L.; Indu, K.M.; Temitope, D.T.O.; et al. Accelerating circular economy solutions to achieve the 2030 agenda for sustainable development goals. Circ. Econ. 2022, 1, 100001. [Google Scholar]

- Take-Back Program: Upcycling T-Shirts—Patagonia. Available online: http://www.patagonia.com/our-footprint/take-back-program.html (accessed on 11 November 2022).

- Waste Gets Cut from Xerox Recycling Efforts. Available online: http://www.documentcompanypr.com/xerox-recycle-to-reduce-waste (accessed on 11 November 2022).

- The Best Takeback Programs from Big Businesses. Available online: http://www.rts.com/blog/the-best-takeback-programs-from-big-businesses (accessed on 11 November 2022).

- Manufacturer & Retailer Take Back Programs for Electronics. Available online: https://productstewardship.net/products/electronics/resources/programs/business (accessed on 11 November 2022).

- Qiao, H.K.; Su, Q. Impact of government subsidy on the remanufacturing industry. Waste Manag. 2021, 120, 433–447. [Google Scholar] [CrossRef] [PubMed]

- Yu, H.; Chang, X.; Liu, W. Cost-based subsidy and performance-based subsidy in a manufacturing-recycling system considering product eco-design. J. Clean. Prod. 2021, 327, 129391. [Google Scholar] [CrossRef]

- Li, J.; Du, W.; Yang, F.; Hua, G. The carbon subsidy analysis in remanufacturing closed-loop supply chain. Sustainability 2014, 6, 3861–3877. [Google Scholar] [CrossRef]

- Gutowski, T.; Murphy, C.; Allen, D.; Bauer, D.; Brass, B.; Piwonka, T.; Sheng, P.; Sutherland, J.; Thurston, D.; Wolf, E. Environmentally benign manufacturing: Observations from Japan, Europe and the United States. J. Clean. Prod. 2005, 13, 1–17. [Google Scholar] [CrossRef]

- Asari, M.; Sakai, S.I. Li-ion battery recycling and cobalt flow analysis in Japan. Resour. Conserv. Recycl. 2013, 81, 52–59. [Google Scholar] [CrossRef]

- Liu, H.; Lei, M.; Deng, H.; Leong, G.K.; Huang, T. A dual channel, quality-based price competition model for the weee recycling market with government subsidy. Omega 2015, 59, 290–302. [Google Scholar] [CrossRef]

- Cruijssen, F.; Dullaert, W.; Fleuren, H. Horizontal cooperation in transport and logistics: A literature review. Transp. J. 2007, 46, 22–39. [Google Scholar] [CrossRef]

- Basso, F.; D’Amours, S.; Rönnqvist, M.; Weintraub, A. A survey on obstacles and difficulties of practical implementation of horizontal collaboration in logistics. Int. Trans. Oper. Res. 2018, 26, 775–793. [Google Scholar] [CrossRef]

- Pan, S.; Trentesaux, D.; Ballot, E.; Huang, G.Q. Horizontal collaborative transport: Survey of solutions and practical implementation issues. Int. J. Prod. Res. 2019, 57, 5340–5361. [Google Scholar] [CrossRef]

- Ferrell, W.; Ellis, K.; Kaminsky, P.; Rainwater, C. Horizontal collaboration: Opportunities for improved logistics planning. Int. J. Prod. Res. 2019, 58, 4267–4284. [Google Scholar] [CrossRef]

- Guajardo, M.; Rönnqvist, M. A review on cost allocation methods in collaborative transportation. Int. Trans. Oper. Res. 2016, 23, 371–392. [Google Scholar] [CrossRef]

- Gansterer, M.; Hartl, R. Collaborative vehicle routing: A survey. Eur. J. Oper. Res. 2018, 268, 1–12. [Google Scholar] [CrossRef]

- Guajardo, M.; Rönnqvist, M.; Flisberg, P.; Frisk, M. Collaborative transportation with overlapping coalitions. Eur. J. Oper. Res. 2018, 271, 238–249. [Google Scholar] [CrossRef]

- Amaro, A.C.S.; Barbosa-Povoa, A.P.F.D. The effect of uncertainty on the optimal closed-loop supply chain planning under different partnerships structure. Comput. Chem. Eng. 2009, 33, 2144–2158. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Van Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Van Wassenhove, L.N. Reverse channel design: The case of competing retailers. Manag. Sci. 2006, 52, 1–14. [Google Scholar] [CrossRef]

- Atasu, A.; Toktay, L.B.; Van Wassenhove, L.N. How collection cost structure drives a manufacturer’s reverse channel choice. Prod. Oper. Manag. 2013, 22, 1089–1102. [Google Scholar] [CrossRef]

- Chen, Y.J.; Sheu, J.-B. Environmental-regulation pricing strategies for green supply chain management. Transport. Res. E-Log. 2009, 45, 667–677. [Google Scholar] [CrossRef]

- Toyasaki, F.; Boyaci, T.; Verter, V. An analysis of monopolistic and competitive take-back schemes for WEEE recycling. Prod. Oper. Manag. 2011, 20, 805–823. [Google Scholar]

- Huang, M.; Song, M.; Lee, L.H.; Ching, W.K. Analysis for strategy of closed-loop supply chain with dual recycling channel. Int. J. Prod. Econ. 2013, 144, 510–520. [Google Scholar] [CrossRef]

- Pangburn, M.S.; Stavrulaki, E. Take back costs and product durability. Eur. J. Oper. Res. 2014, 238, 175–184. [Google Scholar] [CrossRef]

- Hong, X.; Xu, L.; Du, P.; Wang, W. Joint advertising, pricing and collection decisions in a closed-loop supply chain. Int. J. Prod. Econ. 2015, 167, 12–22. [Google Scholar] [CrossRef]

- Dutta, P.; Das, D.; Schultmann, F.; Fröhling, M. Design and planning of a closed-loop supply chain with three way recovery and buy-back offer. J. Clean. Prod. 2016, 135, 604–619. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Closed-loop supply chain models with product take-back and hybrid remanufacturing under technology licensing. J. Clean. Prod. 2017, 142, 3917–3927. [Google Scholar] [CrossRef]

- Feng, D.; Yu, X.; Mao, Y.; Ding, Y.; Zhang, Y. Pricing decision for reverse logistics system under cross-competitive take-back mode based on game theory. Sustainability 2019, 11, 6984. [Google Scholar] [CrossRef]

- Pazoki, M.; Samarghandi, H. Take-back regulation: Remanufacturing or Eco-design. Int. J. Prod. Econ. 2020, 227, 107674. [Google Scholar] [CrossRef]

- Chang, X.; Xu, G.; Wang, Q.; Zhong, Y. A game theoretic approach for eco-design and remanufacturing considering take-back policy. Sustainability 2020, 12, 7174. [Google Scholar] [CrossRef]

- Xu, S.; Liu, H.; Xu, G. Selection of recycling channels and product eco-design with take-back regulation. Sustainability 2021, 13, 8961. [Google Scholar] [CrossRef]

- Lee, D.H.; Yoon, J.-C. Equilibrium decisions on pricing and the greenness degree in supply chains under single- and cross-distribution channels of green and non-green products and government subsidies. Math. Prob. Eng. 2022, 2022, 5525780. [Google Scholar] [CrossRef]

- Robinson, W.C. What is a government subsidy? Natl. Tax J. 1967, 20, 86–93. [Google Scholar] [CrossRef]

- Mitra, S.; Webster, S. Competition in remanufacturing and the effects of government subsidies. Int. J. Prod. Econ. 2008, 111, 287–298. [Google Scholar] [CrossRef]

- Sheu, J.-B. Bargaining framework for competitive green supply chains under governmental financial intervention. Transport. Res. E-Log. 2011, 47, 573–592. [Google Scholar] [CrossRef]

- Xiong, Y.; Zhou, Y.; Li, G.; Chan, H.-K.; Xiong, Z. Don’t forget your supplier when remanufacturing. Eur. J. Oper. Res. 2013, 230, 15–25. [Google Scholar] [CrossRef]

- Wang, Y.; Chang, X.; Chen, Z.; Zhong, Y.; Fan, T. Impact of subsidy policies on recycling and remanufacturing using system dynamics methodology: A case of auto parts in China. J. Clean. Prod. 2014, 74, 161–171. [Google Scholar] [CrossRef]

- Hu, S.; Dai, Y.; Ma, Z.J.; Ye, Y.S. Designing contracts for a reverse supply chain with strategic recycling behavior of consumers. Int. J. Prod. Econ. 2016, 180, 16–24. [Google Scholar] [CrossRef]

- Han, X.; Yang, Q.; Shang, J.; Pu, X. Optimal strategies for trade-old-for-remanufactured programs: Receptivity, durability, and subsidy. Int. J. Prod. Econ. 2017, 193, 602–616. [Google Scholar] [CrossRef]

- Jena, S.K.; Ghadge, A.; Sarmah, S.P. Managing channel profit and total surplus in a closed-loop supply chain network. J. Oper. Res. Soc. 2018, 69, 1345–1356. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Xu, H. Channel structure and pricing in a dual-channel closed-loop supply chain with government subsidy. Int. J. Prod. Econ. 2019, 213, 108–123. [Google Scholar] [CrossRef]

- Wang, Z.; Huo, J.; Duan, Y. Impact of government subsidies on pricing strategies in reverse supply chains of waste electrical and electronic equipment. Waste Manag. 2019, 95, 440–449. [Google Scholar] [CrossRef]

- Zhang, L.; Zhang, Z. Dynamic analysis of the decision of authorized remanufacturing supply chain affected by government subsidies under cap-and-trade policies. Chos Solit. Fractals 2022, 160, 112237. [Google Scholar] [CrossRef]

- Liu, K.; Li, Q.; Zhang, H. Analysis of the impact of remanufacturing process innovation on closed-loop supply chain from the perspective of government subsidy. Sustainability 2022, 14, 11333. [Google Scholar] [CrossRef]

- Ke, G.Y.; Bookbinder, J.H.; Kilgour, D.M. Coordination of transportation and quantity discount decisions, with coalition formation. Int. J. Oper. Res. 2014, 52, 5115–5130. [Google Scholar] [CrossRef]

- Mohebbi, S.; Li, X. Coalitional game theory approach to modeling suppliers’ collaboration in supply networks. Int. J. Prod. Econ. 2015, 169, 333–342. [Google Scholar] [CrossRef]

- Ma, Z.-J.; Zhang, N.; Dai, Y.; Hu, S. Managing channel profits of different cooperative models in closed-loop supply chains. Omega 2016, 59, 251–262. [Google Scholar]

- Jouida, S.B.; Krichen, S.; Klibi, W. Coalition-formation problem for sourcing contract design in supply networks. Eur. J. Oper. Res. 2017, 257, 539–558. [Google Scholar] [CrossRef]

- Alamdar, S.F.; Rabbani, M.; Heydari, J. Pricing, collection, and effort decisions with coordination contracts in a fuzzy, three-level closed-loop supply chain. Expert Syst. Appl. 2018, 104, 261–276. [Google Scholar] [CrossRef]

- Zheng, Q.; Zhou, L.; Fan, T.; Ieromonachou, P. Joint procurement and pricing of fresh produce for multiple retailers with a quantity discount contract. Transport. Res. E-Log. 2019, 130, 16–36. [Google Scholar] [CrossRef]

- Tian, F.; Sošić, G.; Debo, L. Stable recycling networks under the extended producer responsibility. Eur. J. Oper. Res. 2020, 287, 989–1002. [Google Scholar] [CrossRef]

- Kuo, C.-W.; Chen, C.B.; Chen, C.; Yang, Y.-Y. Formulating cross-sector horizontal coalition strategies for multi-product assembly systems with a common component. Comput. Ind. Eng. 2021, 159, 107399. [Google Scholar] [CrossRef]

- Asghari, T.; Taleizadeh, A.A.; Jolai, F.; Moshtagh, M.S. Cooperative game for coordination of a green closed-loop supply chain. J. Clean. Prod. 2022, 363, 132371. [Google Scholar] [CrossRef]

- Zhong, H.; Huo, H.; Zhang, X.; Zheng, S. Sustainable decision-making in a low-carbon supply chain: Fairness preferences and green investment. IEEE Access. 2022, 10, 48761–48777. [Google Scholar] [CrossRef]

- Madzík, P.; Falát, L.; Zimon, D. Supply chain research overview from the early eighties to Covid era—Big data approach based on Latent Dirichlet Allocation. Comput. Ind. Eng. 2023, 183, 109520. [Google Scholar] [CrossRef]

- Debo, L.G.; Toktay, L.B.; Van Wassenhove, L.N. Market segmentation and product technology selection for remanufacturable products. Manag. Sci. 2005, 51, 1193–1205. [Google Scholar] [CrossRef]

- Ferguson, M.E.; Toktay, L.B. The effect of competition on recovery strategies. Prod. Oper. Manag. 2006, 15, 351–368. [Google Scholar] [CrossRef]

- Pazoki, M.; Zaccour, G. A mechanism to promote product recovery and environmental performance. Eur. J. Oper. Res. 2019, 274, 601–614. [Google Scholar] [CrossRef]

| Parameters | Descriptions |

|---|---|

| Acquisition efficiency | |

| Acceptability of remanufactured product | |

| Cost coefficient of the environmental damage of landfills | |

| Decision variables | Descriptions |

| Licensing fee per unit of used product | |

| Take-back penalty per unit of uncollected product | |

| Quantity of collected products | |

| Quantity of new products | |

| Quantity of remanufactured products | |

| Subsidy per unit of remanufactured product | |

| Wholesale price | |

| Functions | Descriptions |

| Selling price of a new product | |

| Selling price of a remanufactured product | |

| Manufacturer’s profit | |

| Retailer’s profit | |

| Remanufacturer’s profit | |

| Sum of retailer’s and remanufacturer’s profits | |

| Supply chain profit | |

| Consumer surplus | |

| Total environmental impact cost | |

| Social welfare |

| Models | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| N/A | |||||||||

| kTSC | sTSC | wTSC | fTSC | |||||

|---|---|---|---|---|---|---|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, D.-H.; Park, E.-H. Decision Making in a Closed-Loop Supply Chain with a Waste Management Program: Manufacturers’ Take-Back Activity and Governmental Subsidies for Remanufacturing. Processes 2023, 11, 3132. https://doi.org/10.3390/pr11113132

Lee D-H, Park E-H. Decision Making in a Closed-Loop Supply Chain with a Waste Management Program: Manufacturers’ Take-Back Activity and Governmental Subsidies for Remanufacturing. Processes. 2023; 11(11):3132. https://doi.org/10.3390/pr11113132

Chicago/Turabian StyleLee, Doo-Ho, and Eun-Hee Park. 2023. "Decision Making in a Closed-Loop Supply Chain with a Waste Management Program: Manufacturers’ Take-Back Activity and Governmental Subsidies for Remanufacturing" Processes 11, no. 11: 3132. https://doi.org/10.3390/pr11113132