Least Quartic Regression Criterion to Evaluate Systematic Risk in the Presence of Co-Skewness and Co-Kurtosis

Abstract

:1. Introduction

2. The Role of Higher Moments in Financial Risk Measurement

3. Methodology

3.1. Co-Moments

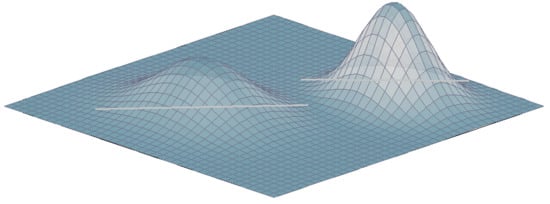

3.2. The Least Quartic Criterion

4. Least Quartic vs. Least Squares Estimators: An Empirical Comparison

- estimate the optimal vector of weights using the estimation window composed of the previous daily returns of each component, where is the rolling window length (three different equal-sized sections of 100–200 and 500 data points are tested);

- compute the returns for the following out-of-sample window, which ends at , keeping fixed the optimal set of weights.

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Alp, Tansel, and Matei Demetrescu. 2010. Joint forecasts of Dow Jones stocks under general multivariate loss function. Computational Statistics and Data Analysis 54: 2360–71. [Google Scholar] [CrossRef] [Green Version]

- Arbia, Giuseppe. 2003. Bivariate Value-at-risk. Statistica 62: 231–47. [Google Scholar]

- Badrinath, Swaminathan G., and Sangit Chatterjee. 1988. On measuring skewness and elongation in common stock return distributions: The case of the market index. The Journal of Business 61: 451–72. [Google Scholar] [CrossRef]

- Bakshi, Gurdip, Nikunj Kapadia, and Dilip Madan. 2003. Stock return characteristics, skew laws, and the differential pricing individual equity options. Review of Financial Studies 16: 101–43. [Google Scholar] [CrossRef]

- Barberis, Nicholas, and Ming Huang. 2008. Stock as lotteries: The implications of probability weighting for security prices. American Economic Review 98: 2066–100. [Google Scholar] [CrossRef] [Green Version]

- Bargès, Mathieu, Hélène Cossette, and Etienne Marceau. 2009. TVaR-based capital allocation with copulas. Insurance: Mathematics and Economics 45: 348–61. [Google Scholar] [CrossRef] [Green Version]

- Barone-Adesi, Giovanni, and Prem P. Talwar. 1983. Market Models and Heteroscedasticity of Residual Security Returns. Journal of Business & Economic Statistics 1: 163–68. [Google Scholar]

- Barone-Adesi, Giovanni, Patrick Gagliardini, and Giovanni Urga. 2004. Testing Asset Pricing anomalies with Coskewness. Journal of Business and Economic Statistics 22: 474–85. [Google Scholar] [CrossRef]

- Barone-Adesi, Giovanni. 1985. Arbitrage equilibrium with skewed asset returns. Journal of Financial and Quantitative Analysis 20: 299–313. [Google Scholar] [CrossRef]

- Beaulieu, Marie-Claude, Jean-Marie Dufour, and Lynda Khalaf. 2008. Finite sample multivariate tests of asset pricing models with coskewness. Computational Statistics and Data Analysis 53: 2008–21. [Google Scholar] [CrossRef]

- Boyer, Brian, Todd Mitton, and Keith Vorkink. 2010. Expected idiosyncratic skewness. Review of Financial Studies 23: 169–202. [Google Scholar] [CrossRef]

- Brooks, Chris, Simon P. Burke, Saeed Heravi, and Gita Persand. 2005. Autoregressive conditional kurtosis. Journal of Financial Econometrics 3: 399–421. [Google Scholar] [CrossRef] [Green Version]

- Brunnermeier, Markus K., Christian Gollier, and Jonathan A. Parker. 2007. Optimal beliefs, asset prices, and the preference for skewed returns. American Economic Review. 97: 159–65. [Google Scholar] [CrossRef] [Green Version]

- Byun, Suk-Joon, and Da-Hea Kim. 2016. Gambling preference and individual equity option returns. Journal of Financial Economics 122: 155–74. [Google Scholar] [CrossRef]

- Christie-David, Rohan, and Mukesh Chaudhry. 2001. Coskewness and cokurtosis in futures markets. Journal of Empirical Finance 8: 55–58. [Google Scholar] [CrossRef]

- Conrad, Jennifer, Robert F. Dittmar, and Eric Ghysels. 2013. Ex ante skewness and expected stock returns. Journal of Finance 68: 85–124. [Google Scholar] [CrossRef] [Green Version]

- Cortese, Federico Pasquale. 2019. Tail dependence in financial markets: A dynamic copula approach. Risks 7: 116. [Google Scholar] [CrossRef] [Green Version]

- Dissmann, Jeffrey, Eike C. Brechmann, Claudia Czado, and Dorota Kurowicka. 2013. Selecting and estimating regular vine copulae and application to financial returns. Computational Statistics and Data Analysis 59: 52–69. [Google Scholar] [CrossRef] [Green Version]

- Dittmar, Robert F. 2002. Nonlinear pricing kernels, kurtosis preference, and evidence from the cross section of equity returns. Journal of Finance 57: 369–403. [Google Scholar] [CrossRef]

- Dubauskas, Gediminas, and Deimantė Teresienė. 2005. Autoregressive conditional skewness and kurtosis and Jarque Bera statistics in Lithuanian stock market measurement. ISSN Engineering Economics 5: 19–24. [Google Scholar]

- Engle, Robert F. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50: 987–1007. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1992. The cross section of expected returns. Journal of Finance 59: 427–65. [Google Scholar] [CrossRef]

- Fang, Hsing, and Tsong-Yue Lai. 1997. Cokurtosis and capital asset pricing. The Financial Review 32: 293–307. [Google Scholar] [CrossRef]

- Fernandez-Perez, Adrian, Bart Frijns, Ana-Maria Fuertes, and Joelle Miffre. 2018. The skewness of commodity futures returns. Journal of Banking & Finance 86: 143–58. [Google Scholar]

- Green, T. Clifton, and Byoung-Hyoun Hwang. 2012. IPO as lotteries: Expected skewness and first-day returns. Management Science 58: 432–44. [Google Scholar] [CrossRef] [Green Version]

- Harvey, Campbell R., and Akhtar Siddique. 1999. Autoregressive conditional skewness in asset pricing tests. Journal of Financial and Quantitative Analysis 34: 465–487. [Google Scholar] [CrossRef]

- Harvey, Campbell R., and Akhtar Siddique. 2000. Conditional skewness in asset pricing tests. Journal of Finance 3: 1263–95. [Google Scholar] [CrossRef]

- Hwang, Soosung, and Stephen E. Satchell. 1999. Modeling emerging market risk premia using higher moments. International Journal of Finance & Economics 4: 271–96. [Google Scholar]

- Jacobson, Nathan. 2009. Basic Algebra, 2nd ed. Mineola, NY: Dover, vol. 1. [Google Scholar]

- Jondeau, Eric, and Michael Rockinger. 2006. Optimal portfolio allocation under higher moments. European Financial Management 12: 29–55. [Google Scholar] [CrossRef] [Green Version]

- Jondeau, Eric, Qunzi Zhang, and Xiaoneng Zhu. 2019. Average skewness matters. Journal of Financial Economics 134: 29–47. [Google Scholar] [CrossRef]

- Kendall, Maurice George, Alan Stuart, and J. Keith Ord. 1983. The Advanced Theory of Statistics. London: Griffin, vol. 1. [Google Scholar]

- Kim, Daeyoung, Jong-Min Kim, Shu-Min Liao, and Yoon-Sung Jung. 2013. Mixture of D-vine copulas for modeling dependence. Computational Statistics and Data Analysis 64: 1–19. [Google Scholar] [CrossRef]

- Kotz, Samuel, Narayanaswamy Balakrishnan, and Norman L. Johnson. 2000. Continuous Multivariate Distributions. Models and Applications. Hoboken: John Wiley and Sons. [Google Scholar]

- Krämer, Walter, and Ralf Runde. 2000. Peaks or tails: What distinguishes financial data? Empirical Economics 25: 665–71. [Google Scholar] [CrossRef] [Green Version]

- Kraus, Alan, and Robert H. Litzenberger. 1976. Skewness preference and the valuation of risky assets. Journal of Finance 31: 1085–100. [Google Scholar]

- Kraus, Alan, and Robert Litzenberger. 1983. On the distributional conditions for a consumption oriented three moment CAPM. Journal of Finance 38: 1381–91. [Google Scholar] [CrossRef]

- Ledoit, Oliver, and Michael Wolf. 2008. Robust performance hypothesis Testing with the Sharpe ratio. Journal of Empirical Finance 15: 850–59. [Google Scholar] [CrossRef] [Green Version]

- Levy, Haim. 1969. A utility function depending on the first three moments. Journal of Finance 20: 587–615. [Google Scholar] [CrossRef]

- Lintner, John. 1965. Security Prices, Risk, and Maximal Gains from Diversification. The Journal of Finance 24: 715–19. [Google Scholar]

- Liu, Qingfu, Pan Jiang, Yunbi An, and Keith Cheung. 2020. The effectiveness of incorporating higher moments in portfolio strategies: Evidence from the Chinese commodity futures markets. Quantitative Finance 20: 653–68. [Google Scholar] [CrossRef]

- McElroy, Tucker, and Agnieszka Jach. 2012. Tail index estimation in the presence of long-memory dynamics. Computational Statistics and Data Analysis 56: 266–82. [Google Scholar] [CrossRef]

- McNeil, Alexander J., and Rüdiger Frey. 2000. Estimation of tail-related risk measures for heteroscedastic financial time series: An extreme value approach. Journal of Empirical Finance 7: 271–300. [Google Scholar] [CrossRef]

- Mitton, Todd, and Keith Vorkink. 2007. Equilibrium under diversification and the preference for skewness. Review of Financial Studies 20: 1255–88. [Google Scholar] [CrossRef]

- Mossin, Jan. 1966. Equilibrium in a capital asset market. Econometrica 1: 768–83. [Google Scholar] [CrossRef]

- Nikoloulopoulos, Aristidis K., Harry Joe, and Haijun Li. 2012. Vine copulas with asymmetric tail dependence and applications to financial return data. Computational Statistics and Data Analysis 56: 3659–73. [Google Scholar] [CrossRef]

- Ranaldo, Angelo, and Laurent Favre. 2005. Hedge Fund Performance & Higher-Moment Market Models. Journal of Alternative Investments 8: 37–51. [Google Scholar]

- Rubinstein, Mark. 1994. Implied binomial trees. Journal of Finance 52: 35–55. [Google Scholar] [CrossRef]

- Sears, R. Stephen, and K. C. John Wei. 1988. The structure of skewness preferences in asset pricing model with higher moments: An empirical test. Financial Review 23: 25–38. [Google Scholar] [CrossRef]

- Sen, Pranab Kumar. 1968. Estimates of the regression coefficient based on Kendall’s tau. Journal of the American Statistical Association 63: 1379–89. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. Journal of Finance 19: 425–42. [Google Scholar]

- So, Mike K. P., and Raymond K. S. Chan. 2014. Bayesian analysis of tail asymmetry based on threshold extreme value model. Computational Statistics and Data Analysis 71: 568–87. [Google Scholar] [CrossRef]

- So, Mike K. P., and Cherry Y. T. Yeung. 2014. Vine-copula GARCH model with dynamic conditional dependence. Computational Statistics and Data Analysis 76: 655–71. [Google Scholar] [CrossRef]

- Subbotin, M. Th. 1923. On the Law of Frequency of Errors. Matematicheskii Sbornik 31: 296–301. [Google Scholar]

- Theil, Henri. 1950. A rank-invariant method of linear and polynomial regression analysis. I, II, III. Nederlandse Akademie van Wetenschappen Proceedings 53: 386–92, 521–25, 1397–412. [Google Scholar]

- Trivedi, Pravin K., and David M. Zimmer. 2005. Copula modeling: An introduction to practitioners. Foundations and Trends in Econometrics 1: 1–115. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Zhengjun, and James Huang. 2006. Extremal financial risk models and portfolio evaluation. Computational Statistics and Data Analysis 51: 2313–38. [Google Scholar] [CrossRef]

- Zhu, Dongming, and Victoria Zinde-Walsh. 2009. Properties and estimation of asymmetric exponential power distribution. Journal of Econometrics 148: 86–99. [Google Scholar] [CrossRef] [Green Version]

| Global | Rolling | |||||||

|---|---|---|---|---|---|---|---|---|

| LS | LQ | LS | LQ | LS | LQ | LS | LQ | |

| 4.963 | 5.884 | 1.946 | 1.995 | 2.283 | 2.333 | 6.748 | 7.219 | |

| 23.821 | 22.955 | 29.013 | 28.993 | 27.075 | 26.622 | 24.943 | 24.469 | |

| 0.969 | 0.933 | 1.073 | 1.065 | 1.056 | 1.036 | 0.974 | 0.953 | |

| 0.242 | 0.284 | 0.066 | 0.069 | 0.089 | 0.093 | 0.974 | 0.953 | |

| 0.899 | 0.908 | 0.797 | 0.810 | 0.823 | 0.826 | 0.859 | 0.861 | |

| - | - | 0.144 | 0.143 | 0.115 | 0.115 | 0.058 | 0.058 | |

| Global | Rolling | |||

|---|---|---|---|---|

| 58 | 53 | 55 | 52 | |

| 74 | 62 | 61 | 69 | |

| 70 | 60 | 63 | 68 | |

| 57 | 53 | 57 | 61 | |

| 56 | 55 | 57 | 61 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arbia, G.; Bramante, R.; Facchinetti, S. Least Quartic Regression Criterion to Evaluate Systematic Risk in the Presence of Co-Skewness and Co-Kurtosis. Risks 2020, 8, 95. https://doi.org/10.3390/risks8030095

Arbia G, Bramante R, Facchinetti S. Least Quartic Regression Criterion to Evaluate Systematic Risk in the Presence of Co-Skewness and Co-Kurtosis. Risks. 2020; 8(3):95. https://doi.org/10.3390/risks8030095

Chicago/Turabian StyleArbia, Giuseppe, Riccardo Bramante, and Silvia Facchinetti. 2020. "Least Quartic Regression Criterion to Evaluate Systematic Risk in the Presence of Co-Skewness and Co-Kurtosis" Risks 8, no. 3: 95. https://doi.org/10.3390/risks8030095