1. Introduction

There are two main types of machine learning: (i) predictive or supervised learning in which the machine trains data and learns the relationship between inputs and outputs and (ii) descriptive and unsupervised learning in which machine uses the inputs and discovers the outputs (

Murphy 2012). Classification and regression are two supervised learning approaches which are well-known in general insurance. One of the objectives of the insurance companies is to charge premiums which is commensurate with the risk characteristics of their policyholders and for this, they classify the policyholders into homogeneous groups according to, say, age, sex, type of policy, subscription to telematics-based insurance pricing (see,

Section 3), etc. Regression analysis and its extensions such as generalised linear modelling (GLM) are strong tools in insurance pricing. Unlike regression models, GLM is not constrained to a normal distribution and can be applied to any distribution from an exponential family. For example, a logistic regression model handles binary responses and thus is suitable for a Bernoulli distribution and a Poisson regression model applies to count data and deals with discrete random variables. GLM has long been used in actuarial practice to model claims amounts and claims frequency in the insurance portfolio (

Haberman and Renshaw 1996;

McCullagh and Nelder 1998).

In this study, we consider motor third party liability (MTPL) insurance. One of the problems in modelling claims frequency in this class of insurance is the number of zero claims and building a model that can capture all these zero claims. Zero claims in MTPL does not necessarily mean that there has been no accident during the term of a policy, rather it means that there has been no reported accident to the insurance company. This particularly happens under a no claim discount (NCD) system as some policyholders, known as

bonus hunger, prefer to benefit from a discount by not reporting a claim. Another problem which is related to the previous one is the problem of

over-dispersion. In a Poisson regression model, claims are distributed according to a Poisson distribution with equal mean and variance. Therefore, to build an appropriate model we need to test our dataset for the presence of over-dispersion (

Peruman-Chaney et al. 2013;

Wilson and Einbeck 2018). Binomial regression, negative binomial (NB) regression and zero-inflated Poisson (ZIP) model are techniques that can handle over and under dispersed data with the latter being able to distinguish between structured and unstructured zeros.

Lambert (

1992) considers a ZIP model where the probability of only possible observation, i.e., 0 and the parameter of a Poisson distribution depend on some covariates.

Lambert (

1992) applies this technique to model the number of defects in manufacturing. Since then, this model has been applied in different settings including insurance pricing. For example,

Lee et al. (

2002) use this model to analyse the impact of lifestyle and motivations on car crashes involving young drivers in Australia.

Yip and Yau (

2005) use ZIP to model claims frequency in car insurance. They compare different types of zero-inflated count models and conclude that a zero-inflated double Poisson regression model is a good fit for their dataset.

Boucher et al. (

2007) compare zero-inflated, hurdle and compound frequency models and conclude that the bonus rate is an important factor for policyholders to report the claim. In another study,

Boucher et al. (

2009) consider the problem of bonus hunger and construct a ZIP model to distinguish between the distribution of the number of claims and the number of accidents.

Model fitting and the selection of risk factors can be challenging in some cases. There are some papers that consider these problems. For example,

Tang et al. (

2014) propose a method to determine the variables in a ZIP model. They combine EM algorithm and adaptive LASSO and find that their technique performs better for the non-inflated part of the ZIP regression.

Liu and Pitt (

2017) also apply LASSO and ridge regression to address this issue in a bivariate negative binomial regression model. See, also,

Cantoni and Auda (

2018),

Chowdhury et al. (

2019) and

Chen et al. (

2019) among others.

The impact of mileage as a risk factor is considered by

Lemaire et al. (

2015). They conclude that annual mileage is a powerful predictor of the number of claims at-fault.

Tselentis et al. (

2017) provide a review of some Usage-based motor insurance (UBI) including Pay-as-you-drive (PAYD), Pay-how-you-drive (PHYD) and Pay-at-the-pump (PATP). PATP is a pricing method that considers fuel consumption as a rating factor but did not get enough attention from researchers. These new pricing methods require telematics data. In recent years, there is much research on telematics data and mileage based (MB) insurance.

Boucher et al. (

2017) apply generalised additive models and consider both time and mileage in insurance pricing. See the following papers on the relevance of including the mileage as a risk factor (

Ayuso et al. 2019;

Guillen et al. 2019;

Verbelen et al. 2018).

In addition to regression analysis, neural network, decision tree, random forest and boosting algorithms such as XGBoost, etc., are other machine learning techniques that can be applied to model claims frequency and insurance pricing. However, although these models have good predictive power, unlike regression models, it is difficult to interpret their parameters and their computation time is long.

Weerasinghe and Wijegunasekara (

2016) study neural network, decision tree and multinomial logistic regression models. Their results show that the neural network has the best predictive performance among the three models. However, they state that to understand the relationship between independent and dependent variables, the logistic regression is the best model.

Fauzan and Murfi (

2018) compare XGBoost, neural network and random forest models and find that in terms of the Gini index, XGBoost is a more accurate algorithm. See, also,

Spedicato et al. (

2018) and

Gao et al. (

2019) and the references therein.

In this study, we consider the classical Poisson and logistic regression and compare our findings with a ZIP model. We divide our dataset into training and validation (hold-out) set to predict the number of zero claims. This paper is organised as follows. In the next section, we present models and notation.

Section 3 discusses our dataset. In

Section 4, we build our models and in

Section 5 we test their validation. Finally,

Section 6 concludes.

2. Methodology and Notation

Risk classification is an important concept in general insurance pricing. An insurance company tries to determine the insurance premium according to risk characteristics of policyholders such as age, sex, type of policy and car model, etc. Regression analysis is a well-known technique to incorporate such risk (rating) factors. In this section, we review Poisson regression, Logistic regression and ZIP model.

Let

be a dependent or response variable such as number of claims, for

that follows a Poisson distribution with parameter

. Assuming a log link function and that

is a linear combination of rating factors

we have

When we consider the average number of claims for each policyholder, we need to specify a unit measure or exposure. We cannot expect two policyholders with the same risk characteristics, but different terms, to be equally risky. Normally, the length of coverage is considered as an exposure. However, in recent years, it is argued that even if policyholders join at different times, some may drive fewer distances than others. Therefore, when such information is available as in telematics data, mileage travelled is considered as a more appropriate exposure (

Guillen et al. 2019). In our study, all policyholders are under observation for one year and thus the exposure for each policyholder is 1.

We use logistic regression when

is a binary, also called dichotomous variable. In that case,

where

g is a logistic link function to ensure that

is between 0 and 1. Hence

or, more commonly

In this paper, we use logistic regression to answer the question: “What is the probability of a claim and zero claims for a given policyholder with particular risk characteristics?”

When the mean and variance of the underlying population is not equal, the assumption of a Poisson distribution is not suitable and a better candidate is a distribution that can allow for over/under dispersion such as a binomial or NB distribution. However, sometimes we deal with a large number of zeros in our dataset. For example, we see in the next section that many policyholders have zero claims, which does not necessarily mean that they were involved in no accidents, but they are low risk. In such cases, we can apply a ZIP model which is a mixture of a point mass at zero, also called structural zeros, and another claims frequency distribution, such as a Poisson or NB, which can be written as

where

is given by Equation (2) and denotes the probability of zeros when zero is the only possible observation. In a ZIP model,

follows a Poisson distribution with parameters being given by Equation (1).

3. Data

We use datasets provided by the French Institute of Actuaries for the 2017 pricing game, which is based on French MTPL insurance. The dataset is available in Package ‘CASdatasets’ by Dutang and

Dutang and Charpentier (

2019) and to the best of the author’s knowledge, this is the first time it is used in a study. The dataset contains some information about the new pricing strategy of the company. The policyholders were given a choice whether they would like to join a new mileage-based (MB) pricing system or not. We would like to see how policyholders’ perception regarding this new system affects their driving behaviour and hence their number of claims. There are two types of datasets: (i) underwriting and (ii) claims dataset. Underwriting datasets are available for three years, whereas claims dataset is only publicly available for year 0. Therefore, we only use data from year 0. After merging claims and underwriting datasets, we randomly split our data into training and validation sets with

being in training and

in the validation set. As some policyholders have more than one car, we assume that each policy covers only one car and therefore consider the number of policies and claims per policy rather than claims per policyholder. We have 100,000 policies (rows in underwriting dataset) and 12,654 policies with claims (rows in claims dataset after consolidation).

Table 1 shows the variables we use in our study. In addition to these variables, information about

Insee town code,

make and model,

marketing duration and

age of driving license are also provided. However, we do not take into account these variables as, for example, there is a considerable number of policies with 113 years for driving license age which is not reasonable.

In

Table 1 policy ID refers to the combination of the vehicle ID and policyholder ID. In this study, we have 100,000 policy ID. Bonus coefficient is the percentage of the full premium that policyholders pay allowing for their claims experience and the allocated discount. There are four types of coverage available: Maxi, Median 2, Median 1 and Mini. The time from the last policy alteration, such as the inclusion of a new driver, is represented by situation duration. Payments can be made annually, semi-annually, quarterly and monthly. As it is usual for the liability insurance, some of the claims amounts are negative

1. Therefore, we set all claims amounts of less than 30 equal to zero (

Ferreira and Minikel 2012;

Frees et al. 2014).

Subscription to mileage-based (MB) policy refers to a new scheme in which one of the main risk factors is the travel distance and policyholders are charged based on their mileage, also known as PAYD scheme. Policy Usage includes WorkPrivate, Retired, Professional and AllTrips. If a policy covers two drivers, age and gender are provided for both drivers. Different features of the car including age, engine power (represented by Din), fuel type, max speed (provided by manufacturing company), type—Tourism and Commercial, value and weight are provided and will be used as rating factors. In this study, we only consider the number of claims as a dependent variable.

We now provide some explanatory analysis based on the training set. The minimum policy term in our dataset is one year, which means all these policies have been under observation for at least one year. Since claims have occurred in Year 0, we consider car years or earned exposure of one year for all policies. The maximum claims number is 6, the oldest policyholder is 103 years old and the oldest car is 66 years old.

Table 2 presents mean and standard deviation of our numerical explanatory variables for all policies, policies without claims and policies with at least one claim based on the training set. In order to examine which variables are considerably different in the group of policies with claims and the group of policies without claims and hence are effective on the frequency of claims, we can apply Mann-Whitney test. The Mann-Whitney test is a nonparametric test of the null hypothesis that it is equally likely that a randomly selected value from one sample is less than or greater than a randomly selected value from a second sample. The Mann-Whitney test shows that the difference in the mean for all these variables is statistically significant with

p-value

, except for policy duration and driver age 2 with

p-values

and

, respectively.

Figure 1 shows the distribution of the number of claims. We can observe that zero claims form a large part of our portfolio.

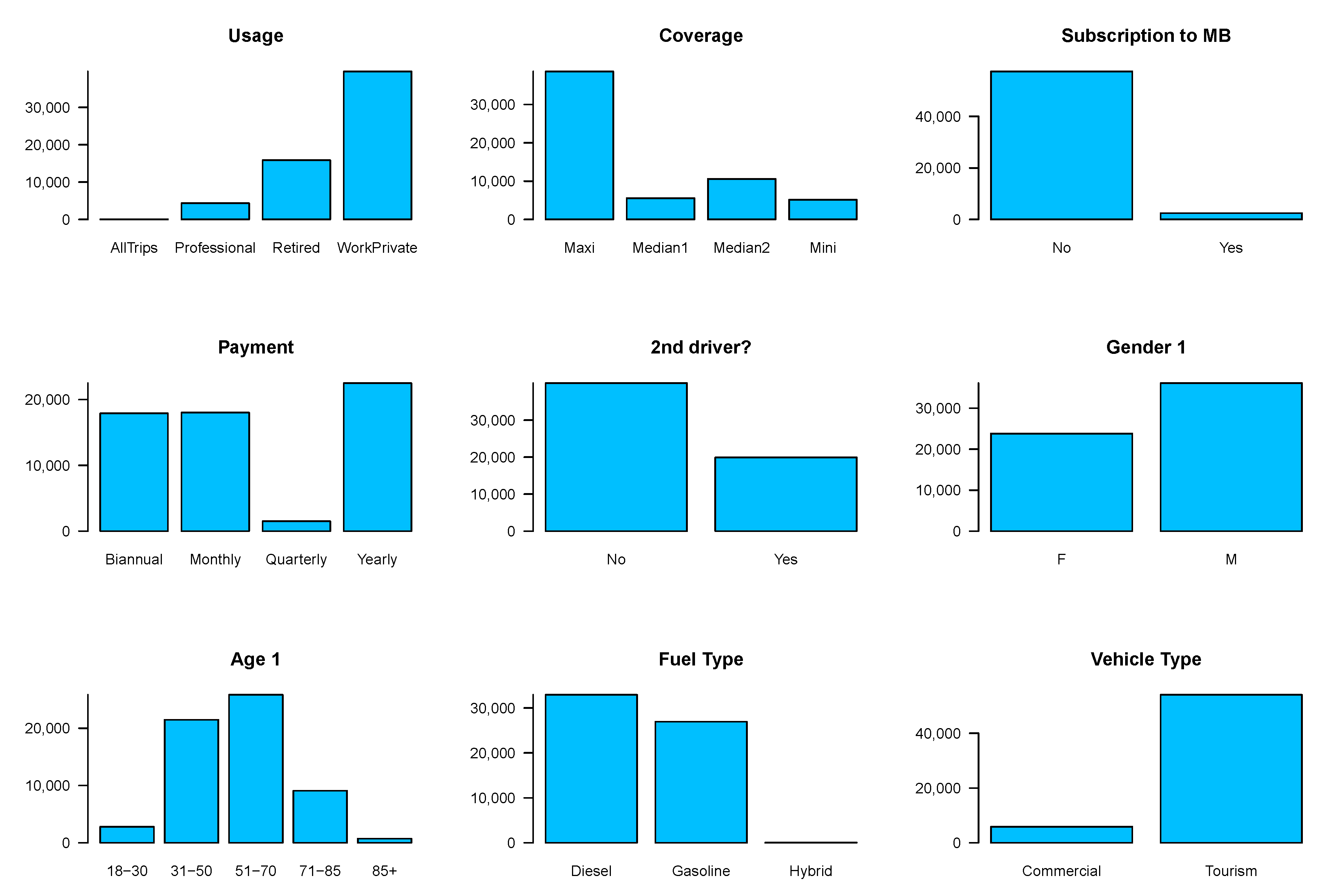

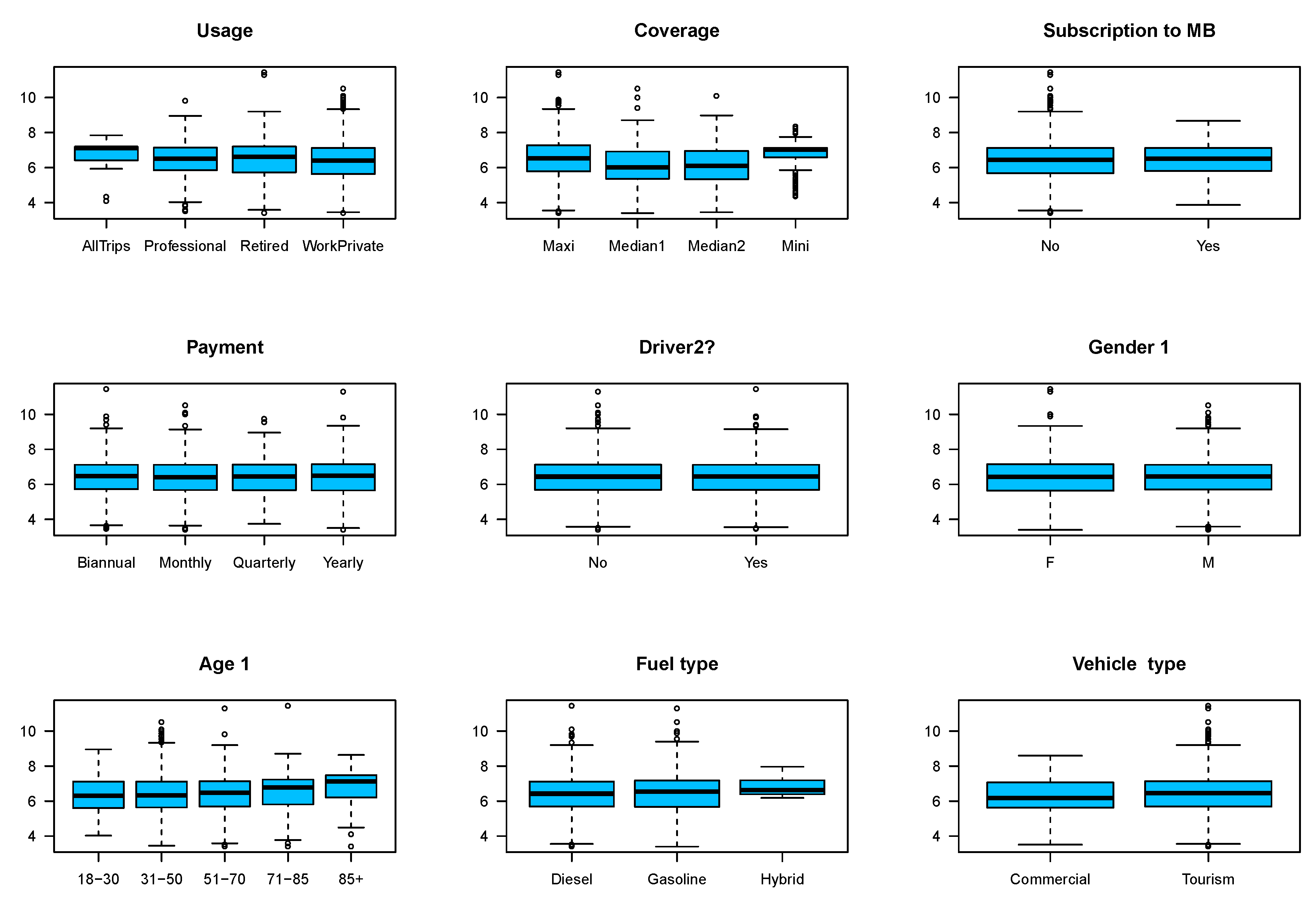

Figure 2 illustrates how policies are distributed across categorical variables. As we can see, most of our policies cover one driver and most of the drivers are men aged between 51 and 70. Our policyholders prefer Maxi and drive tourism cars for work and private purposes. Most of them pay annually and are distributed almost evenly across monthly and biannual payment categories. They have not registered for MB scheme and they use diesel with very few of them using a hybrid car. Next, we see how claims are distributed across categorical variables.

Table 3 presents the distribution of the number of claims across different categories. For the variable

policy usage, although

professional usage forms a small portion of our portfolio, claims under

professional group is more than

private and

retired groups. However, from

Figure 3 professional and

retired groups have almost the same median loss and except for

all trips we can see little difference among policies in this group. Under this insurance, the most comprehensive protection is provided by

maxis and as can be expected this may lead to moral hazard. We can see there are more claims under

maxis than under other types of coverage. The order of coverage is

maxis,

median 2,

median 1 and

mini and unsurprisingly, the percentage of claims reduces in the same order. Under

mini,

of the policies have made zero claims. Perhaps lower coverage is a motivation for policyholders to take more precautious measures.

Figure 3 shows the effect of policy coverage on the amounts of claims and as we can see this will be an effective covariate in our model. From

Table 3 those policyholders who were willing to subscribe to

MB plan are less likely to have an accident.

Figure 3 shows that the subscribers are less dispersed than those who have not subscribed. From the regulatory point of view,

gender cannot be used as a discriminatory factor. In fact, we can see there is no considerable difference between

male’s and

female’s number of claims. In

Figure 2 the least favourable

payment frequency is

quarterly payment, but we do not see considerable differences in claim numbers and amounts for different categories of payments. A large number of policies provide coverage only for one driver, but policies with two drivers have a slightly greater chance of making claims. The

age of the first driver ranges from 19 to 103. We classify the policyholders in different age groups as 18–30, 31–50, 51–70, 71–85 and 85+. Most of the policyholders are in the range 51–70 and the next largest group is between 31 and 50. Both

Table 3 and

Figure 3 do not show a significant difference in claims frequency and claim amounts for different age categories and it seems that some categories can be combined together. In fact, in the next section we see that instead of these categories, we use

age as a numerical covariate in our models as some categories are not statistically significant.

Most of our policyholders drive

gasoline cars and very few of them have

hybrid cars.

2 According to

Table 3, hybrid cars make more claims than gasoline and

diesel cars. Most policies cover

tourism cars and claims percentage made by this type of cars is more than

commercial cars. Our initial analysis suggests that

payment frequency and

gender are not significant variables and therefore can be removed from our study. In the next section, we will see that they are indeed insignificant and are not included in our final models.

4. Results

In this section, we use statistical software R and package “pscl” to build Poisson, logistic and ZIP models (

Zeileis et al. 2008). Our purpose is to estimate the frequency and the probability of claims and compare our results with a ZIP model using Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC).

Table 4 presents three Poisson regression models with their estimated coefficients and their corresponding

p-values. Model 1 is the full model where we consider all the variables from

Section 3. However, according to pricing game document, there is a correlation between vehicle cylinder, weight, value, speed and power and in our dataset, some of the entries for weight, value and cylinder are missing. Therefore, we only incorporate speed and power into our models. We build Model 2 using the stepwise selection of variables that can be implemented in R. In Model 3 we only consider variables which are statistically significant at 0.05.

As we can see, some of the coefficients are statistically significant at

. For example, the coefficient associated with the Bonus is significant and positive as expected. The bonus represents the percentage of the full premium and a large percentage shows an adverse claims history of a policyholder. The positive sign indicates that as the percentage of the full premium increases, the mean of claims frequency will increase. The coefficients associated with Coverage are negative for all categories and significant. The coefficient of Median 2 shows that the policyholders with this type of coverage have fewer claims than policyholders with Maxi coverage (the reference level). For example, in Model 1, a policyholder with a Median 2 has fewer claims than a policyholder with a Maxi coverage by

and a policyholder with a Mini coverage has fewer claims by

. The coefficient of the car’s power, represented by Din, is positive and significant, which indicates that powerful cars are more likely to be involved in an accident and therefore the mean of claims frequency for the owners of the powerful cars is higher. Unlike

Ayuso et al. (

2019) and

Guillen et al. (

2019), we found that Vehicle age has a negative impact on the number of claims. In our study, most of the policyholders are middle-aged and more likely to have old cars. In

Section 3 we saw that the mean of the vehicle age is 9.56 for all policies and 7.30 for policies with at least one claim. Our portfolio of middle-aged policyholders also affects the sign of the coefficient associated with Age 1. Our dataset includes drivers as old as 103. Therefore, it seems reasonable to find a positive impact of age on the mean of the number of claims. In Model 1 the coefficients which are not significantly different from zero include Female 1, car usage for Retired and All trips, Hybrid fuel, Type and Speed. The coefficient of Professional usage indicates that Professional usage increases the mean of claims frequency compared to Work and private usage (the reference level) by

. This is in line with

Table 3 that policies for professional purposes make more claims. We obtain similar results for gasoline cars as in

Table 3. Owners of Gasoline cars have fewer claims than owners of Diesel cars by

. We can see that the coefficient associated with Driver2 is positive. This seems reasonable as a policy that covers two drivers is more likely to make claims. The coefficient of Age 2 is negative. One interpretation can be that the average age of the second drivers is lower than the average age of the first drivers. However, in

Section 3, we saw that driver age 2 is not significantly different for policies with claims and policies without claims. The coefficients associated with Duration and Policy duration are both negative. This implies that more experienced policyholders make fewer claims and also the more stable a policy is, the lower the mean of the number of claims. The coefficient of subscription to MB is negative and therefore this variable reduces the mean of claims frequency. Perhaps those who are willing to be monitored by telematics technology are more confident about their driving behaviour. We saw in the previous section that payment frequency is not a significant variable. As we can see, their corresponding

p-values for some categories in models 1 and 2 are not significant at

and therefore we have removed them from Model 3. However, we decided to keep the variable Usage, although not all categories are significant at 0.05, as we found in the previous section that it is effective on the number of claims. Among our three models, Model 2 has the lowest AIC and Model 3 has the lowest BIC. As we can see, the computation time for Model 2 is longer than the other two models. The reason is that the stepwise algorithm examines different models to find the one with the smallest AIC.

Table 5 presents three logistic models with their coefficients and the corresponding

p-values. Similar to

Table 4, Model 1 includes all variables, Model 2 is based on the stepwise algorithm and Model 3 only includes significant variables. The interpretation of the coefficients in logistic regression is similar to Poisson regression and as we can see, the signs of the coefficients are the same. The only difference is that in logistic regression we look at the impact of variables on the odds of the occurrence of claims. So, for example, the interpretation of the coefficient associated with Bonus is that, the greater the percentage of the full premium (adverse claims history) is, the higher the odds of the occurrence of the claims for the coefficient associated with professional usage; we can say that the odds of the occurrence of claims for policyholders with professional usage increases by

as opposed to policyholders with work and private usage. For the negative coefficient associated with subscription to MB, we can say that the odds of the occurrence of claims fall for a policyholder who joins this scheme. Other variables can be similarly interpreted. Model 2 is built by examining different models and finding the one with the lowest AIC. All variables in this model are the same as the variables in stepwise Poisson regression except for duration which is not included in stepwise logistic regression. For Model 3 we again remove all variables with a

p-value greater than 0.05. In addition, we do not include payment frequency as this has been proved to be insignificant in

Section 3. As we can see, Model 2 has the smallest AIC and Model 3 has the smallest BIC. Further, the computation time for the stepwise algorithm is longer than the stepwise Poisson regression model.

When building a model, it is important to consider the underlying assumptions. For example, to fit a ZIP model to our data, we first need to test for the presence of over-dispersion. One approach is to fit a quasi-Poisson and to determine the dispersion parameter, i.e.,

in Var

E

. In our case, using only significant variables from

Table 4 and

Table 5, the dispersion parameter is

. Alternatively, we can fit NB regression and compare our new model with Poisson regression. In our case, AIC and BIC for NB regression are 46,184 and 46,346, respectively, which are lower than AIC and BIC for the Poisson regression. Now, since we have the problem of over-dispersion and excess zeros, we can fit a ZIP model to our data.

Table 6 shows the estimated coefficients and their

p-values for the Poisson (count) part and zero-inflated part of three ZIP models. Model 1 is the full model where we consider the variables of the full model in

Table 4 for the count part and the variables of the full model in

Table 5 for the zero-inflated part. As we can see, most variables are not significantly different from zero. If we consider the significant level of 0.1, the coefficient associated with Age 1 is positive as in

Table 4 and statistically significant in the count part. In addition, the coefficient associated with Age 2 is positive and significant in the zero-inflated part, but not in the count part. From

Section 3, we know that the second divers are younger than the first drivers. Therefore, we can claim that in this group older drivers are more likely to have zero claims. The coefficient of situation duration in the count part is negative and significant as in

Table 4 with the same interpretation. The coefficients associated with coverage are significant at 0.01 in the count part with the identical signs as in

Table 4, but they are not significant in the zero-inflated part. The interpretation is that the mean frequency of claims for policyholders covered under, for example, Mini coverage is less than the policyholders covered under Maxi coverage by

.

The coefficient of fuel (gasoline) is positive and significant which indicates that the odds of zero claims for drivers of gasoline cars increases by

as opposed to drivers of diesel cars. Further, in the zero-inflated part, the coefficient of Driver2? is negative and significant. Therefore, a policy with two drivers is less likely to have zero claims, in other words, a policy with the 2nd driver is more likely to be involved in an accident and to make a claim. The associated coefficient of vehicle age is positive and significantly different from zero in the zero-inflated part, which is in line with our findings for Poisson and logistic models that it is more likely for the owners of older cars to have zero claims. All other variables including subscription to MB are not significantly different from zero. The variables of Model 2 in the count and zero-inflated part come from the variables of stepwise models in

Table 4 and

Table 5, respectively. The coefficients have the same sign and therefore similar interpretation as in Model 1. Again the coefficient of subscription to MB is not significantly different from zero. Model 3 can be built using the variables of the models that contain only significant variables in

Table 4 and

Table 5. Coverage in the count part and Age 2, Driver2?, fuel and vehicle age in the zero-inflated part are all significantly different from zero. In

Table 6 the signs of some of the coefficients do not conform to

Table 4 and

Table 5. For example, subscription to MB is positive both in the count part and in the zero-inflated part. Since such coefficients are not statistically significant, we can conclude that they are not significantly different from zero. Comparing AIC and BIC of these three models, we can see that the smallest AIC can be obtained by Model 2 where the variables come from stepwise models in

Table 4 and

Table 5 and the smallest BIC by Model 3. In addition, AIC has considerably improved for ZIP models compared to Poisson models in

Table 4. In the next section, we show that the prediction of zero claims by ZIP is considerably better than Poisson regression.