Diversification and Systemic Risk: A Financial Network Perspective

Abstract

:1. Introduction

Note that Greenspan explicitly entertains the idea that the default of any given financial institution may result in “cascading failures” of other banks via spillover effects in a network of direct credit relationships. In the presence of spillover effects, reducing idiosyncratic risk concentrations may thus be beneficial as it reduces the likelihood that individual banks default in the first place.[In the past year] I, particularly, have been focusing on innovations in the management of risk and some of the implications of those innovations for our global economic and financial system. The development of our paradigms for containing risk has emphasized dispersion of risk to those willing, and presumably able, to bear it. If risk is properly dispersed, shocks to the overall economic systems will be better absorbed and less likely to create cascading failures that could threaten financial stability.

Relation to the Literature on Systemic Risk

2. Model and Methodology

2.1. The Model

2.1.1. The Financial Network

- (i)

- All loans in the system are of the same size, normalized to one.

- (ii)

- For every bank k in the network, the ratio (the ratio of equity over total assets) is equal to an exogenously given constant .

- (iii)

- For every bank k in the network, the ratio (the ratio of interbank assets to total assets) is equal to an exogenously given constant .3

2.1.2. Initial Defaults

2.1.3. Diversification

2.2. Spillover Effects

- Perturb the external assets of each bank k by the return realization , that is let .

- If any of the banks defaults, propagate the shock to the asset side of its creditors. The new amount of interbank assets satisfies:

- If the total value of bank k’s assets falls below its liabilities, that is , bank k defaults.

- Repeat Steps 2 and 3 until there is no further default.

2.3. The Network-Generation Process

2.3.1. Homogeneous (Erdos–Renyi) Random Graphs

2.3.2. Inhomogeneous (Core–Periphery) Random Graphs

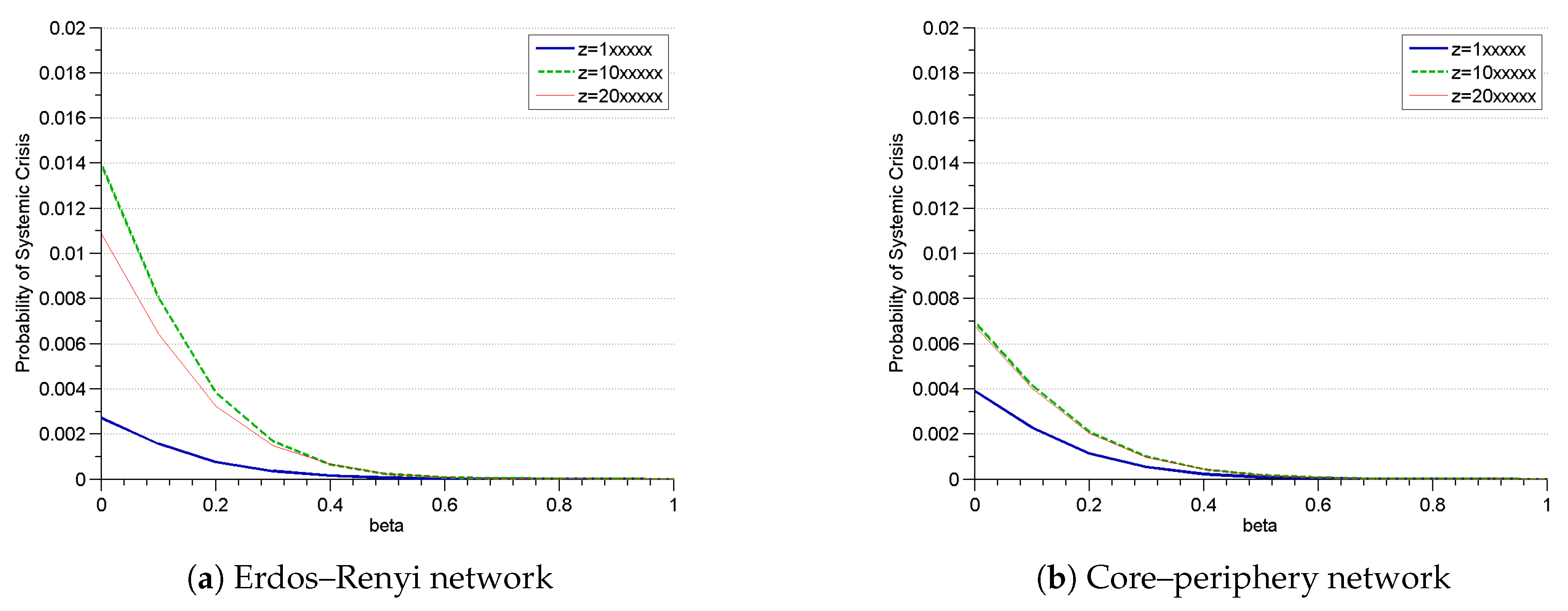

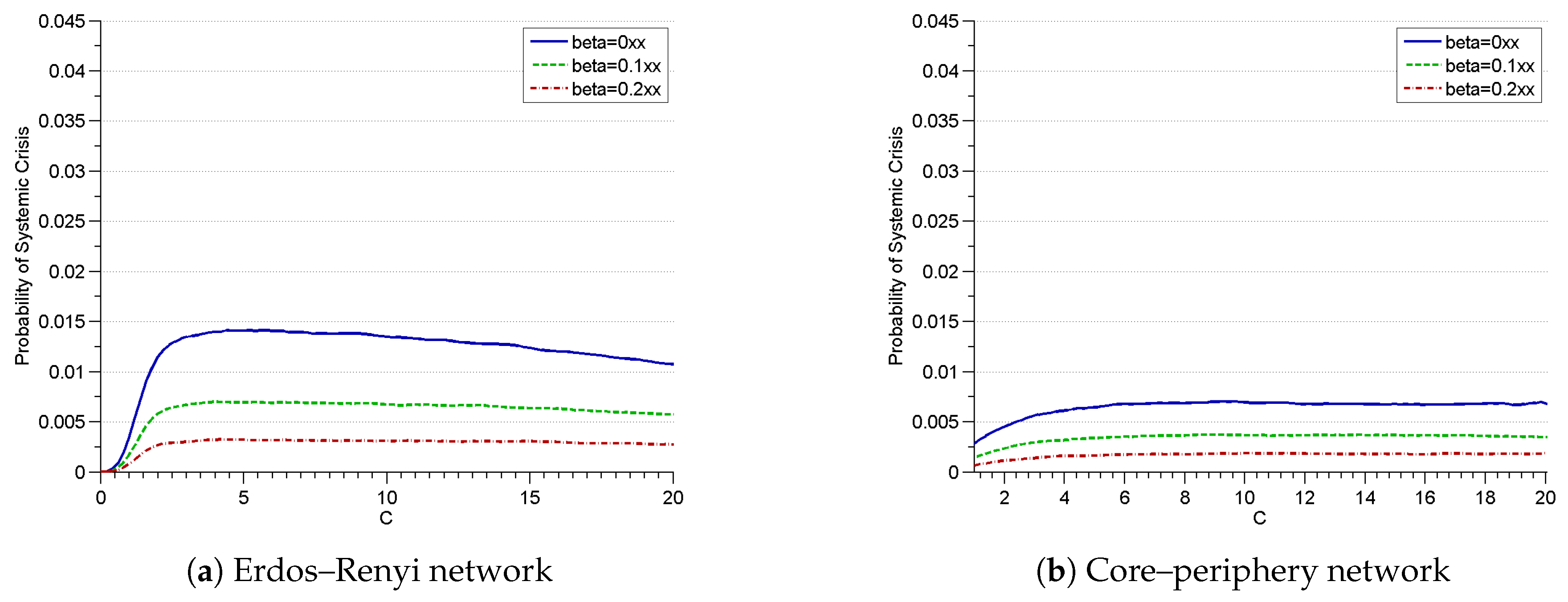

3. Results

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. The Financial Network

References

- Acemoglu, Daron, Asuman Ozdaglar, and Alireza Tahbaz-Salehi. 2015. Systemic risk and stability in financial networks. American Economic Review 105: 564–608. [Google Scholar] [CrossRef]

- Acharya, Viral V., Lasse H. Pedersen, Thomas Philippon, and Matthew Richardson. 2017. Measuring systemic risk. Review of Financial Studies 30: 2–47. [Google Scholar] [CrossRef]

- Acharya, Viral V., and Tanju Yorulmazer. 2007. Too many to fail—An analysis of time-inconsistency in bank closure policies. Journal of Financial Intermediation 16: 1–31. [Google Scholar] [CrossRef]

- Ali, Robleh, Nick Vause, and Filip Zikes. 2016. Systemic Risk in Derivative Markets: A Pilot Study Using CDS Data. London: Bank of England. [Google Scholar]

- Allen, Franklin, and Douglas Gale. 2000. Financial contagion. The Journal of Political Economy 108: 1–33. [Google Scholar] [CrossRef]

- Battiston, Stefano, Domenico Delli Gatti, Mauro Gallegati, Bruce C. N. Greenwald, and Joseph E. Stiglitz. 2012. Credit default cascades: When does risk diversification increase stability? Journal of Financial Stability 8: 138–49. [Google Scholar] [CrossRef]

- Beale, Nicholas, David G. Rand, Heather Battey, Karen Croxson, Robert May, and Martin Nowak. 2011. Individual versus systemic risk and the Regulator’s Dilemma. Proceedings of the National Academy of Sciences of the USA 108: 12647–52. [Google Scholar] [CrossRef] [PubMed]

- Bech, Morten L., and Enghin Atalay. 2010. The topology of the federal funds market. Physica A: Statistical Mechanics and Its Application 389: 5223–46. [Google Scholar] [CrossRef]

- Billio, Monica, Mila Getmansky, Andrew W. Lo, and Loriana Pelizzon. 2015. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics 104: 535–59. [Google Scholar] [CrossRef]

- Bisias, Dimitrios, Mark Flood, Andrew W. Lo, and Stavros Valavanis. 2012. A survey of systemic risk analysis. Annual Review of Financial Economics 4: 255–96. [Google Scholar] [CrossRef]

- Braumolle, Yann, Rachel Kranton, and Martin D’Amours. 2014. Strategic interaction and networks. American Economic Review 104: 898–930. [Google Scholar] [CrossRef]

- Brownlees, Christian, and Robert Engle. 2017. SRISK: A conditional shortfall measure of systemic risk. Review of Financial Studies 30: 48–79. [Google Scholar] [CrossRef]

- Eisenberg, Larry, and Thomas H. Noe. 2001. Systemic risk in financial systems. Management Science 47: 236–49. [Google Scholar] [CrossRef]

- Elliott, Matthew, Benjamin Golub, and Matthew O. Jackson. 2014. Financial networks and contagion. American Economic Review 104: 3115–53. [Google Scholar] [CrossRef]

- Elsinger, Helmut, Alfred Lehar, and Martin Summer. 2006. Using market information for banking system risk assessment. International Journal of Central Banking 2: 137–65. [Google Scholar] [CrossRef] [Green Version]

- Frey, Rüdiger, and Alexander J. McNeil. 2003. Dependent defaults in models of portfolio credit risk. The Journal of Risk 6: 59–92. [Google Scholar] [CrossRef]

- Gai, Prasanna, Andrew Haldane, and Sujit Kapadia. 2011. Complexity, concentration and contagion. Journal of Monetary Economics 58: 453–70. [Google Scholar] [CrossRef]

- Glasserman, Paul, and H. Peyton Young. 2015. How likely is contagion in financial networks? Journal of Banking and Finance 50: 383–99. [Google Scholar] [CrossRef]

- Greenspan, Alan. 2002. Speech before the Council of Foreign Relations. Washington: International Financial Risk Management. [Google Scholar]

- Haldane, Andrew, and Robert M. May. 2011. Systemic Risk in Banking Ecosystems. Nature 469: 351–55. [Google Scholar] [CrossRef] [PubMed]

- Hurd, Tom, Davide Cellai, Huibin Cheng, Sergey Melnik, and Quentin Shao. 2014. Illiquidity and insolvency: A double cascade model of financial crises. arXiv, arXiv:1310.6873. [Google Scholar]

- Hurd, Tom R., and James P. Gleeson. 2011. A framework for analyzing contagion in banking networks. arXiv, arXiv:1110.4312. [Google Scholar]

- Iori, Giulia, Giulia De Masi, Ovidiu Vasile Precup, Giampaolo Gabbi, and Guido Caldarelli. 2008. A network analysis of the italian overnight money market. Journal of Economic Dynamics and Control 32: 259–78. [Google Scholar] [CrossRef]

- Soramäki, Kimmo, Morten L. Bech, Jeffrey Arnold, Robert J. Glass, and Walter E. Beyeler. 2006. The Topology of Interbank Payment Flows. Staff Reports. New York: Federal Research Bank of New York, p. 243. [Google Scholar]

- Upper, Christian, and Andreas Worms. 2004. Estimating bilateral exposures in the german interbank market: Is there a danger of contagion? European Economic Review 48: 827–49. [Google Scholar] [CrossRef]

- Wagner, Wolf. 2010. Diversification at financial institutions and systemic crises. Journal of Financial Intermediation 19: 373–86. [Google Scholar] [CrossRef]

| 1 | For empirical details and real time estimates of the SRISK measure, we refer to the work of the VLAB run by Robert Engle at NYU Stern School of Business, see https://vlab.stern.nyu.edu/. |

| 2 | Throughout the paper, we use the terms graph and network. When talking about a graph, we are concerned with the structure of financial linkages, whereas, when referring to a network, we mean not just connections themselves but also balance sheet quantities of individual banks. |

| 3 | This assumption needs to be refined slightly to avoid certain extreme cases where becomes negative; see Appendix A for details. |

| 4 | Note that we assume that the asset returns of banks are diversified from the outset; potential problems with securitization and credit risk transfer are not the focus of our paper. |

| 5 | Thanks to this assumption, there is no need for a settlement algorithm in the spirit of Eisenberg and Noe (2001). Assuming non-zero recovery rate on distressed loans would however not change the overall quantitative nature of our results. |

| 6 | There are just a few countries where regulators possess reasonably good data on the structure of the interbank market, for example Austria, Mexico, Germany or Brazil. |

| 7 | These parameter values are typical for the Austrian interbank market. |

| 8 | A regulator with access to real data could apply our approach to an actual interbank network. In that situation, one would use some centrality measure to classify a subset of important banks as hubs that form the core of the network. This immediately yields , and the other parameters are then easy to estimate. |

| 9 | In graph theoretic literature, this is known as the average graph degree. |

| 10 | In a special case where a bank has no connections at all, we assume that it puts a portion of its total assets into some riskless investment (such as government bonds) and 1- into risky external assets. We also assume that the size of the balance sheet is 1. We make this technical assumption to prevent banks from having their balance sheet size equal to zero. Note that this assumption has no effect on the analysis itself since a bank with no connections does not affect the rest of system. |

| Assets | Liabilities |

|---|---|

| interbank assets | interbank liabilities |

| external assets | external liabilities |

| equity | |

| total assets | total liabilities |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Frey, R.; Hledik, J. Diversification and Systemic Risk: A Financial Network Perspective. Risks 2018, 6, 54. https://doi.org/10.3390/risks6020054

Frey R, Hledik J. Diversification and Systemic Risk: A Financial Network Perspective. Risks. 2018; 6(2):54. https://doi.org/10.3390/risks6020054

Chicago/Turabian StyleFrey, Rüdiger, and Juraj Hledik. 2018. "Diversification and Systemic Risk: A Financial Network Perspective" Risks 6, no. 2: 54. https://doi.org/10.3390/risks6020054