The Exponential Estimate of the Ultimate Ruin Probability for the Non-Homogeneous Renewal Risk Model

Abstract

:1. Introduction

2. Results

3. Proofs

4. Numerical Examples

| 0 | 1 | k | |

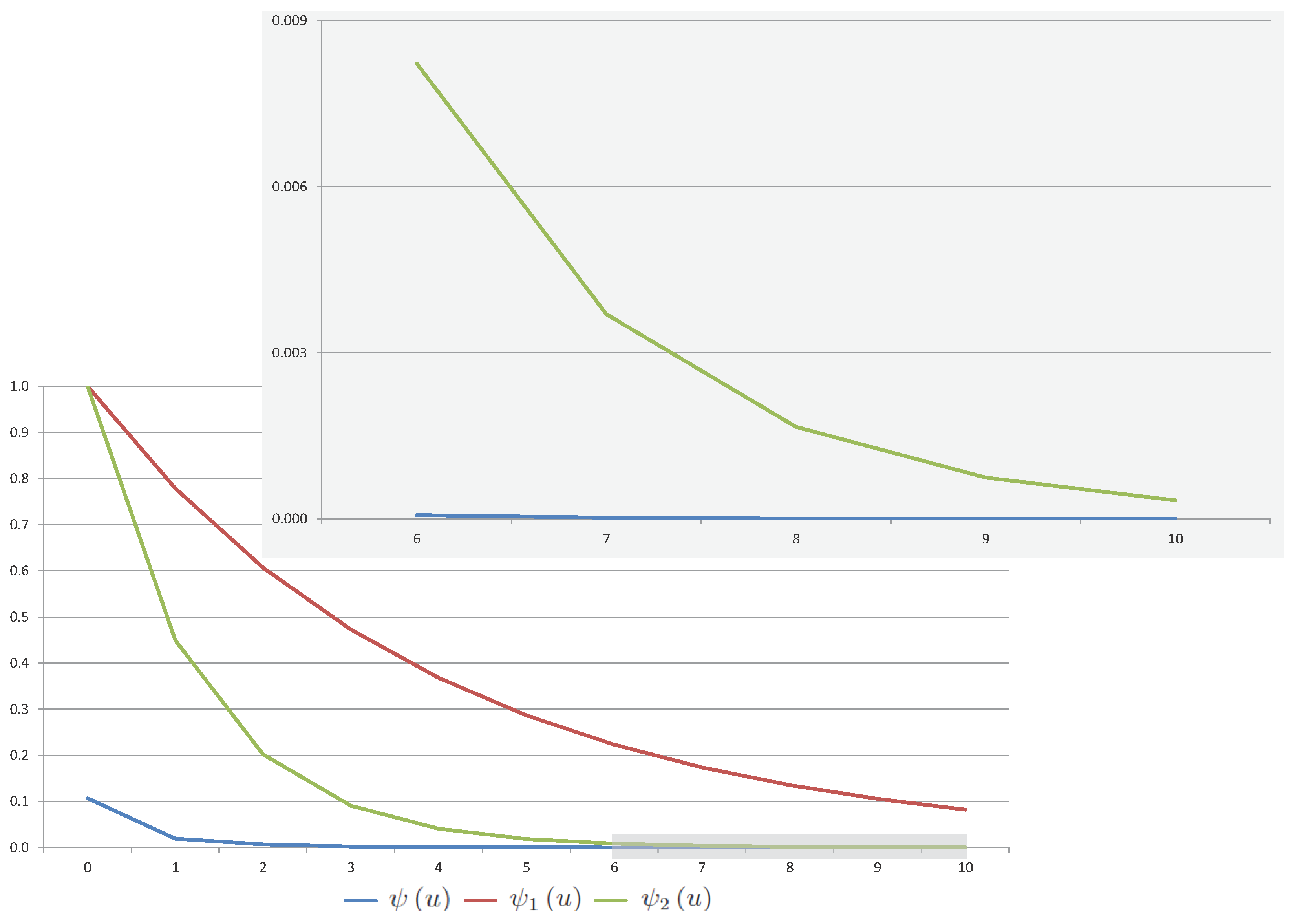

- First of all, we find rough estimate of ruin probability according to Theorem 3. After some calculations, we get thatAccording to the above estimates, we obtain that conditions of Theorem 3 hold with parameters and . Substituting the obtained constants into expression (2), we get that the last parameter . Choosing , we get from the assertion of Theorem 3 thatfor all non-negative values of the initial surplus u.The derived estimate is exponential but quite conservative. For instance, it follows from the obtained inequality that , if .

- Now, we find more precise upper bound of ruin probability on the basis of the Theorem 4. All theorem’s conditions hold due to the derived above estimates andFor positive h, we have thatConsequently, for all , and Theorem 4 implies thatfor all values of the initial surplus .The derived estimate is almost four times accurate with respect to the previous one. For instance, it follows from the obtained inequality that , if .

- Finally, we use the Monte Carlo simulations to get approximate values of ruin probability . For this we use the fact that for fixed u and for sufficiently large N. We consider the case when and . For each u, we simulate trajectories of the renewal risk process with N random claims and we calculate how many times on average they fall below zero in order to get values of . According to the obtained values of ruin probability, we get that , even if the initial surplus is especially small, i.e., .

- After the above calculations, for , we can compare approximate values of ruin probability with their conservative estimate and with their sharp estimate . All results are presented in Table 1 and Figure 1. In fact, the conservative exponential upper bound is quite rough, but it is very easy to obtain an expression of this function using Theorem 3. The values of the sharp exponential upper bound are much closer to the simulated values of the ruin probability, however due to Theorem 4, more deeper analysis of the model elements is needed to obtain this bound. Values of , which are obtained by the Monte Carlo method, are sufficiently accurate, but such a procedure takes a lot of time and resources, because we need to generate a lot of process trajectories in order to get these values.

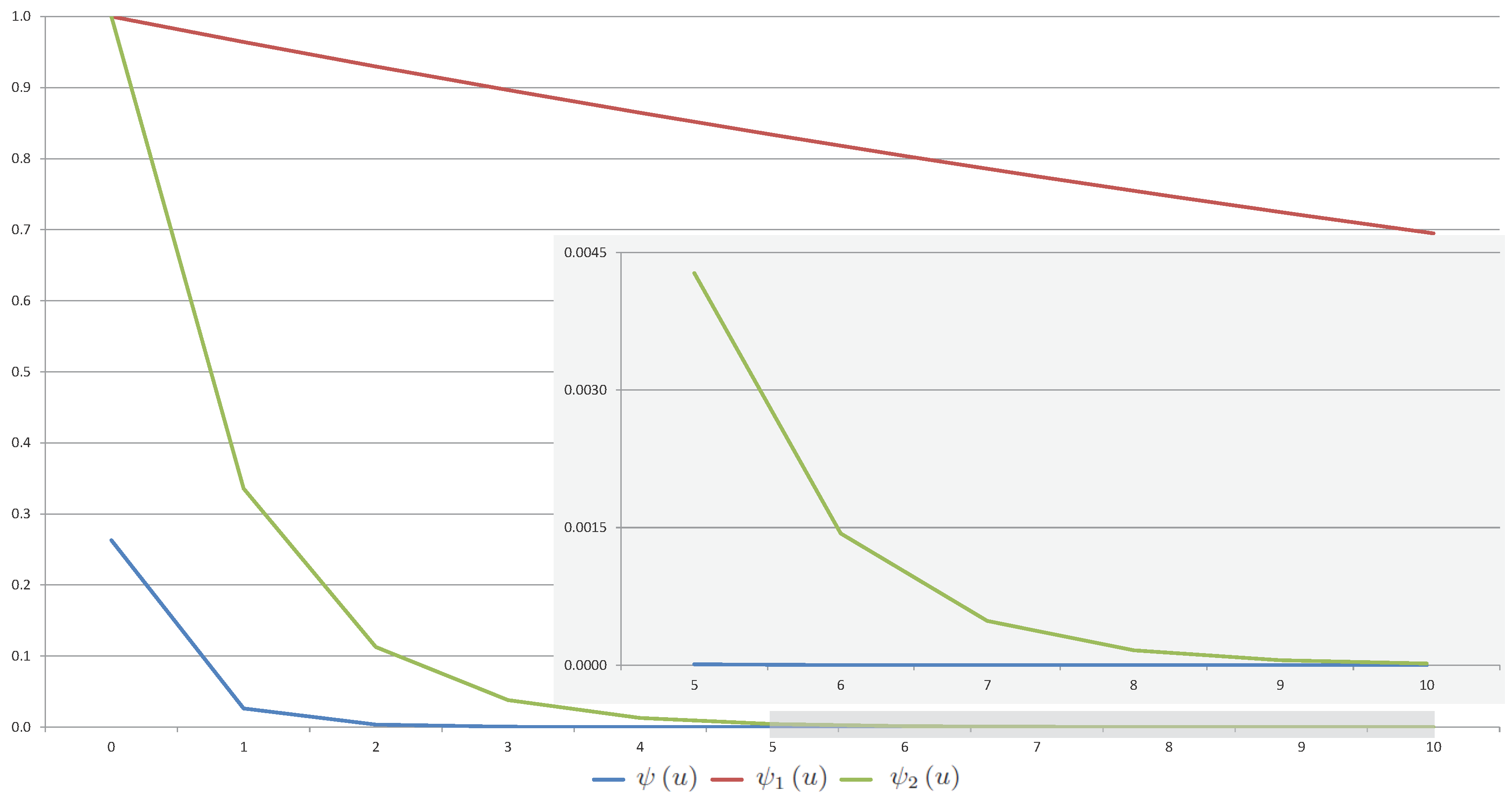

- Firstly, we start with the rough estimate of ruin probability, which can be derived using Theorem 3. In the case, we get thatIn addition, we have thatSince random values and are absolutely continuous, so that random value has density, which for all has the following expressionHence, we get thatAccording to the derived estimates, conditions of Theorem 3 hold with such parameters and . Substituting the obtained constants into expression (2), we get that the parameter should be selected from the interval . If , then Theorem 3 implies thatfor all .The derived estimate is extremely conservative. For instance, it follows from the obtained inequality that , if .

- We can use Theorem 4 to obtain the more sharper upper bound for the ruin probability. Conditions of this theorem are satisfied due to the above estimates andIn addition, we have thatfor all .Accordingly, Theorem 4 together with the remark presented after this theorem imply thatfor all .The derived estimate is exponential and almost 30 times more accurate than the previous one. For instance, it follows from the obtained inequality that , if .

- After all these calculations, we again apply the Monte Carlo method in order to get approximate values of ruin probability as in the previous example. We also analyze the same way, while and , and we simulate trajectories of the renewal risk process with N random claims and with N random inter-arrival times for each u. Although this example is sufficiently erratic, on the basis of the received values of ruin probability , we get that , even if the initial surplus is relatively small, i.e., .

- Ultimately, we can make a comparison of approximate values of ruin probability to their conservative exponential upper bound and to their sharp exponential upper bound for . All results are presented in Table 2 and Figure 2. Actually, the conservative estimate is too rough. The values of sharp estimate are more accurate than . It should be noted that the Monte Carlo method takes even more time in this example than in Example 1, because we need to generate values of two random variables and , which are non-identically distributed for each .

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Albrecher, Hansjörg, and Jef L. Teugels. 2006. Exponential behavior in the presence of dependence in risk theory. Journal of Applied Probability 43: 257–73. [Google Scholar] [CrossRef]

- Andersen, E. Sparre. 1957. On the collective theory of risk in case of contagion between claims. Transactions of the XVth International Congress of Actuaries 2: 219–29. [Google Scholar]

- Andrulytė, Ieva Marija, Emilija Bernackaitė, Dominyka Kievinaitė, and Jonas Šiaulys. 2015. A Lundberg-type inequality for an inhomogeneous renewal risk model. Modern Stochastics: Theory and Applications 2: 173–84. [Google Scholar] [CrossRef]

- Asmussen, Søren, and Hansjörg Albrecher. 2010. Ruin Probabilities. Hackensack: World Scientific. [Google Scholar]

- Bernackaitė, Emilija, and Jonas Šiaulys. 2015. The exponential moment tail of inhomogeneous renewal process. Statistics & Probability Letters 97: 9–15. [Google Scholar]

- Bernackaitė, Emilija, and Jonas Šiaulys. 2017. The finite-time ruin probability for an inhomogeneous renewal risk model. Journal of Industrial and Management Optimization 13: 207–22. [Google Scholar]

- Burnecki, Krzysztof, and Mario Nicoló Giuricich. 2017. Stable weak approximation at work in index-linked catastrophe bond pricing. Risks 5: 64. [Google Scholar] [CrossRef]

- Castañer, Anna, M. Mercè Claramunt, Maude Gathy, Claude Lefèvre, and Maite Mármol. 2013. Ruin problems for a discrete time risk model with non-homogeneous conditions. Scandinavian Actuarial Journal 2013: 83–102. [Google Scholar] [CrossRef]

- Chen, Yiqing, and Kai W. Ng. 2007. The ruin probability of the renewal model with constant interest force and negatively dependent heavy-tailed claims. Insurance: Mathematics and Economics 40: 415–23. [Google Scholar] [CrossRef]

- Constantinescu, Corina, Suhang Dai, Weihong Ni, and Zbigniew Palmowski. 2016. Ruin probabilities with dependence on the number of claims within a fixed time window. Risks 4: 17. [Google Scholar] [CrossRef]

- Cramér, Harald. 1930. On the Mathematical Theory of Risk. Stockholm: Skandia Jubilee Volume. [Google Scholar]

- Cramér, Harald. 1969. Historical review of Filip Lundberg’s works on risk theory. Scandinavian Actuarial Journal 1969: 6–12. [Google Scholar] [CrossRef]

- De Vylder, F. Etienne, and Marc J. Goovaerts. 1988. Recursive calculation of finite-time ruin probabilities. Insurance: Mathematics and Economics 7: 1–7. [Google Scholar] [CrossRef]

- Dickson, David C. M. 2005. Insurance Risk and Ruin. Cambridge: Cambridge University Press. [Google Scholar]

- Embrechts, Paul, Claudia Klüppelberg, and Thomas Mikosch. 1997. Modelling Extremal Events. New York: Springer. [Google Scholar]

- Embrechts, Paul, and Noël Veraverbeke. 1982. Estimates for probability of ruin with special emphasis on the possibility of large claims. Insurance: Mathematics and Economics 1: 55–72. [Google Scholar] [CrossRef]

- Fu, Ke-Ang, and Cheuk Yin Andrew Ng. 2017. Uniform asymptotics for the ruin probabilities of a two-dimensional renewal risk model with dependent claims and risky investments. Statistics & Probability Letters 125: 227–35. [Google Scholar]

- Gerber, Hans U. 1973. Martingales in risk theory. Bulletin Association of Swiss Actuaries 73: 205–16. [Google Scholar]

- Grandell, Jan, and Hanspeter Schmidli. 2011. Ruin probabilities in a diffusion enviroment. Journal of Applied Probability 48A: 39–50. [Google Scholar] [CrossRef]

- Guo, Fenglong, Dingcheng Wang, and Hailiang Yang. 2017. Asymptotic results for ruin probability in a two-dimensional risk model with stochastic investment returns. Journal of Computational and Applied Mathematics 325: 198–221. [Google Scholar] [CrossRef]

- Huang, Xing-Fang, Ting Zhang, Yang Yang, and Tao Jiang. 2017. Ruin probabilities in a dependent discrete-time risk model with gamma-like tailed insurance risks. Risks 5: 14. [Google Scholar] [CrossRef]

- Kievinaitė, Dominyka, and Jonas Šiaulys. 2018. Exponential bounds for the tail probability of the supremum of an inhomogeneous random walk. Modern Stochastics: Theory and Applications. accepted. [Google Scholar]

- Lefèvre, Claude, and Stéphane Loisel. 2008. On finite-time ruin probabilities for classical risk models. Scandinavian Actuarial Journal 2008: 41–60. [Google Scholar] [CrossRef]

- Leipus, Remigijus, and Jonas Šiaulys. 2011. Finite-horizon ruin probability asymptotics in the compound discrete-time risk model. Lithuanian Mathematical Journal 51: 207–19. [Google Scholar] [CrossRef]

- Li, Jinzhu, Qihe Tang, and Rong Wu. 2010. Subexponential tails of discounted aggregate claims in a time-dependent renewal risk model. Advances in Applied Probability 42: 1126–46. [Google Scholar] [CrossRef]

- Li, Zhong, and Kristina P. Sendova. 2015. On a ruin model with both interclaim times and premiums depending on claim sizes. Scandinavian Actuarial Journal 2015: 245–65. [Google Scholar] [CrossRef]

- Liu, Peng, Chunsheng Zhang, and Lanpeng Ji. 2017a. A note on ruin problems in perturbed classical risk models. Statistics & Probability Letters 120: 28–33. [Google Scholar]

- Liu, Rongfei, Dingcheng Wang, and Jiangyan Peng. 2017b. Infinite-time ruin probability of a renewal risk model with exponential Levy process investment and dependent claims and inter-arriwal times. Journal of Industrial and Management Optimization 13: 995–1007. [Google Scholar]

- Liu, Xijun, and Qingwu Gao. 2016. Uniformly asymptotic behavior for the tail probability of discounted aggregate claims in the time-dependent risk model with upper tail assymptotically independent claims. Communications in Statistics—Theory and Methods 45: 5341–54. [Google Scholar] [CrossRef]

- Lundberg, Filip. 1903. Approximerad Framställning av Sannolikehetsfunktionen. Uppsala: Återförsäkring av Kollektivrisker. [Google Scholar]

- Lundberg, Filip. 1932. Some supplementary researches on the collective risk theory. Scandinavian Actuarial Journal 1932: 137–158. [Google Scholar] [CrossRef]

- Mao, Yanzhu, Kaiyong Wang, and Ling Zhu Yue Ren. 2017. Asymptotics for the finite-time ruin probability of a risk model with a general counting process. Japan Journal of Industrial and Applied Mathematics 34: 243–52. [Google Scholar] [CrossRef]

- Menshikov, Mikhail, Serguei Popov, and Andrew Wade. 2016. Non-homogeneous Random Walks. Cambridge: Cambridge University Press. [Google Scholar]

- Mikosch, Thomas. 2009. Non-life Insurance Mathematics. New York: Springer. [Google Scholar]

- Picard, Philippe, and Claude Lefèvre. 1997. The probability of ruin in finite time with discrete claim size distribution. Scandinavian Actuarial Journal 1997: 58–69. [Google Scholar] [CrossRef]

- Rolski, Tomasz, Hanspeter Schmidli, Volker Schmidt, and Jozef Teugels. 1999. Stochastic Processes for Insurance and Finance. Hoboken: John Wiley & Sons Ltd. [Google Scholar]

- Răducan, Anisoara Maria, Raluca Vernic, and Gheorghita Zbaganu. 2015. Recursive calculation of ruin probabilities at or before claim instants for non-iddentically distributed claims. ASTIN Bulletin 45: 421–443. [Google Scholar] [CrossRef]

- Seal, Hilary L. 1969. Stochastic Theory of a Risk Business. New York: Wiley. [Google Scholar]

- Sgibnev, Mikhail. 1997. Submultiplicative moments of the supremum of a random walk with negative drift. Statistics & Probability Letters 32: 377–383. [Google Scholar]

- Shen, Xinmei, Menghao Xu, and Ebenezer Fiifi Emire Atta Mills. 2016. Precise large deviation results for sums of sub-exponential claims in a size-dependent renewal risk model. Statistics & Probability Letters 114: 6–13. [Google Scholar]

- Tang, Qihe. 2004a. Asymptotics for the finite time ruin probability in the renewal model with consistent variation. Stochastic Models 20: 281–97. [Google Scholar] [CrossRef]

- Tang, Qihe. 2004b. The ruin probability of a discrete time risk model under constant interest rate with heavy tails. Scandinavian Actuarial Journal 2004: 229–40. [Google Scholar] [CrossRef]

- Thorin, Olof. 1974. Some comments on the Sparre Andersen model in the risk theory. ASTIN Bulletin 81: 104–25. [Google Scholar] [CrossRef]

- Wang, Kaiyong, Yuebao Wang, and Qingwu Gao. 2013. Uniform asymptotics for the finite-time ruin probability of a dependent risk model with a constant interest rate. Methodology and Computing in Applied Probability 15: 109–24. [Google Scholar] [CrossRef]

- Yang, Yang, and Dimitrios G. Konstantinides. 2015. Asymptotics fot ruin probabilities in a discrete-time risk model with dependent financial and insurance risks. Scandinavian Actuarial Journal 2015: 641–59. [Google Scholar] [CrossRef]

- Yang, Yang, Kaiyong Wang, and Dimitrios G. Konstantinides. 2014. Uniform asymptotics for discounted aggregate claims in dependent risk models. Journal of Applied Probability 51: 669–84. [Google Scholar] [CrossRef]

- Yang, Yang, and Kam C. Yuen. 2016. Finite-time and infinite-time ruin probabilities in a two-dimensional delayed renewal risk model with Sarmanov dependent claims. Journal of Mathematical Analysis and Applications 442: 600–26. [Google Scholar] [CrossRef]

| u | |||

|---|---|---|---|

| 0 | 0.1069843 | 1.0000000 | 1.0000000 |

| 1 | 0.0192021 | 0.7866279 | 0.3906278 |

| 2 | 0.0068947 | 0.6187834 | 0.1525901 |

| 3 | 0.0019112 | 0.4867523 | 0.0596059 |

| 4 | 0.0006655 | 0.3828929 | 0.0232837 |

| 5 | 0.0002378 | 0.3011942 | 0.0090953 |

| 6 | 0.0000675 | 0.2369278 | 0.0035529 |

| 7 | 0.0000217 | 0.1863740 | 0.0013878 |

| 8 | 0.0000060 | 0.1466070 | 0.0005421 |

| 9 | 0.0000014 | 0.1153251 | 0.0002118 |

| 10 | 0.0000006 | 0.0907180 | 0.0000827 |

| u | |||

|---|---|---|---|

| 0 | 0.2628618 | 1.0000000 | 1.0000000 |

| 1 | 0.0262527 | 0.9642545 | 0.3359110 |

| 2 | 0.0035110 | 0.9297868 | 0.1128362 |

| 3 | 0.0005077 | 0.8965511 | 0.0379029 |

| 4 | 0.0000739 | 0.8645034 | 0.0127320 |

| 5 | 0.0000102 | 0.8336013 | 0.0042768 |

| 6 | 0.0000015 | 0.8038039 | 0.0014366 |

| 7 | 0.0000001 | 0.7750715 | 0.0004826 |

| 8 | 0.0000000 | 0.7473662 | 0.0001621 |

| 9 | 0.0000000 | 0.7206512 | 0.0000545 |

| 10 | 0.0000000 | 0.6948912 | 0.0000183 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kizinevič, E.; Šiaulys, J. The Exponential Estimate of the Ultimate Ruin Probability for the Non-Homogeneous Renewal Risk Model. Risks 2018, 6, 20. https://doi.org/10.3390/risks6010020

Kizinevič E, Šiaulys J. The Exponential Estimate of the Ultimate Ruin Probability for the Non-Homogeneous Renewal Risk Model. Risks. 2018; 6(1):20. https://doi.org/10.3390/risks6010020

Chicago/Turabian StyleKizinevič, Edita, and Jonas Šiaulys. 2018. "The Exponential Estimate of the Ultimate Ruin Probability for the Non-Homogeneous Renewal Risk Model" Risks 6, no. 1: 20. https://doi.org/10.3390/risks6010020