Optimal Form of Retention for Securitized Loans under Moral Hazard

Abstract

:1. Introduction

2. Design of Optimal Securitization under Moral Hazard

3. Derivation of the Model

3.1. Investors’ Objective Function

3.2. Participation Constraint

3.3. Incentive Compatibility Constraint

3.4. Technology Constraint

4. Optimal Securitization Contract Model

4.1. No Moral Hazard: μ = 0

4.2. Moral Hazard: μ > 0

5. Analyzing the Result

5.1. Optimal Retention Rate

5.2. Using the Monotone Likelihood Ratio Property (MLRP)

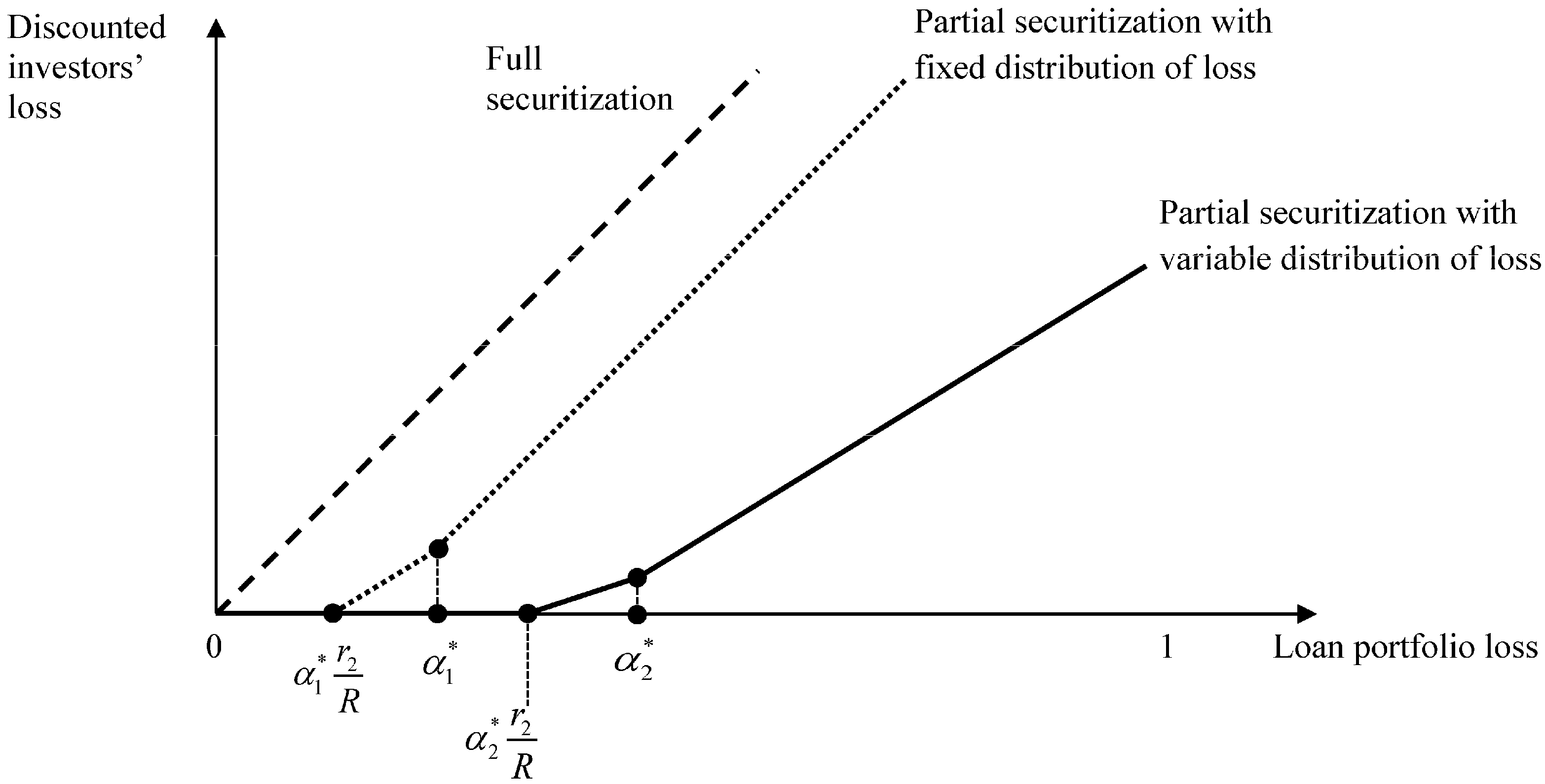

5.3. Representation of the Main Result

6. Conclusions

Author Contributions

Conflicts of Interest

Appendix A. Technology Constraint

Appendix B. Specific Distribution and Constant Risk Aversion Case

Appendix C. Derivative of with Respect to L

References

- Albertazzi, Ugo, Ginette Eramo, Leonardo Gambacorta, and Carmelo Salleo. 2011. Securitization is not that Evil after All. BIS Working papers No. 341. Basel: BIS. [Google Scholar]

- Batty, David Line. 2011. Dodd-Frank’s requirement of skin in the game for asset-backed securities may scalp corporate loan liquidity. North Carolina Banking Institute 15: 13. [Google Scholar]

- Berndt, Antje, and Anurag Gupta. 2009. Moral hazard and adverse selection in the originate-to-distribute model of bank credit. Journal of Monetary Economics 56: 725–43. [Google Scholar] [CrossRef]

- Bolton, Patrick, and Mathias Dewatripont. 2005. Contract Theory. Cambridge: MIT Press, p. 724. [Google Scholar]

- Caillaud, Bernard, Georges Dionne, and Bruno Jullien. 2000. Corporate insurance with optimal financial contracting. Economic Theory 16: 77–105. [Google Scholar] [CrossRef]

- Casu, Barbara, Andrew Clare, Anna Sarkisyan, and Stephen Thomas. 2011. Does securitization reduce credit risk taking? Empirical evidence from US bank holding companies. European Journal of Finance 17: 769–88. [Google Scholar] [CrossRef]

- DeMarzo, Peter, and Darrell Duffie. 1999. A liquidity-based model of security design. Econometrica 67: 65–99. [Google Scholar] [CrossRef]

- Dionne, Georges. 2009. Structured finance, risk management, and the recent financial crisis. Ivey Business Journal. Available online: https://iveybusinessjournal.com/publication/structured-finance-risk-management-and-the-recent-financial-crisis/ (accessed on 19 October 2017). [CrossRef]

- Dionne, Georges, and Tarek M. Harchaoui. 2008. Banks’ capital, securitization and credit risk: An empirical evidence for Canada. Insurance and Risk Management 75: 459–85. [Google Scholar] [CrossRef]

- Dugan, John C. 2010. On the FDIC’s Securitization Proposal. Available online: https://www.occ.treas.gov/news-issuances/congressional-testimony/2010/pub-test-2010-54-oral.pdf (accessed on 19 October 2017).

- Fender, Ingo, and Janet Mitchell. 2009a. The future of securitisation: How to align incentives? BIS Quarterly Review 3: 25–50. [Google Scholar]

- Fender, Ingo, and Janet Mitchell. 2009b. Incentives and Tranche Retention in Securitisation: A Screening Model. National Bank of Belgium Working paper. Brussels: National Bank of Belgium, p. 177. [Google Scholar]

- Froot, Kenneth A., David Scharfstein, and Jeremy C. Stein. 1993. Risk Management: Coordinating Corporate Investment and Financing Policies. Journal of Finance 48: 1629–58. [Google Scholar] [CrossRef]

- Hartman-Glaser, Barney, Tomasz Piskorski, and Alexei Tchistyi. 2012. Optimal securitization with moral hazard. Journal of Financial Economics 104: 186–202. [Google Scholar] [CrossRef]

- Innes, Robert D. 1990. Limited Liability and Incentive Contracting with Ex-ante Action Choices. Journal of Economic Theory 52: 45–67. [Google Scholar] [CrossRef]

- Jeon, Haejun, and Michi Nishihara. 2012. Securitization under asymmetric information and risk retention requirement. SSRN Electronic Journal 9: 153–74. [Google Scholar] [CrossRef]

- Kiff, John, and Michael Kisser. 2010. Asset Securitization and Optimal Retention. Washington: International Monetary Fund. [Google Scholar]

- Levitin, Adam J. 2013. Skin-in-the-game: Risk retention lessons from credit card securitization. Social Science Electronic Publication 81: 813–55. [Google Scholar] [CrossRef]

- LiCalzi, Marco, and Sandrine Spaeter. 2013. Distributions for the first-order approach to principal-agent problems. Economic Theory 21: 167–73. [Google Scholar] [CrossRef] [Green Version]

- Malekan, Sara, and Georges Dionne. 2014. Securitization and optimal retention under moral hazard. Journal of Mathematical Economics 55: 74–85. [Google Scholar] [CrossRef]

- Milgrom, Paul R. 1981. Good News and Bad News: Representation Theorems and Applications. Bell Journal of Economics 12: 380–91. [Google Scholar] [CrossRef]

- Rogerson, William P. 1985. The first-order approach to principal-agent problems. Econometrica 53: 1357–68. [Google Scholar] [CrossRef]

- Selody, Jack, and Elizabeth Woodman. 2009. Reform of securitization. Bank of Canada Financial System Review, 47–52. [Google Scholar]

- Sidley, Austin. 2014. Agencies adopt final Dodd-Frank risk retention rules for asset-backed securities. November 25. Available online: http://www.sidley.com/news/11-25-2014-sidley-update (accessed on 19 October 2017).

- Stein, Jeremy C. 2011. Monetary Policy as Financial-Stability Regulation; Cambridge: National Bureau of Economic Research.

- Winter, Ralph A. 2013. Optimal insurance contracts under moral hazard. In Handbook of Insurance, 2nd ed. Edited by Georgrs Dionne. Berlin and Heidelberg: Springer, pp. 205–30. [Google Scholar]

- Wu, Ho-Mou, and Guixia Guo. 2010. Retention Ratio Regulation of Bank Asset Securitization. Working paper. Beijing: National School of Development, Peking University. [Google Scholar]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dionne, G.; Malekan, S. Optimal Form of Retention for Securitized Loans under Moral Hazard. Risks 2017, 5, 55. https://doi.org/10.3390/risks5040055

Dionne G, Malekan S. Optimal Form of Retention for Securitized Loans under Moral Hazard. Risks. 2017; 5(4):55. https://doi.org/10.3390/risks5040055

Chicago/Turabian StyleDionne, Georges, and Sara Malekan. 2017. "Optimal Form of Retention for Securitized Loans under Moral Hazard" Risks 5, no. 4: 55. https://doi.org/10.3390/risks5040055