Stochastic Optimal Control for Online Seller under Reputational Mechanisms

Abstract

:1. Introduction

2. Explicit Resource Allocation Mechanism

2.1. Mathematical Formulation

2.2. Hamilton-Jacobi-Bellman Formulation

- (i) the drift and volatility are (uniformly) Lipschitz in R and μ,

- (ii) ρ > 0, and

- (iii) we impose an additional boundary condition on the solution as R → ∞ as our indefinite horizon is now .

3. Market Share Based Pricing Mechanism

3.1. Rescaled HJB Model

3.2. Reduced Model

4. Numerical Results

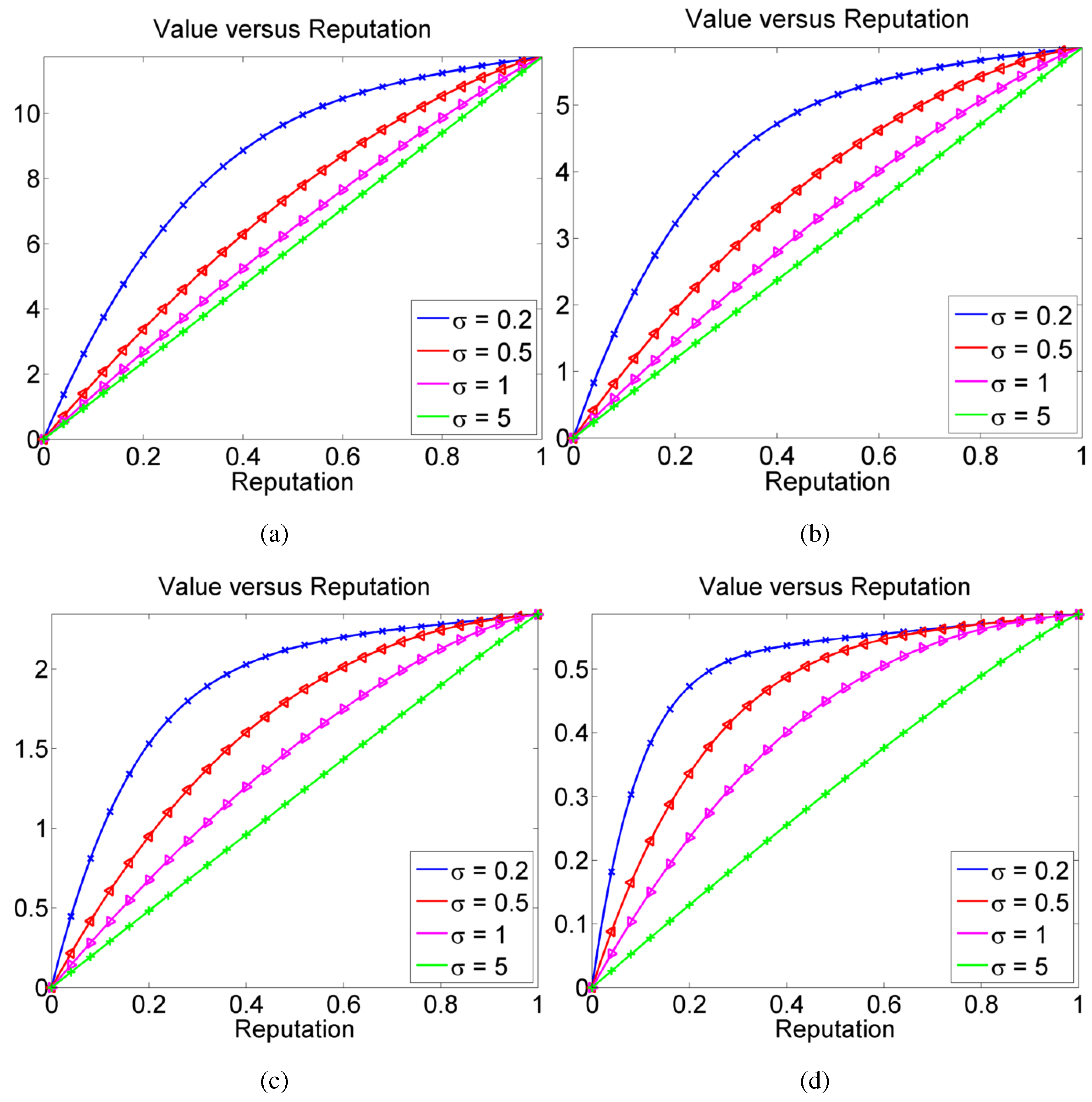

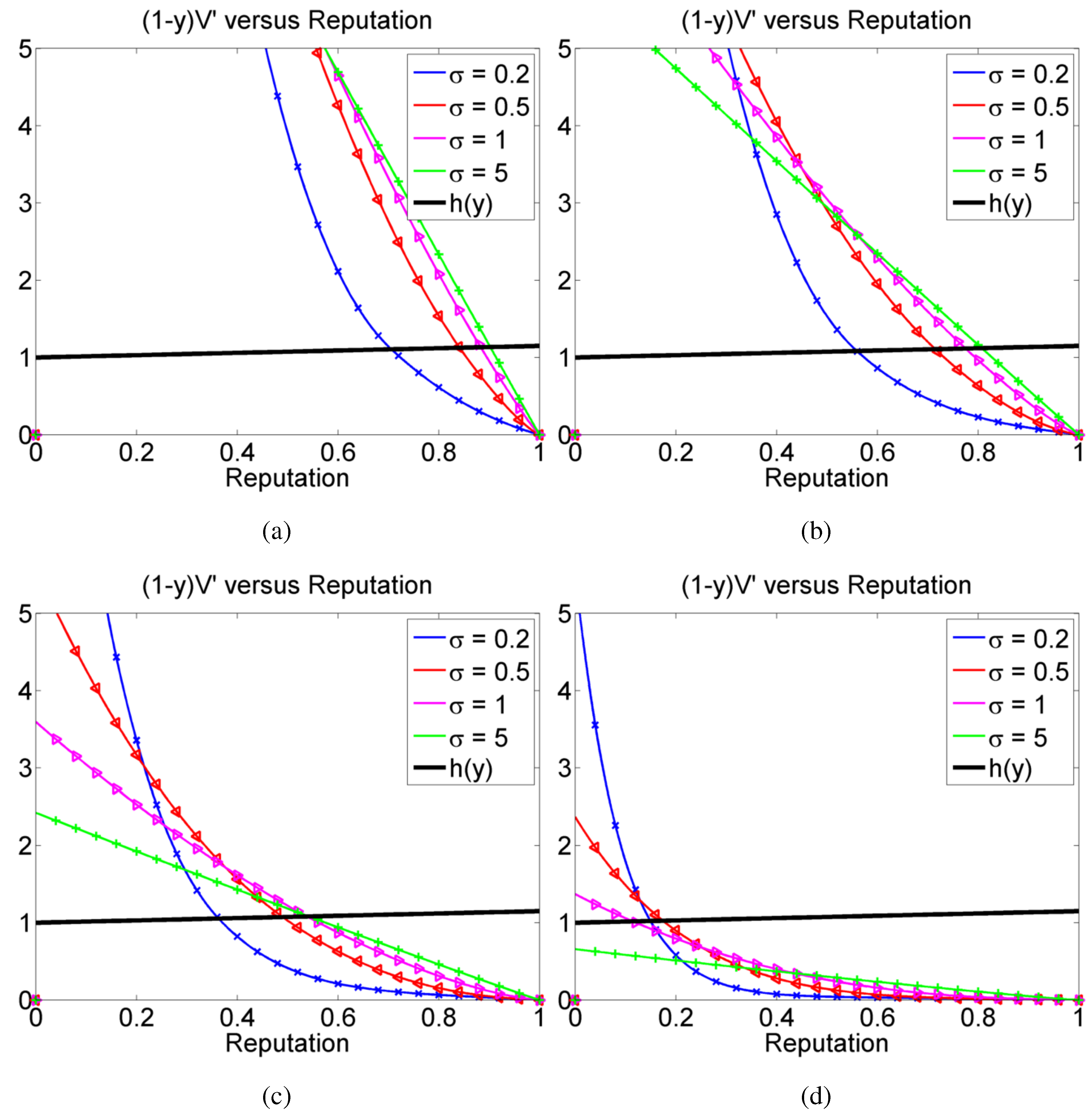

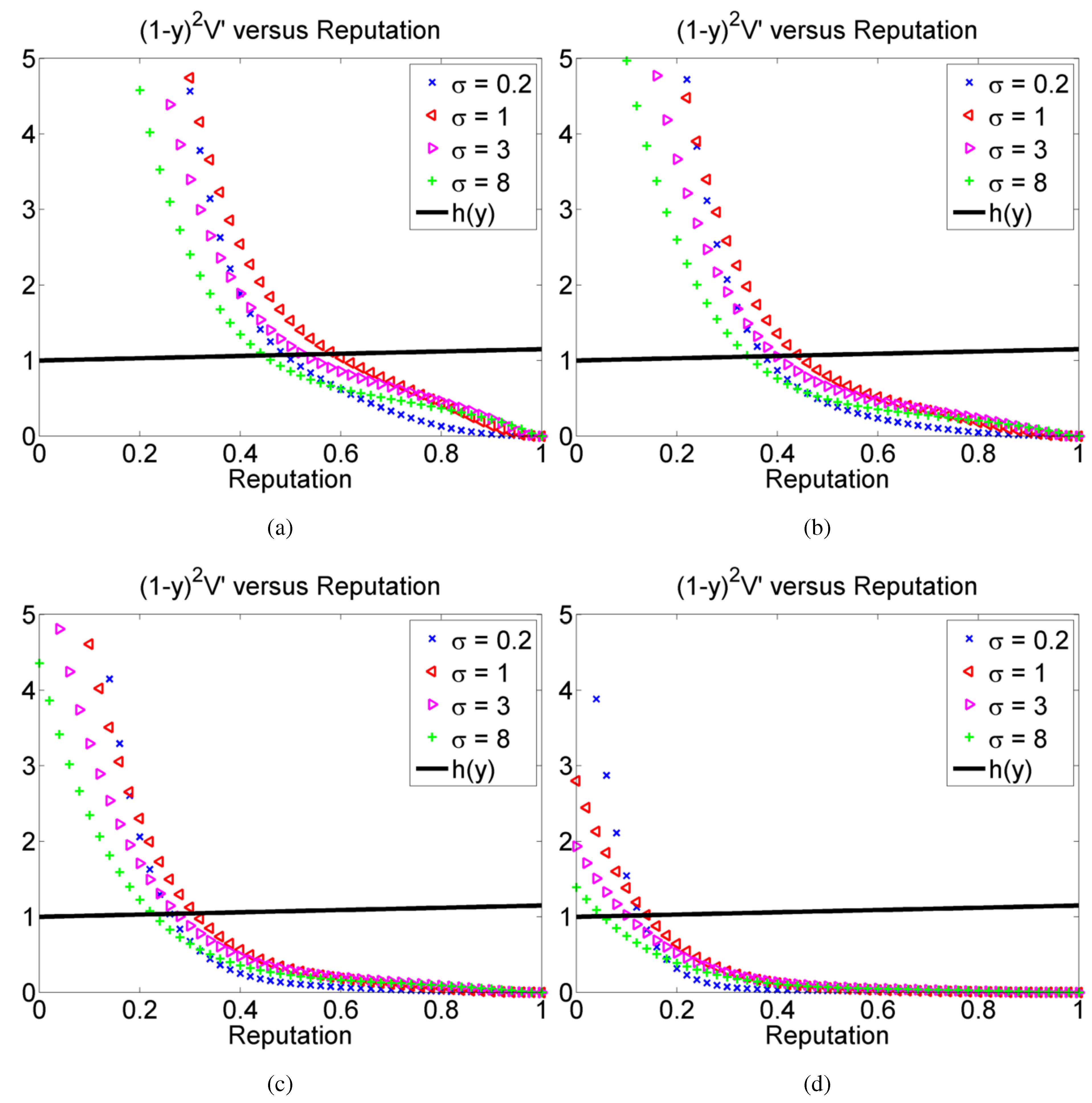

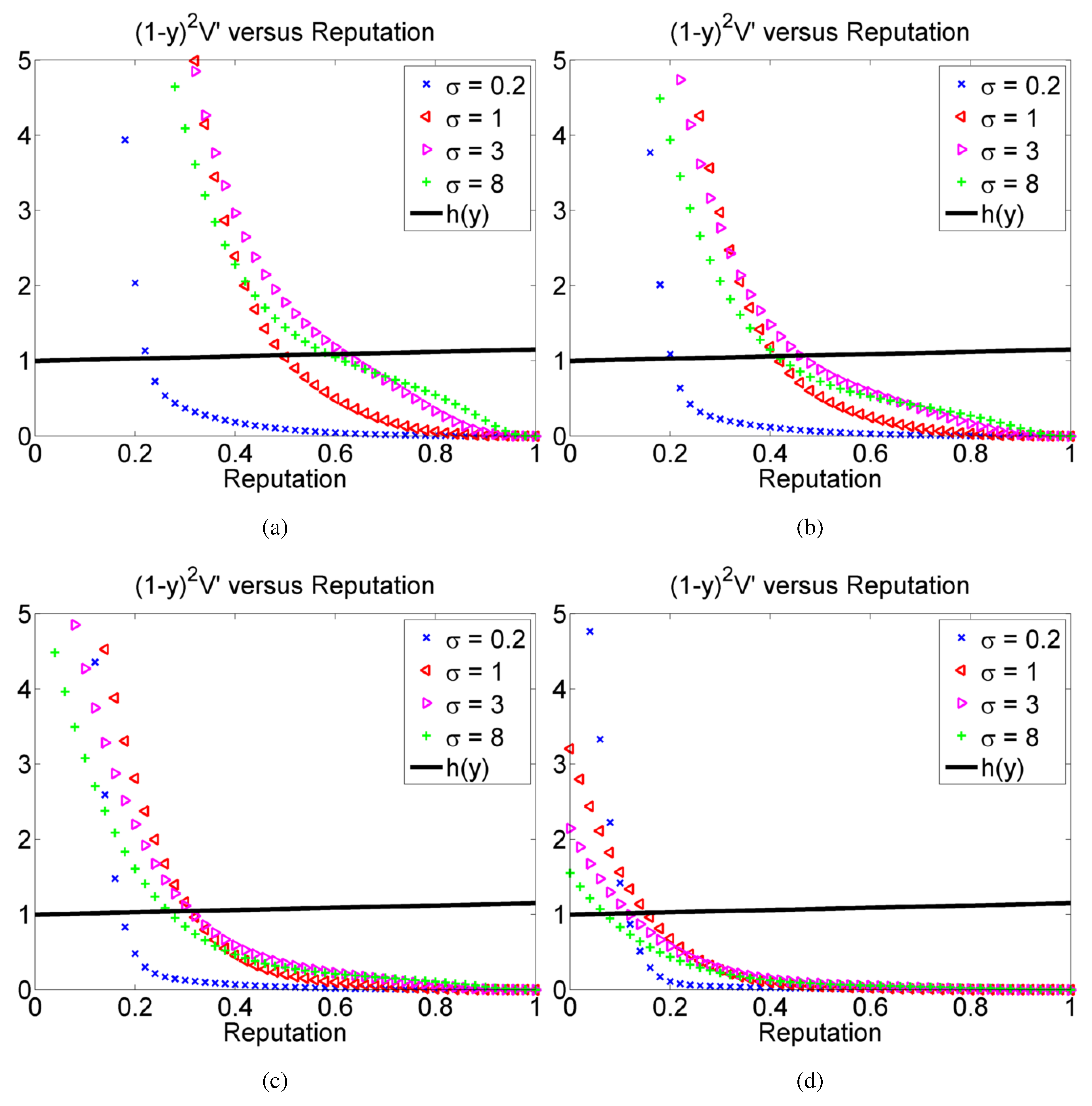

4.1. Numerical Results for the Reduced Model

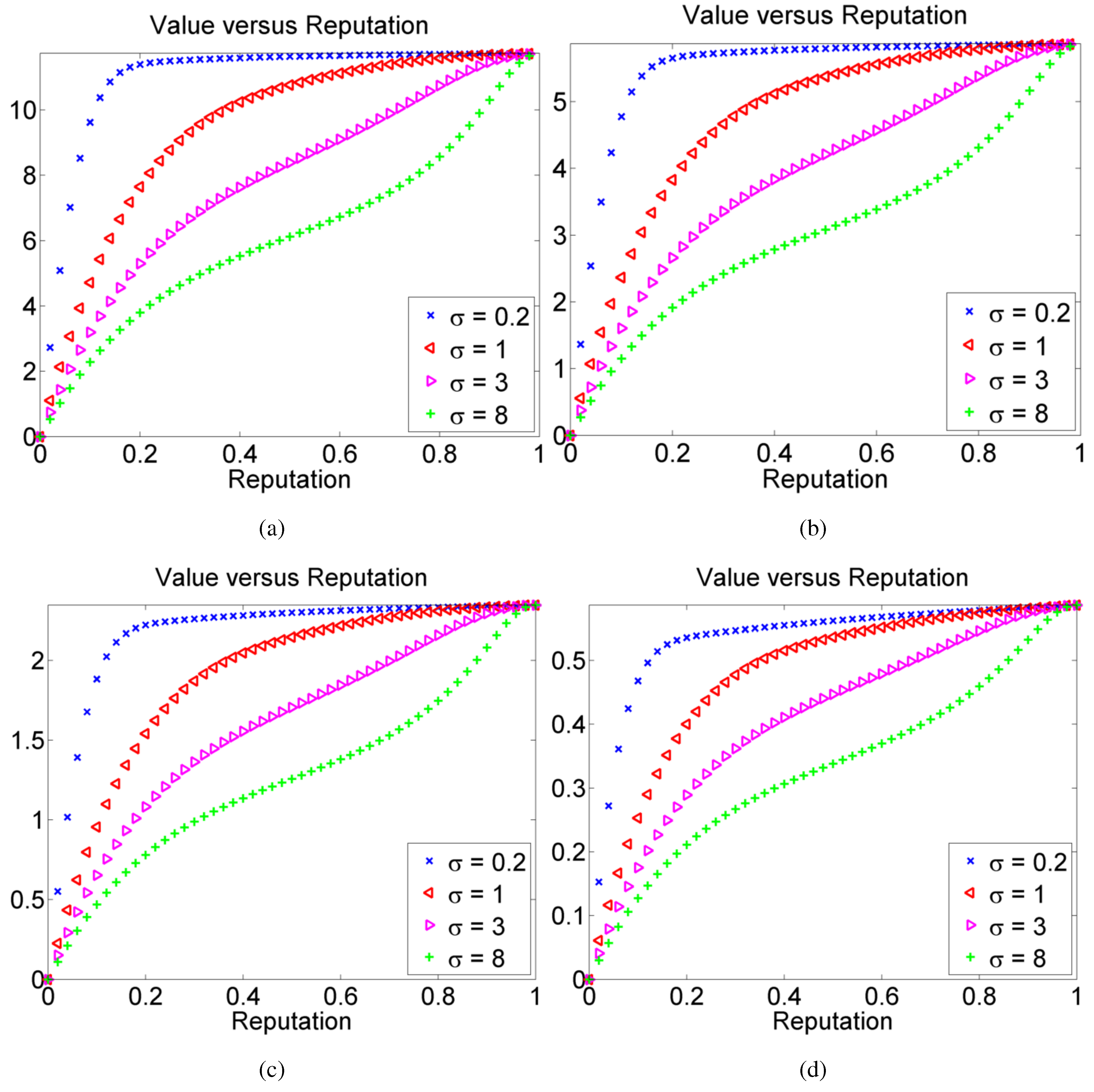

4.2. Numerical Results for the Full Model

5. Conclusions and Future Work

Acknowledgments

Author Contributions

Conflicts of Interest

A. Piecewise Analytic Solution of Reduced Model

A.1. Constructing the Solution

A.2. Comparison With μ ≡ 0.

References

- S.P. Sethi. “Deterministic and stochastic optimization of a dynamic advertising model.” Optim. Control Appl. Methods 4 (1983): 179–184. [Google Scholar] [CrossRef]

- K. Raman. “Boundary value problems in stochastic optimal control of advertising.” Automatica 42 (2006): 1357–1362. [Google Scholar] [CrossRef]

- M. Mink, and S. Seifert. “Reputation on eBay and its Impact on Sales Prices.” In Proceedings of The Group Decision and Negotiation International Conference, Karlsruhe, Germany, 25–28 June 2006; pp. 253–255.

- C. Beam, and A. Segev. Auctions on the Internet: A Field Study. Oxford, UK: Blackwell Publishers Ltd, 1998. [Google Scholar]

- P. Bajari, and A. Hortacsu. “Economic insights from internet auctions.” J. Econ. Lit. 42 (2004): 457–486. [Google Scholar] [CrossRef]

- P. Resnick, R. Zeckhauser, J. Swanson, and K. Lockwood. “The Value of Reputation on eBay: A Controlled Experiment.” Exp. Econ. 9 (2006): 79–101. [Google Scholar] [CrossRef]

- P. Resnick, and R. Zeckhauser. “Trust Among Strangers in Internet Transactions: Empirical Analysis of eBay’s Reputation System.” In The Economics of the Internet and E-Commerce. Edited by M.R. Baye. Volume 11 of Advances in Applied Microeconomics; Amsterdam, The Netherlands: Elsevier Science, 2002, pp. 127–157. [Google Scholar]

- D. Houser, and J. Wooders. “Reputation in Auctions: Theory, and Evidence from eBay.” J. Econ. Manag. Strateg. Blackwell Publ. Vol. 15 (2006): 353–369. [Google Scholar] [CrossRef]

- C. Dellarocas. “Reputation Mechanism Design in Online Trading Environments with Pure Moral Hazard.” Inf. Syst. Res. 16 (2005): 209–230. [Google Scholar] [CrossRef]

- K.R. Apt, and E. Markakis. “Optimal Strategies in Sequential Bidding.” In Proceedings of The 8th International Conference on Autonomous Agents and Multiagent Systems, Budapest, Hungary, 10–15 May 2009; pp. 1189–1190.

- M. Nerlove, and K.J. Arrow. “Optimal Advertising Policy under Dynamic Conditions.” Economica 29 (1962): 129–142. [Google Scholar] [CrossRef]

- R.C. Rao. “Estimating Continuous Time Advertising-Sales Models.” Market. Sci. 5 (1986): 125–142. [Google Scholar] [CrossRef]

- D.J. Levitin. Extracted from The Organized Mind: Thinking Straight in the Age of Information Overload. New York, NY, USA: Dutton Penguin Random House, 2014. [Google Scholar]

- K. Duckworth, and M. Zervos. “A Model for Investment Decisions with Switching Costs.” Ann. Appl. Probab. 11 (2001): 239–260. [Google Scholar] [CrossRef]

- W. Fleming, and H.M. Soner. Controlled Markov Processes and Viscosity Solutions. Stochastic modelling and applied probability; New York, NY, USA: Springer, 2006. [Google Scholar]

- W.H. Fleming, and R.W. Rishel. Deterministic and Stochastic Optimal Control. Berlin, Germany; New York, NY, USA: Springer-Verlag, 1975. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bradonjić, M.; Causley, M.; Cohen, A. Stochastic Optimal Control for Online Seller under Reputational Mechanisms. Risks 2015, 3, 553-572. https://doi.org/10.3390/risks3040553

Bradonjić M, Causley M, Cohen A. Stochastic Optimal Control for Online Seller under Reputational Mechanisms. Risks. 2015; 3(4):553-572. https://doi.org/10.3390/risks3040553

Chicago/Turabian StyleBradonjić, Milan, Matthew Causley, and Albert Cohen. 2015. "Stochastic Optimal Control for Online Seller under Reputational Mechanisms" Risks 3, no. 4: 553-572. https://doi.org/10.3390/risks3040553