1. Introduction

The study of the aggregate (non-discounted) claims has been a classical and important topic in collective risk theory (see, e.g., [

1,

2] for reviews). Exact results concerning the Laplace transform and the moments of the aggregate discounted claims have also been obtained by, e.g., [

3,

4,

5,

6,

7]. Traditionally, the analysis of the aggregate claims is mostly concerned with the aggregate until a fixed time

. Recently, there has been increased interest in the aggregate claims until the ruin time of the underlying risk process (instead of a fixed time). Specifically, under the (perturbed) compound Poisson model and the phase-type renewal models, [

8,

9] studied the distribution of the aggregate claims until ruin without discounting; whereas [

10] (Section 6), [

11] (Section 4.2) and [

12] (Section 5.2) analyzed the expected aggregate discounted claims until ruin. The higher moments of the aggregate discounted claims until ruin were also considered by [

13] (Section 2.1) in a risk process with Markovian claims arrival (e.g., [

14], Chapter XI.1), by [

15] in a renewal risk model with arbitrary inter-claim times and by [

16] in a dependent Sparre–Andersen risk model (e.g., [

17]).

However, the aforementioned contributions in the literature mainly focused on the individual treatment of the moments and/or the distribution of the aggregate claims in various models, and little has been said about the relationship between the aggregate claim amounts and other ruin-related quantities. An exception is [

16], who have recently analyzed the covariance of the aggregate discounted claims until ruin and the time of ruin (conditional on ruin occurring). In the context of a dependent Sparre–Andersen risk model where the inter-claim time and the resulting claim amount are modeled via a Farlie–Gumbel–Morgenstern copula with exponential marginals, they provided numerical illustrations showing that the above covariance could possibly take a negative value and gave some probabilistic interpretations, as well. In addition to the time of ruin, in this paper, we are also interested in the relationship of the aggregate discounted claims until ruin, particularly with the total discounted dividends paid until ruin. Note that the insurer’s surplus is drained by payments made not only to the policyholders (claims), but also to the shareholders (dividends). The dividend payouts are determined based on the overall performance of the company’s business, which is, in turn, affected by insurance claim payments. Moreover, it is worthwhile to point out that although numerous studies have been performed by various researchers on the dividend payments in different risk models, the concurrent analysis of dividends and other ruin-related quantities, such as the time of ruin and the deficit at ruin, only appears in Theorem 1 of [

18] (to the best of our knowledge). The above reasoning leads us to investigate the Gerber–Shiu expected discounted penalty function [

19] in which both the total discounted dividends until ruin and the aggregate discounted claims until ruin are incorporated (see Equation (

3)). A merit of a this proposed approach is that it facilitates the joint analysis of the aforementioned random variables, leading to covariance measures that have never been studied before (see

Section 4).

In this paper, we assume that the baseline risk process

(in the absence of dividends) follows the classical compound Poisson insurance risk model. Let

be the premium rate per unit time received by the insurer,

be the claims counting process, which is a Poisson process with parameter

, and

be the size of the

i-th claim. It is assumed that

forms a sequence of independent and identically distributed positive continuous random variables with common probability density function

and Laplace transform

. In addition,

and

are assumed independent. The aggregate claims process is thus

where

. With the initial surplus

, the surplus process

follows the dynamics:

The positive security loading condition

is assumed to hold true. Since the concept of redistributing part of the insurer’s surplus to the shareholders was proposed by [

20], the dividend strategy that has been studied the most is the barrier strategy (see, e.g., [

21]). Such a strategy will be adopted in this paper, and it is known to be optimal in maximizing the expected total discounted dividends until ruin when

is completely monotone (e.g., Theorem 3 of [

22]). Under a dividend barrier strategy, whenever the surplus process reaches a fixed level

, a dividend is declared and immediately payable at rate

c until the next claim occurs. The modified surplus process

can then be described by:

where the initial surplus

is such that

. The time of ruin of

is defined as

. With

being the aggregate dividend payments until time

, we define the total discounted dividends until ruin to be:

where

is the force of interest and

is the indicator function of the event

A. In the above model, solutions to the Gerber–Shiu function and the moments of

were derived by [

23,

24], respectively. The latter contribution also proposed that the shareholders should cover the deficit at ruin (now known as the “Dickson–Waters modification”), and this was later studied by [

25], as well. For the further analysis of the moments of

, interested readers are referred to [

18,

26] for the Lévy insurance risk process and [

27,

28] for a general skip-free upward stationary Markov process. We also define the aggregate discounted claim costs until ruin as:

where

is the occurrence time of the

i-th claim (

i.e., the

i-th arrival epoch of the Poisson process

) and

is the cost function that associates a cost to each claim. While

represents the discounted payments made to the shareholders, the special case of

when

corresponds to the aggregate discounted claims until ruin, which constitute the total payment to the policyholders (that can be expressed as

).

To provide an analytical tool to jointly study Equations (

1) and (

2) and other ruin-related quantities according to the above discussions, Equations (

1) and (

2) are now incorporated into the Gerber–Shiu function in the form of moment-based components as follows. Throughout the paper, we shall use

and

to denote the set of non-negative integers and the set of positive integers, respectively. For

, we define the Gerber–Shiu type function of our interest as, for

,

where

is the Laplace transform argument with respect to the time of ruin

and

is the penalty function that depends on the surplus prior to ruin

and the deficit at ruin

. Note that we allow dividends and claims to be discounted using different interest rates

and

to account for possibly different time preferences of the shareholders and the policyholders. Moreover, the indicator function

is not needed in the above definition, because ruin occurs almost surely under a barrier strategy. The work in [

15] first proposed a special case of Equation (

3) when

,

for some

, and

w only depends on the deficit in the context of a Sparre–Andersen risk model without dividends. The extended Gerber–Shiu function

in Equation (

3) not only unifies the individual study of each variable involved, but also allows for new quantities to be evaluated. Clearly, when

, it reduces to the usual Gerber–Shiu function proposed by [

19] (which will be denoted by

). On the other hand, if

,

and

, then Equation (

3) reduces to the moments of discounted dividends until ruin (e.g., [

24]). Interesting new quantities that can be computed from Equation (

3) include the following.

- (i)

When

, then Equation (

3) can be regarded as a unification of the usual Gerber–Shiu function and the dividend moments. The analysis of this special case is surprisingly simple, and the general solution can be expressed in terms of quantities available in the literature. See

Section 2.3.

- (ii)

When

and

, Equation (

3) reduces to the joint moments of

and

, from which the covariance of

and

can be calculated. See

Section 4.

- (iii)

When

and

(resp.

), the joint moments of

and

(resp.

) can be obtained by successively differentiating Equation (

3) with respect to

, leading to the covariance of

and

(resp.

). See

Section 4.

The remainder of the paper is organized as follows.

Section 2 deals with the derivation of the integro-differential equation (IDE) in

u satisfied by

along with the boundary condition. The treatment will be different depending on whether

or

. A general solution to

is given, as well. In

Section 3, it is assumed that

(as we are mostly interested in the aggregate discounted claims until ruin),

, and the distribution of each claim follows a combination of exponentials. Explicit expressions for

when

,

when

and

are obtained. These formulas are then applied to generate numerical examples in

Section 4 concerning particularly covariances involving

,

and

. We also provide some explanations of the results.

4. Numerical Illustrations

Now, we shall apply the results in the previous sections to study some new ruin-related quantities with numerical examples. Throughout this section, we assume the cost function

, so that

is the aggregate discounted claim amounts until ruin. The quantities of interest include the expectation and the variance of

, as well as the covariances between any two of

, the total discounted dividends until ruin

and the time of ruin

. For our purposes, it will be sufficient to use the penalty function

. For simplicity, we shall use

to denote the expectation of the random variable

X given an initial surplus

and dividend barrier

b. Then, the variance and the coefficient of variation of

X are

and

, respectively. Similarly,

and

, respectively, represent the covariance and correlation of

and

given

and barrier

b. All of the components required for our analysis are obtainable from the Gerber–Shiu function

in Equation (

3). While the

k-th moments of

and

are simply

and

, respectively, the

k-th moment of

is given by

(and we only need

). Moreover, one has

, and the first order joint moments involving

are

and

.

In all upcoming numerical examples, it is assumed that the Poisson arrival rate is

, the premium rate is

and policyholders and shareholders have the same force of interest

. Three different claim distributions will be considered, namely: (i) a sum of two exponential random variables with means 1/3 and 2/3; (ii) an exponential distribution with mean one; and (iii) a mixture of two exponential distributions with means two and 1/2 and mixing probabilities 1/3 and 2/3, respectively. Their densities are (i)

, (ii)

and (iii)

, which are all in the form of Equation (

24). While they all have the same mean of one, they possess different variances of 0.56, 1 and 2, respectively. Each of

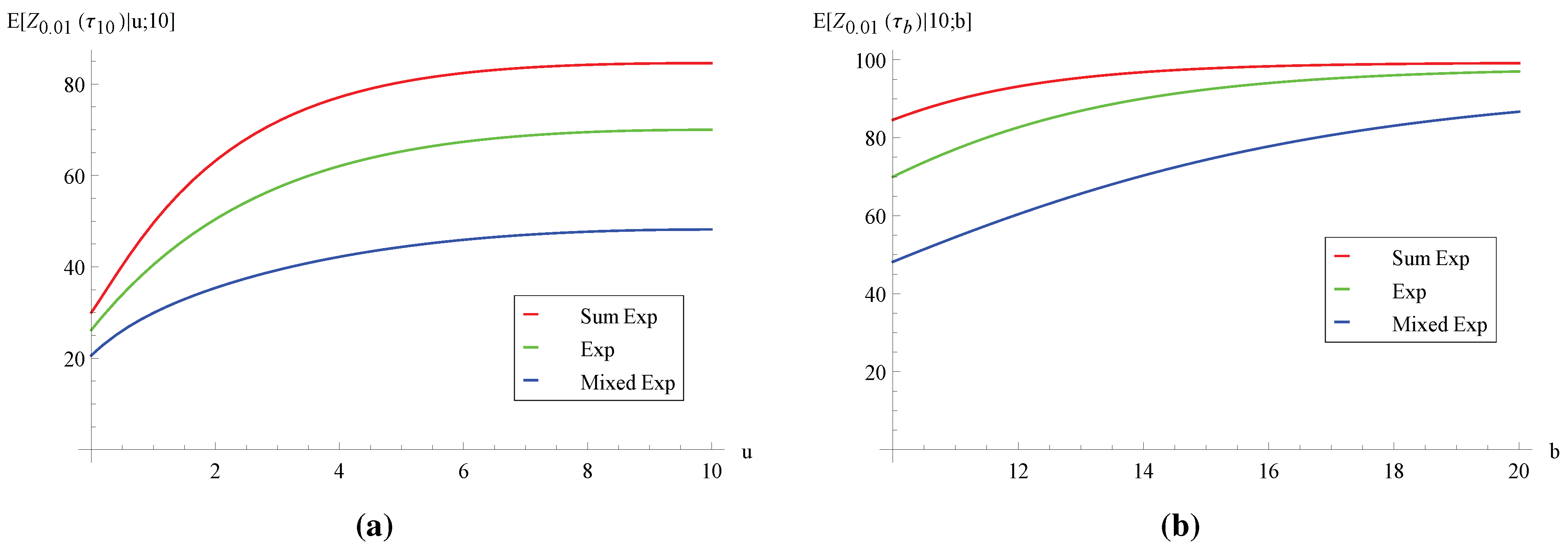

Figure 1 to

Figure 9 contains two subfigures, (a) and (b), where (a) plots the quantity of interest against

u (

) for fixed

, while (b) plots the same quantity against

for fixed

. The curves corresponding to the three claim distributions above are represented in red, green and blue colors, respectively.

Figure 1.

Expected aggregate discounted claims .

Figure 1.

Expected aggregate discounted claims .

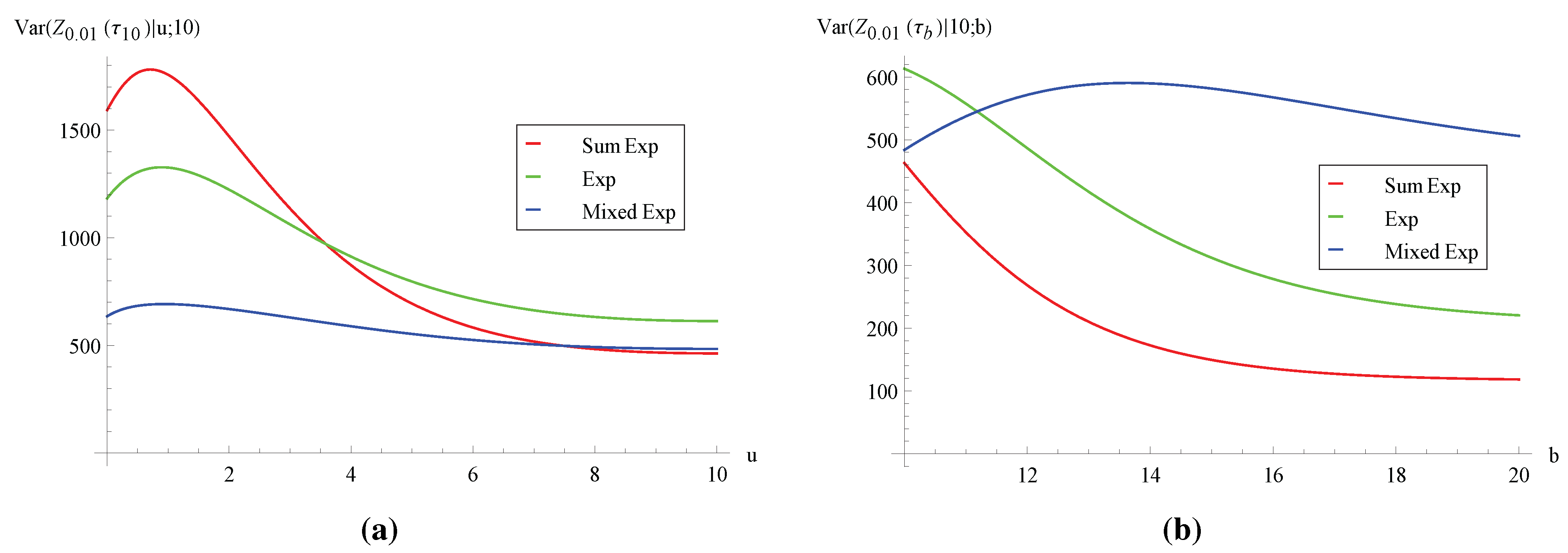

Figure 2.

Variance of aggregate discounted claims Var.

Figure 2.

Variance of aggregate discounted claims Var.

Figure 3.

Coefficient of variation of aggregate discounted claims CV.

Figure 3.

Coefficient of variation of aggregate discounted claims CV.

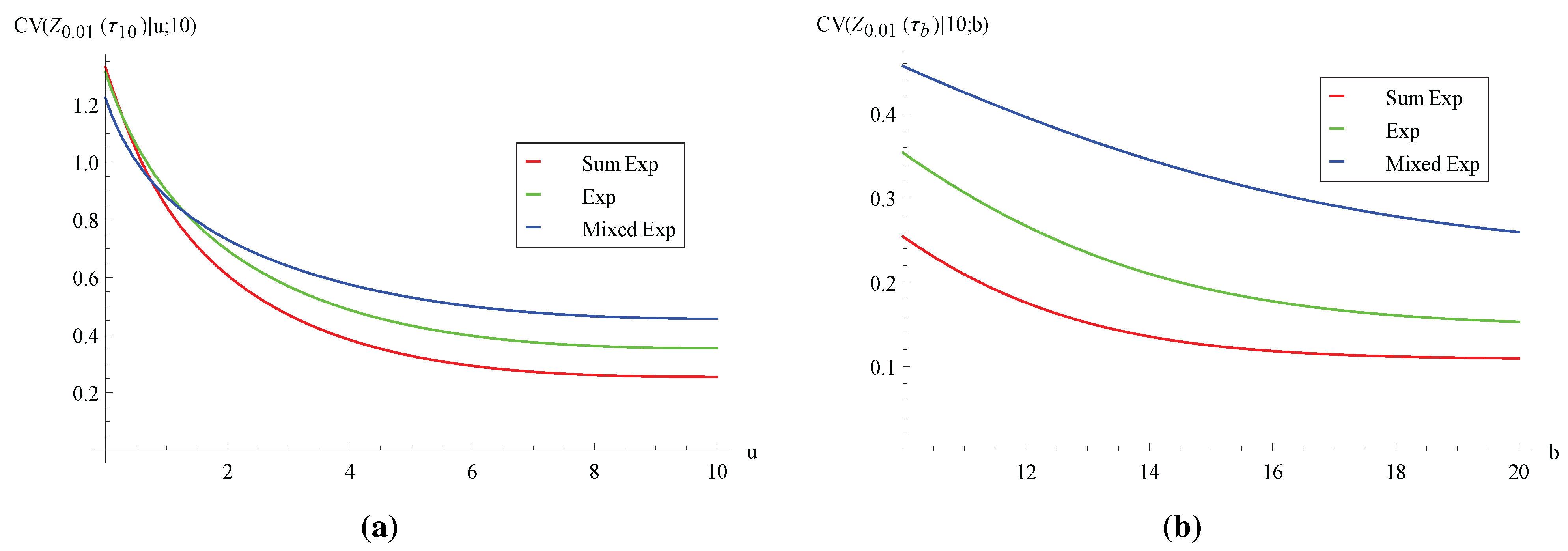

Figure 4.

Covariance of ruin time and aggregate discounted claims Cov.

Figure 4.

Covariance of ruin time and aggregate discounted claims Cov.

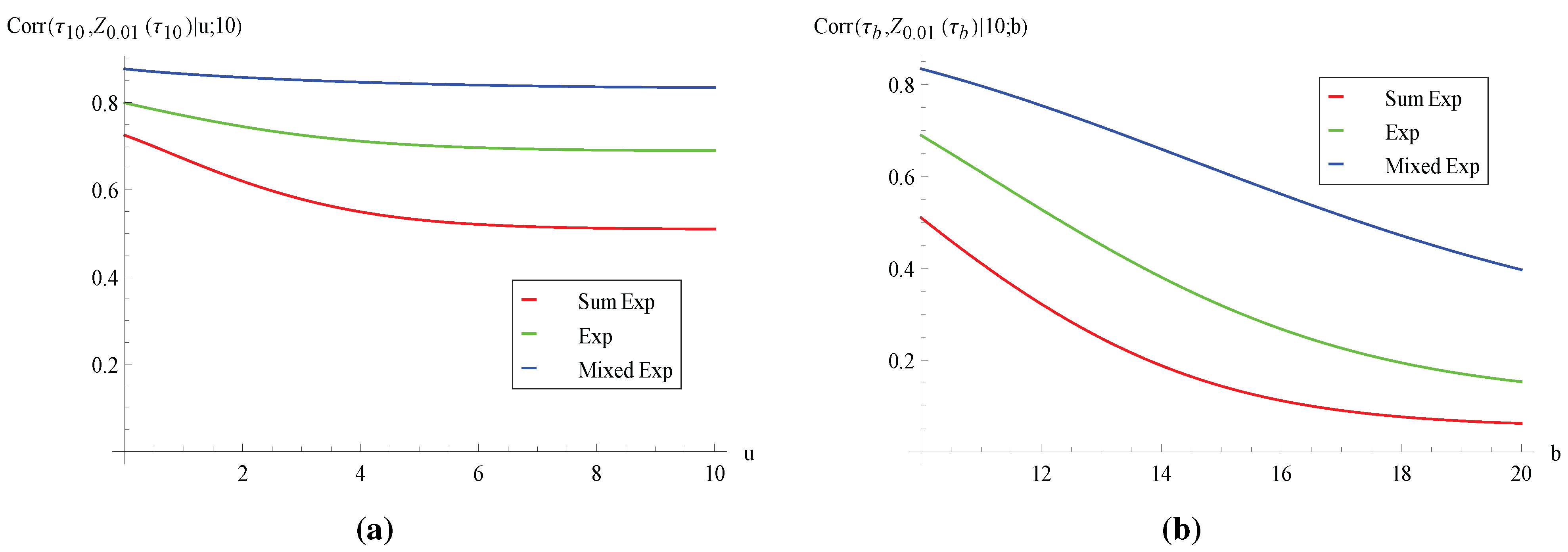

Figure 5.

Correlation of ruin time and aggregate discounted claims Corr.

Figure 5.

Correlation of ruin time and aggregate discounted claims Corr.

Figure 6.

Covariance of ruin time and total discounted dividends Cov.

Figure 6.

Covariance of ruin time and total discounted dividends Cov.

Figure 7.

Correlation of ruin time and total discounted dividends Corr.

Figure 7.

Correlation of ruin time and total discounted dividends Corr.

Figure 8.

Covariance of aggregate discounted claims and total discounted dividends Cov.

Figure 8.

Covariance of aggregate discounted claims and total discounted dividends Cov.

Figure 9.

Correlation of aggregate discounted claims and total discounted dividends Corr.

Figure 9.

Correlation of aggregate discounted claims and total discounted dividends Corr.

First,

Figure 1 depicts the behavior of the expected aggregate discounted claims

. From

Figure 1a, the three curves of

are all increasing in the initial surplus

u. Intuitively, for any given sample path of the aggregate claims process

, a higher value of

u leads to larger ruin time

, and therefore, more claims are included in

, resulting in a larger expectation

.

Figure 1b also shows that

increases in the barrier level

b and then converges to a finite value. Clearly, the increasing property is due to the fact that a larger

b delays ruin, and thus, more claims occur before ruin. However, as

b (and, hence,

) increases further, claims that occur late contribute little to

due to discounting, and consequently,

converges. Interestingly, it is observed from

Figure 1a,b that

increases as the variance of the claim distribution decreases when the pair

is fixed. Indeed, we have separately checked that when the claim’s variance decreases, the expected ruin time

increases for the above concerned domain of fixed

(and the graphs are omitted here for the sake of brevity). As the process

survives longer in expectation, it is natural that on average, more claims occur before ruin. Next, we look at the variance of

, which is shown in

Figure 2. Unfortunately,

Figure 2 does not appear to show much of a pattern that allows for interpretation. However, if we turn to the coefficient of variation in

Figure 3, it can be seen that

and

are decreasing in

u and

b, respectively. Furthermore,

Figure 3 suggests that

increases with the variance of the claim distribution (with the exception of small values of

u in

Figure 3a). In other words, once we have used a standardized measure of dispersion, which is unitless, the variability of the aggregate discounted claims until ruin

is in accordance with that of the individual claim.

After analyzing the first two moments of

, we now look at various covariance measures. Concerning the relationship between the ruin time

and the aggregate discounted claims

for fixed

, consider sample paths of the surplus process

for which

is large (e.g., larger than the mean

). Intuitively, there are two opposing effects on

. A longer ruin time means more time for claims to occur, and this tends to increase

. On the other hand, it also implies that no claims larger than

b occur early, and this may make

smaller in the presence of discounting.

Figure 4 shows that the covariance of

and

is positive, suggesting that the former effect dominates under our parameter setting (interested readers are referred to [

16] (Section 5) for an example where the latter effect dominates and leads to negative covariance in the context of a dependent Sparre–Andersen model without dividends). In addition, we see from

Figure 4 that

decreases as the variance of individual claims increases. This can be attributed to the fact that, according to our discussions following

Figure 1, both

and

are of a larger magnitude when the claim distribution has smaller variance. In order to remove the effect of different magnitudes, we plot the correlation

in

Figure 5. It is instructive to note that the ordering with respect to the claim’s variance is now reversed,

i.e.,

increases with the variance of the claim. Moreover,

is decreasing in both

u and

b. Note also that the correlation can sometimes reach 0.8, suggesting that

and

can be strongly dependent. Now, we turn to the co-movement of the ruin time

and the total discounted dividends

. The covariance

in

Figure 6 is always positive. Clearly, a larger ruin time means that the insurance business survives longer, and hence, the process

stays at the barrier more often for dividends to be paid. It is also observed from

Figure 6 and

Figure 7 that both the covariance and the correlation exhibit the same behavior as in

Figure 4 and

Figure 5 in terms of the shape and ordering of the curves.

Finally, we consider the covariance and the correlation of the aggregate discounted claims

and the total discounted dividends

in

Figure 8 and

Figure 9. Although the covariance

in

Figure 8a is always positive,

in

Figure 8b takes negative values as

b gets larger when the claim distribution is exponential or a sum of two exponentials. The fact that the covariance is possibly negative may be explained as follows. For fixed

, we already know from previous discussions that both

and

tend to be larger when

is large. Meanwhile, it should be noted that both claims and dividends are paid from the insurer’s surplus (which consists of the initial surplus plus the premium collected to date). In this regard, one can argue that

and

may also move in opposite directions. If the covariance is negative, then it means that the latter effect dominates. While the curves in

Figure 8a and

Figure 9a as a function of

u are not ranked according to the variance of the claim distribution, those in

Figure 8b and

Figure 9b as a function of

b suggest that both covariance and correlation increase with the claim’s variance (except for a very, very small portion in

Figure 8b, where the green line is slightly above the blue line when

b is close to 10).