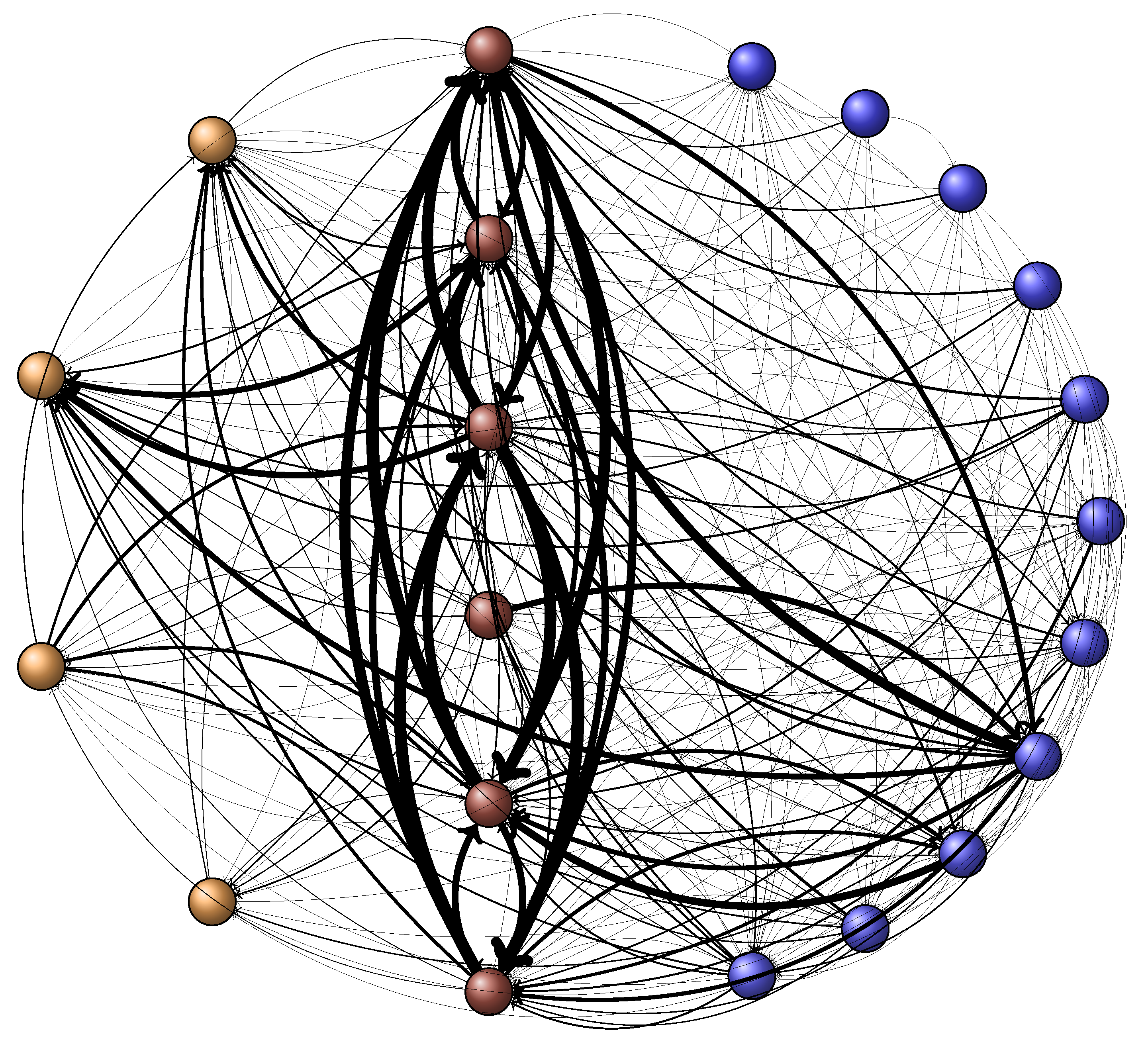

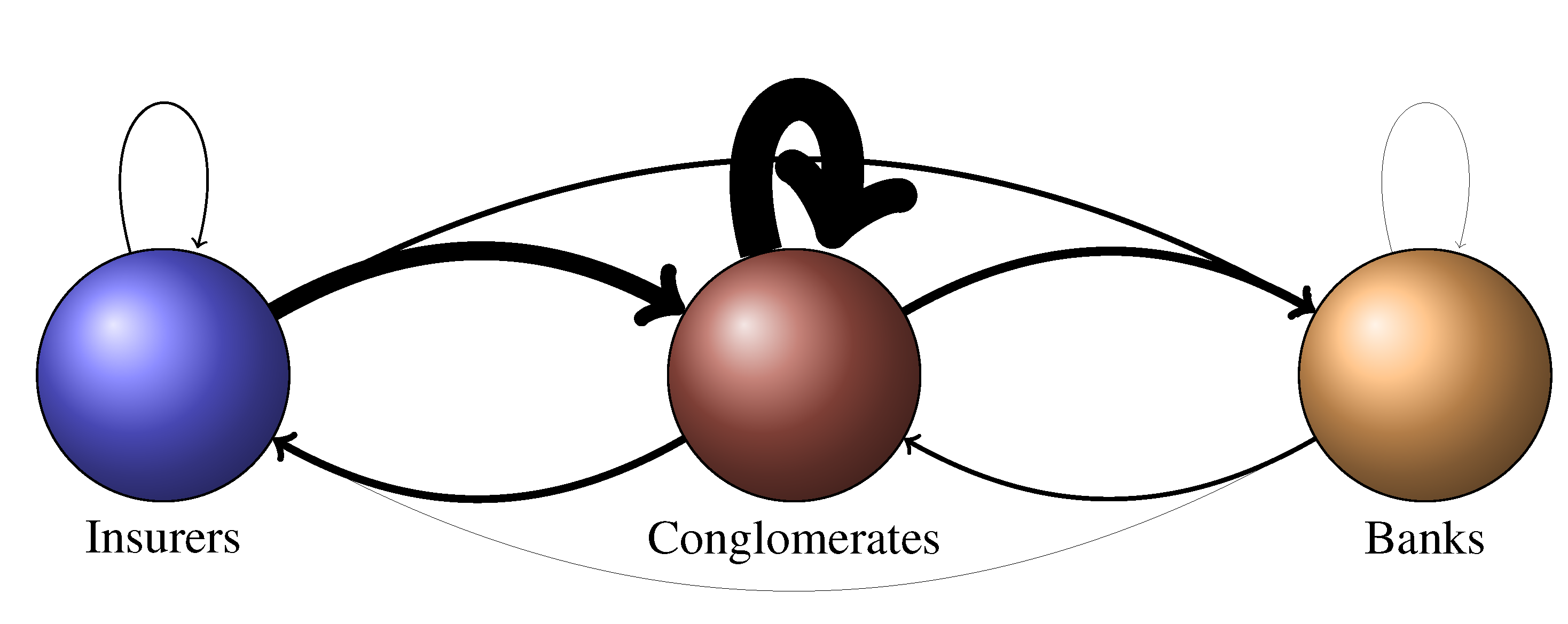

Firstly, we present the main theoretical arguments explaining the emergence of financial conglomerates. These motivations are similar to the explanation of linkages between banks and insurers. Before addressing in greater detail the specific motivations, the business models of banking and insurance explain a different general profile of interconnectedness. Maturity transformation leads banks to borrow partly from other financial institutions and to invest in typically non-financial firms and households. The insurance companies are expected to be exposed to the financial sector, since they invest the proceeds of the policyholders’ premium. Their liabilities are mostly composed of commitments to the policyholders; thus, the exposures of other financial institutions to insurers should be low. Being a financial conglomerate benefits from revenue enhancement and cost savings through diversification effects (see Berger and Ofek [

8, van Lelyveld and Schilder [

9]). For instance, a bank can use its knowledge of clients, as well as its offices to sell insurance products, too. Another motive for interconnections between banks and insurers may be risk transfers, such as reinsurance or securitization (see Subramanian and Wang [

10]). This motive is less relevant for conglomerates, since risks are transferred to other subsidiaries, but remain in the same group. General opinion about the interconnection between financial institutions refers to liquidity management (see Holmstrom and Tirole [

11], Rochet [

12], Tirole [

13]). Liquidity issues are relevant for short-term relationships, such as interbank overnight loans. Their relevance for financial conglomerates is much less clear. It is hard to narrow the advantages of being a conglomerate to a simple advantage in liquidity management. However, this strand of literature provides results worth being kept in mind when analyzing conglomerates. In particular, Allen and Gale [

14] show that the degree of interconnection has an ambiguous effect on financial stability. When institutions are exposed to small and diversified shocks, the optimal structure is a complete network: the interconnections are actually generating an insurance scheme. However, when institutions are exposed to large shocks, a complete network is the worst situation. In that case, interconnections are the support of contagion: the shock is propagated to all institutions, leading to a massive cascade of defaults.

Second, most papers exploiting bilateral exposure data consider only banks. In contrast, our scope includes also financial conglomerates and insurers. Moreover, most papers analyze one national banking sector.

2 In general, little evidence of solvency contagion is found. When liquidity channels are considered, contagion risk may become prominent. Liquidity channels consist of fire sales (see Cifuentes

et al. [

15] for instance) and liquidity hoarding (see Fourel

et al. [

16] for instance). These channels are relevant for banks for which core activity is maturity transformation. For insurance, liquidity concerns are less important. The unique case of international analysis is Alves

et al. [

17], where the interconnections between 53 major European banks are analyzed. Researchers use market data (stock prices) or accounting data (profits, turnover,

etc.) to circumvent the scarcity of bilateral exposure data. Concerning contagion between insurance and banks, Schmid and Walter [

18] investigate the profitability of U.S. financial firms between 1985 and 2004. One of their most relevant results for our paper is that commercial banks do not benefit from developing insurance activity. Brewer and Jackson [

19] analyze the impact of three announcements in 1990 on the abnormal returns of U.S. commercial banks and U.S. life-insurers. Their empirical findings provide mixed results due to an overlapping of information effects and competitiveness effects. They show that there is less contagion risk from the insurance sector to the banking sector than from the banking sector to the insurance sector. Still on the U.S. market, Filson and Olfati [

20] analyze abnormal returns following mergers of U.S. banks between 2001 and 2011. This date range includes the 1999 Gramm-Leach-Bliley Act authorizing commercial banks to perform also investment banking, securities brokerage and insurance activities. They show that diversification creates value, contrasting with Schmid and Walter [

18]. Analyzing extreme stock return co-movements between major financial firms of the U.S., Germany and U.K. between 1990 and 2003, Minderhoud [

21] shows that correlation during normal periods is significantly different from correlation during crisis periods. Interpreting extreme co-movements as contagion phenomena, he concludes that there is contagion risk from the insurance sector to the banking sector, despite the results of Brewer and Jackson [

19]. His results are two-fold: there is no diversification pattern during crisis time, but a diversification advantage may exist in standard periods. Stringa and Monks [

22] study six events in the U.K. financial market between 2002 and 2003 to assess the risk of contagion from the insurance sector to the banking sector. They pinpoint the heterogeneity of banks’ responses to a distress. In particular, financial conglomerates are much more affected than pure banks. A key paper concerning European financial conglomerates is van Lelyveld and Knot [

23]. The authors compare the market performances of major European financial conglomerates with the market performances of major EU banks and insurances between 1995 and 2005. They investigate if a conglomerate has a better performance than the sum of its banking part and of its insurance part. They find that the diversification effect is only a recent phenomenon. Moreover, there is a large heterogeneity of the diversification discount. The authors interpret their results as the outcome of a combination of diversification and opacity.

Empirical papers about financial conglomerates or, more generally, about spill over effects between the banking sector and the insurance sector present contrasting results. The results based on the stock returns of publicly-traded firms unveil market participants’ assessments of financial conglomerates. To the best of our knowledge, our paper is the first paper to provide an empirical analysis based on a specific type of data: bilateral exposure data. Market or accounting data are a collection of individual data. Although very informative, the links that are put in evidence with such data are statistical links, such as correlation or Granger causality. In contrast, bilateral exposures are structural financial links. One aspect of our contribution is therefore to bring a new perspective to the questions previously analyzed in the literature.