Trade Balance Effects on Economic Growth: Evidence from European Union Countries

Abstract

:1. Introduction

2. Theoretical Background of the Trade Balance Impact on Economic Growth

3. Methodology

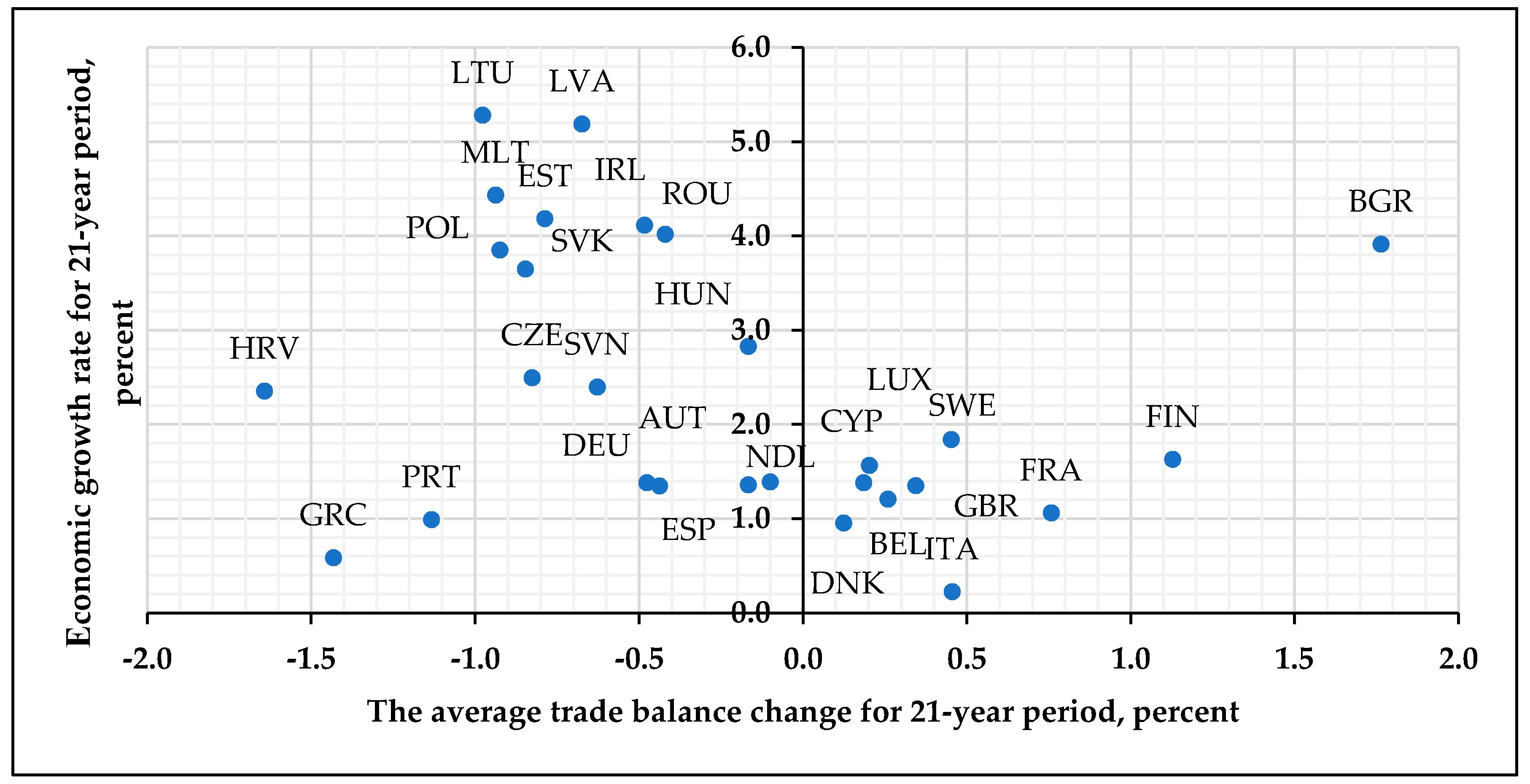

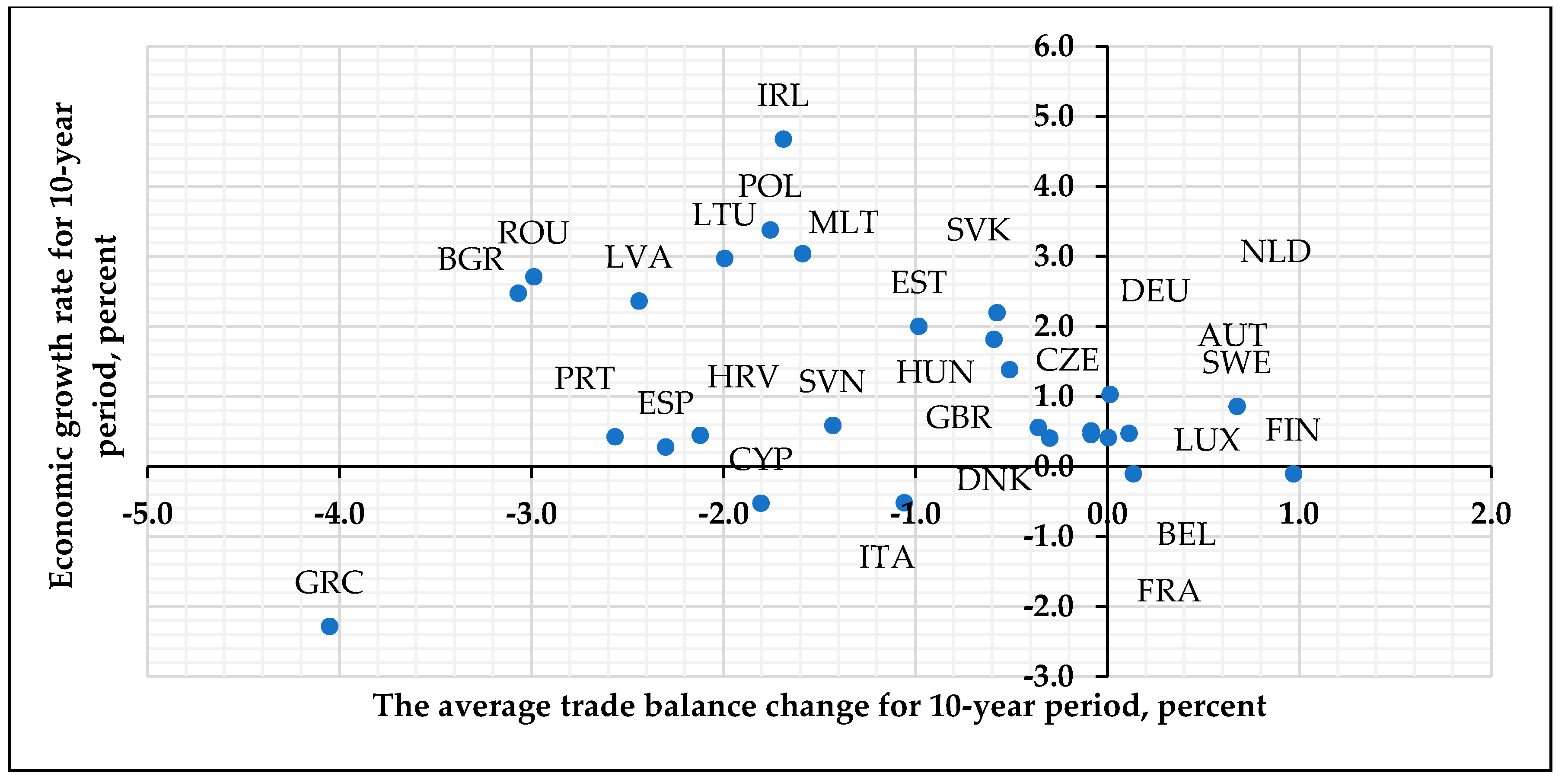

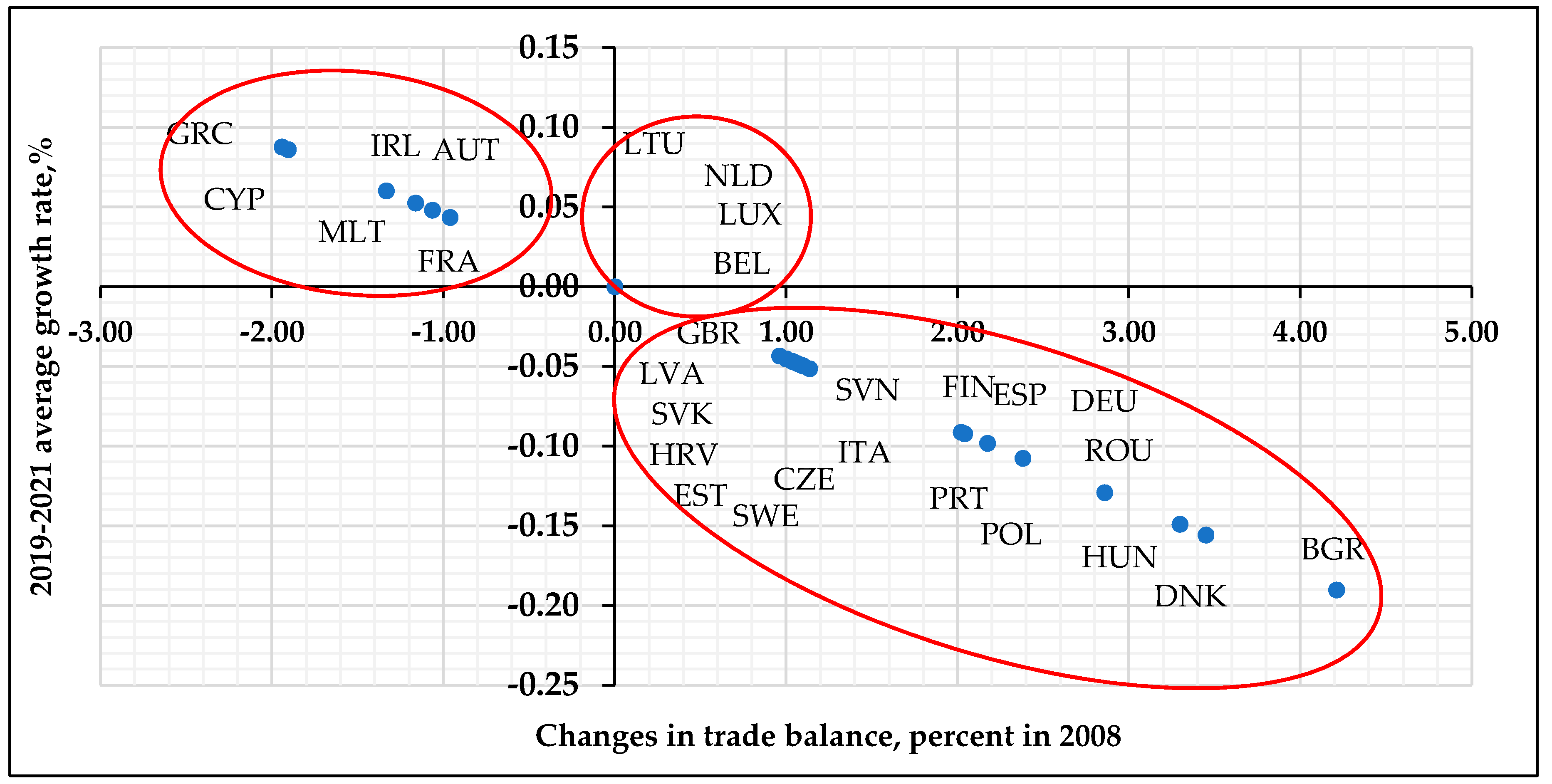

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Researcher(s) | Period | Sample | Method * | Trade Variable | Outcome Variable | Main Results |

|---|---|---|---|---|---|---|

| Michelis and Zestos (2004) | 1950–1990 | Belgium, France, Germany, Greece, Italy, and The Netherlands | VECM and Granger-Causality | First logarithmic differences of export and import | First logarithmic differences of GDP | Bi-directional significant causality from GDP to exports and imports |

| Awokuse (2007) | 1994–2004 | Bulgaria, the Czech Republic, Poland | ECM | Real exports, real imports | Real GDP growth | Significant long-run causal relationship from export and import to GDP |

| Awokuse (2008) | 1994–2004 | Argentina, Colombia, Peru | Granger-Causality | Real exports, real imports | Real GDP growth | Significant causal effects from imports to economic growth |

| Cetintas and Barisik (2008) | 1995–2006 | 13 transition economies | Panel unit root, panel cointegration, panel causality | Export and import growth | GDP growth | Positive significant impact of import on economic growth |

| Awokuse and Christopoulos (2009) | 1960–2005 | Canada, Italy, Japan, the UK, and the US | STAR | Real exports growth | Real GDP growth | Significant non-linear relationship between exports and economic growth |

| Sun and Heshmati (2010) | 2002–2007 | China | SFA, Divisia index | Net export ratio and high-tech exports ratio | Logarithm of GDP | Significant positive effect on economic growth |

| Busse and Königer (2012) | 1971–2005 | 108 countries | OLS, FE, GMM | Volume of exports and imports as a share of lagged total GDP | Growth rates of difference in the logarithm of GDP per capita | Positive and significant on economic growth |

| Abbas and Raza (2013) | 1988–2011 | Pakistan | OLS | Trade deficit | GDP | Significant negative effect on economic growth |

| Velnampy and Achchuthan (2013) | 1970–2010 | Sri Lanka | Time series: simple regression analysis | Export income, import expenses | GDP growth rate | Export income and import expenses have a significant positive effect on GDP |

| Fetahi-Vehapi et al. (2015) | 1996–2012 | 10 SEE countries | GMM | Exports plus imports to GDP | Logarithm of real GDP per capita | Positive significant effects on economic growth |

| Were (2015) | 1991–2011 | 85 countries | Standard growth regression | Exports plus imports, exports and imports as a share of GDP | GDP per capita growth | Positive significant effects of export on economic growth in developed countries |

| Altaee et al. (2016) | 1980–2014 | Kingdom of Saudi Arabia | ARDL, ECM | Real export, real import | Real GDP | Export has a positive impact on economic growth. Import affects real GDP growth negatively |

| Bakari (2017) | 1985–2015 | Germany | VAR, Granger-Causality | Logarithm of export and import | Logarithm of GDP | Exports and imports are the source of economic growth |

| Bakari and Mabrouki (2017) | 1980–2015 | Panama | VAR, Granger-Causality | Exports and imports (current US$) | Logarithm of GDP | No effect |

| Keho (2017) | 1965–2014 | Ivory Coast | ADLB test, VAR, Granger-Causality | Real export per capita plus real import per capita | Real GDP per capita | Trade openness is positively significantly related to economic output |

| Butkus and Seputiene (2018) | 1996–2016 | 152 countries | SYS-GMM, OLS, LSDV | Exports plus imports in percent of GDP | The real per capita GDP of a country five years ahead | Significant impact on debt threshold level |

| Bakari and Tiba (2019) | 2002–2017 | 24 Asian economies | FE, RE | Logarithm of export and import (2010 constant US$) | Logarithm of GDP | Negative significant or no effect |

| Bakari et al. (2019b) | 1970–2017 | Brasilia | VECM | Logarithm of export and import | Logarithm of GDP | Exports have a positive significant effect on economic growth. Imports—significant negative effect |

| Bakari et al. (2019a) | 1960–2015 | China | VECM, Granger Causality | Logarithm of export and import | Logarithm of GDP | Exports have a positive significant effect on economic growth. Imports—significant negative effect |

| Kumar (2020) | 1990–2016 | South Asian Association for Regional Cooperation Countries | ARDL | Import and export share of India with dependent country | GDP growth rate | Trade has significant spillovers on the economic growth |

References

- Abbas, Mohsin, and Hassan Raza. 2013. Effect of trade deficit on the economy of Pakistan. Interdisciplinary Journal of Contemporary Research in Business 4: 176–215. [Google Scholar]

- Akbas, Yusuf E., and Fuat Lebe. 2015. Current Account Deficit, Budget Deficit and Savings gap: Is the twin or triplet deficit hypothesis valid in G7 countries? Prague Economic Papers 25: 271–86. [Google Scholar] [CrossRef] [Green Version]

- Alleyne, Dillon, and Alfred A. Francis. 2008. Balance of payments-constrained growth in developing countries: A theoretical perspective. Metroeconomica 59: 189–202. [Google Scholar] [CrossRef]

- Altaee, Hatem H. A., Mohamed K. Al-Jafari, and Masoud A. Khalid. 2016. Determinants of economic growth in the Kingdom of Saudi Arabia: An application of autoregressive distributed lag model. Applied Economics and Finance 3: 83–92. [Google Scholar] [CrossRef]

- Andersen, Lill, and Ronald Babula. 2009. The link between openness and long-run economic growth. Journal of International Commerce and Economics 2: 31–50. [Google Scholar]

- Apostolakis, George, Nikolaos Giannellis, and Anthanasios Papadopoulos. 2019. Financial stress and asymmetric shocks transmission within the Eurozone. How fragile is the common monetary policy? North American Journal of Economics and Finance 50: 101006. [Google Scholar] [CrossRef]

- Awan, Abdul G., and Sheeza Mukhtar. 2019. Causes of trade deficit and its impact on Pakistan’s economic growth. Global Journal of Management, Social Sciences and Humanities 5: 480–98. [Google Scholar]

- Awokuse, Titus O. 2007. Causality between exports, imports, and economic growth: Evidence from transition economies. Economics letters 94: 389–95. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2008. Trade openness and economic growth: Is growth export–led or import–led? Applied Economics 40: 161–73. [Google Scholar] [CrossRef]

- Awokuse, Titus O., and Dimitris K. Christopoulos. 2019. Nonlinear dynamics and the exports–output growth nexus. Economic Modelling 26: 184–90. [Google Scholar] [CrossRef]

- Bakari, Sayef, and Mohamed Mabrouki. 2017. Impact of exports and imports on economic growth: New evidence from Panama. Journal of Smart Economic Growth 2: 67–79. [Google Scholar]

- Bakari, Sayef, and Sofien Tiba. 2019. The Impact of Trade Openness, Foreign Direct Investment and Domestic Investment on Economic Growth: New Evidence from Asian Developing Countries. MRPA Paper 94489. Available online: https://mpra.ub.uni-muenchen.de/94489/1/MPRA_paper_94489.pdf (accessed on 15 December 2019).

- Bakari, Sayef, Fatma Saaidia, and Ahlem Soualhia. 2019a. Evaluation of Trade Influence on Economic Growth in China: A Time Series Analysis. Journal of Smart Economic Growth 4: 57–72. [Google Scholar]

- Bakari, Sayef, Nissar Fakraoui, and Sofien Tiba. 2019b. Domestic Investment, Export, Import and Economic Growth in Brazil: An Application of Vector Error Correction Model. MPRA Paper 95528. Available online: https://mpra.ub.uni-muenchen.de/95528/1/MPRA_paper_95528.pdf (accessed on 10 December 2019).

- Bakari, Sayef. 2017. Trade and Economic Growth in Germany. LIEI, Faculty of Economic Sciences and Management of Tunis (FSEGT). MPRA Paper No. 77404. Available online: https://mpra.ub.uni–muenchen.de/77404/1/MPRA_paper_77404.pdf (accessed on 30 November 2019).

- Busse, Matthias, and Jens Königer. 2012. Trade and Economic Growth: A Re-Examination of the Empirical Evidence. Available online: http://dx.doi.org/10.2139/ssrn.2009939 (accessed on 10 December 2019).

- Butkus, M., and J. Seputiene. 2018. Growth Effect of Public Debt: The Role of Government Effectiveness and Trade Balance. Economies 6: 62. [Google Scholar] [CrossRef] [Green Version]

- Cecen, Aydin, and Linlan Xiao. 2014. Capital flows and current account dynamics in Turkey: A nonlinear time series analysis. Economic Modelling 39: 240–46. [Google Scholar] [CrossRef]

- Cetintas, Hakan, and Salih Barisik. 2008. Export, Import and Economic Growth: The Case of Transition Economies. Transition Studies Review 15: 636–49. [Google Scholar] [CrossRef]

- Chen, Shyh-Wei. 2011. Current account deficits and sustainability: Evidence from the OECD countries. Economic Modelling 28: 1455–64. [Google Scholar] [CrossRef]

- Cooper, Richard N. 2007. Why a large US deficit is likely to persist. CESifo Forum 8: 6–11. [Google Scholar]

- Fetahi-Vehapi, Merale, Luljeta Sadiku, and Mihail Petkovski. 2015. Empirical analysis of the effects of trade openness on economic growth: An evidence for South East European Countries. Procedia Economics and Finance 1: 17–26. [Google Scholar] [CrossRef] [Green Version]

- Gabberty, James W., and Robert G. Vambery. 2014. Trade Deficits Always Matter. International Business and Economics Research Journal 13: 371–76. [Google Scholar] [CrossRef]

- Garcimartin, Carlos, Virmantas Kvedaras, and Luis Rivas. 2016. Business cycles in a balance-of-payments constrained growth framework. Economic Modelling 57: 120–32. [Google Scholar] [CrossRef]

- Goldin, Claudia. 2016. Human Capital. In Handbook of Cliometrics. Edited by Claude Diebolt and Michael Haupert. Heidelberg: Springer, pp. 55–86. [Google Scholar]

- Hsiao, C. 2003. Analysis of Panel Data, 2nd ed. Cambridge: Cambridge University Press. [Google Scholar]

- Kang, Joong S., and Jay C. Shambaugh. 2016. The rise and fall of European current account deficit. Economic Policy 31: 153–99. [Google Scholar] [CrossRef]

- Keho, Yaya. 2017. The impact of trade openness on economic growth: The case of Cote d’Ivoire. Cogent Economics and Finance 5: 1–14. [Google Scholar] [CrossRef]

- Kumar, Rakesh. 2020. India and South Asia: Geopolitics, regional trade and economic growth spillovers. The Journal of International Trade and Economic Development 29: 69–88. [Google Scholar] [CrossRef]

- Kvedaras, Virmantas, Carlos Garcimartín, and Jhonatan Astudillo. 2020. Balance-of-Payments constrained growth dynamics: An empirical investigation. Economic Modelling 89: 232–44. [Google Scholar] [CrossRef]

- Malik, U., S. Noor, S. Jahangir, N. Tariq, A. Ramzan, and R. Fatima. 2015. The Trade Balance of Pakistan and Its Impact on Exchange Rate of Pakistan: A Research Report. Journal of Economics and Sustainable Development 6: 1–10. [Google Scholar]

- Marfatia, Hardik, Wan-Li Zhao, and Qiang Ji. 2020. Uncovering the global network of economic policy uncertainty. Research in International Business and Finance 53: 101223. [Google Scholar] [CrossRef]

- Marfatia, Hardik. 2016. The Role of Push and Pull Factors in Driving Global Capital Flows. Applied Economics Quarterly 62: 117–46. [Google Scholar] [CrossRef]

- Marfatia, Hardik. 2020. Evaluating the forecasting power of foreign Country’s income growth: A global analysis. Journal of Economic Studies. [Google Scholar] [CrossRef]

- Michelis, Leo, and George K. Zestos. 2004. Exports, imports and GDP growth: Causal relations in six European Union countries. The Journal of Economic Asymmetries 1: 71–85. [Google Scholar] [CrossRef]

- Papadimitriou, Dimitri B., Greg Hannsgen, and Gennaro Zezza. 2008. The Buffett Plan for Reducing the Trade Deficit. The Levy Economics Institute of Bard College Working Paper 538: 1–39. [Google Scholar] [CrossRef] [Green Version]

- Soukiazis, Elias, Eva Muchova, and Pedro A. Cerqueira. 2014a. Is the Slovak Economy Doing Well? A Twin Deficit Growth Approach (No. 2014-08). Coimbra: University of Coimbra. [Google Scholar]

- Soukiazis, Elias, Micaela Antunes, and Ioannis Kostakis. 2018. The Greek economy under the twin-deficit pressure: A demand orientated growth approach. International Review of Applied Economics 32: 215–36. [Google Scholar] [CrossRef] [Green Version]

- Soukiazis, Elias, Pedro A. Cerqueira, and Micaela Antunes. 2012. Modelling economic growth with internal and external imbalances: Empirical evidence from Portugal. Economic Modelling 29: 478–86. [Google Scholar] [CrossRef] [Green Version]

- Soukiazis, Elias, Pedro A. Cerqueira, and Micaela Antunes. 2014b. Explaining Italy’s economic growth: A balance-of-payments approach with internal and external imbalances and non-neutral relative prices. Economic Modelling 40: 334–41. [Google Scholar] [CrossRef] [Green Version]

- Sun, Peng, and Almas Heshmati. 2010. International Trade and its Effects on Economic Growth in China. IZA Discussion Paper 5151. Available online: https://ssrn.com/abstract=1667775 (accessed on 15 December 2019).

- Thirlwall, Anthony P. 1979. The balance of payments constraint as an explanation of the international growth rate differences. PSL Quarterly Review 32: 45–53. [Google Scholar]

- Topalli, Nurgun, and Ibrahim Dogan. 2016. The structure and sustainability of current account deficit: Turkish evidence from regime switching. Journal of International Trade and Economic Development 25: 570–89. [Google Scholar] [CrossRef]

- Velnampy, Thirunavukkarasu, and Sivapalan Achchuthan. 2013. Export, import and economic growth: Evidence from Sri Lanka. Journal of Economics and Sustainable Development 4: 147–55. [Google Scholar]

- Wagner, Joachim. 2007. Exports and productivity: A survey of the evidence from firm level data. The World Economy 30: 60–82. [Google Scholar] [CrossRef] [Green Version]

- Were, Maureen. 2015. Differential effects of trade on economic growth and investment: A cross-country empirical investigation. Journal of African Trade 2: 71–85. [Google Scholar] [CrossRef] [Green Version]

- Wu, Po-Chin, Shiao-Yen Liu, and Sheng-Chieh Pan. 2013. Nonlinear bilateral trade balance-fundamentals nexus: A panel smooth transition regression approach. International Review of Economics & Finance 27: 318–29. [Google Scholar]

| 1 | Country codes: BEL—Belgium, BGR—Bulgaria, CZE—the Czech Republic, DNK—Denmark, DEU—Germany, EST—Estonia, IRL—Ireland, GRC—Greece, ESP—Spain, FRA –France, HRV –Croatia, ITA –Italy, CYP—Cyprus, LVA—Latvia, LTU—Lithuania, LUX –Luxembourg, HUN–Hungary, MLT–Malta, NLD—The Netherlands, AUT—Austria, POL—Poland, PRT—Portugal, ROU—Romania, SVN—Slovenia, SVK—Slovakia, FIN—Finland, SWE—Sweden, GBR—the United Kingdom. |

| 3Y | 4Y | 5Y | 6Y | 7Y | 8Y | 9Y | 10Y | |

|---|---|---|---|---|---|---|---|---|

| const | 0.2180 *** | 0.2475 *** | 0.2651 *** | 0.2732 *** | 0.2786 *** | 0.2822 *** | 0.2737 *** | 0.2530 *** |

| l_RGDP | −0.0245 *** | −0.0263 *** | −0.0271 *** | −0.0274 *** | −0.0275 *** | −0.0273 *** | −0.0266 *** | −0.0253 *** |

| ld_ImEx | −0.0452 *** | −0.0463 *** | −0.0447 *** | −0.0431 *** | −0.0426 *** | −0.0416 *** | −0.0397 *** | −0.0374 *** |

| ld_Lab | 0.0115 *** | 0.0137 *** | 0.0149 *** | 0.0154 *** | 0.0149 *** | 0.0144 *** | 0.0138 *** | 0.0124 *** |

| ld_Cap | 0.0046 | −0.0026 | −0.0070 | −0.0096 ** | −0.0113 *** | −0.0131 *** | −0.0119 *** | −0.0081 ** |

| 3Y | 4Y | 5Y | 6Y | 7Y | 8Y | 9Y | 10Y | |

|---|---|---|---|---|---|---|---|---|

| const | 0.2902 *** | 0.3110 *** | 0.3083 *** | 0.3095 *** | 0.3133 *** | 0.3212 *** | 0.3188 *** | 0.3098 *** |

| l_RGDP | −0.0301 *** | −0.0314 *** | −0.0317 *** | −0.0318 *** | −0.0319 *** | −0.0319 *** | −0.0318 *** | −0.0302 *** |

| ld_ImEx | −0.0313 *** | −0.0352 *** | −0.0355 *** | −0.0341 *** | −0.0328 *** | −0.0325 *** | −0.0299 *** | −0.0272 *** |

| ld_Lab | 0.0150 ** | 0.0176 *** | 0.0186 *** | 0.0186 *** | 0.0179 *** | 0.0170 *** | 0.0159 *** | 0.0144 *** |

| ld_Cap | −0.0049 | −0.0102 | −0.0121 ** | −0.0130 *** | −0.0137 *** | −0.0150 *** | −0.0158 *** | −0.0146 *** |

| Def | 0.0012 | 0.0022 | 0.0018 | 0.0013 | 0.0002 | 0.0002 | −0.0004 | −0.008 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Blavasciunaite, D.; Garsviene, L.; Matuzeviciute, K. Trade Balance Effects on Economic Growth: Evidence from European Union Countries. Economies 2020, 8, 54. https://doi.org/10.3390/economies8030054

Blavasciunaite D, Garsviene L, Matuzeviciute K. Trade Balance Effects on Economic Growth: Evidence from European Union Countries. Economies. 2020; 8(3):54. https://doi.org/10.3390/economies8030054

Chicago/Turabian StyleBlavasciunaite, Deimante, Lina Garsviene, and Kristina Matuzeviciute. 2020. "Trade Balance Effects on Economic Growth: Evidence from European Union Countries" Economies 8, no. 3: 54. https://doi.org/10.3390/economies8030054