2. Literature Review

Prior to the 1990s, the managerial tradition of “the initiated elite” dominated among central banks of developed countries. The essence of it was to ensure that monetary policy strategists should say as little as possible and say it cryptically to support the general idea of the complexity and impossibility to formulate monetary policy ideas in accurate and clear words and sentences (

Brunner 1981).

Today, diametrically opposed management behaviors of central banks have become dominant. There exists clear awareness of the role of behavioral factors in generating long-term cycles in the financial assets markets and, therefore, understanding of the fact that greater openness might actually improve the efficiency of the monetary policy. A more open central bank creates expectations by providing the markets with more detailed, available, and understandable information about its own view of the fundamental factors that influence monetary policy in general and exchange rates in particular. Becoming more predictable for the markets, the central bank, in fact, forms their reaction to its monetary policy. This makes it possible to improve the management of the national economy. Thus, the art of managing expectations is becoming an essential characteristic of the central bank’s communication strategy now (

Woodford 2001).

Long-term expectations are formed by fundamental indicators of development of various sectors of the national economy. But the perception of these indicators by different market participants may differ significantly from completely rational, being under the influence of differences in education, psychology, or risk aversion etc.

Individual peculiarities of the perception of macro-level financial and economic data overlap collective behavioral aspects. The most well-known of these include the self-fulfilling forecast, also known as the theory of reflexivity (

Merton 1948;

Soros 1999).

It is necessary to emphasize the presence of permanent bilateral (reflexive) connections between the cause and effect, and between the expectations and behavior of those who are expecting. Events influence each other and can also reproduce themselves. Ideal examples of reflexivity are financial “soap bubbles”, as well as panics and crashes (

Minsky 1986;

Kindleberger and Aliber 2005).

Excessive volatility in the foreign exchange and other types of financial markets is additional proof of the inefficiency (irrationality) of these markets, and the presence of a significant proportion of information noise in their members’ expectations. Therefore, when market participants can correctly predict actions of the central bank due to its recent communications, they begin making better decisions. Further, volatility, including exchange rate volatility, decreases significantly, and becomes more predictable and manageable (

Poole 2001).

In the literature on development of the central bank’s communication strategy, we can single out a clear emphasis of the fact that relevant communication has a dual function: on the one hand, it gives signals about confident information of the central bank, but on the other, it serves as a tool of over-persuasion of economic agents and influence on their decision-making (

Amato et al. 2002).

According to the Nobel Laureate in economics D. Kahneman, there are certain limitations of how much information could be effectively processed by market participants (

Kahneman 2003).

In practice, many central banks limit their communication. Usually, the internal discussions of the central bank’s board are kept secret. This is because there is a threat that too many fragmented voices are more likely to confuse, rather than enlighten, the market participants, especially when contradictory statements appear. Inconsistent group communication reduces the value of the “signal-to-noise” ratio (

Blinder 2004).

While theoretical literature does not give clear answers about the optimal level of transparency of the central banks’ communication strategy, the study of their actual communication leads to the preliminary conclusion that a range of views on what the “optimal” level and types of communication are, is developing over time towards greater openness (

Ehrmann and Fratzscher 2009).

In the literature that analyzes the practice of central bank’s communications, communication vector is typically analyzed according to the subject matter and the addressees (

Issing 2005).

According to the subject matter, central banks communicate at least four different aspects of monetary policy:

- -

General strategic objectives;

- -

Reasons for specific decisions on monetary policy;

- -

The prospects for the economy (review of the existing conditions and forecasts);

- -

Future decisions on monetary policy.

General strategic objectives (targets) are formed by the central bank independently, or are formulated by the government. However, as in the first and second versions, they usually are: achieving the potential level of Gross Domestic Product (GDP), inflation rate, and employment rate.

Central banks typically spend far more resources than private sector forecasters on forecasting and assessment of the state of various sectors of the national economy and their impact on the dynamics of various financial assets, including the exchange rate of national currencies. Various studies have shown that financial markets in developed countries are very sensitive to information about the perspectives provided by central banks. At the same time, trust in these economic announcements depends on the quality of previous projected targets of the central bank, and on its ability to identify trends and events before they become apparent to the vast majority of the market participants (

Andersson et al. 2006).

After the transition to a floating exchange rate was announced in February 2014, the National Bank of Ukraine (NBU) inevitably faces a problem of pro-cyclical and countercyclical management of the exchange rate dynamics. Synthesis of scientific research in behavioral finance gives grounds to assert that behavioral factors in particular, and not fundamental ones, influence the currency cycles formation. However, the behavioral and fundamental exchange rate factors should be considered as a close relationship, because everything that the NBU is not able to explain by the influence of fundamental indicators is formed by behavioral (often irrational) factors. Moreover, the experience of countries where the exchange rate regime has remained floating over the last few decades shows that the exchange rate can deviate from its fundamentally justified values over a long period of time (

Harvey 2009).

The results of the majority of empirical studies of exchange rate volatility on different time horizons evidence that in the short-term, and even medium-term, perspective, the actual exchange rate dynamics can diverge from its fundamentally justified equilibrium levels. This is due to the influence of behavioral factors. However, theory and practice proved that in the long-term perspective, the exchange rate tends to its fundamental level (

Priewe 2014).

4. Empirical Results and Discussion

One of the main questions, on which we are trying to shed light in this article, relates to issues about which should the NBU communicate with the market participants, considering those specific external and internal conditions, in which Ukraine is and depends on today.

The vector of the central bank’s communication signals takes different forms at different times and under different conditions. In other words, communication should take into account the situation in and specificity of a particular country.

In the context of general strategic objectives, it is worth mentioning that Ukraine needs to essentially modernize the approach of developing basic principles of the monetary policy, which actually determine relevant strategic objectives in our country. Disadvantages of the existing in Ukraine approach are:

- -

Absence of clear and constant objectives;

- -

Lack of strategic approaches to monetary policy;

- -

Communication difficulties;

- -

Overloaded and duplicated information.

It should be mentioned that a partial response to the abovementioned drawbacks is in the new Monetary Policy Strategy for 2016–2020. The main feature of the document is that it is clearly defined: the purpose of introducing inflation targeting; period of transition to the specified regime; medium-term quantitative inflation targets; mechanisms of achieving constant inflation targets; and strategic directions of the monetary communication (

National Bank of Ukraine 2015e).

The new Monetary Policy Strategy of Ukraine is focused on the protection of the purchasing power of the national currency by maintaining stable inflation rate (consumer price index) in the medium-term perspective. In other words, the stated purpose concerns only the internal value of the national currency and is not related to its external value, i.e., the hryvnia exchange rate. However, the exchange rate is also mentioned in the Strategy—in particular, one of the basic principles of the monetary policy in Ukraine is a floating exchange rate regime. It should be mentioned that the hryvnia exchange rate would be largely determined by market conditions without fixing its desired or forecasted value in advance. However, in case of need, the Strategy provides for the possibility of the NBU’s interventions in the foreign exchange market to increase international reserves up to an adequate level, smooth out excessive exchange rate fluctuations, and to maintain the key interest rate as the main tool of the monetary policy. However, quantitative indicators of the exchange rate level will not be fixed. According to the new monetary policy regime, the exchange rate will change its role from a monetary policy tool, to that of the monetary policy transmission indicator.

Monitoring of changes in exchange rates will remain important for fixing the key interest rate, as the exchange rate channel is currently the most powerful in the Ukraine’s transmission monetary mechanism.

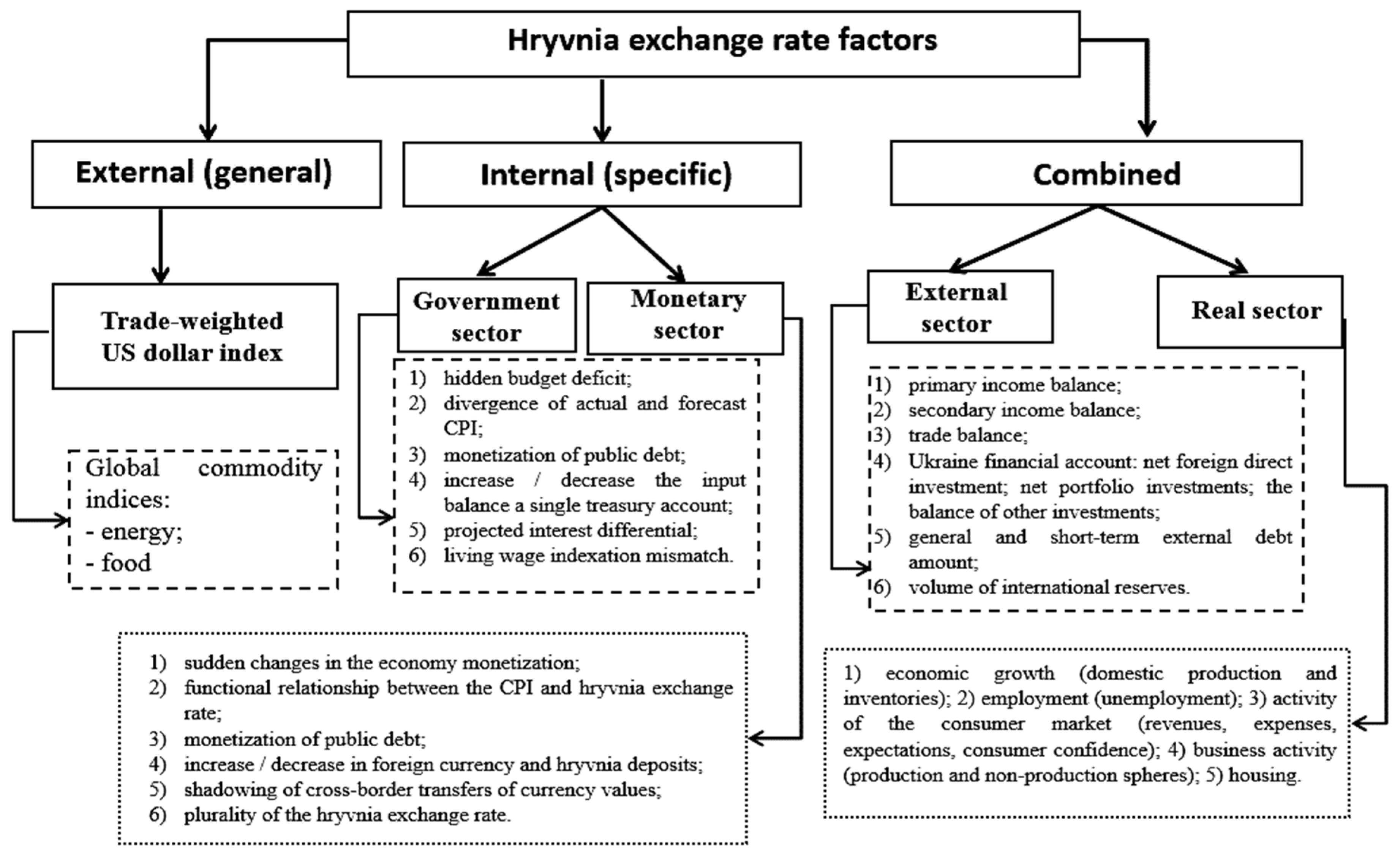

One of the preliminary results of our analysis of peculiarities of the exchange rate arrangement in Ukraine was the selection of three groups from a set of factors of the hryvnia exchange rate formation. Components of these groups are shown in

Figure 1.

Conceptually, behavioral finance finds the causes of the national currency exchange rate dynamics in market participants’ expectations of its future values. Therefore, the main object of the NBU study in the context of the impact on exchange rate expectations should be specific factors of formation of these expectations.

On the basis of systematization and consideration of external, internal, and combined (including behavioral) factors of the hryvnia ER, we suggest a model for forecasting fundamentally justified exchange rate of the national currency. This model is based on the assumption that the dynamics of the exchange rate are well approximated by a normal distribution and correlate with the dynamics of basic indicators of development in various sectors of the national economy. This approach involves consideration of the fact that in any time period, any national basic indicators may not depend on the changes in the global situation, or depend on it completely or partially.

An important component of the model is an indicator of the level of the macroeconomic indicators sensitivity and hryvnia exchange rate to changes in the external environment (external price shocks). In our opinion, the level of this sensitivity should be computed with respect to a particular global reference point (benchmark), which should be representative exponent of the changes in the global financial and economic environment. We suggest to consider the trade-weighted US dollar index as a global benchmark (the reasons for such proposals are disclosed hereinafter in this article). Given this approach, the model will be as such:

where

is the actual nominal exchange rate of hryvnia in time period

t;

is hryvnia exchange rate expected by the Ukrainian foreign exchange market participants in the time period

t;

is change of the hryvnia exchange rate, which depends on changes of individual national basic indicators and does not depend on changes of global pricing conditions in the time period

t;

is coefficient of the sensitivity of the hryvnia exchange rate to external price shocks (changes in the global pricing conditions) in the time period

t;

-US dollar index is a benchmark of changes in global pricing conditions;

is the residual term associated with unexpected events that affect particular fundamental indicator of a particular sector of the national economy in the relevant time period

t.

We believe that our decision is justified, as it is associated with the need to base the modeling process on the exchange correlation of hryvnia to those foreign currencies, whose share in external payments, domestic foreign exchange operations, and international reserves is the largest. Therefore, changes nominal and real effective exchange rate most significantly. For Ukraine at the current stage, this is the US dollar (as of the end of 2015, 76% of international reserves of Ukraine are in US dollars and/or US government securities). Additional arguments in favor of the chosen model benchmark are presented further in the text of this article.

An important condition for the feasibility of the model described above is adequate information support for forecasting of the fundamentally justified hryvnia exchange rate. Specified information support should be developed in the context of a systematic study of aggregate of macroeconomic indicators. Relevant fundamental (macroeconomic) indicators should be grouped by sectors, types of economic activities, as well as with consideration of general economic evaluative characteristics. In order to reflect a broad spectrum of aggregated economic activity of business units. After the grouping, it is important to determine the strength (closeness) of the relationship between indicators of each group and the exchange rate of the hryvnia. The next iteration of forecasting process should be the formulation of a multiple regression equation in the context of each of the respective groups, as well as the integral (synthetic) equation of multiple regression, the components of which are the most significant variables (macroeconomic indicators) of each functional group.

It makes sense to develop and improve information support for forecasting the fundamental value of the national currency only when the country’s Central Bank has introduced a floating exchange rate regime (in Ukraine until February 2014, the ER was de facto fixed with periodic sharp devaluation or revaluation waves). The current regime refers to “dirty” administratively regulated floating).

A complex action plan designed for implementation in the program of Ukrainian financial sector development until 2020, provides for the need of establishing a system of indicators (benchmarks) of the local foreign exchange and money markets. Given this, and the recent declaration of the new hryvnia exchange rate regime, we decided to take the best world experience of collecting, analyzing, and generalizing those macroeconomic indicators which are the factors of the fundamental value of the US dollar as a basis for the development of such a system of indicators. We also used this to demonstrate our own approach to the synthetic forecasting of dynamics of a specified value using the group multiple regressions and their integral consolidation. We suggest considering specified experience and ways of its possible application in Ukraine to analyze the fundamental value of hryvnia-this is the essence of the answer to one of the objectives of this article.

According to the results of the systematization of macro indicators that affect the projected dynamics of the global benchmark exchange rate (US dollar index), we have selected 105 indicators, which were later collected into 11 groups. On the next iteration of the forecasting process of, we found the most important predictors on the results of the regression equations formulation within each of the 11 abovementioned groups. The final iteration of this process was the formation of the integral (synthetic) multiple regression equation; the components of which are the most significant variables (macroeconomic indicators) for each group equation.

Data, selected to formulate group and integral equations of multiple regression for forecasting fundamentally justified value of the US dollar index, is totally representative, as it covers monthly sampled data from 1971 up to and including 2014 (516 levels of freedom).

The integral multiple regression equation for the trade-weighted US dollar index formulated by us allows to make a conclusion that from the totality of the analyzed quantitative group macro indicators, seven of them appeared to be significant predictors of the US dollar index dynamics. Relevant prognostic regression equation looks as such:

Evaluation of the parameters of the above equation gives ground to argue with 95% probability that, with the growth of average hourly wages (AHE) on $ 1 US dollar, the US dollar index will increase at least by 11.7 and up to 18.7 index points; with the growth of prices for purchased homes in the framework of mortgage lending by 1%, the US dollar index will increase at least up to 0.96 and up to 3.98 points; with growth of expenditures on personal consumption (PCE) by 1 index point, the US dollar index will decrease at least by 4.1 and up to 6.1 points; with increasing inflation expectations index (IE) by 1 point, the US dollar index will decrease at least by 3.1 and up to 5.7 points; with an increase of the unemployment rate (UR) by 1%, the US dollar index will decrease at least by 3.2 and up to 4.6 points; with the increase of inventories in warehouses of wholesalers (WI) by 1%, the US dollar index will decline at least by 1.2 and up to 3.3 points; and with growth of the average weighted rate for federal funds (EFFR) by 1%, the dollar index will decline at least by 0.6 and up to 1.9 points.

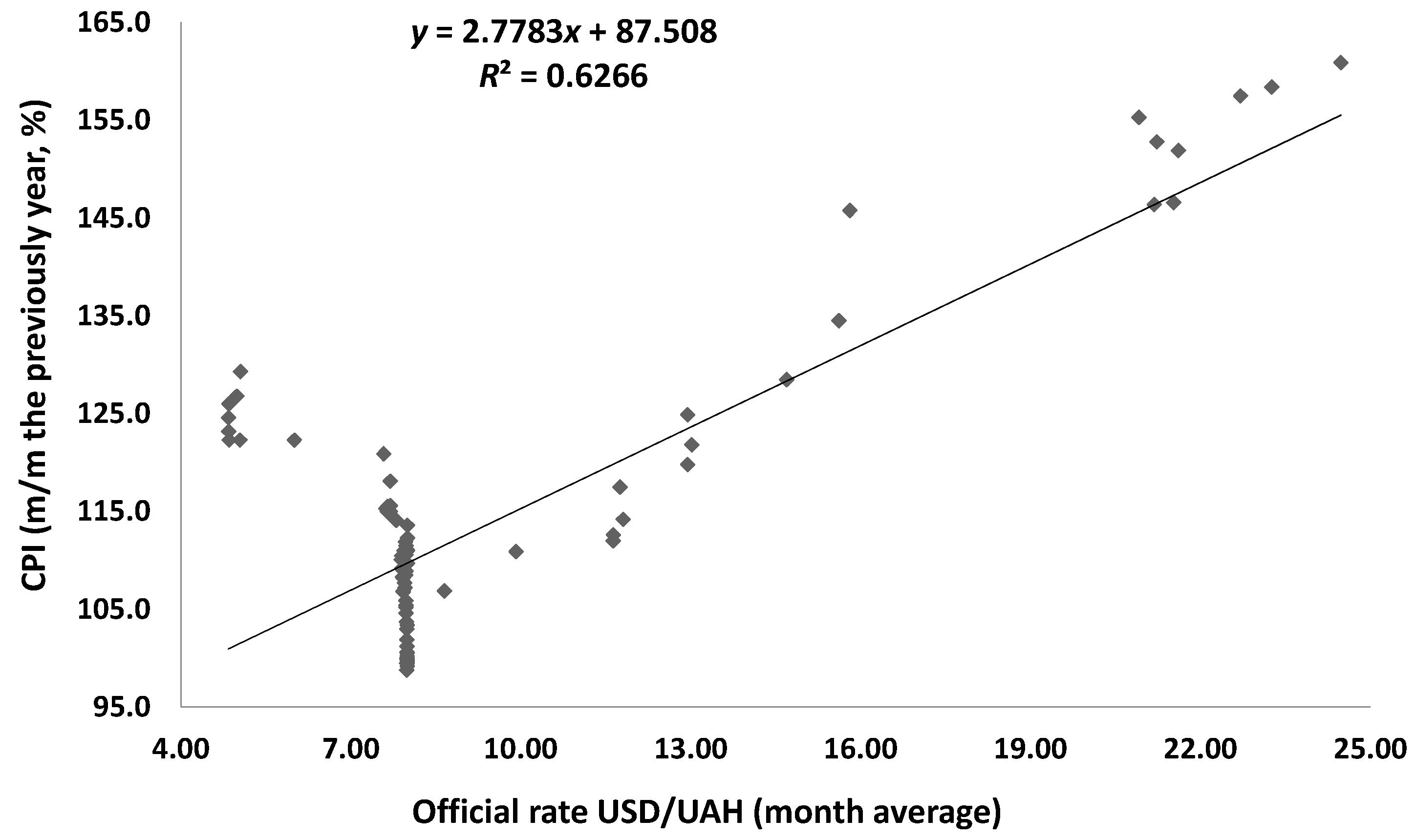

The results of our calculations shown in

Figure 2 and

Figure 3, indicate that the official hryvnia exchange rate and inflation (Consumer Price Index-CPI) are tightly linked in Ukraine. Moreover, today, after the transition to the regime of “dirty” (administratively regulated) floating (since February 2014), the mentioned link, taken with the two-months lag with regard to price reactions to the changes in exchange rates, became almost functional (95, 3% of the inflation volatility is caused by devaluation of the hryvnia exchange rate against the US dollar).

From the above regression equations (see

Figure 3), we can conclude that devaluation of the national currency exchange rate by one hryvnia against the US dollar is accompanied by average growth rate of consumer inflation in Ukraine at the level of 3.6 percent.

Considering the analysis outlined above, we can say that the price channel is one of the major channels, in the context of the hryvnia exchange rate influence on economic processes. Therefore, attempting to regulate the exchange rate through its fixation to stabilize prices is, at first glance, the simplest and the most obvious solution. Following on from the evidence of inflationary effects of the national currency devaluation in the countries with a high proportion of dependence on imports, many domestic scholars tend to focus on different forms of fixing the hryvnia exchange rate, analyzing the advantages and disadvantages of relevant exchange rate policies of the monetary regulator (

Petryk 2007;

Skrypnyk and Varvarenko 2007).

The effects of transferring changes in currency exchange rates on inflation were analyzed by Ukrainian scientists, not only in the context of devaluation, but also with consideration of periods of hryvnia revaluation. The results of the studies indicate that these effects differ seriously-prices in Ukraine reacted significantly to the devaluation of hryvnia and remained virtually unchanged during the hryvnia revaluation (

Bereslavska 2006,

2007).

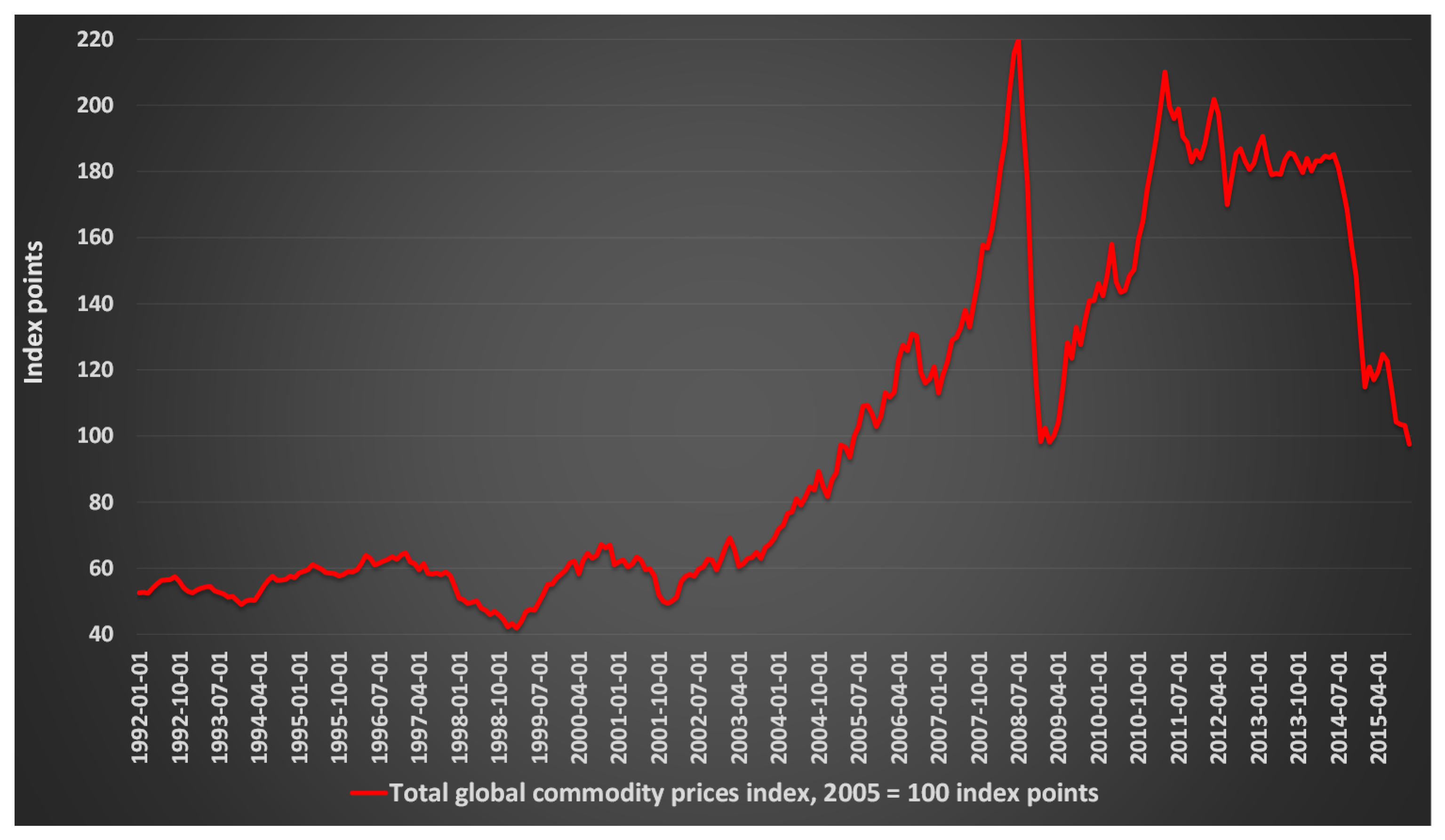

In our view, the increase of global inflation from November 2001 to June 2008 (

Figure 4) was crucial to rethinking the role of the fixed exchange rate regimes as an anti-inflation policy anchor factor in Ukraine.

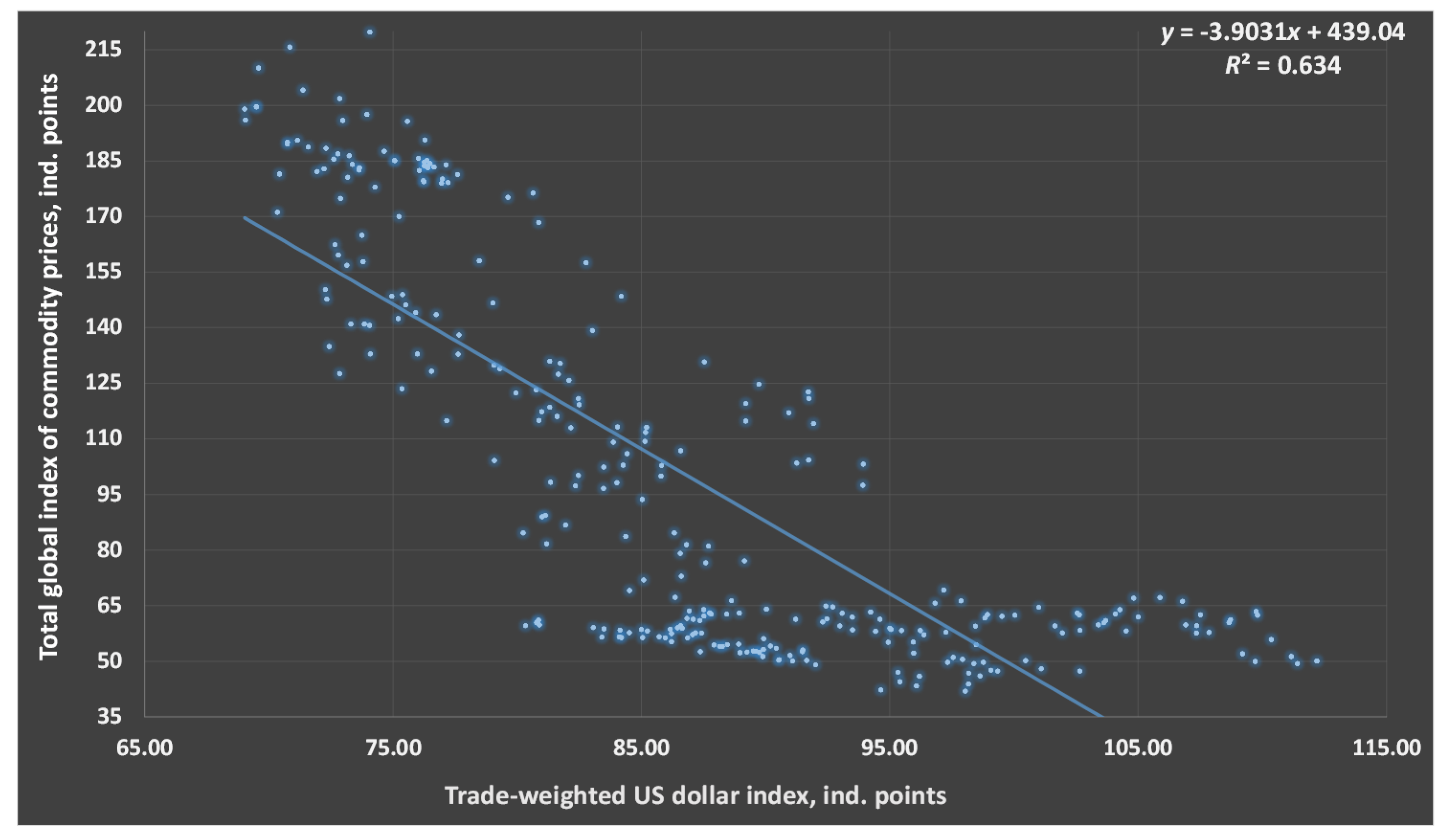

In addition, we have found out that there is a significant inverse relationship between the dynamics of global commodity index and trade-weighted US dollar index (

Figure 5).

We can draw the conclusion from

Figure 5 that with the growth of the trade-weighted US dollar index by one index point, the overall global commodity index decreased by 3.9 index points. Thus, we can state that the US dollar revaluation results in lower prices of goods exported by Ukraine. This causes a significant decrease in revenues of Ukrainian commodity exports, formation of additional demand for deficient freely convertible currency (US dollar), reduction of state budget revenues under the conditions of practically constant or even increasing public expenditure, accelerating inflationary and devaluation processes, growth of the external debt in hryvnia terms and expenses on its servicing, collapsing banking system, etc.

The analysis given above enables to make an important preliminary conclusion that even the best central bank’s communication strategy, the best well-thought-out benchmarks and state monetary policy instruments, as well as floating exchange rate of the national currency, are not able to secure the small, open, resource-based Ukraine's economy from external price shocks.

A substantial increase in export earnings in Ukraine from November 2001 to June 2008, which was the result of the US dollar devaluation and price rise in world commodity markets, as well as the significant inflow of foreign capital, gave rise to the need for the NBU interventions to prevent significant revaluation of hryvnia. These interventions had adverse monetary effects-buying flows of export currency earnings, as well as incoming flows of currency, which came in through the financial account channel (direct, portfolio and other investments in Ukraine), the National Bank was gradually increasing its international reserves. However, with the growth of reserves, the monetization of the Ukrainian economy was also growing rapidly (monetary aggregate M2 to GDP), the level of which caused considerable devaluation pressure on hryvnia. The hryvnia devaluation with a slight time lag became another trigger unwinding the inflationary spiral in the dependence on Ukraine’s imports. Further evidence of our judgments is presented in

Figure 6.

Analysis of correlation and regression data shown in

Figure 6 allows observing the presence of a strong direct correlation between the indicators outlined above. Thus, 77% of dispersion of Ukraine’s economy monetization could be explained by the NBU’s unsterilized interventions, carried out to accumulate international reserves (selling hryvnia to purchase foreign currency without simultaneous sale of government securities from the NBU’s balance to balances at depository corporations). Under such conditions, increases of international reserves to USD 1 billion resulted in the growth of factor of the national economy monetization by 1.1%.

In turn, increasing monetization of the economy explains 74.6% of the dispersion of the hryvnia official exchange rate meanings against the US dollar. Growth of factor of the Ukrainian economy monetization by 1% results in devaluation of the official hryvnia exchange rate by 11 kopecks against the dollar.

Returning to the analysis of the new monetary policy strategy of Ukraine developed by NBU, it should be noted that its main disadvantages include is lack of specificity as to the way in which the National Bank of Ukraine will determine the “excessiveness” of the exchange rate fluctuations.

We suggest basing on the fundamental approach (determining and thorough analysis of the changes of the set of external, internal, and combined fundamental factors of the hryvnia exchange rate). This approach might be an essential contribution in terms of measuring normality and improving the NBU’s communication vector in the exchange rate area.

We agree that a well-fixed inflation targets help to stabilize the actual inflation by eliminating an important source of shocks to the economy. However, taking into account the described above specificity of Ukraine, inflation should be targeted by thoughtful and clear signals of the NBU regarding prospects of the exchange rate situation development and its counter-actions under different scenarios. In addition, we have empirically proved that unsterilized the NBU’s interventions to replenish international reserves are an important trigger of inflation-devaluation processes in Ukraine.

Implementation of international standards of communication of the world-leading central banks with economic agents and government, in the context of macro-forecasting, started in Ukraine in April 2015. It was then that the first Inflation Report of the NBU (for the first quarter of 2015) was published, the contents and structure of which disclose the most important information about the current state and forecasts of the national economy development for all stakeholders (

National Bank of Ukraine 2015b).

Attention is drawn to the structure of the Inflation Report in the context of external and internal environments in relation to the national economy and alternate analysis of external and internal factors that affect the performance of national accounts. These are analyzed and forecasted in the Inflation Report of the NBU.

Thus, already in its first Inflation Report, the NBU recognizes the dependence of prices on changes in the national currency nominal exchange rate against the US dollar and presents its own study of the effect of transferring ER UAH / USD on prices (exchange rate pass-through). The NBU states the fact that fluctuations of ER UAH / USD determine both the cost of imported goods and the cost of imported components and raw materials needed for production of domestic goods, and for the provision of domestic services. All these resulted in the NBU’s statement that knowledge of the level and time of the shock ER UAH / USD transfer on prices is crucial to assessment of the general transmission mechanism of monetary policy and effective forecasting (

National Bank of Ukraine 2015b).

In its second Inflation Report (June 2015), the National Bank of Ukraine again pays considerable attention to the relationship of devaluation-inflation processes. This time, the object of analysis is the impact of these processes on tax revenues of the Consolidated Budget of Ukraine, price competitiveness of Ukrainian goods on foreign markets, and the current account balance (

National Bank of Ukraine 2015d).

In the Inflation Reports for the third and fourth quarters 2015 and the first quarter 2016, the National Bank of Ukraine traditionally, in terms of the monetary sector analysis, characterizes the state of the Ukrainian foreign exchange market, emphasizes volumes, buying and selling of foreign currency in Ukraine and factors of changes in relevant trends. The NBU also describes the nature and objectives of its interventions in the foreign exchange market, and assesses their balance (

National Bank of Ukraine 2015c;

2016a,

2016b).

5. Conclusions

The role of fundamental factors of currency exchange rate increases in the turning points of the downward or upward trend. This is especially the case when values of some macroeconomic indicators reach their critical levels and the exchange rate of the national currency is perceived by most foreign exchange market participants as obviously overvalued (too revaluated) or as clearly undervalued (too devalued). At these particular points, formation of the “bubbles” or panic sales in the foreign exchange market are completed, causing the exchange rate reversal and its movement in the opposite direction. Thus, the main objective of the communication strategy of the NBU, in the context of the impact on exchange rate expectations, should be the constant reminding of participants of the national foreign exchange market about fundamentally justified level of the exchange rate, as well as about the significance of the deviation of the current level from the fundamentally equally-weighted of a particular time. In addition, the mission of the NBU’s “verbal interventions” should consider smoothing out excessive cyclical volatility of hryvnia exchange rate, which is increased by reflexive positive or negative expectations of economic agents. In other words, under extreme conditions, communication used to stabilize market expectations and guide the expectations should be the main tool of monetary policy.

The NBU’s optimal communication strategy should be in constant gradual growth of the factor “information signal / information noise”. However, carefully thought-out, smoothing (in regard to cyclical fluctuations) communication of the NBU should have a much lower “signal-to- noise” ratio at the time of data publications, rather than the same ratio generated by the release of completely confidential (insider) information.

At the present stage of development of the NBU’s institutional competency, the issue of intensity (depth) of its communication with economic agents remains quite disputable. The most striking example of this dilemma is the matter of expediency in disclosing the decision-making process, e.g., release of minutes and voting records (in Ukraine, this process is neither recorded nor disclosed). Note that instead of releasing the minutes, some central banks (e.g., European Central Bank) publish press releases and hold press conferences immediately after taking decisions about their policies (since 2015, the same practice has been implemented in Ukraine).

We believe that excessive intensity of communication will not be the best choice, as in the process of “verbal interventions” intensification errors might accumulate, because of the human factor. Moreover, any serious error or contradiction in announcements could significantly shake faith in the vector of the NBU’s information signals. Badly thought-out communication could do more harm than good, and it is not obvious that it would always be better for national economic agents if the NBU says more.

Besides, before each meeting of the National Bank of Ukraine on monetary policy issues, a certain period of secrecy should be kept, and in some cases before important announcements or reports. The expansion of such practices illustrates most central banks’ belief in the undesirability and harmfulness of communication in certain circumstances.

Considering the abovementioned, the NBU should be very cautious about communication on the issues on which it receives data in the environment of information noise (indices of performance of various sectors of the national economy). On the other hand, it should communicate more confidently and widely their future decisions on interest rates.

It should be emphasized that the central bank’s communication is not its obligation to market participants. Told by the central bank representatives, today should not limit its freedom of maneuverability tomorrow, or reduce the central bank’s operational flexibility, thereby preventing the timely and proper adjustment of the monetary policy. Communication of information to the market participants does not oblige the central bank to any future action or inactivity, but only hints at the possibility of relevant actions in case of favorable or unfavorable circumstances (conditional forecasts).

Our analysis gives reason to argue that despite the monetary regulator’s attempts to form and guide only inflation expectations in Ukraine, the national currency exchange rate plays an important role, in particular, impacting the devaluation-inflation expectations of economic agents significantly. A very significant behavioral guideline for the Ukrainian foreign exchange market is the US dollar dynamics, because of its role in global trends in prices on Ukrainian exports.

It is noticeable that in the analysis of the external environment, a significant role in inflation reports of the NBU is assigned to the US dollar and various commodity price indices (food, metals, and energy products) that on global financial markets are formed with reference to the US dollar. The National Bank of Ukraine acknowledges the predominance of contracts on the US dollar basis in international trade contracts of Ukraine, both in industrial and consumer goods. Considering all of these a separate analysis of the dynamics of nominal and real effective the US dollar exchange rate and the phenomenon of deposit dollarization (45.7%), loans (46.8%), public debt (44.4%), and international reserves (76%) in Ukraine is carried out. In addition, the hryvnia nominal exchange rate against the US dollar is laid in the basis of modeling the impact of exchange rate shock on the NBU prices.

We believe this approach of the NBU to be quite reasonable, since the formation of the exchange rate and inflation expectations is impossible without reliance on exchange rate between the hryvnia and that foreign currency. This share in the foreign payments, internal foreign exchange transactions, and international reserves is the largest one that, accordingly, changes nominal and real effective exchange rates most significantly.

In our view, adhering to a flexible exchange rate regime, the NBU should carefully apply the traditional tools of bank liquidity regulation skillfully, and this information according to the results of its decisions taken on monetary policy. These tools help smooth out excessive exchange rate fluctuations by removing (sterilizing) excessive liquidity from the banking system. Without timely removal, the excessive hryvnia liquidity becomes an additional factor in demand for foreign currency (hryvnia devaluation).

Communication strategy is not limited to the topics defined by us as it should be dynamic, adaptive, and should evolve with the development of the financial sector of Ukraine. In our opinion, vector of the NBU information signals considering the national financial sector development should concentrate on:

- -

completion of refinement of the banking system from schematic, problem, and captive banks with opaque structure of ownership;

- -

development of the market yield curve for government debt instruments;

- -

introduction of the Ukrainian Index of Interbank Rates (UIIR);

- -

development of the primary and secondary securities markets;

- -

development of the derivatives market;

- -

gradual liberalization of capital movements.

We believe that it is impossible to evaluate the effectiveness of the NBU communication vector in Ukraine in the context of the impact on monetary and exchange rate expectations without a developed financial sector, and without financial markets with a wide range of tools. Adequate and proactive econometric evaluation of the impact of the NBU signals on these expectations of the financial markets participants could be done only with use of high-frequency data from financial markets.

Another alternative evaluation of the NBU communications is the use of low-frequency data on the system of macroeconomic indicators. This alternative is a more appropriate task for Ukraine at the present stage of its financial sector development. However, even here there are many challenges associated with the fact that in order to properly evaluate something, you need to create information support for these estimates.

Speaking about the impact on monetary and exchange rate expectations, the crucial role of fundamental factors of the exchange rate should be pointed out. Constant reminding of the national foreign exchange market participants of the fundamentally justified level of the exchange rate, as well as about the deviation significance of the actual rate of the national currency from its fundamental-equilibrium level as of given time, should become an integral part of the NBU communication with regard of the outlined above depreciation-inflation relationships.

While forming a strategy of influencing the exchange rate expectations of the participants of the foreign exchange market of Ukraine, the NBU should additionally consider as a natural the fact that economic agents make decisions while being asymmetrically informed. In turn, the asymmetry in information awareness arises from incomplete or unclear disclosure and individual specific perception of information published by the country's central bank. It should also be taken into account that economic agents tend to collective patterns of behavior.

A set of factors on which exchange rate expectations are formed is not usually fixed in the public consciousness. Different participants of the foreign exchange market independently determine those indicators that shape their decisions and those that might be ignored.