Does Financial Development Drive Private Investment in Ghana?

Abstract

:1. Introduction

2. Financial Development (FD) and Private Investment: A Brief Review

3. Methodological Framework

3.1. Proxy Measures and Data

3.2. Estimation Strategy

The Private Investment Model

4. Empirical Results and Discussion

4.1. Unit Root Test Results

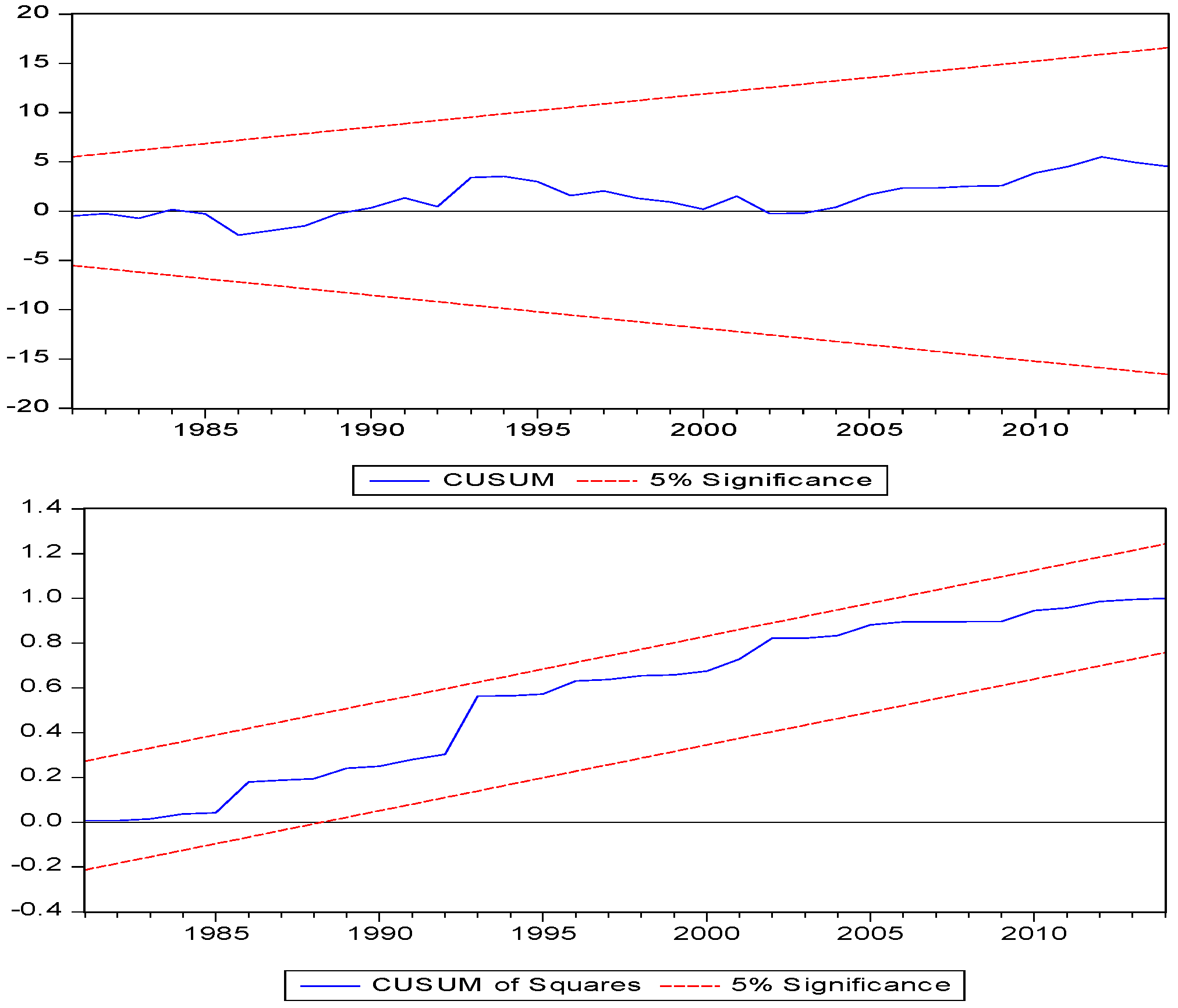

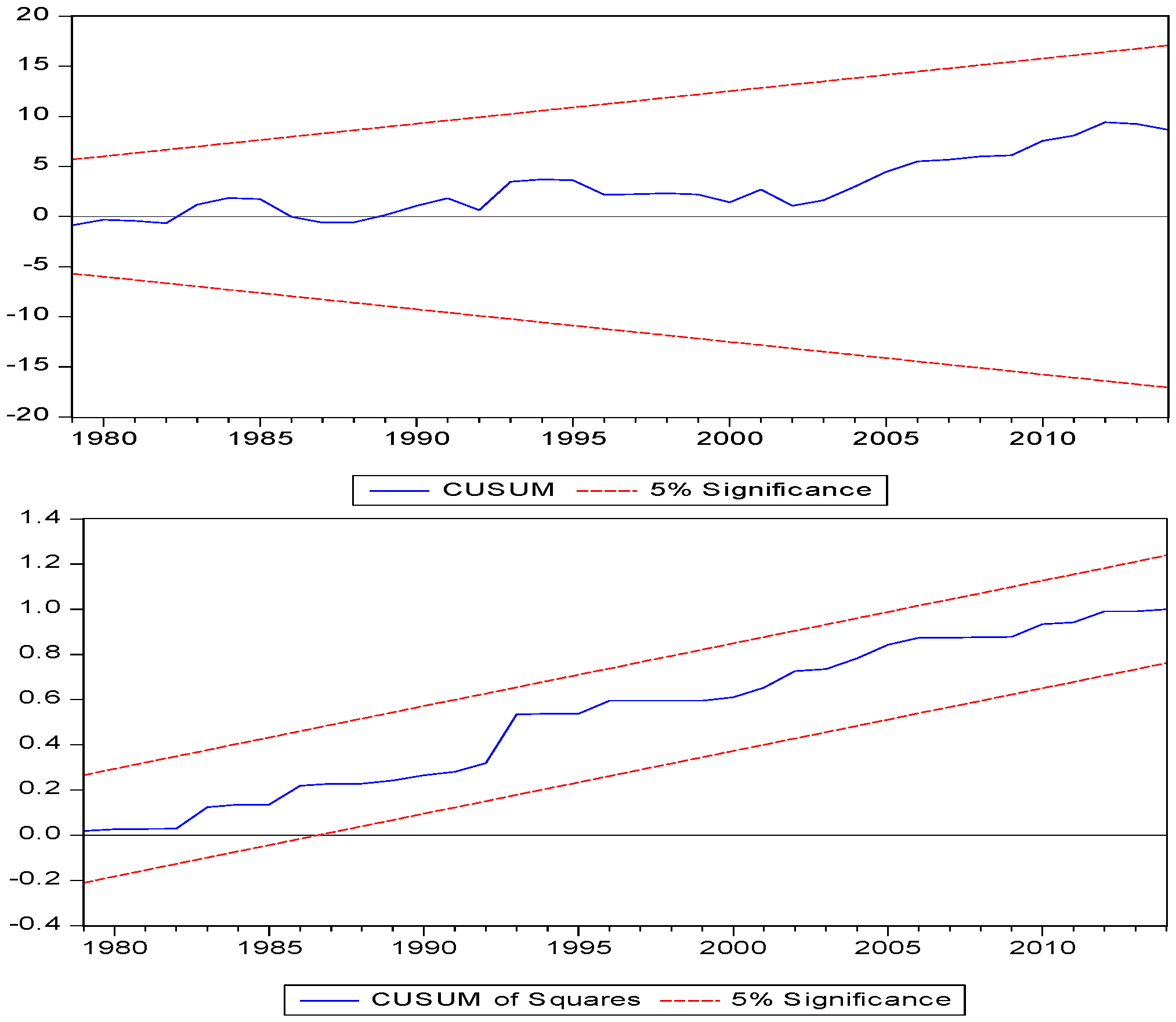

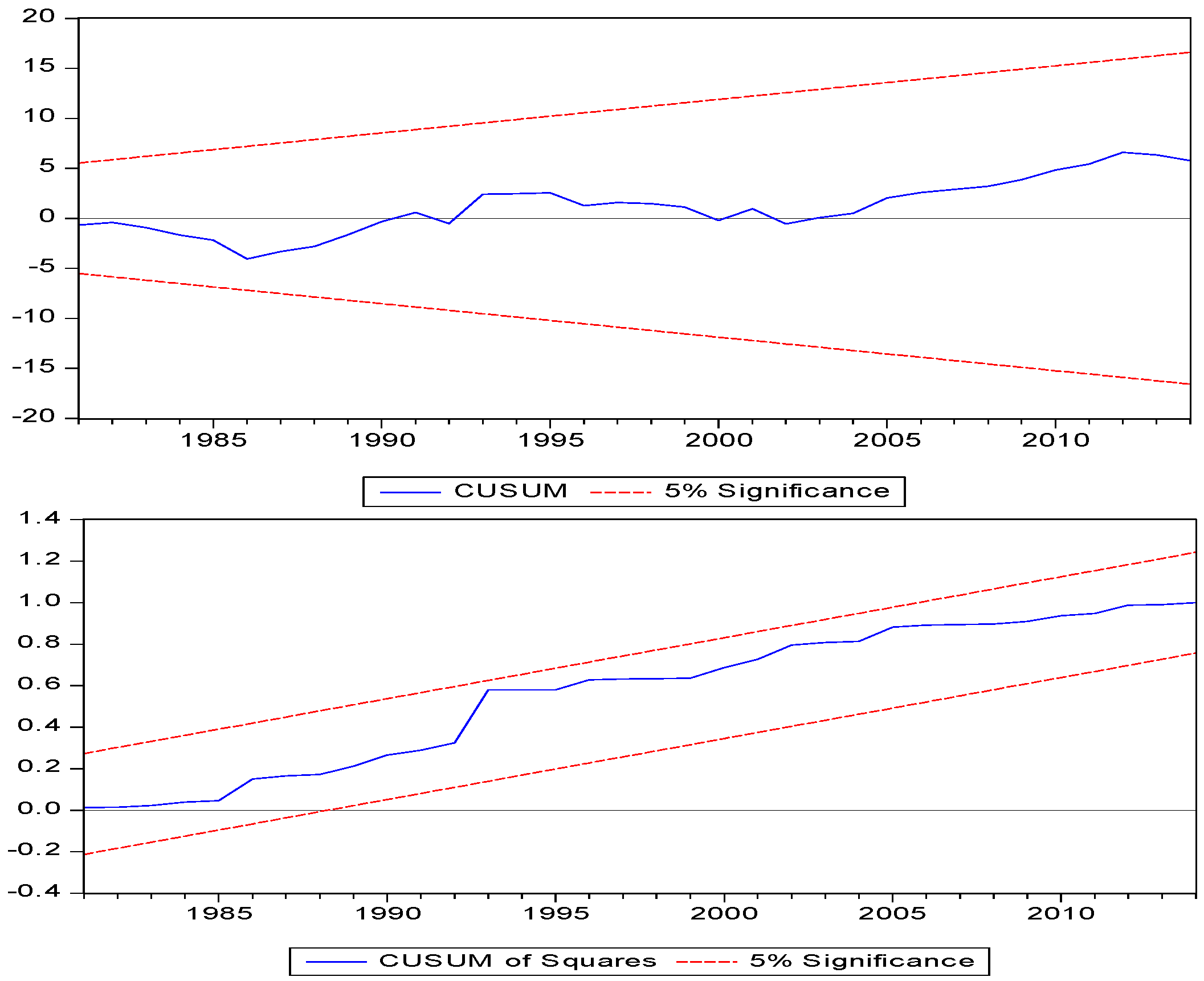

4.2. ARDL Bounds Test and Long Run and Short Run Results

5. Conclusions

Author Contributions

Conflicts of Interest

Appendix

References

- M.S. Khan, and C.M. Reinhart. “Private Investment and Economic Growth in Developing Countries.” World Dev. 18 (1990): 1. [Google Scholar] [CrossRef]

- A. Hoeffler. “Openness, Investment and Growth.” J. Afr. Econ. 10 (2002): 470–497. [Google Scholar] [CrossRef]

- S. Frimpong, and A.M. Adam. “Does financial Sector Development cause investment and growth? Empirical analysis of the case of Ghana.” J. Bus. Enterp. Dev. 2 (2010): 67–84. [Google Scholar]

- R. Coutinho, and G. Gallo. “Do Public and Private Investment Stand in Each Other’s Way. World Development Report background paper, mimeo. World Bank Washington, D.C. Cross-Country Empirical Investigation.” Appl. Econ. 32 (1991): 1819–1829. [Google Scholar]

- L. Serven, and A. Solimano. Private Investment and Macroeconomic Adjustment: Theory, Country Experience and Policy Implications. Washington, DC, USA: World Bank, 1990. [Google Scholar]

- B. Ouattara. Modelling the Long Run Determinants of Private Investment in Senegal. Nottingham, UK: University of Nottingham, 2004. [Google Scholar]

- Y. Huang. Private Investment and Financial Development in a Globalized World. Cambridge, UK: Department of Land Economy, University of Cambridge, 2010. [Google Scholar]

- R. Mckinnon. Money and Capital in Economic Development. Washington, DC, USA: Brookings Institution, 1973. [Google Scholar]

- E. Shaw. Financial Deepening in Economic Development. New York, NY, USA: Oxford University Press, 1973. [Google Scholar]

- A. Singh. “Financial Liberalization, Stock Markets and Economic Development.” Econ. J. 107 (1997): 77–182. [Google Scholar] [CrossRef]

- W. Van. “Interest Rate Management in LDC’s.” J. Mon. Econ. 12 (1983): 433–452. [Google Scholar]

- L. Taylor. Structuralist Macroeconomics: Applicable Models for the Third World. New York, NY, USA: Basic Books, Inc., 1983. [Google Scholar]

- R. Lensink. “The Allocative Efficiency of the Formal versus the Informal Financial Sector.” Appl. Econ. Lett. 3 (1996): 163–165. [Google Scholar] [CrossRef]

- P. Burkett, and A.K. Dutt. “Interest Rate Policy, Effective Demand and Growth in LDCs.” Int. Rev. Appl. Econ. 5 (1991): 127–154. [Google Scholar]

- E. Aryeetey, M. Nissanke, and W.F. Steel. “Intervention and liberalization: Changing policies and performance in the financial sector.” In Economic Reforms in Ghana: The Miracle and the Mirage. Edited by E. Aryeetey, J. Harrigane and M. Nissanke. Oxford, UK: James Currey and Woeli Publishers, 2000. [Google Scholar]

- M. Bawumia. Monetary Policy and Financial Sector Reform in Africa: Ghana’s Experience. Accra, Ghana: Combert Impressions Ghana Ltd., 2010. [Google Scholar]

- E. Asare. “The impact of financial liberalization on private investment in Ghana.” Int. J. Bus. Financ. Res. 7 (2013): 77–90. [Google Scholar]

- F. Naa-Idar, D.T. Ayentimi, and M.J. Frimpong. “A Time Series Analysis of Determinants of Private Investment in Ghana (1960–2010).” J. Econ. Sustain. Dev. 3 (2012): 13. [Google Scholar]

- Y. Asante. Determinants of Private Investment Behaviour. Nairobi, Kenya: African Economic Research Consortium (AERC), 2000. [Google Scholar]

- S.B. Ibrahim. “Modelling the Determinants of Private Investment in Ghana.” Afr. Financ. J. 2 (2000): 15–39. [Google Scholar]

- W. Akpalu. “Modelling Private Investment in Ghana: An Empirical Time Series Econometrics Investigation (1970–1994).” Oguaa J. Soc. Sci. 4 (2002): 186–194. [Google Scholar]

- J.M. Frimpong, and G. Marbuah. “The Determinants of Private Sector Investment in Ghana: An ARDL Approach.” Eur. J. Soc. Sci. 15 (2010): 2. [Google Scholar]

- M.E. Eshun, G. Adu, and E. Buabeng. “Financial Determinants of Private Investment in Ghana.” Int. J. Financ. Econ. 3 (2014): 25–40. [Google Scholar]

- J.M. Keynes. The General Theory Employment, Interest and Money. London, UK: Macmillan, 1936. [Google Scholar]

- J. Tobin. “A General Equilibrium Approach to Monetary Theory.” J. Mon. Cred. Bank. 1 (1969): 15–29. [Google Scholar] [CrossRef]

- D.W. Jorgenson. “Econometric Studies of Investment Behaviour: A Survey.” J. Econ. Lit. 9 (1971): 1111–1147. [Google Scholar]

- R. Pindyck. “Irreversibility, Uncertainty and Investment.” J. Econ. Lit. 29 (1991): 1110–1152. [Google Scholar]

- A. Dixit, and R. Pindyck. Investment under Uncertainty. Princeton, NJ, USA: Princeton University Press, 1994. [Google Scholar]

- World Economic Forum (WEF). The Financial Development Report, 2012. New York, NY, USA: World Economic Forum USA Inc., 2012. [Google Scholar]

- J. Greenwood, and B. Jovanovich. “Financial Development, Growth, and the Distribution of Income.” J. Pol. Econ. 98 (1990): 1076–1107. [Google Scholar] [CrossRef]

- B. Fowowe. “Financial Sector Reforms and Private Investment in Sub-Saharan African Countries.” J. Econ. Dev. 36 (2011): 3. [Google Scholar]

- D.W. Diamond. “Financial intermediation and delegated monitoring.” Rev. Econ. Stud. 51 (1984): 393–414. [Google Scholar] [CrossRef]

- D.W. Diamond, and P. Dybvig. “Bank runs, deposit insurance and liquidity.” J. Pol. Econ. 91 (1983): 401–419. [Google Scholar] [CrossRef]

- V.R. Bencivenga, and B.D. Smith. “Financial intermediation and endogenous growth.” Rev. Econ. Stud. 58 (1991): 195–209. [Google Scholar] [CrossRef]

- J. Greenwood, and B.D. Smith. “Financial markets in development, and the development of financial markets.” J. Econ. Dyn. Control 21 (1997): 145–181. [Google Scholar] [CrossRef]

- N.G. Mbanga. “External debt and private investment in Cameroon.” Afr. J. Econ. Pol. 9 (2002): 109–125. [Google Scholar] [CrossRef]

- L. Ndikumana. “Financial Determinants of Domestic Investment in Sub-Saharan Africa: Evidence from Panel Data.” World Dev. 28 (2000): 381–400. [Google Scholar] [CrossRef]

- O. Ucan, and O. Ozturk. “Financial Determinants of Investment for Turkey.” J. Econ. Soc. Stud. 1 (2011): 83–109. [Google Scholar] [CrossRef]

- T.W. Oshikoya. “Interest Rate Liberalization, Savings, Investment and Growth: The Case of Kenya.” Sav. Dev. 16 (1992): 305–320. [Google Scholar]

- J.B. Ang. “Private Investment and Financial Sector Policies in India and Malaysia.” World Dev. 37 (2009): 1261–1273. [Google Scholar] [CrossRef] [Green Version]

- M.A. Khan. “Financial Development and Economic Growth in Pakistan: Evidence Based on Autoregressive Distributed Lag (ARDL) Approach.” South Asia Econ. J. 9 (2008): 375–391. [Google Scholar] [CrossRef]

- R.G. King, and R. Levine. “Finance, Entrepreneurship and Growth.” J. Mon. Econ. 32 (1993): 30–71. [Google Scholar] [CrossRef]

- H.P.B. Moshi, and A.A.L. Kilindo. The Impact of Government Policy on Macroeconomic Variables: A Case Study of Private Investment in Tanzania. Nairobi, Kenya: African Economic Research Consortium, 1999. [Google Scholar]

- R. Levine, N. Loayza, and T. Beck. “Financial Intermediation and Growth: Causality and Causes.” J. Mon. Econ. 46 (2000): 31–77. [Google Scholar] [CrossRef]

- S.K. Lenka. “Measuring financial development in India: A PCA approach.” Theor. Appl. Econ. 1 (2015): 187–198. [Google Scholar]

- P.O. Demetriades, and K.A. Hussein. “Does financial development cause economic growth? Time-series evidence from 16 countries.” J. Dev. Econ. 51 (1996): 387–411. [Google Scholar] [CrossRef]

- R.G. King, and R. Levine. “Finance and Growth: Schumpeter Might be Right.” Q. J. Econ. 108 (1993): 717–737. [Google Scholar] [CrossRef]

- M.J. Fry. “In Favour of Financial Liberalization.” Econ. J. 107 (1997): 754–770. [Google Scholar] [CrossRef]

- World Bank. World Development Report 1989. New York, NY, USA: Oxford University Press, 1989. [Google Scholar]

- L. Serven. Real Exchange Rate Uncertainty and Private Investment in Developing Countries. Domestic Finance Working Paper 2823; Washington, DC, USA: World Bank, 2002. [Google Scholar]

- 1Asante (2000) [19], Akpalu (2002) [21], Frimpong and Marbuah (2010) [22] and Asare (2013) [17] use only one indicator of financial development, i.e., credit to the private sector (as percent of GDP). Frimpong and Adam (2010) [3] use three measures of financial development, i.e., credit to private sector, bank liquid reserves to bank assets ratio and liquid liability to GDP ratio. Eshun et al. (2014) [23] include credit to private sector and money supply as measures of financial development.

- 2See the Financial Development Report, 2012 [29], published by the World Economic Forum for full details on composition (or pillars) of financial development.

| Variables | ADF | PP | ||||||

|---|---|---|---|---|---|---|---|---|

| Levels | 1st Difference | Levels | 1st Difference | |||||

| C | CT | C | CT | C | CT | C | CT | |

| PI | −1.424 | −3.705 ** | −8.259 *** | −6.408 *** | −1.143 | −3.566 ** | −11.225 *** | 15.394 *** |

| PUINV | −1.590 | −1.598 | −5.971 *** | −5.920 *** | −1.590 | −1.598 | −5.952 *** | −5.894 *** |

| OPEN | −0.825 | −2.154 | −5.871 *** | −5.811 *** | −0.831 | −2.201 | −5.871 *** | −5.811 *** |

| Y | -0.326 | −1.261 | −4.223 *** | −5.829 *** | −0.810 | −0.390 | −4.230 *** | −7.362 *** |

| RER | −1.508 | −2.820 | −3.804 *** | −3.842 ** | −1.169 | −2.100 | −3.608 *** | −3.587 ** |

| R | −2.613 * | −4.769 *** | −7.834 *** | 7.782 *** | −4.390 *** | −4.873 *** | −13.322 *** | −13.296 *** |

| PSC | −0.020 | −1.830 | −5.609 *** | −6.319 *** | −0.097 | −2.154 | −5.584 *** | −6.524 *** |

| BM | −1.088 | −1.688 | −6.246 *** | −6.209 *** | −1.209 | −1.820 | −6.251 *** | 6.209 *** |

| DMG | −0.160 | 2.046 | −4.703 *** | −4.941 *** | −0.506 | 1.685 | −4.688 *** | −4.966 *** |

| FDG | −0.433 | −1.495 | −5.897 *** | −6.033 *** | −0.512 | −1.476 | −5.863 *** | −6.044 *** |

| FDPCA | −0.350 | −1476 | −6.015 *** | −6.215 *** | −0.350 | −1.469 | −5.999 *** | −6.213 *** |

| Models | F-Statistic | K | Critical values | |||

|---|---|---|---|---|---|---|

| 1 | PI = f(PUINV, OPEN, Y, RER R, PSC) | 4.895 | 6 | % | I(0) | I(1) |

| 2 | PI = f(PUINV, OPEN, Y, RER R, BM) | 5.027 | 6 | 10 | 2.12 | 3.23 |

| 3 | PI = f(PUINV, OPEN, Y, RER R, DMG) | 3.534 | 6 | 5 | 2.45 | 3.61 |

| 4 | PI = f(PUINV, OPEN, Y, RER R, FDG) | 4.809 | 6 | 1 | 3.15 | 4.43 |

| 5 | PI = f(PUINV, OPEN, Y, RER R, FDPCA) | 4.090 | 6 | |||

| Variables | Equation | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| PUINV | 0.055 | −0.274 | −0.367 | 0.135 | −0.165 |

| (0.259) | (0.223) | (0.263) | (0.263) | (0.193) | |

| OPEN | 0.166 *** | 0.185 *** | 0.216 *** | 0.138 *** | 0.184 *** |

| (0.042) | (0.037) | (0.058) | (0.037) | (0.039) | |

| Y | 0.230 *** | 0.173 *** | 0.177 *** | 0.191 *** | 0.198 *** |

| (0.050) | (0.039) | (0.040) | (0.057) | (0.045) | |

| RER | −0.020 | −0.012 | 0.015 | −0.023 | −0.020 |

| (0.014) | (0.011) | (0.014) | (0.014) | (0.012) | |

| R | −0.007 | 0.027 | 0.011 | −0.005 | 0.029 |

| (0.023) | (0.029) | (0.025) | (0.023) | (0.023) | |

| SC | −0.414 | - | - | - | - |

| (0.298) | |||||

| BM | - | −0.229 | - | - | - |

| (0.139) | |||||

| DMG | - | - | −0.286 | - | - |

| (0.171) | |||||

| FDG | - | - | - | −0.046 | - |

| (0.236) | |||||

| FDPCA | - | - | - | - | −0.008 |

| (0.006) | |||||

| Constant | −1.385 *** | −0.994 *** | −1.048 *** | −1.163 *** | −1.209 *** |

| (−1.385) | (0.231) | (0.242) | (0.341) | (0.292) | |

| Variables | Equation | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| ∆PUINV | 0.048 | 0.337 | −0.298 | 0.120 | 0.498 |

| (0.227) | (0.261) | (0.203) | (0.236) | (0.310) | |

| ∆OPEN | 0.145 *** | 0.157 *** | 0.176 *** | 0.123 *** | 0.169 *** |

| (0.033) | (0.030) | (0.041) | (0.032) | (0.033) | |

| ∆Y | 0.200 *** | 0.147 *** | 0.144 *** | 0.170 *** | 0.182 *** |

| (0.049) | (0.040) | (0.038) | (0.056) | (0.046) | |

| ∆RER | −0.002 | −0.010 | −0.012 | −0.005 | −0.019 |

| (0.016) | (0.009) | (0.011) | (0.018) | (0.011) | |

| ∆RER(-1) | 0.030 * | - | - | 0.031 * | - |

| (0.017) | (0.018) | ||||

| ∆R | −0.006 | 0.023 | 0.009 | −0.004 | 0.026 |

| (0.020) | (0.024) | (0.020) | (0.021) | (0.022) | |

| ∆PSC | −0.360 | - | - | - | - |

| (0.247) | |||||

| ∆BM | - | −0.584 *** | - | - | - |

| (0.169) | |||||

| ∆DMG | - | - | −0.232 * | - | - |

| (0.129) | |||||

| ∆FDG | - | - | - | −0.041 (0.210) | - |

| ∆FDPCA | - | - | - | - | −0.018 ** (0.007) |

| ECMT-1 | −0.871 *** (0.137) | −0.850 *** (0.124) | −0.813 *** (0.135) | −0.891 *** (0.141) | −0.919 *** (0.132) |

| Models | Autocorrelation a | Heteroscedasticity b | Normality c | Functional Form d |

|---|---|---|---|---|

| 1 | 0.535 | 0.720 | 0.518 | 1.358 |

| (0.591) | (0.687) | (0.771) | (0.252) | |

| 2 | 0.518 | 0.753 | 2.247 | 1.639 |

| (0.600) | (0.659) | (0.325) | (0.209) | |

| 3 | 0.282 | 0.489 | 0.633 | 2.519 |

| (0.756) | (0.836) | (0.782) | (0.121) | |

| 4 | 0.933 | 0.796 | 0.993 | 2.064 |

| (0.404) | (0.623) | (0.609) | (0.161) | |

| 5 | 0.682 | 0.853 | 0.452 | 1.847 |

| (0.513) | (0.574) | (0.798) | (0.183) |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sakyi, D.; Kofi Boachie, M.; Immurana, M. Does Financial Development Drive Private Investment in Ghana? Economies 2016, 4, 27. https://doi.org/10.3390/economies4040027

Sakyi D, Kofi Boachie M, Immurana M. Does Financial Development Drive Private Investment in Ghana? Economies. 2016; 4(4):27. https://doi.org/10.3390/economies4040027

Chicago/Turabian StyleSakyi, Daniel, Micheal Kofi Boachie, and Mustapha Immurana. 2016. "Does Financial Development Drive Private Investment in Ghana?" Economies 4, no. 4: 27. https://doi.org/10.3390/economies4040027