The Determinants of Carbon Intensities of Different Sources of Carbon Emissions in Saudi Arabia: The Asymmetric Role of Natural Resource Rent

Abstract

:1. Introduction

2. Literature Review

3. Methodology

4. Data Analysis

5. Conclusions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abraham, Benjamin M. 2021. A subnational carbon curse? Fossil fuel richness and carbon intensity among US states. The Extractive Industries and Society 8: 100859. [Google Scholar] [CrossRef]

- Ali, Uzair, Qingbin Guo, Zhanar Nurgazina, Arshian Sharif, Mustafa Tevfik Kartal, Serpil Kılıç Depren, and Aftab Khan. 2023. Heterogeneous impact of industrialization, foreign direct investments, and technological innovation on carbon emissions intensity: Evidence from Kingdom of Saudi Arabia. Applied Energy 336: 120804. [Google Scholar] [CrossRef]

- Anderl, Christina, and Guglielmo Maria Caporale. 2022. Nonlinearities and asymmetric adjustment to PPP in an exchange rate model with inflation expectations. Journal of Economic Studies 49: 937–59. [Google Scholar] [CrossRef]

- Arrow, Kenneth, Bert Bolin, Robert Costanza, Partha Dasgupta, Carl Folke, Crawford S. Holling, Bengt-Owe Jansson Simon Levin, Karl-Göran Mäler, Charles Perrings, and David Pimentel. 1995. Economic growth, carrying capacity, and the environment. Ecological Economics 15: 91–95. [Google Scholar] [CrossRef]

- Aziz, Ghazala, and Mohd Saeed Khan. 2022. Empirical relationship between creativity and carbon intensity: A case of Saudi Arabia. Frontiers in Environmental Science 10: 145. [Google Scholar] [CrossRef]

- Belaïd, Fateh, and Camille Massié. 2023. The viability of energy efficiency in facilitating Saudi Arabia’s journey toward net-zero emissions. Energy Economics 124: 106765. [Google Scholar] [CrossRef]

- Breusch, Trevor S. 1978. Testing for autocorrelation in dynamic linear models. Australian Economic Papers 17: 334–55. [Google Scholar] [CrossRef]

- Breusch, Trevor S., and Adrian R. Pagan. 1979. A simple test for heteroscedasticity and random coefficient variation. Econometrica 47: 1287–94. [Google Scholar] [CrossRef]

- Cheng, Yuanyuan, and Xin Yao. 2021. Carbon intensity reduction assessment of renewable energy technology innovation in China: A panel data model with cross-section dependence and slope heterogeneity. Renewable and Sustainable Energy Reviews 135: 110157. [Google Scholar] [CrossRef]

- Chu, Xiaoxiao, Gang Du, Hong Geng, and Xiao Liu. 2021. Can energy quota trading reduce carbon intensity in China? A study using a DEA and decomposition approach. Sustainable Production and Consumption 28: 1275–85. [Google Scholar] [CrossRef]

- Dai, Shufen, Yawen Qian, Weijun He, Chen Wang, and Tianyu Shi. 2022. The spatial spillover effect of China’s carbon emissions trading policy on industrial carbon intensity: Evidence from a spatial difference-in-difference method. Structural Change and Economic Dynamics 63: 139–49. [Google Scholar] [CrossRef]

- Du, Gang. 2023. Nexus between green finance, renewable energy, and carbon intensity in selected Asian countries. Journal of Cleaner Production 405: 136822. [Google Scholar] [CrossRef]

- Global Carbon Atlas. 2023. Global Carbon Atlas. Available online: http://www.globalcarbonatlas.org/en/CO2-emissions (accessed on 15 January 2023).

- Godfrey, Leslie G. 1978. Testing against general autoregressive and moving average error models when the regressors include lagged dependent variables. Econometrica 46: 1293–301. [Google Scholar] [CrossRef]

- Greiner, Patrick Trent, and Julius Alexander McGee. 2020. The asymmetry of economic growth and the carbon intensity of well-being. Environmental Sociology 6: 95–106. [Google Scholar] [CrossRef]

- Grossman, Gene M., and Elhanan Helpman. 1991. Trade, knowledge spillovers, and growth. European Economic Review 35: 517–26. [Google Scholar] [CrossRef]

- Grossman, Gene M., and Alan B. Krueger. 1991. Environmental Impacts of the North American Free Trade Agreement. Cambridge: NBER, Working paper 3914. [Google Scholar]

- Guo, Xiaohong, and Yongqian Tu. 2023. How digital finance affects carbon intensity–The moderating role of financial supervision. Finance Research Letters 55: 103862. [Google Scholar] [CrossRef]

- Huang, Junbing, Lufeng An, Weihui Peng, and Lili Guo. 2023. Identifying the role of green financial development played in carbon intensity: Evidence from China. Journal of Cleaner Production 408: 136943. [Google Scholar] [CrossRef]

- Jarque, Carlos M., and Anil K. Bera. 1987. A test for normality of observations and regression residuals. International Statistical Review 55: 163–72. [Google Scholar] [CrossRef]

- Ji, Zhengsen, Tian Gao, Wanying Li, Dongxiao Niu, Gengqi Wu, Luyao Peng, and Yankai Zhu. 2023. The critical role of digital technology in sustainable development goals: A two-stage analysis of the spatial spillover effect of carbon intensity. Journal of Renewable and Sustainable Energy 15: 35903. [Google Scholar] [CrossRef]

- Jing, Liang, Hassan M. El-Houjeiri, Jean-Christophe Monfort, Adam R. Brandt, Mohammad S. Masnadi, Deborah Gordon, and Joule A. Bergerson. 2020. Carbon intensity of global crude oil refining and mitigation potential. Nature Climate Change 10: 526–32. [Google Scholar] [CrossRef]

- Kahia, Montassar, Bilel Jarraya, Bassem Kahouli, and Anis Omri. 2023. Do Environmental Innovation and Green Energy Matter for Environmental Sustainability? Evidence from Saudi Arabia (1990–2018). Energies 16: 1376. [Google Scholar] [CrossRef]

- Komen, Marinus HC, Shelby Gerking, and Henk Folmer. 1997. Income and environmental R&D: Empirical evidence from OECD countries. Environment and Development Economics 2: 505–15. [Google Scholar]

- Kripfganz, Sebastian, and Daniel C. Schneider. 2020. Response surface regressions for critical value bounds and approximate p-values in equilibrium correction models 1. Oxford Bulletin of Economics and Statistics 82: 1456–81. [Google Scholar] [CrossRef]

- Letchumanan, Raman, and Fumio Kodama. 2000. Reconciling the conflict between the pollution-haven hypothesis and an emerging trajectory of international technology transfer. Research Policy 29: 59–79. [Google Scholar] [CrossRef]

- Li, Jing, Ying Luo, and Shengyun Wang. 2019. Spatial effects of economic performance on the carbon intensity of human well-being: The environmental Kuznets curve in Chinese provinces. Journal of Cleaner Production 233: 681–94. [Google Scholar] [CrossRef]

- Lu, Chenxi, Sergey Venevsky, Xiaoliang Shi, Lingyu Wang, Jonathon S. Wright, and Chao Wu. 2021. Econometrics of the environmental Kuznets curve: Testing advancement to carbon intensity-oriented sustainability for eight economic zones in China. Journal of Cleaner Production 283: 124561. [Google Scholar] [CrossRef]

- Mahmood, Haider. 2022. Nuclear energy transition and CO2 emissions nexus in 28 nuclear electricity-producing countries with different income levels. PeerJ 10: e13780. [Google Scholar] [CrossRef]

- Mahmood, Haider, Muhammad Shahid Hassan, Soumen Rej, and Maham Furqan. 2023a. The Environmental Kuznets Curve and Renewable Energy Consumption: A Review. International Journal of Energy Economics and Policy 13: 279–91. [Google Scholar] [CrossRef]

- Mahmood, Haider, Najia Saqib, Anass Hamadelneel Adow, and Muzaffar Abbas. 2023b. Oil and natural gas rents and CO2 emissions nexus in MENA: Spatial analysis. PeerJ 11: e15708. [Google Scholar] [CrossRef]

- Ng, Serena, and Pierre Perron. 2001. Lag length selection and the construction of unit root tests with good size and power. Econometrica 69: 1519–54. [Google Scholar] [CrossRef]

- OECD. 2020. Investment in the MENA Region in the Time of COVID-19. Available online: https://www.oecd.org/coronavirus/policy-responses/investment-in-the-mena-region-in-the-time-of-covid-19-da23e4c9/ (accessed on 15 July 2023).

- Okorie, David Iheke, and Presley K. Wesseh Jr. 2023. Climate agreements and carbon intensity: Towards increased production efficiency and technical progress? Structural Change and Economic Dynamics 66: 300–13. [Google Scholar] [CrossRef]

- Özkan, Oktay, Hephzibah Onyeje Obekpa, and Andrew Adewale Alola. 2023. Examining the nexus of energy intensity, renewables, natural resources, and carbon intensity in India. Energy and Environment. Online First. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Structural analysis of vector error correction models with exogenous I (1) variables. Journal of Econometrics 97: 293–343. [Google Scholar] [CrossRef]

- Ramsey, James Bernard. 1969. Tests for specification errors in classical linear least-squares regression analysis. Journal of the Royal Statistical Society Series B Statistical Methodology 31: 350–71. [Google Scholar] [CrossRef]

- Ren, Xuedi, Qinglong Shao, and Ruoyu Zhong. 2020. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. Journal of Cleaner Production 277: 122844. [Google Scholar] [CrossRef]

- Shao, Yanmin. 2017. Does FDI affect carbon intensity? New evidence from dynamic panel analysis. International Journal of Climate Change Strategies and Management 10: 27–42. [Google Scholar] [CrossRef]

- Shi, Qiaoling, Yuhuan Zhao, and Chao Zhong. 2022. What drives the export-related carbon intensity changes in China? Empirical analyses from temporal–spatial–industrial perspectives. Environmental Science and Pollution Research 29: 13396–416. [Google Scholar] [CrossRef]

- Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2014. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications. Edited by Robin C. Sickles and William C. Horrace. New York: Springer Science and Business Media, pp. 281–314. [Google Scholar]

- Sweidan, Osama D. 2018. Economic performance and carbon intensity of human well-being: Empirical evidence from the MENA region. Journal of Environmental Planning and Management 61: 699–723. [Google Scholar] [CrossRef]

- Thombs, Ryan P. 2022. The asymmetric effects of fossil fuel dependency on the carbon intensity of well-being: A US state-level analysis, 1999–2017. Global Environmental Change 77: 102605. [Google Scholar] [CrossRef]

- Vukina, Tomislav, John C. Beghin, and Ebru G. Solakoglu. 1999. Transition to markets and the environment: Effects of the change in the composition of manufacturing output. Environment and Development Economics 4: 582–98. [Google Scholar] [CrossRef]

- Wang, Qiang, and Lili Wang. 2021. How does trade openness impact carbon intensity? Journal of Cleaner Production 295: 126370. [Google Scholar] [CrossRef]

- Wang, Qiang, and Xiaoxin Song. 2022. Quantified impacts of international trade on the United States’ carbon intensity. Environmental Science and Pollution Research 29: 33075–94. [Google Scholar] [CrossRef] [PubMed]

- Wang, Mengjiao, Jianxu Liu, Sanzidur Rahman, Xiaoqi Sun, and Songsak Sriboonchitta. 2023a. The effect of China’s outward foreign direct investment on carbon intensity of Belt and Road Initiative countries: A double-edged sword. Economic Analysis and Policy 77: 792–808. [Google Scholar] [CrossRef]

- Wang, Shaojian, Jieyu Wang, Xiangjie Chen, Chuanglin Fang, Klaus Hubacek, Xiaoping Liu, Chunshan Zhou, Kuishuang Feng, and Zhu Liu. 2023b. Impact of International Trade on the Carbon Intensity of Human Well-Being. Environmental Science and Technology 57: 6898–909. [Google Scholar] [CrossRef] [PubMed]

- World Bank. 2023. World Development Indicators. Washington, DC: World Bank. Available online: https://databank.worldbank.org/reports.aspx?source=world-developmentindicators (accessed on 21 January 2023).

- World Population Review. 2023. Oil Reserves by Country 2023. Available online: https://worldpopulationreview.com/country-rankings/oil-reserves-by-country (accessed on 21 January 2023).

- Worldometer. 2023. Natural Gas Reserves by Country. Available online: https://www.worldometers.info/gas/gas-reserves-by-country/ (accessed on 21 January 2023).

- Xin, Li, and Yimin Wang. 2022. Towards a green world: The impact of the Belt and Road Initiative on the carbon intensity reduction of countries along the route. Environmental Science and Pollution Research 29: 28510–26. [Google Scholar] [CrossRef]

- Yang, Xue, and Bin Su. 2019. Impacts of international export on global and regional carbon intensity. Applied Energy 253: 113552. [Google Scholar] [CrossRef]

- Yun, Na. 2023. Nexus among carbon intensity and natural resources utilization on economic development: Econometric analysis from China. Resources Policy 83: 103600. [Google Scholar] [CrossRef]

- Zhang, Rui, Rajesh Sharma, Zhixiong Tan, and Pradeep Kautish. 2022. Do export diversification and stock market development drive carbon intensity? The role of renewable energy solutions in top carbon emitter countries. Renewable Energy 185: 1318–28. [Google Scholar] [CrossRef]

- Zhang, Qian, Saba Anwer, Muhammad Hafeez, Atif Khan Jadoon, and Zahoor Ahmed. 2023. Effect of environmental taxes on environmental innovation and carbon intensity in China: An empirical investigation. Environmental Science and Pollution Research 30: 57129–41. [Google Scholar] [CrossRef]

- Zhong, Sheng, Tian Goh, and Bin Su. 2022. Patterns and drivers of embodied carbon intensity in international exports: The role of trade and environmental policies. Energy Economics 114: 106313. [Google Scholar] [CrossRef]

| Variable | Notation | Unit of Measurement | Source | Expected Sign |

|---|---|---|---|---|

| The natural logarithm of CI from aggregated emissions | CO2Et | Aggregated national emissions in kgCO2/GDP | Global Carbon Atlas (2023) | |

| The natural logarithm of CI from oil emissions | OEt | Oil emissions in kgCO2/GDP | Global Carbon Atlas (2023) | |

| The natural logarithm of CI from gas emissions | GEt | Gas emissions in kgCO2/GDP | Global Carbon Atlas (2023) | |

| The natural logarithm of CI from gas flaring emissions | GFEt | Gas flaring emissions in kgCO2/GDP | Global Carbon Atlas (2023) | |

| The natural logarithm of CI from cement emissions | CEt | Cement emissions in kgCO2/GDP | Global Carbon Atlas (2023) | |

| The natural logarithm of GDP per capita | GDPCt | GDP per capita in constant Saudi Riyals | World Bank (2023) | + |

| The square term of GDPCt | GDPCt2 | The square of GDPCt | − | |

| Trade openness | TOt | Total trade (% of GDP) | World Bank (2023) | +/− |

| Foreign direct investment | FDIt | FDI net inflows (% of GDP) | World Bank (2023) | +/− |

| Natural resource rent | NRRt | Total NRR (% of GDP) | World Bank (2023) | +/− |

| Variable | Mean | Maximum | Minimum | SD |

|---|---|---|---|---|

| CO2Et | 2.6474 | 3.0315 | 1.6464 | 0.2789 |

| OEt | 2.0101 | 2.5397 | −0.0311 | 0.5748 |

| GEt | 0.4413 | 2.0165 | −13.8155 | 2.6576 |

| GFEt | −2.5356 | 2.3331 | −18.4207 | 5.0710 |

| CEt | −1.1872 | −0.0733 | −3.1069 | 0.9094 |

| GDPCt | 11.2707 | 11.8379 | 10.8470 | 0.2562 |

| GDPCt2 | 127.0921 | 140.1367 | 117.6576 | 5.8429 |

| TOt | 75.4066 | 120.6195 | 49.7135 | 13.2828 |

| FDIt | 1.0867 | 8.4964 | −8.2188 | 2.8071 |

| NRRt | 38.0351 | 87.2846 | 17.3184 | 13.7214 |

| Variable | C | C and T |

|---|---|---|

| CO2Et | −0.4461 | −5.2044 |

| OEt | −0.0853 | −2.6650 |

| GEt | −0.9788 | −6.5828 |

| GFEt | −7.7336 | −11.7737 |

| CEt | 0.3522 | −4.9985 |

| GDPCt | −2.4686 | −3.5051 |

| GDPCt2 | −2.4808 | −3.4916 |

| TOt | −6.7225 * | −8.0551 |

| FDIt | −18.0285 *** | −19.7532 ** |

| NRRt | −10.8961 ** | −12.5485 |

| NRRPt | 1.3118 | −8.1019 |

| NRRNt | 1.6520 | −5.8561 |

| ΔCO2Et | −23.4036 *** | −25.4507 *** |

| ΔOEt | −10.8000 ** | −25.1764 *** |

| ΔGEt | −24.9992 *** | −24.9979 *** |

| ΔGFEt | −109.6770 *** | −101.4200 *** |

| ΔCEt | −23.5505 *** | −24.7009 *** |

| ΔGDPCt | −23.7796 *** | −24.0066 *** |

| ΔGDPCt2 | −23.7275 *** | −23.9484 *** |

| ΔTOt | −21.8782 *** | −21.6770 ** |

| ΔFDIt | −24.3180 *** | −24.3616 *** |

| ΔNRRt | −25.6356 *** | −25.6402 *** |

| ΔNRRPt | −25.9477 *** | −25.9271 *** |

| ΔNRRNt | −25.0607 *** | −25.6019 *** |

| Model | Optimal Lag Lengths | F-Statistics | Heteroscedasticity | Serial Correlation | Normality | Functional Form |

|---|---|---|---|---|---|---|

| Linear ARDL | ||||||

| F(CO2Et/GDPCt, GDPCt2, TOt, FDIt, NRRt) | (1,0,1,1,1,1) | 1.7723 | 0.4437 (0.9158) | 0.4337 (0.6511) | 0.5351 (0.6928) | 0.0029 (0.9575) |

| F(OEt/GDPCt, GDPCt2, TOt, FDIt, NRRt)OEt | (1,1,1,1,2,2) | 3.4271 | 0.8220 (0.6349) | 0.2988 (0.7435) | 0.3117 (0.8557) | 2.5195 (0.1210) |

| F(GEt/GDPCt, GDPCt2, TOt, FDIt, NRRt) | (1,2,2,2,2,2) | 8.7704 | 1.1183 (0.3354) | 1.6718 (0.2026) | 0.1331 (0.9171) | 0.5170 (0.6136) |

| F(GFEt/GDPCt, GDPCt2, TOt, FDIt, NRRt) | (1,2,2,0,1,0) | 4.6267 | 1.6813 (0.1134) | 0.3908 (0.6792) | 0.6773 (0.6258) | 0.0974 (0.9809) |

| F(CEt/GDPCt, GDPCt2, TOt, FDIt, NRRt) | (1,2,2,2,2,2) | 7.9359 | 0.0739 (0.7869) | 0.4320 (0.6528) | 0.3578 (0.8362) | 0.4727 (0.6395) |

| Nonlinear ARDL | ||||||

| F(CO2Et/GDPCt, GDPCt2, TOt, FDIt, NRRPt, NRRNt) | (1,0,1,0,1,0,1) | 1.7521 | 0.4692 (0.9004) | 1.1993 (0.3210) | 1.5143 (0.4690) | 0.3341 (0.5664) |

| F(OEt/GDPCt, GDPCt2, TOt, FDIt, NRRPt, NRRNt) | (1,2,2,0,2,0,1) | 3.5608 | 0.4398 (0.9497) | 0.8055 (0.4550) | 1.1894 (0.5517) | 0.4539 (0.6587) |

| F(GEt/GDPCt, GDPCt2, TOt, FDIt, NRRPt, NRRNt) | (1,2,2,2,2,1,2) | 7.9431 | 1.1181 (0.3354) | 2.3233 (0.1138) | 0.1732 (0.8869) | 0.2980 (0.7429) |

| F(GFEt/GDPCt, GDPCt2, TOt, FDIt, NRRPt, NRRNt) | (1,2,2,0,1,1,2) | 4.3444 | 1.6562 (0.1122) | 0.6815 (0.5123) | 0.5466 (0.6789) | 2.0261 (0.1463) |

| F(CEt/GDPCt, GDPCt2, TOt, FDIt, NRRPt, NRRNt) | (1,2,2,2,2,2,2) | 8.7166 | 0.9008 (0.5856) | 0.5547 (0.5800) | 0.4334 (0.8052) | 0.0299 (0.8638) |

| Critical-Bound F-statistics | ||||||

| Linear ARDL | Nonlinear ARDL | |||||

| Lower Bound | Upper Bound | Lower Bound | Upper Bound | |||

| At 1% | 3.3828 | 4.6578 | 3.1213 | 4.4025 | ||

| At 5% | 2.6202 | 3.7704 | 2.4453 | 3.6071 | ||

| At 10% | 2.2599 | 3.3408 | 2.1240 | 3.2189 | ||

| Response Variable | Regressors | Linear | Nonlinear |

|---|---|---|---|

| CO2Et | GDPCt | 30.4647 (0.4534) | 9.5301 (0.6667) |

| GDPCt2 | −1.3352 (0.4555) | −0.4106 (0.6736) | |

| TOt | −1.3333 (0.3307) | 0.7374 (0.1833) | |

| FDIt | 1.8014 (0.7195) | −2.1480 (0.3627) | |

| NRRt | 2.2596 (0.0874) | ||

| NRRPt | 0.2278 (0.6436) | ||

| NRRNt | −0.1510 (0.7806) | ||

| Wald test | 4.2848 (0.0449) | ||

| OEt | GDPCt | 34.6609 (0.4751) | 101.6111 (0.1325) |

| GDPCt2 | −1.5571 (0.4661) | −4.4537 (0.1343) | |

| TOt | −2.2444 (0.0777) | −1.3167 (0.0168) | |

| FDIt | 3.2351 (0.5387) | 0.1050 (0.9798) | |

| NRRt | 0.4037 (0.0059) | ||

| NRRPt | 0.3566 (0.0705) | ||

| NRRNt | 1.0733 (0.0320) | ||

| Wald test | 8.2385 (0.0067) | ||

| GEt | GDPCt | 743.1641 (0.0000) | 520.6722 (0.0197) |

| GDPCt2 | −32.8096 (0.0000) | −23.0184 (0.0191) | |

| TOt | −1.6017 (0.0001) | −1.10822 (0.0214) | |

| FDIt | −0.4138 (0.7674) | −0.1509 (0.9048) | |

| NRRt | 0.2282 (0.0000) | ||

| NRRPt | 0.1443 (0.0021) | ||

| NRRNt | 0.1358 (0.0086) | ||

| Wald test | 0.0010 (0.9744) | ||

| GFEt | GDPCt | 130.5744 (0.7531) | 480.0467 (0.3494) |

| GDPCt2 | −5.3122 (0.7705) | −20.7299 (0.3579) | |

| TOt | 0.9551 (0.2333) | 1.8851 (0.8410) | |

| FDIt | −1.9396 (0.0000) | −1.9035 (0.0001) | |

| NRRt | 0.1507 (0.0486) | ||

| NRRPt | 0.2823 (0.0791) | ||

| NRRNt | 0.1076 (0.0925) | ||

| Wald test | 3.8221 (0.0506) | ||

| CEt | GDPCt | 210.4811 (0.0030) | 106.4833 (0.0143) |

| GDPCt2 | −9.2902 (0.0003) | −4.7326 (0.0134) | |

| TOt | −0.7729 (0.0007) | −1.9733 (0.0178) | |

| FDIt | 1.2622 (0.0000) | 1.4844 (0.0713) | |

| NRRt | 0.1026 (0.0000) | ||

| NRRPt | 0.4112 (0.0070) | ||

| NRRNt | 0.3348 (0.0440) | ||

| Wald test | 0.3209 (0.5711) |

| Response Variable | Regressors | Linear | Nonlinear |

|---|---|---|---|

| CO2Et | ΔGDPCt | 4.8181 (0.0161) | 2.8991 (0.0674) |

| ΔGDPCt2 | −0.1906 (0.0022) | −0.1079 (0.0032) | |

| ΔTOt | 0.0520 (0.6708) | 0.0224 (0.6808) | |

| ΔFDIt | −1.8033 (0.0006) | −1.9322 (0.0001) | |

| ΔNRRt | −0.0211 (0.8761) | ||

| ΔNRRPt | 0.0667 (0.6477) | ||

| ΔNRRNt | 0.0568 (0.0002) | ||

| ECTt−1 | −0.1582 (0.0005) | −0.3042 (0.0000) | |

| OEt | ΔGDPCt | 32.7942 (0.0011) | 5.6705 (0.5774) |

| ΔGDPCt−1 | 31.2704 (0.0019) | ||

| ΔGDPCt2 | −14,551 (0.0011) | −0.2560 (0.5687) | |

| ΔGDPCt−12 | −1.3901 (0.0019) | ||

| ΔTOt | −0.0966 (0.6142) | 0.0418 (0.1484) | |

| ΔFDIt | −2.9655 (0.0026) | −2.1767 (0.0141) | |

| ΔFDIt−1 | −2.2003 (0.0238) | −2.5667 (0.0049) | |

| ΔNRRt | 0.2020 (0.3600) | ||

| ΔNRRt−1 | −0.0060 (0.0102) | ||

| ΔNRRPt | −0.1133 (0.6952) | ||

| ΔNRRNt | −0.9899 (0.0013) | ||

| ECTt−1 | −0.2781 (0.0000) | −0.3170 (0.0000) | |

| GEt | ΔGDPCt | −77.1841 (0.3680) | −140.9580 (0.0888) |

| ΔGDPCt−1 | −420.0267 (0.0000) | −399.1333 (0.0000) | |

| ΔGDPCt2 | 2.6914 (0.4365) | 5.7669 (0.1164) | |

| ΔGDPCt−12 | 18.5073 (0.0000) | 17.5614 (0.0000) | |

| ΔTOt | −0.2822 (0.1061) | −0.6667 (0.6934) | |

| ΔTOt−1 | 0.4053 (0.0498) | 0.4733 (0.0236) | |

| ΔFDIt | −0.2965 (0.0284) | −0.2176 (0.0737) | |

| ΔFDIt−1 | −0.2003 (0.0451) | −0.2556 (0.0164) | |

| ΔNRRt | 0.6293 (0.0014) | ||

| ΔNRRt−1 | 0.6081 (0.0039) | ||

| ΔNRRPt | 0.7036 (0.0020) | ||

| ΔNRRNt | 0.0847 (0.7567) | ||

| ΔNRRNt−1 | 0.8825 (0.0052) | ||

| ECTt−1 | −0.7822 (0.0000) | −0.8601 (0.0000) | |

| GFEt | ΔGDPCt | 193.7941 (0.2558) | 308.2290 (0.0761) |

| ΔGDPCt−1 | 437.2667 (0.0092) | 371.727 (0.0186) | |

| ΔGDPCt2 | −8.5563 (0.2582) | −13.6044 (0.0778) | |

| ΔGDPCt−12 | −19.6765 (0.0085) | −16.8082 (0.0169) | |

| ΔTOt | −0.1253 (0.0769) | −0.0931 (0.0084) | |

| ΔFDIt | −0.5543 (0.0027) | −0.6189 (0.0009) | |

| ΔNRRt | 0.1785 (0.0000) | ||

| ΔNRRPt | 0.1325 (0.0049) | ||

| ΔNRRNt | 0.8471 (0.8608) | ||

| ΔNRRNt−1 | 0.8825 (0.0336) | ||

| ECTt−1 | −0.5928 (0.0000) | −0.6104 (0.0000) | |

| CEt | ΔGDPCt | 33.5527 (0.0000) | 33.0092 (0.0000) |

| ΔGDPCt−1 | −20.6776 (0.0035) | −20.3756 (0.0033) | |

| ΔGDPCt2 | −1.4964 (0.0000) | −1.4833 (0.0000) | |

| ΔGDPCt−12 | 0.9126 (0.0035) | 0.8979 (0.0035) | |

| ΔTOt | −0.2010 (0.1779) | 0.0544 (0.7038) | |

| ΔTOt−1 | 0.7855 (0.0000) | 0.7155 (0.0000) | |

| ΔFDIt | −0.0555 (0.9292) | −0.7222 (0.2496) | |

| ΔFDIt−1 | −0.2061 (0.0037) | −0.2106 (0.0018) | |

| ΔNRRt | −0.3511 (0.0350) | ||

| ΔNRRt−1 | −0.9333 (0.0000) | ||

| ΔNRRPt | −0.5711 (0.0033) | ||

| ΔNRRPt−1 | −0.8222 (0.0009) | ||

| ΔNRRNt | −0.3633 (0.1737) | ||

| ΔNRRNt−1 | −1.2567 (0.0000) | ||

| ECTt−1 | −0.1445 (0.0000) | −0.3348 (0.0000) |

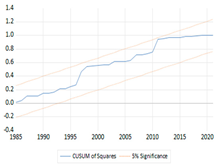

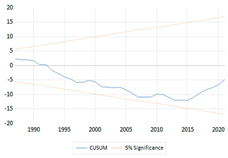

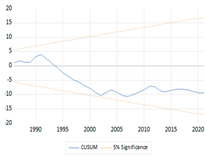

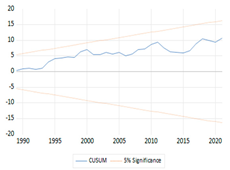

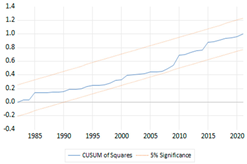

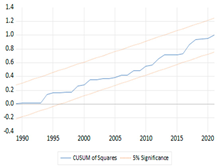

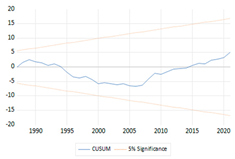

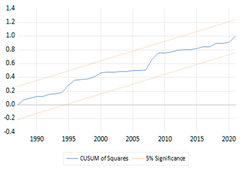

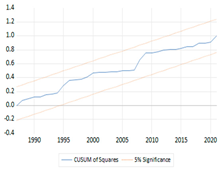

| Response Variable | Test | Linear | Nonlinear |

|---|---|---|---|

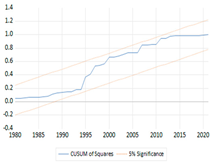

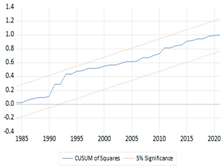

| CO2Et | CUSUM |  |  |

| CO2Et | CUSUMsq |  |  |

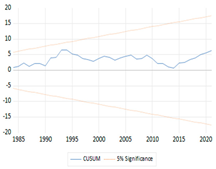

| OEt | CUSUM |  |  |

| OEt | CUSUMsq |  |  |

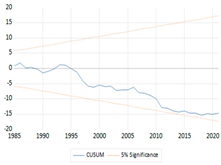

| GEt | CUSUM |  |  |

| GEt | CUSUMsq |  |  |

| GFEt | CUSUM |  |  |

| GFEt | CUSUMsq |  |  |

| CEt | CUSUM |  |  |

| CEt | CUSUMsq |  |  |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mahmood, H. The Determinants of Carbon Intensities of Different Sources of Carbon Emissions in Saudi Arabia: The Asymmetric Role of Natural Resource Rent. Economies 2023, 11, 276. https://doi.org/10.3390/economies11110276

Mahmood H. The Determinants of Carbon Intensities of Different Sources of Carbon Emissions in Saudi Arabia: The Asymmetric Role of Natural Resource Rent. Economies. 2023; 11(11):276. https://doi.org/10.3390/economies11110276

Chicago/Turabian StyleMahmood, Haider. 2023. "The Determinants of Carbon Intensities of Different Sources of Carbon Emissions in Saudi Arabia: The Asymmetric Role of Natural Resource Rent" Economies 11, no. 11: 276. https://doi.org/10.3390/economies11110276