Credibility and Crisis Stress Testing

Abstract

:“Investors don’t like uncertainty. When there’s uncertainty, they always think there’s another shoe to fall.”Kenneth Lay, then-CEO of Enron Corp.20 August 2001

1. Introduction

- The governance of the tests (i.e., the stress tester and the overseer) must be perceived to be independent, with the requisite technical expertise.

- The stress tests themselves must be sufficiently stringent yet plausible. The scope, coverage, scenario design and methodology need to be considered sufficiently comprehensive and robust to capture key risks to the institutions and system.

- The stress tests should be simultaneous, consistent and comparable cross-firm assessments to enable a broader analysis of risks and an evaluation of estimates for individual institutions (Tarullo [2]). From a macroprudential perspective, they should allow for a better understanding of inter-relationships across institutions.

- The stress tests should usefully inform markets about the risks associated with the banks, and the results must be sufficiently granular such that there is clear differentiation among institutions in the first instance, to guide subsequent actions.

- Last but not least, the manner in which the stress test results will be backstopped or used must be clarified early on to guide depositors and investors.

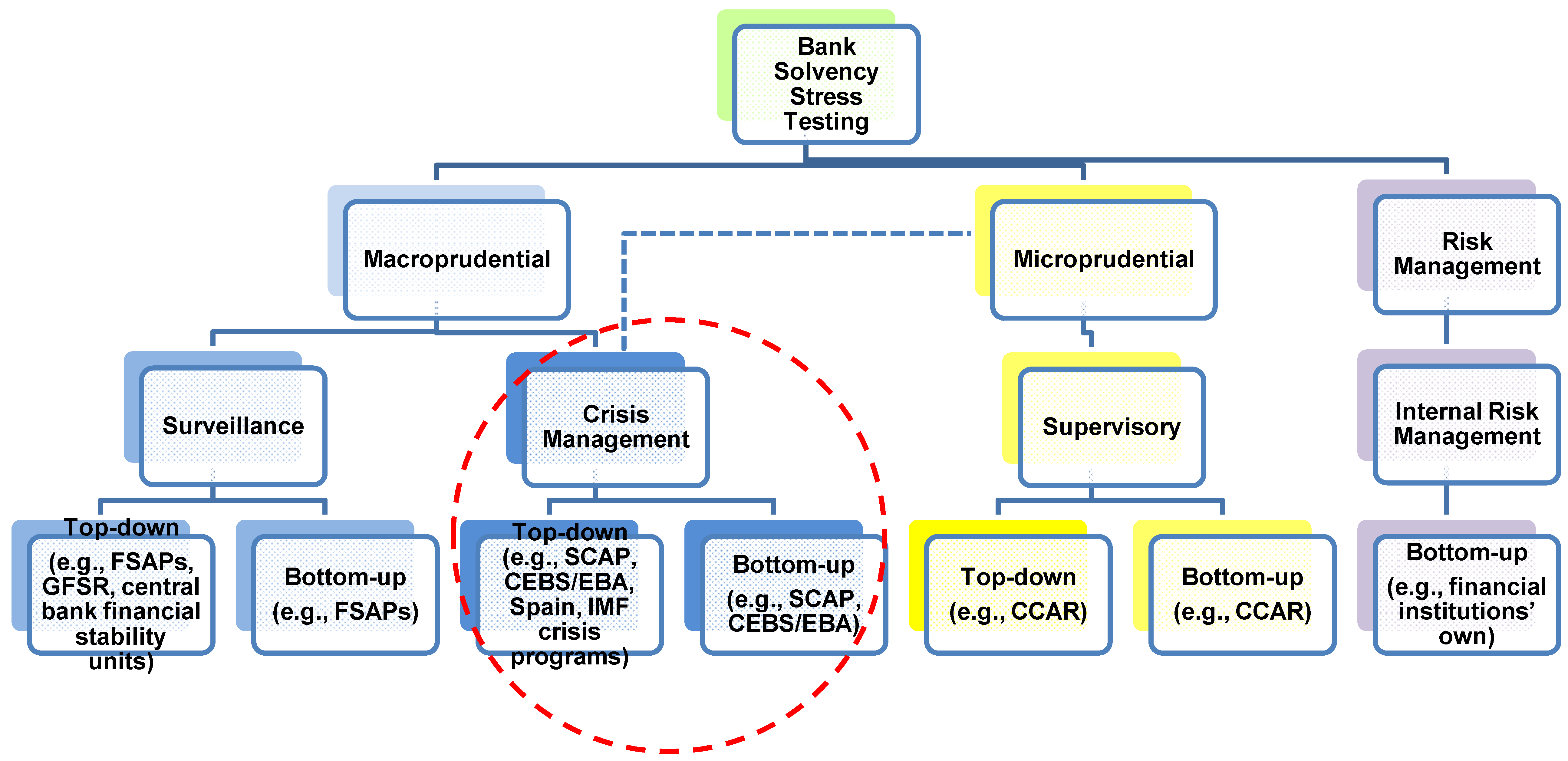

- We first distinguish the effective crisis stress tests using financial market impact studies of recent exercises in the United States, the European Union, Ireland and Spain, including analyzing the statistical performance of the respective financials stock indices and sovereign credit default swap (CDS) spreads around the announcement of the stress test results.

- Next, we apply case study analysis to identify the key elements of a crisis stress test and to formulate the appropriate design of those elements, drawing on qualitative information from previous stress tests.

- Where relevant, we juxtapose our analysis against some of the relevant “best practice” principles presented in the literature (e.g., Basel Committee for Banking Supervision (BCBS) [12]; Board of Governors of the Federal Reserve/Federal Deposit Insurance Corporation/Office of the Comptroller of the Currency [13]; IMF [3]), while highlighting concepts, issues and nuances that may be particular to crisis stress testing.

2. The Data

- We study the financials stock price indices for each jurisdiction as proxies for the market’s assessment of the soundness of the respective banking systems. Stock prices represent a bellwether indicator for market confidence in that shareholders are the “first loss” investors and the evidence shows that they respond very quickly to incorporate all relevant publicly available information in their pricing (Fama [15]).

- We also consider the behavior of sovereign CDS spreads around the stress testing exercises and related events. Sovereign CDS spreads provide an indication of the perceived creditworthiness of a country, which is considered closely linked to the health of its banking sector given the potential implications for the public purse if government support is required (Mody and Sandri [16]). In several banking systems, the high holdings of sovereign debt have focused market concerns on the bank-sovereign feedback loop (Acharya et al. [17]; Committee on the Global Financial System [18]; Angeloni and Wolff [19]; Darraq Paries et al. [20]).

| Jurisdiction | Stress Testing Exercise | Stress Tester | Participating Authorities | |||

|---|---|---|---|---|---|---|

| United States | Supervisory Capital Assessment and Program 2009 | Authorities | Federal Reserve (Fed), Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of Currency (OCC) | |||

| European Union | Committee of European Banking Supervisors (CEBS) 2009 | Authorities | National supervisory authorities, CEBS, European Commission (EC) and European Central Bank (ECB) | |||

| Committee of European Banking Supervisors 2010 | Authorities | National supervisory authorities, CEBS, EC and ECB | ||||

| European Banking Authority (EBA) 2011 | Authorities | National supervisory authorities, EBA, EC, ECB and European Systemic Risk Board (ESRB) | ||||

| Ireland | Prudential Capital Assessment and Review (PCAR) 2011 | Authorities with loan loss inputs from BlackRock Solutions | Central Bank of Ireland (CBI) | |||

| Spain | Top-down (TD) 2012 | Oliver Wyman and Roland Berger | Banco de España (BdE), Ministry of Economy and Competitiveness (MEC), the Troika and representatives from two EU countries | |||

| "Bottom-up" (BU) 2012 | Oliver Wyman | BdE, MEC, the Troika and EBA | ||||

| Jurisdiction | Stock Market | Credit Default Swaps | ||||||

|---|---|---|---|---|---|---|---|---|

| Proxy Index | Bloomberg Ticker | Proxy Index | Bloomberg Ticker | |||||

| United States | S&P 500 Financials Sector Index | S5FINL [Index] | United States EUR senior 5-year | ZCTO CDS EUR SR 5Y [Corp] | ||||

| European Union | STOXX Europe 600 Banks Price EUR | SX7P [Index] | iTraxx SovX Western Europe USD 5-year | SOVWE CDSI GENERIC 5Y [Corp] | ||||

| Ireland | Irish Stock Exchange Financial Index | ISEF [Index] | Ireland USD senior 5-year | IRELND CDS USD SR 5Y [Corp] | ||||

| Spain | MSCI Spain Financials Index | MSES0FN [Index] | Spain USD senior 5-year | SPAIN CDS USD SR 5Y [Corp] | ||||

| Indicator | Effectiveness of Stress Test | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Instrument | Measure | United States | European Union | Ireland | Spain | ||||||||||||||||||

| Crisis | Supervisory | Crisis | Crisis | Surveillance | Crisis | ||||||||||||||||||

| SCAP 2009 | CCAR 2011 | CCAR 2012 | CCAR & DFA 2013 | CEBS 2009 | CEBS 2010 | EBA 2011 | PCAR 2011 + IMF 2/ | FSAP 2012 3/ | TD 2012 | BU 2012 | |||||||||||||

| Pre | Post | Pre | Post | Pre | Post | Pre | Post | Pre | Post | Pre | Post | Pre | Post | Pre | Post | Pre | Post | Pre | Post | Pre | Post | ||

| Financials stock index | Index return

(160-day, in percent) | −13.7 | 19.1 | 11.4 | −20.5 | 24.0 | 1.5 | 17.3 | 8.9 | 63.4 | −1.7 | −0.3 | 2.3 | −19.5 | −21.7 | −67.2 | 78.9 | −24.4 | 21.8 | −21.4 | 23.8 | −1.8 | −5.6 |

| Return volatility

(160-day, in percent) | 6.4 | 2.5 | 1.2 | 2.1 | 2.2 | 1.2 | 0.9 | 0.9 | 2.1 | 1.6 | 2.2 | 1.4 | 1.2 | 2.9 | 4.1 | 3.7 | 2.2 | 2.5 | 2.2 | 2.5 | 2.8 | 1.7 | |

| Credit default swap | Spread

(160-day, in basis points) | −6 | −7 | −4 | 8 | −19 | 4 | 2 | −14 | n.a. | 33 | 43 | 52 | 104 | 67 | 204 | −193 | 161 | −284 | 184 | −288 | −44 | −90 |

3. Identifying the Successful Crisis Stress Tests

- The return on the financials stock index is relatively stable or rises in the six months following the announcement of the test results.

- The volatility of daily returns (calculated as the standard deviation over 130 days) stabilizes or declines in the six months following the announcement of the test results, relative to the preceding six months.

- The sovereign CDS spread stabilizes or narrows in the six months following the announcement of the test results.

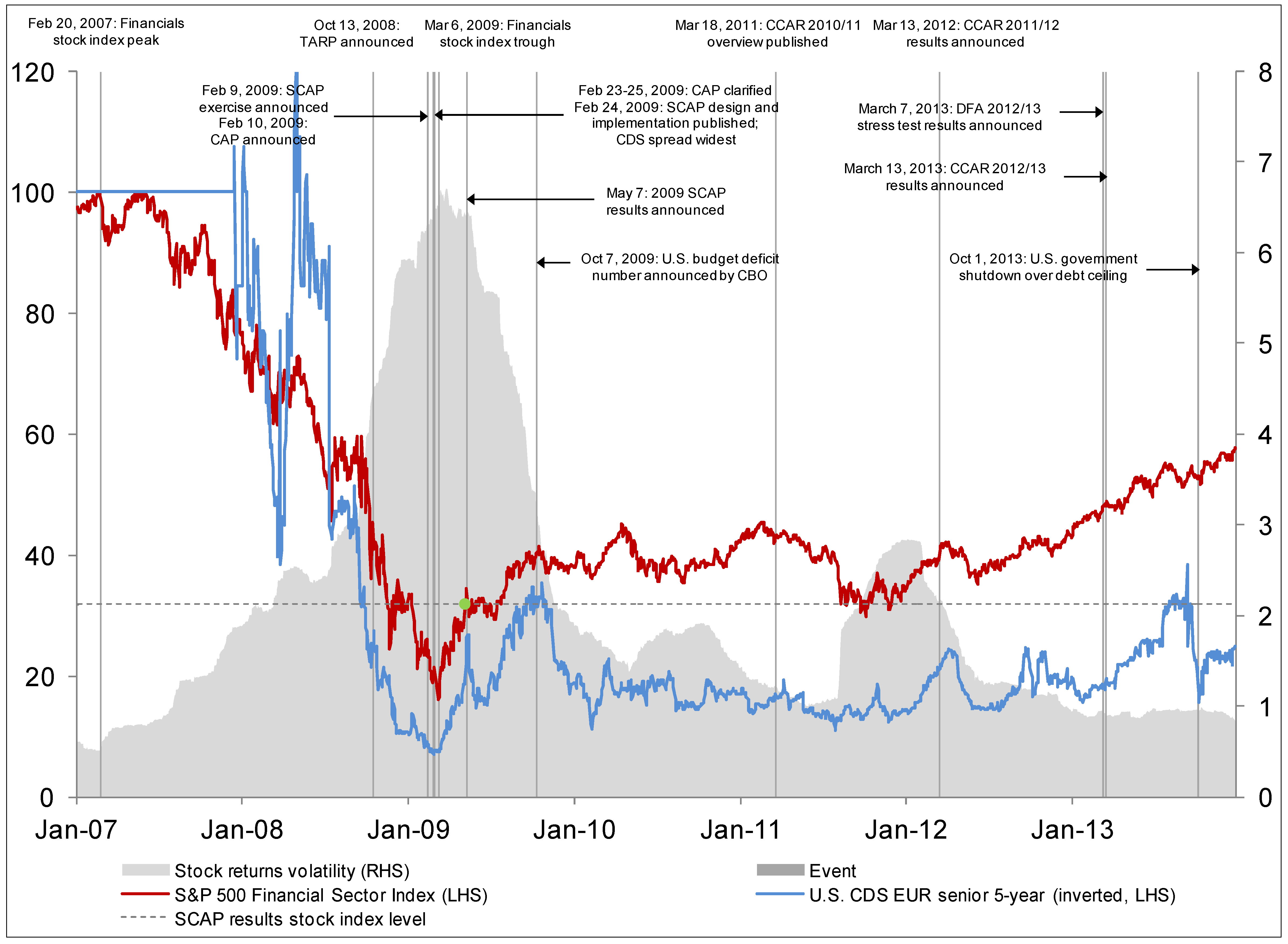

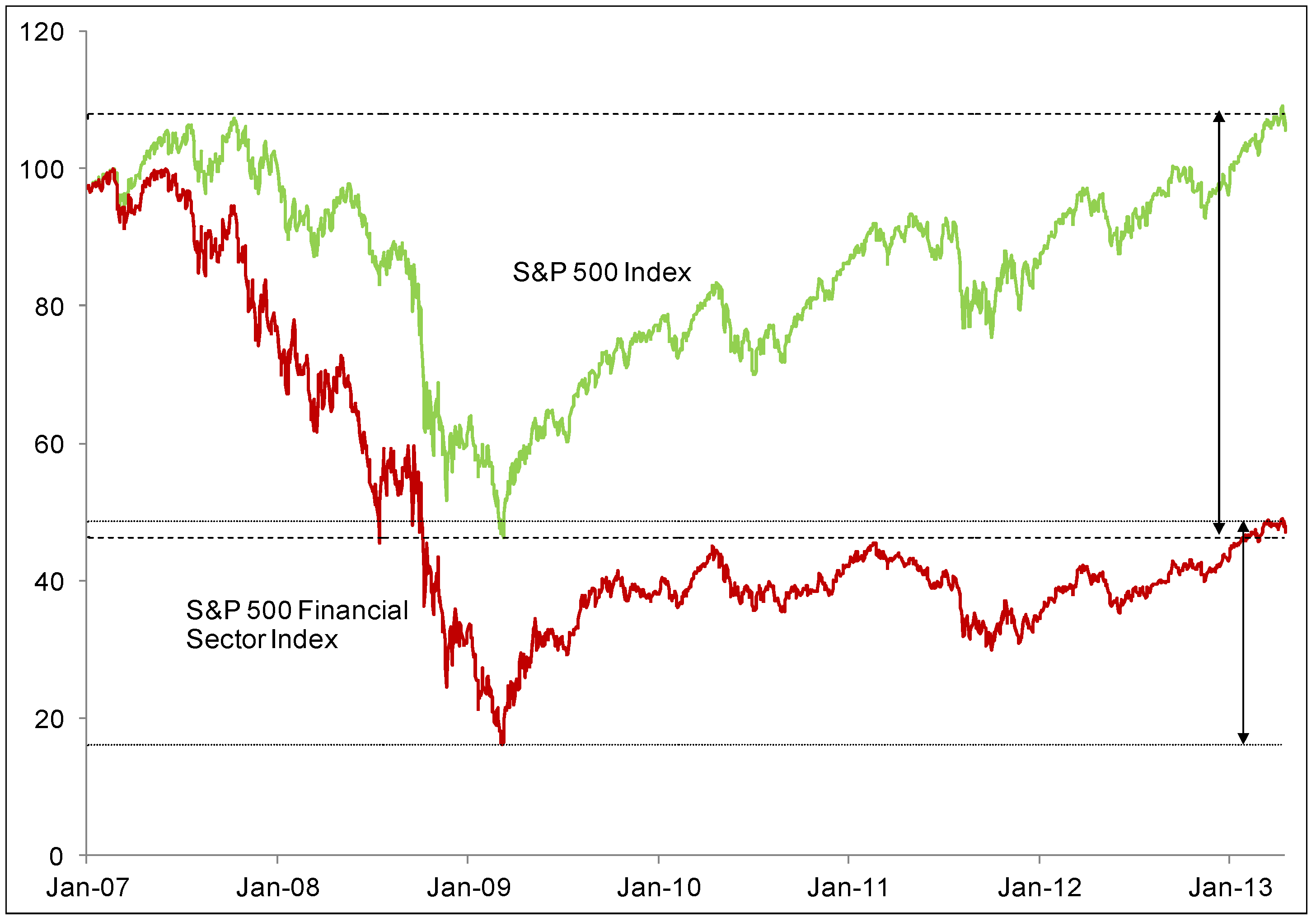

- The release of the SCAP results effectively halted and then reversed the 2-year slide in investor confidence towards the country’s banks. The financials index rose by almost 20 percent in the following six months. At the same time, market volatility—which had peaked just prior to the exercise—declined sharply over this period. Since then, the S&P 500 Financial Sector Index has largely remained above the level established by the SCAP results, although it flirted with that floor during the more volatile period in 2012 Q3.

- U.S. firms have substantially increased their capital since the SCAP. The weighted Tier 1 (T1) Common Equity ratio of the 18 bank holding companies that were in the SCAP sample has more than doubled from an average 5.6 percent at the end of 2008 to 11.3 percent in 2012 Q4, reflecting an increase in T1 Common Equity from $393 billion to $792 billion during the same period.

- U.S. CDS spreads narrowed in tandem with the improvement in the financials index during the SCAP period. However, they subsequently dissociated from developments in the banking sector in September 2011 as markets turned their attention to the fiscal deficit after the Congressional Budget Office (CBO) announced that the U.S. budget deficit had reached its widest as a percentage of GDP since 1945.

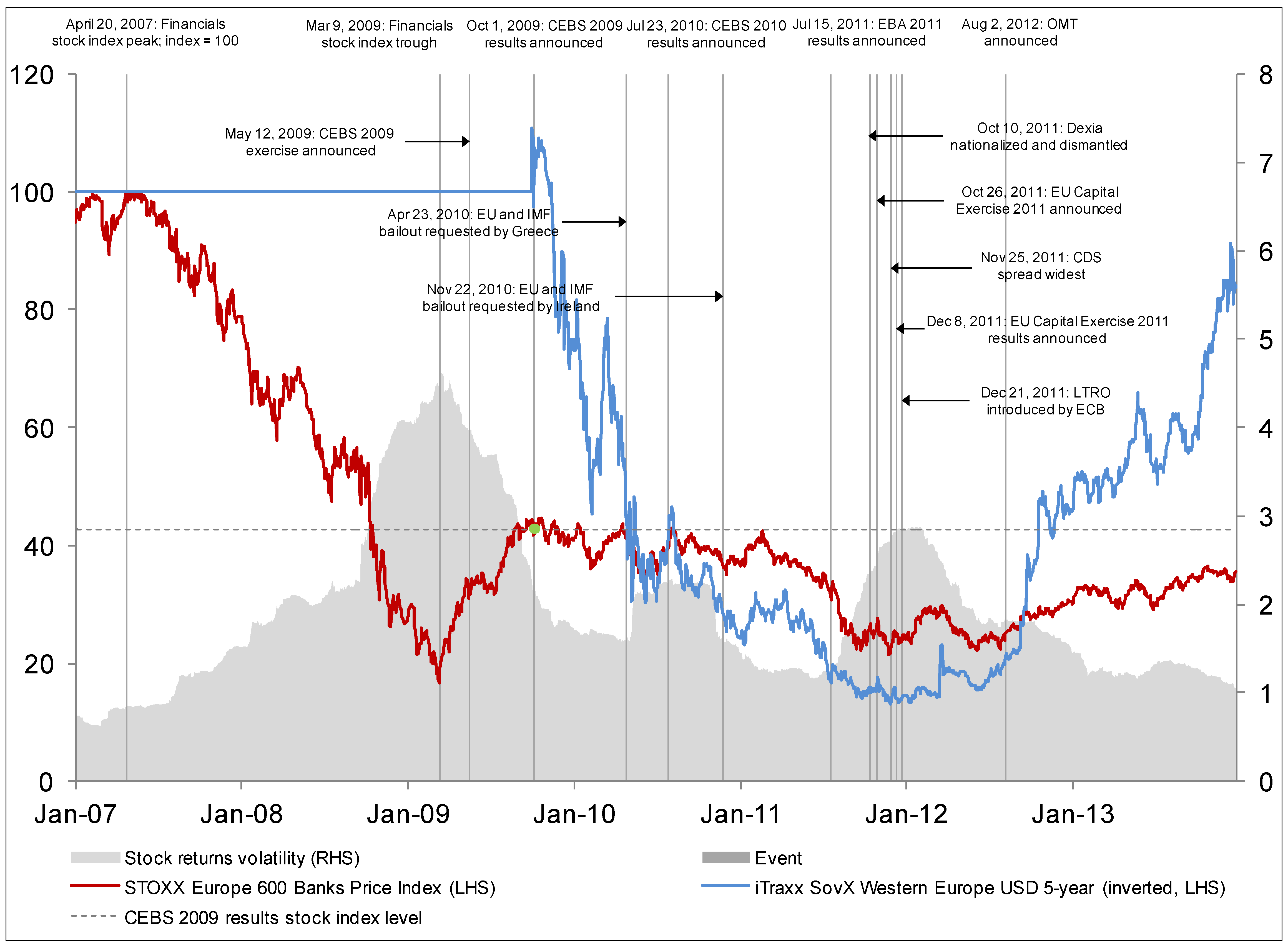

- The stress tests of EU banking systems were less convincing. Although stock prices remained relatively stable following the announcements of the CEBS 2009 and 2010 results, the sovereign CDS spreads continued to widen (Figure 3):

- ➢

- The CEBS 2010 exercise subsequently suffered the ignominy of having Ireland request a bailout from the European Commission (EC), the European Central Bank (ECB) and the IMF (“the Troika”) weeks after the stress tests indicated that EU banks would remain sufficiently capitalized and resilient under adverse scenarios (CEBS [23]; CEBS [24]). The financials stock index followed a downward trend and despite a turnaround, it has not to this day returned to the levels recorded around the time of the CEBS 2009 stress test.

- ➢

- Similarly, systemic banks Dexia (Belgium) and Bankia (Spain) passed the EBA 2011 stress test (EBA [25]) only to require significant restructuring within a few months. These events were accompanied by sharp jumps in the volatility of stock market returns.

- ➢

- The EU Capital Exercise was subsequently announced in October 2011 in response to a rapidly evolving crisis. The disclosure of its results in December 2011, followed by the introduction of the ECB’s Long-term Refinancing Operation (LTRO) facility for financing eurozone banks later that month, halted the deterioration in confidence towards EU sovereigns as evidenced by their narrowing CDS spreads. In the former, the EBA reviewed banks’ actual capital positions as at end-June 2011 and their sovereign exposures in light of the worsening of the sovereign debt crisis in Europe, and requested that they set aside additional capital buffers by June 2012 based on September 2011 sovereign exposure figures and capital positions (EBA [26]). The announcement of the Outright Monetary Transactions (OMT) by the ECB in August 2012 further improved market confidence in the region as a whole.

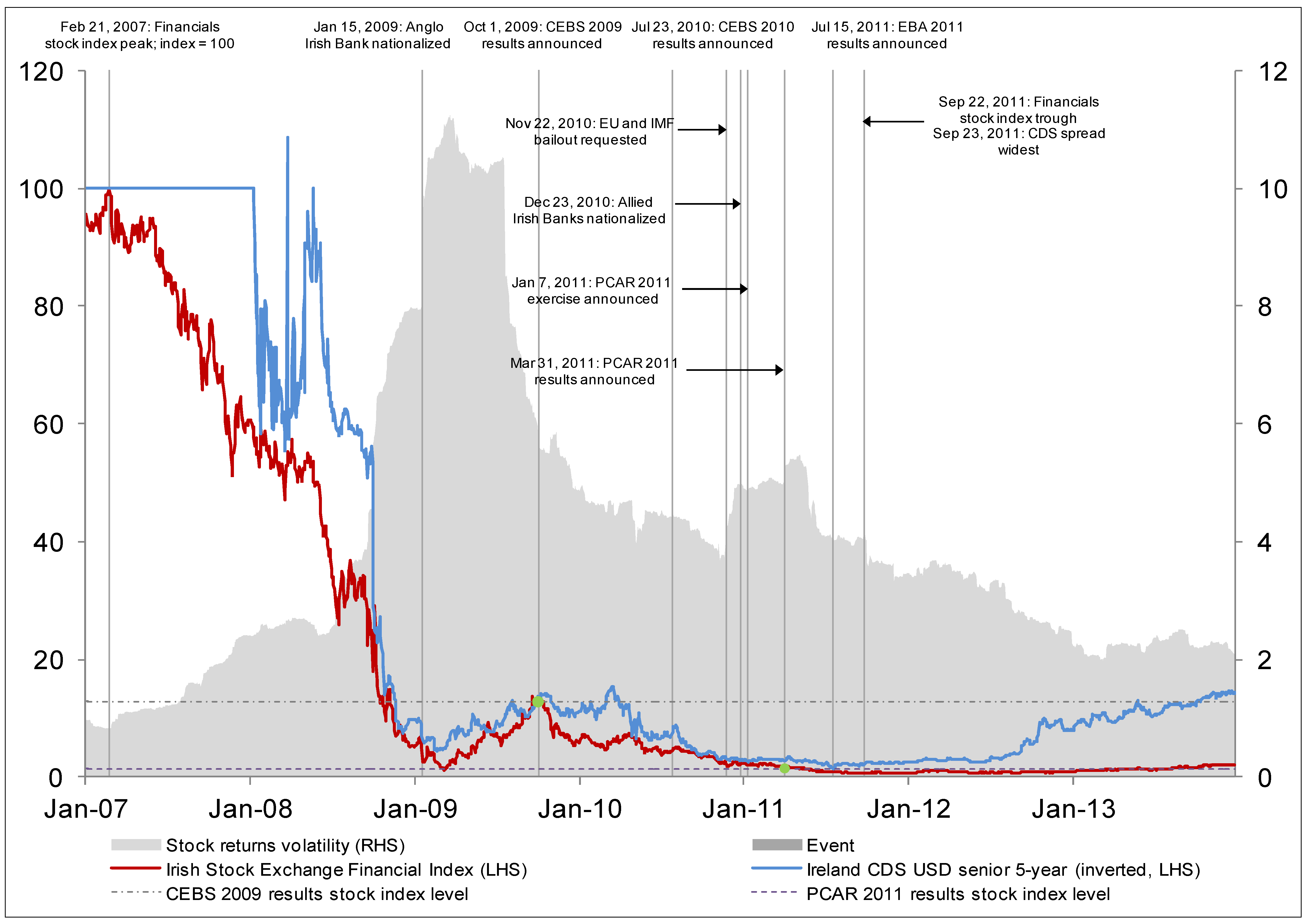

- In Ireland, the Prudential Capital Assessment and Review (PCAR) 2011 exercise contributed to stabilizing market sentiment. However, it was not until the publication of the IMF’s Third Review in September 2011—six months after the release of the PCAR results—indicating that the program’s structural benchmarks had largely been met and that the outcomes of the PCAR were being incorporated into banks’ recapitalization and restructuring plans (IMF [27]), that the exercise gained credibility. In the following six months, the financials stock price index rose by almost 80 percent—albeit from a very low base—the volatility of returns fell and the sovereign CDS spreads tightened by more than 190 basis points (Figure 4).

- In Spain, the third-party BU stress test and corresponding revelation of a comprehensive strategy to identify and deal with problem banks stabilized market sentiment. The announcement of the IMF FSAP and third-party TD stress test results coincided with increased volatility in stock price returns, but also signaled that the authorities were closer to taking concerted action to restructure the banking sector (IMF [28]; Roland Berger [29]; Oliver Wyman [30]). The subsequent publication of the Memorandum of Understanding (MoU) with the Eurogroup in July 2012, which incorporated comprehensive diagnostics of banks’ balance sheets and the details of a financial backstop, reassured investors. Stock price volatility declined sharply and sovereign CDS spreads narrowed by 90 basis points in the 6-month period following the release of the BU results (Figure 5).

| Indicator | Effectiveness of Stress Test | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Instrument | Measure | Desired Change | United States | European Union | Ireland | Spain | |||||||

| Crisis | Supervisory | Crisis | Crisis | Surveillance | Crisis | ||||||||

| SCAP 2009 | CCAR 2011 | CCAR 2012 | CCAR & DFA 2013 | CEBS 2009 | CEBS 2010 | EBA 2011 | PCAR 2011 + IMF | FSAP 2012

1/ | TD 2012 | BU 2012 | |||

| Financials stock index | Index return | Approximately stable or rises | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Return volatility | Falls | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||

| Credit default swap | Spread | Approximately stable or narrows | ✔ | 2/ | 2/ | 2/ | ✔ | ✔ | ✔ | ✔ | |||

| Effectiveness | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||

| Framework | Application to Stress Test | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Component | Element | Design | United States | European Union | Ireland | Spain | |||||||||||||||

| Feature | Importance for Success | SCAP 2009 | CEBS 2009 | CEBS 2010 | EBA 2011 | PCAR 2011 | FSAP 2012 1/ | TD 2012 | BU 2012 | ||||||||||||

| Effectiveness | … | Financials stock index stabilizes/improves and returns volatility falls | ✔ | ✔ | ✔ | Not applicable | ✔ | 2/ | |||||||||||||

| Timing of exercise | … | Stress test is conducted sufficiently early to arrest the decline in confidence | ✔ | 3/ | ✔ | ✔ | ✔ | Not applicable | |||||||||||||

| Governance | Oversight | Oversight is provided by a third party | ✘ | ✔ | ✔ | ✔ | Not applicable | ✔ | ✔ | ||||||||||||

| Stress tester(s) | Stress test is conducted by third party | ✘ | 4/ | ✔ | ✔ | ||||||||||||||||

| Scope | Approach | Stress test approach is bottom-up (BU) | ✘ | 5/ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

| Coverage | Stress test covers at least the systemically important banks and the majority of banking system assets | ✔ | 6/ | ✔ | ✔ | 7/ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||

| Scenario design | Scenarios | Stress test applies large scenario shocks (2 std. devn. or larger) | ✘ | ||||||||||||||||||

| Risk factors | Stress test applies shocks to key risk factors | ✔ | ✔ | 8/ | 8/ | 8/ | ✔ | ✔ | 9/ | ✔ | 9/ | ✔ | 9/ | ||||||||

| Assumptions | Scenarios are standardized across banks | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||

| Behavioral assumptions are standardized across banks | ✘ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||

| Capital standards | Hurdle rate(s) | Stress test applies very high hurdle rate(s) (CET > 6 percent) | ✘ | ✔ | ✔ | ✔ | ✔ | ||||||||||||||

| Transparency | Objective and action plan | Objective | Stress test is associated with a clear and resolute objective | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

| Follow-up action(s) | Stress test is associated with clear follow up action(s) by management/ authorities to address findings as necessary | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||||||

| Financing backstop | Stress test is provided with an explicit financial backstop to support the necessary follow-up action(s) | ✔ | ✔ | ✔ | 10/ | ✔ | |||||||||||||||

| Disclosure of technical details | Design, methodology and implementation | Stress test discloses Information | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||||||||||

| Model(s) | Stress test discloses Information | ✘ | 11/ | ✔ | ✔ | 12/ | |||||||||||||||

| Details of assumptions | Stress test discloses Information | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||

| Bank-by-bank results | Stress test discloses Information | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||||||||||||||

| Asset quality review (AQR) | … | AQR is undertaken as input into stress test | ✔ | 13/ | ✔ | ✔ | |||||||||||||||

| Follow-up stress tests | … | Stress test assumptions on factors that management control are standardized across banks | ✔ | 14/ | ✔ | ✔ | ✔ | 15/ | 15/ | Not applicable | ✔ | 15/ | |||||||||

| Liquidity stress test | … | Liquidity stress test accompanies solvency stress test | ✘ | 16/ | ✔ | ✔ | |||||||||||||||

4. Designing an Effective Crisis Stress Test

4.1. Key Elements

4.1.1. Timing

- The damage to the credibility of the authorities may be too deep-seated to overcome following a lengthy crisis. A consequence could be that they may have to contract third party stress testers and seek independent overseers to enhance the credibility of the exercise.

- Heightened uncertainty about banks’ asset quality and concerns over increasing lender forbearance could mean a more complex, resource-intensive and protracted exercise. The stress test may have to cover a much broader sample of banks than would otherwise be necessary and possibly require additional steps, such as an AQR comprising audits and third-party expert valuations of banks’ portfolios and a DIV exercise.

- Markets are likely to impose higher standards on institutions that are already under extreme pressure if they have lost all trust in the quality of assets (e.g., through expectations of higher loan loss projections and larger capital buffers).

- The United States was first off the rank with the SCAP following two years of decline from the February 2007 historical peak of the S&P 500 Financial Sector Index. The EU CEBS 2009 stress test was also introduced almost 2 years after the STOXX Europe 600 Banks Price Index peaked but has been less effective by comparison. The Ireland and Spain crisis stress tests took place 4 and 5½ years after the apex of their respective financials stock prices. Assuming that the decisions to stress test were made around the end of the year prior to each crisis stress test, the U.S. and European indices would have dropped by anywhere between 65–75 percent by that stage. The long-term (5-, 10- and 15-year) average index levels also do not provide any clear guide to the decision-making process by the authorities as they do not appear to have been used as trigger points. Ireland and Spain conducted their stress tests following their engagement with the Troika for financial support. By that stage, Ireland’s banks had lost almost all their market value, while the equity values of Spanish banks were down by more than 60 percent.

- The PB ratio, which is typically used to assess bank valuations, may yield some hints on the timing of the crisis stress tests. These ratios were richest in late-1990s to early-2000s period for the sample jurisdictions, reaching 3.5 times for the U.S. financials and exceeding 4 times in Ireland and Spain. Long-term averages ranged from 1.8–2.2. The decision to conduct the SCAP would have been made when the PB ratio fell to unity, which could perhaps be considered a “line in the sand” for future reference. The other jurisdictions waited until their respective PB ratios had declined to well below unity, while Ireland’s PCAR would have been contemplated around the time when banks’ average PB ratio had dropped to below 0.3 times.

- Sovereign CDS spreads are an indicator of the market's current perception of sovereign risk. Given the systemic importance of the banking sector for economic activity, market concerns that the government may have to bail out institutions that are too big to fail, and the resulting burden on the fiscal balance, are likely to be reflected in the CDS spreads. In Europe, the sovereign-bank feedback loop from banks’ large holdings of sovereign debt increased the likelihood of losses. Here, any rule-of-thumb that may have been used is less clear—spreads had ballooned to unprecedented levels across the board by the time any decision would have been taken on running the tests.

| Indicator | Statistic | |||||

|---|---|---|---|---|---|---|

| Instrument | Measure | Timing | United States | Europe | Ireland | Spain |

| Financials stock index | Level | Historical peak | 509.6 | 538.8 | 17,951.5 | 158.8 |

| (20 February 2007) | (20 April 2007) | (21 February 2007) | (14 February 2007) | |||

| End of year prior to first crisis stress test | 168.8 | 151.1 | 414.3 | 62.1 | ||

| (31 December 2008) | (31 December 2008) | (31 December 2010) | (31 December 2011) | |||

| Change from peak (percent) | −67.9 | −72.0 | −97.7 | −60.9 | ||

| Average level to end-year prior to stress test | 5-year | 398.7 | 393.5 | 7,528.5 | 101.8 | |

| (2004–2008) | (2004–2008) | (2006–2010) | (2007–2010) | |||

| 10-year | 368.5 | 365.5 | 8,427.3 | 100.4 | ||

| (1999–2008) | (1999–2008) | (2001–2010) | (2002–2010) | |||

| 15-year | 309.0 | 306.5 | 7,434.5 | 91.7 | ||

| (1994–2008) | (1994–2008) | (1996–2010) | (1995–2010) | |||

| Price-to-book ratio of financials stock index | Ratio | Historical peak | 3.50 | 2.21 | 4.16 | 4.74 |

| (12 September 2000) | (15 May 2002) | (1 January 1999) | (17 July 1998) | |||

| End of year prior to first crisis stress test | 0.99 | 0.73 | 0.26 | 0.72 | ||

| (31 December 2008) | (31 December 2008) | (31 December 2010) | (31 December 2011) | |||

| Change (percent) | −71.7 | −67.0 | −93.8 | −84.8 | ||

| Average ratio to end of year prior to stress test | 5-year | 1.84 | 1.75 | 1.25 | 1.36 | |

| (2004–2008) | (2004–2008) | (2006–2010) | (2007–2010) | |||

| 10-year | 2.24 | … | 1.83 | 1.71 | ||

| (1999–2008) | (2001–2010) | (2002–2010) | ||||

| 15-year | 2.21 | … | … | … | ||

| (1994–2008) | ||||||

| Credit default swap | Spread (basis points) | Historical narrowest (based on data availability) | 5.8 | 46.0 | 16.1 | 1.5 |

| (29 April 2008) | (29 September 2009) | (24 March 2008) | (20 June 2005) | |||

| End of year prior to first crisis stress test | 67.4 | … | 608.7 | 380.4 | ||

| (31 December 2008) | (31 December 2008) | (31 December 2010) | (31 December 2011) | |||

| Change from narrowest | +61.6 | … | +592.6 | +378.9 | ||

| Change from narrowest (percent) | +1,062.1 | … | +3,780.7 | +25,260.0 | ||

- By all measures, the “intervention” by the U.S. authorities did halt and turn around the sharp slide in market confidence. That said, the rebound from the 80 percent loss in banks’ market value has been sluggish compared to the overall market, which has recovered all its losses from the crisis (Figure 6). The question then is whether the rise in the financials index would have been quicker and stronger had the supervisors stepped in earlier. Although bank stocks may have arguably been overvalued prior to the crisis, their PB ratio is currently well below the 15-year average.

- The eventual outcomes from the Ireland and Spain stress tests have also been positive but these achievements were almost pyrrhic. The supervisors were perceived to have lost significant credibility with markets by that stage (e.g., The Irish Times [33]; Garicano [34]). External consultants had to be employed to conduct comprehensive AQRs and in the case of Spain, to run the stress tests in order to reassure investors (third-party consultants provided forecast losses for the Ireland stress test). Moreover, the fiscal cost of supporting their respective banking systems had become so onerous that both countries had to eventually request external financial aid.

4.1.2. Governance

- In the United States, the oversight and execution of the SCAP relied on collaboration across supervisory agencies—the Fed, the FDIC and the OCC; supervisors of individual banks were consulted but not involved in the actual stress test analyses.

- The EU-wide stress tests were conducted by national supervisory authorities, overseen and coordinated by the EBA (which did not have direct interaction with the banks prior to or during the exercise) in cooperation with the EC and the ECB/European Systemic Risk Board (ESRB). However, the EBA had argued that it needed more legal powers over the exercise to ensure the reliability of the input data, and hence the results (see Brunsden [35]).

- In contrast, the authorities in Ireland and Spain appointed third-party contractors in their efforts to strengthen perceptions of independence and objectivity in the process. The reputation of the supervisors had been dented after their banks passed the CEBS/EBA stress tests only to require significant restructuring not long afterwards. In the case of Spain, the authorities, the Troika, the EBA and counterparts from two other European central banks were involved in the oversight of the stress testing exercises.

4.1.3. Scope

- The U.S. SCAP consisted of a BU and TD mix, with what we would deem a lower-intensity, quantitative substitute for an AQR. The supervisors applied independent quantitative methods using firm-specific data to support their assessments of banks’ submissions (Fed [36]).

- The EU CEBS 2010 and the EBA 2011 exercises comprised BU tests by cross-border banking groups and simplified stress tests, based on national supervisors and reference parameters provided by the ECB, for less complex institutions. The CEBS 2010 stress test included a peer review of the results and a challenging process, as well as extensive cross-checks by the CEBS (CEBS [14]); the process evolved for the EBA 2011 exercise to incorporate consistency checks by the EBA, a multilateral review and TD analysis by the EBA and the ESRB with ECB assistance (EBA [37]).

- Ireland’s PCAR 2011 was a BU exercise supported by an AQR. Banks were required to model the impact of certain assumptions on their balance sheets and profit and loss accounts (revenues and losses) based on a third party’s assessment of forecast losses (CBI [38]). The stress test was perceived to be particularly credible in that it explicitly compared the loan loss estimates of the CBI with those of the third party as a cross-check of the results, which were subsequently published by the CBI.

- In Spain, two sets of crisis stress tests were conducted in 2012 and the results were published by the third party-consultants who conducted the exercises:

- ➢

- The first exercise was a TD stress test. Two consultants separately considered the historical performance and asset mix for each institution at aggregate levels to generate forward-looking projections. The consultants applied their own models, expert experiences and benchmarks (Roland Berger [29]; Oliver Wyman [30]).

- ➢

- The second stress test was conducted by one consultant, using detailed data from banks and inputs from a comprehensive AQR exercise. Specifically, the test drew on information derived from external reviews by independent auditors and real estate appraisers and from BdE central databases, to estimate individual banks’ capital needs under a baseline and an adverse scenario (Oliver Wyman [39]). Structural analysis of individual banks’ financial statements and business plans were undertaken. Given that the banks only ran their own models on the baseline scenario to generate net revenues, it was essentially another TD exercise—albeit at a much more granular level—but is widely referred to as a bottom-up (BU) exercise. (For differentiation purposes, we refer to the first as the TD test and the second as the BU test).

- The U.S. SCAP included the 19 largest bank holding companies (BHCs), each with total assets greater than $100 billion. They represented two-thirds of banking system assets.

- The EU CEBS 2009 stress test captured 22 large cross-border banks with 60 percent of EU banking assets; the number of banks increased to 91 in subsequent exercises, covering 21 countries and at least 50 percent of each banking sector, for an additional 5 percentage points coverage of EU banking assets. However, the flexibility for country authorities to choose which banks to include in the stress tests was perceived to have reduced the legitimacy of the exercises (Ahmed et al. [43]).

- Ireland’s PCAR 2011 stress tested four financial institutions which accounted for 80 percent of banking system assets.

- In Spain, the TD and BU stress tests covered banks accounting for around 90 percent of total system assets. Initial concerns had been with some medium-sized and smaller banks rather than the largest, most systemic banks. However the slow deterioration in sentiment over a prolonged period and constant revelations of new problems eventually affected perceptions of the entire banking system. In the end, the inclusion of both the largest banks and the smaller problem ones in both stress tests became necessary in order to differentiate the strong institutions from the weak ones.

4.1.4. Scenario Design

- The CEBS 2009 and 2010 and the EBA 2011 exercises applied cumulative growth shocks averaging 1.9, 1.3 and 1.5 standard deviations from their respective baseline growth scenarios (Box 1), with attendant shocks to other macroeconomic variables. However, the test results did not gain wide acceptance.

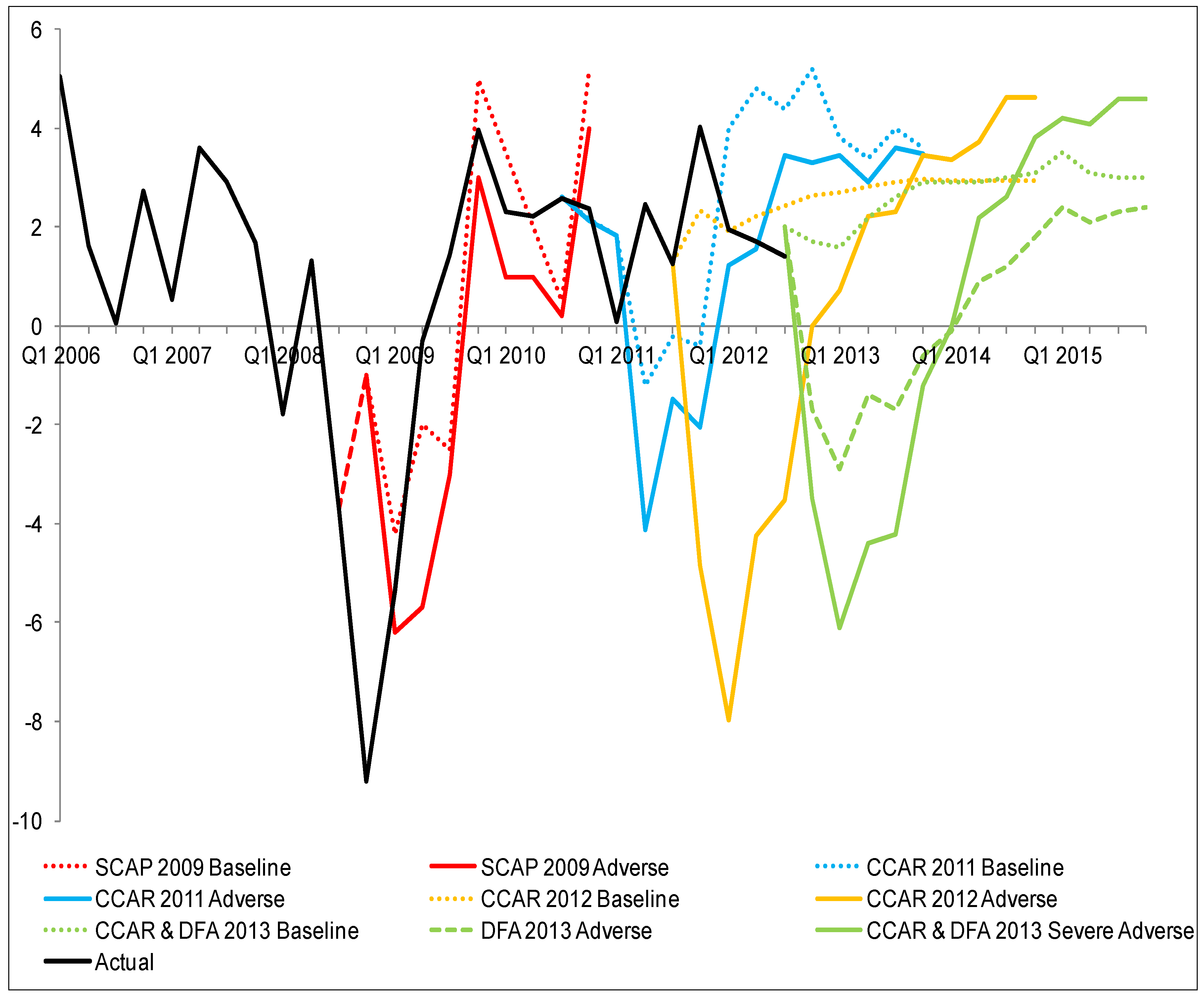

- What is not commonly known is that the adverse growth scenario used in the SCAP was even less stressful than any of the CEBS/EBA shocks. It was equivalent to a cumulative one standard deviation from the baseline over the two-year risk horizon, determined well before the contraction had bottomed out (Figure 7). Indeed, the SCAP stress scenario was criticized by some at the time the results were announced for likely being closer to the actual baseline itself (e.g., Fox [51]). Yet, the SCAP was effective in regaining market confidence.

- Similarly, the growth shocks applied to both the Spain TD and BU stress tests were equivalent to one standard deviation from the projected baseline, while Ireland’s PCAR 2011 used the EBA scenarios.

| Parameter | Application to Stress Test | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | Indicator | United States | European Union | Ireland | Spain | ||||

| SCAP 2009 | CEBS 2009 | CEBS 2010 | EBA 2011 | PCAR 2011 | FSAP 2012 1/ | TD 2012 | BU 2012 | ||

| Growth | Real GDP | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Real GNP | ✔ | ||||||||

| Nominal GDP | ✔ | ✔ | ✔ | ||||||

| Employment | Unemployment rate | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Employment | ✔ | ||||||||

| Price evolution | CPI | 2/ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| HICP | ✔ | ✔ | |||||||

| GDP deflator | ✔ | ✔ | ✔ | ||||||

| Consumption | Private | ✔ | |||||||

| Government | ✔ | ||||||||

| Trade | Exports | ✔ | |||||||

| Imports | ✔ | ||||||||

| Balance of payments | ✔ | ||||||||

| Income and investment | Investment | ✔ | |||||||

| Personal disposable income | ✔ | ||||||||

| Real estate | Real estate prices | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Commercial property | ✔ | ✔ | ✔ | ✔ | |||||

| Residential property | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Land | ✔ | ✔ | |||||||

| Interest rates | Short-term interest rate (12 months or less) | 2/ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Medium-term interest rate (up to 5 years) | 2/ | ✔ | ✔ | ✔ | |||||

| Long-term interest rate (more than 5 years) | 2/ | ✔ | ✔ | ✔ | ✔ | ||||

| Exchange rate | Relative to U.S. dollar | 2/ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Stock market | Stock price index | 2/ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Credit to other resident sectors | Households | ✔ | ✔ | ✔ | |||||

| Non-financial corporate | ✔ | ✔ | ✔ | ||||||

- The EU stress tests have been vociferously criticized for their inadequate capture of important risk factors, owing in part to political economy constraints (see Wilson [52]; Wishart [53]). The failure to properly stress banks’ sovereign exposures was considered particularly egregious in light of the debt crisis and concerns about the bank-sovereign feedback loop (e.g., Ahmed et al. [43]; Das [54]; Steinhauser [49]). Specifically, the haircuts imposed on banks’ sovereign portfolios in the trading book during the EBA 2011 exercise were seen to have been too lenient as they only applied a market value adjustment rather than possible defaults, while the omission of any stress test of the banking book—where the majority of banks’ sovereign exposures resided—meant that the main risk factor at the time had not been adequately captured.

- In Spain, concerns about lender forbearance and possible misclassifications in banks’ loan books were addressed in the BU exercise. Auditors and real estate appraisers were appointed to verify the quality of the input data. The issue of sovereign risk was omitted but was considered less of an issue owing to the availability of the LTRO facility from the ECB by the time of the stress tests. The liquidity support allayed market concerns about banks’ funding costs and possible deep haircuts to their sovereign debt portfolio as the pressure for banks to liquidate their holdings in the hold-to-maturity (HtM) banking book and realize the losses abated.

Box 1. Designing Crisis Stress Test Growth Scenarios.

- Calculate the 2 year growth rates over the preceding 30 years.

- Calculate the standard deviation of the 2-year growth rates over the 30 year period.

- Calculate the desired number of standard deviations of the 2-year growth rate.

- Apportion the standard deviation(s) growth over the 2-year horizon and subtract from each year of the baseline forecast to derive the stressed scenario.

| Risk Factor | Application to Stress Test | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Risk Type | Nature of Accounting | Exposure | United States | European Union | Ireland | Spain | ||||

| SCAP 2009 | CEBS 2009 | CEBS 2010 | EBA 2011 | PCAR 2011 | FSAP 2012 1/ | TD 2012 | BU 2012 | |||

| Credit risk | … | Residential mortgages | ✔ | 4/ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| First lien | ✔ | |||||||||

| Second lien | ✔ | |||||||||

| Commercial and industrial loans 2/ | ✔ | |||||||||

| Corporate loans | 3/ | 4/ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| RE developers | ✔ | ✔ | ✔ | ✔ | ||||||

| SME loans | 3/ | ✔ | ✔ | ✔ | ✔ | |||||

| CRE loans | ✔ | ✔ | ✔ | |||||||

| Financial institutions loans | ✔ | 4/ | ✔ | ✔ | ||||||

| Consumer loans (including credit card) | ✔ | 4/ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| Revolving loans | 3/ | ✔ | ||||||||

| Public works | 3/ | ✔ | ✔ | |||||||

| Sovereign exposure in available-for-sale (AfS) banking book | ✔ | ✔ | ||||||||

| Other loans | ✔ | |||||||||

| Market risk | Trading book | Sovereign portfolio | ✔ | 4/ | ✔ | ✔ | ✔ | ✔ | ||

| Financial institutions portfolio | ✔ | 4/ | ✔ | ✔ | ✔ | ✔ | ||||

| Other securities (incl. MBS and other ABS) | ✔ | ✔ | ||||||||

| Private equity holdings | ✔ | |||||||||

| Counterparty credit exposures to OTC derivatives | ✔ | |||||||||

| Banking book (AfS) | Sovereign portfolio | ✔ | ✔ | |||||||

| Financial institutions portfolio | ✔ | ✔ | ||||||||

| Other securities (incl. MBS and other ABS) | ✔ | ✔ | ||||||||

| Banking book (HtM) | Sovereign portfolio | ✔ | ||||||||

| Financial institutions portfolio | ✔ | |||||||||

| Other securities (incl. MBS and other ABS) | ✔ | ✔ | ||||||||

| Operational risk | … | … | ✔ | ✔ | ||||||

| Separate liquidity risk test | … | … | 5/ | ✔ | ✔ | |||||

- In the SCAP, the U.S. supervisors provided assumptions for the macroeconomic scenarios. Banks were asked to adapt the assumptions to reflect their specific business activities when projecting their potential losses and resources for absorbing those losses; supervisors then reviewed and assessed the firms’ submissions and the quantitative methods that were used to project those losses and resources, as well as the key assumptions (Fed [36,55]). To facilitate horizontal comparisons across firms, supervisors applied their own independent quantitative methods to firm-specific data.

- The EU CEBS/EBA stress tests applied macroeconomic and sovereign shock scenarios and parameters developed by the ECB. Very detailed and prescriptive guidance on assumptions and methodologies were provided for the EBA 2011 exercise (EBA [37]). Banks’ calculations were reviewed and challenged by the respective national supervisors, then analyzed by the EBA, which conducted in-depth consistency checks and challenges with national supervisors.

- Ireland’s PCAR 2011 incorporated many of the parameters used for the EBA 2011 stress test. A private consultancy firm was contracted by the CBI to provide oversight and to challenge the work of the third-party stress tester and to ensure consistency across institutions and portfolios (CBI [38]).

- The Spanish stress tests used the growth scenarios and guidelines provided by a Steering Committee comprising the authorities, the Troika and counterparts from two European central banks. The process and methodology for the BU exercise were closely monitored and agreed upon with an Expert Coordination Committee from the Troika, the EBA and the authorities (Oliver Wyman [39]).

4.1.5. Capital Standards

- The U.S. authorities applied their existing capital framework. Banks were required to meet the T1 capital hurdle of 6 percent post-stress and the higher quality T1 Common Equity ratio of 4 percent post-stress. Basel I risk weights were used to calculate risk-weighted assets (RWA), providing transparency in this aspect of the stress test. Nonetheless, the authorities acknowledged in designing the SCAP that “no single measure of capital adequacy is universally accepted or would guarantee a return of market confidence” (Bernanke [56]).

- The EU, Ireland and Spain stress tests applied the existing Capital Requirement Directive (CRD) at the time (i.e., CRD II) to the calculation of capital. The Basel II risk weights–which are more opaque—were used to calculate RWA. That said, the capital definition deviated from that of the regulatory directive.

- ➢

- The CEBS 2009 and 2010 stress tests applied a T1 hurdle rate of 6 percent. The EBA 2011 stress test evolved in line with Basel III developments—it implemented a commonly-agreed upon definition of common equity capital (“EBA Core Tier 1 (CT1)”) and applied a post-stress hurdle rate of 5 percent, noting that a higher threshold than the legal minimum was “necessary in assessing the resilience of banks in adverse circumstances if credibility and confidence in the banking sector is to be restored” (EBA [57]).

- ➢

- Ireland imposed a hurdle rate of 10.5 percent for the baseline scenario and 6 percent EBA CT1 under stress (up from the 4 percent required minimum), plus an additional protective buffer.

- ➢

- The Spain TD and BU stress tests applied an EBA CT1 hurdle rate of 9 percent under the baseline scenario and 6 percent for the adverse scenario.

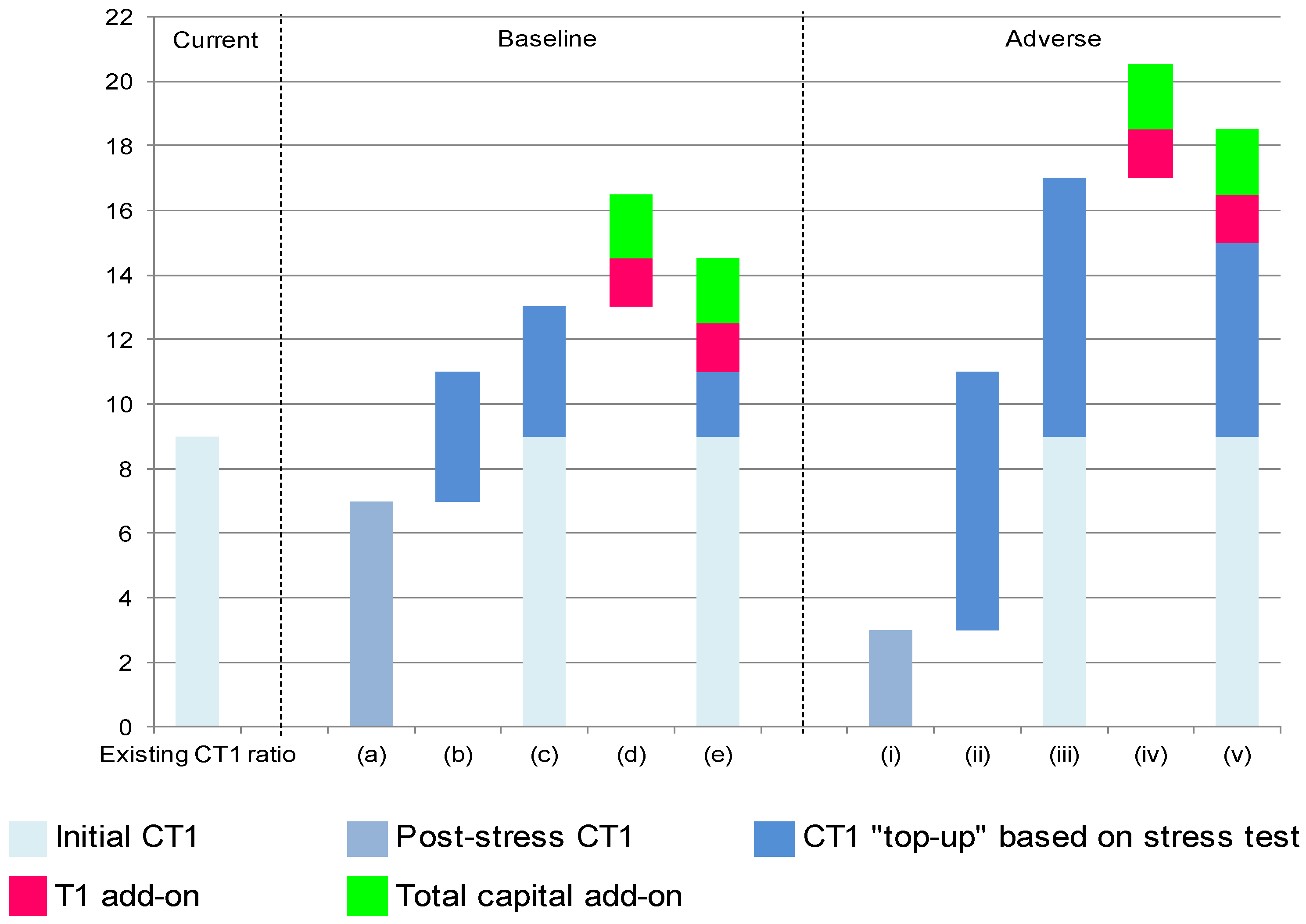

Box 2. The Potential Impact of Capital Hurdle Rates for Crisis Stress Tests.

- Baseline (central case)

- (a)

- Assume that under the baseline scenario, the bank’s CT1 ratio is reduced by 2 percentage points to 7 percent.

- (b)

- The bank is expected to take capital action that would return the CT1 ratio up to 11 percent, i.e., an increase of 4 percentage points.

- (c)

- In other words, the bank would have to “top up” its existing 9 percent CT1 ratio with another 4 percentage points up to 13 percent, in anticipation of the baseline scenario materializing.

- (d)

- This means that the bank would have to hold a total capital adequacy ratio of more than 16 percent, once additional requirements to make up T1 and total capital are included, and even before taking into account possible items such as D-SIB or G-SIB surcharges.

- (e)

- If the central case growth forecast is accurate and the bank’s CT1 ratio is indeed reduced by 2 percentage points, the bank would have a CT1 ratio of the targeted 11 percent.

- Adverse

- (i)

- Assume that under a severe adverse scenario, the tail shock sharply increases the bank’s projected losses and reduces its CT1 ratio by 6 percentage points to 3 percent.

- (ii)

- The bank is expected to take capital action that would return the CT1 ratio back up to 11 percent, i.e., an increase of 8 percentage points.

- (iii)

- In other words, the bank would essentially have to have a CT1 ratio of 17 percent (i.e., the existing 9 percent plus another 8 percentage points).

- (iv)

- This means that the bank would have to hold a total capital adequacy ratio of more than 20 percent, once additional requirements to make up T1 and total capital are included, and even before taking into account possible items such as D-SIB or G-SIB surcharges.

- (v)

- If the baseline scenario were to materialize, the bank would be carrying a CT1 ratio of 15 percent (i.e., 17 percent less the 2 percentage points impact).

| Study | Expected

Losses 1/ | CT1

Threshold | Recapitalization Needs | |||

|---|---|---|---|---|---|---|

| (In percent) | (In percent) | (In billions of euro) | ||||

| 1 | 14 | 10–11 | 79–86 | |||

| 2 | 11–14 | current level | 65 | |||

| 3 | 9 | … | 80 | |||

| 4 | 14 | 10 | 45–55 | |||

| 5 | 16 | 10 | 33–57 | |||

| 6 | 16 | 9 | 90 | |||

| 7 | … | 11 | 68 | |||

| 8 | … | current level | 54–97 | |||

| 9 | 51 | … | 58 | |||

| 10 | 11–19 | RDL 2/2011 | 45–119 |

4.1.6. Transparency

4.1.6.1. Objective, Action Plan and Financial Backstop

- The former should not risk prejudging the final result—the underlying conditions of banks need to be determined first.

- The latter must be in place at the time of the commencement of the exercise to avoid any uncertainty on the part of depositors or investors who may be concerned about their holdings of bank debt or the possible dilution of their shareholdings. It should comprise a clear action plan, and credible financial backstops against possible adverse findings must be at hand (see Schuermann [7]). For instance, the revelation of a potentially large gap in bank capitalization with no market access would require other ready sources of funding to fill that capital need.

- In some cases, the restoration of solvency may require a detailed roadmap for significant balance sheet and cost restructuring. Merely raising capital would be ineffective if cleaning up balance sheets is necessary for their repair (see Borio et al. [46]). Importantly, any restructuring should be carried out swiftly and, as much as possible, in ways that do not worsen sovereign debt burdens (Claessens et al. [59]).

- In other cases, the resolution of non-viable banks may be necessary to ensure the future health of the system. Thus, having an adequate resolution framework in place to take the requisite action is also key to any successful outcome arising from crisis stress tests.

- The U.S. authorities are generally perceived to have stood “wholeheartedly” behind their stress test results (Onado and Resti [11]). The SCAP was designed and implemented to meet a clearly-defined policy objective with the necessary financial support.

- ➢

- The authorities explicitly noted that the aim of the SCAP was to try and change macroeconomic outcomes by ensuring that the largest banks had sufficient capital buffers so that they would remain well-capitalized and be able to continue providing credit and intermediation services even in an economic environment that was more challenging than anticipated at the time (Fed [60]; Tarullo [2]).

- ➢

- At the start of the exercise, the authorities announced that banks needing to augment their capital post-stress test would be given one month to design a detailed plan and six months to raise the requisite extra capital, and that they would be bridged by the Treasury’s firm commitment to provide contingent common equity under the Capital Assistance Program (CAP) of the Troubled Asset Relief Program (TARP) in the meantime.

- ➢

- Clarifications (or “forward guidance”) by the authorities that the SCAP would not be used as a pretext for government takeovers of the largest banks, if nationalization was not necessary, provided support for their stock prices; indeed, the stock prices of SCAP banks outperformed the non-SCAP ones during the stress test period, possibly because it was unclear how the latter would traverse the financial crisis.

- The contrast between the U.S. and EU crisis stress tests has been stark:

- ➢

- The clarity of the EU objectives improved only over time. The stated aim of the CEBS 2009 stress test was vague, with the authority initially noting that the exercise was being held in the context of supervisors’ regular risk assessment of the financial sector (CEBS [61]). In contrast, the objectives of the CEBS 2010 and the EBA 2011 exercises were explicit—to provide policy information about the overall resilience of the EU banking system for the assessment of banks’ resilience to adverse economic developments and to inform policymakers about the ability of banks to absorb those shocks (CEBS [14]; EBA [57]).

- ➢

- Moreover, little guidance was provided on possible action plans and the availability of resources to back them. Follow-up measures to the CEBS 2010 stress test were left to individual national authorities to pursue. The tests failed to reassure the markets, especially when some banking systems subsequently came under severe pressure. The EBA 2011 exercise subsequently required banks showing capital shortfalls to present their plans to restore their capital positions and to implement remedial measures within 6 months. However, the European governments could not reach any agreement prior to any of the CEBS or the EBA stress tests and could not provide any collective financial backstop for the results.

- In Ireland, the PCAR 2011 was undertaken following the government’s request for financial support from the Troika (see Department of Finance—Government of Ireland and CBI [62]). The government had requested an IMF arrangement under the Extended Fund Facility for a period of 36 months in the amount of €22.5 billion, in addition to €45 billion from the European Financial Stabilization Mechanism (EFSM)/European Financial Stability Facility (EFSF) including bilateral loans and own resources, in November 2010. The stress test formed part of the agreed reforms of the domestic banking sector under the Financial Measures Program, the banking element of this package.

- Nowhere was the difference between having a clear objective and action plan in place and not having them more obvious than in the case of Spain. Markets remained unconvinced following the release of the results from the TD stress test in June 2012. The exercise had been undertaken to obtain an “overall figure” for the recapitalization needs of the Spanish banking system as a precursor to a more granular evaluation of individual bank portfolios as part of its request for EU assistance (Ministry of Economy and Competitiveness and BdE [63]). However, it was not accompanied by any specific details on a financial backstop or follow-up action to address the problems in the banking sector. Sentiment only firmed upon the actual signing of the MoU with the Eurogroup in July, under which financial assistance to the banking sector would be provided through the European Stability Mechanism (ESM). The aim was to use the subsequent BU stress test to identify institutions that needed to be restructured and to require concerted reforms of the banking sector as key conditions for financial support.

4.1.6.2. Disclosure of Technical Details

| Framework | Disclosure by Stress Test | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Component | Element | United States | European Union | Ireland | Spain | ||||

| SCAP 2009 | CEBS 2009 | CEBS 2010 | EBA 2011 | PCAR 2011 | FSAP 2012 1/ | TD 2012 | BU 2012 | ||

| Process | Design | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Methodology | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Model(s) | ✔ | 2/ | ✔ | ||||||

| Assumptions | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Macroeconomic scenarios | ✔ | 3/ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Loan loss assumptions | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

| Market assumptions | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| P&L assumptions | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| Behavioral assumptions (incl. capital action as relevant) | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Implementation | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

| Results | System aggregate | ✔ | ✔ | ✔ | ✔ | ||||

| Loan losses | 4/ | ✔ | ✔ | ✔ | ✔ | ||||

| By type | ✔ | ✔ | ✔ | ||||||

| Other portfolio losses | 4/ | ✔ | |||||||

| Impact on P&L | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Capital ratios | ✔ | ✔ | ✔ | ||||||

| Capital components (incl. RWA) | ✔ | ✔ | ✔ | ||||||

| Capital shortfall (incl. buffer) | ✔ | ✔ | ✔ | ||||||

| Capital action (incl. government support measures as relevant) | ✔ | ✔ | ✔ | ✔ | |||||

| Individual bank | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Loan losses | ✔ | 5/ | ✔ | ✔ | ✔ | ||||

| By type | ✔ | 5/ | ✔ | ✔ | ✔ | ||||

| Other portfolio losses | ✔ | 5/ | ✔ | ✔ | ✔ | ||||

| Impact on P&L | ✔ | ✔ | ✔ | ||||||

| Capital ratios | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Capital components (incl. RWA) | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Capital shortfall (incl. buffer as relevant) | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

| Capital action (incl. government support measures as relevant) | ✔ | ✔ | ✔ | ||||||

4.2. Other Important Considerations

4.2.1. Asset Quality Review

- the actual cost of running the exercise, which may require a third party contractor, plus possibly input from auditors and asset valuation companies; and

- the cost of cleaning up the books first if significant inaccuracies in reporting (i.e., incorrect loan and/or non-performing loan classifications) and/or lender forbearance are discovered, through loss recognition of unviable loans via additional provisioning (which flows through profits to capital); this step would be taken ahead of the stress test which would then provide an estimate of potential additional capital needs under hypothetical adverse scenarios (Appendix II).

- Banks were instructed to estimate cash flow losses using a set of indicative loss rate ranges provided by the supervisors for specific loan categories.

- The estimates were adjusted by granular, bank-specific information on factors such as past performance, portfolio composition, origination vintage, borrower characteristics, geographic distribution, international operations and business mix to benchmark indicative loan loss parameters (Fed [36]).

- Reviews of the SCAP submissions by banks were subsequently conducted by experts in accounting and asset pricing and incorporated inputs from on-site supervisors.

| Jurisdiction | Exercise | Objective | System Coverage | Risk Horizon (RH) | Growth Shock Scenarios | Capital Standards | Disclosure | |||||||||||

| Number | Percent | Actual | For | Adverse | Definition | Metric(s) | Hurdle | Publication | Estimated | |||||||||

| of Banks | of | Comparison | Std. Devn. (SD) | SD of 2-year | SD of | (Ratio) | Rate(s) | of | Losses | |||||||||

| Disclosed | System | over 2-year | Calculation | Growth Rate | Shock over 2 | Results | (Billions) | |||||||||||

| Assets | Period | Period | over Period | Years of RH | ||||||||||||||

| United States | SCAP 2009 | Crisis management | 19 | 67 | 2009–10 | 2009–10 | 1979–2008 | 2.9 | 1.0 | Fed's risk-based | Tier 1 common capital | 4 | Yes | USD599.2 | ||||

| capital adequacy | Tier 1 capital | 6 | ||||||||||||||||

| guidelines | ||||||||||||||||||

| European Union | CEBS Stress Test 2009 | Crisis management | 22 | 60 | 2009–10 | 2009–10 | 1979–2008 | 2.0 | 1.9 | CRD | Tier 1 capital | 6 | No | n.a. | ||||

| European Union | CEBS Stress Test 2010 | Crisis management | 91 | 65 | 2010–11 | 2010–11 | 1980–2009 | 2.5 | 1.3 | CRD | Tier 1 capital | 6 | Yes | EUR565.8 | ||||

| European Union | EBA Stress Test 2011 | Crisis management | 90 | 65 | 2011–12 | 2011–12 | 1981–2010 | 2.7 | 1.5 | CRD | Core Tier 1 | 5 | Yes | EUR400.0 | ||||

| European Union | EBA Capital Exercise 2011 | Crisis management | 65 (excl. GRE 6) | n.a. | Position as at Sep 2011 | -- | -- | -- | -- | CRD | Core Tier 1 | 9 | Yes | … | ||||

| United States | CCAR 2011 | Supervisory | 19 | 65 | 2010 Q4– | 2011–12 | 1980–2009 | 3.4 | 1.4 | Fed's risk-based | Tier 1 common capital | 5 | No | n.a. | ||||

| 2013 Q4 | capital adequacy | Tier 1 capital | 6 | |||||||||||||||

| guidelines | Total risk-based capital | 8 | ||||||||||||||||

| Tier 1 leverage | 3 or 4 | |||||||||||||||||

| United States | CCAR 2012 | Supervisory | 19 | 67 | 2011 Q4– | 2011 Q4– | 1981–2010 | 3.5 | 2.5 | Fed's risk-based | Tier 1 common capital | 5 | Yes | USD534.0 | ||||

| 2014 Q4 | 2013 Q3 | capital adequacy | Tier 1 capital | 6 | ||||||||||||||

| guidelines | Total risk-based capital | 8 | ||||||||||||||||

| Tier 1 leverage | 3 or 4 | |||||||||||||||||

| United States | DFA 2013 | Supervisory | 18 | > 70 | 2012 Q4– | 2012 Q4– | 1982–2011 | 3.5 | 2.5 | Fed's risk-based | Tier 1 common capital | 5 | Yes | USD462.0 | ||||

| 2015 Q4 | 2014 Q3 | capital adequacy | Tier 1 capital | 6 | ||||||||||||||

| guidelines | Total risk-based capital | 8 | ||||||||||||||||

| Tier 1 leverage | 3 or 4 | |||||||||||||||||

| United States | CCAR 2013 | Supervisory | 18 | > 70 | 2012 Q4– | 2012 Q4– | 1982–2011 | 3.5 | 2.5 | Fed's risk-based | Tier 1 common capital | 5 | Yes | n.a. | ||||

| 2015 Q4 | 2014 Q3 | 1979–2008 | capital adequacy | Tier 1 risk-based capital | 6 | |||||||||||||

| guidelines | Total risk-based capital | 8 | ||||||||||||||||

4.2.2. Follow-Up Stress Test(s)

4.2.3. Liquidity Stress Test

- Liquidity risk has not been specifically assessed as part of the EBA stress testing exercises. However, a confidential thematic review of liquidity funding risks was initiated in 2011 Q1 to assess banks’ vulnerability in relation to liquidity risk. The EBA 2011 solvency stress test analyzed the evolution of the cost of funding connected to the specific financial structure of the banks in question, in particular, the impact of increases in interest rates on assets and liabilities, including that of sovereign stress on banks’ funding costs.

- Likewise, liquidity stress tests were not conducted in Spain’s case. However, the funding costs in the solvency stress tests were assumed to increase with the proposed scenarios for the solvency stress tests.

- Ireland’s Prudential Liquidity Assessment and Review (PLAR) 2011 has been the only crisis liquidity stress test implemented to date. It covered the four PCAR banks. The exercise set bank specific funding targets consistent with Basel III and other international measures of stable, high quality funding (CBI [38]). The PCAR 2011 specified its constraints and parameters for funding costs and access to funds in line with the PLAR.

5. Comparing Crisis Stress Test Results with Restructuring Costs

- Foremost is that macroprudential stress tests should assume the Going Concern Principle. In other words, banks are assumed to operate as going concerns indefinitely and do not have to realize lifetime losses on their asset portfolios. This means that the banks are assumed to have the ability to hold loans to maturity, and stress test valuations are focused on projected cash flow credit losses related to borrowers’ failure to meet their obligations rather than on their liquidation values (see Bernanke [57]). Since the results of crisis stress tests are used to help identify banks that may need to be restructured, standardization of scenarios and some key assumptions are necessary during this phase.

- Any required restructuring after the initial crisis stress test would be a more bespoke exercise. At that stage, a thorough assessment of the identified banks’ books prior to any recapitalization would be necessary. It would typically entail the recognition of valuation losses (e.g., foreclosed real estate holdings or tax credits) or additional loan losses, which would also include some projections of future losses under stress, to determine an adequate capital buffer. Moreover, the banks’ non-core assets may have to be realized towards the cost of the restructuring effort, which could include selling off investment portfolios in their respective banking books at significant haircuts.

6. Concluding Remarks

- The public nature of crisis stress tests means that they must be designed to withstand intense scrutiny. Therefore, certain elements of the design, such as the timing of the test, its governance, the objective of the exercise, the proposed action plan to address the findings and the nature of disclosure may necessarily have to be executed differently from what would be typical in normal supervisory stress tests.

- Other elements of crisis stress tests must be sufficiently rigorous so that the results are convincing. These include the scope of coverage and the scenario design, although the latter need not necessarily be complex.

- Crisis stress tests also require the support of other activities to enhance their credibility. Specifically, AQRs are vital for the reliability of the inputs, while follow-up stress tests to update markets on developments are important for consolidating previous gains. Separate liquidity stress tests to complement the solvency ones are also increasingly being employed, although not all are published.

- Political economy could play a key role in determining the effectiveness of crisis stress tests. Given the potential economic and reputational implications of the findings, the design of these tests could be influenced by political economy considerations.

- Finally, it would be remiss to discount the importance of luck in any crisis stress test. Its successful implementation may well require a dose of good fortune, e.g., in areas such as the actual health of banks, the timing of the exercise, market conditions and public receptiveness to the disclosures (see Dudley [79]).

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix I. Case Studies of Crisis Solvency Stress Tests: United States, European Union, Ireland and Spain

| Framework | Application to Stress Test | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Component | Element | Design Feature | United States | European Union (EU) | Republic of Ireland | Spain | ||||||

| Supervisory Capital Assessment Program (SCAP) | Committee of European Banking Supervisors (CEBS) 2009 | Committee of European Banking Supervisors (CEBS) 2010 | European Banking Authority (EBA) 2011 | Prudential Capital Assessment Review (PCAR) 2011 | IMF Financial Sector Assessment Program (FSAP) 2012 1/ | Top-down (TD) 2012 Exercise | Bottom-up (BU) 2012 Exercise | |||||

| Effectiveness | … | Financials stock index stabilizes/improves, the index returns volatility falls and the sovereign CDS spread stabilizes or narrows. | ●Yes—The financials stock index never again fell below the level recorded at the time the stress test results were announced; volatility dropped sharply following the announcement of results. | ●No. | ●No. | ●No. | ●Yes, the financial stock index rose sharply; the volatility of returns dropped, and the sovereign CDS spread narrowed significantly after the publication of the IMF’s Third Review in September 2011 helped give credence to the exercise. | ●Not applicable—The FSAP stress test was not intended as a crisis management exercise. | ●No. | ●Yes—The financials stock stabilized around the level recorded at the time the stress test results were announced; volatility dropped sharply; and the sovereign CDS spread narrowed significantly.. | ||

| Timing of exercise | … | Stress test is conducted sufficiently early to arrest the decline in confidence | ●The exercise was conducted 24 months after the peak of the financials stock index, while the index was still falling. | ●The exercise was conducted 23 months after the peak of the financials stock index, while the index was still falling. | ●The results were announced 9 months following the CEBS 2009 results—after the Ireland and Greece bailouts provided some support for market sentiment—despite some loss in credibility. | ●The results were announced 12 months after the CEBS 2010 results, but the exercise had lost significant credibility with markets by that stage. | ●The exercise was conducted 49 months after the peak of financials stock index, after almost all market value had been lost. | ●Not applicable— FSAPs to each S-25 country are conducted mandatorily once every five years; the Spain FSAP took place 60 months after the peak of the financials stock index. | ●The exercise was conducted 64 months from the peak of the financials stock index, after the supervisors had lost significant credibility with markets. | ●The exercise was conducted 3 months after the TD stress test results, of which markets were skeptical given the lack of information on individual banks. | ||

| Governance | Oversight | Stress test is overseen by an independent third party | ●No—The stress test was overseen by the authorities. | ●Yes—The stress test was overseen and coordinated by the CEBS in cooperation with the EC and the ECB. | ●Yes— The stress test was overseen and coordinated by the CEBS in cooperation with the EC and the ECB. | ●Yes— The stress test was overseen and coordinated by the EBA in cooperation with the EC, the ECB and the ESRB. | ●No—The stress test was overseen by the CBI. | ●Not applicable. | ●Yes—The stress test was overseen by a Steering Committee comprising the authorities, supported by an Advisory Panel consisting of the Troika, Banque de France and the Dutch National Bank. | ●Yes—The stress test was overseen by a Strategic Coordination Committee consisting of the authorities, the Troika and the EBA and in consultation with an Expert Coordination Committee comprising the same membership. | ||

| Governance (continued) | Stress tester(s) | Stress test is conducted by an “independent” third party | ●No—The stress test was conducted by the authorities: The Fed, the FDIC and the OCC. | ●No—The stress test was conducted by national supervisory authorities. | ●No—The stress test was conducted by national supervisory authorities. | ●No—The stress test was conducted by national supervisory authorities. | ●No—The stress test was conducted by the CBI with BlackRock Solutions providing forecast losses; Boston Consulting Group provided oversight and challenge to BlackRock’s work. | ●No—The stress test was conducted by the BdE, in collaboration with the IMF. | ●Yes—The stress test was conducted by Oliver Wyman and Roland Berger. | ●Yes—The stress test was conducted by Oliver Wyman, with inputs from auditors and real estate valuation companies, all coordinated by the Boston Consulting Group. | ||

| Scope | Approach | Stress test approach is bottom-up (BU) | ●Yes—BU and TD mix, with authorities providing macroeconomic scenarios and guidance on the estimation of loan loss parameters. | ●Yes—Constrained BU. | ●Yes—Constrained BU (of cross-border groups) and simplified stress tests, based on national supervisors and reference parameters provided by the ECB for less complex institutions, with macroeconomic and sovereign shock scenarios and parameters developed by the ECB. | ●Yes—Constrained BU (of cross-border groups) and simplified stress tests, based on national supervisors and reference parameters provided by the ECB for less complex institutions, with macroeconomic and sovereign shock scenarios and parameters developed by the ECB. | ●No—Constrained TD, relying on BlackRock’s assessment of forecast losses and incorporating much of the methodology and parameters used for the EBA stress test. | ●No—Constrained TD, with the authorities running both IMF and BdE models, applying growth scenarios and assumptions agreed with the IMF. | ●No—TD of individual banks with growth scenarios and some guidelines provided by Steering Committee comprising the Troika, internal and external agencies. | ●No—“BU” exercise comprising TD of individual banks, with growth scenarios and some guidelines provided by Steering Committee comprising the Troika, internal agencies and other EU counterpart agencies. | ||

| Scope (continued) | Approach (continued) | Stress test approach is bottom-up (BU) (continued) | ●Process includes supervisors applying independent quantitative methods using firm-specific data to support their assessments of banks’ submissions. | ●Process includes a peer review of results and challenging process, and extensive cross-checks by the CEBS. | ●Process includes consistency checks by the EBA, a multilateral review and TD analysis by the EBA and the ESRB with ECB assistance. | ●Process includes close consultation with an Expert Coordination Committee comprising the Troika, the EBA and the authorities. | ||||||

| Coverage | Stress test covers at least the systemically important banks and the majority of banking system assets | ●Yes—19 BHCs each with assets > $100 billion. | ●Yes—22 major EU cross-border banking groups. | ●Yes—91 banks, comprising major EU cross-border banking groups and a group of additional, mostly larger credit institutions. | ●Yes—90 banks, comprising major EU cross-border banking groups and a group of additional, mostly larger credit institutions. | ●Yes—All Irish domestically-owned commercial banks (4). | ●Yes--Commercial banks and intervened savings banks (13), including the largest and problem banks. | ●Yes--Commercial banks and intervened savings banks (14), including the largest and problem banks. | ●Yes—14 largest merged banking groups, disaggregated into 17 following stress test. | |||

| Scope (continued) | Coverage (continued) | Stress test covers at least the systemically important banks and the majority of banking system assets (continued) | ●Yes--2/3 of banking system assets. | ●Yes—60 percent of the EU banking system assets. | ●Yes—65 percent of the EU banking system assets and at least 50 percent of assets of each national banking sector. | ●Yes—65 percent of the EU banking system assets and at least 50 percent of assets of each national banking sector. | ●Yes—Approximately 80 percent of banking system assets including foreign subsidiaries. | ●Yes—88 percent of banking system assets excluding foreign branches. | ●Yes—Approximately 90 percent of banking system assets excluding foreign branches. | ●Yes—around 90 percent of banking system assets excluding foreign branches. | ||

| Scenario design | Scenarios | Stress test applies large scenario shocks (2 std. devn. or larger) | ●No—1 baseline and 1 adverse (equivalent to 1 std. devn. of cumulative shock from baseline over 2 years). | ●No—1 baseline and 1 adverse (1.9 std. devn. of cumulative shock from baseline over 2 years). | ●No—1 baseline and 1 adverse (1.3 std. devn. of cumulative shock from baseline over 2 years). | ●No—1 baseline and 1 adverse (1.5 std. devn. of cumulative shock from baseline over 2 years). | ●No—1 baseline and 1 adverse (consistent with the EBA 2011 stress testing exercise). | ●No—1 baseline and 2 adverse (more adverse scenario is 1 std. devn. of cumulative shock from baseline over 2 years). | ●No—1 baseline and 2 adverse (first 2 years identical to FSAP adverse scenario, plus a third year of negative growth). | ●No—1 baseline and 1 adverse (first 2 years identical to FSAP adverse scenario, plus a third year of negative growth). | ||

| Scenario design (continued) | Risk factors | Stress test applies shocks to key risk factors | ●Yes—Credit risk: 12 categories of loans stress tested. | ●Credit risk: Stress tested but little information available. | ●Yes—Credit risk: 5 main portfolios stress tested. | ●Yes—Credit risk: 8 categories of loans stress tested; sovereign exposure in AfS banking book treated as credit risk. | ●Yes—Credit risk: 5 categories of loans stress tested. | ●Yes—Credit risk: 5 categories of loans plus foreclosed assets stress tested. | ●Yes—Credit risk: 6 categories of loans plus foreclosed assets stress tested. | ●Yes—Credit risk: 6 categories of loans plus 5 segments of foreclosed assets stress tested. | ||

| Scenario design (continued) | Assumptions | Macroeconomic scenarios are standardized across banks | ●Yes—Baseline based on industry consensus forecasts; adverse provided by authorities. | ●Yes—Based on collaboration among the CEBS, the EC and the ECB. | ●Yes—Based on collaboration among the CEBS, the EC and the ECB. | ●Yes—Based on collaboration among the EBA, the EC and the ECB/ESRB. | ●Yes—Based on the EBA scenarios. | ●Yes—Agreed upon between IMF staff and authorities. | ●Yes—Based on FSAP scenarios. | ●Yes—Based on FSAP scenarios, extended to a 3-year horizon. | ||

| Behavioral assumptions are standardized across banks | ●No—Banks’ own. | ●Yes—Benchmark risk parameters provided by the ECB; process and guidelines provided by the CEBS. | ●Yes—Range of assumptions provided by the CEBS, in cooperation with the ECB, the EC and national supervisory authorities. | ●Yes—Range of assumptions provided by the EBA, in cooperation with the EC, the ECB, the ESRB and national supervisory authorities. | ●Yes—Assumptions largely based on the EBA stress test. | ●Yes—Range of assumptions provided by IMF staff. | ●No—Assumptions provided by stress testers except for macro scenarios. | ●No—Assumptions except for macro scenarios provided by stress tester with some guidance from Steering Committee. | ||||

| Capital standards | … | Stress test applies very high hurdle rate(s) (CT1 > 6 percent) | ●No—Hurdle rates of T1 capital of 6 percent and T1 common capital of 4 percent for both baseline and adverse scenarios. | ●No—Hurdle rate of T1 capital of 6 percent for both baseline and adverse scenarios. | ●No—Hurdle rate of T1 capital of 6 percent for both baseline and adverse scenarios. | ●No—Hurdle rate of CT1 capital of 5 percent for both baseline and adverse scenarios. | ●Yes—Hurdle rates of CT1 capital of 10.5 percent under the baseline scenario and 6 percent under the adverse scenario. | ●Yes—Hurdle rates of Total capital of 8 percent, T1 capital of 6 percent and CT1 capital of 4 and 7 percent for baseline and both adverse scenarios. | ●Yes—Hurdle rates of CT1 capital of between 6-9 percent. | ●Yes—Hurdle rates of CT1 capital of 9 percent under the baseline scenario and 6 percent under the adverse scenario. | ||

| Transparency | Objective and action plan | Objective | Stress test is associated with a clear and resolute objective | ●Yes—Stated objective was specifically to assess the capital needs of banks that would provide a buffer against higher than generally expected losses and still be able to led to creditworthy borrowers should such losses materialize. | ●No—Stated objective was to carry out an EU-wide forward looking stress testing exercise on the aggregate banking system. | ●Yes—Stated objective was to provide policy information for assessing the resilience of the system to possible adverse economic developments and to assess the ability of to absorb possible shocks on credit and market risks, including sovereign risks. | ●Yes—Stated objective was to assess the resilience of individual institutions and the system to hypothetical stress events under certain restrictive conditions. | ●Yes—Stated objective was to determine the capital resources of domestic banks under a given stress scenario, in order to calculate the cost of recapitalization required to meet central Bank-imposed requirements. | ●No—FSAP stress tests are conducted as part of the overall stability analysis of a financial system and to facilitate policy discussions on crisis preparedness. This objective was not stated explicitly. | ●No—Stated objective was broadly to increase transparency and dispel doubts over the valuation of bank assets. | ●Yes—Stated objective was to adhere to the MoU approved by the Eurogroup on 20 July 2012, which required the estimation of capital needs as an essential element of the roadmap for the recapitalization and restructuring of the banking system. | |

| Transparenc | Objective and action plan (continued) | Follow-up action(s) | Stress test is associated with clear follow up action(s) by management/ authorities to address findings as necessary | ●Yes—Banks needing to augment capital buffers were required to develop a detailed capital plan to be approved and implemented within 6 months. | ●No—National authorities were responsible for any follow-up to the exercise. | ●No—National authorities were responsible for any follow-up to the exercise. | ●Yes—Banks showing capital shortfalls were required to present their plans to restore capital position and to implement remedial measures by year-end. | ●Yes—Recapitalization were required based on loan loss projections, along with further calculations of prospective income, expenditure and deleveraging plans. | ●No—FSAP stress tests are surveillance purposes and to facilitate policy discussions; they typically do not require management action. | ●No. | ●Yes—Recapitalization/ restructuring based on stress test findings required by the MoU with the Eurogroup. | |

| Financing backstop | Stress test is provided with an explicit financial backstop to support the necessary follow-up action(s) | ●Yes—Capital Assistance Program (CAP) under the Troubled Asset Relief Program (TARP). | ●No—Not for the region as a whole. | ●No—Not for the region as a whole. | ●No—Not for the region as a whole. | ●Yes—Already in a crisis program with the Troika. | ●No. | ●No. | ●Yes—The ESM facility per the MoU with the Eurogroup. | |||

| Transparency | Disclosure of technical details | Design, methodology and implementation | Stress test discloses Information | ●Yes—Detailed information provided on stress test design, methodology and implementation. | ●No—Minimal information on exercise was provided. | ●Yes—Detailed information provided on stress test design, methodology and implementation. | ●Yes—Detailed information provided on stress test design, methodology and implementation. | ●Yes—Detailed information provided on stress test design, methodology and implementation | ●Yes—Detailed information provided on stress test design and methodology. | ●Yes—Some information provided on stress test design, methodology and implementation | ●Yes—Detailed information provided on stress test design, methodology and implementation. | |

| Model(s) | Stress test discloses Information | ●No—Information on banks’ stress test models not disclosed, but projections subjected to detailed review and assessment by supervisors. | ●No—Information on banks’ stress test models not disclosed, but results subjected to peer review and challenging process. | ●No—Information on banks’/ national supervisory authorities’ models not disclosed, but results subjected to peer review and challenging process. | ●No—Information on banks’/ national supervisory authorities’ models not disclosed, but results subjected to peer review and challenging process. | ●No—Information on banks’ and third-party models not disclosed, but supervisory challenges and independent assessment undertaken. | ●Yes—Information provided on IMF and Bank of Spain stress test models; results from two models cross-validated. | ●Some information provided on third-party stress test models. | ●No—Information on third party stress test models not disclosed but modeling process shared and discussed with representatives of the Steering Committee. | |||

| Details of assumptions | Stress test discloses Information | ●Yes—High level information on macroeconomic assumptions; detailed information on loan loss assumptions. | ●No—Very limited information provided on macroeconomic assumptions. | ●Yes—Detailed information on macroeconomic and market assumptions. | ●Yes—Detailed information on macroeconomic and market assumptions. | ●Yes—Detailed information on macroeconomic and P&L assumptions and loan losses. | ●Yes—Detailed information on macroeconomic and other behavioral assumptions. | ●Yes—Detailed information on macroeconomic, P&L and loan loss assumptions/estimates. | ●Yes—Detailed information on macroeconomic and P&L assumptions and loan loss estimates. | |||

| Transparency | Disclosure of technical details (continued) | Bank-by-bank results | Stress test discloses detailed Information | ●Yes—Summary results disclosed at individual BHC level, including projected losses, capital components and capital needs. | ●No—Summary results disclosed at system aggregate level. | ●Yes—Summary results disclosed at system aggregate and individual bank levels. | ●Yes—Summary results disclosed at system aggregate and individual bank level, including projected losses, capital components and capital needs. | ●Yes—Detailed results disclosed at individual bank level, including projected losses, capital components and capital needs. | ●No—Summary results provided at aggregated groupwise (according to specific characteristics) and system aggregate levels. | ●No—Summary results provided at system aggregate levels. | ●Yes—Summary results disclosed at individual bank level, including projected loan losses, capital components and capital needs. | |

| Asset quality review (AQR) | … | AQR is undertaken as input into stress test | ●Yes—Lower-intensity, quantitative substitute. | ●No. | ●No. | ●No. | ●Yes—Sample loan review and independent audit conducted. | ●No. | ●No. | ●Yes—Deep dive conducted, supported by real estate appraisers and independent audit. | ||

| Liquidity stress test | … | Liquidity stress test accompanies solvency stress test | ●No. | ●No. | ●No. | ●No—But liquidity profile of banks assessed through a confidential specific thematic review for supervisory purposes. | ●Yes—Prudential Liquidity Assessment Review (PLAR). | ●Yes. | ●No. | ●No. | ||

| Follow-up stress tests | … | Subsequent stress tests are conducted at regular intervals to maintain transparency | ●Yes—CCAR 2011, 2012, 2013 and DFA 2013 by the authorities, designed in a similar manner to the SCAP. | ●Yes—CEBS 2010 by the authorities. | ●Yes—EBA 2011 by the authorities. | ●Not conducted in 2012; another stress testing exercise planned for 2013. | ●Planned for 2014 H1, to take place before the EBA 2014 stress test. | ●Not applicable—As noted above, FSAPs to each S-25 country are conducted mandatorily once every five years. | ●Yes—“BU” exercise as part of MoU with the Troika. | ●Timing to be decided, taking into account the EBA’s AQR and the balance sheet assessment in the context of the SSM, and the EBA 2014 stress test. | ||

Appendix II. The Cost of Direct Recapitalization versus Loss Recognition and Provisioning

- In Example 1, no AQR is conducted and the existing data are used in the stress test:

- The stress test projects a fall in revenue of €10 billion.

- Expected loan losses are €20 billion.

- Net profit decreases from €40 billion to €10 billion.