The Value-Add of Tailored Seasonal Forecast Information for Industry Decision Making

Abstract

:1. Introduction

2. The SECLI-FIRM Methodological Approaches

2.1. Co-Production of the SECLI-FIRM Case Studies

2.2. Selection of Valuation Methods

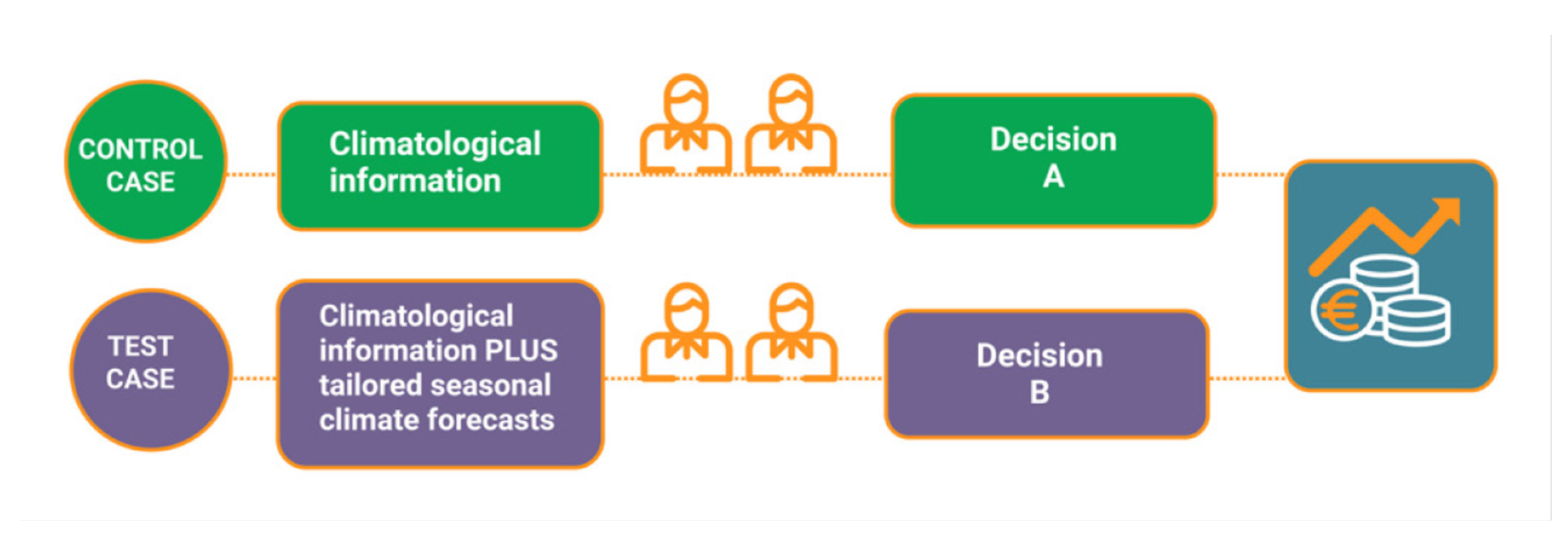

2.3. Baseline and Economic Approaches for Value-Add Assessment

2.4. Econometric Indicators of Performance

2.5. Relative Economic-Value-Based Verification

3. Economic Valuation Results

3.1. Econometric Indicators of Performance

3.2. Relative Economic-Value-Based Verification

4. Discussion of Economic Valuation Results

4.1. Forecast Quality/Skill vs. Economic Value

- The direct model output had more skill than weather-pattern-derived wave forecasts at lead times less than 10 days ahead, whereafter both methods converged and tended towards climatology.

- Both methods successfully discriminated between exceedance/non-exceedance events. At lead times less than 10 days ahead, the weather-pattern-derived wave forecasts were less able to differentiate hits and false alarms than the direct simulations, although they exhibited a similar skill beyond that.

- The results indicated a strong dependence on the site, season, and Hs threshold of interest.

4.2. The Value of Event-Based Case Studies

4.3. Challenges for Quantitative and Economic Valuation

- Weak seasonal forecast signals close to climatology;

- Limited forecast quality, particularly for extreme events;

- Averaging of intra-season and intra-month variability, particularly for extreme events (see Section 3.1);

- Non-weather-related confounding effects (e.g., energy mix, impacts of dam operations on inflow, and market effects beyond company control—see Section 3.1);

- Changes in sector-specific models precluding long-term evaluation (e.g., National Grid energy demand models are updated annually);

- Changes in forecasting systems confounding long-term verification and valuation assessment.

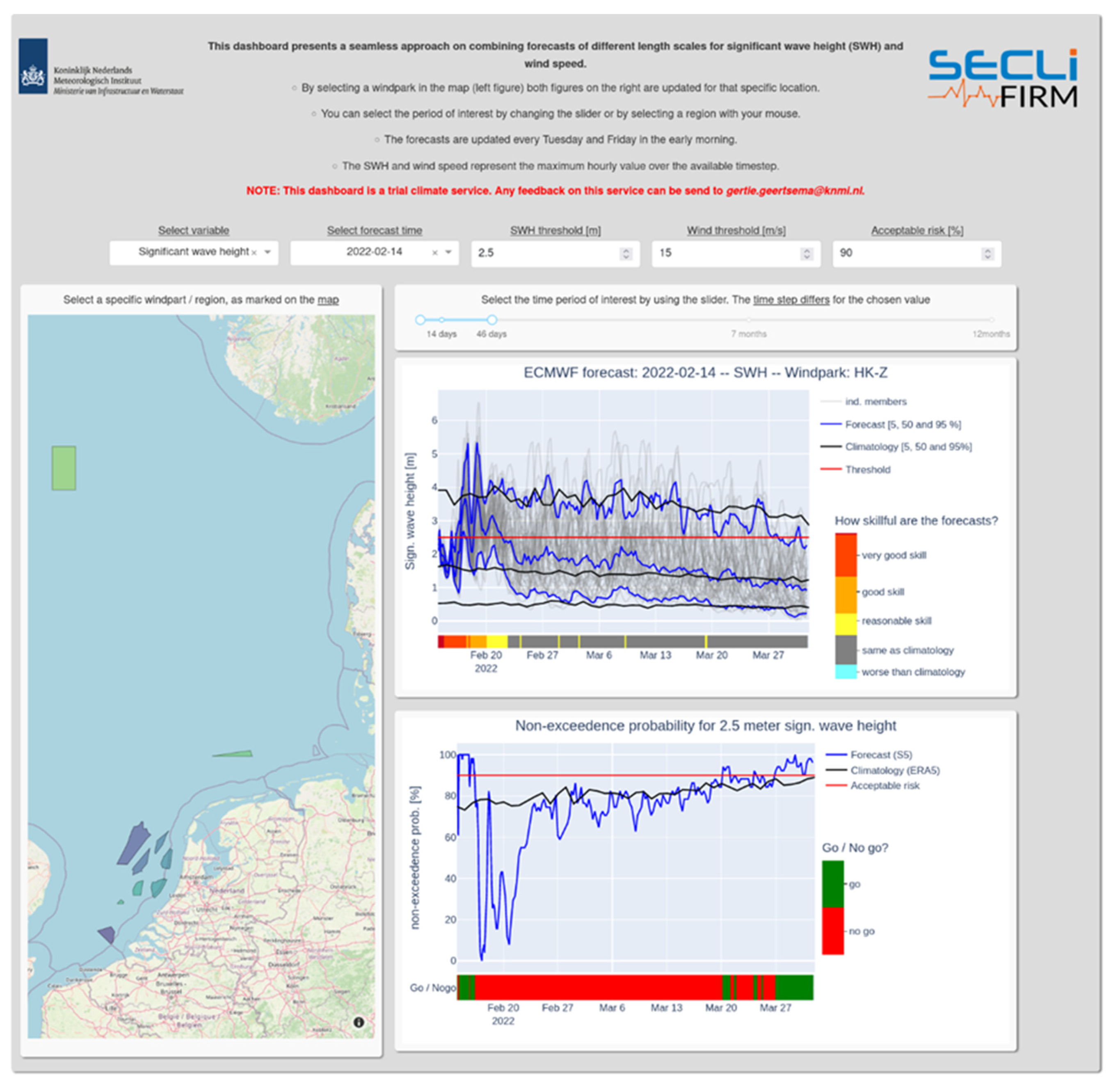

5. Enhancing the Practical Value of Seasonal Forecasts

- Usable: in formats that easily integrate with the user’s existing tools, systems, and approaches

- Useful: as part of a seamless approach to the provision of information on different timescales, particularly if gradually extending the existing approach of the current user, who may already be basing decisions on weather forecasts as in the case of the SECLI-FIRM users.

- User-friendly: in formats such as Teal Tool visualization (a tailored in-house version of the public Teal Tool (https://www.wemcouncil.org/wp/teal accessed on 20 August 2022) was developed by WEMC for Enel during SECLI-FIRM) that are easy to use, even for users unfamiliar with many of the intricacies of weather/climate data.

- Medium-range ensemble forecasts for day 0 to 14 (ENS).

- Extended-range ensemble forecasts for day 15 to day 46 (ENS Extended).

- Seasonal forecasts beyond 46 days and up to seven months ahead (SEAS5).

- The remaining period up to one year ahead was provided by climatology based on ERA5 data over the period 1981–2020.

6. Summary and Recommendations

6.1. Summary

6.2. Recommendations

6.2.1. Early Adopters and Champions

6.2.2. Economic Expertise

6.2.3. Qualitative Approaches

6.2.4. Forecast Performance

6.2.5. Focus on the Decisions

6.2.6. Building the Climate Services Market—From Micro to Macro Scale

6.2.7. Building the Climate Services Market—Transferability to Other Sectors

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- European Commission. A European Research and Innovation Roadmap for Climate Services; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Cortekar, J.; Themessl, M.; Lamich, K. Systematic analysis of EU-based climate service providers. Clim. Serv. 2020, 17, 100125. [Google Scholar] [CrossRef]

- Hoa, E.; Perrels, A.; Le, T.-T. From generating to using climate services—How the EU-MACS and MARCO projects help to unlock the market potential. Clim. Serv. 2018, 11, 86–88. [Google Scholar] [CrossRef]

- Tart, S.; Groth, M.; Seipold, P. Market demand for climate services: An assessment of users’ needs. Clim. Serv. 2020, 17, 100109. [Google Scholar] [CrossRef]

- Perrels, A. Quantifying the uptake of climate services at micro and macro level. Clim. Serv. 2020, 17, 100152. [Google Scholar] [CrossRef]

- Perrels, A.; Le, T.T.; Cortekar, J.; Hoa, E.; Stegmaier, P. How much unnoticed merit is there in climate services? Clim. Serv. 2020, 17, 100153. [Google Scholar] [CrossRef]

- Vaughan, C.; Dessai, S. Climate services for society: Origins, institutional arrangements, and design elements for an evaluation framework. Wires Clim. Change 2014, 5, 587–603. [Google Scholar] [CrossRef] [PubMed]

- Soares, M.B.; Daly, M.; Dessai, S. Assessing the value of seasonal climate forecasts for decision-making. Wires Clim. Change 2018, 9, e523. [Google Scholar] [CrossRef] [Green Version]

- Bosello, F.; Delpiazzo, E.; Dasgupta, S.; Costigliola, G.; Bagli, S. CLARA D4.1 Assessment Framework and Methodological Toolkit. Available online: https://www.researchgate.net/publication/324080018_Assessment_framework_and_methodological_toolkit_for_assessing_the_value_of_climate_services (accessed on 13 October 2022).

- Suhari, M.; Dressel, M.; Schuck-Zoller, S. Challenges and best-practices of co-creation: A qualitative interview study in the field of climate services. Clim. Serv. 2022, 25, 100282. [Google Scholar] [CrossRef]

- Troccoli, A. How are seasonal climate forecasts contributing to energy and water industry management? Open Access Government, 16 December 2020. 13 October 2022. Available online: https://www.openaccessgovernment.org/seasonal-climate-forecasts/100258/ (accessed on 13 October 2022).

- Gardiner, E.P.; Herring, D.D.; Fox, J.F. The U.S. Climate Resilience Toolkit: Evidence of progress. Clim. Change 2019, 153, 477–490. [Google Scholar] [CrossRef]

- Goodess, C.M.; Troccoli, A.; Acton, C.; Anel, J.A.; Bett, P.E.; Brayshaw, D.J.; de Felice, M.; Dorling, S.R.; Dubus, L.; Penny, L.; et al. Advancing climate services for the European renewable energy sector through capacity building and user engagement. Clim. Serv. 2019, 16, 100139. [Google Scholar] [CrossRef]

- Schuck-Zoller, S.; Cortekar, J.; Jacob, D. Evaluating co-creation of knowledge: From quality criteria and indicators to methods. Adv. Sci. Res. 2017, 14, 305–312. [Google Scholar] [CrossRef] [Green Version]

- Visman, E.; Vincent, K.; Steynor, A.; Karani, I.; Mwangi, E. Defining metrics for monitoring and evaluating the impact of co-production in climate services. Clim. Serv. 2022, 26, 100297. [Google Scholar] [CrossRef]

- Crespi, A.; Petitta, M.; Marson, P.; Viel, C.; Grigis, L. Verification and bias adjustment of ECMWF SEAS5 seasonal forecasts over Europe for climate service applications. Climate 2021, 9, 181. [Google Scholar] [CrossRef]

- Alessandri, A. On the optimization of Grand multi-model probabilistic performance and the independence of the contributing seasonal prediction systems. In preparation.

- Durose, C.; Richardson, L.; Perry, B. Craft metrics to value co-production. Nature 2018, 562, 32–33. [Google Scholar] [CrossRef] [Green Version]

- Laudien, R.; Boon, E.; Goosen, H.; van Nieuwaal, K. The Dutch adaptation web portal: Seven lessons learnt from a co-production point of view. Clim. Change 2019, 153, 509–521. [Google Scholar] [CrossRef]

- Meadow, A.M.; Ferguson, D.B.; Guido, Z.; Horangic, A.; Owen, G.; Wall, T. Moving toward the deliberate coproduction of climate science knowledge. Weather Clim. Soc. 2015, 7, 179–191. [Google Scholar] [CrossRef] [Green Version]

- Máñez Costa, M.; Oen, A.M.P.; Neset, T.-S.; Celliers, L.; Suhari, M.; Huang-Lachmann, J.-T.P.R.; Blair, B.; Jeuring, J.; Rodriguez-Camino, E.P.C.; Columbié, Y.J.; et al. Co-Production of Climate Services. CSPR Report No 2021:2; Centre for Climate Science and Policy Research: Norrköping, Sweden, 2021. [Google Scholar]

- Vasilakos, N.; Others, A.N. An introduction to methods for the economic assessment of seasonal climate forecasts: The SECLI-FIRM experience. Climate, In preparation for this special issue.

- Clements, J.; Ray, A.; Anderson, G. The Value of Climate Services Across Economic and Public Sectors: A Review of Relevant Literature; United States Agency for International Development (USAID): Washington DC, USA, 2013.

- Mylne, K.R. Decision-making from probability forecasts based on forecast value. Met. Apps. 2006, 9, 307–315. [Google Scholar] [CrossRef]

- Hersbach, H.; Bell, B.; Berrisford, P.; Hirahara, S.; Horanyi, A.; Munoz-Sabater, J.; Nicolas, J.; Peubey, C.; Radu, R.; Schepers, D.; et al. The ERA5 global reanalysis. Q. J. Roy. Meteor. Soc. 2020, 146, 1999–2049. [Google Scholar] [CrossRef]

- Alessandri, A.; Borrelli, A.; Navarra, A.; Arribas, A.; Deque, M.; Rogel, P.; Weisheimer, A. Evaluation of probabilistic quality and value of the ENSEMBLES multimodel seasonal forecasts: Comparison with DEMETER. Mon. Weather Rev. 2011, 139, 581–607. [Google Scholar] [CrossRef]

- Wilks, D.S. Statistical Methods in the Atmospheric Sciences; Academic Press: Burlington, VT, USA, 2011. [Google Scholar]

- Steele, E.; Neal, R.; Bunney, C.; Evans, B.; Fournier, N.; Gill, P.; Mylne, K.; Saulter, A. Making the most of probabilistic marine forecasts on timescales of days, weeks and months ahead. In Proceedings of the Offshore Technology Conference, Houston, TX, USA, 1–4 May 2017. [Google Scholar] [CrossRef]

- Richardson, D.S. Skill and relative economic value of the ECMWF ensemble prediction system. Q. J. Roy. Meteor. Soc. 2000, 126, 649–667. [Google Scholar] [CrossRef]

- Steele, E.; Neal, R.; Dankers, R.; Fournier, N.; Mylne, K.; Newell, P.; Saulter, A.; Skea, A.; Upton, J. Using weather pattern typology to identify calm weather windows for local marine operations. In Proceedings of the Offshore Technology Conference, Houston, TX, USA, 30 April– 3 May 2018. [Google Scholar] [CrossRef]

- Palmer, T.N. The economic value of ensemble forecasts as a tool for risk assessment: From days to decades. Q. J. Roy. Meteor. Soc. 2002, 128, 747–774. [Google Scholar] [CrossRef]

- Johnson, S.J.; Stockdale, T.N.; Ferranti, L.; Balmaseda, M.A.; Molteni, F.; Magnusson, L.; Tietsche, S.; Decremer, D.; Weisheimer, A.; Balsamo, G.; et al. SEAS5: The new ECMWF seasonal forecast system. Geosci. Model Dev. 2019, 12, 1087–1117. [Google Scholar] [CrossRef] [Green Version]

- Carrasco, A.; Saetra, O.; Bidlot, J.R. Cost-loss analysis of calm weather windows. J. Oper. Ocean. 2013, 6, 17–22. [Google Scholar] [CrossRef] [Green Version]

- Soares, M.B.; Dessai, S. Barriers and enablers to the use of seasonal climate forecasts amongst organisations in Europe. Clim. Chang. 2016, 137, 89–103. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Steele, E.; Brown, H.; Bunney, C.; Gill, P.; Mylne, K.; Saulter, A.; Standen, J.; Blair, L.; Cruickshank, S.; Morten, G. Using Metocean forecast verification information to effectively enhance operational decision-making. In Proceedings of the Offshore Technology Conference, Virtual/Houston, TX, USA, 16–19 August 2021. [Google Scholar] [CrossRef]

- Larosa, F.; Mysiak, J. Business models for climate services: An analysis. Clim. Serv. 2020, 17, 100111. [Google Scholar] [CrossRef]

- Soares, M.B.; Dessai, S. Exploring the use of seasonal climate forecasts in Europe through expert elicitation. Clim. Risk Manag. 2015, 10, 8–16. [Google Scholar] [CrossRef] [Green Version]

- Bruno Soares, M.; Alexander, M.; Dessai, S. Sectoral use of climate information in Europe: A synoptic overview. Clim. Serv. 2018, 9, 5–20. [Google Scholar] [CrossRef]

| Case Study and Co-Design Partners | Climate Input | Source of Observed Data | Forecast Information | Forecast Verification | Economic Valuation Approach | Economic Valuation Metric and Data Used |

|---|---|---|---|---|---|---|

| Case study 1: Heat waves in Italy—July 2015 Case study 2a: Mild conditions in Italy—October–December 2015 (drought) and January–March 2016 (wet) Case study 3: Wind variability in Southern Italy—March 2016 strong/weak winds Case study 4a: High/low winds in Spain—January–March 2014 (strong winds) and December 2014–January 2015 (low winds) Case study 5a: El Niño and Colombia energy mix—January–March 2015 and 2016 ENEL | Temperature, precipitation, and wind speed. Energy demand and generation estimated from climate input by means of proprietary models and link functions, respectively. | ERA5 | Deterministic. ECMWF SEAS5 (weighted mean of ensemble members). Multi-model average: ECMWF, Météo-France, Met Office, and Deutscher Wetterdienst (average of boosted mean of each model—calculated from ensemble members). Monthly averages forecast with lead times of 1/3/5 months. | Simple biases (forecast minus observations). Mean absolute error. | Econometric modelling using Enel’s in-house models, including hedging strategy on market risks and weather exposure. | Profit-company data. Indicators of Performance (IP) = margin minus profit at risk (millions of Euros). |

| Case study 2b Hydropower in Italy Alperia | Inflow estimated from weather variables using downscaling and machine learning. | ERA5 and local gauges | Probabilistic. ECMWF SEAS5. Monthly averages forecast at lead times of 1–6 months. | Mean error, mean absolute error, root-mean-square error. Continuous Ranked Probability Skill Score (CRPSS). | Three different input configurations evaluated for estimation of inflow, hydropower production, and total production. | Potential value of profits. Results not presented in this paper. |

| Case study 4b Wind prediction in Spain—January–March 2014 (strong winds) and December 2014–January 2015 (low winds). UL | Wind flow estimated using random forest models with various predictors. | Local observations from the State Meteorological Agency of Spain (AEMET). | Deterministic. ECMWF SEAS5. Monthly averages forecast at lead times of 1–5 months. | Time series correlation and root-mean-square error. | Performance of different forecasting approaches assessed. No valuation assessed as there was no partner with an economic model. | Results not presented in this paper. |

| Case study 5b Colombia hydropower UL/Celsia | Inflow estimated (a) directly from forecasts, (b) using teleconnections based on sea surface temperature, and (c) random forest models with various predictors. | Inflow measured at Celsia’s hydro plants, precipitation from nearby observations of the State Meteorological Agency of Colombia (IDEAM) and ERA5, ERA5-LAND, and GPCC datasets. | Deterministic/probabilistic, depending on the forecast model. Forecast source using (a) best model combination selected from 11 independent forecasting models, (b) ERA5S. Monthly averages forecast at lead times of 1–3 months. | Time series correlation and root-mean-square error. Brier Skill Score (BSS). | Performance of different forecasting approaches assessed and compared with analog forecasts based on synoptic conditions of the last 3–6 months. Confidentiality issues precluded formal economic assessment. An estimate based on forecast performance was attempted instead. | Results not presented in this paper. |

| Case study 6 Offshore maintenance KNMI/TenneT | Probability of exceedance of user-specified thresholds for significant wave height and wind speed. | ERA5 | Probabilistic. ECMF SEAS5. Daily averages forecast at lead times of 46 days to seven months (also used in the trial climate service: ECMWF extended-range and medium-range forecasts; see Section 5). | Root-mean-square error. Continuous Ranked Probability Skill Score (CRPSS). | Avoided costs. Direct vessel hire cost savings investigated jointly with and reported in case study 7. | Vessel hire daily rates allow estimation of avoided costs. Results not shown in this paper. |

| Case study 7 Offshore maintenance Met Office/Shell | Probability of exceedance of user-specified thresholds for significant wave height. Estimated directly from forecast values and using weather patterns. | Local observations. | Probabilistic. ECMWF extended range forecast. Daily values forecast up to 30 days ahead. | Brier Skill Score (BSS). Receiver Operating Characteristics Skill Score (ROCSS). | Relative Economic Value. Avoided costs. | Relative Economic Value. Avoided costs based on vessel hire daily rates used in the Beast from the East case study. |

| Case study 8 Winter Outlook for energy demand and generation Met Office/National Grid | Temperature including average cold spell, precipitation, and wind. Forecasts used to adjust climatological distributions presented in the Winter Outlook. | Local observations. | Probabilistic. Met Office three-monthly outlook (based on GloSea5). Seasonal (3-monthly) means and daily standard deviations forecast at lead times of 1–3 months. | Comparison of distributions. | Qualitative, including survey. See Section 5. | National Grid demand simulations. Results not shown in this paper. |

| Case study 9 Water demand and asset maintenance/management Met Office/Thames Water | Probability of exceedance of user specified water demand thresholds. | User-demand data. | Probabilistic. ECMWF Extended-range forecast. Daily values forecast up to 30 days ahead. | Brier Skill Score (BSS). Receiver Operating Characteristics Skill Score (ROCSS). | Relative Economic Value. Avoided costs (regulatory fines). | Relative Economic Value. Cost estimates/fines, costs of extreme weather events, maintenance associated with the Beast from the East case study. |

| Single Model ECMWF | Multi-Model Average | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | G | H | ||

| Mni EUR/Mni USD | IPf − IPp | IPc − IPp | |IPf − IPp| < |IPc − IPp| | |IPf − IPp| − |IPc − IPp| | IPf − IPp | IPc − IPp | |IPf − IPp| < |IPc − IPp| | |IPf − IPp| − |IPc − IPp| | |

| CS1 | M-5 | −3.7 | −9.0 | YES | −5.3 | −3.7 | −9.0 | YES | −5.3 |

| M-3 | −5.2 | −9.0 | YES | −3.8 | −4.7 | −9.0 | YES | −4.3 | |

| M-1 | −7.5 | −9.0 | YES | −1.5 | −0.8 | −9.0 | YES | −8.2 | |

| CS2a-Period 1 | M-3 | 20.0 | 22.0 | YES | −2.0 | 21.3 | 22.0 | YES | −0.7 |

| M-1 | 15.0 | 22.0 | YES | −7.0 | 21.5 | 22.0 | YES | −0.5 | |

| CS2a-Period 2 | M-3 | 1.0 | 4.4 | YES | −3.4 | 2.0 | 4.4 | YES | −2.4 |

| M-1 | −22.5 | 4.4 | NO | 18.1 | −30.4 | 4.4 | NO | 26.0 | |

| CS3 | M-5 | 4.8 | −1.0 | NO | 3.8 | 0.8 | −1.0 | YES | −0.1 |

| M-3 | −2.7 | −1.0 | NO | 1.7 | −5.9 | −1.0 | NO | 4.9 | |

| M-1 | −0.4 | −1.0 | YES | −0.6 | −1.9 | −1.0 | NO | 0.9 | |

| CS4a-Period 1 | M-3 | 45.1 | 53.6 | YES | −8.5 | 52.2 | 53.6 | YES | −1.4 |

| M-1 | 74.9 | 53.6 | NO | 21.3 | 56.3 | 53.6 | NO | 2.7 | |

| CS4a -Period 2 | M-3 | 0.5 | −3.4 | YES | −3.0 | −5.1 | −3.4 | NO | 1.7 |

| M-1 | −18.4 | −3.4 | NO | 14.9 | −17.6 | −3.4 | NO | 14.1 | |

| CS5a Period 1 | M-3 | −28.4 | −37.0 | YES | −8.5 | 6.6 | −37.0 | YES | −30.4 |

| M-1 | 8.6 | −37.0 | YES | −28.4 | 23.6 | −37.0 | YES | −13.4 | |

| CS5a Period 2 | M-3 | 6.8 | −44.4 | YES | −37.6 | −23.8 | −44.4 | YES | −20.6 |

| M-1 | −37.4 | −44.4 | YES | −7.0 | −4.0 | −44.4 | YES | −40.5 | |

| Verification Measure | Method | Description | Use in SECLI-FIRM |

|---|---|---|---|

| Skill | Brier Skill Score (BSS) | A measure of the mean squared error of the ensemble forecast. How skilful is the forecast relative to climatology? Maximum score is 1, while negative values indicate less skill than climatology. | CS5b CS7 CS8 |

| Skill | Continuous Ranked Probability Skill Score (CRPSS) | A measure of the difference between the forecast and observed cumulative distributions, equal to the integral of the Brier score over all possible thresholds. How skilful is the forecast relative to climatology? | CS2b CS6 |

| Discrimination | Receiver Operating Characteristics Skill Score (ROCSS) | A measure of the ability of the forecast to discriminate between observations; that is, to have a higher prediction frequency for an outcome whenever that outcome occurs. Does the forecast discriminate between true positives (hits) and false positives (false alarms)? | CS7 CS8 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Goodess, C.M.; Troccoli, A.; Vasilakos, N.; Dorling, S.; Steele, E.; Amies, J.D.; Brown, H.; Chowienczyk, K.; Dyer, E.; Formenton, M.; et al. The Value-Add of Tailored Seasonal Forecast Information for Industry Decision Making. Climate 2022, 10, 152. https://doi.org/10.3390/cli10100152

Goodess CM, Troccoli A, Vasilakos N, Dorling S, Steele E, Amies JD, Brown H, Chowienczyk K, Dyer E, Formenton M, et al. The Value-Add of Tailored Seasonal Forecast Information for Industry Decision Making. Climate. 2022; 10(10):152. https://doi.org/10.3390/cli10100152

Chicago/Turabian StyleGoodess, Clare Mary, Alberto Troccoli, Nicholas Vasilakos, Stephen Dorling, Edward Steele, Jessica D. Amies, Hannah Brown, Katie Chowienczyk, Emma Dyer, Marco Formenton, and et al. 2022. "The Value-Add of Tailored Seasonal Forecast Information for Industry Decision Making" Climate 10, no. 10: 152. https://doi.org/10.3390/cli10100152