Bayesian Analysis of Bubbles in Asset Prices

Abstract

:1. Introduction

2. Econometric Model and Estimation Method

2.1. The Present Value Model and PSY’s Method

2.2. Model and Inferential Task

2.3. Discrete Particle Filter

2.4. Parameter Learning Algorithm

- Propose from a proposal density: .

- Acceptance probability:

- With probability , set , otherwise keep original value.

2.5. Loss Functions for Bubble-Stamping

3. Monte Carlo Study

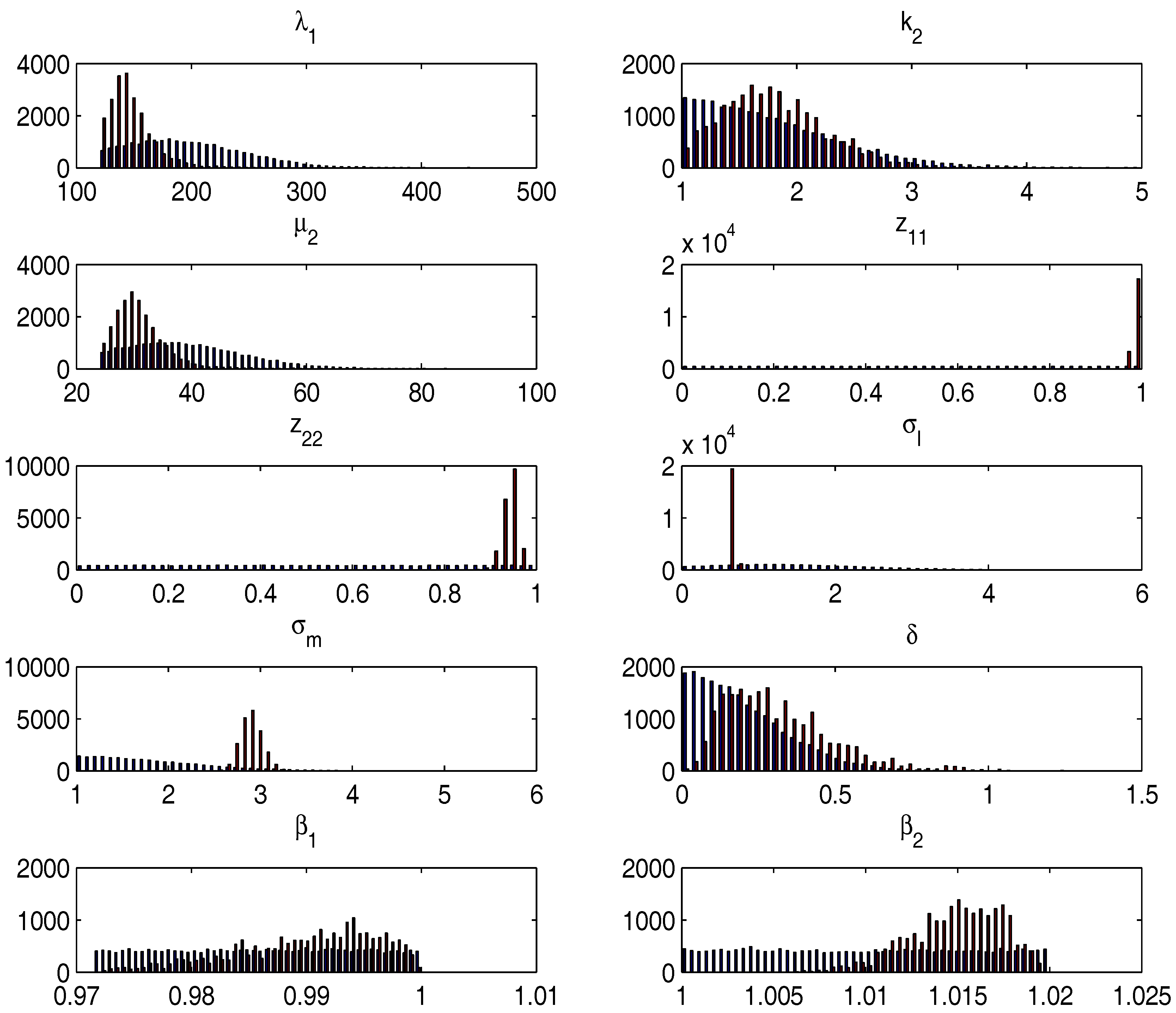

3.1. Priors and Parameter Restrictions

- This is the parameter determining the expected length of a normal regime. To reflect our a priori beliefs that the normal regime should be reasonably long lasting, we enforce the restriction . The prior distribution we use is then a truncated normal with mean and standard deviation parameters of 180 and 60 respectively.

- Determines the shape of the bubble regime distribution. Here we assume that has an increasing probability of exit from the bubble state in duration reflected in a parameter restriction . The prior distribution we use is then a normal distribution truncated from below with mean and standard deviation parameters of 1.

- : Determines the expected length of a bubble spell. Here again we restrict the parameter to focus on reasonably long-lasting bubble spells, by enforcing . Then ,the prior we use is a normal distribution truncated from below with mean and standard deviation parameters of the normal of 36 and 12 respectively.

- For both we use a uniform prior on .

- We use a normal prior truncated below at 0, with .

- Given that this is the ratio of the volatilities between the high and low-volatility states, we use the parameter restriction . Then, the prior distribution we use is a normal prior truncated below with .

- We use a normal prior truncated below at 0, with .

- Measures the mean reversion during the normal regime. The recent literature in finance points towards time-varying discount rates as the main source behind the cyclical variation in the price-dividend ratio (see for instance Cochrane (2011) for a recent overview), usually thought of as a medium-to-low frequency phenomenon. Hence we bound from below the half-life of the mean reversion at 2 years, corresponding to with monthly data. In addition to this we only assume non-explosiveness of the process in the normal regime leading to the uniform prior reflecting the parameter restriction .

- Here we use the parameter restrictions . The upper boundary is chosen to make sure that we cover all empirically relevant parameters of . Then the prior distribution we use is .

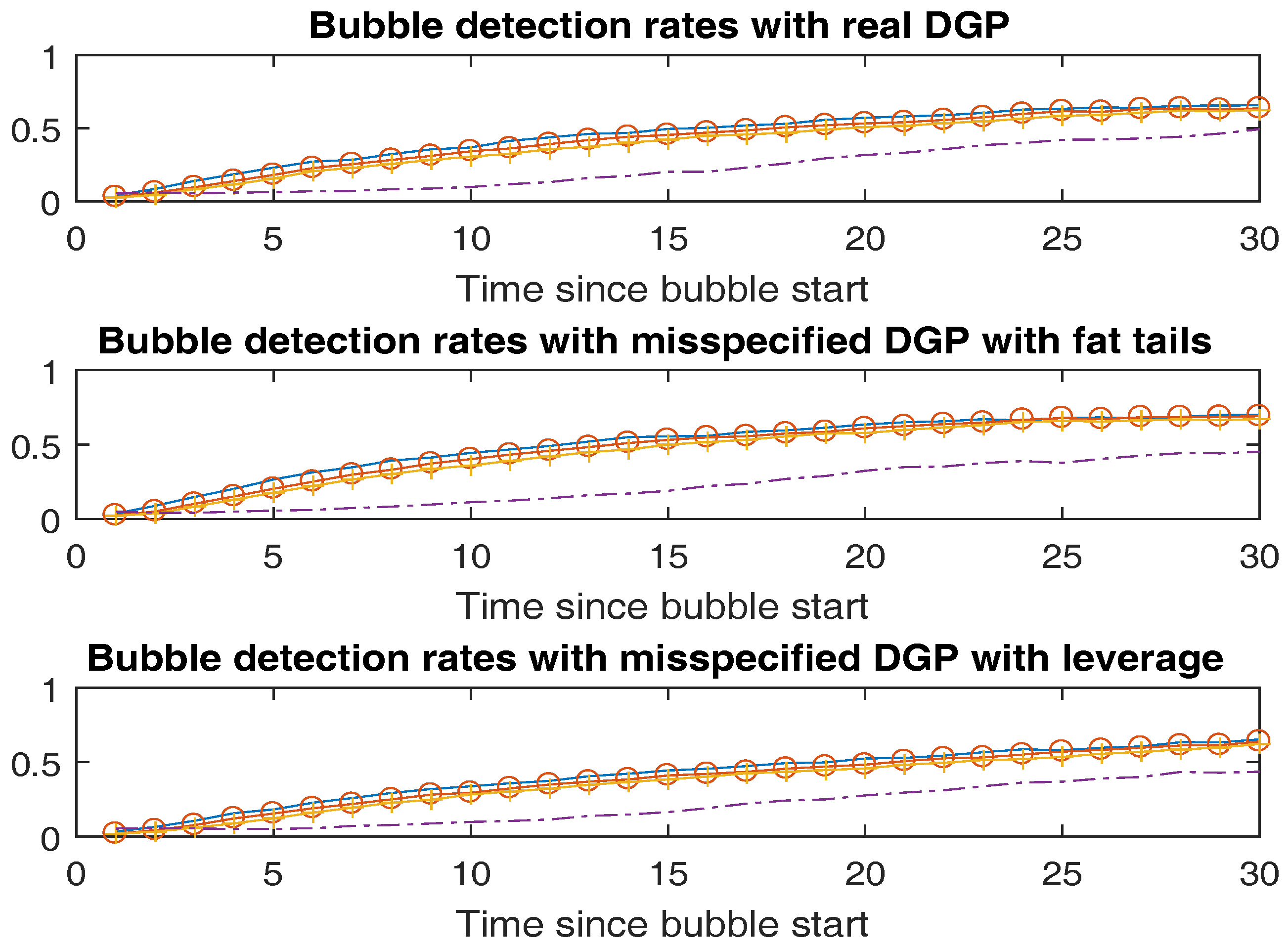

3.2. Monte Carlo Results

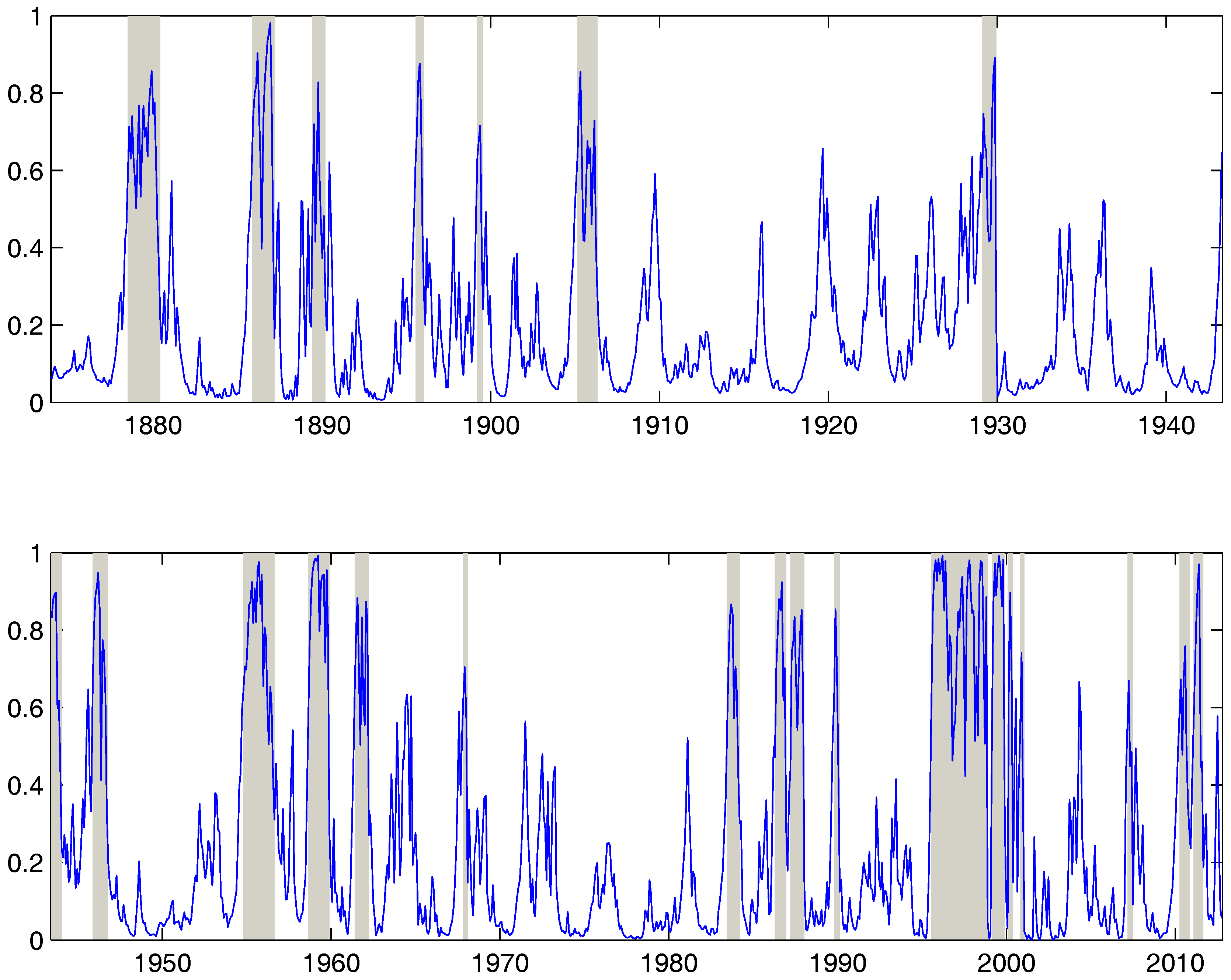

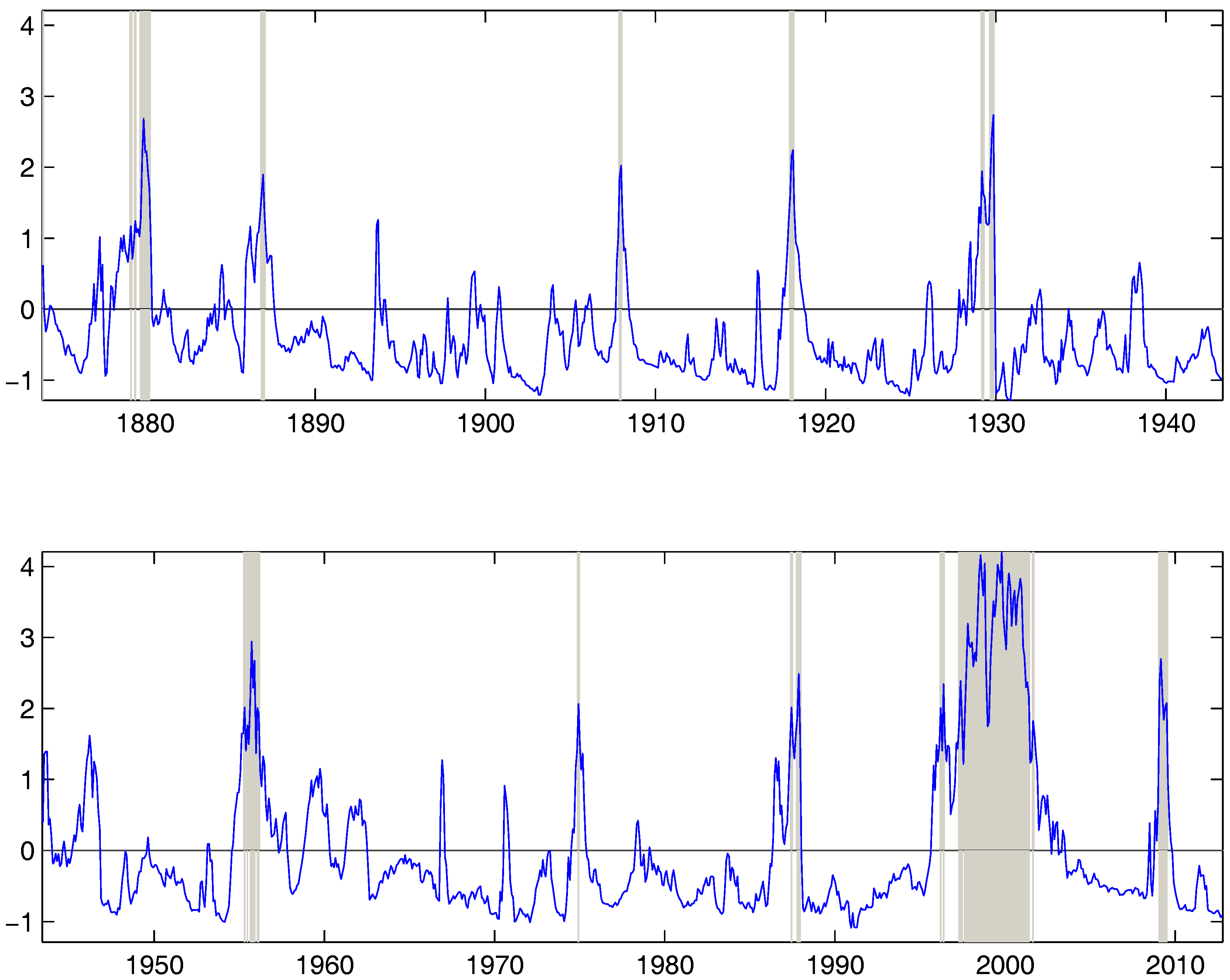

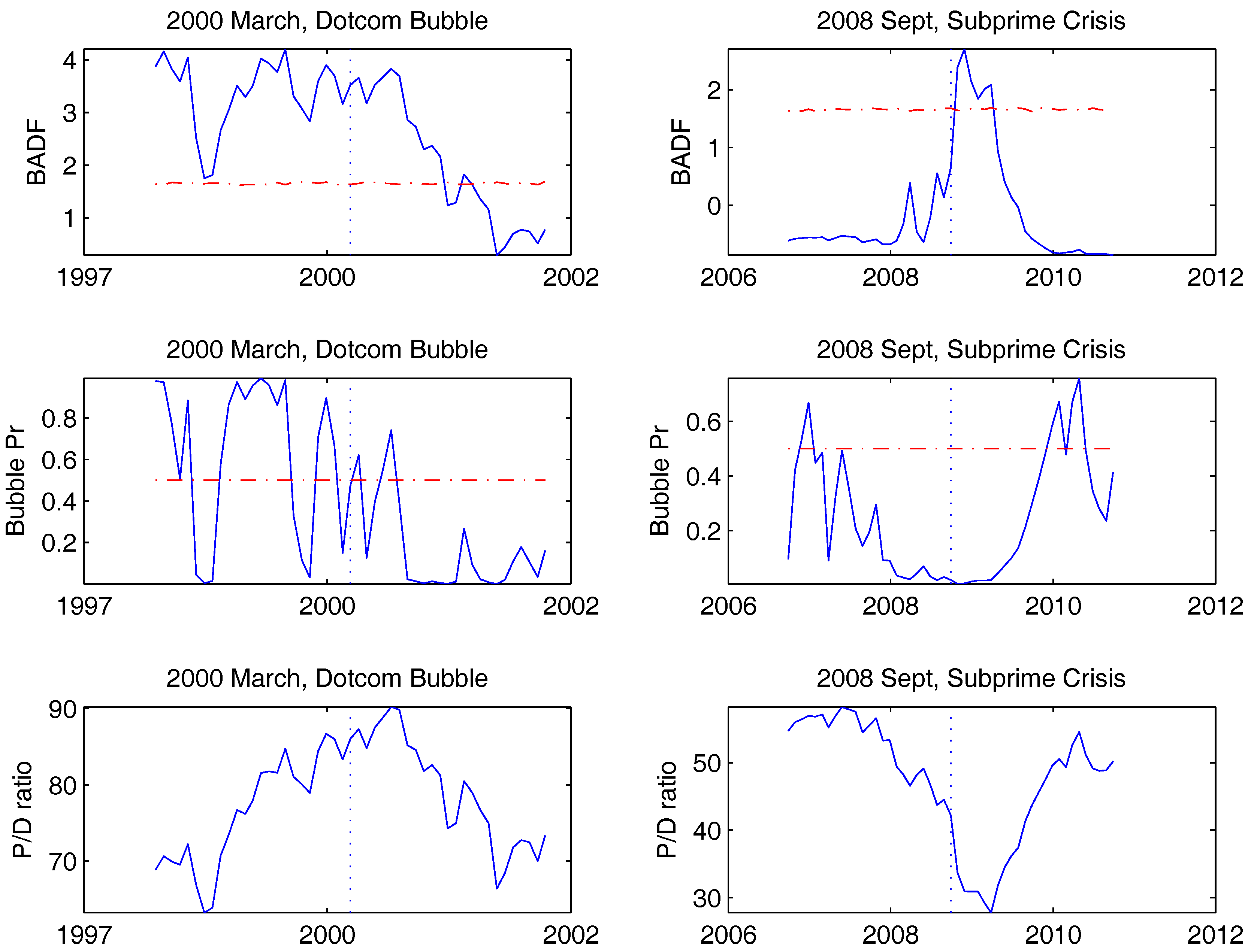

4. Empirical Study

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Ahamed, Liaquat. 2009. Lords of Finance: The Bankers Who Broke the World. New York: Penguin Press. [Google Scholar]

- Andrieu, Christophe, Arnaud Doucet, and Roman Holenstein. 2010. Particle Markov Chain Monte Carlo. Journal of Royal Statistical Society B 72: 1–33. [Google Scholar] [CrossRef]

- Busetti, Fabio, and A. M. Robert Taylor. 2004. Tests of stationarity against a change in persistence. Journal of Econometrics 123: 33–66. [Google Scholar] [CrossRef]

- Caballero, Ricardo J., Emmanuel Farhi, and Pierre-Olivier Gourinchas. 2008. Financial Crash, Commodity Prices and Global Imbalances. Brookings Papers on Economic Activity 2: 1–55. [Google Scholar]

- Campbell, John Y., and Robert J. Shiller. 1988. The dividend-price ratio and expectations of future dividends and discount factors. Review of Financial Studies 1: 195–227. [Google Scholar] [CrossRef]

- Chopin, Nicolas, Pierre E. Jacob, and Omiros Papaspiliopoulos. 2013. SMC2: An efficient algorithm for sequential analysis of state space models. Journal of the Royal Statistical Society B 75: 397–426. [Google Scholar] [CrossRef]

- Cochrane, John H. 2011. Presidential Address: Discount Rates. Journal of Finance 66: 1047–108. [Google Scholar] [CrossRef]

- Diba, Behzad T., and Herschel I. Grossman. 1988. Explosive rational bubbles in stock prices? The American Economic Review 78: 520–30. [Google Scholar]

- Evans, George W. Evans. 1991. Pitfalls in testing for explosive bubbles in asset prices. The American Economic Review 81: 922–30. [Google Scholar]

- Fearnhead, Paul. 1998. Sequential Monte Carlo methods in Filter Theory. Ph.D. thesis, University of Oxford, Oxford, UK. [Google Scholar]

- Fei, Y. 2017. Limit Theory for Mildly Integrated Process with Intercept. Working Paper, Singapore Management University, Singapore. [Google Scholar]

- Fulop, Andras, and Junye Li. 2013. Efficient learning via simulation: A marginalized resample-move approach. Journal of Econometrics 176: 146–61. [Google Scholar] [CrossRef]

- Godfeld, Stephen, and Richard Quandt. 1973. The Estimation of Structural Shifts by Switching Regressions. Annals of Economic and Social Measurement 2: 473–83. [Google Scholar]

- Funke, Michael, Stephen Hall, and Martin Sola. 1994. Rational bubbles during Poland’s hyperinflation: Implications and empirical evidence. European Economic Review 38: 1257–76. [Google Scholar] [CrossRef]

- Hall, Stephen G., Zacharias Psaradakis, and Martin Sola. 1999. Detecting Periodically Collapsing Bubbles: A Markov-Switching Unit Root Test. Journal of Applied Econometrics 14: 143–54. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57: 357–84. [Google Scholar] [CrossRef]

- Homm, Ulrich, and Jörg Breitung. 2012. Testing for Speculative Bubbles in Stock Markets: A Comparison of Alternative Methods. Journal of Financial Econometrics 10: 198–231. [Google Scholar] [CrossRef]

- Jiang, Liang, Xiao hu Wang, and Jun Yu. 2017. In-Fill Asymptotic Theory for Structural Break Point in Autoregression: A Unified Theory. Working paper, Singapore Management University, Singapore. [Google Scholar]

- Kim, Jae-Young. 2000. Detection of change in persistence of a linear time series. Journal of Econometrics 95: 97–116. [Google Scholar] [CrossRef]

- Kohn, Donald L. 2008. Monetary Policy and Asset Prices Revisited. Paper presented at the Cato Institute’s 26th Annual Monetary Policy Conference, Washington, DC, USA, November 19. [Google Scholar]

- Lee, Ji Hyung, and Peter C. B. Phillips. 2016. Asset pricing withfinancial bubble risk. Journal of Empirical Finance 38: 590–622. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Jun Yu. 2011. Dating the Timeline of Financial Bubbles During the Subprime Crisis. Quantitative Economics 2: 455–91. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., Shu ping Shi, and Jun Yu. 2014. Specification Sensitivity in Right-Tailed Unit Root Testing for Explosive Behavior. Oxford Bulletin of Economics and Statistics 76: 315–33. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., Shu ping Shi, and Jun Yu. 2015a. Testing for Multiple Bubbles: Historical Episodes of Exuberance and Collapse in the S&P500. International Economic Review 56: 1043–78. [Google Scholar]

- Phillips, Peter C. B., Shu ping Shi, and Jun Yu. 2015b. Testing for Multiple Bubbles: Limit Theory of Real Time Detector. International Economic Review 56: 1079–134. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., Yang Ru Wu, and Jun Yu. 2011. Explosive behavior in the 1990s Nasdaq: When did exuberance escalate asset values? International Economic Review 52: 201–26. [Google Scholar] [CrossRef]

- Shi, Shu Ping. 2013. Specification Sensitivities in the Markov-Switching Unit Root Test for Bubbles. Empirical Economics 45: 697–713. [Google Scholar] [CrossRef]

- Shi, Shu Ping, and Yong Song. 2015. Identifying Speculative Bubbles with an Infinite Hidden Markov Model. Journal of Financial Econometrics 14: 159–84. [Google Scholar] [CrossRef] [Green Version]

- Wang, Xiao hu, and Jun Yu. 2015. Limit Theory for an Explosive Autoregressive Process. Economic Letters 126: 176–80. [Google Scholar] [CrossRef]

- Yiu, Matthew S., Jun Yu, and Lu Jin. 2013. Detecting Bubbles in Hong Kong Residential Property Market. Journal of Asian Economics 28: 115–24. [Google Scholar] [CrossRef]

| 1. | |

| 2. | A very recent contribution in deriving the asymptotic distribution for the change point estimator was made in Jiang et al. (2017). |

| 3. | In more recent attempts, Phillips et al. (2014), Wang and Yu (2015), Fei (2017) showed the impact of the intercept term on the asymptotics in various model setups. |

| 4. |

| Parameters | True | Post. Mean | Post. Credible Interval | Prior Credible Interval |

|---|---|---|---|---|

| 150 | 189.4 | 126.9 | 153.7 | |

| 1.8 | 1.91 | 1.68 | 1.87 | |

| 30 | 35.95 | 21.15 | 31.01 | |

| 0.98 | 0.97 | 0.01 | 0.89 | |

| 0.94 | 0.93 | 0.049 | 0.90 | |

| 0.65 | 0.65 | 0.04 | 2.7 | |

| 2.8 | 2.77 | 0.37 | 1.88 | |

| 0.3 | 0.214 | 0.428 | 0.477 | |

| 0.99 | 0.989 | 0.006 | 0.025 | |

| 1.015 | 1.014 | 0.005 | 0.0180 |

| Methods | Number of Bubble Spells | Total Bubble Length/T | Avg Bubble Duration in Months |

|---|---|---|---|

| Realized numbers | |||

| 9.07 | 0.164 | 30.24 | |

| Panel A: Correctly Specified DGP | |||

| PSY | 13.2 | 0.095 | 11.0 |

| RS, | 17.4 | 0.095 | 8.9 |

| RS, | 8.6 | 0.091 | 17.3 |

| RS, | 6.9 | 0.087 | 20.6 |

| Panel B: Misspecified DGP with Fat Tails | |||

| PSY | 13.8 | 0.096 | 11.0 |

| RS, | 19.9 | 0.106 | 8.7 |

| RS, | 10.0 | 0.102 | 17.0 |

| RS, | 8.0 | 0.099 | 21.0 |

| Panel C: Misspecified DGP with Leverage | |||

| PSY | 13 | 0.090 | 11.3 |

| RS, | 16.1 | 0.090 | 9.42 |

| RS, | 7.91 | 0.086 | 18.37 |

| RS, | 6.49 | 0.082 | 21.77 |

| Parameters | Posterior Mean | Posterior 5th Prctile | Posterior 95 Prctile |

|---|---|---|---|

| 147 | 123.5 | 183.1 | |

| 1.795 | 1.152 | 2.589 | |

| 30.74 | 25.25 | 38.31 | |

| 0.9842 | 0.9754 | 0.9907 | |

| 0.9412 | 0.9128 | 0.963 | |

| 0.6694 | 0.6367 | 0.7017 | |

| 2.895 | 2.708 | 3.1 | |

| 0.3117 | 0.09392 | 0.6485 | |

| 0.99 | 0.9784 | 0.9982 | |

| 1.015 | 1.01 | 1.018 |

| Methods | Number of Bubble Spells | Total Bubble Length/T | Avg Bubble Duration in Months |

|---|---|---|---|

| PSY | 22 | 0.056 | 4.27 |

| RS, | 58 | 0.16 | 4.5 |

| RS, | 24 | 0.14 | 9.7 |

| RS, | 20 | 0.125 | 10.4 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fulop, A.; Yu, J. Bayesian Analysis of Bubbles in Asset Prices. Econometrics 2017, 5, 47. https://doi.org/10.3390/econometrics5040047

Fulop A, Yu J. Bayesian Analysis of Bubbles in Asset Prices. Econometrics. 2017; 5(4):47. https://doi.org/10.3390/econometrics5040047

Chicago/Turabian StyleFulop, Andras, and Jun Yu. 2017. "Bayesian Analysis of Bubbles in Asset Prices" Econometrics 5, no. 4: 47. https://doi.org/10.3390/econometrics5040047