Unit Roots in Economic and Financial Time Series: A Re-Evaluation at the Decision-Based Significance Levels

Abstract

1. Introduction

2. Decision-Based Level of Significance for Unit Root Tests

2.1. Decision-Theoretic Approach to Unit Root Testing

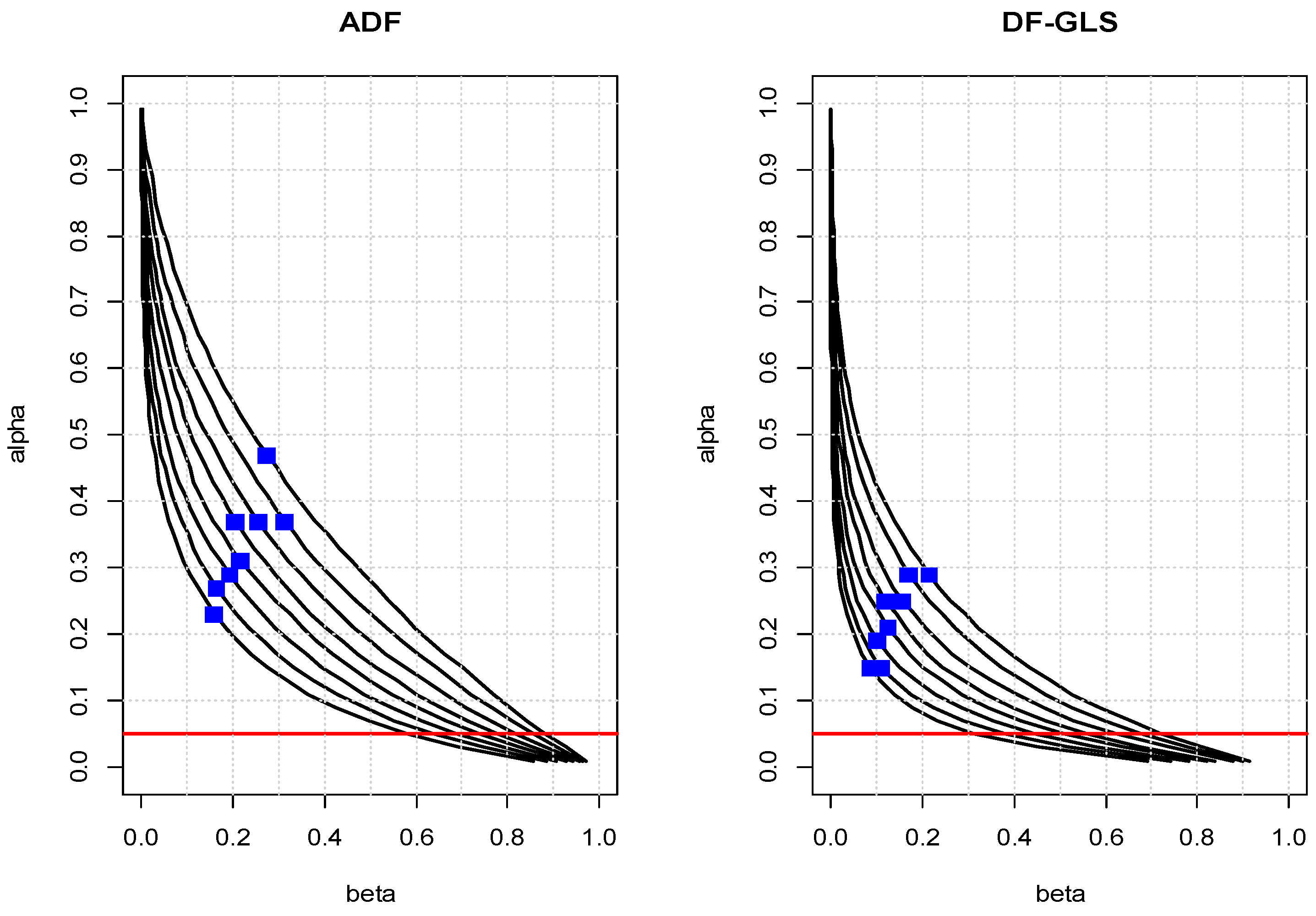

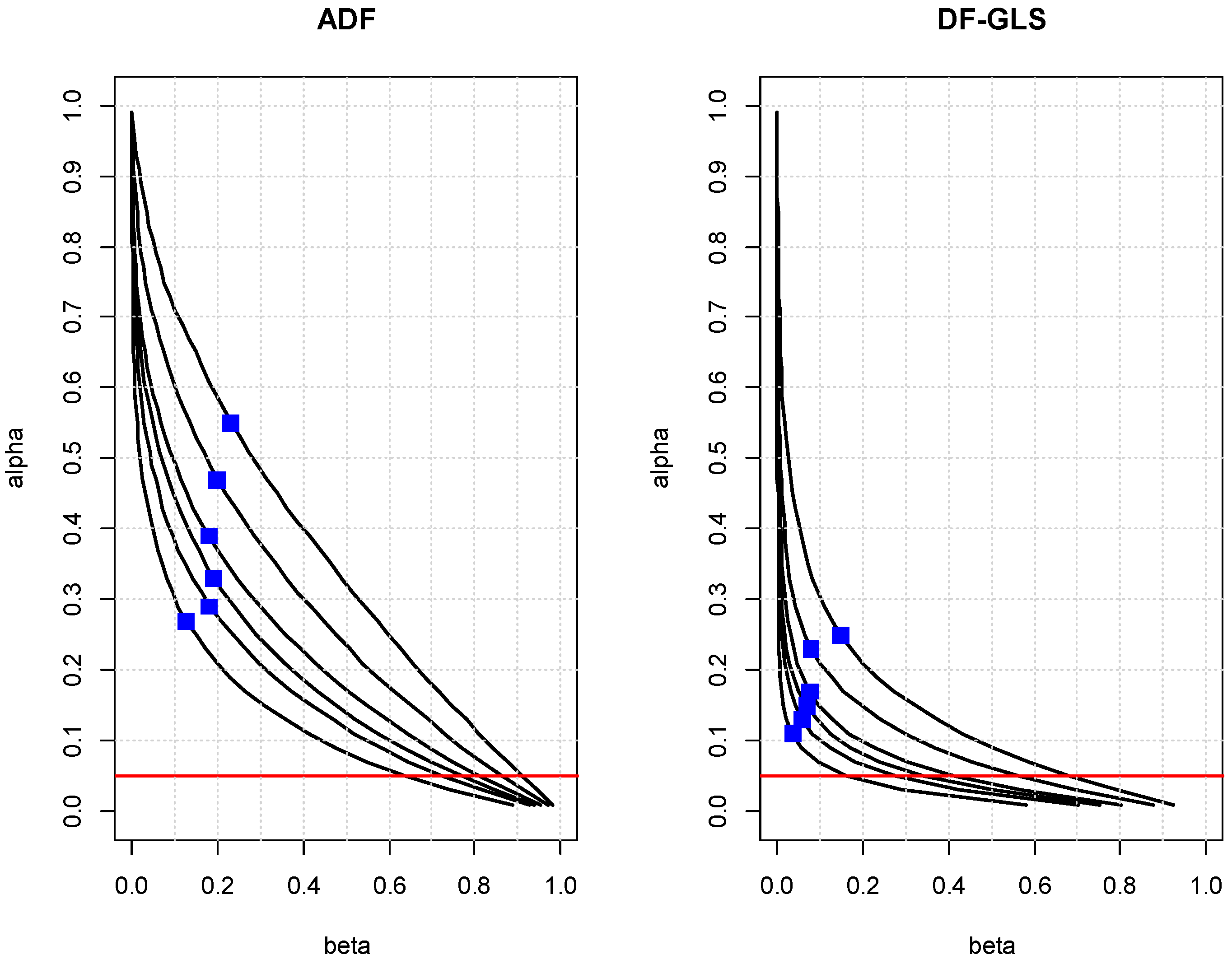

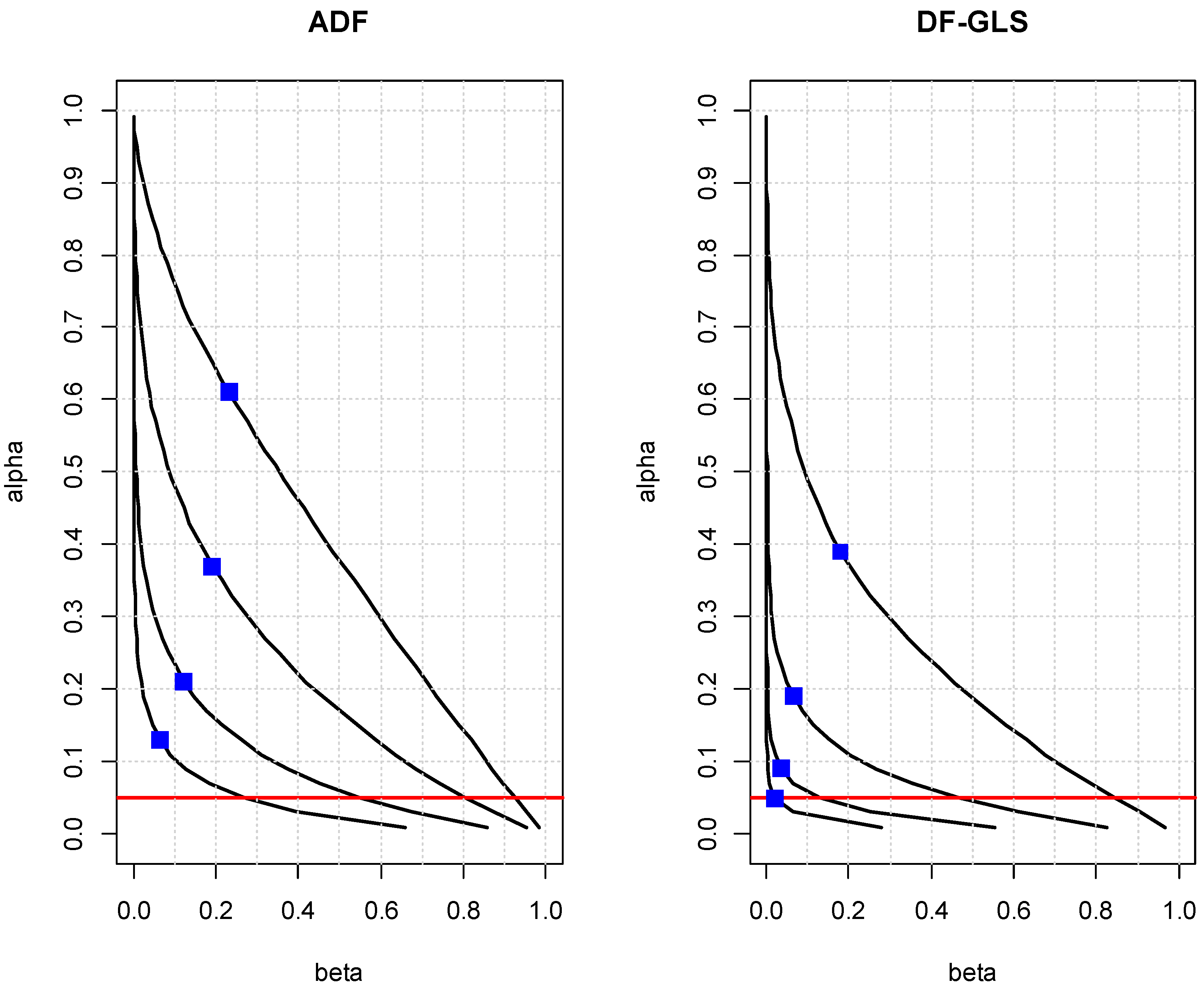

2.2. Line of Enlightened Judgement and Decision-Based Significance Levels

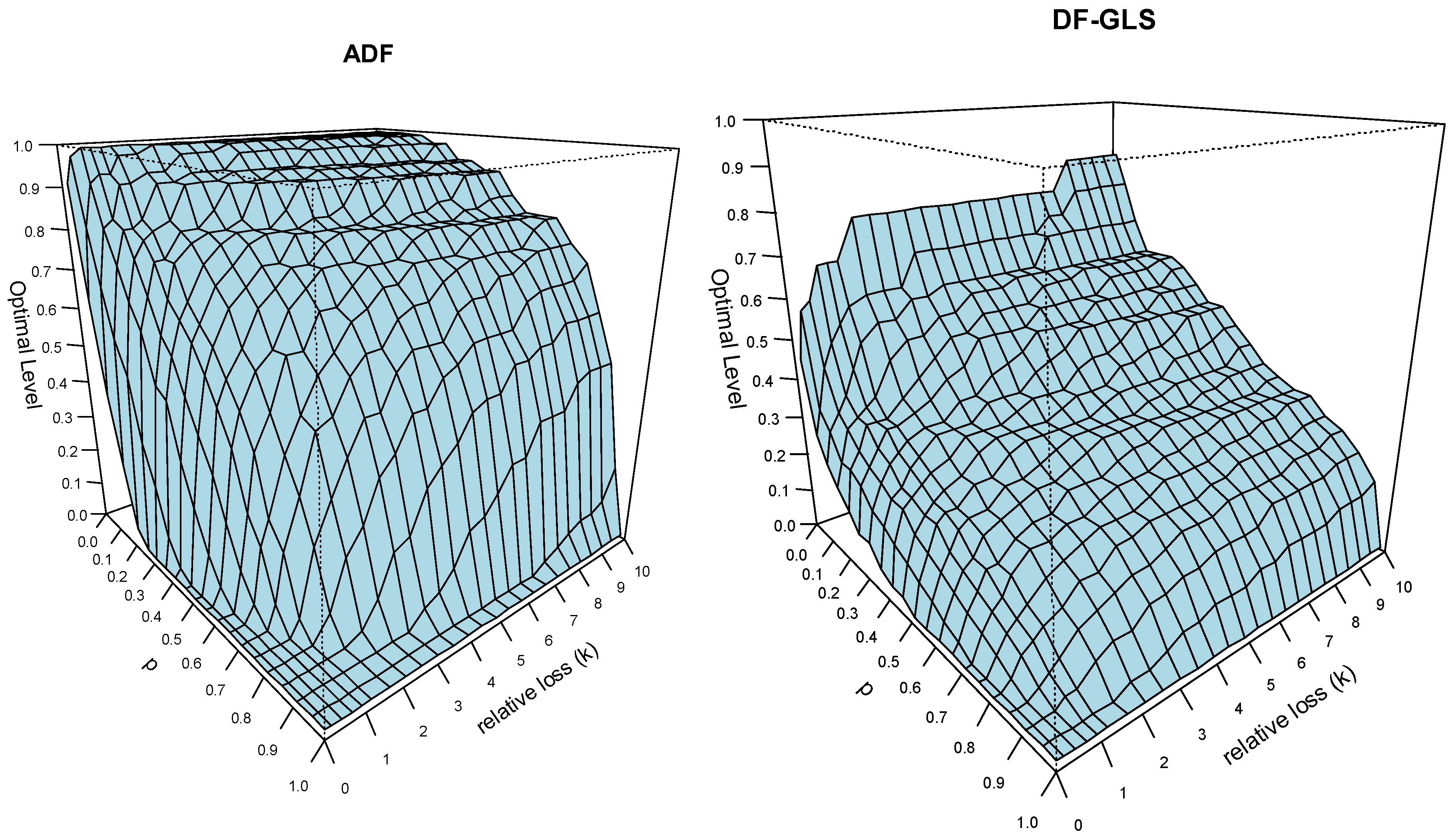

2.3. Factors Affecting the Decision-Based Significance Level

3. Calibration Rules Based on Asymptotic Local Power

- Model with a constant onlyADF:Phillips–Perron:DF-GLS:ERS-P:

- Model with a constant and a linear trendADF:Phillips–Perron:DF-GLS:ERS-P:

4. Re-Evaluation of Past Empirical Results

4.1. Extended Nelson–Plosser Data

4.2. Elliott–Pesavento Data

4.3. Rapach–Weber Data

4.4. Application of the Calibration Rules

4.5. Decision-Based Significance Level under a Specific Loss Function

5. Conclusions

Supplementary Materials

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Further Sensitivity Analyses

| Model with Constant Only | Model with Constant and Time Trend | |||||||

|---|---|---|---|---|---|---|---|---|

| c | c | |||||||

| 2.5 | 7.5 | 12.5 | 17.5 | 2.5 | 7.5 | 12.5 | 17.5 | |

| X0* = 1 | ||||||||

| ADF | 0.58 | 0.38 | 0.22 | 0.13 | 0.60 | 0.46 | 0.31 | 0.22 |

| DF–GLS | 0.40 | 0.17 | 0.09 | 0.05 | 0.56 | 0.41 | 0.20 | 0.14 |

| X0* = 3 | ||||||||

| ADF | 0.59 | 0.38 | 0.22 | 0.13 | 0.59 | 0.46 | 0.31 | 0.21 |

| DF–GLS | 0.41 | 0.21 | 0.14 | 0.09 | 0.56 | 0.41 | 0.23 | 0.17 |

| X0* = 5 | ||||||||

| ADF | 0.59 | 0.38 | 0.22 | 0.12 | 0.60 | 0.46 | 0.30 | 0.21 |

| DF–GLS | 0.44 | 0.28 | 0.21 | 0.17 | 0.55 | 0.44 | 0.28 | 0.22 |

| p-Value | Sensitivity Analysis | |||

|---|---|---|---|---|

| ADF | DF–GLS | ADF | DF–GLS | |

| Real GNP | 0.05 | 0.05 | H0 is rejected for all c values | H0 is rejected for all c values |

| Nominal GNP | 0.58 | 0.49 | H0 is rejected when c = 2.5 | H0 is rejected when c = 2.5 |

| Real per capital GNP | 0.04 | 0.06 | H0 is rejected for all c values | H0 is rejected for all c values |

| Industrial Production | 0.26 | 0.27 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected only when c = 2.5, 7.5 (*) |

| Employment | 0.18 | 0.04 | H0 is rejected for all c values | H0 is rejected for all c values |

| Unemployment Rate | 0.01 | 0.01 | H0 is rejected for all c values | H0 is rejected for all c values |

| GNP deflator | 0.70 | 0.73 | H0 is accepted for all c values | H0 is accepted for all c values |

| Consumer Prices | 0.91 | 0.61 | H0 is accepted for all c values | H0 is accepted for all c values |

| Wages | 0.53 | 0.37 | H0 is rejected when c = 2.5 | H0 is rejected when c = 2.5, 7.5 |

| Real Wages | 0.75 | 0.51 | H0 is accepted for all c values | H0 is rejected when c = 2.5 |

| Money Stock | 0.18 | 0.10 | H0 is rejected for all c values | H0 is rejected for all c values |

| Velocity | 0.78 | 0.87 | H0 is accepted for all c values | H0 is accepted for all c values |

| Interest Rate | 0.98 | 0.33 | H0 is accepted for all c values | H0 is rejected when c = 2.5, 7.5 |

| Common Stock Prices | 0.64 | 0.63 | H0 is accepted for all c values | H0 is accepted for all c values |

- The real GNP and real per capita GNP are found to be trend-stationary for all c and X0* values, for both ADF and DF–GLS tests.

- The employment and money stock are found to be trend-stationary for all c and X0* values, for both ADF and DF–GLS tests.

- The nominal GNP is found to be trend-stationary only when c = 2.5. For other c values, it is found to be difference-stationary.

- Other nominal and price variables are found to be difference-stationary for all values of c and X0* values.

- The results are nearly the same as those reported in Section 4.1 of the paper, showing little sensitivity to the c and X0* values.

| p-Value | Sensitivity Analysis | |||

|---|---|---|---|---|

| ADF | DF-GLS | ADF | DF-GLS | |

| Austria | 0.414 | 0.225 | H0 is rejected when c = 2.5 | H0 is rejected when c = 2.5 (*) |

| Belgium | 0.168 | 0.032 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected for all c values |

| Canada | 0.629 | 0.503 | H0 is accepted for all c values | H0 is accepted for all c values |

| Denmark | 0.116 | 0.020 | H0 is rejected for all c values | H0 is rejected for all c values |

| Finland | 0.150 | 0.061 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected for all c values |

| France | 0.306 | 0.047 | H0 is rejected when c = 2.5, 7.5 | H0 is rejected for all c values |

| Germany | 0.288 | 0.043 | H0 is rejected when c = 2.5, 7.5 | H0 is rejected for all c values |

| Italy | 0.301 | 0.047 | H0 is rejected when c = 2.5, 7.5 | H0 is rejected for all c values |

| Japan | 0.185 | 0.207 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected when c = 2.5 (*) |

| Netherlands | 0.401 | 0.082 | H0 is rejected when c = 2.5 | H0 is rejected for all c values |

| Norway | 0.215 | 0.032 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected for all c values |

| Spain | 0.319 | 0.130 | H0 is rejected when c = 2.5, 7.5 | H0 is rejected when c = 2.5, 7.5 (*) |

| Sweden | 0.201 | 0.044 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected for all c values |

| Switzerland | 0.118 | 0.120 | H0 is rejected for all c values | H0 is rejected when c = 2.5, 7.5 (*) |

| UK | 0.154 | 0.084 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected for all c values |

- For the ADF test, most of real exchange rates are found to be stationary under a wide range of c values, showing little sensitivity to the X0* value. For eight time series, the null hypothesis is rejected for all c values or c ∊ {2.5, 7.5, 12.5}.

- For the DF–GLS test, most of real exchange rates are found to be stationary under a wide range of c values. For ten time series, the null hypothesis is rejected for all c values considered.

- When the DF–GLS test is used, there are cases where the results are sensitive to the choice of X0* value, which might be expected from the nature of the DF–GLS test.

| P-Value | Sensitivity Analysis | |||

|---|---|---|---|---|

| ADF | DF–GLS | ADF | DF–GLS | |

| Belgium | 0.200 | 0.045 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected for all c values |

| Canada | 0.237 | 0.071 | H0 is rejected when c = 2.5, 7.5 | H0 is rejected when c = 2.5, 7.5, 12.5 (*) |

| Denmark | 0.044 | 0.169 | H0 is rejected for all c values | H0 is rejected only when c = 2.5, 7.5 |

| France | 0.253 | 0.025 | H0 is rejected when c = 2.5, 7.5 | H0 is rejected for all c values |

| Ireland | 0.158 | 0.245 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected only when c = 2.5 (*) |

| Italy | 0.138 | 0.139 | H0 is rejected when c = 2.5, 7.5, 12.5 | H0 is rejected only when c = 2.5, 7.5 (*) |

| Japan | 0.120 | 0.038 | H0 is rejected for all c values | H0 is rejected for all c values |

| Netherlands | 0.562 | 0.287 | H0 is rejected only when c = 2.5 | H0 is rejected only when c = 2.5, 7.5 |

| New Zealand | 0.606 | 0.241 | H0 is accepted for all c values | H0 is rejected when c = 2.5, 7.5 (*) |

| UK | 0.039 | 0.009 | H0 is rejected for all c values | H0 is rejected for all c values |

- For the ADF test most of real interest rates are found to be stationary under a wide range of c values, showing little sensitivity to the X0* value. For six time series, the null hypothesis is rejected for all c values or c ∊ {2.5, 7.5, 12.5}. Two additional time series are found to be stationary when c ∊ {2.5, 7.5}.

- For the DF–GLS test, most of the real exchange rates are found to be stationary under a wide range of c values. For five time series, the null hypothesis is rejected for all c values considered or c ∊ {2.5, 7.5, 12.5}. Three additional time series are found to be stationary when c ∊ {2.5, 7.5}.

- When the DF–GLS test is used, there are cases where the results are sensitive to the choice of X0* value, which might be expected from the nature of the DF–GLS test.

References

- Andrews, Donald W. K., and Patrik Guggenberger. 2014. A Conditional-Heteroskedasticity-Robust Confidence Interval for the Autoregressive Parameter. Review of Economics and Statistics 96: 376–81. [Google Scholar] [CrossRef]

- Arrow, Kenneth. 1960. Decision theory and the choice of a level of significance for the t-test. In Contributions to Probability and Statistics: Essays in Honor of Harold Hotelling. Edited by Ingram Olkin. Palo Alto: Stanford University Press, pp. 70–8. [Google Scholar]

- Campbell, John Y., and N. Gregory Mankiw. 1987. Are Output Fluctuations Transitory? Quarterly Journal of Economics 102: 857–80. [Google Scholar] [CrossRef]

- Cheung, Yin-Wong, and Kon S. Lai. 1995. Lag order and critical values of a modified Dickey–Fuller test. Oxford Bulletin of Economics and Statistics 57: 411–19. [Google Scholar] [CrossRef]

- Choi, In. 2015. Almost All about Unit Roots: Foundations, Developments, and Applications. New York: Cambridge University Press. [Google Scholar]

- Cochrane, John H. 1991. A critique of application of unit root tests. Journal of Economic Dynamics and Control 15: 275–84. [Google Scholar] [CrossRef]

- Darné, Olivier. 2009. The uncertain unit root in real GNP: A re-examination. Journal of Macroeconomics 31: 153–66. [Google Scholar] [CrossRef]

- Das, C. 1994. Decision making by classical test procedures using an optimal level of significance. European Journal of Operational Research 73: 76–84. [Google Scholar] [CrossRef]

- Davidson, Russell, and James G. MacKinnon. 1993. Estimation and Inference in Econometrics. Oxford: Oxford University Press. [Google Scholar]

- DeJong, David N., John C. Nankervis, N. E. Savin, and Charles H. Whiteman. 1992. Integration versus trend stationary in time series. Econometrica 60: 423–33. [Google Scholar] [CrossRef]

- DeGroot, Morris. 1975. Probability and Statistics, 2nd ed. Reading: Addison-Wesley. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Diebold, Francis X., and Lutz Kilian. 2000. Unit-Root Tests Are Useful for Selecting Forecasting Models. Journal of Business and Economic Statistics 18: 265–73. [Google Scholar]

- Diebold, Francis X., and Abdelhak S. Senhadji. 1996. The uncertain root in real GNP: Comment. American Economic Review 86: 1291–98. [Google Scholar]

- Elliott, Graham, and Elena Pesavento. 2006. On the Failure of Purchasing Power Parity for Bilateral Exchange Rates after 1973. Journal of Money, Credit, and Banking 38: 1405–29. [Google Scholar] [CrossRef]

- Elliott, Graham, Thomas J. Rothenberg, and James H. Stock. 1996. Efficient tests for an autoregressive unit root. Econometrica 64: 813–36. [Google Scholar] [CrossRef]

- Engsted, Tom. 2009. Statistical vs. economic significance in economics and econometrics: Further comments on McCloskey and Ziliak. Journal of Economic Methodology 16: 393–408. [Google Scholar] [CrossRef]

- Fomby, Thomas B., and David K. Guilkey. 1978. On Choosing the Optimal Level of Significance for the Durbin–Watson test and the Bayesian alternative. Journal of Econometrics 8: 203–13. [Google Scholar] [CrossRef]

- Hausman, Jerry A. 1978. Specification Tests in Econometrics. Econometrica 46: 1251–71. [Google Scholar] [CrossRef]

- Keuzenkamp, Hugo A., and Jan R. Magnus. 1995. On tests and significance in econometrics. Journal of Econometrics 67: 103–28. [Google Scholar] [CrossRef]

- Kilian, Lutz. 1998. Small sample confidence intervals for impulse response functions. The Review of Economics and Statistics 80: 218–30. [Google Scholar] [CrossRef]

- Kim, Jae H. 2004. Bootstrap Prediction Intervals for Autoregression using Asymptotically Mean-Unbiased Parameter Estimators. International Journal of Forecasting 20: 85–97. [Google Scholar] [CrossRef]

- Kim, Jae H. 2015. BootPR: Bootstrap Prediction Intervals and Bias-Corrected Forecasting. R package version 0.60. Available online: http://CRAN.R-project.org/package=BootPR (accessed on 9 February 2016).

- Kim, Jae H., and Philip Inyeob Ji. 2015. Significance Testing in Empirical Finance: A Critical Review and Assessment. Journal of Empirical Finance 34: 1–14. [Google Scholar] [CrossRef]

- Kish, Leslie. 1959. Some statistical problems in research design. American Sociological Review 24: 328–38. [Google Scholar] [CrossRef]

- Koop, Gary, and Mark F. J. Steel. 1994. A Decision-Theoretic Analysis of the Unit-Root Hypothesis Using Mixtures of Elliptical Models. Journal of Business and Economic Statistics 12: 95–107. [Google Scholar]

- Leamer, Edward E. 1978. Specification Searches: Ad Hoc Inference with Nonexperimental Data. New York: Wiley. [Google Scholar]

- Lehmann, Erich L., and Joseph P. Romano. 2005. Testing Statistical Hypothesis, 3rd ed. New York: Springer. [Google Scholar]

- Lothian, James R., and Mark P. Taylor. 1996. Real exchange rate behavior: The recent float from the perspective of the past two centuries. Journal of Political Economy 104: 488–510. [Google Scholar] [CrossRef]

- Luo, Sui, and Richard Startz. 2014. Is it one break or ongoing permanent shocks that explains U.S. real GDP? Journal of Monetary Economics 66: 155–63. [Google Scholar] [CrossRef]

- MacKinnon, James G. 1996. Numerical distribution functions for unit root and cointegration tests. Journal of Applied Econometrics 11: 601–18. [Google Scholar] [CrossRef]

- MacKinnon, James G. 2002. Bootstrap inference in Econometrics. Canadian Journal of Economics 35: 615–44. [Google Scholar] [CrossRef]

- Maddala, G. S., and In-Moo Kim. 1998. Unit Roots, Cointegration and Structural Changes. Cambridge: Cambridge University Press. [Google Scholar]

- Manderscheid, Lester V. 1965. Significance Levels-0.05, 0.01, or? Journal of Farm Economics 47: 1381–85. [Google Scholar] [CrossRef]

- McCallum, Bennett T. 1986. On "Real" and "Sticky-Price" Theories of the Business Cycle. Journal of Money, Credit and Banking 18: 397–414. [Google Scholar] [CrossRef]

- Morrison, Denton E., and Ramon E. Henkel, eds. 1970. The Significance Test Controversy: A Reader. New Brunswick: Aldine Transactions. [Google Scholar]

- Müller, Ulrich K., and Graham Elliott. 2003. Testing for unit roots and the initial condition. Econometrica 71: 1269–86. [Google Scholar] [CrossRef]

- Murray, Christian J., and Charles R. Nelson. 2000. The uncertain trend in U.S. GDP. Journal of Monetary Economics 46: 79–95. [Google Scholar] [CrossRef]

- Neely, Christopher, and David E. Rapach. 2008. Real Interest Rate Persistence: Evidence and Implications. Federal Reserve Bank of St. Louis Review 90: 609–42. [Google Scholar]

- Nelson, Charles R., and Charles R. Plosser. 1982. Trends and random walks in macroeconomic time series. Journal of Monetary Economics 10: 139–62. [Google Scholar] [CrossRef]

- Orcutt, Guy H., and Herbert S. Winokur. 1969. First order autoregression: Inference, estimation and prediction. Econometrica 37: 1–14. [Google Scholar] [CrossRef]

- Papell, David H. 1997. Searching for stationarity: Purchasing power parity under the current float. Journal of International Economics 43: 313–32. [Google Scholar] [CrossRef]

- Papell, David H., and Ruxandra Prodan. 2004. The uncertain unit root in US real GDP: Evidence with restricted and unrestricted structural change. Journal of Money, Credit and Banking 36: 423–27. [Google Scholar] [CrossRef]

- Perez, María-Eglée, and Luis Raúl Pericchi. 2014. Changing statistical significance with the amount of information: The adaptive α significance level. Statistics and Probability Letters 85: 20–24. [Google Scholar] [CrossRef] [PubMed]

- Pericchi, Luis Raúl, and Carlos Pereira. 2016. Adaptive significance levels using optimal decision rules: Balancing by weighting the error probabilities. Brazilian Journal of Probability and Statistics 30: 70–90. [Google Scholar] [CrossRef]

- Pfaff, Bernhard. 2008. Analysis of Integrated and Cointegrated Time Series with R, 2nd ed. New York: Springer. [Google Scholar]

- Phillips, Peter, and Pierre Perron. 1988. Testing for a Unit Root in Time Series Regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Poirier, Dale J. 1995. Intermediate Statistics and Econometrics: A Comparative Approach. Cambridge: MIT Press. [Google Scholar]

- R Core Team. 2014. R: A language and environment for statistical computing. Vienna, Austria: R Foundation for Statistical Computing. Available online: http://www.R-project.org/ (accessed on 9 February 2016).

- Rapach, David E., and Christian E. Weber. 2004. Are real interest rates really nonstationary? New evidence from tests with good size and power. Journal of Macroeconomics 26: 409–30. [Google Scholar] [CrossRef]

- Rose, Andrew K. 1988. Is the real interest rate stable? Journal of Finance 43: 1095–112. [Google Scholar] [CrossRef]

- Rudebusch, Glenn D. 1993. The uncertain unit root in real GNP. American Economic Review 83: 264–72. [Google Scholar]

- Schotman, Peter C., and Herman K. van Dijk. 1991. On Bayesian Roots to Unit Roots. Journal of Applied Econometrics 6: 387–401. [Google Scholar] [CrossRef]

- Schwert, G. William. 1989. Testing for unit roots: A Monte Carlo investigation. Journal of Business and Economic Statistics 7: 147–59. [Google Scholar]

- Sims, Christopher. 1988. Bayesian Scepticism on Unit Root Econometrics. Journal of Economics Dynamics and Control 12: 463–74. [Google Scholar] [CrossRef]

- Sims, Christopher, and Harald Uhlig. 1991. Understanding Unit Rooters: A Helicopter Tour. Econometrica 59: 1591–99. [Google Scholar] [CrossRef]

- Skipper, James K., Anthony L. Guenther, and Gilbert Nass. 1967. The sacredness of 0.05: A note on concerning the use of statistical levels of significance in social science. The American Sociologist 2: 16–18. [Google Scholar]

- Startz, Richard. 2014. Choosing the More Likely Hypothesis. Foundations and Trends in Econometrics 7: 119–89. [Google Scholar] [CrossRef]

- Stine, Robert A., and Paul Shaman. 1989. A fixed point characterization for bias of autoregressive estimators. The Annals of Statistics 17: 1275–84. [Google Scholar] [CrossRef]

- Stock, James H. 1991. Confidence Intervals for the Largest Autoregressive Root in U.S. Macroeconomic Time Series. Journal of Monetary Economics 28: 435–59. [Google Scholar] [CrossRef]

- Wasserstein, Ronald L., and Nicole A. Lazar. 2016. The ASA’s statement on p-values: Context, process, and purpose. The American Statistician 70: 129–33. [Google Scholar] [CrossRef]

- Winer, Benjamin J. 1962. Statistical Principles in Experimental Design. New York: McGraw-Hill. [Google Scholar]

- Ziliak, Stephen Thomas, and Deirdre N. McCloskey. 2008. The Cult of Statistical Significance: How the Standard Error Costs Us Jobs, Justice, and Lives. Ann Arbor: The University of Michigan Press. [Google Scholar]

| 1 | |

| 2 | Reprinted in Morrison and Henkel (1970, p. 139). |

| 3 | Reprinted in Morrison and Henkel (1970, p. 157). |

| 4 | We note that Manderscheid (1965) and DeGroot (1975, p. 380) also propose the same method for choosing the decision-based significance level, without introducing the line of enlightened judgement. |

| 5 | For a comprehensive review of Bayesian unit root tests, see Choi (2015, Chapter 4). |

| 6 | We note that this choice may be specific to the nature of the application at hand. This is also related with what Ziliak and McCloskey (2008) called the minimum oomph, which is the smallest value where the null hypothesis is violated economically. |

| 7 | This choice will be generalized in Section 3 where the calibration rules for the decision-based significance levels are constructed under a wide range of starting values. |

| 8 | Cheung and Lai (1995) provide response surface estimates for the critical values of the DF–GLS test for the model with a linear trend. However, they are only applicable for 5% and 10% levels of significance. |

| 9 | The R package BootPR (Kim 2015) provides computational resources for this bias-corrected estimation. |

| ADF Test | ||||||||

| n | α | β | Power | CR | α* | β* | Power | CR* |

| α fixed at 0.05 | minimize α + β | |||||||

| 60 | 0.05 | 0.88 | 0.12 | −3.49 | 0.47 | 0.27 | 0.73 | −2.22 |

| 70 | 0.05 | 0.86 | 0.14 | −3.48 | 0.37 | 0.31 | 0.69 | −2.41 |

| 80 | 0.05 | 0.82 | 0.18 | −3.47 | 0.37 | 0.25 | 0.75 | −2.41 |

| 90 | 0.05 | 0.78 | 0.22 | −3.46 | 0.37 | 0.21 | 0.79 | −2.41 |

| 100 | 0.05 | 0.74 | 0.26 | −3.46 | 0.31 | 0.22 | 0.78 | −2.54 |

| 110 | 0.05 | 0.69 | 0.31 | −3.46 | 0.29 | 0.19 | 0.81 | −2.58 |

| 120 | 0.05 | 0.64 | 0.36 | −3.45 | 0.27 | 0.16 | 0.84 | −2.63 |

| 130 | 0.05 | 0.58 | 0.42 | −3.44 | 0.23 | 0.16 | 0.84 | −2.72 |

| DF–GLS Test | ||||||||

| n | α | β | Power | CR | α* | β* | Power | CR* |

| α fixed at 0.05 | minimize α + β | |||||||

| 60 | 0.05 | 0.72 | 0.28 | −2.89 | 0.29 | 0.21 | 0.79 | −2.05 |

| 70 | 0.05 | 0.68 | 0.32 | −2.89 | 0.29 | 0.17 | 0.83 | −2.05 |

| 80 | 0.05 | 0.62 | 0.38 | −2.89 | 0.25 | 0.15 | 0.85 | −2.13 |

| 90 | 0.05 | 0.56 | 0.44 | −2.89 | 0.25 | 0.12 | 0.88 | −2.13 |

| 100 | 0.05 | 0.51 | 0.49 | −2.89 | 0.21 | 0.12 | 0.88 | −2.24 |

| 110 | 0.05 | 0.44 | 0.56 | −2.89 | 0.19 | 0.10 | 0.90 | −2.29 |

| 120 | 0.05 | 0.38 | 0.62 | −2.89 | 0.15 | 0.11 | 0.89 | −2.40 |

| 130 | 0.05 | 0.31 | 0.69 | −2.89 | 0.15 | 0.08 | 0.92 | −2.40 |

| ADF Test | ||||||||

| n | α | β | Power | CR | α* | β* | Power | CR* |

| α fixed at 0.05 | minimize α + β | |||||||

| 80 | 0.05 | 0.91 | 0.09 | −2.90 | 0.55 | 0.23 | 0.77 | −1.46 |

| 120 | 0.05 | 0.87 | 0.13 | −2.89 | 0.47 | 0.20 | 0.80 | −1.62 |

| 160 | 0.05 | 0.81 | 0.19 | −2.88 | 0.39 | 0.18 | 0.82 | −1.78 |

| 180 | 0.05 | 0.78 | 0.22 | −2.88 | 0.33 | 0.19 | 0.81 | −1.90 |

| 200 | 0.05 | 0.73 | 0.27 | −2.88 | 0.29 | 0.18 | 0.82 | −1.99 |

| 240 | 0.05 | 0.63 | 0.37 | −2.87 | 0.27 | 0.13 | 0.87 | −2.04 |

| DF–GLS Test | ||||||||

| n | α | β | Power | CR | α* | β* | Power | CR* |

| α fixed at 0.05 | minimize α + β | |||||||

| 80 | 0.05 | 0.68 | 0.32 | −1.94 | 0.25 | 0.15 | 0.85 | −1.08 |

| 120 | 0.05 | 0.56 | 0.44 | −1.94 | 0.23 | 0.08 | 0.92 | −1.14 |

| 160 | 0.05 | 0.41 | 0.59 | −1.94 | 0.17 | 0.08 | 0.92 | −1.33 |

| 180 | 0.05 | 0.34 | 0.66 | −1.94 | 0.15 | 0.07 | 0.93 | −1.40 |

| 200 | 0.05 | 0.27 | 0.73 | −1.94 | 0.13 | 0.06 | 0.94 | −1.48 |

| 240 | 0.05 | 0.16 | 0.84 | −1.94 | 0.11 | 0.04 | 0.96 | −1.57 |

| ADF | DF–GLS | |||||||

|---|---|---|---|---|---|---|---|---|

| ρ1 | −0.5 | 0 | 0.5 | 0.9 | −0.5 | 0 | 0.5 | 0.9 |

| X0* | ||||||||

| 0 | 0.45 | 0.47 | 0.51 | 0.51 | 0.19 | 0.21 | 0.21 | 0.27 |

| 1 | 0.47 | 0.45 | 0.49 | 0.47 | 0.23 | 0.21 | 0.21 | 0.27 |

| 2 | 0.45 | 0.49 | 0.51 | 0.53 | 0.29 | 0.25 | 0.21 | 0.27 |

| 3 | 0.45 | 0.47 | 0.51 | 0.51 | 0.35 | 0.29 | 0.23 | 0.27 |

| 4 | 0.45 | 0.49 | 0.49 | 0.47 | 0.45 | 0.35 | 0.25 | 0.27 |

| 5 | 0.43 | 0.47 | 0.47 | 0.49 | 0.55 | 0.41 | 0.27 | 0.29 |

| 6 | 0.37 | 0.43 | 0.47 | 0.49 | 0.63 | 0.49 | 0.31 | 0.29 |

| 8 | 0.33 | 0.37 | 0.45 | 0.51 | 0.75 | 0.59 | 0.35 | 0.27 |

| 10 | 0.27 | 0.35 | 0.43 | 0.47 | 0.81 | 0.67 | 0.43 | 0.27 |

| (p, k) | ADF | DF–GLS | ||

| True | Estimated | True | Estimated | |

| (0.25, 0.25) | 0.27 | 0.30 | 0.25 | 0.26 |

| (0.25, 1) | 0.63 | 0.65 | 0.49 | 0.49 |

| (0.25, 4) | 0.83 | 0.84 | 0.67 | 0.67 |

| (0.5, 0.25) | 0.03 | 0.03 | 0.07 | 0.05 |

| (0.5, 1) | 0.39 | 0.37 | 0.29 | 0.30 |

| (0.5, 4) | 0.71 | 0.70 | 0.53 | 0.53 |

| (0.75, 0.25) | 0.01 | 0.01 | 0.01 | 0.01 |

| (0.75, 1) | 0.07 | 0.06 | 0.11 | 0.10 |

| (0.75, 4) | 0.47 | 0.46 | 0.37 | 0.36 |

| ADF | DF–GLS | |||

| True | Estimated | True | Estimated | |

| (0.25, 0.25) | 0.27 | 0.29 | 0.25 | 0.26 |

| (0.25, 1) | 0.63 | 0.64 | 0.49 | 0.49 |

| (0.25, 4) | 0.83 | 0.84 | 0.69 | 0.67 |

| (0.5, 0.25) | 0.03 | 0.03 | 0.07 | 0.05 |

| (0.5, 1) | 0.35 | 0.36 | 0.31 | 0.31 |

| (0.5, 4) | 0.67 | 0.69 | 0.55 | 0.54 |

| (0.75, 0.25) | 0.01 | 0.01 | 0.01 | 0.01 |

| (0.75, 1) | 0.07 | 0.06 | 0.11 | 0.10 |

| (0.75, 4) | 0.43 | 0.43 | 0.37 | 0.35 |

| n | ADF | DF–GLS | |||||||

|---|---|---|---|---|---|---|---|---|---|

| p-Value | Decision (α = 0.01/0.05) | α* | Decision* | p-Value | Decision (α = 0.01/0.05) | α* | Decision* | ||

| Real GNP | 80 | 0.05 | Accept | 0.37 | Reject | 0.05 | Accept | 0.25 | Reject |

| Nominal GNP | 80 | 0.58 | Accept | 0.37 | Accept | 0.49 | Accept | 0.25 | Accept |

| Real per capital GNP | 80 | 0.04 | Accept/Reject | 0.37 | Reject | 0.06 | Accept | 0.25 | Reject |

| Industrial Production | 129 | 0.26 | Accept | 0.23 | Accept | 0.27 | Accept | 0.15 | Accept |

| Employment | 99 | 0.18 | Accept | 0.31 | Reject | 0.04 | Accept/Reject | 0.21 | Reject |

| Unemployment Rate | 99 | 0.01 | Reject | 0.31 | Reject | 0.01 | Reject | 0.21 | Reject |

| GNP deflator | 100 | 0.70 | Accept | 0.31 | Accept | 0.73 | Accept | 0.21 | Accept |

| Consumer Prices | 129 | 0.91 | Accept | 0.22 | Accept | 0.61 | Accept | 0.15 | Accept |

| Wages | 89 | 0.53 | Accept | 0.37 | Accept | 0.37 | Accept | 0.25 | Accept |

| Real Wages | 89 | 0.75 | Accept | 0.37 | Accept | 0.51 | Accept | 0.25 | Accept |

| Money Stock | 100 | 0.18 | Accept | 0.31 | Reject | 0.10 | Accept | 0.21 | Reject |

| Velocity | 120 | 0.78 | Accept | 0.27 | Accept | 0.87 | Accept | 0.15 | Accept |

| Interest Rate | 89 | 0.98 | Accept | 0.37 | Accept | 0.33 | Accept | 0.25 | Accept |

| Common Stock Prices | 118 | 0.64 | Accept | 0.27 | Accept | 0.63 | Accept | 0.15 | Accept |

| ADF | DF–GLS | |||||||

|---|---|---|---|---|---|---|---|---|

| Statistic | p-Value | Decision (α = 0.01/0.05) | Decision* (α* = 0.47) | Statistic | p-Value | Decision (α = 0.01/0.05) | Decision* (α* = 0.23) | |

| Austria | −1.729 | 0.414 | Accept | Reject | −1.155 | 0.225 | Accept | Reject |

| Belgium | −2.319 | 0.168 | Accept | Reject | −2.133 | 0.032 | Accept/Reject | Reject |

| Canada | −1.297 | 0.629 | Accept | Accept | −0.487 | 0.503 | Accept | Accept |

| Denmark | −2.507 | 0.116 | Accept | Reject | −2.318 | 0.020 | Accept/Reject | Reject |

| Finland | −2.377 | 0.150 | Accept | Reject | −1.847 | 0.061 | Accept | Reject |

| France | −1.955 | 0.306 | Accept | Reject | −1.965 | 0.047 | Accept/Reject | Reject |

| Germany | −1.996 | 0.288 | Accept | Reject | −2.006 | 0.043 | Accept/Reject | Reject |

| Italy | −1.966 | 0.301 | Accept | Reject | −1.975 | 0.047 | Accept/Reject | Reject |

| Japan | −2.265 | 0.185 | Accept | Reject | −1.208 | 0.207 | Accept | Reject |

| Netherlands | −1.755 | 0.401 | Accept | Reject | −1.714 | 0.082 | Accept | Reject |

| Norway | −2.178 | 0.215 | Accept | Reject | −2.135 | 0.032 | Accept/Reject | Reject |

| Spain | −1.928 | 0.319 | Accept | Reject | −1.478 | 0.130 | Accept | Reject |

| Sweden | −2.219 | 0.201 | Accept | Reject | −1.997 | 0.044 | Accept/Reject | Reject |

| Switzerland | −2.499 | 0.118 | Accept | Reject | −1.521 | 0.120 | Accept | Reject |

| UK | −2.363 | 0.154 | Accept | Reject | −1.703 | 0.084 | Accept | Reject |

| ADF | DF–GLS | |||||||

|---|---|---|---|---|---|---|---|---|

| Statistic | p-Value | Decision (α = 0.01/0.05) | Decision* (α* = 0.33) | Statistic | p-Value | Decision (α = 0.01/0.05) | Decision* (α* = 0.15) | |

| Belgium | −2.22 | 0.200 | Accept | Reject | −1.99 | 0.045 | Accept/Reject | Reject |

| Canada | −2.12 | 0.237 | Accept | Reject | −1.78 | 0.071 | Accept | Reject |

| Denmark | −2.93 | 0.044 | Accept/Reject | Reject | −1.33 | 0.169 | Accept | Accept |

| France | −2.08 | 0.253 | Accept | Reject | −2.23 | 0.025 | Accept/Reject | Reject |

| Ireland | −2.35 | 0.158 | Accept | Reject | −1.10 | 0.245 | Accept | Accept |

| Italy | −2.42 | 0.138 | Accept | Reject | −1.44 | 0.139 | Accept | Reject |

| Japan | −2.49 | 0.120 | Accept | Reject | −2.06 | 0.038 | Accept/Reject | Reject |

| Netherlands | −1.44 | 0.562 | Accept | Accept | −0.99 | 0.287 | Accept | Accept |

| New Zealand | −1.35 | 0.606 | Accept | Accept | −1.11 | 0.241 | Accept | Accept |

| UK | −2.98 | 0.039 | Accept/Reject | Reject | −2.64 | 0.009 | Reject | Reject |

| Phillips–Perron | ERS–P | |||

|---|---|---|---|---|

| X0* | c = 5 | c = 15 | c = 5 | c = 15 |

| 0 | 0.52 | 0.25 | 0.49 | 0.17 |

| 5 | 0.50 | 0.24 | 0.49 | 0.27 |

| ADF | DF–GLS | |||

|---|---|---|---|---|

| δ = 1 | δ = 5 | δ = 1 | δ = 5 | |

| c = 9.37 | ||||

| X0* = 1 | ||||

| p = P(H0) | ||||

| 0.1 | 0.64 | 0.45 | 0.24 | 0.17 |

| 0.5 | 0.32 | 0.05 | 0.13 | 0.07 |

| 0.9 | 0.01 | 0.01 | 0.03 | 0.01 |

| X0* = 3 | ||||

| p = P(H0) | ||||

| 0.1 | 0.63 | 0.45 | 0.32 | 0.22 |

| 0.5 | 0.31 | 0.05 | 0.18 | 0.09 |

| 0.9 | 0.01 | 0.01 | 0.03 | 0.01 |

| c = 7 | ||||

| X0* = 1 | ||||

| p = P(H0) | ||||

| 0.1 | 0.89 | 0.70 | 0.51 | 0.33 |

| 0.5 | 0.48 | 0.01 | 0.25 | 0.07 |

| 0.9 | 0.01 | 0.01 | 0.01 | 0.01 |

| X0* = 3 | ||||

| p = P(H0) | ||||

| 0.1 | 0.88 | 0.70 | 0.55 | 0.37 |

| 0.5 | 0.48 | 0.01 | 0.28 | 0.07 |

| 0.9 | 0.01 | 0.01 | 0.01 | 0.01 |

| c = 13 | ||||

| X0* = 1 | ||||

| p = P(H0) | ||||

| 0.1 | 0.45 | 0.30 | 0.14 | 0.11 |

| 0.5 | 0.21 | 0.07 | 0.09 | 0.05 |

| 0.9 | 0.02 | 0.01 | 0.03 | 0.01 |

| X0* = 3 | ||||

| p = P(H0) | ||||

| 0.1 | 0.43 | 0.30 | 0.22 | 0.17 |

| 0.5 | 0.21 | 0.07 | 0.13 | 0.08 |

| 0.9 | 0.02 | 0.01 | 0.03 | 0.01 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.H.; Choi, I. Unit Roots in Economic and Financial Time Series: A Re-Evaluation at the Decision-Based Significance Levels. Econometrics 2017, 5, 41. https://doi.org/10.3390/econometrics5030041

Kim JH, Choi I. Unit Roots in Economic and Financial Time Series: A Re-Evaluation at the Decision-Based Significance Levels. Econometrics. 2017; 5(3):41. https://doi.org/10.3390/econometrics5030041

Chicago/Turabian StyleKim, Jae H., and In Choi. 2017. "Unit Roots in Economic and Financial Time Series: A Re-Evaluation at the Decision-Based Significance Levels" Econometrics 5, no. 3: 41. https://doi.org/10.3390/econometrics5030041

APA StyleKim, J. H., & Choi, I. (2017). Unit Roots in Economic and Financial Time Series: A Re-Evaluation at the Decision-Based Significance Levels. Econometrics, 5(3), 41. https://doi.org/10.3390/econometrics5030041