Economic Feasibility Analysis of Shale Gas Extraction from UK’s Carboniferous Bowland-Hodder Shale Unit

Abstract

:1. Introduction

2. Methodology

3. Data and Assumptions

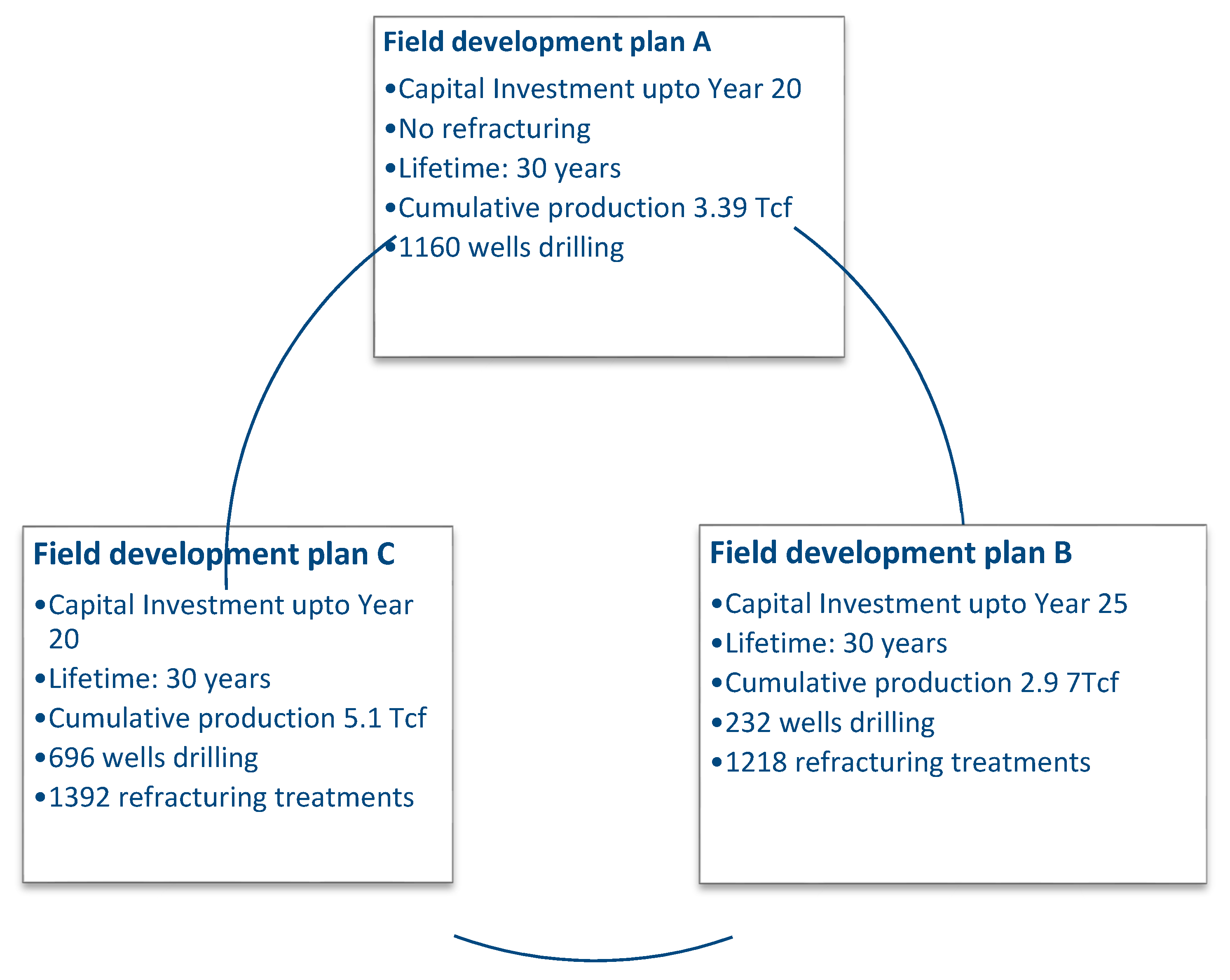

3.1. Field Development Plans

3.2. Production Modelling

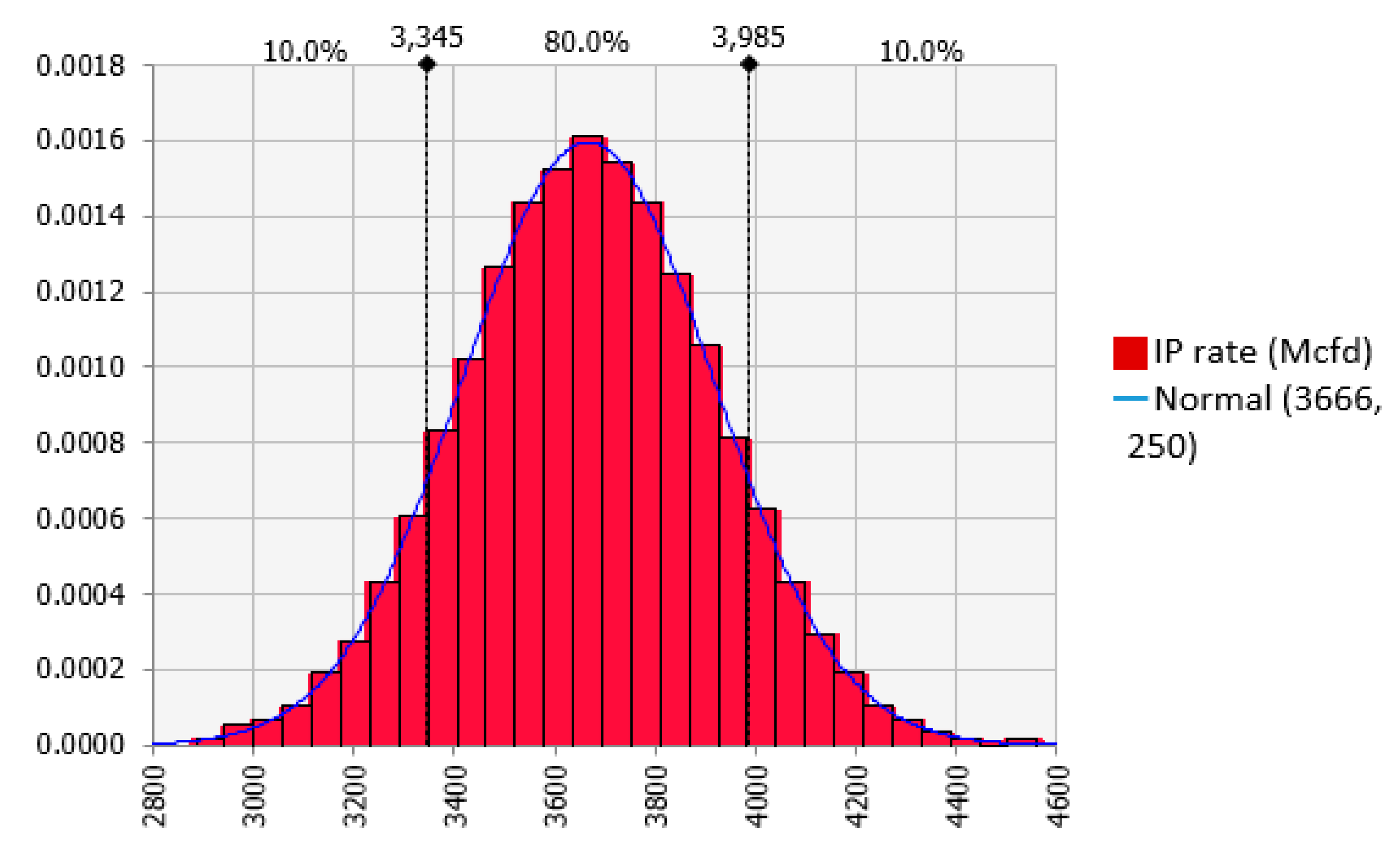

3.2.1. Initial Production Rate

3.2.2. Initial Production Rate (Refrac)

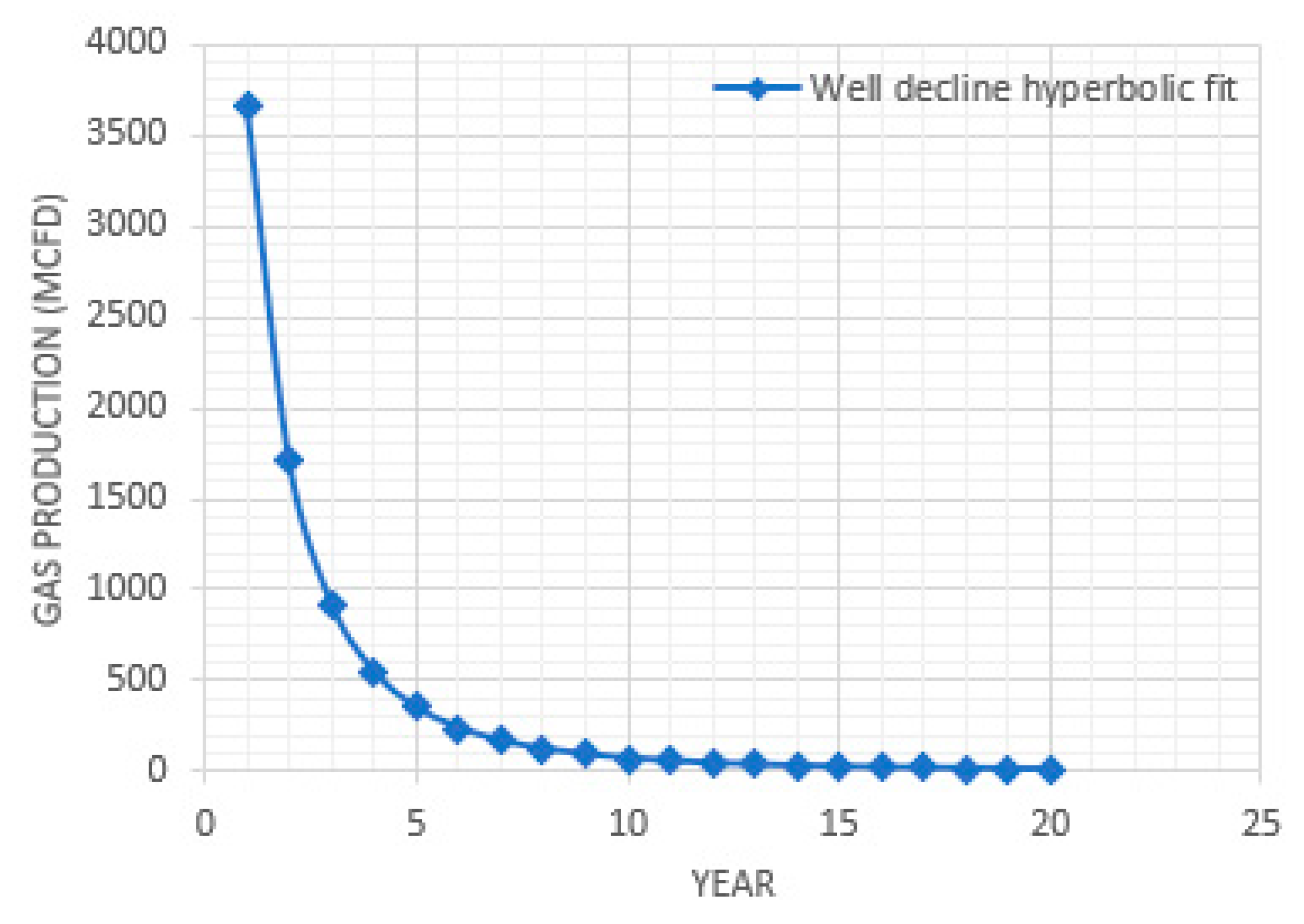

3.2.3. Production Decline

3.2.4. Optimal Time for Refracturing

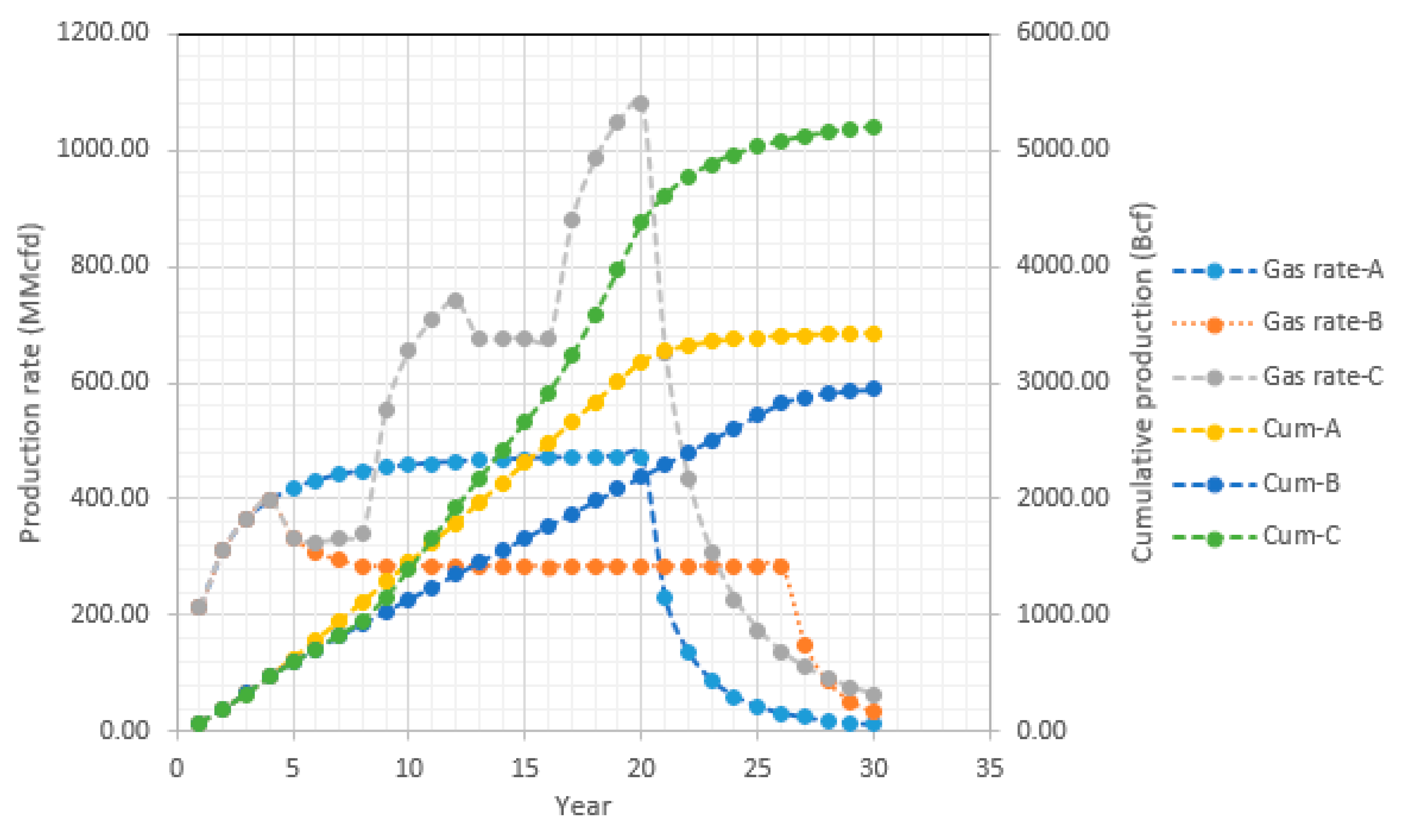

3.3. Production Profiles

3.4. Capital Expenditure

3.4.1. Drilling and Completion Costs

3.4.2. Refracturing Costs

3.4.3. Land Acquisition Costs

3.5. Operating Expenditure

3.6. UK Petroleum Fiscal Regime

3.6.1. Ring Fence Corporation Tax (RFCT)

3.6.2. Supplementary Charge (SC)

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Nomenclature

| RGP | Required gas price |

| NPV | Net present value |

| TOC | Total organic carbon |

| DCA | Decline curve analysis |

| BGS | British geological survey |

| IP | Initial production |

| ac | Acres |

| scfd | Standard cubic feet per day |

| Mcf | Thousand cubic feet |

| Tcf | Trillion cubic feet |

| Mcfd | Thousand cubic feet per day |

| MMcfd | Million cubic feet per day |

| $M | Thousand dollars |

| $MM | Million dollars |

| Std Dev | Standard Deviation |

References

- Parvizi, H.; Rezaei Gomari, S.; Nabhani, F. Robust and Flexible Hydrocarbon Production Forecasting Considering the Heterogeneity Impact for Hydraulically Fractured Wells. Energy Fuels 2018, 31, 8418–8488. [Google Scholar] [CrossRef]

- Insight, I.G. The Economic and Employment Contributions of Shale Gas in the United States; Prepared for America’s Natural Gas Alliance by IHS Global Insight (USA); America’s Natural Gas Alliance: Washington, DC, USA, 2011. [Google Scholar]

- Cooper, J.; Stamford, L.; Azapagic, A. Economic viability of UK shale gas and potential impacts on the energy market up to 2030. Appl. Energy 2018, 215, 577–590. [Google Scholar] [CrossRef]

- Cooper, J.; Stamford, L.; Azapagic, A. Social sustainability assessment of shale gas in the UK. Sustain. Prod. Consum. 2018, 14, 1–20. [Google Scholar] [CrossRef]

- Grecu, E.; Aceleanu, M.I.; Albulescu, C.T. The economic, social and environmental impact of shale gas exploitation in Romania: A cost-benefit analysis. Renew. Sustain. Energy Rev. 2018, 93, 691–700. [Google Scholar] [CrossRef]

- Szolucha, A. Anticipating fracking: Shale gas developments and the politics of time in Lancashire, UK. Extract. Ind. Soc. 2018, 5, 348–355. [Google Scholar] [CrossRef]

- Cooper, J.; Stamford, L.; Azapagic, A. Sustainability of UK shale gas in comparison with other electricity options: Current situation and future scenarios. Sci. Total Environ. 2018, 619, 804–814. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Evensen, D. Review of shale gas social science in the United Kingdom, 2013–2018. Extract. Ind. Soc. 2018, 5, 691–698. [Google Scholar] [CrossRef]

- Bradshaw, M.; Waite, C. Learning from Lancashire: Exploring the contours of the shale gas conflict in England. Glob. Environ. Chang. 2017, 47, 28–36. [Google Scholar] [CrossRef]

- Nwaobi, U.; Anandarajah, G. Parameter determination for a numerical approach to undeveloped shale gas production estimation: The UK Bowland shale region application. J. Nat. Gas Sci. Eng. 2018, 58, 80–91. [Google Scholar] [CrossRef]

- Gray, W.M.; Hoefer, T.A.; Chiappe, A.; Koosh, V.H. A probabilistic approach to shale gas economics. In Proceedings of the Hydrocarbon Economics and Evaluation Symposium, Dallas, TX, USA, 1–3 April 2017; Society of Petroleum Engineers: Houston, TX, USA, 2007. [Google Scholar]

- Agrawal, A. A Technical and Economic Study of Completion Techniques in Five Emerging US Gas Shale Plays. Ph.D. Thesis, Texas A & M University, College Station, TX, USA, 2010. [Google Scholar]

- Ikonnikova, S.; Gülen, G.; Browning, J.; Tinker, S.W. Profitability of shale gas drilling: A case study of the Fayetteville shale play. Energy 2015, 81, 382–393. [Google Scholar] [CrossRef]

- Kaiser, M.J. Profitability assessment of Haynesville shale gas wells. Energy 2012, 38, 315–330. [Google Scholar] [CrossRef]

- Chen, Z.; Osadetz, K.G.; Chen, X. Economic appraisal of shale gas resources, an example from the Horn River shale gas play, Canada. Pet. Sci. 2015, 12, 712–725. [Google Scholar] [CrossRef] [Green Version]

- Saussay, A. Can the US shale revolution be duplicated in continental Europe? An economic analysis of European shale gas resources. Energy Econ. 2018, 69, 295–306. [Google Scholar] [CrossRef] [Green Version]

- Berk, J.; DeMarzo, P.; Harford, J.; Ford, G.; Mollica, V.; Finch, N. Fundamentals of Corporate Finance; Pearson Higher Education AU: San Francisco, CA, USA, 2013. [Google Scholar]

- Newman, D.G. Engineering Economic Analysis; Oxford University Press: New York, NY, USA; London, UK, 1990. [Google Scholar]

- Ikoku, C.U. Economic Analysis and Investment Decisions; Wiley: New York, NY, USA, 1985. [Google Scholar]

- Andrews, I.J. The Carboniferous Bowland Shale Gas Study: Geology and Resource Estimation; British Geological Survey for Department of Energy and Climate Change: London, UK, 2013. [Google Scholar]

- Harvey, A.L.; Andrews, I.J.; Smith, K.; Smith, N.J.P.; Vincent, C.J. DECC/BGS assessment of resource potential of the Bowland Shale, UK. In Proceedings of the 75th EAGE Conference & Exhibition Incorporating SPE EUROPEC 2013, London, UK, 10–13 June 2013. [Google Scholar]

- Ma, L.; Taylor, K.G.; Lee, P.D.; Dobson, K.J.; Dowey, P.J.; Courtois, L. Novel 3D centimetre-to nano-scale quantification of an organic-rich mudstone: The Carboniferous Bowland Shale, Northern England. Mar. Pet. Geol. 2016, 72, 193–205. [Google Scholar] [CrossRef] [Green Version]

- Regeneris and Cuadrilla Resources Ltd. Economic Impact of Shale Gas Exploration & Production in Lancashire and the UK; Regeneris Consulting Ltd.: Altrincham, UK, 2011. [Google Scholar]

- Guo, K.; Zhang, B.; Aleklett, K.; Höök, M. Production patterns of Eagle Ford shale gas: Decline curve analysis using 1084 wells. Sustainability 2016, 8, 973. [Google Scholar] [CrossRef]

- Arps, J.J. Analysis of decline curves. Trans. AIME 1945, 160, 228–247. [Google Scholar] [CrossRef]

- Li, K.; Horne, R.N. A decline curve analysis model based on fluid flow mechanisms. In Proceedings of the SPE Western Regional/AAPG Pacific Section Joint Meeting, Long Beach, CA, USA, 19–24 May 2003; Society of Petroleum Engineers: Houston, TX, USA, 2003. [Google Scholar]

- Cheng, Y.; Wang, Y.; McVay, D.; Lee, W.J. Practical application of a probabilistic approach to estimate reserves using production decline data. SPE Econ. Manag. 2010, 2, 19–31. [Google Scholar] [CrossRef]

- Hughes, J.D.; Flores-Macias, F. Drill, Baby, Drill; Post Carbon Institute: Santa Rosa, CA, USA, 2013. [Google Scholar]

- Acquah-Andoh, E. Economic evaluation of bowland shale gas wells development in the UK. World Acad. Sci. Eng. Technol. Int. J. Soc. Behav. Educ. Econ. Bus. Ind. Eng. 2015, 9, 2577–2585. [Google Scholar]

- Allison, D.; Parker, M. Re-Fracturing Extends Lives of Unconventional Reservoirs; American Oil & Gas Reporter: Derby, KS, USA, 2014. [Google Scholar]

- Wang, S.Y.; Luo, X.L.; Hurt, R.S. What we learned from a study of re-fracturing in Barnett shale: An investigation of completion/fracturing, and production of re-fractured wells. In Proceedings of the IPTC 2013: International Petroleum Technology Conference, Beijing, China, 26–28 March 2013. [Google Scholar]

- Indras, P.; Blankenship, C. A Commercial Evaluation of Refracturing Horizontal Shale Wells. In Proceedings of the SPE Annual Technical Conference and Exhibition, Houston, TX, USA, 28–30 September 2015; Society of Petroleum Engineers: Houston, TX, USA, 2015. [Google Scholar]

- Fanchi, J.R.; Cooksey, M.J.; Lehman, K.M.; Smith, A.; Fanchi, A.C.; Fanchi, C.J. Probabilistic decline curve analysis of Barnett, Fayetteville, Haynesville, and Woodford gas shales. J. Pet. Sci. Eng. 2013, 109, 308–311. [Google Scholar] [CrossRef]

- Cook, P.; Beck, V.; Brereton, D.; Clark, R.; Fisher, B.; Kentish, S.; Toomey, J.; Williams, J. Engineering Energy: Unconventional Gas Production: A Study of Shale Gas in Australia; Australian Council of Learned Academies: Melbourne, Australian, 2013. [Google Scholar]

- Tavassoli, S.; Yu, W.; Javadpour, F.; Sepehrnoori, K. Well screen and optimal time of refracturing: A Barnett shale well. J. Pet. Eng. 2013, 2013, 817293. [Google Scholar] [CrossRef]

- Wood Mackenzie. UK Shale Gas—Fiscal Incentives Unlikely to Be Enough; Wood Mackenzie: Edinburgh, UK, 2012. [Google Scholar]

- Lindsay, G.J.; White, D.J.; Miller, G.A.; Baihly, J.D.; Sinosic, B. Understanding the applicability and economic viability of refracturing horizontal wells in unconventional plays. In Proceedings of the SPE Hydraulic Fracturing Technology Conference, The Woodlands, TX, USA, 9–11 February 2016; Society of Petroleum Engineers: Houston, TX, USA, 2016. [Google Scholar]

- Cafaro, D.C.; Drouven, M.G.; Grossmann, I.E. Optimization models for planning shale gas well refracture treatments. AIChE J. 2016, 62, 4297–4307. [Google Scholar] [CrossRef]

- Eshkalak, M.O.; Aybar, U.; Sepehrnoori, K. An economic evaluation on the re-fracturing treatment of the US shale gas resources. In Proceedings of the SPE Eastern Regional Meeting, Charleston, WV, USA, 21–23 October 2014; Society of Petroleum Engineers: Houston, TX, USA, 2014. [Google Scholar]

- UK Onshore Operators Group. UK Onshore Shale Gas Well Guidelines: Exploration and Appraisal Phase; Issue 1; UK Onshore Operators Group: London, UK, 2013. [Google Scholar]

- Jahn, F.; Cook, M.; Graham, M. Hydrocarbon Exploration and Production; Elsevier: Amsterdam, The Netherlands, 2008; Volume 55. [Google Scholar]

- Institute of Directors. Getting Shale Gas Working; Institute of Directors: London, UK, 2013. [Google Scholar]

- Browning, J.; Ikonnikova, S.; Gülen, G.; Tinker, S. Barnett shale production outlook. SPE Econ. Manag. 2013, 5, 89–104. [Google Scholar] [CrossRef]

- Oil & Gas Authority 2018, UK’s Upstream Fiscal Regime (Overview). Available online: https://www.ogauthority.co.uk/exploration-production/taxation/overview/ (accessed on 27 July 2018).

- HM Revenue & Customs, 1 September 2016-Last Update, Oil Taxation Manual. 2016. Available online: https://www.gov.uk/hmrc-internal-manuals/oil-taxation-manual (accessed on 27 July 2018).

- Ofgem. Wholesale Market Indicators. 2018. Available online: https://www.ofgem.gov.uk/data-portal/wholesale-market-indicators (accessed on 26 September 2018).

- Le, M.T. An assessment of the potential for the development of the shale gas industry in countries outside of North America. Heliyon 2018, 4, e00516. [Google Scholar] [CrossRef] [PubMed]

| Shale Play | Barnett | Bowland |

|---|---|---|

| Age | Early Carboniferous | Late Carboniferous |

| Lithology | Siliceous mudst | Brittle shale |

| Depth (ft) | 7500 | 10,000 |

| Thickness (ft) | 300 | Over 6000 in basin centre |

| High (wt. %) | 9.94 | 8 |

| Average (wt. %) | 3.74 | 1–3 |

| Shale Play | Case | ||

|---|---|---|---|

| Barnett | P50 | 0.869–0.9736 | 0.0212–0.244 |

| Fayetteville | P50 | 0.7372–0.9294 | 0.1011–0.3803 |

| Haynesville | P50 | 0.65501–0.96419 | 0.01153–0.52415 |

| Woodford | P50 | 0.60790–1.42630 | 0.02601–0.72473 |

| Marcellus | - | 0.90 | 0.56 |

| Eagle Ford | - | 0.77 | 0.02 |

| Variable | Unit | Distribution | Probabilistic Range | Static Value |

|---|---|---|---|---|

| Initial Production (IP) | Mcfd | Normal | Mean 3666, SD 250 | 3666 |

| Initial Decline rate | - | Normal | Mean 0.87, SD 0.07 | 0.87 |

| Decline exponent (b) | - | Triangular | T (0.01, 0.27, 1) | 0.27 |

| Well Cost (CAPEX) | $MM | Triangular | T (14, 16, 20) | 16 |

| Well Spacing | ac | - | - | 40 |

| Land Acquisition | $/ac | Uniform | 6670, 16670 | 12,000 |

| Operating Expenditure | $/Mcf | Triangular | T (1.2, 1.5, 2) | 1.5 |

| Royalty Rate | % | - | - | 12.5 |

| Ring Fence Corporation Tax (RFCT) | % | - | - | 30 |

| Supplementary Charge (SC) | % | - | - | 10 |

| Cost of Capital | % | - | - | 10 |

| Initial Production rate (refrac) | % of IP | Triangular | T (50, 70, 90) | 70 |

| Refrac Cost | $MM | Triangular | T (2, 3.5, 4) | 3.5 |

| Refrac time | Years | - | - | 4 |

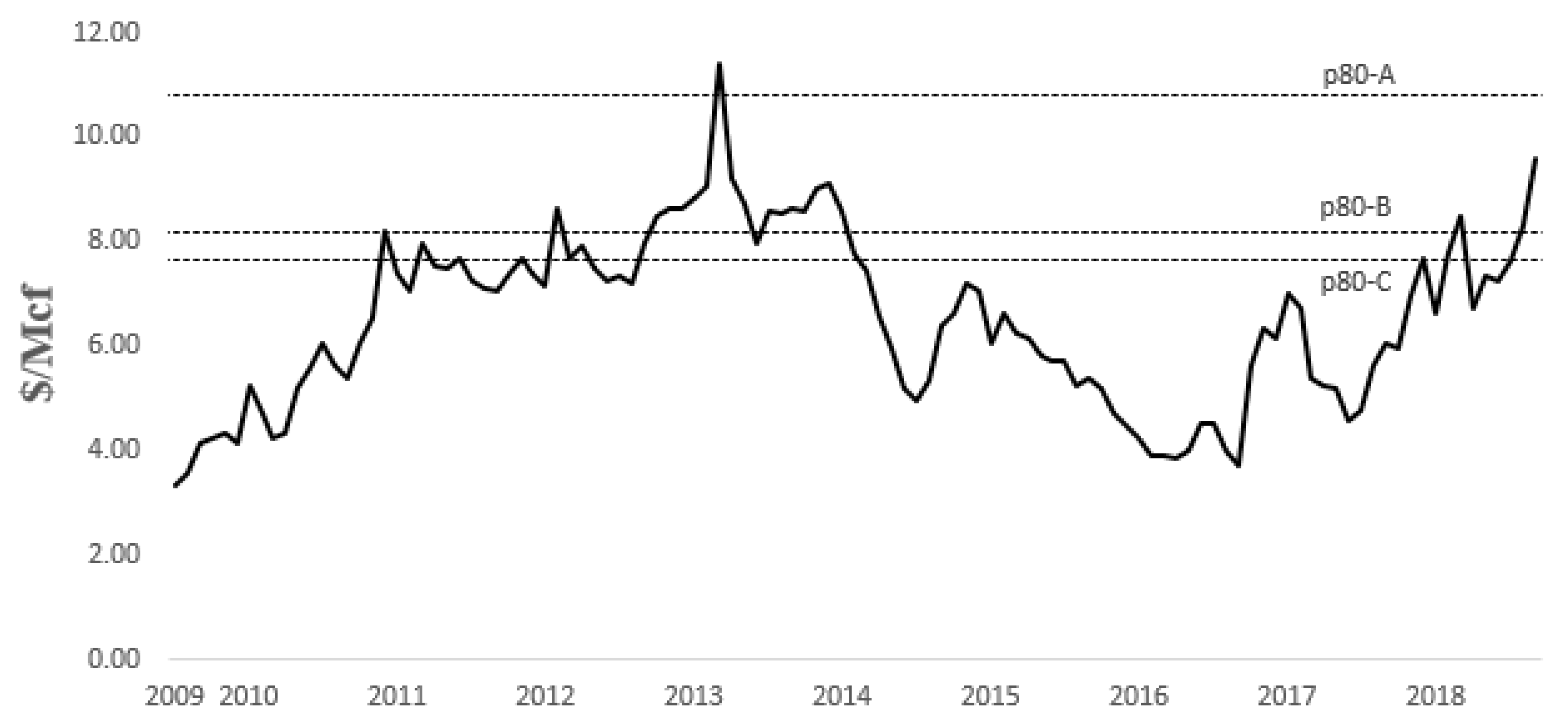

| Field Development Plan | Mean | SD | p20 | p50 | p80 |

|---|---|---|---|---|---|

| A (only drilling) | $9.76 | $1.09 | $8.93 | $9.67 | $10.83 |

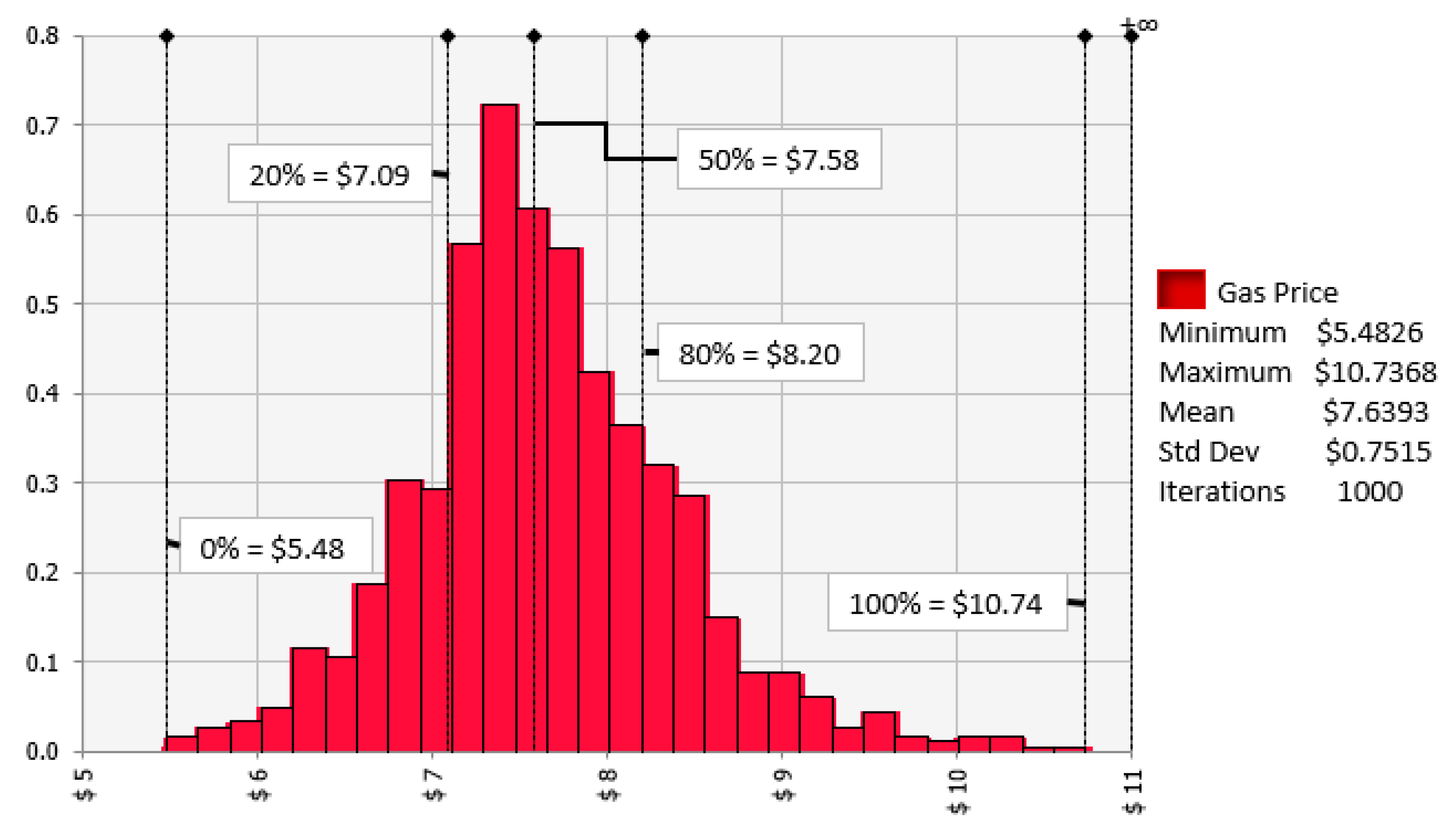

| B (only refracturing initially drilled wells) | $7.64 | $0.75 | $7.09 | $7.58 | $8.20 |

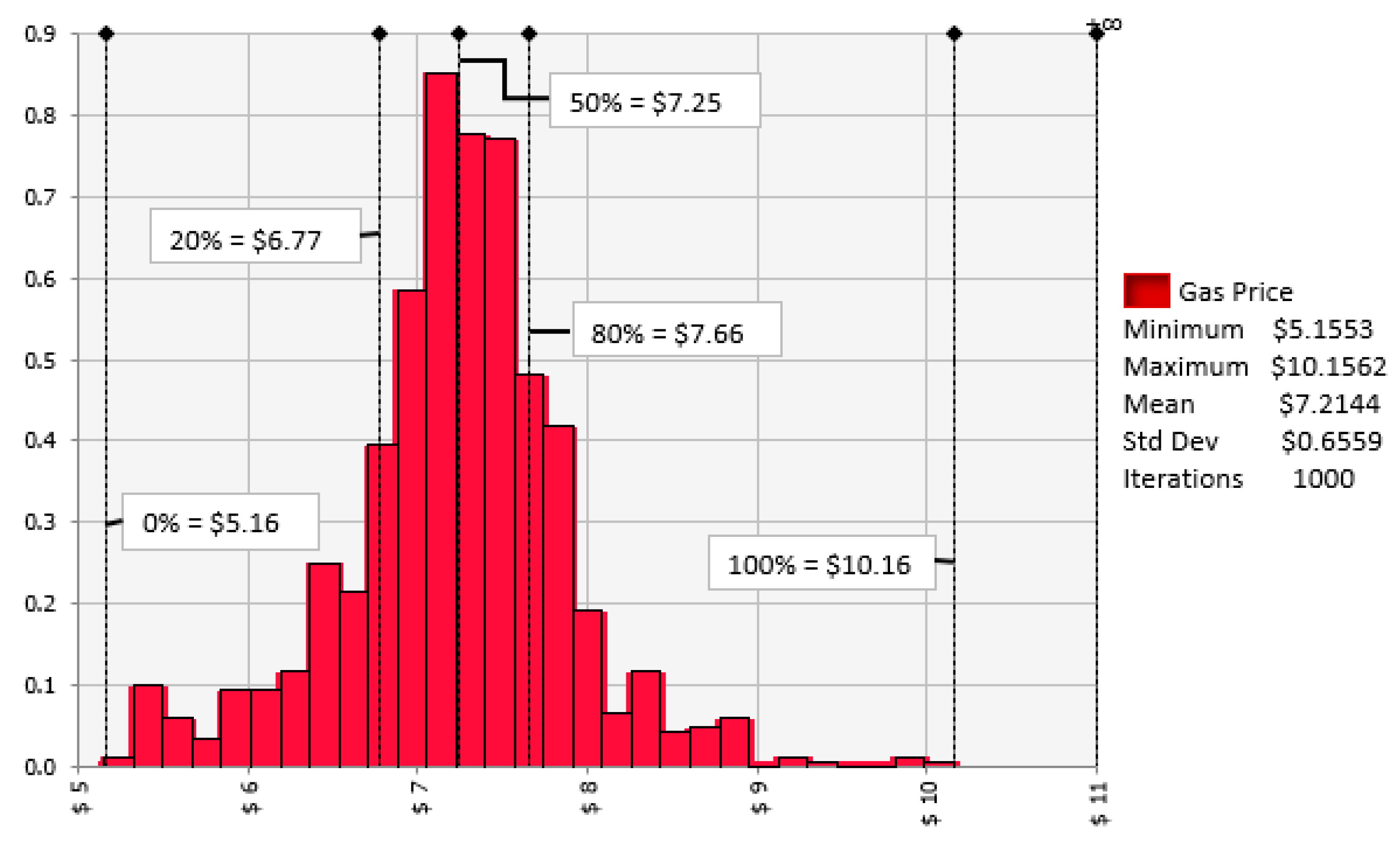

| C (new drilling, refracturing new and old wells) | $7.21 | $0.66 | $6.77 | $7.25 | $7.66 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmed, M.; Rezaei-Gomari, S. Economic Feasibility Analysis of Shale Gas Extraction from UK’s Carboniferous Bowland-Hodder Shale Unit. Resources 2019, 8, 5. https://doi.org/10.3390/resources8010005

Ahmed M, Rezaei-Gomari S. Economic Feasibility Analysis of Shale Gas Extraction from UK’s Carboniferous Bowland-Hodder Shale Unit. Resources. 2019; 8(1):5. https://doi.org/10.3390/resources8010005

Chicago/Turabian StyleAhmed, Muhammad, and Sina Rezaei-Gomari. 2019. "Economic Feasibility Analysis of Shale Gas Extraction from UK’s Carboniferous Bowland-Hodder Shale Unit" Resources 8, no. 1: 5. https://doi.org/10.3390/resources8010005