The Relative Effectiveness of the Minimum Wage and the Earned Income Tax Credit as Anti-Poverty Tools

Abstract

:1. The Minimum Wage in the United States

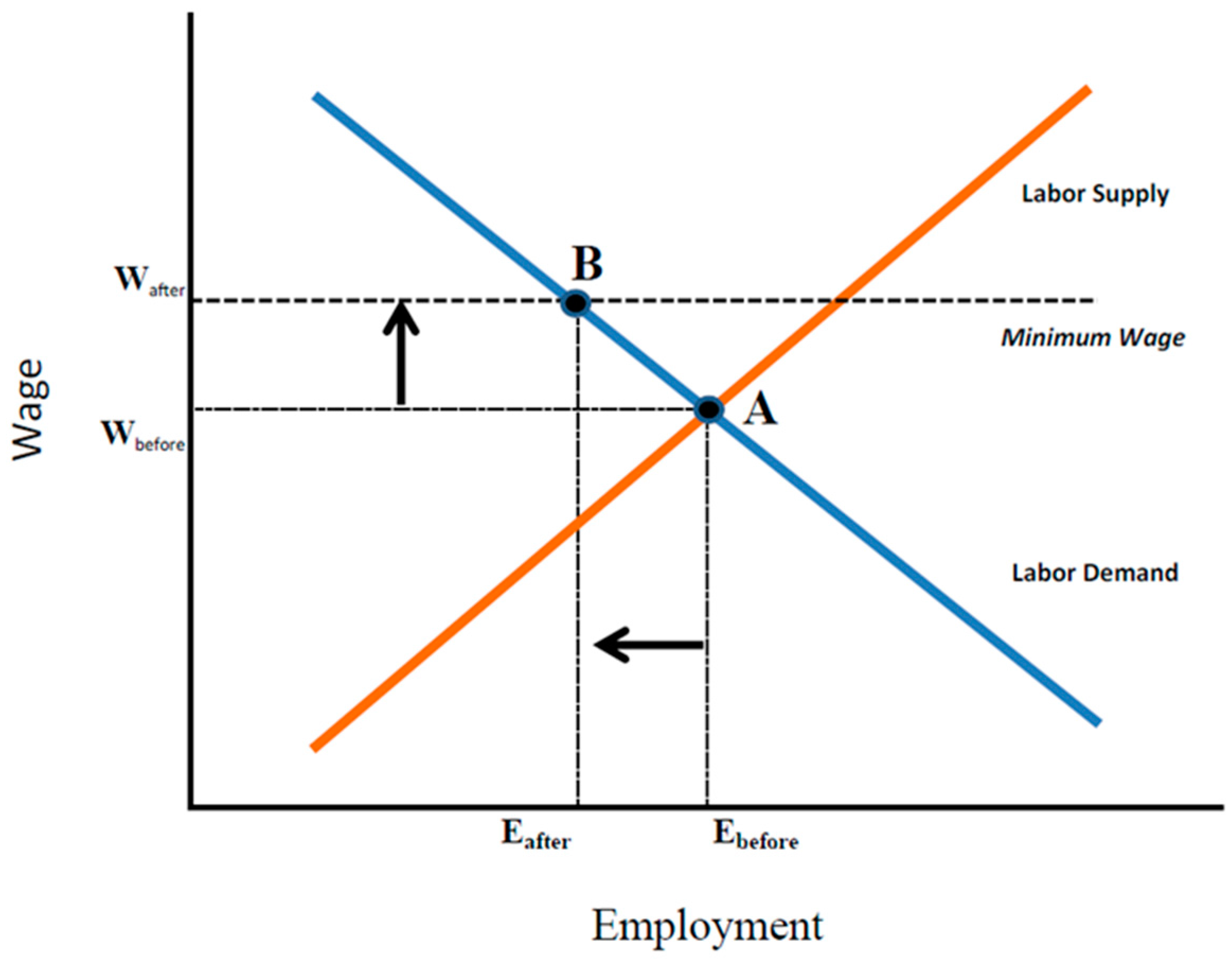

and that, of the research that has avoided some statistical problems they describe,“Bearing in mind that the estimates for the United States reflect a historic experience of moderate increases in the minimum wage, it appears that if negative effects on employment are present, they are too small to be statistically detectable.”11

“little has been able to detect a substantially significant response of employment, measured as the number of jobs, the number of people working, or the number of hours. Although this does not close the issue, the preponderance of the evidence currently leans that way…The corresponding elasticities for eating and drinking establishments in the United States appear to be somewhat larger, with precision weighted means near −0.05.”

2. The Earned Income Tax Credit

3. The Anti-Poverty Effectiveness of the Minimum Wage and the EITC

4. Some Other Aspects of the Minimum Wage and the EITC

5. Conclusions

Author Contributions

Conflicts of Interest

References

- History of minimum wage. BeBusinessed.com. Available online: http://bebusinessed.com/history/history-of-minimum-wage (accessed on 13 April 2017).

- Belman, Dale, and Paul Wolfson. 2014. What Does the Minimum Wage Do? Kalamazoo: Upjohn Institute Press. [Google Scholar]

- Bernstein, Jared, and Heidi Shierholz. 2014. The minimum wage: A crucial labor standard that is well targeted to low and moderate-income households. Journal of Policy Analysis and Management 33: 1036–43. [Google Scholar] [CrossRef]

- Bradley, David. 2015. The Federal Minimum Wage: in Brief. Washington: Congressional Research Service. [Google Scholar]

- Burkhauser, Richard. 2015. The Minimum Wage versus the Earned Income Tax Credit for Reducing Poverty. Bonn: IZA World of Labor. [Google Scholar]

- Burkhauser, Richard, and T. Aldrich Finegan. 1989. The minimum wage and the poor: The end of a relationship. Journal of Policy Analysis and Management 8: 53–71. [Google Scholar] [CrossRef]

- CBPP (Center on Budget, Policy Priorities). 2016a. Policy basics: the Child Tax Credit. Available online: http://www.cbpp.org/research/policy-basics-the-child-tax-credit (accessed on 13 April 2017).

- CBPP (Center on Budget, Policy Priorities). 2016b. Chart Book: the Earned Income Tax Credit and Child Tax Credit. Available online: http://www.cbpp.org/sites/default/files/atoms/files/1-7-15tax-chartbook.pdf (accessed on 13 April 2017).

- CBPP (Center on Budget, Policy Priorities). 2016c. Policy basics: the Earned Income Tax Credit. Available online: http://www.cbpp.org/research/federal-tax/policy-basics-the-earned-income-tax-credit (accessed on 13 April 2017).

- CBPP (Center on Budget, Policy Priorities). 2016d. Policy basics: State Earned Income Tax Credits. Available online: http://www.cbpp.org/research/state-budget-and-tax/policy-basics-state-earned-income-tax-credits (accessed on 13 April 2017).

- CBO (Congressional Budget Office). 2013. Refundable Tax Credits; Washington: U. S. Government Printing Office.

- CBO (Congressional Budget Office). 2014. The Effects of a Minimum-wage Increase on Employment and Family Income; Washington: U. S. Government Printing Office.

- Clemens, Jeffrey, and Michael Wither. 2014. The Minimum Wage and the Great Recession: Evidence on the Effects on the Employment and Income Trajectory of Low-skilled Workers. Working Paper 20724. Cambridge, MA, USA: National Bureau of Economic Research, Available online: http://www.nber.org/papers/w20724 (accessed on 13 April 2017).

- Cooper, Daniel H., Byron F. Lutz, and Michael G. Palumbo. 2011. Quantifying the Role of Federal and State Taxes in Mitigating Income Inequality. Public Policy Discussion Papers No. 11-7. Boston, MA, USA: Federal Reserve Bank of Boston. [Google Scholar]

- Cooper, David, and Douglas Hall. 2013. Raising the Federal Minimum Wage to $10.10 Would Give Working Families, and the overall Economy, a Much-Needed Boost. Briefing Paper #357. Washington, DC, USA: Economic Policy Institute. [Google Scholar]

- The 2016 Democratic Platform. 2016. Available online: https://www.democrats.org/party-platform (accessed on 13 April 2017).

- Economic Policy Institute. 2016. Minimum Wage Tracker. Available online: http://www.epi.org/minimum-wage-tracker/ (accessed on 13 April 2017).

- Glaeser, Edward. 2012. Cash Better Than Food Stamps in Helping Poor: Glaeser. Bloomberg View. February 27. Available online: https://www.bloomberg.com/view/articles/2012-02-28/cash-better-than-food-stamps-in-helping-poor-commentary-by-edward-glaeser (accessed on 13 April 2017).

- Grossman, Jonathan. 1978. Fair Labor Standards Act of 1938: Maximum struggle for minimum wage. Monthly Labor Review 101: 22–30. [Google Scholar] [PubMed]

- Giulietti, Corrado. 2015. Do minimum wages induce immigration? IZA World of Labor. Available online: http://wol.iza.org/articles/do-minimum-wages-induce-immigration (accessed on 13 April 2017).

- Holtz-Eakin, Douglas, and Ben Gitis. 2015. Counterproductive: The Employment and Income Effects of Raising America’s Minimum Wage to $12 and to $15 per Hour. Issue Brief No. 36. New York, NY, USA: Manhattan Institute for Policy Research, American Action Forum, Available online: http://americanactionforum.aaf.rededge.com/uploads/files/research/Counterproductive.pdf (accessed on 13 April 2017).

- Hoynes, Hilary W. 2014. A revolution on poverty policy: The Earned Income Tax Credit and the well-being of American families. Available online: https://web.stanford.edu/group/scspi/_media/pdf/pathways/summer_2014/Pathways_Summer_2014_Hoynes.pdf (accessed on 13 April 2017).

- IRS (Internal Revenue Service). 2016a. 2015 EITC income limits, maximum credit amounts and tax law updates. Available online: https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/eitc-income-limits-maximum-credit-amounts (accessed on 13 April 2017).

- IRS (Internal Revenue Service). 2016b. About EITC. Available online: https://www.eitc.irs.gov/EITC-Central/abouteitc (accessed on 13 April 2017).

- Kaiser Family Foundation. 2015. The facts on Medicare spending and financing. (Fact Sheet). Available online: http://kff.org/medicare/fact-sheet/medicare-spending-and-financing-fact-sheet/ (accessed on 13 April 2017).

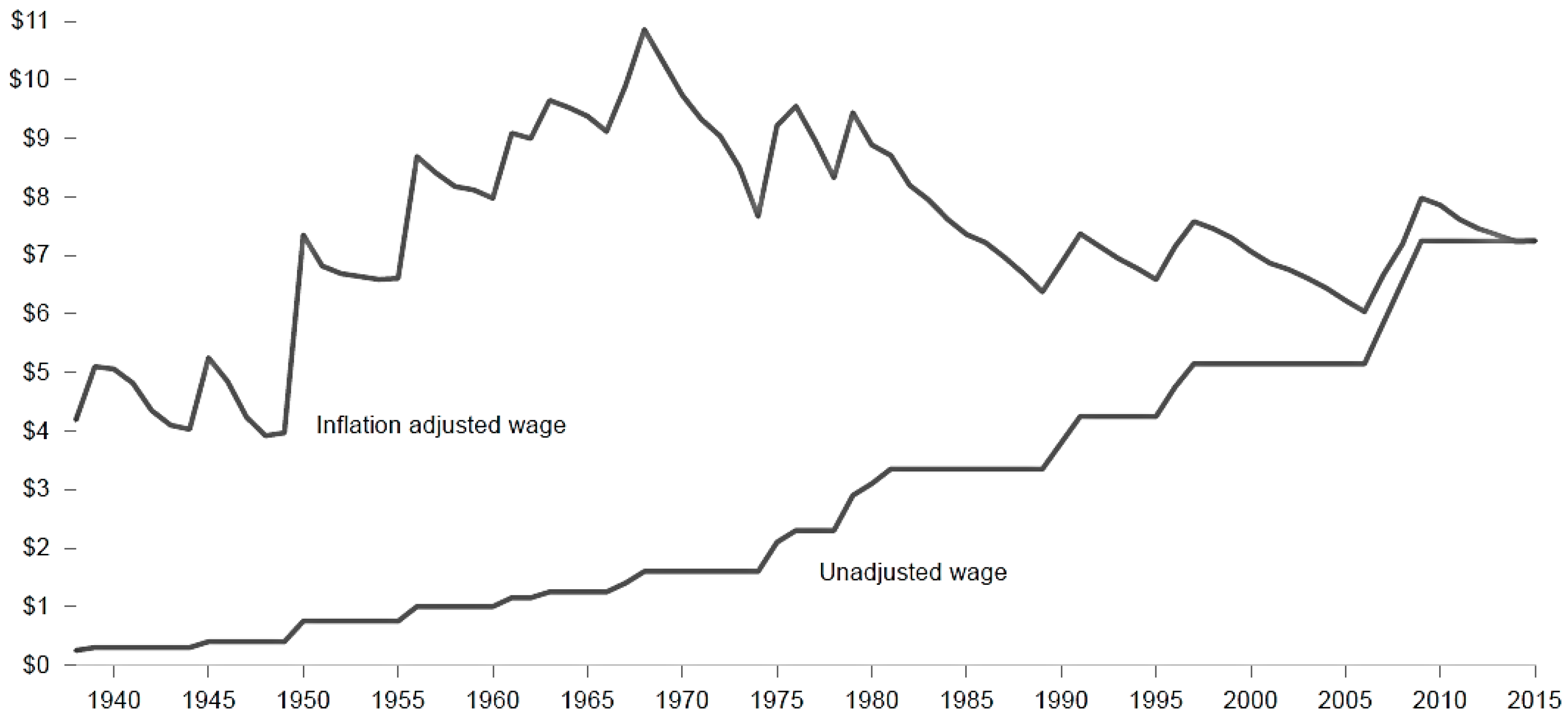

- Kurtz, Annalyn, and Tal Yellin. 2016. Minimum wage since 1938. CNN Money. Available online: http://money.cnn.com/interactive/economy/minimum-wage-since-1938/ (accessed on 13 April 2017).

- Lazo, Alejandro, and Erica Orden. 2016. California, New York governors sign minimum wage increase into law. The Wall Street Journal. April 4. Available online: https://www.wsj.com/articles/california-new-york-governors-sign-minimum-wage-increase-into-law-1459794036 (accessed on 13 April 2017).

- Mankiw, Greg. 2008. Four goals of tax policy. Greg Mankiw’s Blog. January 31. Available online: http://gregmankiw.blogspot.com/2008/01/four-goals-of-tax-policy.html (accessed on 13 April 2017).

- Marr, Chuck, Chye-Ching Huang, Arloc Sherman, and Brandon Debot. 2015. EITC and Child Tax Credit promote work, reduce poverty, and support children’s development, research finds. Center on Budget and Policy Priorities. October 1. Available online: http://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens (accessed on 13 April 2017).

- Meer, Jonathan, and Jeremy West. 2016. Effects of the minimum wage on employment dynamics. Journal of Human Resources 51: 500–22. [Google Scholar] [CrossRef]

- National Employment Law Project. 2016. What’s the minimum wage in your state? Available online: http://www.raisetheminimumwage.com/pages/minimum-wage-state (accessed on 13 April 2017).

- Neumark, David. 2015. The evidence is piling up that higher minimum wages kill jobs. The Wall Street Journal. December 15. Available online: https://www.wsj.com/articles/the-evidence-is-piling-up-that-higher-minimum-wages-kill-jobs-1450220824 (accessed on 13 April 2017).

- Neumark, David, and William Wascher. 2008. Minimum Wages. Cambridge: MIT University Press. [Google Scholar]

- Nicholas, Peter. 2016. Democrats add Bernie Sanders’s $15 minimum wage call to party platform. The Wall Street Journal. July 9. Available online: https://blogs.wsj.com/washwire/2016/07/09/democrats-add-bernie-sanderss-15-minimum-wage-call-to-party-platform/ (accessed on 13 April 2017).

- Purcell, Patrick J. 2015. Income Taxes on Social Security Benefits; Issue Paper No. 2015-02. Washington, DC, USA: US Social Security Administration. Available online: https://www.ssa.gov/policy/docs/issuepapers/ip2015-02.pdf (accessed on 13 April 2017).

- Rothstein, Jesse. 2010. Is the EITC as good as an NIT? Conditional cash transfers and tax incidence. American Economic Journal: Economic Policy 2: 177–208. [Google Scholar] [CrossRef]

- Sabia, Joseph J. 2014a. Minimum wages: An antiquated and ineffective policy tool. Journal of Policy Analysis and Management 33: 1028–36. [Google Scholar] [CrossRef]

- Sabia, Joseph J. 2014b. The minimum wage: No feature, all bugs. Journal of Policy Analysis and Management 33: 1043–46. [Google Scholar] [CrossRef]

- Tax Policy Center. 2015. Model estimates: T15-0138—Tax units with zero or negative income tax. Available online: http://www.taxpolicycenter.org/model-estimates/tax-units-zero-or-negative-income-tax/tax-units-zero-or-negative-income-tax (accessed on 13 April 2017).

- The Initiative on Global Markets. 2015. IGM Forum: $15 Minimum Wage. Chicago: The University of Chicago Booth School of Business, Available online: http://www.igmchicago.org/surveys/15-minimum-wage (accessed on 13 April 2017).

| 1 | In addition to making after-tax incomes less unequal, economists have noted three additional objectives of tax systems: economic stabilization (i.e., to move towards full employment), intergenerational equity (i.e., to maintain fairness between generations), and market efficiency (e.g., to minimize distortions to decision making) (Mankiw 2008). Regarding the first objective, economists at the Federal Reserve Bank of Boston find that, while federal taxes do indeed mitigate wage inequality, the impact varies by state due to differences in state tax policies. Further, the authors find that the impact of taxation on inequality has been relatively constant over time, so that increases in before-tax wage inequality since the mid-1980s have led to increases in after-tax wage inequality (Cooper et al. 2011). |

| 2 | In addition to making after-tax incomes less unequal, economists have noted three additional objectives of tax systems: economic stabilization (i.e., to move towards full employment), intergenerational equity (i.e., to maintain fairness between generations), and market efficiency (e.g., to minimize distortions to decision making) (Mankiw 2008). Regarding the first objective, economists at the Federal Reserve Bank of Boston find that, while federal taxes do indeed mitigate wage inequality, the impact varies by state due to differences in state tax policies. Further, the authors find that the impact of taxation on inequality has been relatively constant over time, so that increases in before-tax wage inequality since the mid-1980s have led to increases in after-tax wage inequality (Cooper et al. 2011). |

| 3 | In-kind benefits provide considerably more assistance than cash benefits do and the ratio of in-kind to cash has been growing over time (Glaeser 2012). |

| 4 | In subtle ways, Social Security and Medicare do have need-based components. For example, although the Social Security benefit one receives after reaching one’s full retirement age does not decline as current earnings or income rise, a proportion of the benefit becomes taxable if one’s income is high enough (Purcell 2015). Similarly, although Medicare eligibility does not depend on income, as Medicaid eligibility does, the premiums paid for Medicare Parts B and C do rise with income (Kaiser Family Foundation 2015). |

| 5 | The first minimum wage was passed in New Zealand in 1894. Massachusetts passed the first state minimum wage in the U.S. in 1912, and 16 other states and the District of Columbia followed suit by 1930 (BeBusinessed.com 2016). |

| 6 | The Fair Labor Standards Act (FLSA) establishes the federal minimum wage and covers about 84% of workers in the labor force (Bradley 2015). Excluded are some seasonal workers (e.g., in summer camps or amusement parks), some agricultural workers (e.g., family members), casual babysitters and newspaper deliverers. In addition, some workers are temporarily exempt from coverage. There is a lower teenage minimum of $4.25/hour for first 90 days of employment, and full time students in retail, service, agriculture, or at an institution of higher learning can be paid 85% of the federal minimum wage. Finally, there is a lower minimum wage ($2.13/hour) for those who depend heavily on tips, but the regular minimum wage applies to the sum of salary and tips. |

| 7 | The Congressional Budget Office (CBO 2014, p. 4) estimates that “about half of workers in the United States live in states where the applicable minimum wage is more than $7.25/hour.” |

| 8 | There are extensive literatures on various impacts of the minimum wage. Appendix B in (CBO 2014) lists five pages of references, including 14 reviews of the literature. |

| 9 | For a list of the economists surveyed and the results see (The Initiative on Global Markets 2015). |

| 10 | This is not the universal view. For example, in a Wall Street Journal op-ed, David Neumark (Neumark 2015) argues that “the evidence is piling up that minimum wages kill jobs,” and notes that the elasticities on job displacement differ by demographic group, and are higher for teenagers and for those with very low skills. See also (Neumark and Wascher 2008, p. 286) for an extensive review of the literature at that time. In their conclusions, they emphasize the “reduction in employment opportunities for low-skilled and directly affected workers” and find “virtually no evidence that minimum wages reduce the proportion of families near or below the poverty line…” |

| 11 | Burkhauser (Burkhauser 2015, p. 5) notes that European minimum wages are typically higher relative to the average wage than they are in the U.S., and that “there has been almost no evidence for adverse employment effects.” The fact that recent changes in the U.S. (real) minimum wage have been modest, and that those historical experiences provide the data on which projections of the impacts of future change will be based, should give one pause when dramatic increases in the minimum wage (e.g., to $10.10, $12 or $15/hour) are being considered. Unless the impacts are linear, and there is no reason to believe they are, past experiences may be a poor guide for future impacts. |

| 12 | The importance of the cost of other factors of production suggests that the impact of a minimum wage increase will differ geographically. A given increase in a firm’s labor costs in a rural area, where rents and other costs are low, will have a much larger percentage impact on total costs than the same increase in the wage bill would have in Manhattan, where rents and other costs are much higher. The more important wages are in total costs, the larger the likely impact of change in the minimum wage. |

| 13 | The increase analyzed, from $7.25 to $10.10, is an increase of $2.85/hour. An increase 50% larger than that would be an increase of $4.27/hour. Adding that to the original $7.25 yields $11.52, rounded to the $11.50/hour used in the CBO study. |

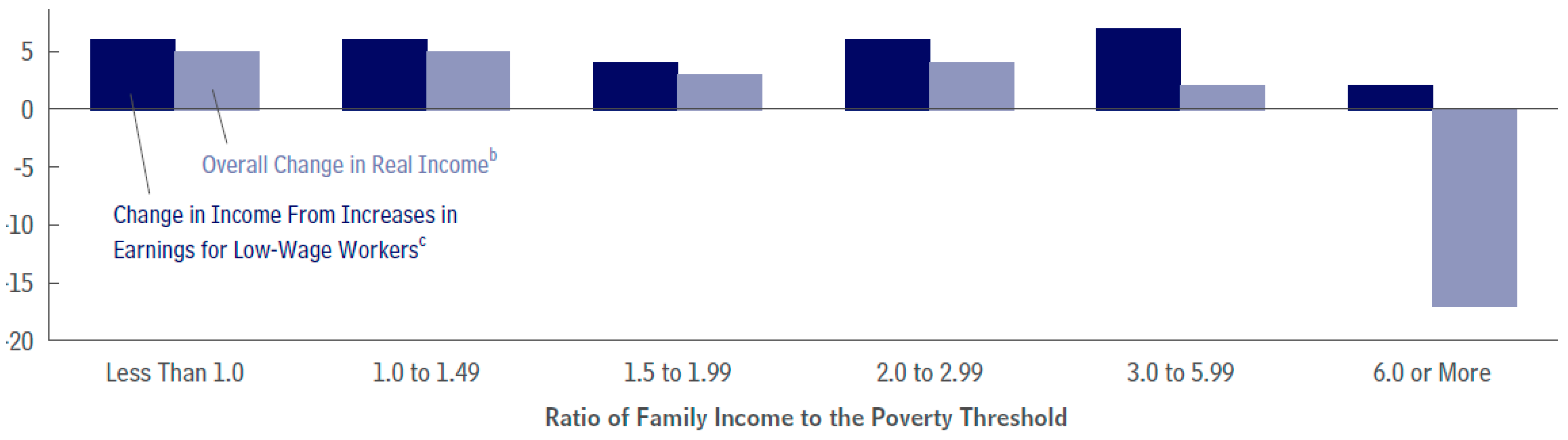

| 14 | This 500,000 decline includes only workers who would have made less than $10.10/hour before the increase in the minimum wage. The authors assume some of those already earning slightly above $10.10/hour (up to $11.50/hour—see footnote 11) would enjoy some wage increase (the “ripple effect”), but none would suffer job losses. This −500,000 is the researchers’ best estimate. Their 67% confidence interval for the loss in jobs ranges from approximately 0 to a loss of 1 million, implying a 33% chance that the change could be outside that range, from a gain in employment to a loss of over 1 million jobs. |

| 15 | In 2016, 6 times the poverty line is roughly $120,000 for a family of three and $150,000 for a family of 6. See (CBO 2014, p. 11). |

| 16 | |

| 17 | For example, Holtz-Eakin and Gitis (Holtz-Eakin and Gitis 2015, Figures 1–4) used the same definition of workers already earning above the minimum wage who might nonetheless enjoy a wage increase—up to wage rates 50% higher than the difference between the old and new minimum wage (see footnote 11). In their $12/hour example, the ripple effects (higher wages after an increase in the minimum wage) occur up to $14.40/hour and in the $15/hour case, up to $18.90/hour. |

| 18 | Holtz-Eakin and Gitis (Holtz-Eakin and Gitis 2015, p. 6) estimate that 25.8 million workers would have earned between $7.25 and $12/hour and another 12.5 million between $12 and $14.40/hour in the absence of an increase in the federal minimum wage, for a total of 38.3 million affected by the increase. Of those, following the increase, 1.3 million would lose their jobs and be worse off, and the remainder (37.0 million) would keep their jobs at the higher wage and be better off. In the $15/hour case, 55.1 million (those earning between $7.25 and $18.90/hour) would be affected, 3.3 million would lose their jobs and the remaining 51.8 million would remain employed. |

| 19 | The number of individuals who are better off and worse off could also be influenced by migration if higher minimum wages attract low-skilled immigrants or induce relocations among recent migrants. A recent review of the literature on migration flows in response to minimum wage laws concludes that the evidence is mixed regarding these potential migration effects (Giulietti 2015). |

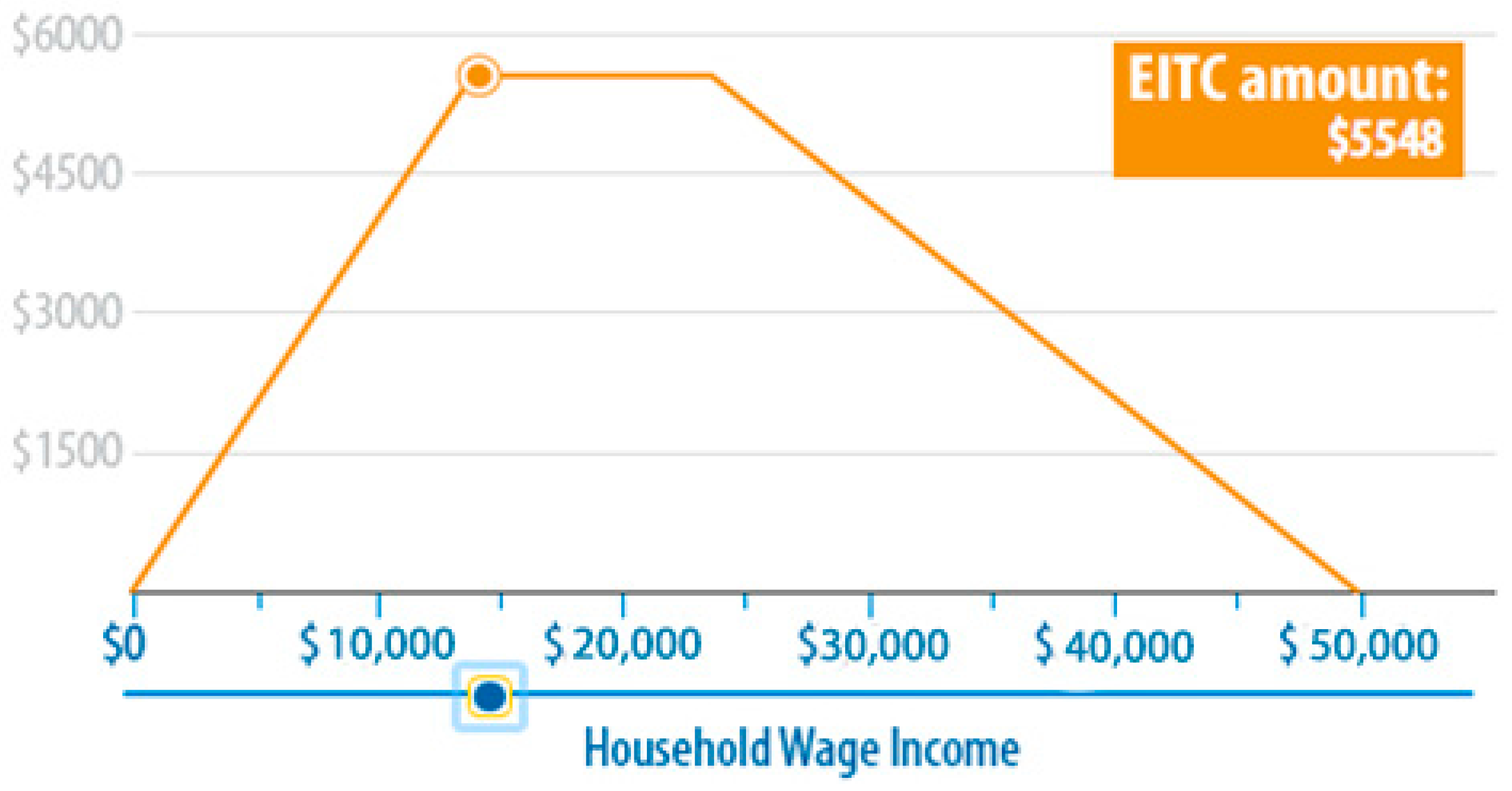

| 20 | Unlike the federal minimum wage, which changes only with legislation, the EITC amounts change each year. For example, the 2015 maximum EITC for a household with two qualifying children, $5,548, increased marginally to $5,572 in 2016. Eligibility also requires that the family have less than $3,400 in investment income for the year. See (IRS 2016a). |

| 21 | How the EITC amount changes with head of household (single or couple), number of children (0 to 3) and family earnings can be seen in a neat interactive graph available at the Center for Budget and Policy Priorities (CBPP 2016b). |

| 22 | Of the states (and DC) that supplement the federal EITC, 24 have refundable grants, like the federal program; four have non-refundable grants, meaning that they can decrease or eliminate tax obligations but any remainder does not go to the family (CBPP 2016d). |

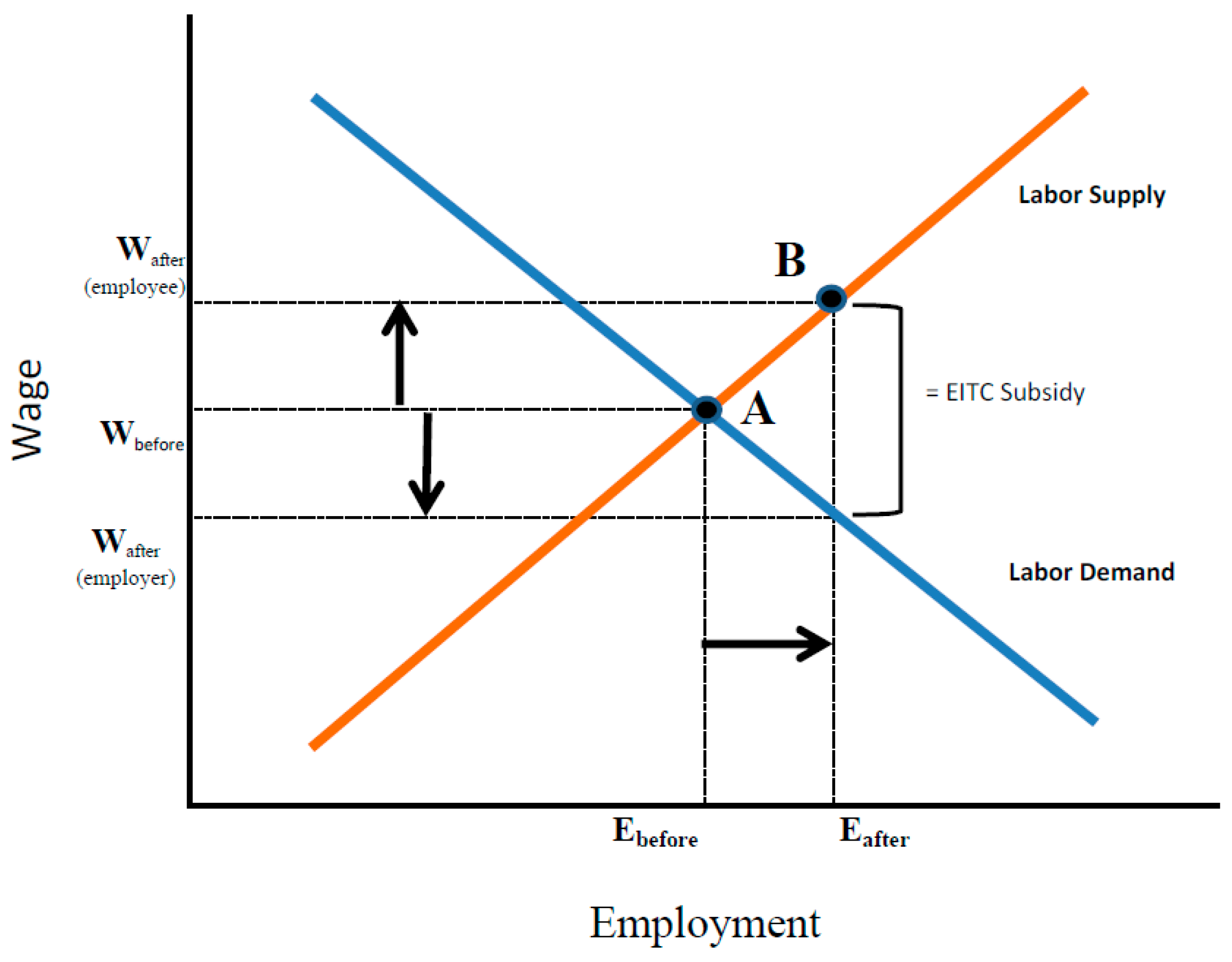

| 23 | In Figure 5, the subsidy appears to be shared about equally, but that is just because of how these supply and demand curves are drawn; there is no reason to expect equal sharing in a real case. Bernstein and Shierholz (Bernstein and Shierholz 2014, p. 1038) cite (Rothstein 2010) who estimates that employers capture about one-quarter of the subsidy via lower pre-tax wages. Rothstein (Rothstein 2010, pp. 6, 205) concludes that “under reasonable demand elasticities substantial portions of the funds expended on the EITC are shifted to employers…Although the exact magnitudes of these effects are sensitive to the details of the simulation, their qualitative importance is quite robust.” |

| 24 | The CBO estimates that, in addition to the 16.5 million workers whose wages are below the new minimum, another 8 million workers would be in this “ripple” range, between $10.10 and $11.50/hour, but the CBO “did not have a basis for estimating the total number of (these “ripple”) workers whose earnings would rise.” (CBO 2014, p. 21) To the extent that any of workers received a raise, the ratio of workers better off: workers worse off would rise above the over 30:1 estimated above. |

| 25 | In this article, Sabia (Sabia 2014a, p. 1031) defines low-wage workers as those “earning less than half of the average private sector wage ($9.87 in 2012) and working at least 15 hours per week and at least 14 weeks in the last year…” With a different definition of ‘low wage’, Sabia’s quantitative results differ from those of the Congressional Budget Office (CBO 2014), but the qualitative results are the same. Sabia extends the work of Burkhauser and Finegan (Burkhauser and Finegan 1989), who were among the first to point out the declining proportion of low-wage workers who were in poor families. Studying the relationship through 1985, Burkhauser and Finegan (Burkhauser and Finegan 1989, p. 65) conclude that “Economists…have mostly ignored the dramatic decline in the target efficiency of minimum-wage legislation…The overwhelming majority of low-wage workers are not poor; over half of the full-time working poor are not helped by the minimum wage; and most of the nonworking poor are hurt by its inflationary side effects.” |

| 26 | These official poverty rates count only gross cash income, and exclude taxes (an important deficiency at the upper end of the income distribution) and tax credits (like the EITC, much more important at the lower end) as well as non-cash government benefits like Medicaid, housing assistance and the Supplemental Nutrition Assistance Program. |

| 27 | The Child Tax Credit provides an additional 15% earning supplement, but only after the first $3000 in earnings, to a maximum of $1,000 per eligible child under age 17 (CBPP 2016a). For more detail on the Child Tax Credit and the Earned Income Tax Credit, see (CBO 2013). |

| 28 | Frances Perkins, the Secretary of Labor when the original minimum wage was legislated, described the goal of the Fair Labor Standards Act as the “elimination of labor conditions detrimental to the maintenance of the minimum standards of living necessary for health, efficiency and well-being of workers” (Bernstein and Shierholz 2014, p. 1038). A minimum wage was only one such mechanism. |

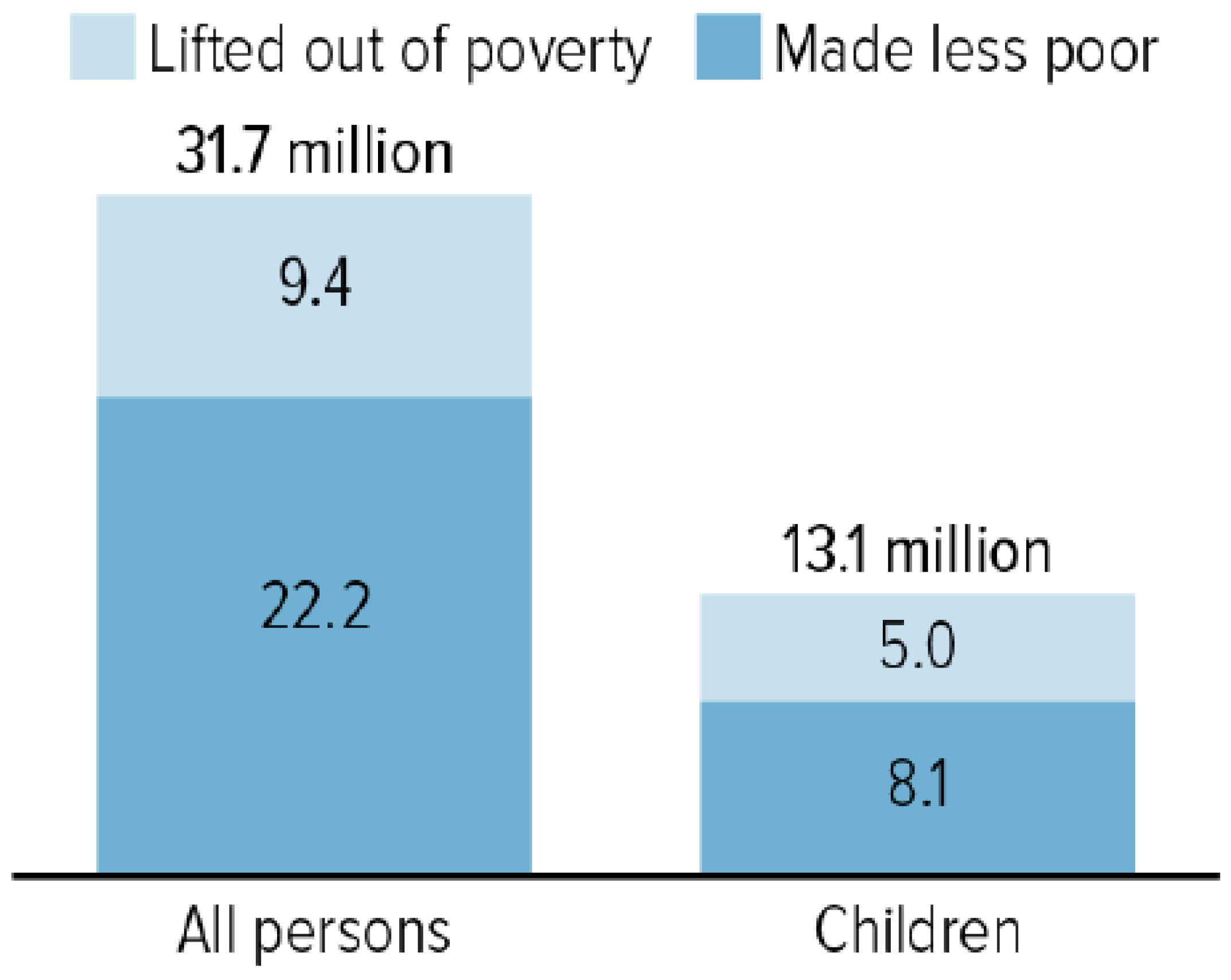

| 29 | See footnote 21. Although the EITC is an expensive program, costing the federal government nearly $70 billion in 2014, some of the cost if recouped by the governments (federal and the states that supplement it) by additional tax revenues from the economic activity associated with the additional employment. |

| 30 | It is interesting to note that, despite this major advantage of the EITC, only the U.S., the U.K. (in 1999) and Canada (a small program in 2007) have adopted some version of the EITC, whereas many countries, including almost all European countries, have minimum wage legislation (Burkhauser 2015, pp. 2, 5, 7). |

| 31 | An increase in the minimum wage would have several offsetting effects on the federal deficit. The deficit will tend to rise as the federal government pays higher wages to a small number of low-paid hourly employees, pays more for some goods and services whose prices rise, receives less tax revenue from businesses whose profits decline, and makes additional transfer payments to workers laid off. But at the same time, the deficit will decline as the government receives more tax revenues from minimum and near-minimum wage workers who now earn more, and as the government pays less in transfer payments to those same workers still employed and enjoying higher incomes. The CBO (CBO 2014, p 14) concludes that “it is unclear whether the effect for the coming decade as a whole would be a small increase of a small decrease in budget deficits.” |

| Percentage Distribution of New Pay Change (%) | ||

|---|---|---|

| Poverty Level | $12/hour | $15/hour |

| less than 1x | 8.1 | 7.0 |

| 1x–3x | 46.9 | 45.1 |

| 3x–6x | 33.3 | 35.0 |

| 6x plus | 11.7 | 13.0 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Quinn, J.F.; Cahill, K.E. The Relative Effectiveness of the Minimum Wage and the Earned Income Tax Credit as Anti-Poverty Tools. Religions 2017, 8, 69. https://doi.org/10.3390/rel8040069

Quinn JF, Cahill KE. The Relative Effectiveness of the Minimum Wage and the Earned Income Tax Credit as Anti-Poverty Tools. Religions. 2017; 8(4):69. https://doi.org/10.3390/rel8040069

Chicago/Turabian StyleQuinn, Joseph F., and Kevin E. Cahill. 2017. "The Relative Effectiveness of the Minimum Wage and the Earned Income Tax Credit as Anti-Poverty Tools" Religions 8, no. 4: 69. https://doi.org/10.3390/rel8040069