1. Introduction

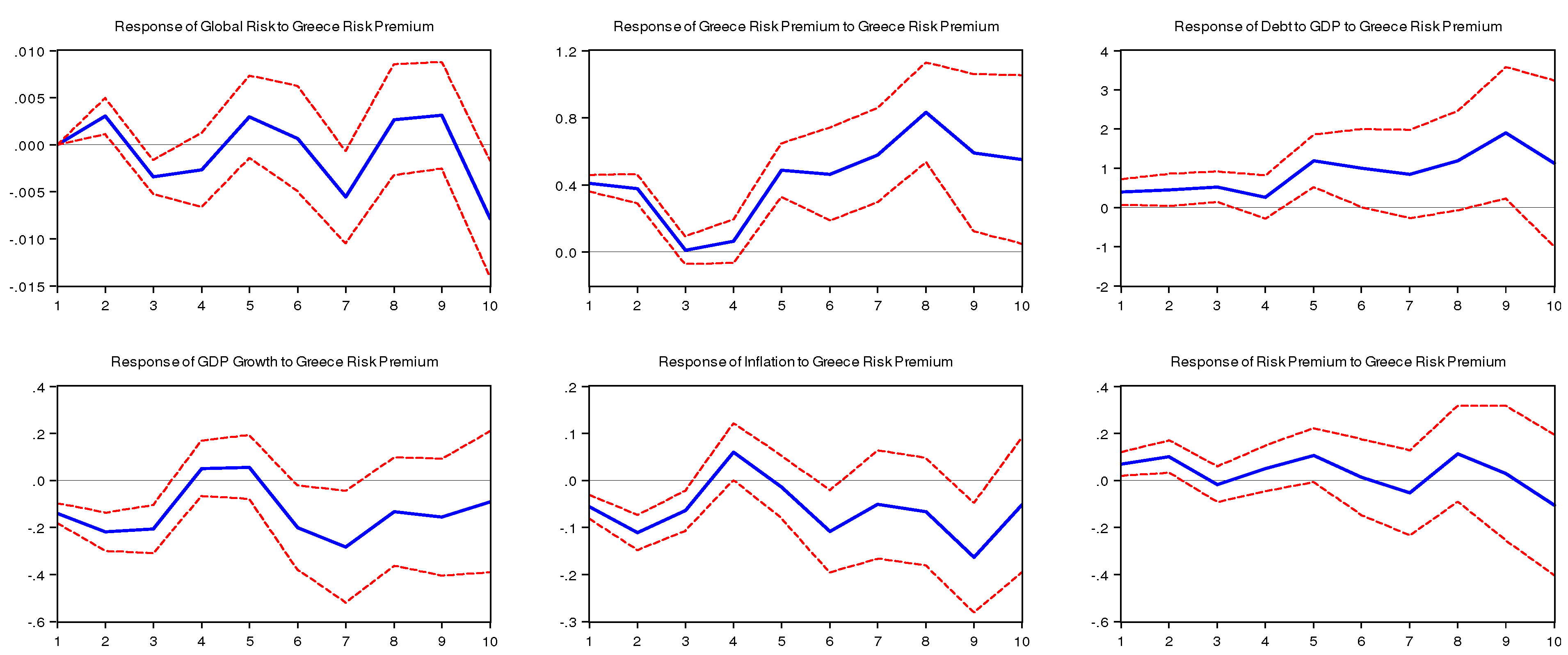

The Euro debt crisis threatens to derail the global recovery following the financial crisis of 2008. This paper examines the transmission of a potential sovereign debt default by contagion in the Euro Area. The European sovereign-debt crisis started in Greece when the government announced in December, 2009, that its debt reached 300 bn euros and its budget deficit for 2009 was 12.7%, four times the level allowed by the Maastricht Treaty. The crisis soon affected other Economic and Monetary Union (EMU) countries, notably Ireland, Portugal, Spain and Italy. Are the refinancing problems of these countries only due to changes in their own economic fundamentals? Are developments in Greece affecting the market’s assessment of other EMU members and causing contagion?

Contagion occurs when financial or macroeconomic imbalances (shocks) create a spillover risk beyond that explained by economic fundamentals [

1,

2]. Contagion differs from macroeconomic interdependence among countries in that transmission of risk to other countries is different under “normal” economic times. Forbes [

2] defines contagion as spillovers resulting from extreme negative effects. If co-movements of markets are similarly high during non-crisis periods and crisis periods, then there is only evidence of strong economic linkages between these economies [

3]. At the center of the Greek debt crisis is a fiscal crisis stemming from corruption, an inefficient tax system and a bloated public sector. One could argue that the Greek phenomenon is independent from the overall European fiscal situation and particular to Greece. Yet, the downgrading of the Greek credit rating was soon followed by similar downgrades for other EMU countries: Ireland, Portugal and Spain, notably.

Several studies [

4,

5,

6] empirically examine the nature of credit shocks and the mechanism by which credit shocks propagate from one country to another. One path of propagation of a shock is through trade linkages; another is through international capital markets. Some institutional investors (such as pension funds) or banks are required to hold bonds with a minimum rating in their portfolio. For banks, often holding bonds with a minimum rating is mandatory to comply with capital requirements or collateral when borrowing from the central bank. Therefore, if a country’s debt is downgraded, these institutions will have to reduce their holdings of debt, which could cause bond yields to rise. Moreover, Euro-area banks hold Euro-area government debt as a diversification strategy; however, these banks are then exposed to changes in the value of government debt. This means that banks are not only exposed to domestic government risk, but also risk emanating from other countries in the Euro-area [

7]. An increase in perceived global risk magnifies the importance of fiscal imbalances, such as excessive debt or budget deficits, which leads investors to discriminate between less fiscally-disciplined countries (such as Greece, Spain, Portugal or Italy] and more disciplined countries (such as Germany or the Netherlands). Consequently, sovereign yield spreads rise [

6]. Cochrane [

8] argues that the contagion effect is dependent on whether the Euro-area will shield investors from potential losses from other periphery countries, so investors are closely watching the Greek bail-out.

There are several approaches to examine the spillover of shocks from one country or region to another. Some studies use global vector autoregressions (GVARs) to examine the dynamic spillover effects of sovereign debt [

9,

5] across countries. The GVAR approach is a multi-country VAR in which one estimates a VAR model for each country included in the sample. In addition to the lagged values of every country’s variables in each equation, each VAR includes global variables, which are constructed as the weighted averages of the variables of the other countries included in the analysis. Typically, the coefficient on the foreign variables are weighted by bilateral-trade or weighted to capture international financial exposure. Another approach uses panel VARs [

10] to examine the transmission of shocks internationally. “This technique combines the traditional VAR approach, which treats all the variables in the system as endogenous, with the panel-data approach, which allows for unobserved individual heterogeneity.” ([

11], p. 193). Panel VARs differ from GVARs in that the coefficients on the foreign variables are restricted to zero and only one set of coefficients are estimated (not one for each country, as in the GVAR). Structural vector error-correction models [

4] are also used to model the propagation of such shocks. Mink and De Haan [

12] use a different approach, an event study, to examine how financial markets respond to news on developments in Greece.

Several papers have examined the relationship of government debt on long-term interest rates [

13,

14] and the spillover effect of rising debt on interest rates in other countries [

9]. These studies find a significant, positive relationship of government debt increases on the long-term interest rate. Empirical evidence is, however, mixed, since the effects of increases in government debt can be offset by private saving and foreign saving via international capital markets, or if the debt is considered high quality, it could indicate increasing liquidity. Caporale and Girardi [

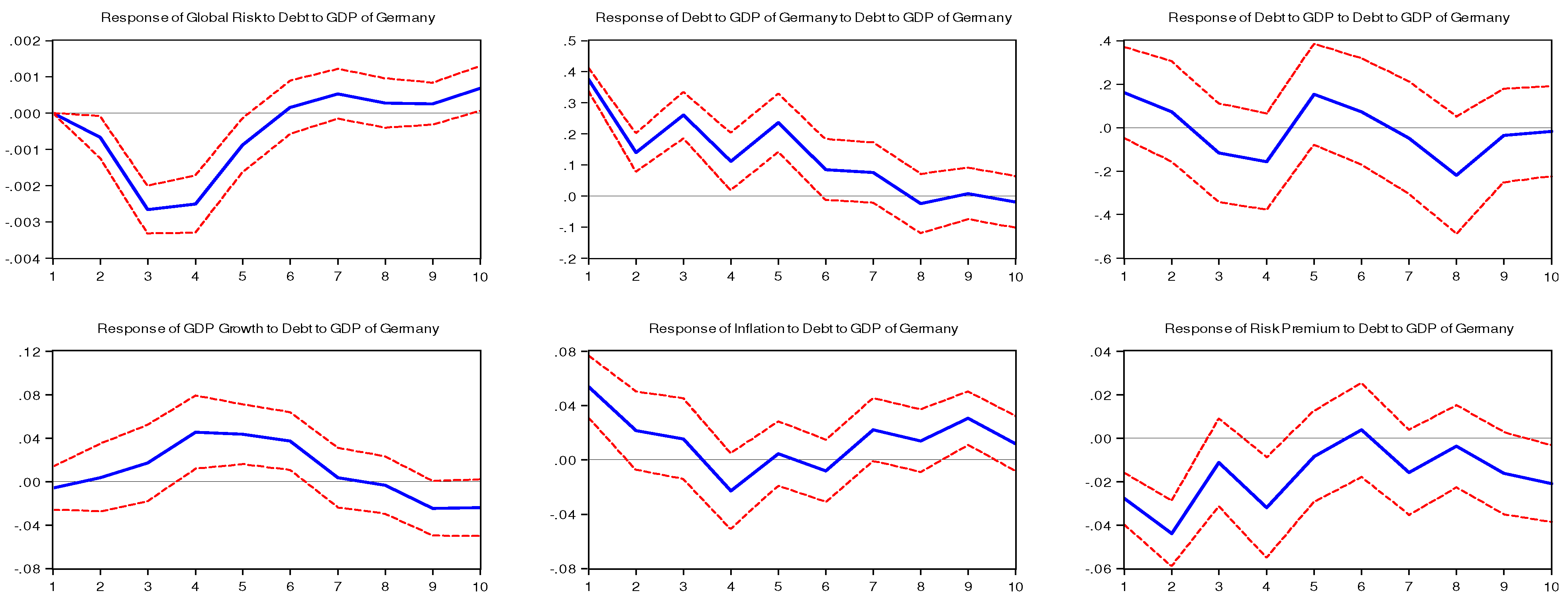

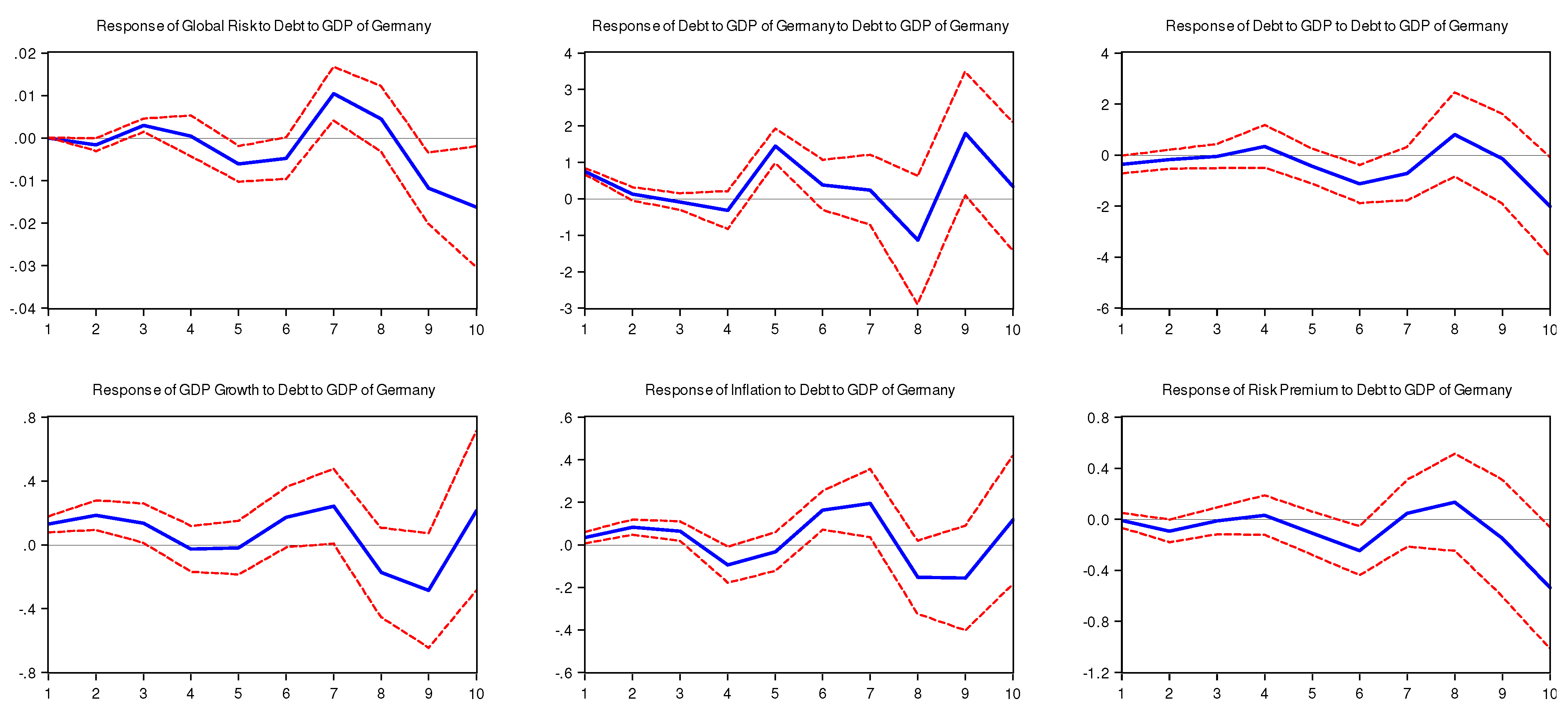

9] find asymmetries between a debt/GDP shock originating in “core” countries compared to “periphery” countries.

1 They find that a debt/shock originating from France or Germany causes the long-term interest rate to fall for other Euro-area countries, suggesting a liquidity benefit to other Euro-area countries. However, the same shock originating from the “periphery” causes long-term interest rates in other Euro-area countries to rise slightly, indicating that default risk in the periphery is increasing borrowing costs for most. De Grauwe and Ji [

15] find evidence of a self-fulfilling rise in sovereign risk spreads emanating from the periphery compared to core countries in the Euro-area and other “stand alone” countries that can issue debt in currencies controlled by their own central bank. Specifically, the debt-to-GDP and debt-to-tax revenue ratios are significant in explaining sovereign risk spreads in the Euro-area, but not “stand-alone” countries, such as the U.S. or UK, which suggests that countries that do not control their own money supplies are vulnerable to rising debt levels.

Using a panel-vector autoregressive (PVAR) model, we assess the extent to which rising debt to GDP ratios and government-bond yield spreads

2 in EMU countries are due to changes in countries’ economic fundamentals and/or contagion from other troubled EMU economies. In addition to analyzing contamination from Greece, we also assess whether contagion from other larger southern countries, notably Spain and Italy, pose a bigger risk on the remaining Euro-area. This study contributes to the existing literature in several ways. First, in addition to debt-to-GDP shock, we examine shocks to sovereign spreads (other papers only analyze the determinants of sovereign spreads). Second, to distinguish interdependence from contagion, we compare the IRF’s obtained from the crisis period (2008–2011) with those obtained for the pre-crisis period (2000–2007). We also control for global uncertainty (global risk aversion) in addition to other economic fundamentals to better isolate risk originating from the peripheral countries in the Euro-area [

16]. Finally, we measure the sovereign risk-spread relative to the U.S., so we can retain Germany in our sample and examine the response of Euro-area countries to an isolated shock originating in Greece and other peripheral countries using the PVAR approach.

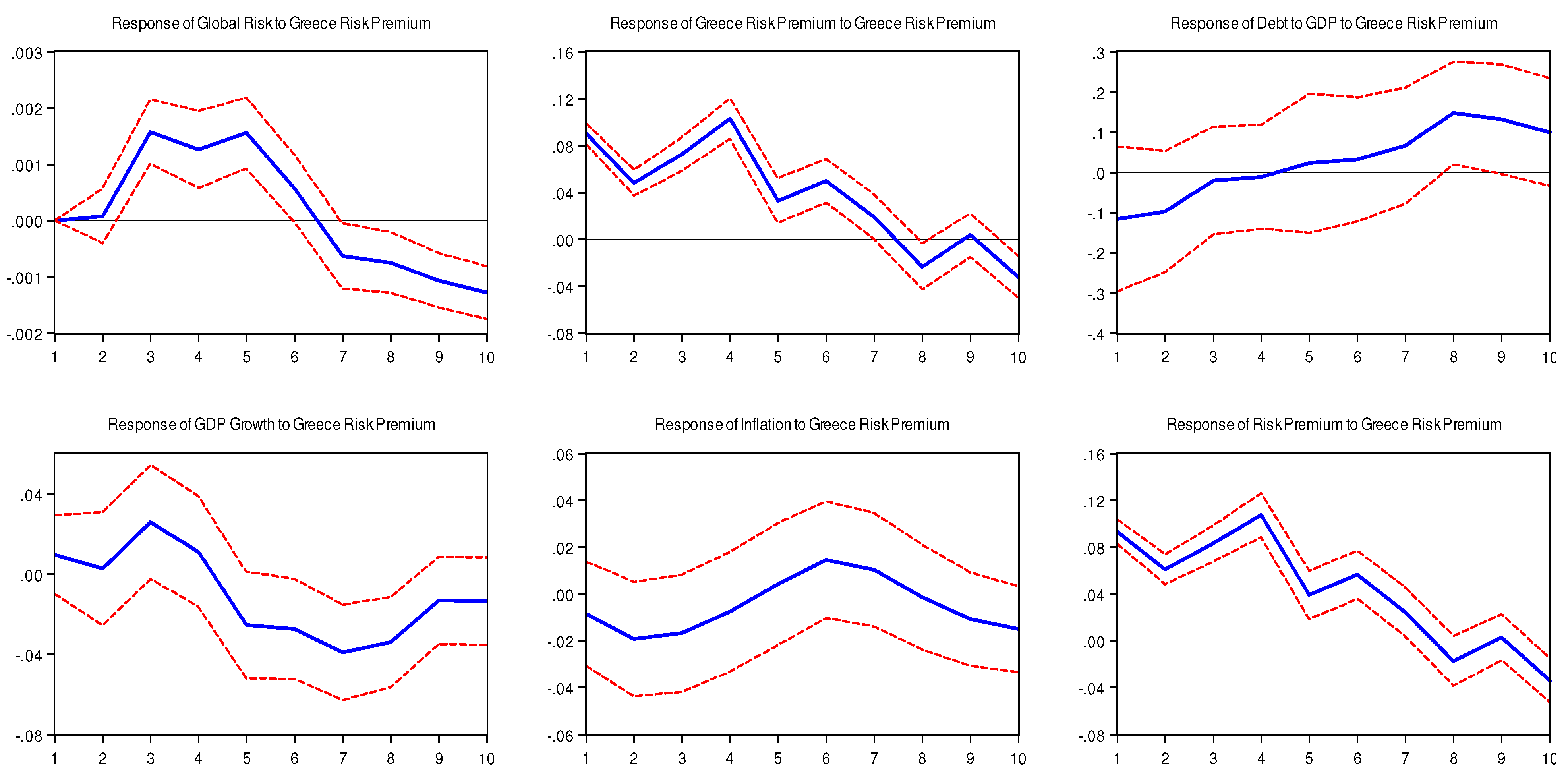

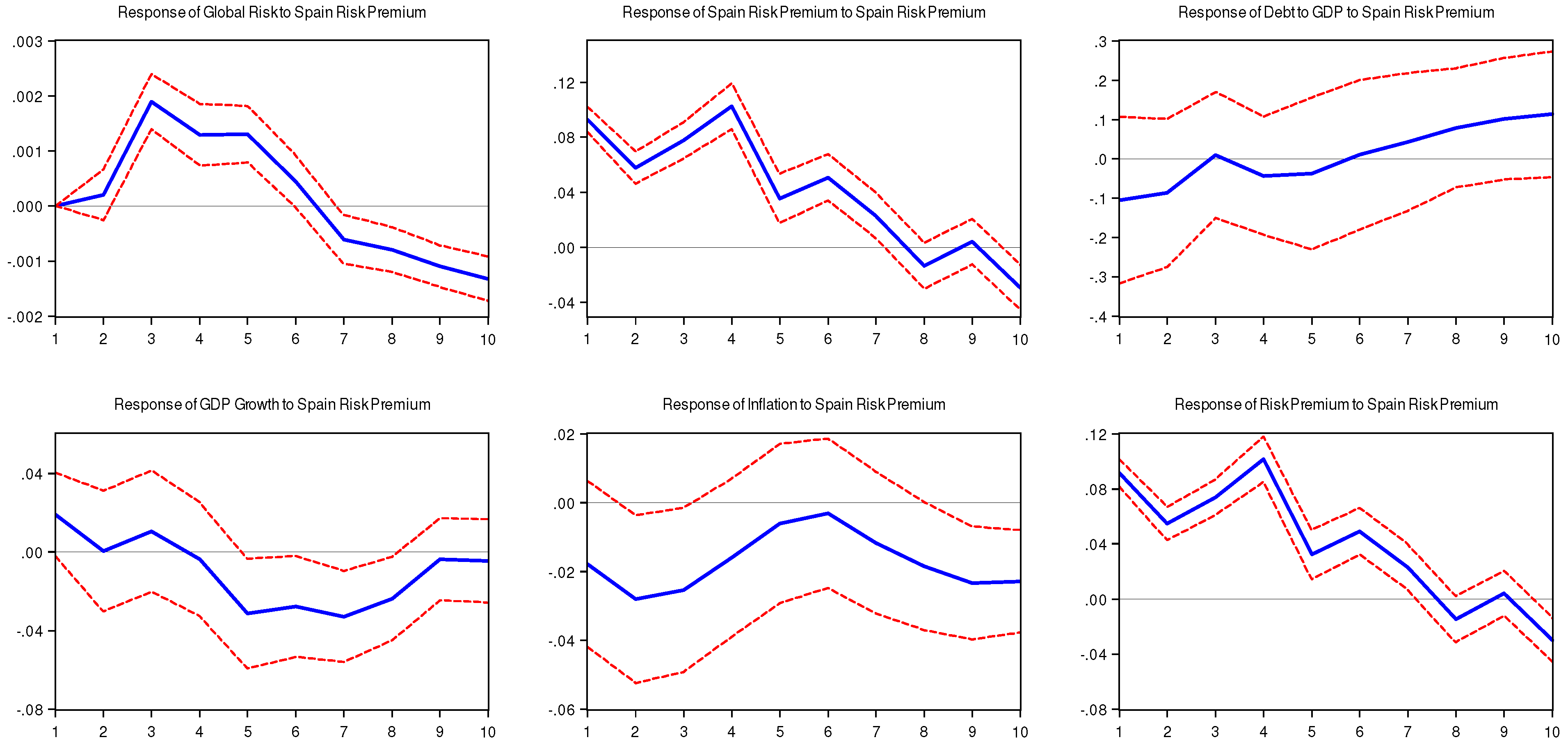

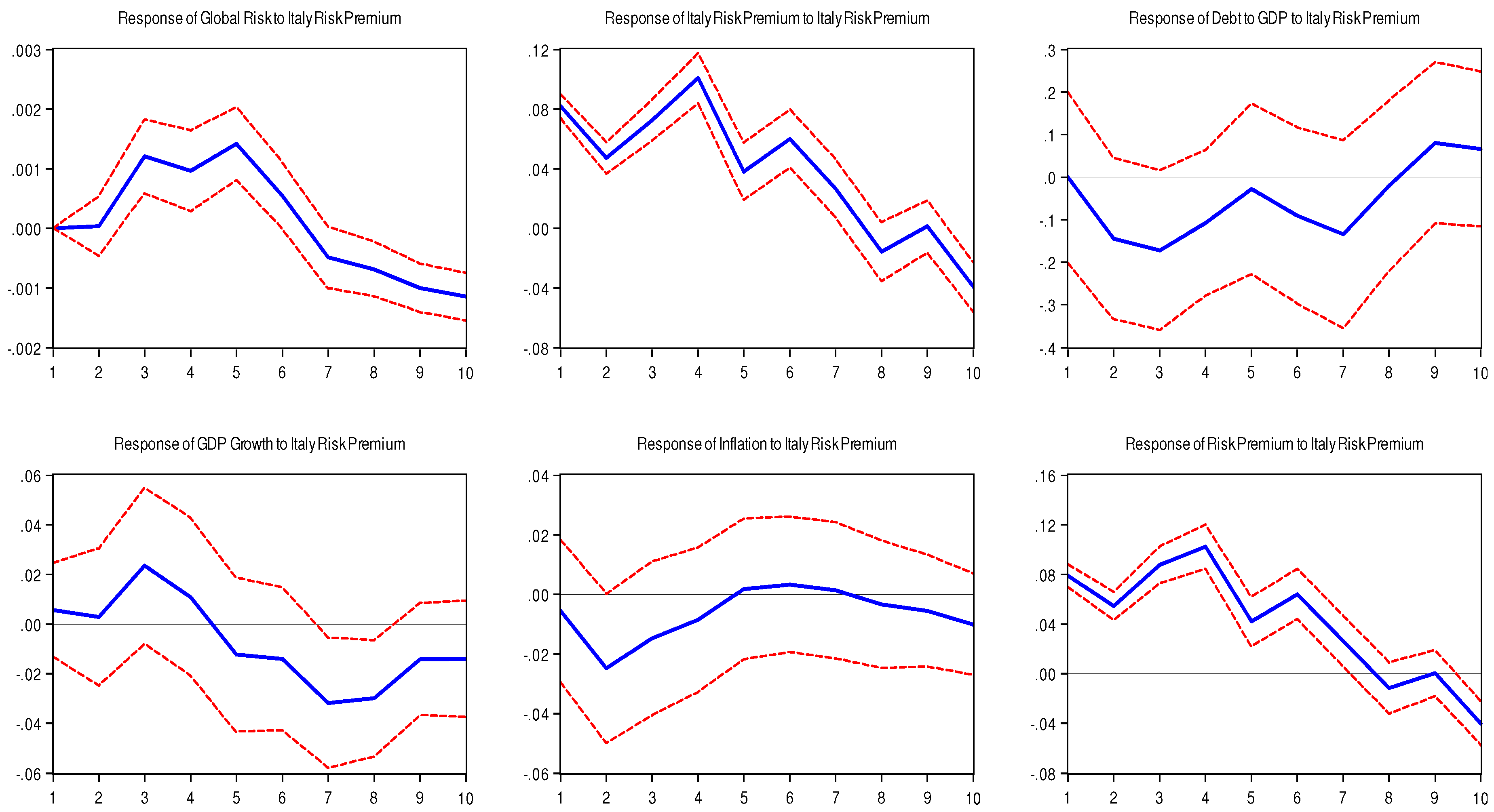

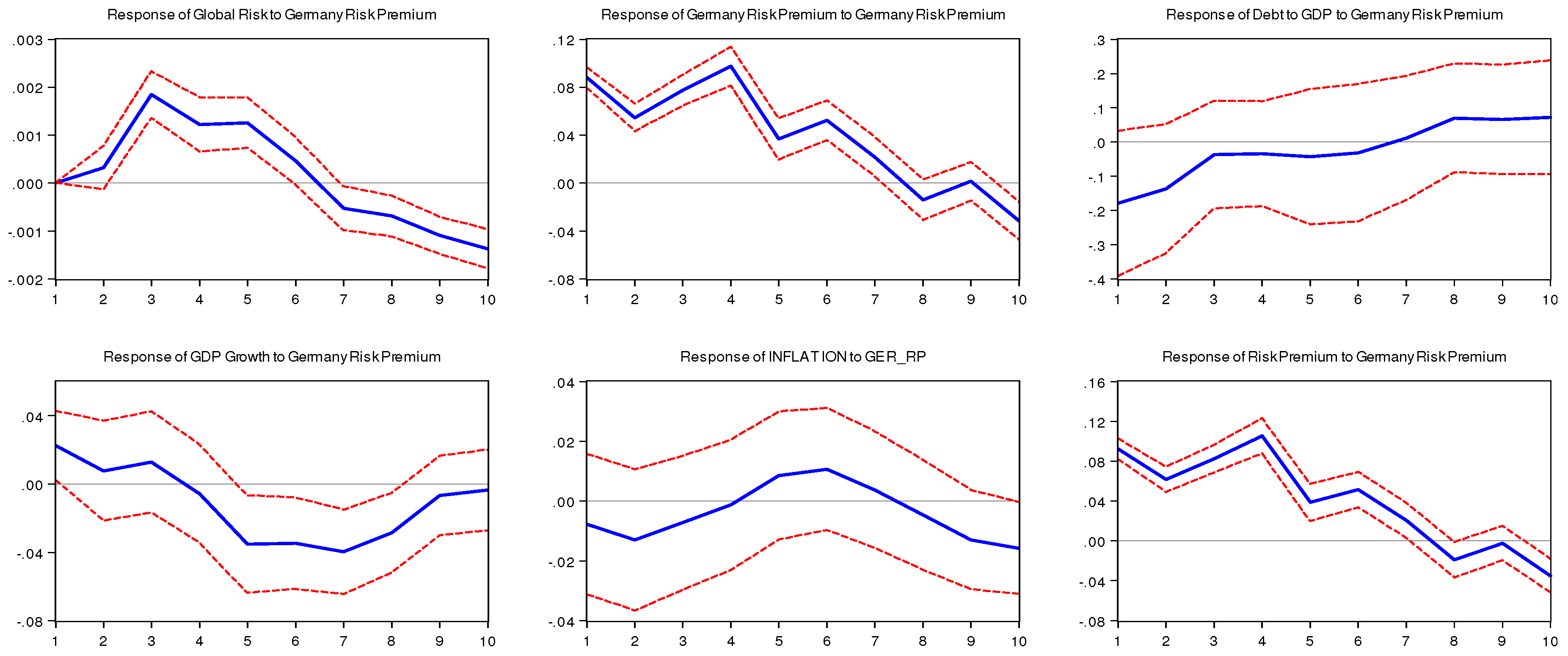

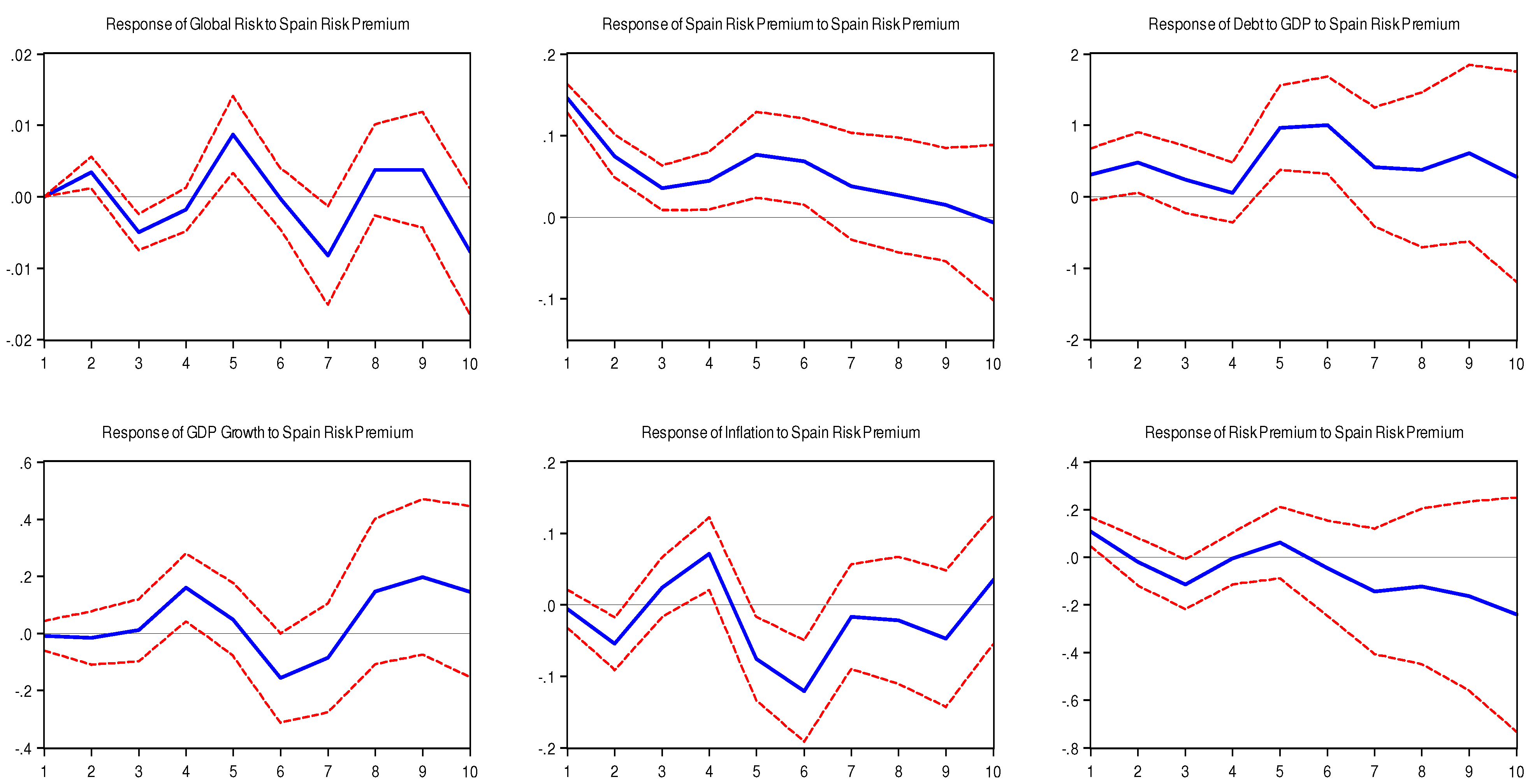

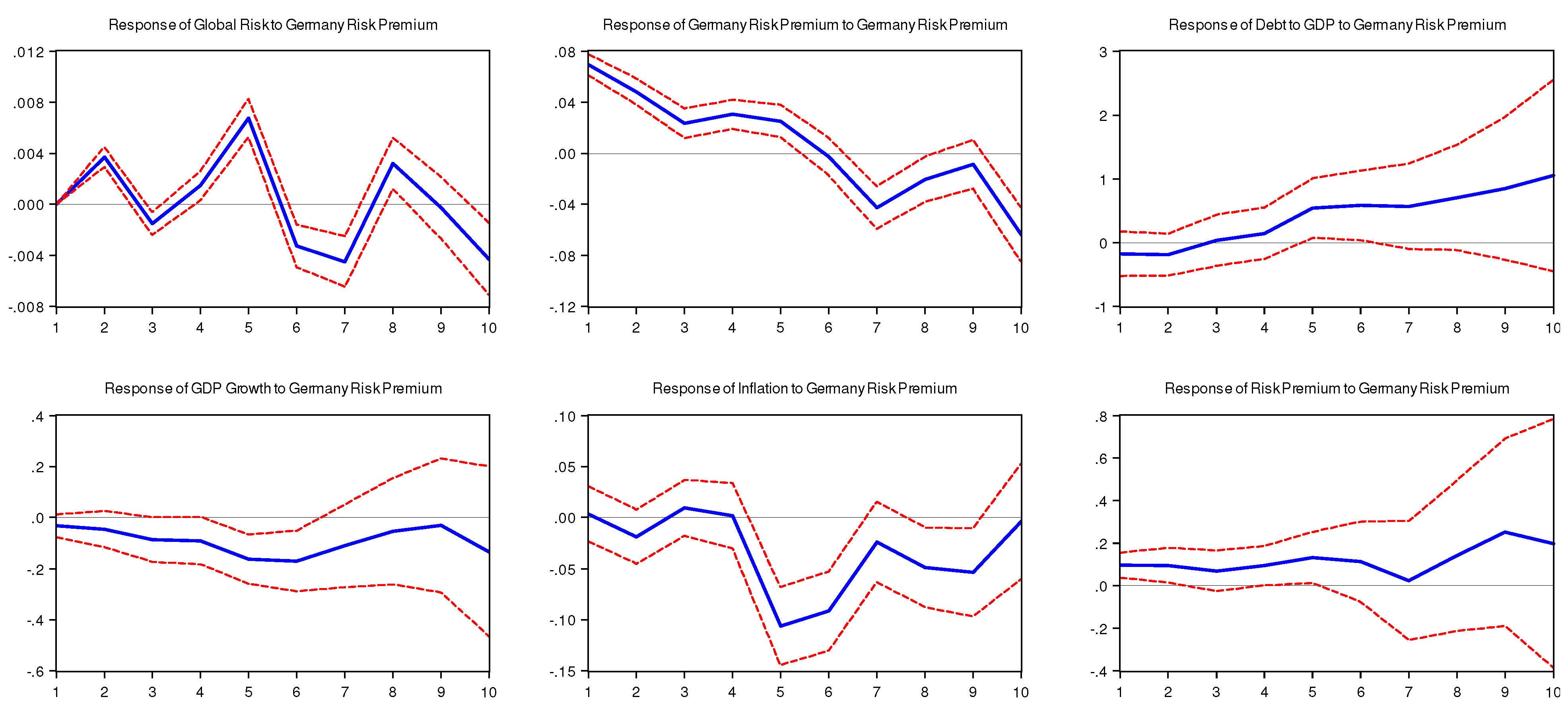

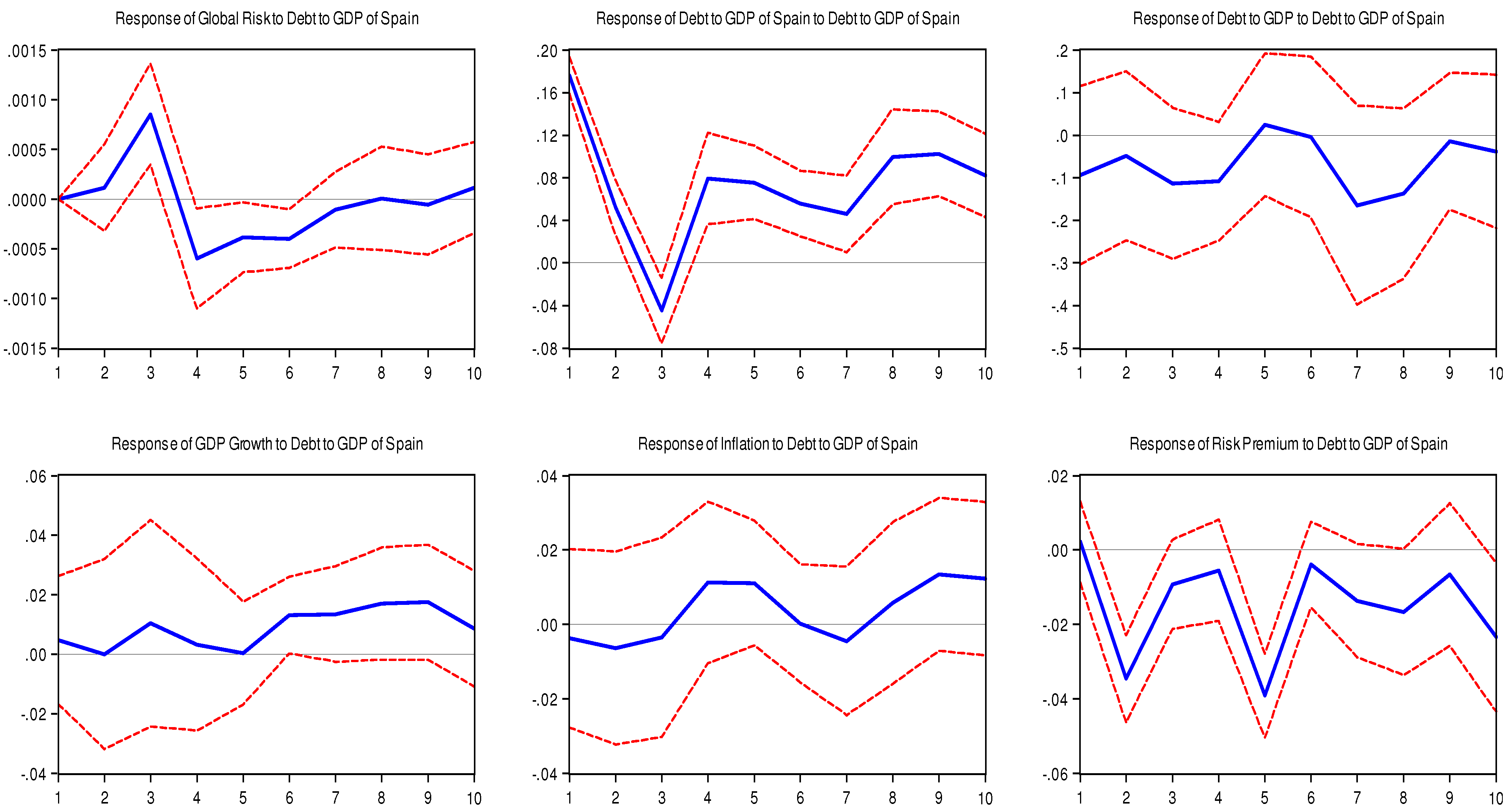

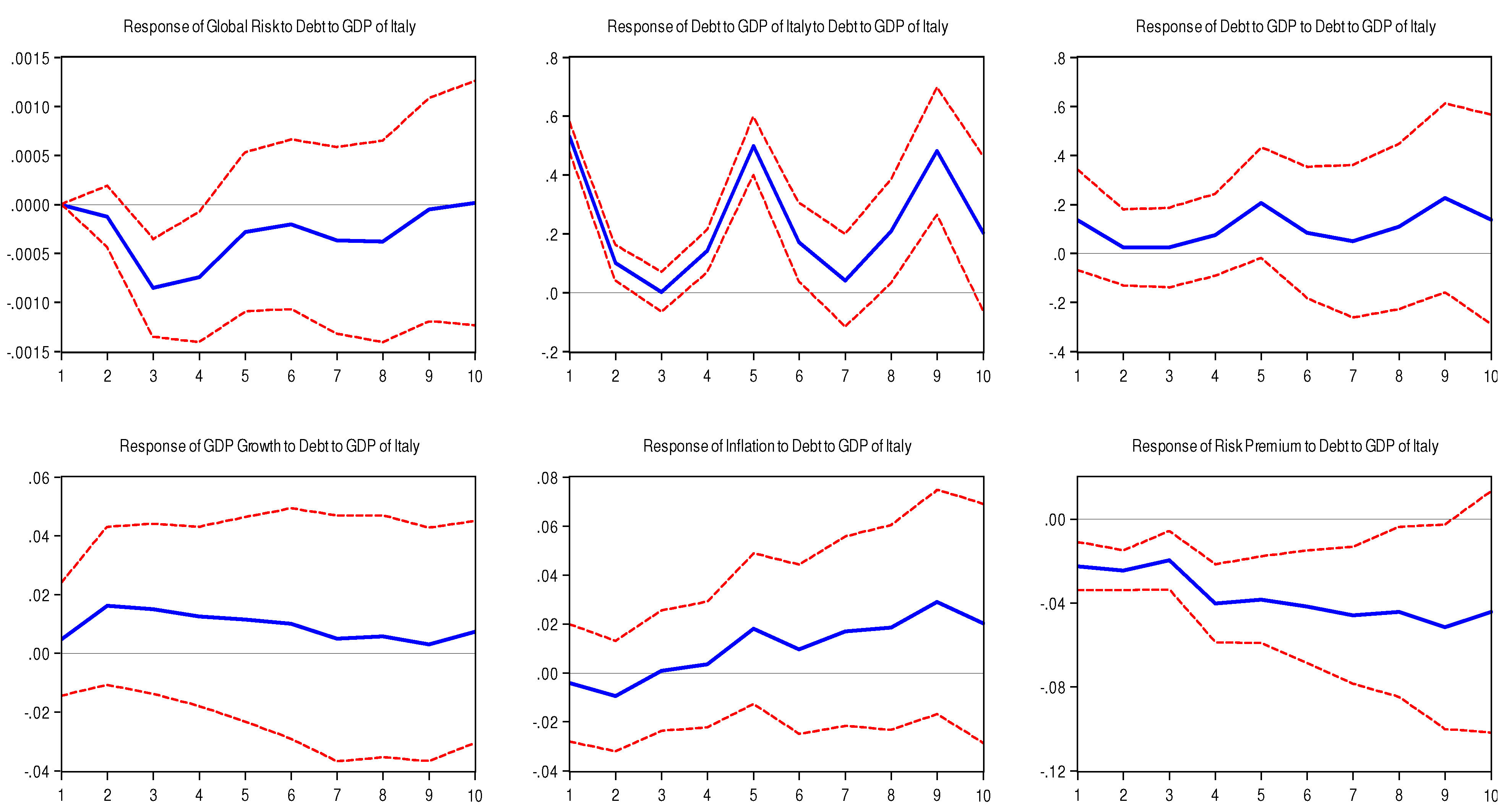

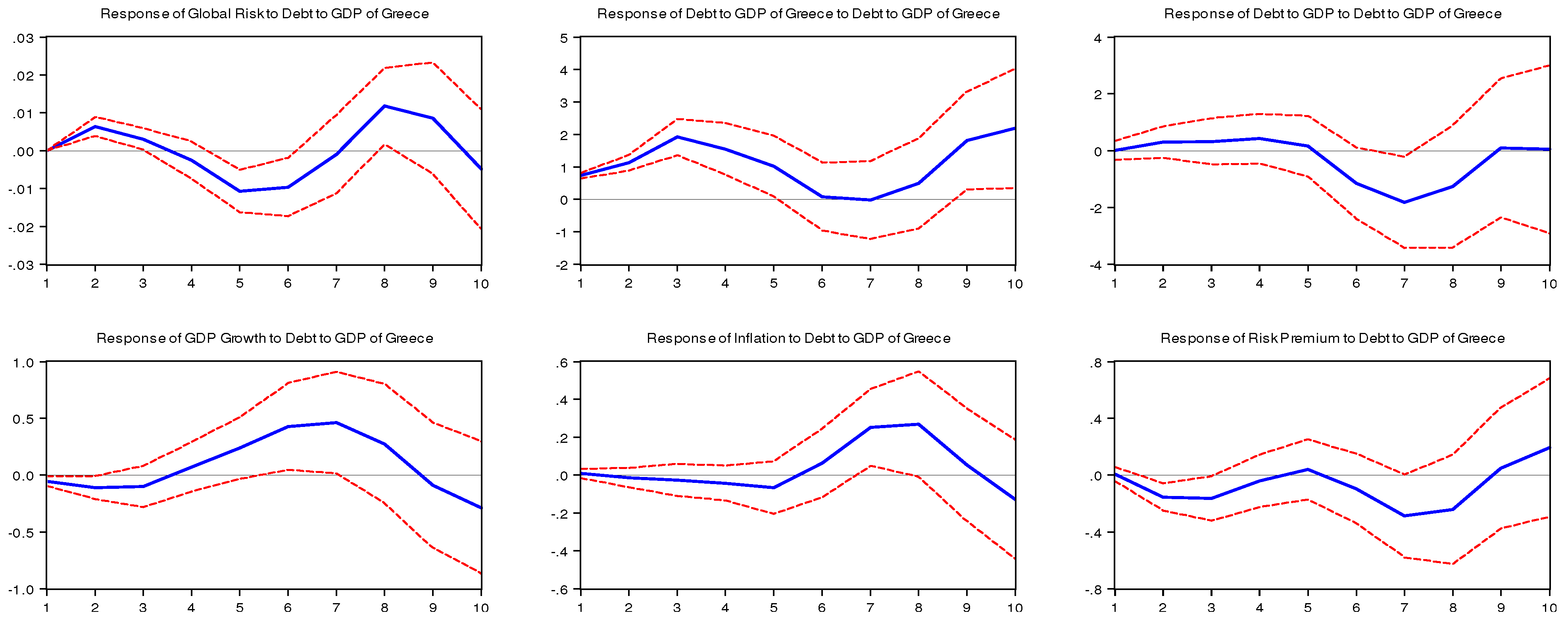

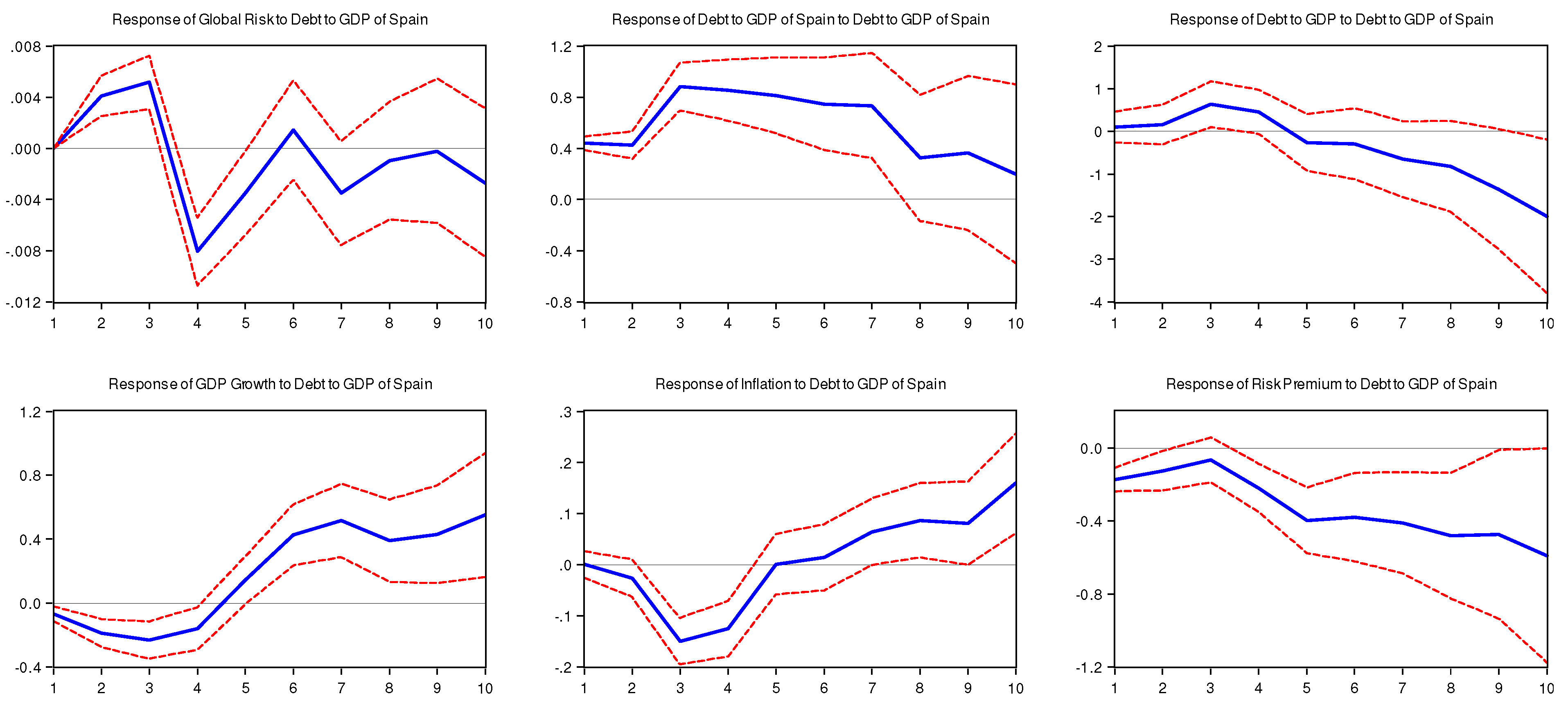

We find that, in the pre-crisis period, an increase in one country’s sovereign spread increases other countries’ sovereign spreads, but does not affect their debt-to-GDP ratios, thus indicating economic interdependence among EMU countries. Following 2008, the same shock to sovereign spreads has a large effect on countries’ debt-to-GDP ratios, if the shock stems from Greece or Spain, suggesting contagion. When the shocks affect debt-to-GDP ratios, we do not find evidence of contagion. However, whether the shock improves or worsens the other EMU economies depends on the debt level of the country “shocked”.

The remainder of the paper is organized as follows. In

Section 2, we describe the PVAR model and the data that we use to analyze whether a shock to an EMU country’s sovereign spread or debt-to-GDP ratio affects the other EMU countries. We discuss in

Section 3 the impulse response functions obtained from the aforementioned shocks. In

Section 4, we make concluding remarks.

2. Data and Estimation Methodology

We estimate our impulse response functions from a six-variable PVAR in log-levels. Estimating the VAR in levels has a few advantages, including the ease of interpreting the impulse response coefficients, as well as avoiding some misspecification issues related to estimating a VAR in first differences or taking into account issues of cointegration (see [

17,

18,

19] for discussion on these points). For example, Ludvigson [

20] notes that even in the case where some variables may be non-stationary, a VAR in levels will have standard asymptotic distributions [

21]. Similarly, Ramaswamy and Sløk [

17] measure the effects of monetary policy on European Union countries in addition to the United Kingdom using a VAR estimated in levels (they also provide discussion on the benefits of estimating the VAR in levels; see ([

17], pp. 379–80), in particular). Ashley and Verbrugge [

22] show that even in the presence of non-stationarity and cointegration, estimating a VAR in levels provides impulse response functions that are robust to those specification issues (see also [

23] for Monte Carlo evidence related to this point).

The PVAR approach has several advantages over individual country VARs. First, we gain degrees of freedom by analyzing a panel of countries. Further, we can better model the spillovers from one country to another, since the panel approach captures country-level heterogeneity.

The PVAR model is given by:

where

is a matrix of endogenous variables,

is a matrix polynomial in the lag operator, L, with country

i=1,…11.

In the baseline specification, the vector, Z, includes the following variables:

the rate of GDP growth

the rate of inflation (measured as the percentage change in Harmonized Consumer Price indices)

the countries’ bond-yield spread measured as the difference between a country’s ten-year bond rate and the rate on the ten-year U.S. Treasury note

the global risk aversion index

and the Country of Interest Sovereign Risk Spread/or debt-to-GDP ratio.

While several papers measure the sovereign spread as the difference between an EMU country’s ten-year bond rate and the rate on the ten-year German bonds [

3,

15,

24], we choose to use the U.S. Treasury note as the risk-free asset benchmark in order to retain Germany in our analysis. How we construct sovereign spreads should not affect our results, given the high correlation between the two measures. Indeed, the correlation between country interest rate spreads measured against the German bond and spreads measured against the U.S. interest rate is 0.973. During the crisis, this correlation increases to 0.99. Therefore, in order to keep Germany in our sample, we use the U.S. Treasury note instead of the German bond. Our sample consists of 11 EMU countries (Austria, Belgium, Finland, France, Ireland, Italy, Germany, Greece, the Netherlands, Portugal and Spain

4). We use quarterly data over the period 1999Q1–2011Q4, which are obtained from the Organization for Economic Cooperation and Development (OECD) Economic Outlook and Eurostat.

Before we discuss the global risk aversion (GRA) and country of interest variables included in our PVAR and performing a more rigorous econometric analysis, it is useful to look at the evolution of EMU countries’ debt-to-GDP ratios and bond-yield-spreads over time.

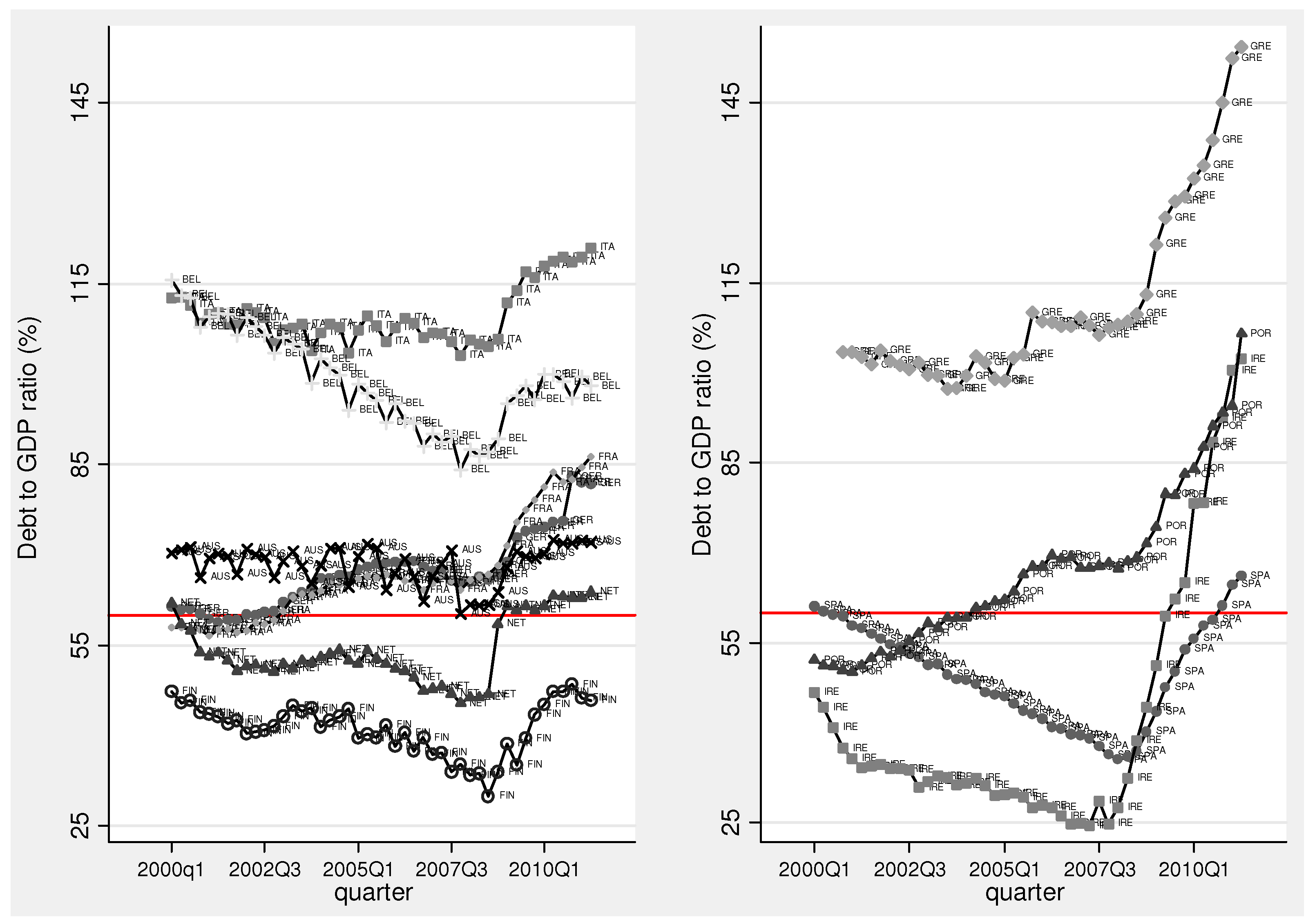

Figure 1 displays the debt-to-GDP ratios of the original 11 EMU countries. To make the graph easier to read, we split the countries between the periphery (Greece, Ireland, Portugal and Spain) and the core (the other seven countries). The red line captures the Stability and Growth Pact limit on government debt set at 60% of GDP. First, it is worth noting that, even before the financial and economic crisis of 2008, only four countries maintained debt-to-GDP ratios below the 60%-threshold: Finland, the Netherlands, Ireland and Spain. Greece, Italy and Belgium all had ratios well above the 60% threshold, averaging respectively 104%, 108% and 99%. While several countries saw their debt ratios fall before the financial crisis, these ratios increased in every country after 2008. The increase is particularly striking in the periphery countries. Between the last quarter of 2008 and early 2011, the debt-to-GDP ratio increased 57.6 percentage points in Ireland, 41.3 percentage points in Greece, 32.9 percentage points in Portugal and 25.9 percentage points in Spain. Unlike Greece, whose debt troubles stemmed from fiscal indiscipline, the rapid rise in Spanish and Irish debts originated from the private sector [

25]. Following the U.S. subprime mortgage crisis, these two countries’ governments were forced to bail-out the private sector (banking systems). Portugal’s debt crisis is caused by much the same problems as Greece: overspending by the government and an overly large and bureaucratic civil service. Consequently, as shown in

Figure 1, the debt-to-GDP ratios of Greece and Portugal had been rising long before the economic crisis of 2008 (especially in Portugal), whereas Spain and Ireland had been able to reduce their debt-to-GDP ratios and keep them below the 60%-threshold before they had to rescue their banking sectors.

Figure 1.

Debt-to-GDP ratio in Economic and Monetary Union (EMU) countries.

Figure 1.

Debt-to-GDP ratio in Economic and Monetary Union (EMU) countries.

Notes: Debt data are not available for 1999. The red line captures the Stability and Growth Pact limit on government debt set at 60% of GDP.

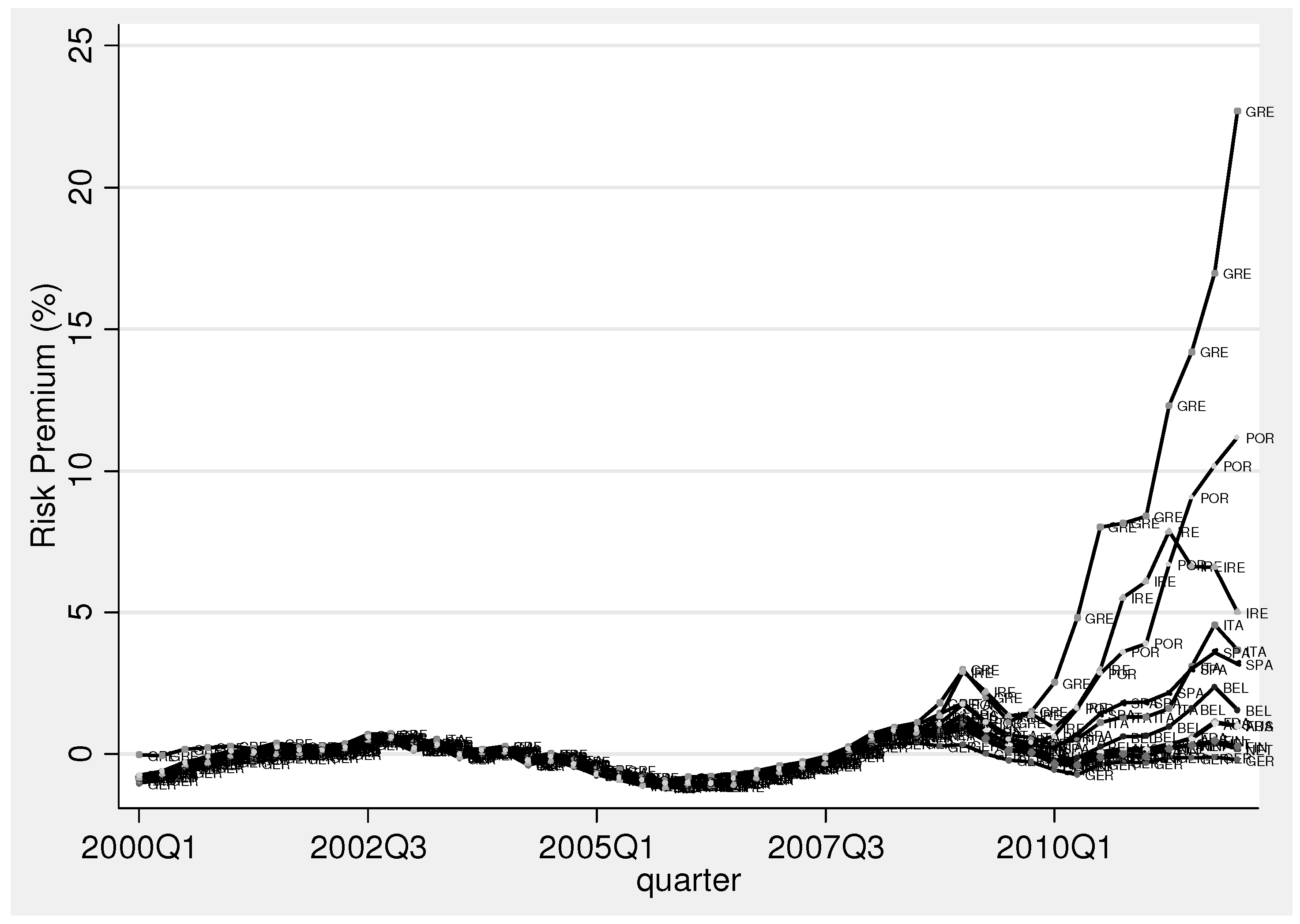

Turning now to the government-bond yield spread (

Figure 2), most EMU countries enjoyed sovereign spreads with U.S. Treasury bonds close to zero and even negative (between 2005 and 2007) until the financial and economic crisis. While many countries experienced a slight increase in their sovereign spreads in 2008, the rapid increase in the risk-premia of periphery countries was initiated by the sovereign debt crisis in Greece in late 2009. These premia have continued to escalate, and reached, in the first quarter of 2012, 22.7% in Greece, 11.18% in Portugal and 3.2% in Spain. Caggiano and Greco [

24] find that the correlation between sovereign spreads and debt-to-GDP ratios (especially for countries where the ratio is >100%) has increased since the financial crisis. Barrios

et al. [

6] find that an increase in general risk perception is more important in explaining rises in sovereign risk spreads than domestic factors. However; increases in perceived risk heighten the effect of domestic imbalances on risk-spreads during times of financial stress. The situation in Ireland is slightly different in so far as its risk premium peaked during the second quarter of 2011. The Irish government’s commitment to public-debt reduction and the ratification by Ireland of the Treaty on Stability, Coordination and Governance in the Economic and Monetary Union by referendum in May, 2012, eased Ireland’s access to funds.

Figure 2.

Risk premia in EMU countries.

Figure 2.

Risk premia in EMU countries.

Note: The risk premium is measured as the difference between a country’s ten-year bond rate and the rate on the ten-year U.S. Treasury note.

In order to assess whether the sovereign debt crisis of one particular country, such as Greece, has affected other countries’ sovereign spreads and economic outcomes, we include the Greek risk premium or its debt-to-GDP ratio in our PVAR. While several papers in the literature assume contagion would stem from Greece alone [

1,

3], we also check the impact of shocks to larger economies, which have seen their sovereign spreads rise more recently, namely Italy and Spain. For comparison purposes, we also examine whether shocks to Germany (the largest economy in the EMU) induce the same type of contagion. Consequently, while our sample includes 11 EMU members, in practice, the PVARs discussed in the next section are estimated with only ten members each that are defined by exclusion of the country defining the “country-of-interest” risk premium.

Because the surge in global risk aversion is a significant factor affecting sovereign spreads [

6,

16,

26], our model also includes a measure of global risk aversion (GRA). At times of high financial market risks, investors tend to sell high-risk government bonds and buy less risky ones, leading to higher sovereign spreads in more risky economies. Our GRA measure is based on the method proposed by Espinoza and Segoviano [

27] and used by Carceres

et al. [

16]. The price of an asset reflects both this asset’s returns and the price that “investors are willing to pay for receiving income in ‘distressed’ states of nature.” (p. 6, [

16]) The index of global risk aversion measures the market price of risk. The GRA measure is constructed using the following formula:

where

is the share of the market price due to idiosyncratic risk as a fraction of the actual probability of a negative event. The GRA index captures the market’s perception of risk at every point in time. The GRA measure is exogenously given and common to all the countries included in the sample. Moreover, insofar as the market price of risk is estimated using the VIX (the Chicago Board Options Exchange Volatility Index) and the U.S. Libor- overnight indexed swap (OIS), the GRA measure also captures liquidity difficulties in financial markets. A rise in the index of global risk aversion implies an increase in global risk aversion. As shown in

Figure 3, the GRA index captures the rise in global aversion observed after August, 2008, and peaking in October, 2008, after Lehman Brothers’ bankruptcy. After a gradual reduction in 2009, the index spikes again in December, 2009, when the Greek government announced that its debts had reached 300 bn euros and its budget deficit for 2009 was 12.7%, four times the level allowed by the Maastricht Treaty. The more recent increase in the last quarter of 2010 corresponds to the spread of the sovereign debt crisis to other EMU countries.

Figure 3.

Index of global risk aversion.

Figure 3.

Index of global risk aversion.

Note: Authors’ own calculation based on Carceres

et al. [

17].

We again follow common practice and identify structural impulse response functions using recursive identification (through the Cholesky decomposition), with the variables ordered as follows: global risk aversion (GRA), “country-of-interest” risk premium, the debt-to-GDP ratio, the rate of real GDP growth, the rate of inflation and the other countries’ risk premium. The recursive order dictates that the other countries’ risk premium responds to changes in the other variables in time t. In contrast, GRA only responds to itself in time t and only with a lag to the other EMU-specific variables. After performing both selection tests and robustness checks and comparing the results at different lag lengths (see the brief discussion below for more detail), we estimate the system with four lags.

Before we discuss the results, we briefly comment on the robustness of the results we report below to alternative specification choices. For example, in our analysis, we order debt-to-GDP ahead of GDP growth based on the logic that the level of debt is not likely to respond immediately to a shock in the growth rate of GDP, but with a lag, as government budgets respond sluggishly to such changes. However, one could argue the contrary if automatic stabilizers immediately change the ratio. We considered this alternative ordering, but the change in ordering does not affect our analysis and conclusions. We attach figures for the alternative options we estimated as an appendix to our main analysis. For brevity, we include the additional results only for Greece. However, a full set of alternative results are available for Spain, Italy and Germany. Given the Appendix with figures only for Greece runs eight pages, the figures for the other three countries are available upon request, but not included here for some semblance of brevity.

Other options we considered included varying the lag length, adding a long-term interest rate for each country (in addition to the risk premium) and different transformations of some of the included variables. With respect to lag length, we considered a lag length of five and six, but the results did not change to a large degree (though, with six lags, the statistical significance of the responses is obviously diminished). After six lags, the degrees of freedom are exhausted for the pre-crisis period. For our crisis period (defined to include 2008 to 2011, which we discuss further below) the impulse response functions do not change much with five lags in the system. However, the statistical significance of the responses becomes weaker, and stretching the lag length beyond five made estimation in the short sample impossible. Estimating with shorter lag lengths did not change the inference greatly, except to make the statistical significance of the impulse response functions more pronounced.

We also estimated the debt-to-GDP ratio in the first differences and GDP in log levels (instead of a growth rate). These alternatives did not change the results substantially, nor did adding the ten year rate for each country (which might be included if one believes the level of a country’s long-term rate has a distinct effect on the system from the risk premium). Lastly, while we focus on the pre-crisis sample versus crisis sample for comparison, the Appendix also reports the results for the full sample period. Overall, changes to the PVAR model along these various lines did not affect our inference to a large degree, especially when comparing the pre-crisis period to the crisis period. Of course, as more data become available over time, a researcher will be less bound by the restrictions we face here in analyzing the crisis period, but we feel the analysis below offers a useful understanding of the spread of financial pressure across the EU, one that is relatively robust to typical variations in PVAR estimation.