In the case study, the economic benefits and pay-off of an IAQ investment in a new healthcare center are examined with ROA from tenant organizations perspective. Specifically, the aim is to demonstrate ROA for the modifiable ventilation capacity investment, which enables adding more ventilation capacity and increase ventilation rate. Based on the results from the earlier empirical studies (see Subsection 3.3), the starting premise in the case study is that a higher ventilation capacity can potentially lead to a reduction in tenant’s sick leave rate, holding other things equal. The economic benefits are measured as cost savings from sick leave rate reductions for the tenant organization. The main sources of data used in this case study consist of the literature review results, tenants’ strategic plans, case projects’ feasibility study reports, articles and briefing, and expert workshops.

The case was selected because it aims to create a new user benefit driven construction management model for the public sector. In fact, the project is a national benchmark project for new practices in public healthcare construction and it is in part funded by the Finnish Funding Agency for Innovation, Tekes [

23]. In addition, the severity of IAQ problems on healthcare buildings in general is large. For example, in Finland national authorities and experts [

24] estimate based on national and building level data that the prevalence of severe IAQ problems in existing healthcare buildings is 20%–26% of total room space. This case selection provided us also with the necessary data to apply ROA to evaluate the profitability of IAQ investments.

3.1. Case History

The tenant, the city’s social and healthcare services organization, recognized the need for new healthcare facilities in 2008. The need was imminent due to two major reasons brought about by changes in tenants’ operations and attributes of the present facility and personnel (

Table 2 and

Table 3). First, the present healthcare facilities do not support the tenants’ new healthcare processes and personnel well-being. The current facilities were built in the 1970s offering few options to adapt to the major changes in user functions by 2030. Moreover, based on employee complaints and frequent respiratory infections the tenant suspects that the IAQ of the building contributes to the personnel sick leave rate (12.4 days per person per year [

26]), which is higher than the estimated average sick leave rate in Finland (8.4) [

27] for municipal workers, but not exceptional in comparison to the sick leave rates of healthcare employees in Finnish benchmark cities (e.g., Kirkkonummi 8.3 [

28], and Hyvinkää 17.8 [

29]). Ventilation rate in the present facilities is 8 L/s/person [

30]. Second, the demand for healthcare services is increasing due to the rapidly ageing population. For example, the number of people over 75 years of age is expected to triple by 2030 in Järvenpää [

31], which in particular requires additional ward capacity and personnel.

Table 2.

Background information on tenant’s operations. Data from [

30]. Copyright 2013 Finland.

Table 2.

Background information on tenant’s operations. Data from [30]. Copyright 2013 Finland.

| Tenant attributes | Current operations | Operations in 2030 |

|---|

| Aim of operations | Perform basic healthcare and social services for the inhabitants of Järvenpää | Generate health benefits to the inhabitants of Järvenpää |

| Basic healthcare visits per year | 88,761 | 112,385 |

| Healthcare staff | 286 | 347 |

Table 3.

Tenant personnel attributes. Data from [

26]. Copyright 2013 Finland.

Table 3.

Tenant personnel attributes. Data from [26]. Copyright 2013 Finland.

| Tenant personnel attributes | Current situation | Metrics |

|---|

| Average age of employees | 47.3 | years |

| Annual turnover of employees | 24.1 | % of total workforce |

| Number of sick leaves | 3,546.0 | days per year |

| Sick leave rate per employee | 12.4 | days per year |

| Top three reported reasons for sick leaves | Respiratory infections, skeletal and muscle systems diseases, mental problems | – |

Consequently, the tenant organization has decided to relocate and is motivated to investigate the economic benefits of operating in the new facilities. In particular, the tenant wants to investigate whether it is worthwhile in the economic sense to pay a higher rent in the new premises in the long-term. As personnel are the tenants’ most valuable resource and largest cost item, a key issue is to evaluate the potential economic benefits related to IAQ in the new facilities. In the following, ROA is demonstrated as a tool to evaluate these economic benefits.

3.2. Key Uncertainties and Investment Opportunities for the Tenant

As a first step of ROA, an expert workshop was organized to identify the key uncertainties for tenant’s operations in the new facility and investments to manage the identified uncertainties. Workshop participants were tenant’s executive director, investor organization’s managing director, two IAQ experts and five construction management professionals. First, the workshop participants reviewed the tenant’s current state of operations and long-term strategic targets and case projects’ feasibility studies and briefing report. Following that, relevant uncertainties were described and categorized. Future personnel well-being and utilization rate were rated as the key source of uncertainty for the tenant in the new facility. After that, the potential investments to manage the uncertainty of personnel well-being and utilization rate were shortlisted and heuristically evaluated against the uncertainties.

As a result of the workshop, the improvement of IAQ was set as a key investment and design theme, and a specific investment opportunity was assigned for ROA to evaluate its economic benefits and profitability.

The investment is modifiable ventilation capacity in the new facility, which represents a potentially valuable option to the tenant. Modifiability enables adding more ventilation capacity (from 15–24 L/s/person) and increase ventilation rates to capture the potential health and economic benefits of higher ventilation rates through lower sick leave rates. Thus, it is an additional and performance enhancing investment to the originally planned ventilation system of the new building with a ventilation capacity of 15 L/s/person. Physically, this means that the building design accommodates future installation additional ventilation units. In the workshop, modifiability of the ventilation capacity was seen to be particularly interesting and important, as the uncertainty on the actual reasons and interactions behind sick leave rates and the magnitude of potential economic benefits is large. The investment period is 20 years.

3.3. Estimation of the Economic Benefits of the Investment with Real Option Analysis

In the following analysis, the economic benefits and pay-off of the IAQ investment are analyzed with ROA. The focus is on analyzing the benefits of better IAQ through increasing the ventilation rates. The examination of economic benefits related to the option to wait and optimal timing of the investment is outside the scope of this study. The measure for the economic benefits of the investment is the savings from reduces personnel sick leaves during investment life-cycle. Sick leave is selected as a measure based on the evidence from earlier literature on the positive association between higher ventilation rates and sick leave rates. Moreover, in this case, the reduction of sick leaves is a high priority for the tenant and sick leave data availability is better than, for example, personnel productivity data. The cash flow scenarios required for calculating the real options value (i.e., the value of the economic benefits of the investments) are drawn from the tenant, building and research information available.

The research process,

i.e., valuation of the potential economic benefits of the investment proceeded in seven steps:

- 1)

Documenting the current state of tenants’ personnel sick leave rate and annual costs and estimating yearly personnel reduction/growth (i.e., the percentage of personnel per year) and the distribution of the sick leave rate during the investment period;

- 2)

Assessing the potential effect of increased ventilation rates on sick leave rate based on the findings from earlier literature and expert workshop;

- 3)

Comprising three different scenarios of annual sick leave rate reductions by connecting the findings from phases 1 and 2;

- 4)

Converting the scenarios into potential the cost savings scenarios achievable with increased ventilation rates;

- 5)

Calculating the real option value of the economic benefits using the potential cost saving scenarios;

- 6)

Calculating the costs of investments;

- 7)

Calculating investment pay-off, i.e., real option pay-off for the investment by converting the cost savings scenarios to net pay-off scenarios by taking account the costs of investments.

Besides the potential connection between ventilation rates and sick leave, the magnitude of cost savings from reduced sick leave depends particularly on the level of the tenants’ sick leave rate in the beginning of the investment period and the anticipated development during the investment period, as well as the estimated number of employees during the investment period. Therefore, the first step of the quantitative analysis was to document the current situation of personnel and sick leave rates in the tenant organization. Currently, the tenant has 286 employees, mainly basic healthcare nurses and physicians, who will transfer to work in the new building in 2016. The sick leave rate is 12.4 days per employee per year, and the total annual cost of the organization’s entire sick leave is 1,064,000 euros for the city assuming that the total cost of a sick leave day for a municipal employee is 300 euros in accordance with the recommendation of the Ministry of Finance in Finland [

32]. To estimate the distribution of sick leave rate during the investment period, the standard deviation of the annual sick leave rate (0.504 percentage points) was calculated based on city’s sick leave rate data available in 2005–2013. The standard deviation was used in scenario formulation to assess and account for the natural variation in the sick leave rate. In addition, the tenant organization’s number of personnel development during 2014–2035 was modeled according to the estimated increase in demand for health care services in the region. The estimation of the demand for health care services was based on a demographic model on Järvenpää region population growth and change in age structure, which in this case both have a significant positive impact on the demand for health care services. Following that, the increase in the number of tenants’ employees was estimated to increase in proportion to the expected increase in demand for healthcare services. The number of employees is estimated to increase from 286 to 355 employees by 2035.

In the second step of the research process, earlier literature was reviewed to find evidence-based inputs on the magnitude of the potential effect of ventilation rates on occupant sick leaves for the estimation of the economic benefits.

Table 4 presents a summary of the earlier studies that address the link between ventilation rates and sick leaves. The recently emerged literature contains very little evidence on how ventilation rates affect sick leave rate. The studies focus on analyzing and comparing the sick leave rates of office workers in independently ventilated facilities and different working spaces, and in schools. Earlier studies that examine the topic in healthcare settings were not found. However, the relevance of the findings in office buildings for this case study is relatively high as office space and appointment rooms represent nearly 50% of the gross area of the new healthcare building [

25].

In a path-breaking study, Milton

et al. [

4] examine the possible link between occupant short-term sick leave and increased ventilation rates. The authors use poisson regression to analyze 1994 sick leaves for 3720 hourly office workers of a company located in Massachusetts USA, in 40 buildings with 115 independently ventilated work areas. The study documented that short-term sick leave rates were reduced by 35% at an outside air ventilation rate of 24 L/s/person compared to 12 L/s/person. According to Milton

et al. [

4], there are two likely mechanisms for a causal association of ventilation with sick leaves,

i.e., irritant and allergic reactions, or increased respiratory illness due to either airborne spread of infection or an increase in susceptibility. The reduction in sick leave rates associated with increased ventilation is similar to the reduction in sick leave observed during the flu season with influenza vaccination of a healthy population. Fisk

et al. [

3] estimate that doubling the outdoor air supply rate can reduce sick leave prevalence by 10% in open plan offices or when the air is recirculated within the office building. The study uses published field data and a theoretical model of airborne transmission of respiratory infections, and studies in which sick leave or short-term illness were the outcomes.

Table 4.

Earlier studies on ventilation rates and sick leaves.

Table 4.

Earlier studies on ventilation rates and sick leaves.

| Study/Authors | Method | Country | Property type | Ventilation rate in studied facilities High/Low, L/s/person | Reported %/L/s/person Difference in annual sick leave rate, +/− |

|---|

| Milton et al. [4] | Empirical case study | USA | Office | 24/12 | −35 (−2.9) |

| Myatt [33] | Empirical case study | USA | Office | 45/40 | 0 (0) |

| Mendell et al. [7] | Empirical case study | USA | School | 20/2 | −1 to −1.5 |

| Fisk et al. [3] | Empirical analysis and theoretical modeling | USA | Open plan office | – | – |

| Saari et al. [5] | Simulation | Finland | Cell office | 45.2/28.6 | −32.7(−2.0) |

| Open plan office | 27.8/12.4 | −43.6 (−2.8) |

| Fisk et al. [1] | Theoretical estimation | USA | Office | 24/12 | −2.9 |

Recently, Mendell

et al. [

7] examined the impact of classroom ventilation rates and illness absence in 28 elementary schools in California, USA. The results suggest that the absence rate is lower in the facilities with higher ventilation rates. In effect, a 1 L/s/person increase in ventilation rate in the range of 2–20 L/s/person is associated with a 1.0%–1.5% decrease in annual illness absences. The associations found between ventilation rates and illness absence is fairly consistent across school districts, climate zones, and ventilation types.

Myatt

et al. [

33] investigate whether a positive association exists between very high ventilation rates and sick leaves. The case study was executed in two office buildings occupied by Polaroid Corporation’s workers and located in Boston, USA. The authors did not find a consistent positive relationship between sick leave and the ventilation rate difference between 40 L/s/person and 45 L/s/person [

33]. This finding is backed by a recent review of scientific literature through 2005 on the effects of ventilation rates on health by Sundell

et al. [

6] and an international expert panel. Higher ventilation rates, up to about 25 L/s/person, are associated with reduced prevalence of short-term sick leaves, sick building syndrome symptoms, inflammation, respiratory infections, asthma symptoms compared to lower ventilation rates [

6].

The results from very few earlier studies suggest that a positive association would seem to exist between higher ventilation rates and lower sick leave rates. Based on the only previous study [

3] that uses both empirical data and theoretical modeling it seems that doubling the ventilation rates reduces the sick leave rate by 10%, which is considered to be the best estimate of the relationship between ventilation rates and sick leave [

34]. Other earlier empirical studies have observed smaller (0%) and higher effects (35%). Most empirical observations for the positive association exist in the ventilation rate range of 12–24 L/s/person.

After the literature review, an expert workshop was organized to review the findings from earlier empirical studies to assess the tenant’s sick leave reduction potential of modifiable ventilation capacity in the new building. In the workshop, the reduction potential was assessed relative to the standard ventilation system in two phases. First, the expert group reviewed the tenant’s status and planned investments were benchmarked relative to the uncertain empirical findings from the literature. The preliminary expert observations on reduction potential were heuristically evaluated against recent findings concerning the state-of-the-art of IAQ problems in existing healthcare buildings in Finland. For example, the prevalence of severe IAQ problems in existing healthcare buildings is estimated to be 20%–26% of total room space and recently 23% of all healthcare employees in Finland reported smell of mold in their workplace in a national survey [

24]. In addition, based on collected clinical experiences of physicians in Finland, the emergence of IAQ problems in a building is anticipated to result in a 50% increase in short-term sick leave for user organizations [

24]. However, direct numerical comparison of the Järvenpää case to benchmark municipalities in Finland was not possible as there are no earlier publications, databases or even standardized measures currently available concerning sick leaves, ventilation rates and construction projects of the public sector in Finland. Second, the experts were asked to estimate the sick leave reduction potential in three scenarios: minimum, best guess and maximum. Following that, an average of expert estimation was calculated to derive the values for reduction potential in minimum, best guess and maximum scenarios. Consequently, three scenarios were established for the reduction of tenant organization’s sick leaves during 2016–2035 by the expert group, which consisted of two leading IAQ experts in Finland and five construction management professionals. After the workshop, the scenarios were reviewed and validated in a meeting of the healthcare construction project’s steering group, which comprises the management team of the tenant organization and investor representatives.

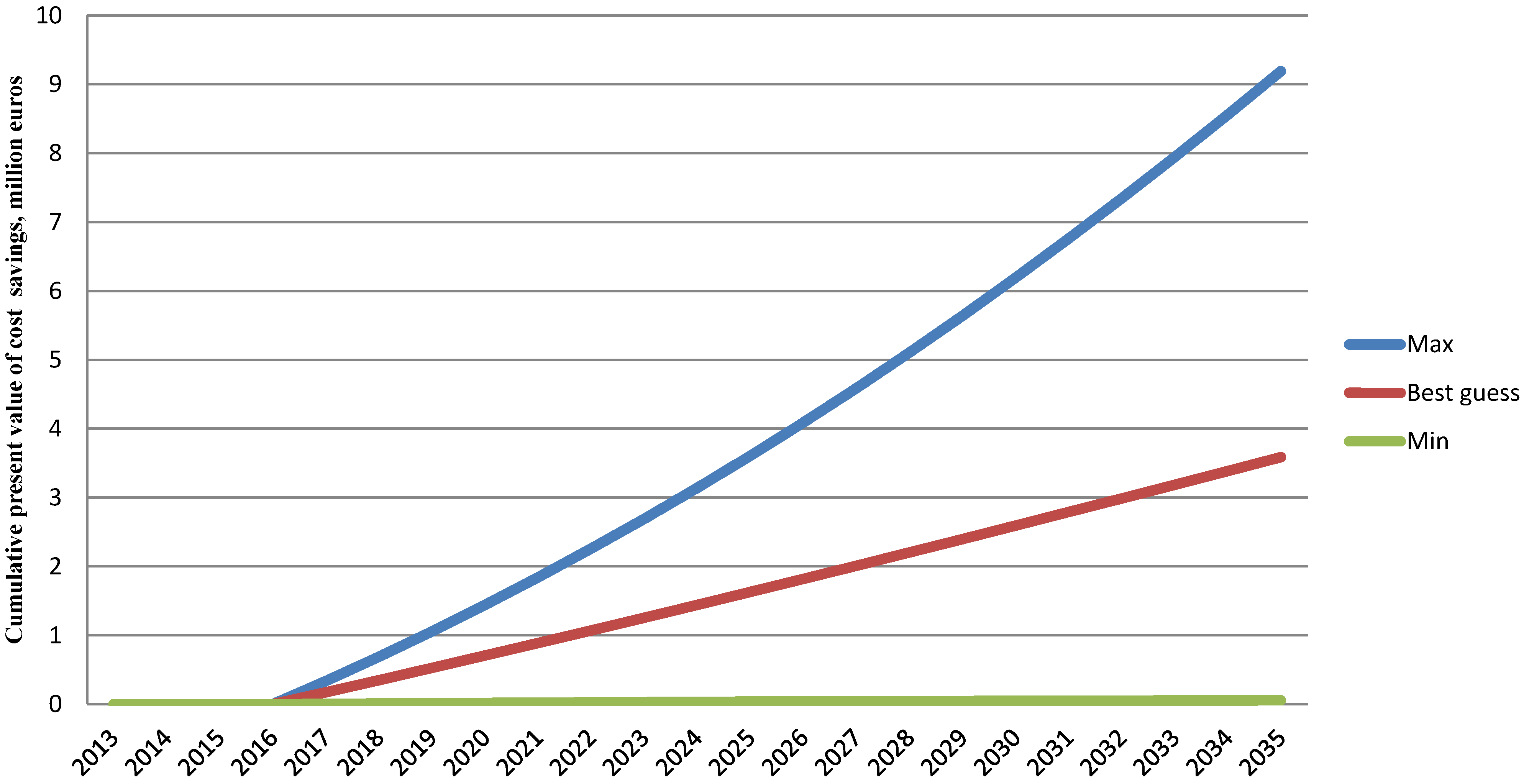

The three validated scenarios and the respective cumulative present value of the cost savings for ROA are illustrated in

Figure 2. In the expert evaluation scenarios, modifiable ventilation capacity’s reduction potential in the tenant’s annual sick leave rate was estimated relative to the standard design of the building (15 L/s/person). In the case of the standard design, ventilation rates were assumed not to have an effect on the development of sick leave rate. In the best guess scenario, the reduction potential is 15% compared to the standard design starting from the year 2017. In the minimum scenario (min), the reduction potential is 0.5%. In the maximum scenario (max), the reduction potential in sick leave rate reaches 25% annually. The distribution of the three scenarios reflects the uncertainty in reduction potential taking into account the possible future events that the sick leave reduction may turn out to be virtually non-existent or considerable. The maximum and best guess scenarios are optimistic in comparison to the expected reduction potential (less than 10%) for the range of 15–24 L/s/person implied by earlier studies [

3]. However, the sick leave reduction potential in all scenarios is below reduction potential implied by highest empirical observation (2.9 L/s/person and a total 26.1% for the range of 15–24 L/s/person [

4]) of earlier empirical studies. Moreover, in this case it could be that a considerable increase in ventilation rates may have a larger than expected effect on sick leave due to the low level of ventilation rates (8 L/s/person) in the present facilities.

Figure 2.

Present value of cumulative cost savings in three scenarios (max, best guess, min).

Figure 2.

Present value of cumulative cost savings in three scenarios (max, best guess, min).

The key input parameters for scenarios are described in

Table 5. All expert evaluation scenarios take into account the tenant sick leave rate variability, estimated growth in the number of employees and the increase in healthcare personnel costs of 2.9% per year according to the official price index for Finnish municipalities’ healthcare costs [

35]. In terms of tenant sick leave rate natural variability, the minimum scenario has a negative trend and the maximum scenario a positive trend for sick leave rate development due to other factors than ventilation rates. The discount rate is 3% in all scenarios, which is equivalent to the cost of financing for the tenant organization.

Table 5.

Key input parameters for three scenarios.

Table 5.

Key input parameters for three scenarios.

| Scenario | Min | Best guess | Max | Source |

|---|

| Tenant’s current sick leave rate (days per employee per year) | 12.4 | 12.4 | 12.4 | City of Järvenpää [26] |

| Estimated reduction in tenant’s annual sick leave rate due to increase in ventilation rates (% ) | 0.5 | 15.0 | 25.0 | Literature review and expert workshop |

| Annual natural variation in tenant’s sick leave rate due to other factors (percentage points) | −0.504 | 0 | +0.504 | City of Järvenpää [26], authors calculations |

| Cost of sick leave day (eur) | 300 | 300 | 300 | Ministry of Finance [32] |

| Total increase in the number of tenant’s employees during investment period | 69 | 69 | 69 | City of Järvenpää, project feasibility study [30] |

| Annual increase in healthcare personnel costs (%) | 2.9 | 2.9 | 2.9 | Finnish Local and Regional Authorities [35] |

| Discount rate (%) | 3 | 3 | 3 | City of Järvenpää |

3.4. Real Option Value of Economic Benefits of the Indoor Air Quality Investment

The input parameters for fuzzy pay-off method (FPOM) calculation are the cumulative present values of the three scenarios, which are 9,191,332 (max), 3,585,374 (best guess) and 55,198 (min), depicted in

Figure 2 and representing the triangular pay-off distribution for the investment. In this case, the whole pay-off distribution is above zero and thus the formula

is applied. When the formula is applied to the input parameters, the real option value of 3, 931,338 euros is calculated. As the level of IAQ improves through an increase in ventilation rate from 15 to 24 L/s/person, it reduces the number of short-term sick leaves, which results in considerable cost savings to the tenant. The value represents the total value of these cost savings to the tenant under uncertainty during the whole investment period. However, the result is indicative only due to the extent of incomplete information on sick leave and ventilation rates in health care settings.

The cost savings are considerable from the tenant’s perspective totaling a present value of 291.2 euros per SQM for the 20-year investment period. Moreover, the cost savings are substantial (19.6%) relative to the tenant’s annual budget (20 Meur) and reach 13,746 eur per employee. The comparison of the cost savings relative to the rent level reveals interesting information to the tenant. The discounted 20-year gross rent level in the new building is 22.72 eur/SQM/month. The gross rent calculation takes into account the capital costs, maintenance costs including the ventilation investment costs of presented in

Section 3.5, the retrofit cost of physical deterioration of the building and fixtures, investor yield target of 5.5%, and a discount rate of 3%. On the other hand, the real option value eur/SQM/month is 1.21 for the 20-year period. From the tenant’s perspective, this means that the economic benefits related to better IAQ represent 5.3% of the gross rent in the new building.

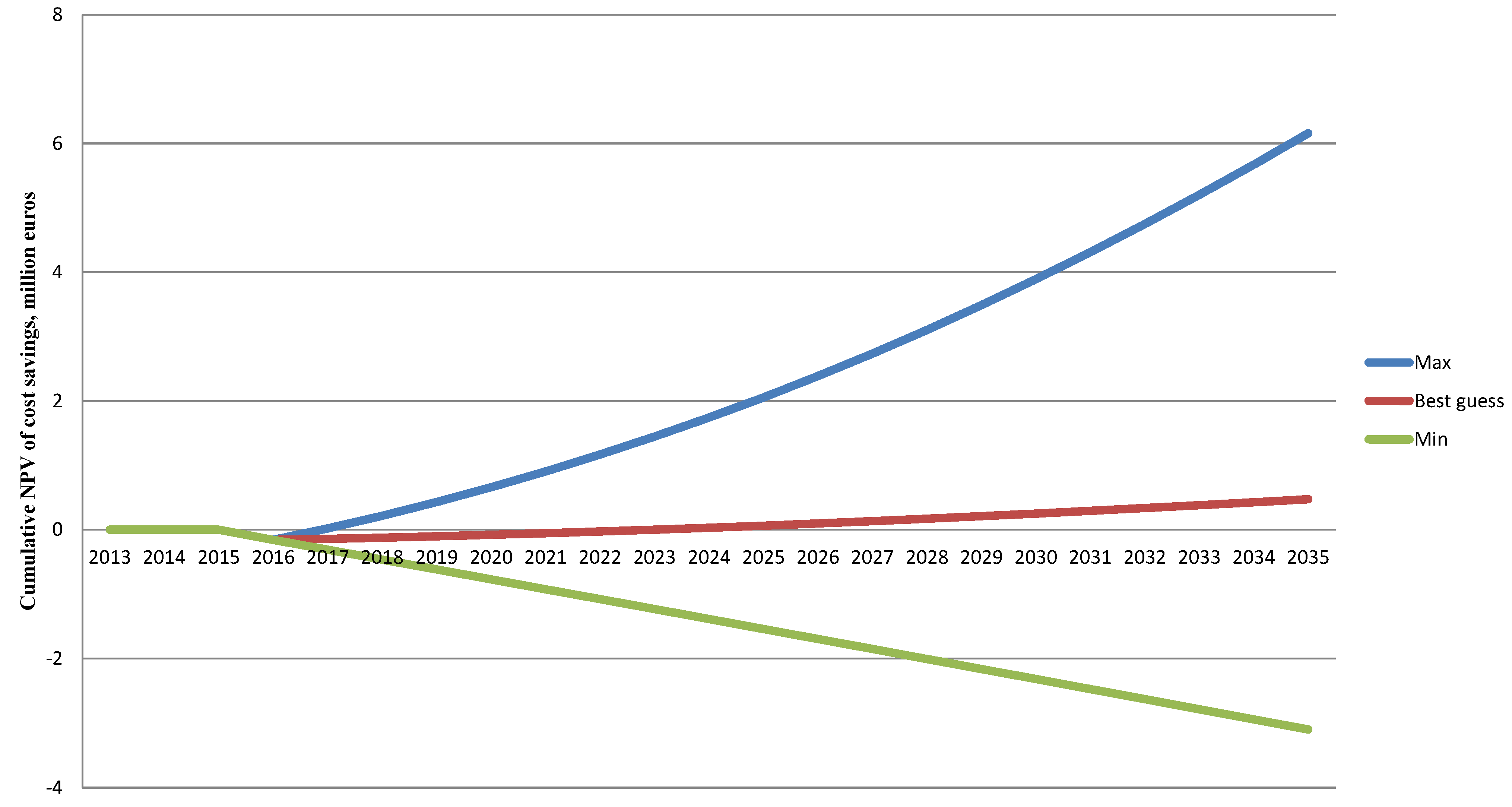

3.6. Real Option Pay-Off of the Indoor Air Quality Investment

In this section, the economic benefits of modifiable ventilation capacity are compared to the costs of the ventilation system,

i.e., standard system and modifiable ventilation capacity. The real option pay-off of the IAQ investment is analyzed by incorporating the investment and maintenance costs in

Table 6 and

Table 7 to the three scenarios presented in

Figure 2. In the analysis, the investment in the standard ventilation system with the embedded modifiability option is completed by the end of 2015 with the deployment of the new building, and additional capacity is implemented after one year of deployment at the end of 2016. The three net pay-off scenarios are presented in

Figure 3.

Figure 3.

Net present value of net cumulative cost savings in three net pay-off scenarios (max, best guess, min).

Figure 3.

Net present value of net cumulative cost savings in three net pay-off scenarios (max, best guess, min).

The input parameters from the three net pay-off scenarios for FPOM calculation are presented in

Table 8. In this case, the pay-off distribution is partly above zero and thus the formula

is applied. When the formula is applied to the input parameters, a real option pay-off of 599,544 euros is calculated.

Table 8.

Real option pay-off of the IAQ investment.

Table 8.

Real option pay-off of the IAQ investment.

| Investment pay-off | Value | Metrics |

|---|

| Max scenario | 6,157,970 | eur |

| Best guess scenario | 472,251 | eur |

| Min scenario | −3,103,810 | eur |

| Real option pay-off | 599,544 | eur |

The positive real option pay-off means that the pay-off of the investment is positive and the investment is profitable. The total pay-off per SQM for the investment period is 44.4 euros. In the best guess scenario, the NPV is 0.15 eur/SQM/month and 1.90 in the maximum scenario. However, in the minimum scenario, the pay-off is negative at −0.96 eur/SQM/month.

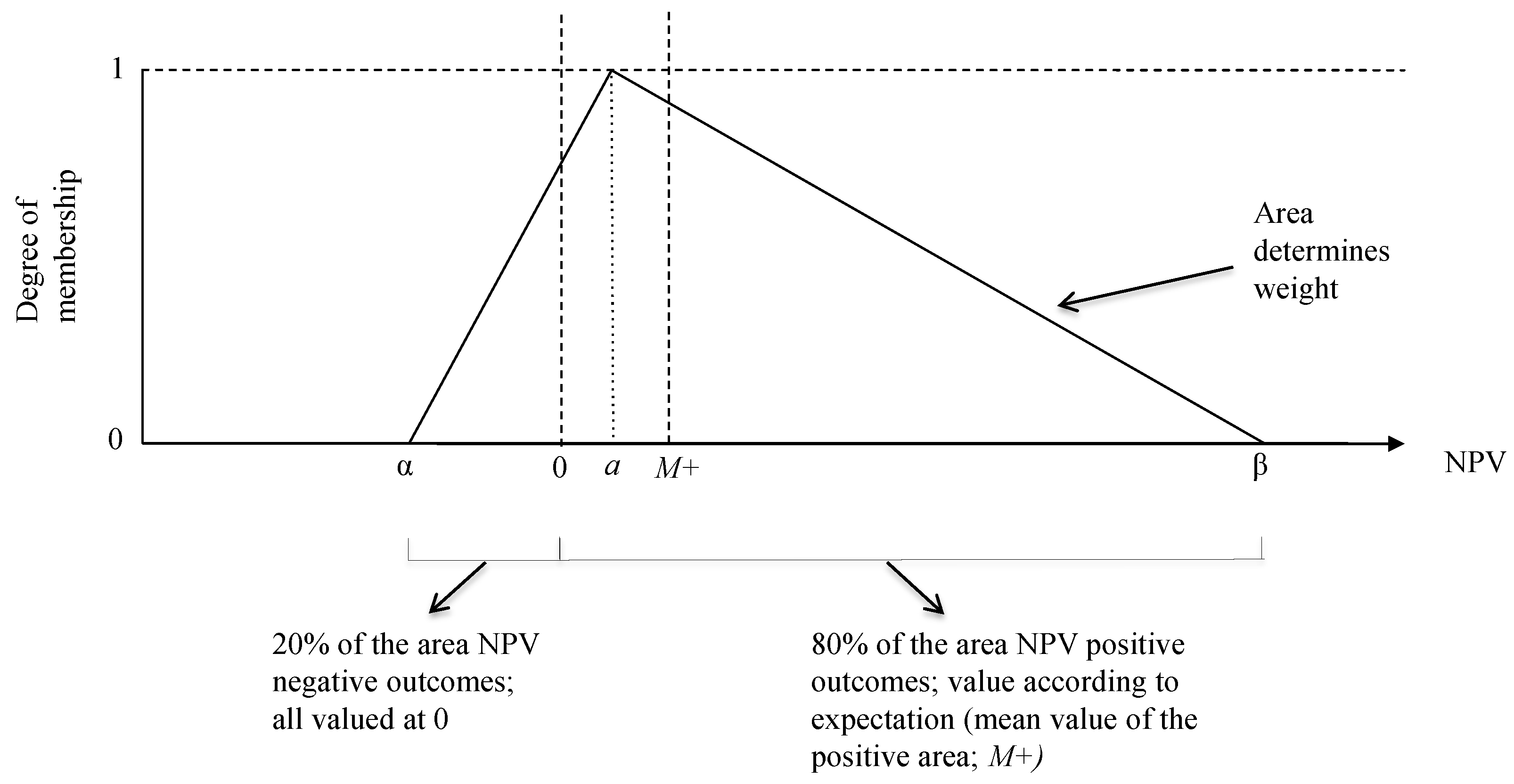

In addition, the tenant and investor could further evaluate the attractiveness of the investment compared to other investment alternatives by computing the success ratio of the investment, which is for illustration purposes presented in

Table 9. The success ratio is calculated by dividing the negative area of the pay-off triangle by the positive area of the pay-off triangle [

22]. The success ratio (in this case 71%) is a measure of the uncertainty on reaching a positive pay-off. The higher the number, the lower the uncertainty on reaching a positive investment pay-off.

Table 9.

Success ratio of the IAQ investment.

Table 9.

Success ratio of the IAQ investment.

| Calculation | Value | Metrics |

|---|

| Positive area of the pay-off triangle | 3,283,928 | eur |

| Negative area the pay-off triangle | 1,346,962 | eur |

| Success ratio | 71 | % |