Optimal Decision in a Dual-Channel Supply Chain under Potential Information Leakage

Abstract

:1. Introduction

- (1)

- Should the retailer invest in demand information acquisition?

- (2)

- Faced with the strategic supplier and retailer, what is the optimal strategy in dual-channel supply chain?

- (3)

- To the retailer, how to strategically share demand information with the supplier?

- (4)

- To the supplier, what is the credible information revelation mechanism?

2. The Model

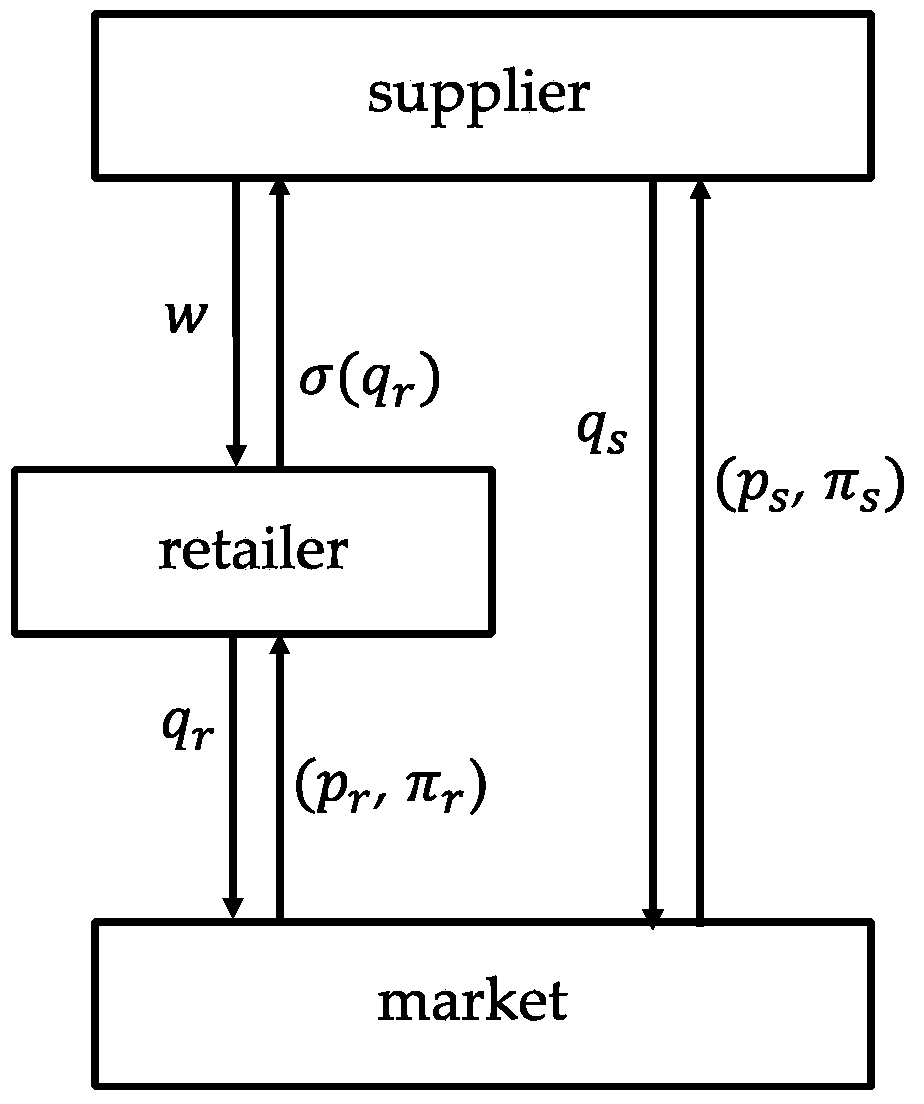

2.1. Dual-Channel Supply Chain Structure

2.2. Optimal Strategy under Potential Information Leakage

2.3. Conditions for the Retailer to Conduct Market Research

3. Numerical Examples

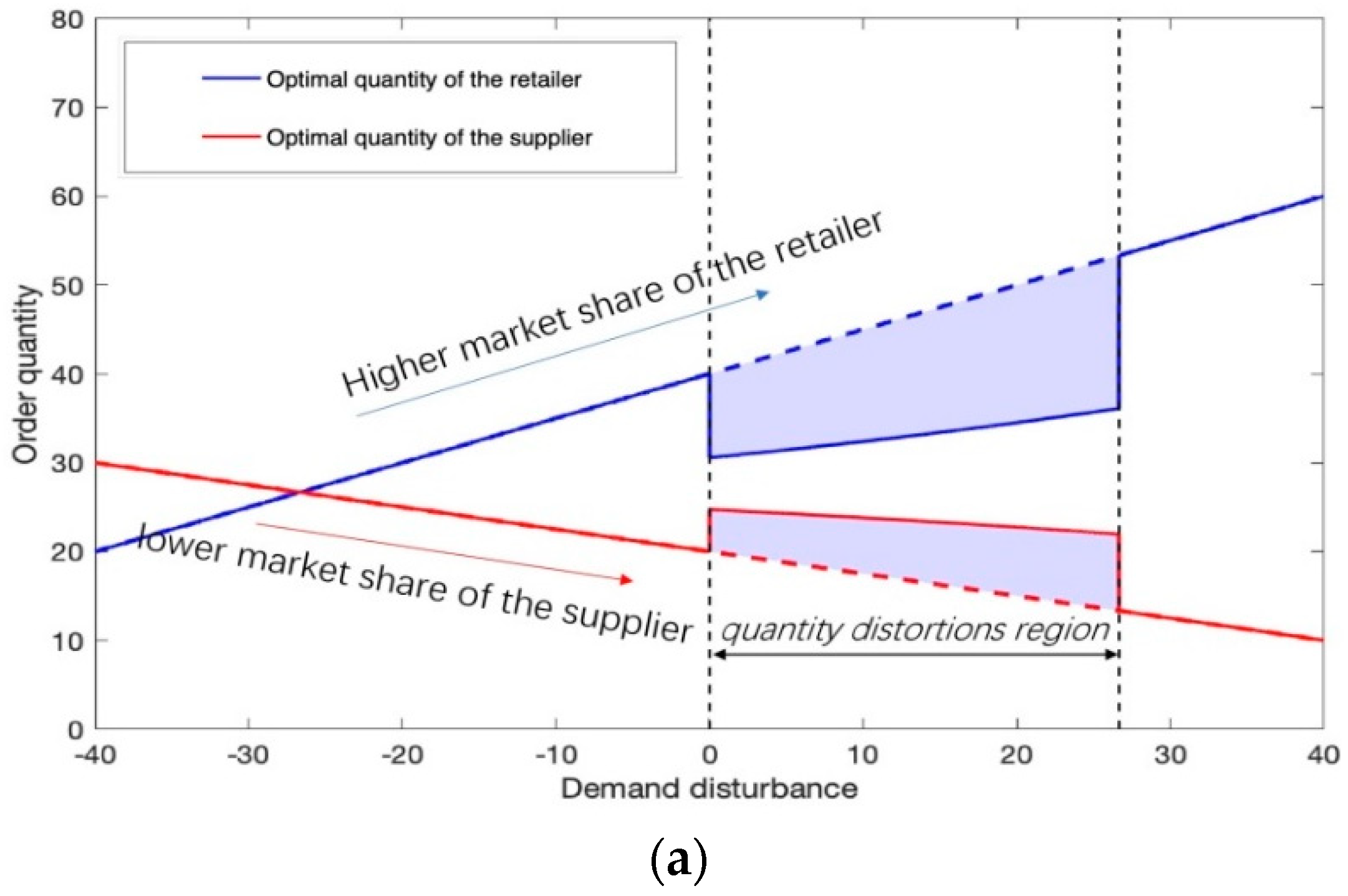

3.1. Optimal Decision with Uniform Distribution of Demand Disturbance

3.2. Impact of Adverse Selection Behavior on the Optimal Quantity

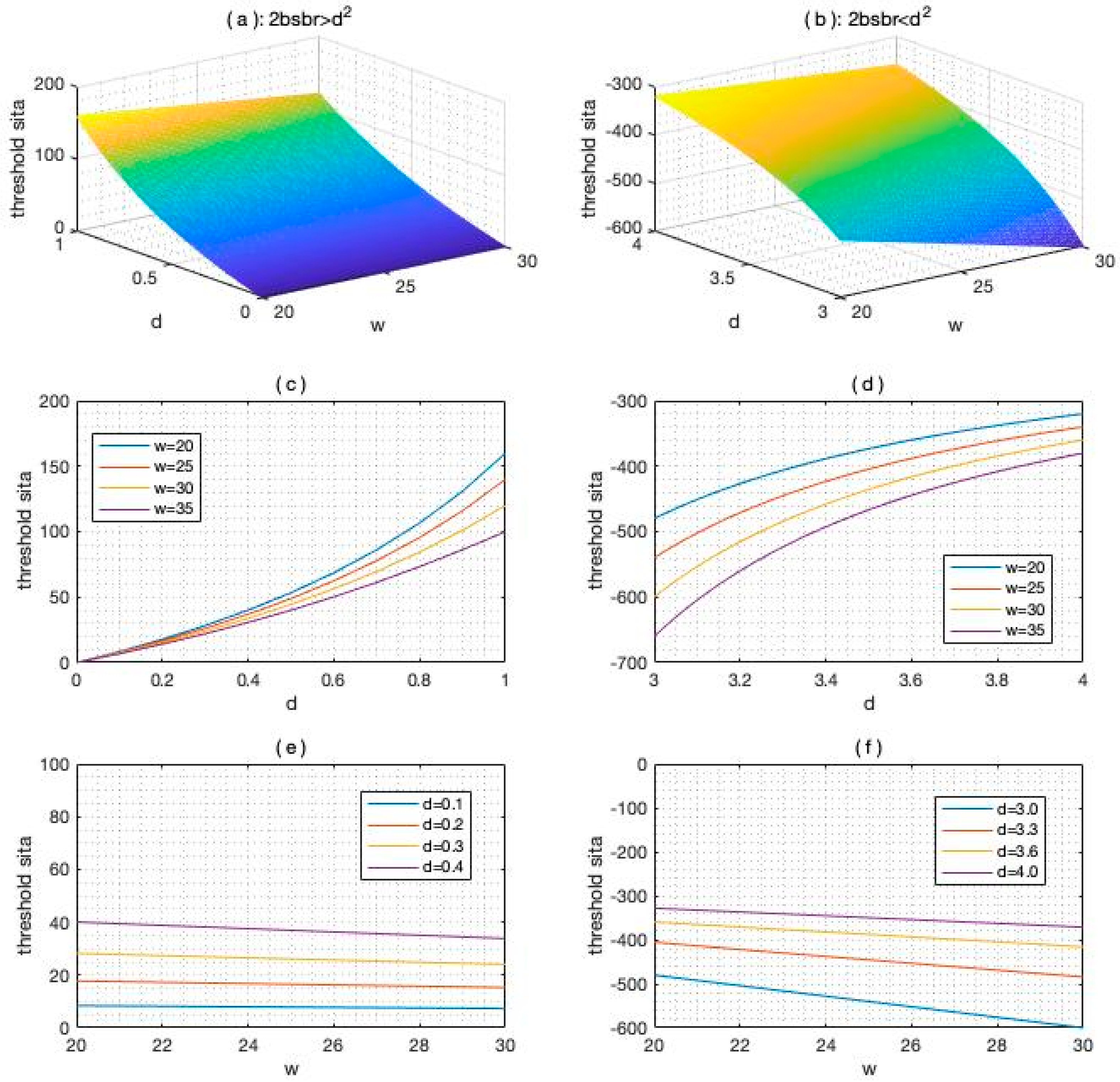

3.3. Impact of Product Heterogeneity and Wholesale Price on the Distortion Threshold

3.4. Discussion

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Cai, G. Channel Selection and Coordination in Dual-Channel Supply Chains. J. Retail. 2010, 86, 22–36. [Google Scholar] [CrossRef]

- Xiao, T.; Jing, S.; Chen, G. Price and leadtime competition, and coordination for make-to-order supply chains. Comput. Ind. Eng. 2014, 68, 23–34. [Google Scholar] [CrossRef]

- Zhi, P.; Toombs, L.; Yan, R. How does the added new online channel impact the supporting advertising expenditure? J. Retail. Consum. Serv. 2014, 21, 229–238. [Google Scholar]

- Lei, M.; Liu, H.; Deng, H.; Huang, T.; Leong, G.K. Demand information sharing and channel choice in a dual-channel supply chain with multiple retailers. Int. J. Prod. Res. 2014, 52, 6792–6818. [Google Scholar] [CrossRef]

- Anand, K.S.; Goyal, M. Strategic Information Management under Leakage in a Supply Chain. Manag. Sci. 2009, 55, 438–452. [Google Scholar] [CrossRef]

- Kong, G.; Rajagopalan, S.; Zhang, H. Revenue Sharing and Information Leakage in a Supply Chain. Manag. Sci. 2013, 59, 556–572. [Google Scholar] [CrossRef]

- Lee, H.L.; So, K.C.; Tang, C.S. The Value of Information Sharing in a Two-Level Supply Chain. Manag. Sci. 2000, 46, 626–643. [Google Scholar] [CrossRef]

- Lin, F.R.; Huang, S.; Lin, S. Effects of information sharing on supply chain performance in electronic commerce. IEEE Trans. Eng. Manag. 2002, 49, 258–268. [Google Scholar]

- Zhao, Y.; Simchilevi, D. The Value of Information Sharing in a Two-Stage Supply Chain with Production Capacity Constraints: The Infinite Horizon Case. Nav. Res. Logist. 2003, 50, 247–274. [Google Scholar] [CrossRef]

- Ganesh, M.; Raghunathan, S.; Rajendran, C. The value of information sharing in a multi-product supply chain with product substitution. IIE Trans. 2008, 40, 1124–1140. [Google Scholar] [CrossRef]

- Wakolbinger, T.; Cruz, J.M. Supply chain disruption risk management through strategic information acquisition and sharing and risk-sharing contracts. Int. J. Prod. Res. 2011, 49, 4063–4084. [Google Scholar] [CrossRef]

- Zhu, X. Outsourcing management under various demand Information Sharing scenarios. Ann. Oper. Res. 2017, 257, 449–467. [Google Scholar] [CrossRef]

- Rached, M.; Bahroun, Z.; Campagne, J.P. Decentralized decision-making with information sharing vs. centralized decision-making in supply chains. Int. J. Prod. Res. 2016, 54, 7274–7295. [Google Scholar] [CrossRef]

- Cao, E.; Ma, Y.; Wan, C.; Lai, M. Contracting with asymmetric cost information in a dual-channel supply chain. Oper. Res. Lett. 2013, 41, 410–414. [Google Scholar] [CrossRef]

- Li, Q.; Li, B.; Chen, P.; Hou, P. Dual-channel supply chain decisions under asymmetric information with a risk-averse retailer. Ann. Oper. Res. 2017, 257, 423–447. [Google Scholar] [CrossRef]

- Li, B.; Chen, P.; Li, Q.; Wang, W. Dual-channel supply chain pricing decisions with a risk-averse retailer. Int. J. Prod. Res. 2014, 52, 7132–7147. [Google Scholar] [CrossRef]

- Li, T.; Ma, J. Complexity analysis of the dual-channel supply chain model with delay decision. Nonlinear Dyn. 2014, 78, 2617–2626. [Google Scholar] [CrossRef]

- Chiang, W.Y.K.; Chhajed, D.; Hess, J.D. Direct Marketing, Indirect Profits: A Strategic Analysis of Dual-Channel Supply-Chain Design. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef] [Green Version]

- Sun, Y.; Liang, X.; Li, X.; Zhang, C. A Fuzzy Programming Method for Modeling Demand Uncertainty in the Capacitated Road–Rail Multimodal Routing Problem with Time Windows. Symmetry 2019, 11, 91. [Google Scholar] [CrossRef]

- Cai, G.; Zhe, G.Z.; Zhang, M. Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. Int. J. Prod. Econ. 2009, 117, 80–96. [Google Scholar] [CrossRef]

- Song, H.; Chao, Y.; Hui, L. Pricing and production decisions in a dual-channel supply chain when production costs are disrupted. Econ. Model. 2013, 30, 521–538. [Google Scholar]

- Song, Z.; He, S.; An, B. Decision and Coordination in a Dual-Channel Three-Layered Green Supply Chain. Symmetry 2018, 10, 549. [Google Scholar] [CrossRef]

- Yue, X.; Liu, J. Demand forecast sharing in a dual-channel supply chain. Eur. J. Oper. Res. 2006, 174, 646–667. [Google Scholar] [CrossRef]

- Yan, R.; Pei, Z. Incentive-Compatible Information Sharing by Dual-Channel Retailers. Int. J. Electron. Commer. 2012, 17, 127–157. [Google Scholar] [CrossRef]

- Hua, G.; Wang, S.; Chengc, T.C.E. Price and lead time decisions in dual-channel supply chains. Eur. J. Oper. Res. 2010, 205, 113–126. [Google Scholar] [CrossRef]

- Chen, J.; Liang, L.; Yao, D.Q.; Sun, S. Price and quality decisions in dual-channel supply chains. Eur. J. Oper. Res. 2016, 259, 935–948. [Google Scholar] [CrossRef]

- He, Y.; Song, H.; Zhang, P. Optimal Selling Strategy in Dual-Channel Supply Chains. In LISS 2012; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Chiangab, W.Y.K. Managing inventories in a two-echelon dual-channel supply chain. Eur. J. Oper. Res. 2005, 162, 325–341. [Google Scholar] [CrossRef]

- Cao, E. Coordination of dual-channel supply chains under demand disruptions management decisions. Int. J. Prod. Res. 2014, 52, 7114–7131. [Google Scholar] [CrossRef]

- Amrouche, N.; Yan, R. A manufacturer distribution issue: How to manage an online and a traditional retailer. Ann. Oper. Res. 2015, 244, 1–38. [Google Scholar] [CrossRef]

- Mahootchi, M. Investigating replenishment policies for centralized and decentralized supply chains using stochastic programming approach. Int. J. Prod. Res. 2015, 53, 41–69. [Google Scholar]

| Information Value | ||||

|---|---|---|---|---|

| −17.7201 | 31.1399 | 208.9 | 91.2 | 117.7507 |

| −1.1699 | 39.4151 | 753.7 | 753.2 | 0.5132 |

| 0 | 40.0000 | 800.0 | 800.0 | 0 |

| 3.7505 | 31.2141 | 878.5 | 950.0 | −71.5472 |

| 10.5887 | 32.5023 | 1116.0 | 1223.5 | −107.4981 |

| 25.1779 | 35.7372 | 1690.7 | 1807.1 | −116.4126 |

| 80/3 (26.6667) | 53.3333 | 1866.7 | 1866.7 | 0 |

| 33.0701 | 56.5350 | 2532.9 | 2122.8 | 410.1118 |

| 37.1911 | 58.5956 | 2806.3 | 2287.6 | 518.6917 |

| Notations | Mathematical Expression | Definition | Mathematical Expression |

|---|---|---|---|

| 0 | |||

| 0 | |||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang, D.; Ren, Q. Optimal Decision in a Dual-Channel Supply Chain under Potential Information Leakage. Symmetry 2019, 11, 308. https://doi.org/10.3390/sym11030308

Fang D, Ren Q. Optimal Decision in a Dual-Channel Supply Chain under Potential Information Leakage. Symmetry. 2019; 11(3):308. https://doi.org/10.3390/sym11030308

Chicago/Turabian StyleFang, Debin, and Qiyu Ren. 2019. "Optimal Decision in a Dual-Channel Supply Chain under Potential Information Leakage" Symmetry 11, no. 3: 308. https://doi.org/10.3390/sym11030308