A New Model for Stock Management in Order to Rationalize Costs: ABC-FUCOM-Interval Rough CoCoSo Model

Abstract

:1. Introduction

2. Literature Review

3. Methods

3.1. ABC Analysis

3.2. Full Consistency Method FUCOM

3.3. A New MCDM Model—Interval Rough CoCoSo Approach

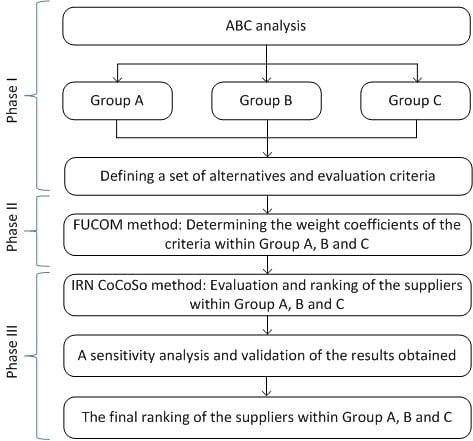

4. Case Study

4.1. Application of ABC Analysis for Product Classification

4.2. Calculation of the Criterion Weights Applying the FUCOM Method

- -

- Group A: ;

- -

- Group B: ; and

- -

- Group C: .

4.3. Evaluation of Suppliers Applying the Interval Rough CoCoSo Model

5. Validation of the Results through Sensitivity Analysis

- (1)

- Group A: Changes in the values of the most significant criterion C1 lead to the changes in the ranks of alternatives A1, A2, A4, A6, A7, and A8. The first-ranked alternative A3 and the fourth-ranked alternative A5 have maintained their positions across all 20 scenarios. Thus, we can conclude that the alternative A3 stands out as the best and has a sufficient advantage over the remaining alternatives. In addition, rank correlation analysis using Spearman’s correlation coefficient has confirmed that the rank changes of the above alternatives are minimal since the average value of the Group A correlation coefficient is 0.88. This value of the correlation coefficient shows that there is a high correlation of the obtained ranks with the initial rank from Table 3, i.e., the changes in the ranks are minimal. Thus, we can conclude that the rank obtained is confirmed and credible.

- (2)

- Group B: From Figure 6, we can see that changes in the value of criterion C1 lead to a change in the rank of the fourth-ranked and fifth-ranked alternatives, A3 and A6. The remaining alternatives have maintained their positions throughout all 20 scenarios. This shows us that alternatives A2 and A4 stand out as the best alternatives that have a sufficient advantage over the other alternatives. As with Group A, there is a high rank correlation here as well, which is confirmed by the mean of correlation coefficient in Group B (Group B = 0.97) which is extremely high.

- (3)

- Group C: Changes in the values of the C1 criterion in 20 scenarios lead to a change in the ranks of alternatives A2, A1, A3, and A4. At the same time, the remaining alternatives A7, A9, A8, A5, and A6 have maintained their rankings across all 20 scenarios. The best-ranked alternative A7 has remained the best-ranked alternative in all 20 scenarios, and we can conclude that the A7 alternative has a sufficient advantage over the remaining alternatives. The Spearman’s correlation coefficient (Group C = 0.91) shows that there is a high correlation between the obtained ranks and the initial rank from Table 7, which leads us to the conclusion that the rank obtained is confirmed and credible.

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Stojčić, M.; Pamučar, D.; Mahmutagić, E.; Stević, Ž. Development of an ANFIS Model for the Optimization of a Queuing System in Warehouses. Information 2018, 9, 240. [Google Scholar] [CrossRef] [Green Version]

- Ten, T.M.; Schmidt, T. Warehouse Management; Springer-Verlag: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

- Van den Berg, J.P.; Zijm, W.H. Models for warehouse management: Classification and examples. Int. J. Prod. Econ. 1999, 59, 519–528. [Google Scholar] [CrossRef]

- Flores, B.E.; Whybark, D.C. Multiple criteria ABC analysis. Int. J. Oper. Prod. Manag. 1986, 6, 38–46. [Google Scholar] [CrossRef]

- Flores, B.E.; Whybark, D.C. Implementing multiple criteria ABC analysis. J. Oper. Manag. 1987, 7, 79–85. [Google Scholar] [CrossRef]

- Flores, B.E.; Olson, D.L.; Dorai, V.K. Management of multicriteria inventory classification. Math. Comput. Model. 1992, 16, 71–82. [Google Scholar] [CrossRef]

- Guvenir, H.A.; Erel, E. Multicriteria inventory classification using a genetic algorithm. Eur. J. Oper. Res. 1998, 105, 29–37. [Google Scholar] [CrossRef] [Green Version]

- Malmborg, C.J.; Balachandran, S.; Kyle, D.M. A model based evaluation of a commonly used rule of thumb for warehouse layout. Appl. Math. Model. 1986, 10, 133–138. [Google Scholar] [CrossRef]

- Ramanathan, R. ABC inventory classification with multiple-criteria using weighted linear optimization. Comput. Oper. Res. 2006, 33, 695–700. [Google Scholar] [CrossRef]

- Fathoni, F.A.; Ridwan, A.Y.; Santosa, B. Development of Inventory Control Application for Pharmaceutical Product Using ABC-VED Cycle Counting Method to Increase Inventory Record Accuracy. In Proceedings of the 2018 International Conference on Industrial Enterprise and System Engineering (IcoIESE), Yogyakarta, Indonesia, 21–22 November 2018; Atlantis Press: Yogyakarta, Indonesia, 2019. [Google Scholar]

- Ishizaka, A.; Lolli, F.; Balugani, E.; Cavallieri, R.; Gamberini, R. DEASort: Assigning items with data envelopment analysis in ABC classes. Int. J. Prod. Econ. 2018, 199, 7–15. [Google Scholar] [CrossRef] [Green Version]

- Cherif, H.; Ladhari, T. A New Hybrid Multi-criteria ABC Inventory Classification Model Based on Differential Evolution and Topsis. In Proceedings of the International Conference on Hybrid Intelligent Systems, Marrakech, Morocco, 21–23 November 2016; Springer: Cham, Switzerland, 2016; pp. 78–87. [Google Scholar]

- Oliveira, F.; Vaz, C.B. Spare parts inventory management using quantitative and qualitative classification. In Engineering Systems and Networks; Springer: Cham, Switzerland, 2017; pp. 233–241. [Google Scholar]

- Arikan, F.; Citak, S. Multiple criteria inventory classification in an electronics firm. Int. J. Inf. Technol. Decis. Mak. 2017, 16, 315–331. [Google Scholar] [CrossRef]

- Hanafi, R.; Mardin, F.; Asmal, S.; Setiawan, I.; Wijaya, S. Toward a green inventory controlling using the ABC classification analysis: A case of motorcycle spares parts shop. IOP Conf. Ser. Earth Environ. Sci. 2019, 343, 012012. [Google Scholar] [CrossRef]

- Aktepe, A.; Ersoz, S.; Turker, A.K.; Barisci, N.; Dalgic, A. An inventory classification approach combining expert systems, clustering, and fuzzy logic with the ABC method and an application. S. Afr. J. Ind. Eng. 2018, 29, 49–62. [Google Scholar] [CrossRef]

- Liu, J.; Liao, X.; Zhao, W.; Yang, N. A classification approach based on the outranking model for multiple criteria ABC analysis. Omega 2016, 61, 19–34. [Google Scholar] [CrossRef]

- Ng, W.L. A simple classifier for multiple criteria ABC analysis. Eur. J. Oper. Res. 2007, 177, 344–353. [Google Scholar] [CrossRef]

- Chen, Y.; Li, K.W.; Levy, J.; Hipel, K.W.; Kilgour, D.M. A rough set approach to multiple criteria ABC analysis. In Transactions on Rough Sets VIII; Springer: Berlin/Heidelberg, Germany, 2008; pp. 35–52. [Google Scholar]

- Gim, B.; Kim, J.W. Multi-criteria evaluation of hydrogen storage systems for automobiles in Korea using the fuzzy analytic hierarchy process. Int. J. Hydrogen Energy 2014, 39, 7852–7858. [Google Scholar] [CrossRef]

- Karmaker, C.; Saha, M. Optimization of warehouse location through fuzzy multi-criteria decision making methods. Decis. Sci. Lett. 2015, 4, 315–334. [Google Scholar] [CrossRef]

- Ashrafzadeh, M.; Rafiei, F.M.; Isfahani, N.M.; Zare, Z. Application of fuzzy TOPSIS method for the selection of warehouse location: A case study. Interdiscip. J. Cont. Res. Bus. 2012, 3, 655–671. [Google Scholar]

- Dey, B.; Bairagi, B.; Sarkar, B.; Sanyal, S.K. A hybrid fuzzy technique for the selection of warehouse location in a supply chain under a utopian environment. Int. J. Manag. Sci. Eng. Manag. 2013, 8, 250–261. [Google Scholar] [CrossRef]

- Chatterjee, K.; Kar, S. Pattern Recognition and Machine Intelligence: An Induced Fuzzy Rasch-VIKOR Model for Warehouse Location Evaluation under Risky Supply Chain; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Sezer, F.; Özkan, B.A.L.I.; Gürol, P. Hazardous materials warehouse selection as a multiple criteria decision making problem. J. Econ. Bibliog. 2016, 3, 63–73. [Google Scholar]

- Emeç, S.; Akkaya, G. Stochastic AHP and fuzzy VIKOR approach for warehouse location selection problem. J. Enterp. Inf. Manag. 2018, 31, 950–962. [Google Scholar] [CrossRef]

- Eko Saputro, T.; Daneshvar Rouyendegh, B. A hybrid approach for selecting material handling equipment in a warehouse. Int. J. Manag. Sci. Eng. Manag. 2016, 11, 34–48. [Google Scholar] [CrossRef] [Green Version]

- Erkan, T.E.; Can, G.F. Selecting the best warehouse data collecting system by using AHP and FAHP methods. Tech. Gaz. 2014, 21, 87–93. [Google Scholar]

- Pamučar, D.; Stević, Ž.; Sremac, S. A new model for determining weight coefficients of criteria in mcdm models: Full consistency method (fucom). Symmetry 2018, 10, 393. [Google Scholar] [CrossRef] [Green Version]

- Bozanic, D.; Tešić, D.; Kočić, J. Multi-criteria FUCOM–Fuzzy MABAC model for the selection of location for construction of single-span bailey bridge. Decis. Mak. Appl. Manag. Eng. 2019, 2, 132–146. [Google Scholar] [CrossRef]

- Durmić, E. Evaluation of criteria for sustainable supplier selection using FUCOM method. Oper. Res. Eng. Sci. Theor. Appl. 2019, 2, 91–107. [Google Scholar] [CrossRef]

- Puška, A.; Stojanović, I.; Maksimović, A. Evaluation of sustainable rural tourism potential in Brcko district of Bosnia and Herzegovina using multi-criteria analysis. Oper. Res. Eng. Sci. Theory Appl. 2019, 2, 40–54. [Google Scholar] [CrossRef]

- Fazlollahtabar, H.; Smailbašić, A.; Stević, Ž. FUCOM method in group decision-making: Selection of forklift in a warehouse. Decis. Mak. Appl. Manag. Eng. 2019, 2, 49–65. [Google Scholar] [CrossRef]

- Stević, Ž.; Durmić, E.; Gajić, M.; Pamučar, D.; Puška, A. A Novel Multi-Criteria Decision-Making Model: Interval Rough SAW Method for Sustainable Supplier Selection. Information 2019, 10, 292. [Google Scholar] [CrossRef] [Green Version]

- Karabasevic, D.; Popovic, G.; Stanujkic, D.; Maksimovic, M.; Sava, C. An approach for hotel type selection based on the single-valued intuitionistic fuzzy numbers. Int. Rev. 2019, 1-2, 7–14. [Google Scholar]

- Naeini, A.B.; Mosayebi, A.; Mohajerani, N. A hybrid model of competitive advantage based on Bourdieu capital theory and competitive intelligence using fuzzy Delphi and ism-gray Dematel (study of Iranian food industry). Int. Rev. 2019, 2, 21–35. [Google Scholar]

- Yazdani, M.; Zarate, P.; Kazimieras Zavadskas, E.; Turskis, Z. A Combined Compromise Solution (CoCoSo) method for multi-criteria decision-making problems. Manag. Decis. 2018, 57, 2501–2519. [Google Scholar] [CrossRef]

- Pamučar, D.; Stević, Ž.; Zavadskas, E.K. Integration of interval rough AHP and interval rough MABAC methods for evaluating university web pages. Appl. Soft Comput. 2018, 67, 141–163. [Google Scholar] [CrossRef]

- Shi, L.; Ye, J. Dombi aggregation operators of neutrosophic cubic sets for multiple attribute decision-making. Algorithms 2018, 11, 29. [Google Scholar]

- Store, R.; Kangas, J. Integrating spatial multi-criteria evaluation and expert knowledge for GIS-based habitat suitability modelling. Landsc. Urb. Plan. 2001, 55, 79–93. [Google Scholar] [CrossRef]

- Pamucar, D.; Chatterjee, K.; Zavadskas, E.K. Assessment of third-party logistics provider using multi-criteria decision-making approach based on interval rough numbers. Comput. Ind. Eng. 2019, 127, 383–407. [Google Scholar] [CrossRef]

- Ciavarella, M.; Carbone, G.; Vinogradov, V. A critical assessment of Kassapoglou’s statistical model for composites fatigue. Facta Univ. Ser. Mech. Eng. 2018, 16, 115–126. [Google Scholar] [CrossRef]

- Chatterjee, K.; Pamucar, D.; Zavadskas, E.K. Evaluating the performance of suppliers based on using the R’AMATEL-MAIRCA method for green supply chain implementation in electronics industry. J. Clean. Prod. 2018, 184, 101–129. [Google Scholar] [CrossRef]

- Pamucar, D.; Sremac, S.; Stević, Ž.; Ćirović, G.; Tomić, D. New multi-criteria LNN WASPAS model for evaluating the work of advisors in the transport of hazardous goods. Neural Comput. Appl. 2019, 31, 5045–5068. [Google Scholar] [CrossRef]

- Scholz-Reiter, B.; Heger, J.; Meinecke, C.; Bergmann, J. Integration of demand forecasts in ABC-XYZ analysis: Practical investigation at an industrial company. Int. J. Prod. Perform. Manag. 2012, 61, 445–451. [Google Scholar] [CrossRef] [Green Version]

- Pamucar, D.; Bozanic, D.; Lukovac, V.; Komazec, N. Normalized weighted geometric bonferroni mean operator of interval rough numbers—Application in interval rough DEMATEL-COPRAS. Facta Univ. Ser. Mech. Eng. 2018, 16, 171–191. [Google Scholar] [CrossRef]

| Number of Products | Annual Value of Procurement | Share in Costs | Cumulative | Group |

|---|---|---|---|---|

| 15 | 380,829.120 | 49.723% | 49.723% | A |

| 22 | 39,389.680 | 5.143% | 54.866% | A |

| 3 | 36,681.750 | 4.789% | 59.655% | A |

| 10 | 30,897.960 | 4.034% | 63.690% | A |

| ... | ||||

| 23 | 17,396.280 | 2.271% | 78.001% | B |

| 63 | 17,285.940 | 2.257% | 80.258% | B |

| 21 | 17,252.950 | 2.253% | 82.510% | B |

| 64 | 14,470.650 | 1.889% | 84.400% | B |

| 53 | 9079.900 | 1.186% | 85.585% | B |

| 38 | 7409.400 | 0.967% | 86.553% | B |

| ... | ||||

| 51 | 210.720 | 0.028% | 99.823% | C |

| 13 | 194.480 | 0.025% | 99.848% | C |

| 82 | 185.920 | 0.024% | 99.873% | C |

| 36 | 169.180 | 0.022% | 99.895% | C |

| 74 | 146.300 | 0.019% | 99.914% | C |

| 61 | 140.000 | 0.018% | 99.932% | C |

| 69 | 120.600 | 0.016% | 99.948% | C |

| 77 | 108.000 | 0.014% | 99.962% | C |

| 76 | 102.960 | 0.013% | 99.975% | C |

| 62 | 87.680 | 0.011% | 99.987% | C |

| 1 | 65.000 | 0.008% | 99.995% | C |

| 55 | 36.750 | 0.005% | 100.000% | C |

| SUM | 765,900.768 | 100.000% | ||

| Group A | |||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| A1 | (P;F), (P;F), (M;M) | (VG;VG), (G;VG), (M;M) | (G;VG), (M;G), (VG;VG) | (F;M), (G;G), (M;M) | (G;VG), (M;G), (G;G) | (VG;VG), (G;G), (G;VG) | (G;VG), (M;G), (M;M) | (G;VG), (F;M), (P;F) | (G;VG), (M;M), (F;M) |

| A2 | (G;VG), (M;G), (F;M) | (F;M), (P;F), (M;G) | (G;G), (M;G), (F;M) | (F;M), (M;G), (G;VG) | (M;G), (G;VG), (M;M) | (VG;VG), (G;G), (G;VG) | (G;VG), (M;G), (M;M) | (G;VG), (M;G), (F;M) | (G;VG), (VG;VG), (M;G) |

| A3 | (VG;VG), (G;VG), (G;G) | (M;G), (G;VG), (M;VG) | (M;G), (G;VG), (F;M) | (P;F), (F;M), (G;VG) | (G;VG), (M;G), (F;M) | (G;VG), (M;G), (G;VG) | (VG;VG), (G;G), (F;M) | (M;G), (G;G), (M;M) | (G;VG), (M;G), (G;G) |

| A4 | (M;G), (M;M), (G;G) | (F;M), (G;G), (F;M) | (VG;VG), (G;G), (G;VG) | (G;VG), (M;G), (M;G) | (G;VG), (M;G), (G;G) | (M;G), (G;VG), (VG;VG) | (G;VG), (M;M), (P;F) | (M;G), (G;VG), (M;VG) | (VG;VG), (G;G), (M;M) |

| A5 | (G;VG), (F;M), (M;G) | (P;P), (F;F), (M;G) | (M;G), (G;VG), (M;M) | (G;VG), (M;G), (G;VG) | (G;G), (M;VG), (VG;VG) | (M;G), (G;VG), (VG;VG) | (G;VG), (F;M), (M;G) | (G;G), (M;VG), (F;M) | (M;G), (VG;VG), (G;G) |

| A6 | (P;F), (F;F), (F;M) | (G;VG), (M;G), (G;G) | (M;G), (G;VG), (F;M) | (G;VG), (VG;VG), (M;M) | (M;M), (G;VG), (VG;VG) | (G;VG), (VG;VG), (M;G) | (G;G), (M;VG), (M;M) | (VG;VG), (M;M), (P;F) | (M;G), (VG;VG), (G;G) |

| A7 | (F;M), (F;M), (M;G) | (G;VG), (M;G), (F;M) | (F;M), (M;G), (VG;VG) | (G;VG), (M;G), (G;VG) | (F;M), (M;G), (G;VG) | (G;VG), (M;G), (VG;VG) | (G;VG), (M;VG), (M;G) | (M;M), (G;G), (F;M) | (VG;VG), (G;G), (F;M) |

| A8 | (G;G), (M;M), (G;VG) | (M;M), (G;G), (G;VG) | (G;VG), (M;M), (VG;VG) | (VG;VG), (G;G), (VG;VG) | (M;G), (G;VG), (VG;VG) | (G;VG), (M;G), (M;G) | (G;VG), (M;VG), (M;G) | (M;G), (G;VG), (M;M) | (G;VG), (M;G), (P;F) |

| Group B | |||||||||

| A1 | (M;M), (G;G), (M;M) | (G;G), (M;VG), (G;G) | (G;VG), (M;G), (G;VG) | (VG;VG), (G;G), (M;G) | (VG;VG), (G;G), (G;VG) | (M;G), (G;G), (M;VG) | (M;M), (G;G), (G;VG) | (G;VG), (M;G), (G;G) | (G;VG), (M;G), (VG;VG) |

| A2 | (G;VG), (M;G), (M;M) | (G;VG), (M;G), (F;M) | (G;VG), (VG;VG), (M;M) | (F;M), (M;G), (G;VG) | (M;G), (G;G), (G;VG) | (G;G), (VG;VG), (M;G) | (VG;VG), (G;G), (VG;VG) | (VG;VG), (M;G), (VG;VG) | (G;VG), (M;G), (G;G) |

| A3 | (VG;VG), (G;G), (M;G) | (G;VG), (M;G), (G;VG) | (F;M), (M;G), (F;M) | (M;G), (G;VG), (VG;VG) | (M;G), (G;G), (G;VG) | (F;M), (M;G), (G;VG) | (G;VG), (M;G), (G;G) | (F;M), (M;G), (G;G) | (G;VG), (M;M), (VG;VG) |

| A4 | (M;G), (G;VG), (M;G) | (G;VG), (M;M), (G;G) | (M;M), (G;G), (M;G) | (VG;VG), (M;G), (G;G) | (VG;VG), (G;G), (G;VG) | (M;G), (G;VG), (VG;VG) | (G;VG), (M;G), (VG;VG) | (M;G), (G;VG), (VG;VG) | (F;M), (M;M), (G;G) |

| A5 | (VG;VG), (G;G), (F;M) | (F;M), (M;G), (M;M) | (P;F), (F;M), (P;F) | (G;VG), (M;G), (G;G) | (G;VG), (M;M), (M;G) | (M;G), (G;VG), (VG;VG) | (M;G), (M;M), (VG;VG) | (M;G), (G;VG), (VG;VG) | (G;G), (M;G), (G;G) |

| A6 | (G;VG), (M;G), (M;VG) | (M;G), (G;VG), (VG;VG) | (M;G), (F;F), (P;P) | (M;G), (G;VG), (VG;VG) | (M;G), (F;M), (F;F) | (F;M), (M;G), (G;VG) | (G;VG), (M;G), (G;VG) | (G;VG), (M;G), (G;VG) | (G;VG), (G;G), (VG;VG) |

| Group C | |||||||||

| A1 | (G;VG), (M;G), (G;VG) | (G;VG), (M;G), (G;VG) | (G;VG), (M;G), (F;M) | (M;G), (F;M), (P;F) | (F;M), (P;F), (G;G) | (G;VG), (M;M), (M;M) | (F;M), (M;G), (G;VG) | (M;G), (F;M), (M;G) | (M;G), (F;M), (M;G) |

| A2 | (VG;VG), (G;G), (VG;VG) | (G;VG), (M;G), (F;M) | (G;VG), (M;G), (G;VG) | (M;G), (F;M), (M;G) | (VG;VG), (M;G), (VG;VG) | (F;M), (M;G), (M;G) | (M;G), (G;VG), (G;VG) | (P;F), (F;M), (P;M) | (G;VG), (M;G), (G;VG) |

| A3 | (G;VG), (M;G), (F;M) | (G;VG), (M;G), (G;VG) | (G;G), (M;M), (F;F) | (F;M), (P;F), (M;G) | (VG;VG), (G;G), (M;G) | (M;G), (F;M), (M;VG) | (M;G), (F;M), (G;VG) | (P;F), (F;M), (M;G) | (F;M), (M;G), (G;VG) |

| A4 | (VG;VG), (G;G), (M;M) | (G;G), (M;M), (F;M) | (G;VG), (M;G), (F;F) | (G;VG), (M;G), (VG;VG) | (G;VG), (M;G), (G;VG) | (M;G), (F;M), (F;M) | (M;G), (G;VG), (VG;VG) | (M;G), (F;F), (G;G) | (G;VG), (M;M), (G;VG) |

| A5 | (G;VG), (M;G), (F;M) | (M;G), (F;M), (G;G) | (G;VG), (M;G), (G;VG) | (VG;VG), (G;G), (M;VG) | (G;VG), (M;G), (G;VG) | (M;G), (F;M), (M;G) | (G;VG), (F;M), (M;G) | (M;G), (F;M), (M;G) | (G;VG), (M;G), (G;VG) |

| A6 | (G;VG), (M;G), (F;M) | (M;G), (F;F), (G;VG) | (G;VG), (M;G), (G;VG) | (G;VG), (G;G), (F;M) | (G;VG), (F;M), (M;G) | (G;VG), (M;G), (G;G) | (M;G), (G;VG), (M;G) | (M;G), (F;M), (G;VG) | (G;VG), (F;M), (M;G) |

| A7 | (VG;VG), (M;G), (G;G) | (G;G), (M;G), (F;M) | (M;G), (F;M), (M;G) | (G;VG), (M;G), (P;F) | (G;VG), (M;G), (G;VG) | (M;G), (F;M), (F;M) | (G;VG), (M;G), (VG;VG) | (M;G), (G;VG), (F;M) | (F;M), (M;G), (P;G) |

| A8 | (G;VG), (M;M), (G;VG) | (G;G), (F;M), (G;VG) | (M;G), (P;F), (F;M) | (VG;VG), (G;G), (M;M) | (M;G), (F;M), (P;P) | (G;VG), (M;G), (G;VG) | (G;VG), (F;M), (G;VG) | (M;G), (F;M), (G;VG) | (P;F), (F;M), (VG;VG) |

| A9 | (G;VG), (M;G), (F;M) | (G;VG), (M;M), (M;G) | (M;G), (F;F), (P;P) | (M;G), (F;M), (G;VG) | (M;G), (F;M), (P;F) | (G;VG), (M;G), (VG;VG) | (M;G), (G;VG), (M;M) | (F;M), (M;G), (G;VG) | (F;F), (M;G), (G;VG) |

| Group A | |||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | |

| A1 | ([1.27, 2.91],[3.22,4.07]) | ([5.81, 7.84],[6.4,8.45]) | ([5.93, 7.96],[7.84,8.77]) | ([3.87, 5.92],[5.2,6.05]) | ([5.82, 6.76],[7.19,8.02]) | ([7.19, 8.02],[7.84,8.77]) | ([5.18, 6.01],[5.81,7.84]) | ([1.62, 4.76],[3.86,6.85]) | ([3.76, 5.81],[5.33,6.95]) |

| A2 | ([3.76, 5.81],[5.81,7.84]) | ([1.66, 3.87],[3.87,5.93]) | ([3.76, 5.81],[5.76,6.73]) | ([3.9, 5.96],[5.96,7.99]) | ([5.2, 6.05],[5.84,7.87]) | ([7.19, 8.02],[7.84,8.77]) | ([5.18, 6.01],[5.81,7.84]) | ([3.76, 5.81],[5.81,7.84]) | ([5.84, 7.87],[7.78,8.74]) |

| A3 | ([7.19, 8.02],[7.78,8.74]) | ([5.2, 6.05],[7.88,8.79]) | ([3.78, 5.84],[5.84,7.87]) | ([1.77, 4.99],[4.04,7.09]) | ([3.76, 5.81],[5.81,7.84]) | ([5.82, 6.76],[7.84,8.77]) | ([4.22, 7.51],[5.81,7.84]) | ([5.2, 6.05],[5.76,6.73]) | ([5.82, 6.76],[7.19,8.02]) |

| A4 | ([5.23, 6.1],[5.82,6.76]) | ([3.34, 4.95],[5.2,6.05]) | ([7.19, 8.02],[7.84,8.77]) | ([5.18, 6.01],[7.19,8.02]) | ([5.82, 6.76],[7.19,8.02]) | ([5.96, 7.99],[7.88,8.79]) | ([1.81, 5.45],[3.86,6.85]) | ([5.2, 6.05],[7.88,8.79]) | ([5.81, 7.84],[5.81,7.84]) |

| A5 | ([3.81, 5.86],[5.86,7.89]) | ([1.7, 3.9],[1.77,4.99]) | ([5.2, 6.05],[5.84,7.87]) | ([5.82, 6.76],[7.84,8.77]) | ([5.93, 7.96],[7.88,8.79]) | ([5.96, 7.99],[7.88,8.79]) | ([3.81, 5.86],[5.86,7.89]) | ([3.76, 5.81],[5.84,7.87]) | ([5.92, 7.95],[7.21,8.06]) |

| A6 | ([1.67, 2.76],[3.22,4.07]) | ([5.82, 6.76],[7.19,8.02]) | ([3.78, 5.84],[5.84,7.87]) | ([5.84, 7.87],[6.4,8.45]) | ([5.96, 7.99],[6.62,8.56]) | ([5.84, 7.87],[7.78,8.74]) | ([5.18, 6.01],[5.84,7.87]) | ([1.84, 6.46],[3.86,6.85]) | ([5.92, 7.95],[7.21,8.06]) |

| A7 | ([3.22, 4.07],[5.23,6.1]) | ([3.76, 5.81],[5.81,7.84]) | ([4.04, 7.09],[5.96,7.99]) | ([5.82, 6.76],[7.84,8.77]) | ([3.9, 5.96],[5.96,7.99]) | ([5.93, 7.96],[7.84,8.77]) | ([5.18, 6.01],[7.78,8.74]) | ([3.78, 5.84],[5.2,6.05]) | ([4.22, 7.51],[5.81,7.84]) |

| A8 | ([5.82, 6.76],[5.93,7.96]) | ([5.86, 6.79],[5.96,7.99]) | ([5.93, 7.96],[6.53,8.52]) | ([7.84, 8.77],[7.84,8.77]) | ([5.96, 7.99],[7.88,8.79]) | ([5.18, 6.01],[7.19,8.02]) | ([5.18, 6.01],[7.78,8.74]) | ([5.2, 6.05],[5.84,7.87]) | ([1.81, 5.45],[4.22,7.51]) |

| Group B | |||||||||

| A1 | ([5.2, 6.05],[5.2,6.05]) | ([5.82, 6.76],[7.21,8.06]) | ([5.82, 6.76],[7.84,8.77]) | ([5.81, 7.84],[7.19,8.02]) | ([7.19, 8.02],[7.84,8.77]) | ([5.2, 6.05],[7.24,8.12]) | ([5.86, 6.79],[5.96,7.99]) | ([5.82, 6.76],[7.19,8.02]) | ([5.93, 7.96],[7.84,8.77]) |

| A2 | ([5.18, 6.01],[5.81,7.84]) | ([3.76, 5.81],[5.81,7.84]) | ([5.84, 7.87],[6.4,8.45]) | ([3.9, 5.96],[5.96,7.99]) | ([5.86, 6.79],[7.24,8.12]) | ([5.84, 7.87],[7.78,8.74]) | ([7.84, 8.77],[7.84,8.77]) | ([6.53, 8.52],[7.84,8.77]) | ([5.82, 6.76],[7.19,8.02]) |

| A3 | ([5.81, 7.84],[7.19,8.02]) | ([5.82, 6.76],[7.84,8.77]) | ([3.19, 4.02],[5.2,6.05]) | ([5.96, 7.99],[7.88,8.79]) | ([5.86, 6.79],[7.24,8.12]) | ([3.9, 5.96],[5.96,7.99]) | ([5.82, 6.76],[7.19,8.02]) | ([3.9, 5.96],[5.86,6.79]) | ([5.93, 7.96],[6.53,8.52]) |

| A4 | ([5.2, 6.05],[7.21,8.06]) | ([5.82, 6.76],[5.86,7.89]) | ([5.2, 6.05],[5.86,6.79]) | ([5.86, 7.89],[7.19,8.02]) | ([7.19, 8.02],[7.84,8.77]) | ([5.96, 7.99],[7.88,8.79]) | ([5.93, 7.96],[7.84,8.77]) | ([5.96, 7.99],[7.88,8.79]) | ([3.9, 5.96],[5.23,6.1]) |

| A5 | ([4.22, 7.51],[5.81,7.84]) | ([3.82, 4.78],[5.2,6.05]) | ([1.15, 1.95],[3.19,4.02]) | ([5.82, 6.76],[7.19,8.02]) | ([5.18, 6.01],[5.86,7.89]) | ([5.96, 7.99],[7.88,8.79]) | ([5.43, 7.12],[5.93,7.96]) | ([5.96, 7.99],[7.88,8.79]) | ([5.82, 6.76],[7,7]) |

| A6 | ([5.18, 6.01],[7.84,8.77]) | ([5.96, 7.99],[7.88,8.79]) | ([1.57, 3.76],[1.62,4.76]) | ([5.96, 7.99],[7.88,8.79]) | ([3.17, 3.99],[3.76,5.81]) | ([3.9, 5.96],[5.96,7.99]) | ([5.82, 6.76],[7.84,8.77]) | ([5.82, 6.76],[7.84,8.77]) | ([7.24, 8.12],[7.84,8.77]) |

| Group C | |||||||||

| A1 | ([5.82, 6.76],[7.84,8.77]) | ([5.82, 6.76],[7.84,8.77]) | ([3.76, 5.81],[5.81,7.84]) | ([1.57, 3.76],[3.76,5.81]) | ([1.73, 4.94],[3.87,5.93]) | ([5.18, 6.01],[5.33,6.95]) | ([3.9, 5.96],[5.96,7.99]) | ([3.78, 4.76],[5.82,6.76]) | ([3.78, 4.76],[5.82,6.76]) |

| A2 | ([7.84, 8.77],[7.84,8.77]) | ([3.76, 5.81],[5.81,7.84]) | ([5.82, 6.76],[7.84,8.77]) | ([3.78, 4.76],[5.82,6.76]) | ([6.53, 8.52],[7.84,8.77]) | ([3.82, 4.78],[5.86,6.79]) | ([5.86, 6.79],[7.88,8.79]) | ([1.15, 1.95],[3.82,4.78]) | ([5.82, 6.76],[7.84,8.77]) |

| A3 | ([3.76, 5.81],[5.81,7.84]) | ([5.82, 6.76],[7.84,8.77]) | ([3.76, 5.81],[3.76,5.81]) | ([1.66, 3.87],[3.87,5.93]) | ([5.81, 7.84],[7.19,8.02]) | ([3.78, 4.76],[5.93,7.96]) | ([3.87, 5.93],[5.93,7.96]) | ([1.7, 3.9],[3.9,5.96]) | ([3.9, 5.96],[5.96,7.99]) |

| A4 | ([5.81, 7.84],[5.81,7.84]) | ([3.76, 5.81],[5.18,6.01]) | ([3.76, 5.81],[4.22,7.51]) | ([5.93, 7.96],[7.84,8.77]) | ([5.82, 6.76],[7.84,8.77]) | ([3.17, 3.99],[5.18,6.01]) | ([5.96, 7.99],[7.88,8.79]) | ([3.87, 5.93],[4.39,6.5]) | ([5.82, 6.76],[6.53,8.52]) |

| A5 | ([3.76, 5.81],[5.81,7.84]) | ([3.87, 5.93],[5.82,6.76]) | ([5.82, 6.76],[7.84,8.77]) | ([5.81, 7.84],[7.84,8.77]) | ([5.82, 6.76],[7.84,8.77]) | ([3.78, 4.76],[5.82,6.76]) | ([3.81, 5.86],[5.86,7.89]) | ([3.78, 4.76],[5.82,6.76]) | ([5.82, 6.76],[7.84,8.77]) |

| A6 | ([3.76, 5.81],[5.81,7.84]) | ([3.87, 5.93],[4.38,7.65]) | ([5.82, 6.76],[7.84,8.77]) | ([4.26, 6.44],[5.81,7.84]) | ([3.81, 5.86],[5.86,7.89]) | ([5.82, 6.76],[7.19,8.02]) | ([5.2, 6.05],[7.21,8.06]) | ([3.87, 5.93],[5.93,7.96]) | ([3.81, 5.86],[5.86,7.89]) |

| A7 | ([5.86, 7.89],[7.19,8.02]) | ([3.76, 5.81],[5.76,6.73]) | ([3.78, 4.76],[5.82,6.76]) | ([1.81, 5.45],[4.22,7.51]) | ([5.82, 6.76],[7.84,8.77]) | ([3.17, 3.99],[5.18,6.01]) | ([5.93, 7.96],[7.84,8.77]) | ([3.78, 5.84],[5.84,7.87]) | ([1.58, 3.78],[5.86,6.79]) |

| A8 | ([5.82, 6.76],[6.53,8.52]) | ([4.39, 6.5],[5.93,7.96]) | ([1.63, 3.81],[3.81,5.86]) | ([5.81, 7.84],[5.81,7.84]) | ([1.57, 3.76],[1.81,5.45]) | ([5.82, 6.76],[7.84,8.77]) | ([4.39, 6.5],[6.53,8.52]) | ([3.87, 5.93],[5.93,7.96]) | ([1.82, 6.06],[4.04,7.09]) |

| A9 | ([3.76, 5.81],[5.81,7.84]) | ([5.18, 6.01],[5.86,7.89]) | ([1.57, 3.76],[1.62,4.76]) | ([3.87, 5.93],[5.93,7.96]) | ([1.57, 3.76],[3.76,5.81]) | ([5.93, 7.96],[7.84,8.77]) | ([5.2, 6.05],[5.84,7.87]) | ([3.9, 5.96],[5.96,7.99]) | ([3.9, 5.96],[4.46,7.71]) |

| C1 | C2 | C3 | … | C9 | |

|---|---|---|---|---|---|

| Group A | |||||

| A1 | ([0, 0.22],[0.26,0.38]) | ([0.58, 0.87],[0.66,0.95]) | ([0, 0.19],[0.16,0.57]) | ... | ([0.28, 0.58],[0.51,0.74]) |

| A2 | ([0.33, 0.61],[0.61,0.88]) | ([0, 0.31],[0.31,0.6]) | ([0.41, 0.6],[0.59,1]) | ([0.58, 0.87],[0.86,1]) | |

| A3 | ([0.79, 0.9],[0.87,1]) | ([0.5, 0.62],[0.87,1]) | ([0.18, 0.58],[0.58,1]) | ([0.58, 0.72],[0.78,0.9]) | |

| A4 | ([0.53, 0.65],[0.61,0.74]) | ([0.24, 0.46],[0.5,0.62]) | ([0, 0.19],[0.15,0.32]) | ([0.58, 0.87],[0.58,0.87]) | |

| A5 | ([0.34, 0.62],[0.62,0.89]) | ([0.01, 0.31],[0.02,0.47]) | ([0.18, 0.58],[0.54,0.71]) | ([0.59, 0.89],[0.78,0.9]) | |

| A6 | ([0.05, 0.2],[0.26,0.38]) | ([0.58, 0.72],[0.78,0.89]) | ([0.18, 0.58],[0.58,1]) | ([0.59, 0.89],[0.78,0.9]) | |

| A7 | ([0.26, 0.38],[0.53,0.65]) | ([0.29, 0.58],[0.58,0.87]) | ([0.16, 0.56],[0.33,0.94]) | ([0.35, 0.82],[0.58,0.87]) | |

| A8 | ([0.61, 0.74],[0.62,0.9]) | ([0.59, 0.72],[0.6,0.89]) | ([0.05, 0.45],[0.16,0.57]) | ([0, 0.52],[0.35,0.82]) | |

| Group B | |||||

| A1 | ([0.22, 0.4],[0.22,0.4]) | ([0.41, 0.6],[0.69,0.86]) | ([0, 0.12],[0.26,0.39]) | ... | ([0.42, 0.83],[0.81,1]) |

| A2 | ([0.21, 0.39],[0.35,0.8]) | ([0, 0.41],[0.41,0.81]) | ([0.04, 0.31],[0.12,0.38]) | ([0.39, 0.59],[0.68,0.85]) | |

| A3 | ([0.35, 0.8],[0.65,0.84]) | ([0.41, 0.6],[0.81,1]) | ([0.36, 0.47],[0.62,0.73]) | ([0.42, 0.83],[0.54,0.95]) | |

| A4 | ([0.22, 0.4],[0.66,0.84]) | ([0.41, 0.6],[0.42,0.82]) | ([0.26, 0.38],[0.36,0.47]) | ([0, 0.42],[0.27,0.45]) | |

| A5 | ([0, 0.72],[0.35,0.8]) | ([0.01, 0.2],[0.29,0.46]) | ([0.62, 0.73],[0.89,1]) | ([0.39, 0.59],[0.64,0.64]) | |

| A6 | ([0.21, 0.39],[0.8,1]) | ([0.44, 0.84],[0.82,1]) | ([0.53, 0.94],[0.66,0.95]) | ([0.69, 0.87],[0.81,1]) | |

| Group C | |||||

| A1 | ([0.41, 0.6],[0.81,1]) | ([0.41, 0.6],[0.81,1]) | ([0.13, 0.41],[0.41,0.7]) | ... | ([0.31, 0.44],[0.59,0.72]) |

| A2 | ([0.81, 1],[0.81,1]) | ([0, 0.41],[0.41,0.82]) | ([0, 0.13],[0.28,0.41]) | ([0.59, 0.72],[0.87,1]) | |

| A3 | ([0, 0.41],[0.41,0.82]) | ([0.41, 0.6],[0.81,1]) | ([0.41, 0.7],[0.41,0.7]) | ([0.32, 0.61],[0.61,0.89]) | |

| A4 | ([0.41, 0.82],[0.41,0.82]) | ([0, 0.41],[0.28,0.45]) | ([0.17, 0.63],[0.41,0.7]) | ([0.59, 0.72],[0.69,0.96]) | |

| A5 | ([0, 0.41],[0.41,0.82]) | ([0.02, 0.43],[0.41,0.6]) | ([0, 0.13],[0.28,0.41]) | ([0.59, 0.72],[0.87,1]) | |

| A6 | ([0.01, 0.01],[0.01,0.11]) | ([0.11, 0.11],[0.11,0.09]) | ([0.09, 0.09],[0.09,0.18]) | ([0.09, 0.09],[0.09,0.88]) | |

| A7 | ([0.42, 0.83],[0.68,0.85]) | ([0, 0.41],[0.4,0.59]) | ([0.28, 0.41],[0.56,0.69]) | ([0, 0.31],[0.6,0.72]) | |

| A8 | ([0.41, 0.6],[0.55,0.95]) | ([0.13, 0.55],[0.43,0.84]) | ([0.4, 0.69],[0.69,0.99]) | ([0.03, 0.62],[0.34,0.77]) | |

| A9 | ([0, 0.41],[0.41,0.82]) | ([0.28, 0.45],[0.42,0.83]) | ([0.56, 0.99],[0.7,1]) | ([0.32, 0.61],[0.4,0.85]) | |

| C1 | C2 | C3 | … | C9 | |

|---|---|---|---|---|---|

| Group A | |||||

| A1 | ([0, 0.04],[0.05,0.07]) | ([0.07, 0.1],[0.08,0.11]) | ([0, 0.02],[0.02,0.05]) | ... | ([0.02, 0.05],[0.04,0.06]) |

| A2 | ([0.06, 0.11],[0.11,0.16]) | ([0, 0.04],[0.04,0.07]) | ([0.04, 0.06],[0.06,0.1]) | ([0.05, 0.07],[0.07,0.08]) | |

| A3 | ([0.14, 0.17],[0.16,0.18]) | ([0.06, 0.07],[0.1,0.11]) | ([0.02, 0.06],[0.06,0.1]) | ([0.05, 0.06],[0.06,0.07]) | |

| A4 | ([0.1, 0.12],[0.11,0.13]) | ([0.03, 0.05],[0.06,0.07]) | ([0, 0.02],[0.01,0.03]) | ([0.05, 0.07],[0.05,0.07]) | |

| A5 | ([0.06, 0.11],[0.11,0.16]) | ([0, 0.04],[0,0.05]) | ([0.02, 0.06],[0.05,0.07]) | ([0.05, 0.07],[0.06,0.07]) | |

| A6 | ([0.01, 0.04],[0.05,0.07]) | ([0.07, 0.08],[0.09,0.1]) | ([0.02, 0.06],[0.06,0.1]) | ([0.05, 0.07],[0.06,0.07]) | |

| A7 | ([0.05, 0.07],[0.1,0.12]) | ([0.03, 0.07],[0.07,0.1]) | ([0.01, 0.05],[0.03,0.09]) | ([0.03, 0.07],[0.05,0.07]) | |

| A8 | ([0.11, 0.13],[0.11,0.16]) | ([0.07, 0.08],[0.07,0.1]) | ([0, 0.04],[0.02,0.05]) | ([0, 0.04],[0.03,0.07]) | |

| Group B | |||||

| A1 | ([0.04, 0.07],[0.04,0.07]) | ([0.04, 0.06],[0.07,0.08]) | ([0, 0.01],[0.02,0.03]) | ... | ([0.03, 0.06],[0.06,0.07]) |

| A2 | ([0.04, 0.07],[0.06,0.14]) | ([0, 0.04],[0.04,0.08]) | ([0, 0.02],[0.01,0.03]) | ([0.03, 0.04],[0.05,0.06]) | |

| A3 | ([0.06, 0.14],[0.11,0.14]) | ([0.04, 0.06],[0.08,0.09]) | ([0.03, 0.04],[0.05,0.06]) | ([0.03, 0.06],[0.04,0.07]) | |

| A4 | ([0.04, 0.07],[0.11,0.14]) | ([0.04, 0.06],[0.04,0.08]) | ([0.02, 0.03],[0.03,0.04]) | ([0, 0.03],[0.02,0.03]) | |

| A5 | ([0, 0.12],[0.06,0.14]) | ([0, 0.02],[0.03,0.04]) | ([0.05, 0.06],[0.07,0.08]) | ([0.03, 0.04],[0.05,0.05]) | |

| A6 | ([0.04, 0.07],[0.14,0.17]) | ([0.04, 0.08],[0.08,0.1]) | ([0.04, 0.07],[0.05,0.07]) | ([0.05, 0.06],[0.06,0.07]) | |

| Group C | |||||

| A1 | ([0.08, 0.11],[0.15,0.19]) | ([0.05, 0.07],[0.1,0.12]) | ([0.01, 0.04],[0.04,0.07]) | ... | ([0.03, 0.04],[0.05,0.06]) |

| A2 | ([0.15, 0.19],[0.15,0.19]) | ([0, 0.05],[0.05,0.1]) | ([0, 0.01],[0.03,0.04]) | ([0.05, 0.06],[0.07,0.08]) | |

| A3 | ([0, 0.08],[0.08,0.15]) | ([0.05, 0.07],[0.1,0.12]) | ([0.04, 0.07],[0.04,0.07]) | ([0.03, 0.05],[0.05,0.08]) | |

| A4 | ([0.08, 0.15],[0.08,0.15]) | ([0, 0.05],[0.03,0.05]) | ([0.02, 0.06],[0.04,0.07]) | ([0.05, 0.06],[0.06,0.08]) | |

| A5 | ([0, 0.08],[0.08,0.15]) | ([0, 0.05],[0.05,0.07]) | ([0, 0.01],[0.03,0.04]) | ([0.05, 0.06],[0.07,0.08]) | |

| A6 | ([0, 0],[0,0.02]) | ([0.01, 0.01],[0.01,0.01]) | ([0.01, 0.01],[0.01,0.02]) | ([0.01, 0.01],[0.01,0.07]) | |

| A7 | ([0.08, 0.15],[0.13,0.16]) | ([0, 0.05],[0.05,0.07]) | ([0.03, 0.04],[0.05,0.07]) | ([0, 0.03],[0.05,0.06]) | |

| A8 | ([0.08, 0.11],[0.1,0.18]) | ([0.01, 0.06],[0.05,0.1]) | ([0.04, 0.07],[0.07,0.1]) | ([0, 0.05],[0.03,0.06]) | |

| A9 | ([0, 0.08],[0.08,0.15]) | ([0.03, 0.05],[0.05,0.1]) | ([0.05, 0.1],[0.07,0.1]) | ([0.03, 0.05],[0.03,0.07]) | |

| Alt. | ||

|---|---|---|

| Group A | ||

| A1 | ([0.28, 0.50],[0.46,0.72]) | ([5.51, 8.26],[8.18,8.64]) |

| A2 | ([0.31, 0.56],[0.55,0.84]) | ([7.07, 8.41],[8.38,8.82]) |

| A3 | ([0.39, 0.66],[0.67,0.93]) | ([7.23, 8.57],[8.58,8.92]) |

| A4 | ([0.30, 0.53],[0.53,0.72]) | ([6.16, 8.31],[8.31,8.64]) |

| A5 | ([0.25, 0.57],[0.54,0.78]) | ([6.76, 8.35],[8.16,8.72]) |

| A6 | ([0.27, 0.58],[0.48,0.74]) | ([7.42, 8.38],[8.19,8.65]) |

| A7 | ([0.22, 0.50],[0.52,0.77]) | ([6.77, 8.26],[8.33,8.71]) |

| A8 | ([0.33, 0.56],[0.51,0.77]) | ([5.37, 8.33],[7.49,8.63]) |

| Group B | ||

| A1 | ([0.30, 0.50],[0.46,0.72]) | ([6.92, 8.25],[8.11,8.64]) |

| A2 | ([0.33, 0.63],[0.57,0.87]) | ([6.98, 8.50],[8.38,8.84]) |

| A3 | ([0.23, 0.53],[0.53,0.78]) | ([5.31, 8.30],[8.31,8.74]) |

| A4 | ([0.30, 0.59],[0.57,0.82]) | ([6.94, 8.44],[8.36,8.77]) |

| A5 | ([0.23, 0.58],[0.50,0.78]) | ([6.04, 8.40],[8.24,8.73]) |

| A6 | ([0.23, 0.48],[0.58,0.86]) | ([5.29, 8.17],[8.30,8.82]) |

| Group C | ||

| A1 | ([0.28, 0.53],[0.60,0.85]) | ([7.51, 8.38],[8.46,8.82]) |

| A2 | ([0.37, 0.56],[0.63,0.81]) | ([5.51, 8.25],[8.49,8.76]) |

| A3 | ([0.25, 0.56],[0.56,0.86]) | ([6.82, 8.40],[8.40,8.84]) |

| A4 | ([0.30, 0.59],[0.48,0.74]) | ([5.41, 8.35],[8.18,8.65]) |

| A5 | ([0.17, 0.42],[0.49,0.73]) | ([4.30, 8.05],[8.20,8.64]) |

| A6 | ([0.11, 0.11],[0.11,0.19]) | ([6.90, 6.90],[6.90,7.27]) |

| A7 | ([0.28, 0.60],[0.62,0.83]) | ([5.30, 8.41],[8.50,8.80]) |

| A8 | ([0.23, 0.55],[0.45,0.82]) | ([6.73, 8.40],[8.02,8.76]) |

| A9 | ([0.23, 0.54],[0.48,0.83]) | ([6.22, 8.35],[8.27,8.80]) |

| Alt. | IR (kia) | IR (kib) | IR (kic) | Rank |

|---|---|---|---|---|

| Group A | ||||

| A1 | ([0.08, 0.13],[0.12,0.17]) | ([1.03, 2.20],[1.91,4.86]) | ([0.59, 0.95],[0.94,1.20]) | 8 |

| A2 | ([0.10, 0.13],[0.13,0.18]) | ([1.26, 2.34],[2.11,5.46]) | ([0.75, 0.97],[0.97,1.24]) | 2 |

| A3 | ([0.10, 0.13],[0.13,0.18]) | ([1.39, 2.59],[2.37,5.86]) | ([0.77, 1.00],[1.00,1.26]) | 1 |

| A4 | ([0.09, 0.13],[0.12,0.17]) | ([1.13, 2.27],[2.08,4.87]) | ([0.66, 0.96],[0.96,1.20]) | 5 |

| A5 | ([0.09, 0.13],[0.12,0.17]) | ([1.14, 2.35],[2.06,5.16]) | ([0.71, 0.96],[0.94,1.21]) | 3 |

| A6 | ([0.10, 0.13],[0.12,0.17]) | ([1.23, 2.37],[1.96,4.97]) | ([0.78, 0.97],[0.94,1.20]) | 4 |

| A7 | ([0.09, 0.13],[0.12,0.17]) | ([1.09, 2.19],[2.05,5.10]) | ([0.71, 0.95],[0.96,1.21]) | 7 |

| A8 | ([0.08, 0.13],[0.11,0.17]) | ([1.09, 2.33],[1.93,5.08]) | ([0.58, 0.96],[0.87,1.20]) | 6 |

| Group B | ||||

| A1 | ([0.13, 0.17],[0.16,0.24]) | ([1.21, 2.10],[1.95,4.82]) | ([0.74, 0.98],[0.94,1.28]) | 6 |

| A2 | ([0.13, 0.17],[0.17,0.25]) | ([1.27, 2.42],[2.22,5.53]) | ([0.75, 1.02],[0.98,1.33]) | 1 |

| A3 | ([0.10, 0.17],[0.17,0.24]) | ([0.93, 2.16],[2.12,5.11]) | ([0.57, 0.99],[0.97,1.30]) | 4 |

| A4 | ([0.13, 0.17],[0.17,0.25]) | ([1.23, 2.32],[2.21,5.26]) | ([0.75, 1.01],[0.98,1.31]) | 2 |

| A5 | ([0.11, 0.17],[0.16,0.24]) | ([1.02, 2.29],[2.05,5.10]) | ([0.65, 1.00],[0.96,1.30]) | 3 |

| A6 | ([0.10, 0.16],[0.17,0.25]) | ([0.93, 2.05],[2.22,5.46]) | ([0.57, 0.97],[0.97,1.32]) | 5 |

| Group C | ||||

| A1 | ([0.09, 0.11],[0.12,0.17]) | ([2.56, 6.28],[6.94,10.05]) | ([0.80, 0.98],[1.01,1.23]) | 3 |

| A2 | ([0.07, 0.11],[0.12,0.17]) | ([2.74, 6.54],[7.18,9.71]) | ([0.61, 0.97],[1.01,1.21]) | 2 |

| A3 | ([0.08, 0.12],[0.11,0.17]) | ([2.29, 6.50],[6.5,10.16]) | ([0.73, 0.98],[0.99,1.23]) | 4 |

| A4 | ([0.07, 0.11],[0.11,0.16]) | ([2.34, 6.80],[5.72,8.98]) | ([0.59, 0.98],[0.96,1.19]) | 5 |

| A5 | ([0.05, 0.11],[0.11,0.16]) | ([1.49, 5.10],[5.79,8.88]) | ([0.46, 0.93],[0.96,1.19]) | 8 |

| A6 | ([0.08, 0.09],[0.09,0.13]) | ([1.52, 2.00],[2.00,3.45]) | ([0.72, 0.77],[0.78,0.95]) | 9 |

| A7 | ([0.07, 0.12],[0.12,0.17]) | ([2.23, 6.87],[7.06,9.92]) | ([0.58, 0.99],[1.01,1.22]) | 1 |

| A8 | ([0.08, 0.12],[0.11,0.17]) | ([2.19, 6.46],[5.46,9.77]) | ([0.72, 0.98],[0.94,1.22]) | 7 |

| A9 | ([0.08, 0.11],[0.11,0.17]) | ([2.11, 6.31],[5.77,9.87]) | ([0.67, 0.97],[0.97,1.22]) | 6 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Erceg, Ž.; Starčević, V.; Pamučar, D.; Mitrović, G.; Stević, Ž.; Žikić, S. A New Model for Stock Management in Order to Rationalize Costs: ABC-FUCOM-Interval Rough CoCoSo Model. Symmetry 2019, 11, 1527. https://doi.org/10.3390/sym11121527

Erceg Ž, Starčević V, Pamučar D, Mitrović G, Stević Ž, Žikić S. A New Model for Stock Management in Order to Rationalize Costs: ABC-FUCOM-Interval Rough CoCoSo Model. Symmetry. 2019; 11(12):1527. https://doi.org/10.3390/sym11121527

Chicago/Turabian StyleErceg, Živko, Vitomir Starčević, Dragan Pamučar, Goran Mitrović, Željko Stević, and Srđan Žikić. 2019. "A New Model for Stock Management in Order to Rationalize Costs: ABC-FUCOM-Interval Rough CoCoSo Model" Symmetry 11, no. 12: 1527. https://doi.org/10.3390/sym11121527