External Pressure on Alliances: What Does the Prisoners’ Dilemma Reveal?

Abstract

:1. Introduction

2. Analysis of a Real-Life Scenario: Boots and Sainsbury’s in the Years 2001–2003

2.1. Setting up the Alliance

The parties propose to enter into arrangements under which Sainsbury’s will withdraw from the retailing of health and beauty products in certain of its edge-of-town and out-of-town stores and instead license Boots to retail its own health and beauty products from within the main body of the Sainsbury’s store (from [3])

The attraction of the Sainsbury’s programme for us is that it allows us to gain some of the footfall in edge-of-town shopping that we are missing out on [6].We want to have 200 outlets on the edge of town, and Sainsbury’s is the way we might do this [7].

We are testing that by putting our brand and Boots together in one location, the customers will find that a more appealing offer than anything we can do singly ourselves (from [10]).

Boots and Sainsbury’s are ending their health and beauty joint venture after a row over how to divide up the revenues from the chemist stores within the supermarket chain [12].

2.2. External Pressure on the Alliance

Boots has been under attack from supermarkets for some time. Tesco and Asda have been eating into its core market with aggressive price cuts on toiletries.But it has fought back with more product promotions and new initiatives such as dentistry, leisure centres and nail bars. Sainsbury’s is also coming from behind, trying to catch rivals Tesco and Asda, which have a greater non-food focus [19].

While British rivals such as Sainsbury’s and Safeway try to improve profitability, Tesco is deliberately keeping its margins flat, ploughing back into lower prices the gains it reaps from economies of scale. That brings more sales, and so more scale economies. …Similarly, the group has moved aggressively into over-the-counter medicines and toiletries. This year, its sales overtook those of Boots, Britain’s leading chemists chain [20].

Sainsbury’s tracks 2000 product lines every four weeks. Monitors Tesco most … ([21] (Appendix 7.4)).

2.3. Bargaining Power of the Partners

The price battle which formed a large part of the private label war has ended in something of a truce between Sainsbury’s, Tesco and Asda. While competition remains fierce, there has been a palpable shift in strategy from cheap and cheerful private label to private label ranges that offer consumer lifestyle solutions, particularly among the top two grocers: Tesco and Sainsbury’s [24].

3. Literature Review on Business Alliances

and shows [29] that business alliances have high failure rates (at or higher than 50%), for non-opportunistic reasons, such as managerial complexity and coordinating costs, but also inter-firm rivalry, as each partner acts to maximize its own benefits.Alliance conditions are composed of collective strengths, inter-partner conflicts, and interdependencies [28].

Later, the same author notes that:This chapter proposes a way to think about the interaction between alliances and competition. It begins by reviewing what the literature in industrial organization has had to say about this question. The short answer is “not much”…

Our study lies in the centre ground of his diagram on p. 45 in [30], and we believe that our simple game-theoretic model sheds light on the viability of an alliance in the presence of a powerful third party. The alliance did not survive long enough for the more sophisticated aspects presented by [30] to emerge, except that it foundered on disagreement about what is referred to there (p. 48) as “Appropriation of Value by Members”, supporting the importance of this aspect of alliances. From a somewhat different standpoint, our analysis of this short-lived alliance supports Propositions 2 and 9 in [31] which analyses the long-established Renault-Nissan alliance.… studies show that there is an intimate link between the balance of cooperation and competition …

Additionally, it addresses some similar questions (for example, the effect of outside changes), but in a quite different context. Although there is some congruence between expressed findings, they depend on congruent interpretations of terms, which might not be justifiable. For example, we might agree that “The very process of designing and maintaining a collaborative relationship to suit a particular context limits the effectiveness of the collaboration in a changed environment” (p. 174 in [34]), but would we mean the same thing? There is no model or analytical framework in [34] to enable this question to be addressed. Regarding what they describe as “the widely stated but little tested argument that inter-firm collaboration is usually beneficial”, the partners in our study reported positive effects in the collaboration. In particular, it significantly improved Boots’s market share and almost certainly exceeded their expectations; by the end of the trial, the nine implants in Sainsbury’s stores provided around of Boots’s sales [35], so they were performing very well in comparison to the group’s 1400 conventional outlets. Our model supports [34] in finding that a change in one partner’s strategy could well have precipitated the breakdown of the alliance, although no commentator at the time saw this as the cause.[a] cooperative agreement between legally separable organisations that [did] not involve establishing [a]separate organisation.

However, as we shall explain, this did not succeed. Rather differently from these authors, we did not identify any feedback loops, so the relationship deteriorated quickly and the alliance was correspondingly short-lived.the partners’ assessments cause[d] them to either engage in renegotiation of the terms of the contract, or to modify their behavior unilaterally, in an attempt to restore balance to the relationship.

4. Our Contribution

and the express intention of the partners [45]:The deal marks an escalation of the supermarket wars as Sainsbury’s desperately tries to recover ground lost to Tesco and Asda,

We have made the key variable for this model customer footfall in the trial stores. Competition in this market is for footfall (see p. 74 in [46]) on the importance of footfall in the health and beauty retail sector); so is where the impact of third parties is felt.The attraction of the Sainsbury’s programme for us is that it allows us to gain some of the footfall in edge-of-town shopping that we are missing out on.

5. Modelling with Prisoners’ Dilemma

Comparison of Boots’s statement here with that made at the outset of the alliance (see p. 755) captures the distinctiveness of its alternative strategy. Moreover, Sainsbury’s extended health and beauty offer included some exclusive niche brands, which Boots had stocked for many years; so, it appears that Sainsbury’s was mimicking the Boots offer and gaining a “second-mover advantage” [48]. Formally speaking, each player has a set of strategies . The meaning of each strategy for each player is the following :Sainsbury’s will now press ahead with its plans for a new health and beauty range that it has been testing in five stores for a year. … The supermarket said it had already added 1,500 extra health and beauty products to its ranges over the past year [33].Sir Peter Davis, the chief executive, said: “The five trial stores have seen significant sales increases which show that we can create sufficient value by operating our own extended health and beauty department.”Boots said it would accelerate its plans for more stores on the edge of town, planning to double the number from 77 to more than 150 within three years.

- for Sainsbury’s means that Sainsbury’s does not retail its health and beauty products and Sainsbury’s lays out concession areas for Boots.

- for Sainsbury’s means that Sainsbury’s retails its proper health and beauty products in its stores. Sainsbury’s breaks the alliance down with Boots, and it does not lay out concession areas for Boots.

- for Boots means that Boots retails its health and beauty products only in Sainsbury’s stores.

- for Boots means that Boots retails its health and beauty products only in Boots stores.

- is the average spend per customer in a Sainsbury’s store without the Boots implant, noting that supermarket prices for health and beauty items were lower than Boots prices [22];

- is the average spend per Sainsbury’s customer in a Sainsbury’s store after the Boots cooperation trial ended. The latter is resulting from the promised “improved customer offer” [49].

- is the average spend per customer in a Sainsbury’s store with the Boots implant, noting a little-publicised aspect of the trial that prices here could be lower than in Boots own outlets [32];

- is the average spend per customer in a Boots outlet.

| Boots’s choice | |||||

| Ally | Alternative | ||||

| Sainsbury’s choice | (fB + fS)h′B | (fB + fS)hB | |||

| Ally | |||||

| (fB + fS)g | fSg | ||||

| 0 | fBhB | ||||

| Alternative | |||||

| (fB + fS)(g + ) | fS(g + hS | ||||

| ↑ | ↑ | ||||

| Sainsbury’s | Boots’s | ||||

| payoffs | payoffs | ||||

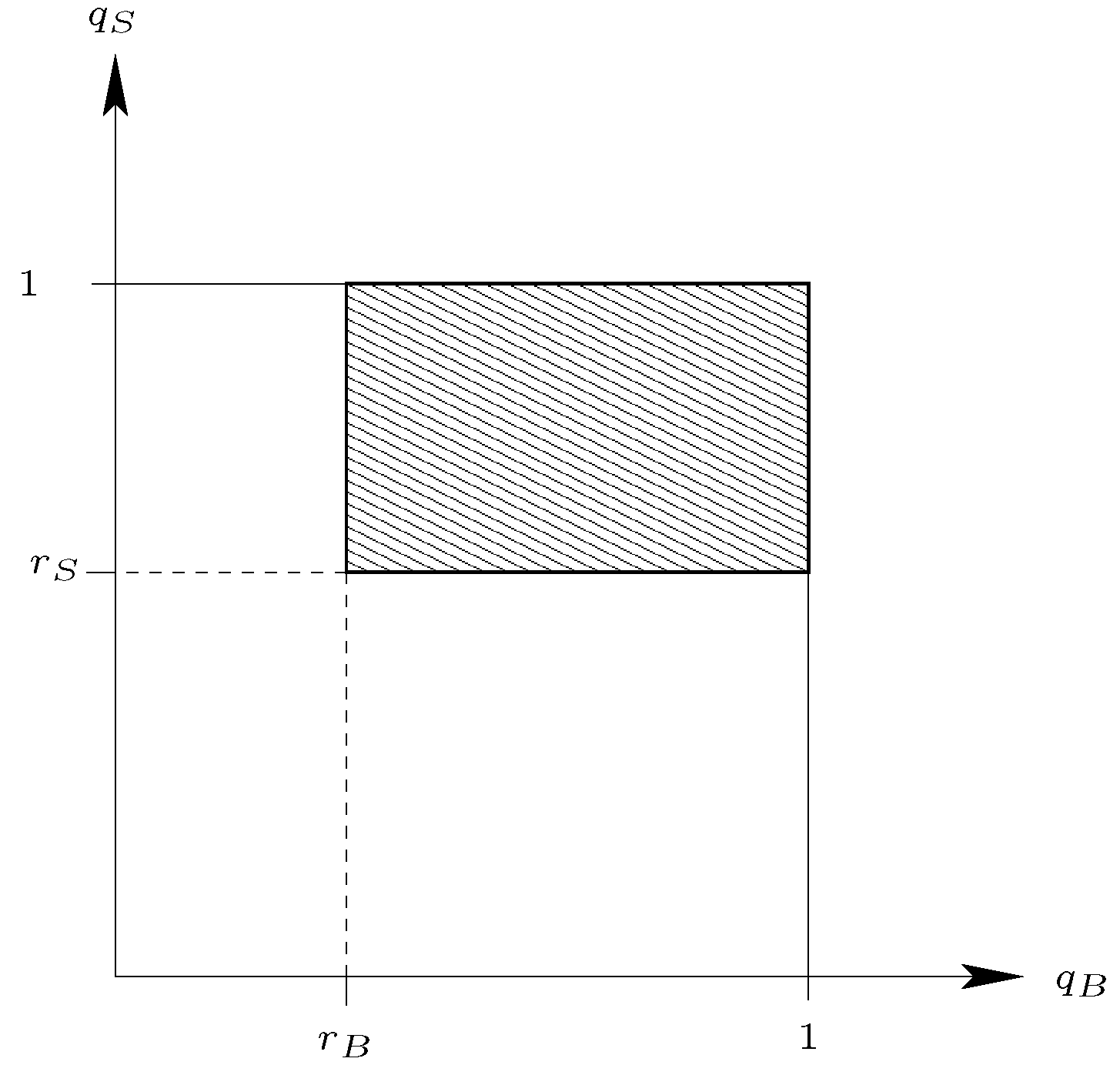

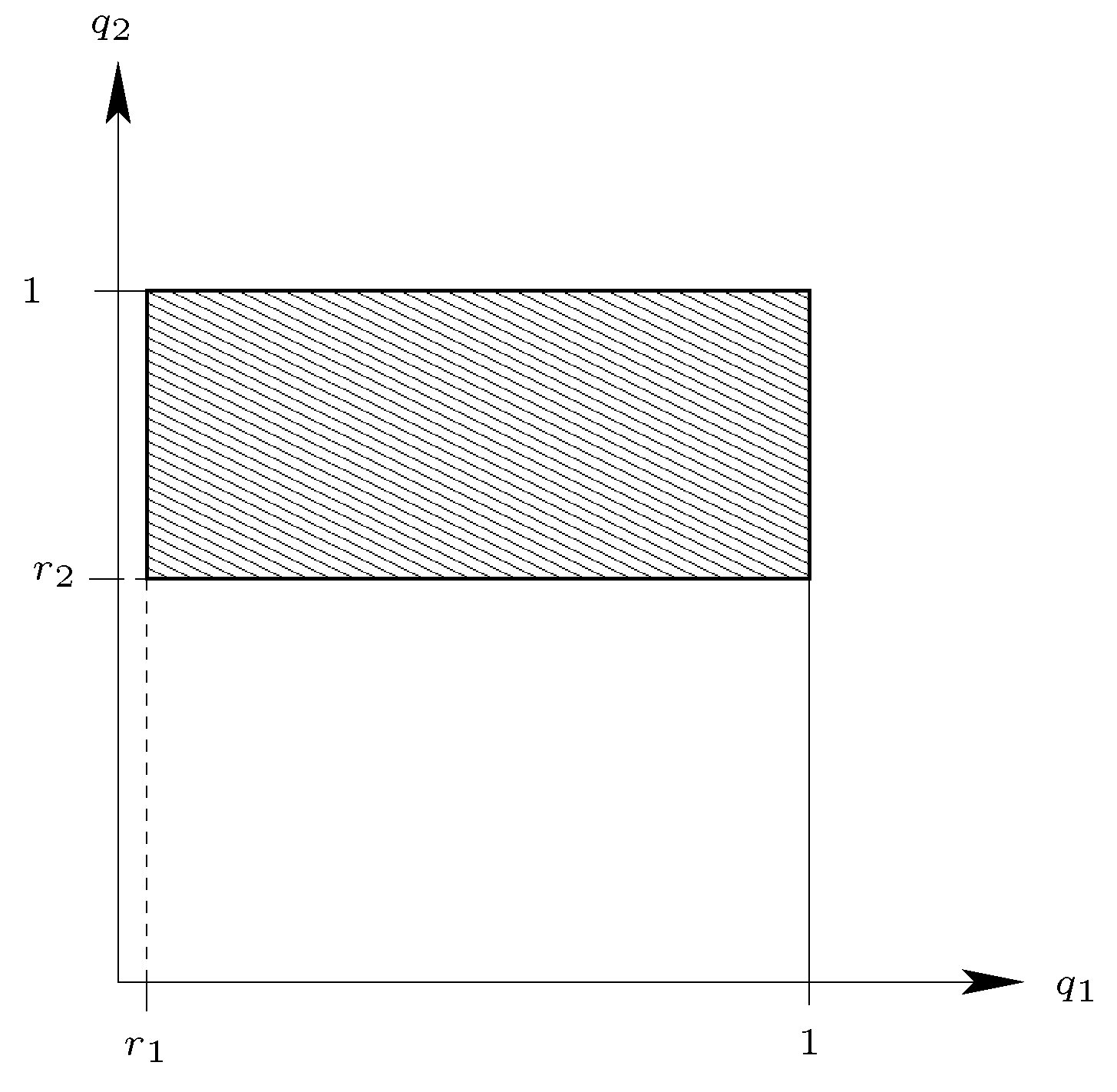

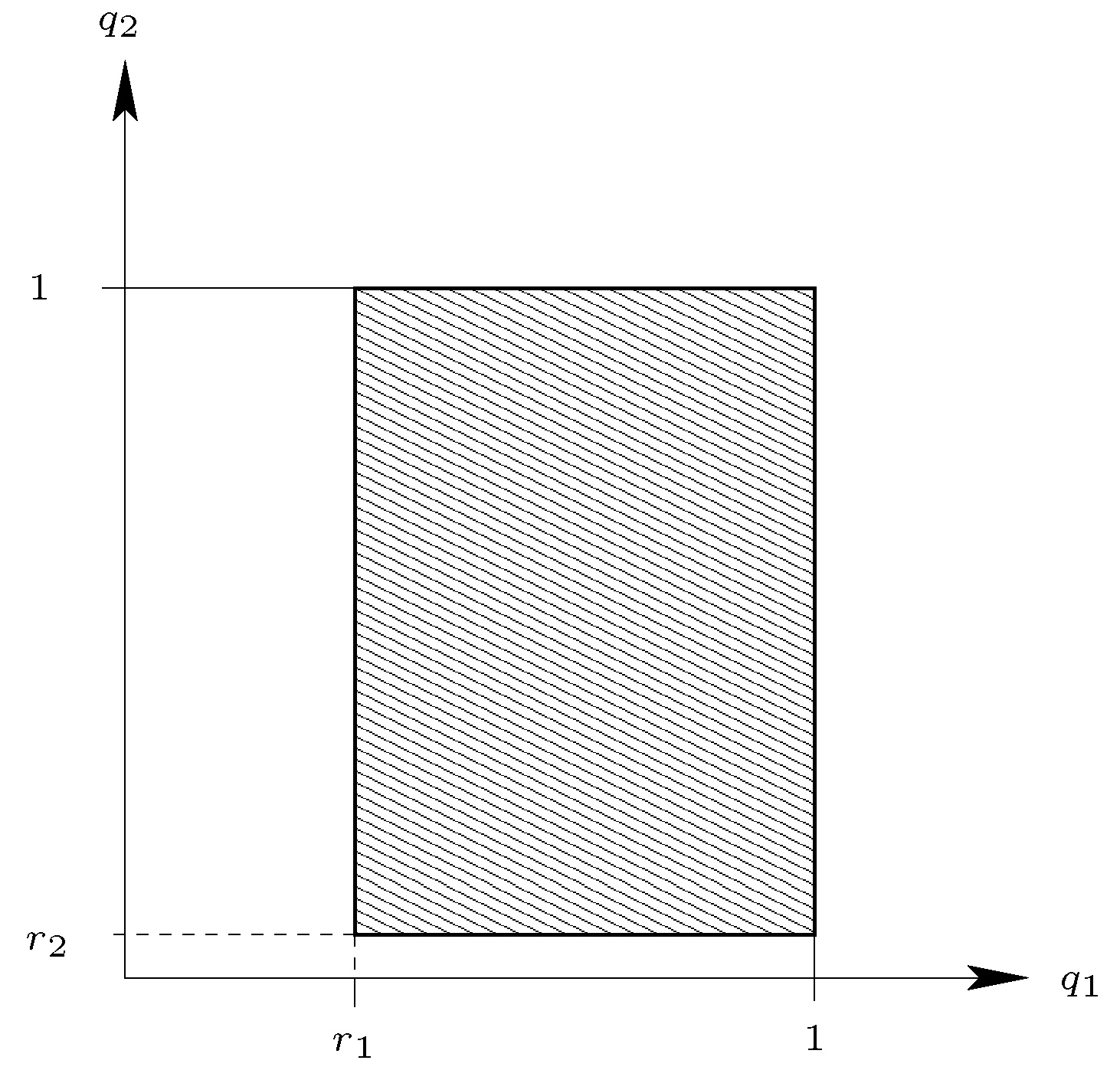

5.1. The Impact of a Third Player

| Boots’s choice | |||||

| Ally | Alternative | ||||

| Sainsbury’s choice | (1 ‒ qB)(fB + fS) | (1 ‒ qB)(fB + fS)hB | |||

| Ally | |||||

| (1 ‒ qB)(fB + fS)g | (1 ‒ qS)fSg | ||||

| 0 | (1 ‒ qB)fBhB | ||||

| Alternative | |||||

| (1 ‒ qS)(fB + fS)(g + ) | (1 ‒ qS)fS(g + hS) | ||||

| ↑ | ↑ | ||||

| Sainsbury’s | Boots’s | ||||

| payoffs | payoffs | ||||

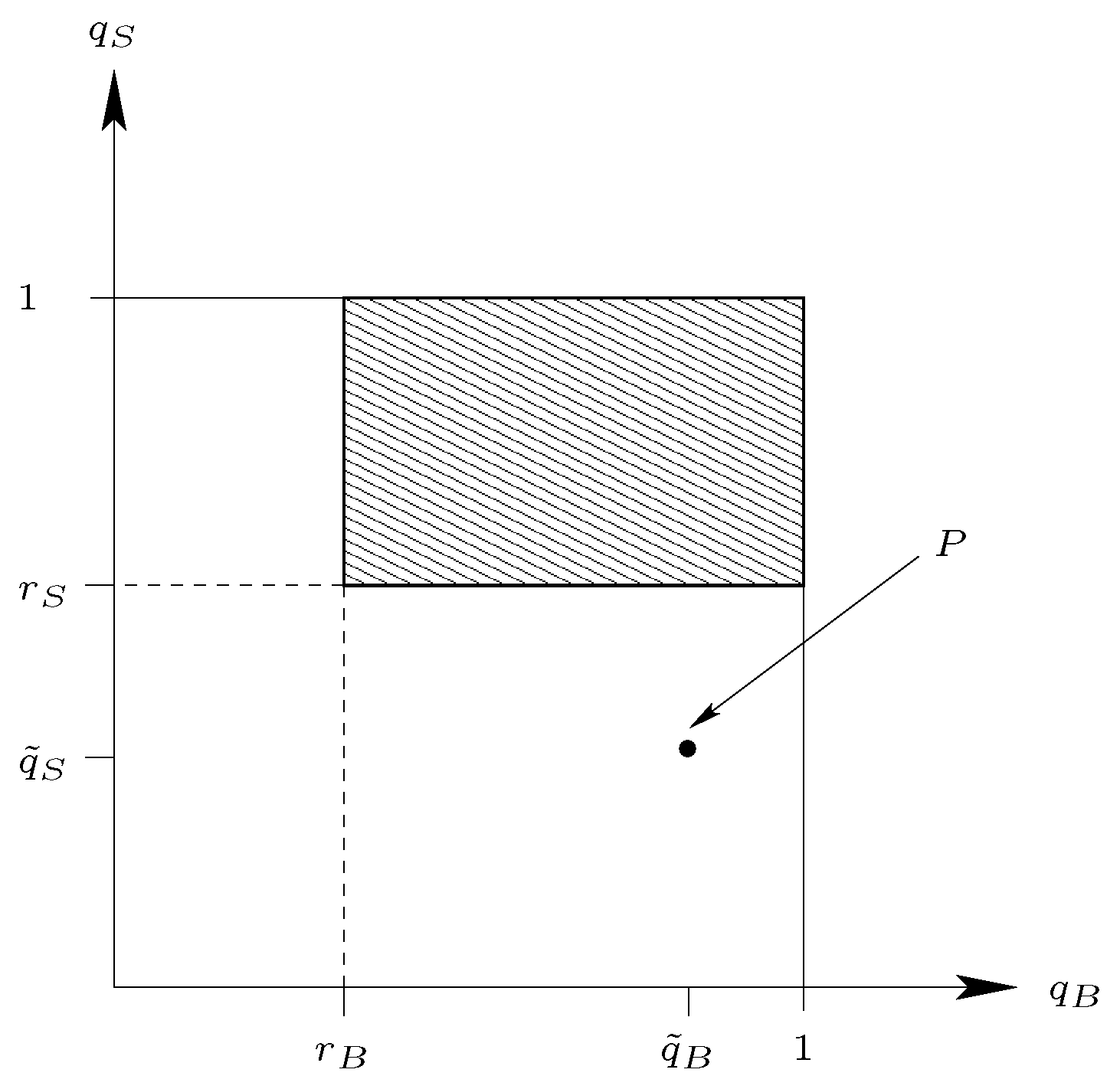

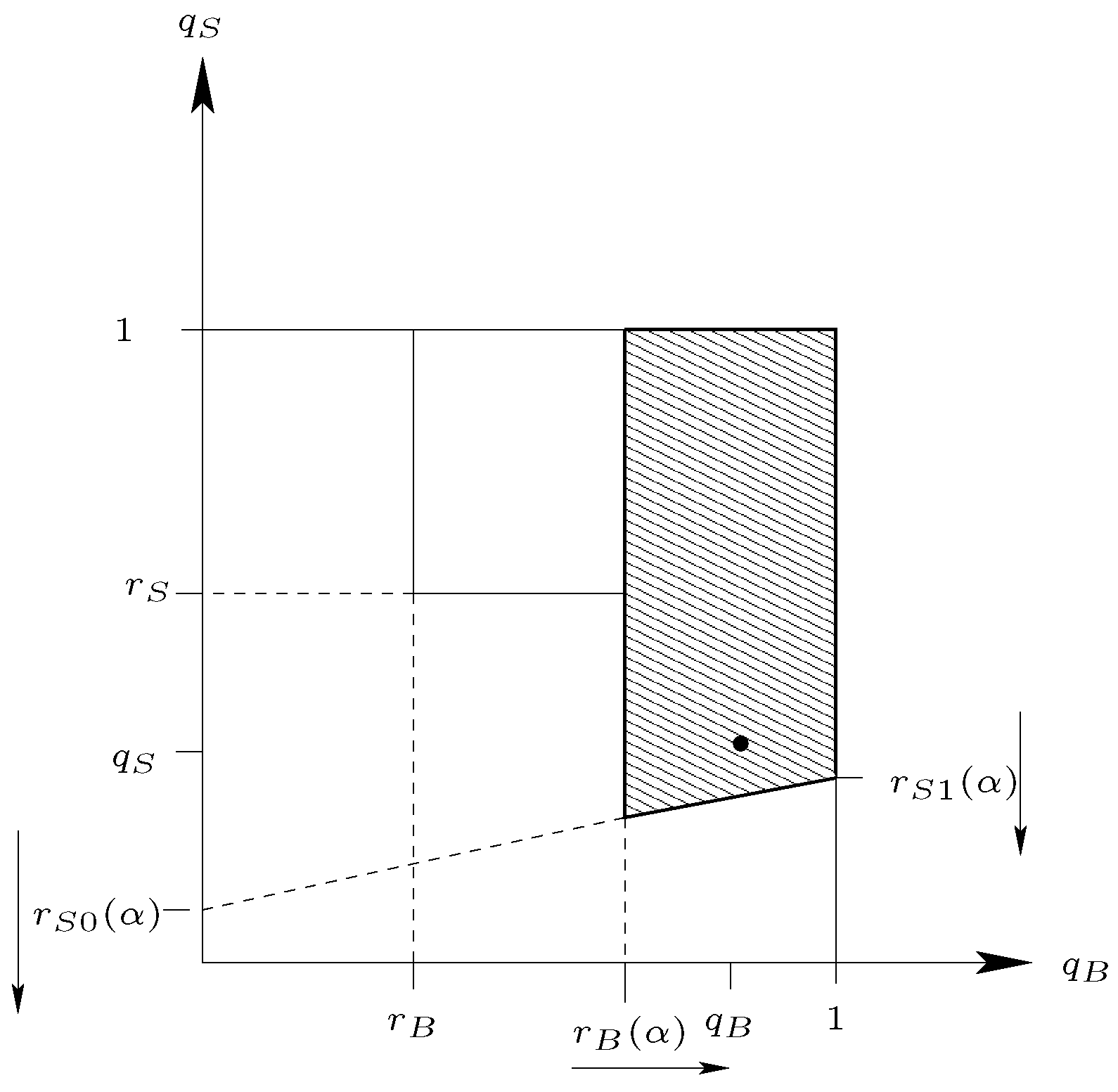

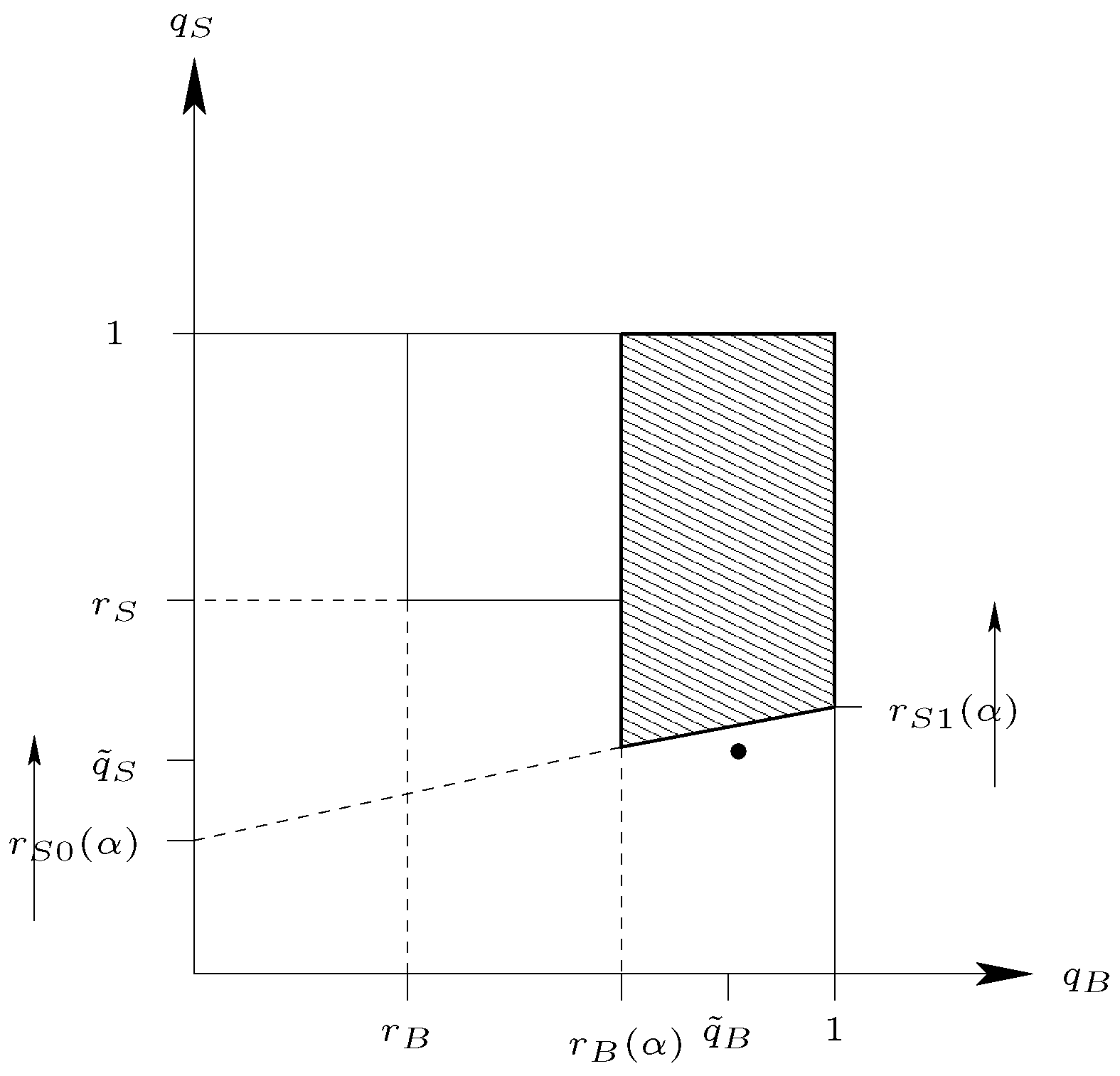

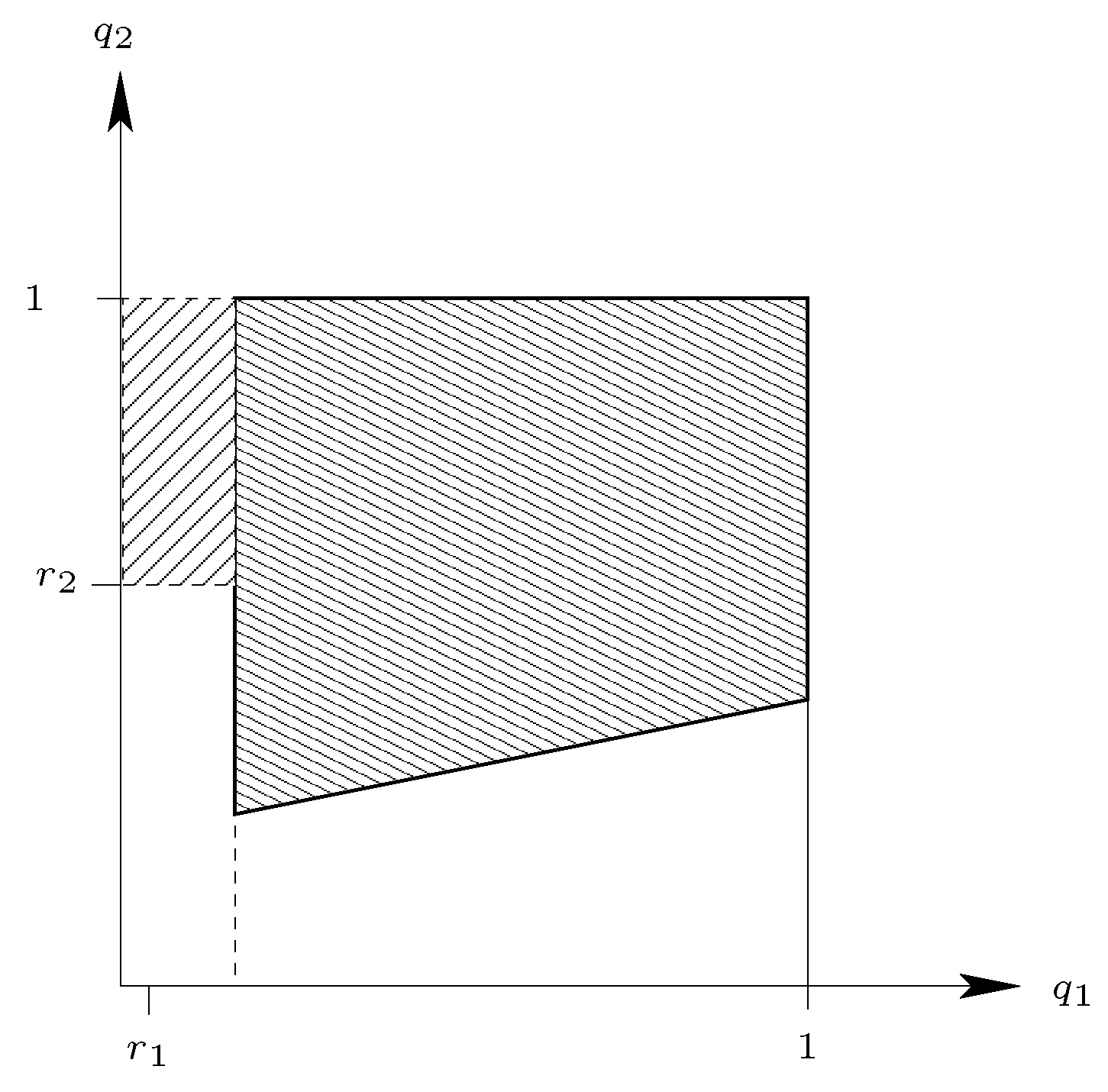

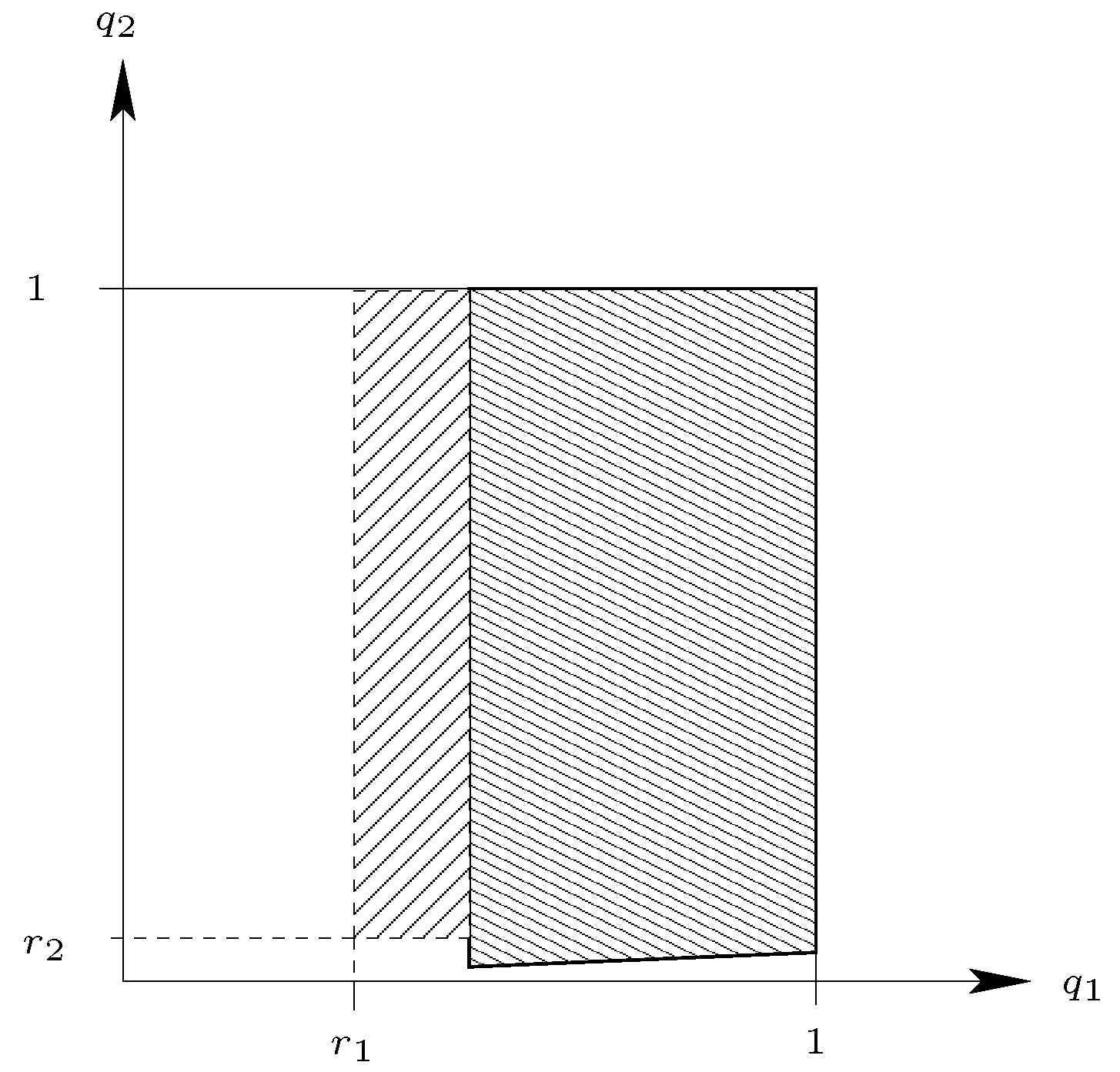

5.2. Alliances Offering Improved Market Performance

| Boots’s choice | |||||

| Ally | Alternative | ||||

| Sainsbury’s choice | (1 ‒ yqB)(fB + fS) | (1 ‒ qB)(fB + fS)hB | |||

| Ally | |||||

| (1 ‒ yqB)(fB + fS)g | (1 ‒ qS)fSg | ||||

| 0 | (1 ‒ qB)fBhB | ||||

| Alternative | |||||

| (1 ‒ qS)(fB + fS)(g + ) | (1 ‒ qS)fS(g + hS) | ||||

| ↑ | ↑ | ||||

| Sainsbury’s | Boots’s | ||||

| payoffs | payoffs | ||||

5.2.1. Sharing the Benefits of Improved Market Performance

5.2.2. Possible Implications for the Boots-Sainsbury’s Example

5.2.3. Further Implications

5.2.4. A View on Unilateral Commitments

6. Discussion, Conclusion and Lessons Learned

- Any analysis of the success or failure of an alliance needs to look carefully not only at the capabilities and intentions of the allies, but at the wider circumstances. Moreover, there are no “obvious” quantitative/formal answers to questions about the viability or advisability of any particular alliance.

- It is possible that a competitor wishing to undermine the alliance will attack the partners in different ways, so they need to be able to recognise when this is happening and have an agreed response.

- If the alliance is to succeed, then the allies need to recognise at the outset that they may face different external pressures and internal motivations and have considered and agreed strategies for dealing with them.

- One should analyse carefully the interactions between the decisions that need to be made and their timing.

Acknowledgments

Conflicts of Interest

- 1.Notwithstanding, in this paper, we have relied only on published material to support our arguments and conclusions.

- 3.We avoid a further discussion about the extensive form of this game based on the agreements between the two companies, because it is out of the scope of this work. However, the dynamic model is not the unique way to describe this real life scenario.

- 4.Here, we justify how Sainsbury’s complete footfall fits naturally within a game theoretical situation, such as the Prisoners’ Dilemma. Therefore, we assume that a part of Boots customers will be retailed by Sainsbury’s if Sainsbury’s strategy is and Boots’s strategy is . We allow x to vary between zero and one, . Then, the south-western-most element in Table 1 becomes . After simple computations, if x satisfies the following condition:then modified Table 1 (where replaces ) still represents the Prisoners’ Dilemma. If Boots’s strategy is and Sainsbury’s is , Boots does not retail Sainsbury’s customers, because Sainsbury’s retails just groceries and Boots retails health and beauty products.

References

- Arend, R.J.; Seale, D.A. Modeling alliance activity: An iterated Prisoners’ Dilemma with exit option. Strateg. Manag. J. 2005, 26, 1057–1074. [Google Scholar] [CrossRef]

- Voyle, S. Boots and Sainsbury in Trial Link-Up; Financial Times: London, UK, 2001. [Google Scholar]

- Boots and Sainsbury Notification Made Under the Competition Act 1998; Technical Report; Office of Fair Trading: Parramatta, Australia, 2001. Available online: http://www.legislation.gov.uk/ (accessed on 13 November 2006).

- Koza, M.P.; Lewin, A.Y. The co-evolution of strategic alliances. Organ. Sci. 1998, 9, 255–264. [Google Scholar] [CrossRef]

- Yeheskel, O.; Shenkar, O.; Fiegenvaum, A.; Cohen, E.; Geffen, I. Cooperative wealth creation: Strategic alliances in israel medical-technology ventures. Acad. Manag. Exec. 2001, 15, 16–25. [Google Scholar] [CrossRef]

- London Focus for Boots Store Revamp. The Pharmaceutical Journal. 2002. Available online: http://www.pjonline.com/ (accessed on 4 June 2008).

- Boots Growth tonic May Be Blue Stores. The Daily Express. 2001. Available online: http://www.express.co.uk/ (accessed on 13 November 2006).

- Sainsbury’s and Oddbins Launch Wine Company. Press release 2 February 2001, J. Sainsbury plc, London. 2001. Available online: http://www.j-sainsbury.co.uk/ (accessed on 2 June 2008).

- Outlook. The Independent. 2001. Available online: http://www.independent.co.uk/ (accessed on 18 July 2011).

- Interim results 21 November 2001. J. Sainsbury plc, Transcript of discussion at shareholders’ meeting. 2001. Available online: http://www.j-sainsbury.co.uk/ (accessed on 8 October 2009).

- Sainsbury and Oddbins have reached the end of the road with their joint venture Destination Wine Company. The Grocer, London 2002. Available online: http://www.thegrocer.co.uk/ (accessed on 2 June 2008).

- Treanor, J. Boots and sainsbury in ugly divorce. The Guardian 2003. Available online: http://www.theguardian.com/uk (accessed on 2 June 2008). [Google Scholar]

- Ariño, A.; Ring, P.S. The role of fairness in alliance formation. Strateg. Manag. J. 2010, 31, 1054–1087. [Google Scholar] [CrossRef]

- Williams, B.R. The Best Butter in the World: A History of Sainsbury’s; Ebury Press: London, UK, 1994. [Google Scholar]

- Owen, G. Corporate Strategy in UK Food Retailing, 1980–2002. Technical Report, Centre for the Analysis of Risk and Regulation, London School of Economics. 2003. Available online: http://cep.lse.ac.uk/ (accessed on 2 June 2008).

- Burt, S.; Sparks, L. Competitive Analysis of the Retail Sector in the UK. Technical Report, Department for Business Innovation and Skills; 2003. Available online: http://webarchive.nationalarchives.gov.uk/ (accessed 2 June 2009). [Google Scholar]

- Burt, S.; Davies, K.; McCauley, A.; Sparks, L. Retail internationalisation: From formats to implants. Eur. Manag. J. 2005, 23, 195–202. [Google Scholar] [CrossRef]

- Banerjee, P. Price interventions in a Cournot oligopoly with a dominant firm. B. E. J. Theor. Econ. 2007, 7, 1–28. [Google Scholar] [CrossRef]

- Lyons, T. Sainsburys Mulls Boots Merger. Mail on Sunday. 2001. Available online: http://www.dailymail.co.uk/ (accessed on 2 June 2008).

- A Global Supermarket Success. The Economist. 2001. Available online: http://www.economist.com/ (accessed on 2 June 2008); subscription required.

- The Competition Commission. Supermarkets: A Report on the Supply of Groceries from Multiple Stores in the United Kingdom. Technical Report, The Competition Commission. 2000. Available online: http://www.competition-commission.org.uk/ (accessed on 2 June 2008).

- Ryle, S. Supermarket Pill Sales Give Boots Headache. The Observer. 2001. Available online: http://www.boots-uk.com/ (accessed on 2 June 2008).

- Boots Group plc. Response to OFT Report—Boots to Open More Pharmacies. Press release 18 July 2001, Boots Group, London. 2003. Available online: http://www.boots-uk.com/ (accessed on 2 June 2008).

- Hayward, N. Private Label in the UK (part 1): the Personalisation of Private Label. Euromonitor. 2002. Available online: http://www.euromonitor.com/ (accessed on 20 October 2013).

- Annual Report 2001. Tesco plc. 2001. Available online: http://www.tescoplc.com/ (accessed on 20 October 2013).

- Euromonitor. Boots on the Edge. Euromonitor. 2003. Available online: http://www.540euromonitor.com/ (accessed on 20 October 2013).

- Gulati, R. Alliances and networks. Strateg. Manag. J. 1998, 19, 293–317. [Google Scholar] [CrossRef]

- Das, D.K.; Teng, B.S. Partner analysis and alliance performance. Scand. J. Manag. 2003, 19, 279–308. [Google Scholar] [CrossRef]

- Park, S.H.; Ungson, G.R. Interfirm rivalry and managerial complexity: A conceptual framework of alliance failure. Organ. Sci. 2001, 12, 37–53. [Google Scholar] [CrossRef]

- Gomes-Casseres, B. How Alliances Reshape Competition. In Handbook of Strategic Alliances; Sage Publications: Thousand Oaks, CA, USA, 2006; pp. 39–53. [Google Scholar]

- Susini, J.P. The determinants of alliance performance: Case study of renault & nissan alliance. Econ. J. Hokkaido Univ. 2004, 33, 233–262. [Google Scholar]

- Cope, N. Boots products may be cheaper in Sainsbury’s. The Independent. 2001. Available online: http://www.independent.co.uk/ (accessed on 14 June 2009).

- Cope, N. Failed venture costs Boots and Sainsbury 10m. The Independent. 2003. Available online: http://www.independent.co.uk/ (accessed on 5 November 2009).

- Mitchell, W.; Singh, K. Survival of businesses using collaborative relationships to commercialize complex goods. Strateg. Manag. J. 1996, 17, 169–195. [Google Scholar] [CrossRef]

- Half Year Results to 30th September 2003. Press release 6th November 2003, Boots Group plc. 2003. Available online: http://www.boots-uk.com/ (accessed on 3 June 2008).

- Ariño, A.; de la Torre, J. Learning from failure: Towards an evolutionary model of collaborative ventures. Organ. Sci. 1998, 9, 306–325. [Google Scholar] [CrossRef]

- Gulati, R.; Khanna, T.; Nohria, N. Unilateral commitments and the importance of process in alliances. Sloan Manag. Rev. 1994, 35, 61–69. [Google Scholar]

- Parkhe, A. Strategic alliance structuring: A game theoretic and transaction cost examination of inter-firm cooperation. Acad. Manag. J. 1993, 36, 794–829. [Google Scholar] [CrossRef]

- Charness, G.; Frèchette, G.; Qin, C.Z. Endogenous transfers in the Prisoner’s Dilemma game: An experimental test of cooperation and coordination. Games Econ. Behav. 2007, 60, 287–306. [Google Scholar] [CrossRef]

- Kolokoltsov, V.N. Nonexpansive maps and option pricing theory. Kybernetika 1998, 34, 713–724. [Google Scholar]

- Sanders, S. Three Essays on the Economics of Conflict and Contest. Ph.D Thesis, Kansas State University, Manhattan, KS, USA, 2007. [Google Scholar]

- Rapaport, A. N-Person Game Theory; University of Michigan Press: Ann Arbor, MI, USA, 1970. [Google Scholar]

- De Ridder, A.; Rusinowska, A. On some procedures of forming a multipartner alliance. J. Econ. Manag. Strateg. 2008, 17, 443–487. [Google Scholar] [CrossRef]

- Day, J. Retail giants join forces. The Guardian. 2001. Available online: http://www.theguardian.com/uk (accessed on 20 october 2013).

- Editorial: Boots and Sainsbury Plan Alliance. The Pharmaceutical Journal. 2001. Available online: http://www.pjonline.com/ (accessed on 9 June 2008).

- Burt, S.; Sparks, L. Competitive Analysis of the Retail Sector in the UK; Technical Report; University of Stirling: Scotland, UK, January 2003. [Google Scholar]

- Chatterjee, K.; Dutta, B.; Ray, D.; Sengupta, K. A noncooperative theory of coalitional bargaining. Rev. Econ. Stud. 1993, 60, 463–477. [Google Scholar] [CrossRef]

- Smirnov, V.; Wait, A. Market entry dynamics with a second-mover advantage. B. E. J. Theor. Econ. 2007, 7. [Google Scholar] [CrossRef]

- Sainsbury’s Rolls out Own Health and Beauty Offer. Press release 3 February 2003, J. Sainsbury plc, London. 2003. Available online: http://www.j-sainsbury.co.uk/ (accessed on 2 June 2008).

- Sainsbury kicks Boots into touch. Daily Mail. 2003. Available online: http://www.dailymail.co.uk/ (accessed on 20 October 2013).

- King, I. No row or acrimony as Davies ends era with Per Una and M&S. TheTimes. 2008. Available online: http://www.thetimes.co.uk/ (accessed on 20 October 2013).

- OFT Recommends Liberalisation of Pharmacy Market. Release Press Office of Fair Trading, London; 2003. Available online: http://www.oft.gov.uk/ (accessed on 20 October 2013).

- Gulati, R.; Lavie, D.; Madhavin, R. How do networks matter? Unpacking the performance effects of interorganizational networks. Res. Organ. Behav. 2011, 31, 207–244. [Google Scholar] [CrossRef]

- Kolokoltsov, V.N.; Malafeyev, O.A. Understanding Game Theory; World Scientific: Singapore, Singapore, 2010. [Google Scholar]

- Binner, J.M.; Fletcher, L.R.; Kolokoltsov, V.N. Existence and Uniqueness of Nash Equilibria in a Simple Lanchester Model of the Costs of Customer Churn. In Game Theory and Applications; Petrosjan, L., Mazalov, V.V., Eds.; Nova: New York, NY, US, 2013; Volume 10, Chapter 2. [Google Scholar]

- Ahuja, G.; Polidoro, F.; Mitchell, W. Structural homophily or social asymmetry? The formation of alliances by poorly embedded firms. Strateg. Manag. J. 2009, 30, 941–958. [Google Scholar] [CrossRef]

© 2013 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Binner, J.M.; Fletcher, L.R.; Kolokoltsov, V.; Ciardiello, F. External Pressure on Alliances: What Does the Prisoners’ Dilemma Reveal? Games 2013, 4, 754-775. https://doi.org/10.3390/g4040754

Binner JM, Fletcher LR, Kolokoltsov V, Ciardiello F. External Pressure on Alliances: What Does the Prisoners’ Dilemma Reveal? Games. 2013; 4(4):754-775. https://doi.org/10.3390/g4040754

Chicago/Turabian StyleBinner, Jane M., Leslie R. Fletcher, Vassili Kolokoltsov, and Francesco Ciardiello. 2013. "External Pressure on Alliances: What Does the Prisoners’ Dilemma Reveal?" Games 4, no. 4: 754-775. https://doi.org/10.3390/g4040754