Shipment Consolidation Policy under Uncertainty of Customer Order for Sustainable Supply Chain Management

Abstract

:1. Introduction

2. Literature Review

3. Mathematical Models

3.1. Quantity-Based Policy to Consideration of Order Cancellation

- : fixed cost of replenish inventory

- : unit replenish cost

- : fixed cost of dispatching shipment to customer

- : unit dispatch cost

- : holding cost per unit per unit time

- : Poisson demand rate

- : order cancellation cost per unit

- : order cancellation rate per unit time ()

- : unit environmental cost during dispatch

- : dispatch quantity (integer, decision variable, )

- : number of dispatch cycles within an inventory replenishment cycle (integer, decision variable, )

- : replenishment quantity ()

- Order Cancellation Cost: Since the company will not dispatch its products until q units of demand accumulate, the order cancellation rate is . Thus, the order cancellation cost per dispatch cycle is . Since there are n dispatch cycles in a replenishment cycle, the customer waiting cost per replenishment cycle is:

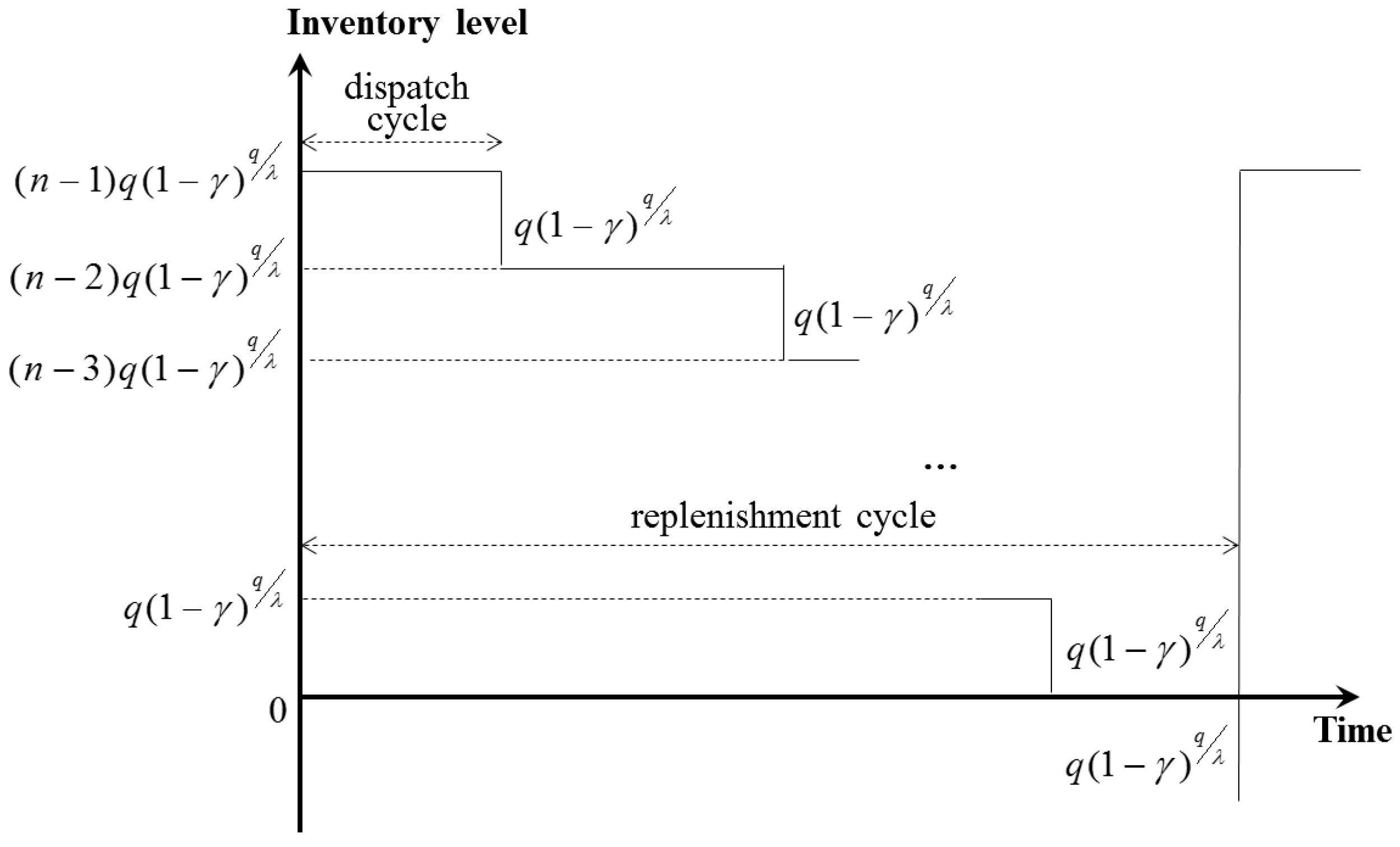

- Replenishment Cost: Since the replenishment quantity, Q, is equal to (see Figure 1), the replenishment cost is:

- Dispatch Cost: Since the dispatch quantity is , the dispatch cost in a dispatch cycle is . There are n dispatch cycles during a replenishment cycle, and, thus, the dispatch cost during the cycle is:

- Inventory Holding Cost: At the beginning of a replenishment cycle, the inventory level is . This implies that the inventory level is kept at throughout the first dispatch cycle, and incurs expected holding cost of . For the ith dispatch cycle, the expected holding cost is . Hence, the total expected inventory holding cost is given by:Using the above results, the expected cost during a replenishment cycle is computed by:Conversely, the expression for the long-run average profit, , is given by:

- The simple enumeration algorithm (SEA_Q)

3.2. Time-Based Policy to Consideration of Order Cancellation

- : dispatch cycle time (decision variable)

- : number of dispatch cycles within an inventory replenishment cycle

- : replenishment quantity (integer, decision variable)

- : demand during dispatch cycles

- Order Cancellation Cost: Since the company will not dispatch its products until T units of time lapses, the order cancellation rate is . Thus, the order cancellation cost per dispatch cycle is . Since there are n dispatch cycles in a replenishment cycle, the customer waiting cost per replenishment cycle is:

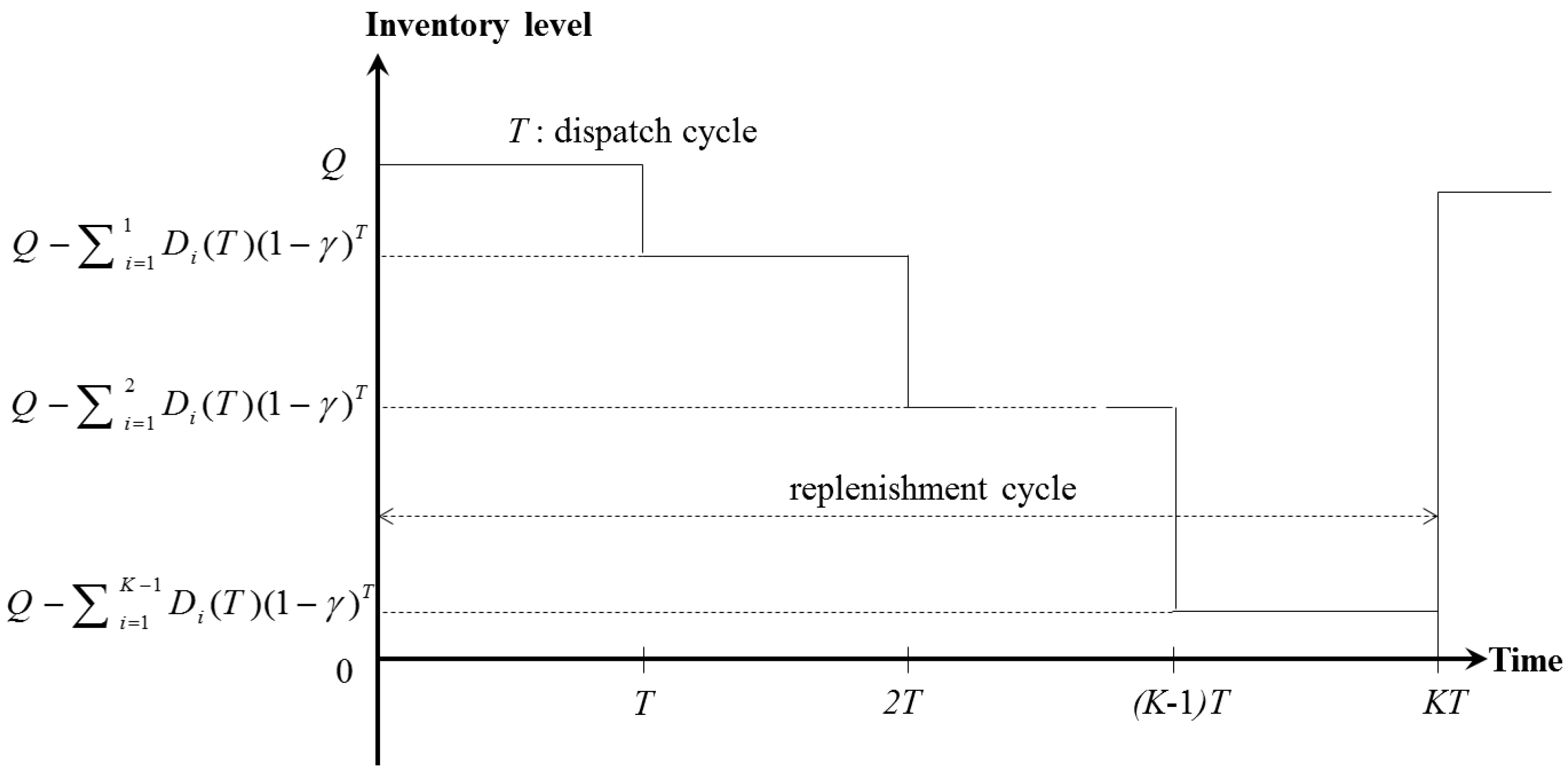

- Replenishment Cost: The expected replenishment quantity is equal to the expected total demand within a replenishment cycle (see Figure 2). The expected replenishment cost is computed by:

- Dispatch Cost: The expected dispatch quantity in a dispatch cycle is , and the expected dispatch cost in a dispatch cycle is . There are dispatch cycles during a replenishment cycle, and, thus, the expected dispatch cost during a replenishment cycle is computed by:

- Inventory Holding Cost: Let I(t) denote the inventory level at time t.Since holding cost is h, the inventory holding cost is given by:Using the above results, the expected cost during a replenishment cycle is computed by:Conversely, the expression for the long-run average profit, TP(Q,T), is given by:

- The simple enumeration algorithm (SEA_T)

4. Numerical Results

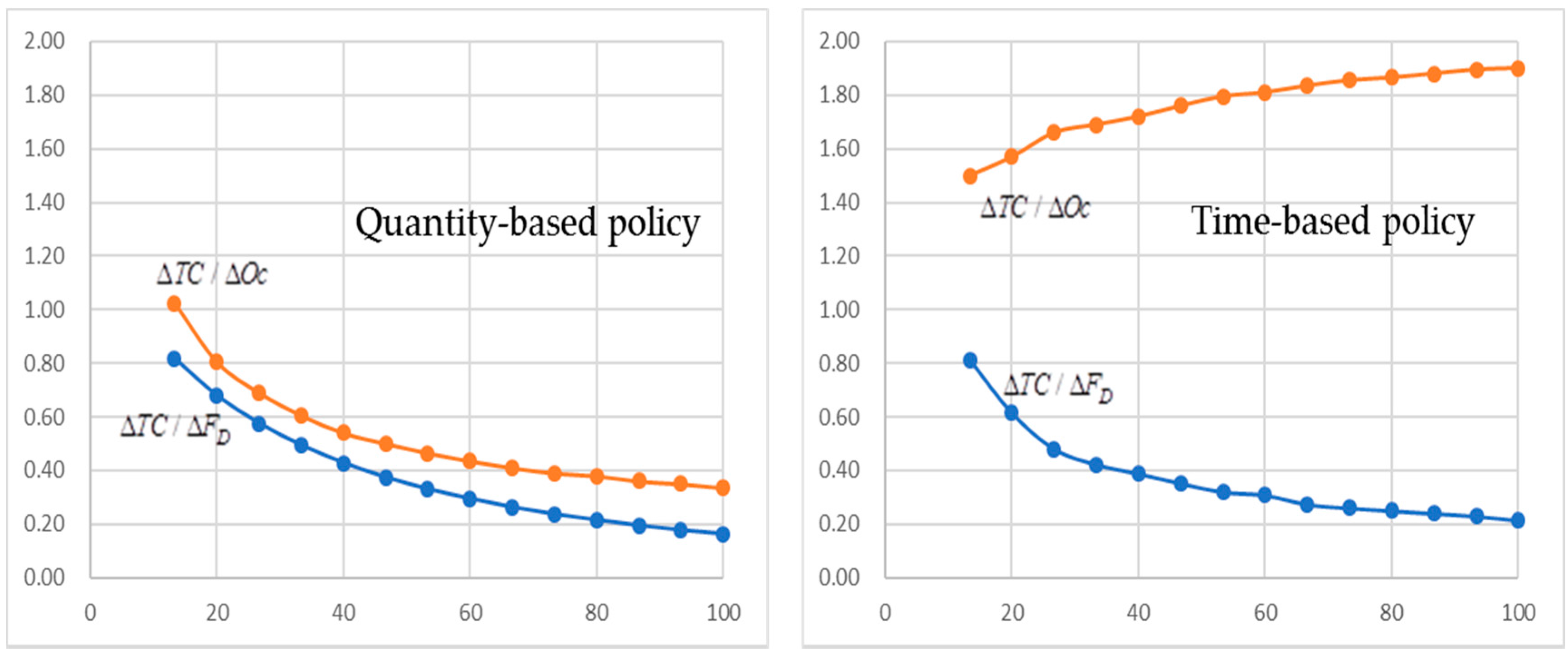

4.1. Sensitivity Analysis

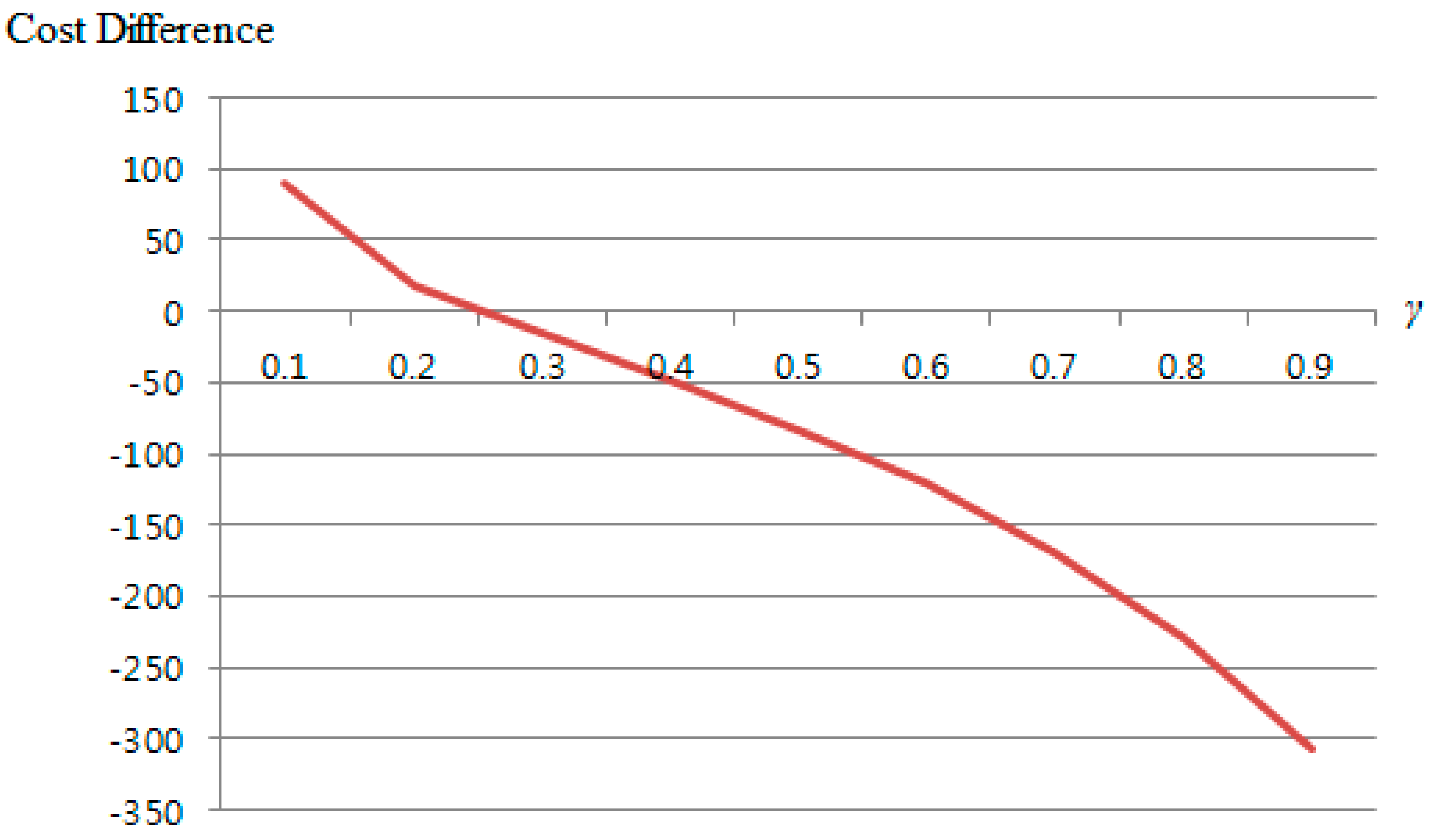

4.2. Comparison of the Quantity-Based and the Time-Based Policies

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Delmas, M.; Montiel, I. Greening the supply chain: When is customer pressure effective? J. Econ. Manag. Strategy 2009, 18, 171–201. [Google Scholar] [CrossRef]

- Aronsson, H.; Brodin, M.H. The environmental impact of changing logistics structures. Int. J. Logist. Manag. 2006, 17, 394–415. [Google Scholar] [CrossRef]

- Colicchia, C. Building environmental sustainability: Empirical evidence from logistics service providers. J. Clean. Prod. 2013, 59, 197–209. [Google Scholar] [CrossRef]

- Higginson, J.K.; Bookbinder, J.H. Markovian decision processes in shipment consolidation. Transp. Sci. 1995, 29, 242–255. [Google Scholar] [CrossRef]

- Ülkü, M.A. Dare to care: Shipment consolidation reduces not only costs, but also environmental damage. Int. J. Prod. Econ. 2012, 139, 438–446. [Google Scholar] [CrossRef]

- Lewis, A.; Fell, M.; Palmer, D. Freight Consolidation Centre Study; Transport and Travel Research Ltd.: London, UK, 2010. [Google Scholar]

- Çetinkaya, S. Coordination of inventory and shipment consolidation decisions: A review of premises, models, and justification. In Applications of Supply Chain Management and E-Commerce Research; Springer: Boston, MA, USA, 2005; pp. 3–51. [Google Scholar]

- Hallowell, R. The relationships of customer satisfaction, customer loyalty, and profitability: An empirical study. Int. J. Serv. Ind. Manag. 1996, 7, 27–42. [Google Scholar] [CrossRef]

- Fera, M.; Fruggiero, F.; Lambiase, A.; Macchiaroli, R.; Miranda, S. The role of uncertainty in supply chains under dynamic modeling. Int. J. Ind. Eng. Comput. 2016, 8, 119–140. [Google Scholar] [CrossRef]

- Hong, K.-S. Integrated inventory and transportation decision for ubiquitous supply chain management. J. Intell. Manuf. 2012, 23, 977–988. [Google Scholar] [CrossRef]

- Benjaafar, S.; Gayon, J.-P.; Tepe, S. Optimal control of a production–inventory system with customer impatience. Oper. Res. Lett. 2010, 38, 267–272. [Google Scholar] [CrossRef]

- Ritchie-Dunham, J. A strategic supply chain simulation model. In Proceedings of the 32nd Conference on Winter Simulation; Society for Computer Simulation International: San Diego, CA, USA, 2000; pp. 1260–1264. [Google Scholar]

- Davis, T.R. Internal service operations: Strategies for increasing their effectiveness and controlling their cost. Organ. Dyn. 1991, 20, 5–22. [Google Scholar] [CrossRef]

- Thöni, A.; Tjoa, A.M. Information technology for sustainable supply chain management: A literature survey. Enter. Inf. Syst. 2017, 11, 828–858. [Google Scholar] [CrossRef]

- Martino, G.; Fera, M.; Iannone, R.; Miranda, S. Supply chain risk assessment in the fashion retail industry: An analytic network process approach. Int. J. Appl. Eng. Res. 2017, 12, 140–154. [Google Scholar]

- Hoffman, W. Who’s Carbon-Free? Traffic World 2007, 22, 1–2. [Google Scholar]

- Darom, N.A.; Hishamuddin, H. Integration of economic and environmental aspects in sustainable supply chain management: A review. In Proceedings of the 6th International Conference on Industrial Engineering and Operations Management, Kuala Lumpur, Malaysia, 8–10 March 2016. [Google Scholar]

- Fera, M.; Macchiaroli, R.; Fruggiero, F.; Lambiase, A.; Miranda, S. Application of a business process model (BPM) method for a warehouse rfid system implementation. Int. J. Technol. 2017, 8, 57–77. [Google Scholar] [CrossRef]

- Busato, D.; Fera, M.; Iannone, R.; Mancini, V.; Schiraldi, M.M. Evaluating rfid opportunity through process analysis. Int. J. Technol. 2013, 5, 81–105. [Google Scholar]

- Mckinnon, A.C. The economic and environmental benefits of increasing maximum truck weight: The british experience. Transp. Res. Part D Transp. Environ. 2005, 10, 77–95. [Google Scholar] [CrossRef]

- Merrick, R.J.; Bookbinder, J.H. Environmental assessment of shipment release policies. Int. J. Phys. Distrib. Logist. Manag. 2010, 40, 748–762. [Google Scholar] [CrossRef]

- Pan, S.; Ballot, E.; Fontane, F. The reduction of greenhouse gas emissions from freight transport by pooling supply chains. Int. J. Prod. Econ. 2013, 143, 86–94. [Google Scholar] [CrossRef]

- Çetinkaya, S.; Mutlu, F.; Lee, C.-Y. A comparison of outbound dispatch policies for integrated inventory and transportation decisions. Eur. J. Oper. Res. 2006, 171, 1094–1112. [Google Scholar] [CrossRef]

- Higginson, J.K.; Bookbinder, J.H. Policy recommendations for a shipment consolidation program. J. Bus. Logist. 1994, 15, 87–112. [Google Scholar]

- Çetinkaya, S.; Bookbinder, J.H. Stochastic models for the dispatch of consolidated shipments. Transp. Res. Part B Methodol. 2003, 37, 747–768. [Google Scholar] [CrossRef]

- Chen, F.Y.; Wang, T.; Xu, T.Z. Integrated inventory replenishment and temporal shipment consolidation: A comparison of quantity-based and time-based models. Ann. Oper. Res. 2005, 135, 197–210. [Google Scholar] [CrossRef]

- Çetinkaya, S.; Lee, C.-Y. Optimal outbound dispatch policies: Modeling inventory and cargo capacity. Naval Res. Logist. 2002, 49, 531–556. [Google Scholar] [CrossRef]

- Moon, I.K.; Cha, B.C.; Lee, C.U. The joint replenishment and freight consolidation of a warehouse in a supply chain. Int. J. Prod. Econ. 2011, 133, 344–350. [Google Scholar] [CrossRef]

- Ching, W.-K.; Tai, A.H. A quantity-time-based dispatching policy for a VMI system. In Proceedings of the International Conference on Computational Science and Its Applications, Singapore, 9–12 May 2005; Springer: Berlin/Heidelberg, Germany, 2005; pp. 342–349. [Google Scholar]

- Günther, H.-O.; Seiler, T. Operative transportation planning in consumer goods supply chains. Flex. Serv. Manuf. J. 2009, 21, 51–74. [Google Scholar] [CrossRef]

- Ülkü, M.A.; Bookbinder, J.H. Optimal quoting of delivery time by a third party logistics provider: The impact of shipment consolidation and temporal pricing schemes. Eur. J. Oper. Res. 2012, 221, 110–117. [Google Scholar] [CrossRef]

- Mutlu, F.; Cetinkaya, S.; Bookbinder, J.H. An analytical model for computing the optimal time-and-quantity-based policy for consolidated shipments. Iie Trans. 2010, 42, 367–377. [Google Scholar] [CrossRef]

- Hong, K.-S.; Lee, C. Optimal time-based consolidation policy with price sensitive demand. Int. J. Prod. Econ. 2013, 143, 275–284. [Google Scholar] [CrossRef]

- Çetinkaya, S.; Mutlu, F.; Wei, B. On the service performance of alternative shipment consolidation policies. Oper. Res. Lett. 2014, 42, 41–47. [Google Scholar] [CrossRef]

- Çetinkaya, S.; Lee, C.-Y. Stock replenishment and shipment scheduling for vendor-managed inventory systems. Manag. Sci. 2000, 46, 217–232. [Google Scholar] [CrossRef]

- Cheung, K.L.; Zhang, A.X. The impact of inventory information distortion due to customer order cancellations. Naval Res. Logist. 1999, 46, 213–231. [Google Scholar] [CrossRef]

- Yuan, X.-M.; Cheung, K.L. Optimal inventory policy for systems with demand cancellations. Iie Trans. 2003, 35, 739–747. [Google Scholar] [CrossRef]

- You, P.-S. Dynamic pricing of inventory with cancellation demand. J. Oper. Res. Soc. 2003, 54, 1093–1101. [Google Scholar] [CrossRef]

- You, P.-S.; Hsieh, Y.-C. A lot size model for deteriorating inventory with back-order cancellation. In Proceedings of the International Conference on Industrial, Engineering and Other Applications of Applied Intelligent Systems, Kyoto, Japan, 26–29 June 2007; Springer: Berlin/Heidelberg, Germany, 2007; pp. 1002–1011. [Google Scholar]

- Yeo, W.M.; Yuan, X.-M. Optimal inventory policy with supply uncertainty and demand cancellation. Eur. J. Oper. Res. 2011, 211, 26–34. [Google Scholar] [CrossRef]

| Quantity-Based Policy | Time-Based Policy | |||||

|---|---|---|---|---|---|---|

| n | q | Total Cost | T | Total Cost | ||

| increases | increases | increases | increases | No impact | increases | |

| No impact | increases | increases | No impact | increases | increases | |

| h | decreases | decreases | increases | decreases | decreases | increases |

| No impact | decreases | increases | No impact | decreases | increases | |

| i | Quantity-Based Policy | Time-Based Policy | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| n | q | Total Cost (TC) | (=TCi − TCi−1) | T | Total Cost (TC) | (=TCi − TCi−1) | |||||

| 1 | 5 | 4 | 4 | 16.36 | - | - | 11 | 1.74 | 25.61 | - | - |

| 2 | 10 | 6 | 4 | 20.45 | 4.09 | 0.82 | 11 | 2.26 | 29.67 | 4.06 | 0.81 |

| 3 | 15 | 7 | 4 | 23.85 | 3.40 | 0.68 | 10 | 2.66 | 32.04 | 3.07 | 0.61 |

| 4 | 20 | 8 | 6 | 26.73 | 2.88 | 0.58 | 10 | 2.96 | 34.44 | 2.40 | 0.48 |

| 5 | 25 | 8 | 8 | 29.20 | 2.47 | 0.49 | 10 | 3.22 | 36.55 | 2.11 | 0.42 |

| 6 | 30 | 8 | 8 | 31.34 | 2.14 | 0.43 | 10 | 3.46 | 38.49 | 1.94 | 0.39 |

| 7 | 35 | 9 | 9 | 33.21 | 1.87 | 0.37 | 10 | 3.67 | 40.25 | 1.76 | 0.35 |

| 8 | 40 | 10 | 9 | 34.86 | 1.65 | 0.33 | 9 | 3.90 | 40.50 | 1.60 | 0.32 |

| 9 | 45 | 10 | 9 | 36.33 | 1.47 | 0.29 | 9 | 4.08 | 42.04 | 1.54 | 0.31 |

| 10 | 50 | 11 | 9 | 37.64 | 1.31 | 0.26 | 9 | 4.26 | 43.41 | 1.37 | 0.27 |

| 11 | 55 | 12 | 9 | 38.82 | 1.18 | 0.24 | 9 | 4.42 | 44.71 | 1.30 | 0.26 |

| 12 | 60 | 12 | 9 | 39.89 | 1.07 | 0.21 | 9 | 4.58 | 45.96 | 1.25 | 0.25 |

| 13 | 65 | 13 | 9 | 40.86 | 0.97 | 0.19 | 9 | 4.73 | 47.16 | 1.20 | 0.24 |

| 14 | 70 | 14 | 10 | 41.74 | 0.88 | 0.18 | 9 | 4.87 | 48.31 | 1.15 | 0.23 |

| 15 | 75 | 14 | 11 | 42.55 | 0.81 | 0.16 | 8 | 5.05 | 47.59 | 1.07 | 0.21 |

| i | Quantity-Based Policy | Time-Based Policy | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| n | q | Total Cost (TC) | (=TCi − TCi−1) | T | Total Cost (TC) | (=TCi − TCi−1) | |||||

| 1 | 2 | 5 | 6 | 17.17 | - | - | 11 | 1.74 | 25.61 | - | - |

| 2 | 4 | 6 | 5 | 19.22 | 2.05 | 1.03 | 11 | 1.62 | 28.61 | 3.00 | 1.50 |

| 3 | 6 | 7 | 4 | 20.83 | 1.61 | 0.81 | 11 | 1.51 | 31.75 | 3.14 | 1.57 |

| 4 | 8 | 8 | 4 | 22.21 | 1.38 | 0.69 | 12 | 1.34 | 35.07 | 3.32 | 1.66 |

| 5 | 10 | 9 | 3 | 23.42 | 1.21 | 0.61 | 12 | 1.32 | 38.54 | 3.38 | 1.69 |

| 6 | 12 | 10 | 3 | 24.50 | 1.08 | 0.54 | 12 | 1.25 | 41.98 | 3.44 | 1.72 |

| 7 | 14 | 11 | 3 | 25.50 | 1.00 | 0.50 | 12 | 1.19 | 45.50 | 3.52 | 1.76 |

| 8 | 16 | 12 | 3 | 26.43 | 0.93 | 0.47 | 12 | 1.13 | 49.09 | 3.59 | 1.80 |

| 9 | 18 | 13 | 2 | 27.30 | 0.87 | 0.44 | 12 | 1.09 | 52.71 | 3.62 | 1.81 |

| 10 | 20 | 14 | 2 | 28.12 | 0.82 | 0.41 | 12 | 1.04 | 56.38 | 3.67 | 1.84 |

| 11 | 22 | 15 | 2 | 28.90 | 0.78 | 0.39 | 12 | 1.00 | 60.09 | 3.71 | 1.86 |

| 12 | 24 | 16 | 2 | 29.66 | 0.76 | 0.38 | 12 | 0.97 | 63.82 | 3.73 | 1.87 |

| 13 | 26 | 17 | 2 | 30.38 | 0.72 | 0.36 | 12 | 0.94 | 67.58 | 3.76 | 1.88 |

| 14 | 28 | 18 | 1 | 31.08 | 0.70 | 0.35 | 12 | 0.91 | 71.37 | 3.79 | 1.90 |

| 15 | 30 | 19 | 1 | 31.75 | 0.67 | 0.34 | 12 | 0.88 | 75.17 | 3.80 | 1.90 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kang, K.; Hong, K.-s.; Kim, K.H.; Lee, C. Shipment Consolidation Policy under Uncertainty of Customer Order for Sustainable Supply Chain Management. Sustainability 2017, 9, 1675. https://doi.org/10.3390/su9091675

Kang K, Hong K-s, Kim KH, Lee C. Shipment Consolidation Policy under Uncertainty of Customer Order for Sustainable Supply Chain Management. Sustainability. 2017; 9(9):1675. https://doi.org/10.3390/su9091675

Chicago/Turabian StyleKang, Kyunghoon, Ki-sung Hong, Ki Hong Kim, and Chulung Lee. 2017. "Shipment Consolidation Policy under Uncertainty of Customer Order for Sustainable Supply Chain Management" Sustainability 9, no. 9: 1675. https://doi.org/10.3390/su9091675