Dynamic Technological Diversification and Its Impact on Firms’ Performance: An Empirical Analysis of Korean IT Firms

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. Related Technological Diversification (RTD) Versus Unrelated Technological Diversification (UTD)

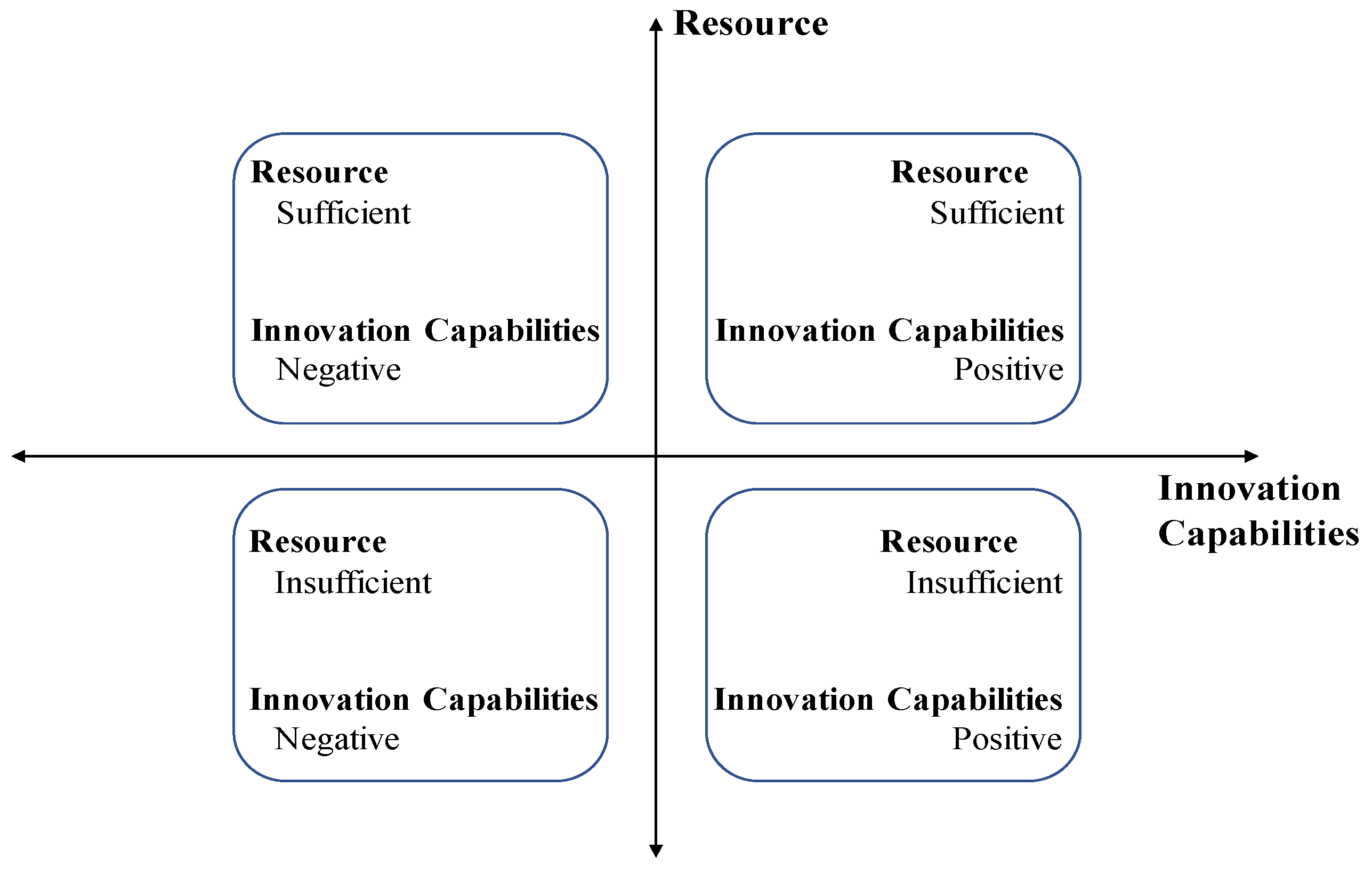

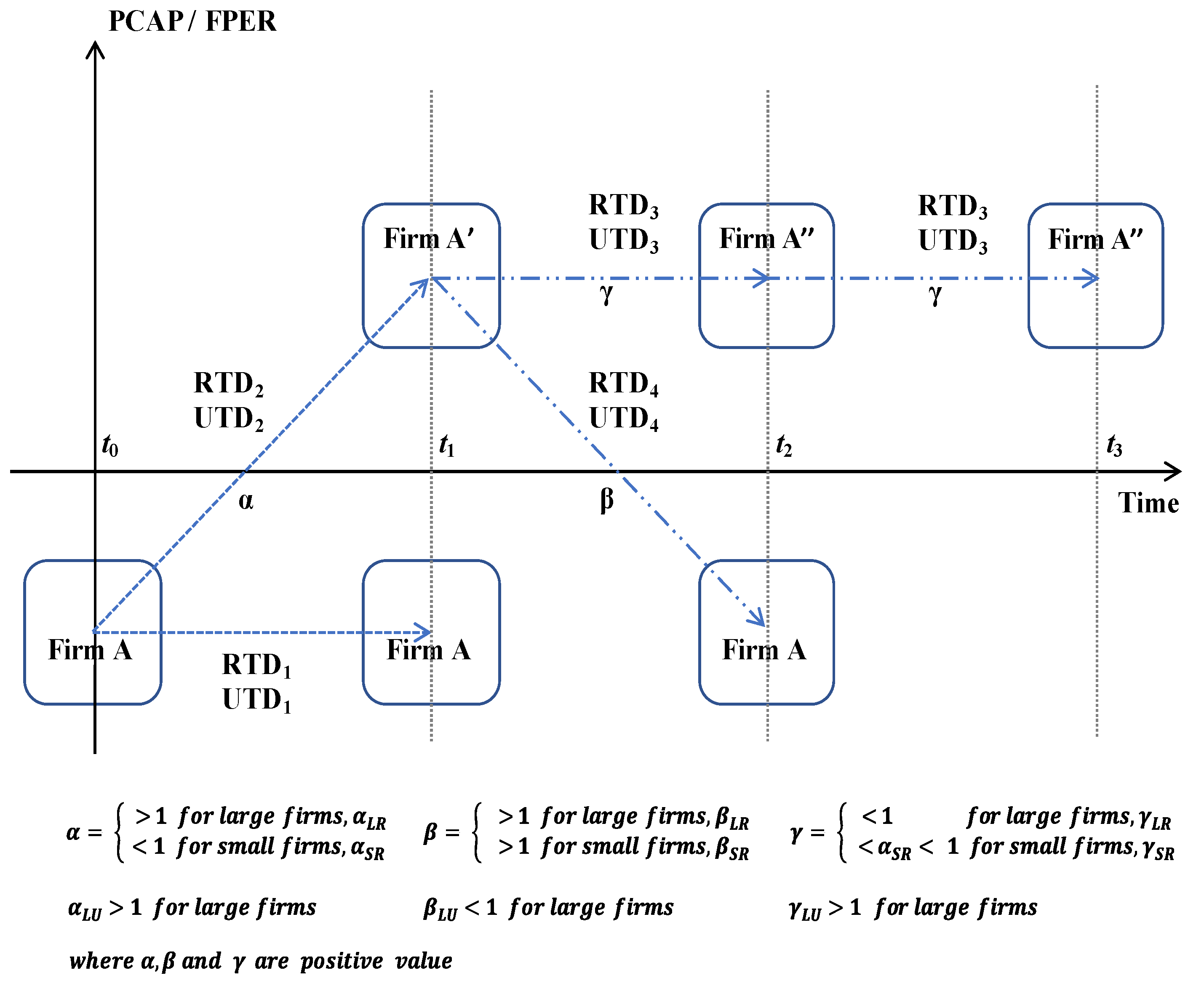

2.2. Dynamic Technological Diversification Strategy Based on a Firm’s Innovation Capabilities

3. Materials and Methods

3.1. Data

3.2. Variables

4. Results

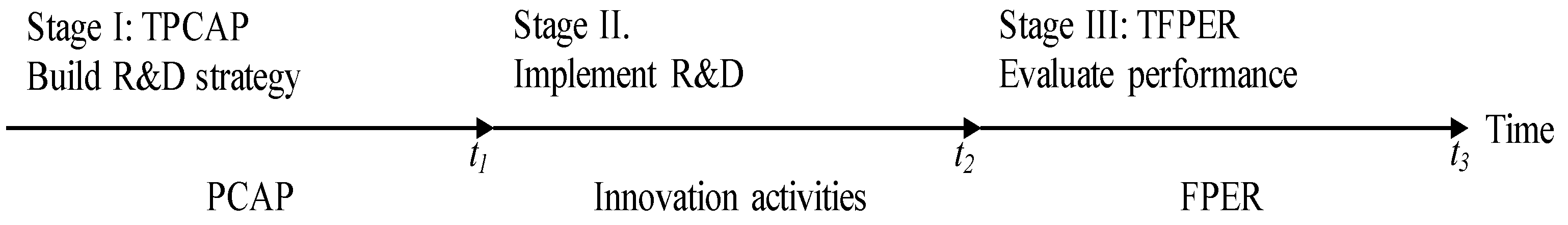

4.1. Time Lag between Technological Diversification Strategy and Performance

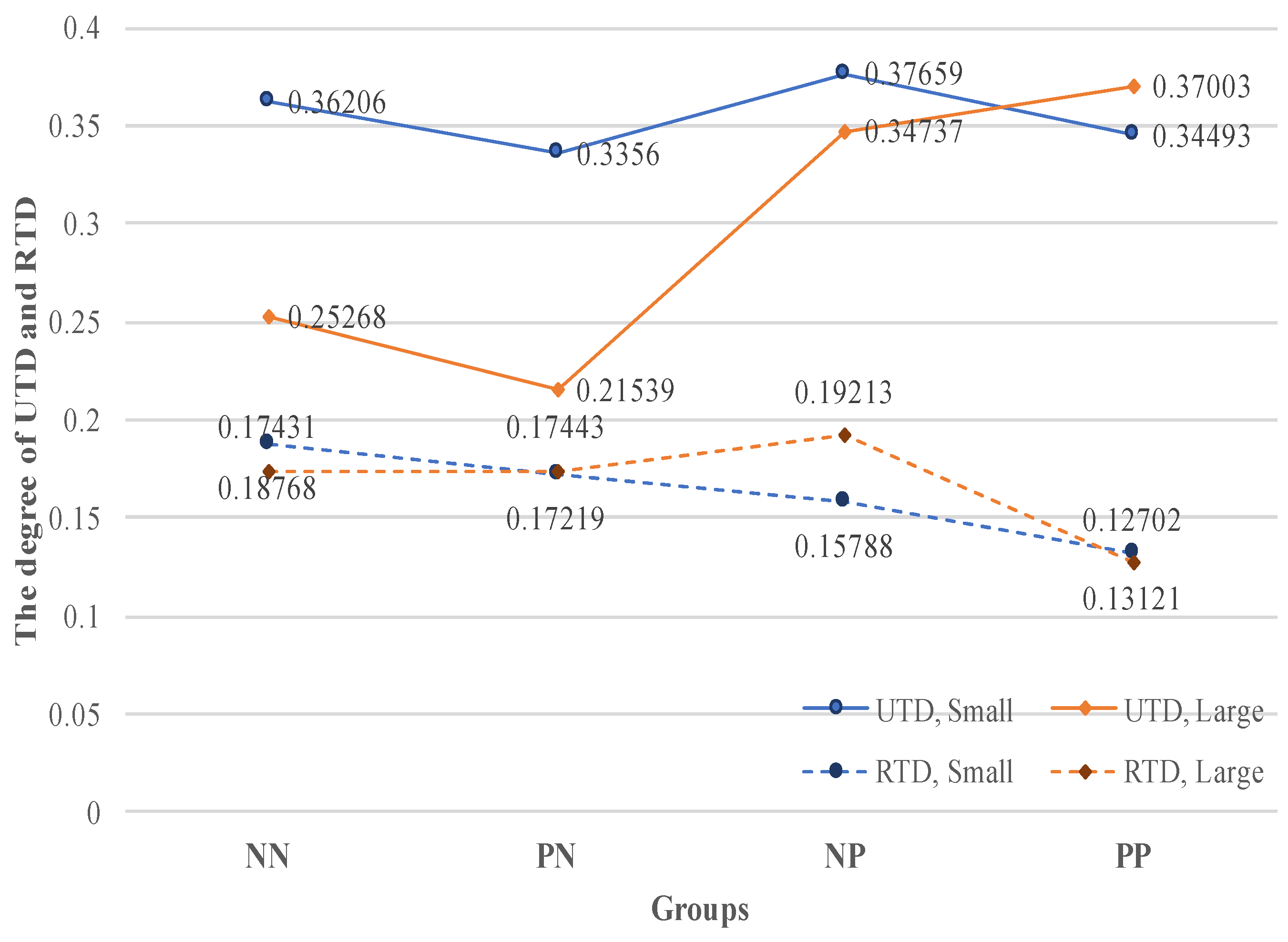

4.2. Statistical Analysis for both UTD and RTD

5. Discussion

5.1. Association of Technological Diversification with FPER

5.2. How to Control Both UTD and RTD Dynamically in Order to Accomplish and Sustain Better FPER?

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Park, S.; Jun, S. Statistical Technology Analysis for Competitive Sustainability of Three Dimensional Printing. Sustainability 2017, 9, 1142. [Google Scholar] [CrossRef]

- Bos-Brouwers, H.E.J. Corporate Sustainability and Innovation in SMEs: Evidence of Themes and Activities in Practice. Bus. Strateg. Environ. 2010, 19, 417–435. [Google Scholar] [CrossRef]

- Rumelt, R.P. Diversification strategy and profitability. Strateg. Manag. J. 1982, 3, 359–369. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Lin, B.-W.; Chen, C.-J.; Wu, H.-L. Patent portfolio diversity, technology strategy, and firm value. IEEE Trans. Eng. Manag. 2006, 53, 17–26. [Google Scholar]

- Garcia-Vega, M. Does technological diversification promote innovation? An empirical analysis for European firms. Res. Policy 2006, 35, 230–246. [Google Scholar] [CrossRef]

- Miller, D.J. Technological diversity, related diversification, and firm performance. Strateg. Manag. J. 2006, 27, 601–619. [Google Scholar] [CrossRef]

- Sanjeev Dewan, F.R. Information Technology and Firm Boundaries: Impact on Firm Risk and Return Performance. Inf. Syst. Res. 2009, 22, 369–388. [Google Scholar] [CrossRef]

- Chang, H.-Y.; Lee, A.Y.-P. The relationship between business diversification and productivity: Considering the impact of process innovation at different corporate life cycles. Technol. Anal. Strateg. Manag. 2016, 28, 827–840. [Google Scholar] [CrossRef]

- Cesaroni, F. Technological diversification, technology strategies and licensing in the chemical processing industry. In The Economics and Management of Technological Diversification; Granstrand, O., Gambardella, A., Cantwell, J., Eds.; Routledge: Abingdon, UK, 2004. [Google Scholar]

- Srivastava, M.K.; Gnyawali, D.R. When do relational resources matter? Leveraging portfolio technological resources for breakthrough innovation. Acad. Manag. J. 2011, 54, 797–810. [Google Scholar] [CrossRef]

- Van de Vrande, V.; de Jong, J.P.J.; Vanhaverbeke, W.; de Rochemont, M. Open innovation in SMEs: Trends, motives and management challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef]

- Cantwell, J.; Gambardella, A.; Granstrand, O. The Economics and Management of Technological Diversification; Routledge: Abingdon, UK, 2004; Volume 34. [Google Scholar]

- Torrisi, S.; Granstrand, O. Technological and business diversification. Econ. Manag. Technol. Diversif. 2004, 34, 21. [Google Scholar]

- Granstrand, O.; Oskarsson, C. Technology diversification in “MUL-TECH” corporations. IEEE Trans. Eng. Manag. 1994, 41, 355–364. [Google Scholar] [CrossRef]

- Leten, B.; Belderbos, R.; Van Looy, B. Technological Diversification, Coherence, and Performance of Firms. J. Prod. Innov. Manag. 2007, 24, 567–579. [Google Scholar] [CrossRef]

- Breschi, S.; Lissoni, F.; Malerba, F. Knowledge-relatedness in firm technological diversification. Res. Policy 2003, 32, 69–87. [Google Scholar] [CrossRef]

- D’Aveni, R.A.; Dagnino, G.B.; Smith, K.G. The age of temporary advantage. Strateg. Manag. J. 2010, 31, 1371–1385. [Google Scholar] [CrossRef]

- Lin, Y.; Wu, L.Y. Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. J. Bus. Res. 2014, 67, 407–413. [Google Scholar] [CrossRef]

- Chiu, Y.-C.; Lai, H.-C.; Lee, T.-Y.; Liaw, Y.-C. Technological diversification, complementary assets, and performance. Technol. Forecast. Soc. Chang. 2008, 75, 875–892. [Google Scholar] [CrossRef]

- Brunswicker, S.; Vanhaverbeke, W. Open Innovation in Small and Medium-Sized Enterprises (SMEs): External Knowledge Sourcing Strategies and Internal Organizational Facilitators. J. Small Bus. Manag. 2015, 53, 1241–1263. [Google Scholar] [CrossRef]

- Hochleitner, F.P.; Arbussà, A.; Coenders, G. Inbound open innovation in SMEs: Indicators, non-financial outcomes and entry-timing. Technol. Anal. Strateg. Manag. 2017, 29, 204–218. [Google Scholar] [CrossRef]

- Galati, F.; Bigliardi, B.; Petroni, A. Open innovation in food firms: Implementation strategies, drivers and enabling factors. Int. J. Innov. Manag. 2015, 20, 1650042. [Google Scholar] [CrossRef]

- Bigliardi, B.; Galati, F. Which factors hinder the adoption of open innovation in SMEs? Technol. Anal. Strateg. Manag. 2016, 28, 869–885. [Google Scholar] [CrossRef]

- Lavie, D. The competitive advantage of interconnected firms: An extension of the resource-based view. Acad. Manag. Rev. 2006, 31, 638–658. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Roberson, Q.; Holmes, O.; Perry, J. Transforming Research on Diversity and Firm Performance: A Dynamic Capabilities Perspective. Acad. Manag. Ann. 2016. [Google Scholar] [CrossRef]

- Gambardella, A.; Torrisi, S. Does technological convergence imply convergence in markets? Evidence from the electronics industry. Res. Policy 1998, 27, 445–463. [Google Scholar] [CrossRef]

- Chen, Y.-M.; Yang, D.-H.; Lin, F.-J. Does technological diversification matter to firm performance? The moderating role of organizational slack. J. Bus. Res. 2013, 66, 1970–1975. [Google Scholar] [CrossRef]

- Giuri, P.; Hagedoorn, J.; Mariani, M. Technological diversification and strategic alliances. In The Economics and Management of Technological Diversification; Granstrand, O., Gambardella, A., Cantwell, J., Eds.; Routledge: Abingdon, UK, 2004; pp. 116–151. [Google Scholar]

- Gemba, K.; Kodama, F. Diversification dynamics of the Japanese industry. Res. Policy 2001, 30, 1165–1184. [Google Scholar] [CrossRef]

- Hussinger, K. On the importance of technological relatedness: SMEs versus large acquisition targets. Technovation 2010, 30, 57–64. [Google Scholar] [CrossRef]

- Chiu, Y.-C.; Lai, H.-C.; Liaw, Y.-C.; Lee, T.-Y. Technological scope: Diversified or specialized. Scientometrics 2010, 82, 37–58. [Google Scholar] [CrossRef]

- Huang, Y.-F.; Chen, C.-J. The impact of technological diversity and organizational slack on innovation. Technovation 2010, 30, 420–428. [Google Scholar] [CrossRef]

- Lin, J.-Y. Effects on diversity of R&D sources and human capital on industrial performance. Technol. Forecast. Soc. Chang. 2014, 85, 168–184. [Google Scholar]

- Kim, B.; Kim, E.; Miller, D.J.; Mahoney, J.T. The impact of the timing of patents on innovation performance. Res. Policy 2016, 45, 914–928. [Google Scholar] [CrossRef]

- Lin, B.-W.; Chen, J.-S. Corporate technology portfolios and R&D performance measures: A study of technology intensive firms. R D Manag. 2005, 35, 157–170. [Google Scholar]

- Kim, H.; Lim, H.; Park, Y. How should firms carry out technological diversification to improve their performance? An analysis of patenting of Korean firms. Econ. Innov. New Technol. 2009, 18, 757–770. [Google Scholar] [CrossRef]

- Lin, C.; Chang, C.-C. The effect of technological diversification on organizational performance: An empirical study of S&P 500 manufacturing firms. Technol. Forecast. Soc. Chang. 2015, 90, 575–586. [Google Scholar]

- Wan, W.P. Country Resource Environments, Firm Capabilities, and Corporate Diversification Strategies. J. Manag. Stud. 2005, 42, 161–182. [Google Scholar] [CrossRef]

- Sudhir, K.; Talukdar, D. The “Peter Pan Syndrome” in Emerging Markets: The Productivity-Transparency Trade-off in IT Adoption. Mark. Sci. 2015, 34, 500–521. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Res. Policy 1986, 15, 285–305. [Google Scholar] [CrossRef]

- Nonaka, I. The Knowledge-Creating Company. Available online: https://hbr.org/2007/07/the-knowledge-creating-company (accessed on 15 July 2017).

- Chen, Y.-S.; Chang, K.-C. Using the entropy-based patent measure to explore the influences of related and unrelated technological diversification upon technological competences and firm performance. Scientometrics 2012, 90, 825–841. [Google Scholar] [CrossRef]

- Kim, J.; Lee, C.-Y.; Cho, Y. Technological diversification, core-technology competence, and firm growth. Res. Policy 2016, 45, 113–124. [Google Scholar] [CrossRef]

- Wang, Y.; Pan, X.; Li, J.; Ning, L. Does technological diversification matter for regional innovation capability? Evidence from China. Technol. Anal. Strateg. Manag. 2016, 28, 323–334. [Google Scholar] [CrossRef]

- Palepu, K. Diversification strategy, profit performance and the entropy measure. Strateg. Manag. J. 1985, 6, 239–255. [Google Scholar] [CrossRef]

- Jacquemin, A.P.; Berry, C.H. Entropy Measure of Diversification and Corporate Growth. J. Ind. Econ. 1979, 27, 359–369. [Google Scholar] [CrossRef]

- Rhéaume, L.; Bhabra, H.S. Value creation in information-based industries through convergence: A study of U.S. mergers and acquisitions between 1993 and 2005. Inf. Manag. 2008, 45, 304–311. [Google Scholar] [CrossRef]

- Singh, M.; Nejadmalayeri, A.; Mathur, I. Performance impact of business group affiliation: An analysis of the diversification-performance link in a developing economy. J. Bus. Res. 2007, 60, 339–347. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing Firm Resources in Dynamic Environments to Create Value: Looking Inside the Black Box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Organisation for Economic Co-operation and Development (OECD). OECD Science, Technology and Industry Scoreboard 2015: Innovation for Growth and Society; Organisation for Economic Co-operation and Development: Paris, France, 2015. [Google Scholar]

- Ernst, H. Patent applications and subsequent changes of performance: Evidence from time-series cross-section analyses on the firm level. Res. Policy 2001, 30, 143–157. [Google Scholar] [CrossRef]

- Ernst, H. Patent portfolios for strategic R&D planning. J. Eng. Technol. Manag. 1998, 15, 279–308. [Google Scholar]

- Hagedoorn, J.; Cloodt, M. Measuring innovative performance: Is there an advantage in using multiple indicators? Res. Policy 2003, 32, 1365–1379. [Google Scholar] [CrossRef]

- Fabry, B.; Ernst, H.; Langholz, J.; Köster, M. Patent portfolio analysis as a useful tool for identifying R&D and business opportunities—An empirical application in the nutrition and health industry. World Pat. Inf. 2006, 28, 215–225. [Google Scholar]

- Fleming, L. Recombinant uncertainty in technological search. Manage. Sci. 2001, 47, 117–132. [Google Scholar] [CrossRef]

- Fleming, L.; Sorenson, O. Science as a map in technological search. Strateg. Manag. J. 2004, 25, 909–928. [Google Scholar] [CrossRef]

- Yam, R.C.M.; Lo, W.; Tang, E.P.Y.; Lau, A.K.W. Analysis of sources of innovation, technological innovation capabilities, and performance: An empirical study of Hong Kong manufacturing industries. Res. Policy 2011, 40, 391–402. [Google Scholar] [CrossRef]

- Adler, P.S.; Shenhar, A. Adapting your technological base: The organizational challenge. MIT Sloan Manag. Rev. 1990, 32, 25. [Google Scholar]

- Yam, R.C.M.; Guan, J.C.; Pun, K.F.; Tang, E.P.Y. An audit of technological innovation capabilities in chinese firms: Some empirical findings in Beijing, China. Res. Policy 2004, 33, 1123–1140. [Google Scholar] [CrossRef]

- Lin, B.-W.; Lee, Y.; Hung, S.-C. R&D intensity and commercialization orientation effects on financial performance. J. Bus. Res. 2006, 59, 679–685. [Google Scholar]

- Artz, K.W.; Norman, P.M.; Hatfield, D.E.; Cardinal, L.B. A Longitudinal Study of the Impact of R&D, Patents, and Product Innovation on Firm Performance. J. Prod. Innov. Manag. 2010, 27, 725–740. [Google Scholar]

- Rogers, M. Networks, Firm Size and Innovation. Small Bus. Econ. 2004, 22, 141–153. [Google Scholar] [CrossRef]

- The Korea Chamber of Commerce and Industry. Survey on Management Status of Graduated SMEs; KCCI: Seoul,Korea, 2014. [Google Scholar]

- Kang, K.-N.; Park, H. Influence of government R&D support and inter-firm collaborations on innovation in Korean biotechnology SMEs. Technovation 2012, 32, 68–78. [Google Scholar]

- Lee, E.Y.; Cin, B.C. The effect of risk-sharing government subsidy on corporate R&D investment: Empirical evidence from Korea. Technol. Forecast. Soc. Chang. 2010, 77, 881–890. [Google Scholar]

- Acs, Z.J.; Audretsch, D.B.; Feldman, M.P. R&D Spillovers and Recipient Firm Size. Rev. Econ. Stat. 1994, 76, 336–340. [Google Scholar]

- Kim, Y. A Study on an Intrinsic Characteristics of Patent: The Inventor Surveys in Korea. Available online: http://www.ndsl.kr/ndsl/search/detail/report/reportSearchResultDetail.do?cn=TRKO201300031267 (accessed on 15 July 2017).

- Purkayastha, S.; Manolova, T.S.; Edelman, L.F. Diversification and Performance in Developed and Emerging Market Contexts: A Review of the Literature. Int. J. Manag. Rev. 2012, 14, 18–38. [Google Scholar] [CrossRef]

- Galati, F.; Bigliardi, B. Does different NPD project’s characteristics lead to the establishment of different NPD networks? A knowledge perspective. Technol. Anal. Strateg. Manag. 2017, 1–14. [Google Scholar] [CrossRef]

| 4 Groups | NN | PN | NP | PP | |||||

|---|---|---|---|---|---|---|---|---|---|

| Firm’s size | NF | PA | NF | PA | NF | PA | NF | PA | |

| Small | 62 | 237 | 175 | 424 | 102 | 279 | 94 | 249 | |

| Large | 19 | 200 | 20 | 344 | 23 | 179 | 12 | 183 | |

| 4 Groups | NN | PN | NP | PP | |||||

|---|---|---|---|---|---|---|---|---|---|

| Firm’s size | Mean | SD | Mean | SD | Mean | SD | Mean | SD | |

| Small | UTD | 0.36206 | 0.25481 | 0.3356 | 0.28608 | 0.37659 | 0.31997 | 0.34493 | 0.27713 |

| RTD | 0.18768 | 0.22851 | 0.17219 | 0.22545 | 0.15788 | 0.18806 | 0.13121 | 0.19917 | |

| Large | UTD | 0.25268 | 0.11083 | 0.21539 | 0.12255 | 0.34737 | 0.23935 | 0.37003 | 0.3349 |

| RTD | 0.17431 | 0.09600 | 0.17443 | 0.08017 | 0.19213 | 0.13620 | 0.12702 | 0.05372 | |

| NN | PN | NP | PP | ||

|---|---|---|---|---|---|

| UTD | NN | 0 | |||

| PN | 0.02646 (0.11855) | 0 | |||

| NP | 0.01453 (0.28705) | 0.04099 * (0.03859) | 0 | ||

| PP | 0.01713 (0.24004) | 0.00933 (0.33995) | 0.03165 (0.11421) | 0 | |

| RTD | NN | 0 | |||

| PN | 0.01549 (0.20013) | 0 | |||

| NP | 0.02980 † (0.05275) | 0.01431 (0.19044) | 0 | ||

| PP | 0.05647 ** (0.00194) | 0.04098 ** (0.009) | 0.02667 † (0.05749) | 0 |

| NN | PN | NP | PP | ||

|---|---|---|---|---|---|

| UTD | NN | 0 | |||

| PN | 0.03729 *** (0.00022) | 0 | |||

| NP | 0.09469 *** (0.00000) | 0.13198 *** (0.00000) | 0 | ||

| PP | 0.11735 *** (0.00000) | 0.15464 *** (0.00000) | 0.02266 (0.23070) | 0 | |

| RTD | NN | 0 | |||

| PN | 0.000115 (0.49405) | 0 | |||

| NP | 0.017818 † (0.06989) | 0.017704 * (0.03142) | 0 | ||

| PP | 0.047294 *** (0.00000) | 0.047409 *** (0.00000) | 0.065112 *** (0.00000) | 0 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kook, S.H.; Kim, K.H.; Lee, C. Dynamic Technological Diversification and Its Impact on Firms’ Performance: An Empirical Analysis of Korean IT Firms. Sustainability 2017, 9, 1239. https://doi.org/10.3390/su9071239

Kook SH, Kim KH, Lee C. Dynamic Technological Diversification and Its Impact on Firms’ Performance: An Empirical Analysis of Korean IT Firms. Sustainability. 2017; 9(7):1239. https://doi.org/10.3390/su9071239

Chicago/Turabian StyleKook, Sang Ho, Ki Hong Kim, and Chulung Lee. 2017. "Dynamic Technological Diversification and Its Impact on Firms’ Performance: An Empirical Analysis of Korean IT Firms" Sustainability 9, no. 7: 1239. https://doi.org/10.3390/su9071239