Firms’ Board Independence and Corporate Social Performance: A Meta-Analysis

Abstract

:1. Introduction

2. Theoretical Background

3. Literature Review and Hypotheses Development

3.1. Linking Board Independence and Corporate Social Performance

3.2. The Moderating Role of Approaches to the Measurement of Corporate Social Performance, Corporate Governance Systems, and the Economic Conditions

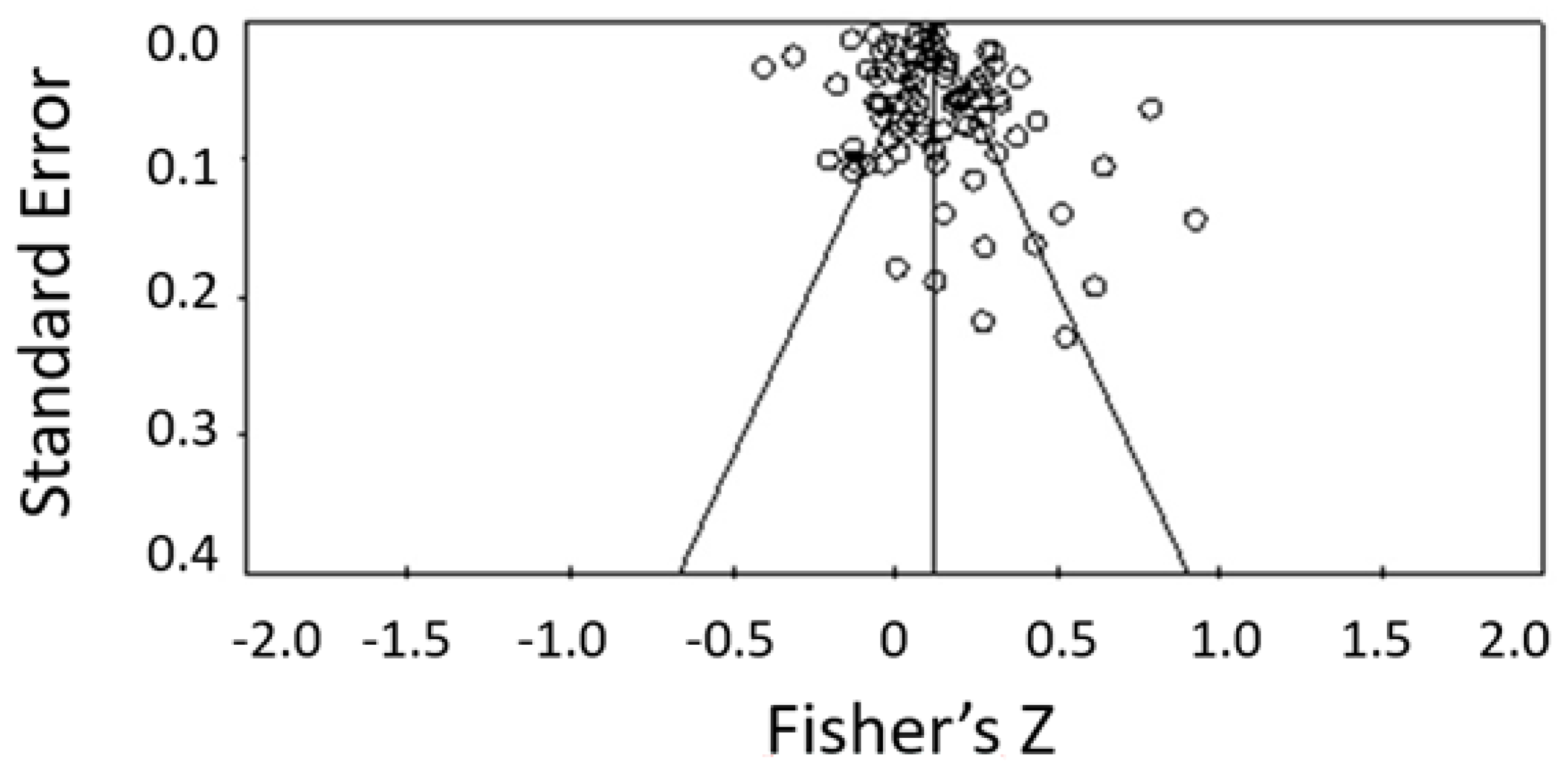

4. Meta-Analytic Procedure

5. Research Design: Inclusion Criteria, Search Process, Study Coding and Variables’ Measurement

- First, relevant electronic databases (e.g., Proquest, EBSCO, Emerald, Wiley, Sciencedirect and Google scholar) are examined by different searches with different combinations of the following keywords: (i) corporate social performance; (ii) corporate environmental performance; (iii) corporate governance; (iv) board structure; and, (v) board independence. This step provided a total of 300 studies.

- In a second step, the initial searches were refined by further examining the different issues of academic journals that publish most of the papers addressing the influence of CG approaches on CSP (e.g., Journal of Business Ethics, Corporate Governance: An International Review, Journal of Financial Economics, International Journal of Economics and Financial Issues). 28 additional papers were included in the sample, giving a total of 328 works.

- In the third step, only those papers focusing on the influence of board independence on CSP from an empirical point of view were selected. After this step, 168 papers were removed from the sample, producing a total of 160 studies.

- In a final step, those empirical studies that did not provided the required statistical data (i.e., correlation coefficients between the variables or the corresponding data to obtain them using Lipsey and Wilson´s [171] conversion method) were removed (73). The final sample included 87 papers.

6. Results and Discussion

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Code | Authors | Year | Sample Size | Sample Period | Countries | CSP Measurement Model | CG System |

|---|---|---|---|---|---|---|---|

| 1 | Amran et al. [77] | 2014 | 113 | 2010 | Global | Self-reported | Others |

| 2 | Amran et al. (B) [78] | 2014 | 111 | 2008 | Global | External-reported | Others |

| 3 | Arayssi et al. [79] | 2016 | 975 | 2007–2012 | UK | Self-reported | Common-law |

| 4 | Arena et al. [80] | 2015 | 288 | 2008–2010 | US | External-reported | Common-law |

| 5 | Arora and Dharwadkar [81] | 2011 | 1522 | 2001–2005 | US | External-reported | Common-law |

| 6 | Barakat et al. [82] | 2015 | 101 | 2011 | Palestine/Jordan | Self-reported | Mixed-law |

| 7 | Barako and Brown [83] | 2008 | 40 | 2007 | Kenya | Self-reported | Common-law |

| 8 | Bear et al. [9] | 2010 | 51 | 2009 | US | External-reported | Common-law |

| 9 | Ben-Amar et al. [84] | 2015 | 541 | 2008–2014 | Canada | Self-reported | Common-law |

| 10 | Benomran et al. [85] | 2015 | 162 | 2006–2012 | Libya | Self-reported | Mixed-law |

| 11 | Berrone and Gómez-Mejía [86] | 2009 | 2088 | 1997–2003 | US | Self-reported | Common-law |

| 12 | Boulouta [87] | 2013 | 820 | 1999–2003 | US | External-reported | Common-law |

| 13 | Bowrin [88] | 2013 | 96 | 2010 | Caribe | Self-reported | Mixed-law |

| 14 | Brammer et al. [89] | 2009 | 199 | 2002 | UK | External-reported | Common-law |

| 15 | Burke et al. [90] | 2017 | 11458 | 2003–2013 | US | External-reported | Common-law |

| 16 | Cho et al. [91] | 2015 | 10297 | 2003–2011 | US | External-reported | Common-law |

| 17 | Choi et al. [92] | 2013 | 2042 | 2002–2008 | Korea | External-reported | Civil-law |

| 18 | Cormier et al. [93] | 2011 | 137 | 2005 | Canada | Self-reported | Common-law |

| 19 | David et al. [94] | 2007 | 730 | 1992–1998 | US | External-reported | Common-law |

| 20 | De Villiers [22] | 2011 | 5997 | 2003–2004 | US | External-reported | Common-law |

| 21 | Deschênes et al. [95] | 2015 | 192 | 2004–2008 | Canada | External-reported | Common-law |

| 22 | Ducassy [96] | 2015 | 41 | 2011 | France | External-reported | Civil-law |

| 23 | Dunn and Sainty [74] | 2009 | 174 | 2002, 2004–2006 | Canada | External-reported | Common-law |

| 24 | Esa et al. [97] | 2012 | 54 | 2005–2007 | Malaysia | Self-reported | Mixed-law |

| 25 | Fernández-Gago et al. [98] | 2016 | 145 | 2005–2010 | Spain | External-reported | Civil-law |

| 26 | Frias-Aceituno et al. [99] | 2013 | 1575 | 2008–2010 | Global | Self-reported | Others |

| 27 | Galbreath [100] | 2011 | 161 | 2004 | Australia | Self-reported | Common-law |

| 28 | Galbreath [23] | 2016 | 300 | 2012 | Australia | External-reported | Common-law |

| 29 | García-Sánchez et al. [101] | 2015 | 5380 | 2003–2009 | Global | Self-reported | Mixed-law |

| 30 | García-Sánchez [102] | 2014 | 686 | 2004–2010 | Spain | Self-reported | Civil-law |

| 31 | Ghazali and Weetman [103] | 2006 | 87 | 2001 | Malaysia | Self-reported | Mixed-law |

| 32 | Gupta et al. [104] | 2015 | 1153 | 2012 | US | External-reported | Common-law |

| 33 | Habbash [105] | 2016 | 267 | 2007–2011 | Saudi Arabia | Self-reported | Mixed-law |

| 34 | Hafsi and Turgut [106] | 2013 | 95 | 2005 | US | External-reported | Common-law |

| 35 | Haldar and Mishra [107] | 2015 | 24 | 2014 | India | Self-reported | Common-law |

| 36 | Haniffa and Cook [14] | 2005 | 278 | 1996, 2002 | Malaysia | Self-reported | Mixed-law |

| 37 | Harjoto et al. [20] | 2015 | 9001 | 1999–2010 | US | External-reported | Common-law |

| 38 | Hogan et al. [108] | 2014 | 540 | 2003–2011 | US | External-reported | Common-law |

| 39 | Hoje and Harjoto [109] | 2011 | 13389 | 1993–2004 | US | External-reported | Common-law |

| 40 | Htay et al. [110] | 2012 | 120 | 1996–2005 | Malaysia | Self-reported | Mixed-law |

| 41 | Huang [111] | 2010 | 297 | 2006–2007 | Taiwan | Self-reported | Civil-law |

| 42 | Hussain et al. [112] | 2016 | 152 | 2007–2011 | US | Self-reported | Common-law |

| 43 | Ienciu et al. [113] | 2012 | 54 | 2009 | Global | Self-reported | Others |

| 44 | Janggu et al. [114] | 2014 | 100 | 2010 | Malaysia | Self-reported | Mixed-law |

| 45 | Javaid Lone et al. [115] | 2016 | 250 | 2010–2014 | Pakistan | Self-reported | Mixed-law |

| 46 | Jizi [116] | 2017 | 1155 | 2007–2012 | UK | External-reported | Common-law |

| 47 | Jizi et al. [117] | 2014 | 291 | 2009–2011 | US | Self-reported | Common-law |

| 48 | Johnson and Greening [12] | 1999 | 252 | 1993 | US | External-reported | Common-law |

| 49 | Khan et al. [118] | 2013 | 580 | 2005–2009 | Bangladeshi | Self-reported | Mixed-law |

| 50 | Khan [119] | 2010 | 30 | 2007–2008 | Bangladeshi | Self-reported | Mixed-law |

| 51 | Kiliç et al. [120] | 2015 | 3106 | 2008–2012 | Turkey | Self-reported | Civil-law |

| 52 | Kock et al. [121] | 2012 | 657 | 1998, 2000 | US | Self-reported | Common-law |

| 53 | Li et al. [122] | 2013 | 613 | 2009–2010 | China | External-reported | Mixed-law |

| 54 | Liao et al. [123] | 2015 | 329 | 2011 | UK | Self-reported | Common-law |

| 55 | Lim et al. [124] | 2007 | 181 | 2001 | Australia | Self-reported | Common-law |

| 56 | Lu [125] | 2013 | 2098 | 2007–2011 | US | External-reported | Common-law |

| 57 | Mallin et al. [76] | 2013 | 221 | 2005–2007 | US | External-reported | Common-law |

| 58 | Martínez-Ferrero et al. [126] | 2015 | 877 | 2004–2010 | Global | External-reported | Mixed-law |

| 59 | Michelon and Parbonetti [13] | 2012 | 114 | 2005–2007 | Global | self-reported | Mixed-law |

| 60 | Mohamad et al. [127] | 2011 | 795 | 2005–2007 | Malaysia | self-reported | Mixed-law |

| 61 | Musteen [128] | 2010 | 324 | 2000 | US | External-reported | Common-law |

| 62 | Ntim and Soobaroyen [73] | 2013 | 600 | 2002–2009 | South Africa | self-reported | Mixed-law |

| 63 | Nurhayati et al. [129] | 2015 | 285 | 2010–2012 | India | self-reported | Common-law |

| 64 | Ortiz de Mandojana et al. [130] | 2016 | 210 | 2008 | Global | self-reported | Mixed-law |

| 65 | Post et al. [131] | 2011 | 78 | 2007 | US | self-reported | Common-law |

| 66 | Post et al. [72] | 2015 | 180 | 2004–2008 | US | self-reported | Common-law |

| 67 | Prado-Lorenzo et al. [132] | 2009 | 288 | 2004–2006 | Spain | self-reported | Civil-law |

| 68 | Prado-Lorenzo and García-Sánchez [133] | 2010 | 283 | 2007 | Global | External-reported | Mixed-law |

| 69 | Rao and Tilt [134] | 2016 | 345 | 2009–2011 | Australia | self-reported | Common-law |

| 70 | Rao et al. [16] | 2012 | 96 | 2008 | Australia | self-reported | Common-law |

| 71 | Rodríguez-Ariza et al. [135] | 2014 | 3521 | 2004–2009 | Global | self-reported | Mixed-law |

| 72 | Rodríguez-Domínguez et al. [136] | 2009 | 351 | 2009 | Global | self-reported | Mixed-law |

| 73 | Roitto [137] | 2013 | 31 | 2012 | Finland | External-reported | Civil-law |

| 74 | Rouf [138] | 2011 | 93 | 2007 | Bangladesh | self-reported | Mixed-law |

| 75 | Sahin et al. [75] | 2011 | 96 | 2007 | Turkey | self-reported | Civil-law |

| 76 | Said et al. [139] | 2009 | 150 | 2006 | Malaysia | self-reported | Mixed-law |

| 77 | Said et al. [140] | 2013 | 120 | 2009 | Malaysia | self-reported | Mixed-law |

| 78 | Sharif and Rashid [141] | 2014 | 22 | 2005–2010 | Pakistan | self-reported | Mixed-law |

| 79 | Shaukat et al. [142] | 2016 | 2028 | 2002–2010 | UK | External-reported | Common-law |

| 80 | Sundarasen et al. [17] | 2016 | 450 | 2011–2012 | Malaysia | self-reported | Mixed-law |

| 81 | Tauringana and Chithambo [143] | 2015 | 860 | 2008–2011 | UK | self-reported | Common-law |

| 82 | Walls and Berrone [19] | 2015 | 1320 | 2001–2007 | US | External-reported | Common-law |

| 83 | Walls and Hoffman [144] | 2013 | 1881 | 2002–2008 | US | External-reported | Common-law |

| 84 | Walls et al. [18] | 2012 | 2002 | 1997–2005 | US | External-reported | Common-law |

| 85 | Wang et al. [145] | 2012 | 446 | 2008 | China | self-reported | Mixed-law |

| 86 | Williams [146] | 2003 | 185 | 1991–1994 | US | self-reported | Common-law |

| 87 | Zhang [147] | 2012 | 475 | 2007–2008 | US | External-reported | Common-law |

References

- Bhattacharya, C.B.; Sen, S. Doing better at doing good: When, why, and how consumers respond to corporate social initiatives. Calif. Manag. Rev. 2004, 47, 9–24. [Google Scholar] [CrossRef]

- ECGI European Corporate Governance Institute. Index of Codes. Available online: http://www.ecgi.org/codes/all_codes.php (accessed on 6 June 2017).

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Moon, J. The contribution of corporate social responsibility to sustainable development. Sustain. Dev. 2007, 15, 296–306. [Google Scholar] [CrossRef]

- Epstein, M.J.; Buhovac, A.R. Making Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental, and Economic Impacts; Berrett-Koehler Publishers: Oakland, CA, USA, 2014. [Google Scholar]

- Martin, R.L. The virtue matrix: Calculating the return on corporate responsibility. Harv. Bus. Rev. 2002, 80, 68–75. [Google Scholar] [PubMed]

- Swanson, D.L.; Orlitzky, M. Toward a Conceptual Integration of Corporate Social and Financial Performance. In Handbook of Integrated CSR Communication; Springer: New York City, NY, USA, 2017; pp. 129–148. [Google Scholar]

- Schaltegger, S.; Wagner, M. Managing sustainability performance measurement and reporting in an integrated manner. Sustainability accounting as the link between the sustainability balanced scorecard and sustainability reporting. In Sustainability Accounting and Reporting; Springer: New York, NY, USA, 2006; pp. 681–697. [Google Scholar]

- Bear, S.; Rahman, N.; Post, C. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. J. Bus. Ethics 2010, 97, 207–221. [Google Scholar] [CrossRef]

- Byron, K.; Post, C. Women on Boards of Directors and Corporate Social Performance: A Meta-Analysis. Corp. Gov. Int. Rev. 2016, 24, 428–442. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. Corporate governance and firm value: The impact of corporate social responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar] [CrossRef]

- Johnson, R.A.; Greening, D.W. The effects of corporate governance and institutional ownership types on corporate social performance. Acad. Manag. J. 1999, 42, 564–576. [Google Scholar] [CrossRef]

- Michelon, G.; Parbonetti, A. The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 2012, 16, 477–509. [Google Scholar] [CrossRef]

- Haniffa, R.M.; Cooke, T.E. The impact of culture and governance on corporate social reporting. J. Account. Public Policy 2005, 24, 391–430. [Google Scholar] [CrossRef]

- Ballesteros, B.C.; Rubio, R.G.; Ferrero, J.M. Efecto de la composición del consejo de administración en las prácticas de responsabilidad social corporativa. Rev. Contab. 2015, 18, 20–31. [Google Scholar] [CrossRef]

- Kathy Rao, K.; Tilt, C.A.; Lester, L.H. Corporate governance and environmental reporting: An Australian study. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 143–163. [Google Scholar] [CrossRef]

- Sundarasen, S.D.D.; Je-Yen, T.; Rajangam, N.; Eweje, G.; Eweje, G. Board Composition and Corporate Social Responsibility in an Emerging Market. Corp. Gov. Int. J. Bus. Soc. 2016, 16. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P. The power of one to make a difference: How informal and formal CEO power affect environmental sustainability. J. Bus. Ethics 2015, 1–16. [Google Scholar] [CrossRef]

- Harjoto, M.; Laksmana, I.; Lee, R. Board diversity and corporate social responsibility. J. Bus. Ethics 2015, 132, 641–660. [Google Scholar] [CrossRef]

- Ayuso, S.; Argandoña, A. Responsible Corporate Governance: Towards a Stakeholder Board of Directors? Working Paper No. 701; IESE Business School: Barcelona, Spain, 2007. [Google Scholar]

- De Villiers, C.; Naiker, V.; van Staden, C.J. The effect of board characteristics on firm environmental performance. J. Manag. 2011, 37, 1636–1663. [Google Scholar] [CrossRef]

- Galbreath, J. The Impact of Board Structure on Corporate Social Responsibility: A Temporal View. Bus. Strategy Environ. 2016. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Rupp, D.E.; Williams, C.A.; Ganapathi, J. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad. Manag. Rev. 2007, 32, 836–863. [Google Scholar] [CrossRef]

- Wood, D.J. Measuring corporate social performance: A review. Int. J. Manag. Rev. 2010, 12, 50–84. [Google Scholar] [CrossRef]

- Garriga, E.; Melé, D. Corporate social responsibility theories: Mapping the territory. J. Bus. Ethics 2004, 53, 51–71. [Google Scholar] [CrossRef]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Clarkson, M.E. A stakeholder framework for analyzing and evaluating corporate social performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Wood, D.J. Corporate social performance revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar]

- Lu, W.; Chau, K.; Wang, H.; Pan, W. A decade’s debate on the nexus between corporate social and corporate financial performance: A critical review of empirical studies 2002–2011. J. Clean. Prod. 2014, 79, 195–206. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social and financial performance. Ann Arbor 2007, 1001. Available online: https://www.hks.harvard.edu/m-rcbg/papers/seminars/margolis_november_07.pdf (accessed on 5 June 2017).

- Visser, W.; Matten, D.; Pohl, M.; Tolhurst, N. The A to Z of Corporate Social Responsibility; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Ortas, E.; Álvarez, I.; Garayar, A. The environmental, social, governance, and financial performance effects on companies that adopt the United Nations Global Compact. Sustainability 2015, 7, 1932–1956. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A stakeholder Approach; Pitman Publishing Inc.: Marshfield, MA, USA, 1984. [Google Scholar]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Garcia-Torea, N.; Fernandez-Feijoo, B.; de la Cuesta, M. Board of director’s effectiveness and the stakeholder perspective of corporate governance: Do effective boards promote the interests of shareholders and stakeholders? BRQ Bus. Res. Q. 2016, 19, 246–260. [Google Scholar] [CrossRef]

- Jamali, D.; Safieddine, A.M.; Rabbath, M. Corporate governance and corporate social responsibility synergies and interrelationships. Corp. Gov. Int. Rev. 2008, 16, 443–459. [Google Scholar] [CrossRef]

- Brown, P.; Beekes, W.; Verhoeven, P. Corporate governance, accounting and finance: A review. Account. Financ. 2011, 51, 96–172. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Milliken, F.J.; Martins, L.L. Searching for common threads: Understanding the multiple effects of diversity in organizational groups. Acad. Manag. Rev. 1996, 21, 402–433. [Google Scholar]

- Daily, C.M.; Dalton, D.R.; Cannella, A.A. Corporate governance: Decades of dialogue and data. Acad. Manag. Rev. 2003, 28, 371–382. [Google Scholar]

- Van den Berghe, L.A.A.; Levrau, A. Evaluating boards of directors: What constitutes a good corporate board? Corp. Gov. Int. Rev. 2004, 12, 461–478. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Boards of directors as an endogenously determined institution: A survey of the economic literature. Econ. Policy Rev. 2003, 9, 7–26. [Google Scholar]

- Freeman, R.E.; Evan, W.M. Corporate governance: A stakeholder interpretation. J. Behav. Econ. 1990, 19, 337–359. [Google Scholar] [CrossRef]

- Ferrarini, G.A.; Filippelli, M. Independent Directors and Controlling Shareholders around the World; Law Working Paper; European Corporate Governance Institute (ECGI): Brussels, Belgium, 2014. [Google Scholar]

- Daily, C.M.; Johnson, J.L.; Dalton, D.R. On the measurements of board composition: Poor consistency and a serious mismatch of theory and operationalization. Decis. Sci. 1999, 30, 83–106. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Ellstrand, A.E.; Johnson, J.L. Meta-analytic reviews of board composition, leadership structure, and financial performance. Strateg. Manag. J. 1998, 19, 269–290. [Google Scholar] [CrossRef]

- Garcia-Meca, E.; Sánchez-Ballesta, J.P. The association of board independence and ownership concentration with voluntary disclosure: A meta-analysis. Eur. Account. Rev. 2010, 19, 603–627. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Bertoni, F.; Meoli, M.; Vismara, S. Board independence, ownership structure and the valuation of IPOs in continental Europe. Corp. Gov. Int. Rev. 2014, 22, 116–131. [Google Scholar] [CrossRef]

- Johanson, D.; Østergren, K. The movement toward independent directors on boards: A comparative analysis of Sweden and the UK. Corp. Gov. Int. Rev. 2010, 18, 527–539. [Google Scholar] [CrossRef]

- Evan, W.M.; Freeman, R.E. A stakeholder theory of the modern corporation: Kantian capitalism. In Ethical Theory and Business; Beauchamp, T., Bowie, N., Eds.; Prentice Hall, Englewood Cliffs: Upper Saddle River, NJ, USA, 1993; pp. 75–83. [Google Scholar]

- Ibrahim, N.A.; Howard, D.P.; Angelidis, J.P. Board members in the service industry: An empirical examination of the relationship between corporate social responsibility orientation and directorial type. J. Bus. Ethics 2003, 47, 393–401. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Angelidis, J.P. The corporate social responsiveness orientation of board members: Are there differences between inside and outside directors? J. Bus. Ethics 1995, 14, 405–410. [Google Scholar] [CrossRef]

- Pivato, S.; Misani, N.; Tencati, A. The impact of corporate social responsibility on consumer trust: The case of organic food. Bus. Ethic 2008, 17, 3–12. [Google Scholar] [CrossRef]

- Jones, T.M. Instrumental stakeholder theory: A synthesis of ethics and economics. Acad. Manag. Rev. 1995, 20, 404–437. [Google Scholar]

- Jo, H.; Harjoto, M.A. The causal effect of corporate governance on corporate social responsibility. J. Bus. Ethics 2012, 106, 53–72. [Google Scholar] [CrossRef]

- De Graaf, F.J.; Stoelhorst, J. The role of governance in corporate social responsibility: Lessons from Dutch finance. Bus. Soc. 2009, 52, 282–317. [Google Scholar] [CrossRef]

- Stuebs, M.; Sun, L. Corporate governance and social responsibility. Int. J. Law Manag. 2015, 57, 38–52. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Dienes, D.; Velte, P. The impact of supervisory board composition on CSR reporting. Evidence from the German two-tier system. Sustainability 2016, 8, 63. [Google Scholar] [CrossRef]

- Post, C.; Byron, K. Women on boards and firm financial performance: A meta-analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Siddiqui, S.S. The association between corporate governance and firm performance—A meta-analysis. Int. J. Account. Inf. Manag. 2015, 23, 218–237. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Johnson, J.L.; Ellstrand, A.E. Number of directors and financial performance: A meta-analysis. Acad. Manag. J. 1999, 42, 674–686. [Google Scholar] [CrossRef]

- Rhoades, D.L.; Rechner, P.L.; Sundaramurthy, C. Board composition and financial performance: A meta-analysis of the influence of outside directors. J. Manag. Issues 2000, 12, 76–91. [Google Scholar]

- Sánchez-Ballesta, J.P.; García-Meca, E. A meta-analytic vision of the effect of ownership structure on firm performance. Corp. Gov. Int. Rev. 2007, 15, 879–892. [Google Scholar] [CrossRef]

- Heugens, P.P.; Van Essen, M.; van Oosterhout, J.H. Meta-analyzing ownership concentration and firm performance in Asia: Towards a more fine-grained understanding. Asia Pac. J. Manag. 2009, 26, 481–512. [Google Scholar] [CrossRef]

- Allouche, J.; Laroche, P. A meta-analytical investigation of the relationship between corporate social and financial performance. Rev. Gest. Ressour. Hum. 2005, 57, 18–41. [Google Scholar]

- Margolis, J.D.; Walsh, J.P. Misery Loves Companies: Whither Social Initiatives by Business? Citeseer: State College, PA, USA, 2001. [Google Scholar]

- Post, C.; Rahman, N.; McQuillen, C. From board composition to corporate environmental performance through sustainability-themed alliances. J. Bus. Ethics 2015, 130, 423–435. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate governance and performance in socially responsible corporations: New empirical insights from a Neo-Institutional framework. Corp. Gov. Int. Rev. 2013, 21, 468–494. [Google Scholar] [CrossRef]

- Dunn, P.; Sainty, B. The relationship among board of director characteristics, corporate social performance and corporate financial performance. Int. J. Manag. Financ. 2009, 5, 407–423. [Google Scholar] [CrossRef]

- Sahin, K.; Basfirinci, C.S.; Ozsalih, A. The impact of board composition on corporate financial and social responsibility performance: Evidence from public-listed companies in Turkey. Afr. J. Bus. Manag. 2011, 5, 2959. [Google Scholar]

- Mallin, C.; Michelon, G.; Raggi, D. Monitoring intensity and stakeholders’ orientation: How does governance affect social and environmental disclosure? J. Bus. Ethics 2013, 114, 29–43. [Google Scholar] [CrossRef]

- Amran, A.; Lee, S.P.; Devi, S.S. The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Bus. Strategy Environ. 2014, 23, 217–235. [Google Scholar] [CrossRef]

- Amran, A.; Periasamy, V.; Zulkafli, A.H. Determinants of climate change disclosure by developed and emerging countries in Asia Pacific. Sustain. Dev. 2014, 22, 188–204. [Google Scholar] [CrossRef]

- Arayssi, M.; Arayssi, M.; Dah, M.; Dah, M.; Jizi, M.; Jizi, M. Women on boards, sustainability reporting and firm performance. Sustain. Account. Manag. Policy J. 2016, 7, 376–401. [Google Scholar] [CrossRef]

- Arena, C.; Bozzolan, S.; Michelon, G. Environmental reporting: Transparency to stakeholders or stakeholder manipulation? An analysis of disclosure tone and the role of the board of directors. Corp Soc. Responsib. Environ. Manag. 2015, 22, 346–361. [Google Scholar] [CrossRef]

- Arora, P.; Dharwadkar, R. Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corp. Gov. Int. Rev. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Barakat, F.S.; Pérez, M.V.L.; Ariza, L.R. Corporate social responsibility disclosure (CSRD) determinants of listed companies in Palestine (PXE) and Jordan (ASE). Rev. Manag. Sci. 2015, 9, 681–702. [Google Scholar] [CrossRef]

- Barako, D.G.; Brown, A.M. Corporate social reporting and board representation: Evidence from the Kenyan banking sector. J. Manag. Gov. 2008, 12, 309–324. [Google Scholar] [CrossRef]

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board gender diversity and corporate response to sustainability initiatives: evidence from the Carbon Disclosure Project. J. Bus. Ethics 2017, 142, 369–383. [Google Scholar] [CrossRef]

- Benomran, N.A.; Haat, M.H.C.; Hashim, H.B.; Mohamad, N.R.B. Influence of Corporate Governance on the Extent of Corporate Social Responsibility and Environmental Reporting. J. Environ. Ecol. 2015, 6, 48–68. [Google Scholar] [CrossRef]

- Berrone, P.; Gomez-Mejia, L.R. Environmental performance and executive compensation: An integrated agency-institutional perspective. Acad. Manag. J. 2009, 52, 103–126. [Google Scholar] [CrossRef]

- Boulouta, I. Hidden connections: The link between board gender diversity and corporate social performance. J. Bus. Ethics 2013, 113, 185–197. [Google Scholar] [CrossRef]

- Bowrin, A.R. Corporate social and environmental reporting in the Caribbean. Soc. Responsib. J. 2013, 9, 259–280. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A.; Pavelin, S. Corporate reputation and women on the board. Br. J. Manag. 2009, 20, 17–29. [Google Scholar] [CrossRef]

- Burke, J.J.; Hoitash, R.; Hoitash, U. The Heterogeneity of Board-Level Sustainability Committees and Corporate Social Performance. J. Bus. Ethics 2017. [Google Scholar] [CrossRef]

- Cho, C.H.; Jung, J.H.; Kwak, B.; Lee, J.; Yoo, C. Professors on the Board: Do They Contribute to Society Outside the Classroom? J. Bus. Ethics 2015, 141, 393–409. [Google Scholar] [CrossRef]

- Choi, B.B.; Lee, D.; Park, Y. Corporate social responsibility, corporate governance and earnings quality: Evidence from Korea. Corp. Gov. Int. Rev. 2013, 21, 447–467. [Google Scholar] [CrossRef]

- Cormier, D.; Ledoux, M.; Magnan, M. The informational contribution of social and environmental disclosures for investors. Manag. Decis. 2011, 49, 1276–1304. [Google Scholar] [CrossRef]

- David, P.; Bloom, M.; Hillman, A.J. Investor activism, managerial responsiveness, and corporate social performance. Strateg. Manag. J. 2007, 28, 91–100. [Google Scholar] [CrossRef]

- Deschênes, S.; Rojas, M.; Boubacar, H.; Prud'homme, B.; Ouedraogo, A. The impact of board traits on the social performance of Canadian firms. Corp. Gov. 2015, 15, 293–305. [Google Scholar] [CrossRef]

- Ducassy, I.; Montandrau, S. Corporate social performance, ownership structure, and corporate governance in France. Res. Int. Bus. Financ. 2015, 34, 383–396. [Google Scholar] [CrossRef]

- Esa, E.; Anum Mohd Ghazali, N. Corporate social responsibility and corporate governance in Malaysian government-linked companies. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 292–305. [Google Scholar] [CrossRef]

- Fernández-Gago, R.; Cabeza-García, L.; Nieto, M. Corporate social responsibility, board of directors, and firm performance: An analysis of their relationships. Rev. Manag. Sci. 2016, 10, 85–104. [Google Scholar] [CrossRef]

- Frias-Aceituno, J.V.; Rodriguez-Ariza, L.; Garcia-Sanchez, I. The role of the board in the dissemination of integrated corporate social reporting. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 219–233. [Google Scholar] [CrossRef]

- Galbreath, J. Are there gender-related influences on corporate sustainability? A study of women on boards of directors. J. Manag. Organ. 2011, 17, 17–38. [Google Scholar] [CrossRef]

- García-Sánchez, I.; Rodríguez-Domínguez, L.; Frías-Aceituno, J. Board of directors and ethics codes in different corporate governance systems. J. Bus. Ethics 2015, 131, 681–698. [Google Scholar] [CrossRef]

- Garcia-Sanchez, I.; Cuadrado-Ballesteros, B.; Sepulveda, C. Does media pressure moderate CSR disclosures by external directors? Manag. Decis. 2014, 52, 1014–1045. [Google Scholar] [CrossRef]

- Ghazali, N.A.M.; Weetman, P. Perpetuating traditional influences: Voluntary disclosure in Malaysia following the economic crisis. J. Int. Account. Audit. Tax. 2006, 15, 226–248. [Google Scholar] [CrossRef]

- Gupta, P.P.; Lam, K.C.; Sami, H.; Zhou, H. Board Diversity and Its Long-Term Effect on Firm Financial and Non-Financial Performance. Available online: http://dx.doi.org/10.2139/ssrn.2531212 (accessed on 30 January 2017).

- Habbash, M. Corporate governance and corporate social responsibility disclosure: Evidence from Saudi Arabia. J. Econ. Soc. Dev. 2016, 3, 87. [Google Scholar] [CrossRef]

- Hafsi, T.; Turgut, G. Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence. J. Bus. Ethics 2013, 112, 463–479. [Google Scholar] [CrossRef]

- Haldar, P.; Mishra, L. The Changing Facets of Corporate Governance and Corporate Social Responsibilities in India and their Interrelationship. Inf. Manag. Bus. Rev. 2015, 7, 6–16. [Google Scholar]

- Hogan, K.; Olson, G.T.; Sharma, R. The Role of Corporate Philanthropy on Ratings of Corporate Social Responsibility and Shareholder Return. J. Leadersh. Account. Ethics 2014, 11, 108. [Google Scholar]

- Harjoto, M.A.; Jo, H. Corporate governance and CSR nexus. J. Bus. Ethics 2011, 100, 45–67. [Google Scholar] [CrossRef]

- Htay, S.N.N.; Ab Rashid, H.M.; Adnan, M.A.; Meera, A.K.M. Impact of corporate governance on social and environmental information disclosure of Malaysian listed banks: Panel data analysis. Asian J. Financ. Account. 2012, 4. Available online: http://www.macrothink.org/journal/index.php/ajfa/article/view/810/1060 (accessed on 6 June 2017). [CrossRef]

- Huang, C. Corporate governance, corporate social responsibility and corporate performance. J. Manag. Organ. 2010, 16, 641–655. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate Governance and Sustainability Performance: Analysis of Triple Bottom Line Performance. J. Bus. Ethics 2016, 1–22. [Google Scholar] [CrossRef]

- Ienciu, I.; Popa, I.E.; Ienciu, N.M. Environmental reporting and good practice of corporate governance: Petroleum industry case study. Proc. Econ. Financ. 2012, 3, 961–967. [Google Scholar] [CrossRef]

- Janggu, T.; Darus, F.; Zain, M.M.; Sawani, Y. Does good corporate governance lead to better sustainability reporting? An analysis using structural equation modeling. Proc. Soc. Behav. Sci. 2014, 145, 138–145. [Google Scholar] [CrossRef]

- Javaid Lone, E.; Javaid Lone, E.; Ali, A.; Ali, A.; Khan, I.; Khan, I. Corporate governance and corporate social responsibility disclosure: Evidence from Pakistan. Corp. Gov. Int. J. Bus. Soc. 2016, 16, 785–797. [Google Scholar] [CrossRef]

- Jizi, M. The Influence of Board Composition on Sustainable Development Disclosure. Bus. Strategy Environ. 2017. [Google Scholar] [CrossRef]

- Jizi, M.I.; Salama, A.; Dixon, R.; Stratling, R. Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector. J. Bus. Ethics 2014, 125, 601–615. [Google Scholar] [CrossRef]

- Khan, A.; Muttakin, M.B.; Siddiqui, J. Corporate governance and corporate social responsibility disclosures: Evidence from an emerging economy. J. Bus. Ethics 2013, 114, 207–223. [Google Scholar] [CrossRef]

- Khan, H. The effect of corporate governance elements on corporate social responsibility (CSR) reporting: Empirical evidence from private commercial banks of Bangladesh. Int. J. Law Manag. 2010, 52, 82–109. [Google Scholar] [CrossRef]

- Kiliç, M.; Kuzey, C.; Uyar, A. The impact of ownership and board structure on Corporate Social Responsibility (CSR) reporting in the Turkish banking industry. Corp. Gov. 2015, 15, 357–374. [Google Scholar] [CrossRef]

- Kock, C.J.; Santaló, J.; Diestre, L. Corporate governance and the environment: What type of governance creates greener companies? J. Manag. Stud. 2012, 49, 492–514. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, J.; Foo, C.T. Towards a theory of social responsibility reporting: Empirical analysis of 613 CSR reports by listed corporations in China. Chin. Manag. Stud. 2013, 7, 519–534. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Lim, S.; Matolcsy, Z.; Chow, D. The association between board composition and different types of voluntary disclosure. Eur. Account. Rev. 2007, 16, 555–583. [Google Scholar] [CrossRef]

- Lu, W. An Exploration of the Associations among Corporate Sustainability Performance, Corporate Governance, and Corporate Financial Performance. Ph.D. Thesis, University of Texas at Austin, Austin, TX, USA, 2016. [Google Scholar]

- Martínez-Ferrero, J.; Vaquero-Cacho, L.; Cuadrado-Ballesteros, B.; García-Sánchez, I. El gobierno corporativo y la responsabilidad social corporativa en el sector bancario: El papel del consejo de administración. Investig. Eur. Dir. Econ. Empresa 2015, 21, 129–138. (In Spanish) [Google Scholar] [CrossRef]

- Mohamad, N.R.; Abdullah, S.; Zulkifli Mokhtar, M.; Kamil, N.F.B. The effects of board independence, board diversity and corporate social responsibility on earnings management. In Proceedings of the Finance and Corporate Governance Conference, Melbourne, Australia, 28–29 April 2011. [Google Scholar]

- Musteen, M.; Datta, D.K.; Kemmerer, B. Corporate reputation: Do board characteristics matter? Br. J. Manag. 2010, 21, 498–510. [Google Scholar] [CrossRef]

- Nurhayati, R.; Taylor, G.; Tower, G. Investigating social and environmental disclosure practices by listed Indian textile firms. J. Dev. Areas 2015, 49, 361–372. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Aguilera-Caracuel, J.; Morales-Raya, M. Corporate Governance and Environmental Sustainability: The Moderating Role of the National Institutional Context. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 150–164. [Google Scholar] [CrossRef]

- Post, C.; Rahman, N.; Rubow, E. Green governance: Boards of directors’ composition and environmental corporate social responsibility. Bus. Soc. 2011, 50, 189–223. [Google Scholar] [CrossRef]

- Lorenzo, J.M.P.; Sánchez, I.M.G.; Gallego-Álvarez, I. Características del consejo de administración e información en materia de responsabilidad social corporativa. Spanish J. Financ. Account. Rev. Esp. Financ. Contab. 2009, 38, 107–135. (In Spanish) [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.; Garcia-Sanchez, I. The role of the board of directors in disseminating relevant information on greenhouse gases. J. Bus. Ethics 2010, 97, 391–424. [Google Scholar] [CrossRef]

- Rao, K.; Rao, K.; Tilt, C.; Tilt, C. Board diversity and CSR reporting: An Australian study. Med. Account. Res. 2016, 24, 182–210. [Google Scholar] [CrossRef]

- Rodríguez-Ariza, L.; Aceituno, J.V.F.; Rubio, R.G. El consejo de administración y las memorias de sostenibilidad. Rev. Contab. 2014, 17, 5–16. (In Spanish) [Google Scholar] [CrossRef]

- Rodriguez-Dominguez, L.; Gallego-Alvarez, I.; Garcia-Sanchez, I.M. Corporate governance and codes of ethics. J. Bus. Ethics 2009, 90, 187–202. [Google Scholar] [CrossRef]

- Roitto, A. Factors Effecting Corporate Social Responsibility Disclosure Ratings: An Empirical Study of Finnish Listed Companies. Master’s Thesis, University of Oulu, Oulu, Finland, 2013. [Google Scholar]

- Rouf, M. The corporate social responsibility disclosure: A study of listed companies in Bangladesh. Bus. Econ. Res. J. 2011, 2, 19–32. [Google Scholar]

- Said, R.; Hj Zainuddin, Y.; Haron, H. The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Soc. Responsib. J. 2009, 5, 212–226. [Google Scholar] [CrossRef]

- Said, R.; Omar, N.; Nailah Abdullah, W. Empirical investigations on boards, business characteristics, human capital and environmental reporting. Soc. Responsib. J. 2013, 9, 534–553. [Google Scholar] [CrossRef]

- Sharif, M.; Rashid, K. Corporate governance and corporate social responsibility (CSR) reporting: An empirical evidence from commercial banks (CB) of Pakistan. Qual. Quant. 2014, 48, 2501–2521. [Google Scholar] [CrossRef]

- Shaukat, A.; Qiu, Y.; Trojanowski, G. Board attributes, corporate social responsibility strategy, and corporate environmental and social performance. J. Bus. Ethics 2015, 135, 569–585. [Google Scholar] [CrossRef]

- Tauringana, V.; Chithambo, L. The effect of DEFRA guidance on greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 425–444. [Google Scholar] [CrossRef]

- Walls, J.L.; Hoffman, A.J. Exceptional boards: Environmental experience and positive deviance from institutional norms. J. Organ. Behav. 2013, 34, 253–271. [Google Scholar] [CrossRef]

- Wang, P.; Wang, F.; Zhang, J.; Yang, B. The effect of ultimate owner and regulation policy on corporate social responsibility information disclosure: Evidence from China. Afr. J. Bus. Manag. 2012, 6, 6183. [Google Scholar] [CrossRef]

- Williams, R.J. Women on corporate boards of directors and their influence on corporate philanthropy. J. Bus. Ethics 2003, 42, 1–10. [Google Scholar] [CrossRef]

- Zhang, L. Board demographic diversity, independence, and corporate social performance. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 686–700. [Google Scholar] [CrossRef]

- Zhang, J.Q.; Zhu, H.; Ding, H. Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes-Oxley era. J. Bus. Ethics 2013, 114, 381–392. [Google Scholar] [CrossRef]

- Zahra, S.A.; Pearce, J.A. Boards of directors and corporate financial performance: A review and integrative model. J. Manag. 1989, 15, 291–334. [Google Scholar] [CrossRef]

- Dixon-Fowler, H.R.; Slater, D.J.; Johnson, J.L.; Ellstrand, A.E.; Romi, A.M. Beyond “does it pay to be green?” A meta-analysis of moderators of the CEP–CFP relationship. J. Bus. Ethics 2013, 112, 353–366. [Google Scholar] [CrossRef]

- O’Boyle, E.H.; Pollack, J.M.; Rutherford, M.W. Exploring the relation between family involvement and firms' financial performance: A meta-analysis of main and moderator effects. J. Bus. Ventur. 2012, 27, 1–18. [Google Scholar] [CrossRef]

- Wagner, D.; Block, J.H.; Miller, D.; Schwens, C.; Xi, G. A meta-analysis of the financial performance of family firms: Another attempt. J. Fam. Bus. Strategy 2015, 6, 3–13. [Google Scholar] [CrossRef]

- Mar Miras-Rodríguez, M.; Carrasco-Gallego, A.; Escobar-Pérez, B. Are Socially Responsible Behaviors Paid Off Equally? A Cross-cultural Analysis. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 237–256. [Google Scholar] [CrossRef]

- Van der Laan Smith, J.; Adhikari, A.; Tondkar, R.H. Exploring differences in social disclosures internationally: A stakeholder perspective. J. Account. Public Policy 2005, 24, 123–151. [Google Scholar] [CrossRef]

- Ball, R.; Kothari, S.; Robin, A. The effect of international institutional factors on properties of accounting earnings. J. Account. Econ. 2000, 29, 1–51. [Google Scholar] [CrossRef]

- Morgan, G.; Whitley, R.; Moen, E. Changing Capitalisms? Internationalization, Institutional Change, and Systems of Economic Organization; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Whitley, R. Business Systems in East Asia: Firms, Markets and Societies; Sage: Newcastle upon Tyne, UK, 1992. [Google Scholar]

- Whitley, R. European Business Systems: Firms and Markets in Their National Contexts; Sage: Newcastle upon Tyne, UK, 1992. [Google Scholar]

- Haake, S. National business systems and industry-specific competitiveness. Organ. Stud. 2002, 23, 711–736. [Google Scholar] [CrossRef]

- Gallego-Alvarez, I.; Ortas, E.; Vicente-Villardón, J.L.; Álvarez Etxeberria, I. Institutional Constraints, Stakeholder Pressure and Corporate Environmental Reporting Policies. Bus. Strategy Environ. Bus Strat Environ. 2017. [Google Scholar] [CrossRef]

- Tengblad, S.; Ohlsson, C. The framing of corporate social responsibility and the globalization of national business systems: A longitudinal case study. J. Bus. Ethics 2010, 93, 653–669. [Google Scholar] [CrossRef]

- Kock, C.J.; Min, B.S. Legal Origins, Corporate Governance, and Environmental Outcomes. J. Bus. Ethics 2016, 138, 507–524. [Google Scholar] [CrossRef]

- Ducassy, I. Does Corporate Social Responsibility Pay Off in Times of Crisis? An Alternate Perspective on the Relationship between Financial and Corporate Social Performance. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 157–167. [Google Scholar] [CrossRef]

- Karaibrahimoglu, Y.Z. Corporate social responsibility in times of financial crisis. Afr. J. Bus. Manag. 2010, 4, 382. [Google Scholar]

- Adams, R.B. Governance and the financial crisis. Int. Rev. Financ. 2012, 12, 7–38. [Google Scholar] [CrossRef]

- European Commission. Action Plan: European Company Law and Corporate Governance—A Modern Legal Framework for More Engaged Shareholders and Sustainable Companies; European Commission: Brussels, Belgium; Luxembourg, 2012. [Google Scholar]

- Ortas, E.; Moneva, J.M.; Álvarez, I. Sustainable supply chain and company performance: A global examination. Supply Chain Manag. Int. J. 2014, 19, 332–350. [Google Scholar] [CrossRef]

- Njoroge, J. Effects of the global financial crisis on corporate social responsibility in multinational companies in Kenya. Ethical Inf. Anal. Intern Covalence SA Geneva 2009. Available online: http://www.covalence.ch/docs/Kenya-Crisis.pdf (accessed on 28 January 2017).

- Gallego-Álvarez, I.; García-Sánchez, I.M.; Silva Vieira, C. Climate change and financial performance in times of crisis. Bus. Strategy Environ. 2014, 23, 361–374. [Google Scholar] [CrossRef]

- Botella, J.; Sánchez-Meca, J. Meta análisis en Ciencias Sociales y de la Salud; Síntesis: Madrid, Spain, 2015. (In Spanish) [Google Scholar]

- Lipsey, M.W.; Wilson, D.B. Practical Meta-Analysis; Sage: Newcastle upon Tyne, UK, 2001. [Google Scholar]

- Schmidt, F.L.; Hunter, J.E. Methods of Meta-Analysis: Correcting Error and Bias in Research Findings; Sage: Newcastle upon Tyne, UK, 2014. [Google Scholar]

- Borenstein, M.H.; Hedges, L.V.; Higgins, J.P.T.; Rothstein, H.R. Introduction to Meta-Analysis; Wiley: Chichester, UK, 2009. [Google Scholar]

- Hedges, L.V.; Vevea, J.L. Fixed-and random-effects models in meta-analysis. Psychol. Methods 1998, 3, 486. [Google Scholar] [CrossRef]

- Hedged, V.; Olkin, I. 1985, Statistical Methods for Metaanalysis; Academic Press: Cambridge, MA, USA, 1990. [Google Scholar]

- Field, A.P.; Gillett, R. How to do a meta-analysis. Br. J. Math. Stat. Psychol. 2010, 63, 665–694. [Google Scholar] [CrossRef] [PubMed]

- Conover, W.J. Practical Nonparametric Statistics; Wiley: New York, NY, USA, 1999. [Google Scholar]

- Higgins, J.; Thompson, S.G. Quantifying heterogeneity in a meta-analysis. Stat. Med. 2002, 21, 1539–1558. [Google Scholar] [CrossRef] [PubMed]

- Rosenthal, R. The file drawer problem and tolerance for null results. Psychol. Bull. 1979, 86, 638. [Google Scholar] [CrossRef]

- Hedges, L.V. Estimation of effect size under nonrandom sampling: The effects of censoring studies yielding statistically insignificant mean differences. J. Educ. Behav. Stat. 1984, 9, 61–85. [Google Scholar] [CrossRef]

- Dickersin, K.; Min, Y.; Meinert, C.L. Factors influencing publication of research results: Follow-up of applications submitted to two institutional review boards. JAMA 1992, 267, 374–378. [Google Scholar] [CrossRef] [PubMed]

- Van Essen, M.; van Oosterhout, J.H.; Carney, M. Corporate boards and the performance of Asian firms: A meta-analysis. Asia Pac. J. Manag. 2012, 29, 873–905. [Google Scholar] [CrossRef]

- Samaha, K.; Khlif, H.; Hussainey, K. The impact of board and audit committee characteristics on voluntary disclosure: A meta-analysis. J. Int. Account. Audit. Tax. 2015, 24, 13–28. [Google Scholar] [CrossRef]

- GRI. GRI G4 Part2 Implementation Manual; GRI: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Jensen, M.C. Value maximization, stakeholder theory, and the corporate objective function. J. Appl. Corp. Financ. 2001, 14, 8–21. [Google Scholar] [CrossRef]

- Johnson, J.L.; Daily, C.M.; Ellstrand, A.E. Boards of directors: A review and research agenda. J. Manag. 1996, 22, 409–438. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

| Code | Authors | Year | Sample Size | Observed r a | Number of r’s Reported | Measure of CSP b | Measure of Firm Board Independence c |

|---|---|---|---|---|---|---|---|

| 1 | Amran et al. [77] | 2014 | 113 | 0.016 | 1 | Sustainability reporting quality index (D) | % of outside and independent directors (OUT, IND) |

| 2 | Amran et al. (B) [78] | 2014 | 111 | 0.307 (t) | 1 | Bloomberg database of environmental disclosure ratings (SA/P/O) | % of independent and non-executive directors (IND, EX) |

| 3 | Arayssi et al. [79] | 2016 | 975 | 0.300 | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 4 | Arena et al. [80] | 2015 | 288 | 0.164 to 0.459 | 2 | Kinder, Lydenberg and Domini (KLD) environmental data (SA/P/O) | % of independent directors (IND) |

| 5 | Arora and Dharwadkar [81] | 2011 | 1522 | −0.300 to 0.400 | 2 | KLD positive and negative ratings (SA/P/O) | % of independent directors (IND) |

| 6 | Barakat et al. [82] | 2015 | 101 | −0.200 | 1 | CSR disclosure index (including products, consumers and community involvement) (D) | % of independent directors (IND) |

| 7 | Barako and Brown [83] | 2008 | 40 | 0.272 | 1 | Social disclosure index (D) | % of non-executive directors (EX) |

| 8 | Bear et al. [9] | 2010 | 51 | 0.420 to 0.104 | 2 | KLD social scores (SA/P/O) | Director diversity Blau´s index (IND, EX, OUT) |

| 9 | Ben-Amar et al. [84] | 2015 | 541 | 0.250 | 1 | Environmental disclosures (D) | % of independent directors (IND) |

| 10 | Benomran et al. [85] | 2015 | 162 | 0.020 | 1 | Social and environmental disclosures (D) | % of non-executive directors (EX) |

| 11 | Berrone and Gómez-Mejía [86] | 2009 | 2088 | −0.040 to −0.080 | 2 | Environmental performance (D) | % of outside directors (OUT) |

| 12 | Boulouta [87] | 2013 | 820 | −0.023 to 0.101 | 3 | KLD social scores (SA/P/O) | Ratio between outside and inside directors (OUT) |

| 13 | Bowrin [88] | 2013 | 96 | −0.083 (t) | 1 | Social and environmental disclosures (D) | % of non-executive directors (EX) |

| 14 | Brammer et al. [89] | 2009 | 199 | −0.036 | 1 | Corporate reputation indices (R) | % of non-executive directors (EX) |

| 15 | Burke et al. [90] | 2017 | 11458 | 0.130 | 1 | Morgan Stanley Capital Investment (MSCI) CSP data (SA/P/O) | % of independent directors (IND) |

| 16 | Cho et al. [91] | 2015 | 10297 | 0.070 (t) | 1 | KLD social scores (SA/P/O) | % of independent directors (IND) |

| 17 | Choi et al. [92] | 2013 | 2042 | 0.280 | 1 | KEJI social scores (SA/P/O) | % of outside directors (OUT) |

| 18 | Cormier et al. [93] | 2011 | 137 | −0.010 to −0.020 | 2 | Social and environmental disclosures (D) | % of independent directors (IND) |

| 19 | David et al. [94] | 2007 | 730 | −0.040 | 1 | KLD CSP ratings (SA/P/O) | % of outside directors (OUT) |

| 20 | De Villiers [22] | 2011 | 5997 | 0.110 | 1 | KLD environmental ratings (SA/P/O) | % of independent directors (IND) |

| 21 | Deschênes et al. [95] | 2015 | 192 | 0.414 (t) | 1 | JANTZI CSP scores (SA/P/O) | % of independent directors (IND) |

| 22 | Ducassy [96] | 2015 | 41 | 0.410 | 1 | CFIE CSP scores (SA/P/O) | % of independent directors (IND) |

| 23 | Dunn and Sainty [74] | 2009 | 174 | 0.219 | 1 | JANTZI CSP scores (SA/P/O) | Business´s board independence score (IND) |

| 24 | Esa et al. [97] | 2012 | 54 | −0.003 to 0.153 | 2 | Sustainability disclosures (D) | % of independent and non-executive directors (IND, EX) |

| 25 | Fernández-Gago et al. [98] | 2016 | 145 | 0.361 | 1 | CPS rating scores (SA/P/O) | % of independent directors (IND) |

| 26 | Frias-Aceituno et al. [99] | 2013 | 1575 | 0.062 | 1 | Sustainability disclosures (D) | % of non-executive directors (EX) |

| 27 | Galbreath [100] | 2011 | 161 | 0.020 to 0.280 | 2 | Social and environmental disclosures (D) | % of outside directors (OUT) |

| 28 | Galbreath [23] | 2016 | 300 | −0.250 to −0.270 | 2 | GES environmental and social ratings (SA/P/O) | % of inside directors (OUT) |

| 29 | García-Sánchez et al. [101] | 2015 | 5380 | 0.037 to 0.112 | 2 | EIRIS ethics codes (CP/V) | % of independent directors (IND) |

| 30 | García-Sánchez [102] | 2014 | 686 | 0.157 (t) | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 31 | Ghazali and Weetman [103] | 2006 | 87 | −0.129 (t) | 1 | Social and environmental disclosures (D) | % of independent and non-executive directors (IND, EX) |

| 32 | Gupta et al. [104] | 2015 | 1153 | 0 to 0.240 | 4 | KLD scores (SA/P/O) | Average of the annual % of independent directors over the 10-year period (IND) |

| 33 | Habbash [105] | 2016 | 267 | −0.040 | 1 | Sustainability disclosures and ISO 26000 (D, CP/V) | % of non-executive directors (EX) |

| 34 | Hafsi and Turgut [106] | 2013 | 95 | 0.130 | 1 | KLD CSP scores (SA/P/O) | % of outside directors (OUT) |

| 35 | Haldar and Mishra [107] | 2015 | 24 | 0.295 | 1 | Sustainability reporting (D) | % of independent directors (IND) |

| 36 | Haniffa and Cook [14] | 2005 | 278 | −0.182 to −0.241 | 4 | Social disclosure index (R) | % of non-executive directors (EX) |

| 37 | Harjoto et al. [20] | 2015 | 9001 | −0.060 to 0.270 | 3 | MSCI CSP scores (SA/P/O) | % of outside directors (OUT) |

| 38 | Hogan et al. [108] | 2014 | 540 | −0.020 to 0.050 | 3 | Bloomberg environmental and social disclosure scores (SA/P/O, D) | % of independent directors (IND) |

| 39 | Hoje and Harjoto [109] | 2011 | 13389 | 0.190 | 1 | KLD CSP data (SA/P/O) | % of outside and independent directors (IND, OUT) |

| 40 | Htay et al. [110] | 2012 | 120 | 0.120 | 1 | Social and environmental disclosures (D) | % of independent and non-executive directors (IND, EX) |

| 41 | Huang [111] | 2010 | 297 | 0.060 to 0.129 | 6 | Sustainability disclosures (D) | % of independent directors (IND) |

| 42 | Hussain et al. [112] | 2016 | 152 | −0.042 to 0.325 | 3 | Sustainability reporting (D) | % of independent directors (IND) |

| 43 | Ienciu et al. [113] | 2012 | 54 | 0.476 | 1 | Environmental disclosures (D) | % of independent directors (IND) |

| 44 | Janggu et al. [114] | 2014 | 100 | -0.124 | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 45 | Javaid Lone et al. [115] | 2016 | 250 | 0.660 | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 46 | Jizi [116] | 2017 | 1155 | 0.101 (t) | 1 | Bloomberg CSP scores (SA/P/O) | % of independent directors (IND) |

| 47 | Jizi et al. [117] | 2014 | 291 | 0.199 (t) | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 48 | Johnson and Greening [12] | 1999 | 252 | −0.050 to 0.060 | 5 | KLD CSP scores (SA/P/O) | % of outside directors (OUT) |

| 49 | Khan et al. [118] | 2013 | 580 | 0.269 | 1 | Social and environmental disclosures (D) | % of independent directors (IND) |

| 50 | Khan [119] | 2010 | 30 | 0.550 | 1 | Sustainability disclosures (D) | % of non-executive directors (EX) |

| 51 | Kiliç et al. [120] | 2015 | 3106 | 0.010 | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 52 | Kock et al. [121] | 2012 | 657 | 0.170 to 0.180 | 2 | IRRC environmental performance data (SA/P/O) | % of independent directors (IND) |

| 53 | Li et al. [122] | 2013 | 613 | −0.080 to −0,050 | 4 | HEXUN CSP data (SA/P/O) | % of independent directors (IND) |

| 54 | Liao et al. [123] | 2015 | 329 | 0.280 to 0.310 | 2 | Carbon Disclosure Project (D) | % of independent and non-executive directors (IND, EX) |

| 55 | Lim et al. [124] | 2007 | 181 | 0.248 | 1 | Social and environmental disclosures (D) | % of independent directors (IND) |

| 56 | Lu [125] | 2013 | 2098 | 0.113 | 1 | KLD CSP scores (SA/P/O) | Dichotomized board independence measure above and below the median (IND) |

| 57 | Mallin et al. [76] | 2013 | 221 | −0.033 to 0.123 | 7 | Sustainability reporting and KLD CSP scores (D, SA/P/O) | % of independent directors (IND) |

| 58 | Martínez-Ferrero et al. [126] | 2015 | 877 | −0,380 | 1 | EIRIS CSP scores (SA/P/O) | % of independent directors (IND) |

| 59 | Michelon and Parbonetti [13] | 2012 | 114 | −0.170 to 0.088 | 7 | Sustainability disclosures (D) | % of independent directors (IND) |

| 60 | Mohamad et al. [127] | 2011 | 795 | 0.164 to −0.027 | 3 | Sustainability disclosures (D) | % of independent directors (IND) |

| 61 | Musteen [128] | 2010 | 324 | 0.190 | 1 | Fortune’s reputational rankings (R) | % of outside directors (OUT) |

| 62 | Ntim and Soobaroyen [73] | 2013 | 600 | 0.155 | 1 | Sustainability disclosures (D) | % of independent and non-executive directors (IND, EX) |

| 63 | Nurhayati et al. [129] | 2015 | 285 | −0.056 | 1 | Sustainability disclosures (D) | % of independent and non-executive directors (IND, EX) |

| 64 | Ortiz de Mandojana et al. [130] | 2016 | 210 | −0.270 | 1 | Dichotomized environmental sustainability index (R) | % of independent directors (IND) |

| 65 | Post et al. [131] | 2011 | 78 | −0.010 to 0.039 | 7 | Sustainability disclosures and KLD environmental scores (D, SA/P/O) | % of outside directors (OUT) |

| 66 | Post et al. [72] | 2015 | 180 | 0.085 | 1 | KLD environmental performance scores (SA/P/O) | % of independent directors (IND) |

| 67 | Prado-Lorenzo et al. [132] | 2009 | 288 | 0.270 | 1 | Sustainability disclosures (D) | % of non-executive directors (EX) |

| 68 | Prado-Lorenzo and García-Sánchez [133] | 2010 | 283 | −0.044 | 1 | Carbon Disclosure Project (D) | % of independent directors (IND) |

| 69 | Rao and Tilt [134] | 2016 | 345 | 0,050 (t) | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 70 | Rao et al. [16] | 2012 | 96 | −0.062 to −0.111 | 2 | Environmental disclosures (D) | % of independent directors (IND) |

| 71 | Rodríguez-Ariza et al. [135] | 2014 | 3521 | −0.025 | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 72 | Rodríguez-Domínguez et al. [136] | 2009 | 351 | 0.078 to 0.212 | 3 | Dichotomized Ethics code draw up (CP/V) | % of independent directors (IND) |

| 73 | Roitto [137] | 2013 | 31 | 0.127 (t) | 1 | CSP Hub disclosure rating (SA/P/O) | % of independent directors (IND) |

| 74 | Rouf [138] | 2011 | 93 | 0.569 | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 75 | Sahin et al. [75] | 2011 | 96 | 0.101 | 1 | Sustainability disclosures (D) | % of independent directors (IND) |

| 76 | Said et al. [139] | 2009 | 150 | −0.011 | 1 | Sustainability disclosures (D) | % of non-executive directors (EX) |

| 77 | Said et al. [140] | 2013 | 120 | −0.126 | 1 | Environmental disclosures (D) | % of independent and non-executive directors (IND, EX) |

| 78 | Sharif and Rashid [141] | 2014 | 22 | 0.874 | 1 | Social disclosures (D) | % of non-executive directors (EX) |

| 79 | Shaukat et al. [142] | 2016 | 2028 | 0.270 to 0.720 | 2 | ASSET 4 environmental and social performance scores (SA/P/O) | % of independent directors (IND) |

| 80 | Sundarasen et al. [17] | 2016 | 450 | −0.054 to 0.255 | 2 | Sustainability disclosures (D) | % of independent and non-executive directors (IND, EX) |

| 81 | Tauringana and Chithambo [143] | 2015 | 860 | 0.160 | 1 | Greenhouse gas (GHG) disclosures (D) | % of non-executive directors (EX) |

| 82 | Walls and Berrone [19] | 2015 | 1320 | 0.120 | 1 | Trucost Environmental scores (SA/P/O) | % of outside directors (OUT) |

| 83 | Walls and Hoffman [144] | 2013 | 1881 | 0.050 | 1 | KLD environmental scores (SA/P/O) | % of outside directors (OUT) |

| 84 | Walls et al. [18] | 2012 | 2002 | 0.130 to 0.250 | 2 | KLD environmental scores (SA/P/O) | % of outside directors (OUT) |

| 85 | Wang et al. [145] | 2012 | 446 | 0.020 to 0.061 | 2 | Environmental disclosures (D) | % of independent directors (IND) |

| 86 | Williams [146] | 2003 | 185 | 0.040 | 1 | Social performance charitable contributions (SA/P/O) | Ratio between outside and inside directors (OUT) |

| 87 | Zhang [147] | 2012 | 475 | −0.230 to −0.110 | 4 | KLD CSP institutional and technical scores (SA/P/O) | % of outside directors (OUT) |

| N | K | −95% CI | +95% CI | Q-Stat | I2-Stat | Rosenthal Fail-Safe | |||

|---|---|---|---|---|---|---|---|---|---|

| Direct effect | |||||||||

| 1 | Impact of board independence on CSP | 100.359 | 87 | 0.1258 | 0.0946 | 0.1566 | 1749.24 *** | 95.6108 | 12.736 |

| Moderating effects | |||||||||

| Corporate Social Performance measurement | |||||||||

| Self-reported CSP measures | 28.418 | 52 | 0.1386 | 0.0966 | 0.1800 | 559.31 *** | 90.8816 | ||

| External CSP data measures | 77.542 | 35 | 0.1096 | 0.0612 | 0.1575 | 1189.55 *** | 97.1418 | ||

| Corporate governance systems | |||||||||

| 2 | Civil law | 6.732 | 9 | 0.1838 | 0.0828 | 0.2811 | 112.79 *** | 92.9072 | |

| 3 | Common law | 75.624 | 46 | 0.1293 | 0.0869 | 0.1712 | 1031.57 *** | 95.6377 | |

| 4 | Mixed law | 5.414 | 21 | 0.1217 | 0.0537 | 0.1887 | 290.93 *** | 95.7885 | |

| 5 | Other CG systems | 12.589 | 11 | 0.0752 | −0.0139 | 0,1631 | 237.45 *** | 93.1254 | |

| Economic conditions | |||||||||

| 8 | From 2010 to 2017 | 5.214 | 16 | 0.1844 | 0.1085 | 0.2581 | 157.08 *** | 90.4507 | |

| 9 | From 2007 to 2009 | 5.608 | 19 | 0.1688 | 0.0977 | 0.2382 | 227.78 *** | 92.0975 | |

| 10 | From 2002 to 2006 | 13.596 | 17 | 0.1096 | 0.0373 | 0.1808 | 390.53 *** | 95.9030 | |

| 11 | Before 2002 | 1.759 | 6 | 0.0710 | −0.0509 | 0.1907 | 14.28 * | 64.9888 | |

| Multi-period papers | 74.182 | 29 | 0.0951 | 0.0429 | 0.1468 | 897.42 *** | 96.8800 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ortas, E.; Álvarez, I.; Zubeltzu, E. Firms’ Board Independence and Corporate Social Performance: A Meta-Analysis. Sustainability 2017, 9, 1006. https://doi.org/10.3390/su9061006

Ortas E, Álvarez I, Zubeltzu E. Firms’ Board Independence and Corporate Social Performance: A Meta-Analysis. Sustainability. 2017; 9(6):1006. https://doi.org/10.3390/su9061006

Chicago/Turabian StyleOrtas, Eduardo, Igor Álvarez, and Eugenio Zubeltzu. 2017. "Firms’ Board Independence and Corporate Social Performance: A Meta-Analysis" Sustainability 9, no. 6: 1006. https://doi.org/10.3390/su9061006