Low Carbon Economy Performance Analysis with the Intertemporal Effect of Capital in China

Abstract

:1. Introduction

2. Literature Review

3. Basics of Three-Stage Dynamic Malmquist Model

3.1. First Stage: Dynamic Malmquist Calculation

3.2. Second Stage: Tobit Model Based on Panel Data

3.3. Third Stage: Adjustment and Managerial Performance Re-Calculation

4. Data

5. Empirical Results

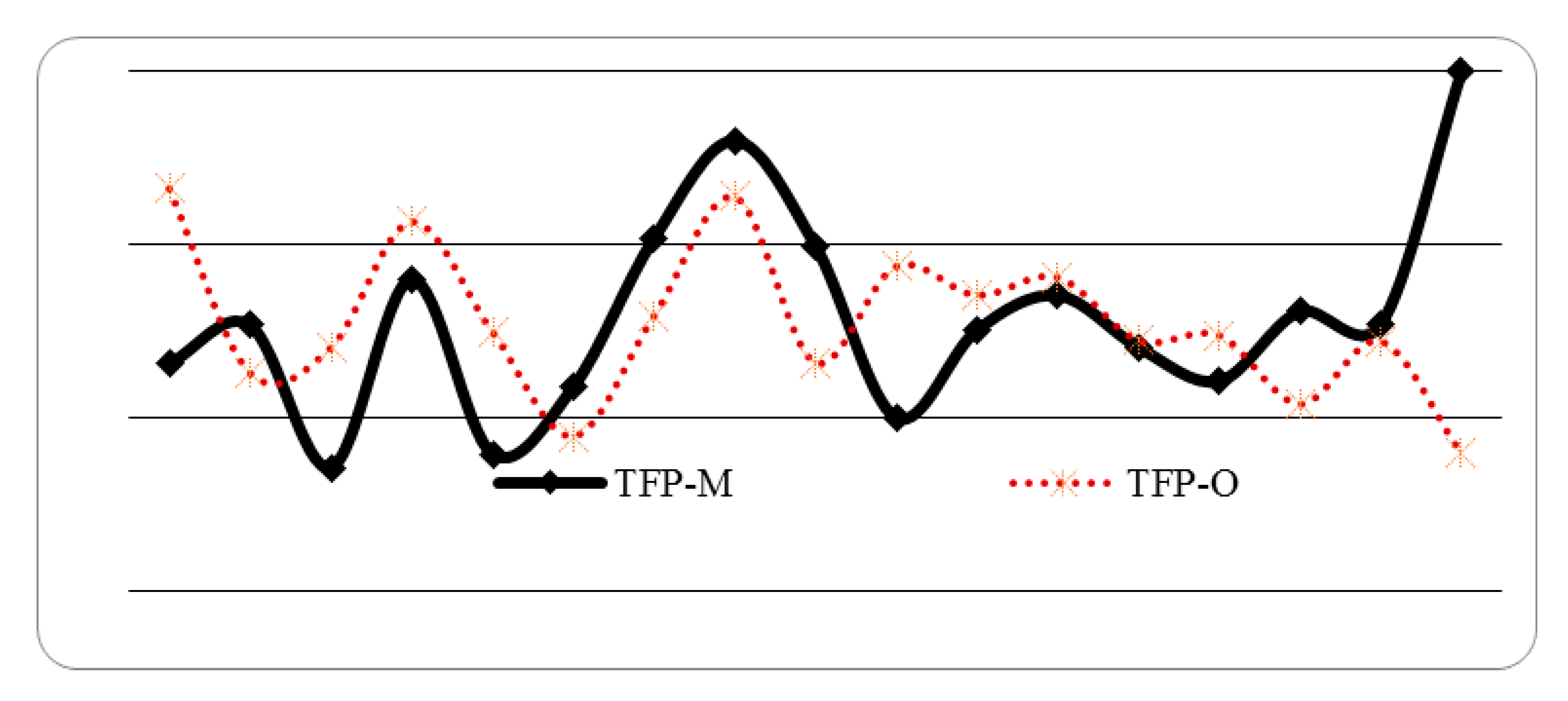

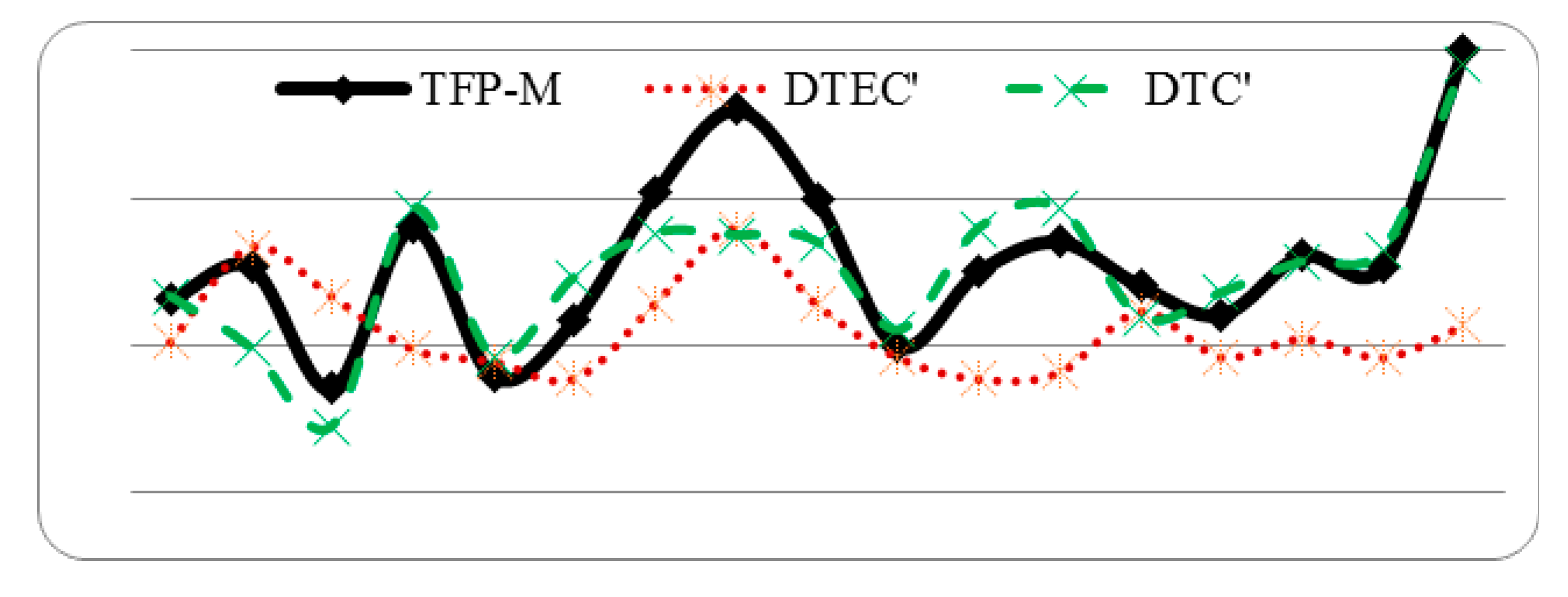

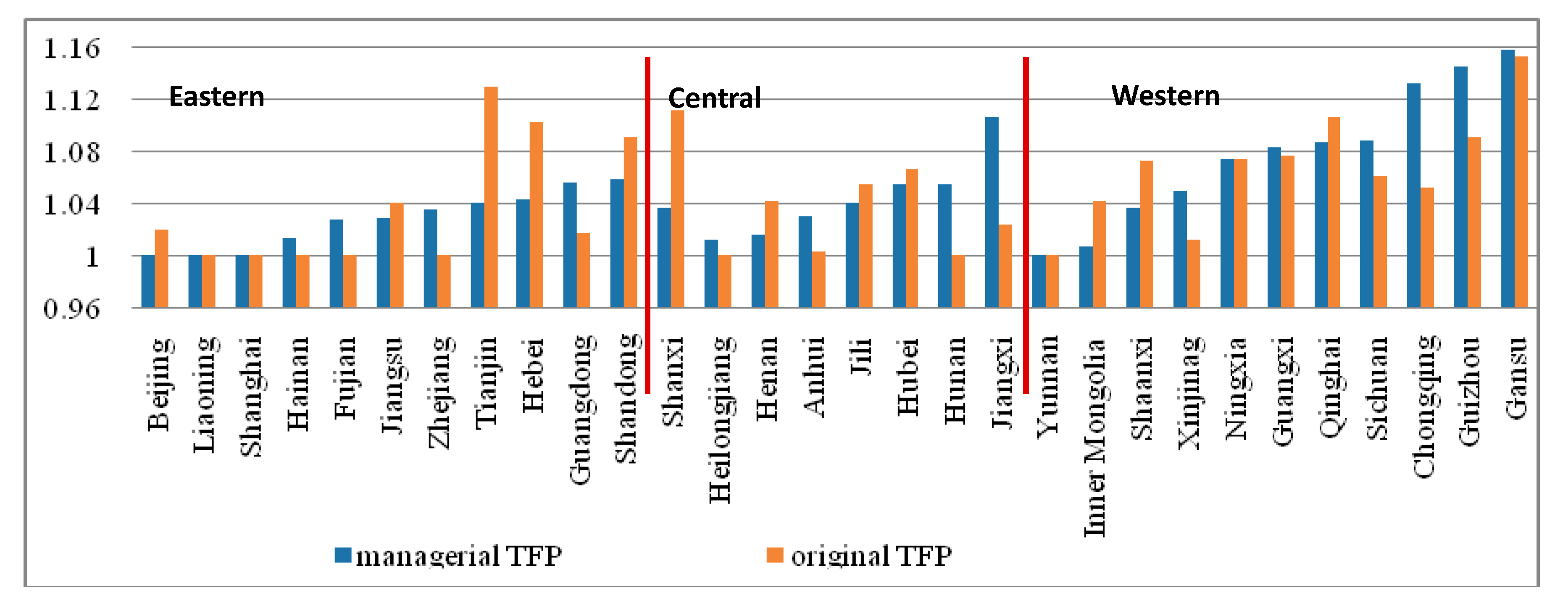

5.1. Comparsion of Low-Carbon Economy Performance with Uncontrollable Influence

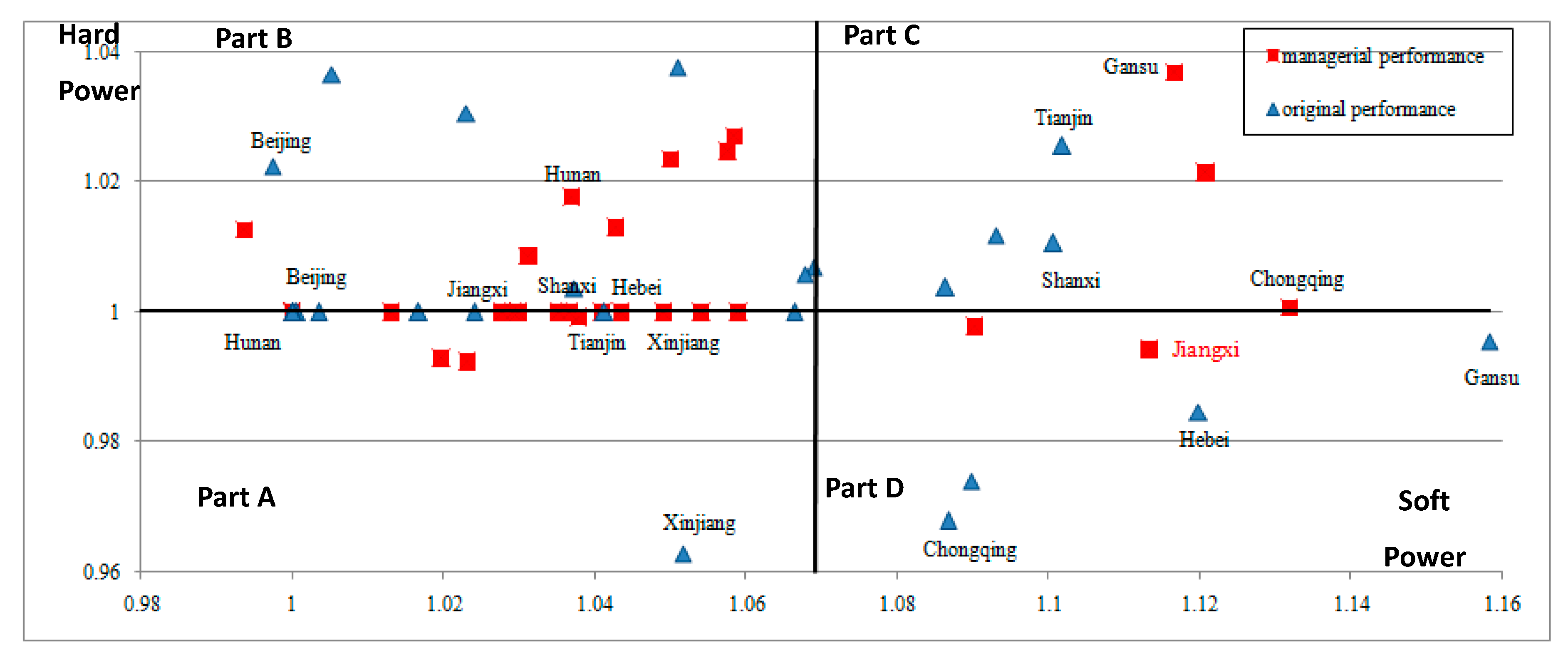

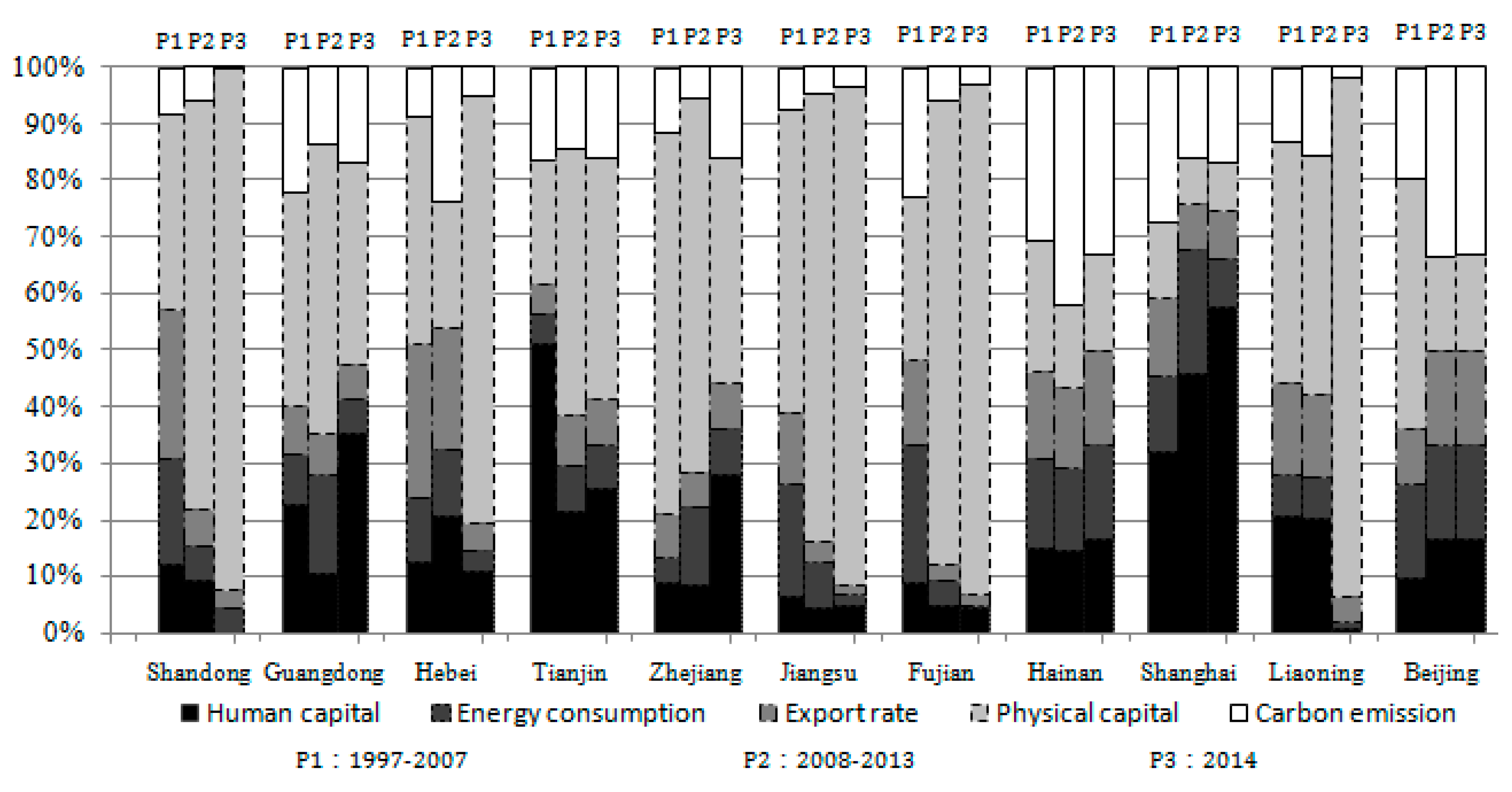

5.2. Weighted Analysis of Resource Factors for the Low-Carbon Economy

6. Conclusions

- (1)

- Optimizing industrial structures for the improvement of carbon productivity. The development of a low-carbon economy relies on the optimization of industrial structures. This indicates that policy supports for the low-carbon economy are necessary to increase the value of products. Meanwhile, the industrial internal update should be improved according the regional resource endowment of low-carbon economy performance. For example, industries in the western region should be encouraged to switch from high-energy to low-carbon consumption. By contrast, in the central region, integrating the development of production services and manufacturing would be more effective. In the eastern region, internet industrialization and intelligent industrialization would keep the regional advantage of low-carbon economy.

- (2)

- Optimizing the energy structure for the differentiation strategy of carbon emission. Most developed countries consider energy structure optimization to be the future direction of a low-carbon economy. For example, according to the city government announcement, Santiago, U.S., promised to realize 100% renewable energy sources within 20 years. By contrast, carbon reduction while stabilizing economic growth is suitable for China. A feasible path for China also involves the optimization of energy consumption structures. From the empirical results, the regional differentiation of carbon emission performance is obvious; the provinces with low managerial performance should adjust their own resource endowment structures according to the experience of the more advantaged provinces. For the provinces with high managerial performance, future policy support for renewable energy is crucial.

- (3)

- Improving technical innovation abilities to promote soft power. Soft power is the driving force of low-carbon performance improvement. Thus, innovations in low-carbon technology are crucial in carbon reduction. However, for the optimal allocation of resources, the construction of an innovation platform must be the accumulation of multilateral forces. The dominance of innovative enterprises should be established, and the perfection of the innovation system, should become a priority. Moreover, a cooperative alliance among enterprises, universities, and research institutes should be established and receive effective guidance.

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Wu, D. Discussion on the distinction between haze and frog and analysis and processing of data. Environ. Chem. 2008, 3, 327–330. [Google Scholar]

- Li, K.; Lin, B. Economic growth model, structural transformation, and green productivity in China. Appl. Energy 2017, 187, 489–500. [Google Scholar] [CrossRef]

- Kondyli, J. Measurement and Evaluation of Sustainable Development: A Composite Indicator for the Islands of the North Aegean Region, Greece. Environ. Impact Assess. Rev. 2010, 30, 347–356. [Google Scholar] [CrossRef]

- Reilly, M.J. Green growth and the efficient use of natural resources. Energy Econ. 2012, 34, 85–93. [Google Scholar] [CrossRef]

- Krugman, P. The myth of Asia’s miracle. Foreign Aff. 1994, 73, 62–78. [Google Scholar] [CrossRef]

- Hu, A. Economy growth depends on the increasing of total factor productivity. Policy 2003, 1, 29–30. [Google Scholar]

- Zheng, X. Again knowledge of total factor productivity. J. Quant. Tech. Econ. 2007, 24, 3–11. [Google Scholar]

- Li, X.; Yang, X.; Wang, Y. Does international trade improve the carbon productivity in China’s manufacturing? J. Environ. Econ. 2016, 2, 8–24. [Google Scholar]

- Färe, R.; Grosskopf, S.; Lindgren, B.; Roos, P. Productivity changes in Swedish pharmacies 1980–89: A non-parametric Malmquist approach. J. Product. Anal. 1992, 3, 85–101. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–435. [Google Scholar] [CrossRef]

- Hoekstra, R.; van den Bergh, J.C.J.M. Comparing structural decomposition analysis and index. Energy Econ. 2003, 25, 39–64. [Google Scholar] [CrossRef]

- Kennedy, C.; Steinberger, J.; Gasson, B.; Hansen, Y.; Hillman, T.; Havranek, M.; Pataki, D.; Phdungsilp, A.; Ramaswami, A.; Villalba, G. Methodology for inventorying greenhouse gas emissions from global cities. Energy Policy 2010, 38, 4828–4837. [Google Scholar] [CrossRef]

- Arabi, B.; Munisamy, S.; Emrouznejad, A.; Shadman, F. Power industry restructuring and eco-efficiency changes: A new slacks-based model in Malmquist-Luenberger index measure. Energy Policy 2014, 68, 132–145. [Google Scholar] [CrossRef]

- Holtz-Eakin, D.; Selden, T.M. Stoking the fires? CO2 emissions and economic growth. J. Public Econ. 1995, 57, 85–101. [Google Scholar] [CrossRef]

- Oh, I.; Wehrmeyer, W.; Mulugetta, Y. Decomposition analysis and mitigation strategies of CO2 emissions from energy consumption in South Korea. Energy Policy 2010, 38, 364–377. [Google Scholar] [CrossRef]

- He, F.; Zhang, Q.; Lei, J.; Fu, W.; Xu, X. Energy efficiency and productivity change of China’s iron and steel industry: Accounting for undesirable outputs. Energy Policy 2013, 54, 204–213. [Google Scholar] [CrossRef]

- Hu, J.-L.; Wang, S.-C. Total-factor energy efficiency of regions in China. Energy Policy 2006, 17, 3206–3217. [Google Scholar] [CrossRef]

- Liu, X. On decarburization of industrial structure and international comparison among cities. Product. Res. 2010, 4, 199–202. [Google Scholar]

- Lin, B.; Sun, C. Evaluating carbon dioxide emissions in international trade of China. Energy Policy 2010, 38, 613–621. [Google Scholar] [CrossRef]

- Zhao, R.; Su, H.; Chen, X.; Yu, Y. Commercially available materials selection in sustainable design: An integrated multi-attribute. Sustainability 2016, 8, 79–93. [Google Scholar] [CrossRef]

- Pacala, S.; Socolow, R. Stabilization wedges: Solving the climate problem for the next 50 years with current technologies. Science 2004, 305, 968–972. [Google Scholar] [CrossRef] [PubMed]

- Chen, W. The costs of mitigating carbon emissions in China: Findings from China Markal-macro modeling. Energy Policy 2005, 33, 885–896. [Google Scholar] [CrossRef]

- Oh, D. A global Malmquist-Luenberger productivity index. J. Product. Anal. 2010, 34, 183–197. [Google Scholar] [CrossRef]

- Li, L.; Fan, F.; Ma, L.; Tang, Z. Energy utilization evaluation of carbon performance in public projects by FAHP and cloud model. Sustainability 2016, 8, 630–647. [Google Scholar] [CrossRef]

- Guo, Y.; Li, J.; Xia, D.; Sun, B. Dynamic changes of carbon dioxide emissions in six provinces of central China. Res. Environ. Sci. 2016, 2, 1279–1287. [Google Scholar]

- Herrala, R.; Goel, R.K. Global CO2 efficiency: Countries estimates using a stochastic cost frontier. Energy Policy 2012, 45, 762–770. [Google Scholar] [CrossRef]

- Lorek, S.; Spangenberg, H.J. Sustainable consumption within a sustainable economy-beyond green growth and green economies. J. Clean. Prod. 2014, 63, 33–44. [Google Scholar] [CrossRef]

- Chen, S. Evaluation of low carbon transformation process for Chinese provinces. Econ. Res. J. 2012, 8, 32–44. [Google Scholar]

- Lilin, Z.; Qigui, Z. Re-estimatio of total factor productivity in China accounting for the energy and environment factors. Econ. Res. J. 2013, 30, 9–17. [Google Scholar]

- Liangke, X. How human capital and R&D investments influence TFP. J. Quant. Tech. Econ. 2010, 4, 78–94. [Google Scholar]

- Kander, A.; Malanima, P. The energy-capital relation—Sweden 1870–2000. Struct. Chang. Econ. Dyn. 2007, 18, 291–305. [Google Scholar] [CrossRef]

- Dou, X. Low carbon-economy development: China’s pattern and policy selection. Energy Policy 2013, 63, 1013–1020. [Google Scholar] [CrossRef]

- Foxon, J.T. A coevolutionary framework for analysing a transition to a sustainable low carbon economy. Ecol. Econ. 2011, 70, 2258–2267. [Google Scholar] [CrossRef]

- Solow, M.R. A contribution to the theory of economic growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Lei, M.; Yu, X. Analysis of Low carbon economy growth and dynamic effect mechanism. Econ. Sci. 2015, 2, 44–57. [Google Scholar]

- Ramakrishnan, R. A multi-factor efficiency perspective to the relationships among world GDP: Energy consumption and carbon dioxide emission. Technol. Forecast. Soc. Chang. 2006, 73, 483–494. [Google Scholar]

- Ürge-Vorsatz, D.; Kelemen, A.; Tirado-Herrero, S.; Thomas, S.; Thema, J.; Mzavanadze, N.; Hauptstock, D.; Suerkemper, F.; Teubler, J.; Gupta, M.; et al. Measuring multiple impacts of low-carbon energy options in a green economy context. Appl. Energy 2016, 179, 1409–1426. [Google Scholar] [CrossRef]

- Mandil, C. Tracking Industrial Energy Efficiency and CO2 Emissions; International Energy Agency: Paris, France, 2007. [Google Scholar]

- Meng, F.; Su, B.; Thomson, E.; Zhou, D.; Zhou, P. Measuring China’s regional energy and carbon emission efficiency with DEA models: A survey. Appl. Energy 2016, 183, 1–21. [Google Scholar] [CrossRef]

- Pastor, J.T.; Lovell, C.A.K. A global Malmquist productivity index. Econ. Lett. 2005, 88, 266–271. [Google Scholar] [CrossRef]

- Lamdany, R. IMF Performance in the Run-Up to the Financial and Economic Crisis: IMF Surveillance in 2004-07; International Monetary Fund: Washington, DC, USA, 2011; p. 5. [Google Scholar]

- Tone, K.; Tsutsui, M. Tuning regression results for use in multi-stage data adjustment approach of DEA. J. Oper. Res. Soc. Jpn. 2009, 52, 76–85. [Google Scholar]

- Fried, O.H.; Schnidt, S.S.; Yaisawarng, S. Incorporating the operating environment into a nonparametric measure of technical efficiency. J. Product. Anal. 1999, 12, 249–267. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, W.P. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–46. [Google Scholar] [CrossRef]

- Gimenez, V.S.; Prior, D.; Thieme, C. Technical efficiency, managerial efficiency and objective-setting in the educational system: an international comparison. J. Oper. Res. Soc. 2007, 58, 996–1007. [Google Scholar] [CrossRef]

- Banker, D.R.; Natarajan, R. Evaluating contextual variables affecting productivity using data envelopment analysis. Oper. Res. 2008, 56, 48–58. [Google Scholar] [CrossRef]

- Shang, J.-K.; Hung, W.-T; Wang, F.-C. Service outsourcing and hotel performance: Three-stage DEA analysis. Appl. Econ. Lett. 2008, 15, 1053–1057. [Google Scholar] [CrossRef]

- Tsutsui, M.; Goto, M. A multi-division efficiency evaluation of U.S. electric power companies using a weighted slacks-based measure. Socio-Econ. Plan. Sci. 2009, 43, 201–208. [Google Scholar] [CrossRef]

- Malmquist, S. Index numbers and indifference surfaces. Trabajos de Estadistica Y de Investigacion Operativa 1953, 4, 209–242. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Dynamic DEA with network structure: A slacks-based measure approach. Omega 2014, 42, 124–131. [Google Scholar]

- Färe, R.; Grosskopf, S; Norris, M.; Zhongyang, Z. Productivity growth, technical progress, and efficiency change in industrialized countries. Am. Econ. Rev. 1994, 84, 66–83. [Google Scholar]

- Cooper, W.W.; Seiford, M.W.; Tone, K. Data Envelopment Analysis: A Comprehensive Text with Model, Applications, References and DEA-Solver Software, 2nd ed.; Springer: New York, NY, USA, 2007; p. 376. [Google Scholar]

- Jondrow, J.; Lovell, C.A.K.; Materov, I.; Schmidt, P. On the estimation of technical inefficiency in the stochastic frontier production function model. J. Econ. 1982, 19, 233–238. [Google Scholar] [CrossRef]

- Ayres, R.U.; Warr, B. Accounting for growth: The role of physical work. Struct. Chang. Econ. Dyn. 2005, 16, 181–209. [Google Scholar] [CrossRef]

- Kander, A.; Malanima, P.; Warde, P. Power to the People: Energy in Europe over the Last Five Centuries; Princeton University Press: Princeton, NJ, USA, 2014. [Google Scholar]

- Martínez, C.I.P. Energy efficiency development in German and Colombian non-energy-intensive sectors: A non-parametric analysis. Energy Effic. 2011, 4, 115–131. [Google Scholar] [CrossRef]

- Warr, B.; Ayres, R.U. Useful work and information as drivers of economic growth. Ecol. Econ. 2012, 73, 93–102. [Google Scholar] [CrossRef]

- He, D. Correlation analysis among investment flow, structural adjustment and upgrade. Econ. Res. J. 2001, 11, 45–51. [Google Scholar]

- Hou, R. An analysis of investment results in fixed assets and its hysteresis effect. J. Quant. Tech. Econ. 2002, 19, 13–16. [Google Scholar]

- Kander, A.; Jiborn, M.; Moran, D.D.; Wiedmann, T.O. National greenhouse-gas accounting for effective climate policy on international trade. Nat. Clim. Chang. 2015, 5, 431–435. [Google Scholar] [CrossRef]

- Kander, A.; Warde, P.; Henriques, S.T.; Nielsen, H.; Kulionis, V.; Hagen, S. International trade and energy intensity during European industrialization, 1870–1935. Ecol. Econ. 2017, 139, 33–44. [Google Scholar] [CrossRef]

- Zhao, Q.; Zhang, C. Foreign direct investment and China’s technical efficiency improvement: an empirical analysis based on stochastic frontiers production model. World Econ. Study 2009, 6, 61–67. [Google Scholar]

- Shan, H. Reestimating the capital stock of China: 1952–2006. J. Quant. Tech. Econ. 2008, 10, 17–31. [Google Scholar]

- Wu, Y. China’s capital stock series by region and sector. Front. Econ. China 2016, 1, 156–172. [Google Scholar]

| Factors | Unit | Sample | Average | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Human capital stock | score/per-capita | 540 | 8.567 | 1.078 | 5.930 | 13.329 |

| Energy consumption | ton of standard coal/per-capita | 540 | 2.423 | 1.513 | 0.065 | 7.947 |

| Export rate | % | 540 | 15.7 | 18.5 | 1.5 | 86.4 |

| Physical capital stock | ten thousand yuan/per-capita | 540 | 1.573 | 1.998 | 0.030 | 13.272 |

| Carbon emission | tons/per-capita | 540 | 1353.874 | 1413.733 | 1.404 | 7896.442 |

| Gross Domestic Product (GDP) | yuan/per-capita | 540 | 22,473.797 | 19,595.437 | 2199.173 | 103,684.245 |

| Human Capital Stock | Energy Consumption | Export Rate | Physical Capital Stock | GDP | Carbon Emission | |

|---|---|---|---|---|---|---|

| Fiscal Expenditure | * | * | * | * | * | * |

| CPI | * | * | ||||

| PPI | * | * | * | |||

| Application Rate of fixed assets | * | |||||

| Railway Mileage | * | * | ||||

| Highway Mileage | * | * | ||||

| Wage | * | |||||

| Freight Turnover | * | * | ||||

| Passenger Turnover | * | * | ||||

| Electric rate | * | * | ||||

| R&D Expenditure | * | * | * | * | * | |

| R&D Staff | * |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, X.; Zhong, C. Low Carbon Economy Performance Analysis with the Intertemporal Effect of Capital in China. Sustainability 2017, 9, 853. https://doi.org/10.3390/su9050853

Zhao X, Zhong C. Low Carbon Economy Performance Analysis with the Intertemporal Effect of Capital in China. Sustainability. 2017; 9(5):853. https://doi.org/10.3390/su9050853

Chicago/Turabian StyleZhao, Xinna, and Chongwen Zhong. 2017. "Low Carbon Economy Performance Analysis with the Intertemporal Effect of Capital in China" Sustainability 9, no. 5: 853. https://doi.org/10.3390/su9050853