Effects of an Energy Tax (Carbon Tax) on Energy Saving and Emission Reduction in Guangdong Province-Based on a CGE Model

Abstract

:1. Introduction

2. Methods and Data

2.1. Construction of Economy and Energy Social Accounting Matrix (SAM) of Guangdong Province

2.1.1. Energy Consumption Statistics and Carbon Emission Calculation for Guangdong Province

2.1.2. Construction of the Energy Input-Output (IO) Table

2.1.3. Construction of the Energy Social Accounting Matrix (SAM) Table

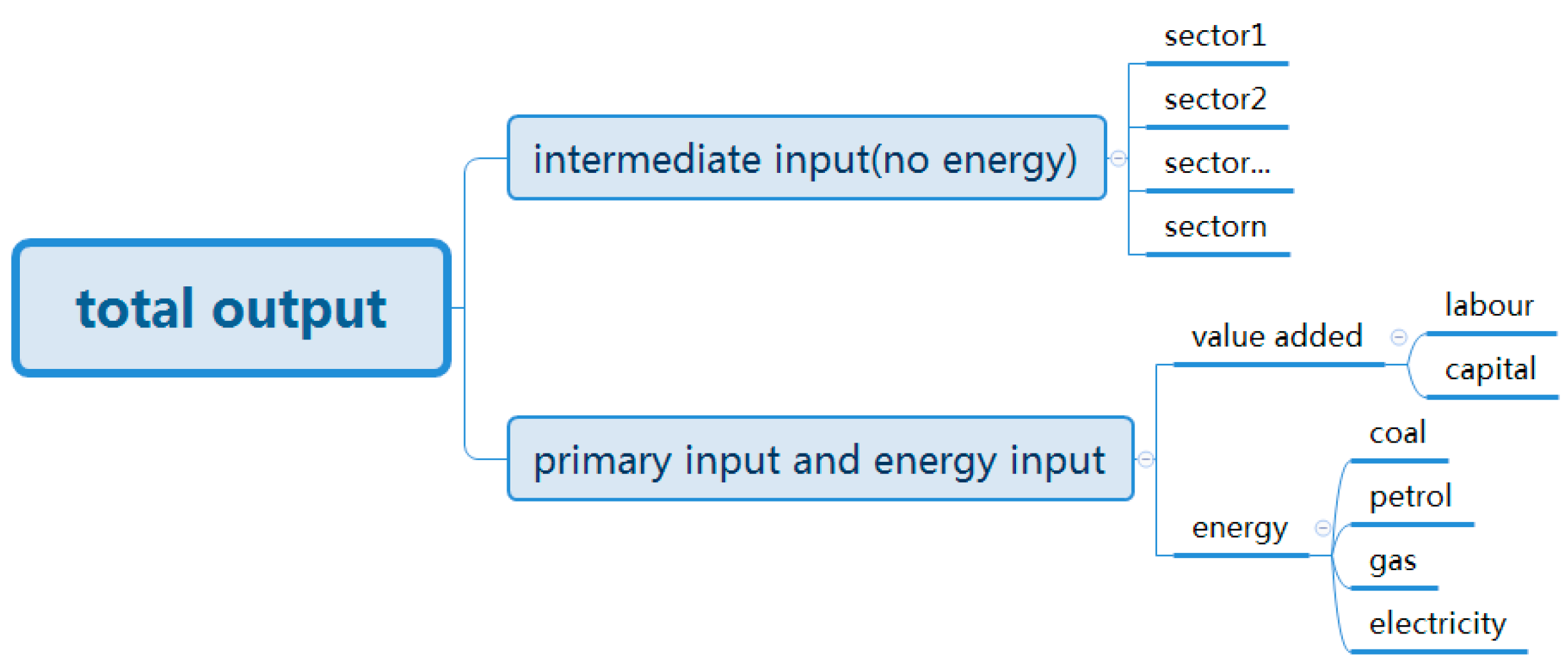

2.2. Model Structure

2.2.1. Production Module

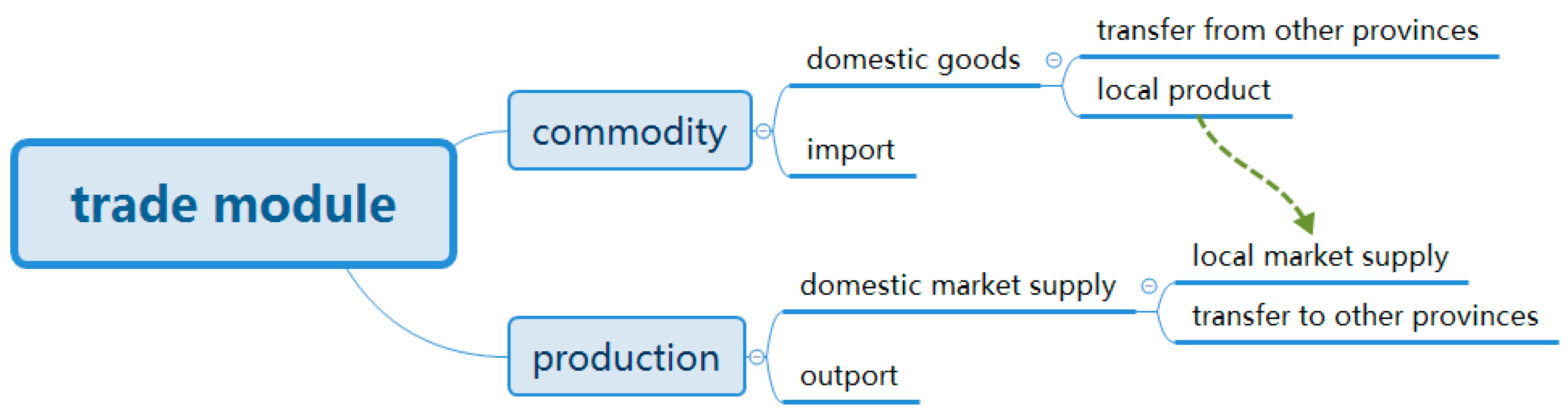

2.2.2. Trade Module

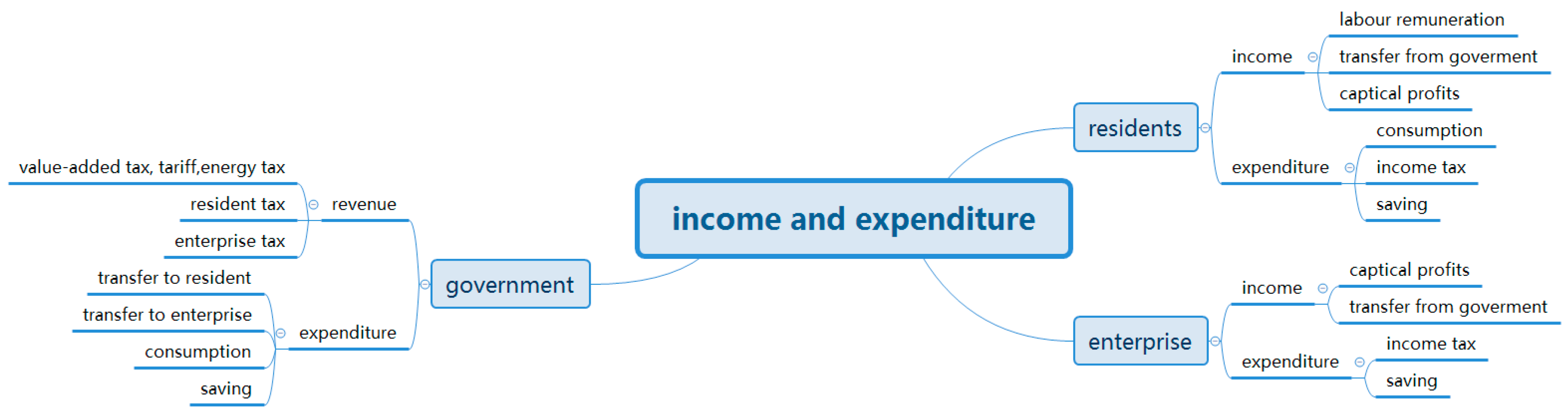

2.2.3. Income and Expenditure Module

2.2.4. Equilibrium and Macro Closed Module

2.2.5. Tax Imposition Module

2.2.6. Parameter Setting and Model Test

Parameter Calibration

Determination of Elastic Coefficients

Model Test

3. Simulation Analysis for the Imposition of an Energy Tax (Carbon Tax)

3.1. Setting of Scenarios

3.2. Simulation Results and Analysis

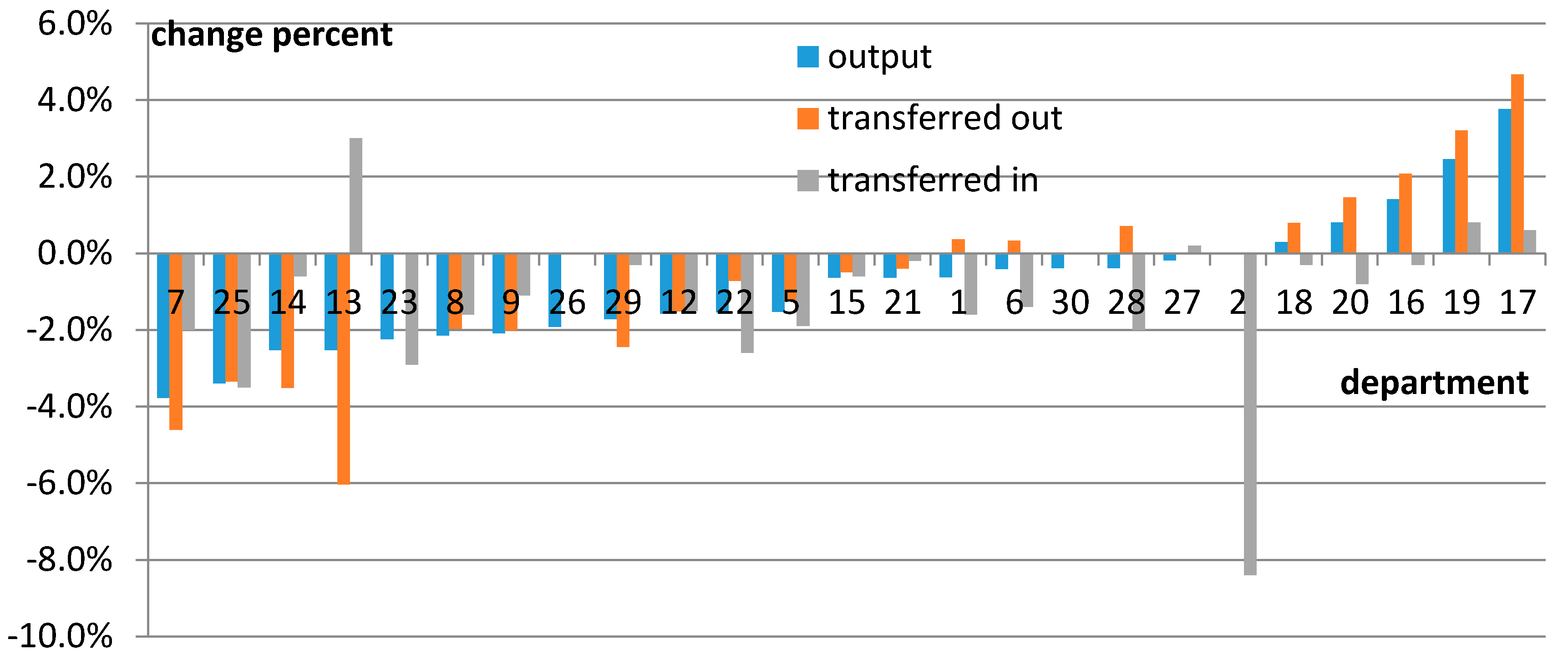

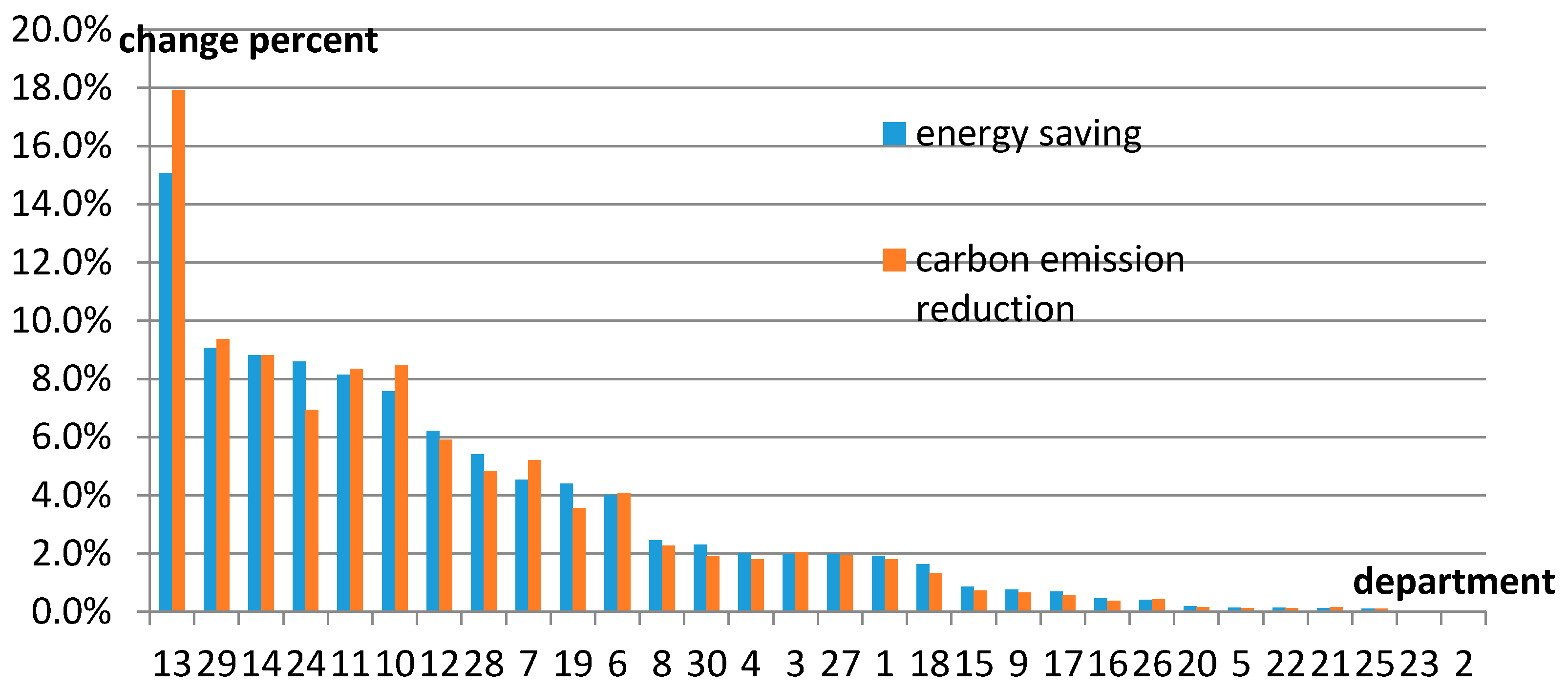

3.2.1. Effects of the Energy Tax upon Energy Saving and Emission Reduction and Influences upon the Social Economy

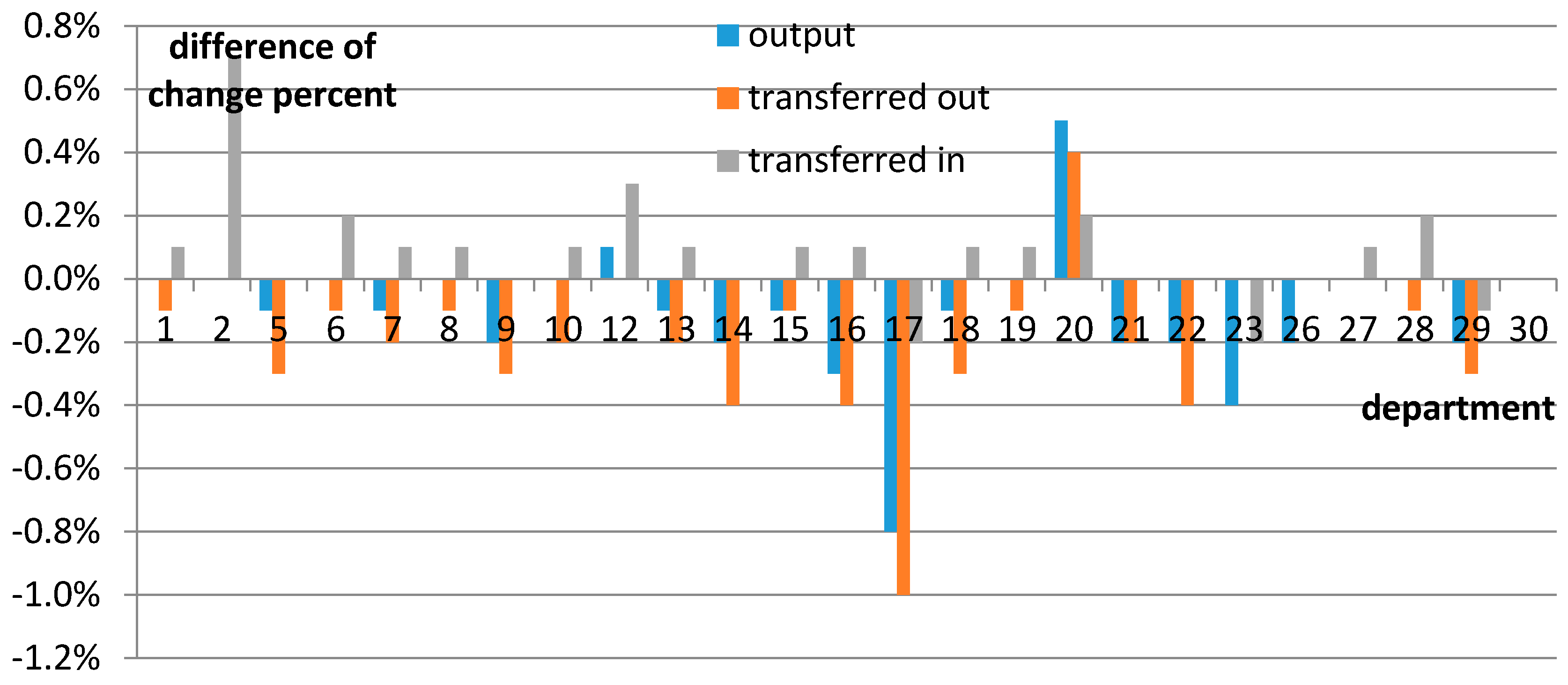

3.2.2. Comparison between a Carbon Tax and an Energy Tax

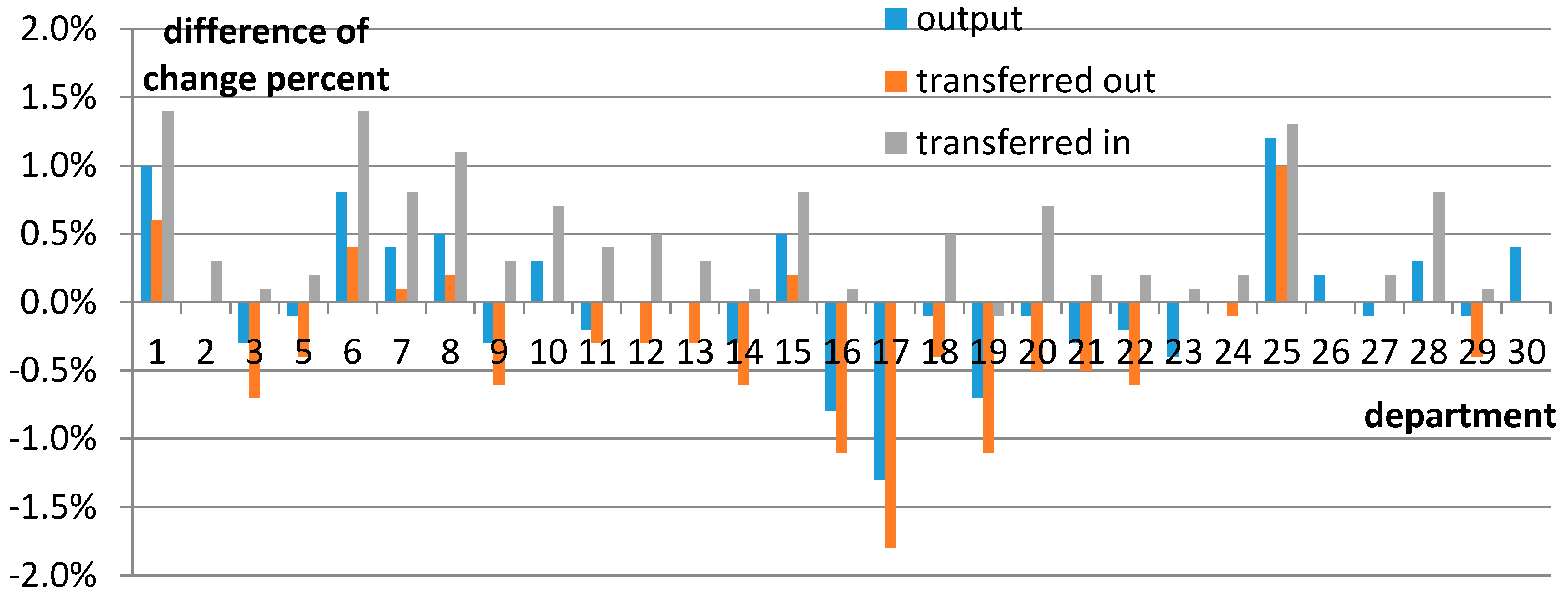

3.2.3. Analysis of the Mitigation Measures

Reducing or Remitting the Tax of Energy Departments

Subsidizing the Residents

Subsidizing the Enterprises

3.2.4. Sensitivity Analysis

4. Conclusions and Suggestions

- The taxation of the energy tax or carbon tax can achieve a preferable energy saving and emission reduction effect. When the energy tax rate is at 100–200 yuan/tce or carbon tax at 50–100 yuan/t CO2, the energy consumption of Guangdong Province reduces by 5.8–11.21%, and carbon emissions by 5.94–11.61%. Nonmetallic mineral products, communications and transportation, electric power, petroleum coking, and papermaking and printing are the major potential departments for energy saving and emission reduction. Since the implementation of energy saving and emission reduction will incur a series of adverse impacts upon the social economy, and the increase of the tax rate will aggravate the adverse impacts along with an increase of emission reduction costs, it is of great significance to setup appropriate tax rates on the basis of comprehensive impact factors.

- A carbon tax can produce better effects on energy savings and emission reduction than that of the energy tax under the equivalent tax revenue, and pose fewer influences on the social economy than the latter. Therefore, a carbon tax can be conducive to the transfer of social capital towards the non-energy-intensive industries.

- To relieve the negative impacts caused by an energy tax or carbon tax, some supporting mitigation measures or compensation measures can be taken into consideration, such as appropriately reducing the energy tax or carbon tax of those departments which consume energy in a large amount. As a matter of fact, Guangdong Province has enlisted the departments with large energy consumption into its carbon emission permission management system and constructed carbon emission trading pilots. If the price of carbon emission permits equals that of the carbon tax, it can achieve the same energy saving and emission reduction effects, but with fewer social emission reduction costs than the latter. If the tax revenue is returned to the residents, their income can be increased in the short term, but GDP, government revenue, transferred amount, imports, and exports will all be decreased while the carbon emission costs will be aggravated, which proves to be ineffective. If the tax revenue is returned to the enterprises, no virtual improvement will be brought about to the social production, resulting only in the revenue transfer between government revenue and the enterprises’ income.

- The sensitivity analysis indicates that GDP shows no sensitivity towards each elastic coefficient, and the carbon emission amount shows slight sensitivity towards certain parameters, showing that the higher the substitution coefficient is valued, the larger the carbon emission amount becomes. Since the values of the elastic coefficients are relatively small, the predicted results also tend to be conservative. With the social economic development, the elastic coefficients will increase to a certain extent, and the energy saving and emission reduction effect will be better when the energy tax or carbon tax is levied, facilitating the transfer of social capital towards low-energy and low-carbon departments.

- When considering the combination of total energy, this model adopts a fixed proportion method by energy, unable to simulate the substitution effect among different types of energy and failing to subdivide the values of elastic coefficients into each department, which may lead to a slightly rough prediction. Therefore, further in-depth studies can be carried out in these regards for the sake of a more accurate prediction.

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Department | Order in This Paper | Order in IO Table |

|---|---|---|

| Farming, Forestry, Animal Husbandry, and Fisheries | 1 | 01 |

| Mining and Washing of Coal | 2 | 02 |

| Extraction of Petroleum and Natural Gas | 3 | 03 |

| Mining and Dressing of Metal Ores | 4 | 04 |

| Mining and Dressing of Nonmetal Ores | 5 | 05 |

| Manufacture of Food and Tobacco | 6 | 06 |

| Textile Industry | 7 | 07 |

| Manufacture of Textile Garments, Footwear and Leather, Fur, and Feather Goods | 8 | 08 |

| Manufacture of Furniture, Timber Processing, Bamboo, Cane, Palm Fiber Goods | 9 | 09 |

| Papermaking, Printing and Manufacture of Cultural, Educational and Sports Goods | 10 | 10 |

| Petroleum Refining, Coking, and Nuclear Fuel | 11 | 11 |

| Manufacture of Chemical Products | 12 | 12 |

| Nonmetal Mineral Products | 13 | 13 |

| Smelting and Pressing of Metals | 14 | 14 |

| Metal Products | 15 | 15 |

| Manufacture of General-purpose and Special-purpose Machinery | 16 | 16, 17 |

| Manufacture of Transport Equipment | 17 | 18 |

| Manufacture of Electrical Machinery and Equipment | 18 | 19 |

| Manufacture of Communication Equipment, Computers, and Other Electronic Equipment | 19 | 20 |

| Manufacture of Instruments and Meters | 20 | 21 |

| Handicraft and Other Manufactures | 21 | 22 |

| Recycling and Disposal of Waste | 22 | 23 |

| Manufacture of Metal Products, Machinery, and Equipment Maintenance | 23 | 24 |

| Production and Supply of Electric Power and Heat Power | 24 | 25 |

| Production and Supply of Gas | 25 | 26 |

| Production and Supply of Water | 26 | 27 |

| Construction | 27 | 28 |

| Transport, Storage and Post | 28 | 29, 30 |

| Wholesale, Retail Trade and Hotel, Restaurants | 29 | 31 |

| Main Types | Detailed Types |

|---|---|

| Coal | Cleaned coal, other washed coal, briquette, gangue, coke, coke oven gas, blast furnace gas, converter gas and other gas |

| Petroleum | Bitumen asphalt, petroleum coke, LPG, refinery gas, other petroleum products |

| Natural gas | Natural gas, LNG |

| Power, heat and others | Heat, electricity, other energy |

| Output | Intermediate Demand | Final Demand | Total Product | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Input | 1 | 2 | ... | n | Consumption | Investment | Net Out-Port | ||

| Intermediate input | 1 | ||||||||

| 2 | |||||||||

| ... | |||||||||

| n | Zij | fi | Xi | ||||||

| Primary input | labor | ||||||||

| Fix assets depreciation | |||||||||

| Net production tax | Vj | ||||||||

| Retained earnings | |||||||||

| Energy | Nkj | ||||||||

| Total input | Xj | ||||||||

| Sector | Commodity | Elements | Enterprise | Resident | EnergyTax | Government | Save-Investment | Province | Abroad | Total | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Labor | Capital | Depreciation | |||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 12 | |||

| Sector | 1 | QDAL | tec | QDAP | QE | QA | |||||||||

| Commodity | 2 | QINTA | QH | GH | QINV | ||||||||||

| Element | Labor | 3 | QLD | QLD0 | |||||||||||

| Capital | 4 | QKD | QKD0 | ||||||||||||

| Depreciation | 5 | ||||||||||||||

| Enterprise | 6 | shifentk | transfrentg | YENT | |||||||||||

| Resident | 7 | QLD | transfrhg | YH | |||||||||||

| Energy tax | 8 | ETAX | |||||||||||||

| Government | 9 | TVA | tmc | tiENT | tih | ETAX | YG | ||||||||

| Save-investment | 10 | DEPR | ENTSAV | HSAV | GSAV | QINV0 | |||||||||

| Province | 11 | QDCP | QDCP | ||||||||||||

| Abroad | 12 | QM | QM | ||||||||||||

| Total | 13 | QA | QLD0 | QKD0 | DEPR0 | YENT | EH | EG | QINV0 | QDAP | QM | ||||

Appendix B. Equations

Parameters and Variables

| Symbol | Description |

| a | Activity department |

| c | Commercial department |

| c1 | No-energy commercial department |

| c2 | energy commercial department |

| deltaAa(a) | Share parameter of CES function of QA |

| deltaEVA(a) | Share parameter of CES function of QEVA |

| deltaVA(a) | Share parameter of CES function of QVA |

| deltaCET(a) | Share parameter of CET function of QA |

| deltaQDA(a) | Share parameter of CET function of QDA |

| deltaQq(c) | Share parameter of Armington function of QQ |

| deltaQDC(c) | Share parameter of Armington function of QDC |

| EG | Government expend |

| EH | Habitant expend |

| EINV | investment |

| ENTSAV | Enterprise saving |

| EXR | Exchange rate |

| FSAV | Foreign saving |

| GDP | Real gross domestic product |

| GSAV | Government saving |

| ic1a(c1, a) | Consumption coefficient of non-energy product |

| ic2a(c1, a) | Consumption coefficient of energy product |

| mpc | Marginal propensity to consume |

| PA(a) | Price of product a |

| PDA(a) | Price of domestic product for domestic use |

| PDAL(a) | Price of provincial product for use in the province |

| PDAP(a) | Price of provincial product for use out of the province |

| PDC(c) | Price of domestic commodity for domestic use |

| PDCL(c) | Price of provincial commodity for use in the province |

| PDCP(c) | Price of provincial commodity for use out of the province |

| PE(a) | Price of domestic product for export |

| PM(c) | Price of import commodity |

| PGDP | Price index of GDP |

| PINTA(a) | Price of intermediate input |

| PQ(c) | Price of domestic commodity |

| PVA(a) | Price of the added value |

| PEVA | Price of the bundle of energy and added value |

| pwe(a) | World price of product for out-port |

| pwm(c) | World price of commodity for in-port |

| QA(a) | Quantity of product a |

| QE(a) | Quantity of product a for export |

| QED(a) | Demand of fixed energy |

| QES | Total supply of energy |

| QG(c) | Demand of government for commodity c |

| QH(c) | Demand of habitant for commodity c |

| QINT(c, a) | Department quantity of intermediate input |

| QINTA(a) | Total quantity of intermediate input |

| QINV(c) | Final demand of investment for commodity c |

| Symbol | Description |

| QDA(a) | Quantity of domestic product used in the country |

| QDAL(a) | Quantity of provincial product used in the province |

| QDAP(a) | Quantity of provincial product used out of the province |

| QDC(c) | Quantity of domestic commodity used in the country |

| QDCL(c) | Quantity of provincial commodity used in the province |

| QDCP(c) | Price of provincial commodity used out of the province |

| QKD(a) | Demand for capital |

| QKS | Supply of capital |

| QLD(a) | Demand for labor |

| QLS | Supply of labor |

| QM(c) | Quantity of import |

| QQ(c) | Quantity of commodity in domestic market |

| QVA(a) | Quantity of added value |

| QEVA | Quantity of the bundle of energy and added-value |

| rhoAa(a) | Power parameter of CES function of QA |

| rhoEVA(a) | Power parameter of CES function of QEVA |

| rhoVA(a) | Power parameter of CES function of QVA |

| rhoQq(c) | Power parameter of Armington function of QQ |

| rhoQDC(c) | Power parameter of Armington function of QDC |

| rhoCET(c) | Power parameter of CET function of QA |

| rhoQDC(c) | Power parameter of CET function of QDA |

| scaleAa(a) | scale parameter of CES function of QA |

| scaleEVA(a) | scale parameter of CES function of QEVA |

| scaleVA(a) | scale parameter of CES function of VA |

| scaleCET(c) | scale parameter of CET function of QA |

| scaleQDA(c) | scale parameter of CET function of QDA |

| scaleQq(c) | scale parameter of Armington function of QQ |

| scaleQDC(c) | scale parameter of Armington function of QDC |

| shifentk | Share of capital revenue to enterprise |

| shifhk | Share of capital revenue to habitant |

| shrh(c) | Expanding share of habitant revenue to commodity c |

| te(c) | Export subsidy rate |

| tiEnt | Income tax of enterprise |

| tih | Income tax of habitant |

| tm(c) | Tariff of commodity c |

| transfrentg | Transferred revenue from government to enterprise |

| transfrhg | Transferred revenue from government to habitant |

| tva(a) | Indirect tax for department a |

| tvc(a) | Energy tax for department a |

| VBIS | Dummy variable for saving-investment check |

| WE | Price of fixed energy |

| WK | Price of capital |

| WL | Price of labor |

| YENT | Enterprise revenue |

| YG | Government revenue |

| YH | Habitant revenue |

References

- Legislative Affairs Office of the State Council. Notice on Soliciting Public Opinions about Environmental Protection Tax Law of the People’s Republic of China (Exposure Draft). Available online: http://www.gov.cn/xinwen/2015-06/11/content_2877863.htm (accessed on 12 February 2017). (In Chinese)

- General Office of the State Council of the People’s Republic of China. Instruction about Further Promoting Paid Use and Trading Pilots of Emission Permit. Available online: http://www.gdep.gov.cn/zwxx_1/zfgw/shbtwj/201404/t20140415_169011.html (accessed on 12 February 2017). (In Chinese)

- People’s Government of Guangdong Province. Regulations on the Paid Use of Emission Permits and Trading Pilots in Guangdong Province. Available online: http://www.gov.cn/zhengce/content/2014-08/25/content_9050.htm (accessed on 12 February 2017). (In Chinese)

- Zhang, X. Principles of Computable General Equilibrium (CGE) Modeling and Programming; Shanghai People’s Publishing House: Shanghai, China, 2010. (In Chinese) [Google Scholar]

- Statistics Bureau of Guangdong Province. Guangdong Statistical Yearbook 2011. Available online: http://www.gdstats.gov.cn/tjsj/gdtjnj/ (accessed on 12 February 2017). (In Chinese)

- People’s Government of Guangdong Province. Outline of the Twelfth Five-Year Plan for National Economic and Social Development of Guangdong Province. Available online: http://zwgk.gd.gov.cn/006939748/201105/t20110513_86534.html (accessed on 12 February 2017). (In Chinese)

- Development and Reform Commission of Guangdong Province. 12th Five-Year Plan for Energy Development of Guangdong Province. Available online: http://zwgk.gd.gov.cn/006939748/201105/t20110513_86534.html (accessed on 12 February 2017). (In Chinese)

- Scrimgeour, F.; Oxley, L.; Fatai, K. Reducing carbon emissions? The relative effectiveness of different types of environmental tax: The case of New Zealand. Environ. Model. Softw. 2005, 20, 1439–1448. [Google Scholar] [CrossRef]

- Wissema, W.; Dellink, R. AGE analysis of the impact of a carbon energy tax on the Irish economy. Ecol. Econ. 2007, 61, 671–683. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J.M.; Rodríguez, M. Green tax reforms in Spain. Eur. Environ. 2004, 14, 290–299. [Google Scholar] [CrossRef]

- Meng, S.; Siriwardana, M.; McNeill, J. The environmental and economic impact of the carbon tax in Australia. Environ. Resour. Econ. 2013, 54, 313–332. [Google Scholar] [CrossRef]

- Zhang, X.P.; Guo, Z.Q.; Zheng, Y.H.; Zhu, J.C.; Yang, J. A CGE analysis of the impacts of a carbon tax on provincial economy in China. Emerg. Mark. Financ. Trade 2016, 52, 1372–1384. [Google Scholar] [CrossRef]

- Lu, C.Y.; Tong, Q.; Liu, X.M. The impacts of carbon tax and complementary policies on Chinese economy. Energy Policy 2010, 38, 7278–7285. [Google Scholar] [CrossRef]

- Liang, Q.M.; Fan, Y.; Wei, Y.M. Carbon taxation policy in China: How to protect energy and trade intensive sectors? J. Policy Model. 2007, 29, 311–333. [Google Scholar] [CrossRef]

- Liang, Q.M.; Wei, Y.M. Distributional impacts of taxing carbon in China: Results from the CEEPA model. Appl. Energy 2012, 92, 545–551. [Google Scholar] [CrossRef]

- Guo, Z.Q.; Zhang, X.P.; Zheng, Y.H.; Rao, R. Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ. 2014, 45, 455–462. [Google Scholar] [CrossRef]

- Hu, Z.Y.; Cai, W.B. The study on the impacts of energy intensity imposed by the taxation of energy taxes: A CGE approach. J. Hunan Univ. Soc. Sci. 2001, 21, 57–61. (In Chinese) [Google Scholar]

- Yang, L.; Mao, X.Q.; Liu, Q.; Liu, Z.Y. Impact assessment for energy taxation policy based on a Computable General Equilibrium (CGE) model. China Popul. Resour. Environ. 2009, 19, 24–29. (In Chinese) [Google Scholar]

- He, J.W.; Li, S.T. The impact of energy tax and environmental tax on China’s economy. J. Quant. Tech. Econ. 2009, 1, 31–44. (In Chinese) [Google Scholar]

- State Statistics Bureau. China Energy Statistical Yearbook 2013; China Statistical Press: Beijing, China, 2013. (In Chinese)

- Statistics Bureau of Guangdong Province. Guangdong Statistical Yearbook 2013. Available online: http://www.gdstats.gov.cn/tjsj/gdtjnj/ (accessed on 12 February 2017). (In Chinese)

- Bian, J. The Analysis of the Influence Factors and Forecast of Carbon Emission in Guangdong Province; Jinan University: Guangzhou, China, 2013. (In Chinese) [Google Scholar]

- Editorial Board of China Tax Year Book. Tax Year Book of China 2013; China Tax Publishing House: Beijing, China, 2013. (In Chinese)

| Sectors | Coal/(104 tce) | Petroleum/(104 tce) | Natural Gas/(104 tce) | Power, Heat and Others/(104 tce) |

|---|---|---|---|---|

| Agriculture, forestry, animal husbandry and fisheries | 43.79 | 166.43 | 0.00 | 272.77 |

| Manufacturing industry | 4868.95 | 2376.40 | 455.05 | 10,708.41 |

| Industry | 2.23 | 526.79 | 0.00 | 199.43 |

| Transport, Storage and Post | 1.73 | 2731.68 | 0.00 | 234.16 |

| Wholesale and retail | 59.26 | 351.39 | 97.09 | 879.79 |

| Other service industries | 0.00 | 92.47 | 0.00 | 1479.65 |

| Living consumption | 118.52 | 1407.44 | 161.60 | 2371.60 |

| Parameters | Value | Description |

|---|---|---|

| rh0Aa(a) | 0.3 | Substitution elasticity of intermediate input and labor-capital-energy bundle. |

| rh0EVA(a) | 0.2 | Substitution elasticity of labor-capital bundle and energy. |

| rh0VA(a) | 0.2 | Substitution elasticity of labor and capital. |

| rh0Qq(cc) | 0.6 | Substitution elasticity of domestic commodity and import commodity under the Armington condition. |

| rh0QDC(cc) | 0.6 | Substitution elasticity of local commodities and commodities from other provinces under the Armington condition. |

| rh0CET(a) | 1.4 | Substitution elasticity of domestic commodity and export commodity in the CET function. |

| rh0QDA(a) | 1.4 | Substitution elasticity of local commodities and commodities from other provinces in the CET function. |

| Index | Present Values | Simulated Values |

|---|---|---|

| Energy consumption/(104 t) | 25,547 | 25,553.96 |

| Carbon emission/(104 t) | 13,902 | 13,899.78 |

| Actual GDP/(108 yuan) | 55,462.15 | 55,463.20 |

| Government revenue/(108 yuan) | 8276.15 | 8313.93 |

| Residents’ income/(108 yuan) | 27,713.06 | 27,720.92 |

| Enterprises’ income/(108 yuan) | 14,364.85 | 14,369.78 |

| Imports/(108 yuan) | 30,860.73 | 30,848.66 |

| Exports/(108 yuan) | 39,985.67 | 39,973.55 |

| Labor remuneration/(108 yuan) | 27,239.83 | 27,239.83 |

| Capital/(108 yuan) | 20,839.41 | 20,839.41 |

| Scenarios | Setting |

|---|---|

| BASE | No energy tax |

| ETAX | Levy energy tax by the heat value of the final energy consumption at three tax rates: 100 yuan/tce, 150 yuan/tce, 200 yuan/tce |

| CTAX | Levy carbon tax by the carbon emission of the final energy consumption at three tax rates: 50 yuan/t CO2, 75 yuan/t CO2, 100 yuan/t CO2 |

| CTAXM1 | Levy carbon tax at the tax rate of 75 yuan/t CO2, excluding energy department |

| CTAXM2 | Levy carbon tax at the rate of 75 yuan/t CO2 and subsidize the residents |

| CTAXM3 | Levy carbon tax at the rate of 75 yuan/t CO2 and subsidize the enterprises |

| Index | Base | ETAX200 | ETAX150 | ETAX100 |

|---|---|---|---|---|

| Energy consumption/(104 t) | 25,553.96 | −10.97% | −8.46% | −5.80% |

| CO2 emission/(104 t) | 50,976 | −11.22% | −8.65% | −5.94% |

| Actual GDP/(108 yuan) | 55,463.20 | −0.17% | −0.12% | −0.08% |

| Government revenue/(108 yuan) | 8313.93 | 3.45% | 2.67% | 1.84% |

| Residents’ income/(108 yuan) | 27,720.92 | −0.91% | −0.70% | −0.48% |

| Enterprises’ income/(108 yuan) | 14,369.78 | −1.40% | −1.08% | −0.73% |

| Goods transferred out/(108 yuan) | 21,434.55 | −2.58% | −1.97% | −1.33% |

| Goods transferred in/(108 yuan) | 27,238.89 | −2.45% | −1.89% | −1.29% |

| Imports/(108 yuan) | 30,848.66 | −0.20% | −0.16% | −0.11% |

| Exports/(108 yuan) | 39,973.55 | −0.16% | −0.12% | −0.08% |

| CO2 emission reduction costs/(yuan/t) | / | 165 | 151 | 146 |

| Tax revenue/(108 yuan) | / | 455 | 351 | 240 |

| Code | Output | Transferred out | Transferred in | Export | Import |

|---|---|---|---|---|---|

| 4 | −42.33% | −73.51% | −12.60% | −42.80% | −12.00% |

| 11 | −11.69% | −14.19% | −6.10% | −13.00% | −5.40% |

| 3 | −9.88% | −8.92% | −12.30% | −8.80% | −11.70% |

| 24 | −7.27% | −8.55% | −6.60% | −8.50% | −6.00% |

| 10 | −3.93% | −4.43% | −0.80% | −4.90% | −0.10% |

| 7 | −3.77% | −4.61% | −2.00% | −5.10% | −1.30% |

| 25 | −3.39% | −3.35% | −3.50% | 0.00% | 0.00% |

| 14 | −2.53% | −3.51% | −0.60% | −4.10% | 0.10% |

| 13 | −2.52% | −6.03% | 3.00% | −6.30% | 3.80% |

| 23 | −2.24% | 0.00% | −2.90% | 0.00% | 0.00% |

| 8 | −2.14% | −1.96% | −1.60% | −2.60% | −0.90% |

| 9 | −2.09% | −2.01% | −1.10% | −2.60% | −0.50% |

| 26 | −1.92% | 0.00% | 0.00% | 0.00% | 0.00% |

| 29 | −1.71% | −2.44% | −0.30% | −3.10% | 0.40% |

| 12 | −1.57% | −1.51% | −1.50% | −2.20% | −0.80% |

| 22 | −1.54% | −0.72% | −2.60% | −1.40% | −2.00% |

| 5 | −1.53% | −1.22% | −1.90% | −1.90% | −1.20% |

| 15 | −0.63% | −0.49% | −0.60% | −1.20% | 0.10% |

| 21 | −0.63% | −0.40% | −0.20% | −1.10% | 0.50% |

| 1 | −0.62% | 0.37% | −1.60% | −0.30% | −0.90% |

| 6 | −0.41% | 0.33% | −1.40% | −0.40% | −0.70% |

| 30 | −0.39% | 0.00% | 0.00% | 0.40% | −1.40% |

| 28 | −0.38% | 0.71% | −2.00% | 0.02% | −1.30% |

| 27 | −0.18% | 0.00% | 0.20% | −1.20% | 0.90% |

| 2 | 0.00% | 0.00% | −8.40% | 0.00% | −7.70% |

| 18 | 0.29% | 0.79% | −0.30% | 0.10% | 0.40% |

| 20 | 0.80% | 1.46% | −0.80% | 0.80% | −0.10% |

| 16 | 1.41% | 2.08% | −0.30% | 1.40% | 0.30% |

| 19 | 2.46% | 3.21% | 0.80% | 2.60% | 1.50% |

| 17 | 3.77% | 4.67% | 0.60% | 4.20% | 1.30% |

| Index | CTAX100 | CTAX75 | CTAX50 | CTAX100 |

|---|---|---|---|---|

| Energy consumption/(104 t) | −11.21% | −8.66% | −5.95% | −11.21% |

| CO2 emission/(104 t) | −11.61% | −8.97% | −6.17% | −11.61% |

| Actual GDP/(108 yuan) | −0.18% | −0.13% | −0.08% | −0.18% |

| Government revenue/(108 yuan) | 3.41% | 2.65% | 1.83% | 3.41% |

| Residents’ income/(108 yuan) | −0.88% | −0.67% | −0.45% | −0.88% |

| Enterprises’ income/(108 yuan) | −1.39% | −1.06% | −0.72% | −1.39% |

| Goods transferred out/(108 yuan) | −2.50% | −1.90% | −1.29% | −2.50% |

| Goods transferred in/(108 yuan) | −2.35% | −1.80% | −0.96% | −2.35% |

| Imports/(108 yuan) | −0.07% | −0.06% | −0.04% | −0.07% |

| Exports/(108 yuan) | −0.06% | −0.04% | −0.03% | −0.06% |

| CO2 emission reduction costs/(yuan/t) | 169 | 158 | 141 | 169 |

| Tax revenue/(108 yuan) | 451 | 348 | 239 | 451 |

| Code | Output | Transferred out | Transferred in | Code | Output | Transferred out | Transferred in |

|---|---|---|---|---|---|---|---|

| 1 | −0.10% | −0.10% | −0.10% | 16 | 0.20% | 0.30% | 0.10% |

| 2 | 0.00% | 0.00% | −0.20% | 17 | 0.00% | 0.00% | 0.00% |

| 3 | −0.50% | −0.50% | −0.50% | 18 | 0.10% | 0.20% | 0.00% |

| 4 | 11.80% | 11.80% | 3.00% | 19 | 0.50% | 0.60% | 0.30% |

| 5 | −0.30% | −0.30% | −0.30% | 20 | 1.20% | 1.20% | 0.04% |

| 6 | −0.10% | −0.10% | 0.00% | 21 | −0.40% | −0.50% | 0.00% |

| 7 | −0.80% | −1.10% | −0.30% | 22 | −0.30% | −0.20% | −0.20% |

| 8 | −0.50% | −0.60% | −0.10% | 23 | −0.10% | 0.00% | 0.00% |

| 9 | −0.10% | −0.20% | −0.10% | 24 | 0.20% | 0.40% | −0.10% |

| 10 | −0.70% | −0.80% | 0.00% | 25 | 0.00% | 0.00% | 0.00% |

| 11 | −0.50% | −0.50% | −0.10% | 26 | 0.00% | 0.30% | 0.00% |

| 12 | −0.10% | −0.10% | −0.20% | 27 | −0.10% | −0.20% | 0.00% |

| 13 | −0.60% | −1.40% | 0.80% | 28 | 0.00% | −0.04% | −0.10% |

| 14 | −0.20% | −0.10% | −0.06% | 29 | −0.10% | −0.10% | 0.10% |

| 15 | 0.00% | 0.10% | −0.02% | 30 | 0.00% | 0.10% | 0.00% |

| Index | CTAX75 | CTAXM1 | CTAXM2 | CTAXM3 |

|---|---|---|---|---|

| Energy consumption/(104 t) | −8.66% | −7.96% | −8.67% | −8.66% |

| CO2 emission/(104 t) | −8.97% | −8.24% | −8.98% | −8.97% |

| Actual GDP/(108 yuan) | −0.13% | −0.04% | −0.15% | −0.13% |

| Government revenue/(108 yuan) | 2.65% | 2.69% | −1.45% | −1.41% |

| Residents’ income/(108 yuan) | −0.67% | −0.64% | 0.77% | −0.67% |

| Enterprises’ income/(108 yuan) | −1.06% | −0.95% | −0.93% | 1.36% |

| Imports/(108 yuan) | −0.06% | 0.03% | −0.27% | −0.06% |

| Exports/(108 yuan) | −0.04% | 0.02% | −0.21% | −0.04% |

| reduction costs/(yuan/t) | 158 | 53 | 182 | 158 |

| Tax revenue (108 yuan) | 348 | 300 | 348 | 348 |

| Code | Output | Transferred out | Transferred in | Code | Output | Transferred out | Transferred in |

|---|---|---|---|---|---|---|---|

| 1 | 0.00% | −0.10% | 0.10% | 16 | −0.30% | −0.40% | 0.10% |

| 2 | 0.00% | 0.00% | 0.70% | 17 | −0.80% | −1.00% | −0.20% |

| 3 | 9.70% | 10.10% | 9.10% | 18 | −0.10% | −0.30% | 0.10% |

| 4 | −36.20% | −36.30% | −9.50% | 19 | 0.00% | −0.10% | 0.10% |

| 5 | −0.10% | −0.30% | 0.00% | 20 | 0.50% | 0.40% | 0.20% |

| 6 | 0.00% | −0.10% | 0.20% | 21 | −0.20% | −0.20% | 0.00% |

| 7 | −0.10% | −0.20% | 0.10% | 22 | −0.20% | −0.40% | 0.00% |

| 8 | 0.00% | −0.10% | 0.10% | 23 | −0.40% | 0.00% | −0.20% |

| 9 | −0.20% | −0.30% | 0.00% | 24 | 0.20% | 1.20% | −0.80% |

| 10 | 0.00% | −0.20% | 0.10% | 25 | 0.30% | 0.60% | −0.10% |

| 11 | 10.40% | 11.70% | 1.10% | 26 | −0.20% | 0.00% | 0.00% |

| 12 | 0.10% | 0.00% | 0.30% | 27 | 0.00% | 0.00% | 0.10% |

| 13 | −0.10% | −0.20% | 0.10% | 28 | 0.00% | −0.10% | 0.20% |

| 14 | −0.20% | −0.40% | 0.00% | 29 | −0.20% | −0.30% | −0.10% |

| 15 | −0.10% | −0.10% | 0.10% | 30 | 0.00% | 0.00% | 0.00% |

| Code | Output | Transferred out | Transferred in | Code | Output | Transferred out | Transferred in |

|---|---|---|---|---|---|---|---|

| 1 | 1.00% | 0.60% | 1.40% | 16 | −0.80% | −1.10% | 0.10% |

| 2 | 0.00% | 0.00% | 0.30% | 17 | −1.30% | −1.80% | 0.00% |

| 3 | −0.30% | −0.70% | 0.10% | 18 | −0.10% | −0.40% | 0.50% |

| 4 | −49.60% | −49.70% | −13.00% | 19 | −0.70% | −1.10% | −0.10% |

| 5 | −0.10% | −0.40% | 0.20% | 20 | −0.10% | −0.50% | 0.70% |

| 6 | 0.80% | 0.40% | 1.40% | 21 | −0.30% | −0.50% | 0.20% |

| 7 | 0.40% | 0.10% | 0.80% | 22 | −0.20% | −0.60% | 0.20% |

| 8 | 0.50% | 0.20% | 1.10% | 23 | −0.40% | 0.00% | 0.10% |

| 9 | −0.30% | −0.60% | 0.30% | 24 | 0.00% | −0.10% | 0.20% |

| 10 | 0.30% | 0.00% | 0.70% | 25 | 1.20% | 1.00% | 1.30% |

| 11 | −0.20% | −0.30% | 0.40% | 26 | 0.20% | 0.00% | 0.00% |

| 12 | 0.00% | −0.30% | 0.50% | 27 | −0.10% | 0.00% | 0.20% |

| 13 | 0.00% | −0.30% | 0.30% | 28 | 0.30% | 0.00% | 0.80% |

| 14 | −0.30% | −0.60% | 0.10% | 29 | −0.10% | −0.40% | 0.10% |

| 15 | 0.50% | 0.20% | 0.80% | 30 | 0.40% | 0.00% | 0.00% |

| Parameter | Change Rate of Elastic Coefficient/(%) | Change Rate of GDP/(%) | Change Rate of Carbon Emission/(%) |

|---|---|---|---|

| rh0Aa | 50 | 0 | −0.08 |

| −50 | 0 | 0.05 | |

| rh0EVA | 50 | 0 | 0 |

| −50 | 0 | 0 | |

| rh0VA | 50 | −0.01 | −0.04 |

| −50 | 0 | 0.64 | |

| rh0Qq | 50 | −0.02 | −0.56 |

| −50 | 0 | 0.08 | |

| rh0QDC | 50 | −0.08 | −2.34 |

| −50 | 0.01 | 0.37 | |

| rh0CET | 50 | 0 | 0.09 |

| −20 | −0.02 | −0.71 | |

| rh0QDA | 50 | 0.02 | 0.58 |

| −20 | −0.07 | −2.13 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, W.; Zhou, J.-F.; Li, S.-Y.; Li, Y.-C. Effects of an Energy Tax (Carbon Tax) on Energy Saving and Emission Reduction in Guangdong Province-Based on a CGE Model. Sustainability 2017, 9, 681. https://doi.org/10.3390/su9050681

Chen W, Zhou J-F, Li S-Y, Li Y-C. Effects of an Energy Tax (Carbon Tax) on Energy Saving and Emission Reduction in Guangdong Province-Based on a CGE Model. Sustainability. 2017; 9(5):681. https://doi.org/10.3390/su9050681

Chicago/Turabian StyleChen, Wei, Jin-Feng Zhou, Shi-Yu Li, and Yao-Chu Li. 2017. "Effects of an Energy Tax (Carbon Tax) on Energy Saving and Emission Reduction in Guangdong Province-Based on a CGE Model" Sustainability 9, no. 5: 681. https://doi.org/10.3390/su9050681