1. Introduction

As reported by the TIMES of London in 2010, universities in Scotland would confront a brain drain unless the investment on higher education is properly addressed. Brain drain, a term commonly used to refer to the loss of highly educated people who leave an area in search of appropriate jobs or further education, has also been a long-standing problem in South Korea with migration from the rest of Korea (ROK) to the Seoul Metropolitan Area (SMA). Korea is composed of seven metro cities and nine provinces; two metro cities and a single province comprise the SMA, while five other metro cities and eight other provinces comprise the ROK. The Neoclassical school of thought argues that human capital tends to flow into labor-scarce regions while capital moves to capital-scarce regions due to the advantage of higher marginal revenue of the factors, eventually leading to economic convergence between regions. In contrast, Lucas (2002) showed that capital does not flow to capital-scarce regions because marginal revenue of labor is still higher in capital abundant regions [

1]. Rather, capital tends to move into labor-abundant/capital-scarce regions where capital price is over 3.3 times thanks to externality of human capital in leading regions. This pattern was attributed to human capital externalities, suggesting economic divergence. In addition, in Korea, capital has concentrated in the SMA. In addition, since the early 1960s, the national government of Korea has focused on an efficiency-oriented economic development policy in the SMA, resulting in the ROK lagging far behind the SMA [

2]. Starting in the 1980s, regulatory policies have been implemented to control excessive investment in the SMA, including high residence tax in the major cities within the SMA and establishment of a growth management system (greenbelt) around the SMA. The government has focused on allocating more resources to the ROK’s higher education institutions (HEIs) and developing industrial parks in the ROK since the 1990s. Despite these efforts of the Korean government, human capital, as well as financial capital, is concentrated in the SMA. For example, the Korean Graduates Occupational Mobility Survey (2008) showed that 80.2% of students originally from the ROK who moved to the SMA for post-secondary education, entered employment status in the SMA after graduating from university. In contrast, only 17.1% of students originally from the SMA who graduated from the ROK remained in the ROK for economic activities. According to the 2010 national account statistics, the SMA has 48.0% of the total population and 52.7% of the prime working age population (25–49 years old age cohort), occupying 11.9% of the national total land area. In addition, 63.8% of workers in Korea with a master or higher degree were SMA residents. The SMA accounted for 48.8% of the GDP in South Korea. Even the Korean government’s policy to expand investment in the ROK’s HEIs and industrial parks since the 1990s failed to narrow the regional economic disparity between the SMA and the ROK. Consequently, it is worthwhile to identify how human capital accumulation and brain drain affect the regional disparity in terms of mobility of regional policymaking process.

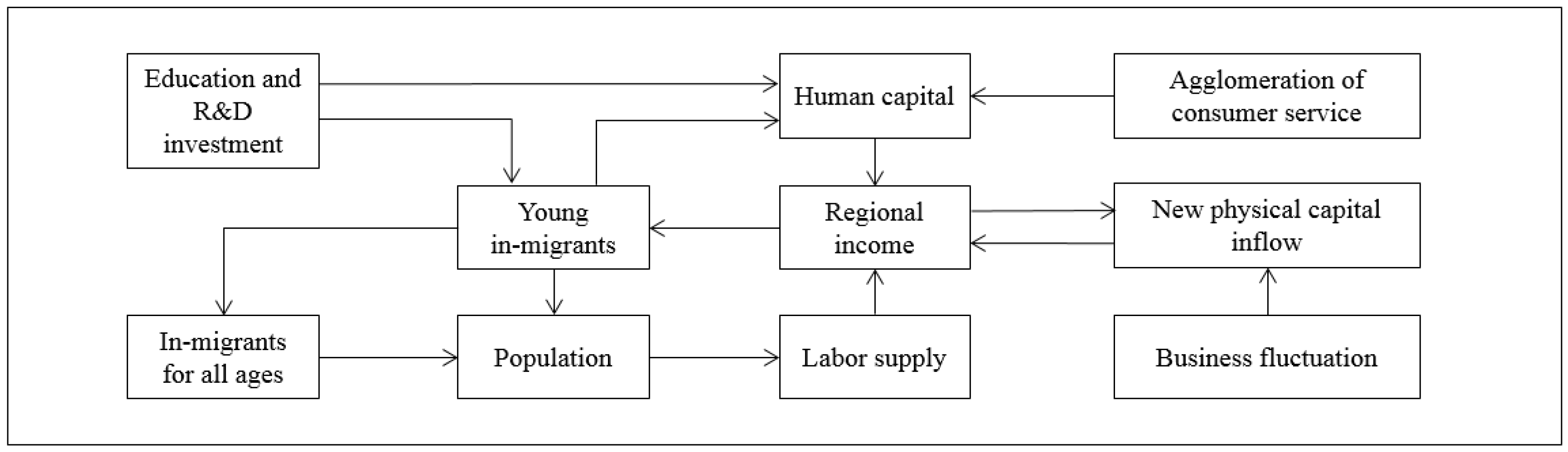

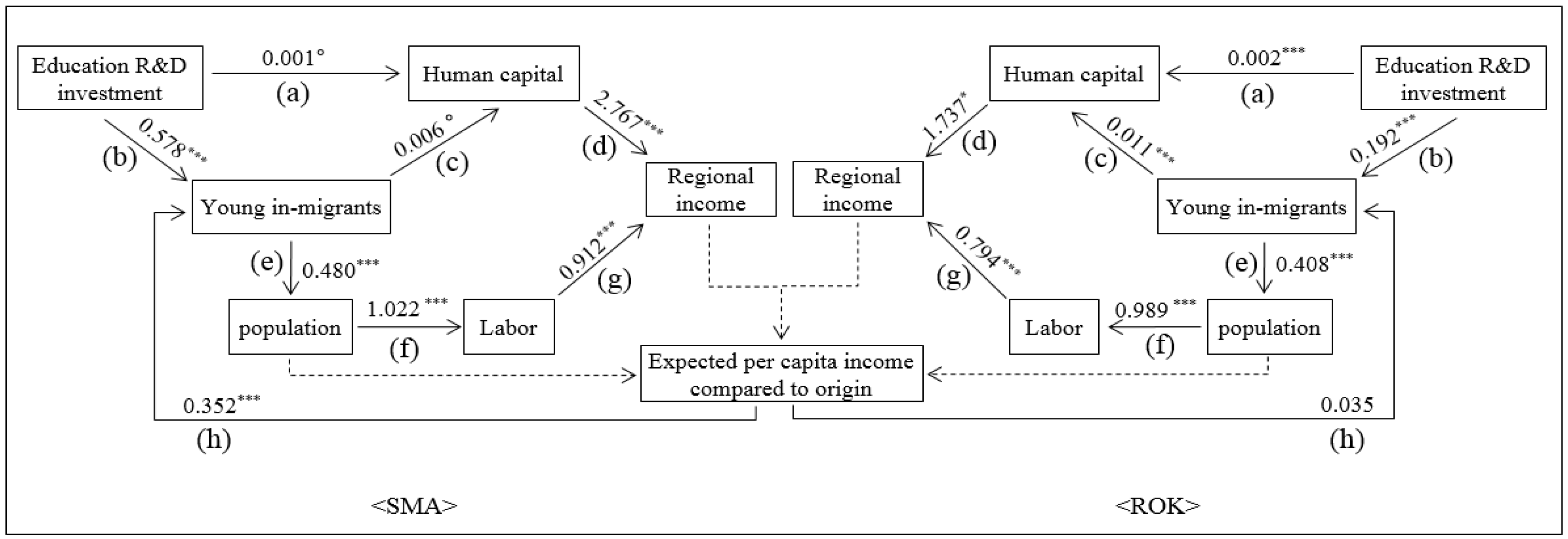

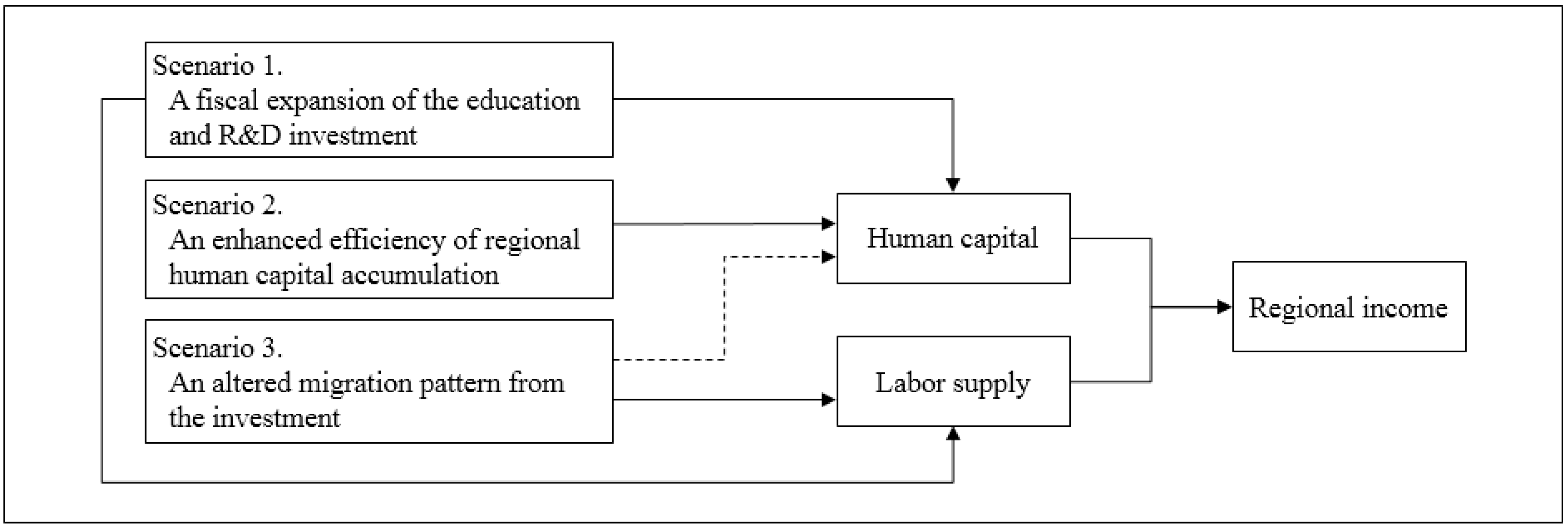

The major focus of this paper is to analyze the impact of education and R&D investment on the ROK’s economic growth in South Korea. We develop a simultaneous model of production, human capital accumulation, migration, population and physical capital investment of two regions. We decompose the regional growth path into a “quality path” and a “quantity path”. The quality path is defined as the enhancement of labor productivities in the production process. The quantity path is described as expanded labor supply caused by the inflows of human capital to a region. We also run counterfactual simulations to evaluate three alternative policies by estimating effectiveness and adaptability: (1) a fiscal expansion of the investment; (2) an enhanced efficiency of regional human capital accumulation; and (3) an altered migration pattern from the investment. The main contribution of this paper is developing and applying a method to decompose the growth path. Quantity expansion of human capital has been found to have a bigger impact on regional income growth, whereas quality enhancement has shown a somewhat limited impact on regional income growth in both leading and lagging regions. However, this decomposition method also shows that quality improvement is more effective in lagging region than in leading region. While previous works have focused on the analysis of the overall effect of intellectual capital investments, distinguishing the two types of growth paths can be useful in identifying how lagging regions economically grow [

3,

4,

5,

6]. The rest of the paper is organized as follows. Our literature review in

Section 2 comprises two major parts: In the first part, we assess the relation between human capital and regional economic growth. In the second part, we summarize the determinants of migration of human capital.

Section 3 describes the data and the measurement scheme, methodology for empirical models and the policy simulations on how education and R&D investment affects regional economic growth and disparity.

Section 4 presents conclusions and further agenda.

2. Literature Review

Endogenous growth theory shows that regions with better access to human capital grow cumulatively over time [

7,

8,

9,

10,

11,

12]. The new economic geography model provides evidence of substantial increasing returns to scale with relatively large urban populations due to the different degree of factor mobility [

13,

14]. In other words, highly educated workers tend to move to regions with larger market potentials, which is a fundamental driver of per capita income growth [

13,

15,

16,

17]. Such unbalanced growth is further amplified as investment flows into economically advanced areas [

1]. Accumulated human capital in a region improves the marginal product of capital, which entirely eliminates the predicted return differentials. Two related questions arise: how does human capital affect regional economic growth and how is human capital accumulated in the regions? For the former, there have been various assessments of whether human capital performs better in economically leading regions or lagged regions. For the latter, the concentration and further accumulation of highly educated workforce are more evident in the regions with larger market potentials.

In the first part of the literature review, we examine how the uneven spatial distribution of human capital may further increase regional inequality in terms of labor productivity and economic growth [

18,

19,

20]. The returns on human capital vary by regional capacity and endowment [

21]. Aggregate returns to human capital investment are generally higher in regions with a shortage of human capital. This indicates that education investment policy might have a larger marginal impact when implemented in lagged regions. Thus, investment in human capital formation has been one of the key considerations for regional development policy in regions with lagging human capital [

22,

23]. In contrast, the existing literature concludes that human capital could contribute more to regional economic growth in leading regions [

12,

24,

25]. The different perspectives can be traced back to the additional treatment of regions’ capacity to yield higher returns to human capital. Lopez-Bazo and Moreno showed the law of diminishing social returns to human capital accumulation in a region [

21]. They argue regions with relatively lower human capital endowments would exhibit higher aggregate return. Other literature highlights the importance of a regions’ capacity, partly represented by the accumulation of human capital, which might yield technological innovation. Specifically, Crescenzi investigated European regions from 1990 to 2003 and estimated that the impact of innovation on regional economic development varied with regional conditions such as peripherality and educational attainment level [

24]. Sterlacchini applied a “technology-gap” model of economic growth for 197 European NUTS-II regions aimed to test the rationale of Lisbon strategy, which is an economic development plan to make the EU “the most competitive and dynamic knowledge-based economy in the world capable of sustainable economic growth with more and better jobs and greater social cohesion” by 2010 [

25]. R&D was found to be the only factor yielding regional economic growth beyond a certain threshold of GDP per capita (linked, for example, with Northern Europe). Nijkamp and Poot also showed that the lack of appropriate local conditions such as peripherality, education, large labor pool, and urbanization, impeded the adoption of diffused technological innovation [

12]. Work on these issues is summarized as follows: Regions, where human capital was relatively scarce, exhibited the law of diminishing returns, which means so that lagged regions could achieve higher marginal benefits. In regions where human capital was abundant, technological efficiency and innovation were due to agglomeration economies, hence providing a better access to endogenous economic growth. According to new economic geography theory, regions endowed with insufficient financial, physical and human capital do seem to have limited ability to attract highly educated people.

In the second part, as empirically shown by many previous studies, human capital relocates with the aim of maximizing their utilities through migration. Among many potential factors, higher expected income had been mainly recognized as one of the most important factors to attract human capital to a region. Skill-biased technological change and professional jobs have incentivized migration to the regions while yielding lower wages for unskilled workers in the same regions [

26,

27,

28,

29]. Providing appropriate local employment opportunities is crucial to retaining top quality graduates, although college graduates tend to stay in a region if those graduates were born or attended high school in the same state [

29]. In the process of the cumulative causation introduced by Massey [

30], investing in HEIs is the prerequisite for sustainable regional economic growth to generate proper local employment opportunities. According to Anselin et al. [

31], knowledge accumulated in regional establishments such as universities, research institutions, specialized agencies, and associated industries, not only stimulates basic research in regions but also attracts human capital to the regions. Specifically, managing universities is crucial to improving human capital performance and regional development [

32]. When debating the importance of regional income and universities, Florida et al. [

33] showed that consumer service amenities retain human capital in that region. This sector has been measured by consumer and personal service [

34] and cultural sector [

33,

35]. Education subsidies were not found to accumulate human capital in an open economy system [

36]. Other empirical studies found that physical capital formation [

37], education quality [

38,

39], industrial structure [

40] and agglomeration [

41] served as major pulling factors to attract a well-educated worker. Land price [

40,

42] and living costs [

38,

40] negatively influenced concentration on human capital in regions. Finally, skilled workers tended to reside within metropolitan areas where they consistently performed creative activities thanks to agglomeration economies [

43,

44]. Some of the key factors found to be crucial for attracting the highly educated are the levels of HEIs’ R&D activities, the opportunities for professional jobs, and higher income. In short, there were two effective paths to accumulate human capital in a region: (1) knowledge and skill acquisition through investment; and (2) inflow of skills [

45].

With respect to human capital and regional economic growth, Gennaioli et al. [

46] employed an economic model combining human capital externalities, talent allocation between entrepreneurship and employment, and interregional labor migration with the aim to test the role of human capital in regional development. They found differentiated impacts between the quality of human capital (education attainment level) and total quantity (the number of people with certain levels of education attainment). While regional education as a means to expand the quantity of human capital in a region is a key factor for regional development, the bigger impact of enhanced human capital quality for regional development is evident. Enhancing quality of human capital in a region is primarily through education of employees, training for entrepreneurs, and regional externalities. Social returns to education for entrepreneurs through externalities are larger than that for employee education/training. Our approach also differentiates two paths: quality and quantity for regional growth. Recently, Hanushek et al. [

47] tested the impact of knowledge capital of a state on varying GDP per capita among US states. In order to measure regional knowledge capital, authors combined cognitive skills measured by test scores with a traditional measure of human capital accumulation—education attainment level. Their findings clearly indicate that approximately 20–30% of GDP per capita variation among US states can be explained by varying levels of knowledge capital accumulation. Roughly equal shares of contribution were found between education attainment and cognitive skills. Quality of life is another important estimator for regional growth. However, interactive impact of quality of life and human capital on regional growth has been rarely investigated. Fan et al. [

48] found reinforcing impact of these two factors for wage growth among US counties between 2000 and 2007. Both quality of life and human capital significantly stimulated economic growth and more importantly, the impact of human capital on regional growth was larger in counties with higher quality of life by attracting and retaining human capital into the counties.

To summarize, human capital can achieve higher marginal economic benefits in lagging regions. Knowledge embedded labor, however, tends to concentrate in leading regions with technological efficiency and innovation due to agglomeration economies. In this context, an important policy question is whether education and R&D expenditure [

30,

31] can boost lagging regions’ economic growth and thereby lead to regional convergence in the long run. We, therefore implement the following main working processes to compare the results between leading and lagged regions, respectively: (1) the effect of education and R&D investment on human capital formation and inflow of human capital; (2) the effect of human capital inflow on human capital formation; and (3) the effect of human capital on regional economic growth.

4. Conclusions

The purpose of this paper was to examine the impact of education and R&D investment on regional economic growth in South Korea. We develop a simultaneous model of production, human capital accumulation, migration, population and physical capital investment of the SMA and the ROK. We decomposed the regional growth path into a quality path and a quantity path to identify how regions economically grow and run simulations to evaluate alternative policies in terms of effectiveness and adaptability. The impact through the quantity path is greater in both the SMA and the ROK than those through quality path. The impact of educational investment on regional growth in the ROK is only 22.3% of that in the SMA due to lower elasticity of young in-migrants with respect to education investment in the ROK. The impact through quantity path is greater in both regions than that through quality path. The total effect through quality and quantity path is 58.1% and 20.8% in the ROK, compared to the SMA, respectively. Specifically, the impact through quantity path is greater in both regions than that through quality path. The total effects through quality path in the ROK is 58.1% of that in the SMA, while the total effects through quantity path in the ROK is only 20.8% of that in the SMA.

The highest priority should be placed on enhancing labor productivities with expanded government investment for education and R&D activities in a lagging region. Our analysis found that this was the most viable and efficient to reduce regional disparity in Korea. The effect of financing human capital formation varies depending on regional characteristics [

21]. Local government should play a leading role to design and implement region-specific programs, while the central government’s role can be confined to providing funding, and administrating the allocation of resources across the sub-national regions. For example, local vocational education programs and region-specific systems to stimulate the formation of regional human capital could be effective.

With respect to changes in quality and quantity of regional human capital, our estimation results differ greatly from the calibration results by Gennaioli et al. [

46] in that investment through the quantity path produces a larger impact than that through the quality path. Our models used aggregated regional investment for education and R&D activities through local universities. For this reason, it is impossible to distinguish how such investment has been allocated to specific activities such as worker training/education programs, education for entrepreneurs and so forth. Instead, the quality path shows limited impact on regional growth both in the SMA and in the ROK compared to quantity path’s role to bring in immediate impact, but the relative impact through quality path in the ROK is found to be bigger than that in the SMA. This implies that targeted investment along quality path such as education for entrepreneurs in the ROK can yield greater and more sustainable contributions to regional economic growth. The relative importance of regional human capital accumulation along quality path shown in Scenario 2 conforms to Hanushek et al. [

47] in that providing adequate state-level policy support to improve the quality of education and raise human capital level would be more desirable. Moreover, the ROK as a lagging region in Korea expects a largely limited impact of investment along quantity path. The ROK has limited human capital in-migrants unlike cases such as among U.S. states where the flows of human capital are much more frequent. Though this study does not directly control varying quality of life among study areas, findings from Fan et al. [

48] provide supplementary policy implications. Limited impact on regional growth through the quantity path, especially in the ROK, can be reinforced when combined with supplementary policies to enhance quality of life in the lagging region. This is a sustainable path for the ROK in the long run since the ROK generally has higher quality of life-based on natural amenities compared to that in the SMA. Therefore, community development policies can stimulate the reinforcing impact of human capital and quality of life in the ROK along quantity path in the long run, while the focus of education and R&D investment policy should be on local human capital accumulation along quality path. For example, the rural and regional policy of Norwegian government aims to implement a decentralized education structure to develop attractive local education opportunities [

65]. Universities and polytechnic colleges in Helsinki are trying to invite outstanding researchers to foster younger students who are domiciled in the region though this is not regional policy. Korea’s local universities have continued to recruit excellent personnel who are domiciled in the region and give incentives to get a job in the region since 2015.

A few points need to be mentioned regarding the prospect of future research. First, the analysis should be recalibrated to account for current underemployment trends. The stylized production function used in this paper assumed full employment which means that labor demand follows labor supply. Additionally, we considered structural or involuntary unemployment condition as well. Adopting an increasing divergence between the unemployment and the underemployment rate, or using labor hours may provide more accurate method to estimate labor demand since the beginning of the great recession [

66]. A second modification is to capture the different levels of complementarity between capital and educational investment, or between education and technology progress introduced by Lin [

17]. These relationships could differ across regions. This heterogeneity could shed light on concrete policies of technical progress and physical capital as well as human capital accumulation. Third, it would be useful to develop a migration model for highly educated workers’ migration decisions which can be influenced by various other factors such as job availability, local labor market characteristics and regionally unique amenities. Our migration model mainly focused on the role of education and R&D investment and pecuniary benefit in measuring the relative regional income compared to origin as Todaro’s model [

38]. The migration function could be extended to better explain a behavioral channel of brain drain in a stochastic framework. Finally, we did not include the economic agents—two regional households and one national (central) government. It would be interesting to measure the changes in reduced demands for intermediate or final goods in many developed countries facing sluggish growth or aging population. This could allow the number of in-migrants to be more accurately calibrated.