1. Introduction

As is known to all, the negative impact of asymmetric price transmission in gasoline and diesel prices that we refer to as the Rockets and Feathers on China’s macro-economy is well-established [

1,

2,

3].

On the one hand, China’s oil prices increase quickly when international oil prices increase, but decrease slowly when international oil prices decrease. This induces a negative effect on consumers’ welfare [

4,

5]. In recent years, China has become the world’s largest vehicle market and has a distinct institutional and regulatory environment for gasoline and diesel pricing [

6,

7]. China’s state-owned gasoline stations raise oil prices when international crude oil prices go up, but they do not lower oil prices as much as the gasoline stations in the U.S. do when international crude oil prices go down. Thus, consumers in China have long thought that gasoline stations tend to raise oil prices and resist lowering them. In this case, China’s consumers have to pay more than consumers in other countries do when international crude oil prices decrease.

China’s oil price transmission mechanism has been in the process of being reformed from the planned economy to the market one since 1998. However, the two integrated oil companies of China, i.e., Petro China and Sinopec, have a powerful force to influence the oil prices adjustments and make profits via lowering consumers’ welfare. For example, the oligopolists are reluctant to lower gasoline and diesel prices when international oil prices decrease. It is obvious that the asymmetric price transmission in gasoline and diesel prices will cause some social conflicts over time. That is because, in China, the government controls state-owned enterprises. Once the state-owned enterprises make mistakes, the government cannot escape the responsibility. Following such logic, if Petro China and Sinopec impair the public’s welfare (no doubt the public consume most of the oil), the public will not just blame Petro China and Sinopec, but also complain about the government’s dereliction of duty. As a result, people’s dissatisfaction with the government is becoming stronger and stronger. Thus, the adjustment of China’s refined oil prices is not only an economic issue but also a social issue.

On the other hand, the asymmetric price transmission in gasoline and diesel prices is harmful to the pricing mechanism that reflects both the real demand and product cost of gasoline and diesel fuel. What’s more, misallocation of resources is a result of asymmetric price transmission. Misallocation of resources can contribute to slow economic growth and lower energy efficiency, especially in oil importing countries. Thus, investigating the asymmetric price transmission in gasoline and diesel prices not only helps to propel the reform of China’s oil pricing mechanism but also tends to ease social conflicts in China.

In practice, since February 2006, China’s wholesale prices not only increase but also tend to rise more when international oil prices rise than they fall when international oil prices fall. Throughout the period, gasoline prices were higher than diesel prices in China, but showing the same pattern of co-movement with international crude oil prices, i.e., increasing quickly when international oil prices increase, but decreasing slowly when international oil prices decline. Since Bacon [

1] tested the hypothesis that UK retail gasoline prices respond more quickly to increase in crude oil prices than to decrease, many economists have attempted to replicate the test of asymmetric adjustment of price changes in other countries.

In the U.S., many researchers argued that the response of gasoline prices to crude oil price changes was asymmetric [

8,

9,

10,

11,

12,

13,

14]. Venditti [

15] demonstrated the response of weekly gasoline and gasoil prices to crude oil price changes through using nonlinear impulse response functions and forecast accuracy tests. He found that both approaches support the presence of asymmetries in the adjustment of retail prices. Radchenko and Shapiro [

16] pointed out that those gasoline price adjustments were faster and stronger by a statistically significant margin for anticipated changes in oil prices and inventory levels than for unanticipated changes. For Europe, Grasso and Manera [

17] used three different models including asymmetric error-correction model (ECM), autoregressive threshold ECM and ECM with threshold co-integration, and tested the asymmetry with monthly data of gasoline prices from France, Germany, Italy, Spain and UK over the period 1985–2003. They argued that the response of retail gasoline prices to changes in crude oil prices was asymmetric. Polemis [

18] and Polemis and Fotis [

19] investigated the asymmetries in the transmission of shocks to input prices into the wholesale and retail gasoline prices in 11 euro zone countries using generalized method of moments (GMM) estimation and a panel data error-correction model (ECM).

For other countries, Liu et al. [

20] examined pre-tax refined product prices in New Zealand, and found asymmetric responses to changes in crude oil prices for diesel but not for gasoline. Using weekly data from 2007 to 2012, Valadkhani [

21] tested for asymmetry in the adjustments of retail prices to changes in wholesale prices in 111 locations across Australia. He found significant evidence in 28 locations, mainly in Tasmania, Queensland and New South Wales.

However, in China, most studies on gasoline and diesel prices focused on oil price regulation [

22] rather than asymmetric price transmission. The few papers on asymmetric transmission were mainly written before the rise in international oil prices and the take-off in car ownership in the middle of the last decade [

23]. As a result, the existing literature failed to elucidate the adjustment of China’s wholesale prices of gasoline and diesel products in response to international crude oil prices.

In this paper, we focus on testing for whether the adjustment of wholesale prices of gasoline and diesel to crude oil price changes is asymmetric in China. It is organized as follows.

Section 2 derives the model and

Section 3 describes the data.

Section 4 presents the empirical results.

Section 5 presents the discussion and conclusion.

2. Methodology

As in most previous literature about international oil price transmission, this paper tests for both the long-run relationship and short-run dynamics of gasoline and diesel price changes in China. The long-run relationship between China’s wholesale prices and international oil prices is based on the following reduced-form equation:

where

is China’s wholesale prices of gasoline and diesel products at time

t − 1;

represents international oil prices in Chinese

yuan per ton at time

t − 1; we take the logarithm for all the oil prices;

denotes the error term at time

t − 1;

and

are the model parameters.

is a coefficient representing the constant markup and

is a coefficient representing the degree of pass-through in the long run. In fact,

is the elasticity of China’s refined oil prices to international crude oil prices.

If both time series of prices are integrated of order one

and co-integrated, we employ the error-correction methodology [

24] to examine the short-run dynamics of gasoline or diesel price changes in response to changes in international oil prices:

where

represents first differencing, and

that shows the deviation of

from its long-run value,

, in other words, the “error” in the previous period.

and

are the model parameters.

shows the “correction” of

to the “error” and its value represents the speed of adjustment.

is a coefficient reflecting the impact of changes in the growth rate of the benchmark international oil price on the growth rate of China’s refined oil prices.

is the observations number.

Next, we extend Equation (2) to a dynamic ECM based on the idea of a lagged relationship between China’s wholesale prices and international oil prices:

where

is the maximum lags number for the changes in international oil prices which still affect China’s wholesale prices, and

denotes the error term at time

t.

Now, we can extend Equation (3) to the case of asymmetric adjustments and obtain an asymmetric error-correction model (AECM), following Galeotti et al. [

25] and Grasso and Manera [

17] and Balaguer and Ripollés [

26], by decomposing the short-run dynamics or both the short-run dynamics and the error-correction term into positive and negative values. Therefore, we can obtain the following econometric specifications:

where if

, then

and

, if

, then

and

, and if

, then

and

.

where if

, then

and

, if

, then

and

, and if

, then

and

.

If , rising international oil prices have a greater effect on wholesale prices of gasoline and diesel products than do falling international crude prices. Similarly, would imply that falling crude prices have a greater effect, and would imply no asymmetric adjustment in changes of wholesale prices. Assume that , thus indicates an asymmetry in the responses of China’s wholesale prices to changes in international oil prices, and indicates no asymmetry.

As Honarvar [

27] pointed out, a non-competitive gasoline market caused by oil price regulation or interventions carried out by the local government can have a significant effect on the fluctuations of gasoline and diesel prices in a country or region, possibly impairing market efficiency, at least on a microeconomic level. In fact, the Chinese government sets maximum retail prices for retail prices of gasoline and diesel (

Table 1) and relatively low prices for the military, Xinjiang Production and Construction Corps, and national reserve oil. Under this circumstance, we assume that wholesale prices of gasoline and diesel are influenced by maximum retail prices because wholesale prices are always less than retail prices, which are restrained by maximum retail prices.

In order to identify the different impact of increases and decreases of both international oil prices and maximum retail prices on wholesale prices, we decompose the time series of wholesale prices, international oil prices and maximum retail prices into positive and negative sequences, and regress the positive (or negative) series of wholesale prices on maximum retail prices and international oil prices. The econometric specifications are as follows:

where

denotes maximum retail prices of gasoline or diesel products and if

, then

and

, if

, then

and

, and if

, then

and

.

When there is no change in maximum retail prices, that is, both and are zero, changes in China’s gasoline and diesel prices are only a function of changes in international oil prices. In this case, we can estimate the adjustments of gasoline and diesel prices by using the Equations (4) and (5).

3. Data Description

Prior to 1998, wholesale prices were fixed by the Chinese government. Since June 1998, they have been determined by market forces, but the Chinese government still sets maximum retail prices on the basis of an international crude oil price benchmark. From June 1998 to October 2001, the benchmark price was the Singapore spot price. From November 2001 to November 2005, the benchmark price was calculated as 0.6 × New York spot price + 0.3 × Singapore spot price + 0.1 × Rotterdam spot price. Since early 2006, it has been 0.4 × European Brent spot price + 0.3 × Asian Dubai Fateh spot price + 0.3 × Indonesian Minas spot price (Unlike the existing literature, a document entitled “A Rule of Regulation for Oil Prices in China” (in Chinese) issued by China’s Development Research Center of the State Council in 2013 argues that China’s gasoline and diesel prices are only decided by Chinese government until June 1998. Since the market-oriented reform of China’s oil pricing mechanism began in June 1998, the gasoline and diesel prices in China have been not only decided by Chinese government. China’s gasoline and diesel prices are determined by both the international crude oil prices and the maximum retail prices on the basis of an international crude oil price benchmark since June 1998. The maximum retail price can adjust only if the benchmark price increases (decreases) by more than 4% in 22 days successively with the consideration that international oil prices are time-varying every day. Both international crude oil prices and maximum retail prices increase, China’s gasoline and diesel prices can increase. China’s gasoline and diesel prices decrease when international crude oil prices and maximum retail prices decrease. This is the key point. In practice, from June 1998 to October 2001, the benchmark price was the Singapore spot price. From November 2001 to November 2005, the benchmark price was calculated as q1 × New York spot price + q2 × Singapore spot price + (1 − q1 − q2) × Rotterdam spot price with q1 = 0.6 and q2 = 0.3. Since early 2006, it has been q3 × European Brent spot price + q4 × Asian Dubai Fateh spot price + (1 − q3 − q4) × Indonesian Minas spot price with q3 = 0.4 and q4 = 0.3).

To avoid changes in the data-generating process and ensure data availability, the sample period of this paper starts from February 2006. There are three gasoline octane ratings in China, including 90#, 93#, and 97# (# means octane) and two diesel octane ratings, 0# and −10#. Therefore, this paper uses all the prices of 90#, 93#, and 97# gasoline and 0# and −10# diesel and the benchmark price represented by three international crude oil streams. All monthly data are taken from the website of China’s Development Research Center of the State Council and Wind Industrial Database, and cover the period from February 2006 to October 2013. We seasonally adjust the data and convert dollars per barrel to Chinese yuan per ton using a conversion factor of 7.35 barrels per ton and exchange rates from Wind Information Databases.

Table 2 indicates the descriptive statistics of China’s gasoline and diesel prices and the benchmark crude oil price.

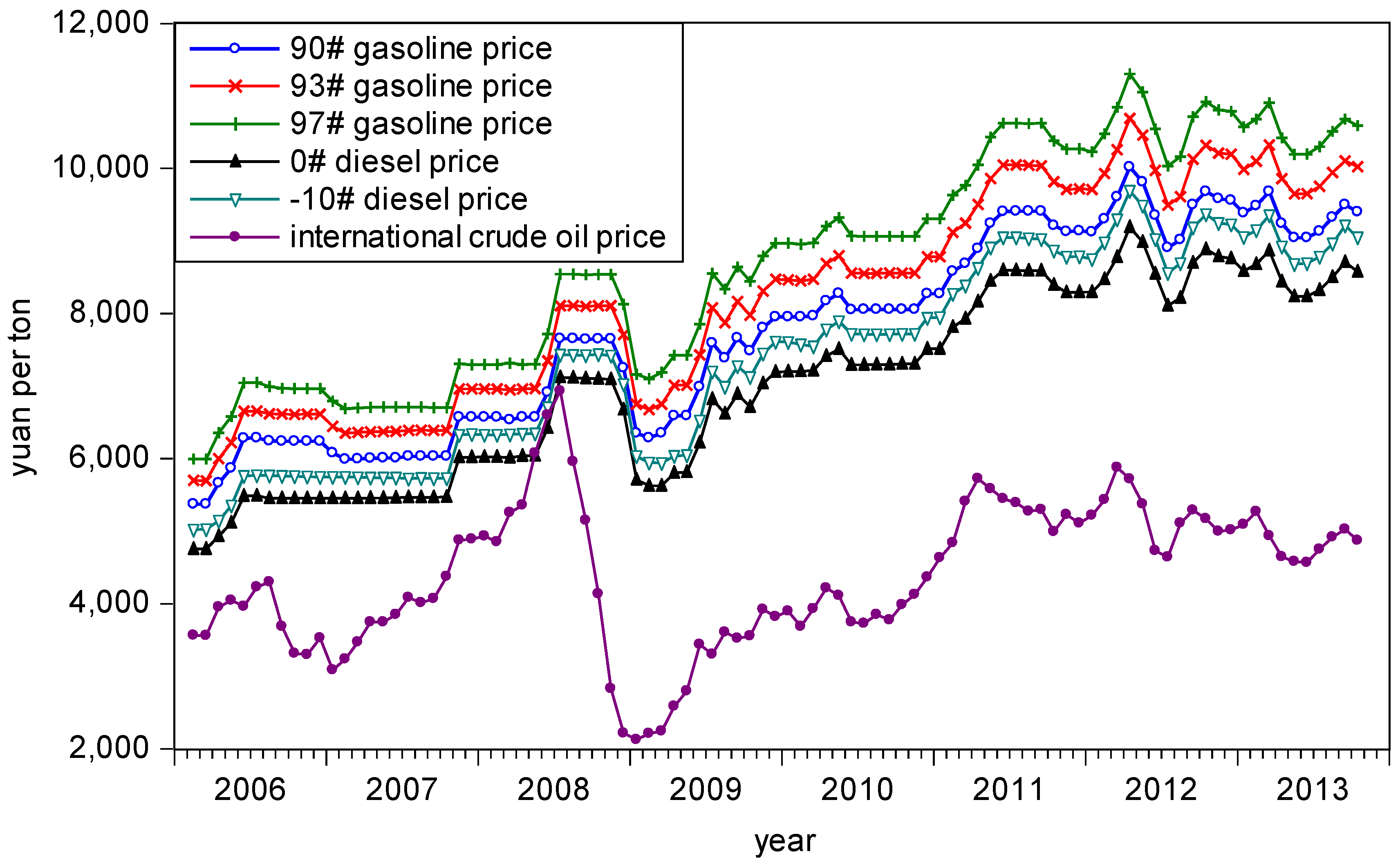

Figure 1 presents the fluctuation of all the prices from 2006 to 2013. As is shown in

Figure 1, there exists a structural break point during 2008. In fact, both of the sharp declines of China’s refined oil prices and the benchmark crude oil price are caused by the financial crisis in 2008. As a result, it is inevitable to experience a sharp decline in oil demand.

4. Empirical Results

Many of the time series in this paper are non-stationary, thus we need to perform stationary tests in order to avoid spurious correlation. Using the augmented Dickey-Fuller (ADF) unit root test, based on the Schwarz Criterion (SC), we test for stationarity of all the prices and the unit root test results are shown in

Table 3.

We conclude that both China’s gasoline and diesel prices and the benchmark price of international crude oil are first-order stationary which can be expressed as

I(1). Then, we use the Johansen co-integration test to investigate the long-run equilibrium between China’s wholesale prices and the benchmark price. The empirical results in

Table 4 indicate that there is a long-run co-integration relationship between China’s wholesale prices and international oil prices, significant at the 5% level.

Various methods exist to obtain the optimal lag order of the independent variables, including the Likelihood Ratio Test, Final Prediction Error, Akaike Information Criterion (AIC), Schwarz Information Criterion and Hannan–Quinn Information Criterion. This paper uses the AIC and obtains an optimal lag order of 2. Thus, the optimal lag intervals for the effects of increases and decreases of international oil prices are two months since the data are monthly. Using the AECM in Equation (4), the price adjustment equations for 90#, 93# and 97# gasoline and 0# and −10# diesel can be obtained.

These coefficients shown in

Table 5, with the exception of those on ∆log(

bpt−2+) and

ecmt−1, are significant at the 10% level. Though not all differences are statistically significant, this may indicate that the impacts of the growth rate of international oil price increases on the growth rate of China’s gasoline and diesel prices are less persistent than those of decreases. The effects of increases in the growth rate of international oil prices on the growth rate of gasoline and diesel prices are positive and peak in the next month. The estimated coefficients of ∆log(

bpt+) mean that a one percent increase in the growth rate of international oil prices increases the growth rate of 90#, 93# and 97# gasoline and 0# and −10# diesel prices by 0.110 percent, 0.109 percent, 0.117 percent, 0.144 percent and 0.140 percent, respectively, in the same month, and the estimated coefficients of ∆log(

bpt−1+) indicate that a one percent increase in international oil prices increases the growth rate of gasoline and diesel fuel prices by 0.213 percent, 0.214 percent, 0.215 percent, 0.259 percent and 0.260 percent, respectively, in the next month. The effect is somewhat larger for diesel than for gasoline, though not by a statistically significant margin. The effects of decreases in the growth rate of international oil prices also peak in the next month and appear larger for diesel than for gasoline. However, in contrast to the effects of the growth rate of international oil price increases, the effects of the growth rate of international oil price decreases remain significant at the 10% level in the second following month.

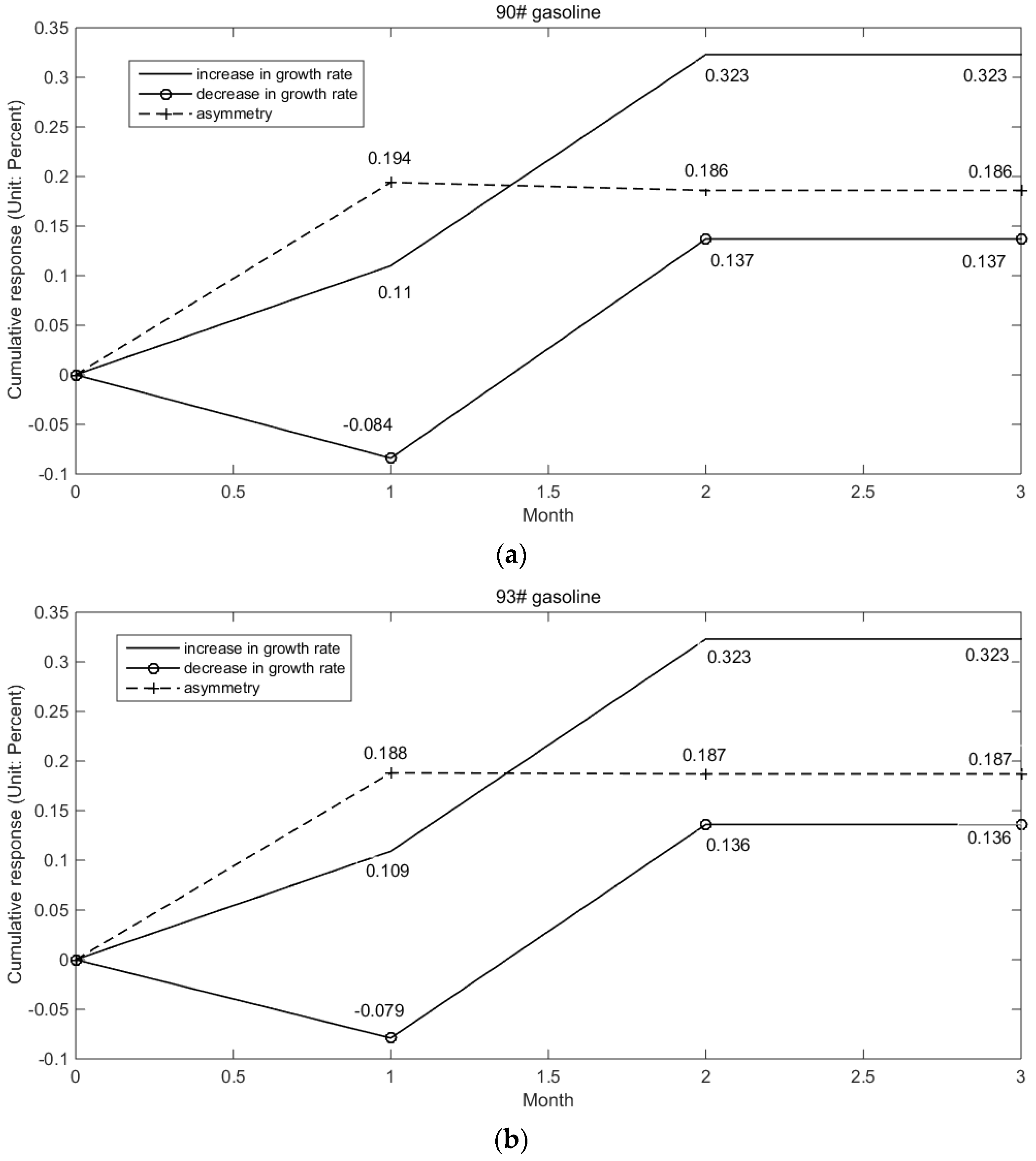

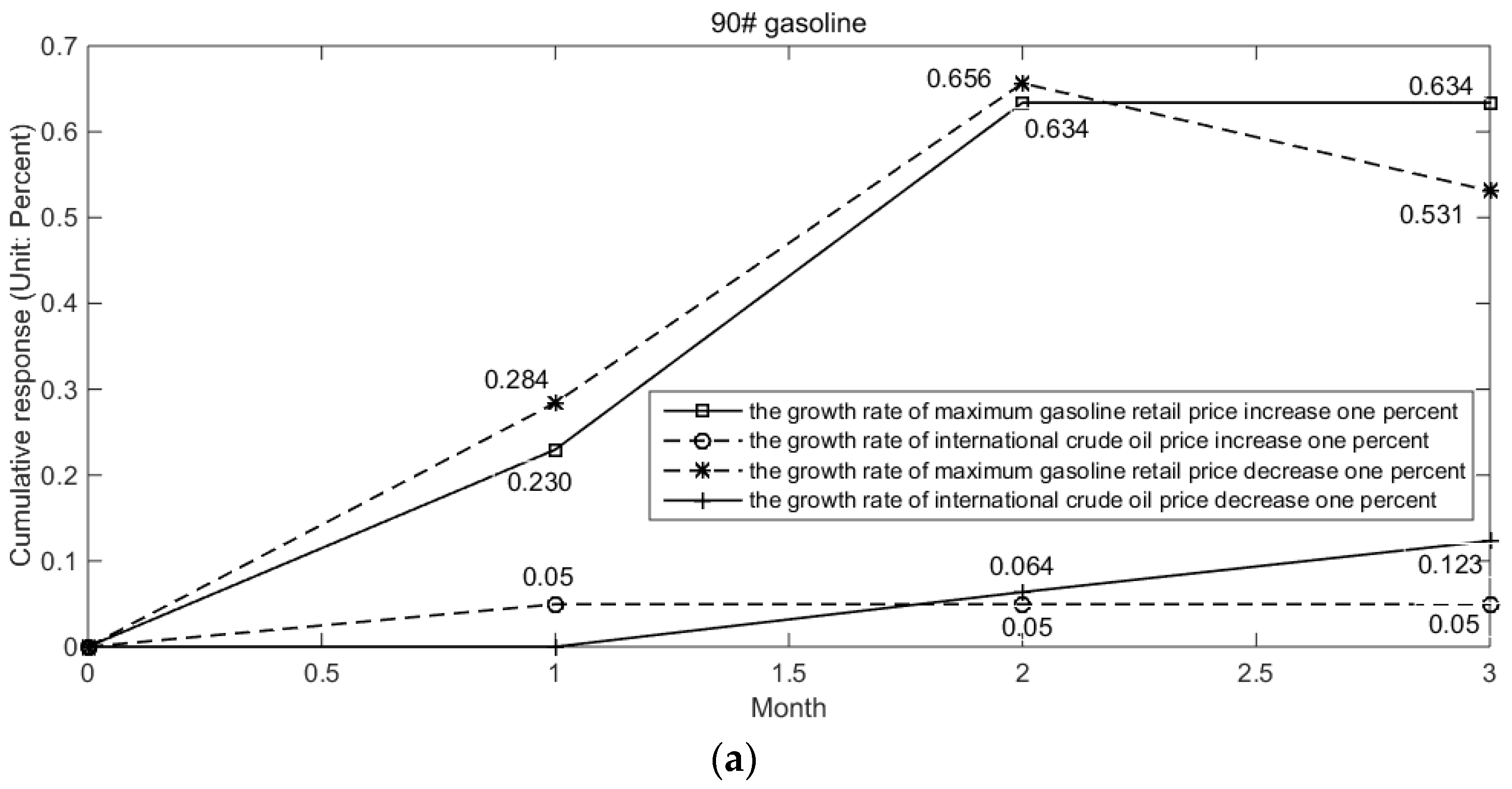

Turning to cumulative response over three months showed in

Figure 2, a one percent increase in the growth rate of international oil prices increases the growth rate of 90#, 93# and 97# gasoline and 0# and −10# diesel prices in China by 0.323 percent, 0.323 percent, 0.3332 percent, 0.403 percent and 0.34 percent, respectively. And a one percent decrease in the growth rate of international oil prices decreases the growth rate of 90#, 93# and 97# gasoline and 0# and −10# diesel prices by 0.137 percent, 0.136 percent, 0.142 percent, 0.240 percent and 0.243 percent, respectively. According to the definition of asymmetry expressed by

and

, there is an asymmetry in the adjustments of China’s gasoline and diesel prices to the changes in the growth rate of international oil prices.

According to the estimated results in

Table 6, we find that the asymmetric adjustments of gasoline prices in China are similar to that in the developed countries. In the previous literature, economists have offered numerous explanations for the asymmetric transmission. Brown and Yücel [

28] provided a formal econometric exercise to test various explanations for price asymmetry and found that in the United States the asymmetric response of gasoline prices to changes in international crude oil prices is the result of market power. Bagnai and Ospina [

29] argued that the observed asymmetry in the Italian gasoline market depends on oligopolistic coordination and non-competitive behavior in the gasoline retail markets.

By contrast, Lewis [

30] proposed a new explanation for interpreting the asymmetry by employing a search model. He assumed consumers’ expectations of prices are based on the prices observed during previous purchases and consumers search less when gasoline prices are falling, which results in a slower price response to the cost changes. As a result, the asymmetric transmission is caused by consumer search costs. Furthermore, Al-Gudhea et al. [

31] used threshold and momentum models of co-integration with daily prices at different stages in the distribution chain to support Lewis’ [

30] empirical results. When dividing all the external shocks into small and large ones, Al-Gudhea et al. [

31] obtained that the asymmetry is more pronounced for small shocks, which may be the result of consumer search costs.

Kaufmann and Laskowski [

11] revisited the issue of asymmetry in the relation between gasoline prices and international crude oil prices in the United States and proposed that the asymmetric relation is generated by refinery utilization rates and inventory behavior. The mechanism of asymmetry seems to be from the fact that inventories give profit-maximizing firms a way to spread the effects of unanticipated changes in demand over time. An unanticipated decline in demand urges firms to cut production and sell inventories. Conversely, an unanticipated rise in demand causes prices to increase sharply because finite inventories and lags in production constrain the short-run supply response. However, Radchenko and Shapiro [

16] disagreed with Kaufmann and Laskowski [

11]. They argued that gasoline price adjustments are faster and stronger for anticipated changes in international crude oil prices and inventory levels than for unanticipated changes, and this difference is statistically significant. They presented some interesting discussions from two aspects. One is that production and holding costs can make it suboptimal for refineries to adjust instantly. However, when the shock is anticipated, the refineries might start and complete the adjustment earlier, which would make the response to unanticipated shocks more delayed. The other is that the response to the anticipated shock is much stronger and is hard to reconcile with the explanation that would be based solely on the cost considerations. It is well known that gasoline prices would increase or decrease significantly after a decrease or increase in gasoline inventory. This result is common sense given that the most probable source of the inventory shock is actually the demand shock. Furthermore, Radchenko and Shapiro [

16] pointed out that the changes in gasoline inventories have a significantly asymmetric effect on gasoline prices and that gasoline inventories have a feedback effect on oil prices. Especially, an increase in gasoline inventories leads to a significant decrease in oil prices.

As is shown above, Brown and Yücel [

28] pointed out that in the United States the asymmetry which means that gasoline prices rise more quickly when crude oil prices are rising than they fall when crude oil prices are falling is unlikely to be the result of monopoly power generated by large, integrated oil companies. However, in China, we argue that price regulation and market power, especially the monopoly power in refined products, may be the significant factors of the asymmetries in the adjustments of oil wholesale prices. In practice, the four integrated oil companies, namely, Petro China, Sinopec, China National Offshore Oil Corporation and China National Aviation Fuel, have more than 90% market share in the refined oil market in China. The four dominant companies may engage in an unspoken collusion to maintain higher profit margins. When international oil prices rise, each firm is quick to raise its selling prices, while when international crude oil prices fall, the oligopolists are reluctant to lower gasoline and diesel prices. The feasible methods for the government to lower wholesale prices are to offer subsidies and carry out maximum retail prices by force.

5. Discussions

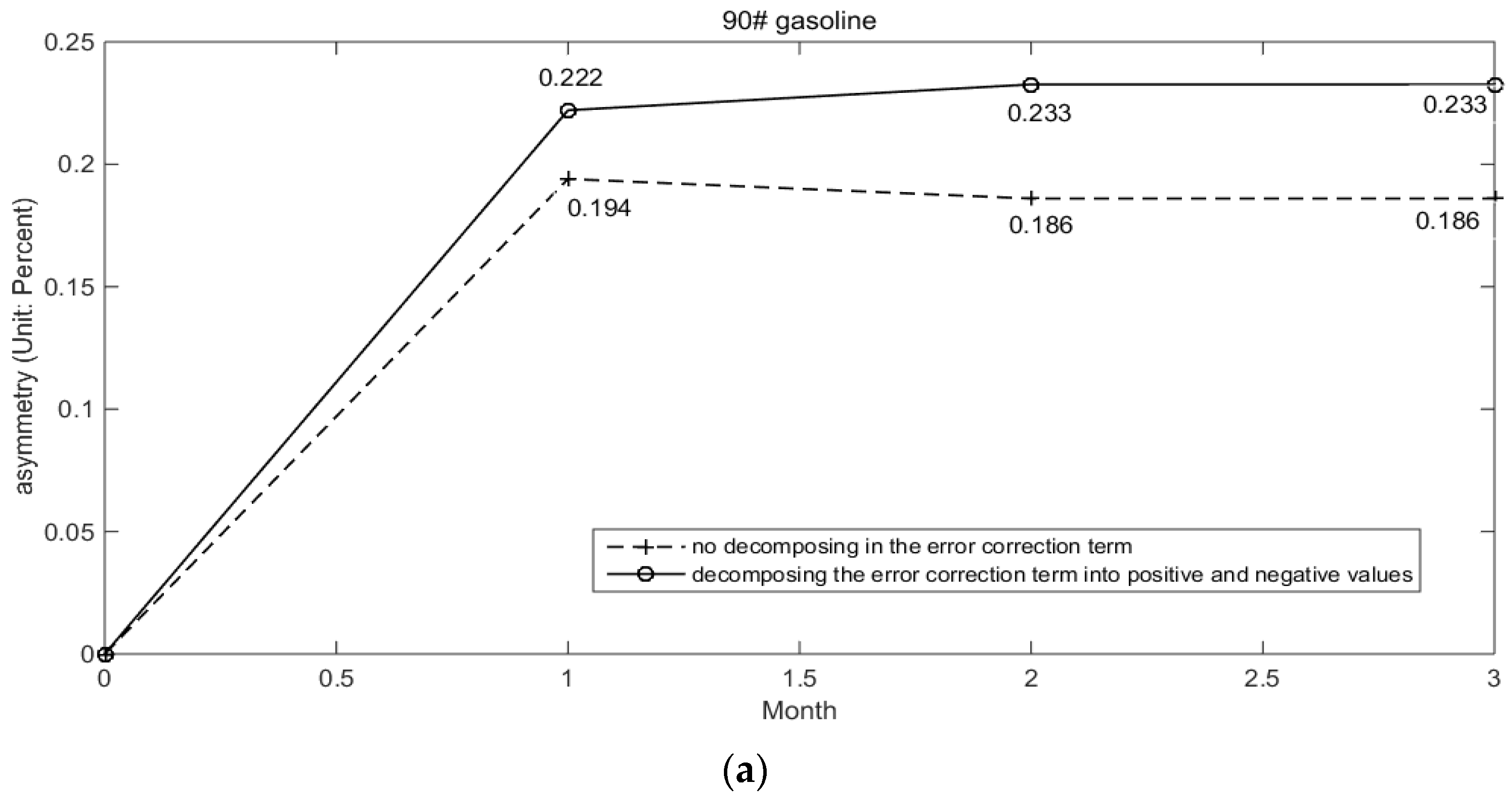

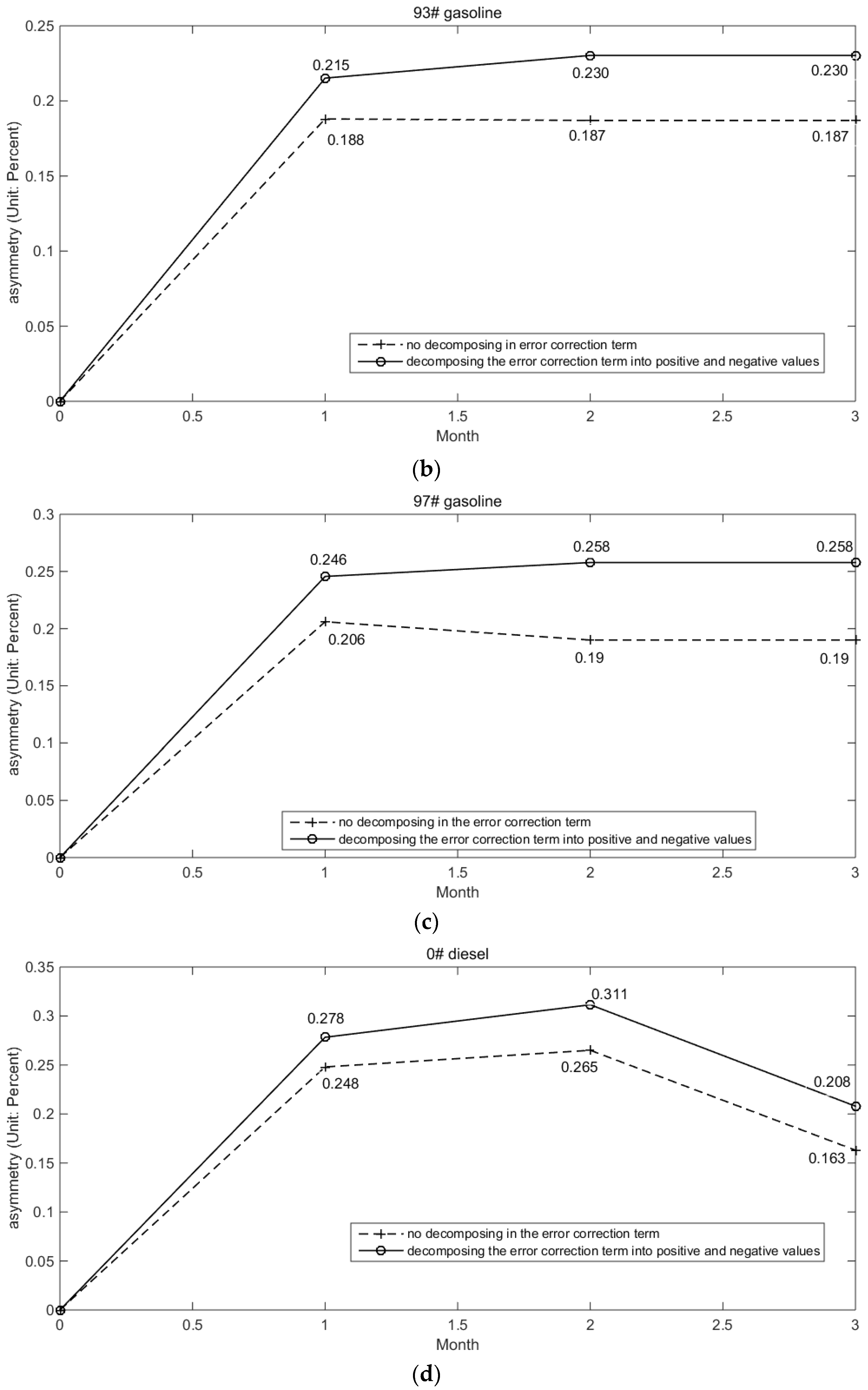

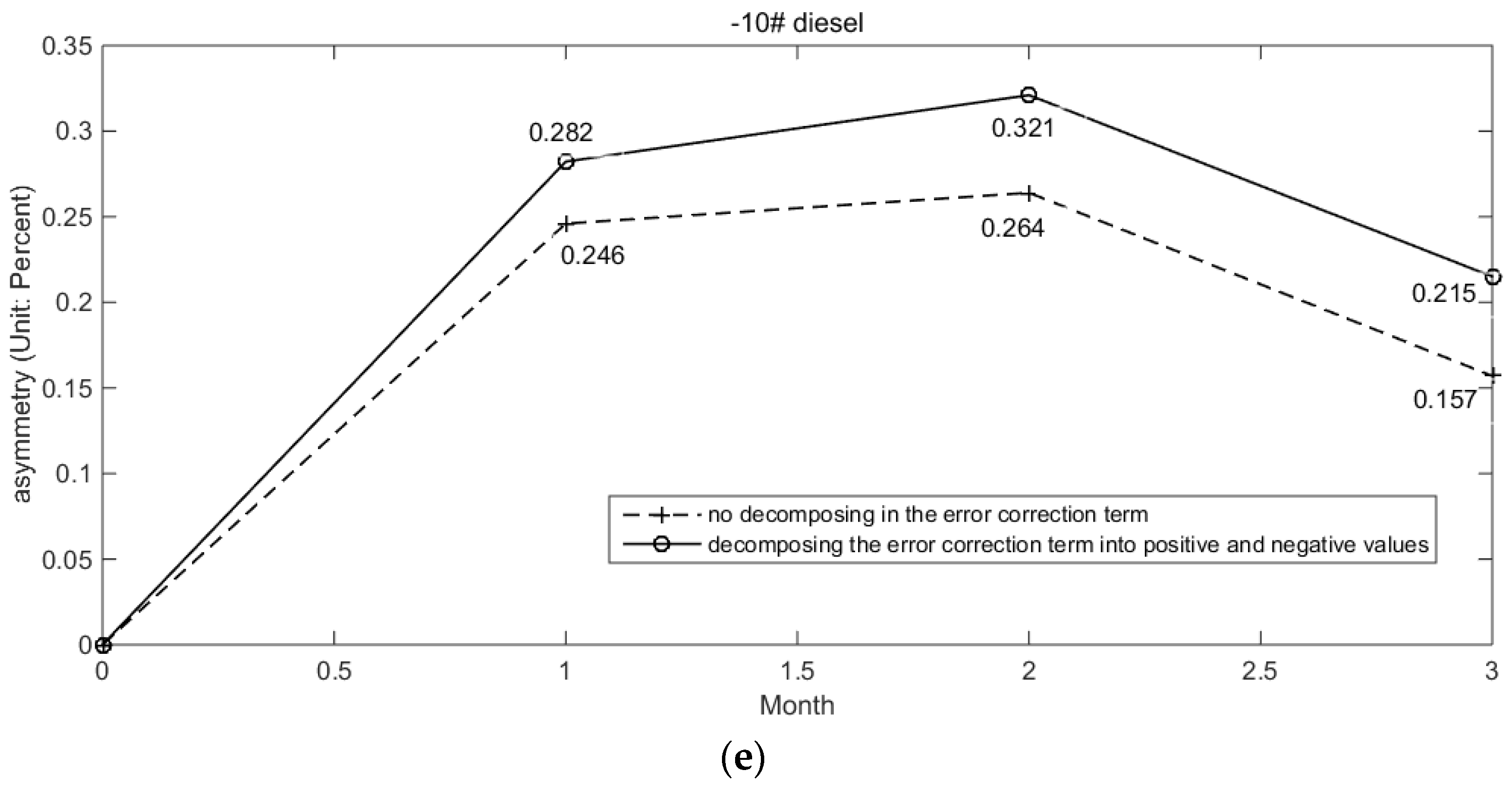

We test for the asymmetry in the response of China’s gasoline and diesel prices to international crude oil prices in two different ways. The first method is decomposing the error-correction term into positive and negative values based on Equation (4), from which we can obtain Equation (5).

Incorporating positive and negative error-correction terms into the basic AECM of Equation (4) does not change the signs of coefficients and has minimal effect on the R

2 or adjusted R

2 of gasoline and diesel prices adjustment equations. The results in

Figure 3 indicate that there still exists an asymmetric transmission in the responses of China’s gasoline and diesel prices to international oil prices. Moreover, the estimated values of asymmetry have increased obviously when decomposing the error-correction term into positive and negative values over three months.

The second method considers maximum retail prices, which were adjusted upwards or downwards 41 times between February 2006 and October 2013. In this paper, we use a monthly average of the maximum retail prices in consideration that, in June and September 2009 and June, July and September 2013, prices were adjusted twice.

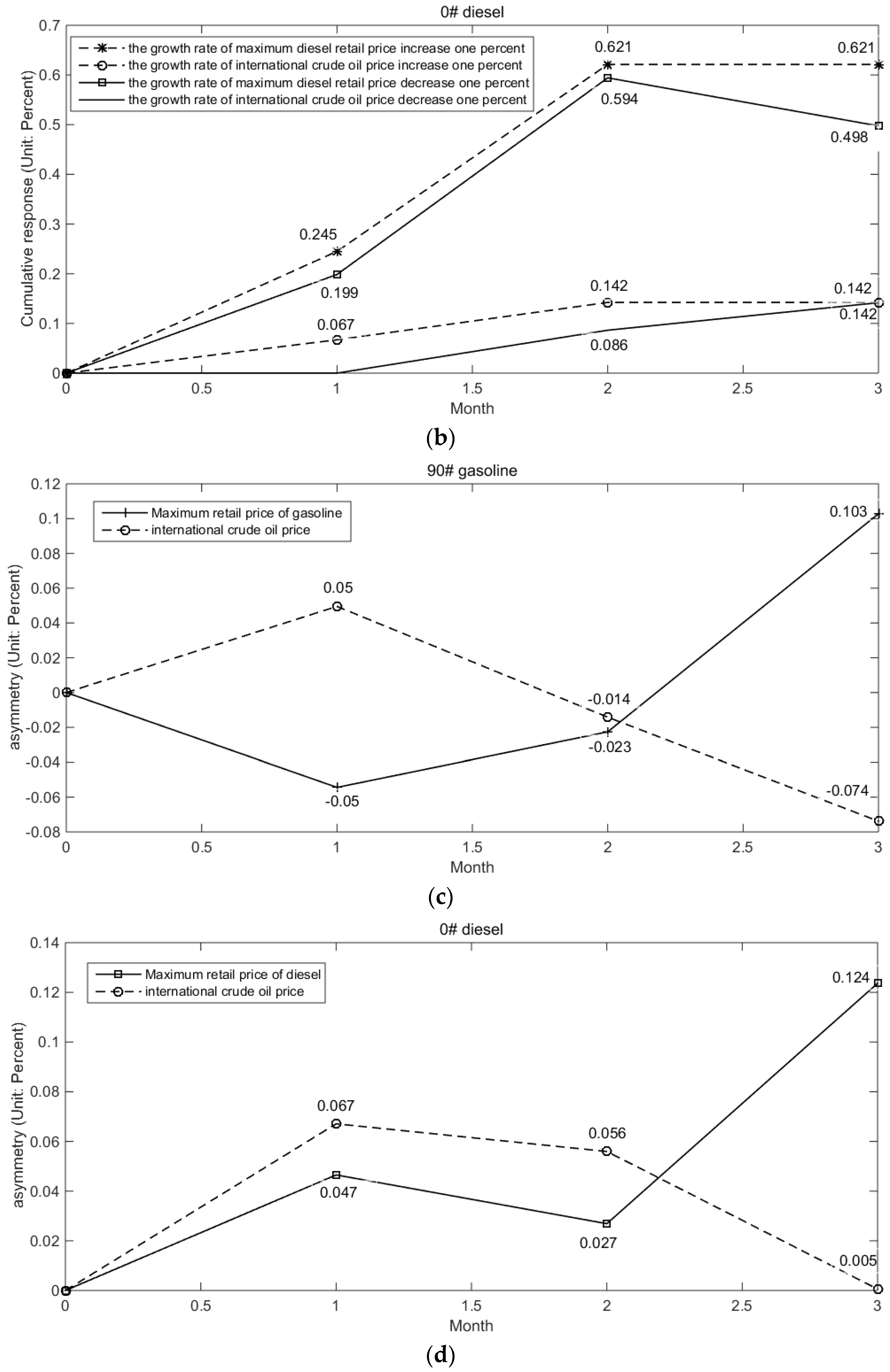

We use the Equations (6) and (7) to estimate the impacts of maximum retail prices and international oil prices on gasoline and diesel wholesale prices. The empirical results in

Figure 4 show the asymmetry and cumulative response of gasoline and diesel prices to changes in the growth rate of maximum retail prices and international oil prices. One percent increase in maximum retail prices of gasoline would cause the growth rate of 90# gasoline price to rise by 0.230 percent in the same month and by 0.634 percent over three months. The impact of increases in the growth rate of maximum retail prices of gasoline over the three month is greater than that for diesel, where the coefficient is 0.621 percent.

One percent increase in the growth rate of international oil prices increases the growth rate of 90# gasoline price by 0.05 percent in the same month and by 0.05 percent over three months, and increases the growth rate of 0# diesel price by 0.067 percent in the same month and by 0.142 percent over three months. Asymmetry which is represented by is significant for both the responses of 90# gasoline and 0# diesel prices to the changes in international oil prices and maximum retail prices.

6. Conclusions and Implications

This paper attempts to investigate the asymmetry in the response of China’s gasoline and diesel prices to international crude oil price changes and find out the reasons for the asymmetry. The main contribution of this paper is that there exists asymmetry in the gasoline and diesel fuel markets and the asymmetry results from both the international crude oil prices and maximum retail prices according to the empirical results. The main conclusions and implications are as follows:

6.1. Conclusions

Using the monthly data on wholesale prices of gasoline and diesel prices in China and international crude oil prices from February 2006 to October 2013, this paper tests the asymmetry in the response of China’s refined oil prices to international crude oil prices by applying an asymmetric error-correction model. We draw a conclusion that, in China, increases and decreases in international oil prices have asymmetric effects on both wholesale prices of gasoline and diesel fuel. In particular, China’s gasoline and diesel prices increase quickly when international crude oil prices rise, but decrease slowly when international crude oil prices decline. The impacts of increases in the growth rate of international crude oil prices are larger but less persistent than those of decreases. What’s more, both increases and decreases in the growth rate of international crude oil prices have a greater effect on China’s diesel prices than on gasoline prices.

If there is a change in the growth rate of maximum retail prices, that is, the benchmark price (a weighted international crude oil price among the European Brent spot price, Asian Dubai Fateh spot price and Indonesian Minas spot price) changes by 4% in 22 days successively, the price transmission between international crude oil and wholesale prices of gasoline and diesel products in China, and maximum retail prices with reference to an international crude oil price benchmark set by the Chinese government are the main reasons for the asymmetric response. This result is the main marginal contribution of this paper.

However, if the benchmark price changes by less than 4% in 22 days successively, that is, there is no change in maximum retail prices, then the transmission of oil prices from international to domestic is the only mechanism generating asymmetry in China’s wholesale prices.

6.2. Implications

On the basis of empirical results, we propose some important policy implications for China. In the current pricing mechanism, China’s gasoline and diesel prices are determined by the international crude oil prices and maximum retail prices. With the consideration that maximum retail prices change only when the benchmark price (a weighted international crude oil price) increases (or decreases) by more than 4% in 22 days successively, in the short run, the first policy implication, therefore, is for the government to shorten the adjustment period of maximum retail prices and to eliminate the change limit of 4% in the benchmark price. Under this circumstance, the maximum retail prices can change frequently as well as the international crude oil prices which are time-varying every day. That is, the frequency of adjustment in China’s gasoline and diesel fuel prices would increase by the comprehensive application of the policy.

It is shown that the maximum retail prices create an asymmetry in the response of China’s gasoline and diesel prices to the changes in international crude oil prices. Therefore, in the long run, the second policy implication is to abolish the maximum retail prices set by the Chinese government. As a consequence of eliminating the maximum retail prices, China’s gasoline and diesel prices would increase (or decrease) instantly when international crude oil prices rise (or decline). This policy is helpful to increase the consumers’ welfare and ease several social conflicts in China.