Financing Sino-Singapore Tianjin Eco-City: What Lessons Can Be Drawn for Other Large-Scale Sustainable City-Projects?

Abstract

:1. Introduction

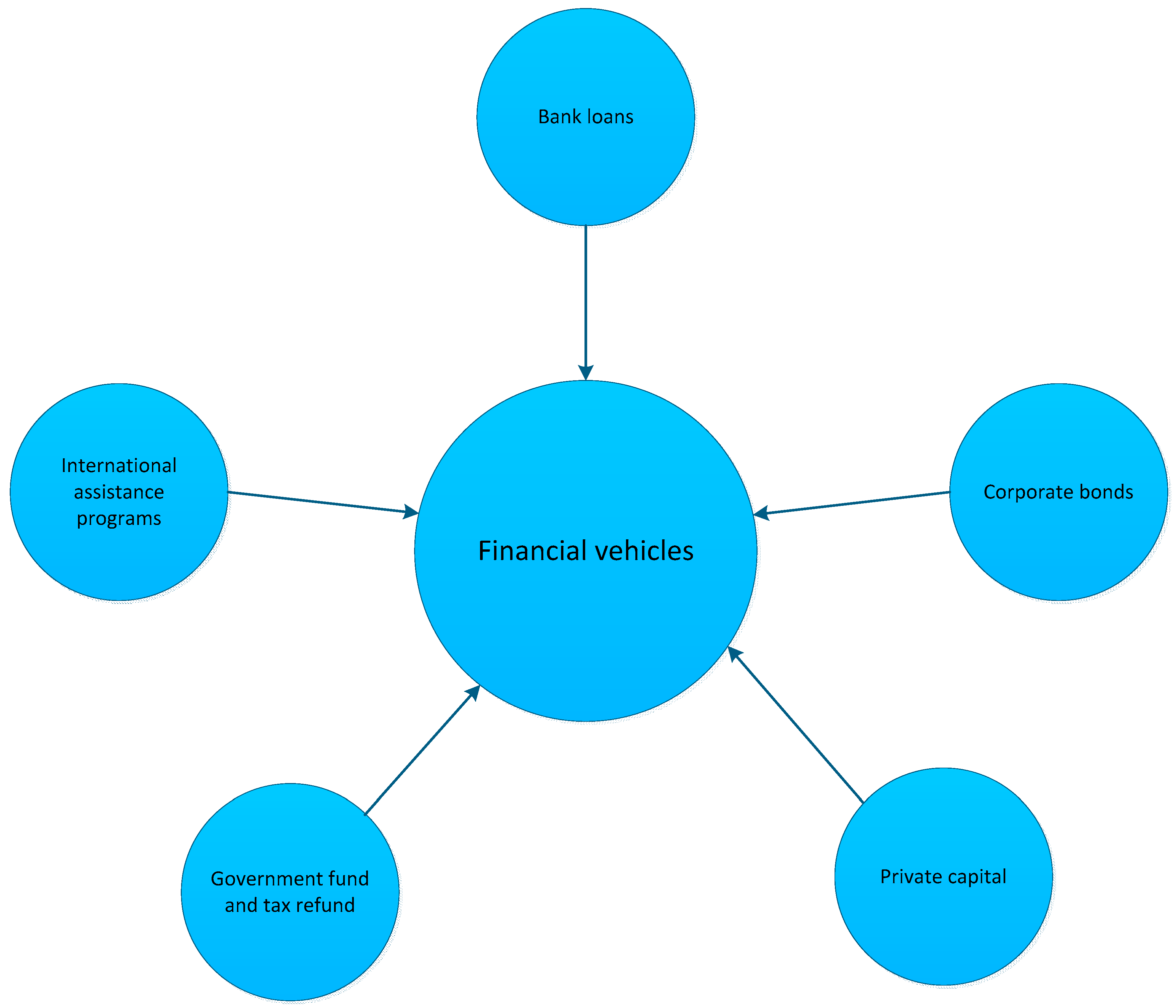

2. Financial Vehicles Used in SSTEC

2.1. Bank Loans

2.2. Corporate Bonds

On 29 October 2015, TEID successfully issued a 3-year bond with a total amount of CNY 1 billion at a coupon rate of 4.65% in Singapore. The ‘Tianjin Eco-city Investment and Development’ bond is of more than symbolic importance. It is the first bond directly issued by a China-based non-financial company in an international market. Besides, the money raised will be used for SSTEC’s construction, which matches the financing activities for eco-city development well. The experience of issuing bonds for the development of sustainable cities in the international market is intended to serve as a model for other eco-cities in China.[45]

2.3. International Assistance Programs

2.4. Government Grants and Tax Refund

2.5. Private Capital

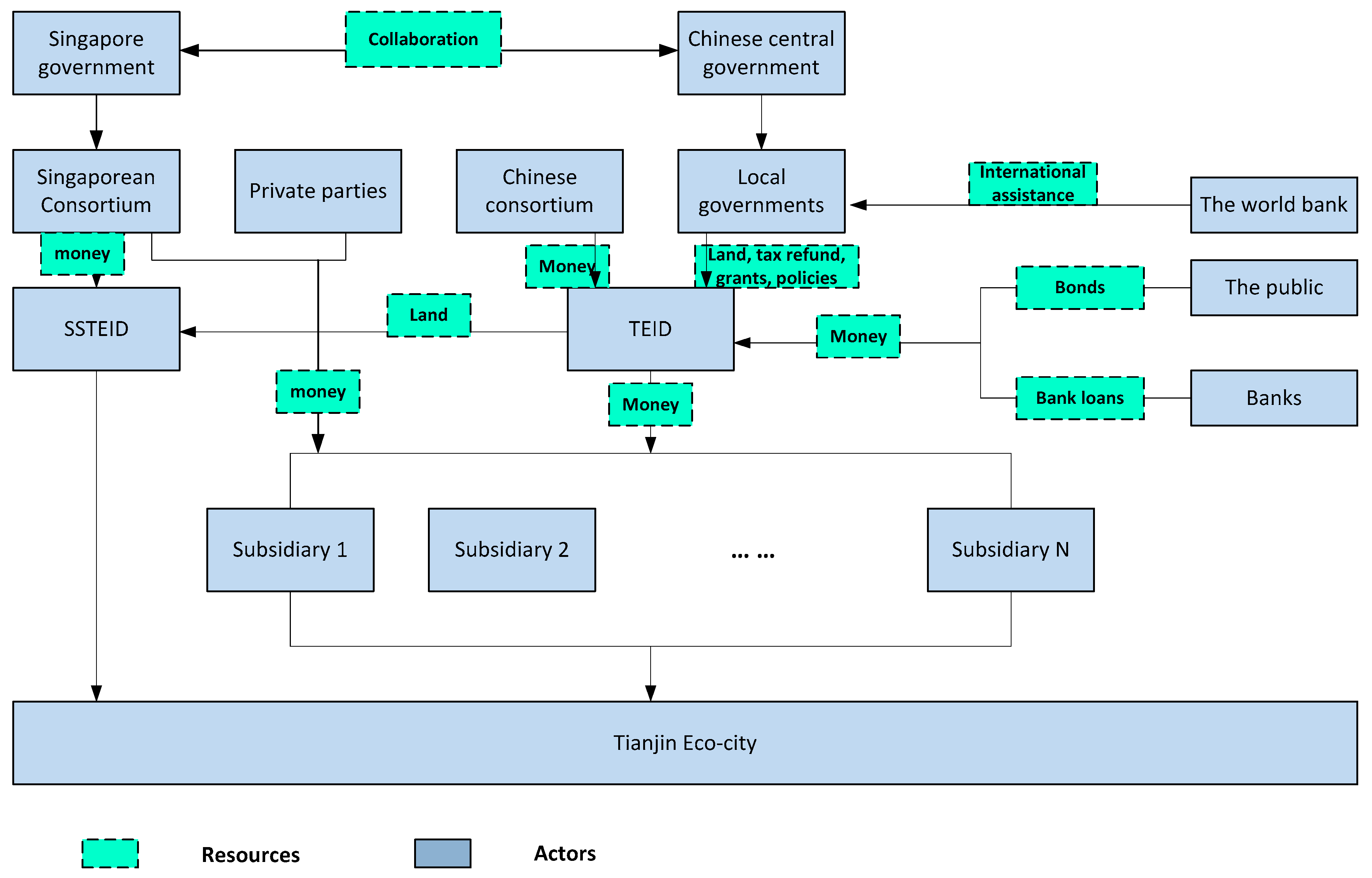

3. Stakeholder Analysis

3.1. Players Involved in SSTEC

3.2. The Role of Involved Actors Playing in Financial Arrangements

4. Lessons Learned from SSTEC

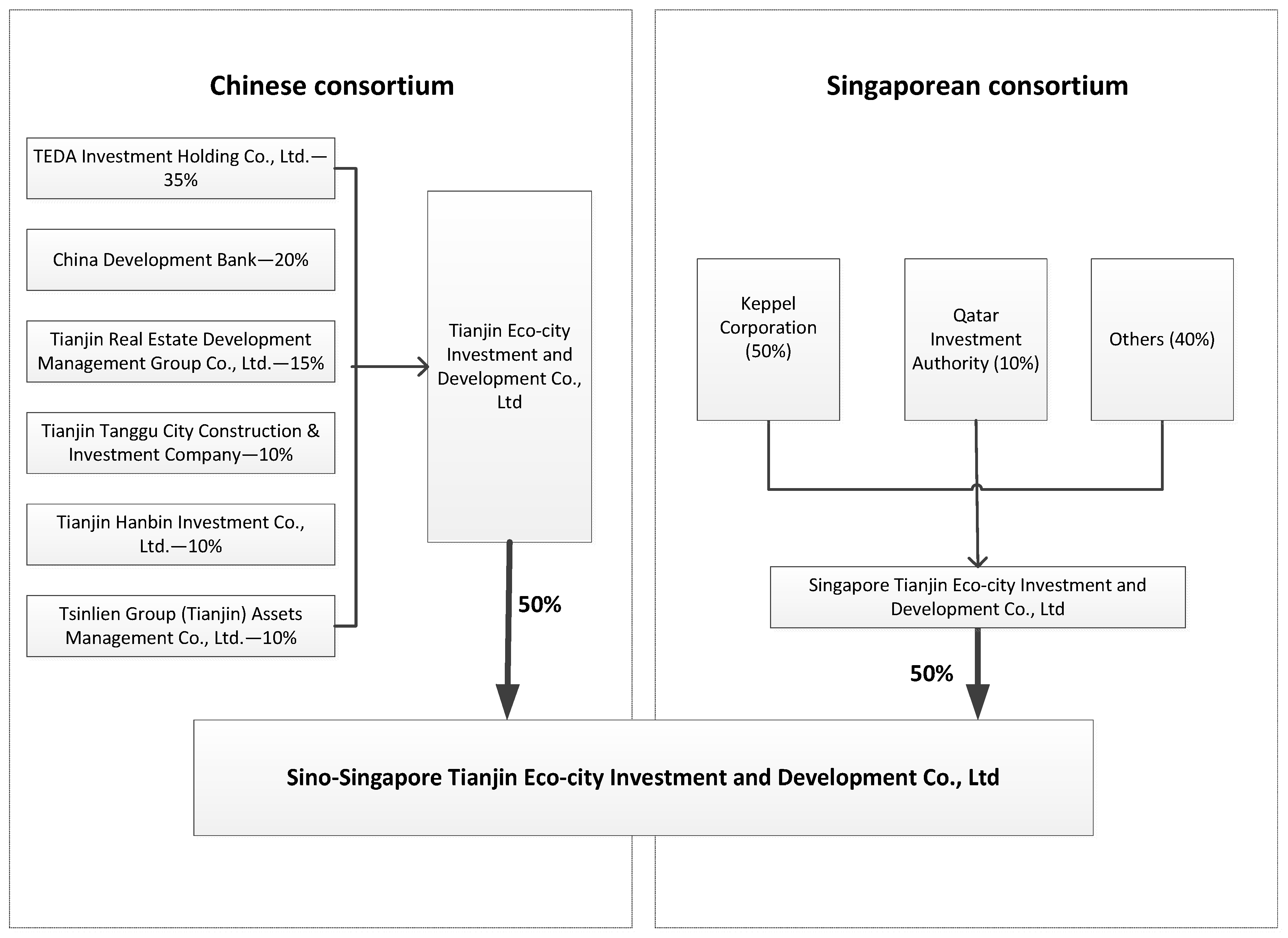

4.1. Diversified Ownership Structure

4.2. Supporting Policies

4.3. Market-Based Operation Mode

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Register, R. EcoCities: Rebuilding Cities in Balance with Nature; New Society Publishers: Gabriola Island, BC, Canada, 2006. [Google Scholar]

- Roseland, M. Dimensions of the Eco-city. Cities 1997, 14, 197–202. [Google Scholar] [CrossRef]

- Perrone, M.F. Financing Instruments for Smart City Projects. Available online: http://tesi.eprints.luiss.it/13129/1/perrone-filippo-maria-tesi-2014.pdf (accessed on 20 July 2016).

- De Jong, M.; Wang, D.; Yu, C. Exploring the Relevance of the Eco-city Concept in China: The Case of Shenzhen Sino-Dutch Low Carbon City. J. Urban Technol. 2013, 20, 95–113. [Google Scholar] [CrossRef]

- De Jong, M.; Yu, C.; Chen, X.; Wang, D.; Weijnen, M. Developing Robust Organizational Frameworks for Sino-foreign Eco-cities: Comparing Sino-Dutch Low Carbon City with Other Initiatives. J. Clean. Prod. 2013, 57, 209–220. [Google Scholar] [CrossRef]

- Low, S.P.; Liu, J.Y.; Wu, P. Sustainable Facilities: Institutional Compliance and the Sino-Singapore Tianjin Eco-city Project. Facilities 2009, 27, 368–386. [Google Scholar]

- United Nations Environment Programme (UNEP). The Sino-Singapore Tianjin Eco-City: A Practical Model for Sustainable Development. 2013. Available online: http://www.unep.org/chinese/south-south-cooperation/case/casefiles.aspx?csno=114 (accessed on 11 August 2015).

- Caprotti, F.; Springer, C.; Harmer, N. ‘Eco’ for Whom? Envisioning Eco-urbanism in the Sino-Singapore Tianjin Eco-city, China. Int. J. Urban Reg. Res. 2015, 3, 495–517. [Google Scholar] [CrossRef]

- Rapoport, E. Utopian Visions and Real Estate Dreams: The Eco-city Past, Present and Future. Geogr. Compass 2014, 8, 137–149. [Google Scholar] [CrossRef]

- Chang, I.-C.C.; Leitner, H.; Sheppard, E. A Green Leap Forward? Eco-State Restructuring and the Tianjin-Binhai Eco-City Model. Reg. Stud. 2016, 50, 929–943. [Google Scholar] [CrossRef]

- De Jong, M.; Yu, C.; Joss, S.; Wennersten, R.; Yu, L.; Zhang, X.; Ma, X. Eco City Development in China: Addressing the Policy Implementation Challenge. J. Clean. Prod. 2016, 134, 31–41. [Google Scholar] [CrossRef]

- Caprotti, F. Critical Research on Rco-cities? A Walk through the Sino-Singapore Tianjin Eco-City, China. Cities 2014, 36, 10–17. [Google Scholar] [CrossRef]

- Lehmann, S. The Principles of Green Urbanism: Transforming the City for Sustainability; Earthscan: London, UK, 2010. [Google Scholar]

- Joss, S.; Molella, A.P. The Eco-city as Urban Technology: Perspectives on Caofeidian International Eco-City (China). J. Urban Technol. 2013, 1, 115–137. [Google Scholar] [CrossRef]

- Geels, F.W. Technological Transitions as Evolutionary Reconfiguration Processes: A Multi-level Perspective and a Case-study. Res. Policy 2002, 31, 1257–1274. [Google Scholar] [CrossRef]

- Cugurullo, F. How to Build a Sandcastle: An Analysis of the Genesis and Development of Masdar City. J. Urban Technol. 2013, 1, 23–37. [Google Scholar] [CrossRef]

- Gunawansa, A. Contractual and Policy Challenges to Developing Ecocities. Sustain. Dev. 2011, 6, 382–390. [Google Scholar] [CrossRef]

- Weiss, L. Tianjin Eco-City China: A Bilateral Institutional NEXUS for Cutting-Edge Sustainable Metropolitan Development. Available online: http://www2.giz.de/wbf/4tDx9kw63gma/05_UrbanNEXUS_CaseStudy_Tianjin.pdf (accessed on 29 October 2015).

- Dale, A.; Naylor, T. Dialogue and Public Space: An Exploration of Radio and Information Communications Technologies. Can. J. Political Sci. 2005, 1, 203–225. [Google Scholar] [CrossRef]

- Sabel, C. A Quiet Revolution of Democratic Governance: Towards Democratic Experimentalism. In Governance in the 21st Century; Organisation for Economic Co-operation and Development: Paris, France, 2001. [Google Scholar]

- Bradford, N. Why Cities Matter: Policy Research Perspectives for Canada; Canadian Policy Research Networks (CPRN) Discussion Paper; Canadian Policy Research Networks: Ottawa, ON, Canada, 2003. [Google Scholar]

- Van Bueren, E.; van Bohemen, H.; Itard, L.; Visscher, H. Sustainable Urban Environments: An Ecosystem Approach; Springer: Dordrecht, The Netherlands, 2012. [Google Scholar]

- Miao, B.; Lang, G. A Tale of Eco-cities: Experimentation under Hierarchy in Shanghai and Tianjin. Urban Policy Res. 2015, 2, 247–263. [Google Scholar] [CrossRef]

- Pow, C.P.; Neo, H. Seeing Red over Green: Contesting Urban Sustainabilities in China. Urban Stud. 2013, 11, 2256–2274. [Google Scholar] [CrossRef]

- Van Berkel, R.; Fujita, T.; Hashimoto, S.; Geng, Y. Industrial and Urban Symbiosis in Japan: Analysis of the Eco-town Program 1997–2006. J. Environ. Manag. 2009, 3, 1544–1556. [Google Scholar] [CrossRef] [PubMed]

- Keeton, R. Rising in the East—Contemporary New Towns in Asia; SUN Architecture: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Altshuler, A.; Luberoff, D. Mega-Projects: The Changing Politics of Urban Public Investment; Brookings Institution Press: Washington, DC, USA, 2003; pp. 45–75. [Google Scholar]

- Corsatea, T.D.; Giaccaria, S.; Arantegui, R.L. The Role of Sources of Finance on the Development of Wind Technology. Renew. Energy 2014, 66, 140–149. [Google Scholar] [CrossRef]

- Olmos, L.; Ruester, S.; Liong, S.J. On the Selection of Financing Instruments to Push the Development of New Technologies: Application to Clean Energy Technologies. Energy Policy 2012, 43, 252–266. [Google Scholar] [CrossRef]

- Luzadis, V.A.; Alkire, C.; Mater, C.M.; Romm, J.; Stewart, W.; Wills, L.; Vaagen, D.R. Investing in Ecosystems and Communities. J. Sustain. For. 2001, 12, 169–194. [Google Scholar] [CrossRef]

- Van Dijk, M.P.; Etajak, S.; Mwalwega, B.; Ssempebwa, J. Financing Sanitation and Cost Recovery in the Slums of Dar es Salaam and Kampala. Habitat Int. 2014, 43, 206–213. [Google Scholar] [CrossRef]

- Caplan, E. What Drives New Generation Construction? An Analysis of the Financial Arrangements behind New Electric Generation Projects in 2011. Electr. J. 2012, 25, 48–61. [Google Scholar] [CrossRef]

- Koppenjan, J.; Leijten, M.; ten Heuvelhof, E.; Veeneman, W.; van der Voort, H. Dealing with Competing Project Management Values under Uncertainty: The Case of RandstadRail. Eur. J. Transp. Infrastruct. Res. 2010, 10, 63–76. [Google Scholar]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Megaprojects and Risk, An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Hult, A. The Circulation of Swedish Urban Sustainability Practices: To China and back. Environ. Plan. A 2015, 47, 537–553. [Google Scholar] [CrossRef]

- Baeumler, A.; Mehndiratta, S. Financing a Low-Carbon City: Introduction. In Sustainable Low-Carbon City Development in China; Baeumler, A., Ijjasz-Vasquez, E., Mehndiratta, S., Eds.; World Bank: Washington DC, USA, 2012; p. 467. [Google Scholar]

- Zhan, C.; de Jong, M.; de Bruijn, H. Path Dependence in Financing Urban Infrastructure Development in China: 1949–2016. J. Urban Technol. 2017. forthcoming. [Google Scholar]

- Novick, D.A. Life-Cycle Considerations in Urban Infrastructure Engineering. J. Manag. Eng. 1990, 6, 186. [Google Scholar] [CrossRef]

- Rahim, F.A.; Muzaffar, S.A.; Yusoff, N.S.M.; Zainon, N.; Wang, C. Sustainable Construction through Life Cycle Costing. J. Build. Perform. 2014, 5, 84–94. [Google Scholar]

- The World Bank. Sino-Singapore Tianjin Eco-City: A Case Study of an Emerging Eco-City in China; World Bank: Washington DC, USA, 2009. [Google Scholar]

- DAC & Cities. Tianjin: A Model Eco-City in the Eastern World. Available online: http://www.dac.dk/en/dac-cities/sustainable-cities/all-cases/master-plan/tianjin-a-model-eco-city-in-the-eastern-world/ (accessed on 18 December 2015).

- TEID. Annual Report of Tianjin Eco-City Investment and Development Co. Ltd. (2013). 2014. Available online: http://www.sse.com.cn/disclosure/bond/corporate/annualreport/enterprisebulletin/c/2014-04-21/122569_20140422_1.pdf (accessed on 18 October 2015).

- TEID. Auditing Report of Tianjin Eco-City Investment and Development Co. Ltd. (2014). 2015. Available online: http://www.sse.com.cn/disclosure/bond/corporate/annualreport/enterprisebulletin/c/2015-04-20/122569_20150420_1.pdf (accessed on 18 October 2015).

- TEID. Auditing Report of Tianjin Eco-city Investment and Development Co. Ltd. (2015). 2016. Available online: http://www.google.nl/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0ahUKEwjhn9SZ2ZvNAhWKuBoKHR2PDP4QFggeMAA&url=http%3A%2F%2Fwww.cninfo.com.cn%2Ffinalpage%2F2016-04-26%2F1202256431.PDF&usg=AFQjCNFM6BfrQxHoQET5xdbEdM9hV0xYtg&sig2=mv4esglv_bnS6i0bPU_qXw (accessed on 4 May 2016).

- Financial staff 2 (TEID, Tianjin, China). Interview, 23 February 2016.

- TEID. TEID Successfully Issued CNY 600 Million Short-Term Financing Bonds. 2016. Available online: http://www.tjeco-city.com/cn/news_1.asp?<=&action=RecordDetail&kind=200803181530560000C0A801B07993&id=2016020209252800003C1E1C492754 (accessed on 11 May 2016).

- TEID. TEID Successfully Issued CNY 400 Million Medium-Term Notes. 2016. Available online: http://www.tjeco-city.com/cn/news_1.asp?<=&action=RecordDetail&kind=200803181530560000C0A801B07993&id=2016031709121000003C1E1C496010 (accessed on 11 May 2016).

- The World Bank. Global Environment Facility Grant Agreement. Available online: http://documents.worldbank.org/curated/en/921331468028859374/GEF-Grant-Agreement-TF097018-Conformed (accessed on 10 September 2015).

- Tianjin Municipal People’s Government. Regulations for Administration of The Sino-Singapore Tianjin Eco-City. 2008. Available online: http://www.tj.gov.cn/zwgk/wjgz/szfl/200809/t20080927_72776.htm (accessed on 20 October 2015). [Google Scholar]

- Financial staff 1 (TEID, Tianjin, China). Interview, 21 July 2015.

- Civil servant (SSTECAC, Tianjin, China). Interview, 15 May 2015.

- IESingapore. Overview of the Sino-Singapore Tianjin Eco-City Project. Available online: http://www.iesingapore.gov.sg/Content-Store/Industrial-Parks-and-Projects/Overview-of-the-Sino-Singapore-Tianjin-Eco-City-project (accessed on 20 December 2015).

- TEID. Listed Announcement of Tianjin Eco-city Investment and Development Co. Ltd. for Corporate Bonds (2012). 2012. Available online: http://www.sse.com.cn/disclosure/bond/c/2012-09-24/122569_20120924_1.pdf (accessed o 18 October 2015).

- SSTEID. About Sino-Singapore Tianjin Eco-City Investment & Development Co., Ltd. Available online: http://stc.dashilan.cn/en/SinglePage.aspx?column_id=10304 (accessed on 20 October 2015).

- Ba, S.; Yang, X. The New Urbanization Financing and Financial Reform; China Workers Press: Beijing, China, 2014. [Google Scholar]

| Consolidated Balance Sheet | 31 December 2015 | 31 December 2014 | 31 December 2013 |

| Inventory | 7541.11 | 8338.98 | 7868.58 |

| Original value of fixed assets | 2370.34 | 2095.07 | 1621.42 |

| Total assets | 17,881.17 | 17,251.06 | 16,803.63 |

| Short-term loan | 468 | 459.28 | 313.5 |

| Non-current liabilities due within one year | 1461.03 | 1025.67 | 1773.82 |

| Long-term loan | 5169.44 | 6403.57 | 5552.98 |

| Bonds payable | 1938.38 | 1186.90 | 1182.35 |

| Consolidated Income Statement | 2015 | 2014 | 2013 |

| Government grants | 61.54 | 119.17 | 119.01 |

| Profit after tax | 46.99 | 45.57 | 39.69 |

| Consolidated Cash Flow Statement | 2015 | 2014 | 2013 |

| Cash received from bank loans | 2615.50 | 2799.17 | 3596.85 |

| Cash received from issuing bonds | - | - | - |

| Items | Pros | Cons |

|---|---|---|

| Bank loans | Flexible, with many options in loan terms and loan types | High costs, complicated procedures, and limited credit amounts |

| Corporate bonds | Lower costs; possibility to raise large amounts of money and mobilize social resources | High financial risks; strict restriction terms |

| Private capital | Flexible; financing responsibility transferred to the private sector, which relieves the financial burden on governments. | Difficulty to find successor if public–private partnership breaks down; higher living costs for inhabitants |

| Government funds and tax refund | No need to repay | Heavy dependence on government policies |

| International assistance programs | No need to repay | Aimed at particular projects and not available for all projects. |

| Stakeholder | Key Interests | Importance to the Eco-City | Influence on the Eco-City Construction | Role |

|---|---|---|---|---|

| A. Primary direct | ||||

| Local government |

| High. Will provide overall leadership and local business support | High. Will have influence on all aspects of local policy | Responsible for all functions and under close scrutiny of the central government |

| Sino-Singapore Tianjin Eco-City Administrative Committee |

| High. Will make guidelines and administrate the construction of SSTEC | High. Will have influence on all aspects of local policy | Responsible for all functions and under close scrutiny of both central and local government |

| Tianjin Eco-City Investment and Development company and subsidiaries |

| High. Will integrate lessons learned across all projects and carry out construction | High. Will have influence on input into each sub-project, including finance and physical development | Master developer and implementer, responsible for developing real estate and public facilities |

| Sino-Singapore Tianjin Eco-City Investment and Development Company |

| High. Will introduce advanced know-how from Singapore and help design | High. Will have influence on design | Engaged in long-term investment, design, development and promotion of sustainable lifestyles |

| B. Primary indirect | ||||

| Chinese central government |

| High. Will provide overall leadership and political support | High. Will have influence on all policy aspects | Responsible for overseeing project progress |

| Singaporean central government |

| High. Will provide overall leadership and political support | High. Will have influence on policies where Singaporean players are concerned | Responsible for overseeing project progress |

| C. Secondary | ||||

| Banks |

| High. Will provide financial support | Low. Cannot intervene | Creditors |

| Private companies (including Singaporean) involved in eco-city construction |

| High. Will provide financial and technical support | Low. Cannot intervene | Investors and consultants |

| Other companies in the eco-city |

| Low. Key component in eco-city after completion | Low. Not involved in construction | Beneficiaries of successful construction |

| Public in China and Singapore |

| High. Will provide financial support | Low. Not involved in construction | Buying bonds issued by SSTEC |

| Local residents |

| Low. Key component in eco-city after completion | High. Not involved in construction | Beneficiaries of successful construction |

| Subsidiary | Sector | Registration Capital (CNY 10 Thousand) | Shareholding Ratio (%) | Role |

|---|---|---|---|---|

| Tianjin Eco-city Energy Investment and Construction Co., Ltd. (EID) | Engineering design | 23,529.42 | TEID 51

Others: 49 | Responsible for construction, development, and utilization of renewable energy; design, construction, management, operation, maintenance and consulting of the public energy facilities in Tianjin eco-city, including heating, water supply, and gas. |

| Tianjin Eco-city Municipal Engineering and Landscape Architecture Co., Ltd. (MELA) | Engineering | 10,000.00 | TEID: 65

Others: 35 | Responsible for construction and management of municipal engineering |

| Tianjin Eco-city Construction and Investment Co., Ltd. (CI) | Real estate development | 30,000.00 | TEID: 90

Others: 10 | Responsible for investment, construction, and maintenance of public facilities Tianjin Eco-city |

| Tianjin Eco-city Industrial Park Operation and Management Co., Ltd. (IPOM) | Real estate development | 27,500.00 | TEID: 100 | Responsible for development and management of real estate |

| Tianjin Eco-city Public House Construction Co., Ltd. (PHC) | Real estate development | 31,950.93 | TEID: 100 | Responsible for investment, construction, and maintenance of public housing in Tianjin Eco-city |

| Tianjin Eco-city Urban Resources Operation Co., Ltd. (URO) | Advertisement and consultant | 1000.00 | TEID: 100 | Responsible for outdoor advertisements, municipal facilities and the naming of commercial facilities |

| Tianjin Eco-city Water Investment and Construction Co., Ltd. (WIC) | Hydraulic engineering | 10,000.00 | TEID: 60

Others: 40 | Responsible for water treatment; wholesale, retail, import and export of water treatment equipment as well as operation and management of water management facilities |

| Tianjin Eco-city Information Park Investment and Development Co., Ltd. (IPID) | Information development | 26,483.00 | TEID: 61.15

Others: 38.85 | Responsible for development, operation, transfer and consultancy of information technology; development of real estate; lease and management of self-owned housing and property services |

| Tianjin Eco-city Green Transportation Co., Ltd. (GT) | Transport operation | 10,000 | TEID: 85

Others: 15 | Operation and management of public transport and school buses; construction, operation and maintenance of railway as well as technical consulting, technical service and technical collaboration in the field of railway and new energy automobiles |

| Tianjin Eco-city Environmental Technology Consulting Co., Ltd. (ETC) | Technical advisory | 1086 | TEID: 70

Others: 30 | Responsible for environmental impact assessment of construction projects and planning, environmental-social and health impact assessment |

| Tianjin Eco-city Environmental Protection Co., Ltd. (EP) | Garbage disposal | 10,000 | TEID: 80

Others: 20 | Responsible for the treatment of environmental contamination, ecological restoration and conservation, and investment, construction, operation and maintenance of water and other systems related to environmental hygiene |

| Fields | Methods | |

|---|---|---|

| Non-operational public utilities and infrastructure | Environmental protection, roads, bridges, cleaning, municipal administration, green maintenance, etc. | Local governments sign contracts with TEID and buy public services from it, while TEID provides products and services for local governments. |

| Operational and quasi-operational projects | Energy utilization, environmental governance, public utilities, outdoor advertisement, network construction, land consolidation, etc. | These will realize through signing concession agreement between local governments and TEID. |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhan, C.; De Jong, M. Financing Sino-Singapore Tianjin Eco-City: What Lessons Can Be Drawn for Other Large-Scale Sustainable City-Projects? Sustainability 2017, 9, 201. https://doi.org/10.3390/su9020201

Zhan C, De Jong M. Financing Sino-Singapore Tianjin Eco-City: What Lessons Can Be Drawn for Other Large-Scale Sustainable City-Projects? Sustainability. 2017; 9(2):201. https://doi.org/10.3390/su9020201

Chicago/Turabian StyleZhan, Changjie, and Martin De Jong. 2017. "Financing Sino-Singapore Tianjin Eco-City: What Lessons Can Be Drawn for Other Large-Scale Sustainable City-Projects?" Sustainability 9, no. 2: 201. https://doi.org/10.3390/su9020201