Effects of Soft Loans and Credit Guarantees on Performance of Supported Firms: Evidence from the Czech Public Programme START

Abstract

:1. Introduction

1.1. Background

1.2. Review of Empirical Studies

1.3. Public Programme START

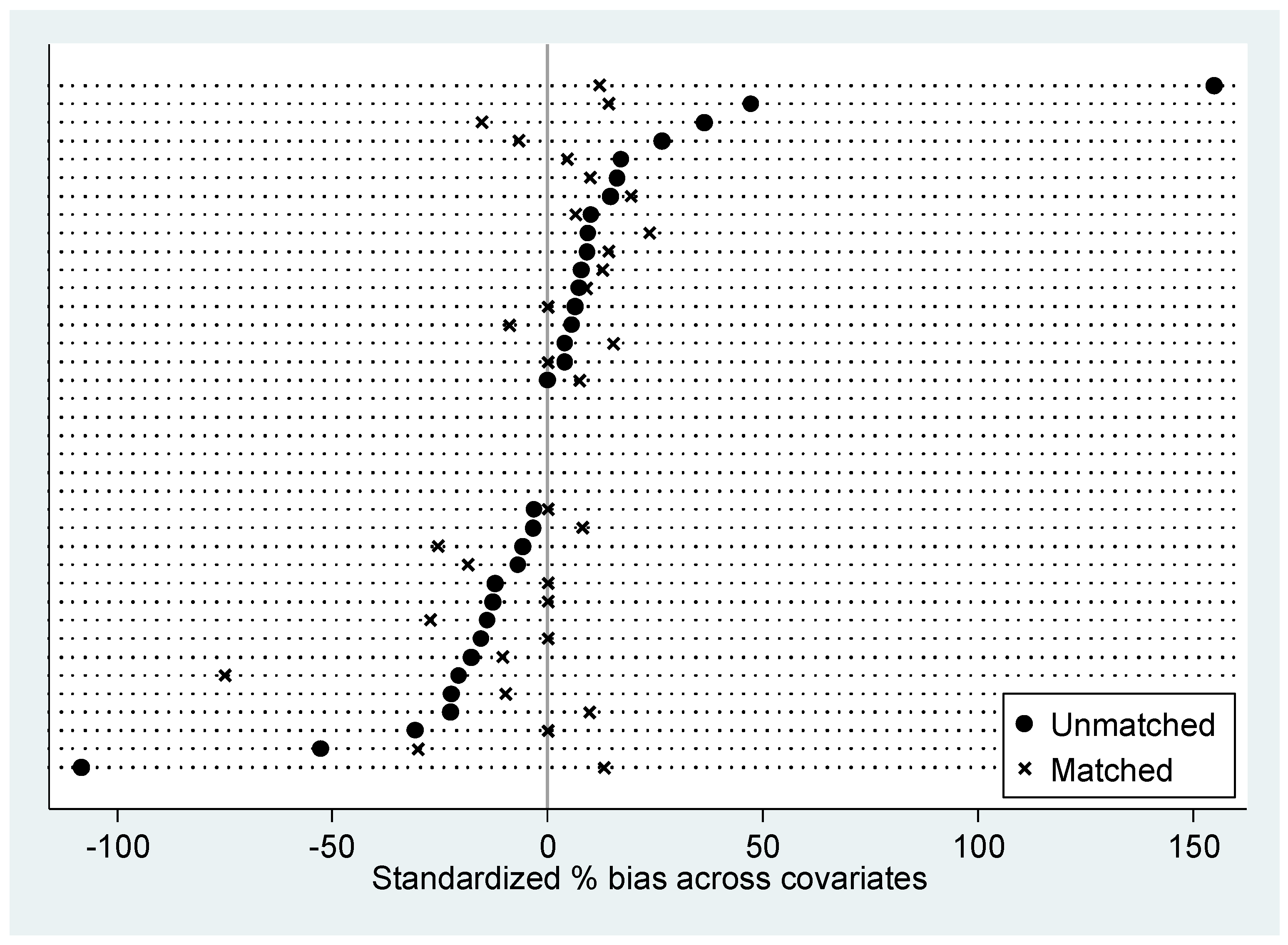

2. Materials and Methods

3. Results

4. Discussion

5. Conclusions

Acknowledgments

Conflicts of Interest

Appendix A

| Sector | Frequency (%) |

|---|---|

| Administrative and Support Service Activities | 1.14 |

| Transportation and Storage | 1.70 |

| Information and Communication | 2.70 |

| Arts, Entertainment and Recreation | 0.00 |

| Other Service Activities | 10.23 |

| Financial and Insurance Activities | 1.14 |

| Professional, Scientific and Technical Activities | 6.25 |

| Construction | 10.23 |

| Mining and Quarrying | 0.00 |

| Accommodation and Food Service Activities | 5.68 |

| Wholesale and Retail Trade, Repair of Motor Vehicles | 19.32 |

| Public Administration and Defence | 0.00 |

| Education | 0.57 |

| Electricity, Gas, Steam and Air Conditioning Supply | 7.39 |

| Human Health and Social Work Activities | 5.68 |

| Agriculture, Forestry and Fishing | 3.41 |

| Manufacturing | 21.02 |

| Water Supply, Sewerage, Waste management | 1.70 |

| Real Estate Activities | 2.27 |

References

- Grimm, M.; Paffhausen, A.L. Do interventions targeted at micro-entrepreneurs and small and medium-sized firms create jobs? A systematic review of the evidence for low and middle income countries. Labour Econ. 2015, 32, 67–85. [Google Scholar] [CrossRef] [Green Version]

- Dvouletý, O. Can Policy Makers Count with Positive Impact of Entrepreneurship on Economic Development of the Czech Regions? J. Entrepreneurship Emerg. Econ. 2017, 9, 286–299. [Google Scholar] [CrossRef]

- Dvouletý, O. Determinants of Nordic Entrepreneurship. J. Small Bus. Enterp. Dev. 2017, 24, 12–33. [Google Scholar] [CrossRef]

- Van Stel, A.; Storey, D. The link between firm births and job creation: Is there a Upas tree effect? Reg. Stud. 2004, 38, 893–909. [Google Scholar] [CrossRef]

- Shane, S.A. (Ed.) Economic Development through Entrepreneurship: Government, University and Business Linkages; Edward Elgar Publishing: Cheltenham, UK, 2007. [Google Scholar]

- Craig, B.R.; Jackson, W.E.; Thomson, J.B. Small Firm Finance, Credit Rationing, and the Impact of SBA-Guaranteed Lending on Local Economic Growth. J. Small Bus. Manag. 2007, 45, 116–132. [Google Scholar] [CrossRef]

- Van Praag, C.M.; Versloot, P.H. What is the value of entrepreneurship? A review of recent research. Small Bus. Econ. 2007, 29, 351–382. [Google Scholar] [CrossRef]

- Boesenkopf, F.A. Entrepreneurial Ecosystem: How to Improve Your Local Ecosystem with Political Initiatives. In Handbook of Cyber-Development, Cyber-Democracy, and Cyber-Defense; Springer: Cham, Switzerland, 2017; pp. 1–24. [Google Scholar]

- Pergelova, A.; Angulo-Ruiz, F. The impact of government financial support on the performance of new firms: The role of competitive advantage as an intermediate outcome. Entrepreneurship Reg. Dev. 2014, 26, 663–705. [Google Scholar] [CrossRef]

- Millán, J.M.; Congregado, E.; Román, C. Persistence in entrepreneurship and its implications for the European entrepreneurial promotion policy. J. Policy Model. 2014, 36, 83–106. [Google Scholar] [CrossRef]

- Lukeš, M. Entrepreneurs as Innovators: A Multi-Country Study on Entrepreneurs’ Innovative Behaviour. Prague Econ. Pap. 2013, 22, 72–84. [Google Scholar] [CrossRef]

- Thurik, A.R. Entreprenomics: Entrepreneurship, economic growth and policy. In Entrepreneurship, Growth and Public Policy; Cambridge University Press: Cambridge, UK, 2009; pp. 219–249. [Google Scholar]

- Stevenson, L.; Lundström, A. Patterns and Trends in Entrepreneurship/SME Policy and Practice in Ten Economies; Swedish Foundation for Small Business Research: Stockholm, Sweden, 2001. [Google Scholar]

- Román, C.; Millán, A.; Millán, J.M.; van Stel, A. Does the effectiveness of employment incentive programs vary by firm size? J. Econ. Issues 2017, 51, 222–237. [Google Scholar] [CrossRef]

- Lee, S.H.; Lim, E.S.; Hwang, J. Do credit guarantees for small and medium enterprises mitigate the business cycle? Evidence from Korea. Empir. Econ. 2017, 52, 1367–1378. [Google Scholar] [CrossRef]

- Dvouletý, O.; Lukeš, M. Review of Empirical Studies on Self-Employment out of Unemployment: Do Self-Employment Policies Make a Positive Impact? Int. Rev. Entrepreneurship 2016, 14, 361–376. [Google Scholar]

- Bosma, N.S.; Stam, F.C.; Terjesen, S.A. Advancing Public Policy for High-Growth, Female, and Social Entrepreneurs. Public Admin. Rev. 2016, 76, 230–239. [Google Scholar]

- Foreman-Peck, J. Effectiveness and efficiency of SME innovation policy. Small Bus. Econ. 2013, 41, 55–70. [Google Scholar] [CrossRef]

- Kim, Y.; Oh, I.; Lee, J.D. Economic Impact Assessment of Public–Private Matching Fund Programs Using Firm-Level Data. Singap. Econ. Rev. 2015, 60, 1550060. [Google Scholar] [CrossRef]

- Biagi, F.; Bondonio, D.; Martini, A. Counterfactual Impact Evaluation of Enterprise Support Programmes; Evidence from a Decade of Subsidies to Italian Firm; European Regional Science Association: Louvain-la-Neuve, Belgium, 2015. [Google Scholar]

- Antonioli, D.; Marzucchi, A.; Montresor, S. Regional innovation policy and innovative behaviour: Looking for additional effects. Eur. Plan. Stud. 2014, 22, 64–83. [Google Scholar] [CrossRef]

- Sternberg, R. Success factors of university-spin-offs: Regional government support programs versus regional environment. Technovation 2014, 34, 137–148. [Google Scholar] [CrossRef]

- Åstebro, T. The private financial gains to entrepreneurship: Is it a good use of public money to encourage individuals to become entrepreneurs? Small Bus. Econ. 2017, 48, 323–329. [Google Scholar] [CrossRef]

- Mason, C.; Brown, R. Creating good public policy to support high-growth firms. Small Bus. Econ. 2013, 40, 211–225. [Google Scholar] [CrossRef]

- Acs, Z.; Åstebro, T.; Audretsch, D.; Robinson, D.T. Public policy to promote entrepreneurship: A call to arms. Small Bus. Econ. 2016, 47, 35–51. [Google Scholar] [CrossRef] [Green Version]

- Cho, Y.; Honorati, M. Entrepreneurship programs around the developing world: A meta analysis. Labour Econ. 2014, 28, 110–130. [Google Scholar] [CrossRef]

- Nyikos, G. The Role of Financial Instruments in Improving Access to Finance. Eur. Struct. Invest. Funds J. 2015, 3, 105–121. [Google Scholar]

- Michie, R.; Wishlade, F. Between Scylla and Charybdis: Navigating Financial Engineering Instruments through Structural Fund and State Aid Requirements; IQ-Net Thematic Paper; University of Strathclyde: Glasgow, UK, 2012. [Google Scholar]

- Ughetto, E.; Scellato, G.; Cowling, M. Cost of capital and public loan guarantees to small firms. Small Bus. Econ. 2017, 49, 319–337. [Google Scholar] [CrossRef]

- Gaia, L.; Ielasi, F.; Rossolini, M. SMEs, public credit guarantees and mutual guarantee institutions. J. Small Bus. Enterp. Dev. 2016, 23, 1208–1228. [Google Scholar] [CrossRef]

- Buckland, R.; Davis, E.W. Finance for Growing Enterprises; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Gozzi, J.C.; Schmukler, S. Public Credit Guarantees and Access to Finance. Eur. Econ. 2015, 27, 101–117. [Google Scholar]

- Tucker, J.; Lean, J. Small firm finance and public policy. J. Small Bus. Enterp. Dev. 2003, 10, 50–61. [Google Scholar] [CrossRef]

- Denis, D.J. Entrepreneurial finance: An overview of the issues and evidence. J. Corpor. Financ. 2004, 10, 301–326. [Google Scholar] [CrossRef]

- Cowling, M.; Ughetto, E.; Lee, N. The innovation debt penalty: Cost of debt, loan default, and the effects of a public loan guarantee on high-tech firms. Technol. Forecast. Soc. Chang. 2017, in press. [Google Scholar] [CrossRef]

- Cumming, D.J.; Grilli, L.; Murtinu, S. Governmental and independent venture capital investments in Europe: A firm-level performance analysis. J. Corpor. Financ. 2017, 42, 439–459. [Google Scholar] [CrossRef]

- Rahman, A.; Belas, J.; Kliestik, T.; Tyll, L. Collateral requirements for SME loans: Empirical evidence from the Visegrad countries. J. Bus. Econ. Manag. 2017, 18, 650–675. [Google Scholar] [CrossRef]

- Bondonio, D. Impact Identification Strategies for Evaluating Business Incentive Programs; POLIS Working Paper; POLIS: Jerusalem, Israel, 2009; Volume 129. [Google Scholar]

- Arping, S.; Lóránth, G.; Morrison, A.D. Public initiatives to support entrepreneurs: Credit guarantees versus co-funding. J. Financ. Stab. 2010, 6, 26–35. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Rai, A.; Klonner, S. Adverse Selection in Credit Markets: Evidence from a Policy Experiment; No. 2007-01; Department of Economics, Williams College: Williamstown, MA, USA, 2007. [Google Scholar]

- Parker, S.C.; Van Praag, C.M. Schooling, capital constraints, and entrepreneurial performance: The endogenous triangle. J. Bus. Econ. Stat. 2006, 24, 416–431. [Google Scholar] [CrossRef]

- Janda, K. Agency theory approach to the contracting between lender and borrower. Acta Oecon. Prag. 2006, 14, 32–45. [Google Scholar]

- Janda, K. The comparison of credit subsidies and guarantees in transition and post-transition economies. Ekonomický Časopis 2005, 53, 383–398. [Google Scholar]

- Chatzouz, M.; Gereben, Á.; Lang, F.; Torfs, W. Credit Guarantee Schemes for SME Lending in Western Europe; No. 2017/02; EIB Working Papers; EIB: Luxembourg, 2017. [Google Scholar]

- Wishlade, F.; Michie, R.; Familiari, G.; Schneiderwind, P.; Resch, A. Ex-Post Evaluation of Cohesion Policy Programs 2007-13, Focusing on the European Regional Development Fund (ERDF) and Cohesion Fund (CF): Work Package 3: Financial Instruments for Enterprise Support; Publications Office of the European Union: Luxembourg, 2016. [Google Scholar]

- Asdrubali, P.; Signore, S. The Economic Impact of EU Guarantees on Credit to SMEs Evidence from CESEE Countries; No. 002; Directorate General Economic and Financial Affairs (DG ECFIN), European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Garcia-Tabuenca, A.; Crespo-Espert, J.L. Credit guarantees and SME efficiency. Small Bus. Econ. 2010, 35, 113–128. [Google Scholar] [CrossRef]

- Sauka, A.; Chepurenko, A. Entrepreneurship in Transition Economies: Diversity, Trends, and Perspectives; Springer: Berlin, Germany, 2017. [Google Scholar]

- Polok, D.; Michalski, P.; Szewczyk, D.; Keil, D.; Wieczore, S.; Kaciakova, P.; Incze, Z.; Rycerz, J.; Nisztuk, T.; Dvouletý, O.; et al. Future of the Visegrad Group. 2016. Available online: http://paga.org.pl/projekty/raport-future-of-the-visegrad-group/future-of-the-visegrad-group/report?lang=en (accessed on 17 October 2016).

- Dvouletý, O. Relationship between Unemployment and Entrepreneurship Dynamics in the Czech Regions: A Panel VAR Approach. Acta Univ. Agric. Silvic. Mendel. Brun. 2017, 65, 987–995. [Google Scholar] [CrossRef]

- Dvoulety, O. What is the Relationship between Entrepreneurship and Unemployment in Visegrad Countries? Cent. Eur. Bus. Rev. 2017, 6, 42–53. [Google Scholar] [CrossRef]

- Dvouletý, O.; Mareš, J. Determinants of regional entrepreneurial activity in the Czech Republic. Econ. Stud. Anal./Acta VSFS 2016, 10, 31–46. [Google Scholar]

- Dvouletý, O.; Mareš, J. Relationship between unemployment and entrepreneurial activity: Evidence found among Visegrad countries. In Proceedings of the Innovation Management, Entrepreneurship and Corporate Sustainability (IMECS 2016), Prague, Czech Republic, 26–27 May 2016; pp. 146–156. [Google Scholar]

- Karsai, J. Are CEE States Successful as Venture Capitalists? No. 1539; Institute of Economics, Centre for Economic and Regional Studies, Hungarian Academy of Sciences: Budapest, Hungary, 2015. [Google Scholar]

- Cieślik, J.; van Stel, A. Comparative analysis of recent trends in private sector development in CEE transition economies. Entrepreneurship Res. J. 2014, 4, 205–235. [Google Scholar] [CrossRef]

- Welter, F.; Smallbone, D. (Eds.) Handbook of Research on Entrepreneurship Policies in Central and Eastern Europe; Edward Elgar Publishing: Cheltenham, UK, 2011. [Google Scholar]

- Manolova, T.S.; Eunni, R.V.; Gyoshev, B.S. Institutional environments for entrepreneurship: Evidence from emerging economies in Eastern Europe. Entrepreneurship Theory Pract. 2008, 32, 203–218. [Google Scholar] [CrossRef]

- Klonowski, D. Venture capital as a method of financing enterprise development in Central and Eastern Europe. Int. J. Emerg. Mark. 2006, 1, 165–175. [Google Scholar] [CrossRef]

- Mateut, S. Subsidies, financial constraints and firm innovative activities in emerging economies. Small Bus. Econ. 2017, in press. [Google Scholar] [CrossRef]

- Čadil, J.; Mirošník, K.; Rehák, J. The lack of short-term impact of cohesion policy on the competitiveness of SMEs. Int. Small Bus. J. 2017, 35, 991–1009. [Google Scholar] [CrossRef]

- Stonkute, E.; Vveinhardt, J. Rural Development Policy Incentives encouraging Entrepreneurship in selected EU Countries. In Economic Science for Rural Development Conference Proceedings; No. 44; Latvijas Lauksaimniecības Universitātes Ekonomikas un Sabiedrības attīstības fakultāte: Jelgava, Latvia, 2017; pp. 197–204. [Google Scholar]

- Papadimitriou, D.; Baltag, D.; Surubaru, N.C. Assessing the Performance of the European Union in Central and Eastern Europe and in its Neighbourhood. East Eur. Polit. 2017, 33, 1–16. [Google Scholar] [CrossRef]

- Blažková, I. The Impact of the Public Support for R & D on the Economic Performance of SMEs. Acta Univ. Agric. Silvic. Mendel. Brun. 2016, 64, 213–222. [Google Scholar]

- Dvouletý, O.; Blažková, I. Are Publicly Supported Companies in the Czech Food and Drink Industry Performing Better? Initial Findings from the Microdata. In Proceedings of the Innovation Management, Entrepreneurship and Sustainability (IMES 2017), Prague, Czech Republic, 25–26 May 2017; pp. 168–179. [Google Scholar]

- Mirošník, K.; Čadil, J.; Čermáková, K. Small business and cohesion policy-statistical evidence from the Czech Republic. Int. J. Entrepreneurship Small Bus. 2016, 29, 398–415. [Google Scholar] [CrossRef]

- Krause, J. Evaluation of the Impact of Innovative Activites on Productivity–Example from the Czech Republic. Pol. J. Manag. Stud. 2016, 13, 101–109. [Google Scholar] [CrossRef]

- Srholec, M.; Žížalová, P. Mapping the Geography of R&D: What Can We Learn for Regional Innovation Policy in the Czech Republic and Beyond? Eur. Plan. Stud. 2014, 22, 1862–1878. [Google Scholar]

- Potluka, O.; Brůha, J.; Špaček, M.; Loun, J. The Impacts of Subsidies on Czech Firms. Statistika 2013, 50, 56–62. [Google Scholar]

- Hartsenko, J.; Sauga, A. The role of financial support in SME and economic development in Estonia. Bus. Econ. Horiz. 2013, 9, 10–22. [Google Scholar] [CrossRef]

- Kopečná, V. Counterfactual Impact Evaluation of the Project Internships for Young Job Seekers. Cent. Eur. J. Public Policy 2016, 10, 48–66. [Google Scholar] [CrossRef]

- Potluka, O.; Brůha, J.; Špaček, M.; Vrbová, L. Counterfactual Impact Evaluation on EU Cohesion Policy Interventions in Training in Companies. Ekonomický Časopis 2016, 64, 575–595. [Google Scholar]

- Dvouletý, O. Does the Self-employment Policy Reduce Unemployment and Increase Employment? Empirical Evidence from the Czech Regions. Cent. Eur. J. Public Policy 2017, 11. [Google Scholar] [CrossRef]

- Hora, O.; Suchanec, M. Zhodnocení Programů Aktivní Politiky Zaměstnanosti Realizovaných v České Republice v Období Krize; Česká politika zaměstnanosti v době krize a po krizi; MUNIpress/Albert: Brno, Czech Republic, 2014; pp. 143–182. [Google Scholar]

- Saxonberg, S.; Sirovátka, T.; Janoušková, M. When do policies become path dependent? The Czech example. J. Eur. Soc. Policy 2013, 23, 437–450. [Google Scholar] [CrossRef]

- European Commission. Operational Programme Entrepreneurship and Innovation. 2016. Available online: http://ec.europa.eu/regional_policy/en/atlas/programmes/2007-2013/czech-republic/operational-programme-enterprises-and-innovations (accessed on 5 August 2016).

- Ministry of Industry and Trade. Programme START. 2016. Available online: http://www.mpo-oppi.cz/start/ (accessed on 5 August 2016).

- Maggioni, V.; Sorrentino, M.; Williams, M. Mixed consequences of government aid for new venture creation: Evidence from Italy. J. Manag. Gov. 1999, 3, 287–305. [Google Scholar] [CrossRef]

- Honjo, Y.; Harada, N. SME policy, financial structure and firm growth: Evidence from Japan. Small Bus. Econ. 2006, 27, 289–300. [Google Scholar] [CrossRef]

- Kang, J.W.; Heshmati, A. Effect of credit guarantee policy on survival and performance of SMEs in Republic of Korea. Small Bus. Econ. 2008, 31, 445–462. [Google Scholar] [CrossRef]

- Zecchini, S.; Ventura, M. The impact of public guarantees on credit to SMEs. Small Bus. Econ. 2009, 32, 191–206. [Google Scholar] [CrossRef]

- Oh, I.; Lee, J.D.; Heshmati, A.; Choi, G.G. Evaluation of credit guarantee policy using propensity score matching. Small Bus. Econ. 2009, 33, 335–351. [Google Scholar] [CrossRef]

- Kösters, S. Subsidizing start-ups: Policy targeting and policy effectiveness. J. Ind. Compet. Trade 2010, 10, 199–225. [Google Scholar] [CrossRef]

- Gubert, F.; Roubaud, F. The Impact of Microfinance Loans on Small Informal Enterprises in Madagascar. A Panel Data Analysis; Social Protection Discussion Paper Series; No. 77931; World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Cowling, M.; Siepel, J. Public intervention in UK small firm credit markets: Value-for-money or waste of scarce resources? Technovation 2013, 33, 265–275. [Google Scholar] [CrossRef]

- European Commission. European Regional Development Fund. 2016. Available online: http://ec.europa.eu/regional_policy/EN/funding/erdf/ (accessed on 5 August 2016).

- Czech-Moravian Guarantee and Development Bank. Czech-Moravian Guarantee and Development Bank. 2016. Available online: http://www.cmzrb.cz/?lang=2/ (accessed on 5 August 2016).

- Ministry of Industry and Trade. List of Supported Companies. 2016. Available online: http://www.mpo.cz/dokument141459.html (accessed on 5 August 2016).

- Eurostat. Nominal Exchange Rate CZK/EUR. 2016. Available online: http://ec.europa.eu/eurostat/data/database (accessed on 5 January 2017).

- Bondonio, D.; Greenbaum, R.T. Revitalizing regional economies through enterprise support policies: An impact evaluation of multiple instruments. Eur. Urban Reg. Stud. 2014, 29, 79–103. [Google Scholar] [CrossRef]

- Brealey, R.; Myers, S.; Allen, F. Principles of Corporate Finance, 12th ed.; McGraw-Hill Education: New York, NY, USA, 2017. [Google Scholar]

- Bisnode. Database Albertina—Gold Edition. 2016. Available online: http://www.albertina.cz/ (accessed on 5 August 2016).

- Hawawini, G.; Subramanian, V.; Verdin, P. Is performance driven by industry-or firm-specific factors? A new look at the evidence. Strateg. Manag. J. 2003, 24, 1–16. [Google Scholar] [CrossRef]

- Dehejia, R.H.; Wahba, S. Causal effects in nonexperimental studies: Reevaluating the evaluation of training programs. J. Am. Stat. Assoc. 1999, 94, 1053–1062. [Google Scholar] [CrossRef]

- Becker, S.O.; Ichino, A. Estimation of average treatment effects based on propensity scores. Stata J. 2002, 2, 358–377. [Google Scholar]

- Abadie, A.; Drukker, D.; Herr, J.L.; Imbens, G.W. Implementing matching estimators for average treatment effects in Stata. Stata J. 2004, 4, 290–311. [Google Scholar]

- Caliendo, M.; Kopeinig, S. Some practical guidance for the implementation of propensity score matching. J. Econ. Surv. 2008, 22, 31–72. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Shane, S. Why encouraging more people to become entrepreneurs is bad public policy. Small Bus. Econ. 2009, 33, 141–149. [Google Scholar] [CrossRef]

- Henrekson, M.; Johansson, D. Gazelles as job creators: A survey and interpretation of the evidence. Small Bus. Econ. 2010, 35, 227–244. [Google Scholar] [CrossRef]

- Czemiel-Grzybowska, W. Barriers to financing small and medium business enterprises in Poland. Bus. Econ. Horiz. 2013, 9, 44–52. [Google Scholar] [CrossRef]

- Bruothová, M.; Hurný, F. Selected Characteristics of Business Environment in Visegrad Region. Cent. Eur. J. Manag. 2016, 3, 23–35. [Google Scholar] [CrossRef]

- Dvouletý, O.; Mareš, J. Entrepreneurial activity in the Czech regions: Are business companies and self-employed individuals affected by the same factors? In Proceedings of the 10th International Days of Statistics and Economics, Prague, Czech Republic, 8–10 September 2016; pp. 418–428. [Google Scholar]

- Radosevic, S. Upgrading technology in Central and Eastern European economies. IZA World Labor 2017, 338, 1–11. [Google Scholar]

- Ostapenko, N. Perceptions of government actions and entrepreneurship performance: An indirect effect of national culture/comparative analysis of Ukraine and Slovak Republic. J. Enterp. Community People Places Glob. Econ. 2012, 10, 363–396. [Google Scholar] [CrossRef]

- Bia, M.; Mattei, A. Assessing the effect of the amount of financial aids to Piedmont firms using the generalized propensity score. Stat. Methods Appl. 2012, 21, 485–516. [Google Scholar] [CrossRef]

- De Blasio, G.; De Mitri, S.; D’Ignazio, A.; Finaldi Russo, P.; Stoppani, L. Public Guarantees to SME Borrowing; A RDD Evaluation; Working Papers; Bank of Italy: Rome, Italy, 2016. [Google Scholar]

- Pellegrini, G.; Bernini, C.; Cerqua, A. Public subsidies, TFP and Efficiency: A Tale of Complex Relationships; ERSA Conference Papers; No. ERSA15p461; European Regional Science Association: Brussels, Belgium, 2015. [Google Scholar]

- Potluka, O.; Brůha, J. Zkušenosti s kontrafaktuální dopadovou evaluací v České republice. Evaluační Teorie a Praxe 2013, 1, 53–68. [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Strömberg, P. Financial contracting theory meets the real world: An empirical analysis of venture capital contracts. Rev. Econ. Stud. 2003, 70, 281–315. [Google Scholar] [CrossRef]

| Variable | Definition |

|---|---|

| Treated | Dummy variable indicating, whether the particular firm participated in the program START (188 participating enterprises). |

| Net Profit | Outcome variable, calculated as an average of net profits of the firm during the years 2011–2014. |

| Return on Assets (ROA) | Outcome variable, calculated as an average percentage share of net profits of the firm and its assets during the years 2011–2014. |

| Return on Equity (ROE) | Outcome variable, calculated as an average percentage share of net profits of the firm and its own capital during the years 2011–2014. |

| Sales | Outcome variable, calculated as an average sales for own products and services during the years 2011–2014. |

| Assets Turnover | Outcome variable, calculated as an average ratio of sales/turnover and assets during the years 2011–2014. |

| Debt Ratio | Outcome variable, calculated as an average percentage share of liabilities of the firm and its assets during the years 2011–2014. |

| Year of Registration | Control variable, referring to a year when the company was officially established. |

| Company Size | Control variable, dividing firms into the four dummy categories, according to a number of employees reported: Micro (less than 10 employees), Small (10–49 employees), Medium (50–249 employees) and Large (more than 250 employees). |

| Sector | Control variable, dividing firms into the 21 NACE dummy categories according to their business activity. |

| Region | Control variable, dividing firms into the 14 NUTS3 dummy categories according to the Czech region, where they operate. |

| Variable | Coefficient | Std. Error | P > z |

|---|---|---|---|

| Year of Registration | 0.18 *** | 0.01 | 0.00 |

| Region Praha | (omitted) | ||

| Region Jihomoravský | −1.03 *** | 0.39 | 0.01 |

| Region Jihočeský | 0.28 | 0.41 | 0.48 |

| Region Karlovarský | −0.25 | 0.69 | 0.71 |

| Region Královéhradecký | −0.18 | 0.41 | 0.66 |

| Region Liberecký | −0.30 | 0.59 | 0.71 |

| Region Moravskoslezský | −0.60 | 0.40 | 0.14 |

| Region Olomoucký | 0.09 | 0.44 | 0.84 |

| Region Pardubický | 0.74 * | 0.40 | 0.07 |

| Region Plzeňský | −0.34 | 0.49 | 0.49 |

| Region Středočeský | 0.24 | 0.41 | 0.56 |

| Region Vysočina | 0.15 | 0.48 | 0.75 |

| Region Zlínský | 0.53 | 0.41 | 0.20 |

| Region Ústecký | (omitted) | ||

| Micro | −2.34 *** | 0.24 | 0.00 |

| Small | −5.14 *** | 0.38 | 0.00 |

| Medium | (omitted) | ||

| Large | (omitted) | ||

| Administrative and Support Service Activities | −0.77 | 0.95 | 0.41 |

| Transportation and Storage | −0.66 | 0.76 | 0.39 |

| Information and Communication | 0.06 | 0.73 | 0.94 |

| Arts, Entertainment and Recreation | (omitted) | ||

| Other Service Activities | 1.81 *** | 0.58 | 0.00 |

| Financial and Insurance Activities | 0.57 | 0.97 | 0.56 |

| Professional, Scientific and Technical Activities | 1.53 *** | 0.59 | 0.01 |

| Construction | 0.95 * | 0.58 | 0.10 |

| Mining and Quarrying | (omitted) | ||

| Accommodation and Food Service Activities | 1.11 * | 0.60 | 0.07 |

| Wholesale and Retail Trade, Repair of Motor Vehicles | 1.37 *** | 0.53 | 0.01 |

| Public Administration and Defence | (omitted) | ||

| Education | −0.39 | 1.56 | 0.80 |

| Electricity, Gas, Steam and Air Conditioning Supply | 0.90 | 0.65 | 0.16 |

| Human Health and Social Work Activities | 1.58 *** | 0.63 | 0.01 |

| Agriculture, Forestry and Fishing | 0.81 | 0.69 | 0.24 |

| Manufacturing | 1.50 *** | 0.53 | 0.01 |

| Water Supply, Sewerage, Waste management | −0.52 | 0.84 | 0.53 |

| Real Estate Activities | (omitted) | ||

| Constant | −362.99 *** | 26.72 | 0.00 |

| Wald chi2(32) | 458.51 | Number of Obs. | 4715 |

| Prob > chi2 | 0.0000 | Pseudo R2 | 0.364 |

| L. P. Likelihood | −477.98 | ||

| Outcome | Net Profit | Return on Assets | Return on Equity | |||

| Group | Control | Treated | Control | Treated | Control | Treated |

| N | 10,681 | 57 | 10,681 | 57 | 10,681 | 57 |

| mean | 6182.45 | −112.497 | 1.48 | −27.67 | 12.97 | −70.87 |

| min | −5,613,094 | −11,200 | −264.48 | −1624.55 | −398.90 | −3701.49 |

| max | 2,583,422 | 3008.75 | 256.67 | 33.56 | 387.37 | 499.41 |

| Outcome | Sales | Assets Turnover | Debt Ratio | |||

| Group | Control | Treated | Control | Treated | Control | Treated |

| N | 10,681 | 57 | 10,681 | 57 | 10,681 | 57 |

| mean | 124,803.8 | 3715.8 | 0.82 | 0.43 | 67.60 | 743.85 |

| min | −2577 | 0 | −0.05 | 0.00 | −290.04 | 3.72 |

| max | 6.15 × 107 | 58,995.5 | 132.79 | 4.22 | 399.47 | 37,250.63 |

| Outcome Variable | Matching | ATET | Std. Error | P > abs. Z | N |

|---|---|---|---|---|---|

| Net Profit | Nearest Neighbour (1) | −525.137 | 342.190 | 0.125 | 9238 |

| Net Profit | PSM | −665.338 | 510.174 | 0.192 | 4595 |

| Net Profit | Kernel | −466.281 | 330.221 | 0.136 | 4595 |

| Return on Assets | Nearest Neighbour (1) | −28.715 | 29.078 | 0.323 | 9238 |

| Return on Assets | PSM | −29.068 | 22.731 | 0.201 | 4595 |

| Return on Assets | Kernel | −20.666 | 36.692 | 0.573 | 4595 |

| Return on Equity | Nearest Neighbour (1) | −84.544 | 69.570 | 0.224 | 9238 |

| Return on Equity | PSM | −92.416 | 64.924 | 0.155 | 4595 |

| Return on Equity | Kernel | −87.592 | 71.600 | 0.221 | 4595 |

| Sales | Nearest Neighbour (1) | −7816.04 *** | 3168.15 | 0.014 | 9238 |

| Sales | PSM | −12,807.15 ** | 6021.29 | 0.033 | 4595 |

| Sales | Kernel | −16,402.37 *** | 4168.82 | 0.000 | 4595 |

| Log(Sales) | Nearest Neighbour (1) | −0.807 *** | 0.080 | 0.000 | 9213 |

| Log(Sales) | PSM | −0.883 *** | 0.602 | 0.001 | 4573 |

| Log(Sales) | Kernel | −0.982 ** | 0.427 | 0.022 | 4573 |

| Assets Turnover | Nearest Neighbour (1) | −0.770 *** | 0.277 | 0.005 | 9238 |

| Assets Turnover | PSM | −0.645 | 0.427 | 0.131 | 4595 |

| Assets Turnover | Kernel | −0.512 *** | 0.145 | 0.000 | 4595 |

| Debt Ratio | Nearest Neighbour (1) | 677.685 | 657.62 | 0.303 | 9238 |

| Debt Ratio | PSM | 675.783 | 717.82 | 0.346 | 4595 |

| Debt Ratio | Kernel | 709.764 | 689.15 | 0.303 | 4595 |

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dvouletý, O. Effects of Soft Loans and Credit Guarantees on Performance of Supported Firms: Evidence from the Czech Public Programme START. Sustainability 2017, 9, 2293. https://doi.org/10.3390/su9122293

Dvouletý O. Effects of Soft Loans and Credit Guarantees on Performance of Supported Firms: Evidence from the Czech Public Programme START. Sustainability. 2017; 9(12):2293. https://doi.org/10.3390/su9122293

Chicago/Turabian StyleDvouletý, Ondřej. 2017. "Effects of Soft Loans and Credit Guarantees on Performance of Supported Firms: Evidence from the Czech Public Programme START" Sustainability 9, no. 12: 2293. https://doi.org/10.3390/su9122293