The Relationship between the Efficiency, Service Quality and Customer Satisfaction for State-Owned Commercial Banks in China

Abstract

:1. Introduction

2. Theoretical Background

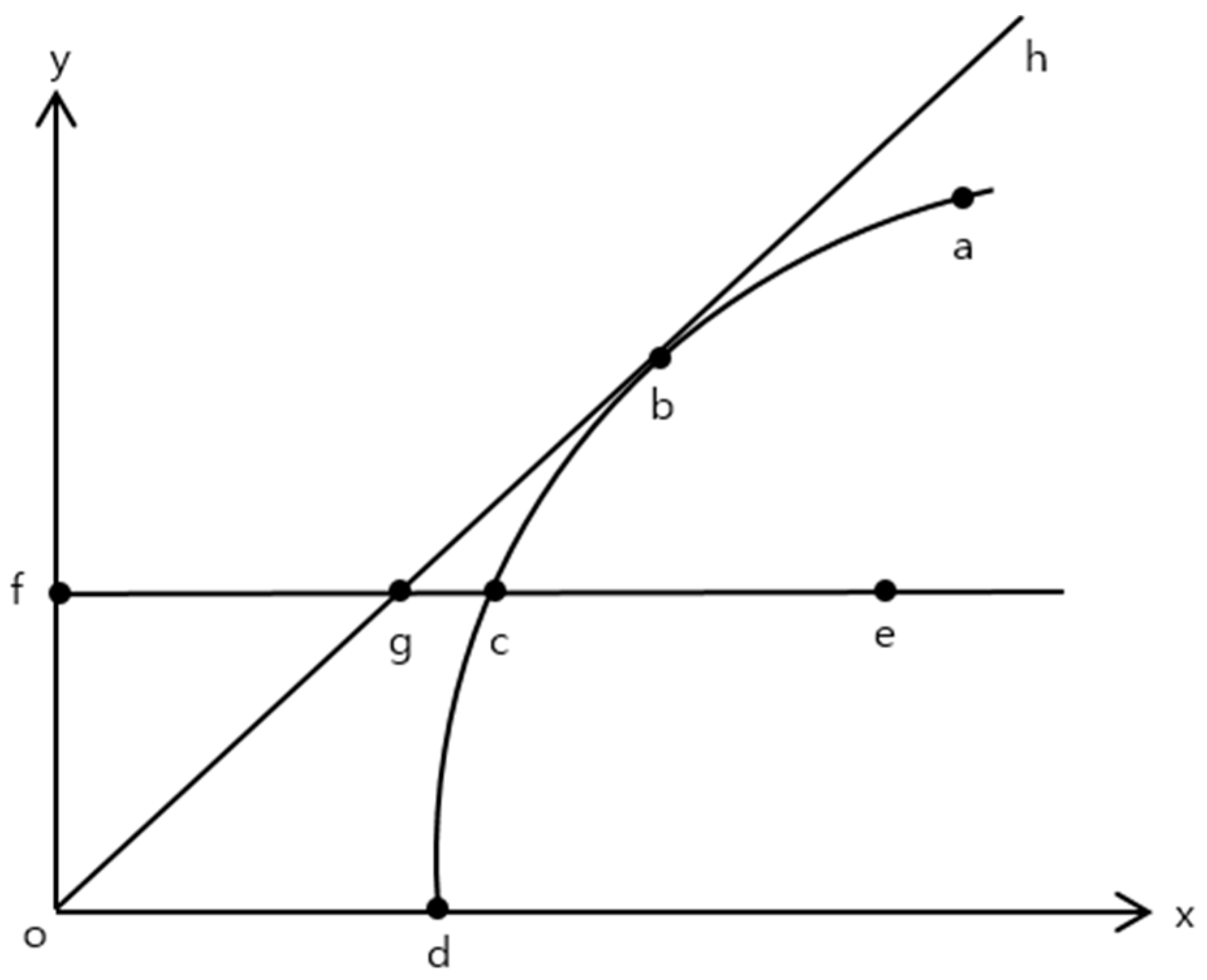

2.1. Concept of DEA

2.2. Bank Efficiency Using DEA

2.3. Bank Service Quality and Customer Satisfaction

3. Research Method

3.1. Input and Output Selection

3.2. Data Collection

4. Results

4.1. Relative Efficiencies of the Banks

4.2. Efficiency and Service Quality

4.3. Customer Satisfaction Analysis

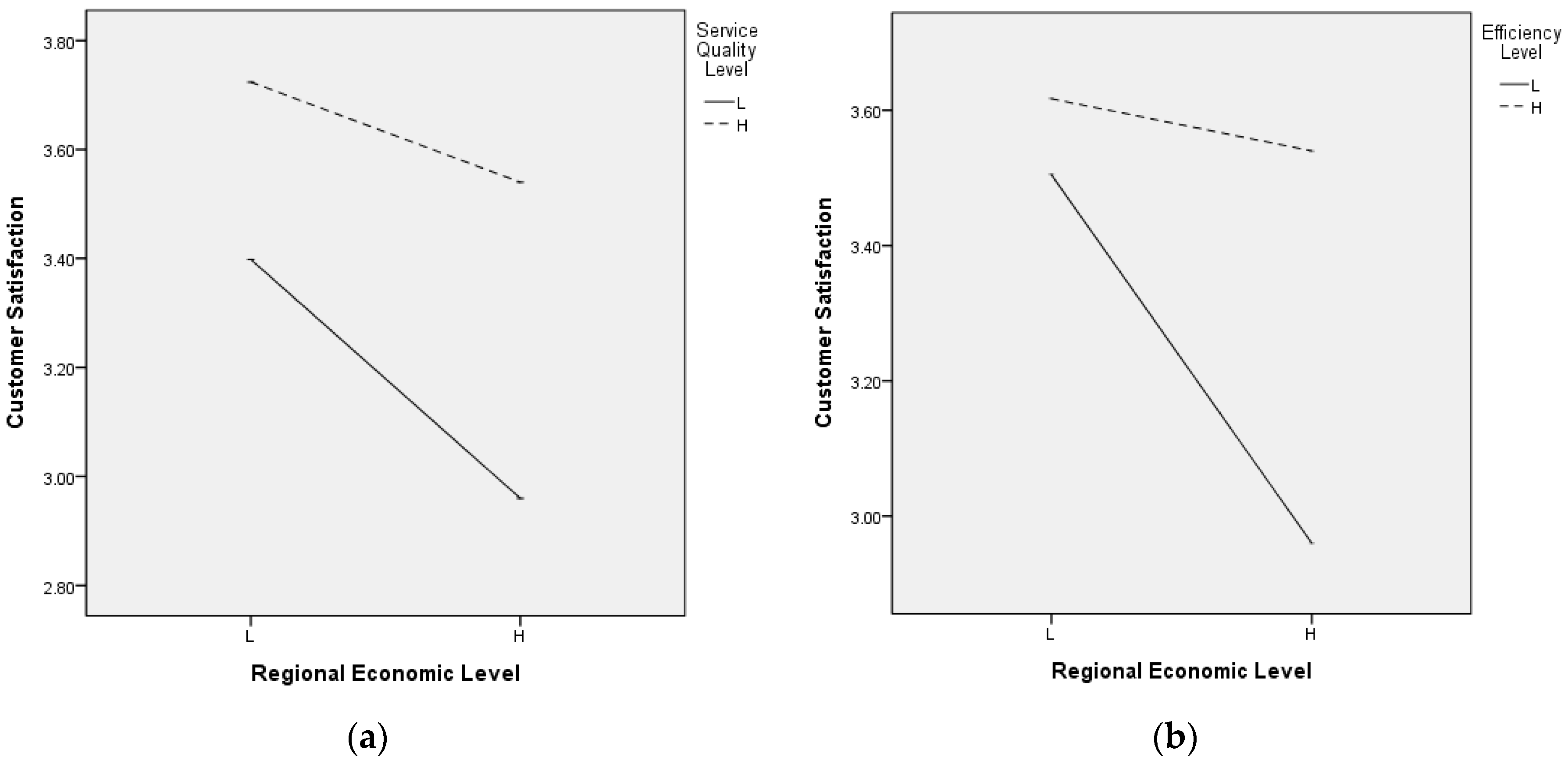

4.4. Relationship between Service Quality, Efficiency and Customer Satisfaction with Respect to Regional Economic Level

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Cho, G.W. A Study on the Reform of the Stocks of State-Owned Commercial Banks in China. Master’s Thesis, Pukyong National University, Busan, Korea, 2007. [Google Scholar]

- Gupta, A.; Dey, A.; Singh, G. Commenting corporations and communities: Towards a theory of social inclusive open innovation. J. Open Innov. Technol. Market Complex. 2017, 3, 17. [Google Scholar] [CrossRef]

- Han, J. Exploitation of architectural knowledge and innovation. J. Open Innov. Technol. Market Complex. 2017, 3, 15. [Google Scholar]

- Park, C.I. Development of China’s financial system in response to economic growth. Foreign Econ. Stud. 2003, 7, 29–63. [Google Scholar]

- Cooke, P. Complex spaces: Global innovation networks & territorial innovation systems in Fl formation & communication technologies. J. Open Innov. Technol. Market Complex. 2017, 3, 9. [Google Scholar]

- Zhou, L.X. A Dimension-specific Analysis of Performance-only Measurement of Service Quality and Satisfaction in China’s Retail Banking. J. Serv. Mark. 2004, 18, 534–546. [Google Scholar]

- Durusu-Ciftci, D.; Ispir, M.S.; Yetkiner, H. Financial development and economic growth: Some theory and more evidence. J. Policy Model. 2017, 39, 290–306. [Google Scholar] [CrossRef]

- Duncan, E.; Elliot, G. Customer Service Quality and Financial Performance among Australian Retail Financial Institutions. J. Financ. Serv. Mark. 2002, 7, 25–41. [Google Scholar]

- Levesque, T.; McDougall, G.H.G. Determinants of Customer Satisfaction on Retail Banking. Int. J. Bank. Mark. 1996, 14, 12–20. [Google Scholar] [CrossRef]

- Je, H.G.; Cho, D.W. A comparative analysis of the efficiency of Chinese commercial banks before and after joining the WTO. Int. Manag. Stud. 2007, 18, 27–52. [Google Scholar]

- Rust, R.T.; Zahorik, A.J.; Keiningham, T.L. Return on Quality: Measuring the Financial Impact of Your Company’s Quest for Quality; Probus Professional Pub.: Chicago, IL, USA, 1994. [Google Scholar]

- Gummesson, E. Productivity, Quality and Relationship Marketing in Service Operations. Int. J. Contemp. Hosp. Manag. 1998, 10, 4–15. [Google Scholar] [CrossRef]

- Yun, J.; Won, D.; Park, K. Dynamics from open innovation to evolutionary change. J. Open Innov. Technol. Market Complex. 2016, 2, 1–22. [Google Scholar] [CrossRef]

- Yun, J. How do we conquer the growth limits of capitalism? Schumpeterian dynamics of open innovation? J. Open Innov. Technol. Market Complex. 2015, 1, 1–20. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimation Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Tone, K. A slack-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Park, C.M.; Kim, T.S. A Study on the Efficiency of Logistics Industry in Korea using DEA-SBM. Korean J. Logist. 2014, 22, 26–46. [Google Scholar]

- Sherman, H.D.; Gold, F. Bank Branch Operating Efficiency: Evaluation with Data Envelopment Analysis. J. Bank. Financ. 1985, 9, 297–315. [Google Scholar] [CrossRef]

- Wèi, Y.; Wáng, L. A Study on the Efficiency of Chinese Commercial Banks: A Non-Participatory Analysis. Financ. Res. 2000, 3, 88–96. [Google Scholar]

- Huáng, Q. A Study on the Effectiveness and Differentiation of Chinese Commercial Banks; Jinqing Economic Research Institute, Xi’an Jiaotong University: Xi’an, China, 2004. [Google Scholar]

- Lĭ, N. Research on Performance Evaluation of China’s Commercial Banks Based on DEA; Dalian Maritime University: Dalian, China, 2006. [Google Scholar]

- Hwang, R.H. Analysis of Commercial Bank Efficiency in China Using Directional Production Distance Function. Master’s Thesis, Inha University, Nam-gu, Korea, 2008. [Google Scholar]

- Oh, D.W. China’s Financial Reform and Changes in Banking Productivity. Bank Korea 2008, 14, 101–137. [Google Scholar]

- Bao, J.H.; Jiang, T. An Analysis of the Efficiency of China’s Listed Commercial Banks. Theor. Res. 2010, 405, 22–25. [Google Scholar]

- Soteriou, A.C.; Zenios, S.A. Using data envelopment analysis for costing bank products. Eur. J. Oper. Res. 1999, 114, 234–248. [Google Scholar] [CrossRef]

- Weill, L. Measuring cost efficiency in European banking: A comparison of frontier techniques. J. Product. Anal. 2004, 21, 133–152. [Google Scholar] [CrossRef]

- Xiaogang, C.; Skully, M.; Brown, K. Banking efficiency in China: Application of DEA to pre-and post-deregulation eras: 1993–2000. China Econ. Rev. 2005, 16, 229–245. [Google Scholar]

- Camanho, A.S.; Dyson, R.G. Data envelopment analysis and Malmquist indices for measuring group performance. J. Product. Anal. 2006, 26, 35–49. [Google Scholar] [CrossRef]

- Wu, D.D.; Yang, Z.; Liang, L. Efficiency analysis of cross-region bank branches using fuzzy data envelopment analysis. Appl. Math. Comput. 2006, 181, 271–281. [Google Scholar] [CrossRef]

- Ariff, M.; Luc, C. Cost and profit efficiency of Chinese banks: A non-parametric analysis. China Econ. Rev. 2008, 19, 260–273. [Google Scholar] [CrossRef]

- Yao, S.; Han, Z.; Feng, G. Ownership Reform, Foreign Competition and Efficiency of Chinese Commercial Banks: A Non-parametric Approach. World Econ. 2008, 31, 1310–1326. [Google Scholar] [CrossRef]

- Thoraneenitiyan, N.; Avkiran, N.K. Measuring the impact of restructuring and country-specific factors on the efficiency of post-crisis East Asian banking systems: Integrating DEA with SFA. Socio-Econ. Plan. Sci. 2009, 43, 240–252. [Google Scholar] [CrossRef]

- Matthews, K.; Zhang, N.X. Bank productivity in China 1997–2007: Measurement and convergence. China Econ. Rev. 2010, 21, 617–628. [Google Scholar] [CrossRef]

- Fung, M.K.; Leung, M.K. X-Efficiency and Convergence of Productivity among the National Commercial Banks in China. 2011. Available online: www.ceauk.org.uk/2008-conference-papers/X-efficiency-MK_Leung%26Mike_Fung_HKPolyU.doc (accessed on 22 November 2017).

- Wang, K.; Huang, W.; Wu, J.; Liu, Y.N. Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega 2014, 44, 5–20. [Google Scholar] [CrossRef]

- Gronroos, C. A Service Quality Model and its Marketing Implications. Eur. J. Mark. 1984, 18, 36–44. [Google Scholar] [CrossRef]

- Parasuraman, A.; Zeithaml, V.A.; Berry, L.L. A Conceptual Model of Service Quality and Its Implications for Future Research. J. Mark. 1985, 49, 41–50. [Google Scholar] [CrossRef]

- Cowling, A.; Newman, K. Banking on People: TQM, Service Quality and Human Resources. Pers. Rev. 1995, 24, 25–40. [Google Scholar] [CrossRef]

- Wang, Y.G.; Lo, H.P.; Hui, Y.V. The antecedents of service quality and product quality and their influences on bank reputation: Evidence from the banking industry in China. Manag. Serv. Qual. Int. J. 2003, 13, 72–83. [Google Scholar] [CrossRef]

- Kim, M.H. A Comparative Study on the Banking Service Quality between Korea and China: Based on the Traditional Banking Service and the Internet Banking Service. Ph.D. Thesis, Keimyung University, Daegu, Korea, 2005. [Google Scholar]

- Fethi, M.D.; Pasiouras, F. Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey. Eur. J. Oper. Res. 2010, 204, 189–198. [Google Scholar] [CrossRef]

- Paradi, J.C.; Zhu, H. A survey on bank branch efficiency and performance research with data envelopment analysis. Omega 2013, 41, 61–79. [Google Scholar] [CrossRef]

- CBRC. China Banking Regulatory Commission Annual Report 2015; China Financial Publishing House: Beijing, China, 2015. [Google Scholar]

- Lee, S.S. A Study on the Relationship between Service Quality, Customer Satisfaction and Cross-purchase Intention in Bank Service; Korea and China. J. Bus. Manag. 2012, 41, 83–106. [Google Scholar]

- Witt, U. Capitalism as a complex adaptive system and its growth. J. Open Innov. Technol. Market Complex. 2017, 3, 1–15. [Google Scholar] [CrossRef]

- Parasuraman, A.; Zeithaml, V.A.; Berry, L.L. Servqual. J. Retail. 1988, 64, 12–37. [Google Scholar]

- Heskett, J.L.; Sasser, W.E., Jr.; Schlesinger, L.A. The Service Profit Chain: How Leading Companies Link Profit to Loyalty, Satisfaction, and Value; Free Press: New York, NY, USA, 1997. [Google Scholar]

- Leydesdorff, L.; Ivanova, I. Open Innovation and triple helix models of innovation: Can synergy in innovation systems be measured? J. Open Innov. Technol. Market Complex. 2016, 2, 11. [Google Scholar] [CrossRef]

- Schiuma, G.; Lerro, A. The business model prism: managing and innovating business models of arts and cultural organization. J. Open Innov. Technol. Market Complex. 2017, 3, 1–13. [Google Scholar] [CrossRef]

- Hwang, B.Y.; Jun, H.J.; Chang, M.H.; Kim, D.C. A case study on the improvement of institution of high-risk high return R&D in Korea. J. Open Innov. Technol. Market Complex. 2017, 3, 19. [Google Scholar]

- Schiuma, G. Arts catalyst of creative organizations for the fourth industrial revolution. J. Open Innov. Technol. Market Complex. 2017, 3, 20. [Google Scholar] [CrossRef]

- Anderson, S.; Pearo, S.K.; Widener, S.K. Drivers of Service Satisfaction: Linking Customer Satisfaction to the Service Concept and Customer Characteristics. J. Serv. Res. 2008, 10, 365–381. [Google Scholar] [CrossRef]

| Author | DMU | Input | Output | Model | Objectives |

|---|---|---|---|---|---|

| Soteriou and Zenios [26] | 67 Cyprian banks | total branch cost | foreign currency accounts, interbranch transactions, current and saving accounts, credit accounts, loan initializations, loan renewals | DEA | Present a method for providing efficient and reliable cost estimates of bank products at the branch level, based on the non-parametric benchmarking technique |

| Weill [27] | 688 European banks | personnel expenses, other non-interest expenses, interest paid | loans, investment assets | DEA SFA DFA | Analyze the robustness of the frontier approaches applied in banking on five European banking sectors |

| Xiaogang et al. [28] | 43 Chinese banks | interest expenses, non-interest expenses, price of capital | loans, deposits, non-interest income | DEA | Identify the change in Chinese banks’ efficiency following the program of deregulation initiate by the government in 1995 |

| Camanho and Dyson [29] | 144 Portuguses banks | number of employees, operational costs | deposits, loans, total value of off balance sheet business, number of general service transactions | DEA Malmquist | Identify the best performing schemes for bank branch business, both in terms of managerial strategies and environmental conditions |

| Wu et al. [30] | 808 bank branches (Ontario, Quebec, and Alberta) | financial inputs: personnel, equipment, occupancy, other expenses environmental inputs: income level, population, density, economy | mortgage, non-term deposit, term deposit, personal loans, small business loan, SLOC | DEA | Access the performance of bank branches from different regions using the fuzzy logic into DEA to deal with the environment variables |

| Je and Cho [10] | 75 Chinese banks | number of employees, fixed assets, stockholder’s equity | loans, operating profit | DEA | Compare efficiency of Chinese banks before and after joining the WTO |

| Ariff and Luc [31] | 28 Chinese banks | total loanable funds, number of employees, physical capital | total loans, investments | DEA | Investigate the cost and profit efficiency of Chinese banks using a non-parametric approach and sources of bank efficiency using tobit regressions |

| Yao et al. [32] | 15 Chinese banks | interest expenses, non-interest expenses, asset quality | interest income, non-interest income | DEA | Analyze whether ownership reform and foreign competition improve efficiency of Chinese banks during 1998–2005 |

| Thoraneen-itiyan and Avkiran [33] | 110 Asian banks (Indonesia, South Korea, Thailand, Malaysia, and Philippines) | total deposits, labor capital, physical capital | loans, investments and other earning assets, fee income, off-balance sheet items | SBM-DEA SFA | Investigate the relationship between post-crisis bank restructuring, country-specific conditions and bank efficiency in Asian Countries from 1997 to 2001 |

| Matthews and Zhang [34] | 314 Chinese banks | m1: deposits, overheads, fixed assets m2: deposits, overheads, fixed assets m3: overheads, fixed assets m4: overheads, fixed assets m5: overheads, fixed assets | m1: loans, other earning assets, net free income m2: loans less NPLs, other earning assets, net free income, RNPLs as undesirable output m3: Loans, other earning assets, net free income, deposits m4: loans less RNPLs, other earning assets, net free income, RNPLs as undesirable output, deposits m5: net interest earnings, net free income | DEA Malmquist | Examine the productivity growth of the nationwide banks of China and a sample of city commercial banks for the ten years to 2007 |

| Fung and Leung [35] | 17 Chinese banks | deposits, labor input, fixed capital | interest income, non-interest income | DEA | Estimate and compare the productivity of the national commercial banks in China during the period of 1996–2005 |

| Wang et al. [36] | 16 Chinese banks | fixed assets, labor intermediate measures: deposits | non-interest incomes, interest incomes, non-performing loans or bad loans | two-stage network DEA | Detect Chinese banking system’s weak areas to ascertain how to devote an appropriate effort to improve the performance |

| Input Variables | Output Variables |

|---|---|

| Number of employees | Interest income |

| Fixed assets Deposits | Non-interest income |

| Regions | DMUs | Input Number of Employees | Variables Fixed Assets | Deposits | Output Interest Income | Variables Non-Interest Income |

|---|---|---|---|---|---|---|

| Shanghai | DMU1 | 14,553 | 12,899.63 | 10,698.35 | 5246.59 | 151.95 |

| DMU2 | 8424 | 5385.69 | 4194.9 | 3126.88 | 77.09 | |

| DMU3 | 10,355 | 9241.66 | 7567.2 | 3702.94 | 103.21 | |

| DMU4 | 9559 | 7684.15 | 6003.26 | 3120.16 | 97.77 | |

| Hebei | DMU5 | 17,791 | 4395.06 | 4063.74 | 2563.4 | 54.51 |

| DMU6 | 20,019 | 4417.16 | 4199.79 | 1988.19 | 81.76 | |

| DMU7 | 9561 | 2239.76 | 2058.51 | 1309.68 | 30.17 | |

| DMU8 | 12,739 | 3896.02 | 4231.97 | 2401.81 | 66 | |

| Beijing | DMU9 | 16,038 | 23,900 | 21,748.49 | 4205.24 | 340.51 |

| DMU10 | 9738 | 10,152.29 | 5116.75 | 1907.18 | 65.06 | |

| DMU11 | 11,831 | 12,243.82 | 9046.9 | 3576.98 | 110.18 | |

| DMU12 | 8242 | 6392 | 5590.87 | 2323.55 | 107 | |

| Henan | DMU13 | 24,574 | 11,057.35 | 3763.77 | 1392.89 | 53.25 |

| DMU14 | 20,074 | 4357.26 | 3985.25 | 2531.19 | 60.32 | |

| DMU15 | 15,302 | 3669.01 | 3297.4 | 2076.39 | 48.84 | |

| DMU16 | 17,572 | 4290.57 | 4066.69 | 2250.03 | 72.48 | |

| Shandong | DMU17 | 23,886 | 7230.86 | 8013.96 | 5321.53 | 155.94 |

| DMU18 | 21,084 | 6906.5 | 7220.7 | 6396.13 | 152.99 | |

| DMU19 | 17,505 | 5634.13 | 4869.82 | 3686.75 | 88.76 | |

| DMU20 | 19,822 | 5907.61 | 6453.36 | 4385.48 | 136.16 |

| DMUs | Tangible | Reliable | Responsive | Assurance | Empathy | Satisfaction |

|---|---|---|---|---|---|---|

| DMU1 | 3.41 | 3.45 | 2.91 | 3.3 | 3.14 | 3.51 |

| DMU2 | 3.62 | 3.68 | 3.35 | 3.87 | 3.47 | 3.75 |

| DMU3 | 3.98 | 3.91 | 3.67 | 3.90 | 3.70 | 3.87 |

| DMU5 | 3.31 | 3.45 | 3.32 | 2.99 | 3.28 | 3.30 |

| DMU6 | 3.55 | 3.32 | 2.80 | 3.52 | 3.13 | 3.37 |

| DMU7 | 3.55 | 3.61 | 3.33 | 3.67 | 3.47 | 3.56 |

| DMU8 | 3.46 | 3.50 | 3.11 | 3.43 | 3.16 | 3.52 |

| DMU9 | 3.81 | 3.78 | 3.59 | 3.83 | 3.57 | 3.89 |

| DMU10 | 3.26 | 3.18 | 2.89 | 3.43 | 3.12 | 3.36 |

| DMU11 | 3.98 | 3.73 | 3.09 | 3.68 | 3.38 | 3.68 |

| DMU13 | 3.04 | 3.08 | 2.71 | 3.38 | 2.94 | 2.96 |

| DMU17 | 3.78 | 3.65 | 3.12 | 3.73 | 3.23 | 3.54 |

| DMUs | CRS | VRS | SE | RTS | SBM CRS | SBM VRS |

|---|---|---|---|---|---|---|

| DMU1 | 1 | 1 | 1 | CRS | 1 | 1 |

| DMU2 | 1 | 1 | 1 | CRS | 1 | 1 |

| DMU3 | 0.985 | 0.985 | 0.999 | IRS | 0.835 | 0.876 |

| DMU4 | 0.927 | 0.933 | 0.994 | DRS | 0.877 | 0.880 |

| DMU5 | 0.712 | 0.780 | 0.869 | IRS | 0.57 | 0.667 |

| DMU6 | 0.919 | 0.999 | 0.919 | IRS | 0.568 | 0.723 |

| DMU7 | 0.718 | 1 | 0.718 | IRS | 0.589 | 1 |

| DMU8 | 0.748 | 0.914 | 0.791 | IRS | 0.687 | 0.840 |

| DMU9 | 1 | 1 | 1 | CRS | 1 | 1 |

| DMU10 | 0.648 | 0.663 | 0.753 | IRS | 0.497 | 0.518 |

| DMU11 | 0.850 | 0.850 | 0.999 | IRS | 0.687 | 0.695 |

| DMU12 | 1 | 1 | 1 | CRS | 1 | 1 |

| DMU13 | 0.668 | 0.747 | 0.833 | IRS | 0.304 | 0.362 |

| DMU14 | 0.717 | 0.793 | 0.860 | IRS | 0.586 | 0.687 |

| DMU15 | 0.711 | 0.821 | 0.825 | IRS | 0.585 | 0.744 |

| DMU16 | 0.841 | 0.922 | 0.897 | IRS | 0.617 | 0.721 |

| DMU17 | 0.943 | 0.996 | 0.951 | DRS | 0.836 | 0.851 |

| DMU18 | 1 | 1 | 1 | CRS | 1 | 1 |

| DMU19 | 0.860 | 0.914 | 0.927 | IRS | 0.754 | 0.834 |

| DMU20 | 1 | 1 | 1 | CRS | 1 | 1 |

| Variables | Estimate | Std. Error | t Value | p-Values |

|---|---|---|---|---|

| intercept | −0.9443 | 0.8106 | −1.165 | 0.2711 |

| Service quality | 0.5238 | 0.2362 | 2.217 | 0.0509 . |

| Variables | Estimate | Std. Error | t Value | p-Values |

|---|---|---|---|---|

| intercept | −0.00818 | 0.435172 | −0.019 | 0.985 |

| service quality | 1.03208 | 0.126813 | 8.139 | 1.01 × 10−5 ** |

| efficiency | 0.8266 | 0.2810 | 2.941 | 0.0148 * |

| Shanghai | Hebei | Beijing | Henan | Shandong | |

|---|---|---|---|---|---|

| GRDP | 25,123.45 | 29,806.11 | 23,014.59 | 37,002 | 63,002 |

| mean | 35,589.73 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, M.; Jang, H.-B.; Li, Y.-M.; Kim, D. The Relationship between the Efficiency, Service Quality and Customer Satisfaction for State-Owned Commercial Banks in China. Sustainability 2017, 9, 2163. https://doi.org/10.3390/su9122163

Chang M, Jang H-B, Li Y-M, Kim D. The Relationship between the Efficiency, Service Quality and Customer Satisfaction for State-Owned Commercial Banks in China. Sustainability. 2017; 9(12):2163. https://doi.org/10.3390/su9122163

Chicago/Turabian StyleChang, Meehyang, Han-Byeol Jang, Yi-Mei Li, and Daecheol Kim. 2017. "The Relationship between the Efficiency, Service Quality and Customer Satisfaction for State-Owned Commercial Banks in China" Sustainability 9, no. 12: 2163. https://doi.org/10.3390/su9122163