1. Introduction

Internet is an area that has experienced tremendous recent development. It has not only changed people’s life-style, but has also brought about a dramatic alteration among the structure of supply chain. For example, the expansion of some new platforms, such as mobile devices, provides new channels in many industries. Although a multi-channel structure provides more opportunities for companies, it is also creating a challenge to traditional channels, thus changing the strategies and operations of companies [

1]. Therefore, new distribution systems, also known as dual-channel supply chains, become a possible option, and manufacturers, such as Dell, HP, IBM, Nike and Mattel, extend their selling activities from single channels to a dual-channel approach in which manufacturers tend to acquire consumers’ subliminal need, enhance the efficiency of the supply chain and gain huge profits [

2,

3].

In fact, a growing number of studies have focused on electronic supply chains and the competition between direct channels and traditional channels. Whether new channels should be established is a crucial question for companies, and literature shows that adding new channels may generally benefit the performance of a company [

4,

5,

6]. Researchers also discuss this question through a game theoretical approach, where pricing competition is a main focus in this horizontal channel conflict. For example, Chiang, Chhajed [

7] model a price-setting game between a manufacturer and its independent retailer in a dual-channel supply chain and find that direct marketing can improve the manufacturer’s overall profitability. Cattani, Gilland [

8] find that the manufacturer, the retailer and consumers can prefer the same equal-pricing strategies when the manufacturer opens up a direct channel with a traditional channel partner. Huang and Swaminathan [

9] find that a new competing channel sometimes benefits the incumbent firm because of the new consumers brought by the new channel and the cost advantage of the incumbent; in this case, a mixed firm might have a higher pricing strategy. Matsui [

10] investigates the pricing competition between two symmetric manufacturers and compares their different channel policies. In addition, some literature has considered inventory decisions. For example, Yao, Yue [

11] study three inventory strategies in retail and e-tail stores. Chiang [

12] assumes that the supplier and the retailer could choose their own base-stock level, and finds that the positive effect of combined vertical-horizontal competition on supply chain efficiency may not always exist in a dual-channel supply chain. Moreover, Dumrongsiri, Fan [

13] study the decision-making in both price and order quantity choices, and find that the manufacturer may benefit from the dual-channel. Huang, Yang [

14] consider the changes to the prices and production plan under a demand disruption, and they conclude that the optimal pricing decisions are affected by consumers’ preference for the direct channel and the market scale change. Apart from the pricing and inventory management, Tsay and Agrawal [

3] discuss the manufacturer’s channel selection through optimizing the sales effort in each channel. Much research indicates that manufacturers and retailers tend to introduce direct channels as a beneficial strategy.

Dual channels force manufacturers to face both vertical channel conflicts (e.g., double marginalization) and horizontal channel conflicts (e.g., retailers’ rival), thus, it is important for them to find a feasible way to remain their profitability continuously and sustainability. Although manufacturers’ profits may increase to some extent, the competition with retailers may lead to counterproductive results [

3]. As an example, Compaq Computer used to be a famous computer producer with its highest market share (around 26%) in 1995. Nevertheless, it blindly followed Dell’s dual-channel strategy, and deprived distributors of their profits, then Compaq Computer finally acquired by HP because of distributors’ counterattacks in 2001. The example of Compaq Computer can be seen as a lesson of unsustainable development. Therefore, apart from the value creating activities, companies should also focus on the sustainable economy which is described as “a system that built on collaboration and sharing, rather than aggressive competition” (p. 43) [

15]. In this case with incorporating a new channel, efficient coordinating the supply chain with the traditional channel and online channel has been a new major issue that should be paid more attention on.

In order to promote the inter-organizational relationship and address the problem of profitable but unsustainable development, supply chain coordination is an appropriate solution in the literature and practice, which promotes a way of corporation instead of brutal competition. A large volume of literature has focused on dual-channel supply chain coordination that increases the channel members’ profits, and the results are quite different from that in a single channel supply chain. Some papers have argued that most of the well-known contracts in single-channel situation, such as price-only, buy-back, rebate, revenue-sharing and vendor manage inventory contracts, fail to coordinate a multi-channel distribution system [

16], a risk-neutral dual-channel supply chain can be coordinated by some new contracts. For example, a profit-sharing contract [

17,

18], a compensation-commission contract [

16], a two-part tariff contract [

17] and a combination of a revenue-sharing contract and a pricing scheme [

19]. However, under the sustainability consideration, profit maximization is not the only objective for channel members. The decision makers are facing more intense competition now than years ago, especially in a dual-channel case, which implies that they would consider uncertainties as a necessary factor when they are making decisions. The competitive new direct channel of manufacturers boosts the risk exposure of downstream retailers, thus it is reasonable and necessary for retailers to consider the risk factor as well as the profits and combine them to make their decisions. In contrast to the papers above, we consider the risk preference of firms and assume the retailers are risk-averse. Although there is a growing stream of research in the dual-channel supply chain coordination, there has been relatively little focused on the increasing risk averseness under updated market environment. As exceptions, several studies develop contracts to coordinate a dual-channel supply chain with risk-averse entities, such as profit-sharing contracts [

20], a two-way revenue sharing contract [

2] and a risk-sharing contract [

21]. However, apart from these complex contracts, the common contracts used in reality are the simple ones, e.g., buy-back contracts. Although the simple contracts are not perfect in a risk-averse situation, they are widely exploited because of the simplification and operability [

22], thus it is insightful to discuss their application in a risk-averse circumstance within a multi-channel supply chain.

How to measure the impact of risk-averse degree on entities’ optimal decisions and profits is an important question that contributes to the operations efficiency. Mean-variance and Conditional Value-at-Risk (CVaR) are two major risk models that are widely used in literature. Some studies considered risk-averse newsvendor problems with the mean-variance approach and compared the different strategies developed for risk-averse and risk-neutral objectives [

2,

23]. Some papers used the CVaR framework to study the newsvendor problem with price and order decisions [

24,

25,

26,

27,

28,

29] and measured service levels [

30]. However, the mean-variance model is only suitable for the case where the profit distribution is symmetric, which means that this model may have bias on risk measure [

31]. As applied widely both in theoretical research and practical areas, CVaR model makes a balance between the expected profit and the risk [

32]. Therefore, in this paper, we use CVaR model instead of maximizing the profit to measure the risk attitude of the retailer.

Motivated by these facts, this paper aims to discuss the coordination of several single contracts from a risk-averse perspective and design a different yet practical contract. We consider a two-echelon supply chain model consisting of a risk-neutral manufacturer and a risk-averse retailer. The manufacturer sells its single product through a traditional retail channel as well as a direct channel. We develop a quantity-decide model, and coordinate the manufacturer and the retailer with our risk-averse contract. Besides, we assume that the demand model depending linearly on the prices, market shares and substitutability of the product in two channels.

This study contributes to the literature in two main ways. First, we analyze the limitations of traditional contracts which might lose efficacy under the risk-averse condition. Previous research has argued that traditional contracts such as revenue-sharing contract and wholesale price contract cannot coordinate a dual-channel supply chain [

16,

21]. However, their assumptions simplify the cost structure and thus amplify the side effect of double marginalization. For example, the assumption of zero producing cost narrows down the scope of possible wholesale price [

21], which may influence the coordination results significantly. Actually, our results show that these contracts can still coordinate the supply chain in a low risk-averse supply chain. Problems only arise when a negative wholesale price is required in traditional contracts when the retailer’s risk-averse degree is higher than a threshold. The limitation of traditional contracts on the risk-averse degree cannot be ignored, thus, we also contribute to the literature as well as practice by proposing a risk-sharing contract. A negative wholesale price restricts the usage rate of traditional contracts in this risk-averse situation. Therefore, calling for new coordination schemes is of important significance in practical application. Compared with traditional contracts, the new risk-sharing contract sets the wholesale price within a threshold which can ensure the manufacturer’s acceptance. A fixed risk-sharing degree can coordinate the system under varied risk-averse degrees, which has significant advantage when the retailer’s risk degree is vibrating under uncertainties and challenges. This property benefits the stability and sustainability of the long-term relationship. Results also show that the risk-sharing contract can also be applicable when channel members have the power to control selling prices. We provide managerial insights in the conclusion to connect our research closely with practice.

The remainder of the paper is organized as follows. In

Section 2, we detail our model assumptions. In

Section 3, we model the retailer’s risk aversion by CVaR model and verify two coordinating contracts designed for channels consisting of risk-neutral channel members. In

Section 4, we propose a new risk-sharing contract that achieves the coordination and then provide detailed discussions about the sensitivity. We also extend our research by considering the cases when channel members have the power to decide selling prices. In

Section 5, we conclude the paper and provide managerial insights. All proofs are presented in

Appendix A.

2. Model Assumptions

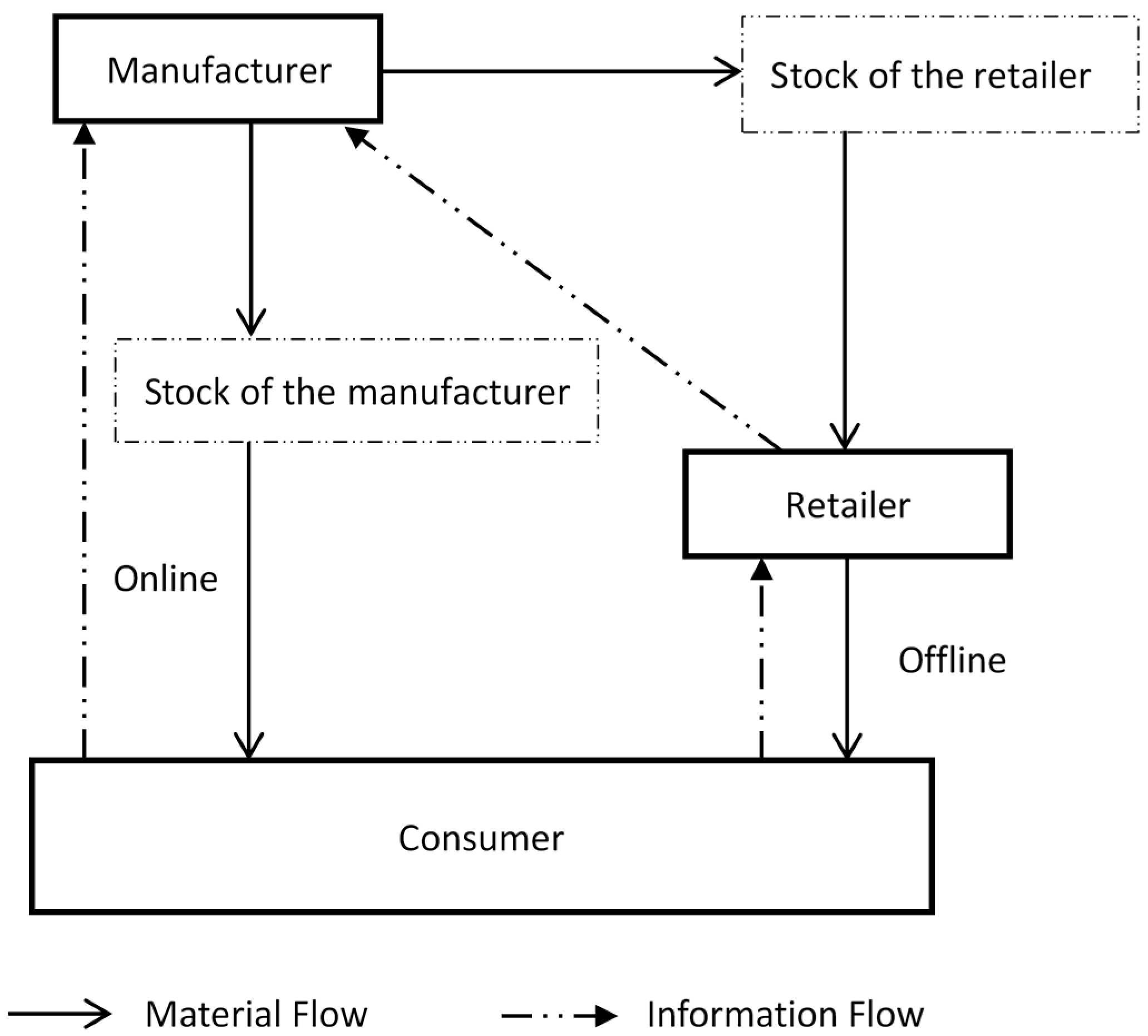

We first assume there are one manufacturer and one retailer. With the rising of e-commerce, the manufacturer adds an additional channel through Internet called online channel, (i.e., direct channel) as a graphical structure in

Figure 1. Therefore, the manufacturer extends its operations to both producting and selling activities, and this dual-channel strategy can reduce its risks with a portfolio [

3]. The retailer, however, has more risk exposure, and its situation has changed from cooperating with a single retail-channel manufacturer to competing with the manufacturer’s vertical integration strategy. Therefore, we consider the case when the manufacturer is risk-neutral and the retailer is risk-averse.

The notations used in this paper are listed as follows:

| Price per unit of the retail channel and the direct channel, ; |

| Sales volume of the retail channel and the direct channel, ; |

| Market share of the retail channel (); |

| Stochastic consumer demand with ; |

| Substitutability of the products in two channels (), ; |

| Cumulative distribution function of ; |

| Probability density function of ; |

| Wholesale price per unit; |

| Production cost per unit; |

| Salvage value per unit for the retailer and the manufacturer, ; |

| Order quantity of the retail channel and the direct channel, ; |

| Profit of the retailer; |

| Profit of the manufacturer; |

| CVaR value of the retailer. |

We consider a linear demand function with selling prices and market demand in each channel, where subscript 1 and 2 denote the retail channel and direct channel, respectively. In line with [

9], the demands for the retail and online channels are defined as:

where

,

,

X is a random variable with

and denotes the stochastic consumer demand. The cumulative distribution function and probability density function of

is

and

, respectively.

We use the parameter

to represent the market share of the retail channel, then

would increase if more consumers prefer to purchase in retail stores instead of the online shop. The range of

is not simply determined by the difference in service quality and the number of retail stores, it is also affected by individuals’ acceptance of network resources, consumption patterns and residence location. Generally, the online channel has significantly developed and it is more convenient for people who will not prefer wasting extra travelling time [

33]. However, the online channel still has some limits such as the uncertain quality, increased risk and the consumers’ preference for traditional retailers. For example, the acceptance of online shopping is much higher for young people than older people, and there exist consumers who prefer to search online and purchase in retail stores [

34,

35,

36]. Note that although we present a fixed parameter

for the consumer segmentation, this doesn’t mean that a single consumer’s channel preference is constant. In fact, consumers’ purchasing attitude is changing from time to time, while we aim to capture a general ratio in the whole market. In practice, consumer segmentation is an important factor for companies’ decision making, and many third-party companies, such as IBM and Alibaba, release reports to capture consumers’ behavior and preference annually [

37].

The

denotes the channel substitutability as the single product is selling in the market. Normally we assume

[

38]. More specifically,

measures the percentage change of demand in one channel that occurs in response to a percentage change of price in the other channel. Perishable products with a short shelf life, for example vegetables, are more suitable to offline purchasing. Whereas products with a steady consumption rate and long shelf life, for example shampoo, are more likely to be switched to online channel from traditional offline channel. Therefore, the substitutability of shampoo is expected to be larger than that of other perishable products. In this linear demand function, although consumers have their initial preferred channel, their purchasing decision may change according to the selling prices in channels.

We assume the products sold in two channels are identical and thus they have the production cost (

) and salvage value (

). The inventory cost can be derived from the salvage value (

): unsold items can be sold in next selling-period and a holding cost (

) would be expended, thus a salvage cost represents the sourcing cost minus the holding cost. For example, the salvage value for the retailer can be interpreted as

, and the salvage value for the retailer can be interpreted as

. For simplification purpose, we assume that the order quantity of the retailer can always be fulfilled by the manufacturer. The retailer orders quantity

and the manufacturer produces quantity

for its direct selling online. Therefore, the profit functions of the manufacturer and the retailer are:

Assuming the manufacturer’s product is highly substitutable with other similar products selling in the market, then consumers in this case tend to be more price sensitive. Thus in a competitive market, channel members may have no power to control the online and retail prices [

11], in which case horizontal retailers have reached a balance where the selling price can neutralize the production and operating costs and ensure certain profit margin to maintain the running of channel members in the supply chains. If a product remains a higher selling price than other similar products, the demand would become low and channel members would loss the consumers; although a lower selling price can attract consumers, companies marketing other products would adjust their prices to win back consumers, thus the pricing competition would achieve the equilibrium as would be expected and the price is determined by factors as the products’ quality, market potential and consumers’ purchasing behaviors instead of the seller’s individual willingness. Following Yao, Yue [

11] and Boyaci [

16], we consider the case when the selling prices are exogenous and channel members can only decide their order quantities based on their inventory level and the market demand. In our discussion about the risk-sharing contract, we also test the contract by extending our model to the case when selling prices become endogenous.

In line with Li, Chen [

28], we follow the Nash bargaining framework and assume that the manufacturer and the retailer has the identical bargaining power and move simultaneously in the retailing level, i.e., the manufacturer decides its wholesale price and then both the manufacturer and the retailer order certain numbers of products which are fulfilled by the manufacturer later.

3. Supply Chain Coordination

In this section, we consider the decentralized and centralized optimal order quantities and then compare several traditional contracts used in practice. A centralized supply chain system usually behaves better than a decentralized system; a contract which helps to coordinate a supply chain makes the entities’ optimal decisions equal to the centralized system and should be acceptable for each entity which means their utilities should be higher or at least steady [

39,

40].

Definition 1. A contract can coordinate a supply chain if (1) the profit of the manufacturer is no less than the initial profit in the decentralized case; (2) the CVaR value of the retailer is no more than the initial CVaR value; (3) and the total profit of the supply chain reach the maximin, i.e., the manufacturer and the retailer’s order quantities equal that in the centralized system.

Let

denote the retailer’s function of CVaR value without supply chain contracts. According to Rockafellar and Uryasev [

32], the retailer’s CVaR value is:

In the centralized system, the order quantities are deducted from the profit in the whole supply chain. In the decentralized system, however, the manufacturer and the retailer set their order quantities, respectively. Gotoh and Takano [

41] had provided the optimal solution of minimizing CVaR in a newsvendor model. We denote

and

as the centralized optimal order quantity of the retail and the direct channels and denote

and

as the decentralized optimal order quantity.

Theorem 1. The optimal order quantities in the centralized and decentralized system are distinguished as detailed in Table 1, where denotes the inverse function of .

Corollary 1. If the random variable X follows a uniform distribution, i.e., , the optimal order quantities and optimal wholesale price in a decentralized system are: The manufacturer’s expected profits and the retailer’s CVaR value in the decentralized system are:

As shown in

Table 1, the decentralized order quantity equals the centralized order quantity in the direct channel, thus the main purpose of coordination contracts is to change the retailer’s order quantity to satisfy that in the centralized situation. Although we can have

(i.e., if

, we have

, then

. As

, thus

is decreasing in

and

) in a simple wholesale-price contract which unifies the retailer’s order quantity in two systems (i.e., centralized and decentralized), it is not acceptable for the manufacturer without any compensation for its loss in the retailing activities (i.e., the wholesale price is smaller than the production cost). Therefore, another requirement for the coordination contracts is their feasibility that will not cause the obvious loss for the entities.

3.1. Traditional Coordination Contracts

We test the channel coordination efficiency of several traditional contracts including revenue-sharing and buy-back contracts. First, we consider four revenue-sharing contracts, in first two contracts the manufacturer shares part of its revenue or profit to the retailer: portion of total revenue, i.e., or portion of whole profit, i.e., . The manufacturer can also reduce the wholesale price to inspire the retailer, and the retailer shares part of its revenue to the retailer as an exchange. The portion that the retailer shares here in two retailer’s revenue-sharing contracts include: portion of its revenue, i.e., or portion of its whole profit, i.e., .

Lemma 1. (1) In the contract where the manufacturer shares portion of total revenue to the retailer, the retailer can order the centralized order quantity and the supply chain’s total profit is maximized when (2) In the contract where the retailer shares portion of its revenue to the manufacturer, can make the retailer order the centralized order quantity and maximize the supply chain’s profit only when (3) In the contract where the retailer shares portion of its profit to the manufacturer, can make the retailer order the centralized order quantity and maximize the supply chain’s profit when These outcomes in Lemma 1 yield a number of insights. One might conjecture that the compensation from the manufacturer’s profits or revenue to the retailer can be an appropriate way to reduce the channel conflict if the manufacturer is adding another online channel. However, we have shown that this is not always the case. Actually, our unintuitive results illustrate that the lower wholesale price is a better way to influence the retailer’s order quantity and approach the coordination. As shown in Lemma 1, a dual-channel supply chain can still choose a traditional revenue-sharing contract with the condition

. This condition is also proved in a single-channel supply chain with a risk-averse retailer [

39] as well as a risk-neutral single-channel supply chain [

42]. In a dual-channel supply chain, a lower wholesale price is not only a constraint for the manufacturer when the retailer promises to share its revenue in the traditional channel, but also some compensation for the retailer when the manufacturer raises another channel. Let the manufacturer’s revenue-sharing contract, retailer’s revenue-sharing contract and retailer’s profit-sharing contract represent three contracts in Lemma 1, respectively. We will further illustrate their relationship with each other in the following discussion.

Second, with a buy-back contract, the manufacturer promises to buy the excess products back with price from the retailer. Compared with a quantity-discount contract, the retailer prefers a buy-back contract because it can reduce the downstream channel member’s risk. We denote as the buy-back price, and .

Lemma 2. A buy-back contract can make the retailer order the centralized order quantity and maximize the supply chain’s profit only when Theorem 2. When , the retailer’s profit-sharing contract and retailer’s revenue-sharing contract have the same coordination influence as the buy-back contract on the supply chain with either a risk-neutral or risk-averse retailer.

As shown in Theorem 2, the retailer’s revenue/profit-sharing and buy-back schemes have the same impact on entities’ profit change. No matter what the retailer shares to the manufacturer, i.e., revenue or profit, their profit changes are identical as they will accept different wholesale prices which cause the same result. Lemmas 1 and 2 and Theorem 2 also illustrate that there exists restriction (i.e., if , we have in Lemma 1.) on the risk-averse degree due to the nonnegative wholesale price. Thus, traditional contracts are also applicable when the risk-averse degree .

Corollary 2. If the retailer is more risk-averse, in the four channels discussed above (i.e., manufacturer’s revenue-sharing contract, retailer’s profit-sharing contract, retailer’s revenue-sharing contract, and the buy-back contract), the wholesale price would be lower.

The finding in Corollary 2 is intuitive that in order to coordinate a supply chain with a risk-averse retailer, a contract should provide more compensation to the retailer through the wholesale activities. In the retailer’s revenue-sharing contract and profit-sharing contract, the retailer sacrifices part of its revenue or profit to gain a low wholesale price, while the manufacturer should provide a lower wholesale price when the retailer’s risk-averse degree is high.

3.2. Discussion

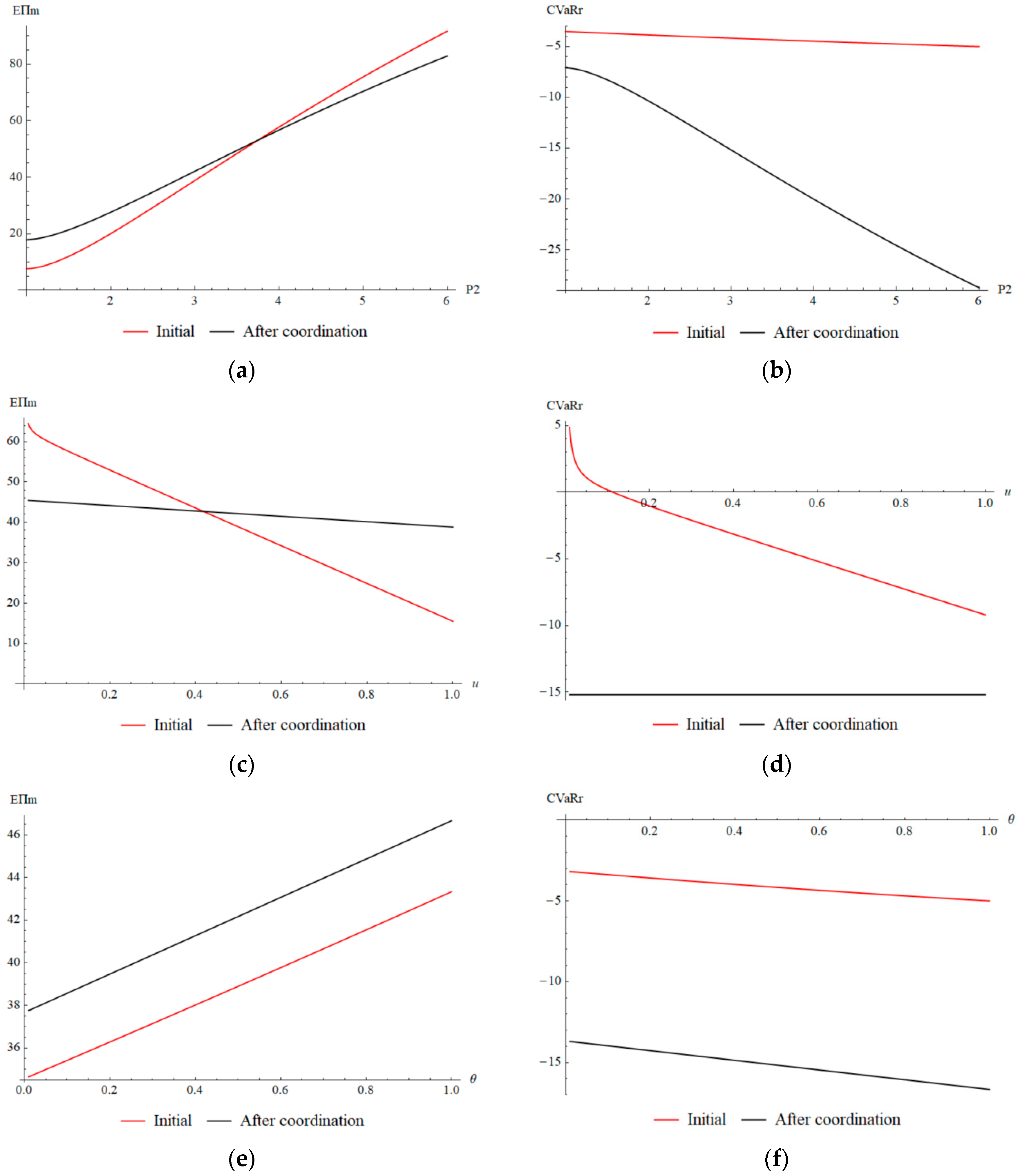

To generate insightful implications from the analytical results, we conduct a numerical analysis to further compare the contracts and explore deeper insights. Recap that and denote the manufacturer’s expected profits and the retailer’s CVaR value in the decentralized system, respectively. We assume to represent the increment of manufacturer’s expected profits after adopting a contract, thus, the manufacturer will accept the contract when its profit with the contract exceeds its initial profit, i.e., . In addition, as the retailer will accept the contracts if its CVaR value decreases, we also assume to represent the opposite difference caused by the contracts. Thus, the retailer would accept the contracts only when . Then the pareto zone can be found when both and are nonnegative, i.e., the contract can benefit both entities and thus coordinate the supply chain. We use the example with , , , , and we consider the uniform distribution with .

Figure 2 shows profits of the manufacturer and CVaR values of the retailer in different contracts. Specially,

Figure 2b illustrates three contracts in Theorem 1 that have identical impact on the changes of profit and CVaR value. Here,

denotes the contract parameter in the retailer’s profit-sharing contract and revenue-sharing contract, we also have

denotes the buy-back price in the buy-back contract. Although the contracts can maximize the supply chain’s total profit,

Figure 2a shows that the manufacturer revenue-sharing contract cannot increase the utilities of the manufacturer and the retailer simultaneously.

Previous research, assuming the producing cost is zero [

24] or the constraint that the wholesale price is larger than the production cost [

16], argues that traditional contracts cannot coordinate the dual-channel supply chain within their assumptions. However, this is not necessarily the case when we release the constraints on the wholesale price. Our result is inconsistence with previous research and shows that traditional contracts can still play their roles as coordinating the supply chain in

Figure 2b. The condition that the wholesale price is lower than the production cost illustrates a negative profit in the manufacturer’s retail channel, however, this is not unacceptable because the extra profit from the direct channel can mitigate the loss and balance the manufacturer’s total profit in two channels. Actually, our finding is consistent with business practice in the real world. Single contracts are still in common practice due to their simplification and ease of process [

22], for example, Apple is still holding a revenue-sharing agreement with AT&T’s Cingular Wireless, the second largest provider of mobile telephone services, although Apple operates direct and indirect channels together.

5. Conclusions

In this paper, we studied a dual-channel supply chain in which the manufacturer uses both vertical integration online and an offline intermediary. Demand is dependent on selling prices, degree of channel substitutability as well as the market segmentation. We considered a risk-neutral manufacturer and a risk-averse retailer whose risk attitude is measured with CVaR approach. We first studied common contracts widely used in single-channel supply chains, including revenue-sharing contracts and a buy-back contract. Although these contracts could coordinate the supply chain, there are still limitations on the retailer’s risk-averse degree. We then developed a risk-sharing contract which is a hybrid with multiple contracts: the wholesale-price contract can mitigate the side effect of double marginalization; the revenue-sharing contract and buy-back contract with different contract parameters neutralize distribution of profits to avoid the extreme unbalance. Sensitive analysis showed that the risk-sharing contract can perform steadily when the market circumstance varies. We also explored the risk-sharing contract when the channel members are more powerful and considered different pricing strategies as decision variables.

Our study has several managerial insights. First, traditional contracts are not necessarily inefficient in dual-channel supply chains; they can still coordinate the supply chain under low risk exposure, which is ignored by other literature. Inconsistence with previous research, our results prove the coordinating function of these contracts in a low risk-averse situation. This seems to corroborate the business model of Apple and AT&T's Cingular Wireless. Given the conflict between practice and previous literature, it is fair to raise an interesting question: is contract change the necessary process encountering the change of channel structure? Our findings have shown that the answer is no. In a low risk exposure circumstance, the retailer’s cooperation behavior is affected but not significantly, and the change may increase extra operational and administrative burden and uncertainties in a stable inter-organizational relationship. Therefore, traditional contracts can still come into play and boost the cooperation outcomes in the supply chain.

Our results have also shown that when the situation changes dramatically, new contracting schemes should be introduced for the coordination purpose. The risk-sharing contract we presented is one of many ways. As we discussed in the risk-sharing contract, contract design among multi-channel companies should consider the distribution of profit in separate channels. Vertical competition raises the problem of double marginalization which restricts the application of single contracts in practice. Although channel members’ total profits may reach the peak under some coordinating schemes, they may not accept them because of the visible loss in a single channel. The multiple channels operated by a focal company are always treated as “swim lanes” and seek for the profitability in each channel. Therefore, contracts that can bring about nonnegative profits in single channels are more likely to be considered in practice. When the contractual vertical marketing relationship is built between upstream and downstream channel members, the consideration of balanced profit distribution among channels cannot be ignored no matter which channel member designs the contract.

Second, relationship building and appropriate information sharing are needed especially for a more powerful manufacturer. The risk-sharing contract developed in this paper enables positive profit margin for channel members and thus coordinates the entire supply chain. This is applicable not only when channel members cannot control selling prices in a competitive market with highly substitutable products, but also when the retailer has the power to decide retail price and the manufacturer chooses to follow. However, this is not always the case when the manufacturer decides their online price separately. The risk-averse retailer may adopt a conservative strategy instead of processing the risk-sharing contract especially when the manufacturer is powerful and can get access to rich resources in the market. Also, the manufacturer tends to unify the vertical supply chain if it can significantly influence the retailer’s selling price. Therefore, unforeseeable competition becomes a poisoning factor to the contractual relationship building. From the retailer’s perspective, our finding shows that the retailer’s bargaining power is vital in this case to pull the relationship back on a proper track, therefore, the retailer should develop its power through actions such as reducing its dependence on a single manufacturer and increasing the value added to the manufacturer through introducing new markets and brand promotion.

Last but not least, sustainable issues explored in this research focus on the sustainable contracting relationship building with other channel members. The risk-sharing contract here can coordinate the supply chain steadily when market factors and risk attitude vary from time to time, which is vital to remain the cooperation. In addition, a fixed risk-sharing degree can coordinate the supply chain under varied risk-averse degrees. We highlight the sustainability through pointing out the relatively stable contracting strategy under a series of uncertainties and challenges. The long-term relationship marketing is the first step forward to the goal of fulfilling “triple bottom line”, as this sustainability need be reached through the network of business and corporation instead of one single company. Further research can explore this question from an in-depth perspective to address the issue of sustainable business in a multi-channel market.