1. Introduction

The “low carbon” concept was introduced at the World Climate Change Conference in Copenhagen, Denmark, 2009, after which low carbon economies became the major focus in many countries, leading to the development of the green supply chain (GSC) [

1]. As one of the industries with the highest carbon emissions, the construction sector accounts for over one-third of global carbon dioxide emissions [

2,

3,

4,

5]. In addition to the carbon emissions from the daily operation of buildings, China has been undertaking many urban construction projects [

6], which has led to a tremendous rise in construction carbon emissions [

7]. In particular, as one of the six largest energy-consuming industries in China, the construction material industry represents 9% of the total energy consumption and 6% of total electricity consumption in China [

8]. It is also a pillar industry in China since its added value makes up about 1% of the gross domestic product (GDP) each year [

9]. The construction material industry has great potential with respect to energy conservation and carbon dioxide emission reduction, which could be of great significance to the achievement of total energy consumption control and transformation of low-carbon development. Enterprises, as the basic elements in the supply chain (SC), are required to take responsibility for the environmental performance of the supply chain participants [

10]. As enterprises in supply chains are closely related, all are simultaneously affected by any carbon emission regulations. Therefore, SC enterprises must jointly adjust their operating and production plans to effectively achieve individual environmentally friendly performance [

1]. Several advantages of the GSC have been identified, such as a positive corporate image, improved efficiency, and innovative leadership [

1], all of which have encouraged more decision-makers to embrace GSC management (GSCM). When carbon emission regulations are imposed in a marketplace, scientifically designed environmental plans can enhance innovation, reduce total production costs, and highlight enterprise value [

11]. Therefore, for each GSC member, low-carbon operations can represent a valuable, non-substitutable advantage [

12]. Further, GSCM is a means for reducing potential losses from poor carbon emission performance that can intensify regulatory pressures [

13], damage an enterprise’s image, attract government fines, and lead to customer boycotts or order cancellations [

14,

15].

At the same time, the focus on the protection of benefits in environmentally-related construction issues has grown, becoming a primary norm for the development of socioeconomic policies [

16,

17,

18]. Therefore, further environmental policies and institutional acts on this topic are urgently required for greener approaches in the area of construction engineering [

19]. Governments around the world have promulgated various policies to reduce carbon emissions, with carbon trading and carbon taxes considered the most effective policy schemes for reducing carbon emissions [

20,

21]. Carbon trading, which is a mainstay in emission trading programs, is specifically aimed at reducing carbon emissions [

22]. In the carbon trading market, enterprises which want more than their allocated carbon emissions can purchase rights to emit more, and firms who do not require their allocated carbon emissions can sell their carbon emission rights to other enterprises [

22]. There has been a sharp rise in the number of carbon emission trading schemes in recent decades. For example, in 2005, 374 million t of equivalent carbon dioxide were exchanged, but by 2011, the carbon trading volume had risen to 10.28 billion CO

t, with the global carbon trading market valued at 176 billion US dollars [

23]. Carbon taxes, which are a type of Pigovian tax [

24], are a potentially cost-effective method for reducing greenhouse gas emissions [

25]. Many European countries, such as the Netherlands, Sweden, Finland, and Norway, implemented carbon taxes many decades ago [

26]. However, the Chinese government only introduced a carbon tax around 2013, which has severely affected the domestic market in China [

27].

As stated above, most scholars have tended to study GSC from government or enterprise perspectives; however, while there have been many studies on carbon trading and carbon tax, many have only focused on the impact of a single policy on the macroeconomic development of carbon emission reductions, and the mutual relationships between supply chain enterprise operations and government policies have been ignored. In addition, there has been a lack of research on the performance of integrated carbon trading and carbon tax policies. To address this research gap, this paper explored the government and SC producer carbon reduction problems associated with integrated carbon trading and carbon tax policies. The government initially determines the annual free carbon emission allowances for the producer based on the average carbon emission level of the industry and its historical emission data. To control total carbon emissions and reduce the adverse impact of carbon emission reduction, the government, whose objective is to maximize social welfare, imposes a carbon tax on the producers. Under the dual constraints of emission allowance and carbon tax, the SC producers must be allocated sufficient carbon emissions to satisfy their daily operations. As the SC producers cannot exceed emission allowance limitations, they must either trade any remaining carbon emission allowances on the carbon trading market or directly purchase additional allowances to meet their emissions requirements. However, now carbon tax and the consumer’s low-carbon preference must be taken into serious consideration, while at the same time considering the carbon tax and consumer preference for low-carbon operations. Producers can achieve emission reductions by flexibly combining emission reduction investments and emission rights purchasing. Finally, to maximize their own profits, the SC producers must weigh up the emission costs and benefits under different strategy combinations to determine the final emission level and the associated product prices.

Because of the multiple decision-makers and the complex interactions, bi-level mathematical programming is proposed as it can accurately describe the interests of the decision-makers. Bi-level models have been widely applied in SC management [

28,

29,

30,

31,

32]. For example, Ghosh and Shah [

28] developed a bi-level supplier/manufacturer SC to examine SC coordination issues under a carbon emission policy. Song and Leng [

29] included the carbon emission factors into a single-cycle newsboy model to examine the influences of different carbon emission policies on producers’ orders. Choi [

30] examined the impact of a carbon footprint tax on bi-level fashion SC systems, and the importance of the carbon footprint tax on SC fashion management. Du et al. [

31] considered an emission-dependent SC to examine an emission-dependent manufacturer and an emission permit supplier under a cap-and-trade system. Jaber et al. [

32] researched bi-level manufacturer/retailer SC game processes and coordination mechanisms under carbon cap-and-trade conditions.

These studies have inspired researchers with novel management insights into government carbon emission regulations and GSC operations; however, the carbon emission regulation parameters have been generally regarded as exogenous variables, with the governments not being involved in the decision-making processes. Therefore, the main contributions of this paper are as follows. First, the integration of carbon reduction policies and their relationships within GSCs are explored. Second, optimal decision results are theoretically derived through the development of a bi-level optimization model, in which the leader, which has a social welfare maximization objective, determines the carbon tax and emission allowance allocations, and the following producers, which have a profit maximization objective, determine their production output and sales quantities. Third, it is shown that the sustainable GSC development and a trade-off between environmental protection and economic development can be achieved by employing the proposed methodology.

The remainder of this paper is organized as follows.

Section 2 gives the research and problem statement, including the research background and the decision-making relationship analysis. In

Section 3, a methodology, including a bi-level mathematical model and an interactive algorithm, is established as an abstraction of the real problem. To confirm the generality of the methodology, a general case, results, and some further discussions are given in

Section 4. Finally,

Section 5 gives the conclusions and suggestions for future studies.

2. Research and Problem Statement

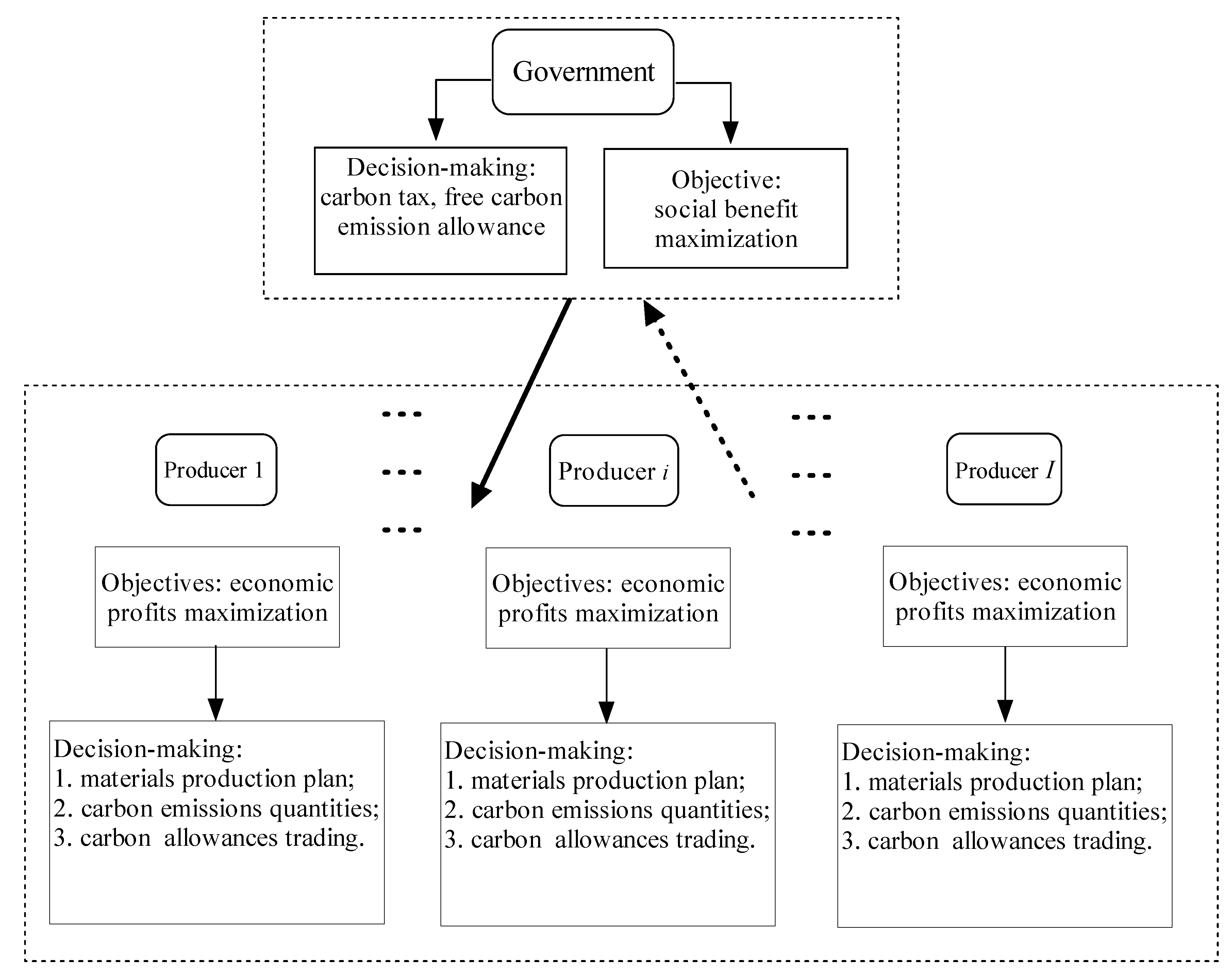

In an integrated carbon policy-based carbon emission reduction problem, there are various decision-makers: the government as the leading decision-maker and the GSC producers as the following decision-makers who act based on the government’s decisions. Both parties have individual contradictory carbon reduction targets. The government seeks to effectively reduce overall carbon emissions, while safeguarding the economic interests of the producers, with the aim of stimulating participation and enthusiasm for emission reduction, and maximizing total social welfare, while the producers seek to obtain as high a carbon emission allowance as possible to reduce their emission costs and maximize profits. Both of parties have individual but interacting decision-making variables; the government’s decision-making variables are the free carbon emission allowances and the carbon tax; while the producer’s variables are production and sales quantities. It is assumed that the GSC producers have an equal market position and each independently trades their carbon emission allowances on the open market. As the producers’ profits are considered when the government sets the carbon emission reductions targets, the decisions made by the producers not only determine their own objectives but also influence the government’s goals. Therefore, the government’s decisions also need to consider the influence of the producers’ responses to its own goals. Therefore, the carbon emission reduction problem in this paper is a dynamic optimization decision-making process, within which the government needs to monitor the carbon trading market, assess the effectiveness of the carbon tax level, and improve their emission reduction strategies based on the responses from the market and the producers.

The above analysis has shown that the carbon emission reduction decision-making process is an interactive decision-making mechanism comprised of the government as the leading decision-maker responsible for the overall carbon reduction plan and control, and the producers as the following decision-makers who have independent decision-making rights in terms of their own carbon reduction goals. As the government is in the lead decision-making position, it has the advantage of moving first. From this description, this integrated emission reduction decision-making policy problem has the same characteristics and mechanisms as a general bi-level decision-making problem, which is similar to the hierarchical decision leader–followers Stackelberg game, in which the leader is more powerful and the follower reacts rationally to the leader’s decisions [

33,

34]. Therefore, the bi-level Stackelberg game can be used to examine this level of this government/producers carbon emission reduction decision-making relationship.

This problem can be abstracted as a bi-level mathematical model for calculation, which, along with the hierarchical structure makes it a complex problem, as shown in the concept model in

Figure 1.

5. Conclusions

Carbon emission reduction is important to the sustainable development of the construction material industry. Most construction material activities, such as material producer selection, material production plans, dynamic inventories, and assignment problems, are interrelated, which means that contradictions between the government and construction material enterprises are unavoidable. Previous research has demonstrated that to achieve sustainable development in the construction material industry, these contradictions need to be reduced or fully resolved [

2,

4,

36,

42].

However, research on carbon emission reduction problems in the construction material supply chain has been restricted to a simple overall GSC system, or only a single carbon emission policy was assumed. Therefore, there were several difficulties that remained unresolved. Firstly, the hierarchical decision-making relationships between the government and the producers were not considered; however, as there are multiple stakeholders within this structure, contradictions must be considered. Secondly, linearization assumptions and simplifications were often employed to ensure model tractability, which led to loss of generality in the mathematical models. Thirdly, uncertainty and complications in the decision-making environment were not considered when dealing with the collected data.

To overcome these difficulties, this paper proposed an integrated methodology for carbon emission reduction problems under an integrated carbon reduction policy. The integrated methodology combined a bi-level mathematical model and an iterative interactive algorithm. The bi-level mathematical model was formulated to handle the leader–followers contradictions and competition between the stakeholders, and FRVs were used to reflect the inherent uncertainties in the problem, all of which made the bi-level mathematical model more complex but better related to the practical environment. An iterative interactive algorithm was designed to solve the non-linear bi-level mathematical model. Then, the proposed methodology was applied to a real-world case, the results from which clearly showed that satisfactory solutions for both the government and the producers could be obtained, and a suitable trade-off reached between economic development and environmental protection. Solution analysis, study of the impact of carbon tax, and comparative analysis in different decision-making environments were conducted to illustrate the applicability and robustness of the proposed methodology.