Shedding New Light on Project Portfolio Risk Management

Abstract

:1. Introduction

- RQ1: What risks are characteristic of a project portfolio?

- RQ2: What risks cause negative portfolio phenomena?

- RQ3: Do such negative phenomena affect each other and how?

2. Portfolio Risk Management—Theoretical Background

2.1. Project Portfolio Management

2.2. Project Portfolio Risk Management

3. Hypothesis Development

- Hypothesis 1 (H1). The latent variable describing the phenomenon “Improper portfolio structure” (P5) has a causal connection with the latent variable describing the phenomenon “Occurrence of interpersonal conflicts” (P4).

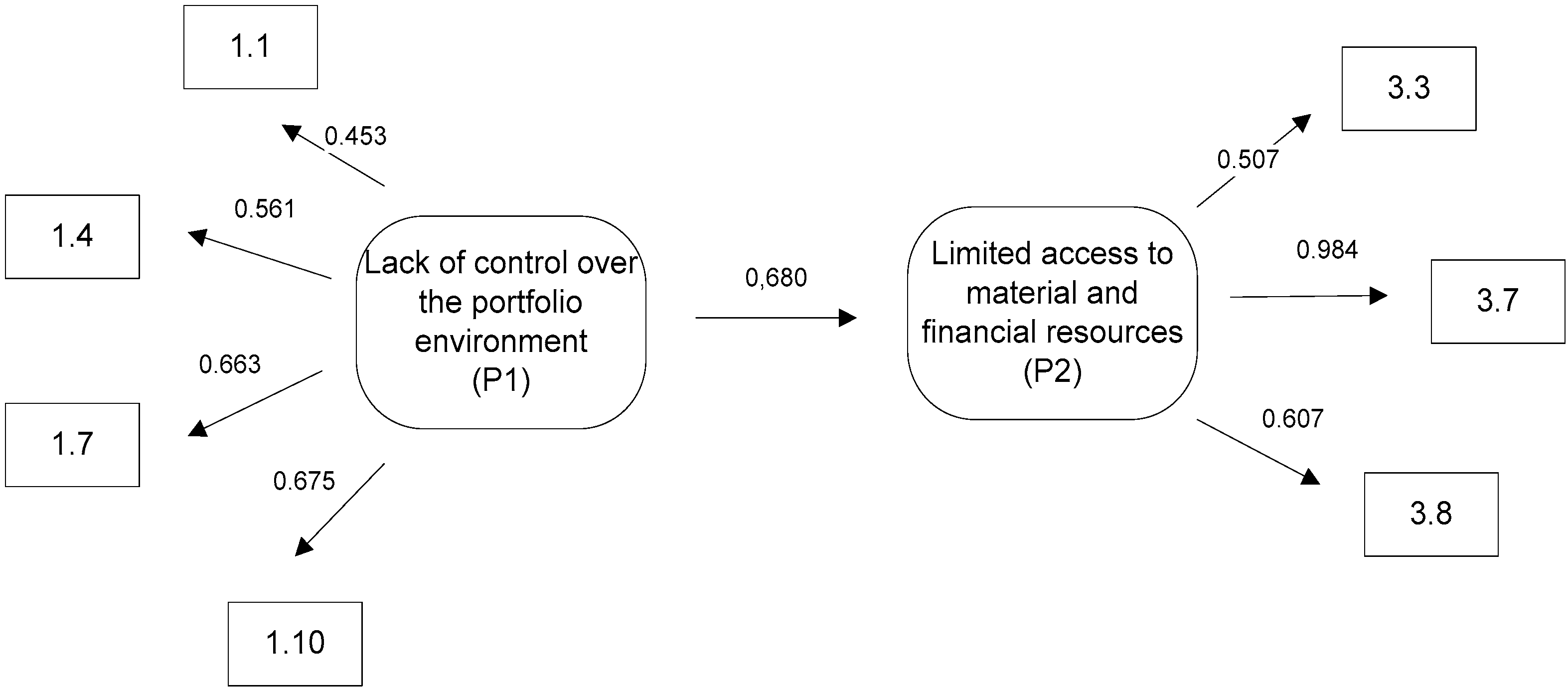

- Hypothesis 2 (H2). The latent variable describing the phenomenon “Lack of control over the portfolio environment” (P1) has a causal connection with the latent variable describing the phenomenon “Limited access to material and financial resources” (P2).

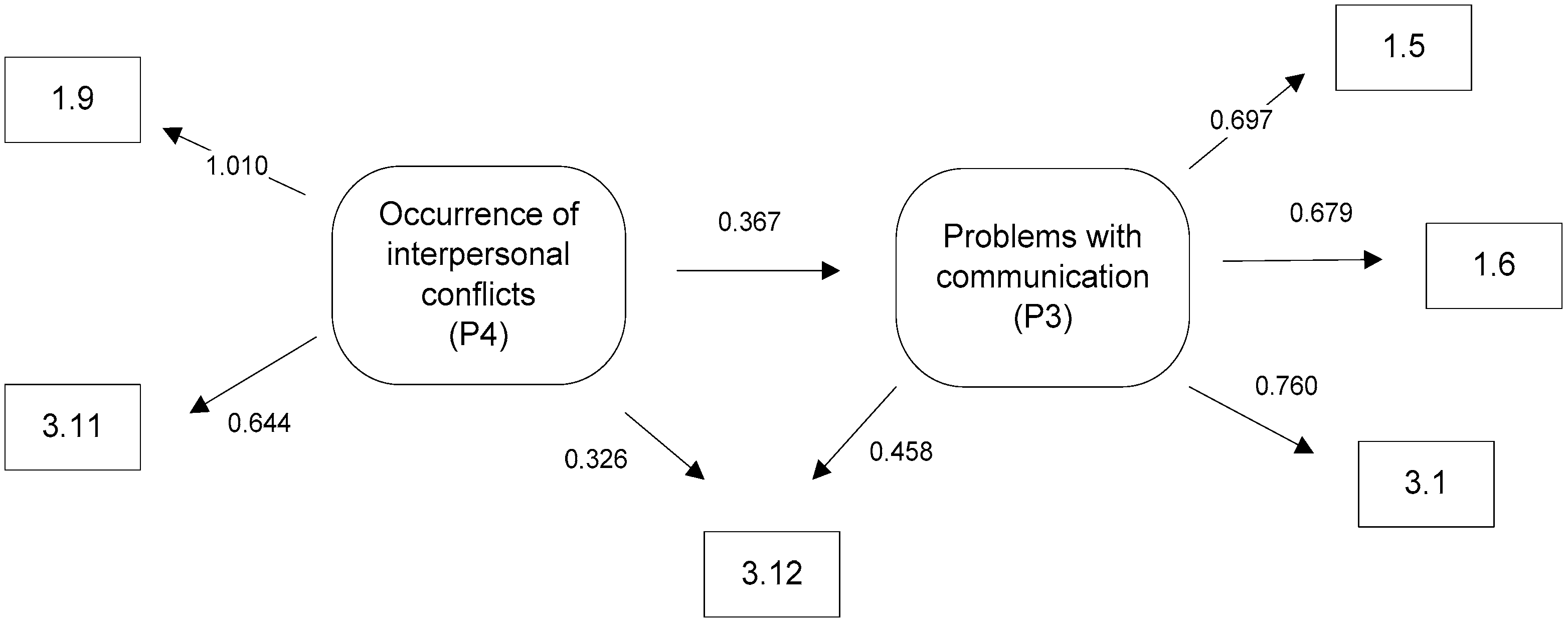

- Hypothesis 3 (H3). The latent variable describing the phenomenon “Occurrence of interpersonal conflicts” (P4) has a causal connection with the latent variable describing the phenomenon “Problems with communication” (P3).

- Hypothesis 4 (H4). The latent variable describing the phenomenon “Irregularities in the portfolio balance” (P6) has a causal connection with the latent variable describing the phenomenon “Limited access to material and financial resources”(P2).

- Hypothesis 5 (H5). The latent variable describing the phenomenon “Lack of control over the portfolio environment” (P1) has a causal connection with the latent variable describing the phenomenon “Occurrence of interpersonal conflicts” (P4).

- Hypothesis 6 (H6). The latent variable describing the phenomenon “Problems with communication” (P3) has a causal connection with the latent variable describing the phenomenon “Limited access to material and financial resources” (P2).

4. Project Portfolio Risks and Negative Phenomena Dependencies

4.1. Sample Description

4.2. Method

4.3. Results

4.4. Findings

5. Conclusions

Acknowledgments

Limitations

Author Contributions

Conflicts of Interest

References

- Jaafari, A. Management of risks, uncertainties and opportunities on projects: Time for a fundamental shift. Int. J. Proj. Manag. 2001, 19, 90–91. [Google Scholar] [CrossRef]

- Raz, T.; Michael, E. Use and benefits of tools for project risk management. Int. J. Proj. Manag. 2001, 19, 9–17. [Google Scholar] [CrossRef]

- Baccarini, D.; Archerv, R. The risk ranking of projects: A methodology. Int. J. Proj. Manag. 2001, 19, 139–145. [Google Scholar] [CrossRef]

- De Bakker, K.; Boonstra, A.; Wortmann, H. Risk management affecting IS/IT project success through communicative action. Proj. Manag. J. 2011, 42, 75–90. [Google Scholar] [CrossRef]

- Olsson, R. In search of opportunity management. Is the risk management process enough? Int. J. Proj. Manag. 2007, 25, 745–752. [Google Scholar] [CrossRef]

- Anavi-Isakow, S.; Golany, B. Managing multi-project environments through constant work-in-process. Int. J. Proj. Manag. 2003, 21, 9–18. [Google Scholar] [CrossRef]

- Olsson, R. Risk management in a multi-project environment. An approach to manage portfolio risks. Int. J. Qual. Reliab. Manag. 2008, 25, 60–71. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio selection: Efficient diversification of investments; John Wiley & Sons, Inc.: New York, NY, USA, 1959. [Google Scholar]

- Sanchez, H.; Robert, B.; Pellerin, R. A project portfolio risk-opportunity identification framework. Proj. Manag. J. 2008, 39, 97–109. [Google Scholar] [CrossRef]

- Pellegrinelli, S. Programme management: Organising project-based change. Int. J. Proj. Manag. 1997, 15, 141–149. [Google Scholar] [CrossRef]

- Lee, K.; Lee, N.; Li, H. A particle swarm optimization-driven cognitive map approach to analyzing information systems project risk. J. Am. Soc. Inf. Sci. Technol. 2009, 60, 1208–1221. [Google Scholar]

- Project Management Institute (PMI). The Standard for Portfolio Management, 2nd ed.; PMI: Newton Square, PA, USA, 2008. [Google Scholar]

- Teller, J.; Unger, B.; Kock, A.; Gemünden, H. Formalization of project portfolio management. The moderating role of project portfolio complexity. J. Prod. Innov. Manag. 2012, 30, 559–600. [Google Scholar] [CrossRef]

- Teller, J.; Kock, A. An empirical investigation on how portfolio risk management influences project portfolio success. Int. J. Proj. Manag. 2013, 31, 817–829. [Google Scholar] [CrossRef]

- Kutsch, E.; Hall, M. The rational choice of not applying project risk management in information technology projects. Proj. Manag. J. 2009, 40, 72–81. [Google Scholar] [CrossRef]

- De Reyck, B.; Grushka-Cockayne, Y.; Lockett, M.; Calderini, S.; Moura, M.; Sloper, A. The impact of project portfolio management on information technology projects. Int. J. Proj. Manag. 2005, 23, 524–537. [Google Scholar] [CrossRef]

- Jonas, D. Empowering project portfolio managers. How management involvement impacts project portfolio management performance. Int. J. Proj. Manag. 2010, 28, 818–831. [Google Scholar] [CrossRef]

- Beringer, C.; Jonas, D.; Kock, A. Behavior of internal stakeholders in project portfolio management and its impact on success. Int. J. Proj. Manag. 2013, 31, 830–846. [Google Scholar] [CrossRef]

- Unger, B.; Gemünden, H.; Aubry, M. The three roles of a project portfolio management office: Their impact on portfolio management execution and success. Int. J. Proj. Manag. 2012, 30, 608–620. [Google Scholar] [CrossRef]

- Blomquist, T.; Müller, R. Practices, roles and responsibilities of middle managers in program and portfolio management. Proj. Manag. J. 2006, 37, 52–66. [Google Scholar]

- Sanchez, H.; Robert, B.; Bourgault, M.; Pellerin, R. Risk management applied to projects, programs, and portfolios. Int. J. Manag. Proj. Bus. 2009, 2, 14–35. [Google Scholar] [CrossRef]

- Teller, J.; Kock, A.; Gemünden, H. Risk Management in Project Portfolios Is More Than Managing Project Risks: A Contingency Perspective on Risk Management. Proj. Manag. J. 2013, 45, 67–80. [Google Scholar] [CrossRef]

- Teller, J. Portfolio Risk Management and Its Contribution to Project Portfolio Success: An Investigation of Organization, Process and Culture. Proj. Manag. J. 2013, 44, 36–51. [Google Scholar] [CrossRef]

- Pinto, J.K.; Covin, J.G. Critical factors in project implementation: A comparison of construction and R&D projects. Technovation 1989, 9, 49–62. [Google Scholar]

- Patanakul, P. Key attributes of effectiveness in managing project portfolio. Int. J. Proj. Manag. 2015, 33, 1084–1097. [Google Scholar] [CrossRef]

- Costantino, F.; Di Gravio, G.; Nonino, F. Project selection in project portfolio management: An artificial neural network model based on critical success factors. Int. J. Proj. Manag. 2015, 33, 1744–1754. [Google Scholar] [CrossRef]

- Spalek, S. Success factors in project management. Literature review. In Proceedings of the 8th International Technology, Education and Development Conference INTED2014, Valencia, Spain, 10–12 March 2014. [Google Scholar]

- Linstone, H.; Turoff, M. Delphi: A brief look backward and forward. Technol. Forecast. Soc. Chang. 2011, 78, 1712–1719. [Google Scholar] [CrossRef]

- Bollen, K. With new incremental structural index for general equation models made. Sociol. Methods Res. 1989, 17, 303–316. [Google Scholar] [CrossRef]

- Meskendahl, S. The influence of business strategy on project portfolio management and its success—A conceptual framework. Int. J. Proj. Manag. 2010, 28, 807–817. [Google Scholar] [CrossRef]

- Taroun, A. Towards a better modeling and assessment of construction risk: Insights from a literature review. Int. J. Proj. Manag. 2014, 32, 101–115. [Google Scholar] [CrossRef]

- Wheelwright, S.; Clark, K. Creating project plans to focus product development. Harvard Bus. Rev. 1992, 70, 67–83. [Google Scholar]

- Cooper, R.; Edgett, S.; Kleinschmid, E. Portfolio management for new product development: Results of an industry practices study. R D Manag. 2001, 31, 361–380. [Google Scholar] [CrossRef]

- Patanakul, P.; Milosevic, D. The effectiveness in managing a group of multiple projects: Factors of influence and measurement criteria. Int. J. Proj. Manag. 2009, 27, 216–233. [Google Scholar] [CrossRef]

- Chapman, C.; Ward, S. Why risk efficiency is a key aspect of best practice projects. Int. J. Proj. Manag. 2004, 22, 619–632. [Google Scholar] [CrossRef]

- Office of Government Commerce (OGC). Portfolio Management Guide; The Stationery Office: Norwich, UK, 2008.

- Martinsuo, M.; Poskela, J. Use of evaluation criteria and innovation performance in the front end of innovation. J. Prod. Innov. Manag. 2011, 28, 896–914. [Google Scholar] [CrossRef]

- Müller, R.; Martinsuo, M.; Blomquist, T. Project portfolio control and portfolio management performance in different contexts. Proj. Manag. J. 2008, 39, 28–42. [Google Scholar] [CrossRef]

- Jerbrant, A.; Karrbom-Gustavsson, T. Managing project portfolios: Balancing flexibility and structure by improvising. Int. J. Manag. Proj. Bus. 2013, 6, 131–151. [Google Scholar] [CrossRef]

- Pennypacker, J.; Dye, L. Portfolio management and managing multiple projects. Planning, Scheduling and Allocating Resources for Competitive Advantage. In Managing Multiple Projects; Pennypacker, J., Dye, L., Eds.; Marcel Dekker Inc.: New York, NY, USA; Basel, Switzerland, 2002; pp. 1–10. [Google Scholar]

- Elonen, S.; Artto, K. Problems in managing internal development projects in multi-project environments. Int. J. Proj. Manag. 2003, 21, 395–402. [Google Scholar] [CrossRef]

- Kendall, G.; Rollins, S. Advanced Project Portfolio Management and the PMO; J. Ross Publishing: Plantation, FL, USA, 2003; pp. 3–448. [Google Scholar]

- De Meyer, A.; Loch, H.; Pich, T. Managing project uncertainty. From variation to chaos. MIT Sloan Manag.Rev. 2002, 43, 60–67. [Google Scholar] [CrossRef]

- Perminova, O.; Gustafsson, M.; Wikström, K. Defining uncertainty in projects: A new perspective. Int. J. Proj. Manag. 2008, 26, 73–79. [Google Scholar] [CrossRef]

- Martinsuo, M.; Korhonen, T.; Laine, T. Identifying, framing and managing uncertainties in project portfolios. Int. J. Proj. Manag. 2014, 32, 732–746. [Google Scholar] [CrossRef]

- Petit, Y.; Hobbs, B. Project portfolios in dynamic environments: Sources of uncertainty and sensing mechanisms. Proj. Manag. J. 2010, 41, 46–58. [Google Scholar] [CrossRef]

- Petit, Y. Project portfolios in dynamic environments: Organizing for uncertainty. Int. J. Proj. Manag. 2012, 30, 539–553. [Google Scholar] [CrossRef]

- Korhonen, T.; Laine, T.; Martinsuo, M. Management Control of Project Portfolio Uncertainty: A Managerial Role Perspective. Proj. Manag. J. 2014, 45, 21–37. [Google Scholar] [CrossRef]

- Kliem, R.; Ludin, I. Reducing Project Risk; Gower Publishing Limited: Aldershot, UK, 1997. [Google Scholar]

- Kwak, Y.; Stoddard, J. Project risk management: Lessons learned from software development environment. Technovation 2004, 24, 915–920. [Google Scholar] [CrossRef]

- Patterson, F.; Neailey, K. A Risk Register Database System to aid the management of project risk. Int. J. Proj. Manag. 2002, 20, 365–374. [Google Scholar] [CrossRef]

- Marcelino-Sádaba, S.; Pérez-Ezcurdia, A.; Echeverría Lazcano, A.; Villanueva, P. Project risk management methodology for small firms. Int. J. Proj. Manag. 2014, 32, 327–340. [Google Scholar] [CrossRef]

- Aritua, B.; Smith, N.; Bower, D. Construction client multi-projects: A complex adaptive systems perspective. Int. J. Proj. Manag. 2009, 27, 72–79. [Google Scholar] [CrossRef]

- McFarlan, F. Portfolio approach to information systems. Harvard Bus. Rev. 1981, 59, 142–150. [Google Scholar]

- Ghim Hwee, N.; Tiong, R. Model on cash flow forecasting and risk analysis for contracting firms. Int. J. Proj. Manag. 2002, 20, 351–363. [Google Scholar] [CrossRef]

- Caron, F.; Fumagalli, M.; Rigamonti, A. Engineering and contracting projects: A value at risk based approach to portfolio balancing. Int. J. Proj. Manag. 2007, 25, 569–578. [Google Scholar] [CrossRef]

- Jun, L.; Qiuzhen, W.; Qingguo, M. The effects of project uncertainty and risk management on IS development project performance. A vendor perspective. Int. J. Proj. Manag. 2011, 29, 923–933. [Google Scholar] [CrossRef]

- Archer, N.; Ghasemzadeh, F. An integrated framework for project portfolio selection. Int. J. Proj. Manag. 1999, 17, 207–216. [Google Scholar] [CrossRef]

- Fricke, S.; Shenhar, A. Managing multiple engineering projects in a manufacturing support environment. IEEE Trans. Eng. Manag. 2000, 47, 258–268. [Google Scholar] [CrossRef]

- Cooper, R.; Edgett, S.; Kleinschidit, E. New problems, New solutions. Making portfolio management more effective. In Managing Multiple Projects; Pennypacker, J., Dye, L., Eds.; Marcel Dekker Inc.: New York, NY, USA; Basel, Switzerland, 2002. [Google Scholar]

- Archer, N.; Ghasemzadeh, F. Project portfolio selection and management. In The Wiley Guide to Managing Projects; Morris, P.W.G., Pinto, J.K., Eds.; John Wiley & Sons Inc.: New York, NY, USA, 2004; pp. 237–255. [Google Scholar]

- Martinsuo, M.; Lehtonen, P. Role of single-project management in achieving portfolio management efficiency. Int. J. Proj. Manag. 2007, 25, 56–65. [Google Scholar] [CrossRef]

- Rajegopal, S.; McGuin, P.; Waller, J. Project Portfolio Management; Palgrave Macmillan: London, UK, 2007; pp. 134–136. [Google Scholar]

- Blichfeldt, B.; Eskerod, P. Project portfolio management—There’s more to it than what management enacts. Int. J. Proj. Manag. 2008, 26, 359–363. [Google Scholar] [CrossRef]

- Payne, H. Management of multiple simultaneous projects. A state-of-the-art review. Int. J. Proj. Manag. 2009, 27, 72–79. [Google Scholar] [CrossRef]

- Kaisera, M.; Arbib, F.-E.; Ahlemannc, F. Successful project portfolio management beyond project selection techniques: Understanding the role of structural alignment. Int. J. Proj. Manag. 2015, 33, 126–139. [Google Scholar] [CrossRef]

- Kopmann, J.; Kock, A.; Killen, C.; Gemünden, H. The role of project portfolio management in fostering both deliberate and emergent strategy. Int. J. Proj. Manag. 2017, 35, 557–570. [Google Scholar] [CrossRef]

- Pender, S. Managing incomplete knowledge. Why risk management is not sufficient. Int. J. Proj. Manag. 2001, 19, 79–87. [Google Scholar] [CrossRef]

- Von der Gracht, H. Consensus measurement in Delphi studies. Review and implications for future quality assurance. Technol. Forecast. Soc. Chang. 2012, 79, 1525–1536. [Google Scholar] [CrossRef]

- Paquin, J.-P.; Gauthier, C.; Morin, P.-P. The downside risk of project portfolios: The impact of capital investment projects and the value of project efficiency and project risk management programmes. Int. J. Proj. Manag. 2016, 34, 1460–1470. [Google Scholar] [CrossRef]

- Relich, M. A knowledge-based system for new product portfolio selection. In New Frontiers in Information and Production Systems Modelling and Analysis; Różewski, P., Novikov, D., Bakhtadze, N., Zaikin, O., Eds.; Springer: Cham, Switzerland, 2016. [Google Scholar]

- Project Management Institute (PMI). A Guide to the Project Management Body of Knowledge, (PMBOK© Guide), 3rd ed.; PMI: Newton Square, PA, USA, 2004. [Google Scholar]

- International Project Management Association (IPMA). International Competence Baseline Version 3.0; Van Haren Publishing NL: Zaltbommel, The Netherlands, 2006. [Google Scholar]

- Marsh, H.; Hocevar, D. Application of Confirmatory Factory Analysis to the Study of Self-concept: First- and Higher-Order Factor Models and Their Invariance across Groups. Psychol. Bull. 1986, 97, 562–582. [Google Scholar] [CrossRef]

- De Carvalho, J.; Chima, F. Applications of Structural Equation Modeling in Social Sciences Research. Am. Int. J. Contemp. Res. 2014, 4, 6–11. [Google Scholar]

- Hu, L.; Bentler, P. Cutoff Criteria for Fit Indexes in Covariance Structure Analysis: Conventional Criteria versus New Alternatives. Struct. Equ. Model. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Guilford, P. Psychometric Methods, 2nd ed.; McGraw-Hill: New York, NY, USA, 1954; pp. 482–483. [Google Scholar]

| Component Risk | Structural Risk | Overall Risk |

|---|---|---|

| 1.1 Significant changes in the project or program environment 1.2 Change in an approach of key project or program stakeholders 1.3 Significant change in the basic parameters of particular portfolio elements 1.4 Improperly defined priorities for particular portfolio elements 1.5 Disturbances in information flow and communication within the portfolio elements 1.6 Ignoring risks by portfolio element managers 1.7 Lack of developed methodical standards within the scope of portfolio element management 1.8 Improperly operating steering committees of projects, project groups and programs 1.9 Conflicts between project and program managers within the portfolio 1.10 Conflicts between portfolio element managers and the parent organisation’s decision-makers 1.11 Improper competencies of project and program managers 1.12 Risks arising from the application of innovative technical and material solutions in the portfolio elements | 2.1 Too large a portfolio from the point of view of the portfolio executors’ capacity 2.2 Significant portfolio fragmentation 2.3 Overly complicated hierarchical structure of portfolio management 2.4 Significant portfolio homogeneity 2.5 Portfolio diversity range too wide from the point of view of portfolio executors’ applied capacity 2.6 Mismatch between the portfolio structure and the parent organisation’s strategy 2.7 Improper portfolio balance | 3.1 Lack of transfer of information and knowledge among the portfolio elements 3.2 Improper control over life cycles of projects and programs 3.3 Unavailability of resources necessary to execute works within the portfolio 3.4 Lack of coordination of the involvement of key resources in the execution of the portfolio 3.5 Relationships among products created by the portfolio elements 3.6 Problems with access to the portfolio financing capital 3.7 Possibility of the lack of financial liquidity within the portfolio 3.8 Portfolio financing collapse 3.9 Non-compliance of a key element strategy with the portfolio’s strategy 3.10 Conflicts among objectives of projects and programs executed within the portfolio 3.11 Conflicts between portfolio managers and portfolio element managers 3.12 Lack of involvement of top-level and middle-level managers in portfolio execution 3.13 Lack of appropriate competencies of the portfolio manager and of the portfolio support structures 3.14 Risks arising from the unknowns at the cost estimation of the execution of selected portfolio elements 3.15 Risks related to the personnel stability of the portfolio managing team and the possibility of losing key portfolio element managers 3.16 Lack of developed methodical standards within the scope of portfolio management 3.17 Formulation of fixed-price contracts for the portfolio elements |

| Phenomenon | Associated Risks | Risk Category |

|---|---|---|

| P1—Lack of control over the environment of the portfolio | 1.1 Occurrence of significant changes in the project or program environment | Component risk |

| 1.4 Improperly defined priorities for particular portfolio elements | ||

| 1.7 Lack of developed methodical standards within the scope of portfolio element management | ||

| 1.10 Occurrence of conflicts between the portfolio element managers and the parent organisation’s decision-makers | ||

| P2—Limitation of material and financial resources | 3.3 Unavailability of resources necessary to execute works within the portfolio | Overall risk |

| 3.7 Possibility of the lack of financial liquidity within the portfolio | ||

| 3.8 Portfolio financing collapse | ||

| P3—Problems with communication within the portfolio | 1.5 Disturbances of information flow and communication within the elements of the portfolio | Component risk |

| 3.1 Lack of transfer of information and knowledge between the elements of the portfolio | Overall risk | |

| 1.6 Ignoring risks taken by portfolio element managers | Component risk | |

| P4—Occurrence of interpersonal conflicts | 1.9 Conflicts between the project and program managers within the portfolio | Component risk |

| 3.11 Conflicts between portfolio managers and portfolio element managers | Overall risk | |

| P5—Improper portfolio structure | 2.3 Overly complicated hierarchical structure of portfolio management | Structural risk |

| 2.5 Portfolio diversity range is too wide from the point of view of the portfolio executors’ applied capacity | ||

| 2.6 Mismatch between the portfolio structure and the parent organisation’s strategy | ||

| P6—Irregularities in the portfolio balance | 1.4 Improperly defined priorities for particular portfolio elements | Component risk |

| 2.7 Improper portfolio balance | Structural risk | |

| 1.7 Lack of developed methodical standards within the scope of portfolio element management | Component risk |

| Estimate | Std. Err | Z-Value | P(>|z|) | Std. lv | Std. all | |

|---|---|---|---|---|---|---|

| Latent variables: | ||||||

| fac1 =~ | ||||||

| y3 | 1.000 | 0.678 | 0.672 | |||

| y5 | 0.885 | 0.280 | 3.160 | 0.002 | 0.600 | 0.612 |

| y6 | 0.612 | 0.205 | 2.983 | 0.003 | 0.414 | 0.519 |

| fac2 =~ | ||||||

| x9 | 1.000 | 0.758 | 0.898 | |||

| z11 | 0.943 | 0.289 | 3.260 | 0.001 | 0.715 | 0.725 |

| Regressions: | ||||||

| fac2 ~ | ||||||

| fac1 | 0.570 | 0.207 | 2.753 | 0.006 | 0.509 | 0.509 |

| Estimate | Std. Err | Z-Value | P(>|z|) | Std. lv | Std. all | |

|---|---|---|---|---|---|---|

| Latent variables: | ||||||

| fac1 =~ | ||||||

| x1 | 1.000 | 0.433 | 0.453 | |||

| x4 | 1.212 | 0.413 | 2.934 | 0.003 | 0.525 | 0.561 |

| x7 | 1.410 | 0.449 | 3.144 | 0.002 | 0.611 | 0.663 |

| x10 | 1.630 | 0.515 | 3.162 | 0.002 | 0.706 | 0.675 |

| fac2 =~ | ||||||

| z3 | 1.000 | 0.460 | 0.507 | |||

| z7 | 2.400 | 0.599 | 4.005 | 0.000 | 1.103 | 0.984 |

| z8 | 1.283 | 0.328 | 3.917 | 0.000 | 0.590 | 0.607 |

| Regressions: | ||||||

| fac2 ~ | ||||||

| fac1 | 0.722 | 0.289 | 2.494 | 0.013 | 0.680 | 0.680 |

| Estimate | Std. Err | Z-Value | P(>|z|) | Std. lv | Std. all | |

|---|---|---|---|---|---|---|

| Latent variables: | ||||||

| fac1 =~ | ||||||

| x9 | 1.000 | 0.845 | 1.000 | |||

| z11 | 0.760 | 0.229 | 3.314 | 0.001 | 0.642 | 0.651 |

| fac2 =~ | ||||||

| x5 | 1.000 | 0.695 | 0.676 | |||

| x6 | 0.967 | 0.216 | 4.477 | 0.000 | 0.672 | 0.663 |

| z1 | 1.072 | 0.226 | 4.731 | 0.000 | 0.744 | 0.796 |

| Regressions: | ||||||

| fac2 ~ | ||||||

| fac1 | 0.424 | 0.162 | 2.616 | 0.009 | 0.516 | 0.516 |

| Estimate | Std. Err | Z-Value | P(>|z|) | Std. lv | Std. all | |

|---|---|---|---|---|---|---|

| Latent variables: | ||||||

| fac1 =~ | ||||||

| x9 | 1.000 | 0.853 | 1.010 | |||

| z11 | 0.745 | 0.221 | 3.368 | 0.001 | 0.636 | 0.644 |

| fac2 =~ | ||||||

| x5 | 1.000 | 0.716 | 0.697 | |||

| x6 | 0.961 | 0.202 | 4.744 | 0.000 | 0.688 | 0.679 |

| z1 | 0.992 | 0.196 | 5.070 | 0.000 | 0.710 | 0.760 |

| Regressions: | ||||||

| fac2 ~ | ||||||

| fac1 | 0.308 | 0.138 | 2.236 | 0.025 | 0.367 | 0.367 |

| z12 | 0.300 | 0.087 | 3.440 | 0.001 | 0.419 | 0.458 |

| fac1 ~ | ||||||

| z12 | 0.255 | 0.085 | 2.982 | 0.003 | 0.299 | 0.326 |

| Estimate | Std. Err | Z-Value | P(>|z|) | Std. lv | Std. all | |

|---|---|---|---|---|---|---|

| Latent variables: | ||||||

| fac1 =~ | ||||||

| x4 | 1.000 | 0.580 | 0.619 | |||

| y7 | 0.732 | 0.285 | 2.567 | 0.010 | 0.424 | 0.401 |

| x7 | 0.918 | 0.279 | 3.294 | 0.001 | 0.532 | 0.577 |

| fac2 =~ | ||||||

| z3 | 1.000 | 0.461 | 0.508 | |||

| z7 | 2.371 | 0.602 | 3.938 | 0.000 | 1.093 | 0.975 |

| z8 | 1.295 | 0.331 | 3.917 | 0.000 | 0.597 | 0.614 |

| Regressions: | ||||||

| fac2 ~ | ||||||

| fac1 | 0.570 | 0.220 | 2.590 | 0.010 | 0.718 | 0.718 |

| Model | Hypothesis | Co-Variance Coefficient | p-Value | RMSEA | CFI | Statistically * Significant |

|---|---|---|---|---|---|---|

| Model 1 | H1 (P5 –> P4) | 0.509 | 0.395 | 0.017 | 0.999 | Yes |

| Model 2 | H2 (P1 –> P2) | 0.680 | 0.201 | 0.065 | 0.967 | Yes |

| Model 3a | H3 (P4 –> P3) | 0.516 | 0.445 | 0.000 | 1.000 | Yes |

| Model 3b | H3 (P4 –> P3) | 0.367 | 0.647 | 0.000 | 1.000 | Yes |

| Model 4 | H4 (P6 –> P2) | 0.718 | 0.111 | 0.093 | 0.945 | Yes |

| Model 5 | H5 (P1 –> P4) | - | 0.715 | 0.000 | 1.000 | No |

| Model 6 | H6 (P3 –> P2) | - | 0.982 | 0.000 | 1.000 | No |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hofman, M.; Spalek, S.; Grela, G. Shedding New Light on Project Portfolio Risk Management. Sustainability 2017, 9, 1798. https://doi.org/10.3390/su9101798

Hofman M, Spalek S, Grela G. Shedding New Light on Project Portfolio Risk Management. Sustainability. 2017; 9(10):1798. https://doi.org/10.3390/su9101798

Chicago/Turabian StyleHofman, Mariusz, Seweryn Spalek, and Grzegorz Grela. 2017. "Shedding New Light on Project Portfolio Risk Management" Sustainability 9, no. 10: 1798. https://doi.org/10.3390/su9101798

APA StyleHofman, M., Spalek, S., & Grela, G. (2017). Shedding New Light on Project Portfolio Risk Management. Sustainability, 9(10), 1798. https://doi.org/10.3390/su9101798