1. Introduction

In the past few decades, the growth of many late-coming but globalizing regions has shown divergent developmental trajectories, which have significant implications not only for revealing the structural and functional reconfiguration of global economic networks, but also for understanding the nature and dynamics of regional economies in terms of development, sustainability, resilience, and so on [

1,

2]. In contrast to the developed regions in the Western countries that are fostered by indigenous forces, the rapid industrialization and economic growth of these late-coming regions are highly driven by non-local actors such as transnational corporations (TNCs), global buyers and state institutions through the globalization process of the regions. The rise of East Asia and many other developing countries has witnessed the effectiveness of this trajectory. However, the economic sustainability of these regions is in question. On the one hand, they normally attract foreign investments by offering low-cost incentives, which are normally replicable by other regions. Hence, these regions would always be in a competition of “locational tournament” [

3]. On the other hand, these regions would be in the danger of over dependency on extra-regional forces (foreign firms), so local firms/indigenous forces would be marginalized and take a limited share of regional economic benefits [

4]. If that is so, the economic trajectories of these regions are bound to be unsustainable, and local economies would be vulnerable. However, why are so many developing regions still following this trajectory? Have latecomer firms found a way to avoid the destiny of being replaced? What kinds of regional resources can be used to increase economic sustainability? The contemporary literature of regional development is still insufficient to answer these questions. Studies from economic geography have been focusing on how extra-regional forces reshape the catching-up trajectories of latecomer regions, but they did not pay sufficient attention to investigating the actions of local firms in the initiatives of escaping from over-dependency on foreign forces [

2,

5]. Latecomer regions and firms in this research refer to actors that are late behind in economic development but have articulated themselves into the global economic networks. Hence, they are apparently late and have strong desire to catch up with the earlier movers, that is, the advanced economies in developed countries.

The regional development trajectories in the Pearl River Delta (PRD) in Southern China give a good opportunity for this paper to investigate the interrelation between globalization and regional economic sustainability. Since China’s national opening and reform in 1978, the PRD has transformed from an economic backwater into one of the key manufacturing hubs and destinations for foreign direct investment (FDI) in the global economy. However, it has been significantly shocked by the 2008 global economic crisis [

6]. This rapid economic growth of the PRD is attributed to? the global integration of the PRD through the process of strategic coupling in which local actors (firms and organizations) exchange regional resources with TNCs for plugging into global production networks [

7]. The earlier studies have termed the pattern of strategic coupling as export-oriented industrialization in which local firms couple with international buyers and TNCs as their processers, subcontractors or low-tier manufacturers [

8,

9]. However, this paper finds that local economies in the PRD do not integrate with the global economy in the same ways, but have developed two different modes of strategic coupling that lead to different performances in regional economic growth, particularly in the response to the 2008 global financial crisis (the 2008 crisis hereafter). These two different trajectories are that: cities in the eastern PRD develop a more captive form of coupling, while the western PRD is in a more proactive form of coupling. Hence, this paper elaborates on the formation of these divergent trajectories in relation to three geographical factors: location; institutional embeddedness, and; local initiatives. Statistical analysis is conducted to show the divergent economic performance of these two areas during and after the 2008 crisis, which raises questions regarding regional economic sustainability.

The purpose of this paper is to trace the developmental trajectory, reveal the formation of divergent strategic coupling in the region, and examine the subsequent regional sustainability in relation to export, gross domestic product (GDP) growth and resilience. This work advances the understanding of regional economic sustainability by elaborating it in the context of globalization and latecomer regional development. The concept of strategic coupling applied in this paper offers a more critical view in contrast to previous studies focusing on intra-regional factors such as the agricultural production system or ecological balance.

To achieve this goal, this paper applies qualitative methods that are more feasible for revealing the complicated causal process of a phenomenon, rather than quantifying the causality between specific variables, such as strategic coupling and sustainability. The collected information and evidence came from archives, existing studies, in particular some written in Chinese, reports and interviews conducted in fieldwork. Statistical analysis serves as a complement, and this part of the data are collected from official statistical reports and statistics yearbooks about the PRD. Evidence and data were derived from the authors’ multiple fieldworks conducted from February–October 2010, October–December 2012 and May, July and December 2013 in the PRD. Forty nine in-depth interviews were conducted with local firms (26), foreign invested firms (14) and regional/local governmental agencies (nine) (Interviewees were recommended by the authors’ local contacts who were experienced officials in governmental agencies or middle-level and above managers in firms. Each of the interviews lasted about 2–3 h with informed consent. Ninety five percent of the interviewed firms have an annual industrial output of over five million yuan; while 20% of them over 500 million yuan.). It must be admitted that the major research questions of this fieldwork were related to globalization, industrial upgrading and innovation, while sustainability was a minor question asked of the interviewees at that time. However, the information given by the interviewees was apparently valuable for the sustainability quested after in this paper.

This paper is organized in five sections. The next section critically discusses how to understand uneven regional development and resilience in developing regions. The third section shows how captive coupling and proactive coupling have been developed and impact regional economies within the PRD. The fourth section shows how cities under these two types of trajectories respond to the 2008 crisis. The last section discusses the theoretical contributions, policy implications and unresolved issues of this study.

2. Economic Sustainability and Resilience in Developing Regions

The sustainability of a regional economy refers to the ability of this region to grow continuously by fostering a proper limit of population and economic activities without exhausting resources or degrading the environment [

10]. In an era of globalization, this understanding should be extended because regional economies are no longer growing purely based on indigenous resources and inward-looking developmental goals. The territorial ensembles of economies, such as places, cities and regions, are interconnected as complex production networks scattering at a global scale [

11,

12]. However, the contemporary studies of economic sustainability mainly focus on the issue of agricultural production stability, environmental/ecological balance, social harmony and population safety [

13,

14,

15]. They have yet to unpack regional economic sustainability in relation to regional growth, technological/industrial upgrading and resilience, particularly in the context of globalization.

What makes globalization different from earlier stages is that the global shift of production networks breaks up a commodity chain into many segments that are geographically separated among different, while interconnected, sites [

16]. The global integration of latecomer regions thus becomes the strategic coupling of three key actors from different scales [

17,

18]. These actors are: (1) TNCs orchestrating their production networks from a global scale; (2) state institutions that manipulate their territorialized resources to attract foreign investments and foster domestic economic growth; (3) local firms that have strong initiatives for catching up. Strategic coupling here means that this process is not purely based on arm-length market transaction, but based on the exchange of resources, the complementarity of production techniques and committed cooperation among the coupled counterparts [

7]. The engagement of these three actors poses a paradoxical question to the contemporary studies of sustainability: if being more dependent on exogenous forces will be a promising way to latecomer regions or the reverse.

Theoretically, there would be two basic types of strategic coupling for latecomer regions to adopt: being a quick follower or being a proactive learner. In the first situation, termed captive coupling in this paper, local firms choose to serve as subordinated suppliers or low-tier subcontractors for global buyers or foreign-invested firms (FIFs), specialized in processing and manufacturing segments. Meanwhile, regional governments focus on providing preferential policies (e.g., fiscal incentives and land-rent waiver) for FDI promotion and industrial relocation. This captive coupling will save tremendous time and costs for local actors to boost their economies because foreign investment firms (FIEs) will provide production technologies for local firms. Local firms not only earn a living through being “quick followers”, but also gradually learn by conducting manufacturing activities. Foreign actors are willing to do so because they need to secure the stability of local supply networks and improve productivity [

19]. The problem of captive coupling is that local economies tended to be marginalized in conducting low value-added and undifferentiated activities [

4]. FIEs tend to share unsophisticated and standard technologies with local firms. Hence, regional economies will grow quickly, but industrial upgrading happens in a very slow and limited manner. Local firms can only work as subcontractors and gradually learn from what FIEs have offered to them. This captive relation may blind their capabilities to adapt new technologies and changing market trends [

17]. In this situation, regional economies would be unsustainable because they are vulnerable to market changes or external shocks once FIEs stop offering help. Regional resilience may be weak when encountering FDI disinvestment or market downturns. Even so, local firms still can access the incumbent production technologies and market trends while being passive followers. Once they can find a way to practice their skills that are learned from FIEs, the situation would not be so pessimistic.

In the second situation, termed as proactive coupling in this paper, local firms may still work as suppliers and subcontractors for foreign firms, but they selectively articulate themselves into multiple value chains and explore their own markets rather than fully depending on foreign firms and traders. Regional governments devote efforts to foster local entrepreneurship and even indigenous innovation, whereas the policies of FDI and export promotion are also implemented simultaneously. This situation is similar to the strategy of value chain multitasking. This means that local firms work with different buyers and explore different markets at the same time so as to learn technologies in both manufacturing and marketing. Some of the local firms can even find a profit niche by learning up-to-date technologies from a developed market and applying them to a less-developed market [

20,

21,

22]. In doing so, local actors can secure a more independent position within global production networks and become less sensitive to external economic shocks. They may be more able to adopt new technologies and market trends, not because they are more capable, but because they have diverse market channels to practice the knowledge they learn from foreign firms. Their learning opportunities mainly come from knowledge spillover and spin off, rather than direct technological assistance from foreign firms. Overall, this pathway would be more sustainable and resilient because local firms have more market channels and indigenous production capabilities to adapt to changes and external shocks. The trade-off is that local economies would grow slower because FIEs surely will constrain technological sharing and transfers when coupling with such smart local partners and even may not choose to couple with them. On many occasions, FIEs tend to develop technological enclaves so as to keep their technological advantages [

23,

24].

Is a more resilient region more sustainable? The contemporary studies are yet to answer this question. During the past decade, studies of resilience have been spreading from the disciplines of physical engineering and ecological sciences to psychology, political science, organization science and urban studies. More recently, this insightful concept has greatly attracted the attention of scholars from regional analysis, spatial economics, as well as economic geography. It triggered rounds of debates about new ways to examine, evaluate and construct the anti-shock economic capabilities of cities or regions, and even a whole country [

25,

26]. The momentum was reinforced when the 2008 economic crisis swept across much of the globe, which resulted in austerity policies and critical reevaluation towards previous developmental trajectories in both developed and developing regions. In order to better explain uneven responses of different regions to the crisis, geographers have provided alternative analytical frameworks and perspectives beyond equilibrists’ modeling approaches offered by economists [

27,

28,

29]. However, these works are on the premise of an indigenous view and mainly grounded on the experiences of the global North, such as cities and regions in the United States and the United Kingdom [

30,

31,

32,

33]. The ongoing regional economic dynamics in the global South are lacking sufficient attention. Will those regions under captive coupling become less resilient and thus suffer more in a volatile market environment in the contemporary global industrial shifts, or they will they take advantage of being quick followers to grow up and escape from the control of TNCs? Will regions under proactive coupling and more independent be more resilient and sustainable? These questions drive this paper to look into the experiences in the PRD cities since the 1980s.

3. Divergent Trajectories of Regional Development in the Pearl River Delta

By examining the three decades of remarkable economic growth in the PRD, this study finds that the above two situations have appeared in the region. The eastern cities are going through a dependent and passive form of captive coupling, while the western cities are more based on proactive coupling. This regional divergence serves as a good opportunity to examine the relations between coupling and sustainability through the lens of resilience. This section probes into the case of the PRD to see how captive and proactive coupling are developed, and the next section examines different economic responses of these two sub-regions to the 2008 global economic crisis.

The PRD is the largest alluvial delta in Guangdong Province in South China. It currently includes nine cities and 10 counties with an area of 41,698 km

2. Since 1978, the central state had strategically set the PRD as a national vanguard of FDI promotion and the experimental field of institutional reform. Most of the marketization policies were implemented here first and transferred to other parts of the country if successful. It resulted in a specific form of “Red Capitalism” in China in which the market logics of capitalism were practiced in the name of market socialism [

34,

35]. This institutional arrangement became a key factor underpinning the region’s integration with the global economy. This PRD thus achieved remarkable economic growth based on export-oriented industrialization [

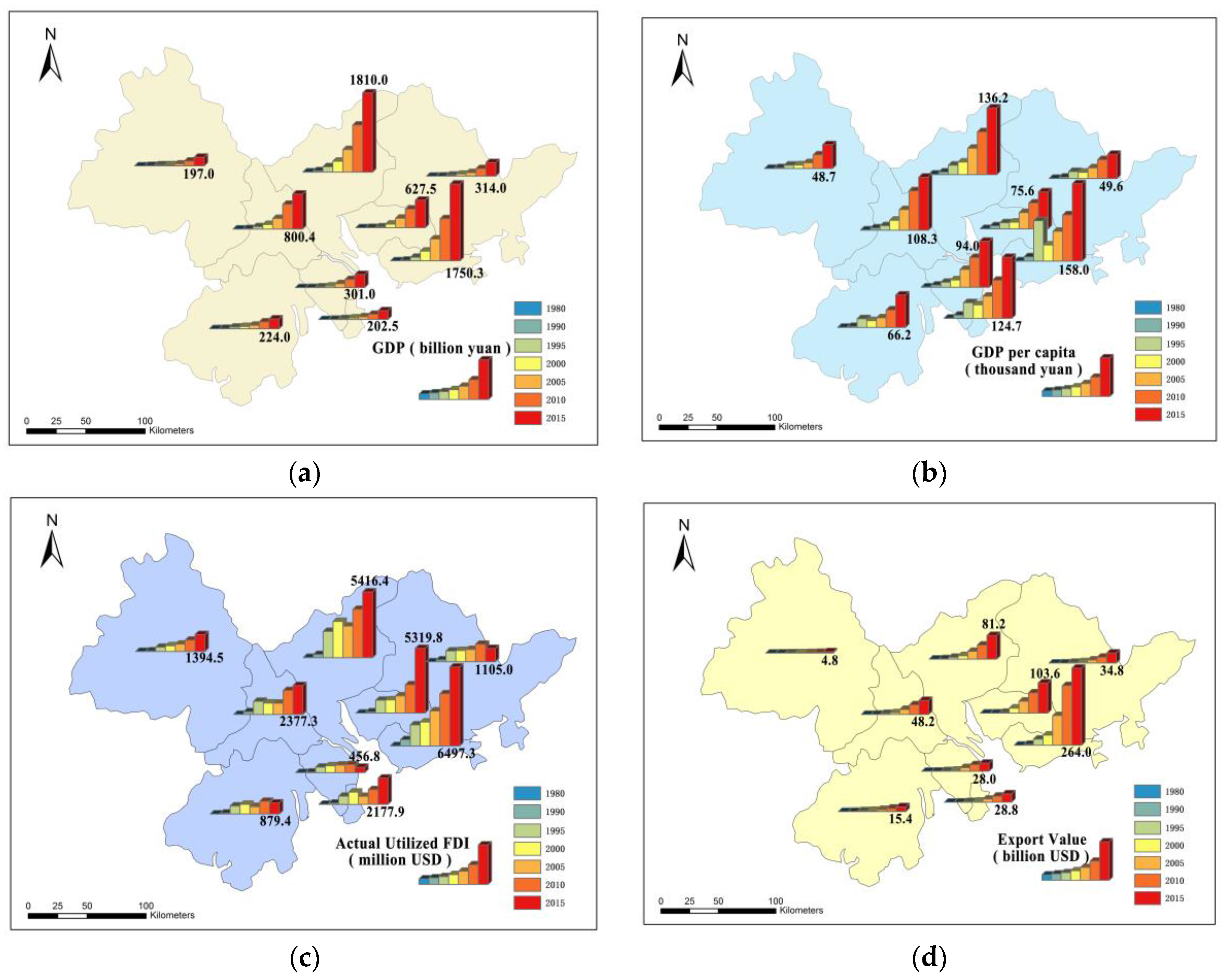

36]. From 1979 to 2010, GDP in this region increased by 15%–17% annually, from about 10 billion yuan to more than 2500 billion yuan (the data were real GDP at the 2000 constant price.) [

37]. In 2015, the total utilization of FDI was USA

$25.6 billion, accounting for 20.3% of the national total; the export value was

$608.7 billion, which was about 26.8% of the whole country (The export data were at the current price.)

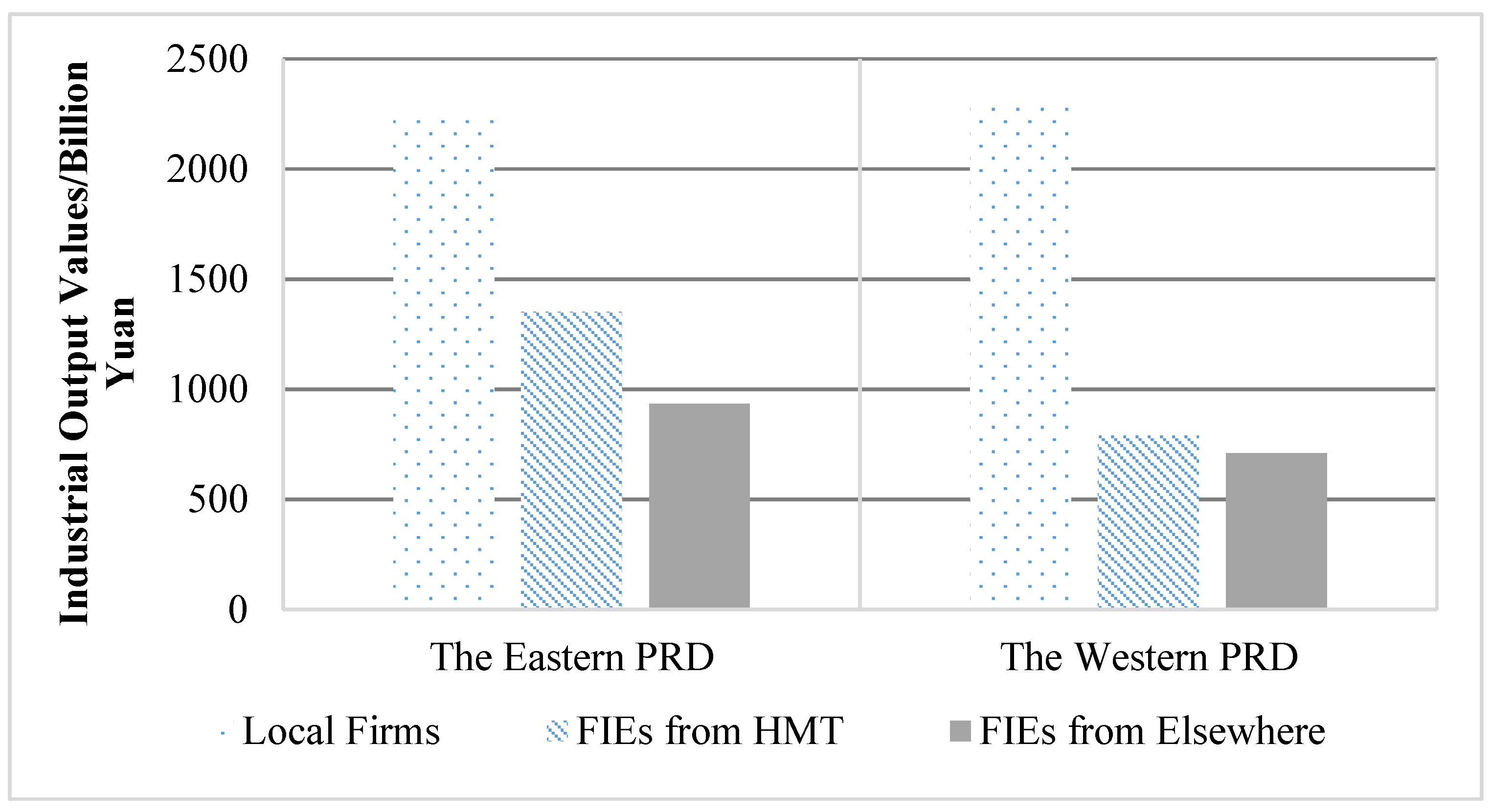

While the whole region went through exogenously-driven growth, divergent trajectories of economic growth have been developed between the eastern and western PRD in the form of different ways of global integration. Since the 1980s, the eastern PRD depended on a highly captive form of integration in which exogenous forces represented by foreign investment firms (FIEs) and global buyers played a dominant role. In contrast, the western PRD went through a more independent way of integration in which local firms were taking the lead. By 2016, 50.42% of industrial output values in the eastern PRD were contributed by FIEs, while they only contributed 39.53% in the western area (see

Figure 1). Throughout three decades of rapid growth, the eastern PRD cities have been heavily utilizing FDI and relying on exportation, particularly the cities of Shenzhen and Dongguan. However, FDI and exportation did not play a dominant role in the western PRD (see

Figure 2). These divergent trajectories lead to different economic outcomes. In terms of GDP, the eastern PRD cities grew faster than the western PRD cities. However, in terms of GDP per capita, the gap between the western and the eastern cities was not significant.

Based on in-depth interviews and field observation, this study finds that this divergence was not a market-selection result, but was influenced by various regional resources and strategic interests of local actors. The first factor is location, which affected the cost-driven locational choice of the earlier foreign investors mostly from Hong Kong and Taiwan later on in the 1980s, the so-called economic taking-off period of the PRD [

42]. While the whole region was set as the economic experimental field, the eastern cities were more favored by Hong Kong investors due to better proximity. A regional division of production was gradually developed, which was called the front-shop-back-factory model in the PRD. Local firms in Shenzhen and Dongguan representing the eastern cities worked as back factories for Hong Kong firms, which received orders from Hong Kong markets, such as the Li & Fund group. (Li & Fund Company is one of the largest trading groups in Hong Kong, which offers subcontracting services for a wide range of global buyers) Following the footsteps of Hong Kong firms, thousands of TNCs subsequently relocated their manufacturing segments to the PRD to take advantage of low production costs and preferential policy [

43,

44]. To those investors, moving to the western PRD was less economic because of the underdeveloped transportation infrastructures over there. A comment from the president of the Electronic Industrial Association of Dongguan reflects this point, as below:

“Yes, the western cities were actually not so far away from here (Dongguan), and the wage and land rents were cheaper than here a little bit. But it cost too much to ship materials to there and move the products out. They (Hong Kong firms) were not doing some high value added works so this logistic cost was critical. Hence these firms chose Shenzhen first, and Dongguan was the second chose.” (Interview on 8 July 2010 in Dongguan).

While the locational factor mattered in the beginning, local governments between the eastern and western PRD adopted contrasting developmental strategies due to different institutional embeddedness and local initiatives. Being comparatively less-developed for a long time, many local governments in the eastern PRD were based on more agricultural-based economies than the governments in western PRD. Without sufficient prior knowledge of manufacturing and entrepreneurial management, governments in the eastern PRD tended to embrace foreign investors and allowed them to take the lead of local industrial development [

45]. For instance, the prefectural government in Dongguan not only actively attracted foreign investors by offering highly preferential urban policies, but also stimulated township and village authorities to compete for foreign investments by their own efforts [

46]. This strategy greatly spurred industrialization through a bottom-up approach, which produced rapid economic growth based on export-processing works at the expense of extensive usage of resources [

47,

48]. On the one hand, the local authorities were keen on providing substantial fiscal incentives for foreign investors and constructing plenty of small industrial parks/districts without supportive innovation systems. On the other hand, local firms preferred to become captive to foreign investors by establishing export-processing enterprises (EPEs) with them. EPEs were called the San Lai Yi Bu enterprises in China. These enterprises have no domestic sale quota, and all finished goods must be exported. Foreign investors were in charge of investing in facilities (including machines, plants and basic equipment), importing parts of the raw materials, providing designs and managerial assistance and exporting final products to global markets. With very low entry barriers, local firms provided all other resources such as land, workshops and low-wage workers, except capital and technologies [

8]. This captive form of global integration led to remarkable economic growth in the eastern PRD by which foreign firms kept delivering market orders and matured production technologies to their local partners.

In contrast to the eastern PRD, governments in the western PRD cities strategically took a more independent way of global integration, which can be regarded as a proactive type of strategic coupling. Many of the cities and villages in this area not only had a long history of being wealthier than the eastern PRD, but also had developed certain manufacturing industries during the planned economic period of China since 1949, such as Foshan and Jiangmen cities [

45,

49]. While using the same strategies as the eastern cities in the FDI promotion, the western regional and local governments proactively encouraged the establishment of locally owned township and village enterprises (TVEs), rather than establishing export-processing firms. Thousands of TVEs mushroomed and served as the local suppliers or subcontractors of foreign firms. Many local officials became entrepreneurs because they had a family tradition in conducing trading and manufacturing business [

50]. In other words, while local firms in the eastern PRD were earning the easy and quick money, TVEs in the western PRD started to accumulate indigenous production and marketing skills that they learned from foreign firms and reverse engineering. During the 1980s, regional and local governments provided crucial credit guarantees for these TVEs to access financial resources from regional banking systems. During the 1990s, some of the local governments radically privatized these TVEs from collectively-owned firms into shareholding companies so as to vitalize the initiatives and competiveness of local firms [

51,

52]. These local efforts enabled the TVEs to be restructured and upgrade into competitive corporations in domestic markets [

5].

The difference between Dongguan and Foshan cities can embody the influences of institutional embeddedness and local initiatives towards the formation of captive and proactive coupling. By being captive to foreign investors, Dongguan became a global arena of transplanted factories, particularly the ones from East Asian contract manufacturers. Most of the industrial clusters in Dongguan were dominated by FIEs, and local firms served as their suppliers or low-tier subcontractors, such as the electronics industry in Qingxi and Shilong towns and the apparel industry in Humen and Dalang towns [

53,

54]. Local firms in Dongguan firstly relied on export processing markets and started to pay attention to domestic markets since the 2000s. Different from Dongguan, industrial clusters in Foshan were mainly dominated by local firms, such as the home appliance industry in the towns of Beijiao and Ronggui and the apparel industry in the towns of Yanbu and Junan [

51,

55]. Local firms in Foshan firstly imitated incumbent products and sold them in domestic markets with their own brands. In doing so, they reaped ample profits, reinvested into innovation and gradually upgraded their production capabilities. In the meantime, they conducted subcontracting business in the global markets for knowing market trends and new technologies. This dual-market strategy allowed them to gradually upgrade from low-end branded manufacturers into domestic lead firms [

49]. Since the 2000s, they started to explore global markets with their owned brands, such as Midea and Galanz.

The dependent form of integration of the eastern PRD has caused questions of regional resilience and sustainability. The competitive advantage has been reduced due to land resource exhaustion and serious environmental pollution. As a result, East Asian contract manufacturers, in particular the Taiwanese firms, are relocating their higher value-added segments to the Yangzi River Delta and keeping their PRD production plants at lower value-added segments [

56,

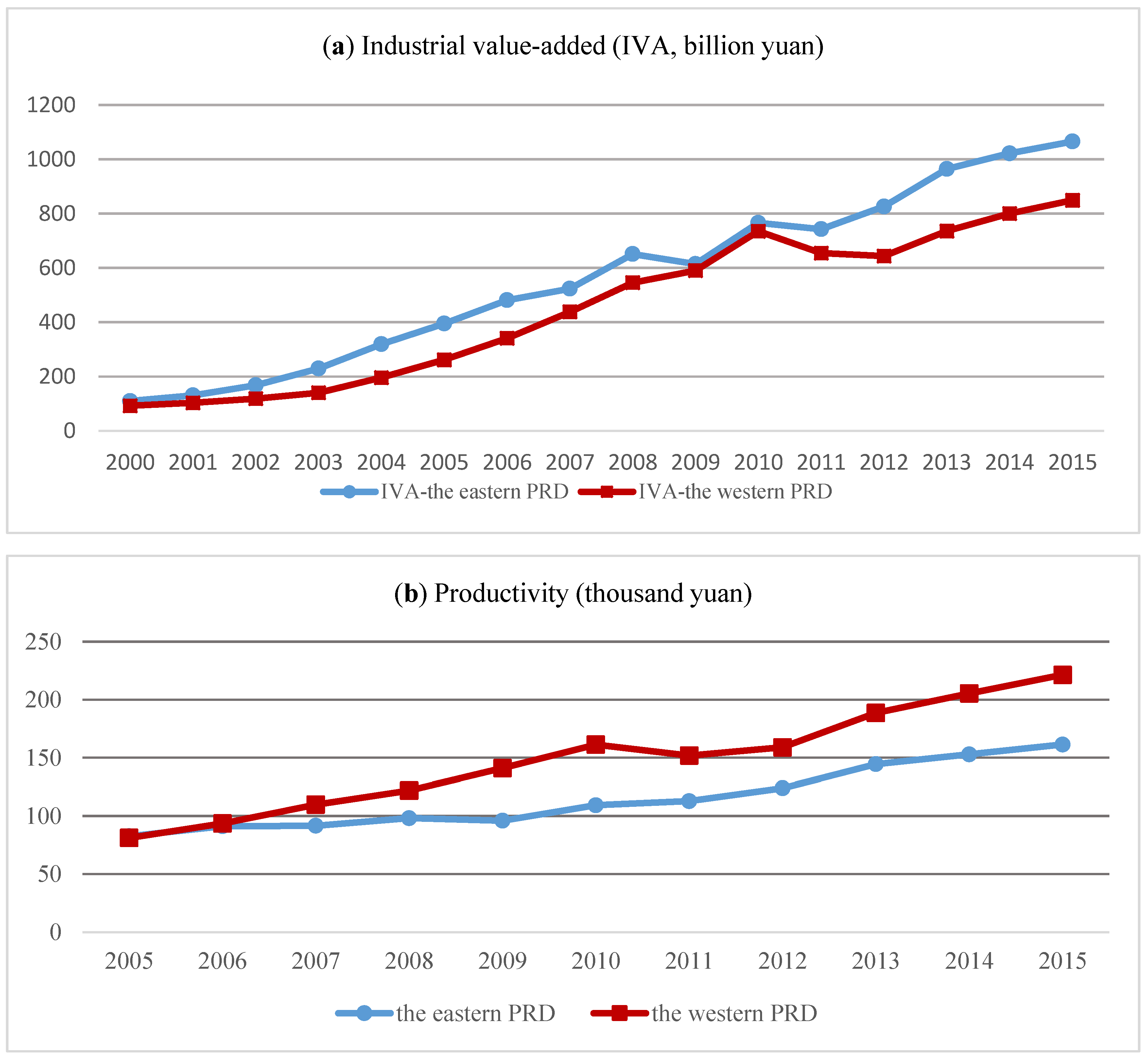

57]. In the western PRD, thought local firms have been growing more slowly than the eastern ones, they were catching up quickly in the 2000s. As

Figure 3 shows, the total industrial value-added of the western PRD still lagged behind the eastern RPD throughout the 2000s. However, the productivity (the average industrial value-added per enterprise) of the western PRD has outperformed the eastern PRD in 2005 and kept enlarging the gap in the subsequent development.

Synthesizing

Figure 1,

Figure 2 and

Figure 3 and all the previous studies about the PRD, particularly during the period before 2010, the divergence of the eastern and western PRD has been quite coherent with the general understanding of sustainability. Captive coupling in the eastern PRD has led to less sustainability, while the western PRD would be more promising due to proactive coupling. However, if taking into account the more recent development and the field observations of this study, the economic sustainability between the eastern and western PRD would be critically reexamined. As shown by

Figure 3, from 2010 onward, the industrial value-added (IVA) of eastern PRD rebounded very soon and took the growing-up momentum back again. Meanwhile, the average IVA of the western PRD was more volatile than the eastern PRD from 2008 to 2012. In order to unpack this question further, the next section examines how these two sub-regions will respond and recover during the recent global financial crisis based on general statistical data.

4. Regional Response of the Pearl River Delta during and after the 2008 Global Economic Crisis

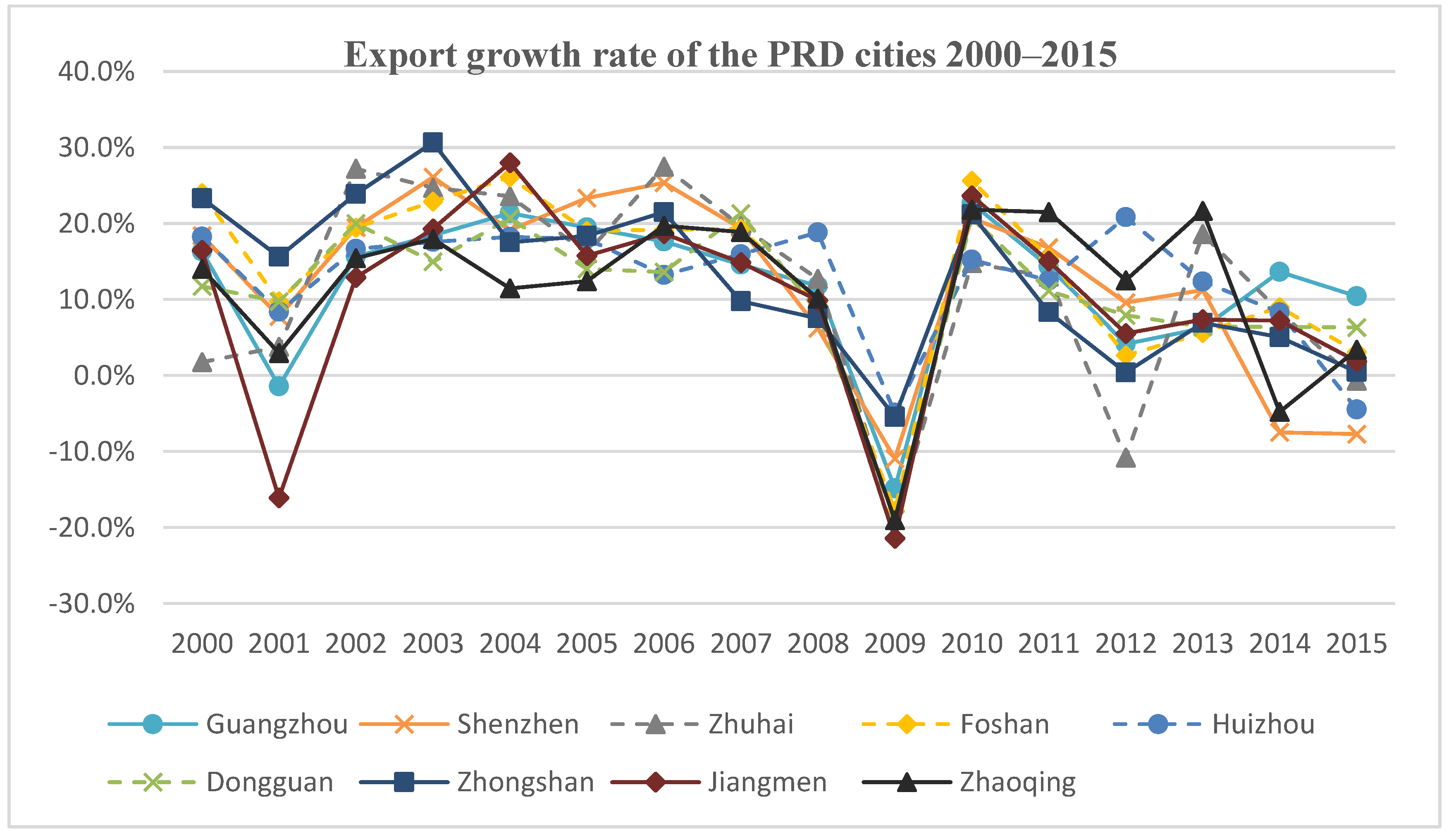

For most of the developing regions like the PRD, the main recessionary impact of the 2008 global economic crisis was the decline of international trade that caused negative impacts on FDI, exportation and domestic production. In the PRD, cities suffered from a similar trend of decline and rebound. As shown by

Figure 4, exportation in all the cities dived from 2008 to 2009. It soon recovered during 2010 and 2011, but dropped down again in 2012. From 2012 to 2016, the export market of the PRD was rather diverse, and there was no significant trend between the eastern and western PRD. However, one thing clear is that the growth rate has not recovered to the height before 2008. The change of GDP growth rate was roughly synchronized with the situations of exportation. From 2001 to 2009, the average GDP growth rate sharply dropped from about 18% to 5%–10%. The worst recession came from Dongguan in the eastern PRD and Zhuhai in the western PRD. Meanwhile, the resilience of the PRD was unstable. All these cities quickly rebounded from 2009 to 2010. However, in 2012, the growth rate dropped down again and gradually became stable by 2016 (GPBS 2005, 2011, 2016).

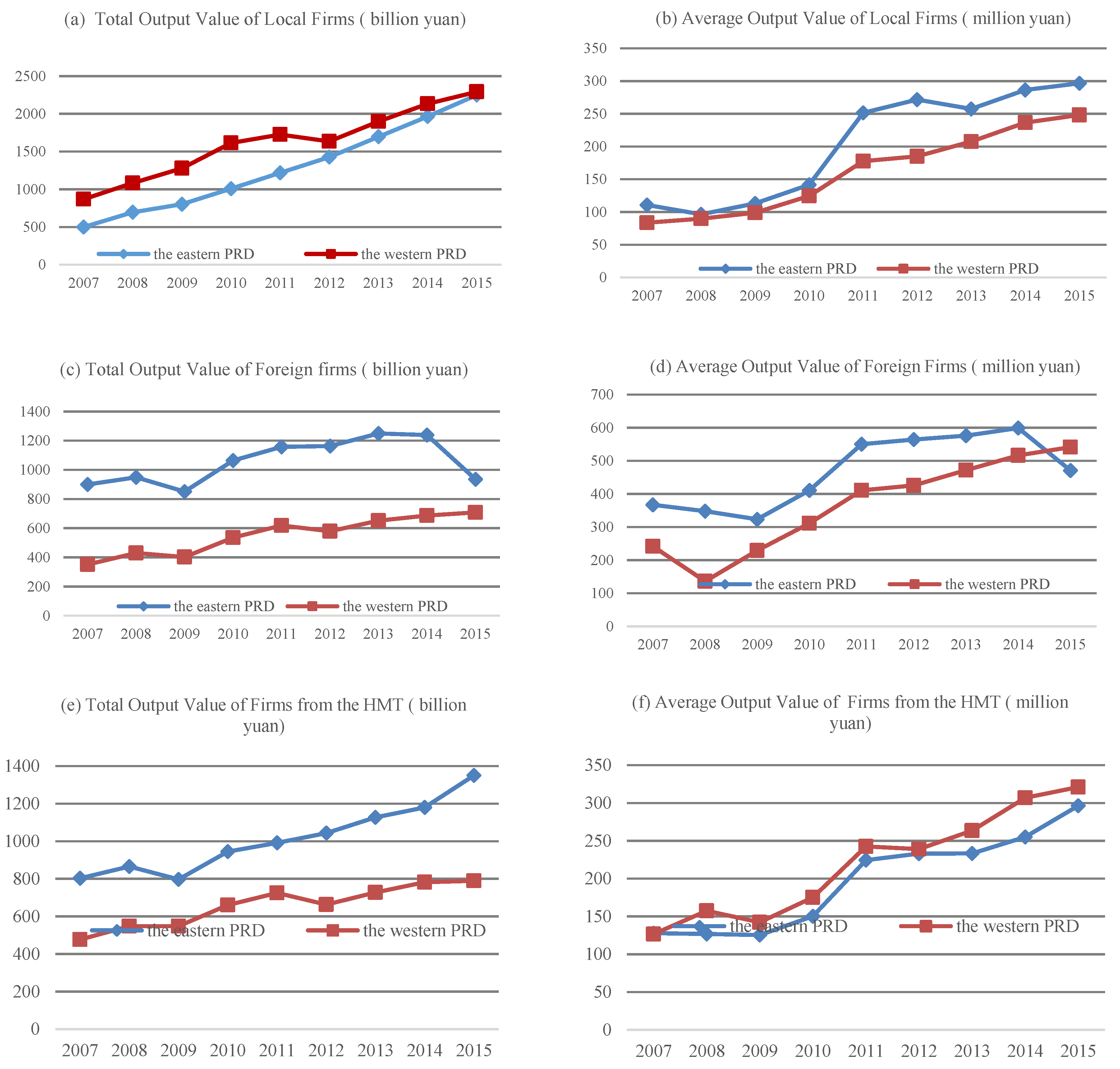

A further examination of different ownerships of firms found that the country origin and location of firms both matter towards the response to the crisis (see

Figure 5) (The firm-level data in 2012 were not comparable due to the change of the statistical caliber.). Overall, local firms were less vulnerable than foreign firms to the shock according to the changes of the total and average output values of firms, which is coherent with the traditional understanding that FIEs were leading the regional economies, while local firms were the followers. However, the interesting point is that all types of firms in the western PRD were less vulnerable and more capable of adapting to the shock. However, all types of firms in the eastern PRD recovered soon and took back the momentum of economic growth, which outperformed the western PRD clearly. In terms of local firms, the eastern ones had a drop of average industrial output value from 2009 and 2010, while the western local firms almost outperformed the eastern ones in this period (

Figure 5a,b). But local firms in the eastern PRD soared up after 2010. In terms of foreign firms, all had undergone a drop between 2008 and 2009, but the eastern foreign firms apparently had a more significant drop than the western ones between 2008–2009 and 2014–2015 (

Figure 5c,d). The performance of Hong Kong, Macao and Taiwan (HMT) firms also showed great divergence (

Figure 5e,f). From 2007 to 2011, the output values of the HMT firms in the eastern PRD had a significant drop, while the western PRD was stable and even had a slight increase; since 2008 HMT firms in the western PRD had outperformed the eastern ones and the tendency was reinforced since 2012. Overall, six sub-figure of

Figure 5 shows that foreign firms suffered most in the 2008–2009 crisis and performed relatively poorly in more recent development, while local firms and HMT firms were more resilient. In terms of sub-regional difference, firms from the eastern PRD were more resilient than the western ones.

Although detailed data about the firm-level responses to the crisis were unavailable, such as the changes of portions between domestic and international markets, or the number of firms that relocated from the region, the presented data so far are able to inform that, during the post-crisis time frame, in terms of the total/average output of firms, the eastern PRD was quite resilient as a whole and local firms were more resilient than foreign firms no matter where they were located.

To this point, one may question that the resilience of the eastern PRD should be attributed to the rebound of the global market. Hence, the more dependent on the export market the city is, the more resilient it will be. However, this argument is untenable. By carefully examining

Figure 4, there was no significant sign of export-market rebound. The export growth rage of all the cities were merely back to normal after 2008 and then decreased gradually over times. From 2010 to 2015, cities with higher export growth rate were Huizhou, Zhaoqing and Zhuhai from the western PRD, whereas Shenzhen and Dongguan representing the eastern PRD suffered from more than a 10% drop. Therefore, the resilience reflected by total/average industrial outputs cannot be attributed to the change of export markets in the case of the PRD. As

Figure 5 shows, the major difference was between the foreign firms and the local/HMT firms in which the former seemed to be recovering quickly, but suffered from serious decline again after 2013. A potential explanation may be that the competent regionalized supply network and emerging domestic markets in China allow firms with more home-based advantages to be more resilient. Hence, local firms in the eastern PRD would have better performance than the western ones because they have learned greatly from the neighborhood FIEs. Feedback from the interviews, particularly those conducted around 2010, had supported this point. The fieldwork found that the PRD has developed about 50 specialized-industrialized clusters, each of which has developed comprehensive local production networks composed of hundreds and thousands of small manufactures and component suppliers [

60]. Recent studies have reported the situation that the Guangdong provincial government established transplanted industrial parks and intensive subsidies to relocate labor-intensive industries out of the PRD, but only a few thousand firms followed this policy [

61]. The total industrial output of these firms accounted for a very limited share of the whole region. For many of the local firms, no matter whether they located in the eastern or western PRD, by selling acceptable/good products to domestic markets for years, they have learned by doing and upgraded into their own manufacturing brands [

49,

62]. This situation was not significant before the crisis. However, nowadays, it is becoming quite a normal strategy for local firms to adopt.

5. Conclusions

Illustrating the experiences of the PRD before and after the 2008 global economic crisis, this paper advances the studies of sustainability by bringing in the context of globalization and questing sustainability in relation to strategic coupling and resilience. Based on the empirical findings, this paper argues that sustainability in late-coming regions cannot be explained by either intra-regional forces or the way of global integration alone. In contrast, it has to be explained by the combination of both, the alleged strategic coupling process between local firms, regional governments and foreign firms. This effort contributes to the literature of sustainability by two-fold.

First, it sheds light on the geography of regional economic sustainability, which goes beyond the previous analytical scopes of sustainability that focus more on the agriculture system, resource utilization, or ecological/environmental balance. This paper highlights the importance of some new geographical factors towards regional economic sustainability. These factors vary over space, together with the factors proposed by previous studies, constituting the variegated conditions that sustain regional economic growth. Empirically, this paper found that the divergence of coupling results from four geographical factors: the global interests of industrial relocation; locality; institutional embeddedness, and; local initiatives. While the globally shifting TNCs are attracted by low-cost production resources in China, locality plays a primary factor that shapes the strategy of foreign firms to choose local partners, firstly in Hong Kong and later in the PRD. The responses of local firms and urban government varied due to different institutional embeddedness and local initiatives. This start-up institutional setting shaped the trajectory of regional growth. Local firms not only benefit from the co-production of value creation with foreign firms, though in a captive or subordinate role, and distribution, but also learned from them, and some of them have upgraded and grown into competent players.

Second, while not criticizing or proposing a specific point of view, this paper offers a critical perspective towards the studying of sustainability by revealing the trade-off of globalization in relation to economic growth, learning and resilience. It affirms that exogenous-based economic growth, resilience and sustainability are not necessarily correlated. In the context of globalizing regional development, policymakers cannot arbitrarily judge the sustainability of a region by whether there is continuous growth or good resilience, but have to carefully look into the actual performance of firms.

In the case of the PRD, captive coupling had led to high export dependency in regional economies that were growing faster and were more vulnerable to external market shocks. However, the capabilities of these sub-regional economies were growing, as well, so that they have shown good resilience during and after the 2008 global financial crisis. Comparing with captive coupling, proactive coupling had led to a more indigenous way of growth, without much surprise, and led to relatively slower regional economic growth. This situation looks more promising because the average level of industrial value added is higher than that of under captive coupling. However, eventually, sub-regional economies under proactive coupling did not show salient resilience during and after the crisis. One potential reason may be that local firms proactively chose to rely more on themselves, thus receiving less learning opportunities than the firms under captive coupling. Meanwhile, this study found that the country origin of firms and the ways of coupling have a relation to the formation of the developmental trajectories and resilience of latecomer regions. Although foreign firms have a larger contribution, they did not necessarily have better performance than local firms. After the crisis, the local firms in eastern PRD have the best resilience and performance.

Further studies can focus on constructing an index system for measuring regional economic sustainability in relation to the degree of globalization, the content of strategic coupling and the level of resilience, which have not been done by this paper. In terms of policy implication, this paper would suggest that policy makers in late-coming economies not only have to pay attention to the value co-creation and distribution process, but also have to pay attention to the interactions between the coupled partners in which technological diffusion and learning happen. It is important to identify the trade-off of globalization between rapid economic growth and resilience so as to have a more critical understanding of sustainability in the process of economic catching-up.