Factors Affecting the Survival of SMEs: A Study of Biotechnology Firms in South Korea

Abstract

:1. Introduction

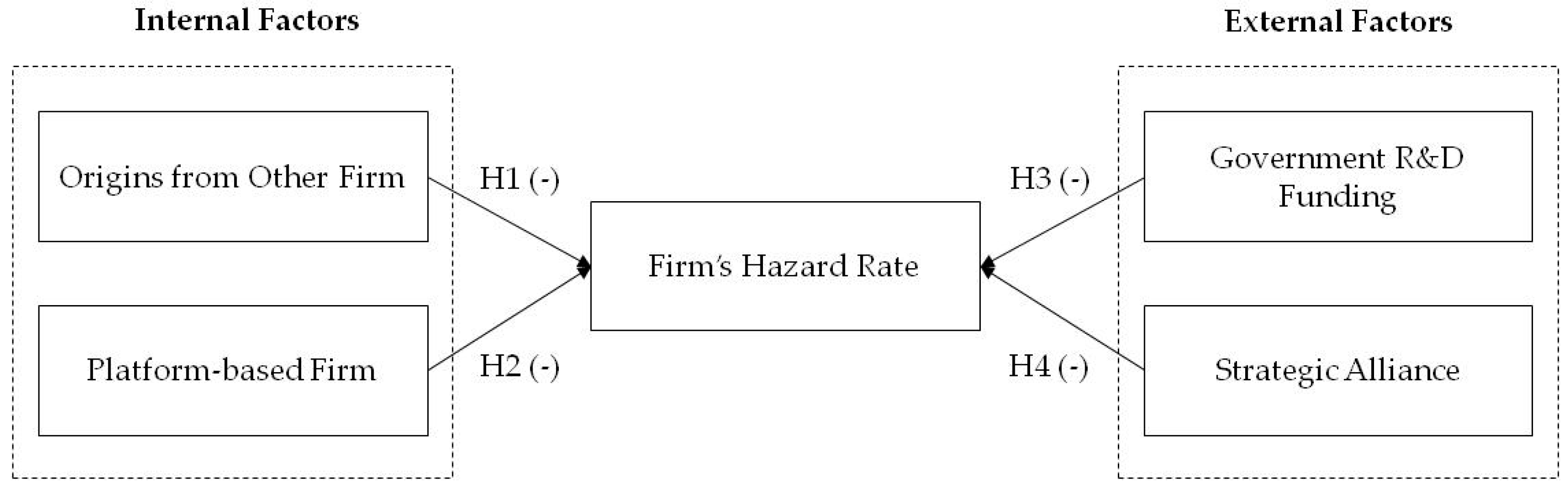

2. Theoretical Background and Hypotheses

2.1. The Origin of a Firm

2.2. Platform-Based Firm

2.3. Government R&D Funding

2.4. Strategic Alliance

3. Data and Method

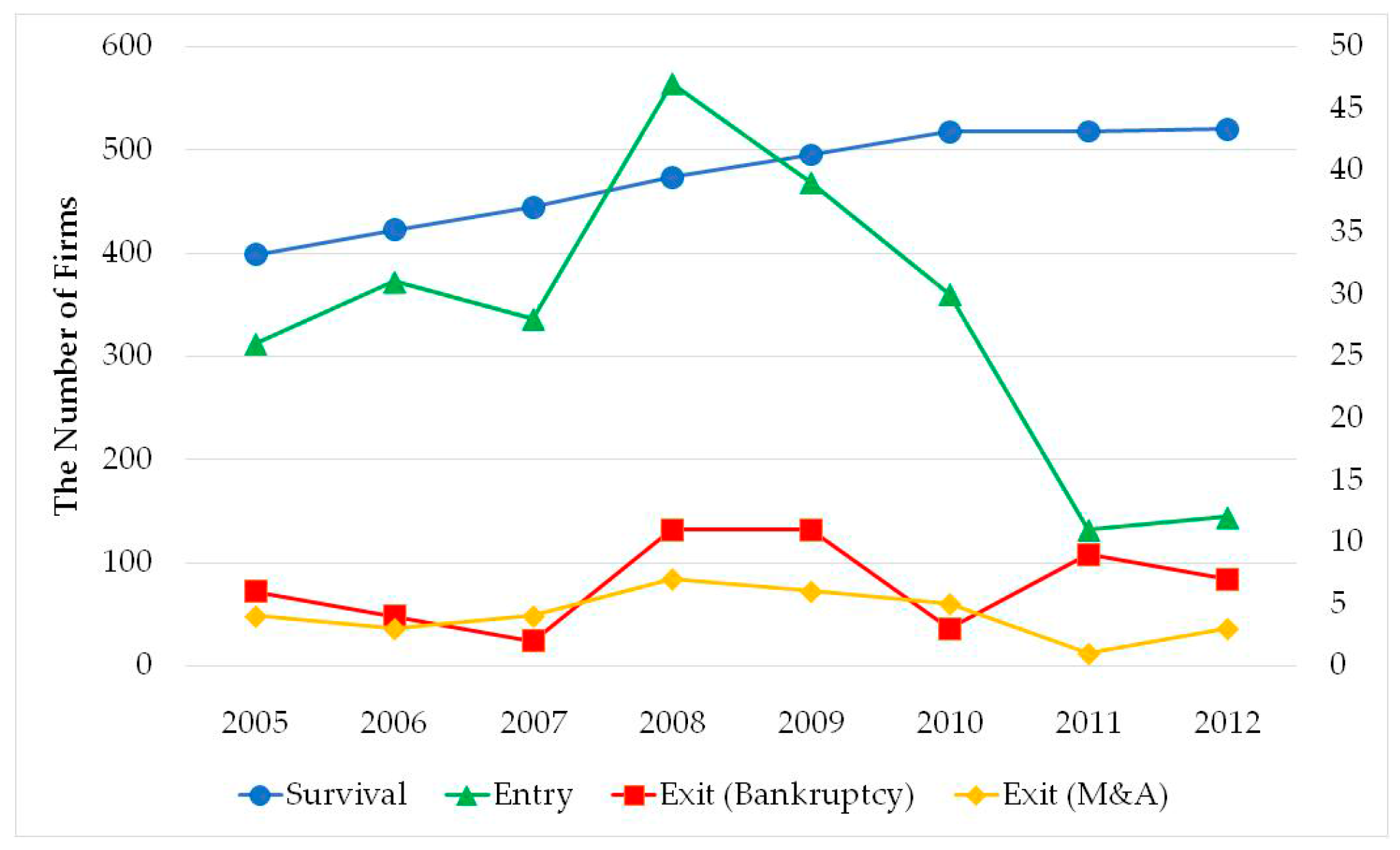

3.1. Data

3.2. Method

4. Results and Discussion

5. Conclusions

Author Contributions

Conflicts of Interest

References

- The CMR International Pharmaceutical R&D Factbook 2014. Available online: http://cmr.thomsonreuters.com/services/factbook (accessed on 2 November 2016).

- Galati, F.; Bigliardi, B. The Unintended Effect of the Orphan Drug Act on the Adoption on Open Innovation. Sci. Public Policy 2016. [Google Scholar] [CrossRef]

- EvaluatePharma World Preview 2012. Available online: http://www.evaluategroup.com/public/EvaluatePharma-World-Preview-2018-Embracing-the-Patent-Cliff.aspx (accessed on 2 November 2016).

- Coriat, B.; Orsi, F.; Weinstein, O. Does biotech reflect a new science-based innovation regime? Ind. Innov. 2003, 10, 231–253. [Google Scholar] [CrossRef]

- Innovation in Science, Technology and Industry: Key Biotechnology Indicators. Available online: https://www.oecd.org/innovation/inno/keybiotechnologyindicators.htm (accessed on 2 November 2016).

- Pisano, G.P. Science Business: The Promise, the Reality, and the Future of Biotech; Harvard Business School Press: Boston, MA, USA, 2006. [Google Scholar]

- Thorsteinsdóttir, H.; Daar, A.S.; Singer, P.A.; Archambault, É.; Arunachalam, S. Health biotechnology publishing takes-off in developing countries. Int. J. Biotechnol. 2006, 8, 23–42. [Google Scholar] [CrossRef]

- Casper, S. Institutional frameworks and public policy towards biotechnology: Can Asia learn from Europe? Asian Bus. Manag. 2009, 8, 363–394. [Google Scholar] [CrossRef]

- Hopenhayn, H.A. Entry, exit, and firm dynamics in long run equilibrium. Econom. Soc. 1992, 60, 1127–1150. [Google Scholar] [CrossRef]

- Audretsch, D.B. New-firm survival and the technological regime. Rev. Econ. Stat. 1991, 73, 441–450. [Google Scholar] [CrossRef]

- Klepper, S. Firm survival and the evolution of oligopoly. RAND J. Econ. 2002, 33, 37–61. [Google Scholar] [CrossRef]

- Mata, J.; Portugal, P.; Guimaraes, P. The survival of new plants: Start-up conditions and post-entry evolution. Int. J. Ind. Organ. 1995, 13, 459–481. [Google Scholar] [CrossRef]

- Das, S.; Srinivasan, K. Duration of firms in an infant industry: The case of Indian computer hardware. J. Dev. Econ. 1997, 53, 157–167. [Google Scholar] [CrossRef]

- Cottrell, T.; Nault, B.R. Product variety and firm survival in the microcomputer software industry. Strateg. Manag. J. 2004, 25, 1005–1025. [Google Scholar] [CrossRef]

- Cefis, E.; Marsili, O. Survivor: The role of innovation in firms’ survival. Res. Policy 2006, 35, 626–641. [Google Scholar] [CrossRef]

- Honjo, Y. Business failure of new firms: An empirical analysis using a multiplicative hazards model. Int. J. Ind. Organ. 2000, 18, 557–574. [Google Scholar] [CrossRef]

- Zahra, S.A. Governance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Acad. Manag. J. 1996, 39, 1713–1735. [Google Scholar] [CrossRef]

- Baum, J.A.; Calabrese, T.; Silverman, B.S. Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strateg. Manag. J. 2000, 21, 267–294. [Google Scholar] [CrossRef]

- Baum, J.A.; Silverman, B.S. Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. J. Bus. Ventur. 2004, 19, 411–436. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Manufacturing strategy and new venture performance: A comparison of independent and corporate ventures in the biotechnology industry. J. High Technol. Manag. Res. 1999, 10, 313–345. [Google Scholar] [CrossRef]

- Casper, S.; Kettler, H. National institutional frameworks and the hybridization of entrepreneurial business models: The German and UK biotechnology sectors. Ind. Innov. 2001, 8, 5–30. [Google Scholar] [CrossRef]

- Willemstein, L.; Van der Valk, T.; Meeus, M.T. Dynamics in business models: An empirical analysis of medical biotechnology firms in the Netherlands. Technovation 2007, 27, 221–232. [Google Scholar] [CrossRef]

- Teece, D.J. Firm organization, industrial structure, and technological innovation. J. Econ. Behav. Organ. 1996, 31, 193–224. [Google Scholar] [CrossRef]

- Alvarez, S.A.; Busenitz, L.W. The entrepreneurship of resource-based theory. J. Manag. 2001, 27, 755–775. [Google Scholar] [CrossRef]

- Fetterhoff, T.J.; Voelkel, D. Managing open innovation in biotechnology. Res. Technol. Manag. 2006, 49, 14–18. [Google Scholar]

- Bianchi, M.; Cavaliere, A.; Chiaroni, D.; Frattini, F.; Chiesa, V. Organisational modes for Open Innovation in the bio-pharmaceutical industry: An exploratory analysis. Technovation 2011, 31, 22–33. [Google Scholar] [CrossRef]

- Malerba, F. Sectoral systems of innovation and production. Res. Policy 2002, 31, 247–264. [Google Scholar] [CrossRef]

- Biotech Policy Research Center of the Republic of Korea, Biotechnology in Korea 2014. Available online: https://www.bioin.or.kr/board.do?bid=w_paper (accessed on 2 November 2016).

- Barney, J.B. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wade, M.; Hulland, J. Review: The resource-based view and information systems research: Review, extension, and suggestions for future research. MIS Q. 2004, 28, 107–142. [Google Scholar] [CrossRef]

- Child, J. Organizational structure, environment and performance: The role of strategic choice. Sociology 1972, 6, 1–22. [Google Scholar] [CrossRef]

- Mellahi, K.; Wilkinson, A. Organizational failure: A critique of recent research and a proposed integrative framework. Int. J. Manag. Rev. 2004, 5, 21–41. [Google Scholar] [CrossRef]

- Barney, J.B. Is the resource-based “view” a useful perspective for strategic management research? Yes. Acad. Manag. Rev. 2001, 26, 41–56. [Google Scholar]

- Hannan, M.T.; Freeman, J. Where do organizational forms come from? Sociol. Forum 1986, 1, 50–72. [Google Scholar] [CrossRef]

- Astley, W.G.; Van de Ven, A.H. Central perspectives and debates in organization theory. Adm. Sci. Q. 1983, 28, 245–273. [Google Scholar] [CrossRef]

- Peng, M.W.; Heath, P.S. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Acad. Manag. J. 1996, 21, 492–528. [Google Scholar]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Stanford University Press: Stanford, CA, USA, 2003. [Google Scholar]

- Child, J. Strategic choice in the analysis of action, structure, organizations and environment: Retrospect and prospect. Organ. Stud. 1997, 18, 43–76. [Google Scholar] [CrossRef]

- Sharma, S. Managerial interpretations and organizational context as predictors of corporate choice of environmental strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar] [CrossRef]

- Heirman, A.; Clarysse, B. How and why do research-based start-ups differ at founding? A resource-based configurational perspective. J. Technol. Transf. 2004, 29, 247–268. [Google Scholar] [CrossRef]

- Zucker, L.G.; Darby, M.R. Individual action and the demand for institutions star scientists and institutional transformation. Am. Behav. Sci. 1997, 40, 502–513. [Google Scholar] [CrossRef]

- Aspelund, A.; Berg-Utby, T.; Skjevdal, R. Initial resources’ influence on new venture survival: A longitudinal study of new technology-based firms. Technovation 2005, 25, 1337–1347. [Google Scholar] [CrossRef]

- Meyer, M. Academic entrepreneurs or entrepreneurial academics? Research–based ventures and public support mechanisms. R&D Manag. 2003, 33, 107–115. [Google Scholar]

- Clarysse, B.; Moray, N. A process study of entrepreneurial team formation: The case of a research-based spin-off. J. Bus. Ventur. 2004, 19, 55–79. [Google Scholar] [CrossRef]

- Vallas, S.P.; Kleinman, D.L. Contradiction, convergence and the knowledge economy: The confluence of academic and commercial biotechnology. Socio-Econ. Rev. 2008, 6, 283–311. [Google Scholar] [CrossRef]

- Baden-Fuller, C.W. Exit from declining industries and the case of steel castings. Econ. J. 1989, 99, 949–961. [Google Scholar] [CrossRef]

- Deeds, D.L.; Hill, C.W. An examination of opportunistic action within research alliances: Evidence from the biotechnology industry. J. Bus. Ventur. 1999, 14, 141–163. [Google Scholar] [CrossRef]

- Wennberg, K.; Wiklund, J.; Wright, M. The effectiveness of university knowledge spillovers: Performance differences between university spinoffs and corporate spinoffs. Res. Policy 2011, 40, 1128–1143. [Google Scholar] [CrossRef]

- Buenstorf, G. Creation and pursuit of entrepreneurial opportunities: An evolutionary economics perspective. Small Bus. Econ. 2007, 28, 323–337. [Google Scholar] [CrossRef]

- Arregle, J.; Batjargal, B.; Hitt, M.A.; Webb, J.W.; Miller, T.; Tsui, A.S. Family ties in entrepreneurs’ social networks and new venture growth. Entrep. Theory Pract. 2015, 39, 313–344. [Google Scholar] [CrossRef]

- LeBrasseur, R.; Zanibbi, L.; Zinger, T.J. Growth momentum in the early stages of small business start-ups. Int. Small Bus. J. 2003, 21, 315–330. [Google Scholar] [CrossRef]

- Carayannopoulos, S.; Auster, E.R. External knowledge sourcing in biotechnology through acquisition versus alliance: A KBV approach. Res. Policy 2010, 39, 254–267. [Google Scholar] [CrossRef]

- Hermans, R.; Kauranen, I. Value creation potential of intellectual capital in biotechnology–empirical evidence from Finland. R&D Manag. 2005, 35, 171–185. [Google Scholar]

- Chiaroni, D.; Chiesa, V.; Frattini, F. Investigating the adoption of open innovation in the bio-pharmaceutical industry: A framework and an empirical analysis. Eur. J. Innov. Manag. 2009, 12, 285–305. [Google Scholar] [CrossRef]

- Casper, S. Institutional adaptiveness, technology policy, and the diffusion of new business models: The case of German biotechnology. Organ. Stud. 2000, 21, 887–914. [Google Scholar] [CrossRef]

- Fisken, J.; Rutherford, J. Business models and investment trends in the biotechnology industry in Europe. J. Commer. Biotechnol. 2002, 8, 191–199. [Google Scholar]

- Martin, S.; Scott, J.T. The nature of innovation market failure and the design of public support for private innovation. Res. Policy 2000, 29, 437–447. [Google Scholar] [CrossRef]

- Guellec, D.; Van Pottelsberghe De La Potterie, B. The impact of public R&D expenditure on business R&D. Econ. Innov. New Technol. 2003, 12, 225–243. [Google Scholar]

- Busom, I. An empirical evaluation of the effects of R&D subsidies. Econ. Innov. New Technol. 2000, 9, 111–148. [Google Scholar]

- Blanes, J.V.; Busom, I. Who participates in R&D subsidy programs? The case of Spanish manufacturing firms. Res. Policy 2004, 33, 1459–1476. [Google Scholar]

- Shane, S. Why encouraging more people to become entrepreneurs is bad public policy. Small Bus. Econ. 2009, 33, 141–149. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Licht, G. Additionality of public R&D grants in a transition economy. Econ. Transit. 2006, 14, 101–131. [Google Scholar]

- Cantner, U.; Kösters, S. Picking the winner? Empirical evidence on the targeting of R&D subsidies to start-ups. Small Bus. Econ. 2012, 39, 921–936. [Google Scholar]

- Kang, K.N.; Park, H. Influence of government R&D support and inter-firm collaborations on innovation in Korean biotechnology SMEs. Technovation 2012, 32, 68–78. [Google Scholar]

- Christensen, C.M.; Suárez, F.F.; Utterback, J.M. Strategies for survival in fast-changing industries. Manag. Sci. 1998, 44, S207–S220. [Google Scholar] [CrossRef]

- Wynarczyk, P.; Piperopoulos, P.; McAdam, M. Open innovation in small and medium-sized enterprises: An overview. Int. Small Bus. J. 2013, 31, 240–242. [Google Scholar] [CrossRef]

- Bigliardi, B.; Galati, F. Which factors hinder the adoption of open innovation in SMEs? Technol. Anal. Strateg. 2016, 28, 869–885. [Google Scholar] [CrossRef]

- Freel, M.; Robson, P.J. Appropriation strategies and open innovation in SMEs. Int. Small Bus. J. 2016. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Schoonhoven, C.B. Resource-based view of strategic alliance formation: Strategic and social effects in entrepreneurial firms. Organ. Stud. 1996, 7, 136–150. [Google Scholar] [CrossRef]

- Coombs, J.E.; Bierly, P.E. Measuring technological capability and performance. R&D Manag. 2006, 36, 421–438. [Google Scholar]

- Cooke, P. Regional innovation systems, clusters, and the knowledge economy. Ind. Corp. Chang. 2001, 10, 945–974. [Google Scholar] [CrossRef]

- George, G.; Zahra, S.A.; Wheatley, K.K.; Khan, R. The effects of alliance portfolio characteristics and absorptive capacity on performance: A study of biotechnology firms. J. High Technol. Manag. Res. 2001, 12, 205–226. [Google Scholar] [CrossRef]

- Oliver, A.L. Strategic alliances and the learning life-cycle of biotechnology firms. Organ. Stud. 2001, 22, 467–489. [Google Scholar] [CrossRef]

- Delmar, F.; Shane, S. Legitimating first: Organizing activities and the survival of new ventures. J. Bus. Ventur. 2004, 19, 385–410. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Deeds, D.L. Alliance type, alliance experience and alliance management capability in high-technology ventures. J. Bus. Ventur. 2006, 21, 429–460. [Google Scholar] [CrossRef]

- Tsai, W.; Erickson, S. Early-stage biotech companies: Strategies for survival and growth. Biotechnol. Healthc. 2006, 3, 49–53. [Google Scholar] [PubMed]

- Raz, O.; Gloor, P.A. Size really matters-new insights for start-ups’ survival. Manag. Sci. 2007, 53, 169–177. [Google Scholar] [CrossRef]

- Fisher, L.D.; Lin, D.Y. Time-dependent covariates in the Cox proportional-hazards regression model. Annu. Rev. Public Health 1999, 20, 145–157. [Google Scholar] [CrossRef] [PubMed]

- Fine, J.P.; Gray, R.J. A proportional hazards model for the subdistribution of a competing risk. J. Am. Stat. Assoc. 1999, 94, 496–509. [Google Scholar] [CrossRef]

- Colombo, M.G.; Grilli, L. Founders’ human capital and the growth of new technology-based firms: A competence-based view. Res. Policy 2005, 34, 795–816. [Google Scholar] [CrossRef]

- González, X.; Pazó, C. Do public subsidies stimulate private R&D spending? Res. Policy 2008, 37, 371–389. [Google Scholar]

- Gulati, R. Social structure and alliance formation patterns: A longitudinal analysis. Admin. Sci. Q. 1995, 40, 619–652. [Google Scholar] [CrossRef]

- Kale, P.; Dyer, J.H.; Singh, H. Alliance capability, stock market response, and long-term alliance success: The role of the alliance function. Strateg. Manag. J. 2002, 23, 747–767. [Google Scholar] [CrossRef]

- Oxley, J.E.; Sampson, R.C. The scope and governance of international R&D alliances. Strateg. Manag. J. 2004, 25, 723–749. [Google Scholar]

- Oxley, J.E. Institutional environment and the mechanisms of governance: The impact of intellectual property protection on the structure of inter-firm alliances. J. Econ. Behav. Organ. 1999, 38, 283–309. [Google Scholar] [CrossRef]

- Lin, C.; Wu, Y.J.; Chang, C.; Wang, W.; Lee, C.Y. The alliance innovation performance of R&D alliances—The absorptive capacity perspective. Technovation 2012, 32, 282–292. [Google Scholar]

- Rothaermel, F.T.; Deeds, D.L. Exploration and exploitation alliances in biotechnology: A system of new product development. Strateg. Manag. J. 2004, 25, 201–221. [Google Scholar] [CrossRef]

- Hall, L.; Bagchi-Sen, S. An analysis of R&D, innovation and business performance in the US biotechnology industry. Int. J. Biotechnol. 2001, 3, 267–286. [Google Scholar]

- Buisseret, T.J.; Cameron, H.M.; Georghiou, L. What difference does it make? Additionality in the public support of R&D in large firms. Int. J. Technol. Manag. 1995, 10, 587–600. [Google Scholar]

- Griliches, Z. Market value, R&D, and patents. Econ. Lett. 1981, 7, 183–187. [Google Scholar]

- Caloghirou, Y.; Kastelli, I.; Tsakanikas, A. Internal capabilities and external knowledge sources: complements or substitutes for innovative performance? Technovation 2004, 24, 29–39. [Google Scholar] [CrossRef]

- Neter, J.; Wasserman, W.; Kutner, M. Applied Linear Statistical Models; Irwin: Chicago, IL, USA, 1985. [Google Scholar]

- Moustakbal, A. The disappearance of dedicated biotechnology firms in Canada. Int. J. Biotechnol. 2014, 13, 66–89. [Google Scholar] [CrossRef]

- Mata, J.; Portugal, P. Life duration of new firms. J. Ind. Econ. 1994, 42, 227–245. [Google Scholar] [CrossRef]

- Klepper, S.; Simons, K.L. The making of an oligopoly: Firm survival and technological change in the evolution of the US tire industry. J. Political Econ. 2000, 108, 728–760. [Google Scholar] [CrossRef]

- Bayus, B.L.; Agarwal, R. The role of pre-entry experience, entry timing, and product technology strategies in explaining firm survival. Manag. Sci. 2007, 53, 1887–1902. [Google Scholar] [CrossRef]

- Lyles, M.A.; Saxton, T.; Watson, K. Venture survival in a transitional economy. J. Manag. 2004, 30, 351–375. [Google Scholar] [CrossRef]

- Gompers, P.; Lerner, J. The venture capital revolution. J. Econ. Perspect. 2001, 15, 145–168. [Google Scholar] [CrossRef]

- Wang, L.; Zajac, E.J. Alliance or acquisition? A dyadic perspective on interfirm resource combinations. Strateg. Manag. J. 2007, 28, 1291–1317. [Google Scholar] [CrossRef]

- Porrini, P. Can a previous alliance between an acquirer and a target affect acquisition performance? J. Manag. 2004, 30, 545–562. [Google Scholar] [CrossRef]

- Science and Technology Policy Institute of the Republic of Korea (STEPI) 20 Years of Korean Biotech Venture: Past, Present and Challenges for Future. Available online: https://www.kdevelopedia.org/resource/view/05201402100130423.do (accessed on 2 November 2016).

- Wang, J.H.; Chen, T.Y.; Tsai, C.J. In search of an innovative state: The development of the biopharmaceutical industry in Taiwan, South Korea and China. Dev. Chang. 2012, 43, 481–503. [Google Scholar] [CrossRef]

- Whitley, R. Business Systems in East Asia: Firms, Markets and Societies; Sage: London, UK, 1992. [Google Scholar]

- Avgerou, C. The link between ICT and economic growth in the discourse of development. In Organizational Information Systems in the Context of Globalization; Korpela, M., Montealegre, R., Poulymenakou, A., Eds.; Springer: New York, NY, USA, 2003; pp. 373–386. [Google Scholar]

- Kumar, N.K.; Quach, U.; Thorsteinsdottir, H.; Somsekhar, H.; Daar, A.S.; Singer, P.A. Indian biotechnology—Rapidly evolving and industry led. Nat. Biotechnol. 2004, 22, DC31–DC36. [Google Scholar] [CrossRef] [PubMed]

- Zhenzhen, L.; Jiuchun, Z.; Ke, W.; Thorsteinsdóttir, H.; Quach, U.; Singer, P.A.; Daar, A.S. Health biotechnology in China—Reawakening of a giant. Nat. Biotechnol. 2004, 22, DC13–DC18. [Google Scholar] [CrossRef] [PubMed]

| Business Area | The Number of Firms | Proportion (%) | The Number of Firms | Proportion (%) | |

|---|---|---|---|---|---|

| Therapeutic Products | Bio-Medicine | 324 | 52.43 | 393 | 63.60 |

| Diagnostic Kits and Reagents | 69 | 11.17 | |||

| Platform | Supporting Services | 161 | 26.05 | 225 | 36.40 |

| Measurement and Analysis Equipment | 64 | 10.35 | |||

| Total | 618 | 100 | 618 | 100 | |

| Variable | Operational Definition |

|---|---|

| FIRMORI | 1 if firm established by founder with work experience at companies or spun out from a parent firm, 0 otherwise |

| PLATFORM | 1 if a platform-based firm, 0 otherwise |

| lnGOV | Log-transformed ratio of total amount of R&D funding supported by the government |

| GOV | Total amount of R&D funding supported by the government |

| ALLI | Number of strategic alliances |

| RDALLY | Number of R&D alliances |

| MMALLY | Number of manufacturing and marketing alliances |

| SIZE | Number of employees |

| AGE | Number of years since founding |

| RDIN | Log-transformed ratio of R&D expenses to revenues |

| DIV | Number of business areas in which the firm is engaged |

| GROW | The value resulting from dividing the difference between the number of entering firms and exiting firms by the number of existing firms in a given year |

| Variable | Mean | Std. dev. | FIRMORI | PLATFORM | lnGOV | GOV | ALLI | RDALLY | MMALLY | SIZE | AGE | RDIN | DIV | GROW |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FIRMORI | 0.4268 | 0.4947 | 1 | |||||||||||

| PLATFORM | 0.4345 | 0.4957 | −0.0545 *** | 1 | ||||||||||

| lnGOV | −5.3366 | 8.1560 | 0.0814 *** | −0.0155 | 1 | |||||||||

| GOV | 148.1536 | 398.6472 | 0.0141 | 0.0021 | 0.5436 *** | 1 | ||||||||

| ALLI | 0.1456 | 0.6357 | 0.0038 | −0.0019 | 0.1302 *** | 0.2671 *** | 1 | |||||||

| RDALLY | 0.0594 | 0.3272 | −0.0045 | 0.0311 * | 0.0936 *** | 0.1876 *** | 0.8501 *** | 1 | ||||||

| MMALLY | 0.0861 | 0.3969 | 0.0098 | −0.0287 † | 0.1313 *** | 0.2731 *** | 0.9008 *** | 0.5371 *** | 1 | |||||

| SIZE | 37.6967 | 58.8286 | 0.1385 *** | −0.0141 | 0.0710 *** | 0.1450 *** | 0.1852 *** | 0.1614 *** | 0.1636 *** | 1 | ||||

| AGE | 8.5180 | 5.4100 | −0.0254 † | 0.0153 | −0.0166 | 0.0703 *** | 0.1923 *** | 0.2028 *** | 0.1408 *** | 0.3897 *** | 1 | |||

| RDIN | −5.8467 | 5.3461 | 0.1237 *** | 0.0156 | 0.3770 *** | 0.1770 *** | 0.0699 *** | 0.0519 *** | 0.0691 *** | 0.0259 | −0.0408 ** | 1 | ||

| DIV | 1.3953 | 0.6429 | 0.0533 *** | 0.0647 *** | 0.1554 *** | 0.0562 *** | 0.1841 *** | 0.0920 *** | 0.0588 *** | 0.0306 † | 0.1006 *** | 0.1673 *** | 1 | |

| GROW | 0.0319 | 0.0221 | −0.0224 | −0.0103 | 0.0055 | 0.040 ** | −0.038 | 0.0108 | −0.0027 | 0.0320 * | −0.2542 *** | 0.1094 *** | 0.0199 | 1 |

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Estimate | Error | Estimate | Error | Estimate | Error | Estimate | Error | Estimate | Error | |

| FIRMORI | −0.4297 | 0.1245 *** | −0.4457 | 0.1248 *** | −0.4356 | 0.1246 *** | −0.4228 | 0.1245 *** | ||

| PLATFORM | −0.8095 | 0.1240 *** | −0.7953 | 0.1240 *** | −0.8202 | 0.1239 *** | −0.8067 | 0.1241 *** | ||

| lnGOV | −0.0598 | 0.0101 *** | −0.0581 | 0.0100 *** | −0.0604 | 0.0101 *** | ||||

| GOV | −0.0010 | 0.0003 *** | ||||||||

| ALLI | 0.2452 | 0.0802 ** | 0.2694 | 0.0852 ** | ||||||

| RDALLY | 0.3725 | 0.1736 * | ||||||||

| MMALLY | 0.3594 | 0.1115 ** | ||||||||

| SIZE | −0.0097 | 0.0022 *** | −0.0080 | 0.0019 *** | −0.0082 | 0.0019 *** | −0.0078 | 0.0019 *** | −0.0081 | 0.0019 *** |

| AGE | −0.1476 | 0.0210 *** | −0.1680 | 0.0230 *** | −0.1583 | 0.0227 *** | −0.1677 | 0.0230 *** | −0.1682 | 0.0231 *** |

| RDIN | −0.1975 | 0.0152 *** | −0.1714 | 0.0155 *** | −0.1851 | 0.0154 *** | −0.1713 | 0.0155 *** | −0.1712 | 0.0155 *** |

| DIV | −0.4125 | 0.1099 *** | −0.3117 | 0.1128 ** | −0.3067 | 0.1128 ** | −0.3048 | 0.1125 ** | −0.3087 | 0.1125 ** |

| GROW | −2.1881 | 2.6154 | −4.0944 | 2.6776 | −3.8129 | 2.6700 | −4.2209 | 2.6778 | −3.9764 | 2.6776 |

| Variable | Model 6 | Model 7 | Model 8 | Model 9 | ||||

|---|---|---|---|---|---|---|---|---|

| Estimate | Error | Estimate | Error | Estimate | Error | Estimate | Error | |

| FIRMORI | −0.9348 | 0.1969 *** | −0.9192 | 0.1966 *** | −0.9385 | 0.1969 *** | ||

| PLATFORM | −0.3819 | 0.1407 ** | −0.3696 | 0.1406 *** | −0.3925 | 0.1406 *** | ||

| lnGOV | −0.1114 | 0.0203 *** | −0.1117 | 0.0203 *** | −0.1114 | 0.0204 *** | ||

| ALLI | −0.7122 | 0.3455 * | ||||||

| RDALLY | −0.6102 | 0.2850 * | ||||||

| MMALLY | −2.0584 | 0.9731 * | ||||||

| SIZE | −0.0173 | 0.0035 *** | −0.0125 | 0.0033 *** | −0.0129 | 0.0033 *** | −0.0124 | 0.0032 *** |

| AGE | −0.0640 | 0.0243 *** | −0.0902 | 0.0264 *** | −0.0903 | 0.0264 *** | −0.0897 | 0.0263 *** |

| RDIN | −0.5965 | 0.0921 *** | −0.6009 | 0.1054 *** | −0.6031 | 0.1067 *** | −0.6000 | 0.1051 *** |

| DIV | −0.2418 | 0.1334 * | 0.0004 | 0.1365 | −0.0197 | 0.1372 | 0.0032 | 0.1363 |

| GROW | 0.2263 | 3.2648 | −2.2383 | 3.3715 | −2.1526 | 3.3694 | −2.2562 | 3.3744 |

| Variable | Model 10 | Model 11 | Model 12 | Model 13 | ||||

|---|---|---|---|---|---|---|---|---|

| Estimate | Error | Estimate | Error | Estimate | Error | Estimate | Error | |

| FIRMORI | −0.4867 | 0.2194 * | −0.5171 | 0.2186 ** | −0.4817 | 0.2193 * | ||

| PLATFORM | −2.0672 | 0.3312 *** | −2.0965 | 0.3309 *** | −2.0637 | 0.3312 *** | ||

| lnGOV | −0.0303 | 0.0129 * | −0.0254 | 0.0126 * | −0.0308 | 0.0130 *** | ||

| ALLI | 0.3590 | 0.0797 *** | ||||||

| RDALLY | 0.6283 | 0.1834 *** | ||||||

| MMALLY | 0.4815 | 0.1066 *** | ||||||

| SIZE | −0.0043 | 0.0021 * | −0.0045 | 0.0022 * | −0.0043 | 0.0022 * | −0.0047 | 0.0022 * |

| AGE | −0.4061 | 0.0548 *** | −0.4348 | 0.0556 *** | −0.4394 | 0.0554 *** | −0.4322 | 0.0560 *** |

| RDIN | −0.0613 | 0.0183 *** | −0.0485 | 0.0188 *** | −0.0481 | 0.0189 *** | −0.0467 | 0.0188 ** |

| DIV | −0.6278 | 0.1890 *** | −0.5308 | 0.1923 *** | −0.5312 | 0.1912 *** | −0.5242 | 0.1917 *** |

| GROW | −2.9882 | 4.4336 | −5.1522 | 4.5313 | −5.6622 | 4.5277 | −4.8077 | 4.5430 |

© 2017 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shin, K.; Park, G.; Choi, J.Y.; Choy, M. Factors Affecting the Survival of SMEs: A Study of Biotechnology Firms in South Korea. Sustainability 2017, 9, 108. https://doi.org/10.3390/su9010108

Shin K, Park G, Choi JY, Choy M. Factors Affecting the Survival of SMEs: A Study of Biotechnology Firms in South Korea. Sustainability. 2017; 9(1):108. https://doi.org/10.3390/su9010108

Chicago/Turabian StyleShin, Kwangsoo, Gunno Park, Jae Young Choi, and Minkyung Choy. 2017. "Factors Affecting the Survival of SMEs: A Study of Biotechnology Firms in South Korea" Sustainability 9, no. 1: 108. https://doi.org/10.3390/su9010108

APA StyleShin, K., Park, G., Choi, J. Y., & Choy, M. (2017). Factors Affecting the Survival of SMEs: A Study of Biotechnology Firms in South Korea. Sustainability, 9(1), 108. https://doi.org/10.3390/su9010108